Proxy Statement

March 21, 2016

Important Voting Information Inside

TFS Capital Investment Trust

Please vote immediately!

You can vote through the internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

TFS Capital Investment Trust

TFS Market Neutral Fund (TFSMX)

TFS Small Cap Fund (TFSSX)

TFS Hedged Futures Fund (TFSHX)

SPECIAL MEETING OF SHAREHOLDERS

Important Voting Information Inside

TABLE OF CONTENTS

| IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS | 7 |

| PROXY STATEMENT | 10 |

| PROPOSAL 1: TO APPROVE A PROPOSED NEW ADVISORY AGREEMENT WITH THE ADVISER, ON BEHALF OF EACH FUND | 10 |

| PROPOSAL 2: TO ELECT FOUR NOMINEES TO SERVE ON THE BOARD OF TRUSTEES | 19 |

| PROPOSAL 3: TO APPROVE ADJOURNMENTS OF THE MEETING FROM TIME TO TIME TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE MEETING TO CONSITUTTE A QUORUM OR TO APPROVE THE OTHER PROPOSALS. | 27 |

| PROPOSAL 4: TO TRANSACT ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF IN THE DISCRETION OF THE PROXIES OR THEIR SUBSTITUTES | 27 |

| OUTSTANDING SHARES AND VOTING REQUIREMENTS | 28 |

| ADDITIONAL INFORMATION ON THE OPERATION OF THE FUNDS | 30 |

| OTHER MATTERS | 31 |

| EXHIBIT A: FORM OF NEW ADVISORY AGREEMENT | 33 |

TFS Capital Investment Trust

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

March 21, 2016

Dear Shareholder:

You are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of the TFS Market Neutral Fund, TFS Small Cap Fund and TFS Hedged Futures Fund (individually, a “Fund,” collectively, the “Funds”), each a series of TFS Capital Investment Trust (the “Trust”). The Meeting will be held at 10:30 a.m., Eastern Time, on May 5, 2016 at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246 to vote on the proposals listed below. Formal notice of the Meeting appears after this letter, followed by the proxy statement. We hope that you can attend the Meeting in person; however, we urge you in any event to vote your shares at your earliest convenience by completing and returning the enclosed proxy in the envelope provided or voting by telephone or through the Internet.

Several transitions have occurred at the Funds' investment adviser TFS Capital LLC (the “Adviser’) over the past eighteen months, as certain owners and other senior management personnel have assumed an advisory role. In particular, Lawrence S. Eiben, a trustee of the Trust and a founding principal of the Adviser, transitioned to an advisory role at the Adviser and recently has entered into an agreement to sell his ownership interest in the Adviser to the remaining owners of the Adviser. This purchase agreement is expected to close within 60 days after shareholders approve the new investment advisory agreements on behalf of each Fund, or on such other date as the parties determine. If shareholders do not approve the new advisory agreements Mr. Eiben will maintain his ownership in the Adviser and the Funds will continue to be managed by the Adviser under the current advisory agreements. In addition, Mr. Eiben has announced his intention to resign from his position as a trustee on the Board of Trustees of the Trust, as discussed below.

The purchase of Mr. Eiben’s ownership interest in the Adviser will constitute a “change in control” of the Adviser and, in accordance with the requirements of the Investment Company Act of 1940, will automatically terminate the current investment advisory agreements on behalf of each Fund. The approval by each Fund of a new investment advisory agreement requires shareholder approval. Your approval of the new investment advisory agreement will not change the portfolio management of the Fund(s) or the advisory fee rate paid to the Adviser. The Adviser has also committed to maintaining each Fund’s expense ratio at the currently agreed upon expense caps.

Shareholders are also being asked to vote on the election of four individuals to serve on the Trust’s Board of Trustees. Four persons currently serve on the Board of Trustees. As previously noted above, Mr. Eiben intends to step down from the Board upon shareholder approval of the proposed Trustees. Mr. Eiben is considered an interested trustee under the Investment Company Act of 1940 because he is an owner of the Adviser. On February 17, 2016, the Board of Trustees nominated Mr. Eric S. Newman, an owner of the Adviser and portfolio manager of the Funds, for election by shareholders of the Trust. Although Mr. Newman is not currently a member of the Board, he has served as President of the Trust since January 2015 and acted as a portfolio manager for each Fund since its inception. Mr. Newman has served as the Adviser’s Chief Investment Officer since July 2014. The Board of Trustees is recommending that Mr. Eric Newman be elected to the Board of Trustees, and that shareholders elect the three independent trustees who currently serve. The result would be a board of four Trustees (including one Interested Trustee).

| PROPOSAL 1. | To approve, with respect to each Fund, a new Investment Advisory Agreement with TFS Capital LLC (to be voted on separately by shareholders of each Fund) |

| PROPOSAL 2. | To elect four individuals to serve on the Board of Trustees of the Trust (to be voted on by all shareholders of the Funds collectively) |

| PROPOSAL 3. | To approve adjournments of the Meeting from time to time to solicit additional proxies if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve the other Proposals. |

| PROPOSAL 4. | To transact any other business, not currently contemplated, that may properly come before the Meeting or any adjournment thereof in the discretion of the proxies or their substitutes. |

The Trust’s Board of Trustees recommends that you vote “FOR” each Proposal. In addition, the Adviser has agreed to pay all the fees and expenses associated with this Special Meeting of Shareholders.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement and cast your vote. It is important that your vote be received no later than May 4, 2016.

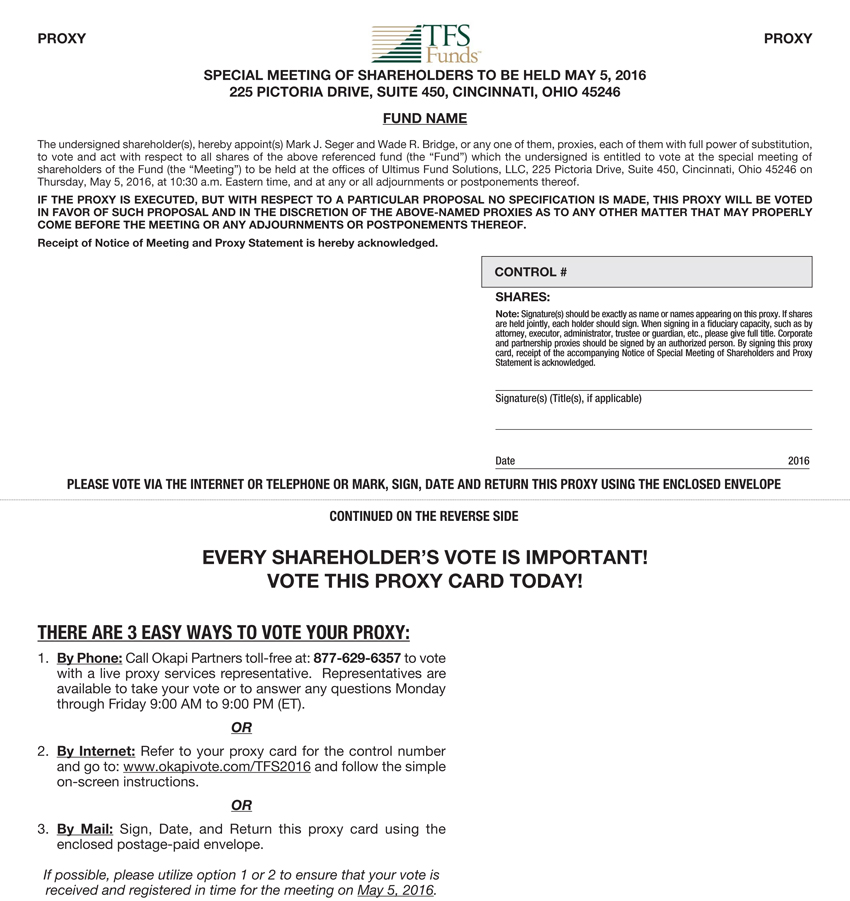

In addition to voting by mail you may also vote either by telephone or through the Internet as follows:

| | TO VOTE BY TELEPHONE: | | | TO VOTE BY INTERNET: |

| 1) | Read the Proxy Statement and have the enclosed proxy card at hand | | 1) | Read the Proxy Statement and have the enclosed proxy card at hand |

| 2) | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | | 2) | Go to the website that appears on the enclosed proxy card and follow the simple instructions |

We encourage you to vote by telephone or through the Internet using the control number that appears on the enclosed proxy card. Use of telephone or Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

We appreciate your participation and prompt response in this matter. If you should have any questions regarding the proposals, or to quickly vote your shares, please call Okapi Partners, the Funds’ proxy solicitor, toll-free at 877-629-6357. Thank you for your continued support.

| | |

| | Sincerely, |

| |  |

| | Eric S. Newman |

| | President |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held at 10:30 a.m., Eastern Time, on May 5, 2016. The Proxy Statement is available at www.okapivote.com/TFS or by calling the Trust at 1-888-534-2001.

