Exhibit 99.2

Supplemental Analyst Package Second Quarter 2009 Earnings Call July 29, 2009

Table of Contents Financial Highlights 1 Consolidated Balance Sheets 2 Consolidated Statements of Operations 3 Consolidated Statements of Funds from Operations 4 Wholly-owned Property Results of Operations 5 Seasonality of Operations 6 Capital Structure 7 Portfolio Overview 8 2009/2010 Leasing Status 9 2009/2010 Leasing Trends 12 Owned Development Update 13 Third-party Development Update 14 Management Services Update 15 Investor Information 16

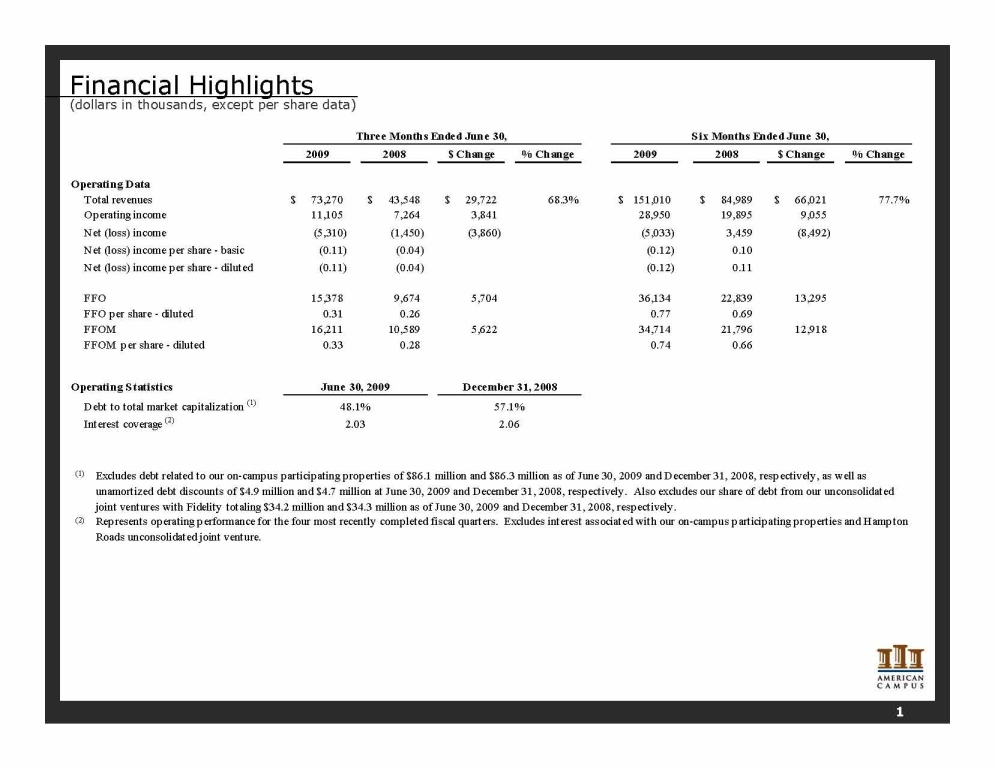

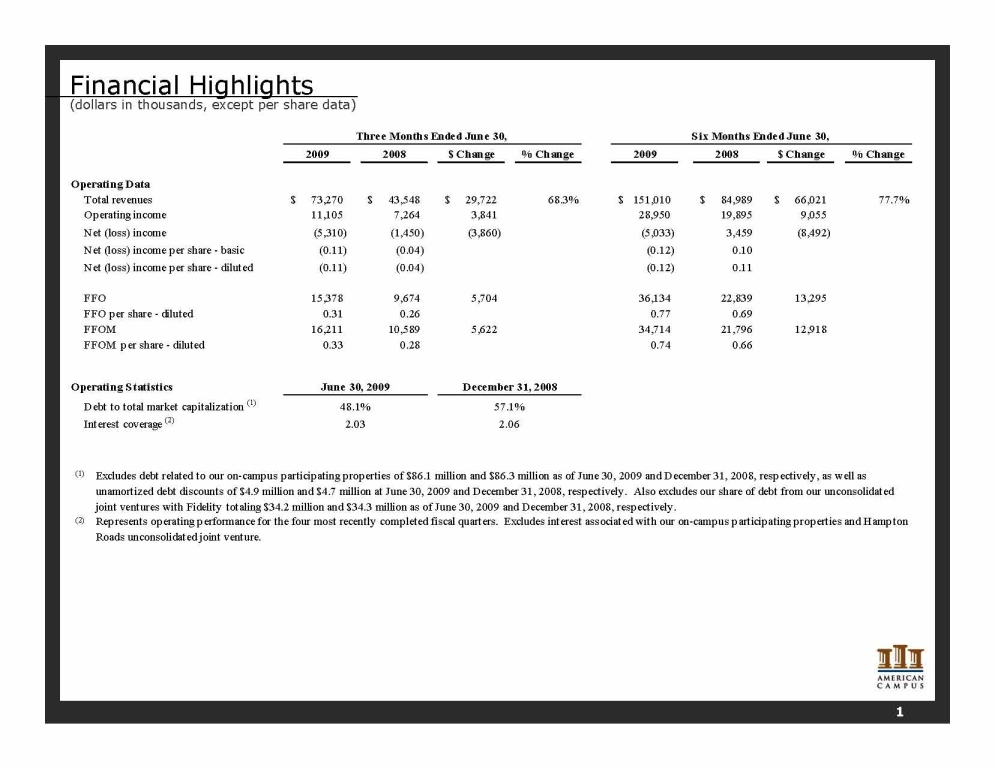

Financial Highlights (dollars in thousands, except per share data) 2009 2008 $ Change % Change 2009 2008 $ Change % Change 73,270 $ 43,548 $ 29,722 $ 68.3% 151,010 $ 84,989 $ 66,021 $ 77.7% 11,105 7,264 3,841 28,950 19,895 9,055 (5,310) (1,450) (3,860) (5,033) 3,459 (8,492) Net (loss) income per share - basic (0.11) (0.04) (0.12) 0.10 Net (loss) income per share - diluted (0.11) (0.04) (0.12) 0.11 15,378 9,674 5,704 36,134 22,839 13,295 FFO per share - diluted 0.31 0.26 0.77 0.69 16,211 10,589 5,622 34,714 21,796 12,918 FFOM per share - diluted 0.33 0.28 0.74 0.66 Six Months Ended June 30, 48.1% 57.1% Three Months Ended June 30, June 30, 2009 December 31, 2008 2.03 2.06 Interest coverage (2) (2) (1) Excludes debt related to our on-campus participating properties of $86.1 million and $86.3 million as of June 30, 2009 and December 31, 2008, respectively, as well as unamortized debt discounts of $4.9 million and $4.7 million at June 30, 2009 and December 31, 2008, respectively. Also excludes our share of debt from our unconsolidated joint ventures with Fidelity totaling $34.2 million and $34.3 million as of June 30, 2009 and December 31, 2008, respectively. Represents operating performance for the four most recently completed fiscal quarters. Excludes interest associated with our on-campus participating properties and Hampton Roads unconsolidated joint venture. Debt to total market capitalization (1) Operating Data Total revenues FFO FFOM Operating income Net (loss) income Operating Statistics 1

Consolidated Balance Sheets (dollars in thousands) 2 June 30, 2009 December 31, 2008 (unaudited) Assets Investments in real estate: Wholly-owned properties, net 2,029,470 $ 1,986,833 $ On-campus participating properties, net 67,301 69,302 Investments in real estate, net 2,096,771 2,056,135 Cash and cash equivalents 57,183 25,600 Restricted cash 31,559 32,558 Student contracts receivable, net 4,891 5,185 Other assets 58,751 64,431 Total assets 2,249,155 $ 2,183,909 $ Liabilities and equity Liabilities: Secured debt 1,089,735 $ 1,162,221 $ Senior secured term loan 100,000 100,000 Unsecured revolving credit facility - 14,700 Accounts payable and accrued expenses 29,165 35,440 Other liabilities 47,307 56,052 Total liabilities 1,266,207 1,368,413 Redeemable noncontrolling interests 30,215 26,286 Equity: American Campus Communities, Inc. and Subsidiaries stockholders' equity: Common stock 521 423 Additional paid in capital 1,098,071 901,641 Accumulated earnings and distributions (145,900) (111,828) Accumulated other comprehensive loss (3,737) (5,117) 948,955 785,119 Noncontrolling interests 3,778 4,091 Total equity 952,733 789,210 Total liabilities and equity 2,249,155 $ 2,183,909 $ Total American Campus Communities, Inc. and Subsidiaries stockholders' equity

