EXHIBIT 99.2

| | | | | | | | |

| | Highlights |

| | Customer Metrics |

| | Financial Metrics |

| | Capital Structure |

| | 5G Network Leadership |

| | Merger & Integration |

| | Guidance |

| | Events & Contacts |

| | Financial and Operational Tables |

Unless otherwise noted, historical results for T-Mobile from the close of the merger (“Merger”) with Sprint Corporation (“Sprint”) on April 1, 2020 reflect the Merger transactions and are inclusive of the results and operations of Sprint, while historical results prior to April 1, 2020 do not reflect the Merger transactions and are inclusive of the results and operations of stand-alone T-Mobile only. As such, the year-over-year changes may not be meaningful as they are reflective of both the Merger as well as the combined company business performance as further detailed in this Investor Factbook.

T-Mobile Crosses 100 Million Total Customer Milestone and Raises Second Half 2020 Financial Guidance Across the Board with Strong Third Quarter 2020 Results

Industry-Leading Customer Growth

•Record-high 2,035,000 total net additions, best in industry

•Record-high 1,979,000 postpaid net additions, best in industry

•689,000 postpaid phone net additions, best in industry

•56,000 prepaid net additions

•Record-high 100.4 million total customers at the end of Q3 2020

Strong Financial Results Drive Guidance Raise Across the Board

•Total revenues of $19.3 billion and service revenues of $14.1 billion

•Net income(1) of $1.3 billion and diluted earnings per share (“EPS”) of $1.00

•Adjusted EBITDA(1) of $7.1 billion, raising H2 2020 guidance

•Net cash provided by operating activities of $2.8 billion, raising H2 2020 guidance

•Free Cash Flow(1) of $352 million, raising H2 2020 guidance

Delivering Merger Synergies Faster Than Expected

•Expect to deliver more than $1.2 billion of synergies in 2020

•15 percent of Sprint postpaid customer traffic has already been moved over to the T-Mobile network and customer migrations have begun

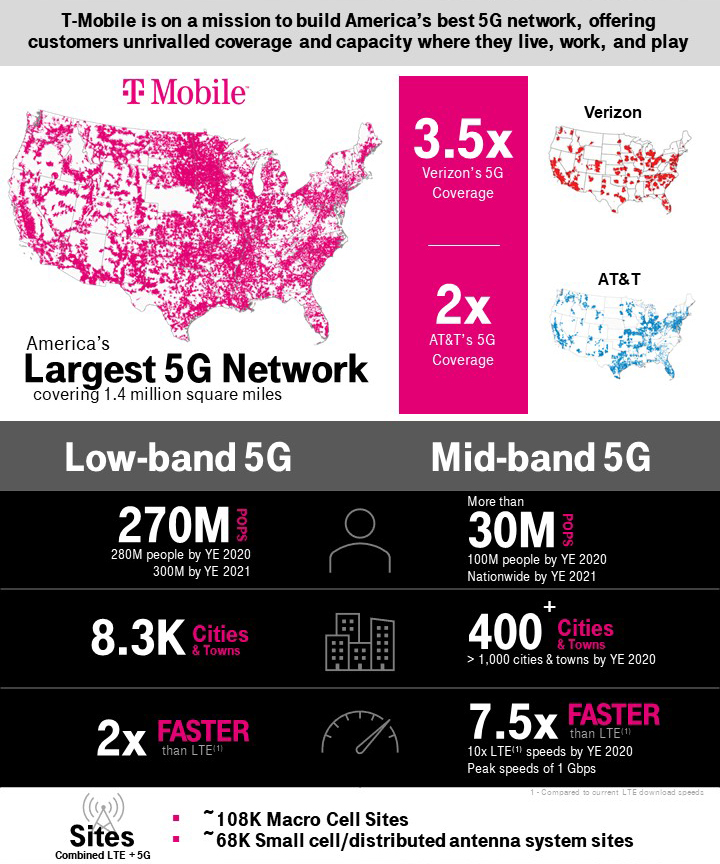

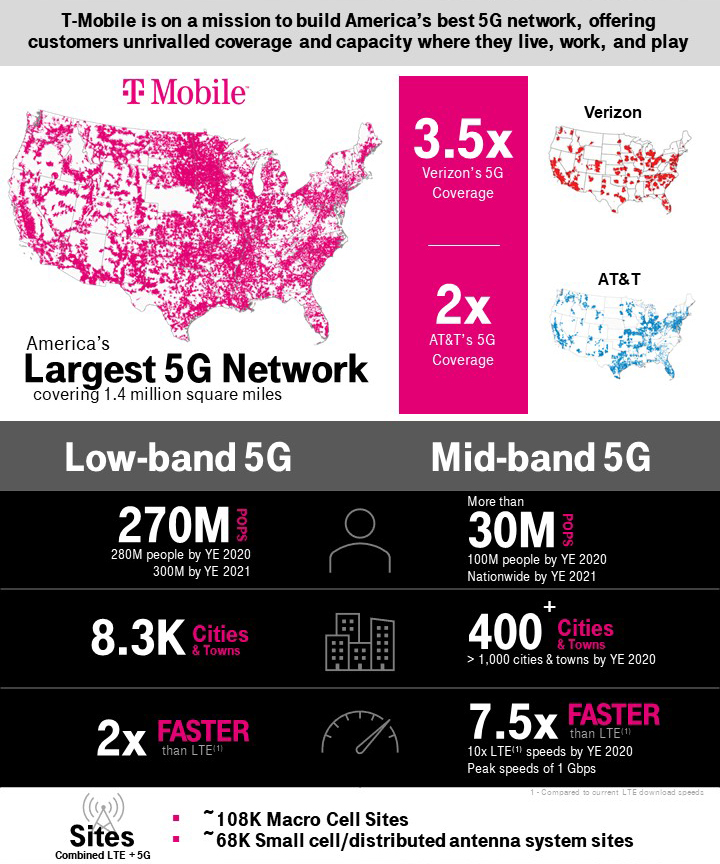

Extending 5G Network Leadership

•America’s largest 5G network covering 270 million people with more geographic coverage than Verizon and AT&T combined

•Supercharged experience with mid-band (2.5 GHz) 5G network covering more than 30 million people and expect to cover 100 million people by the end of 2020

| | | | | | | | | | | |

| | | |

| | “Last quarter T-Mobile overtook AT&T to become #2 in U.S. wireless and today we announced our highest ever postpaid net adds. Now, with over 100 million wireless customers and America’s largest 5G network, there is no doubt that we’re the growth leader in wireless. Customers are choosing T-Mobile in record numbers because we are the only ones that can deliver this combination of value and experience with a true 5G network that is available to customers in every single state! We’re consistently and profitably outpacing the competition – and we’re just getting started!” | |

| | Mike Sievert, CEO | |

_________________

(1)Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for these non-GAAP financial measures to the most directly comparable financial measures are provided in the Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures tables. We are not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP Net income including, but not limited to, Income tax expense, stock-based compensation expense and Interest expense. Adjusted EBITDA should not be used to predict Net income as the difference between the two measures is variable.

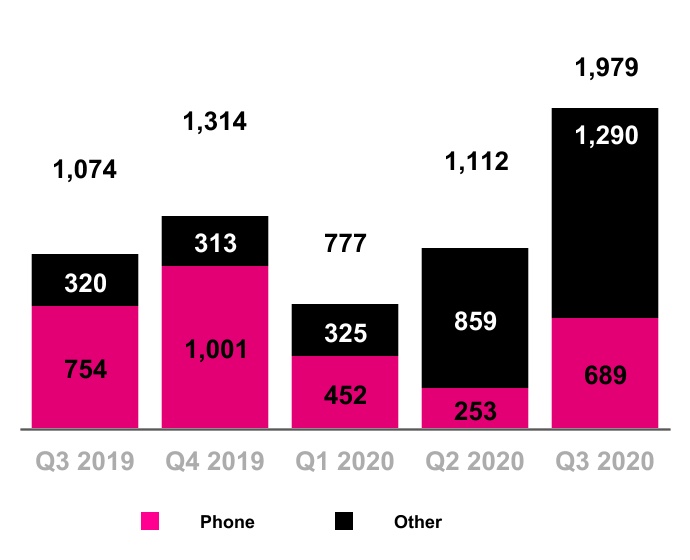

Total Postpaid Net Additions

(in thousands)

Postpaid phone net customer additions were 689,000 in Q3 2020, compared to 253,000 in Q2 2020 and 754,000 in Q3 2019.

▪Sequentially, the increase was due to promotional activity and higher switching activity due to increased store traffic, partially offset by a seasonal increase in churn.

▪Year-over-year, the decrease was primarily due to higher churn from customers acquired in the Merger, partially offset by lower switching activity in the industry from reduced store traffic arising from the COVID-19 Pandemic (the “Pandemic”).

Postpaid other net customer additions were a record 1,290,000 in Q3 2020, compared to 859,000 in Q2 2020 and 320,000 in Q3 2019.

▪Sequentially and year-over-year, the increase was primarily due to higher gross additions from connected devices primarily due to educational institution additions. Year-over-year, the increase was partially offset by lower switching activity in the industry arising from the Pandemic.

Postpaid net customer additions were a record 1,979,000 in Q3 2020, compared to 1,112,000 in Q2 2020 and 1,074,000 in Q3 2019.

The postpaid upgrade rate was approximately 4.3% in Q3 2020, compared to 4.5% in Q2 2020 and 4.7% in Q3 2019.

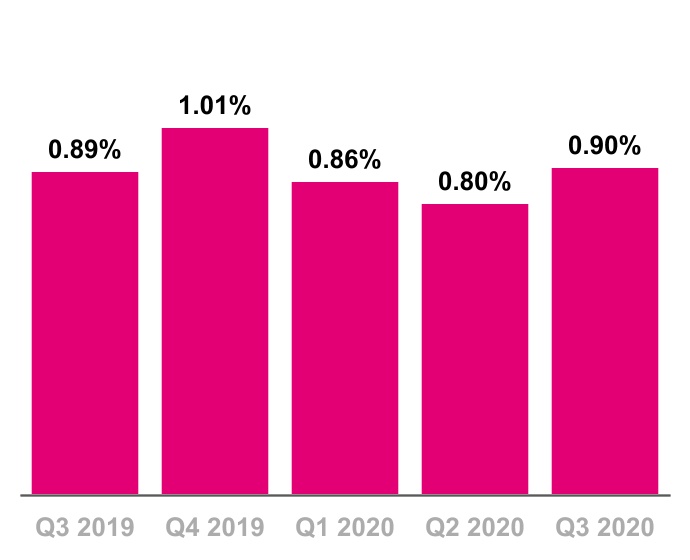

Postpaid phone churn was 0.90% in Q3 2020, up 10 basis points from 0.80% in Q2 2020 and up 1 basis point from 0.89% in Q3 2019.

▪Sequentially, the increase was primarily due to seasonally higher switching activity as well as less switching restrictions from the Pandemic compared to Q2 2020.

▪Year-over-year, postpaid phone churn was essentially flat as an increase in churn from the inclusion of the Sprint customer base was offset by lower switching activity in the industry arising from the Pandemic.