To the Shareholders of TFS Capital Investment Trust:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of TFS Capital Investment Trust (the “Trust”) will be held at 10:30 a.m., Eastern time, on May 5, 2016 at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The purpose of the Meeting is to consider and vote on the following matters:

| 1. | To approve a new investment advisory agreement with TFS Capital Investment Trust, on behalf of each Fund of the Trust. No fee increase is being proposed. |

| 2. | To elect four nominees to serve on the Board of Trustees of the Trust. |

| 3. | To approve adjournments of the Meeting from time to time to solicit additional proxies if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve the other Proposals. |

| 4. | To transact any other business, not currently contemplated, that may properly come before the Meeting or any adjournment thereof in the discretion of the proxies or their substitutes. |

Shareholders of record as of the close of business on March 14, 2016 will be entitled to notice of and to vote at the Meeting or any adjournment thereof. A Proxy Statement and proxy card solicited by the Trust are included herein.

Your vote is important to us. Thank you for taking the time to consider the proposals.

| | |

| | By order of the Board of Trustees, |

| | |

| |  |

| | Wade R. Bridge |

| | Secretary |

| | TFS Capital Investment Trust |

March 21, 2016

IMPORTANT Please vote by telephone or through the Internet by following the instructions on your proxy card, thus avoiding unnecessary expense and delay. You may also execute the enclosed proxy and return it promptly in the enclosed envelope. No postage is required if mailed in the United States. The proxy is revocable and will not affect your right to vote in person if you attend the Meeting. |

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS

While we encourage you to carefully read the entire text of the Proxy Statement, for your convenience we have provided answers to some of the most frequently asked questions and a brief summary of the proposals to be voted on by shareholders.

QUESTIONS AND ANSWERS

Q: What is happening? Why did I get this package of materials?

A: TFS Market Neutral Fund, TFS Small Cap Fund and TFS Hedged Futures Fund (individually, a “Fund” and collectively, the “Funds”), each a series of the Trust, are conducting a special meeting of shareholders of the Trust scheduled to be held at 10:30 a.m., Eastern time, on May 5, 2016. According to our records, you are a shareholder of record for this meeting as of the Record Date.

Q: Why am I being asked to vote on a proposed New Advisory Agreement?

A: The principals of TFS Capital LLC (the “Adviser”), the investment adviser to each Fund, have agreed to purchase all of Mr. Lawrence S. Eiben’s ownership interests (i.e. voting shares) in the Adviser (the “Transaction”). The Transaction contemplates that Mr. Eiben’s 25.3% ownership interest in the Adviser will be purchased in its entirety by the other owners of the Adviser, creating a presumption of a “change in control” of the Adviser under the Investment Company Act of 1940, as amended (the “1940 Act”). Pursuant to the terms of the existing investment advisory agreements and the 1940 Act, a change of control at the Adviser will automatically terminate the investment advisory agreements between the Trust, on behalf of the Funds and the Adviser (the “Present Advisory Agreements”). The Transaction is expected to close within 60 days after shareholders approve the new investment advisory agreements (the “New Advisory Agreements) on behalf of each Fund, or on such other date as the parties determine. If shareholders do not approve the New Advisory Agreements the Transaction will not be consummated and the Funds will continue to be managed under the Present Advisory Agreements.

Because of the proposed Transaction, on February 17, 2016, the Board of Trustees, including all the Independent Trustees voting separately, approved the New Advisory Agreements between the Trust, on behalf of each Fund, and the Adviser to replace the Present Advisory Agreements. The New Advisory Agreements are substantially identical to the Present Advisory Agreements, except for certain non-material differences that are described below. Pursuant to each New Advisory Agreement, the Adviser will serve as the investment adviser to each Fund, subject to approval by each Fund’s shareholders. Additional information about the New Advisory Agreements, including the considerations made by the Board of Trustees in approving the New Advisory Agreements, is set forth herein under Proposal 1.

Q: How do the proposed New Advisory Agreements differ from the Present Advisory Agreements?

A: The terms and conditions of the New Advisory Agreements are substantially identical to those of the Present Advisory Agreements and differ only with respect to the changes described below, none of which management of the Trust believes to be material:

1. A change to the effective and termination date.

2. Incorporating the January 1, 2014 amendment to the Present Advisory Agreements into the body of the New Advisory Agreements. The amendment was for the purpose of lowering the advisory fee rate paid by each Fund.

3. The addition of a forum selection clause.

Pursuant to the Trust’s Declaration of Trust, the Board of Trustees (in particular the Independent Trustees) is responsible for overseeing the contractual agreements entered into by the Trust. As part of this responsibility the Board is expected to act in what it believes to be the best interest of all shareholders. Following discussions with experienced legal counsel, the Board of Trustees concluded that adding a forum selection clause will not result in any negative implications to shareholders. In addition, it is the Board’s belief, based on advice from experienced legal counsel, that a forum selection clause would provide considerable assurance that the court hearing any matter involving the New Advisory Agreements has sufficient expertise in the applicable law. Such expertise, in the Board’s opinion, should provide for a more efficient and equitable handling of any matter for the Trust and the shareholders of the Funds.

Q: How will the Transaction affect the shareholders of the Funds?

A: Other than the change in the ownership structure of the Adviser, the operations of the Adviser and the persons responsible for the day-to-day management of the Funds are expected to stay the same. Upon the approval of the New Advisory Agreements, Messrs. Kevin Gates, Richard Gates, Eric Newman and David Hall will continue to manage the portfolio of each Fund.

Q: Will the total fees payable under the Present Advisory Agreements increase?

A: No. The advisory fee rate payable to the Adviser under the New Advisory Agreements will be the same as the rate paid under the Present Advisory Agreements. Moreover, the Adviser’s commitment to limit the ordinary operating expenses of each Fund for the life of the Fund will not change.

Q: Will the expense limitation agreements continue to apply to the Funds?

A: Yes. The Adviser has entered into an expense limitation agreement on behalf of each Fund whereby it has agreed to limit each Fund’s expenses for the lifetime of the Fund.

Q: When will the New Advisory Agreements take effect?

A: If approved by shareholders of each Fund, the New Advisory Agreements would become effective if and when the Transaction is completed. Currently this is expected to occur on or about June 30, 2016.

Q: Why are shareholders of the Funds being asked to elect Trustees?

A: The Board of Trustees is asking shareholders to vote on the election of Eric Newman, a new nominee, as well as the election of three existing Trustees, Gregory R. Owens, Mark J. Malone and Brian O’Connell, to serve on the Board. These elections are requested to satisfy the requirement that at least two-thirds of the members of the Board of Trustees have been elected by shareholders. Information regarding the qualifications of each nominee is set forth herein under Proposal 2.

Q: How does the Board of Trustees recommend that I vote?

A: After careful consideration of the proposals, the Board of Trustees unanimously recommends that you vote FOR each of the proposals. The various factors that the Board of Trustees considered in making these determinations are described in the Proxy Statement.

Q: What will happen if there are not enough votes to hold the Meeting?

A: It is important that shareholders vote by telephone or Internet or complete and return signed proxy cards promptly, but no later than May 4, 2016 to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or a proxy solicitor if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting or have not received enough votes to approve Proposals 1 and 2, pursuant to Proposal 3 we may adjourn the Meeting to a later date so we can continue to seek more votes.

Q: Whom should I call for additional information?

