EXHIBIT 99.2

| | | | | | | | |

| | Highlights |

| | Customer Metrics |

| | Financial Metrics |

| | Capital Structure |

| | 5G Network Leadership |

| | Merger & Integration |

| | Guidance |

| | Contacts |

| | Financial and Operational Tables |

Unless otherwise noted, historical results for T-Mobile from the close of the merger (“Merger”) with Sprint Corporation (“Sprint”) on April 1, 2020 reflect the Merger transactions and are inclusive of the results and operations of Sprint, while historical results prior to April 1, 2020 do not reflect the Merger transactions and are inclusive of the results and operations of stand-alone T-Mobile only. As such, the year-over-year changes may not be meaningful as further detailed in this Investor Factbook.

T-Mobile Raises 2021 Guidance as Network Leadership Fuels

Industry-Leading Growth with Strong First Quarter 2021 Results

Industry-Leading Customer Growth

•Total net additions of 1.4 million, best in industry

•Postpaid net additions of 1.2 million, best in industry and raising 2021 guidance

•Postpaid phone net additions of 773 thousand, best in industry

Strong Financial Results Drive Guidance Raise

•Total revenues of $19.8 billion and service revenues of $14.2 billion

•Net income of $933 million, diluted earnings per share (“EPS”) of $0.74 and Adjusted EBITDA(1) of $6.9 billion

•Core Adjusted EBITDA(1) of $5.9 billion, raising 2021 guidance

•Net cash provided by operating activities of $3.7 billion and Free Cash Flow(1) of $1.3 billion, raising 2021 guidance

Raising 2021 Merger Synergies Guidance on Continued Integration Progress

•Expect Merger synergies of $2.8 billion to $3.1 billion

•Approximately 50 percent of Sprint customer traffic is now carried on the T-Mobile network, 2x more than last quarter

•Approximately 20 percent of Sprint customers have been moved to the T-Mobile network

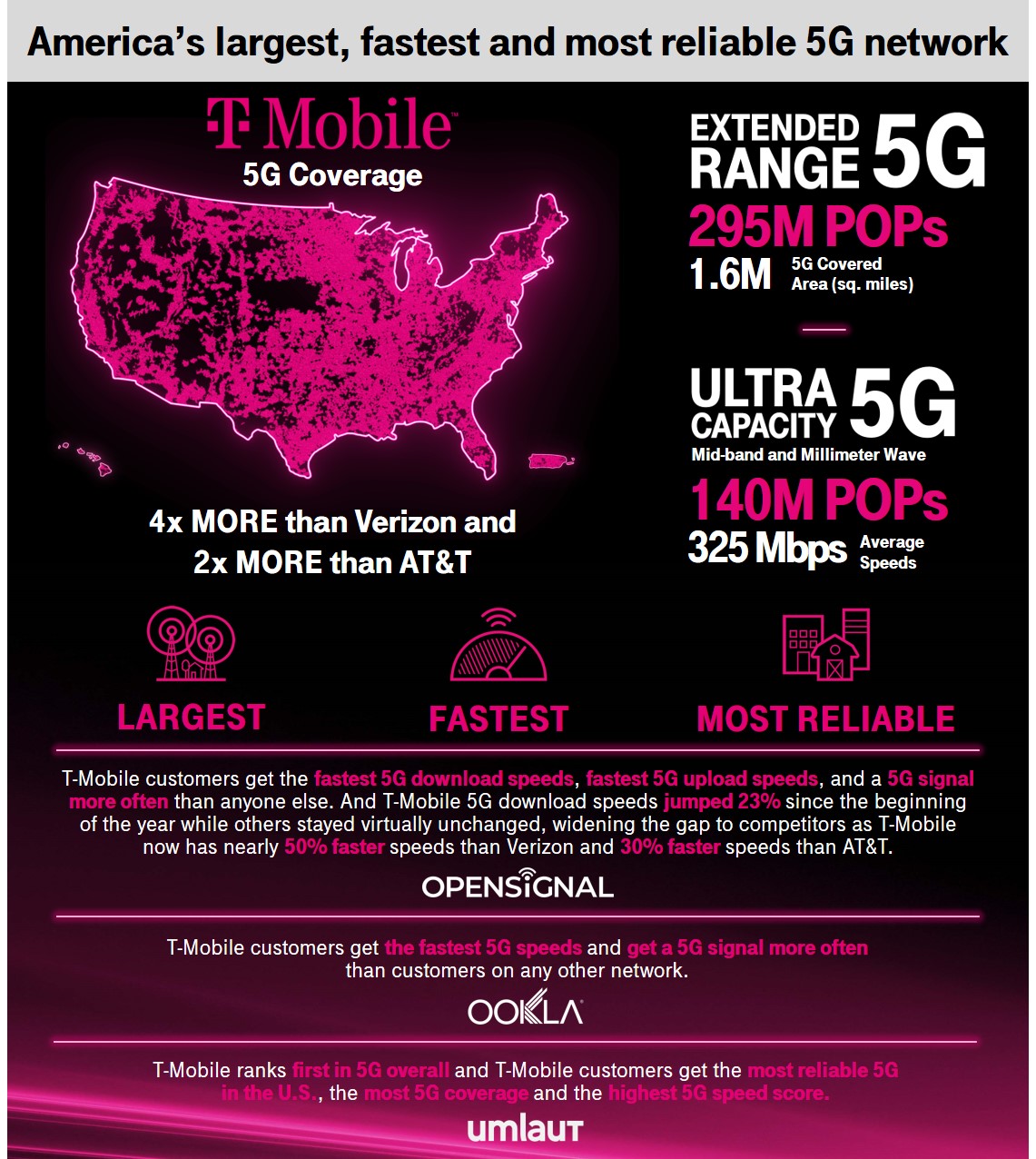

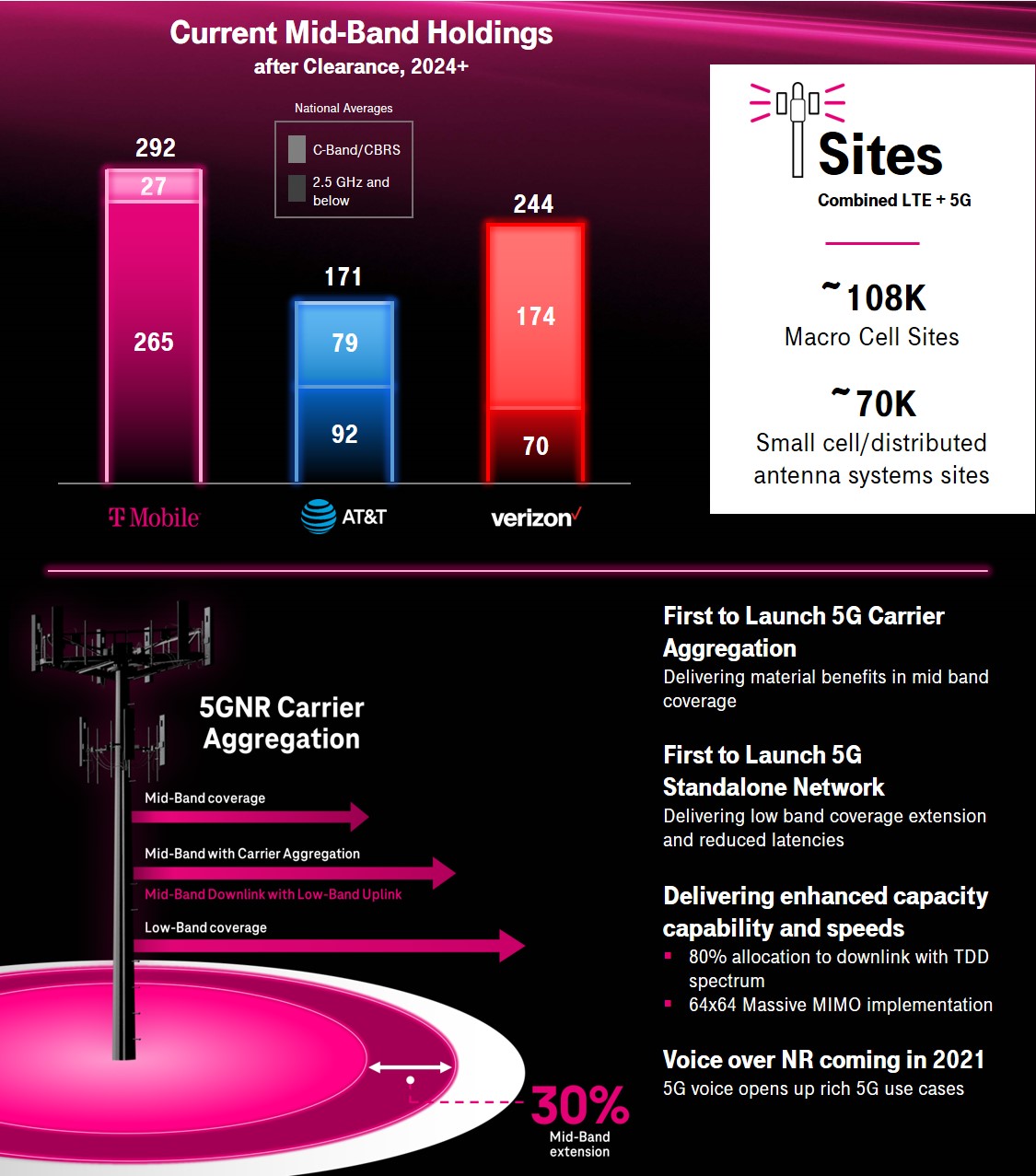

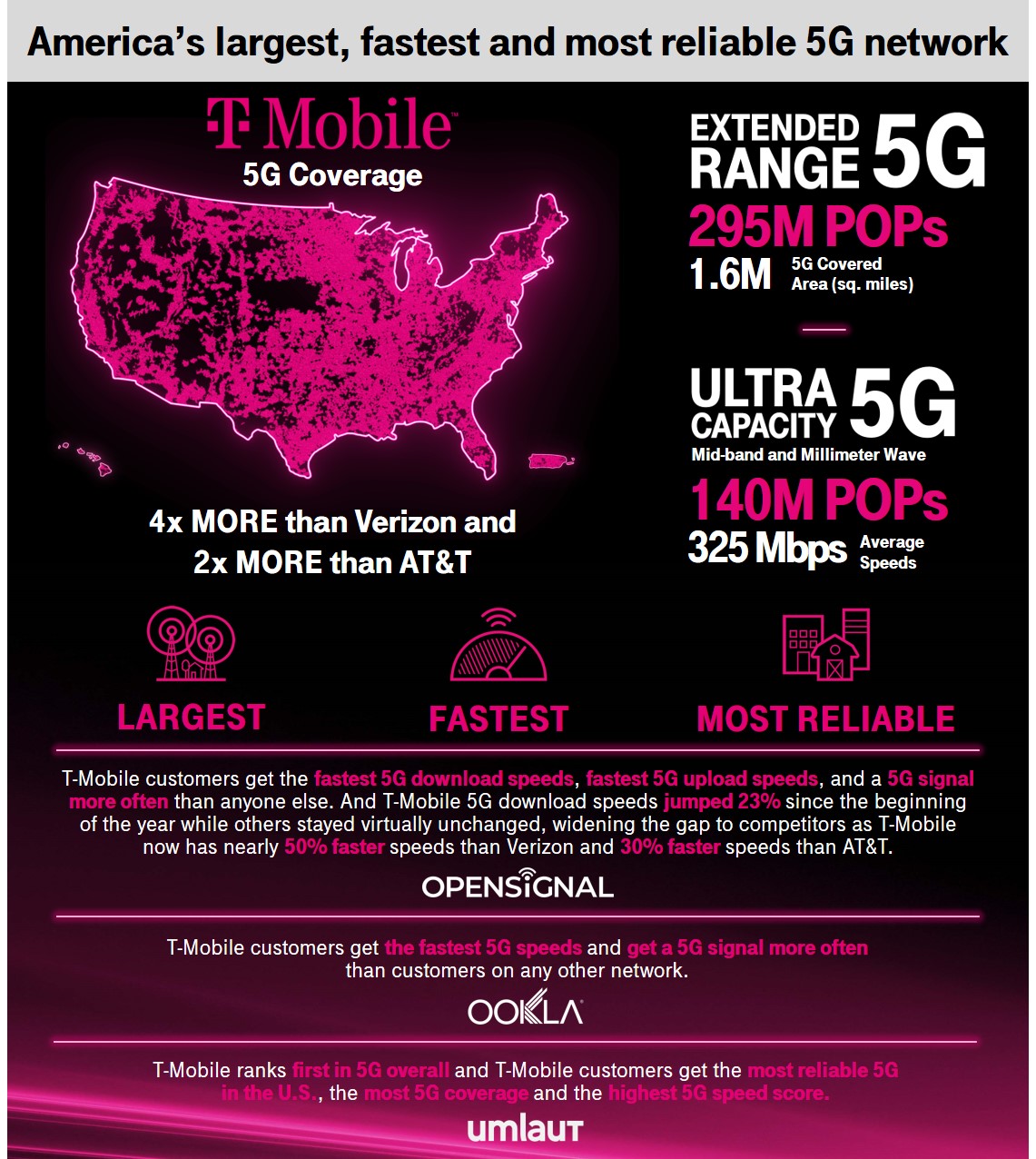

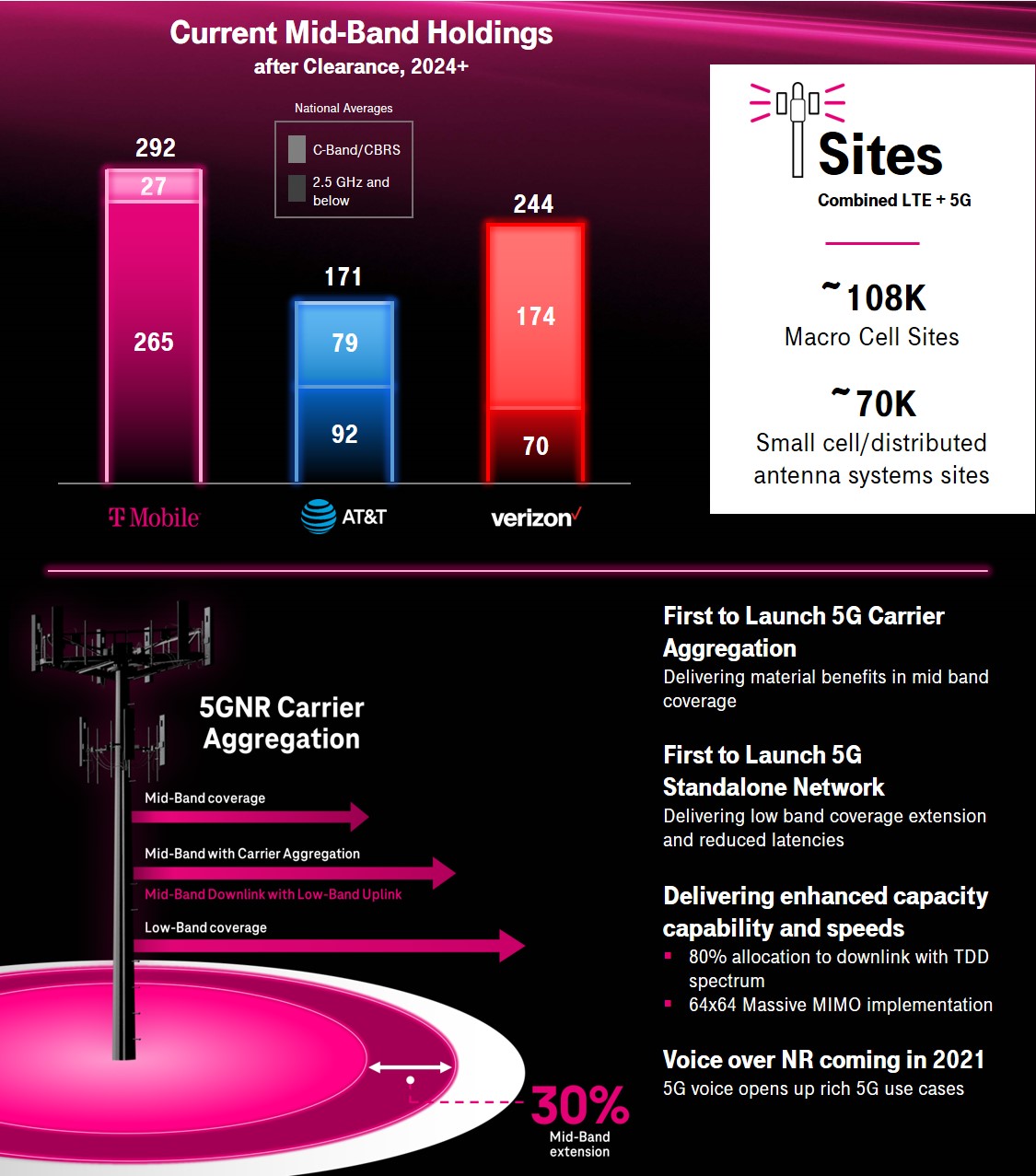

America’s Largest, Fastest and Most Reliable 5G Network Extends its Lead

•Extended Range 5G covers 295 million people across 1.6 million square miles, 4x more than Verizon and 2x more than AT&T

•Ultra Capacity 5G covers 140 million people and on track to cover 200 million people nationwide by the end of 2021

•Majority of independent third-party network benchmarking reports show T-Mobile as the clear leader in 5G speed and availability

•Network perception catching up to reality with a nearly 120 percent increase in consumers who view T-Mobile as “The 5G Company” since Q3 2019

| | | | | | | | | | | |

| | | |

| | “T-Mobile puts customers at the center of everything we do by giving them the best network, value and experience all at once – and this quarter’s stellar, industry-leading results prove that they’re noticing. We just keep pushing further ahead of the competition. Our network leadership is fueling customer momentum, delivering merger synergies and expanding our addressable markets for growth. We have so much confidence that we are raising 2021 guidance just one quarter into the year. Our mission is to be the very best at connecting customers to their world and we’re delivering on it.” | |

| | Mike Sievert, CEO | |

(1)Adjusted EBITDA, Core Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for these non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures tables. We are not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect Net income including, but not limited to, Income tax expense, stock-based compensation expense and Interest expense. Adjusted EBITDA and Core Adjusted EBITDA should not be used to predict Net income as the difference between either of the two measures and Net Income is variable.

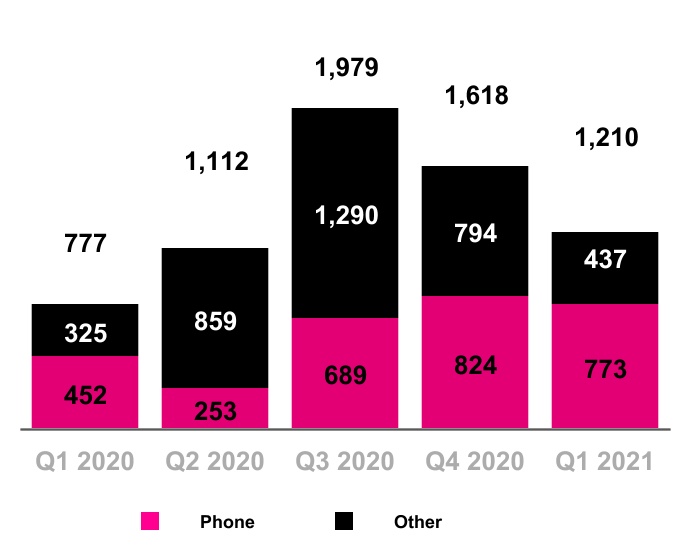

Total Postpaid Net Additions

(in thousands)

Postpaid phone net customer additions were 773 thousand in Q1 2021, compared to 824 thousand in Q4 2020 and 452 thousand in Q1 2020.

▪Sequentially, the decrease was primarily due to lower gross customer additions driven by seasonality, partially offset by lower churn.

▪Year-over-year, the increase was primarily due to expanded retail presence as a result of the Merger and increased retail store traffic due to closures arising from the COVID-19 pandemic (the “Pandemic”) in the prior period, as well as increased growth from T-Mobile for Business, partially offset by higher churn from customers acquired in the Merger.

Postpaid other net customer additions were 437 thousand in Q1 2021, compared to 794 thousand in Q4 2020 and 325 thousand in Q1 2020.

▪Sequentially, the decrease was primarily due to lower additions in the public and educational sector, as well as higher churn.

▪Year-over-year, the increase was primarily due to expanded retail presence as a result of the Merger, higher gross additions from connected devices, increased retail store traffic due to closures arising from the Pandemic in the prior year period and lower churn.

Total postpaid net customer additions were 1.2 million in Q1 2021, compared to 1.6 million in Q4 2020 and 777 thousand in Q1 2020.

The postpaid upgrade rate was approximately 4.8% in Q1 2021, compared to 5.7% in Q4 2020 and 3.8% in Q1 2020.

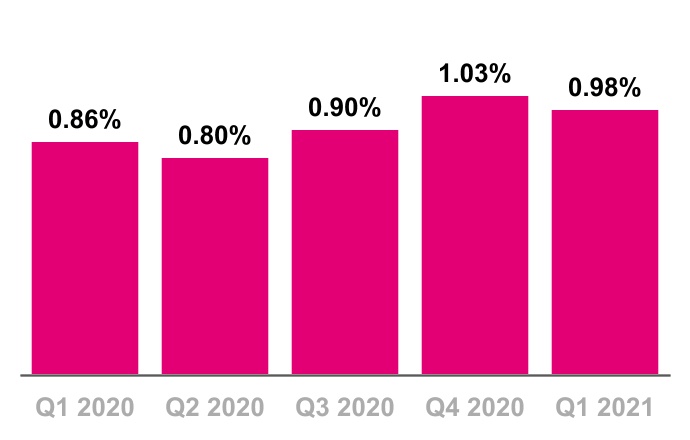

Postpaid phone churn was 0.98% in Q1 2021, down 5 basis points from 1.03% in Q4 2020 and up 12 basis points from 0.86% in Q1 2020.

▪Sequentially, the decrease was primarily due to continued network improvement, and the continued enhancement of the value proposition and network experience of Sprint customers.

▪Year-over-year, the increase was primarily driven by the inclusion of the customer base acquired in the Merger with higher churn.

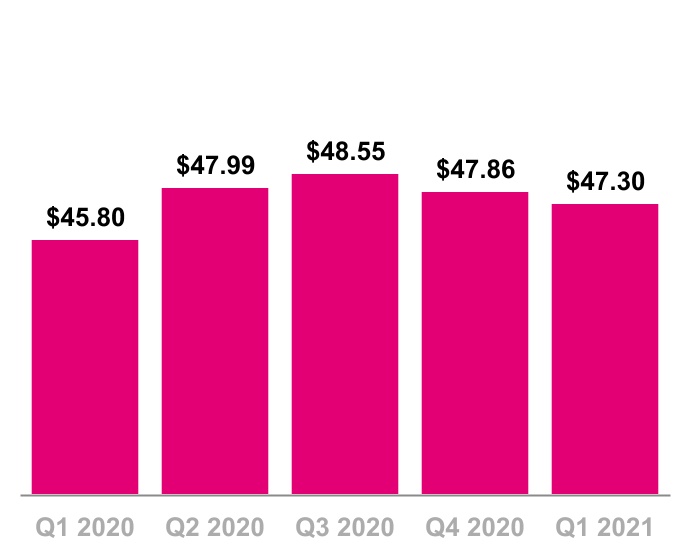

Postpaid phone ARPU was $47.30 in Q1 2021, down 1.2% from $47.86 in Q4 2020 and up 3.3% from $45.80 in Q1 2020.

▪Sequentially, the decrease was primarily due to lower recurring charges from customers acquired in the Merger including from the impact of rate plan migrations, an increase in average customers per account and a decrease in late and restore fees associated with improved collections activity.

▪Year-over-year, the increase was primarily due to the net impact of customers acquired in the Merger, which have higher ARPU, and higher premium service revenues, partially offset by ongoing promotional activity.

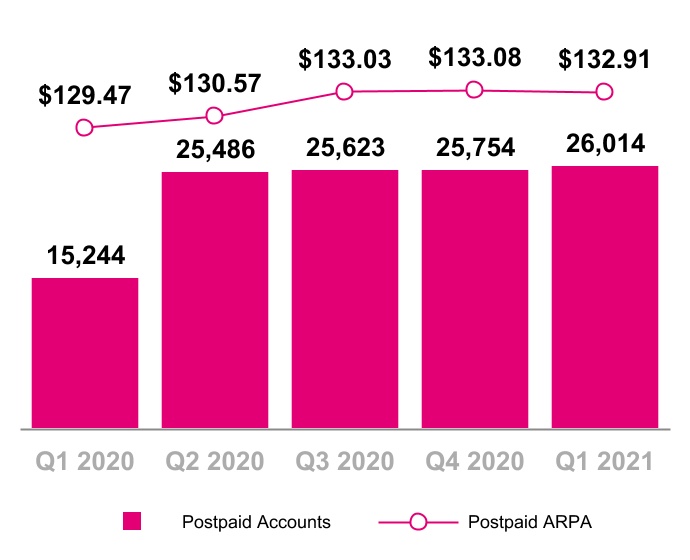

Total postpaid accounts were 26.0 million at the end of Q1 2021, compared to 25.8 million at the end of Q4 2020 and 15.2 million at the end of Q1 2020.

Postpaid ARPA was $132.91 in Q1 2021, essentially flat compared to $133.08 in Q4 2020 and up 2.7% compared to $129.47 in Q1 2020.

▪Sequentially, postpaid ARPA was essentially flat. A decrease in late and restore fees associated with improved collections activity, lower recurring charges from customers acquired in the Merger including rate plan migrations and ongoing promotional activity were mostly offset by an increase in average customers per account.

▪Year-over-year, the increase was primarily due to an increase in customers per account, including further penetration in connected devices, higher premium service revenues, and the net impact of customers acquired in the Merger, partially offset by ongoing promotional activity.

Postpaid Accounts & Postpaid ARPA

(Accounts in thousands)

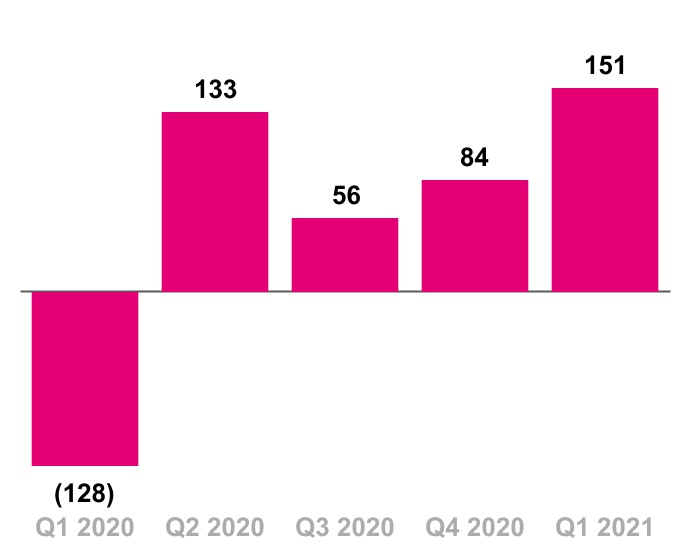

Total Prepaid Net (Losses) Additions

(in thousands)

Prepaid net customer additions were 151 thousand in Q1 2021, compared to net additions of 84 thousand in Q4 2020 and net losses of 128 thousand in Q1 2020.

▪Sequentially and year-over-year, the increase was primarily due to lower churn.

▪Migrations to postpaid plans reduced prepaid net customer additions in Q1 2021 by approximately 170 thousand, up from 165 thousand in Q4 2020 and 115 thousand in Q1 2020.

Prepaid churn was 2.78% in Q1 2021, compared to 2.92% in Q4 2020 and 3.52% in Q1 2020.

▪Sequentially and year-over-year, the decrease was primarily due to lower switching activity and the improved quality of recently acquired customers.

Prepaid ARPU was $37.81 in Q1 2021, down 0.7% from $38.08 in Q4 2020 and down 0.8% from $38.11 in Q1 2020, primarily driven by ongoing promotional activities.

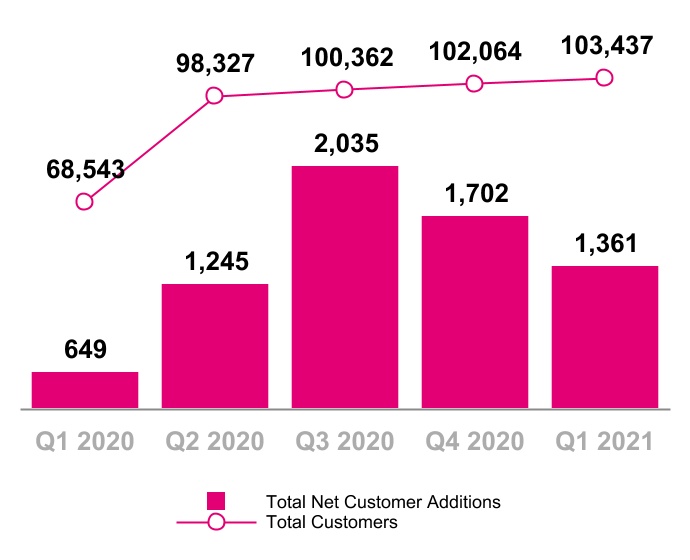

Total net customer additions were 1.4 million in Q1 2021, compared to 1.7 million in Q4 2020 and 649 thousand in Q1 2020.

Total customers were 103.4 million at the end of Q1 2021, compared to 102.1 million at the end of Q4 2020 and 68.5 million at the end of Q1 2020.

Total devices sold or leased were 10.6 million units in Q1 2021, compared to 11.7 million units in Q4 2020 and 7.2 million units in Q1 2020.

▪Total phones sold or leased were 9.6 million units in Q1 2021, compared to 10.1 million units in Q4 2020 and 6.4 million units in Q1 2020.

▪Mobile broadband and IoT devices sold or leased were 1.0 million units in Q1 2021, compared to 1.6 million units in Q4 2020 and 758 thousand units in Q1 2020.

Total Customers

(in thousands)

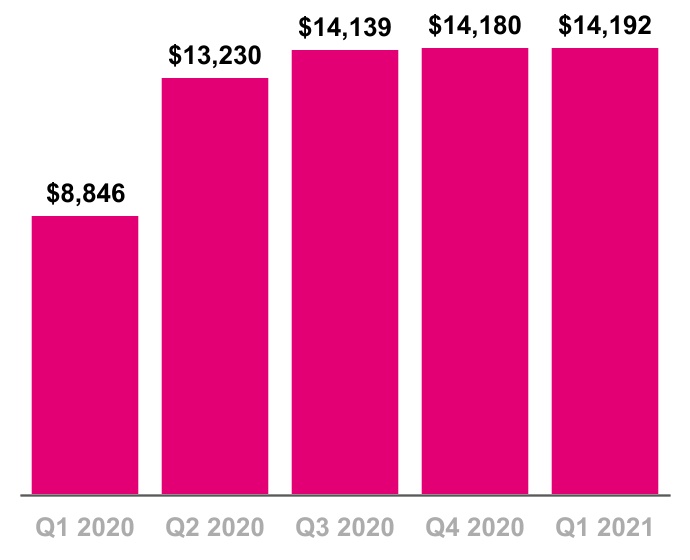

Service Revenues

($ in millions)

Service revenues were $14.2 billion in Q1 2021, essentially flat compared to $14.2 billion in Q4 2020 and up 60% from $8.8 billion in Q1 2020.

▪Sequentially, an increase in Postpaid service revenues was partially offset by seasonally lower Wholesale revenues.

▪Year-over-year, the increase was primarily due to an increase in Postpaid service revenues, primarily due to customers acquired in the Merger and continued Postpaid customer growth, an increase in Wholesale revenues primarily driven by our Master Network Service Agreement with DISH, which went into effect on July 1, 2020, and higher Roaming and other service revenues, primarily from the inclusion of wireline and Lifeline operations acquired in the Merger.

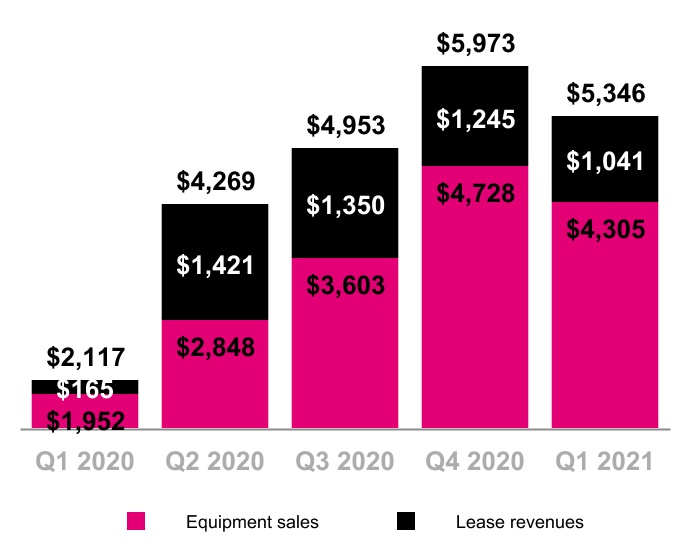

Equipment revenues were $5.3 billion in Q1 2021, down 10% from $6.0 billion in Q4 2020 and up 153% from $2.1 billion in Q1 2020. Lease revenues included in equipment revenues were $1.0 billion in Q1 2021 compared to $1.2 billion in Q4 2020 and $165 million in Q1 2020.

▪Sequentially, the decrease was primarily due to:

▪A decrease in the number of devices sold, driven by seasonality and iconic device launches in the prior quarter;

▪Lower average revenue per device sold, excluding purchased leased devices, driven by a decrease in the high-end device mix; and

▪A decrease in lease revenues due to the continued planned shift in device financing from leasing to equipment installation plans.

▪Year-over-year, the increase was primarily due to:

▪An increase in the number of devices sold, excluding purchased leased devices, due to an increased customer base as the result of the Merger;

▪Higher average revenue per device sold, excluding purchased leased devices, due to an increase in the high-end device mix primarily driven by a larger postpaid customer base as a result of the Merger;

▪An increase in lease revenues due to a higher number of customer devices under lease, primarily from leases acquired in the Merger; and

▪An increase in purchased leased devices, primarily due to a larger base of leased devices as a result of the Merger.

Equipment Revenues

($ in millions)

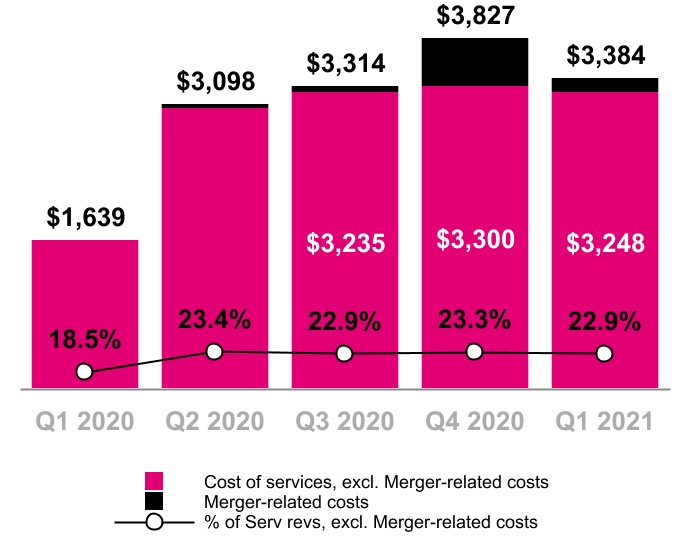

Cost of Services, exclusive of D&A

($ in millions, % of Service revs excl. Merger-related costs)

Cost of services, exclusive of depreciation and amortization (D&A), was $3.4 billion in Q1 2021, down 12% from $3.8 billion in Q4 2020 and up 106% from $1.6 billion in Q1 2020.

▪Sequentially, the decrease was primarily due to lower Merger-related costs in the current quarter, as well as higher realized Merger synergies, which were partially offset by increased costs related to site upgrades.

▪Year-over-year, the increase was primarily due to an increase in expenses associated with leases, backhaul agreements, other network expenses, the continued build-out of our nationwide 5G network, and higher employee-related and benefit-related costs, primarily due to the Merger.

▪Merger-related costs primarily related to incremental costs associated with network decommissioning and integration were $136 million in Q1 2021 compared to $527 million in Q4 2020 and $0 in Q1 2020.

▪As a percentage of Service revenues, Cost of Services, exclusive of D&A, and excluding Merger-related costs, decreased by 40 basis points sequentially, and increased by 440 basis points year-over-year.