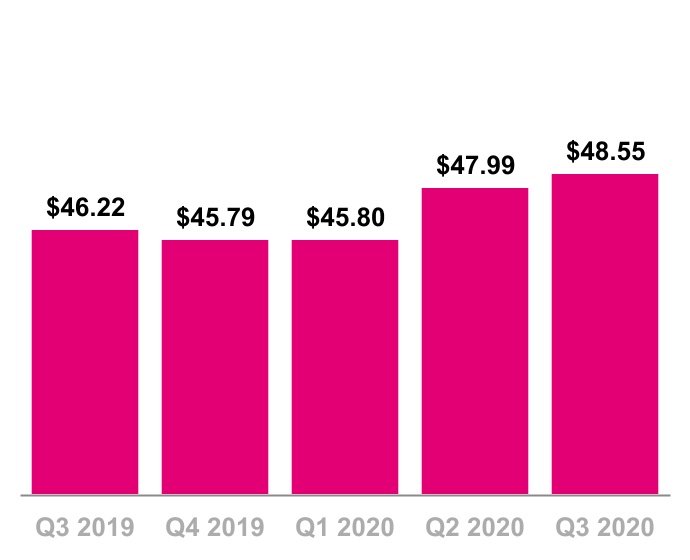

Postpaid phone ARPU was $48.55 in Q3 2020, up 1.2% from $47.99 in Q2 2020 and up 5.0% from $46.22 in Q3 2019.

▪Sequentially, the increase was primarily due to higher premium service revenues and certain one-time charges.

▪Year-over-year, the increase was primarily due to the net impact of higher ARPU customers acquired in the Merger and higher premium service revenues, partially offset by an increase in our promotional activities.

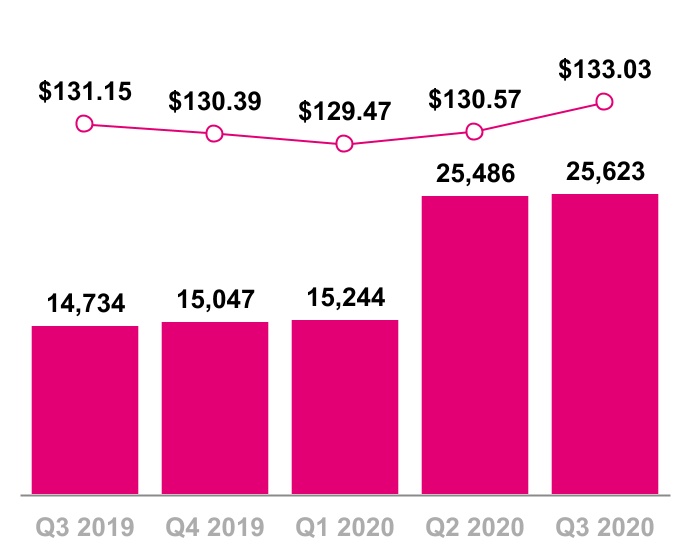

Total postpaid accounts were 25.6 million at the end of Q3 2020, compared to 25.5 million at the end of Q2 2020 and 14.7 million at the end of Q3 2019.

Postpaid ARPA was $133.03 in Q3 2020, up 1.9% compared to $130.57 in Q2 2020 and up 1.4% compared to $131.15 in Q3 2019.

▪Sequentially, the increase was primarily due an increase in average account size, the success of new customer segments and rate plans and higher premium service revenues.

▪Year-over-year, the increase was primarily due to an increase in average account size, including further penetration in connected devices, the success of new customer segments and rate plans and higher premium service revenues, partially offset by an increase in our promotional activities.

Postpaid Accounts & Postpaid ARPA

(Accounts in thousands)

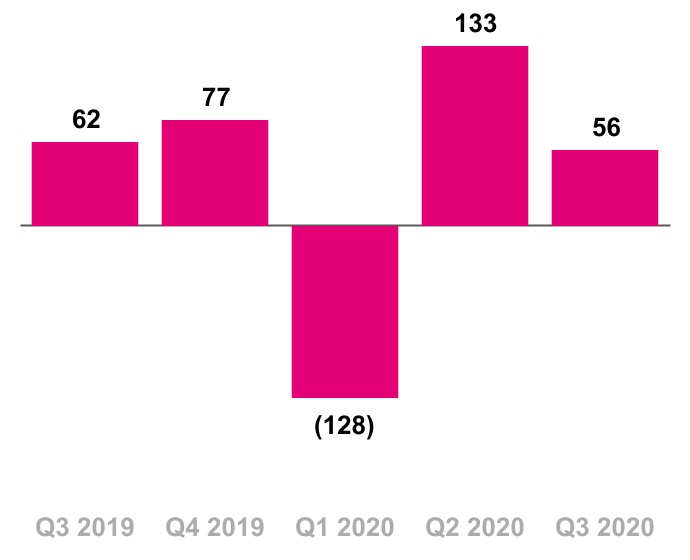

Total Prepaid Net Additions (losses)

(in thousands)

Prepaid net customer additions were 56,000 in Q3 2020, compared to net additions of 133,000 in Q2 2020 and net additions of 62,000 in Q3 2019.

▪Sequentially, the decrease was primarily due to lower prepaid industry switching activity.

▪Year-over-year, the slight decrease was primarily due to lower switching activity in the industry due to the Pandemic, partially offset by lower churn.

▪Migrations to postpaid plans reduced prepaid net customer additions in Q3 2020 by approximately 130,000, up from 90,000 in Q2 2020 and flat compared to Q3 2019.

Prepaid churn was 2.86% in Q3 2020, compared to 2.81% in Q2 2020 and 3.98% in Q3 2019.

▪Sequentially, prepaid churn was essentially flat.

▪Year-over year, the decrease was primarily due to lower switching activity in the industry due to the Pandemic.

Prepaid ARPU was $38.49 in Q3 2020, up 1.8% from $37.80 in Q2 2020 and up 0.9% from $38.16 in Q3 2019.

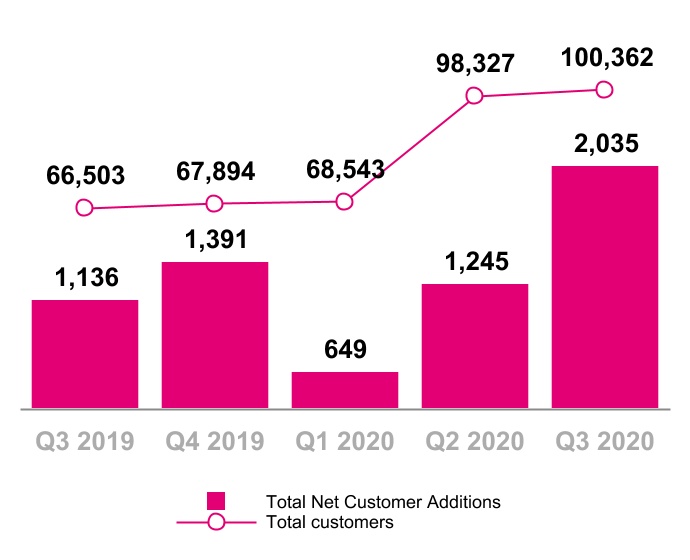

Total net customer additions were a record 2,035,000 in Q3 2020, compared to 1,245,000 in Q2 2020 and 1,136,000 in Q3 2019.

Total customers were 100.4 million at the end of Q3 2020, compared to 98.3 million at the end of Q2 2020 and 66.5 million at the end of Q3 2019.

Total devices sold or leased were 11.4 million units in Q3 2020, compared to 10.1 million units in Q2 2020 and 8.0 million units in Q3 2019.

▪Sequentially, the increase was primarily due to higher phone sales driven by a shift in device financing to equipment installment plans and the sale of devices to educational institutions, partially offset by lower leased devices.

▪Year-over-year, the increase was primarily due to the Merger and increased device sales to educational institutions.

▪Total phones sold or leased were 9.2 million units in Q3 2020, compared to 8.9 million units in Q2 2020 and 7.4 million units in Q3 2019.

▪Mobile broadband and IoT devices sold or leased were 2.2 million units in Q3 2020, compared to 1.2 million units in Q2 2020 and 0.6 million units in Q3 2019.

Total Customers

(in thousands)

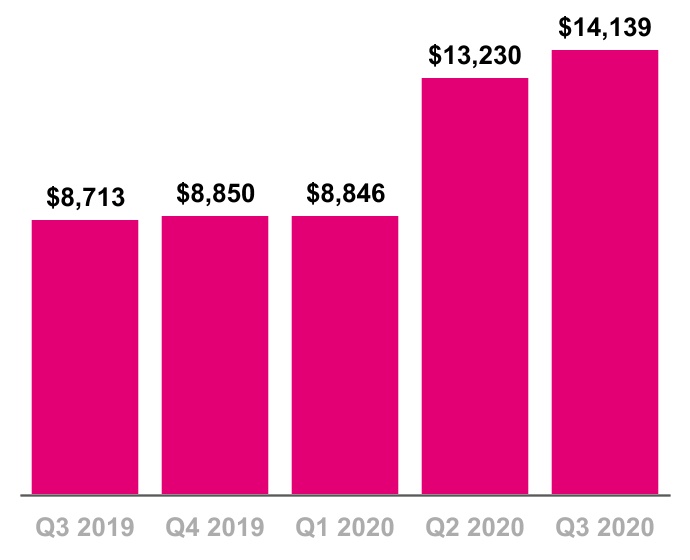

Service Revenues

($ in millions)

Service revenues were $14.1 billion in Q3 2020, up 7% from $13.2 billion in Q2 2020 and up 62% from $8.7 billion in Q3 2019.

▪Sequentially, the increase was primarily due to an increase of 128% in Wholesale revenues driven by our Master Network Service Agreement with DISH, which went into effect on July 1, 2020, as well as an increase of 3% in Postpaid service revenues. The revenue associated with Sprint prepaid customers divested to DISH on July 1, 2020 was reflected in discontinued operations in Q2 2020.

▪Year-over-year, the increase was primarily due to a 78% increase in Postpaid service revenues, largely driven by customers acquired in the Merger and continued growth in existing and new markets, an increase in Wholesale revenues primarily driven by our Master Network Service Agreement with DISH, which went into effect on July 1, 2020, and higher Roaming and other service revenues, primarily from the inclusion of wireline operations acquired in the Merger.

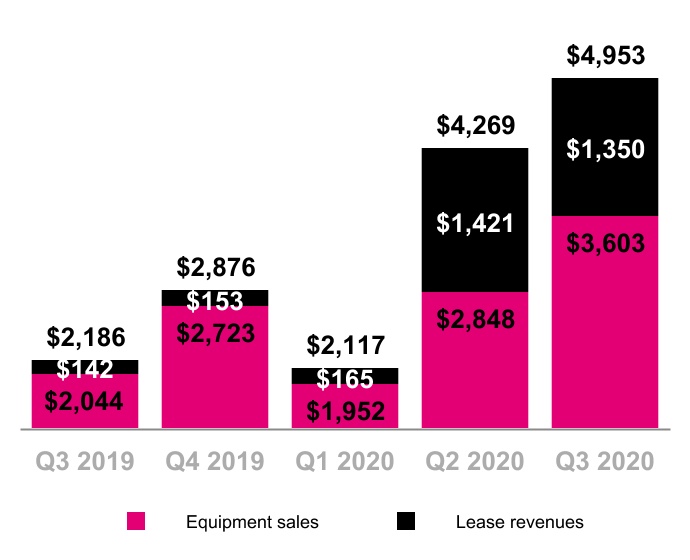

Equipment revenues were $5.0 billion in Q3 2020, up 16% from $4.3 billion in Q2 2020 and up 127% from $2.2 billion in Q3 2019. Lease revenues included in equipment revenues were $1.4 billion in Q3 2020 compared to $1.4 billion in Q2 2020 and $142 million in Q3 2019.

▪Sequentially, the increase was primarily due to an increase in device sales revenue driven by a shift in device financing from leasing to equipment installment plans, and an increase in the number of devices sold, excluding purchased leased devices, partially offset by a decrease in lease revenues.