A: We will be happy to answer your questions regarding this proxy solicitation. Should you have any questions, please call the Funds’ proxy solicitor Okapi Partners LLC toll-free at 877-629-6357. Representatives are available to take your call Monday-Friday 9am-9pm EST.

TFS CAPITAL INVESTMENT TRUST

SPECIAL MEETING OF SHAREHOLDERS

To Be Held on May 5, 2016

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or “Board of Trustees”) of TFS Capital Investment Trust (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of the TFS Market Neutral Fund, TFS Small Cap Fund and the TFS Hedged Futures Fund (individually, a “Fund” and collectively, the “Funds”), each a series of the Trust. The principal address of the Trust is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio. This Proxy Statement and proxy card were first mailed to shareholders on or about March 25, 2016.

As described in more detail below, at the Meeting shareholders are being asked to consider the approval of a new investment advisory agreement between the Trust, on behalf of each Fund, and TFS Capital LLC (the “Adviser”), the current investment adviser to each Fund (Proposal 1). Shareholders are also being asked to elect four nominees to serve as trustees on the Trust’s Board of Trustees (Proposal 2). In addition, Proposal 3 is asking Shareholders to approve adjournments of the Meeting if there are insufficient votes at the time of the Meeting to constitute a quorum or approve the other Proposals.

PROPOSAL 1: TO APPROVE A PROPOSED NEW ADVISORY AGREEMENT WITH THE ADVISER, ON BEHALF OF EACH FUND

The Present Advisory Agreements. The Adviser currently serves as the investment advisor to each series of the Trust; the TFS Market Neutral Fund, the TFS Small Cap Fund and the TFS Hedged Futures Fund pursuant to separate advisory agreements on behalf of each Fund.

| · | The Present Advisory Agreement on behalf of the TFS Market Neutral Fund is dated June 23, 2004 and was first amended effective June 24, 2011 for the purpose of incorporating breakpoints into the advisory fee schedule and was further amended effective January 1, 2014 for the purpose of lowering the advisory fee rate to 1.65% per annum of the Fund’s average daily net assets. The Present Advisory Agreement on behalf of the TFS Market Neutral Fund was initially approved by the Board of Trustees, including a majority of the Trustees who are not interested persons, as defined in the 1940 Act, as amended (the “Independent Trustees”), on June 10, 2004 and was last approved by the Board of Trustees, including a majority of the Independent Trustees, on June 4, 2015. The Present Advisory Agreement on behalf of the TFS Market Neutral Fund was approved by the initial shareholder of the Fund on June 28, 2004. |

| · | The Present Advisory Agreement on behalf of the TFS Small Cap Fund is dated March 1, 2010 and was amended effective January 1, 2014 for the purpose of lowering the advisory fee rate to 1.15% per annum of the Fund’s average daily net assets. The Present Advisory Agreement on behalf of the TFS Small Cap Fund was initially approved by the Board of Trustees, including a majority of the Independent Trustees, on December 18, 2009 and was last approved by the Board of Trustees, including a majority of the Independent Trustees, on June 4, 2015. The Present Advisory Agreement on behalf of the TFS Small Cap Fund was approved by shareholders of the Fund on February 26, 2010. |

| · | The Present Advisory Agreement on behalf of the TFS Hedged Futures Fund is dated December 15, 2011 and was amended effective January 1, 2014 for the purpose of lowering the advisory fee rate to 1.50% per annum of the Fund’s average daily net assets. The Present Advisory Agreement on behalf of the TFS Hedged Futures Fund was initially approved by the Board of Trustees, including a majority of the Independent Trustees, on December 15, 2011 and was last approved by the Board of Trustees on June 4, 2015. The Present Advisory Agreement on behalf of the TFS Hedged Futures Fund was approved by the initial shareholder of the Fund on December 29, 2011. |

The Expense Limitation Agreements. The Adviser and the Trust have entered into expense limitation agreements (the “Expense Limitation Agreements”) under which the Adviser has agreed, for the life of each Fund, to reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the annual operating expenses (excluding acquired fund fees and expenses and certain other expenses) to 1.90% for the TFS Market Neutral Fund, 1.50% for the TFS Small Cap Fund and 1.80% for the TFS Hedged Futures Fund. The Expense Limitation Agreements will remain in place regardless of whether shareholders approve the New Advisory Agreements. Under the terms of the Expense Limitation Agreements, the Adviser may recover from the Funds any management fee reductions and expense reimbursements for a period of three years after such fees or expenses were incurred, provided that the repayments do not cause the Fund’s total annual fund operating expenses (excluding acquired fund fees and certain other expenses) to exceed the agreed upon limits. If the Adviser decides in the future to lower a Fund’s expense cap arrangement, any reimbursements for previous management fee reductions and expense reimbursements will only be made if such repayments do not cause the Fund’s total annual fund operating expenses (excluding acquired fund fees and certain other expenses) to exceed the then current agreed upon limits. The amounts available for recapture will remain available to the Adviser regardless of whether the shareholders approve the New Advisory Agreements.

Advisory Fees Paid by the Funds and Advisory Fee Reductions. During the October 31, 2015 fiscal year, the Funds paid the following advisory fees to the Adviser:

| | Advisory Fees Accrued | Advisory Fee Reductions by the Adviser | Advisory Fees Received by the Adviser |

| TFS Market Neutral Fund | $12,230,156 | $425,955 | $11,804,201 |

| TFS Small Cap Fund | $1,205,064 | $190,498 | $1,014,566 |

| TFS Hedged Futures Fund | $321,855 | $233,949 | $87,906 |

As of October 31, 2015, the Adviser may recover fee reductions and expense reimbursements in the following amounts no later than the dates listed below. These amounts will remain available for recapture no later than the dates listed below regardless of whether the shareholders approve the New Advisory Agreements.

| | Recapture Amount by October 31, 2016 | Recapture Amount by October 31, 2017 | Recapture Amount by October 31, 2018 | Total Recapture Amount |

| TFS Market Neutral Fund | ----- | $205,839 | $425,955 | $631,794 |

| TFS Small Cap Fund | $33,364 | $77,861 | $190,498 | $301,723 |

| TFS Hedged Futures Fund | $58,934 | $157,600 | $233,949 | $450,483 |

The Transaction. Mr. Eiben, a controlling person of the Adviser, has entered into an agreement to sell his entire ownership interest in the Adviser to the remaining shareholders of the Adviser, effective within 60 days after the date shareholders approve the New Advisory Agreements or on such other date as agreed to by the parties (the “Transaction”). Mr. Eiben presently owns 25.3% of the Adviser and under applicable law, a person who owns beneficially 25% or more of the voting securities of a company is presumed to control such company. Because of this presumption the Transaction will result in a change of control of the Adviser. Under the 1940 Act and the terms of each Present Advisory Agreement, the Present Advisory Agreements will automatically terminate upon the consummation of the Transaction. However, the Transaction will not result in a change in the operations of the Adviser or the persons responsible for the day-to-day management of the Funds.

The New Advisory Agreements. Because the Transaction will result in the termination of the Present Advisory Agreements, the Board of Trustees has approved a new investment advisory agreement between the Trust, on behalf of each Fund, and the Adviser (the “New Advisory Agreements”) at an in-person meeting held on February 17, 2016.

Shareholders are being asked to vote on the New Advisory Agreement, on behalf of the applicable Fund. Each New Advisory Agreement is substantially identical to the Present Advisory Agreement and differs only with respect to the following changes, none of which management of the Trust believes to be material: (i) a change to the effective and termination date; (ii) incorporating the January 1, 2014 amendment to the Present Advisory Agreements into the body of the New Advisory Agreements. (The amendment was for the purpose of lowering the advisory fee rate paid by each Fund); and (iii) the addition of a forum selection clause.

The Trust is organized as an Ohio business trust and the validity of the Present Advisory Agreement and the New Advisory Agreement and the rights and liabilities of the Trust and the Adviser thereunder are determined in accordance with the laws of the State of Ohio to the extent such laws are consistent with the 1940 Act. The purpose of including the forum selection clause in Section 13 of the New Advisory Agreement is to provide considerable assurance to the Trust and the shareholders of the Funds that a court hearing any matter relating to the New Advisory Agreement has sufficient expertise in the applicable Ohio law. Accordingly, the forum selection clause provides that exclusive jurisdiction over any matter under the New Advisory Agreement shall lie in the Court of Common Pleas Commercial Docket sitting in Hamilton County, Ohio. Such expertise in Ohio law, in the Board’s opinion, should provide for a more efficient and equitable handling of any matter regarding the New Advisory Agreement.

