AUGUST 3, 2021 HollyFrontier Corporation & Holly Energy Partners, L.P. Combination with Sinclair Oil Corporation & Sinclair Transportation Company Exhibit 99.2

Disclosure Statement FORWARD LOOKING STATEMENTS: Statements contained herein that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “project,” “expect,” “plan,” “goal,” “forecast,” “strategy”, “intend,” “should,” “would,” “could,” “believe,” “may,” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the acquisition by HollyFrontier and HEP of Sinclair Oil Corporation and Sinclair Transportation Company (collectively, “Sinclair”, and such transactions, the “Sinclair Transactions”), pro forma descriptions of the combined companies and their operations, integration and transition plans, synergies, opportunities and anticipated future performance. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier and/or HEP, and they are not guarantees of future performance. These forward-looking statements are based on assumptions using currently available information and expectations as of the date thereof that HollyFrontier and HEP management believe are reasonable, but that involve certain risks and uncertainties and may prove inaccurate. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in these statements. Any differences could be caused by a number of factors including, but not limited to (i) the failure of HollyFrontier and HEP to successfully close the Sinclair Transactions or, once closed, integrate the operations of Sinclair with their existing operations and fully realize the expected synergies of the Sinclair Transactions or on the expected timeline; (ii) the satisfaction or waiver of the conditions precedent to the proposed Sinclair Transactions, including, without limitation, the receipt of the HollyFrontier stockholder approval for the issuance of HF Sinclair common stock at closing and regulatory approvals (including clearance by antitrust authorities necessary to complete the Sinclair Transactions) on the terms and timeline desired, (iii) risks relating to the value of the shares of HF Sinclair’s common stock and the value of HEP’s common units to be issued at the closing of the Sinclair Transactions from sales in anticipation of closing and from sales by the Sinclair holders following the closing, (iv) legal proceedings that may be instituted against HollyFrontier or HEP following the announcement of the proposed Sinclair Transactions, (v) HollyFrontier’s failure to successfully close its recently announced Puget Sound Refinery transaction or, once closed, integrate the operations of the Puget Sound Refinery with its existing operations and fully realize the expected synergies of the Puget Sound Refinery Transaction or on the expected timeline; (vi) disruption the Sinclair Transaction may cause to customers, vendors, business partners and HollyFrontier’s and HEP’s ongoing business, (vii) the extraordinary market environment and effects of the COVID-19 pandemic, including a significant decline in demand for refined petroleum products in the markets we serve, risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum or lubricant and specialty products in HollyFrontier’s and HEP’s markets, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products or lubricant and specialty products, the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines, whether due to infection in the work force or in response to reductions in demand, effects of current and future governmental and environmental regulations and policies, including the effects of current and future restrictions on various commercial and economic activities in response to the COVID-19 pandemic, and (viii) other factors, including those listed in the most recent annual, quarterly and periodic reports of HollyFrontier and HEP filed with the Securities and Exchange Commission (“SEC”), whether or not related to either proposed transaction. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date made and, other than as required by law, HollyFrontier and HEP undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. ADDITIONAL INFORMATION AND WHERE TO FIND IT: The issuance of shares of HF Sinclair common stock to Sinclair in the proposed transactions (the “Sinclair Stock Consideration”) will be submitted to HollyFrontier’s stockholders for their consideration. In connection with the issuance of the Sinclair Stock Consideration, HollyFrontier will (i) prepare a proxy statement for HollyFrontier’s stockholders to be filed with the SEC, (ii) mail the proxy statement to its stockholders, and (iii) file other documents regarding the issuance of the Sinclair Stock Consideration and the proposed transactions with the SEC. This communication is not intended to be, and is not, a substitute for such filings or for any other document that HollyFrontier may file with the SEC in connection with the issuance of the Sinclair Stock Consideration or the proposed transactions. SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, CAREFULLY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement and other relevant materials (when they become available) and any other documents filed or furnished by HollyFrontier with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from HollyFrontier by going to its investor relations page on its corporate web site at www.hollyfrontier.com. PARTICIPANTS IN THE SOLICITATION: HollyFrontier and its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the issuance of the Sinclair Stock Consideration. Information about HollyFrontier’s directors and executive officers is set forth in its definitive proxy statement filed with the SEC on March 25, 2021. The proxy statement is available free of charge from the sources indicated above and from HollyFrontier by going to its investor relations page on its corporate web site at www.hollyfrontier.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the issuance of the Sinclair Stock Consideration will be included in the proxy statement and other relevant materials HollyFrontier files with the SEC in connection with the proposed transactions.

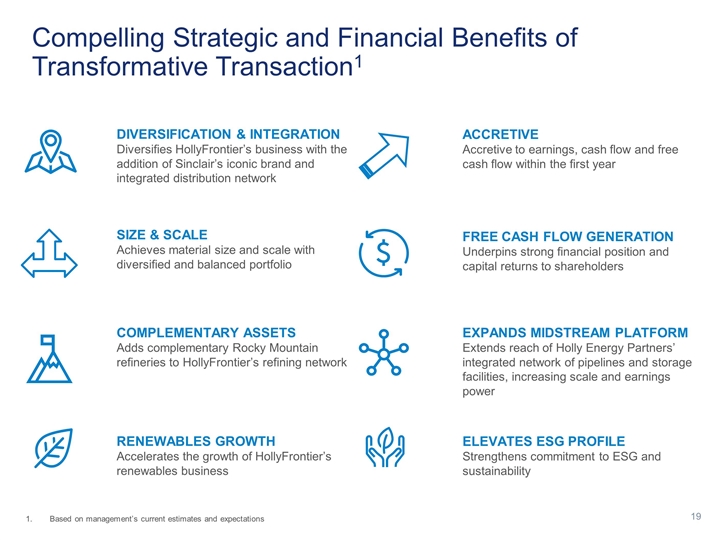

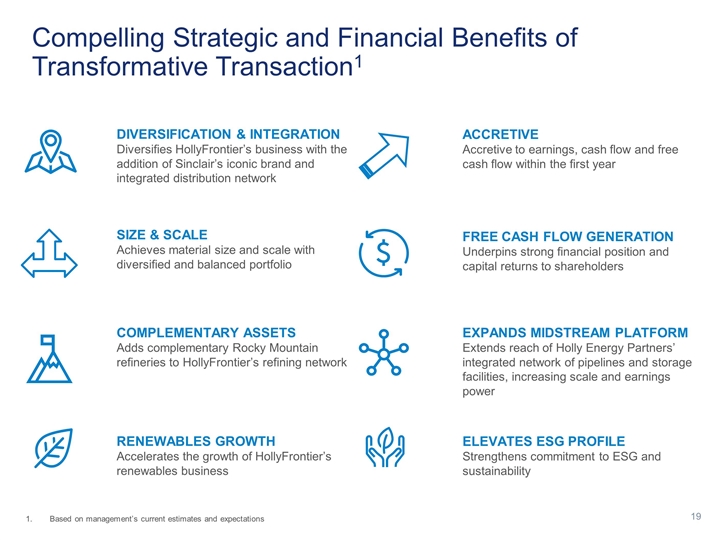

ACCRETIVE Accretive to earnings, cash flow and free cash flow within the first year FREE CASH FLOW GENERATION Underpins strong financial position and capital returns to shareholders EXPANDS MIDSTREAM PLATFORM Extends reach of Holly Energy Partners’ integrated network of pipelines and storage facilities, increasing scale and earnings power ELEVATES ESG PROFILE Strengthens commitment to ESG and sustainability DIVERSIFICATION & INTEGRATION Diversifies HollyFrontier’s business with the addition of Sinclair’s iconic brand and integrated distribution network SIZE & SCALE Achieves material size and scale with diversified and balanced portfolio COMPLEMENTARY ASSETS Adds complementary Rocky Mountain refineries to HollyFrontier’s refining network RENEWABLES GROWTH Accelerates the growth of HollyFrontier’s renewables business Compelling Strategic and Financial Benefits of Transformative Transaction1 Based on management’s current estimates and expectations