2009 2008 $ Change 2009 2008 $ ChangeRevenues:Wholly-owned properties 66,152 $ 37,294 $ 28,858 $ 133,484 $ 68,975 $ 64,509 $On-campus participating properties 3,922 3,948 (26) 10,796 10,692 104Third-party development services 886 723 163 1,938 2,379 (441)Third-party management services 2,105 1,222 883 4,347 2,144 2,203Resident services 205 361 (156) 445 799 (354)Total revenues 73,270 43,548 29,722 151,010 84,989 66,021Operating expenses:Wholly-owned properties 32,891 16,738 16,153 64,377 30,623 33,754On-campus participating properties 2,783 2,499 284 4,813 4,794 19Third-party development and management services 2,810 2,328 482 5,787 4,436 1,351General and administrative 2,829 3,237 (408) 5,577 5,371 206Depreciation and amortization 20,400 11,114 9,286 40,502 19,143 21,359Ground/facility leases 452 368 84 1,004 727 277Total operating expenses 62,165 36,284 25,881 122,060 65,094 56,966Operating income 11,105 7,264 3,841 28,950 19,895 9,055Nonoperating income and (expenses):Interest income 40 642 (602) 80 804 (724)Interest expense (15,446) (8,733) (6,713) (31,332) (15,712) (15,620)Amortization of deferred financing costs (780) (448) (332) (1,581) (759) (822)Loss from unconsolidated joint ventures (483) (129) (354) (1,037) (255) (782)Other nonoperating income 402 - 402 402 - 402Total nonoperating expenses (16,267) (8,668) (7,599) (33,468) (15,922) (17,546)(Loss) income before income taxes, redeemable noncontrollinginterests and discontinued operations (5,162) (1,404) (3,758) (4,518) 3,973 (8,491)Income tax provision (135) (73) (62) (270) (133) (137)Redeemable noncontrolling interests share of loss (income) 81 (13) 94 27 (319) 346Net (loss) income from continuing operations (5,216) (1,490) (3,726) (4,761) 3,521 (8,282)Income attributable to discontinued operations - 92 (92) - 92 (92)Net (loss) income (5,216) (1,398) (3,818) (4,761) 3,613 (8,374)Net income attributable to noncontrolling interests (94) (52) (42) (272) (154) (118)Net (loss) income attributable to American CampusCommunities, Inc. and Subsidiaries (5,310) $ (1,450) $ (3,860) $ (5,033) $ 3,459 $ (8,492) $Net (loss) income per share attributable to American CampusCommunities, Inc. and Subsidiaries common stockholders:Basic (0.11) $ (0.04) $ (0.12) $ 0.10 $Diluted (0.11) $ (0.04) $ (0.12) $ 0.11 $Weighted-average common shares outstanding:Basic 47,897,196 35,692,653 45,152,665 31,512,271Diluted 49,198,944 37,098,977 46,409,294 33,272,354Three Months Ended June 30, Six Months Ended June 30,Consolidated Statements of Operations(dollars in thousands, except share and per share data)3

Consolidated Statements of Funds from Operations(dollars in thousands, except share and per share data)2009 2008 $ Change 2009 2008 $ ChangeNet (loss) income attributable to American Campus Communities, Inc.and Subsidiaries (5,310) $ (1,450) $ (3,860) $ (5,033) $ 3,459 $ (8,492) $Noncontrolling interests 13 65 (52) 245 473 (228)Loss from unconsolidated joint ventures 483 129 354 1,037 255 782FFO from unconsolidated joint ventures (1) 192 (13) 205 153 (139) 292Real estate related depreciation and amortization 20,000 10,943 9,057 39,732 18,791 20,941Funds from operations ("FFO") 15,378 9,674 5,704 36,134 22,839 13,295Elimination of operations of on-campus participating propertiesand unconsolidated joint venture:Net loss (income) from on-campus participating properties 1,605 1,356 249 (409) (326) (83)Amortization of investment in on-campus participating properties (1,092) (1,074) (18) (2,182) (2,143) (39)FFO from Hampton Roads unconsolidated joint venture (2) (56) 83 (139) 180 209 (29)15,835 10,039 5,796 33,723 20,579 13,144Modifications to reflect operational performance of on-campusparticipating properties:Our share of net cash flow (3) 200 368 (168) 492 727 (235)Management fees 176 182 (6) 499 490 9Impact of on-campus participating properties 376 550 (174) 991 1,217 (226)Funds from operations – modified for operational performanceof on-campus participating properties ("FFOM") 16,211 $ 10,589 $ 5,622 $ 34,714 $ 21,796 $ 12,918 $FFO per share - diluted 0.31 $ 0.26 $ 0.77 $ 0.69 $FFOM per share - diluted 0.33 $ 0.28 $ 0.74 $ 0.66 $Weighted average common shares outstanding - diluted 49,666,473 37,383,565 46,864,604 33,272,354(1)(2)(3)Six Months Ended June 30,Represents our share of the FFO from three joint ventures in which we are a minority partner. Includes the Hampton Roads Military Housing joint venture in which we have a minimal economic interest as well as our10% minority interest in two joint ventures (the "Fidelity Joint Ventures") formed or assumed as part of the company's acquisition of GMH. For the three and six months ended June 30, 2009, ACC's 10% share of theFFO of the Fidelity Joint Ventures was $0.1 million and $0.3 million, respectively. For the three and six months ended June 30, 2009, ACC's 10% share of the net operating income of the Fidelity Joint Ventures was $0.7million and $1.4 million, respectively.Our share of the FFO from the Hampton Roads Military Housing unconsolidated joint venture is excluded from the calculation of FFOM, as management believes this amount does not accurately reflect the company'sparticipation in the economics of the transaction.50% of the properties' net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents amounts accrued for the interimperiods.Three Months Ended June 30,4

Wholly-Owned Property Results of Operations(dollars in thousands)2009 2008 $ Change % Change 2009 2008 $ Change % ChangeWholly-owned property revenuesSame store properties 32,443 $ 31,478 $ 965 $ 3.1% 64,562 $ 62,789 $ 1,773 $ 2.8%New properties - GMH portfolio 29,080 6,127 22,953 58,425 6,127 52,298New properties - other 4,834 50 4,784 10,942 858 10,084Total revenues (1) 66,357 $ 37,655 $ 28,702 $ 76.2% 133,929 $ 69,774 $ 64,155 $ 91.9%Wholly-owned property operating expensesSame store properties 15,762 $ 14,588 $ 1,174 $ 8.0% 29,568 $ 27,935 $ 1,633 $ 5.8%New properties - GMH portfolio 15,835 2,150 13,685 31,339 2,149 29,190New properties - other 1,294 - 1,294 3,470 539 2,931Total operating expenses 32,891 $ 16,738 $ 16,153 $ 96.5% 64,377 $ 30,623 $ 33,754 $ 110.2%Wholly-owned property net operating incomeSame store properties 16,681 $ 16,890 $ (209) $ -1.2% 34,994 $ 34,854 $ 140 $ 0.4%New properties - GMH portfolio 13,245 3,977 9,268 27,086 3,978 23,108New properties - other 3,540 50 3,490 7,472 319 7,153Total net operating income 33,466 $ 20,917 $ 12,549 $ 60.0% 69,552 $ 39,151 $ 30,401 $ 77.7%(1) Includes revenues which are reflected as Resident Services Revenue on the accompanying consolidated statements of operations.Three Months Ended June 30, Six Months Ended June 30,5