Under the New Advisory Agreements, the Adviser will regularly provide investment advice to each Fund and continuously supervise the investment and reinvestment of cash, securities and other property composing the assets of each Fund and, upon making any purchase or sale decision, place orders for the execution of such portfolio transactions, all in accordance with the 1940 Act and any rules thereunder, the supervision and control of the Board of Trustees of the Trust and the investment policies, procedures and limitations of each Fund. Each of the New Advisory Agreements provides an advisory fee, computed and accrued daily and paid monthly, at the same contractual rate that exists in the Present Advisory Agreement.

If the New Advisory Agreement is approved by shareholders of the respective Fund, it will become effective upon the consummation of the Transaction. Each New Advisory Agreement will remain in force for an initial term of two years, and from year to year thereafter, subject to annual approval by (a) the Board of Trustees or (2) a vote of a majority of the outstanding voting shares (as defined in the 1940 Act) of such Fund. In either event, continuance of the New Advisory Agreements must also be approved by a majority of the Independent Trustees, by a vote cast in person at a meeting called for the purpose of voting on the continuance. The New Advisory Agreements may be terminated at any time, on 60 days’ written notice, without the payment of any penalty, by the Board of Trustees, by a vote of a majority of the outstanding voting shares of the applicable Fund, or by the Adviser. The New Advisory Agreements automatically terminate in the event of their assignment, as defined by the 1940 Act and the rules thereunder.

The New Advisory Agreements provide that the Adviser shall not be liable for any error of judgment or mistake of law or for any act or omission in the course of, or connected with, rendering services under the agreement or for any loss suffered by the Trust or the Fund or any shareholder of the Fund in connection with the performance of the agreement, except a loss resulting from willful misfeasance, bad faith, gross negligence or the reckless disregard of the obligations or duties thereunder on the part of the Adviser, or a breach of fiduciary duty with respect to receipt of compensation under the agreement.

The New Advisory Agreements will become effective upon consummation of the Transaction. If shareholders of a Fund do not approve the New Advisory Agreement, the Transaction will not be consummated and the Adviser will continue to serve as the investment adviser of the Funds pursuant to the terms of the Present Advisory Agreements. The form of the proposed New Advisory Agreement is attached as Exhibit A. The descriptions of the New Advisory Agreements set forth in this Proxy Statement are qualified in their entirety by reference to Exhibit A.

Information about the Present Advisory Agreement for the TFS Hedged Futures Strategy Offshore Fund Ltd. (Applicable to Shareholders of the TFS Hedged Futures Fund Only)

The TFS Hedged Futures Fund may invest up to 25% of its total assets in a wholly-owned and controlled Cayman Islands subsidiary, the TFS Hedged Futures Strategy Offshore Fund Ltd. (the “Subsidiary”). The TFS Hedged Futures Fund purchases investments in the Subsidiary to provide exposure to the commodity futures market, which otherwise may not be possible in a mutual fund structure. The Subsidiary is not registered under the 1940 Act and the TFS Hedged Futures Fund is the sole shareholder of the Subsidiary. The Adviser serves as the investment adviser to the Subsidiary pursuant to a separate investment advisory agreement, but receives no compensation for its services. In the event shareholders approve the New Advisory Agreement on behalf of the TFS Hedged Futures Fund, the TFS Hedged Futures Fund, as sole shareholder of the Subsidiary, will approve a New Advisory Agreement for the Subsidiary. The New Advisory Agreement for the Subsidiary will be substantially identical to the Present Advisory Agreement for the Subsidiary except for the effective and termination dates. Shareholders receiving this Proxy Statement are not being asked to approve the New Advisory Agreement for the TFS Hedged Futures Strategy Offshore Fund Ltd.

Information about the Adviser

TFS Capital LLC, is a limited liability company organized in Virginia and having its principal office located at 10 North High Street, Suite 500, West Chester, Pennsylvania 19380. The Adviser was founded in October 1997 and is a registered investment adviser to private investment funds (hedge funds) and open-end investment companies (mutual funds). Subject to the investment objectives and policies approved by the Trustees of the Trust, the Adviser manages each Fund’s portfolio, makes all investment decisions for each Fund, and continuously reviews, supervises and administers each Fund’s investment program. As of December 31, 2015, the Adviser had approximately $856 million in assets under management.

As of the date of this Proxy Statement, Messrs. Eiben, Richard Gates, Kevin Gates, Chen and Newman own in the aggregate all of the outstanding voting interests of the Adviser. Following the Transaction, Messrs. Richard Gates, Kevin Gates, Chen and Newman will own in the aggregate all of the outstanding interests of the Adviser. Mr. Richard Gates and Mr. Kevin Gates will each continue to beneficially own more than 25% of the voting stock of the Adviser following the Transaction and will be presumed to control the Adviser.

The following is a list of the current executive officers of the Adviser and their current position with the Trust. The address of each officer is 10 North High Street, Suite 500, West Chester, Pennsylvania 19380.

| Name | Position with the Adviser | Position with the Trust |

| Eric S. Newman | Owner, Co-Portfolio Manager and Chief Investment Officer | President |

| Kevin J. Gates | Owner, Co-Portfolio Manager | Vice President |

| Richard J. Gates | Owner, Co-Portfolio Manager | Vice President |

| Dr. Chao Chen | Owner | None |

| Lawrence S. Eiben | Owner | Trustee |

| Gregory M. Sekelsky | Chief Financial Officer | None |

| Steven G. Soles | General Counsel | None |

| Mary K. Ziegler | Chief Compliance Officer | None |

| Mark F. Schlegel | Chief Operating Officer | None |

Evaluation by the Board of Trustees

At an in-person meeting held on February 17, 2016, the Board of Trustees considered whether to approve the New Advisory Agreements, on behalf of each Fund. To assist the Board in considering the New Advisory Agreements, the Adviser provided the Board with various written materials in advance of the meeting, including information about the Transaction and updated financial and performance information. At the February 17, 2016 meeting, the Board considered that the contractual terms and conditions of the Present Advisory Agreements and the New Advisory Agreements are substantially identical and differ only with respect to the following changes, none of which management of the Trust believes to be material: (i) a change to the effective and termination date; (ii) incorporating the January 1, 2014 amendment to the Present Advisory Agreements into the body of the New Advisory Agreements (The amendment was for the purpose of lowering the advisory fee rate paid by each Fund); and (iii) the addition of a forum selection clause.

The Board of Trustees was advised that Section 15(f) of the 1940 Act provides that when a change in the control of an investment adviser occurs, the investment adviser or any of its affiliated persons (such as Mr. Eiben) may receive any amount or benefit in connection therewith as long as two conditions are satisfied.

| · | An “unfair burden” must not be imposed on the investment company as a result of the transaction relating to the change in control, or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” includes any arrangement during the two-year period after the change in control where the investment adviser (or predecessor or successor adviser), or any interested person of such adviser receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its shareholders (other than fees for bona fide investment advisory or other services) or from any person, in connection with the purchase or sale of securities or other property to, from, or on behalf of the investment company (other than fees for bona fide principal underwriting services). The Board and the Adviser are not aware of any actual or potential “unfair burden” of the type contemplated by Section 15(f). |

| · | During the three-year period immediately following consummation of the Transaction, at least 75% of the Trust’s Board of Trustees must not be “interested persons” of the investment adviser or predecessor investment adviser within the meaning of the 1940 Act. The Board currently satisfies the requirement and will continue to do so following the election of trustees (see Proposal 2). |

The Trustees determined that the scope, quality, and nature of services, to be provided by the Adviser and the fees to be paid to the Adviser under the New Advisory Agreements will be substantially the same as to the scope, quality and nature of services provided, and fees paid, under the Present Advisory Agreements. As part of the discussion, the Adviser stressed that no changes were anticipated in its operations or approach to the portfolio management process for the Funds as a result of the Transaction. The Board also determined that the Transaction would not likely have an adverse effect on the performance of the Funds because no changes to the Funds’ portfolio management team are being contemplated as a result of the Transaction. The Board further concluded that the profitability of the Adviser is not expected to increase as a result of the Transaction.