HollyFrontier: A Decade of Growth and Value Creation Returned over $3.6 billion through special and regular dividends Returned over $2.3 billion through share repurchases Delivered Significant Value to Shareholders2 Expanding refining business Emerging renewables business 5 complex refineries with 554,000 BPD of crude oil processing capacity inclusive of our recently announced acquisition of the 149,000 BPD Puget Sound Refinery1 Addition of renewable diesel unit (RDU) and pre-treatment unit (PTU) at Artesia refinery, and conversion of the Cheyenne refinery into an RDU facility in progress Growing lubricants business built through key acquisitions Benefiting from Interest in HEP 2017: Petro-Canada Lubricants 2018: Sonneborn 34,000 barrels per day of lubricant production capacity Facilitating the growth of midstream MLP partner through drop-downs and external acquisitions Puget Sound Refinery (“PSR”) acquisition expected to close in 4Q2021 Since the merger of Holly Oil Corporation (HOC) & Frontier Oil Corporation (FTO) on 7/1/2011

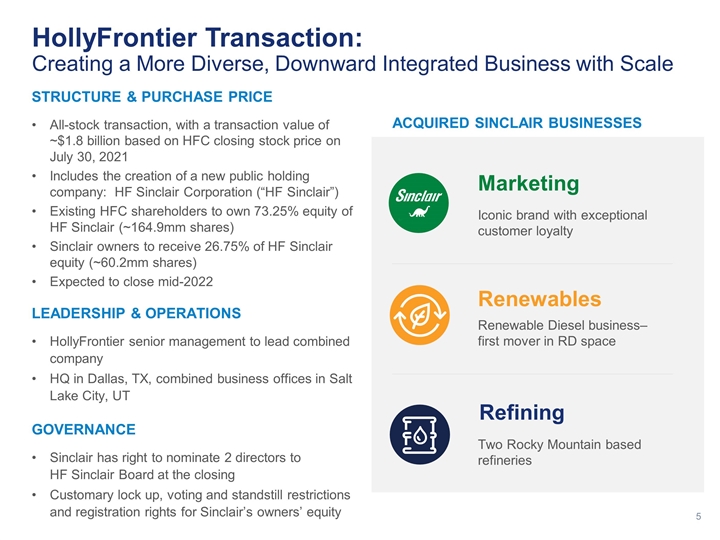

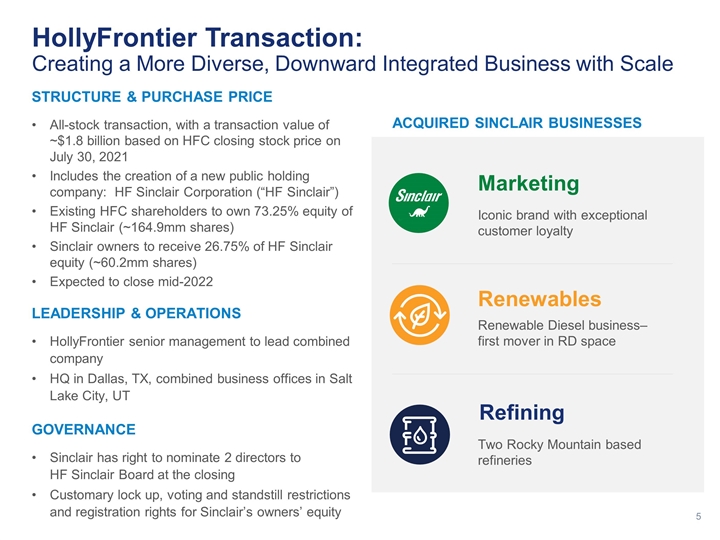

HollyFrontier Transaction: Creating a More Diverse, Downward Integrated Business with Scale Two Rocky Mountain based refineries Iconic brand with exceptional customer loyalty Renewable Diesel business–first mover in RD space STRUCTURE & PURCHASE PRICE All-stock transaction, with a transaction value of ~$1.8 billion based on HFC closing stock price on July 30, 2021 Includes the creation of a new public holding company: HF Sinclair Corporation (“HF Sinclair”) Existing HFC shareholders to own 73.25% equity of HF Sinclair (~164.9mm shares) Sinclair owners to receive 26.75% of HF Sinclair equity (~60.2mm shares) Expected to close mid-2022 LEADERSHIP & OPERATIONS HollyFrontier senior management to lead combined company HQ in Dallas, TX, combined business offices in Salt Lake City, UT GOVERNANCE Sinclair has right to nominate 2 directors to HF Sinclair Board at the closing Customary lock up, voting and standstill restrictions and registration rights for Sinclair’s owners’ equity Marketing Renewables Refining ACQUIRED SINCLAIR BUSINESSES