Seasonality of Operations(dollars in thousands, except per bed amounts)6September 30, 2008 December 31, 2008 March 31, 2009 June 30, 2009 Total/Weighted AverageSame store properties (1)Revenue per occupied bedRental rate per occupied bed per month 512 $ 533 $ 532 $ 523 $ 525 $Other income per occupied bed per month (2) 68 33 34 42 44Total revenue per occupied bed 580 $ 566 $ 566 $ 565 $ 569 $Average number of owned beds 20,000 20,000 20,000 20,000 20,000Average physical occupancy 94.1% 96.3% 96.6% 93.7% 95.2%Total revenue 32,720 $ 32,718 $ 32,773 $ 31,789 $ 130,000 $Property operating expenses 18,281 13,987 14,270 15,298 61,836Net operating income 14,439 $ 18,731 $ 18,503 $ 16,491 $ 68,164 $Operating margin 44.1% 57.2% 56.5% 51.9% 52.4%New properties (legacy)Revenue per occupied bedRental rate per occupied bed per month 496 $ 541 $ 541 $ 542 $ 534 $Other income per occupied bed per month (2) 59 56 58 62 59Total revenue per occupied bed 555 $ 597 $ 599 $ 604 $ 593 $Average number of owned beds 1,898 3,107 3,107 3,107 2,805Average physical occupancy 94.9% 97.9% 97.7% 97.5% 97.2%Total revenue 2,997 $ 5,447 $ 5,454 $ 5,488 $ 19,386 $Property operating expenses 1,191 1,694 1,718 1,752 6,355Net operating income 1,806 $ 3,753 $ 3,736 $ 3,736 $ 13,031 $Operating margin 60.3% 68.9% 68.5% 68.1% 67.2%New properties (GMH)Revenue per occupied bedRental rate per occupied bed per month 432 $ 441 $ 437 $ 444 $ 439 $Other income per occupied bed per month (2) 29 37 31 29 32Total revenue per occupied bed 461 $ 478 $ 468 $ 473 $ 471 $Average number of owned beds 23,471 23,471 23,471 23,471 23,471Average physical occupancy 78.8% 88.0% 89.0% 87.3% 85.8%Total revenue 25,556 $ 29,659 $ 29,345 $ 29,080 $ 113,640 $Property operating expenses 19,340 17,570 15,498 15,841 68,249Net operating income 6,216 $ 12,089 $ 13,847 $ 13,239 $ 45,391 $Operating margin 24.3% 40.8% 47.2% 45.5% 39.9%ALL PROPERTIESRevenue per occupied bedRental rate per occupied bed per month 468 $ 489 $ 487 $ 486 $ 483 $Other income per occupied bed per month (2) 48 37 34 37 39Total revenue per occupied bed 516 $ 526 $ 521 $ 523 $ 522 $Average number of owned beds 45,369 46,578 46,578 46,578 46,276Average physical occupancy 87.1% 92.2% 92.8% 90.7% 90.8%Total revenue 61,273 $ 67,824 $ 67,572 $ 66,357 $ 263,026 $Property operating expenses 38,812 33,251 31,486 32,891 136,440Net operating income 22,461 $ 34,573 $ 36,086 $ 33,466 $ 126,586 $Operating margin 36.7% 51.0% 53.4% 50.4% 48.1%(1) Includes all properties owned during the full year ended December 31, 2008.(2) Other income is all income other than Net Student Rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, etc.Three Months Ended

Capital Structure as of June 30, 2009(dollars in thousands)Total Debt (1) 1,108,458 $Total Equity Market Value (2) 1,197,345Total Market Capitalization 2,305,803 $Debt to Total Market Capitalization 48.1%Interest Coverage (3) 2.03PrincipalOutstanding (1)Weighted AverageInterest RateAverage Term toMaturityFixed Rate Mortgage Loans 878,260 $ 5.79% 5.0 YearsVariable Rate Construction Loans 130,198 1.75% .4 YearsRevolving Credit Facility (4) - 0.00% ..1 YearsSenior Secured Term Loan (5) 100,000 3.80% 1.9 YearsTotal / Weighted Average 1,108,458 $ 5.14% 4.2 Years(1)(2)(3)(4)(5) In the firs t quarter 2009, we ente red into an inte res t rate swap agreement whereby we fixed the LIBOR po rtio n o f the rate to 1.79% thro ugh maturity o f the lo an.Fixed Rate Mortgage Loans Maturity ScheduleExc lude s debt re la ted to o ur o n-c ampus pa rtic ipa ting pro pe rties to ta ling $ 86.1 millio n with a we ighte d a ve ra ge interes t ra te o f 7.17% and average term to maturity o f 11.2 years . Als o excludes netunamo rtized de bt dis co unts o f $ 4.9 millio n as well a s o ur s hare o f de bt from o ur unco ns o lidated jo int ve ntures with F idelity to ta ling $ 34.2 millio n.Bas ed o n s hare price o f $ 22.18 at J une 30, 2009. As s umes co nvers io n o f all commo n and preferred Operating P artners hip units as well as any o ther s ecurities co nvertible into commo n s hares .Repre s ents o pe ra ting perfo rmance fo r the fo ur mo s t re cently completed fis ca l quarters . Exclude s intere s t as s o ciated with o ur o n-campus participating pro perties and Hampto n Ro adsunco ns o lidated jo int ve nture.Our re vo lving credit fac ility matures in Augus t 2009, a t whic h time we antic ipa te re newing the fa cility as we ll as inc re as ing its s ize to a n amo unt abo ve its c urre nt ca pac ity o f $ 160 millio n.$7,960$84,404$ 97,072$74,655 $84,028 $86,812$190,182$197,127$43,700$12,320$0$20,000$40,000$60,000$80,000$100,000$120,000$140,000$160,000$180,000$200,000$220,0002009 2010 2011 2012 2013 2014 2015 2016 2017 2018+7

Portfolio Overview as of June 30, 2009 (1) Units Beds 2009 2008 Same Store Wholly-owned Properties (ACC) 6,458 20,689 91.3% 91.6% Same Store Wholly-owned Properties (GMH) 7,481 23,471 86.0% 87.1% Same Store Wholly-owned Properties - Total 13,939 44,160 88.5% 89.2% New Wholly-owned Properties 1,411 4,139 98.5% (2) N/A Wholly Owned Properties - Total 15,350 48,299 89.0% (2) 89.2% (3) On-campus Participating Properties 1,863 4,519 13.1% (4) 14.9% (4) Joint Venture Properties (5) 3,644 12,051 87.0% 90.8% (1) (2) (3) Excludes properties under construction as of June 30, 2008 (Chestnut Ridge, Vista del Sol, and Barrett Honors College). (4) (5) Includes 21 properties owned in two joint ventures with Fidelity, of which we own a 10% interest. Physical Occupancy at June 30, Property Type For a detailed disclosure of occupancy for each property, please refer to the company's Form 10-K for the year ended December 31, 2008. Excludes Barrett Honors College, which was under construction as of June 30, 2009 and is anticipated to be completed and open for occupancy in August 2009. Occupancy at our on-campus participating properties is low during the summer months due to the expiration of the 9-month leases concurrent with the end of the spring semester. 8

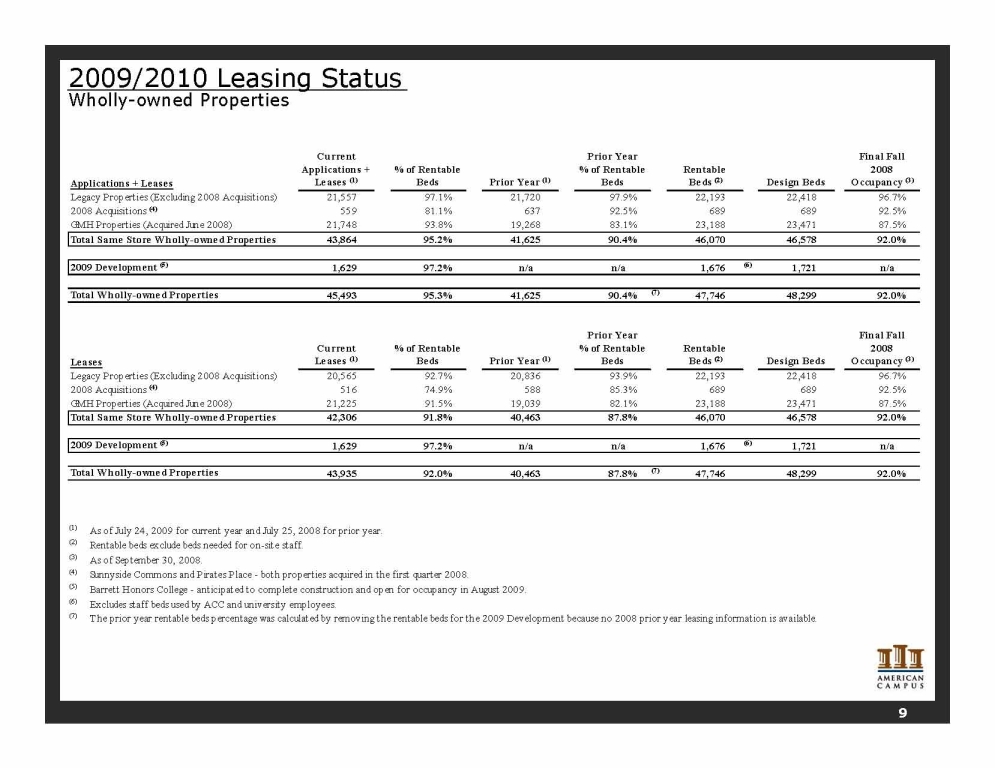

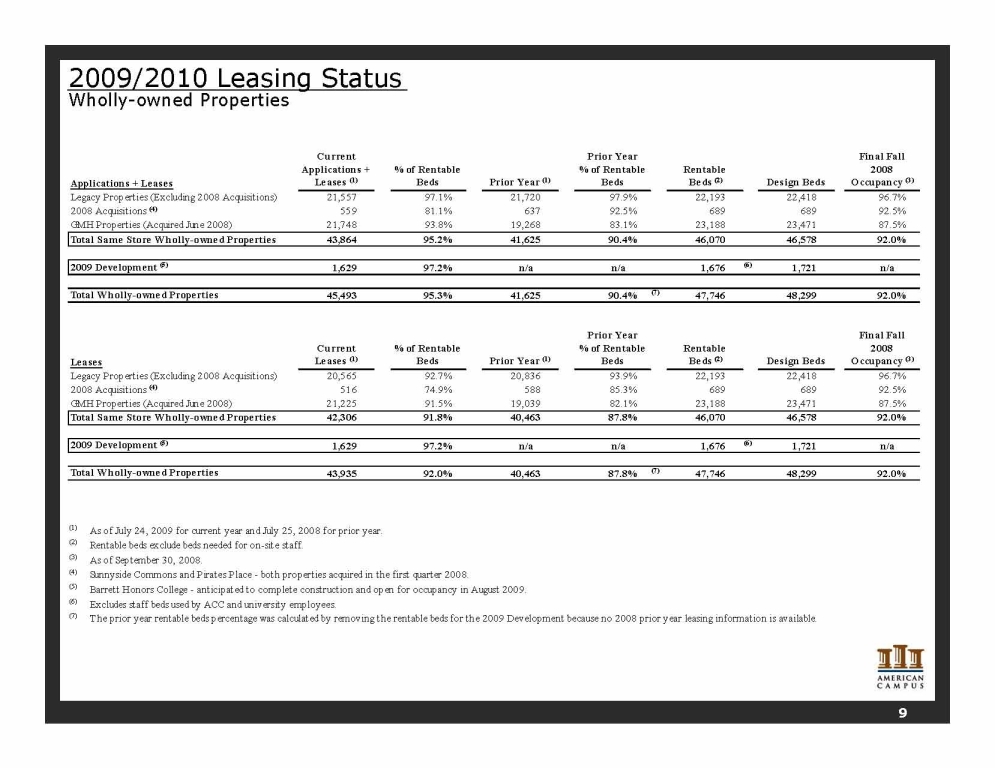

2009/2010 Leasing Status Wholly-owned Properties 9 Applications + Leases Current Applications + Leases (1) % of Rentable Beds Prior Year (1) Prior Year % of Rentable Beds Rentable Beds (2) Design Beds Final Fall 2008 Occupancy (3) Legacy Properties (Excluding 2008 Acquisitions) 21,557 97.1% 21,720 97.9% 22,193 22,418 96.7% 2008 Acquisitions (4) 559 81.1% 637 92.5% 689 689 92.5% GMH Properties (Acquired June 2008) 21,748 93.8% 19,268 83.1% 23,188 23,471 87.5% Total Same Store Wholly-owned Properties 43,864 95.2% 41,625 90.4% 46,070 46,578 92.0% 2009 Development (5) 1,629 97.2% n/a n/a 1,676 (6) 1,721 n/a Total Wholly-owned Properties 45,493 95.3% 41,625 90.4% (7) 47,746 48,299 92.0% Leases Current Leases (1) % of Rentable Beds Prior Year (1) Prior Year % of Rentable Beds Rentable Beds (2) Design Beds Final Fall 2008 Occupancy (3) Legacy Properties (Excluding 2008 Acquisitions) 20,565 92.7% 20,836 93.9% 22,193 22,418 96.7% 2008 Acquisitions (4) 516 74.9% 588 85.3% 689 689 92.5% GMH Properties (Acquired June 2008) 21,225 91.5% 19,039 82.1% 23,188 23,471 87.5% Total Same Store Wholly-owned Properties 42,306 91.8% 40,463 87.8% 46,070 46,578 92.0% 2009 Development (5) 1,629 97.2% n/a n/a 1,676 (6) 1,721 n/a Total Wholly-owned Properties 43,935 92.0% 40,463 87.8% (7) 47,746 48,299 92.0% (1) As of July 24, 2009 for current year and July 25, 2008 for prior year. (2) Rentable beds exclude beds needed for on-site staff. (3) As of September 30, 2008. (4) Sunnyside Commons and Pirates Place - both properties acquired in the first quarter 2008. (5) Barrett Honors College - anticipated to complete construction and open for occupancy in August 2009. (6) Excludes staff beds used by ACC and university employees. (7) The prior year rentable beds percentage was calculated by removing the rentable beds for the 2009 Development because no 2008 prior year leasing information is available.

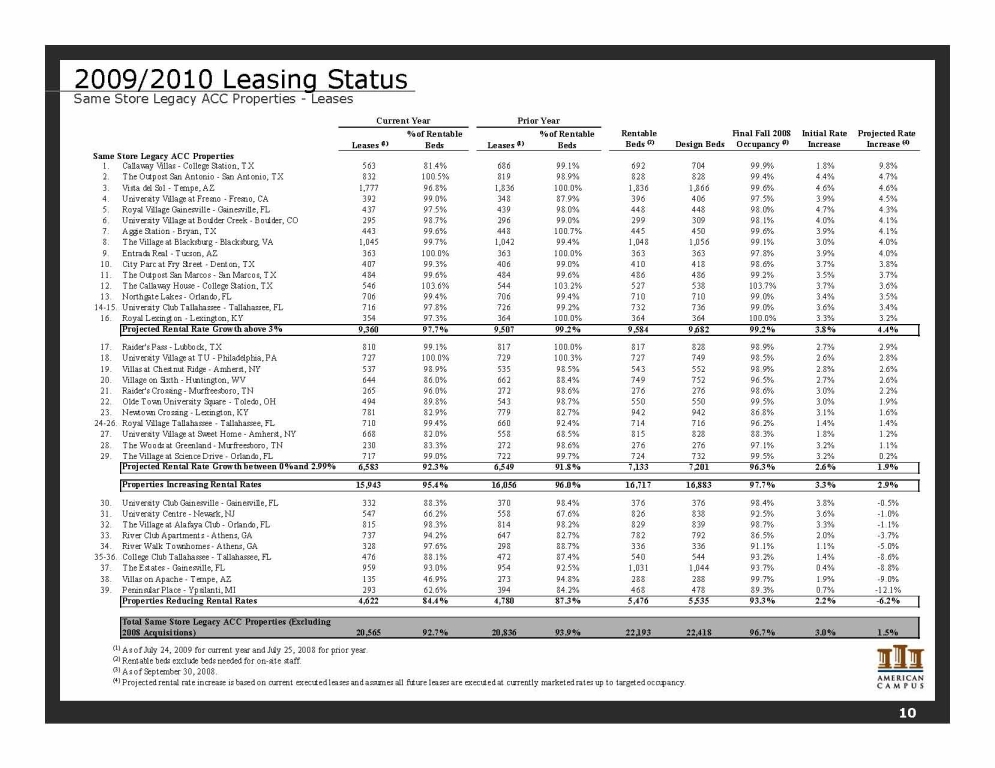

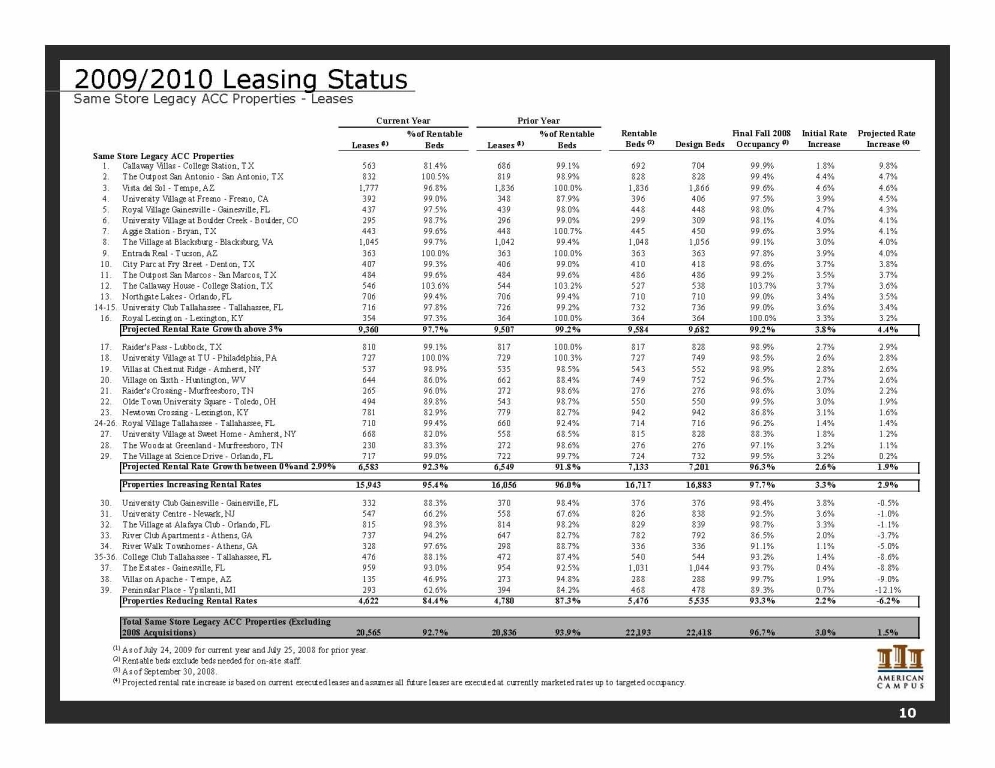

Leases (1) % of Rentable Beds Leases (1) % of Rentable Beds Same Store Legacy ACC Properties 1. Callaway Villas - College Station, TX 563 81.4% 686 99.1% 692 704 99.9% 1.8% 9.8% 2. The Outpost San Antonio - San Antonio, TX 832 100.5% 819 98.9% 828 828 99.4% 4.4% 4.7% 3. Vista del Sol - Tempe, AZ 1,777 96.8% 1,836 100.0% 1,836 1,866 99.6% 4.6% 4.6% 4. University Village at Fresno - Fresno, CA 392 99.0% 348 87.9% 396 406 97.5% 3.9% 4.5% 5. Royal Village Gainesville - Gainesville, FL 437 97.5% 439 98.0% 448 448 98.0% 4.7% 4.3% 6. University Village at Boulder Creek - Boulder, CO 295 98.7% 296 99.0% 299 309 98.1% 4.0% 4.1% 7. Aggie Station - Bryan, TX 443 99.6% 448 100.7% 445 450 99.6% 3.9% 4.1% 8. The Village at Blacksburg - Blacksburg, VA 1,045 99.7% 1,042 99.4% 1,048 1,056 99.1% 3.0% 4.0% 9. Entrada Real - Tucson, AZ 363 100.0% 363 100.0% 363 363 97.8% 3.9% 4.0% 10. City Parc at Fry Street - Denton, TX 407 99.3% 406 99.0% 410 418 98.6% 3.7% 3.8% 11. The Outpost San Marcos - San Marcos, TX 484 99.6% 484 99.6% 486 486 99.2% 3.5% 3.7% 12. The Callaway House - College Station, TX 546 103.6% 544 103.2% 527 538 103.7% 3.7% 3.6% 13. Northgate Lakes - Orlando, FL 706 99.4% 706 99.4% 710 710 99.0% 3.4% 3.5% 14-15. University Club Tallahassee - Tallahassee, FL 716 97.8% 726 99.2% 732 736 99.0% 3.6% 3.4% 16. Royal Lexington - - Lexington, KY 354 97.3% 364 100.0% 364 364 100.0% 3.3% 3.2% Projected Rental Rate Growth above 3% 9,360 97.7% 9,507 99.2% 9,584 9,682 99.2% 3.8% 4.4% 17. Raider's Pass - Lubbock, TX 810 99.1% 817 100.0% 817 828 98.9% 2.7% 2.9% 18. University Village at TU - Philadelphia, PA 727 100.0% 729 100.3% 727 749 98.5% 2.6% 2.8% 19. Villas at Chestnut Ridge - Amherst, NY 537 98.9% 535 98.5% 543 552 98.9% 2.8% 2.6% 20. Village on Sixth - Huntington, WV 644 86.0% 662 88.4% 749 752 96.5% 2.7% 2.6% 21. Raider's Crossing - Murfreesboro, TN 265 96.0% 272 98.6% 276 276 98.6% 3.0% 2.2% 22. Olde Town University Square - Toledo, OH 494 89.8% 543 98.7% 550 550 99.5% 3.0% 1.9% 23. Newtown Crossing - Lexington, KY 781 82.9% 779 82.7% 942 942 86.8% 3.1% 1.6% 24-26. Royal Village Tallahassee - Tallahassee, FL 710 99.4% 660 92.4% 714 716 96.2% 1.4% 1.4% 27. University Village at Sweet Home - Amherst, NY 668 82.0% 558 68.5% 815 828 88.3% 1.8% 1.2% 28. The Woods at Greenland - Murfreesboro, TN 230 83.3% 272 98.6% 276 276 97.1% 3.2% 1.1% 29. The Village at Science Drive - Orlando, FL 717 99.0% 722 99.7% 724 732 99.5% 3.2% 0.2% Projected Rental Rate Growth between 0% and 2.99% 6,583 92.3% 6,549 91.8% 7,133 7,201 96.3% 2.6% 1.9% Properties Increasing Rental Rates 15,943 95.4% 16,056 96.0% 16,717 16,883 97.7% 3.3% 2.9% 30. University Club Gainesville - Gainesville, FL 332 88.3% 370 98.4% 376 376 98.4% 3.8% -0.5% 31. University Centre - Newark, NJ 547 66.2% 558 67.6% 826 838 92.5% 3.6% -1.0% 32. The Village at Alafaya Club - Orlando, FL 815 98.3% 814 98.2% 829 839 98.7% 3.3% - -1.1% 33. River Club Apartments - Athens, GA 737 94.2% 647 82.7% 782 792 86.5% 2.0% -3.7% 34. River Walk Townhomes - Athens, GA 328 97.6% 298 88.7% 336 336 91.1% 1.1% -5.0% 35-36. College Club Tallahassee - T allahassee, FL 476 88.1% 472 87.4% 540 544 93.2% 1.4% -8.6% 37. The Estates - Gainesville, FL 959 93.0% 954 92.5% 1,031 1,044 93.7% 0.4% -8.8% 38. Villas on Apache - Tempe, AZ 135 46.9% 273 94.8% 288 288 99.7% 1.9% -9.0% 39. Peninsular Place - Ypsilanti, MI 293 62.6% 394 84.2% 468 478 89.3% 0.7% -12.1% Properties Reducing Rental Rates 4,622 84.4% 4,780 87.3% 5,476 5,535 93.3% 2.2% -6.2% Total Same Store Legacy ACC Properties (Excluding 2008 Acquisitions) 20,565 92.7% 20,836 93.9% 22,193 22,418 96.7% 3.0% 1.5% (1) As of July 24, 2009 for current year and July 25, 2008 for prior year. (2) Rentable beds exclude beds needed for on-site staff. (3) As of September 30, 2008. (4) Projected rental rate increase is based on current executed leases and assumes all future leases are executed at currently marketed rates up to targeted occupancy. Initial Rate Increase Projected Rate Increase (4) Current Year Design Beds Final Fall 2008 Occupancy (3) Rentable Beds (2) Prior Year 2009/2010 Leasing Status Same Store Legacy ACC Properties - Leases 10

Leases (1) % of Rentable Beds Leases (1) % of Rentable Beds Same Store GMH Portfolio 1. University Crossings - Philadelphia, PA 998 99.8% 1,004 100.4% 1,000 1,016 98.1% 4.2% 5.4% 2. Aztec Corner - San Diego, CA 602 99.3% 602 99.3% 606 606 99.3% 5.0% 5.0% 3. Campus T rails - Starkville, MS 467 99.2% 469 99.6% 471 480 97.9% 4.2% 4.5% 4. Abbott Place - East Lansing, MI 635 98.9% 527 82.1% 642 654 95.3% 3.9% 4.4% 5. Campus Way - Tuscaloosa, AL 669 99.4% 668 99.3% 673 684 92.7% 3.5% 3.5% 6. University T rails - Lubbock, TX 666 98.4% 679 100.3% 677 684 98.4% 3.4% 3.4% 7. Southview - Harrisonburg, VA 926 97.1% 957 100.3% 954 960 99.6% 2.7% 3.0% 8. Brookstone Village - Wilmington, NC 225 96.2% 210 89.7% 234 238 94.1% 2.9% 3.0% Projected Rental Rate Growth above 3% 5,188 98.7% 5,116 97.3% 5,257 5,322 96.9% 3.8% 4.0% 9. Campus Walk - Wilmington - Wilmington, NC 189 66.5% 232 81.7% 284 290 92.8% 2.6% 2.7% 10. Stonegate - Harrisonburg, VA 658 98.7% 667 100.0% 667 672 99.4% 2.5% 2.6% 11. University Mills - Cedar Falls, IA 476 99.0% 472 98.1% 481 481 99.0% 4.8% 2.5% 12. University Village - Sacramento - Sacramento, CA 277 72.3% 298 77.8% 383 394 91.4% 1.2% 2.4% 13. University Pointe - Lubbock, TX 673 99.7% 668 99.0% 675 682 96.6% 2.2% 2.4% 14. Campus Corner - Bloomington, IN 783 99.9% 519 66.2% 784 796 77.9% 2.3% 2.1% 15. Campus Ridge - Johnson City, TN 409 78.2% 415 79.3% 523 528 93.6% 1.9% 1.8% 16. University Gables - Murfreesboro, TN 593 92.9% 397 62.2% 638 648 74.7% 1.1% 1.7% 17. University Pines - Statesboro, GA 484 88.6% 424 77.7% 546 552 98.0% 3.3% 1.5% 18. Pirates Cove - Greenville, NC 1,018 98.0% 656 63.1% 1,039 1,056 69.9% 1.1% 1.1% 19-20. Willowtree Apartments and Towers - Ann Arbor, MI 598 70.9% 669 79.4% 843 851 91.8% 0.6% 0.6% 21. Tower at 3rd, Champaign, IL 290 99.0% 257 87.7% 293 295 95.6% 1.0% 0.4% 22. GrandMarc - - Seven Corners - Minneapolis, MN 382 88.6% 353 81.9% 431 440 88.4% -1.0% 0.4% 23. Campus Club - Statesboro - Statesboro, GA 915 93.8% 833 85.4% 975 984 90.5% 0.4% 0.0% Projected Rental Rate Growth between 0% and 2.99% 7,745 90.5% 6,860 80.1% 8,562 8,669 90.0% 1.5% 1.6% Properties Increasing Rental Rates 12,933 93.6% 11,976 86.7% 13,819 13,991 91.7% 2.5% 2.4% 24. University Meadows - Mt. Pleasant, MI 595 98.0% 467 76.9% 607 616 82.5% 4.3% -0.2% 25. Cambridge at Southern - Statesboro, GA 412 73.8% 424 76.0% 558 564 89.5% 1.6% -0.2% 26. The Commons - Harrisonburg, VA 415 79.2% 514 98.1% 524 528 97.0% 3.1% -0.5% 27. University Manor - Greenville, NC 595 100.0% 490 82.4% 595 600 87.7% -0.9% -1.0% 28. Riverside Estates - Cayce, SC 561 81.0% 648 93.5% 693 700 95.4% 1.3% -1.7% 29. The Club - Athens, GA 471 99.2% 384 80.8% 475 480 90.4% 1.1% -1.9% 30. The Edge (formerly Pegasus Connection) - Orlando, FL 900 97.9% 750 81.6% 919 930 86.9% 1.7% -2.5% 31-33. Jacob Heights / The Summitt - Mankato, MN 771 83.4% 776 83.9% 925 930 90.8% 0.7% -3.2% 34. University Highlands - Reno, NV 679 94.7% 354 49.4% 717 732 63.0% -5.8% -4.2% 35. Lakeside - Athens, GA 675 87.8% 715 93.0% 769 776 94.5% 2.5% -4.5% 36. University Centre - Kalamazoo - Kalamazoo, MI 684 98.0% 342 49.0% 698 700 56.0% -5.8% -5.3% 37. Hawks Landing - Oxford, OH 367 76.5% 345 71.9% 480 484 74.4% -6.2% -6.2% 38. University Place - Charlottesville, VA 342 67.7% 323 64.0% 505 528 76.1% 1.2% -7.8% 39. Campus Walk - - Oxford - Oxford, MS 348 82.1% 245 57.8% 424 432 56.9% -9.2% -10.1% 40. The Enclave I - Bowling Green, OH 477 99.4% 286 59.6% 480 480 65.4% -6.8% -14.4% Properties Reducing Rental Rates 8,292 88.5% 7,063 75.4% 9,369 9,480 81.4% -0.1% - -3.9% Total Same Store GMH Portfolio 21,225 91.5% 19,039 82.1% 23,188 23,471 87.5% 1.6% 0.5% (1) As of July 24, 2009 for current year and July 25, 2008 for prior year. (2) Rentable beds exclude beds needed for on-site staff. (3) As of September 30, 2008. (4) Projected rental rate increase is based on current executed leases and assumes all future leases are executed at currently marketed rates up to targeted occupancy. Current Year Prior Year Initial Rate Increase Projected Rate Increase (4) Final Fall 2008 Occupancy (3) Rentable Beds (2) Design Beds 2009/2010 Leasing Status, continued Same Store GMH Portfolio – Leases 11

12 2009/2010 Leasing Trends Same Store Wholly-owned Properties – Applications + Leases Same Store Wholly-Ow ned Legacy Properties (Excluding 2008 Acquisitons) - 5,000 10,000 15,000 20,000 25,000 11/14/2008 12/14 /2008 1/14/2009 2/14/2009 3/14/ 2009 4/14/2009 5/14/2009 6/14/ 2009 7/14/2009 8/14/2009 9/14/2009 2008 2009 Capacity Total Same Store Wholly-Ow ned Properties - 10,000 20,000 30,000 40,000 50,000 11/14/2008 12/14/2008 1/14/2009 2/14/2009 3/14/ 2009 4/14/ 2009 5/14/2009 6/14/2009 7/14/ 2009 8/14/ 2009 9/14/ 2009 2008 2009 Capacity GMH Properties - 5,000 10,000 15,000 20,000 25,000 11/14/2008 12/14/2008 1/14/ 2009 2/14/ 2009 3/14/2009 4/14/ 2009 5/14/ 2009 6/14/ 2009 7/14/2009 8/14/2009 9/14/ 2009 2008 2009 Capacity

Owned Development Update (dollars in thousands) PROJECT UNDER CONSTRUCTION Location Primary University Served Units Beds Estimated Project Cost % Complete (1) Scheduled to Open for Occupancy Tempe, AZ Arizona State University 601 1,721 132,000 $ 93% August 2009 PROJECTS IN PRE-DEVELOPMENT (2) Location Anticipated Commencement Approximate Targeted Beds Estimated Project Cost Targeted Completion TBD 860 42,500 $ August 2011 ASU Component III - ACE (3) Tempe, AZ TBD 1,500 110,000 TBD Carbondale Development (4) Carbondale, IL TBD 650 32,100 TBD 184,600 $ ACE AWARDS (5) Project Location Approximate Targeted Beds 140 1,000 University of New Mexico - Phase I Albuquerque, NM 1,300 University of New Mexico - Phase II Albuquerque, NM 600 Portland State University Portland, OR 1,000 Washington State University Phase I Pullman, WA 700 Washington State University Phase II Pullman, WA TBD ASU - West Campus Phase I Phoenix, AZ 600 ASU - West Campus Phase II Phoenix, AZ TBD Northern Arizona University Flagstaff, AZ 1,450 (1) (2) Does not include 5 undeveloped land parcels in 5 university markets totaling $22.8 million as of June 30, 2009. (3) (4) (5) 160 TBD TBD TBD TBD Targeted Completion TBD August 2011 August 2012 TBD TBD TBD TBD TBD TBD TBD TBD TBD August 2012 TBD ACE awards provide the company with the opportunity to exclusively negotiate with the subject universities and commencement is subject to final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions. Component development is contingent upon execution of all transactional documents, including a facility lease agreement with Arizona State University and Board of Regents approval. Commencement of this project is subject to final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions. Based on costs incurred under general construction contract as of June 30, 2009. As of June 30, 2009, the total Construction in Progress balance for this project is $108.9 million, representing costs incurred under the total project budget. Project Barrett Honors College - ACE 575 Project Approximate Targeted Units Boise State Univ. Phase IA - ACE Boise, ID 225 Boise, ID Estimated Project Cost TBD Boise State University - Phase II Boise State University - Phase IB Boise, ID 7,500 $ 13

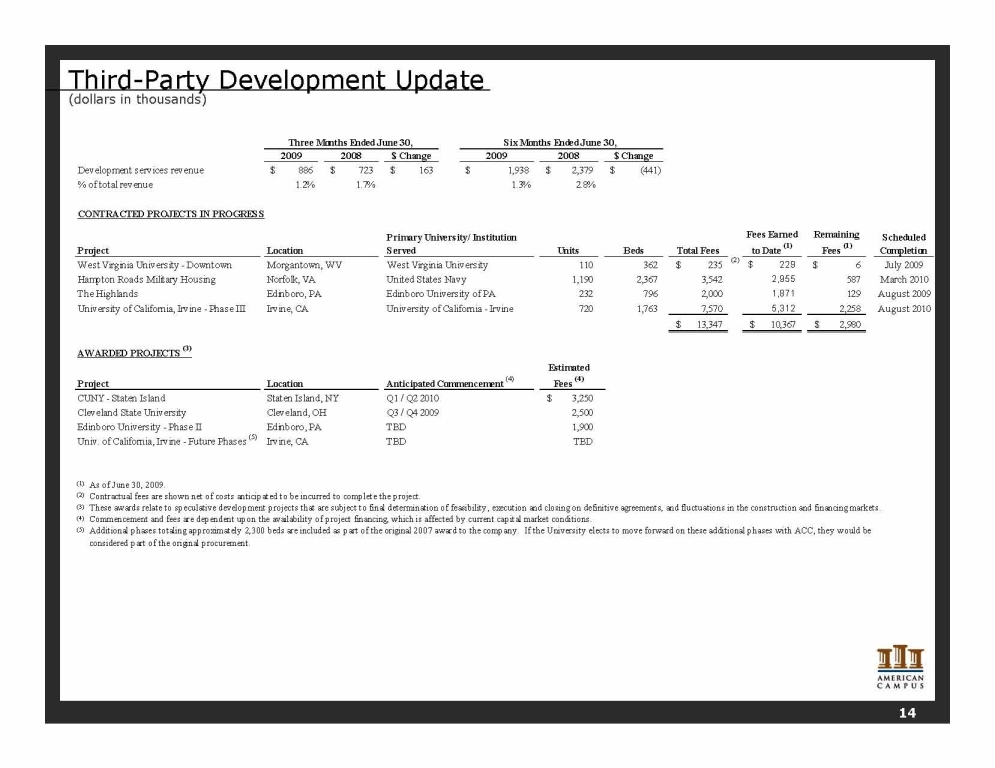

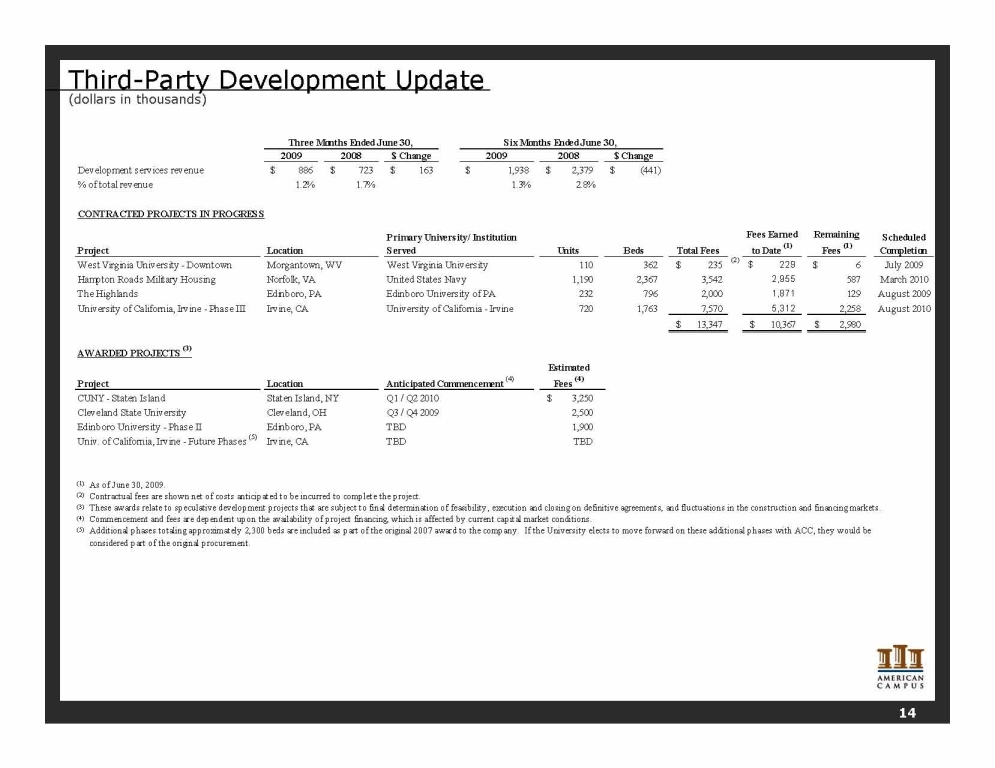

Third-Party Development Update (dollars in thousands) 2009 2008 $ Change 2009 2008 $ Change Development services revenue 886 $ 723 $ 163 $ 1,938 $ 2,379 $ (441) $ % of total revenue 1.2% 1.7% 1.3% 2.8% CONTRACTED PROJECTS IN PROGRESS Project Units Beds Total Fees Fees Earned to Date (1) Remaining Fees (1) Scheduled Completion West Virginia University - Downtown West Virginia University 110 362 235 $ (2) 229 $ 6 $ July 2009 Hampton Roads Military Housing 1,190 2,367 3,542 2,955 587 March 2010 The Highlands Edinboro, PA Edinboro University of PA 232 796 2,000 1,871 129 August 2009 University of California, Irvine - Phase III Irvine, CA University of California - Irvine 720 1,763 7,570 5,312 2,258 August 2010 13,347 $ 10,367 $ 2,980 $ AWARDED PROJECTS (3) Project Estimated Fees (4) CUNY - Staten Island Staten Island, NY Q1 / Q2 2010 3,250 $ Cleveland State University Cleveland, OH Q3 / Q4 2009 2,500 Edinboro University - Phase II Edinboro, PA TBD 1,900 Univ. of California, Irvine - Future Phases (5) Irvine, CA TBD TBD (1) As of June 30, 2009. (2) Contractual fees are shown net of costs anticipated to be incurred to complete the project. (3) (4) Commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions. (5) United States Navy Morgantown, WV Location These awards relate to speculative development projects that are subject to final determination of feasibility, execution and closing on definitive agreements, and fluctuations in the construction and financing markets. Anticipated Commencement (4) Norfolk, VA Additional phases totaling approximately 2,300 beds are included as part of the original 2007 award to the company. If the University elects to move forward on these additional phases with ACC, they would be considered part of the original procurement. Six Months Ended June 30, Three Months Ended June 30, Location Primary University/ Institution Served 14

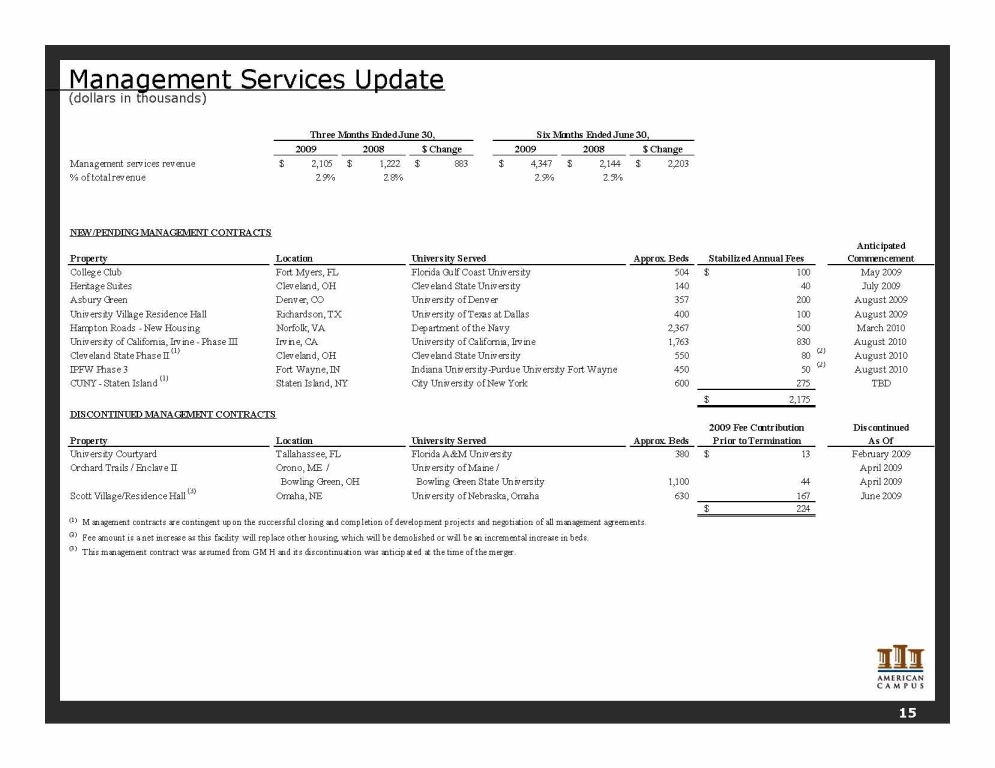

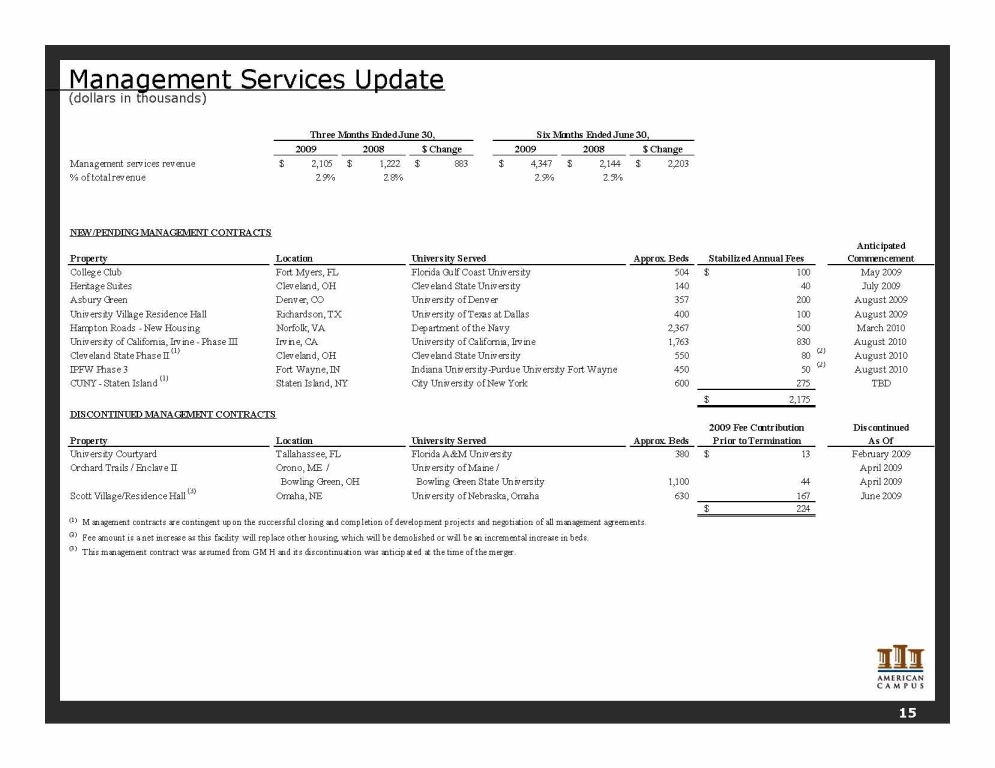

Management Services Update (dollars in thousands) 2009 2008 $ Change 2009 2008 $ Change Management services revenue 2,105 $ 1,222 $ 883 $ 4,347 $ 2,144 $ 2,203 $ % of total revenue 2.9% 2.8% 2.9% 2.5% NEW/PENDING MANAGEMENT CONTRACTS Property Approx. Beds Stabilized Annual Fees Anticipated Commencement College Club Fort Myers, FL Florida Gulf Coast University 504 100 $ May 2009 Heritage Suites Cleveland, OH Cleveland State University 140 40 July 2009 Asbury Green Denver, CO University of Denver 357 200 August 2009 University Village Residence Hall Richardson, TX University of Texas at Dallas 400 100 August 2009 Hampton Roads - New Housing Norfolk, VA Department of the Navy 2,367 500 March 2010 University of California, Irvine - Phase III Irvine, CA University of California, Irvine 1,763 830 August 2010 Cleveland State Phase II (1) Cleveland, OH Cleveland State University 550 80 (2) August 2010 IPFW Phase 3 Fort Wayne, IN Indiana University-Purdue University Fort Wayne 450 50 (2) August 2010 CUNY - Staten Island (1) Staten Island, NY City University of New York 600 275 TBD 2,175 $ DISCONTINUED MANAGEMENT CONTRACTS Property Approx. Beds 2009 Fee Contribution Prior to Termination Discontinued As Of University Courtyard Tallahassee, FL Florida A&M University 380 13 $ February 2009 Orchard Trails / Enclave II Orono, ME / University of Maine / April 2009 Bowling Green, OH Bowling Green State University 1,100 44 April 2009 Scott Village/Residence Hall (3) Omaha, NE University of Nebraska, Omaha 630 167 June 2009 224 $ (1) (2) (3) This management contract was assumed from GMH and its discontinuation was anticipated at the time of the merger. Fee amount is a net increase as this facility will replace other housing, which will be demolished or will be an incremental increase in beds. Location University Served Management contracts are contingent upon the successful closing and completion of development projects and negotiation of all management agreements. Three Months Ended June 30, Location University Served Six Months Ended June 30, 15

Investor Information Executive Management William C. Bayless, Jr. Chief Executive Officer Brian Nickel Chief Investment Officer Greg A. Dowell Chief Operating Officer Jon Graf Chief Financial Officer Research Coverage Michelle Ko / Andrew Ryu Bank of America / Merrill Lynch (212) 449-6935 / (212) 449-6237 m_ko@ml.com / andrew_ryu@ml.com David Toti / Michael Bilerman Citigroup Equity Research (212) 816-1909/ (212) 816-1383 david.toti@citi.com / michael.bilerman@citi.com Andrew McCulloch / Chris Van Ens Green Street Advisors (949) 640-8780 amcculloch@greenstreetadvisors.com / cvanens@greenstreetadvisors.com Steve Sakwa / Dave Bragg ISI Group Inc. (212) 446-9462 / (212) 446-9458 ssakwa@isigrp.com / dbragg@isigrp.com Anthony Paolone / Joseph Dazio J.P. Morgan Securities (212) 622-6682 / (212) 622-6416 anthony.paolone@jpmorgan.com / joseph.c.dazio@jpmorgan.com Stephen Swett Keefe, Bruyette, & Woods (212) 887-3680 sswett@kbw.com Jordan Sadler / Karin Ford KeyBanc Capital Markets (917) 368-2280 / (917) 368-2293 jsadler@keybanccm.com / kford@keybanccm.com Paula Poskon / Lindsey Yao Robert W. Baird & Co., Inc. (703) 821-5782 / (703) 918-7852 pposkon@rwbaird.com / lyao@rwbaird.com Alexander Goldfarb / James Milam Sandler O'Neill + Partners, L.P. (212) 466-7937 / (212) 466-8066 agoldfarb@sandleroneillcom / jmilam@sandleroneillcom David Kaplan Sidoti & Company (212) 894-3335 dkaplan@sidoti.com Investor Relations: Gina Cowart VP, Investor Relations and Corporate Marketing (512) 732-1041 American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, Inc.'s performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of American Campus Communities, Inc. or its management. American Campus Communities, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Additional Information Corporate Headquarters: American Campus Communities, Inc. 805 Las Cimas Parkway, Suite 400 Austin, Texas 78746 Tel: (512) 732-1000; Fax: (512) 732-2450 16

Forward Looking Statements This supplemental package contains forward-looking statements, which express the current beliefs and expectations of management. Except for historical information, the matters discussed in this news release are forward-looking statements and can be identified by the use of the words "anticipate," "believe," "expect," "intend," "may," "might," "plan," "estimate," "project," "should," "will," "result" and similar expressions. Such statements are based on current expectations and involve a number of known and unknown risks and uncertainties that could cause our future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including risks and uncertainties related to the national economy, the real estate industry in general, and in our specific markets; legislative or regulatory changes including changes to laws governing REITS; our dependence on key personnel whose continued service is not guaranteed; availability of qualified acquisition and development targets; availability of capital and financing; rising interest rates; rising insurance rates; impact of ad valorem and income taxation; changes in generally accepted accounting principles; and our continued ability to successfully lease and operate our properties. While we believe these forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be achieved. These forward-looking statements are made as of the date of this news release, and we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.