The Independent Trustees discussed the proposed approval of the New Advisory Agreements with management and also met in Executive Session where the Independent Trustees were advised by independent counsel of their legal and fiduciary obligations in approving the New Advisory Agreements. The Board determined that the overall arrangement between each Fund and the Adviser, as provided in the New Advisory Agreements, was fair and reasonable and that approval of the New Advisory Agreements was in the best interests of each Fund and its shareholders. The Board of Trustees, with the Independent Trustees voting separately, unanimously approved each of the New Advisory Agreements and recommended approval of the New Advisory Agreements to each Fund’s shareholders to become effective upon consummation of the Transaction. Mr. Eiben is a party to and will benefit from the Transaction and, as an interested Trustee, voted to approve the New Advisory Agreements.

Throughout this process, the Independent Trustees were advised and supported by independent counsel having experience in the 1940 Act and other federal securities law matters. The following describes the Trustees’ considerations at the February 17, 2016 meeting:

Nature, extent and quality of services

The Trustees received and considered information on the responsibilities of the Adviser under the New Advisory Agreements, noting that the Adviser is responsible for providing each Fund with investment research and advice, and determining the securities to be purchased and sold in accordance with the investment objective and policies of each Fund. The Trustees gave weight to the Adviser’s representations that (i) the responsibilities of the Adviser under the New Advisory Agreements are substantially the same in all material respects as under the Present Advisory Agreements; (ii) the operations of the Adviser and the level or quality of advisory services provided to the Funds will not be materially affected as a result of the New Advisory Agreements; (iii) the same personnel of the Adviser who currently provide investment advisory services to the Funds will continue to do so upon approval of the New Advisory Agreements. The Trustees reviewed the qualifications, backgrounds and responsibilities of the advisory personnel primarily responsible for the day-to-day management of the Funds and were mindful that no changes to the personnel responsible for the daily portfolio management of the Funds are contemplated as a result of the Transaction. The Trustees discussed and considered the quality of administrative and other services provided to the Trust, the Adviser’s compliance program and the Adviser’s role in coordinating services and programs for the purpose of mitigating compliance risks. The Trustees considered the operational changes of the Adviser over the past year, which included a reallocation of resources and responsibilities among the Adviser’s existing senior personnel and the hiring of additional personnel. They noted that Eric Newman was named Chief Investment Officer of the Adviser in July 2014, managing the analysis and technology teams of the Adviser and continuing his service as a portfolio manager of the Funds. The Trustees considered that all of the operational and personnel changes at the Adviser noted herein have taken place seamlessly with no negative impact to the Funds and their respective shareholders.

The Trustees considered the Adviser’s responsibilities with regards to brokerage selection and best execution. The Trustees also considered that the Adviser does not participate in “soft dollar” arrangements.

After reviewing the foregoing information, the Trustees concluded that the quality, extent and nature of the services provided by the Adviser to each Fund were satisfactory.

Investment Performance of the Funds

The Trustees compared the performance of the TFS Market Neutral Fund with the performance of the Standard & Poor’s 500 Index (“S&P 500 Index”), the Fund’s primary benchmark, for the one year periods ended October 31, 2013, 2014 and 2015 and the since inception period ended October 31, 2015. They discussed the TFS Market Neutral Fund’s underperformance for the stated periods, finding that the Fund’s investment strategies are not designed to keep pace or outperform the S&P 500 Index during periods when the market is experiencing a broad-based rally and/or when the market is favoring large capitalization companies. The Trustees were also provided with comparative performance statistics of the universe of funds categorized by Morningstar as “market neutral” funds. The Trustees noted that the TFS Market Neutral Fund’s returns were higher than the average fund in the market neutral category over the five and ten year periods ended December 31, 2015 but trailed the performance of the average fund in the category for the one and three year periods ended December 31, 2015. The Trustees reviewed performance information with respect to the Adviser’s other managed accounts, concluding that due to the differences in how these accounts are managed, the comparison is not particularly relevant. The Trustees also considered the consistency of the Adviser’s management of the TFS Market Neutral Fund with the Fund’s investment objective and policies. After considerable discussion, the Trustees concluded that the overall investment performance of the TFS Market Neutral Fund has been above average.

The Trustees compared the performance of the TFS Small Cap Fund with the performance of the Russell 2000 Index, the Fund’s primary benchmark, for the one year periods ended October 31, 2013, 2014 and 2015 and the since inception period ended October 31, 2015. It was noted by the Trustees that the TFS Small Cap Fund outperformed the Russell 2000 Index for each of the stated periods. The Independent Trustees were also provided with comparative performance statistics of the universe of funds categorized by Morningstar as “small cap blend” funds, which is the category to which the TFS Small Cap Fund has been assigned. The Independent Trustees noted that the TFS Small Cap Fund’s returns were higher than the returns of the average fund in the small cap blend category for the three and five year periods ended December 31, 2015 but trailed the performance of the average fund in the category for the one year period ended December 31, 2015. They also reviewed performance information with respect to the Adviser’s other clients but concluded that none of these clients provided a good comparison due to differences in investment objectives. The Trustees considered the consistency of the Adviser’s management of the TFS Small Cap Fund with the Fund’s investment objective and policies. After further discussion, the Trustees concluded that the investment performance of the TFS Small Cap Fund has been above average.

The Trustees next compared the performance of the TFS Hedged Futures Fund to the performance of the Standard & Poor’s Diversified Trends Indicator (“S&P DTI”), the Fund’s primary benchmark, for the one year periods ended October 31, 2013, 2014 and 2015 and the since inception period ended October 31, 2015. It was noted by the Trustees that the TFS Hedged Futures Fund outperformed the S&P DTI for the most recent one year period ended October 31, 2015 and the since inception period ended October 31, 2015, but trailed the performance of the S&P DTI for the one year periods ended October 31, 2013 and 2014. The Trustees were also provided with comparative performance statistics of the universe of funds categorized by Morningstar as “managed futures” funds, which is the category to which the TFS Hedged Futures Fund has been assigned. The Trustees noted that the TFS Hedged Futures Fund outperformed the average returns for the funds in the managed futures category for the one year period ended December 31, 2015 but trailed the performance of the average fund in the category for the three period ended December 31, 2015. The Trustees also reviewed performance information with respect to the Adviser’s other clients but concluded that none of these other clients provided a good comparison due to differences in investment objectives. The Trustees considered the consistency of the Adviser’s management of the TFS Hedged Futures Fund with the Fund’s investment objective and policies. They also discussed the TFS Hedged Futures Fund’s lack of correlation to the other funds in the managed futures category along with other broad based securities indices. After further discussion, the Trustees concluded that the investment performance of the TFS Hedged Futures Fund has been satisfactory.

Cost of Services and Profits to be Realized by the Adviser

The Trustees compared the rate of advisory fees that will be paid by the Funds under the New Advisory Agreements with average advisory fee ratios of similar mutual funds compiled from statistics reported by Morningstar. They also compared the total operating expense ratios of the Funds during the most recent fiscal year with average expense ratios of representative funds in their respective Morningstar categories. The Trustees found that each Fund’s current advisory fee rate was higher than the average advisory fee rate and the overall expense ratios were higher than the average expense ratios in its comparative Morningstar category, except the overall expense ratio for the TFS Hedged Futures Fund was lower than the average expense ratio for the Morningstar managed futures category. The Independent Trustees noted that the Adviser has agreed to continue the expense limitation agreements for each Fund for the life of the Fund (assuming the Adviser continues to serve as investment adviser) following the approval by shareholders of the New Advisory Agreements.