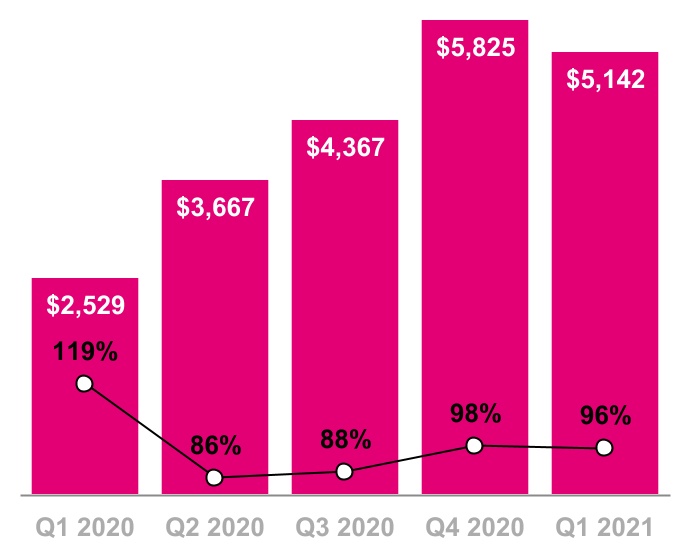

Cost of equipment sales, exclusive of D&A, was $5.1 billion in Q1 2021, down 12% from $5.8 billion in Q4 2020 and up 103% from $2.5 billion in Q1 2020.

▪Sequentially, the decrease was primarily due to:

▪A decrease in the number of devices sold, driven by seasonality and iconic device launches in the prior quarter; and

▪A lower average cost per device sold, excluding purchased leased devices, primarily driven by a decrease in the high-end device mix.

▪Year-over-year, the increase was primarily due to:

▪An increase in the number of devices sold, excluding purchased leased devices, primarily due to an increased customer base as a result of the Merger;

▪A higher average cost per device sold, excluding purchased leased devices, primarily driven by an increase in the high-end device mix, primarily driven by a larger postpaid customer base as a result of the Merger; and

▪An increase in purchased leased devices, primarily due to a larger base of leased devices as a result of the Merger.

Cost of Equipment Sales, exclusive of D&A

($ in millions, % of Equipment Revs)

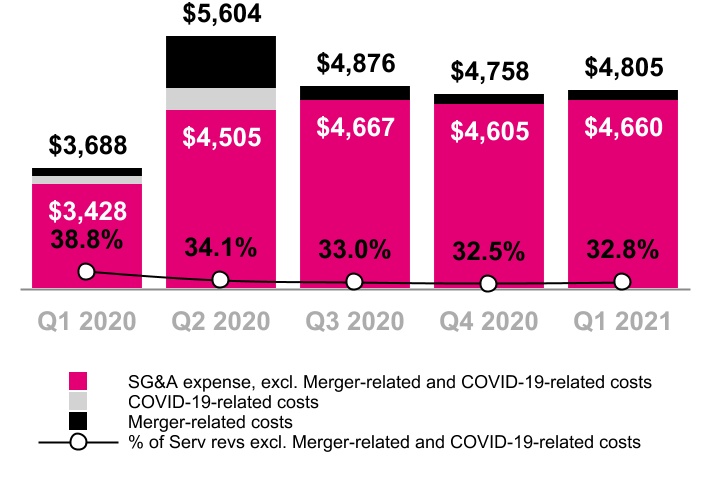

Selling, General and Administrative (SG&A) Expense

($ in millions, % of Service revs excl. Merger-related and COVID-19-related costs)

Selling, general and administrative (SG&A) expense was $4.8 billion in Q1 2021, essentially flat compared to $4.8 billion in Q4 2020 and up 30% from $3.7 billion in Q1 2020.

▪Sequentially, the slight increase was primarily driven by higher employee-related costs, including expenses associated with annual stock-based compensation vesting, which were mostly offset by lower bad debt expense and Merger synergies realized.

▪Year-over-year, the increase was primarily due to higher external labor and professional services, advertising, lease expense and employee-related costs, primarily from the Merger, as well as higher commission expense, primarily due to higher gross customer additions, partially offset by lower bad debt expense.

▪Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were insignificant in Q1 2021 and Q4 2020 and $117 million in Q1 2020.

▪Merger-related costs were $145 million in Q1 2021 compared to $153 million in Q4 2020 and $143 million in Q1 2020.

▪As a percentage of Service revenues, SG&A expense, excluding Merger-related and COVID-19-related costs, increased 30 basis points sequentially and decreased 600 basis points year-over-year.

▪Total bad debt expense and losses from sales of receivables (reported within SG&A expense) was $64 million in Q1 2021, compared to $112 million in Q4 2020 and $138 million in Q1 2020. As a percentage of Total revenues, total bad debt expense and losses from sales of receivables was 0.32% in Q1 2021, compared to 0.55% in Q4 2020 and 1.24% in Q1 2020.

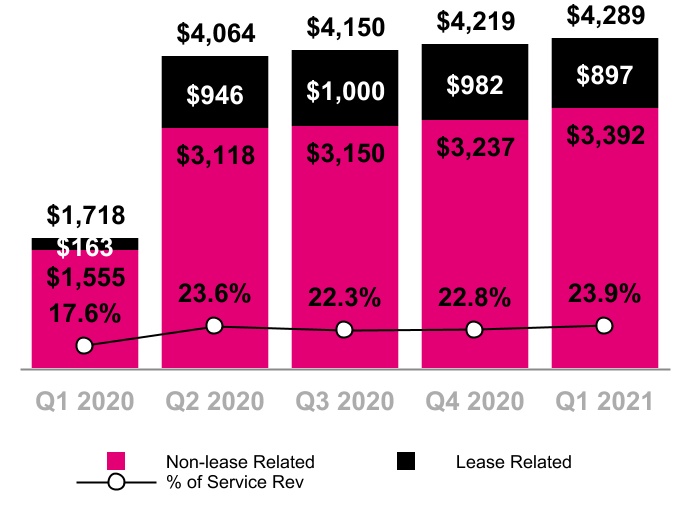

D&A was $4.3 billion in Q1 2021, up 2% from $4.2 billion in Q4 2020 and up 150% from $1.7 billion in Q1 2020. This includes D&A related to Leased devices of $897 million in Q1 2021, compared to $982 million in Q4 2020 and $163 million in Q1 2020.

▪Sequentially, the increase was primarily driven by higher depreciation expense from the continued build-out of our nationwide 5G network, partially offset by lower depreciation expense on leased devices resulting from a lower total number of customer devices under lease.

▪Year-over-year, the increase was primarily due to higher depreciation expense from assets acquired in the Merger, excluding leased devices, and network expansion from the continued build-out of our nationwide 5G network, higher depreciation expense on leased devices, primarily due to a larger base of leased devices as a result of the Merger and higher amortization from intangible assets acquired in the Merger.

Depreciation & Amortization

($ in millions, Non-lease D&A % of Service Revs)

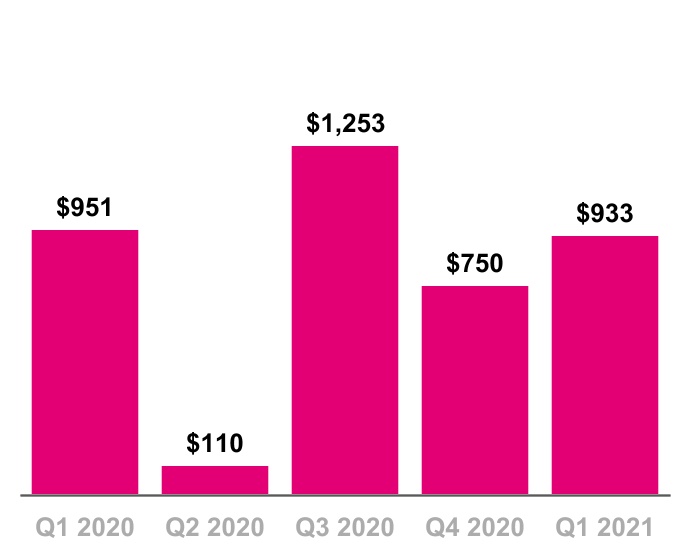

Net Income

($ in millions)

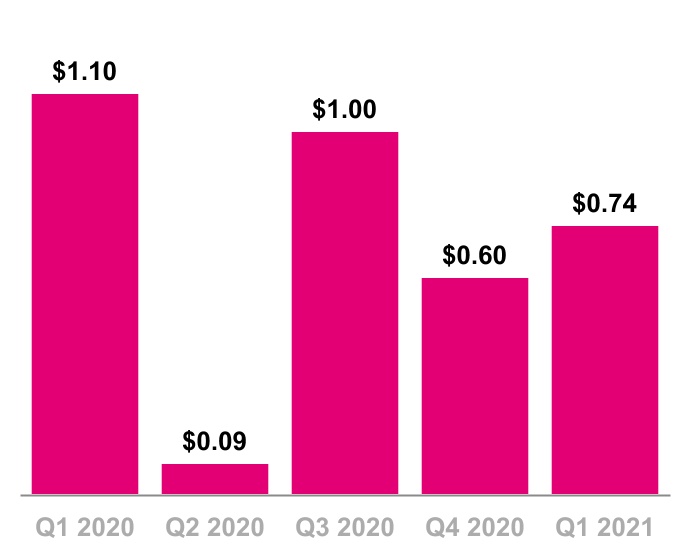

Diluted Earnings Per Share (Diluted EPS)

Net income was $933 million in Q1 2021, up 24% from $750 million in Q4 2020 and down 2% from $951 million in Q1 2020. Diluted EPS was $0.74 in Q1 2021, up from $0.60 in Q4 2020 and down from $1.10 in Q1 2020.

▪Sequentially, the increase in Net income and diluted EPS was primarily due to lower Cost of equipment sales and Cost of services, partially offset by lower Equipment revenues and higher Income tax expense.

▪Year-over-year, the decrease in Net income was driven by higher Cost of equipment sales, D&A, Cost of services, SG&A and interest expense, partially offset by higher Service and Equipment revenues. Diluted EPS also decreased due to an increase in outstanding shares as a result of the Merger.

▪Net income and diluted EPS, respectively, were impacted by Merger-related costs, net of tax, for Q1 2021 of $220 million and $0.18, compared to $506 million and $0.40 in Q4 2020 and $117 million and $0.14 in Q1 2020.

▪Net income margin was 6.6% in Q1 2021, compared to 5.3% in Q4 2020 and 10.8% in Q1 2020. Net income margin is calculated as Net income divided by Service revenues.

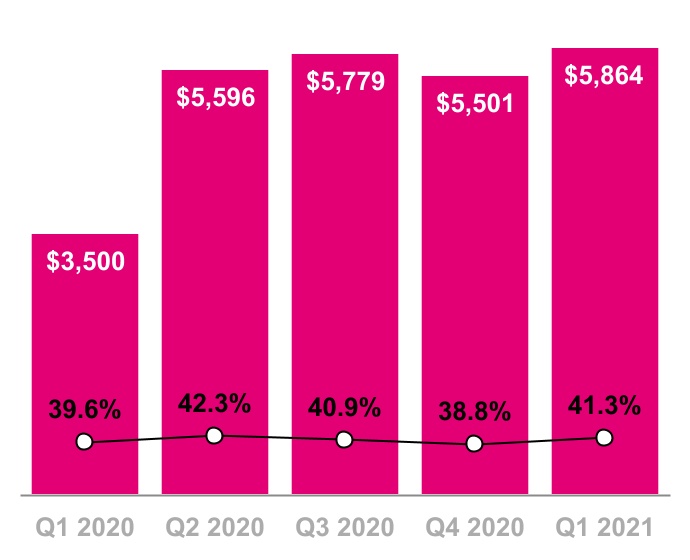

Core Adjusted EBITDA

($ in millions, % of Service Revs)

Core Adjusted EBITDA was $5.9 billion in Q1 2021, up 7% from $5.5 billion in Q4 2020 and up 68% from $3.5 billion in Q1 2020.

▪Sequentially, the increase was primarily due to lower Cost of equipment sales and lower Cost of services, excluding Merger-related costs, partially offset by lower Equipment revenues, excluding lease revenues, and higher SG&A expense, excluding Merger-related costs.

▪Year-over-year, the increase was primarily due to higher Service revenues and Equipment revenues, excluding lease revenues, partially offset by higher Cost of equipment sales, higher Cost of services, both excluding Merger-related costs, and higher SG&A expense, excluding Merger-related and COVID-related costs.

▪Core Adjusted EBITDA excludes Merger-related costs of $298 million in Q1 2021 compared to $686 million in Q4 2020 and $143 million in Q1 2020, as well as COVID-related costs of $117 million in Q1 2020.

▪Core Adjusted EBITDA margin was 41.3% in Q1 2021, compared to 38.8% in Q4 2020 and 39.6% in Q1 2020.

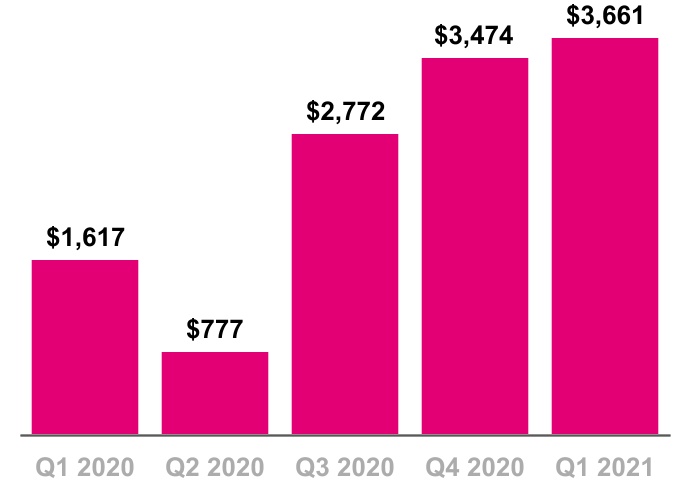

Net cash provided by operating activities was $3.7 billion in Q1 2021, compared to $3.5 billion in Q4 2020 and $1.6 billion in Q1 2020.

▪Sequentially, the increase was primarily due to an increase in Net income, adjusted for non-cash income and expenses, partially offset by an increase in net cash outflows from changes in working capital. The change in working capital was primarily due to higher use of cash from Accounts payable and accrued liabilities and Other current and long-term liabilities, mostly offset by lower use of cash from Accounts and Equipment installment plan receivables, Inventories and Other current and long-term assets.

▪Year-over-year, the increase was primarily due to an increase in Net income, adjusted for non-cash income and expense, partially offset by an increase in net cash outflows from changes in working capital. The change in working capital was primarily due to higher use of cash from Accounts payable and accrued liabilities, Equipment installment plan receivables and Other current and long-term liabilities, partially offset by lower use from Accounts receivable and Inventories.

▪The impact of payments for Merger-related costs on Net cash provided by operating activities was $277 million in Q1 2021 compared to $583 million in Q4 2020 and $161 million in Q1 2020.

Net Cash Provided by Operating Activities

($ in millions)

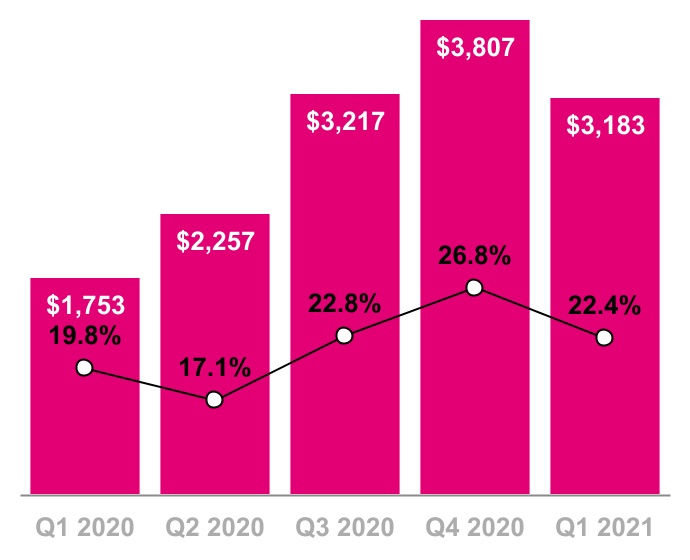

Cash Purchases of Property and Equipment

($ in millions, % of Service Revenues)

Cash purchases of property and equipment were $3.2 billion in Q1 2021, compared to $3.8 billion in Q4 2020 and $1.8 billion in Q1 2020. Capitalized interest included in cash purchases of property and equipment was $84 million in Q1 2021, compared to $101 million in Q4 2020 and $112 million in Q1 2020.

▪Sequentially the decrease was primarily driven by the timing of network capital spending.

▪Year-over-year, the increase was primarily driven by network integration related to the Merger and the continued build-out of our nationwide 5G network.

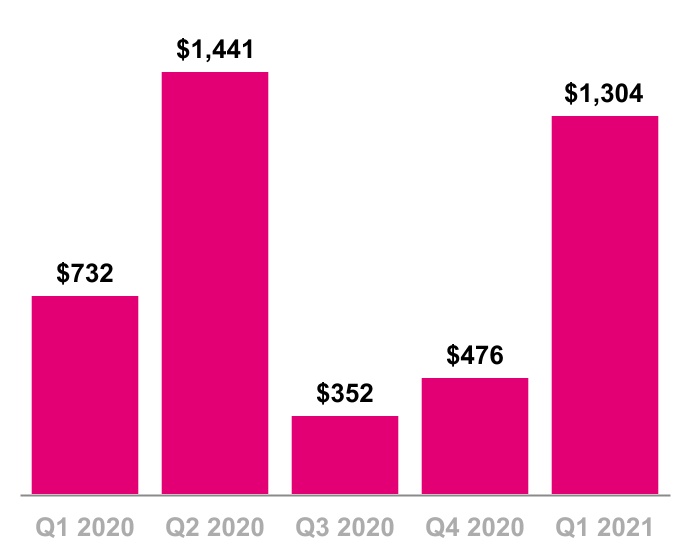

Free Cash Flow was $1.3 billion in Q1 2021, compared to $476 million in Q4 2020 and $732 million in Q1 2020.

▪Sequentially, the increase was primarily due to lower cash purchases of property and equipment, including capitalized interest, and higher Net cash provided by operating activities.

▪Year-over-year, the increase was primarily due to higher Net cash provided by operating activities, partially offset by higher cash purchases of property and equipment, including capitalized interest, from network integration related to the Merger and the continued build-out of our nationwide 5G network.

▪The impact of payments for Merger-related costs on Free Cash Flow was $277 million in Q1 2021 compared to $583 million in Q4 2020 and $161 million in Q1 2020.

Free Cash Flow, Excluding Gross Payments for the Settlement of Interest Rate Swaps

($ in millions)

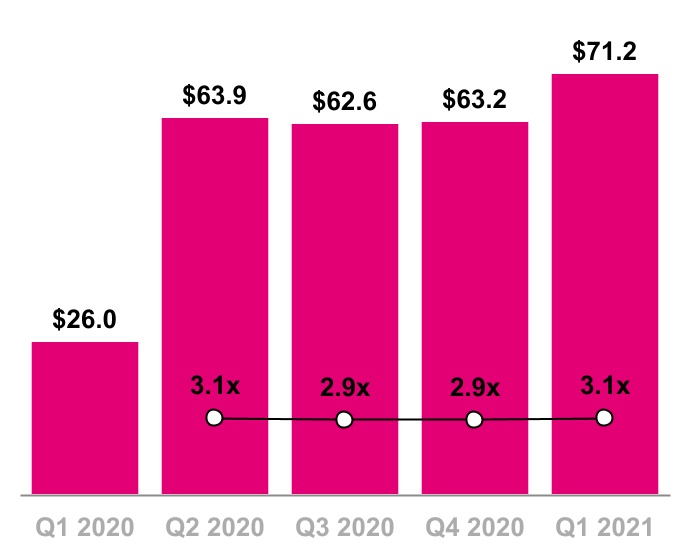

Net Debt (Excluding Tower Obligations) & Net Debt to LTM Pro Forma Core Adj. EBITDA Ratio

($ in billions)

Total debt, excluding tower obligations, at the end of Q1 2021 was $77.9 billion.

Net debt, excluding tower obligations, at the end of Q1 2021 was $71.2 billion.

▪The ratio of net debt, excluding tower obligations, to Pro Forma Core Adjusted EBITDA for the last twelve months (“LTM”) period was 3.1x at the end of Q1 2021 compared to 2.9x at the end of Q4 2020.

▪The ratio of net debt, excluding tower obligations, to Pro Forma Adjusted EBITDA for the LTM period was 2.6x at the end of Q1 2021 compared to 2.3x at the end of Q4 2020.

Financing activity in Q1 2021 includes:

▪On January 14, 2021, we issued Senior Notes in an aggregate amount of $3.0 billion at an average interest rate of approximately 2.58%, setting record low yields for 5-year, 8-year and 10-year tranches in the high yield market; and

▪On March 23, 2021, we issued Senior Notes in an aggregate amount of $3.8 billion at an average interest rate of 3.18%.

▪On March 27, 2021, we redeemed $2.0 billion of 6.50% Senior Notes due 2026.

| | | | | | | | | | | | | | |

| T-Mobile expects the total net present value of Merger synergies to be more than $70 billion – up more than 60 percent from the original Merger guidance of $43 billion. | |

| | | | |

| Improvements for Sprint customers | | The company expects Merger synergies to be $2.8 billion to $3.1 billion in 2021, more than doubling the $1.3 billion delivered in 2020 and an increase from its prior guidance of $2.7 billion to 3.0 billion. ▪Approximately $1.35 billion to $1.5 billion of sales, general, and administrative (SG&A) synergies achieved through SG&A expense reductions ▪Approximately $450 million to $600 million of network synergies achieved through cost of service expense reductions ▪Approximately $1 billion of network synergies related to avoided costs from new site builds

Merger-related costs in Q1 2021 were $298 million compared to $686 million in Q4 2020 and $143 million in Q1 2020.

Merger-related costs include: ▪Integration costs to achieve efficiencies in network, retail, information technology and back office operations; ▪Restructuring costs, including severance, store rationalization and network decommissioning; and ▪Transaction costs, including legal and professional services related to the completion of the Merger and the acquisitions of affiliates.

| |

| ~50% | | |

| of Sprint customer traffic has already been moved over to the T-Mobile network | | |

| ————————— | | |

| | | |

| ~20% | | |

| Sprint customer network migrations completed | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merger-Related Costs |

| (in millions) |

| | | | | | | | | | | Sequential Change | | Year-over-year Change |

| Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | $ | | % | | $ | | % |

| Cost of services | $ | — | | | $ | 40 | | | $ | 79 | | | $ | 527 | | | $ | 136 | | | $ | (391) | | | (74) | % | | $ | 136 | | | NM |

| Cost of equipment sales | — | | | — | | | — | | | 6 | | | 17 | | | 11 | | | 183 | % | | 17 | | | NM |

| Selling, general & administrative | 143 | | | 758 | | | 209 | | | 153 | | | 145 | | | (8) | | | (5) | % | | 2 | | | 1 | % |

| Total Merger-related costs | $ | 143 | | | $ | 798 | | | $ | 288 | | | $ | 686 | | | $ | 298 | | | $ | (388) | | | (57) | % | | $ | 155 | | | 108 | % |

| | | | | | | | | | | | | | | | | |

| Cash payments for Merger-related costs | $ | 161 | | | $ | 370 | | | $ | 379 | | | $ | 583 | | | $ | 277 | | | $ | (306) | | | (52) | % | | $ | 116 | | | 72 | % |

| | | | | | | | | | | | | | | | | |

NM - Not Meaningful

2021 Outlook

| | | | | | | | | | | |

| Metric | Previous | Revised | Change at Midpoint |

| Postpaid net customer additions | 4.0 to 4.7 million | 4.4 to 4.9 million | 300 thousand |

Net income (1) | N/A | N/A | N/A |

Core Adjusted EBITDA (2) | $22.6 to $23.1 billion | $22.8 to $23.2 billion | $150 million |

Capital expenditures (3) | $11.7 to $12.0 billion | $11.7 to $12.0 billion | No change |

Merger-related costs (4) | $2.5 to $3.0 billion | $2.7 to $3.0 billion | $100 million |

| Net cash provided by operating activities | $13.0 to $13.5 billion | $13.2 to $13.6 billion | $150 million |

Free Cash Flow (5) | $4.9 to $5.4 billion | $5.1 to $5.5 billion | $150 million |

(1)We are not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP Net income, including, but not limited to, Income tax expense, stock-based compensation expense and Interest expense. Core Adjusted EBITDA should not be used to predict Net income as the difference between these measures and Net Income is variable.

(2)Management uses Core Adjusted EBITDA as a measure to monitor the financial performance of our operations, excluding the impact of lease revenues from our related device financing programs. Our guidance ranges assume a continued reduction in lease revenues to $3.7 to $3.9 billion for 2021.

(3)Capital expenditures means cash purchases of property and equipment, including capitalized interest.

(4)Merger-related costs are excluded from Core Adjusted EBITDA but will impact Net income and cash flows.

(5)Free Cash Flow guidance does not assume any material net cash inflows from securitization in 2021.

Investor Relations

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| Jud Henry | | Justin Taiber | | Trina Schurman | |

| Senior Vice President | | Senior Director | | Senior Director | |

| Investor Relations | | Investor Relations | | Investor Relations | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Samia Bhatti | | Zach Witterstaetter | | Rose Kopecky | | Jacob Marks | |

| Investor Relations | | Investor Relations | | Investor Relations | | Investor Relations | |

| Manager | | Manager | | Manager | | Manager | |

investor.relations@t-mobile.com

http://investor.t-mobile.com

T-Mobile US, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (in millions, except share and per share amounts) | March 31, 2021 | | December 31, 2020 |

| Assets | | | |

| Current assets | | | |

| | | |

| Cash and cash equivalents | $ | 6,677 | | | $ | 10,385 | |

| Accounts receivable, net of allowance for credit losses of $143 and $194 | 3,592 | | | 4,254 | |

| Equipment installment plan receivables, net of allowance for credit losses and imputed discount of $512 and $478 | 3,841 | | | 3,577 | |

| Accounts receivable from affiliates | 20 | | | 22 | |

| Inventory | 2,209 | | | 2,527 | |

| | | |

| Prepaid expenses | 670 | | | 624 | |

| | | |

| Other current assets | 1,770 | | | 2,496 | |

| | | |

| Total current assets | 18,779 | | | 23,885 | |

| | | |

| Property and equipment, net | 40,549 | | | 41,175 | |

| Operating lease right-of-use assets | 27,793 | | | 28,021 | |

| Financing lease right-of-use assets | 2,899 | | | 3,028 | |

| Goodwill | 11,158 | | | 11,117 | |

| Spectrum licenses | 82,901 | | | 82,828 | |

| Other intangible assets, net | 4,892 | | | 5,298 | |

| Equipment installment plan receivables due after one year, net of allowance for credit losses and imputed discount of $124 and $127 | 2,221 | | | 2,031 | |

| | | |

| Other assets | 12,140 | | | 2,779 | |

| | | |

| Total assets | $ | 203,332 | | | $ | 200,162 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| | | |

| Accounts payable and accrued liabilities | $ | 8,712 | | | $ | 10,196 | |

| Payables to affiliates | 108 | | | 157 | |

| Short-term debt | 4,423 | | | 4,579 | |

| | | |

| Deferred revenue | 972 | | | 1,030 | |

| Short-term operating lease liabilities | 3,498 | | | 3,868 | |

| Short-term financing lease liabilities | 1,013 | | | 1,063 | |

| | | |

| Other current liabilities | 769 | | | 810 | |

| | | |

| Total current liabilities | 19,495 | | | 21,703 | |

| | | |

| Long-term debt | 66,395 | | | 61,830 | |

| Long-term debt to affiliates | 4,721 | | | 4,716 | |

| Tower obligations | 2,974 | | | 3,028 | |

| Deferred tax liabilities | 10,154 | | | 9,966 | |

| Operating lease liabilities | 26,602 | | | 26,719 | |

| Financing lease liabilities | 1,316 | | | 1,444 | |

| | | |

| | | |

| Other long-term liabilities | 5,298 | | | 5,412 | |

| | | |

| Total long-term liabilities | 117,460 | | | 113,115 | |

| Commitments and contingencies | | | |

| Stockholders' equity | | | |

| | | |

| | | |

| Common Stock, par value $0.00001 per share, 2,000,000,000 shares authorized; 1,248,334,491 and 1,243,345,584 shares issued, 1,246,773,175 and 1,241,805,706 shares outstanding | — | | | — | |

| Additional paid-in capital | 72,839 | | | 72,772 | |

| Treasury stock, at cost, 1,561,316 and 1,539,878 shares issued | (14) | | | (11) | |

| Accumulated other comprehensive loss | (1,545) | | | (1,581) | |

| Accumulated deficit | (4,903) | | | (5,836) | |

| | | |

| Total stockholders' equity | 66,377 | | | 65,344 | |

| Total liabilities and stockholders' equity | $ | 203,332 | | | $ | 200,162 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in millions, except share and per share amounts) | March 31,

2021 | | December 31,

2020 | | March 31,

2020 | | | | |

| Revenues | | | | | | | | | |

| | | | | | | | | |

| Postpaid revenues | $ | 10,303 | | | $ | 10,251 | | | $ | 5,887 | | | | | |

| Prepaid revenues | 2,351 | | | 2,354 | | | 2,373 | | | | | |

| Wholesale revenues | 897 | | | 927 | | | 325 | | | | | |

| Roaming and other service revenues | 641 | | | 648 | | | 261 | | | | | |

| | | | | | | | | |

| Total service revenues | 14,192 | | | 14,180 | | | 8,846 | | | | | |

| | | | | | | | | |

| Equipment revenues | 5,346 | | | 5,973 | | | 2,117 | | | | | |

| Other revenues | 221 | | | 188 | | | 150 | | | | | |

| | | | | | | | | |

| Total revenues | 19,759 | | | 20,341 | | | 11,113 | | | | | |

| | | | | | | | | |

| Operating expenses | | | | | | | | | |

| | | | | | | | | |

| Cost of services, exclusive of depreciation and amortization shown separately below | 3,384 | | | 3,827 | | | 1,639 | | | | | |

| Cost of equipment sales, exclusive of depreciation and amortization shown separately below | 5,142 | | | 5,825 | | | 2,529 | | | | | |

| Selling, general and administrative | 4,805 | | | 4,758 | | | 3,688 | | | | | |

| | | | | | | | | |

| Depreciation and amortization | 4,289 | | | 4,219 | | | 1,718 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating expenses | 17,620 | | | 18,629 | | | 9,574 | | | | | |

| | | | | | | | | |

| Operating income | 2,139 | | | 1,712 | | | 1,539 | | | | | |

| | | | | | | | | |

| Other income (expense) | | | | | | | | | |

| | | | | | | | | |

| Interest expense | (792) | | | (757) | | | (185) | | | | | |

| Interest expense to affiliates | (46) | | | (41) | | | (99) | | | | | |

| Interest income | 3 | | | 8 | | | 12 | | | | | |

| Other expense, net | (125) | | | (101) | | | (10) | | | | | |

| Total other expense, net | (960) | | | (891) | | | (282) | | | | | |

| Income before income taxes | 1,179 | | | 821 | | | 1,257 | | | | | |

| Income tax expense | (246) | | | (71) | | | (306) | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | $ | 933 | | | $ | 750 | | | $ | 951 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | $ | 933 | | | $ | 750 | | | $ | 951 | | | | | |

| Other comprehensive income (loss), net of tax | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Unrealized gain (loss) on cash flow hedges, net of tax effect of $12, $11 and ($276) | 34 | | | 34 | | | (792) | | | | | |

| Unrealized gain on foreign currency translation adjustment, net of tax effect of $0, $0 and $0 | 2 | | | — | | | — | | | | | |

| | | | | | | | | |

| Net unrecognized gain (loss) on pension and other postretirement benefits, net of tax effect of $0, $2 and $0 | — | | | 6 | | | — | | | | | |

| | | | | | | | | |

| Other comprehensive income (loss) | 36 | | | 40 | | | (792) | | | | | |

| | | | | | | | | |

| Total comprehensive income | $ | 969 | | | $ | 790 | | | $ | 159 | | | | | |

| Earnings per share | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic | $ | 0.75 | | | $ | 0.60 | | | $ | 1.11 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted | $ | 0.74 | | | $ | 0.60 | | | $ | 1.10 | | | | | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | 1,243,520,026 | | | 1,241,578,615 | | | 858,148,284 | | | | | |

| Diluted | 1,252,783,564 | | | 1,251,566,899 | | | 865,998,532 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in millions) | March 31,

2021 | | December 31,

2020 | | March 31,

2020 | | | | |

| Operating activities | | | | | | | | | |

| Net income | $ | 933 | | | $ | 750 | | | $ | 951 | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | | | | | | | |

| | | | | | | | | |

| Depreciation and amortization | 4,289 | | | 4,219 | | | 1,718 | | | | | |

| Stock-based compensation expense | 138 | | | 136 | | | 138 | | | | | |

| Deferred income tax expense | 211 | | | 79 | | | 310 | | | | | |

| Bad debt expense | 82 | | | 113 | | | 113 | | | | | |

| (Gains) losses from sales of receivables | (18) | | | (1) | | | 25 | | | | | |

| | | | | | | | | |

| Losses on redemption of debt | 101 | | | 100 | | | — | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Changes in operating assets and liabilities | | | | | | | | | |

| Accounts receivable | 96 | | | (489) | | | (748) | | | | | |

| Equipment installment plan receivables | (727) | | | (1,343) | | | 69 | | | | | |

| Inventories | 279 | | | (609) | | | (511) | | | | | |

| Operating lease right-of-use assets | 1,124 | | | 939 | | | 527 | | | | | |

| Other current and long-term assets | 54 | | | (296) | | | 6 | | | | | |

| Accounts payable and accrued liabilities | (1,384) | | | 507 | | | (405) | | | | | |

| Short and long-term operating lease liabilities | (1,369) | | | (752) | | | (725) | | | | | |

| Other current and long-term liabilities | (217) | | | (16) | | | 79 | | | | | |

| Other, net | 69 | | | 137 | | | 70 | | | | | |

| | | | | | | | | |

| Net cash provided by operating activities | 3,661 | | | 3,474 | | | 1,617 | | | | | |

| Investing activities | | | | | | | | | |

| | | | | | | | | |

| Purchases of property and equipment, including capitalized interest of ($84), ($101) and ($112) | (3,183) | | | (3,807) | | | (1,753) | | | | | |

| Purchases of spectrum licenses and other intangible assets, including deposits | (8,922) | | | (506) | | | (99) | | | | | |

| | | | | | | | | |

| Proceeds related to beneficial interests in securitization transactions | 891 | | | 809 | | | 868 | | | | | |

| Net cash related to derivative contracts under collateral exchange arrangements | — | | | — | | | (580) | | | | | |

| Acquisition of companies, net of cash and restricted cash acquired | (29) | | | — | | | — | | | | | |

| Proceeds from the divestiture of prepaid business | — | | | (14) | | | — | | | | | |

| Other, net | 4 | | | (129) | | | (16) | | | | | |

| | | | | | | | | |

| Net cash used in investing activities | (11,239) | | | (3,647) | | | (1,580) | | | | | |

| Financing activities | | | | | | | | | |

| | | | | | | | | |

| Proceeds from issuance of long-term debt | 6,763 | | | 8,643 | | | — | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Repayments of financing lease obligations | (287) | | | (257) | | | (282) | | | | | |

| Repayments of short-term debt for purchases of inventory, property and equipment and other financial liabilities | (55) | | | (74) | | | (25) | | | | | |

| Repayments of long-term debt | (2,219) | | | (4,209) | | | — | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Tax withholdings on share-based awards | (218) | | | (88) | | | (141) | | | | | |

| | | | | | | | | |

| Cash payments for debt prepayment or debt extinguishment costs | (65) | | | — | | | — | | | | | |

| Other, net | (45) | | | (36) | | | (5) | | | | | |

| | | | | | | | | |

| Net cash provided by (used in) financing activities | 3,874 | | | 3,979 | | | (453) | | | | | |

| Change in cash and cash equivalents, including restricted cash | (3,704) | | | 3,806 | | | (416) | | | | | |

| Cash and cash equivalents, including restricted cash | | | | | | | | | |

| Beginning of period | 10,463 | | | 6,657 | | | 1,528 | | | | | |

| End of period | $ | 6,759 | | | $ | 10,463 | | | $ | 1,112 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

T-Mobile US, Inc.

Condensed Consolidated Statements of Cash Flows (Continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in millions) | March 31,

2021 | | December 31,

2020 | | March 31,

2020 | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | | |

| Interest payments, net of amounts capitalized | $ | 945 | | | $ | 844 | | | $ | 341 | | | | | |

| Operating lease payments | 1,651 | | | 1,126 | | | 875 | | | | | |

| Income tax payments | 22 | | | 100 | | | 24 | | | | | |

| Non-cash investing and financing activities | | | | | | | | | |

| Non-cash beneficial interest obtained in exchange for securitized receivables | $ | 1,381 | | | $ | 1,560 | | | $ | 1,613 | | | | | |

| | | | | | | | | |

| Change in accounts payable and accrued liabilities for purchases of property and equipment | (173) | | | 1,144 | | | (301) | | | | | |

| Leased devices transferred from inventory to property and equipment | 485 | | | 443 | | | 309 | | | | | |

| Returned leased devices transferred from property and equipment to inventory | (445) | | | (430) | | | (59) | | | | | |

| | | | | | | | | |

| Operating lease right-of-use assets obtained in exchange for lease obligations | 911 | | | 1,083 | | | 555 | | | | | |

| Financing lease right-of-use assets obtained in exchange for lease obligations | 109 | | | 361 | | | 178 | | | | | |

n.gT-Mobile US, Inc.

Supplementary Operating and Financial Data

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in thousands) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Customers, end of period | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Postpaid phone customers (1) | | | | | | | 40,797 | | | 65,105 | | | 65,794 | | | 66,618 | | | 67,402 | | | | | |

Postpaid other customers (1) | | | | | | | 7,014 | | | 12,648 | | | 13,938 | | | 14,732 | | | 15,170 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total postpaid customers | | | | | | | 47,811 | | | 77,753 | | | 79,732 | | | 81,350 | | | 82,572 | | | | | |

| | | | | | | | | | | | | | | | | | | |

Prepaid customers (1) | | | | | | | 20,732 | | | 20,574 | | | 20,630 | | | 20,714 | | | 20,865 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total customers | | | | | | | 68,543 | | | 98,327 | | | 100,362 | | | 102,064 | | | 103,437 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Acquired customers, net of base adjustments (1)(2) | | | | | | | — | | | 29,228 | | | — | | | — | | | 12 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1)Includes customers acquired in connection with the Merger and certain customer base adjustments. See Reconciliations to Beginning Customers.

(2)In the first quarter of 2021, we acquired 11,000 postpaid phone customers and 1,000 postpaid other customers through an acquisition of an affiliate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in thousands) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Net customer additions (losses) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Postpaid phone customers | | | | | | | 452 | | | 253 | | | 689 | | | 824 | | | 773 | | | | | |

| Postpaid other customers | | | | | | | 325 | | | 859 | | | 1,290 | | | 794 | | | 437 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total postpaid customers | | | | | | | 777 | | | 1,112 | | | 1,979 | | | 1,618 | | | 1,210 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Prepaid customers | | | | | | | (128) | | | 133 | | | 56 | | | 84 | | | 151 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total customers | | | | | | | 649 | | | 1,245 | | | 2,035 | | | 1,702 | | | 1,361 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter |

| (in millions, except percentages) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Devices sold or leased | | | | | | | | | | | | | | | | | | | |

| Phones | | | | | | | 6.4 | | 8.9 | | 9.2 | | 10.1 | | 9.6 | | | | |

| Mobile broadband and IoT devices | | | | | | | 0.8 | | 1.2 | | 2.2 | | 1.6 | | 1.0 | | | | |

| Total | | | | | | | 7.2 | | 10.1 | | 11.4 | | 11.7 | | 10.6 | | | | |

| | | | | | | | | | | | | | | | | | | |

| Postpaid upgrade rate | | | | | | | 3.8 | % | | 4.5 | % | | 4.3 | % | | 5.7 | % | | 4.8 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Churn | | | | | | | | | | | | | | | | | | | |

| Postpaid phone churn | | | | | | | 0.86 | % | | 0.80 | % | | 0.90 | % | | 1.03 | % | | 0.98 | % | | | | |

| Prepaid churn | | | | | | | 3.52 | % | | 2.81 | % | | 2.86 | % | | 2.92 | % | | 2.78 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in thousands) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Accounts, end of period | | | | | | | | | | | | | | | | | | | |

Total postpaid customer accounts (1) | | | | | | | 15,244 | | 25,486 | | 25,623 | | 25,754 | | 26,014 | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1)Includes accounts acquired in connection with the Merger and certain account base adjustments. See Reconciliations to Beginning Customers and Accounts in this Investor Factbook.

T-Mobile US, Inc.

Supplementary Operating and Financial Data (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in millions, except percentages) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Financial Measures | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Service revenues | | | | | | | $ | 8,846 | | | $ | 13,230 | | | $ | 14,139 | | | $ | 14,180 | | | $ | 14,192 | | | | | |

| Total revenues | | | | | | | 11,113 | | | 17,671 | | | 19,272 | | | 20,341 | | | 19,759 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | $ | 951 | | | $ | 110 | | | $ | 1,253 | | | $ | 750 | | | $ | 933 | | | | | |

| Net income margin | | | | | | | 10.8 | % | | 0.8 | % | | 8.9 | % | | 5.3 | % | | 6.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | $ | 3,665 | | | $ | 7,017 | | | $ | 7,129 | | | $ | 6,746 | | | $ | 6,905 | | | | | |

| Adjusted EBITDA margin | | | | | | | 41.4 | % | | 53.0 | % | | 50.4 | % | | 47.6 | % | | 48.7 | % | | | | |

| Core Adjusted EBITDA | | | | | | | $ | 3,500 | | | $ | 5,596 | | | $ | 5,779 | | | $ | 5,501 | | | $ | 5,864 | | | | | |

| Core Adjusted EBITDA margin | | | | | | | 39.6 | % | | 42.3 | % | | 40.9 | % | | 38.8 | % | | 41.3 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| Cost of services | | | | | | | $ | 1,639 | | | $ | 3,098 | | | $ | 3,314 | | | $ | 3,827 | | | $ | 3,384 | | | | | |

| Merger-related costs | | | | | | | — | | | 40 | | | 79 | | | 527 | | | 136 | | | | | |

| Cost of services excluding Merger-related costs | | | | | | | $ | 1,639 | | | $ | 3,058 | | | $ | 3,235 | | | $ | 3,300 | | | $ | 3,248 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative | | | | | | | $ | 3,688 | | | $ | 5,604 | | | $ | 4,876 | | | $ | 4,758 | | | $ | 4,805 | | | | | |

| Merger-related costs | | | | | | | 143 | | | 758 | | | 209 | | | 153 | | | 145 | | | | | |

COVID-19-related costs (1) | | | | | | | 117 | | | 341 | | | — | | | — | | | — | | | | | |

| Selling, general and administrative excluding Merger-related costs and COVID-19-related costs | | | | | | | $ | 3,428 | | | $ | 4,505 | | | $ | 4,667 | | | $ | 4,605 | | | $ | 4,660 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total bad debt expense and losses from sales of receivables | | | | | | | $ | 138 | | | $ | 263 | | | $ | 125 | | | $ | 112 | | | $ | 64 | | | | | |

| Bad debt and losses from sales of receivables as a percentage of Total revenues | | | | | | | 1.24 | % | | 1.49 | % | | 0.65 | % | | 0.55 | % | | 0.32 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| Cash purchases of property and equipment including capitalized interest | | | | | | | $ | 1,753 | | | $ | 2,257 | | | $ | 3,217 | | | $ | 3,807 | | | $ | 3,183 | | | | | |

| Capitalized interest | | | | | | | 112 | | | 119 | | | 108 | | | 101 | | | 84 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net cash proceeds from securitization | | | | | | | (5) | | | (99) | | | 5 | | | (130) | | | 22 | | | | | |

(1)Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were not significant for Q3 and Q4 2020 and Q1 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in millions, except percentages) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Device Financing - Equipment Installment Plans | | | | | | | | | | | | | | | | | | | |

| Gross EIP financed | | | | | | | $ | 1,440 | | | $ | 1,825 | | | $ | 2,356 | | | $ | 4,126 | | | $ | 3,379 | | | | | |

| EIP billings | | | | | | | 1,790 | | | 2,217 | | | 2,130 | | | 2,285 | | | 2,556 | | | | | |

| EIP receivables, net | | | | | | | 3,773 | | | 4,593 | | | 4,481 | | | 5,608 | | | 6,062 | | | | | |

| EIP receivables classified as prime | | | | | | | 52 | % | | 48 | % | | 53 | % | | 57 | % | | 57 | % | | | | |

| EIP receivables classified as prime (including EIP receivables sold) | | | | | | | 53 | % | | 50 | % | | 54 | % | | 57 | % | | 56 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| Device Financing - Leased Devices | | | | | | | | | | | | | | | | | | | |

| Lease revenues | | | | | | | $ | 165 | | | $ | 1,421 | | | $ | 1,350 | | | $ | 1,245 | | | $ | 1,041 | | | | | |

| Leased device depreciation | | | | | | | 163 | | | 946 | | | 1,000 | | | 982 | | | 897 | | | | | |

| Leased devices transferred from inventory to property and equipment | | | | | | | 309 | | | 1,444 | | | 599 | | | 443 | | | 485 | | | | | |

| Returned leased devices transferred from property and equipment to inventory | | | | | | | (59) | | | (538) | | | (433) | | | (430) | | | (445) | | | | | |

| Leased devices included in property and equipment, net | | | | | | | 819 | | | 6,621 | | | 5,788 | | | 4,819 | | | 3,962 | | | | | |

| Leased devices (units) included in property and equipment, net | | | | | | | 2.1 | | 17.0 | | 15.8 | | 14.2 | | 12.4 | | | | |

T-Mobile US, Inc.

Calculation of Operating Measures

(Unaudited)

The following table illustrates the calculation of our operating measures ARPA and ARPU from the related service revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except average number of accounts and customers, ARPA and ARPU) | | | | | | | Quarter | | |

| | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| Calculation of Postpaid ARPA | | | | | | | | | | | | | | | | | | | |

| Postpaid service revenues | | | | | | | $ | 5,887 | | | $ | 9,959 | | | $ | 10,209 | | | $ | 10,251 | | | $ | 10,303 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Divided by: Average number of postpaid accounts (in thousands) and number of months in period | | | | | | | 15,155 | | | 25,424 | | | 25,582 | | | 25,677 | | | 25,840 | | | | | |

| Postpaid ARPA | | | | | | | $ | 129.47 | | | $ | 130.57 | | | $ | 133.03 | | | $ | 133.08 | | | $ | 132.91 | | | | | |

| Calculation of Postpaid Phone ARPU | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Postpaid service revenues | | | | | | | $ | 5,887 | | | $ | 9,959 | | | $ | 10,209 | | | $ | 10,251 | | | $ | 10,303 | | | | | |

| Less: Postpaid other revenues | | | | | | | (310) | | | (618) | | | (677) | | | (762) | | | (820) | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Postpaid phone service revenues | | | | | | | 5,577 | | | 9,341 | | | 9,532 | | | 9,489 | | | 9,483 | | | | | |

| Divided by: Average number of postpaid phone customers (in thousands) and number of months in period | | | | | | | 40,585 | | 64,889 | | 65,437 | | 66,084 | | 66,834 | | | | |

| Postpaid phone ARPU | | | | | | | $ | 45.80 | | | $ | 47.99 | | | $ | 48.55 | | | $ | 47.86 | | | $ | 47.30 | | | | | |

| Calculation of Prepaid ARPU | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Prepaid service revenues | | | | | | | $ | 2,373 | | | $ | 2,311 | | | $ | 2,383 | | | $ | 2,354 | | | $ | 2,351 | | | | | |

| Divided by: Average number of prepaid customers (in thousands) and number of months in period | | | | | | | 20,759 | | | 20,380 | | | 20,632 | | | 20,605 | | | 20,728 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Prepaid ARPU | | | | | | | $ | 38.11 | | | $ | 37.80 | | | $ | 38.49 | | | $ | 38.08 | | | $ | 37.81 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures

(Unaudited)

This Investor Factbook includes non-GAAP financial measures. The non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided below. T-Mobile is not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, Income tax expense, stock-based compensation expense and Interest expense. Adjusted EBITDA and Core Adjusted EBITDA should not be used to predict Net income as the difference between these measures and Net income is variable.

The following table includes the impact of the Sprint Merger on a prospective basis from the close date of April 1, 2020. Historical results have not been restated and reflect standalone T-Mobile.

Adjusted EBITDA and Core Adjusted EBITDA are reconciled to Net income as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | | | | | |

| (in millions) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | | | | | |

| Net income | | | | | | | $ | 951 | | | $ | 110 | | | $ | 1,253 | | | $ | 750 | | | $ | 933 | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | | | | | | — | | | (320) | | | — | | | — | | | — | | | | | | | | | |

| Income from continuing operations | | | | | | | 951 | | | (210) | | | 1,253 | | | 750 | | | 933 | | | | | | | | | |

| Interest expense | | | | | | | 185 | | | 776 | | | 765 | | | 757 | | | 792 | | | | | | | | | |

| Interest expense to affiliates | | | | | | | 99 | | | 63 | | | 44 | | | 41 | | | 46 | | | | | | | | | |

| Interest income | | | | | | | (12) | | | (6) | | | (3) | | | (8) | | | (3) | | | | | | | | | |

| Other (income) expense, net | | | | | | | 10 | | | 195 | | | 99 | | | 101 | | | 125 | | | | | | | | | |

| Income tax expense | | | | | | | 306 | | | 2 | | | 407 | | | 71 | | | 246 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | | | | | 1,539 | | | 820 | | | 2,565 | | | 1,712 | | | 2,139 | | | | | | | | | |

| Depreciation and amortization | | | | | | | 1,718 | | | 4,064 | | | 4,150 | | | 4,219 | | | 4,289 | | | | | | | | | |

Operating income from discontinued operations (1) | | | | | | | — | | | 432 | | | — | | | — | | | — | | | | | | | | | |

Stock-based compensation (2) | | | | | | | 123 | | | 139 | | | 125 | | | 129 | | | 130 | | | | | | | | | |

| Merger-related costs | | | | | | | 143 | | | 798 | | | 288 | | | 686 | | | 298 | | | | | | | | | |

COVID-19-related costs (3) | | | | | | | 117 | | | 341 | | | — | | | — | | | — | | | | | | | | | |

| Impairment expense | | | | | | | — | | | 418 | | | — | | | — | | | — | | | | | | | | | |

Other, net (4) | | | | | | | 25 | | | 5 | | | 1 | | | — | | | 49 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | 3,665 | | | 7,017 | | | 7,129 | | | 6,746 | | | 6,905 | | | | | | | | | |

| Lease revenues | | | | | | | (165) | | | (1,421) | | | (1,350) | | | (1,245) | | | (1,041) | | | | | | | | | |

| Core Adjusted EBITDA | | | | | | | $ | 3,500 | | | $ | 5,596 | | | $ | 5,779 | | | $ | 5,501 | | | $ | 5,864 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1)Following the Prepaid Transaction (as defined below), starting on July 1, 2020, we provide MVNO services to DISH. We have included the operating income from discontinued operations in our determination of the Adjusted EBITDA to reflect contributions of the Prepaid Business that has been replaced by the MVNO Agreement beginning on July 1, 2020 in order to enable management, analysts and investors to better assess ongoing operating performance and trends.

(2)Stock-based compensation includes payroll tax impacts and may not agree to stock-based compensation expense in the Condensed Consolidated Financial Statements. Additionally, certain stock-based compensation expenses associated with the Sprint Merger have been included in Merger-related costs.

(3)Supplemental employee payroll, third-party commissions and cleaning-related COVID-19 costs were not significant for Q3 and Q4 2020 and Q1 2021.

(4)Other, net may not agree to the Condensed Consolidated Statements of Comprehensive Income, primarily due to certain non-routine operating activities, such as other special items that would not be expected to reoccur or are not reflective of T-Mobile’s ongoing operating performance, and are therefore excluded in Adjusted EBITDA and Core Adjusted EBITDA.

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures (continued)

(Unaudited)

Net debt (excluding tower obligations) to the LTM Pro Forma Adjusted EBITDA and Pro Forma Core Adjusted EBITDA ratios are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except net debt ratios) | | | | | | | Mar 31,

2020 | | Jun 30,

2020 | | Sep 30,

2020 | | Dec 31,

2020 | | Mar 31,

2021 |

| | | | | | | | | | | | | | | |

| Short-term debt | | | | | | | $ | — | | | $ | 3,818 | | | $ | 3,713 | | | $ | 4,579 | | | $ | 4,423 | |

| Short-term debt to affiliates | | | | | | | 2,000 | | | 1,235 | | | — | | | — | | | — | |

| Short-term financing lease liabilities | | | | | | | 918 | | | 1,040 | | | 1,050 | | | 1,063 | | | 1,013 | |

| Long-term debt | | | | | | | 10,959 | | | 62,783 | | | 58,345 | | | 61,830 | | | 66,395 | |

| Long-term debt to affiliates | | | | | | | 11,987 | | | 4,706 | | | 4,711 | | | 4,716 | | | 4,721 | |

| Financing lease liabilities | | | | | | | 1,276 | | | 1,416 | | | 1,373 | | | 1,444 | | | 1,316 | |

| Less: Cash and cash equivalents | | | | | | | (1,112) | | | (11,076) | | | (6,571) | | | (10,385) | | | (6,677) | |

| | | | | | | | | | | | | | | |

| Net debt (excluding tower obligations) | | | | | | | $ | 26,028 | | | $ | 63,922 | | | $ | 62,621 | | | $ | 63,247 | | | $ | 71,191 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Divided by: Last twelve months Pro Forma Adjusted EBITDA | | | | | | | | | $ | 26,250 | | | $ | 26,975 | | | $ | 27,543 | | | $ | 27,797 | |

| Net debt (excluding tower obligations) to LTM Pro Forma Adjusted EBITDA Ratio | | | | | | | | | 2.4 | | | 2.3 | | | 2.3 | | | 2.6 | |

| Divided by: Last twelve months Pro Forma Core Adjusted EBITDA | | | | | | | | | $ | 20,511 | | | $ | 21,357 | | | $ | 22,125 | | | $ | 22,740 | |

| Net debt (excluding tower obligations) LTM Pro Forma Core Adjusted EBITDA Ratio | | | | | | | | | 3.1 | | | 2.9 | | | 2.9 | | | 3.1 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

LTM Adjusted EBITDA and LTM Core Adjusted EBITDA reflect combined company results of New T-Mobile for Q1 2021, Q4 2020, Q3 2020 and Q2 2020 and standalone T-Mobile for prior periods. To illustrate the twelve month results of the combined company as if the Merger had closed on January 1, 2019, we have presented pro forma LTM Adjusted EBITDA and pro forma LTM Core Adjusted EBITDA ratios through December 31, 2020. Pro forma LTM Adjusted EBITDA for the LTM period ended December 31, 2020 is calculated as the sum of Q4 2020, Q3 2020 and Q2 2020 actual Adjusted EBITDA of $6.7 billion, $7.1 billion and $7.0 billion, respectively, plus the pro forma Adjusted EBITDA from Q1 2020 of $6.7 billion. Pro forma LTM Core Adjusted EBITDA for the LTM period ended December 31, 2020 is calculated as the sum of Q4 2020, Q3 2020 and Q2 2020 actual Core Adjusted EBITDA of $5.5 billion, $5.8 billion and $5.6 billion plus the pro forma Core Adjusted EBITDA from Q1 2020 of $5.2 billion. The same method applies to pro forma LTM Adjusted EBITDA and pro forma LTM Core Adjusted EBITDA for the LTM periods ended September 30 and June 30, 2020. These metrics are provided for illustrative purposes only and do not purport to represent what the actual consolidated results would have been had the Merger actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. Additional information regarding pro forma adjustments is provided in Pro Forma Income Statement Metrics within this Investor Factbook. LTM Adjusted EBITDA and LTM Core Adjusted EBITDA for Q1 2021 represent the sum of actual Adjusted EBITDA and Core Adjusted EBITDA, respectively, for Q2 2020, Q3 2020, Q4 2020, and Q1 2021 and were not prepared on a pro forma basis.

Free Cash Flow and Free Cash Flow, excluding gross payments for the settlement of interest rate swaps, are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Quarter | | |

| (in millions) | | | | | | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | Q1 2021 | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | | | | | $ | 1,617 | | | $ | 777 | | | $ | 2,772 | | | $ | 3,474 | | | $ | 3,661 | | | | | |

| Cash purchases of property and equipment | | | | | | | (1,753) | | | (2,257) | | | (3,217) | | | (3,807) | | | (3,183) | | | | | |

| Proceeds related to beneficial interests in securitization transactions | | | | | | | 868 | | | 602 | | | 855 | | | 809 | | | 891 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Cash payments for debt prepayment or debt extinguishment costs | | | | | | | — | | | (24) | | | (58) | | | — | | | (65) | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | | | | | | 732 | | | (902) | | | 352 | | | 476 | | | 1,304 | | | | | |

| Gross cash paid for the settlement of interest rate swaps | | | | | | | — | | | 2,343 | | | — | | | — | | | — | | | | | |

| Free Cash Flow, excluding gross payments for the settlement of interest rate swaps | | | | | | | $ | 732 | | | $ | 1,441 | | | $ | 352 | | | $ | 476 | | | $ | 1,304 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures (continued)

(Unaudited)

Our current guidance range for Free Cash Flow is calculated as follows:

| | | | | | | | | | | |

| FY 2021 |

| (in millions) | Current Guidance Range |

| | | |

| Net cash provided by operating activities | $ | 13,200 | | | $ | 13,600 | |

| | | |

| Cash purchases of property and equipment | (11,700) | | | (12,000) | |

Proceeds related to beneficial interests in securitization transactions (1) | 3,700 | | | 3,900 | |

| Cash payments for debt prepayment or debt extinguishment costs | (100) | | | — | |

| | | |

| Free Cash Flow | $ | 5,100 | | | $ | 5,500 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

(1)Free Cash Flow guidance does not assume any material net cash inflows from securitization in 2021.

Our previous guidance range for Free Cash Flow is calculated as follows:

| | | | | | | | | | | |

| FY 2021 |

| (in millions) | Previous Guidance Range |

| | | |

| Net cash provided by operating activities | $ | 13,000 | | | $ | 13,500 | |

| | | |

| Cash purchases of property and equipment | (11,700) | | | (12,000) | |

Proceeds related to beneficial interests in securitization transactions (1) | 3,700 | | | 3,900 | |

| Cash payments for debt prepayment or debt extinguishment costs | (100) | | | — | |

| | | |

| Free Cash Flow | $ | 4,900 | | | $ | 5,400 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

(1)Free Cash Flow guidance does not assume any material net cash inflows from securitization in 2021.

T-Mobile US, Inc.

Reconciliations to Beginning Customers and Accounts

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Postpaid phone customers | | Postpaid other customers | | Total postpaid customers | | Prepaid customers | | Total customers |

| Reconciliation to beginning customers | | | | | | | | | |

| T-Mobile customers as reported, end of period March 31, 2020 | 40,797 | | | 7,014 | | | 47,811 | | | 20,732 | | | 68,543 | |

| Sprint customers as reported, end of period March 31, 2020 | 25,916 | | | 8,428 | | | 34,344 | | | 8,256 | | | 42,600 | |

| Total combined customers, end of period March 31, 2020 | 66,713 | | | 15,442 | | | 82,155 | | | 28,988 | | | 111,143 | |

| Adjustments | | | | | | | | | |

Reseller reclassification to wholesale customers (1) | (199) | | | (2,872) | | | (3,071) | | | — | | | (3,071) | |

EIP reclassification from postpaid to prepaid (2) | (963) | | | — | | | (963) | | | 963 | | | — | |

Divested prepaid customers (3) | — | | | — | | | — | | | (9,207) | | | (9,207) | |

Rate plan threshold (4) | (182) | | | (918) | | | (1,100) | | | — | | | (1,100) | |

Customers with non-phone devices (5) | (226) | | | 226 | | | — | | | — | | | — | |

Collection policy alignment (6) | (150) | | | (46) | | | (196) | | | — | | | (196) | |

Miscellaneous adjustments (7) | (141) | | | (43) | | | (184) | | | (302) | | | (486) | |

| Total Adjustments | (1,861) | | | (3,653) | | | (5,514) | | | (8,546) | | | (14,060) | |

| Adjusted beginning customers as of April 1, 2020 | 64,852 | | | 11,789 | | | 76,641 | | | 20,442 | | | 97,083 | |

| | | | | | | | | |

(1)In connection with the closing of the Merger, we refined our definition of wholesale customers resulting in the reclassification of certain postpaid and prepaid reseller customers to wholesale customers. Starting with the three months ended March 31, 2020, we discontinued reporting wholesale customers to focus on postpaid and prepaid customers and wholesale revenues, which we consider more relevant than the number of wholesale customers given the expansion of M2M and IoT products.

(2)Prepaid customers with a device installment billing plan historically included as Sprint postpaid customers have been reclassified to prepaid customers to align with New T-Mobile policy.

(3)Customers associated with the Sprint wireless prepaid and Boost brands that were divested on July 1, 2020, have been excluded from our reported customers.