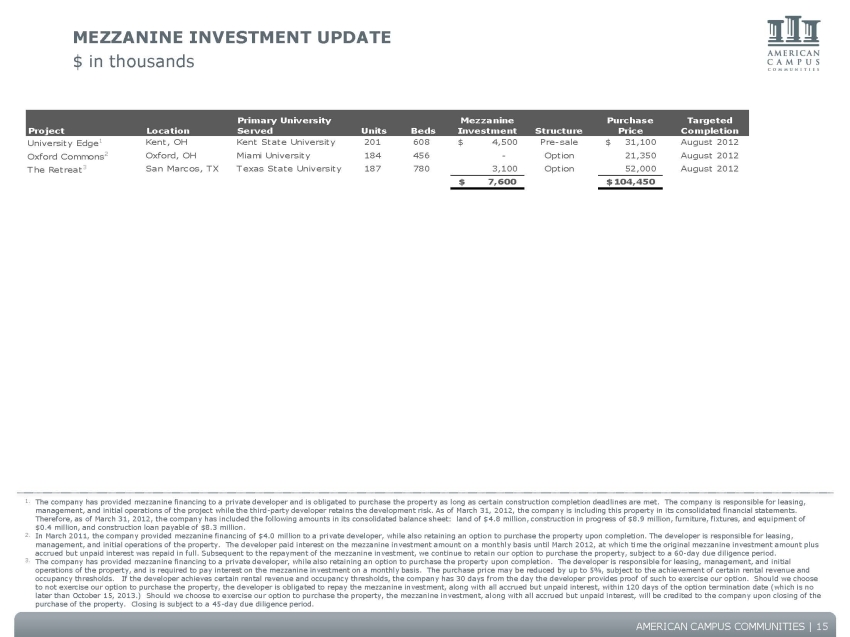

AMERICAN CAMPUS COMMUNITIES | MEZZANINE INVESTMENT UPDATE $ in thousands 1.The company has provided mezzanine financing to a private developer and is obligated to purchase the property as long as certain construction completion deadlines are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains the development risk. As of March 31, 2012, the company is including this property in its consolidated financial statements. Therefore, as of March 31, 2012, the company has included the following amounts in its consolidated balance sheet: land of $4.8 million, construction in progress of $8.9 million, furniture, fixtures, and equipment of $0.4 million, and construction loan payable of $8.3 million. 2.In March 2011, the company provided mezzanine financing of $4.0 million to a private developer, while also retaining an option to purchase the property upon completion. The developer is responsible for leasing, management, and initial operations of the property. The developer paid interest on the mezzanine investment amount on a monthly basis until March 2012, at which time the original mezzanine investment amount plus accrued but unpaid interest was repaid in full. Subsequent to the repayment of the mezzanine investment, we continue to retain our option to purchase the property, subject to a 60-day due diligence period. 3.The company has provided mezzanine financing to a private developer, while also retaining an option to purchase the property upon completion. The developer is responsible for leasing, management, and initial operations of the property, and is required to pay interest on the mezzanine investment on a monthly basis. The purchase price may be reduced by up to 5%, subject to the achievement of certain rental revenue and occupancy thresholds. If the developer achieves certain rental revenue and occupancy thresholds, the company has 30 days from the day the developer provides proof of such to exercise our option. Should we choose to not exercise our option to purchase the property, the developer is obligated to repay the mezzanine investment, along with all accrued but unpaid interest, within 120 days of the option termination date (which is no later than October 15, 2013.) Should we choose to exercise our option to purchase the property, the mezzanine investment, along with all accrued but unpaid interest, will be credited to the company upon closing of the purchase of the property. Closing is subject to a 45-day due diligence period.

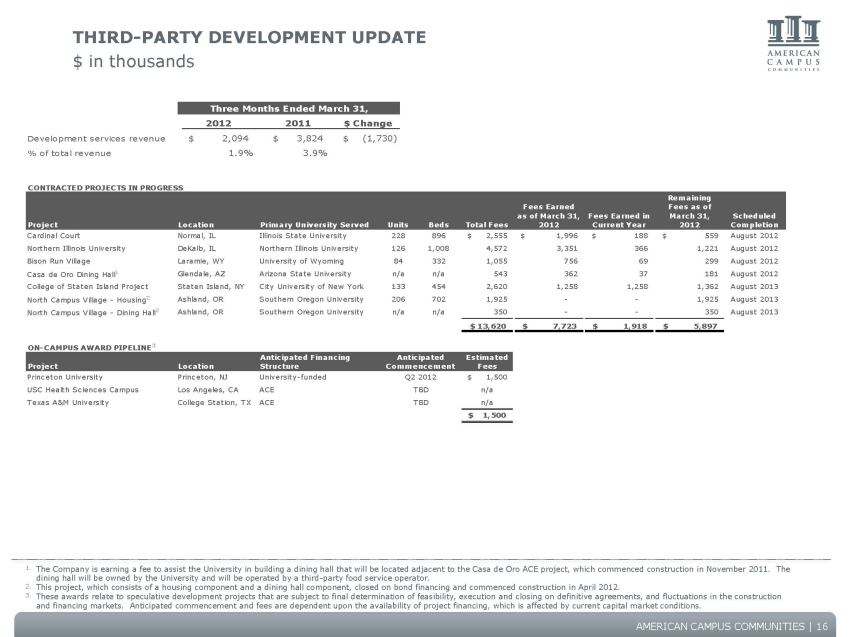

AMERICAN CAMPUS COMMUNITIES THIRD-PARTY DEVELOPMENT UPDATE $ in thousands 1.The Company is earning a fee to assist the University in building a dining hall that will be located adjacent to the Casa de Oro ACE project, which commenced construction in November 2011. The dining hall will be owned by the University and will be operated by a third-party food service operator. 2.This project, which consists of a housing component and a dining hall component, closed on bond financing and commenced construction in April 2012. 3.These awards relate to speculative development projects that are subject to final determination of feasibility, execution and closing on definitive agreements, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions.

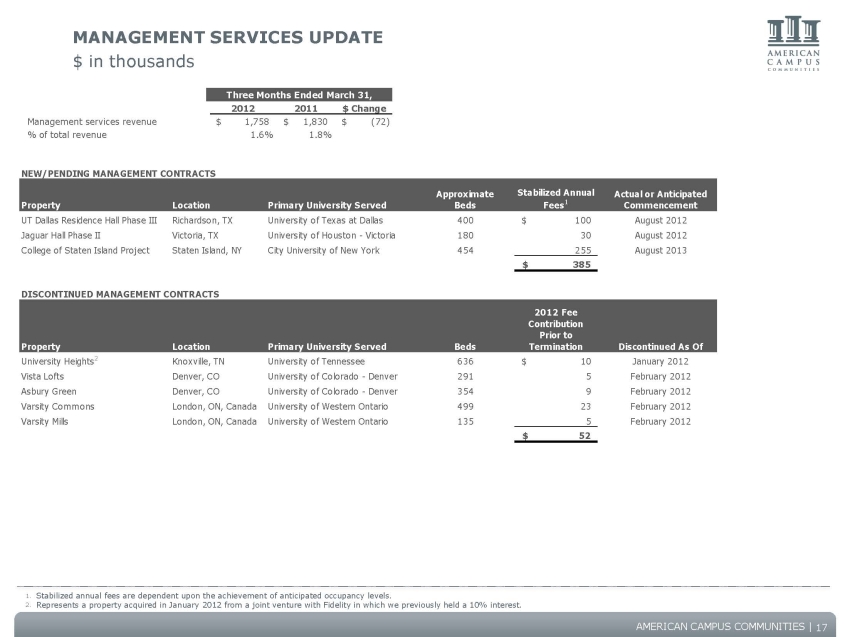

AMERICAN CAMPUS COMMUNITIES MANAGEMENT SERVICES UPDATE $ in thousands 1.Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels. 2.Represents a property acquired in January 2012 from a joint venture with Fidelity in which we previously held a 10% interest.

COMMUNITIES INVESTOR INFORMATION

LOOKING STATEMENTIn addition to historical information, this supplemental package contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which American Campus operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.