The Independent Trustees next considered the Adviser’s analysis of its revenues and expenses with respect to the services provided to each Fund for the one-year period ended December 31, 2015. They discussed the impact the advisory fee reductions and lower expense cap arrangements have had on the revenues of the Adviser and noted that overall revenues derived by the Adviser from its management of the Funds has decreased over the past two years. They noted that, although the Adviser continues to receive significant revenue from the TFS Market Neutral Fund, there are significant costs associated with managing the TFS Market Neutral Fund, especially in the areas of research and development, retention of its investment professionals and hiring new personnel. The Independent Trustees further considered that the investment and research process utilized by Adviser is broader and more sophisticated than the process used by most other investment advisers as it involves frequent position rebalancing, trading in small capitalization companies, the development of proprietary multiple trading models and the use of a team approach that involves many participants. The Independent Trustees next reviewed the balance sheet of the Adviser as of December 31, 2015, noting that the Adviser is financially stable and has assets sufficient to satisfy its commitments to the Funds. The Independent Trustees also discussed the structure of the Transaction, concluding that the Transaction will not directly impact the financial condition of the Adviser. The Independent Trustees considered the “fallout benefits” to the Adviser, including the additional exposure the Adviser has received as a result of managing the Funds. After a thorough discussion and consideration of the foregoing, the Trustees concluded that the fees to be paid by each Fund to the Adviser are reasonable in light of the quality of the services received.

Economies of Scale

The Independent Trustees noted that each Fund’s New Advisory Agreement does not contain breakpoints. They further noted that the Adviser has agreed to continue its contractual fee reductions and expense reimbursement arrangements with each Fund. The Independent Trustees noted that the Adviser has waived a portion of its advisory fee and absorbed operating expenses for each Fund during the October 31, 2015 fiscal year to the extent necessary to limit the Fund’s annual operating expenses to the contractual amounts. The Independent Trustee concluded that due to the Adviser’s commitment to maintain the advisory fees and expense limitations at their current levels, it is not necessary or appropriate at this time to consider adding fee breakpoints to the advisory fee schedule for the Funds.

The Board of Trustees recommends that shareholders of each Fund vote FOR the New Advisory Agreements.

PROPOSAL 2: TO ELECT FOUR NOMINEES TO SERVE ON THE BOARD OF TRUSTEES

Shareholders are being asked to elect four Nominees to serve on the Board of Trustees of the Trust to ensure that at least two-thirds of the members of the Board have been elected by shareholders of the Trust as required by the 1940 Act. Each of the four Nominees, except for Eric S. Newman, currently serves on the Board. Of the three Nominees that currently serve on the Board, two have been elected by shareholders. Mr. Lawrence S. Eiben has indicated his intention to resign from the Board of Trustees upon the election of Mr. Newman. Mr. Eiben has served as an Interested Trustee of the Trust under the 1940 Act because he is an owner of the Adviser and has served as a principal executive officer, manager and employee of the Adviser. Mr. Newman has been appointed by the Board of Trustees to fill the vacancy created by the resignation of Mr. Eiben. If elected by shareholders, Mr. Newman will be an Interested Trustee because he is an owner and employee of the Adviser.

The Nominating Committee of the Board of Trustees (the ‘Nominating Committee”), which is comprised entirely of the Independent Trustees, is responsible for nominating, selecting and appointing the Trustees to stand for election. The Nominating Committee has recommended, with the approval of the Board of Trustees, that the following individuals stand for election by shareholders of the Funds: Gregory R. Owens, Mark J. Malone, Brian O’Connell and Eric S. Newman (the “Nominees”), who are described herein. Except for Mr. Newman, all the Nominees currently are Trustees and have served in that capacity for the length of time indicated in the table below.

On February 17, 2016 the Nominating Committee, which currently consists of three Independent Trustees, met to review pertinent information on the nomination of Mr. Newman to the Board of Trustees. After considering Mr. Newman’s background and experience with the Adviser and his service as President of the Trust, the Nominating Committee selected and nominated Mr. Newman for election as a Trustee. Prior to nominating Mr. Newman, the Board discussed Mr. Newman’s ownership in the Adviser and considered that his ownership interest will be increased upon the consummation of the Transaction. The Board of Trustees is asking shareholders to vote on the election of Eric S. Newman as well as the election of three current Trustees, Gregory R. Owens, Mark J. Malone and Brian O’Connell, to serve on the Board. These elections are requested to ensure that at least two-thirds of the members of the Board of Trustees have been elected by shareholders as required by the 1940 Act.

The term of office of each Nominee will be until he resigns, is removed, dies, or becomes incapacitated or otherwise unable to serve. Each Nominee has indicated a willingness to serve as a member of the Board of Trustees if elected. If any of the Nominees should not be available for election, the persons named as proxies (or their substitutes) may vote for other persons in their discretion. However, management has no reason to believe that any Nominee will be unavailable for election. The Board of Trustees recommends that you vote in favor of the election of each Nominee.

The Board of Trustees Generally

The Board of Trustees oversees the management of the Trust and meets in person at regularly scheduled meetings four times throughout the year to review reports about the Trust’s operations. In addition, the Trustees may meet in person or by telephone at special meetings. The Independent Trustees also meet at least quarterly in Executive Session without the presence of any representatives of management. The Board of Trustees provides broad supervision over the affairs of the Trust. The Board of Trustees, in turn, elects the officers of the Trust to actively supervise the Funds’ day-to-day operations. Subject to the 1940 Act, the Declaration of Trust and applicable Ohio law, the Trustees may fill vacancies in or increase or decrease the number of Board members, and may elect and remove such officers and appoint and terminate such agents as they consider appropriate. The Trustees may appoint from their own number and establish and terminate one or more committees consisting of two or more Trustees who may exercise the powers and authority of the Board to the extent that the Trustees determine. The Trustees may, in general, delegate such authority as they consider desirable to any officer of the Trust, to any Committee of the Board and to any agent or employee of the Trust.

The Declaration of Trust for the Trust protects the Trustees and officers against personal liability for any act, omission or obligation in their capacity as Trustee or officer of the Trust, except that no Trustee or officer shall be indemnified against any liability to the Trust or its shareholders to which such Trustee or officer would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of the office of Trustee or officer of the Trust.

Identifying and Evaluating Trustee Nominees. The Nominating Committee reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board. In evaluating a candidate for nomination or election as a Trustee, the Nominating Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Nominating Committee believes contribute to good governance for the Trust. The Nominating Committee has not developed a formal policy with regards to the diversity of Board membership as it believes the primary purpose behind the process of identifying and evaluating potential nominees is to find the best possible nominee. The Board has concluded, based on each Nominee’s experience, qualifications, attributes and skills, on an individual basis and in combination with the other Nominees, that each Nominee is qualified to serve on the Board. The Board believes that the Nominees’ ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Adviser, other service providers, legal counsel and the independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Trustees support this conclusion. In determining that a particular Nominee is qualified to serve as a Trustee, the Board considers a variety of criteria, none of which, in isolation, is controlling. In identifying potential nominees for the Board, the Nominating Committee may consider candidates recommended by one or more of the following sources: (i) the current Trustees; (ii) the Trust’s officers; (iii) the Adviser; and (iv) any other source the Independent Trustees deem to be appropriate. The Trust has not adopted procedures by which shareholders of the Funds may recommend nominees to the Board of Trustees.

Set forth below is a summary of the specific experience, qualifications, attributes and/or skills for each Nominee. In determining that a particular Nominee is and will continue to be qualified to serve as a Trustee, the Nominating Committee considers a variety of criteria, none of which, in isolation, is controlling. References to the qualifications, attributes and skills of Nominees are being made pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out the Board or any Nominee as having any special expertise or experience, and shall not impose any greater responsibility on any such person or on the Board by reason thereof.

| Independent Trustee Nominees |

| Gregory R. Owens | Gregory R. Owens is an independent financial strategy consultant and Managing Director with The Fahrenheit Group in Richmond, VA. Mr. Owens served as an executive in the Finance organization of Capital One Financial Corporation from 1996 to March 2015. He holds a B.S. in Accounting from The Pennsylvania State University and Masters in Business Administration from the University of Richmond. In addition, he is a former Certified Public Accountant in the audit practice of Arthur Andersen & Co. from 1988 to 1994. Mr. Owens has been a Trustee of the Trust since October 2011. The Board has concluded that Mr. Owens is suitable to serve as a Trustee because of his business and finance acumen and academic background. |

| Mark J. Malone | Mark J. Malone has been Managing Director of Institutional Equities of Guggenheim Securities, LLC since February 2015. Mr. Malone served as Managing Director of Janney Capital Markets from December 2013 to February 2015. From March 2008 to December 2013, he was a Managing Director of Lazard Capital Markets. Mr. Malone holds a B.S. in Business Administration from the University of Richmond. He has been a Trustee of the Trust since 2004. The Board has concluded that Mr. Malone is suitable to serve as a Trustee because of his past service and experience as a Trustee of the Trust, his professional investment and business experience and his academic background. |

| Brian O’Connell | Brian O’Connell has been a freelance writer covering business news and trends in the financial, Internet and technology sectors since 1994. Prior to 1994 Mr. O’Connell was a senior writer and/or editor of several financial publications. From 1983 to 1989, Mr. O’Connell worked on the Philadelphia Stock Exchange and on the fixed income trading desk of the Delaware Funds as a bond trader. Mr. O’Connell has authored 10 books on various financial topics and has appeared as an expert commentator on business issues for networks such as CNN, Fox News, Bloomberg and other broadcast media outlets. Mr. O’Connell holds a B.A. degree in Journalism from the University of Massachusetts. He has been a Trustee of the Trust since 2004. The Board has concluded that Mr. O’Connell is suitable to serve as a Trustee because of his past service and experience as a Trustee of the Trust and his professional investment and business experience and his academic background. |

| Interested Trustee Nominee |

| Eric S. Newman | Mr. Newman has been President of the Trust since January 2015 and has served as a co-portfolio manager of each Fund since its inception. He is an owner, co-portfolio manager and Chief Investment Officer of the Adviser, primarily responsible for strategy development and security analysis and assists with the execution of trades. He has worked in this capacity at the Adviser since 2003. Prior to that date, he was employed by Capital One Financial Corporation as an analyst from December 2000 until February 2003. Mr. Newman holds a B.A. degree in Mathematics from Kenyon College and an M.S.E. in Mathematical Sciences from John Hopkins University. The Board has concluded that Mr. Newman is suitable to serve as a Trustee because of his past service and experience as co-portfolio manager, owner and Chief Investment Officer of the Adviser, his professional investment and business experience and his academic background. |

The following is a list of Nominees, whose business address is 10 North High Street, Suite 500, West Chester, Pennsylvania 19380. The Nominee who is an “Interested Trustee of the Trust is indicated as such below and the other Nominees are Independent Trustees; that is, they are not considered “interested persons” of the Trust under the 1940 Act because they are not employees or officers of, and have no financial interest in, the Trust’s affiliates or its service providers. No Nominee holds any directorships of any other investment company registered under the 1940 Act or any company whose securities are registered under the Securities Exchange Act of 1934 or who file reports under that Act.

| Name and Year of Birth | Position(s) held with the Trust | Length of Time Served | Principal Occupation During Past Five Years* | Number of Portfolios in Fund Complex** Overseen |

| Independent Trustees | | | | |

Gregory R. Owens (1966 ) | Trustee and Nominee | Since October 2011 | Managing Director with The Fahrenheit Group since April 2015; Finance Executive with Capital One Financial Corp. 1996 to 2015; CPA & auditor with Arthur Andersen & Co. 1988 to 1994 | 3 |

Mark J. Malone (1966) | Trustee and Nominee | Since June 2004 | Managing Director Institutional Equities of Guggenheim Securities, LLC since February 2015; Managing Director of Janney Capital Markets from December 2013 to February 2015; Managing Director of Lazard Capital Markets from March 2008 to December 2013 | 3 |

Brian O’Connell (1959) | Trustee and Nominee | Since June 2004 | Independent writer/author | 3 |

| Interested Trustee |

Eric S. Newman (1974)*** | President and Nominee | President Since 2015 | President of the Trust since January 2015; Owner, Co-Portfolio Manager and Chief Investment Officer of the Adviser | 3**** |

| * | None of the Trustees are directors of public companies. |

| ** | The Fund Complex consists of the TFS Market Neutral Fund, TFS Small Cap Fund and TFS Hedged Futures Fund. |

| *** | Eric Newman, as an affiliated person of the Adviser is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. |

| **** | Reflects the number of Funds that would be overseen by Mr. Newman if elected by shareholders. |

The following is a list of the executive officers of the Trust. The business address of each executive officer is 10 N. High Street, Suite 500, West Chester, Pennsylvania 19380, except for Messrs. Dorsey, Bridge and Seger, whose business address is 225 Pictoria Drive, Cincinnati, Ohio 45246 and Mr. Jones, whose business address is 442 Fleming Street, Suite 7, Key West, Florida. No changes to the executive officers of the Trust are being contemplated as a result of the Transaction.

Executive Officers |

Name and Year of Birth | Length of Time Served | Position held with the Trust | Principal Occupations(s) During Past Five Years |

Eric S. Newman (1974) | Since January 2015 | President | President of the Trust since January 2015; Owner, Co-Portfolio Manager and Chief Investment Officer of the Adviser |

Kevin J. Gates (1971) | Since October 2011 | Vice President | Owner and Co-Portfolio Manager of the Adviser |

Richard J. Gates (1971) | Since October 2011 | Vice President | Owner and Co-Portfolio Manager of the Adviser |

Robert G. Dorsey (1957) | Since June 2004 | Vice President | Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, the administrator and underwriter, respectively for the Trust |

Mark J. Seger (1962) | Since June 2004 | Treasurer | Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC |

Wade R. Bridge (1968) | Since June 2011 | Secretary | Director of Administration of Ultimus Fund Solutions, LLC and Vice President of Ultimus Fund Distributors, LLC |

David D. Jones (1957) | Since December 2007 | Chief Compliance Officer | Managing Member of Drake Compliance, LLC, a compliance service provider |

| * | Kevin Gates and Richard Gates are brothers |

Board Leadership Structure, Risk Oversight and Committee Arrangements

The Board of Trustees currently consists of four Trustees, three of whom are Independent Trustees. The proposed resignation of Mr. Eiben and the proposed addition of Mr. Newman would maintain a Board of Trustees of four, three of whom will be Independent Trustees. The Board is responsible for the oversight of the Trust, the Adviser and the Trust’s other service providers in the operations of the Funds in accordance with the 1940 Act, other applicable federal and state laws, and the Declaration of Trust. The Independent Trustees have engaged independent legal counsel, and may from time to time engage consultants and other advisors to assist them in performing their oversight responsibilities. Each current Trustee attended 75% or more Board meetings held during the most recently completed fiscal year and 75% or more committee meetings held by the committees of the Board on which he served.

Board Leadership. If elected by shareholders, the Board of Trustees will be led by its President and Trustee nominee, Eric Newman. Mr. Newman is an Interested Person of the Trust because he is an owner, Chief Investment Officer and Co-Portfolio Manager of the Adviser. Mr. Newman has served in various leadership capacities at the Adviser since February 2003 and presently works closely with the Board, reporting on the investment operations of the Funds. Mr. Newman currently provides quarterly updates on Fund performance which include updates relating to the investment models used to manage the assets of the Funds. If elected to the Board, Mr. Newman will participate with officers of the Adviser, the Trust’s service providers and independent legal counsel in setting the agenda for each Board meeting. He will also serve with officers of the Adviser and other Trustees as the Board’s liaison with the various service providers. The Board has determined that the addition of Mr. Newman provides the Board with considerable insight into the day-to-day portfolio management of the Funds. Additional principals and employees of the Adviser participate in Board meetings to provide information regarding trading, distribution, compliance and operations.

The Board of Trustees has not appointed a lead “independent trustee.” It was determined by the Board that due to its size and the size of the fund complex, it is not necessary to appoint a lead “independent trustee.” The Independent Trustees believe that they have consistently worked well together and have demonstrated an ability to provide appropriate oversight to the operations of the Funds. The Board reviews its structure regularly and believes that its leadership structure, including having a majority of Independent Trustees, coupled with the responsibilities undertaken by Mr. Newman is appropriate and in the best interests of the Trust, given its specific characteristics. The Board also believes its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from Trust management and legal counsel.

Board Committees. The Board has established an Audit Committee, a Nominating Committee and a Qualified Legal Compliance Committee (“QLCC”). The Board of Trustees has determined that its committees help ensure that the Funds have effective and independent governance and oversight. The members of the Audit Committee, the Nominating Committee and the QLCC are the three Independent Trustees: Gregory R. Owens, Mark J. Malone and Brian O’Connell. The members of these Committees have indicated their intention to continue serving on such Committees following their election.

Audit Committee. The Audit Committee is led by its Chairman, Gregory R. Owens, and assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Trust. The Audit Committee is responsible for selecting the Trust’s independent registered public accounting firm, reviewing the methods, scope, and results of the audits, approving the fees charged for audit and non-audit services, and reviewing the Trust’s internal accounting procedures and controls. The Audit Committee met two times during the fiscal year ended October 31, 2015.

Nominating Committee. The Nominating Committee is charged with the duty of nominating all Independent Trustees and committee members, and presenting these nominations to the Board. The Nominating Committee does not currently consider nominees recommended by shareholders. The Nominating Committee meets as necessary and did not meet during the fiscal year ended October 31, 2015.

Qualified Legal Compliance Committee. The QLCC is responsible for receiving and investigating reports from attorneys representing the Trust of material violations of securities laws, material breaches of fiduciary duty or similar material violations. The QLCC meets as necessary and did not meet during the fiscal year ended October 31, 2015.

Risk Oversight. An integral part of the Board’s overall responsibility for overseeing the management and operations of the Trust is the Board’s oversight of the risk management of the Trust’s investment programs and business affairs. The Funds are subject to a number of risks, such as investment risk, valuation risk, operational risk, and legal, compliance and regulatory risk. The Trust, the Adviser and other service providers have implemented various processes, procedures and controls to identify risks, to lessen the probability of their occurrence and to mitigate any adverse effect should they occur. Different processes, procedures and controls are employed with respect to different types of risks. These systems include those that are embedded in the conduct of the regular operations of the Board and in the regular responsibilities of the officers of the Trust and the other service providers.

The Board exercises oversight of the risk management process through the Board itself and through its committee structure. In addition to adopting, and periodically reviewing, policies and procedures designed to address risks to the Funds, the Board of Trustees requires management of Adviser and the Trust, including the Trust’s Chief Compliance Officer, to regularly report to the Board and the Committees on a variety of matters, including matters relating to risk management. The Board and the Audit Committee receive regular reports from the Trust’s independent registered public accounting firm on internal control and financial reporting matters. On at least an annual basis, the Independent Trustees meet separately with the Trust’s Chief Compliance Officer, outside the presence of management, to discuss issues related to compliance. Furthermore, the Board receives an annual written report from the Trust’s Chief Compliance Officer regarding the operation of the compliance policies and procedures of the Trust and its primary service providers.

The Board receives quarterly reports from Adviser on the investments and securities trading of the Funds, including investment performance, as well as reports regarding the valuation of the Funds’ securities. The Board also receives quarterly reports on purchases and redemptions of Fund shares. In addition, in its annual review of the Funds’ investment advisory agreements, the Board reviews information provided by the Adviser relating to its operational capabilities, financial condition and resources. The Board conducts an annual self-evaluation that includes a review of its effectiveness in overseeing, among other things, the number of funds overseen by the Board and the effectiveness of the Board’s committee structure.

Although the risk management policies of the Adviser and the Trust’s other service providers are designed to be effective, those policies and their implementation vary among service providers and over time, and there is no guarantee that they will be effective. Not all risks that may affect the Trust can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are simply beyond the control of the Trust, the Adviser and other service providers to the Trust. The Board may at any time, and in its sole discretion, change the manner in which it conducts its risk oversight role.

Beneficial Ownership of Shares of the Funds. The table below shows, for each Trustee/Nominee, the value of shares of the Funds beneficially owned, and the aggregate value of investments in shares in the Fund Complex, as of December 31, 2015:

| Name of Trustee | Dollar Range of Fund Shares Owned by Nominee | Aggregate Dollar Range of Shares of All Funds in Fund Complex* Overseen by Nominee |

| Independent Trustees |

| Gregory R. Owens | $10,001- $50,000: TFS Market Neutral Fund Over $100,000: TFS Small Cap Fund $10,001 - $50,000: TFS Hedged Futures Fund | Over $100,000 |

| Mark J. Malone | Over $100,000: TFS Market Neutral Fund $50,001- $100,000: TFS Small Cap Fund $50,001 - $100,000: TFS Hedged Futures Fund | Over $100,000 |

| Brian O’Connell | $1-$10,000: TFS Market Neutral Fund $ 0: TFS Small Cap Fund $ 0: TFS Hedged Futures Fund | $1-$10,000 |

| Interested Trustee |

| Eric S. Newman | Over $100,000: TFS Market Neutral Fund Over $100,000: TFS Small Cap Fund Over $100,000: TFS Hedged Futures Fund | Over $100,000 |

| * | The Fund Complex consists of the TFS Market Neutral Fund, TFS Small Cap Fund and TFS Hedged Futures Fund. |

Ownership in Fund Affiliates. As of the Record Date, none of the Independent Trustees or members of their immediate families, owned, beneficially or of record, securities of the Adviser, Ultimus Fund Distributors, LLC, the Funds’ principal underwriter or any affiliate of the Adviser or the principal underwriter.

Compensation. Officers of the Trust and the Trustees who are Interested Trustees receive no salary from the Trust. Each Independent Trustee receives from the Trust an annual retainer of $20,000 payable in quarterly installments, a fee of $7,500 for each regularly scheduled meeting attended in person; a fee of $2,500 for each telephone meeting attended; and a fee of $1,500 for attending special meetings of the Board. The Chairman of the Audit Committee receives an additional fee of $1,000 for each Audit Committee meeting attended. The table below reflects the amount of compensation received by each Nominee during the fiscal year ended October 31, 2015:

| Trustee | Aggregate Compensation From each Fund | Pension or Retirement Benefits Accrued As Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Fund Complex* Paid to Trustees |

| Gregory R. Owens | $12,833 | None | None | $34,500 |

| Mark J. Malone | $10,833 | None | None | $32,500 |

| Brian O’Connell | $10,833 | None | None | $32,500 |

| Eric S. Newman** | None | None | None | None |

| * | The Fund Complex consists of the TFS Market Neutral Fund, TFS Small Cap Fund and TFS Hedged Futures Fund. |

| ** | Mr. Newman, if elected by shareholders, will be considered an Interested Trustee and, as a result, will not receive any compensation from the Trust for his service as Trustee. |

PROPOSAL 3: TO APPROVE ADJOURNMENTS OF THE MEETING FROM TIME TO TIME TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE MEETING TO CONSITUTTE A QUORUM OR TO APPROVE THE OTHER PROPOSALS.

The purpose of this proposal is to allow the holder of proxies solicited hereby to vote the shares represented by proxies in favor of adjournment of the Meeting to a later time, in order to allow more time to solicit additional proxies, as necessary if there are insufficient votes at the time of the Meeting to approve the other Proposals.

Any adjournment may be made without notice, other than by an announcement made at the Meeting, of the time, date and place of the adjourned meeting.

Any adjournment of the Meeting for the purpose of soliciting additional proxies will allow Shareholders who have already sent in their proxies to revoke them at any time prior to their use at the Meeting, as adjourned.

If Proposal 3 is approved and a quorum to transact business is not present or the vote required to approve the other Proposals is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with the Trust’s Declaration of Trust and applicable law to permit such further solicitation of proxies as may be deemed necessary or advisable.

Approval of Proposal 3 for the power to adjourn the Meeting will require the affirmative vote of a majority of the shares voted, whether or not a quorum is present.

If your proxy card is signed and dated and no instructions are indicated on your proxy card, your shares will be voted “FOR” the proxy holder having discretionary authority to approve any adjournment of the Meeting, if a quorum is not present, in person or by proxy, at the Meeting or if necessary to solicit additional proxies to approve the other Proposals.

PROPOSAL 4: TO TRANSACT ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF IN THE DISCRETION OF THE PROXIES OR THEIR SUBSTITUTES

The proxy holders have no present intention of bringing any other matter before the Meeting other than the matters described herein or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS