1 American Campus Communities Other Placeholder: Investor Presentation January 2009 Exhibit 99.1

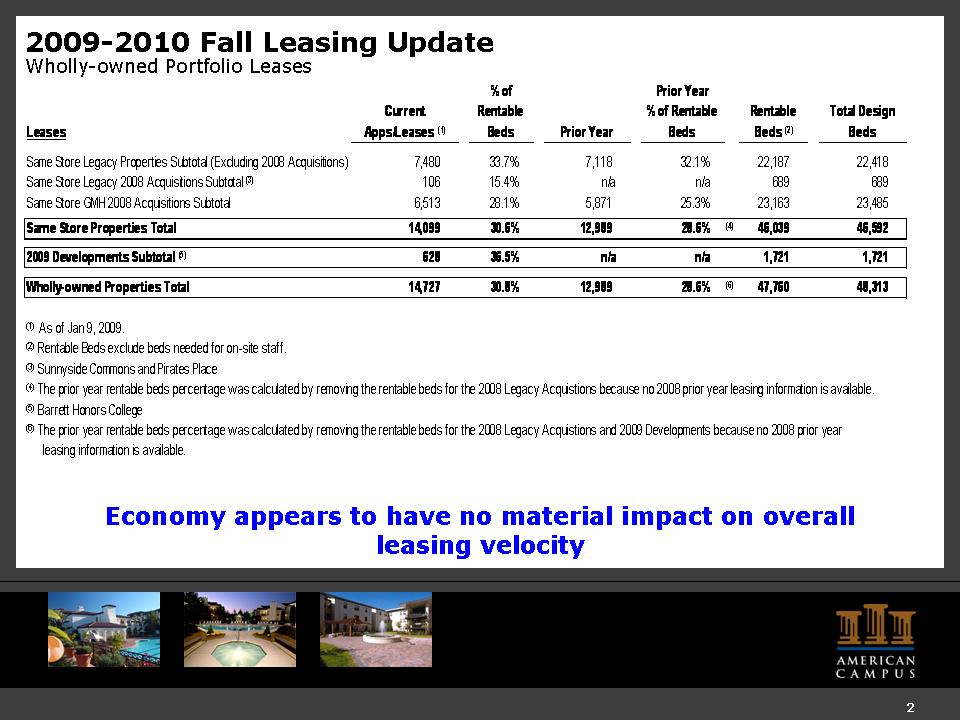

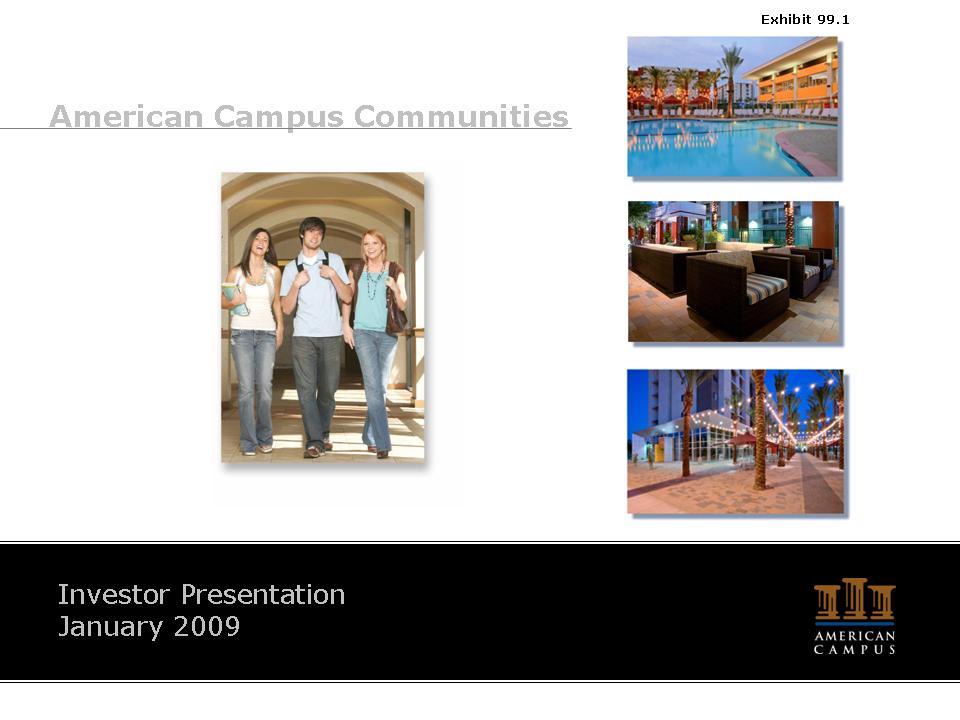

2 2009-2010 Fall Leasing Update Wholly-owned Portfolio Leases Economy appears to have no material impact on overall leasing velocity Leases Current Apps/Leases (1)% of Rentable BedPrior Year Prior Year Rentable Beds (Total Design Beds Same Store Legacy Properties Subtotal (Excluding 2008 Acquisitions) 7,480 33.7% 7,118 32.1% 22,187 22,418 Same Store Legacy 2008 Acquisitions Subtotal (3) 106 15.4% n/a n/a 689 689 Same Store GMH 2008 Acquisitions Subtotal 6,513 28.1% 5,871 25.3% 23,163 23,485 Same Store Properties Total 14,099 30.6% 12,989 28.6% (4) 46,039 46,592 2009 Developments Subtotal (5) 628 36.5% n/a n/a 1,721 1,721 Wholly-owned Properties Total 14,727 30.8% 12,989 28.6% (6) 47,760 48,313 (1) As of Jan 9, (2009.) (2) Rentable Beds exclude beds needed for on-site staff. (3) Sunnyside Commons and Pirates Place (4) The prior year rentable beds percentage was calculated by removing the rentable beds for the 2008 Legacy Acquistions because no 2008 prior year leasing information is available. (5) Barrett Honors College (6) The prior year rentable beds percentage was calculated by removing the rentable beds for the 2008 Legacy Acquistions and 2009 Developments because no 2008 prior year leasing information is available.

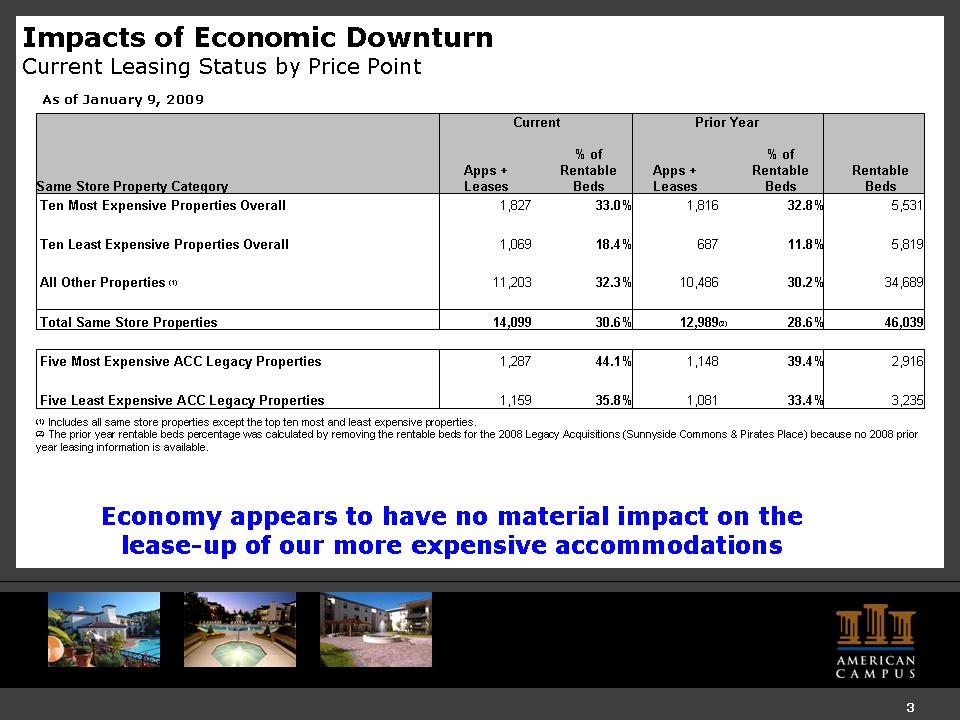

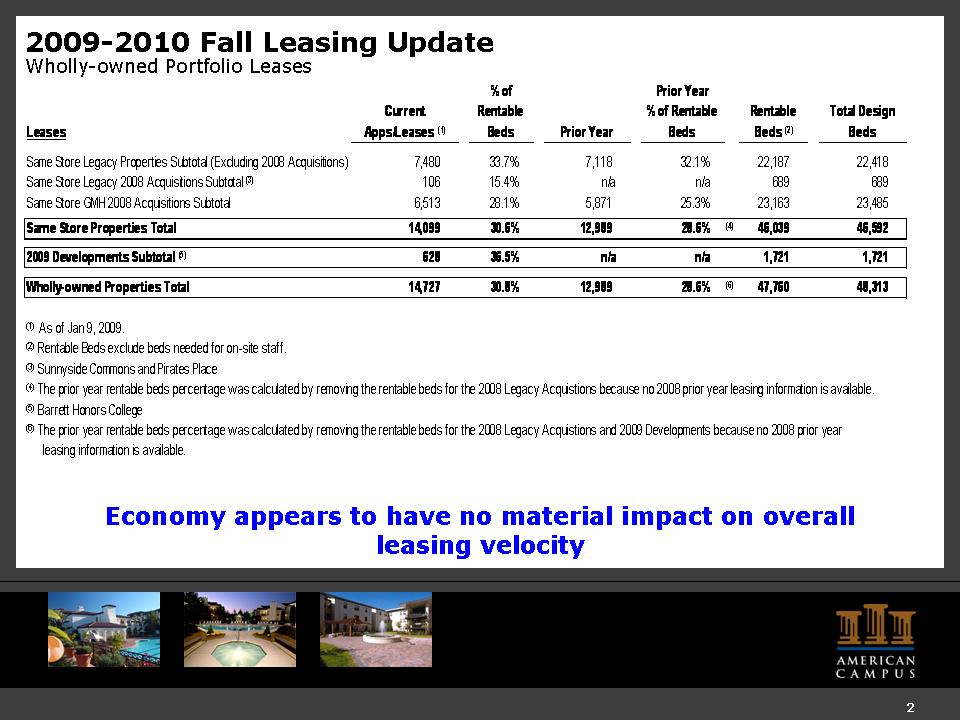

3 Impacts of Economic Downturn Current Leasing Status by Price Point As of January 9, 2009 Current Prior Year Same Store Property Category Apps + Leases % of Rentable Beds Apps + Leases % of Rentable Beds Rentable Beds Ten Most Expensive Properties Overall 1,827 33.0% 1,816 32.8% 5,531 Ten Least Expensive Properties Overall 1,069 18.4% 687 11.8% 5,819 All Other Properties (1) 11,203 32.3% 10,486 30.2% 34,689 Total Same Store Properties 14,099 30.6% 12,989 (2) 28.6% 46,039 Five Most Expensive ACC Legacy Properties 1,287 44.1% 1,148 39.4% 2,916 Five Least Expensive ACC Legacy Properties 1,159 35.8% 1,081 33.4% 3,235 (1) Includes all same store properties except the top ten most and least expensive properties. (2) The prior year rentable beds percentage was calculated by removing the rentable beds for the 2008 Legacy Acquisitions (Sunnyside Commons & Pirates Place) because no 2008 prior year leasing information is available.