▪Year-over year, the increase was primarily due to an increase in lease revenues due to a higher number of customer devices under lease acquired in the Merger, an increase in the number of devices sold, excluding purchased leased devices, primarily due to an increased customer base as the result of the Merger and a higher average revenue per device sold due to an increase in the high-end device mix due to the Merger.

Equipment Revenues

($ in millions)

| | | | | | | | |

| Total revenues were $19.3 billion in Q3 2020, up 9% from $17.7 billion in Q2 2020 and up 74% from $11.1 billion in Q3 2019. | |

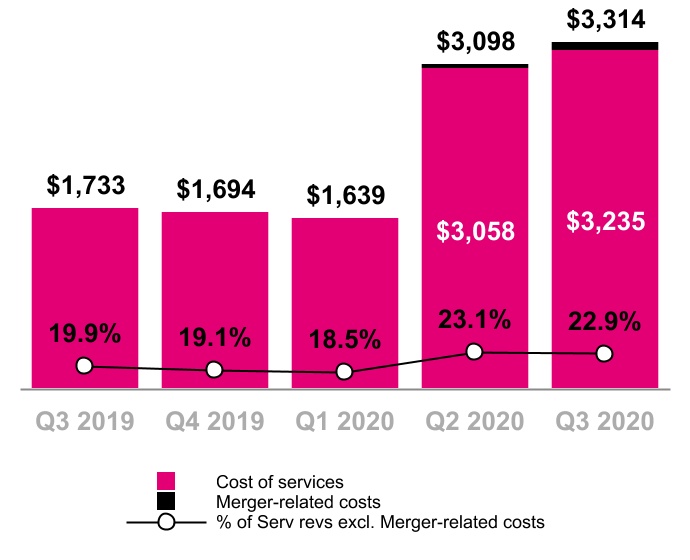

Cost of Services, exclusive of D&A

($ in millions, % of Service revs excl. Merger-related costs)

Cost of services, exclusive of depreciation and amortization (D&A), was $3.3 billion in Q3 2020, up 7% from $3.1 billion in Q2 2020 and up 91% from $1.7 billion in Q3 2019.

▪Sequentially, the increase was primarily driven by an increase in leases and tower expenses.

▪Year-over-year, the increase was primarily due to an increase in expenses associated with leases, backhaul agreements and tower expenses acquired in the Merger and the continued build-out of our nationwide 5G network.

▪Merger-related costs were $79 million in Q3 2020 compared to $40 million in Q2 2020 and $0 in Q3 2019.

▪As a percentage of Service revenues, Cost of Services, exclusive of D&A, and excluding Merger-related costs, decreased by 23 basis points sequentially and increased by 299 basis points year-over-year.

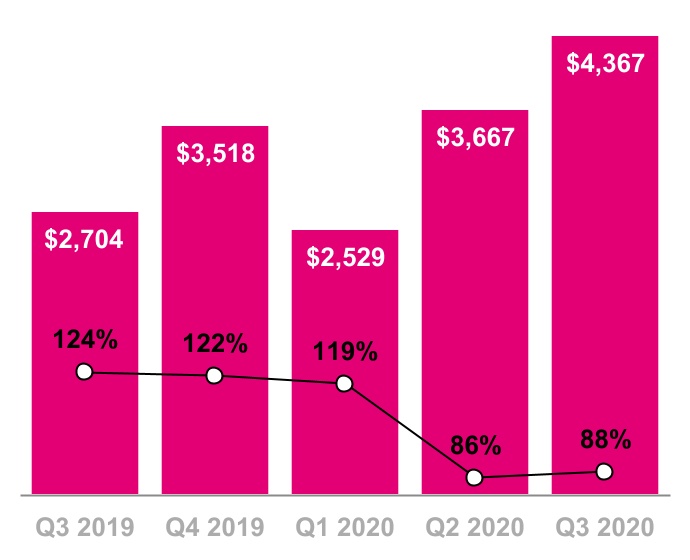

Cost of equipment sales, exclusive of D&A, was $4.4 billion in Q3 2020, up 19% from $3.7 billion in Q2 2020 and up 62% from $2.7 billion in Q3 2019.

▪Sequentially, the increase was primarily due to an increase in device cost of equipment sales driven by a shift in device financing from leasing to equipment installment plans, as well as an increase in the number of devices sold, excluding purchased leased devices.

▪Year-over-year, the increase was primarily from an increase in the number of devices sold, excluding purchased leased devices, due to a higher customer base as a result of the Merger and higher average costs per device sold due to an increase in the high-end device mix due to the Merger.

Cost of Equipment Sales, exclusive of D&A

($ in millions, % of Equipment Revs)

Selling, General and Administrative (SG&A) Expense

($ in millions, % of Service revs excl. Merger-related costs and COVID-19-related costs)

Selling, general and administrative (SG&A) expense was $4.9 billion in Q3 2020, down 13% from $5.6 billion in Q2 2020 and up 39% from $3.5 billion in Q3 2019.

▪Sequentially, the decrease was driven by lower Merger-related and supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs and lower bad debt expense.

▪Year-over-year, the increase was primarily due to the Merger including higher employee-related costs, external labor, advertising, lease and rent, and commissions expense due to higher gross customer additions, as well as higher Merger-related costs.

▪Merger-related costs were $209 million in Q3 2020 compared to $758 million in Q2 2020 and $159 million in Q3 2019. The sequential decrease was due to restructuring costs and transaction expenses incurred in Q2 2020.

▪COVID-19-related costs that were included in SG&A expense but excluded from adjusted EBITDA were $341 million in Q2 2020 and $0 in Q3 2019. Those costs were not significant in Q3 2020.

▪As a percentage of Service revenues, SG&A expense, excluding Merger-related and COVID-19-related costs, decreased 110 basis points sequentially and decreased 530 basis points year-over year.

▪Total bad debt expense and losses from sales of receivables (reported within SG&A expense) was $125 million in Q3 2020, compared to $263 million in Q2 2020 and $102 million in Q3 2019. The decrease sequentially was primarily due to lower expected credit loss reserves. The year-over-year increase was primarily driven by higher bad debt expense due to customers acquired as a result of the Merger, partially offset by lower expected credit loss reserves and lower write-offs.

▪As a percentage of Total revenues, Total bad debt expense and losses from sales of receivables was 0.65% in Q3 2020, compared to 1.49% in Q2 2020 and 0.92% in Q3 2019.

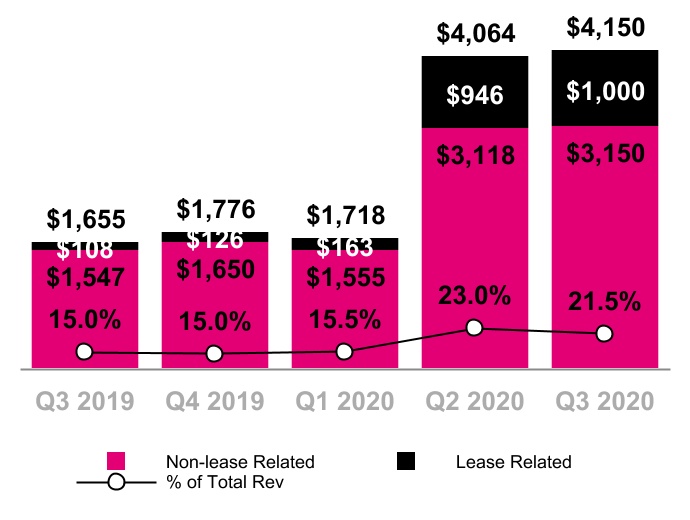

D&A was $4.2 billion in Q3 2020, up 2% from $4.1 billion in Q2 2020 and up 151% from $1.7 billion in Q3 2019. This includes D&A related to leased devices of $1.0 billion in Q3 2020, compared to $946 million in Q2 2020 and $108 million in Q3 2019.

▪Sequentially the increase was primarily driven by higher depreciation expense on leased devices and from the continued build-out of our nationwide 5G network.

▪Year-over-year, the increase was primarily due to higher depreciation expense from assets acquired in the Merger, excluding leased devices, and expansion from the continued build-out of our nationwide 5G network, higher depreciation expense on leased devices resulting from a higher total number of customer devices under lease primarily from customers acquired in the Merger, and higher amortization from intangible assets acquired in the Merger.

Depreciation & Amortization

($ in millions, % of Total Revs)

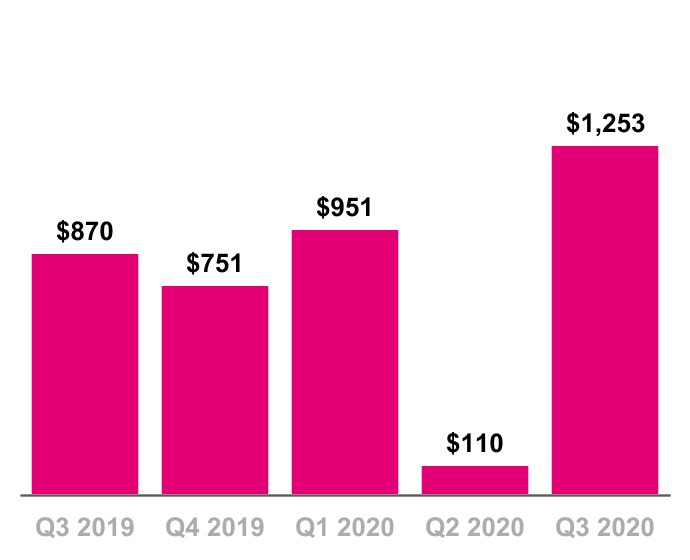

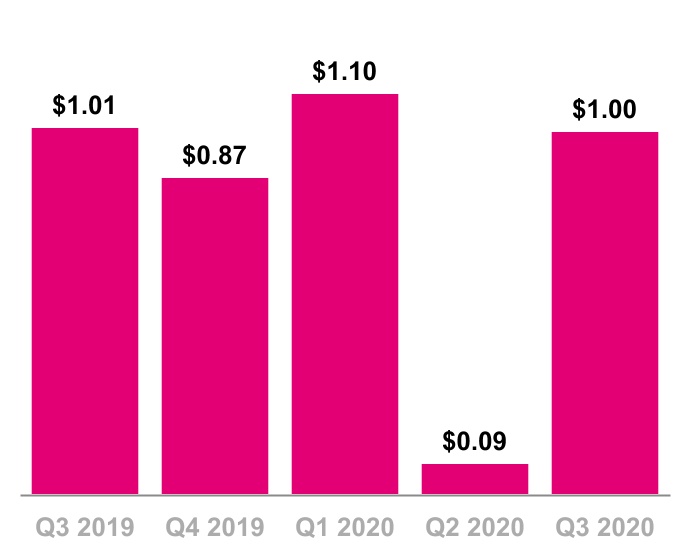

Net Income

($ in millions)

Diluted Earnings Per Share

Net income was $1.3 billion in Q3 2020, up 1,039% from $110 million in Q2 2020 and up 44% from $870 million in Q3 2019. EPS was $1.00 in Q3 2020, up from $0.09 in Q2 2020 and down from $1.01 in Q3 2019.

▪Sequentially, the increases in Net income and EPS were primarily due to higher Service and Equipment revenues and lower SG&A expense, partially offset by higher Cost of equipment sales, lower Impairment expense, higher Income tax expense and higher Cost of services. Net income and EPS were impacted by the following:

▪Merger-related costs, net of tax, for Q3 2020 of $208 million and $0.17, respectively, compared to $635 million and $0.51 in Q2 2020, respectively.

▪COVID-19-related costs, net of tax, for Q2 2020 of $253 million and $0.20, respectively. Those costs were not significant in Q3 2020.

▪Impairment expense, net of tax, for Q2 2020 of $366 million and $0.30, respectively. There was no impairment expense in Q3 2020.

▪The income associated with the Sprint prepaid subscribers divested to DISH on July 1, 2020 was reflected in discontinued operations in Q2 2020.

▪Year-over-year, the increase in Net income was primarily due to higher Service and Equipment revenues, partially offset by higher D&A, higher Cost of equipment sales, higher Cost of services, higher SG&A expense and higher Interest expense. EPS was relatively flat year-over-year due to an increase in outstanding shares as the result of the Merger. Net income and EPS were impacted by the following:

▪Merger-related costs, net of tax, for Q3 2020 of $208 million and $0.17, respectively, compared to $128 million and $0.15 in Q3 2019, respectively.

▪Net income margin was 8.9% in Q3 2020, compared to 0.8% in Q2 2020 and 10.0% in Q3 2019. Net income margin is calculated as Net income divided by Service revenues.

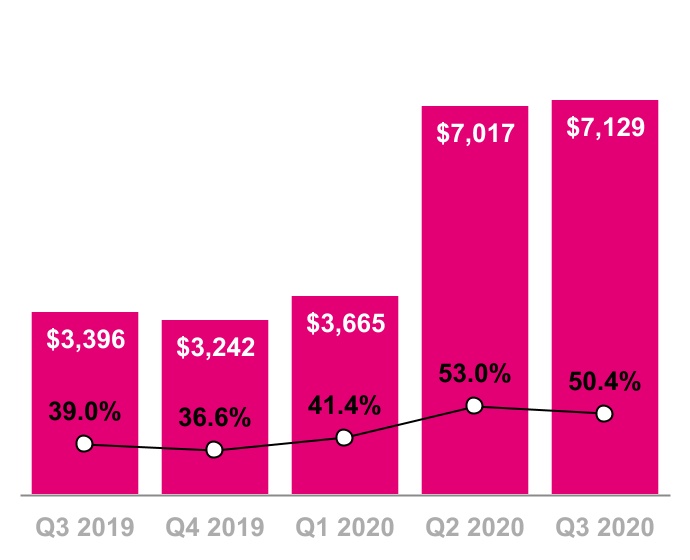

Adjusted EBITDA

($ in millions, % of Service Revs)

Adjusted EBITDA was $7.1 billion in Q3 2020, up 2% from $7.0 billion in Q2 2020 and up 110% from $3.4 billion in Q3 2019.

▪Sequentially the increase was primarily due to higher Postpaid Service and Equipment revenues, partially offset by higher Cost of equipment sales, higher Cost of services, excluding Merger-related costs, and higher SG&A expense, excluding Merger-related and COVID-19-related costs.

▪Year-over-year, the increase was primarily due to higher Service and Equipment revenues, partially offset by higher Cost of equipment sales, higher Cost of services, excluding Merger-related costs, and higher SG&A expense, excluding Merger-related costs.

▪Adjusted EBITDA excludes Merger-related costs of $288 million in Q3 2020 compared to $798 million in Q2 2020 and $159 million in Q3 2019.

▪Adjusted EBITDA in Q2 2020 excluded COVID-19-related costs of $341 million. These costs were not significant in Q3 2020.

▪Adjusted EBITDA margin was 50.4% in Q3 2020, compared to 53.0% in Q2 2020 and 39.0% in Q3 2019. The sequential decrease in margin was primarily due to service revenue associated with Sprint prepaid subscribers divested to DISH on July 1, 2020 being reflected in discontinued operations and excluded from service revenue in Q2 2020.

Net cash provided by operating activities was $2.8 billion in Q3 2020, compared to $777 million in Q2 2020 and $1.7 billion in Q3 2019.

▪Sequentially, the increase was primarily due to higher Net Income as well as a decrease in net cash outflows from changes in working capital. The change in working capital was primarily due to the one-time impact of $2.3 billion in gross payments for the settlement of interest rate swaps related to Merger financing in Q2 2020, partially offset by higher use from Accounts receivable and Equipment installment plan receivables.

▪Year-over-year, the increase was primarily due to higher non-cash adjustments to Net income, primarily from D&A and higher Net income, partially offset by an increase in net cash outflows from changes in working capital.

▪The impact of payments for Merger-related costs on Net cash provided by operating activities was $379 million in Q3 2020 compared to $370 million in Q2 2020 and $124 million in Q3 2019.

▪The impact of COVID-19-related costs on Net cash provided by operating activities was $198 million in Q3 2020 compared to $243 million in Q2 2020.

Net Cash Provided by Operating Activities

($ in millions)

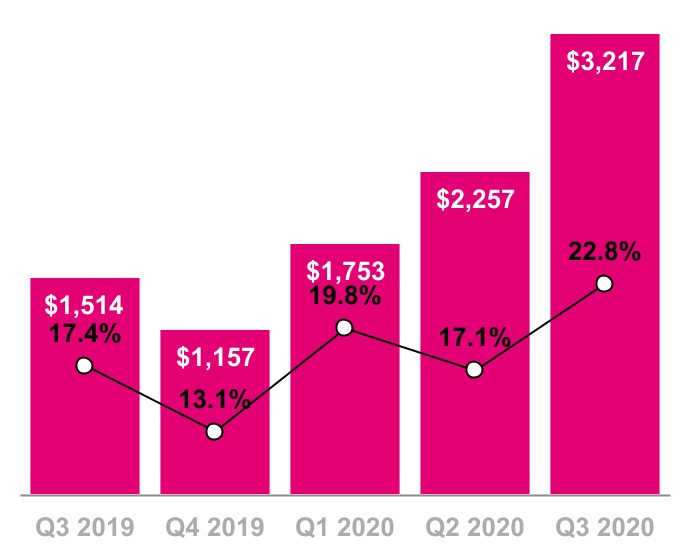

Cash Purchases of Property and Equipment

($ in millions, % of Service Revenues)

Cash purchases of property and equipment were $3.2 billion in Q3 2020, compared to $2.3 billion in Q2 2020 and $1.5 billion in Q3 2019. Capitalized interest included in cash purchases of property and equipment was $108 million in Q3 2020, compared to $119 million in Q2 2020 and $118 million in Q3 2019.

▪Sequentially and year-over-year, the increase was primarily driven by network integration related to the Merger and the continued build-out of our nationwide 5G network.

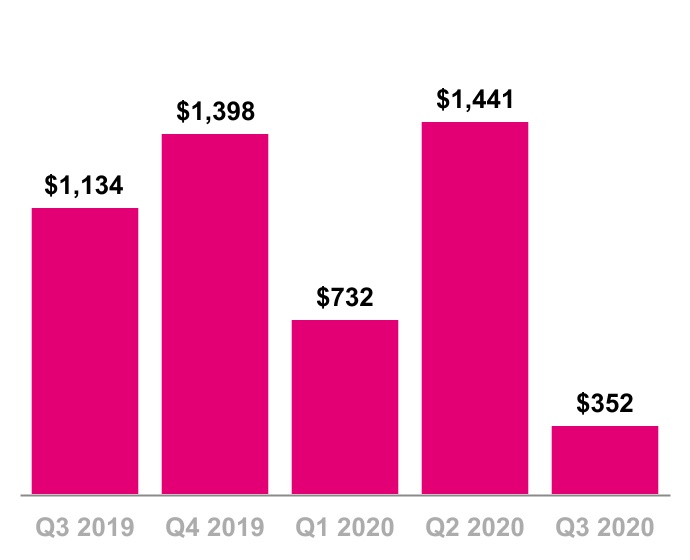

Free Cash Flow, excluding gross payments for the settlement of interest rate swaps related to Merger financing, was $352 million in Q3 2020, compared to $1.4 billion in Q2 2020 and $1.1 billion in Q3 2019.

▪Sequentially, the decrease was impacted by the following:

▪Higher cash purchases of property and equipment, including capitalized interest; and

▪Lower Net cash provided by operating activities, excluding one-time gross payments for the settlement of interest rate swaps related to Merger financing of $2.3 billion in Q2 2020 which is excluded from Free Cash Flow; partially offset by

▪Higher proceeds related to our deferred purchase price from securitization transactions.

▪Year-over-year, the decrease was impacted by the following:

▪Higher cash purchases of property and equipment, including capitalized interest; partially offset by

▪Higher Net cash provided by operating activities, as described above.

Free Cash Flow, Excluding Gross Payments for the Settlement of Interest Rate Swaps

($ in millions)

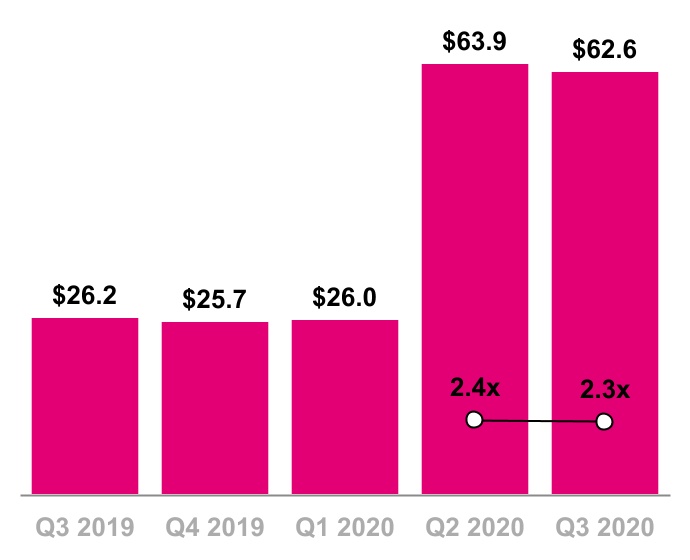

Total Net Debt, Excluding Tower Obligations & Leverage Ratio: Net Debt to Pro Forma Adj. EBITDA

($ in billions)

Total debt, excluding tower obligations, at the end of Q3 2020 was $69.2 billion.

Net debt, excluding tower obligations, at the end of Q3 2020 was $62.6 billion.

▪The ratio of net debt, excluding tower obligations, to Pro Forma Adjusted EBITDA for the trailing last twelve months (“LTM”) period was 2.3x at the end of Q3 2020 compared to 2.4x at the end of Q2 2020.

▪Since closing the Merger on April 1, 2020, we have issued approximately $36 billion of secured debt at an average interest rate of approximately 3.5% and an average tenor of approximately 14 years.

▪Since closing the Merger on April 1, 2020, we utilized these proceeds to retire approximately $28 billion of debt, including Sprint debt repaid at close, which allowed us to double the average maturity of our debt portfolio from 4.3 years to 9.2 years, and lowered the average cost of debt from approximately 5.7% to approximately 5.1%, excluding amortization of swaps.

Capital markets activity since the close of Q2 2020 includes:

▪On July 4, we redeemed $1.0 billion 6.500% Senior Notes due 2024 and $1.3 billion 5.125% Senior Notes to Affiliates due 2021.

▪On August 15, we repaid $1.5 billion 7.000% Senior Notes due 2020.

▪On September 1, we redeemed $1.7 billion 6.375% Senior Notes due 2025.

▪On September 16, we increased our Revolving Credit Facility from $4.0 billion to $5.5 billion.

▪On October 6, we issued Senior Secured Notes in an aggregate amount of $4.0 billion.

▪On October 9, we repaid our $4.0 billion Term Loan Facility.

▪On October 28, we issued Senior Secured Notes in an aggregate amount of $4.75 billion.

▪On October 30, we entered into a $5.0 billion senior secured term loan commitment with certain financial institutions. Up to $5.0 billion of loans under the commitment may be drawn at any time (subject to customary conditions precedent) through June 30, 2021.

| | | | | | | | | | | | | | |

| T-Mobile remains highly confident in its ability to integrate the networks, people and assets of Sprint and T-Mobile. This integration is expected to deliver $6 billion in annualized savings and deliver a net present value of synergies of $43 billion through a combination of expense reductions and cost avoidance. | |

| | | | |

| Improvements for Sprint customers | | Two quarters in, we are delivering on these synergies faster than expected and are targeting more than $1.2 billion in realized synergies in 2020. We expect to realize:

▪Over $600 million of network synergies in 2020, primarily from avoided new site builds and early site decommissioning. ▪Approximately $500 million of sales, service and marketing synergies in 2020, primarily from an acceleration in the rationalization of retail stores, marketing consolidation and organizational redesign. ▪Approximately $100 million of back office synergies in 2020, primarily from an accelerated organizational redesign. Merger-related costs in Q3 2020 were $288 million compared to $798 million in Q2 2020 and $159 million in Q3 2019. We continue to expect 2H 2020 Merger-related costs of $800 million to $1.0 billion.

Merger-related costs include: ▪Transaction costs, including legal and professional services related to the completion of the Merger; ▪Restructuring costs, including severance, store rationalization and network decommissioning ▪Integration costs to achieve efficiencies in network, retail, information technology and back office operations.

| |

| 15% | | |

| of Sprint’s postpaid traffic is currently carried on to the New

T-Mobile network. | | |

| ————————— | | |

| 85% | | |

| of Sprint’s postpaid customers

have handsets that are

compatible with the T-Mobile

network today. | | |

| | | |

| | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merger-Related Costs |

| (in millions) |

| | | | | | | | | | | Sequential Change | | Year-over-year Change |

| Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | $ | | % | | $ | | % |

| Cost of services | $ | — | | | $ | — | | | $ | — | | | $ | 40 | | | $ | 79 | | | $ | 39 | | | 98 | % | | $ | 79 | | | NM |

| Selling, general & administrative | 159 | | | 126 | | | 143 | | | 758 | | | 209 | | | (549) | | | (72) | % | | 50 | | | 31 | % |

| Total Merger-related costs | $ | 159 | | | $ | 126 | | | $ | 143 | | | $ | 798 | | | $ | 288 | | | $ | (510) | | | (64) | % | | $ | 129 | | | 81 | % |

| | | | | | | | | | | | | | | | | |

| Cash payments for Merger-related costs | $ | 124 | | | $ | 133 | | | $ | 161 | | | $ | 370 | | | $ | 379 | | | $ | 9 | | | 2 | % | | $ | 255 | | | 206 | % |

| | | | | | | | | | | | | | | | | |

NM - Not Meaningful

H2 2020 Outlook

| | | | | | | | | | | |

| Previous | Current | Change at Midpoint |

| Postpaid Net Customer Additions | 1.7 to 1.9 million | Achieved in Q3 2020 | N/A |

| Postpaid Phone Net Customer Additions | N/A | 1.3 to 1.4 million | N/A |

Net Income (1) | N/A | N/A | N/A |

| Adjusted EBITDA | $12.4 to $12.7 billion | $13.6 to $13.7 billion | $1.1 billion |

| Leasing Revenue | $2.4 to $2.6 billion | $2.5 to $2.6 billion | $50 million |

Capital Expenditures (2) | $6.5 to $6.9 billion | $6.7 to $6.9 billion | $100 million |

Merger-related costs (3) | $0.8 to $1.0 billion | $0.8 to $1.0 billion | No change |

| Net cash provided by operating activities | $5.3 to $5.7 billion | $5.9 to $6.1 billion | $500 million |

Free Cash Flow (4) | $300 to $500 million | $700 to $900 million | $400 million |

(1)We are not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP Net income, including, but not limited to, Income tax expense, stock-based compensation expense and Interest expense. Adjusted EBITDA should not be used to predict Net income as the difference between the two measures is variable.

(2)Capital expenditures includes capitalized interest.

(3)Merger-related costs are excluded from Adjusted EBITDA but will impact Net income and cash flows.

(4)Free Cash Flow guidance does not assume any material net cash inflows from securitization in 2020.

Upcoming Events

(All dates and attendance tentative)

| | | | | |

| Event | Date |

| MoffetNathanson 5G Summit | November 12, 2020 (Virtual) |

| New Street Research/Boston Consulting Group 5G Conference | November 17, 2020 (Virtual) |

| Morgan Stanley European TMT Conference | November 18-20, 2020 (Virtual) |

| Bank of America Leveraged Finance Conference | November 30, 2020 (Virtual) |

| UBS Technology Media and Telecom Conference | December 7-9, 2020 (Virtual) |

| Oppenheimer 5G Conference | December 15, 2020 (Virtual) |

| T-Mobile Analyst Day | 1Q21 (Virtual) |

Contact Information

investor.relations@t-mobile.com

http://investor.t-mobile.com

T-Mobile US, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (in millions, except share and per share amounts) | September 30, 2020 | | December 31, 2019 |

| Assets | | | |

| Current assets | | | |

| | | |

| Cash and cash equivalents | $ | 6,571 | | | $ | 1,528 | |

| Accounts receivable, net of allowance for credit losses of $208 and $61 | 4,313 | | | 1,888 | |

| Equipment installment plan receivables, net of allowance for credit losses and imputed discount of $450 and $333 | 3,083 | | | 2,600 | |

| Accounts receivable from affiliates | 19 | | | 20 | |

| Inventory | 1,931 | | | 964 | |

| | | |

| Prepaid expenses | 659 | | | 333 | |

| | | |

| Other current assets | 2,889 | | | 1,972 | |

| | | |

| Total current assets | 19,465 | | | 9,305 | |

| | | |

| Property and equipment, net | 38,567 | | | 21,984 | |

| Operating lease right-of-use assets | 27,999 | | | 10,933 | |

| Financing lease right-of-use assets | 3,038 | | | 2,715 | |

| Goodwill | 10,906 | | | 1,930 | |

| Spectrum licenses | 82,891 | | | 36,465 | |

| Other intangible assets, net | 5,660 | | | 115 | |

| Equipment installment plan receivables due after one year, net of allowance for credit losses and imputed discount of $87 and $66 | 1,398 | | | 1,583 | |

| | | |

| Other assets | 2,519 | | | 1,891 | |

| | | |

| Total assets | $ | 192,443 | | | $ | 86,921 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| | | |

| Accounts payable and accrued liabilities | $ | 8,389 | | | $ | 6,746 | |

| Payables to affiliates | 135 | | | 187 | |

| Short-term debt | 3,713 | | | 25 | |

| | | |

| Deferred revenue | 1,078 | | | 631 | |

| Short-term operating lease liabilities | 3,658 | | | 2,287 | |

| Short-term financing lease liabilities | 1,050 | | | 957 | |

| | | |

| Other current liabilities | 1,817 | | | 1,673 | |

| | | |

| Total current liabilities | 19,840 | | | 12,506 | |

| | | |

| Long-term debt | 58,345 | | | 10,958 | |

| Long-term debt to affiliates | 4,711 | | | 13,986 | |

| Tower obligations | 3,079 | | | 2,236 | |

| Deferred tax liabilities | 10,373 | | | 5,607 | |

| Operating lease liabilities | 26,658 | | | 10,539 | |

| Financing lease liabilities | 1,373 | | | 1,346 | |

| | | |

| | | |

| Other long-term liabilities | 3,577 | | | 954 | |

| | | |

| Total long-term liabilities | 108,116 | | | 45,626 | |

| Commitments and contingencies | | | |

| Stockholders' equity | | | |

| | | |

| | | |

| Common Stock, par value $0.00001 per share,2,000,000,000 shares authorized; 1,242,003,310 and 858,418,615 shares issued, 1,240,458,618 and 856,905,400 shares outstanding | — | | | — | |

| Additional paid-in capital | 72,705 | | | 38,498 | |

| Treasury stock, at cost, 1,544,692 and 1,513,215 shares issued | (11) | | | (8) | |

| Accumulated other comprehensive loss | (1,621) | | | (868) | |

| Accumulated deficit | (6,586) | | | (8,833) | |

| | | |

| Total stockholders' equity | 64,487 | | | 28,789 | |

| Total liabilities and stockholders' equity | $ | 192,443 | | | $ | 86,921 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended September 30, |

| (in millions, except share and per share amounts) | September 30, 2020 | | June 30,

2020 | | September 30, 2019 | | 2020 | | 2019 |

| Revenues | | | | | | | | | |

| | | | | | | | | |

| Postpaid revenues | $ | 10,209 | | | $ | 9,959 | | | $ | 5,746 | | | $ | 26,055 | | | $ | 16,852 | |

| Prepaid revenues | 2,383 | | | 2,311 | | | 2,385 | | | 7,067 | | | 7,150 | |

| Wholesale revenues | 930 | | | 408 | | | 321 | | | 1,663 | | | 938 | |

| Roaming and other service revenues | 617 | | | 552 | | | 261 | | | 1,430 | | | 710 | |

| | | | | | | | | |

| Total service revenues | 14,139 | | | 13,230 | | | 8,713 | | | 36,215 | | | 25,650 | |

| | | | | | | | | |

| Equipment revenues | 4,953 | | | 4,269 | | | 2,186 | | | 11,339 | | | 6,965 | |

| Other revenues | 180 | | | 172 | | | 162 | | | 502 | | | 505 | |

| | | | | | | | | |

| Total revenues | 19,272 | | | 17,671 | | | 11,061 | | | 48,056 | | | 33,120 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | | |

| | | | | | | | | |

| Cost of services, exclusive of depreciation and amortization shown separately below | 3,314 | | | 3,098 | | | 1,733 | | | 8,051 | | | 4,928 | |

| Cost of equipment sales, exclusive of depreciation and amortization shown separately below | 4,367 | | | 3,667 | | | 2,704 | | | 10,563 | | | 8,381 | |

| Selling, general and administrative | 4,876 | | | 5,604 | | | 3,498 | | | 14,168 | | | 10,483 | |

| Impairment expense | — | | | 418 | | | — | | | 418 | | | — | |

| Depreciation and amortization | 4,150 | | | 4,064 | | | 1,655 | | | 9,932 | | | 4,840 | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating expenses | 16,707 | | | 16,851 | | | 9,590 | | | 43,132 | | | 28,632 | |

| | | | | | | | | |

| Operating income | 2,565 | | | 820 | | | 1,471 | | | 4,924 | | | 4,488 | |

| | | | | | | | | |

| Other income (expense) | | | | | | | | | |

| | | | | | | | | |

| Interest expense | (765) | | | (776) | | | (184) | | | (1,726) | | | (545) | |

| Interest expense to affiliates | (44) | | | (63) | | | (100) | | | (206) | | | (310) | |

| Interest income | 3 | | | 6 | | | 5 | | | 21 | | | 17 | |

| Other expense, net | (99) | | | (195) | | | 3 | | | (304) | | | (12) | |

| Total other expense, net | (905) | | | (1,028) | | | (276) | | | (2,215) | | | (850) | |

| Income from continuing operations before income taxes | 1,660 | | | (208) | | | 1,195 | | | 2,709 | | | 3,638 | |

| Income tax expense | (407) | | | (2) | | | (325) | | | (715) | | | (921) | |

| | | | | | | | | |

| Income from continuing operations | 1,253 | | | (210) | | | 870�� | | | 1,994 | | | 2,717 | |

| Income from discontinued operations, net of tax | — | | | 320 | | | — | | | 320 | | | — | |

| Net income | $ | 1,253 | | | $ | 110 | | | $ | 870 | | | $ | 2,314 | | | $ | 2,717 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | $ | 1,253 | | | $ | 110 | | | $ | 870 | | | $ | 2,314 | | | $ | 2,717 | |

| Other comprehensive income (loss), net of tax | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Unrealized gain (loss) on cash flow hedges, net of tax effect of $12, $3, ($88), ($261), ($256) | 33 | | | 2 | | | (257) | | | (757) | | | (738) | |

| Unrealized gain on foreign currency translation adjustment, net of tax effect of $1, $0, $0, $1, and $0 | 4 | | | — | | | — | | | 4 | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other comprehensive income (loss) | 37 | | | 2 | | | (257) | | | (753) | | | (738) | |

| | | | | | | | | |

| Total comprehensive income | $ | 1,290 | | | $ | 112 | | | $ | 613 | | | $ | 1,561 | | | $ | 1,979 | |

| Earnings per share | | | | | | | | | |

| Basic earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 1.01 | | | $ | (0.17) | | | $ | 1.02 | | | $ | 1.79 | | | $ | 3.18 | |

| Discontinued operations | — | | | 0.26 | | | — | | | 0.29 | | | — | |

| Basic | $ | 1.01 | | | $ | 0.09 | | | $ | 1.02 | | | $ | 2.08 | | | $ | 3.18 | |

| Diluted earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 1.00 | | | $ | (0.17) | | | $ | 1.01 | | | $ | 1.78 | | | $ | 3.15 | |

| Discontinued operations | — | | | 0.26 | | | — | | | 0.28 | | | — | |

| Diluted | $ | 1.00 | | | $ | 0.09 | | | $ | 1.01 | | | $ | 2.06 | | | $ | 3.15 | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | 1,238,450,665 | | | 1,236,528,444 | | | 854,578,241 | | | 1,111,511,964 | | | 853,391,370 | |

| Diluted | 1,249,798,740 | | | 1,236,528,444 | | | 862,690,751 | | | 1,122,040,528 | | | 862,854,654 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended September 30, |

| (in millions) | September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | 2020 | | 2019 |

| Operating activities | | | | | | | | | |

| Net income | $ | 1,253 | | | $ | 110 | | | $ | 870 | | | $ | 2,314 | | | $ | 2,717 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | | | | | | | |

| | | | | | | | | |

| Depreciation and amortization | 4,150 | | | 4,064 | | | 1,655 | | | 9,932 | | | 4,840 | |

| Stock-based compensation expense | 161 | | | 259 | | | 126 | | | 558 | | | 366 | |

| Deferred income tax expense | 335 | | | 98 | | | 294 | | | 743 | | | 849 | |

| Bad debt expense | 143 | | | 233 | | | 74 | | | 489 | | | 218 | |

| (Gains) losses from sales of receivables | (18) | | | 30 | | | 28 | | | 37 | | | 91 | |

| | | | | | | | | |

| Losses on redemption of debt | 108 | | | 163 | | | — | | | 271 | | | 19 | |

| | | | | | | | | |

| | | | | | | | | |

| Impairment expense | — | | | 418 | | | — | | | 418 | | | — | |

| Changes in operating assets and liabilities | | | | | | | | | |

| Accounts receivable | (1,538) | | | (498) | | | (745) | | | (2,784) | | | (2,693) | |

| Equipment installment plan receivables | (306) | | | 127 | | | (78) | | | (110) | | | (478) | |

| Inventories | (549) | | | (553) | | | (36) | | | (1,613) | | | (139) | |

| Operating lease right-of-use assets | 1,062 | | | 937 | | | 491 | | | 2,526 | | | 1,395 | |

| Other current and long-term assets | (8) | | | (104) | | | (118) | | | (106) | | | (288) | |

| Accounts payable and accrued liabilities | (964) | | | (1,261) | | | (395) | | | (2,630) | | | (339) | |

| Short and long-term operating lease liabilities | (1,145) | | | (1,077) | | | (549) | | | (2,947) | | | (1,592) | |

| Other current and long-term liabilities | (51) | | | (2,190) | | | 42 | | | (2,162) | | | 136 | |

| Other, net | 139 | | | 21 | | | 89 | | | 230 | | | 185 | |

| | | | | | | | | |

| Net cash provided by operating activities | 2,772 | | | 777 | | | 1,748 | | | 5,166 | | | 5,287 | |

| Investing activities | | | | | | | | | |

| | | | | | | | | |

| Purchases of property and equipment, including capitalized interest of ($108), ($119), ($118), ($339) and ($361) | (3,217) | | | (2,257) | | | (1,514) | | | (7,227) | | | (5,234) | |

| Refunds (purchases) of spectrum licenses and other intangible assets, including deposits | 17 | | | (745) | | | (13) | | | (827) | | | (863) | |

| | | | | | | | | |

| Proceeds related to beneficial interests in securitization transactions | 855 | | | 602 | | | 900 | | | 2,325 | | | 2,896 | |

| Net cash related to derivative contracts under collateral exchange arrangements | — | | | 1,212 | | | — | | | 632 | | | — | |

| Acquisition of companies, net of cash and restricted cash acquired | — | | | (5,000) | | | (31) | | | (5,000) | | | (31) | |

| Proceeds from the divestiture of prepaid business | 1,238 | | | — | | | — | | | 1,238 | | | — | |

| Other, net | (25) | | | (168) | | | 1 | | | (209) | | | (6) | |

| | | | | | | | | |

| Net cash used in investing activities | (1,132) | | | (6,356) | | | (657) | | | (9,068) | | | (3,238) | |

| Financing activities | | | | | | | | | |

| | | | | | | | | |

| Proceeds from issuance of long-term debt | — | | | 26,694 | | | — | | | 26,694 | | | — | |

| Payments of consent fees related to long-term debt | — | | | (109) | | | — | | | (109) | | | — | |

| Proceeds from borrowing on revolving credit facility | — | | | — | | | 575 | | | — | | | 2,340 | |

| Repayments of revolving credit facility | — | | | — | | | (575) | | | — | | | (2,340) | |

| Repayments of financing lease obligations | (246) | | | (236) | | | (235) | | | (764) | | | (550) | |

| Repayments of short-term debt for purchases of inventory, property and equipment and other financial liabilities | (231) | | | (151) | | | (300) | | | (407) | | | (300) | |

| Repayments of long-term debt | (5,678) | | | (10,529) | | | — | | | (16,207) | | | (600) | |

| | | | | | | | | |

| Issuance of common stock | 2,550 | | | 17,290 | | | — | | | 19,840 | | | — | |

| Repurchases of common stock | (2,546) | | | (16,990) | | | — | | | (19,536) | | | — | |

| Proceeds from issuance of short-term debt | — | | | 18,743 | | | — | | | 18,743 | | | — | |

| Repayments of short-term debt | — | | | (18,929) | | | — | | | (18,929) | | | — | |

| Tax withholdings on share-based awards | (72) | | | (138) | | | (4) | | | (351) | | | (108) | |

| | | | | | | | | |

| Cash payments for debt prepayment or debt extinguishment costs | (58) | | | (24) | | | — | | | (82) | | | (28) | |

| Other, net | 137 | | | 7 | | | (4) | | | 139 | | | (13) | |

| | | | | | | | | |

| Net cash (used in) provided by financing activities | (6,144) | | | 15,628 | | | (543) | | | 9,031 | | | (1,599) | |

| Change in cash and cash equivalents, including restricted cash | (4,504) | | | 10,049 | | | 548 | | | 5,129 | | | 450 | |

| Cash and cash equivalents, including restricted cash | | | | | | | | | |

| Beginning of period | 11,161 | | | 1,112 | | | 1,105 | | | 1,528 | | | 1,203 | |

| End of period | $ | 6,657 | | | $ | 11,161 | | | $ | 1,653 | | | $ | 6,657 | | | $ | 1,653 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Cash Flows (Continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended September 30, |

| (in millions) | September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | 2020 | | 2019 |

| Supplemental disclosure of cash flow information | | | | | | | | | |

| Interest payments, net of amounts capitalized | $ | 940 | | | $ | 608 | | | $ | 327 | | | $ | 1,889 | | | $ | 912 | |

| Operating lease payments | 1,349 | | | 1,269 | | | 703 | | | 3,493 | | | 2,094 | |

| Income tax payments | 63 | | | 31 | | | 5 | | | 118 | | | 77 | |

| Non-cash investing and financing activities | | | | | | | | | |

| Non-cash beneficial interest obtained in exchange for securitized receivables | $ | 1,535 | | | $ | 1,486 | | | $ | 1,734 | | | $ | 4,634 | | | $ | 4,862 | |

| Non-cash consideration for the acquisition of Sprint | — | | | 33,533 | | | — | | | 33,533 | | | — | |

| Decrease in accounts payable and accrued liabilities for purchases of property and equipment | (216) | | | (38) | | | (460) | | | (555) | | | (906) | |

| Leased devices transferred from inventory to property and equipment | 599 | | | 1,444 | | | 298 | | | 2,352 | | | 612 | |

| Returned leased devices transferred from property and equipment to inventory | (433) | | | (538) | | | (65) | | | (1,030) | | | (189) | |

| Short-term debt assumed for financing of property and equipment | — | | | 38 | | | 475 | | | 38 | | | 775 | |

| Operating lease right-of-use assets obtained in exchange for lease obligations | 11,833 | | | 658 | | | 989 | | | 13,046 | | | 3,083 | |

| Financing lease right-of-use assets obtained in exchange for lease obligations | 219 | | | 515 | | | 395 | | | 912 | | | 943 | |

T-Mobile US, Inc.

Supplementary Operating and Financial Data

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in thousands) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Customers, end of period | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Postpaid phone customers (1) | 37,880 | | | 38,590 | | | 39,344 | | | 40,345 | | | 40,797 | | | 65,105 | | | 65,794 | | | 39,344 | | | 65,794 | |

Postpaid other customers (1) | 5,658 | | | 6,056 | | | 6,376 | | | 6,689 | | | 7,014 | | | 12,648 | | | 13,938 | | | 6,376 | | | 13,938 | |

| | | | | | | | | | | | | | | | | |

| Total postpaid customers | 43,538 | | | 44,646 | | | 45,720 | | | 47,034 | | | 47,811 | | | 77,753 | | | 79,732 | | | 45,720 | | | 79,732 | |

| | | | | | | | | | | | | | | | | |

Prepaid customers (1),(2) | 21,206 | | | 21,337 | | | 20,783 | | | 20,860 | | | 20,732 | | | 20,574 | | | 20,630 | | | 20,783 | | | 20,630 | |

| | | | | | | | | | | | | | | | | |

| Total customers | 64,744 | | | 65,983 | | | 66,503 | | | 67,894 | | | 68,543 | | | 98,327 | | | 100,362 | | | 66,503 | | | 100,362 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Adjustment to prepaid customers (2) | — | | | — | | | (616) | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)Includes customers acquired in connection with the Merger and certain customer base adjustments. See Customer Base Adjustments and Net Customer Additions (Losses) tables.

(2)On July 18, 2019, we entered into an agreement whereby certain T-Mobile prepaid products will now be offered and distributed by a current MVNO partner. As a result, we included a base adjustment in Q3 2019 to reduce prepaid customers by 616,000.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in thousands) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Net customer additions (losses) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Postpaid phone customers | 656 | | | 710 | | | 754 | | | 1,001 | | | 452 | | | 253 | | | 689 | | | 2,120 | | | 1,394 | |

| Postpaid other customers | 363 | | | 398 | | | 320 | | | 313 | | | 325 | | | 859 | | | 1,290 | | | 1,081 | | | 2,474 | |

| | | | | | | | | | | | | | | | | |

| Total postpaid customers | 1,019 | | | 1,108 | | | 1,074 | | | 1,314 | | | 777 | | | 1,112 | | | 1,979 | | | 3,201 | | | 3,868 | |

| | | | | | | | | | | | | | | | | |

Prepaid customers (1) | 69 | | | 131 | | | 62 | | | 77 | | | (128) | | | 133 | | | 56 | | | 262 | | | 61 | |

| | | | | | | | | | | | | | | | | |

| Total customers | 1,088 | | | 1,239 | | | 1,136 | | | 1,391 | | | 649 | | | 1,245 | | | 2,035 | | | 3,463 | | | 3,929 | |

| Acquired customers, net of base adjustments | — | | | — | | | — | | | — | | | — | | | 29,228 | | | — | | | — | | | 29,228 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)On July 18, 2019, we entered into an agreement whereby certain T-Mobile prepaid products will now be offered and distributed by a current MVNO partner. As a result, we included a base adjustment in Q3 2019 to reduce prepaid customers by 616,000.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in millions, except percentages) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Devices sold or leased | | | | | | | | | | | | | | | | | |

| Phones | 7.4 | | 6.5 | | 7.4 | | 8.3 | | 6.4 | | 8.9 | | 9.2 | | 21.3 | | 24.5 |

| Mobile broadband and IoT devices | 0.6 | | 0.6 | | 0.6 | | 0.8 | | 0.8 | | 1.2 | | 2.2 | | 1.8 | | 4.2 |

| Total | 8.0 | | 7.1 | | 8.0 | | 9.1 | | 7.2 | | 10.1 | | 11.4 | | 23.1 | | 28.7 |

| | | | | | | | | | | | | | | | | |

| Postpaid upgrade rate | 4.9 | % | | 4.5 | % | | 4.7 | % | | 5.6 | % | | 3.8 | % | | 4.5 | % | | 4.3 | % | | 14.1 | % | | 12.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Churn | | | | | | | | | | | | | | | | | |

| Postpaid phone churn | 0.88 | % | | 0.78 | % | | 0.89 | % | | 1.01 | % | | 0.86 | % | | 0.80 | % | | 0.90 | % | | 0.85 | % | | 0.85 | % |

| Prepaid churn | 3.85 | % | | 3.49 | % | | 3.98 | % | | 3.97 | % | | 3.52 | % | | 2.81 | % | | 2.86 | % | | 3.77 | % | | 3.07 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in thousands) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Accounts, end of period | | | | | | | | | | | | | | | | | |

Total postpaid customer accounts (1) | 14,234 | | 14,480 | | 14,734 | | 15,047 | | 15,244 | | 25,486 | | 25,623 | | 14,734 | | 25,623 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)Includes accounts acquired in connection with the Merger and certain account base adjustments. See Reconciliations to Beginning Customers and Accounts in this Investor Factbook.

T-Mobile US, Inc.

Supplementary Operating and Financial Data (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in millions, except percentages) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Financial Measures | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Service revenues | $ | 8,391 | | | $ | 8,546 | | | $ | 8,713 | | | $ | 8,850 | | | $ | 8,846 | | | $ | 13,230 | | | $ | 14,139 | | | $ | 25,650 | | | $ | 36,215 | |

| Total revenues | $ | 11,080 | | | $ | 10,979 | | | $ | 11,061 | | | $ | 11,878 | | | $ | 11,113 | | | $ | 17,671 | | | $ | 19,272 | | | $ | 33,120 | | | $ | 48,056 | |

| | | | | | | | | | | | | | | | | |

| Net income | $ | 908 | | | $ | 939 | | | $ | 870 | | | $ | 751 | | | $ | 951 | | | $ | 110 | | | $ | 1,253 | | | $ | 2,717 | | | $ | 2,314 | |

| Net income margin | 10.8 | % | | 11.0 | % | | 10.0 | % | | 8.5 | % | | 10.8 | % | | 0.8 | % | | 8.9 | % | | 10.6 | % | | 6.4 | % |

| | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 3,284 | | | $ | 3,461 | | | $ | 3,396 | | | $ | 3,242 | | | $ | 3,665 | | | $ | 7,017 | | | $ | 7,129 | | | $ | 10,141 | | | $ | 17,811 | |

| Adjusted EBITDA margin | 39.1 | % | | 40.5 | % | | 39.0 | % | | 36.6 | % | | 41.4 | % | | 53.0 | % | | 50.4 | % | | 39.5 | % | | 49.2 | % |

| | | | | | | | | | | | | | | | | |

| Cost of services | $ | 1,546 | | | $ | 1,649 | | | $ | 1,733 | | | $ | 1,694 | | | $ | 1,639 | | | $ | 3,098 | | | $ | 3,314 | | | $ | 4,928 | | | $ | 8,051 | |

| Merger-related costs | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 40 | | | $ | 79 | | | $ | — | | | $ | 119 | |

| Cost of services excluding Merger-related costs | $ | 1,546 | | | $ | 1,649 | | | $ | 1,733 | | | $ | 1,694 | | | $ | 1,639 | | | $ | 3,058 | | | $ | 3,235 | | | $ | 4,928 | | | $ | 7,932 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative | $ | 3,442 | | | $ | 3,543 | | | $ | 3,498 | | | $ | 3,656 | | | $ | 3,688 | | | $ | 5,604 | | | $ | 4,876 | | | $ | 10,483 | | | $ | 14,168 | |

| Merger-related costs | $ | 113 | | | $ | 222 | | | $ | 159 | | | $ | 126 | | | $ | 143 | | | $ | 758 | | | $ | 209 | | | $ | 494 | | | $ | 1,110 | |

COVID-19-related costs (1) | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 117 | | | $ | 341 | | | $ | — | | | $ | — | | | $ | 458 | |

| Selling, general and administrative excluding Merger-related costs and COVID-19-related costs | $ | 3,329 | | | $ | 3,321 | | | $ | 3,339 | | | $ | 3,530 | | | $ | 3,428 | | | $ | 4,505 | | | $ | 4,667 | | | $ | 9,989 | | | $ | 12,600 | |

| | | | | | | | | | | | | | | | | |

| Total bad debt expense and losses from sales of receivables | $ | 108 | | | $ | 99 | | | $ | 102 | | | $ | 128 | | | $ | 138 | | | $ | 263 | | | $ | 125 | | | $ | 309 | | | $ | 526 | |

| Bad debt and losses from sales of receivables as a percentage of Total revenues | 0.98 | % | | 0.90 | % | | 0.92 | % | | 1.07 | % | | 1.24 | % | | 1.49 | % | | 0.65 | % | | 0.93 | % | | 1.09 | % |

| | | | | | | | | | | | | | | | | |

| Cash purchases of property and equipment including capitalized interest | $ | 1,931 | | | $ | 1,789 | | | $ | 1,514 | | | $ | 1,157 | | | $ | 1,753 | | | $ | 2,257 | | | $ | 3,217 | | | $ | 5,234 | | | $ | 7,227 | |

| Capitalized interest | $ | 118 | | | $ | 125 | | | $ | 118 | | | $ | 112 | | | $ | 112 | | | $ | 119 | | | $ | 108 | | | $ | 361 | | | $ | 339 | |

| | | | | | | | | | | | | | | | | |

| Net cash proceeds from securitization | $ | (18) | | | $ | 95 | | | $ | (3) | | | $ | (9) | | | $ | (5) | | | $ | (99) | | | $ | 5 | | | $ | 74 | | | $ | (99) | |

(1)Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were not significant for Q3 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in millions, except percentages) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Device Financing - Equipment Installment Plans | | | | | | | | | | | | | | | | | |

| Gross EIP financed | $ | 1,742 | | | $ | 1,625 | | | $ | 1,535 | | | $ | 2,235 | | | $ | 1,440 | | | $ | 1,825 | | | $ | 2,356 | | | $ | 4,902 | | | $ | 5,621 | |

| EIP billings | $ | 1,663 | | | $ | 1,645 | | | $ | 1,688 | | | $ | 1,762 | | | $ | 1,790 | | | $ | 2,217 | | | $ | 2,130 | | | $ | 4,996 | | | $ | 6,137 | |

| EIP receivables, net | $ | 4,128 | | | $ | 4,050 | | | $ | 3,894 | | | $ | 4,183 | | | $ | 3,773 | | | $ | 4,593 | | | $ | 4,481 | | | $ | 3,894 | | | $ | 4,481 | |

| EIP receivables classified as prime | 46 | % | | 50 | % | | 51 | % | | 53 | % | | 52 | % | | 48 | % | | 53 | % | | 51 | % | | 53 | % |

| EIP receivables classified as prime (including EIP receivables sold) | 52 | % | | 52 | % | | 52 | % | | 53 | % | | 53 | % | | 50 | % | | 54 | % | | 52 | % | | 54 | % |

| | | | | | | | | | | | | | | | | |

| Device Financing - Leased Devices | | | | | | | | | | | | | | | | | |

| Lease revenues | $ | 161 | | | $ | 143 | | | $ | 142 | | | $ | 153 | | | $ | 165 | | | $ | 1,421 | | | $ | 1,350 | | | $ | 446 | | | $ | 2,936 | |

| Leased device depreciation | $ | 184 | | | $ | 125 | | | $ | 108 | | | $ | 126 | | | $ | 163 | | | $ | 946 | | | $ | 1,000 | | | $ | 417 | | | $ | 2,109 | |

| Leased devices transferred from inventory to property and equipment | $ | 147 | | | $ | 167 | | | $ | 298 | | | $ | 394 | | | $ | 309 | | | $ | 1,444 | | | $ | 599 | | | $ | 612 | | | $ | 2,352 | |

| Returned leased devices transferred from property and equipment to inventory | $ | (57) | | | $ | (67) | | | $ | (65) | | | $ | (78) | | | $ | (59) | | | $ | (538) | | | $ | (433) | | | $ | (189) | | | $ | (1,030) | |

| Leased devices included in property and equipment, net | $ | 442 | | | $ | 418 | | | $ | 543 | | | $ | 732 | | | $ | 819 | | | $ | 6,621 | | | $ | 5,788 | | | $ | 543 | | | $ | 5,788 | |

| Leased devices (units) included in property and equipment, net | 2.4 | | 2.0 | | 2.0 | | 2.1 | | 2.1 | | 17.0 | | 15.8 | | 2.0 | | 15.8 |

T-Mobile US, Inc.