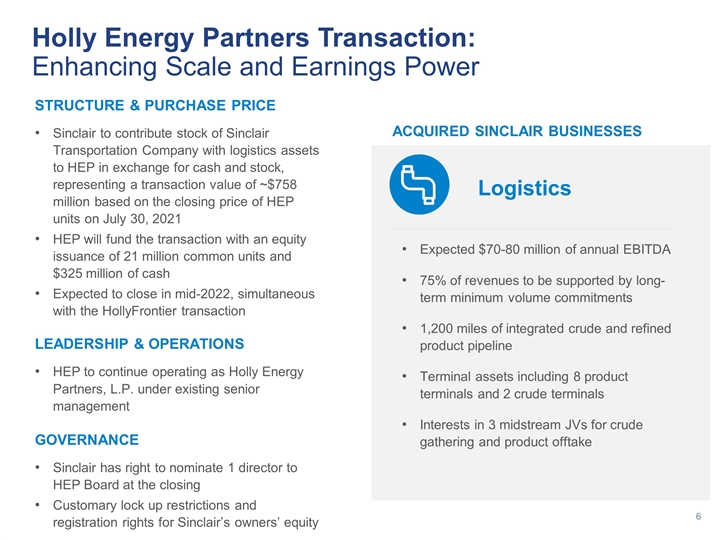

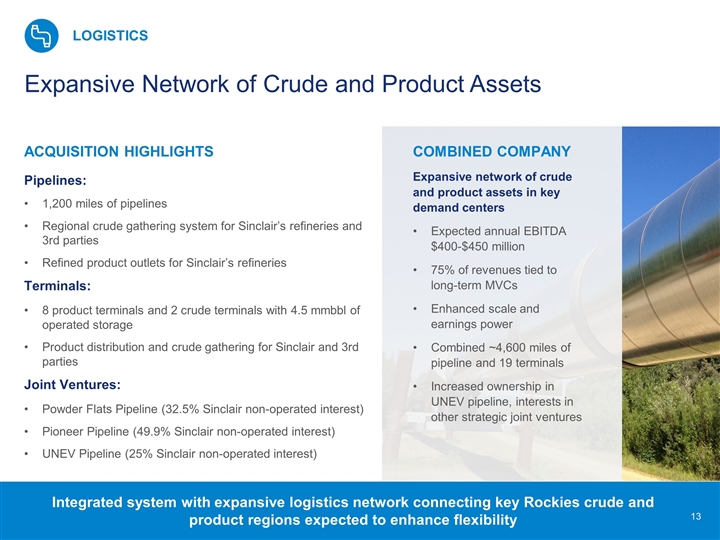

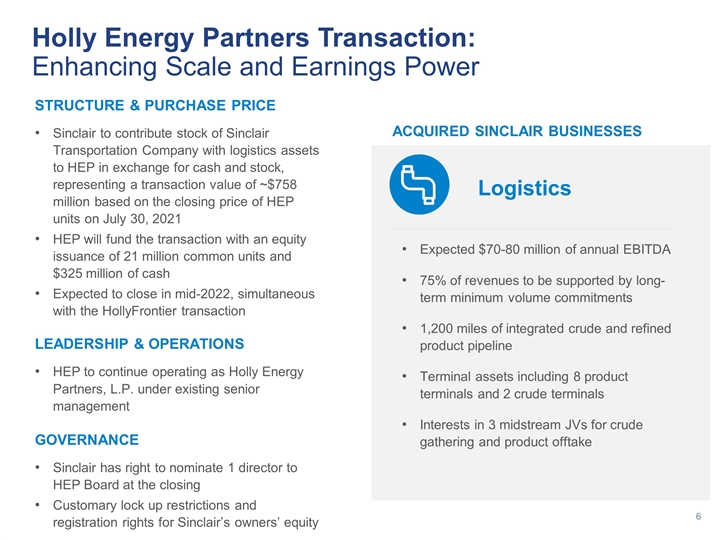

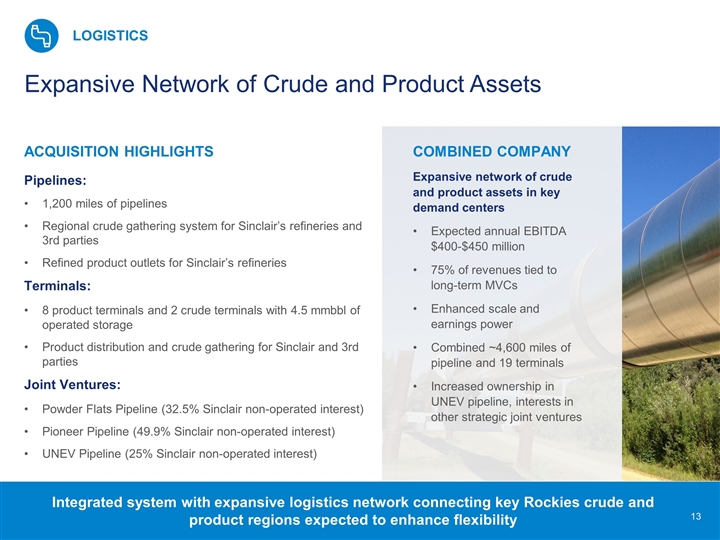

Holly Energy Partners Transaction: Enhancing Scale and Earnings Power Expected $70-80 million of annual EBITDA 75% of revenues to be supported by long-term minimum volume commitments 1,200 miles of integrated crude and refined product pipeline Terminal assets including 8 product terminals and 2 crude terminals Interests in 3 midstream JVs for crude gathering and product offtake STRUCTURE & PURCHASE PRICE Sinclair to contribute stock of Sinclair Transportation Company with logistics assets to HEP in exchange for cash and stock, representing a transaction value of ~$758 million based on the closing price of HEP units on July 30, 2021 HEP will fund the transaction with an equity issuance of 21 million common units and $325 million of cash Expected to close in mid-2022, simultaneous with the HollyFrontier transaction LEADERSHIP & OPERATIONS HEP to continue operating as Holly Energy Partners, L.P. under existing senior management GOVERNANCE Sinclair has right to nominate 1 director to HEP Board at the closing Customary lock up restrictions and registration rights for Sinclair’s owners’ equity Logistics ACQUIRED SINCLAIR BUSINESSES

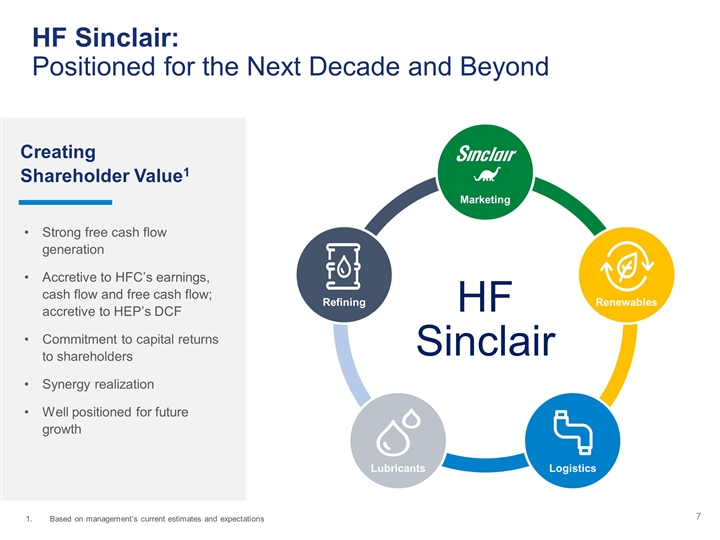

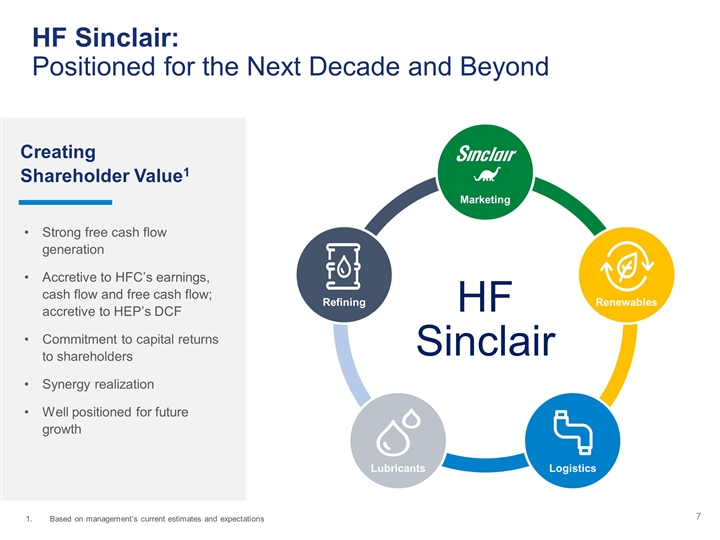

HF Sinclair: Positioned for the Next Decade and Beyond Strong free cash flow generation Accretive to HFC’s earnings, cash flow and free cash flow; accretive to HEP’s DCF Commitment to capital returns to shareholders Synergy realization Well positioned for future growth Creating Shareholder Value1 Based on management’s current estimates and expectations HF Sinclair Marketing Renewables Logistics Refining Lubricants

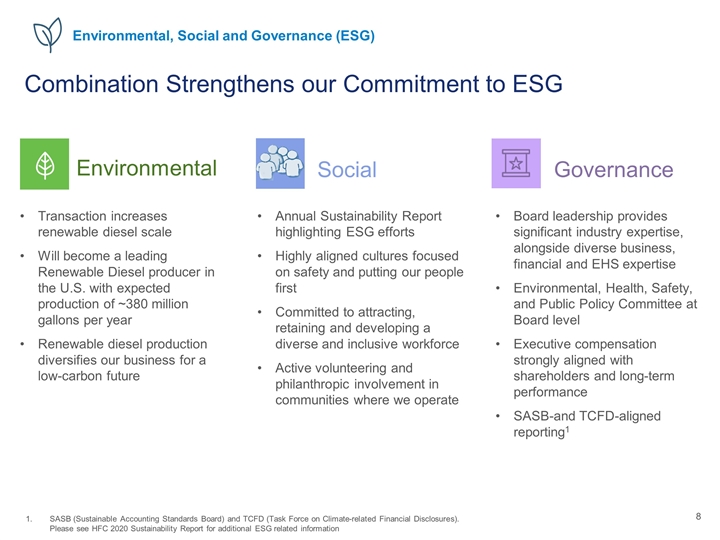

Combination Strengthens our Commitment to ESG Environmental, Social and Governance (ESG) Environmental Social Governance Transaction increases renewable diesel scale Will become a leading Renewable Diesel producer in the U.S. with expected production of ~380 million gallons per year Renewable diesel production diversifies our business for a low-carbon future Board leadership provides significant industry expertise, alongside diverse business, financial and EHS expertise Environmental, Health, Safety, and Public Policy Committee at Board level Executive compensation strongly aligned with shareholders and long-term performance SASB-and TCFD-aligned reporting1 Annual Sustainability Report highlighting ESG efforts Highly aligned cultures focused on safety and putting our people first Committed to attracting, retaining and developing a diverse and inclusive workforce Active volunteering and philanthropic involvement in communities where we operate SASB (Sustainable Accounting Standards Board) and TCFD (Task Force on Climate-related Financial Disclosures). Please see HFC 2020 Sustainability Report for additional ESG related information

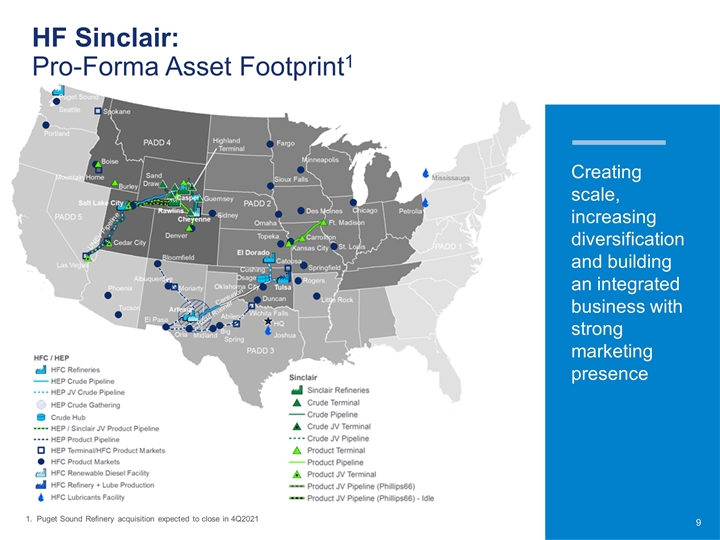

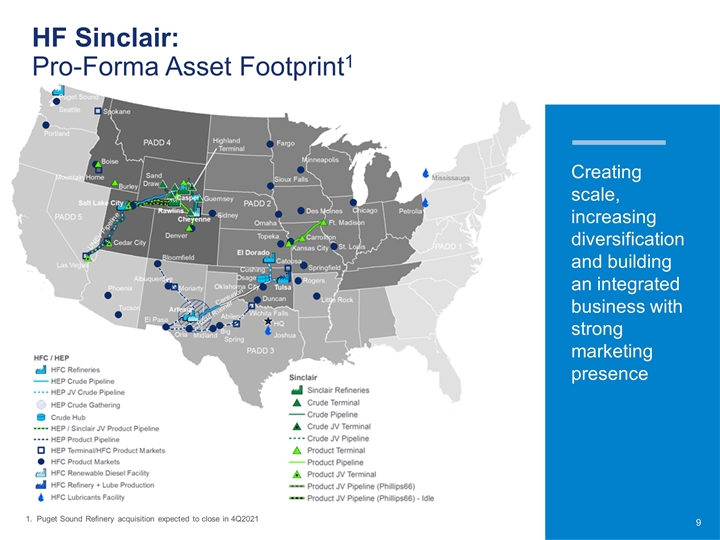

HF Sinclair: Pro-Forma Asset Footprint1 Creating scale, increasing diversification and building an integrated business with strong marketing presence 1. Puget Sound Refinery acquisition expected to close in 4Q2021

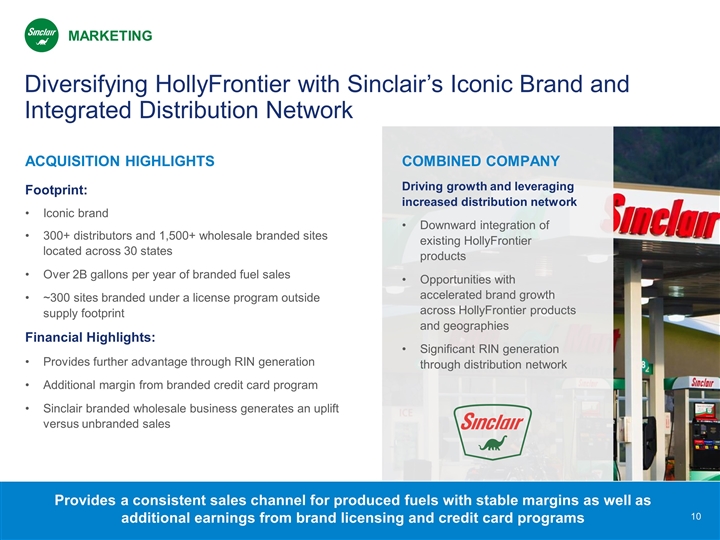

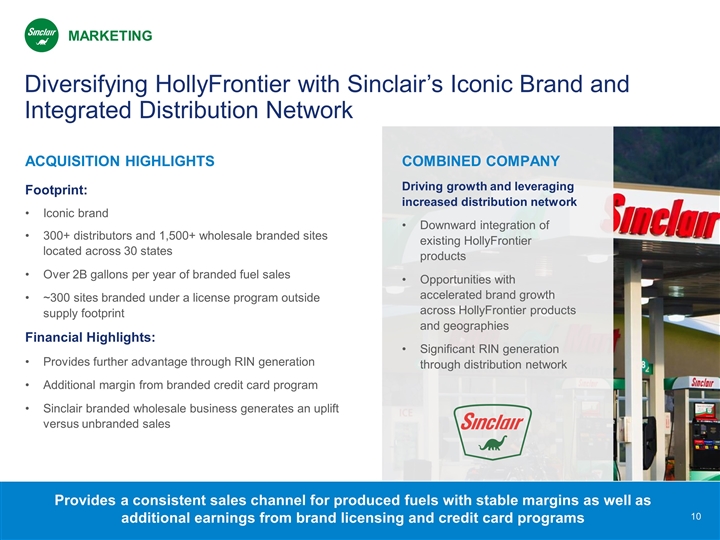

MARKETING Diversifying HollyFrontier with Sinclair’s Iconic Brand and Integrated Distribution Network ACQUISITION HIGHLIGHTS Footprint: Iconic brand 300+ distributors and 1,500+ wholesale branded sites located across 30 states Over 2B gallons per year of branded fuel sales ~300 sites branded under a license program outside supply footprint Financial Highlights: Provides further advantage through RIN generation Additional margin from branded credit card program Sinclair branded wholesale business generates an uplift versus unbranded sales COMBINED COMPANY Driving growth and leveraging increased distribution network Downward integration of existing HollyFrontier products Opportunities with accelerated brand growth across HollyFrontier products and geographies Significant RIN generation through distribution network Provides a consistent sales channel for produced fuels with stable margins as well as additional earnings from brand licensing and credit card programs

ACQUISITION HIGHLIGHTS Sinclair is a First Mover in Renewables 10,000 BPD Renewable Diesel Unit co-located at Sinclair, WY refinery Renewable Diesel Unit operational since 2018 LCFS program pathways in California and British Columbia Feedstock Pretreatment Unit Construction of pre-treatment unit in progress, expected completion mid-2022 Pre-treatment mitigates single feedstock risk Target the processing of lower CI distillers corn oil, tallow and lower priced degummed soybean oil Feedstock flexibly generates higher LCFS value through lower CI feedstock COMBINED COMPANY Combination creates large scale renewables business A leading U.S. producer of Renewable Diesel with 3 production facilities Expect to produce ~380 million gallons of renewable diesel annually 2 pre-treatment units providing significant feedstock flexibility Size and scale support operational synergies RENEWABLES Growing the Size and Scale of HollyFrontier’s Renewables Business Creating a leading renewable diesel business

Adding Complementary Rocky Mountain Refineries to HollyFrontier’s Footprint ACQUISITION HIGHLIGHTS Sinclair Refinery: 94,000 BPD operating capacity with 3.74mmbbl of storage Crude slate: Canadian heavy and Rockies sweet crudes Product yield: diesel, gasoline, asphalt, jet fuel, LPG Products primarily distributed by pipelines to Denver and Salt Lake City Casper Refinery: 30,000 BPD operating capacity with 1.45 mmbbl of storage Crude slate: Rockies sweet crudes Product yield: diesel, gasoline and heavy oil Products primarily distributed by pipelines serving the Rocky Mountain region and South Dakota COMBINED COMPANY1 Opportunity to create value through increased reliability and improved cost structure Expanded footprint centered around Mid-Continent, Southwest, Rocky Mountain and Pacific Northwest 7 complex refineries that convert discounted, heavy and sour crudes into a high percentage of gasoline, diesel and other high-value products 678,000 BPD: oil processing capacity REFINING Expanding geographically through feedstock advantaged assets with access to Canadian and Rocky Mountain crudes 1. Includes the 149KBPD Puget Sound Refinery, acquisition expected to close in 4Q2021

Expansive Network of Crude and Product Assets ACQUISITION HIGHLIGHTS Pipelines: 1,200 miles of pipelines Regional crude gathering system for Sinclair’s refineries and 3rd parties Refined product outlets for Sinclair’s refineries Terminals: 8 product terminals and 2 crude terminals with 4.5 mmbbl of operated storage Product distribution and crude gathering for Sinclair and 3rd parties Joint Ventures: Powder Flats Pipeline (32.5% Sinclair non-operated interest) Pioneer Pipeline (49.9% Sinclair non-operated interest) UNEV Pipeline (25% Sinclair non-operated interest) COMBINED COMPANY Expansive network of crude and product assets in key demand centers Expected annual EBITDA $400-$450 million 75% of revenues tied to long-term MVCs Enhanced scale and earnings power Combined ~4,600 miles of pipeline and 19 terminals Increased ownership in UNEV pipeline, interests in other strategic joint ventures Integrated system with expansive logistics network connecting key Rockies crude and product regions expected to enhance flexibility LOGISTICS

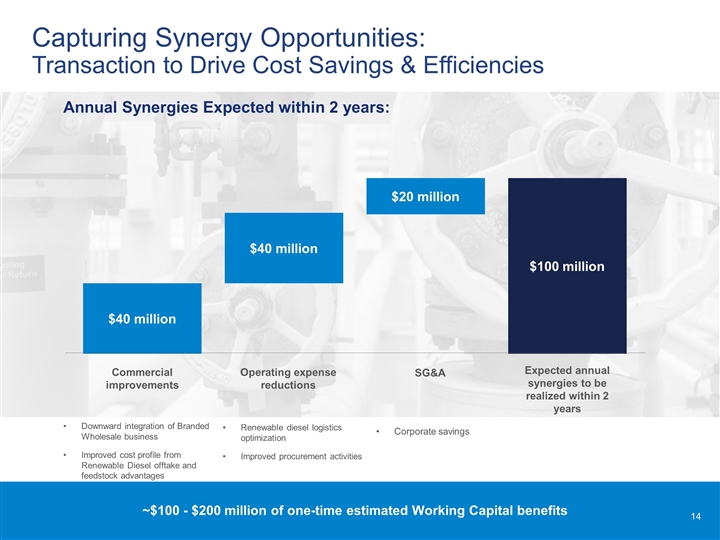

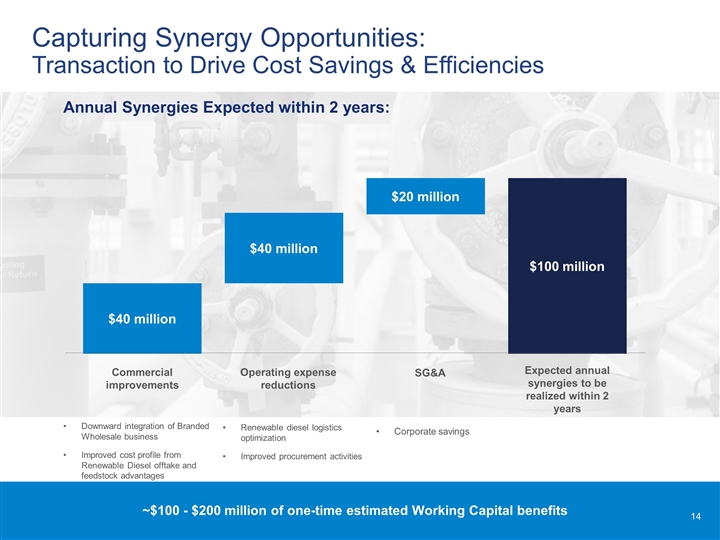

Capturing Synergy Opportunities: Transaction to Drive Cost Savings & Efficiencies $100 million $40 million $40 million $20 million Expected annual synergies to be realized within 2 years SG&A Operating expense reductions Commercial improvements Annual Synergies Expected within 2 years: Downward integration of Branded Wholesale business Improved cost profile from Renewable Diesel offtake and feedstock advantages Renewable diesel logistics optimization Improved procurement activities Corporate savings ~$100 - $200 million of one-time estimated Working Capital benefits

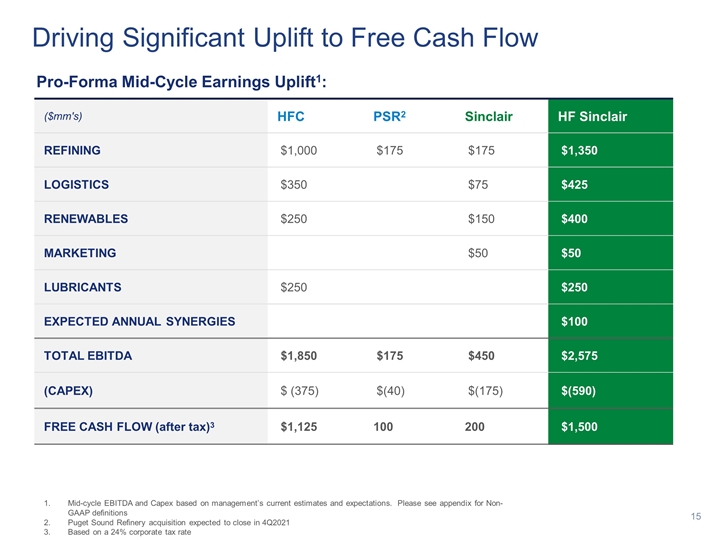

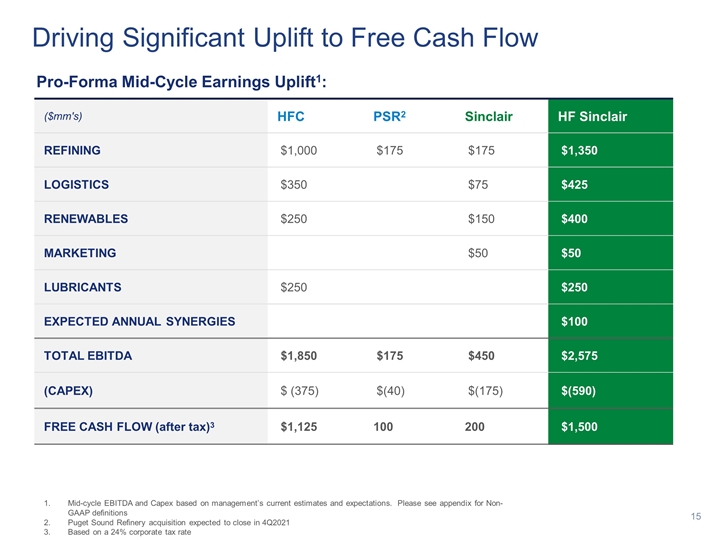

Pro-Forma Mid-Cycle Earnings Uplift1: ($mm's) HFC PSR2 Sinclair HF Sinclair REFINING $1,000 $175 $175 $1,350 LOGISTICS $350 $75 $425 RENEWABLES $250 $150 $400 MARKETING $50 $50 LUBRICANTS $250 $250 EXPECTED ANNUAL SYNERGIES $100 TOTAL EBITDA $1,850 $175 $450 $2,575 (CAPEX) $ (375) $(40) $(175) $(590) FREE CASH FLOW (after tax)3 $1,125 100 200 $1,500 Driving Significant Uplift to Free Cash Flow Mid-cycle EBITDA and Capex based on management’s current estimates and expectations. Please see appendix for Non-GAAP definitions Puget Sound Refinery acquisition expected to close in 4Q2021 Based on a 24% corporate tax rate

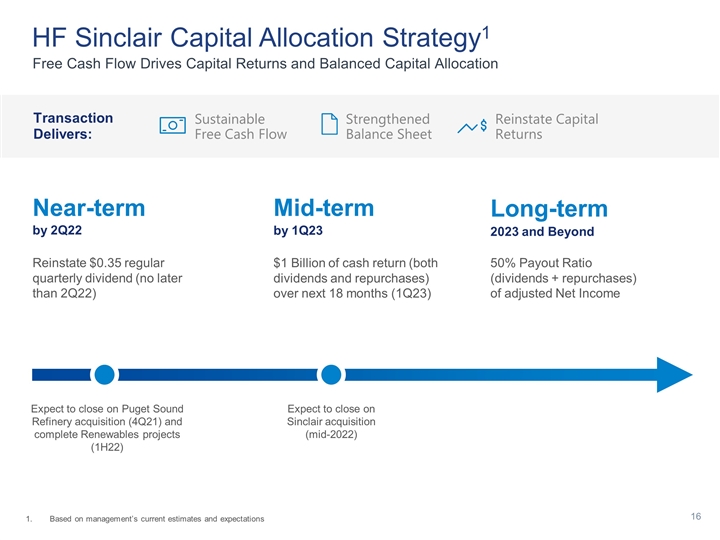

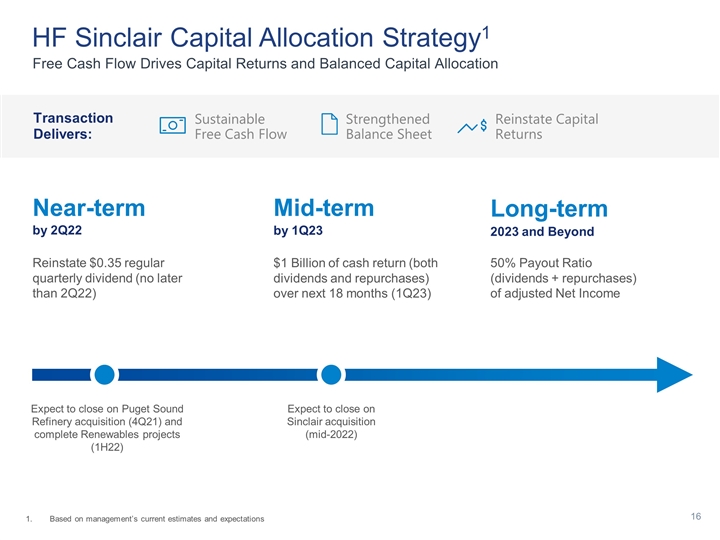

50% Payout Ratio (dividends + repurchases) of adjusted Net Income Reinstate $0.35 regular quarterly dividend (no later than 2Q22) Expect to close on Puget Sound Refinery acquisition (4Q21) and complete Renewables projects (1H22) $1 Billion of cash return (both dividends and repurchases) over next 18 months (1Q23) Expect to close on Sinclair acquisition (mid-2022) Near-term Long-term Mid-term by 2Q22 2023 and Beyond by 1Q23 HF Sinclair Capital Allocation Strategy1 Free Cash Flow Drives Capital Returns and Balanced Capital Allocation Strengthened Balance Sheet Reinstate Capital Returns Sustainable Free Cash Flow Transaction Delivers: Based on management’s current estimates and expectations

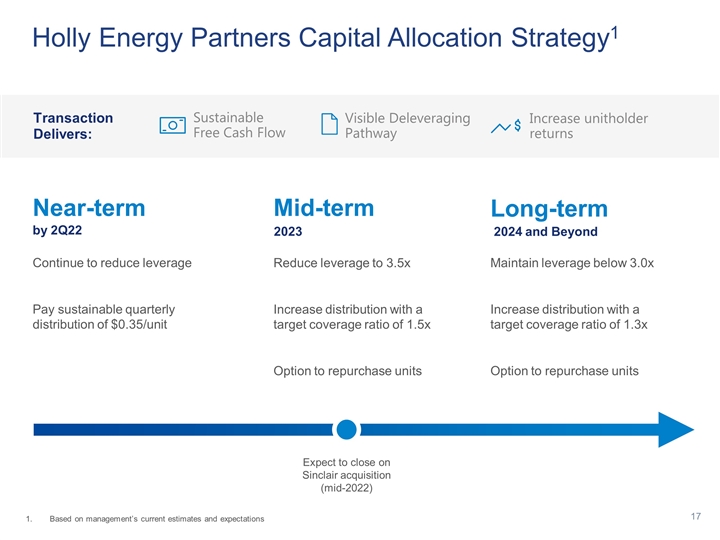

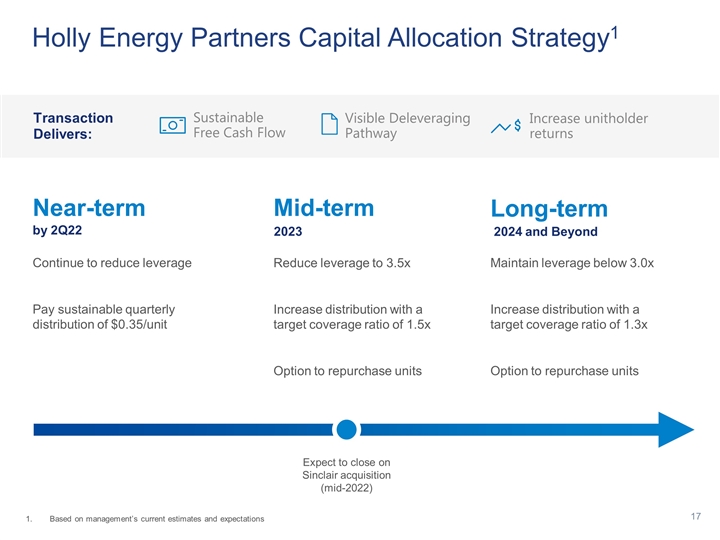

Holly Energy Partners Capital Allocation Strategy1 Near-term Long-term Mid-term by 2Q22 2024 and Beyond 2023 Maintain leverage below 3.0x Increase distribution with a target coverage ratio of 1.3x Option to repurchase units Continue to reduce leverage Pay sustainable quarterly distribution of $0.35/unit Reduce leverage to 3.5x Increase distribution with a target coverage ratio of 1.5x Option to repurchase units Expect to close on Sinclair acquisition (mid-2022) Visible Deleveraging Pathway Increase unitholder returns Sustainable Free Cash Flow Transaction Delivers: Based on management’s current estimates and expectations

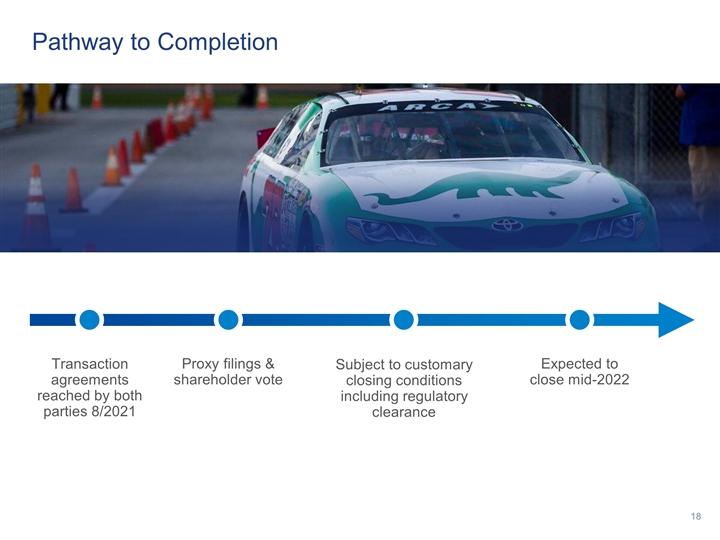

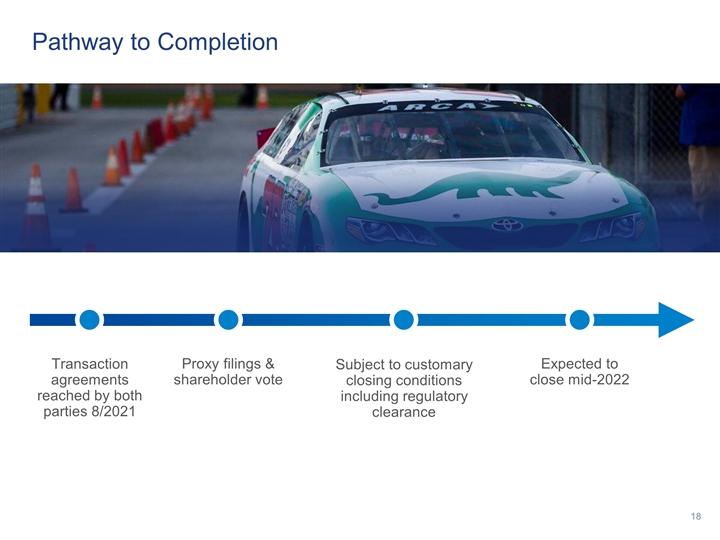

Pathway to Completion Expected to close mid-2022 Subject to customary closing conditions including regulatory clearance Proxy filings & shareholder vote Transaction agreements reached by both parties 8/2021

ACCRETIVE Accretive to earnings, cash flow and free cash flow within the first year FREE CASH FLOW GENERATION Underpins strong financial position and capital returns to shareholders EXPANDS MIDSTREAM PLATFORM Extends reach of Holly Energy Partners’ integrated network of pipelines and storage facilities, increasing scale and earnings power ELEVATES ESG PROFILE Strengthens commitment to ESG and sustainability DIVERSIFICATION & INTEGRATION Diversifies HollyFrontier’s business with the addition of Sinclair’s iconic brand and integrated distribution network SIZE & SCALE Achieves material size and scale with diversified and balanced portfolio COMPLEMENTARY ASSETS Adds complementary Rocky Mountain refineries to HollyFrontier’s refining network RENEWABLES GROWTH Accelerates the growth of HollyFrontier’s renewables business Compelling Strategic and Financial Benefits of Transformative Transaction1 Based on management’s current estimates and expectations

Appendix

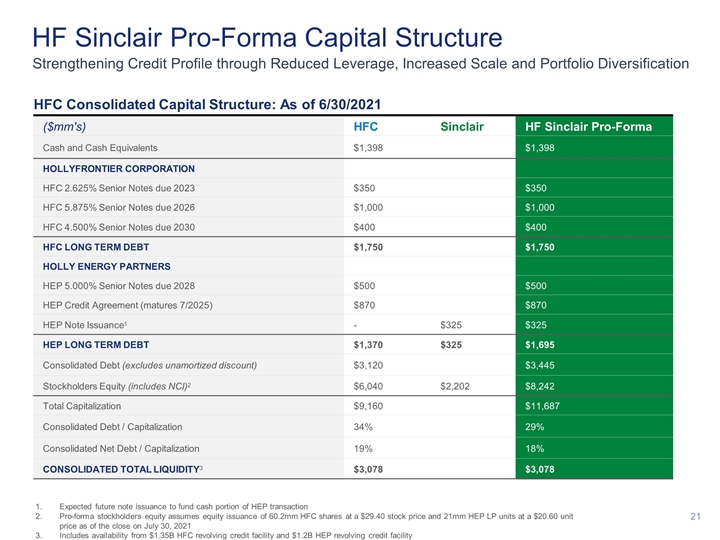

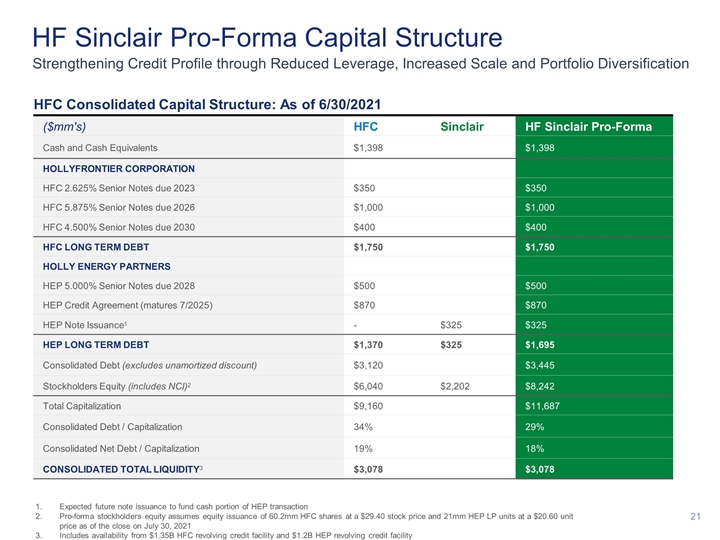

Expected future note issuance to fund cash portion of HEP transaction Pro-forma stockholders equity assumes equity issuance of 60.2mm HFC shares at a $29.40 stock price and 21mm HEP LP units at a $20.60 unit price as of the close on July 30, 2021 Includes availability from $1.35B HFC revolving credit facility and $1.2B HEP revolving credit facility ($mm's) HFC Sinclair HF Sinclair Pro-Forma Cash and Cash Equivalents $1,398 $1,398 HOLLYFRONTIER CORPORATION HFC 2.625% Senior Notes due 2023 $350 $350 HFC 5.875% Senior Notes due 2026 $1,000 $1,000 HFC 4.500% Senior Notes due 2030 $400 $400 HFC LONG TERM DEBT $1,750 $1,750 HOLLY ENERGY PARTNERS HEP 5.000% Senior Notes due 2028 $500 $500 HEP Credit Agreement (matures 7/2025) $870 $870 HEP Note Issuance1 - $325 $325 HEP LONG TERM DEBT $1,370 $325 $1,695 Consolidated Debt (excludes unamortized discount) $3,120 $3,445 Stockholders Equity (includes NCI)2 $6,040 $2,202 $8,242 Total Capitalization $9,160 $11,687 Consolidated Debt / Capitalization 34% 29% Consolidated Net Debt / Capitalization 19% 18% CONSOLIDATED TOTAL LIQUIDITY3 $3,078 $3,078 HF Sinclair Pro-Forma Capital Structure Strengthening Credit Profile through Reduced Leverage, Increased Scale and Portfolio Diversification HFC Consolidated Capital Structure: As of 6/30/2021

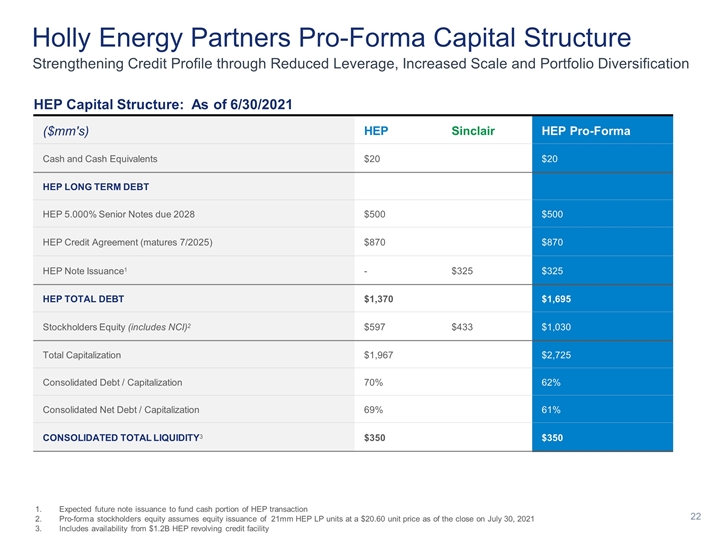

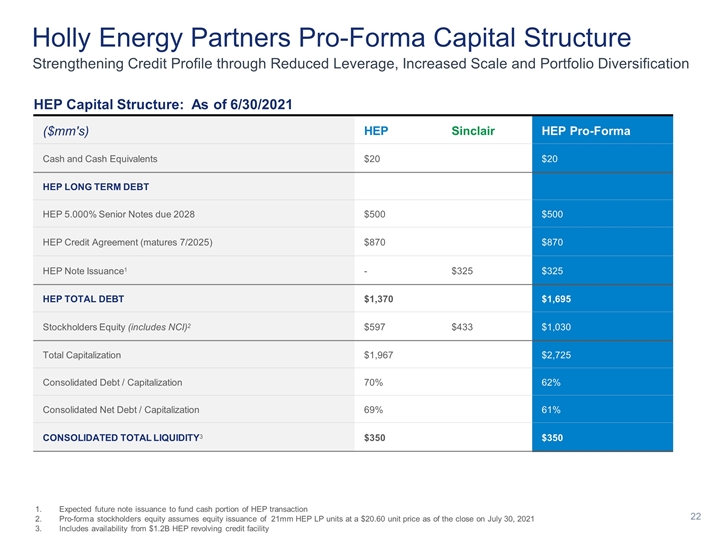

Expected future note issuance to fund cash portion of HEP transaction Pro-forma stockholders equity assumes equity issuance of 21mm HEP LP units at a $20.60 unit price as of the close on July 30, 2021 Includes availability from $1.2B HEP revolving credit facility ($mm's) HEP Sinclair HEP Pro-Forma Cash and Cash Equivalents $20 $20 HEP LONG TERM DEBT HEP 5.000% Senior Notes due 2028 $500 $500 HEP Credit Agreement (matures 7/2025) $870 $870 HEP Note Issuance1 - $325 $325 HEP TOTAL DEBT $1,370 $1,695 Stockholders Equity (includes NCI)2 $597 $433 $1,030 Total Capitalization $1,967 $2,725 Consolidated Debt / Capitalization 70% 62% Consolidated Net Debt / Capitalization 69% 61% CONSOLIDATED TOTAL LIQUIDITY3 $350 $350 Holly Energy Partners Pro-Forma Capital Structure Strengthening Credit Profile through Reduced Leverage, Increased Scale and Portfolio Diversification HEP Capital Structure: As of 6/30/2021

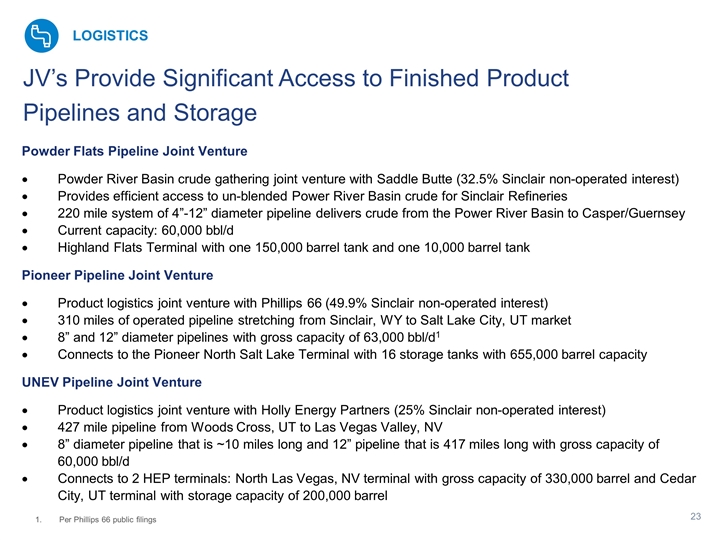

JV’s Provide Significant Access to Finished Product Pipelines and Storage Powder Flats Pipeline Joint Venture Powder River Basin crude gathering joint venture with Saddle Butte (32.5% Sinclair non-operated interest) Provides efficient access to un-blended Power River Basin crude for Sinclair Refineries 220 mile system of 4”-12” diameter pipeline delivers crude from the Power River Basin to Casper/Guernsey Current capacity: 60,000 bbl/d Highland Flats Terminal with one 150,000 barrel tank and one 10,000 barrel tank Pioneer Pipeline Joint Venture Product logistics joint venture with Phillips 66 (49.9% Sinclair non-operated interest) 310 miles of operated pipeline stretching from Sinclair, WY to Salt Lake City, UT market 8” and 12” diameter pipelines with gross capacity of 63,000 bbl/d1 Connects to the Pioneer North Salt Lake Terminal with 16 storage tanks with 655,000 barrel capacity UNEV Pipeline Joint Venture Product logistics joint venture with Holly Energy Partners (25% Sinclair non-operated interest) 427 mile pipeline from Woods Cross, UT to Las Vegas Valley, NV 8” diameter pipeline that is ~10 miles long and 12” pipeline that is 417 miles long with gross capacity of 60,000 bbl/d Connects to 2 HEP terminals: North Las Vegas, NV terminal with gross capacity of 330,000 barrel and Cedar City, UT terminal with storage capacity of 200,000 barrel LOGISTICS Per Phillips 66 public filings

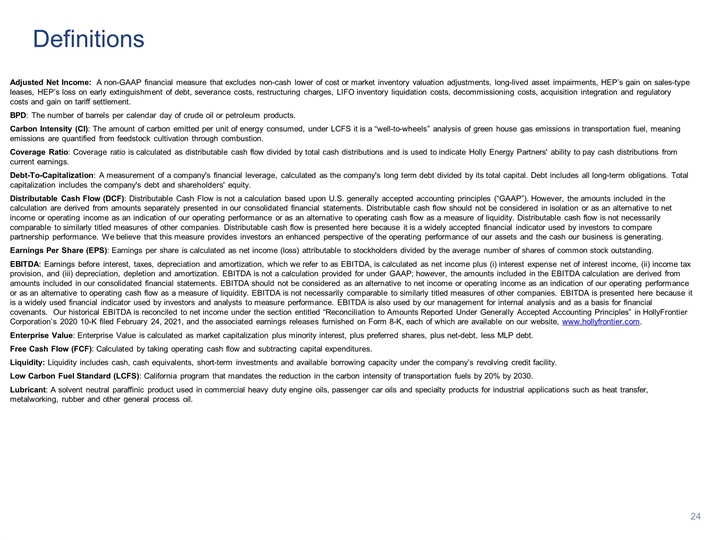

Adjusted Net Income: A non-GAAP financial measure that excludes non-cash lower of cost or market inventory valuation adjustments, long-lived asset impairments, HEP’s gain on sales-type leases, HEP’s loss on early extinguishment of debt, severance costs, restructuring charges, LIFO inventory liquidation costs, decommissioning costs, acquisition integration and regulatory costs and gain on tariff settlement. BPD: The number of barrels per calendar day of crude oil or petroleum products. Carbon Intensity (CI): The amount of carbon emitted per unit of energy consumed, under LCFS it is a “well-to-wheels” analysis of green house gas emissions in transportation fuel, meaning emissions are quantified from feedstock cultivation through combustion. Coverage Ratio: Coverage ratio is calculated as distributable cash flow divided by total cash distributions and is used to indicate Holly Energy Partners' ability to pay cash distributions from current earnings. Debt-To-Capitalization: A measurement of a company's financial leverage, calculated as the company's long term debt divided by its total capital. Debt includes all long-term obligations. Total capitalization includes the company's debt and shareholders' equity. Distributable Cash Flow (DCF): Distributable Cash Flow is not a calculation based upon U.S. generally accepted accounting principles (“GAAP”). However, the amounts included in the calculation are derived from amounts separately presented in our consolidated financial statements. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. We believe that this measure provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. Earnings Per Share (EPS): Earnings per share is calculated as net income (loss) attributable to stockholders divided by the average number of shares of common stock outstanding. EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer to as EBITDA, is calculated as net income plus (i) interest expense net of interest income, (ii) income tax provision, and (iii) depreciation, depletion and amortization. EBITDA is not a calculation provided for under GAAP; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2020 10-K filed February 24, 2021, and the associated earnings releases furnished on Form 8-K, each of which are available on our website, www.hollyfrontier.com. Enterprise Value: Enterprise Value is calculated as market capitalization plus minority interest, plus preferred shares, plus net-debt, less MLP debt. Free Cash Flow (FCF): Calculated by taking operating cash flow and subtracting capital expenditures. Liquidity: Liquidity includes cash, cash equivalents, short-term investments and available borrowing capacity under the company’s revolving credit facility. Low Carbon Fuel Standard (LCFS): California program that mandates the reduction in the carbon intensity of transportation fuels by 20% by 2030. Lubricant: A solvent neutral paraffinic product used in commercial heavy duty engine oils, passenger car oils and specialty products for industrial applications such as heat transfer, metalworking, rubber and other general process oil. Definitions

Net Debt: Net debt is total balance sheet debt net of cash, cash equivalents and short-term investments. Non GAAP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. Also, we have not reconciled to non-GAAP forward-looking measures or guidance to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable effort. Renewable Diesel (RD): A fuel derived from vegetable oils or animal fats that meets the requirements of ASTM 975. Renewable diesel is distinct from biodiesel. It is produced through various processes, most commonly through hydro-treating, reacting the feedstock with hydrogen under temperatures and pressure in the presence of a catalyst. Renewable Diesel is chemically identical to petroleum based diesel and therefore has no blend limit. Renewable Identification Number (RIN): A serial number assigned to each batch of biofuel produced until that gallon is blended with gasoline or diesel resulting in the separation of the RIN to be used for compliance. RIN category (D-code) is assigned for each renewable fuel pathway determined by feedstock, production process and fuel type. Sour Crude: Crude oil containing quantities of sulfur greater than 0.4 percent by weight, while “sweet crude oil” means crude oil containing quantities of sulfur equal to or less than 0.4 percent by weight. Definitions (continued)

HollyFrontier Corporation (NYSE: HFC) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyfrontier.com Craig Biery | Vice President, Investor Relations Trey Schonter | Investor Relations investors@hollyfrontier.com 214-954-6510 Media Inquiries: media@hollyfrontier.com Holly Energy Partners, L.P. (NYSE: HEP) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyenergy.com