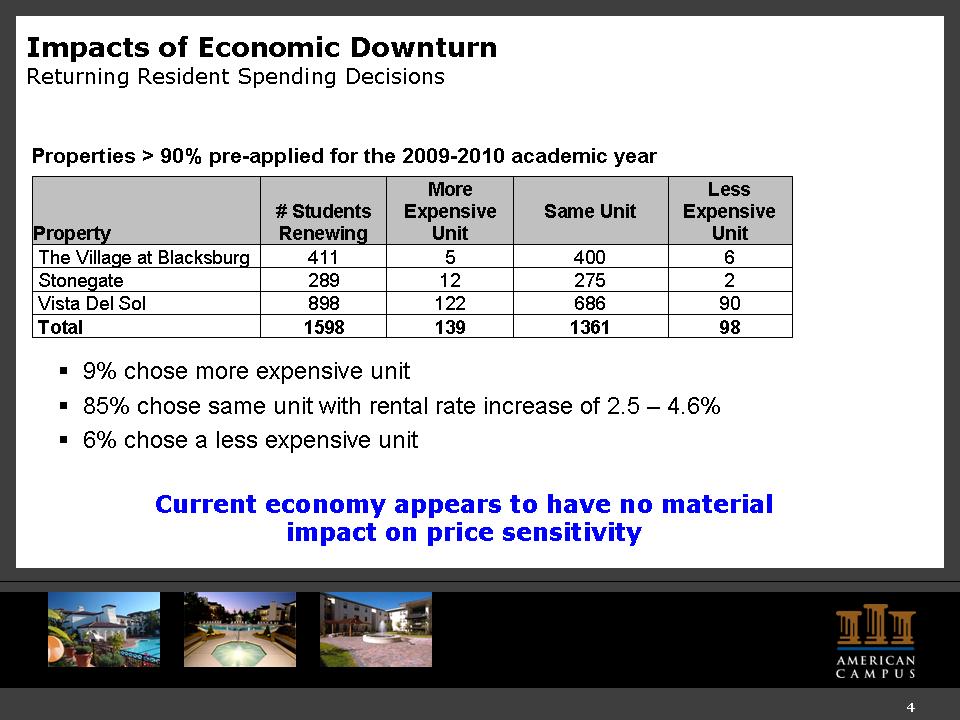

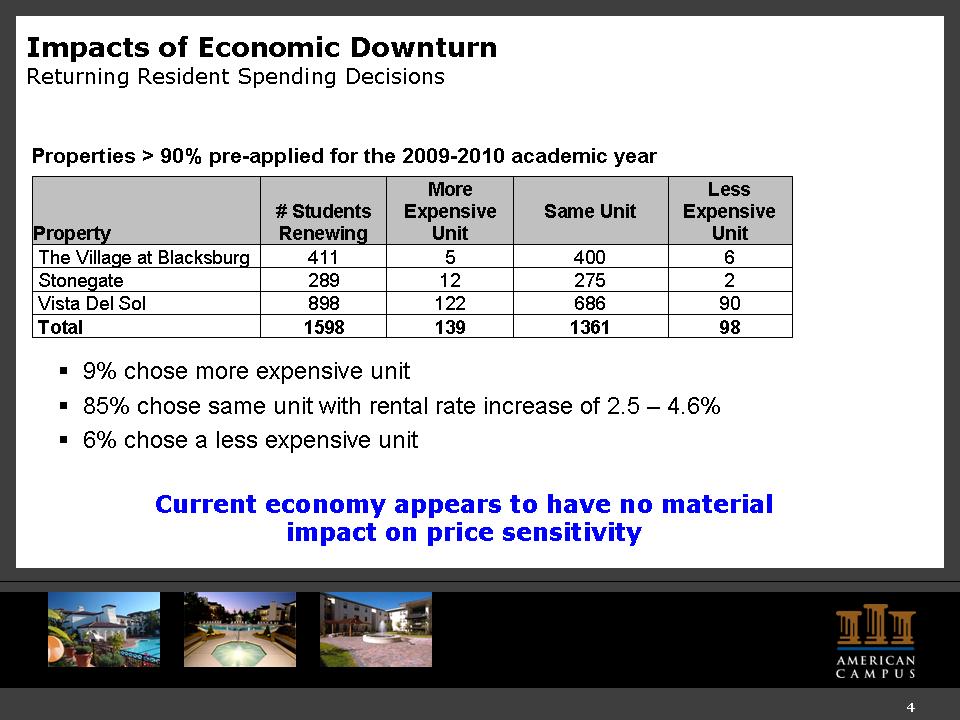

4 Title: Impacts of Economic Downturn Returning Resident Spending Decisions Other Placeholder: Properties > 90% pre-applied for the 2009-2010 academic year 9% chose more expensive unit 85% chose same unit with rental rate increase of 2.5 – 4.6% 6% chose a less expensive unit Current economy appears to have no material impact on price sensitivity Property # Students Renewing More Expensive Unit Same Unit Less Expensive Unit The Village at Blacksburg 411 5 400 6 Stonegate 289 12 275 2 Vista Del Sol 898 122 686 90 Total 1598 139 1361 98

Forward Looking Statements Body: This presentation contains forward-looking statements, which express the current beliefs and expectations of management. Except for historical information, the matters discussed in this presentation are forward-looking statements and can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “result” and similar expressions. Such statements are based on current expectations and involve a number of known and unknown risks and uncertainties that could cause future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. Actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including risks and uncertainties related to our ability to successfully integrate the operations of GMH Communities Trust, the national economy, the real estate industry in general, and in our specific markets; the effect of terrorism or the threat of terrorism; legislative or regulatory changes including changes to laws governing REITs; dependence on key personnel whose continued service is not guaranteed; availability of qualified acquisition and development targets; availability of capital and financing; rising interest rates; rising insurance rates; impact of ad valorem and income taxation; changes in generally accepted accounting principles; and continued ability to successfully lease and operate the properties. While management believes these forward-looking statements are based on reasonable assumptions, there can be no assurance that such expectations will be achieved. These forward-looking statements are made as of the date of this presentation, and management undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.