Calculation of Operating Measures

(Unaudited)

The following table illustrates the calculation of our operating measures ARPA and ARPU and reconciles these measures to the related service revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except average number of customers, ARPA and ARPU) | Quarter | | Nine Months Ended September 30, |

| Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| Calculation of Postpaid ARPA | | | | | | | | | | | | | | | | | |

| Postpaid service revenues | $ | 5,493 | | | $ | 5,613 | | | $ | 5,746 | | | $ | 5,821 | | | $ | 5,887 | | | $ | 9,959 | | | $ | 10,209 | | | $ | 16,852 | | | $ | 26,055 | |

| Divided by: Average number of postpaid accounts (in thousands) and number of months in period | 14,108 | | | 14,354 | | | 14,602 | | | 14,881 | | | 15,155 | | | 25,424 | | | 25,582 | | | 14,355 | | | 22,054 | |

| Postpaid ARPA | $ | 129.77 | | | $ | 130.36 | | | $ | 131.15 | | | $ | 130.39 | | | $ | 129.47 | | | $ | 130.57 | | | $ | 133.03 | | | $ | 130.44 | | | $ | 131.27 | |

| Calculation of Postpaid Phone ARPU | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Postpaid service revenues | $ | 5,493 | | | $ | 5,613 | | | $ | 5,746 | | | $ | 5,821 | | | $ | 5,887 | | | $ | 9,959 | | | $ | 10,209 | | | $ | 16,852 | | | $ | 26,055 | |

| Less: Postpaid other revenues | (310) | | | (326) | | | (346) | | | (362) | | | (310) | | | (618) | | | (677) | | | (982) | | | (1,605) | |

| | | | | | | | | | | | | | | | | |

| Postpaid phone service revenues | 5,183 | | | 5,287 | | | 5,400 | | | 5,459 | | | 5,577 | | | 9,341 | | | 9,532 | | | 15,870 | | | 24,450 | |

| Divided by: Average number of postpaid phone customers (in thousands) and number of months in period | 37,504 | | 38,226 | | 38,944 | | 39,736 | | 40,585 | | 64,889 | | 65,437 | | 38,225 | | 56,971 |

| Postpaid phone ARPU | $ | 46.07 | | | $ | 46.10 | | | $ | 46.22 | | | $ | 45.79 | | | $ | 45.80 | | | $ | 47.99 | | | $ | 48.55 | | | $ | 46.13 | | | $ | 47.69 | |

| Calculation of Prepaid ARPU | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Prepaid service revenues | $ | 2,386 | | | $ | 2,379 | | | $ | 2,385 | | | $ | 2,393 | | | $ | 2,373 | | | $ | 2,311 | | | $ | 2,383 | | | $ | 7,150 | | | $ | 7,067 | |

| Divided by: Average number of prepaid customers (in thousands) and number of months in period | 21,122 | | | 21,169 | | | 20,837 | | | 20,691 | | | 20,759 | | | 20,380 | | | 20,632 | | | 21,043 | | | 20,591 | |

| | | | | | | | | | | | | | | | | |

| Prepaid ARPU | $ | 37.65 | | | $ | 37.46 | | | $ | 38.16 | | | $ | 38.54 | | | $ | 38.11 | | | $ | 37.80 | | | $ | 38.49 | | | $ | 37.76 | | | $ | 38.13 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures

(Unaudited)

This Investor Factbook includes non-GAAP financial measures. The non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided below. T-Mobile is not able to forecast net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, income tax expense, stock-based compensation expense and interest expense. Adjusted EBITDA should not be used to predict net income as the difference between the two measures is variable.

Adjusted EBITDA is reconciled to net income as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter | | Nine Months Ended September 30, | | | | |

| (in millions) | | | | | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 | | | | |

| Net income | | | | | $ | 908 | | | $ | 939 | | | $ | 870 | | | $ | 751 | | | $ | 951 | | | $ | 110 | | | $ | 1,253 | | | $ | 2,717 | | | $ | 2,314 | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | | | | — | | | — | | | — | | | — | | | — | | | (320) | | | — | | | — | | | (320) | | | | | |

| Income from continuing operations | | | | | 908 | | | 939 | | | 870 | | | 751 | | | 951 | | | (210) | | | 1,253 | | | 2,717 | | | 1,994 | | | | | |

| Interest expense | | | | | 179 | | | 182 | | | 184 | | | 182 | | | 185 | | | 776 | | | 765 | | | 545 | | | 1,726 | | | | | |

| Interest expense to affiliates | | | | | 109 | | | 101 | | | 100 | | | 98 | | | 99 | | | 63 | | | 44 | | | 310 | | | 206 | | | | | |

| Interest income | | | | | (8) | | | (4) | | | (5) | | | (7) | | | (12) | | | (6) | | | (3) | | | (17) | | | (21) | | | | | |

| Other (income) expense, net | | | | | (7) | | | 22 | | | (3) | | | (4) | | | 10 | | | 195 | | | 99 | | | 12 | | | 304 | | | | | |

| Income tax expense | | | | | 295 | | | 301 | | | 325 | | | 214 | | | 306 | | | 2 | | | 407 | | | 921 | | | 715 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | | | 1,476 | | | 1,541 | | | 1,471 | | | 1,234 | | | 1,539 | | | 820 | | | 2,565 | | | 4,488 | | | 4,924 | | | | | |

| Depreciation and amortization | | | | | 1,600 | | | 1,585 | | | 1,655 | | | 1,776 | | | 1,718 | | | 4,064 | | | 4,150 | | | 4,840 | | | 9,932 | | | | | |

Operating income from discontinued operations (1) | | | | | — | | | — | | | — | | | — | | | — | | | 432 | | | — | | | — | | | 432 | | | | | |

Stock-based compensation (2) | | | | | 93 | | | 111 | | | 108 | | | 111 | | | 123 | | | 139 | | | 125 | | | 312 | | | 387 | | | | | |

| Merger-related costs | | | | | 113 | | | 222 | | | 159 | | | 126 | | | 143 | | | 798 | | | 288 | | | 494 | | | 1,229 | | | | | |

COVID-19-related costs (3) | | | | | — | | | — | | | — | | | — | | | 117 | | | 341 | | | — | | | — | | | 458 | | | | | |

| Impairment expense | | | | | — | | | — | | | — | | | — | | | — | | | 418 | | | — | | | — | | | 418 | | | | | |

Other, net (4) | | | | | 2 | | | 2 | | | 3 | | | (5) | | | 25 | | | 5 | | | 1 | | | 7 | | | 31 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | $ | 3,284 | | | $ | 3,461 | | | $ | 3,396 | | | $ | 3,242 | | | $ | 3,665 | | | $ | 7,017 | | | $ | 7,129 | | | $ | 10,141 | | | $ | 17,811 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(1)Following the Prepaid Transaction (as defined below), starting on July 1, 2020, we will provide MVNO services to DISH. We have included the operating income from discontinued operations in our determination of the Adjusted EBITDA to reflect contributions of the Prepaid Business that will be replaced by the MVNO Agreement beginning on July 1, 2020 in order to enable management, analysts and investors to better assess ongoing operating performance and trends.

(2)Stock-based compensation includes payroll tax impacts and may not agree to stock-based compensation expense in the Condensed Consolidated Financial Statements. Additionally, certain stock-based compensation expenses associated with the Transactions have been included in Merger-related costs.

(3)Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were not significant for Q3 2020.

(4)Other, net may not agree to the Condensed Consolidated Statements of Comprehensive Income primarily due to certain non-routine operating activities, such as other special items that would not be expected to reoccur or are not reflective of T-Mobile’s ongoing operating performance, and are therefore excluded in Adjusted EBITDA.

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures (continued)

(Unaudited)

Net debt (excluding tower obligations) to the last twelve months Adjusted EBITDA ratios is calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except net debt ratios) | Mar 31,

2019 | | Jun 30,

2019 | | Sep 30,

2019 | | Dec 31,

2019 | | Mar 31,

2020 | | Jun 30,

2020 | | Sep 30,

2020 |

| | | | | | | | | | | | | |

| Short-term debt | $ | 250 | | | $ | 300 | | | $ | 475 | | | $ | 25 | | | $ | — | | | $ | 3,818 | | | $ | 3,713 | |

| Short-term debt to affiliates | 598 | | | — | | | — | | | — | | | 2,000 | | | 1,235 | | | — | |

| Short-term financing lease liabilities | 911 | | | 963 | | | 1,013 | | | 957 | | | 918 | | | 1,040 | | | 1,050 | |

| Long-term debt | 10,952 | | | 10,954 | | | 10,956 | | | 10,958 | | | 10,959 | | | 62,783 | | | 58,345 | |

| Long-term debt to affiliates | 13,985 | | | 13,985 | | | 13,986 | | | 13,986 | | | 11,987 | | | 4,706 | | | 4,711 | |

| Financing lease liabilities | 1,224 | | | 1,314 | | | 1,440 | | | 1,346 | | | 1,276 | | | 1,416 | | | 1,373 | |

| Less: Cash and cash equivalents | (1,439) | | | (1,105) | | | (1,653) | | | (1,528) | | | (1,112) | | | (11,076) | | | (6,571) | |

| | | | | | | | | | | | | |

| Net debt (excluding tower obligations) | $ | 26,481 | | | $ | 26,411 | | | $ | 26,217 | | | $ | 25,744 | | | $ | 26,028 | | | $ | 63,922 | | | $ | 62,621 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Divided by: Last twelve months Pro Forma Adjusted EBITDA | | | | | | | | | | | $ | 26,250 | | | $ | 26,975 | |

| Net debt (excluding tower obligations) to last twelve months Pro Forma Adjusted EBITDA Ratio | | | | | | | | | | | 2.4 | | | 2.3 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

LTM Adjusted EBITDA reflects combined company results of New T-Mobile for Q3 2020 and Q2 2020 and standalone T-Mobile for prior periods. To illustrate the twelve month results of the combined company as if the Merger had closed on January 1, 2019, we have presented pro forma LTM Adjusted EBITDA ratios. Pro forma LTM Adjusted EBITDA is calculated as the sum of Q3 2020 and Q2 2020 actual Adjusted EBITDA of $7.1 billion and $7.0 billion, respectively, plus the Pro forma Adjusted EBITDA from Q1 2020 and Q4 2019 of $6.7 billion and $6.2 billion, respectively. These metrics are provided for illustrative purposes only and do not purport to represent what the actual consolidated results would have been had the Merger actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. Additional information regarding pro forma adjustments is provided in Pro Forma Income Statement Metrics within this Investor Factbook.

Free Cash Flow and Free Cash Flow, excluding gross payments for the settlement of interest rate swaps, are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Nine Months Ended September 30, |

| (in millions) | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | 2019 | | 2020 |

| | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | $ | 1,392 | | | $ | 2,147 | | | $ | 1,748 | | | $ | 1,537 | | | $ | 1,617 | | | $ | 777 | | | $ | 2,772 | | | $ | 5,287 | | | $ | 5,166 | |

| Cash purchases of property and equipment | (1,931) | | | (1,789) | | | (1,514) | | | (1,157) | | | (1,753) | | | (2,257) | | | (3,217) | | | (5,234) | | | (7,227) | |

| Proceeds related to beneficial interests in securitization transactions | 1,157 | | | 839 | | | 900 | | | 980 | | | 868 | | | 602 | | | 855 | | | 2,896 | | | 2,325 | |

| Proceeds from sales of tower sites | — | | | — | | | — | | | 38 | | | — | | | — | | | — | | | — | | | — | |

| Cash payments for debt prepayment or debt extinguishment costs | — | | | (28) | | | — | | | — | | | — | | | (24) | | | (58) | | | (28) | | | (82) | |

| | | | | | | | | | | | | | | | | |

| Free Cash Flow | 618 | | | 1,169 | | | 1,134 | | | 1,398 | | | 732 | | | (902) | | | 352 | | | 2,921 | | | 182 | |

| Gross cash paid for the settlement of interest rate swaps | — | | | — | | | — | | | — | | | — | | | 2,343 | | | — | | | — | | | 2,343 | |

| Free Cash Flow, excluding gross payments for the settlement of interest rate swaps | $ | 618 | | | $ | 1,169 | | | $ | 1,134 | | | $ | 1,398 | | | $ | 732 | | | $ | 1,441 | | | $ | 352 | | | $ | 2,921 | | | $ | 2,525 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |