Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2008

CHINA CARBON GRAPHITE GROUP, INC.

(Exact name of registrant as specified in its charter)

Nevada | 98-0550699 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

China Carbon Graphite Group, Inc.

c/o Xinghe Yongle Carbon Co., Ltd.

787 Xicheng Wai

Chengguantown

Xinghe County

Inner Mongolia, China

(Address of principal executive offices)

(86) 474-7209723

(Issuer’s telephone number)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 of 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes x No o

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, see definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of Exchange Act. Check one:

| Large accelerated filer | o | Accelerated filer | o | |||

Non-accelerated filer (Do not check if smaller reporting company) | o | Smaller reporting company | x |

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

On November 13, 2008, the Registrant had 12,218,412 shares of common stock, par value $.001 per share, outstanding.

Transitional Small Business Disclosure Format: Yes o No x

1

CHINA CARBON GRAPHITE GROUP, INC. AND SUBSIDIARIES

| Page | |

| Part I. Financial Information | |

| Item 1. Condensed Consolidated Financial Statements | |

| Condensed Consolidated Balance Sheets as of September 30, 2008 (Unaudited) and December 31, 2007 | 3 |

| Condensed Consolidated Statements of Income for the nine months ended September 30, 2008 and 2007 (Unaudited) | 4 |

| Condensed Consolidated Statements of Income for the three months ended September 30, 2008 and 2007 (Unaudited) | 5 |

| Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2008 and 2007 (Unaudited) | 6 |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | 7 |

| Item 2. Management’s Discussion and Analysis or Plan of Operation | 17 |

| Item 4. Controls and Procedures | 24 |

| Part II. Other Information | |

| Item 6. Exhibits | 26 |

2

Condensed Consolidated Balance Sheets

(US Dollars) | |||||||

Unaudited | Audited | ||||||

September 30, 2008 | December 31, 2007 | ||||||

ASSETS | |||||||

Current Assets | |||||||

| Cash and cash equivalents | $ | 52,102 | $ | 4,497 | |||

| Trade accounts receivable | 5,854,729 | 4,868,263 | |||||

| Notes receivable | - | 243,426 | |||||

| Other receivables | 491,145 | 766,945 | |||||

| Advance to suppliers | 885,705 | 636,660 | |||||

| Inventories | 17,163,642 | 14,626,927 | |||||

| Prepaid expenses | 30,487 | - | |||||

Total current assets | 24,477,810 | 21,146,718 | |||||

Property and equipment | 20,081,305 | 19,583,329 | |||||

Construction in progress | 2,625,861 | 38,282 | |||||

Land use rights, net | 3,622,908 | 2,841,954 | |||||

| $ | 50,807,884 | $ | 43,610,283 | ||||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Current Liabilities | |||||||

| Accounts payable and accrued expenses | $ | 907,846 | $ | 988,470 | |||

| Advance from customers | 3,520,899 | 2,466,810 | |||||

| Taxes payable | 325,470 | 232,234 | |||||

| Notes payable | 4,886,873 | 6,715,778 | |||||

| Convertible note payable | - | 400,000 | |||||

| Loan from shareholder | 4,800,453 | 4,543,648 | |||||

| Other payables | 508,452 | - | |||||

Total current liabilities | 14,949,993 | 15,346,940 | |||||

Stockholders' Equity | |||||||

| Convertible preferred stock, par value $0.001 per share, authorized 20,000,000 shares, issued and outstanding 1,200,499 shares at September 30, 2008; none authorized at December 31, 2007 | $ | 1,200 | $ | - | |||

| Common stock, $0.001 par value, authorized 100,000,000 shares, issued and outstanding 12,218,412 shares and 13,218,412 shares at September 30, 2008 and December 31, 2007, respectively | 12,218 | 13,218 | |||||

| Additional paid-in capital | 8,690,426 | 6,637,326 | |||||

| Accumulated other comprehensive income | 5,012,768 | 2,948,244 | |||||

| Retained earnings | 22,141,279 | 18,814,255 | |||||

| Treasury Stock-common at cost - none at September 30,2008 and 1,000,000 shares at December 31, 2007 | - | (149,700 | ) | ||||

| 35,857,891 | 28,263,343 | ||||||

$ | 50,807,884 | $ | 43,610,283 | ||||

See accompanying notes to condensed consolidated financial statements.

3

Condensed Consolidated Statements of Income and Comprehensive income (Unaudited)

(US Dollars) | |||||||

Nine months ended September 30, | |||||||

2008 | 2007 | ||||||

Sales | $ | 21,160,851 | 18,799,732 | ||||

Cost of Goods Sold | 15,567,633 | 15,067,613 | |||||

Gross Margin | 5,593,218 | 3,732,119 | |||||

Operating Expenses | |||||||

| Selling expenses | 439,004 | 110,050 | |||||

| General and administrative | 575,936 | 541,059 | |||||

| Depreciation and amortization | 49,399 | 13,176 | |||||

| 1,064,339 | 664,285 | ||||||

Operating Income Before Other Income (Expense) and Income Tax Expense | 4,528,879 | 3,067,834 | |||||

Other Income (Expense) | |||||||

| Other income | 224,705 | 286,779 | |||||

| Interest income | 910 | 377 | |||||

| Interest expense | (413,039 | ) | (393,540 | ) | |||

| Other expense | (11,431 | ) | (18,458 | ) | |||

| (198,855 | ) | (124,842 | ) | ||||

Income Before Income Tax Expense | 4,330,024 | 2,942,992 | |||||

Income tax expense | - | - | |||||

Net income | 4,330,024 | 2,942,992 | |||||

Deemed preferred stock dividend | (854,300 | ) | - | ||||

Net income available to common shareholders | $ | 3,475,724 | $ | 2,942,992 | |||

Comprehensive income: | |||||||

| Net income | $ | 4,330,024 | $ | 2,942,992 | |||

Other comprehensive income | |||||||

| Foreign currency translation gain | 2,064,524 | 988,404 | |||||

Comprehensive Income | $ | 6,394,548 | $ | 3,931,396 | |||

Share data | |||||||

| Basic earnings per share | $ | 0.27 | $ | 0.28 | |||

| Diluted earnings per share | $ | 0.18 | $ | 0.28 | |||

| Weighted average common shares outstanding, | |||||||

| basic | 12,716,587 | 10,388,172 | |||||

| Weighted average common shares outstanding, | |||||||

| diluted | 19,365,223 | 10,388,172 | |||||

See accompanying notes to condensed consolidated financial statements.

4

China Carbon Graphite Group, Inc

Condensed Consolidated Statements of Income and Comprehensive income (Unaudited)

(US Dollars) | |||||||

Three months ended September 30, | |||||||

2008 | 2007 | ||||||

Sales | $ | 7,509,072 | $ | 7,353,710 | |||

Cost of Goods Sold | 5,384,214 | 5,967,498 | |||||

Gross Margin | 2,124,858 | 1,386,212 | |||||

Operating Expenses | |||||||

| Selling expenses | 269,002 | 19,034 | |||||

| General and administrative | 177,019 | 301,602 | |||||

| Depreciation and amortization | 18,672 | 11,725 | |||||

| 464,693 | 332,361 | ||||||

Operating Income Before Other Income (Expense) | |||||||

and Income Tax Expense | 1,660,165 | 1,053,851 | |||||

Other Income (Expense) | |||||||

| Other income | 11,032 | 46,773 | |||||

| Interest income | 493 | 233 | |||||

| Interest expense | (143,482 | ) | (61,213 | ) | |||

| Other expense | (120 | ) | (10,792 | ) | |||

| (132,077 | ) | (24,999 | ) | ||||

Income before income taxes | 1,528,088 | 1,028,852 | |||||

Income taxes | - | - | |||||

Net income | 1,528,088 | 1,028,852 | |||||

Other comprehensive income | |||||||

| Foreign currency translation gain | 84,634 | 363,683 | |||||

Comprehensive Income | $ | 1,612,722 | $ | 1,392,535 | |||

Share data | |||||||

| Basic earnings per share | $ | 0.13 | $ | 0.10 | |||

| Diluted earnings per share | $ | 0.08 | $ | 0.10 | |||

| Weighted average common shares outstanding, | |||||||

| basic | 12,218,412 | 10,388,172 | |||||

| Weighted average common shares outstanding, | |||||||

| diluted | 19,418,911 | 10,388,172 | |||||

See accompanying notes to condensed consolidated financial statements.

5

Condensed Consolidated Statements of Cash Flows (Unaudited)

(US Dollars) | |||||||

Nine months ended September 30, | |||||||

2008 | 2007 | ||||||

Cash flows from operating activities | |||||||

Net Income | $ | 4,330,024 | $ | 2,942,992 | |||

Adjustments to reconcile net cash provided by operating activities | |||||||

| Depreciation and amortization | 954,924 | 832,927 | |||||

Change in operating assets and liabilities | |||||||

| Trade accounts receivable | (680,934 | ) | (921,340 | ) | |||

| Notes receivable | 258,703 | (140,124 | ) | ||||

| Prepaid expenses | (30,487 | ) | (10,644 | ) | |||

| Other receivables | 323,933 | (158,108 | ) | ||||

| Advance to suppliers | (209,088 | ) | - | ||||

| Inventory | (1,618,729 | ) | (234,183 | ) | |||

| Accounts payable and accrued expenses | (36,385 | ) | (398,050 | ) | |||

| Advance from customers | 899,273 | - | |||||

| Taxes payable | 78,661 | 448,261 | |||||

| Other payables | 508,451 | - | |||||

Net cash provided by operating activities | 4,778,346 | 2,361,731 | |||||

Cash flows from investing activities | |||||||

| Acquisition of property and equipment | (132,731 | ) | |||||

| Payment for construction in progress | (2,625,861 | ) | |||||

| Additional payment on land use rights | (653,028 | ) | (1,684,847 | ) | |||

Net cash used in investing activities | (3,411,620 | ) | (1,684,847 | ) | |||

Cash flows from financing activities | |||||||

| Repayment to related parties | (28,353 | ) | (639,055 | ) | |||

| Repayment on notes payable | (1,506,456 | ) | (92,232 | ) | |||

Net cash used in financing activities | (1,534,809 | ) | (731,287 | ) | |||

Effect of exchange rate changes on cash | 215,688 | 60,264 | |||||

Net increase in cash and cash equivalents | 47,605 | 5,861 | |||||

Cash and cash equivalents at beginning of period | 4,497 | 45,460 | |||||

Cash and cash equivalents at end of period | $ | 52,102 | $ | 51,321 | |||

Supplemental disclosure of cash flow information | |||||||

| Interest paid | $ | 413,039 | $ | 393,540 | |||

| Income taxes paid | $ | - | $ | - | |||

Non-cash financing activities: | |||||||

| Deemed preferred dividend reflected in paid-in capital | $ | 854,300 | $ | - | |||

See accompanying notes to condensed consolidated financial statements.

6

China Carbon Graphite Group, Inc.

1. | Organization and Business |

China Carbon Graphite Group, Inc. (the “Company”), is a Nevada corporation, incorporated on February 13, 2003 under the name Achievers Magazine Inc. In connection with the reverse acquisition transaction described below, the Company’s corporate name was changed to China Carbon Graphite Group, Inc. on January 30, 2008.

On December 17, 2007, the Company completed a share exchange pursuant to a share exchange agreement, dated as of December 14, 2007, with Sincere Investment (PTC), Ltd. (“Sincere”), a British Virgin Islands corporation, which is the sole stockholder of Talent International Investment Limited (“Talent”), a British Virgin Islands corporation, which is the sole stockholder of Xinghe Yongle Carbon Co., Ltd. (“Yongle”), a company organized under the laws of the People’s Republic of China (the “PRC”). Pursuant to the share exchange agreement, the Company, then known as Achievers Magazine, Inc., issued 9,388,172 shares of common stock to Sincere in exchange for all of the outstanding common stock of Talent, and Talent became the Company’s wholly-owned subsidiary. From and after December 17, 2007, the Company’s sole business became the business of Talent, its subsidiaries and its affiliated variable interest entities.

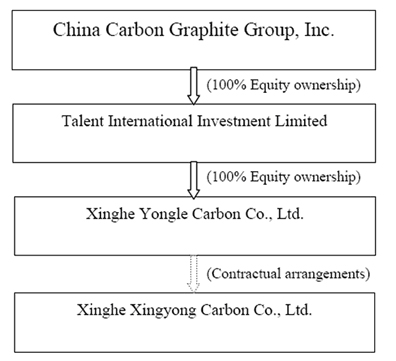

Talent owns 100% of the stock of Yongle, which is a wholly foreign-owned enterprise under the laws of the PRC. Yongle is a party to a series of contractual arrangements with Xinghe Xingyong Carbon Co., Ltd. (“Xingyong”), a corporation organized under the laws of the PRC. Xingyong’s sole stockholder is the Company’s chief executive officer. These agreements give the Company the ability to operate and manage the business of Xingyong and to derive the profit (or sustain the loss) from Xingyong’s business. As a result, the operations of Xingyong are consolidated with those of the Company for financial reporting purposes. The relationship among the above companies as follows:

The Company manufactures graphite electrodes, fine grain graphite, high purity graphite and other carbon derived products.

Stock conversion

On January 22, 2008, the Company affected a 1.6-for-one stock conversion whereby each share of common stock became converted into 1.6 shares of common stock. All references to share and per share information in these financial statements reflect this stock conversion.

2. | Basis of Preparation of Financial Statements |

Management acknowledges its responsibility for the preparation of the accompanying interim condensed consolidated financial statements which reflect all adjustments, consisting of normal recurring adjustments, considered necessary in its opinion for a fair statement of its consolidated financial position and the results of its operations for the interim period presented. These condensed consolidated financial statements should be read in conjunction with the summary of significant accounting policies and notes to condensed consolidated financial statements included in the Company’s Form 10-KSB annual report for the year ended December 31, 2007. Certain prior period balances have been reclassified to conform to the current period’s financial statement presentation. These reclassifications had no impact on previously reported financial position, results of operations or cash flows.

7

The accompanying unaudited condensed consolidated financial statements for China Carbon Graphite Group, Inc., its subsidiaries and variable interest entity, have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Form 10-Q and Article 8-03 of Regulation S-X. Operating results for interim periods are not necessarily indicative of results that may be expected for the fiscal year as a whole.

The Company maintains its books and accounting records in Renminbi (“RMB”), and its reporting currency is United States dollars.

The financial statements have been prepared in order to present the financial position and results of operations of the Company, its subsidiaries and Xingyong, which is an affiliated company whose financial condition is consolidated with the Company pursuant to FIN 46R, in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

Under US GAAP, the acquisition by the Company of Talent is considered to be a capital transaction in substance, rather than a business combination. That is, the acquisition is equivalent, in the acquisition by Talent of the Company, then known as Achievers Magazine, Inc., with the issuance of stock by Talent for the net monetary assets of the Company. This transaction is accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the acquisition is identical to that resulting from a reverse acquisition, except that no goodwill is recorded. Under reverse takeover accounting, the comparative historical financial statements of the Company, as the legal acquirer, are those of the accounting acquirer, Talent. Since Talent and Yongle did not have any business activities, the Company’s financial statements prior to the closing on the reverse acquisition, reflect the only business of Xingyong. The accompanying financial statements reflect the recapitalization of the stockholders’ equity as if the transactions occurred as of the beginning of the first period presented. Thus, the 9,388,172 shares of common stock issued to Sincere and the 2,803,040 shares purchased by other investors are deemed to be outstanding for all period covered by these financial statements.

The Company’s condensed consolidated financial statements include the financial statements of its wholly owned subsidiaries, Talent and Yongle, as well as Xingyong, which is a variable interest entity whose financial statements are consolidated with those of the Company pursuant to FASB Interpretation No. 46R “Consolidation of Variable Interest Entities” (“FIN 46R”), an Interpretation of Accounting Research Bulletin No. 51. All significant intercompany accounts and transactions have been eliminated in the combination.

FIN 46R requires a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of loss for the variable interest entity or is entitled to receive a majority of the variable interest entity’s residual returns. Variable interest entities are those entities in which the Company, through contractual arrangements, bears the risks of, and enjoys the rewards normally associated with ownership of the entities, and therefore the Company is the primary beneficiary of these entities.

Yongle is a party to a series of contractual arrangements with Xingyong. These agreements include a management agreement pursuant to which all net income after deduction of necessary expenses, if any, generated by Xingyong is paid to Yongle and Yongle is responsible for paying Xingyong’s obligations incurred in connection with its business. In addition, Yongle manages and controls all of the funds of Xingyong. Yongle also has the right to purchase Xingyong’s equipment and patents and lease its manufacturing plants, land and remaining equipment. This agreement is designed so that Yongle can conduct its business in China. Pursuant to two other agreements, the sole stockholder of Xingyong, who is also the Company’s chief executive officer, has pledged all of his equity in Xingyong as security for performance of Xingyong’s obligations to Yongle. As a result, Xingyong is considered a variable interest entity.

3. | Summary of Significant Accounting Policies |

Use of estimates - The preparation of these financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affected the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of net sales and expenses during the reported periods.

Significant estimates included values and lives assigned to acquired property, equipment and intangible assets, reserves for customer returns and allowances, uncollectible accounts receivable, slow moving, obsolete and/or damaged inventory and stock warrant valuation. Actual results may differ from these estimates.

8

Cash and cash equivalents - The Company considers all highly liquid debt instruments purchased with maturity period of three months or less to be cash equivalents. The carrying amounts reported in the accompanying balance sheet for cash and cash equivalents approximate their fair value. Substantially all of the Company’s cash is held in bank accounts in The People’s Republic of China and is not protected by FDIC insurance or any other similar insurance.

Inventory - Inventory is stated at the lower of cost or market. Cost is determined using the weighted average method. Market value represents the estimated selling price in the ordinary course of business less the estimated costs necessary to complete the sale.

The cost of inventories comprises all costs of purchases, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. The costs of conversion of inventories include fixed and variable production overhead, taking into account the stage of completion.

Accounts receivable - The Company uses the allowance method to account for uncollectible accounts receivable. As of September 30, 2008 all accounts receivable, advances to suppliers and other receivables were considered collectible and there was no allowance for bad debts required.

Property and equipment - Property and equipment is stated at the historical cost, less accumulated depreciation. Land use rights are being amortized to expense on a straight line basis over the life of the rights. Depreciation on property, plant and equipment is provided using the straight-line method over the estimated useful lives of the assets for both financial and income tax reporting purposes as follows:

| Buildings | 25 - 40 years | ||

| Machinery and equipment | 10 - 20 years | ||

| Motor vehicles | 5 years |

Expenditures for renewals and betterments were capitalized while repairs and maintenance costs are normally charged to the statement of operations in the year in which they are incurred. In situations where it can be clearly demonstrated that the expenditure has resulted in an increase in the future economic benefits expected to be obtained from the use of the asset, the expenditure is capitalized as an additional cost of the asset.

Upon sale or disposal of an asset, the historical cost and related accumulated depreciation or amortization of such asset were removed from their respective accounts and any gain or loss is recorded in the Statements of Income.

The Company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition, and other economic factors. Based on this assessment there was no impairment recorded during the nine months ended at September 30, 2008 and 2007.

Construction in progress - Construction in progress represents the costs incurred in connection with the construction of buildings or additions to the Company’s plant facilities. No depreciation is provided for construction in progress until such time as the assets are completed and placed into service.

Land Use Rights - There is no private ownership of land in the PRC. The Company has acquired land use rights to a total of 2,356,209 square feet, on which a 290,626 square feet facility is located. The land use right has a term of 50 years, commencing in 2002. The cost of the land use rights is amortized over the 50-year term of the land use right. The Company evaluates the carrying value of intangible assets during the fourth quarter of each year and between annual evaluations if events occur or circumstances change that would more likely than not reduce the fair value of the intangible asset below its carrying amount. There were no impairments recorded during the nine months ended September 30, 2008 or 2007.

Income recognition - Revenue is recognized in accordance with Staff Accounting Bulletin No. 104, Revenue Recognition, which states that revenue should be recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the service has been rendered; (3) the selling price is fixed or determinable; and (4) collection of the resulting receivable is reasonably assured. The Company believes that these criteria are satisfied when the goods are shipped pursuant to a purchase order.

9

Interest income is recognized when earned, taking into account the average principal amounts outstanding and the interest rates applicable

Advertising - The Company expenses advertising costs as they are incurred. Advertising expenses are $7,400 and $1,057 for the nine months ended September 30, 2008 and 2007. No advertising expenses incurred during the three months ended September 30, 2008 and 2007.

Shipping and handling costs - The Company follows Emerging Issues Task Force (“EITF”) No. 00-10, Accounting for Shipping and Handling Fees and Costs. The Company does not charge its customers for shipping and handling. The Company classifies shipping and handling costs as part of the operating expenses. For the nine months ended September 30, 2008 and 2007, shipping and handling costs were $396,119 and $105,684.

Segment reporting - Statement of Financial Accounting Standards No 131 (“SFAS 131”), “Disclosure about Segments of an Enterprise and Related Information”, requires use of the “management approach” model for segment reporting. Under this model, segment reporting is consistent with the manner that the Company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

The Company only sells carbon graphite products and sells only to Chinese distributors and end users.

Taxation - Taxation on profits earned in the PRC has been calculated on the estimated assessable profits for the year at the rates of taxation prevailing in the PRC where the Company operates after taking into effect the benefits from any special tax credits or “tax holidays” allowed in the county of operations.

The Company does not accrue United States income tax since it has no significant operating income in the United States. Its operating subsidiaries are organized and located in the PRC and do not conduct any business in the United States.

In 2006, the Financial Accounting Standards Board (FASB) issued FIN 48, which clarifies the application of SFAS 109 by defining a criterion that an individual income tax position must meet for any part of the benefit of that position to be recognized in an enterprise’s financial statements and provides guidance on measurement, recognition, classification, accounting for interest and penalties, accounting in interim periods, disclosure and transition. In accordance with the transition provisions, the Company adopted FIN 48 effective January 1, 2007.

The Company recognizes that virtually all tax positions in the PRC are not free of some degree of uncertainty due to tax law and policy changes by the state. However, the Company cannot reasonably quantify political risk factors and thus must depend on guidance issued by current government officials.

Based on all known facts and circumstances and current tax law, the Company believes that the total amount of unrecognized tax benefits as of September 30, 2008 is not material to its results of operations, financial condition or cash flows. The Company also believes that the total amount of unrecognized tax benefits as of September 30, 2008, if recognized, would not have a material effect on its effective tax rate. The Company further believes that there are no tax positions for which it is reasonably possible, based on current Chinese tax law and policy, that the unrecognized tax benefits will significantly increase or decrease over the next 12 months producing, individually or in the aggregate, a material effect on the Company’s results of operations, financial condition or cash flows.

Enterprise income tax

Under the Provisional Regulations of The People’s Republic of China Concerning Income Tax on Enterprises promulgated by the PRC, income tax is payable by enterprises at a rate of 33% of their taxable income. Preferential tax treatment may, however, be granted pursuant to any law or regulations from time to time promulgated by the State Council.

The Company has been granted a tax holiday from 100% of the Enterprises Income Tax from the Xing He District Local Tax Authority in the Nei Mongol province for the five years 2003 through 2007.

On March 16, 2007, the PRC’s parliament, the National People���s Congress, adopted the Enterprise Income Tax Law, which took effect on January 1, 2008. The new income tax law sets unified income tax rate for domestic and foreign companies at 25% except a 15% corporation income tax rate for qualified high and new technology enterprises. In accordance with this new income tax law, low preferential tax rate in accordance with both the tax laws and administrative regulations prior to the promulgation of this Law shall gradually transit to the new tax rate within five years after the implementation of this law.

10

The Company has been recognized as a high technology and science company by the Ministry of Science and Technology of the People’s Republic of China. Therefore, Xing He District Local Tax Authority in the Nei Mongol province granted tax holiday from 100% of Enterprises Income Tax for additional three years 2008 through 2010. Afterwards, based on the present tax law, the Company will be subject to a corporation income tax rate of 15% effective in 2011.

The enterprise income tax is calculated on the basis of the statutory profit for financial reporting purposes, adjusted for income and expense items that are not assessable or deductible for income tax purposes.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets, including tax loss and credit carry forwards, and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred income tax expense represents the change during the period in the deferred tax assets and deferred tax liabilities. The components of the deferred tax assets and liabilities are individually classified as current and non-current based on their characteristics. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Value added tax

The Provisional Regulations of The People’s Republic of China Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax (“VAT”) is imposed on goods sold in or imported into the PRC and on processing, repair and replacement services provided within the PRC.

VAT payable in The People’s Republic of China is charged on an aggregated basis at a rate of 13% or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided, but excluding, in respect of both goods and services, any amount paid in respect of VAT included in the price or charges, and less any deductible value added tax already paid by the taxpayer on purchases of goods and services in the same financial year.

The Company has been granted an exemption from VAT by the Xing He County People’s Government and Xing He Tax Authority on some products in which an exchange agreement is in place for raw materials and fuel.

Contingent liabilities and contingent assets - A contingent liability is a possible obligation that arises from past events and whose existence will only be confirmed by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the Company. It can also be a present obligation arising from past events that is not recognized because it is not probable that the Company will incur a liability or obligations as a result. A contingent liability, which might occur but is not probable, is not recorded but is disclosed in the notes to the financial statements. The Company will recognize a liability or obligation when it is probable that the Company will incur it.

A contingent asset is an asset, which could possibly arise from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain events not wholly within the control of the Company. Contingent assets are not recorded but are disclosed in the notes to the financial statements when it is likely that the Company will recognize an economic benefit. When the benefit is virtually certain, the asset is recognized.

Retirement benefit costs - According to PRC regulations on pensions, the Company contributes to a defined contribution retirement program organized by the municipal government in the province in which the Company was registered and all qualified employees are eligible to participate in the program. Contributions to the program are calculated at 23.5% of the employees’ salaries above a fixed threshold amount and the employees contribute 2% to 8% while the Company contributes the balance contribution of 15.5% to 21.5%. The Company has no other material obligation for the payment of retirement benefits beyond the annual contributions under this program.

Fair value of financial instruments - In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. This statement does not require any new fair value measurements; rather, it applies under other accounting pronouncements that require or permit fair value measurements. The provisions of this statement are to be applied prospectively as of the beginning of the fiscal year in which this statement is initially applied, with any transition adjustment recognized as a cumulative-effect adjustment to the opening balance of retained earnings. The provisions of SFAS 157 are effective for the fiscal years beginning after November 15, 2007.

11

Effective January 1, 2008, the Company adopted SFAS 157, Fair Value Measurements (SFAS 157). The adoption of SFAS No. 157 did not have a material impact on the Company’s fair value measurements. The carrying amounts of certain financial instruments, including cash, accounts receivable, notes receivable, other receivables, accounts payable, commercial notes payable, accrued expenses, and other payables approximate their fair values as of September 30, 2008 and December 31, 2007 because of the relatively short-term maturity of these instruments.

Foreign currency translation - The reporting currency of the Company is the U.S. dollar. The functional currency of the Company is the local currency, the Chinese Renminbi (“RMB”). Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. Translation adjustments for the nine months ended September 30, 2008 and 2007 are $2,064,524 and $988,404, respectively. The cumulative translation adjustment and effect of exchange rate changes on cash for the nine months ended September 30, 2008 and 2007 was $215,687 and $60,265, respectively. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Asset and liability accounts at September 30, 2008 and December 31, 2007 were translated at 6.8551 RMB to $1.00 USD and at 7.3141 RMB to $1.00 USD, respectively. Equity accounts were stated at their historical rate. The average translation rates applied to income statements for the nine months ended September 30, 2008 and 2007 were 6.99886 RMB and 7.72999 RMB to $1.00 USD, respectively. In accordance with Statement of Financial Accounting Standards No. 95, "Statement of Cash Flows," cash flows from the Company's operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Earnings per share - Basic earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive shares of common stock consist of the common stock issuable upon the conversion of convertible debt, preferred stock and warrants (using the if-converted method).

Accumulated other comprehensive income - The Company follows Statement of Financial Accounting Standards No. 130 (SFAS 130) "Reporting Comprehensive Income" to recognize the elements of comprehensive income. Comprehensive income is comprised of net income and all changes to the statements of stockholders' equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. For the Company, comprehensive income for the nine months ended September 30, 2008 and 2007 included net income and foreign currency translation adjustments.

Related parties - Parties are considered to be related to the Company if the parties that, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests.

4. | Concentrations of Business and Credit Risk |

Substantially all of the Company’s bank accounts are in banks located in the PRC and are not covered by any type of protection similar to that provided by the FDIC on funds held in U.S. banks.

The Company is operating in the PRC, which may give rise to significant foreign currency risks from fluctuations and the degree of volatility of foreign exchange rates between U.S. dollars and the Chinese RMB.

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash, trade accounts receivables and inventories, the balances of which are stated on the balance sheet. The Company places its cash in banks located in China. Concentration of credit risk with respect to trade accounts receivables is limited due to the Company's large number of diverse customers in different locations in China. The Company does not require collateral or other security to support financial instruments subject to credit risk.

12

For the periods ended September 30, 2008 and 2007 no single customer accounted for 10% or more of sales revenues. As of September 30, 2008, accounts receivable from two customers constitute 25% and 19% respectively of the Company’s total accounts receivable as of September 30, 2008.

As of September 30, 2008 and 2007, the Company had insurance expense of $5,778 and $0 respectively. Accrual for losses is not recognized until such time a loss has occurred.

5. | Income Taxes |

Under the Provisional Regulations of The People’s Republic of China Concerning Income Tax on Enterprises promulgated by the PRC, income tax is payable by enterprises at a rate of 33% of their taxable income. Preferential tax treatment may, however, be granted pursuant to any law or regulations from time to time promulgated by the State Council.

The Company has been granted a 100% tax holiday from Enterprises Income Tax Policy from the Xing He District Local Tax Authority for the eight years 2003 through 2010. This tax holiday could be challenged by higher taxing authorities in the PRC, which could result in taxes and penalties owed for those years. For the periods ended September 30, 2008 and 2007, the enterprise income tax at the statutory rates would have been approximately $1,428,908 and $ 971,187, respectively.

A reconciliation of the provision for income taxes with amounts determined by the PRC statutory income tax rate to income before income taxes is as follows:

| 2008 | 2007 | ||||||

| Computed tax at the PRC statutory rate of 33% | $ | 1,428,908 | $ | 971,187 | |||

| Benefit of tax holiday | (1,428,908 | ) | (971,187 | ) | |||

| Income tax expenses per books | $ | - | $ | - | |||

6. | Inventories |

As of September 30, 2008 and December 31, 2007, inventory consisted of the following:

| 2008 | 2007 | ||||||

| Raw materials | $ | 3,511,000 | $ | 1,198,174 | |||

| Work in process | 10,603,487 | 10,119,774 | |||||

| Finished goods | 2,995,332 | 3,270,125 | |||||

| Repair Parts | 53,823 | 38,854 | |||||

| $ | 17,163,642 | $ | 14,626,927 | ||||

Raw materials consist primarily asphalt, petroleum coke, needle coke and other materials used in production. Finished goods consist graphite electrodes, fine grain graphite and high purity graphite. The costs of finished goods include direct costs of raw materials as well as direct labor used in production. Indirect production costs such as utilities and indirect labor related to production such as shipping and handling costs are also included in the cost of inventory.

13

7. | Property and Equipment; Land Use Rights |

As of September 30, 2008 and December 31, 2007, property and equipment consist of the following:

| September 30, 2008 | December 31, 2007 | ||||||

| Building | $ | 6,743,619 | $ | 6,320,420 | |||

| Machinery and equipment | 19,505,594 | 18,234,302 | |||||

| Motor vehicles | 40,846 | - | |||||

| 26,290,059 | 24,554,722 | ||||||

| Less: Accumulated depreciation | 6,208,754 | 4,971,393 | |||||

| $ | 20,081,305 | $ | 19,583,329 | ||||

For the nine months ended September 30, 2008 and 2007, depreciation expense was $905,525 and $819,751.

As of September 30, 2008 and December 31, 2007, land use rights consist of the following:

| 2008 | 2007 | ||||||

| Land Use Right | $ | 3,811,039 | $ | 2,971,009 | |||

| Less: Accumulated amortization | 188,131 | 129,055 | |||||

| $ | 3,622,908 | $ | 2,841,954 | ||||

For the nine months ended September 30, 2008 and 2007, amortization expenses were $49,399 and $13,176 respectively.

Amortization expense for the next five years ended September 30:

| 2009 | $ | 74,655 | ||

| 2010 | 74,655 | |||

| 2011 | 74,655 | |||

| 2012 | 74,655 | |||

| 2013 | 74,655 | |||

| Thereafter | 3,249,633 | |||

| Total | $ | 3,622,908 |

8. | Stockholders’ equity |

| (a) | Restated Certificate of Incorporation |

On January 22, 2008, the Company changed its authorized capital stock to 120,000,000 shares of capital stock, of which 20,000,000 shares are shares of preferred stock, par value $0.001 per share, and 100,000,000 shares are shares of common stock, par value $0.001 per share. The restated certificate of incorporation included a statement of designations of the rights, preferences, privileges and limitation of the holders of the series A preferred stock. The terms of the statement of designations is set forth under “Conversion of Convertible Notes.”

| (b) | Conversion of Convertible Notes. |

On January 22, 2008, upon the filing of a restated certificate of incorporation and a statement of designation for a newly created series of preferred stock designated as the series A convertible preferred stock, outstanding convertible notes in the principal amount of $1,200,000 were automatically converted into 1,200,499 shares of series A convertible preferred stock and warrants to purchase 3,000,000 shares of common stock at $1.20 per share and 3,000,000 shares of common stock at $2.00 per share. The statement of designation for the series A preferred stock provides the following:

| · | Each share of series A preferred stock is convertible into one share of common stock, at a conversion price of $1.00, subject to adjustment. |

14

| · | While the series A preferred stock is outstanding, if the Company issues common stock at a price or warrants or other convertible securities at a conversion or exercise price which is less than the conversion price then in effect, the conversion price shall be adjusted on a formula basis. |

| · | While the Series A Preferred Stock is outstanding, without the approval of the holders of 75% of the outstanding shares of Series A Preferred Stock, the Company may not pay cash dividends or other distributions of cash, property or evidences of indebtedness, nor redeem any shares of Common Stock. |

| · | No dividends are payable with respect to the series A preferred stock. |

| · | Upon any voluntary or involuntary liquidation, dissolution or winding-up, the holders of the series A preferred stock are entitled to a preference of $1.00 per share before any distributions or payments may be made with respect to the common stock or any other class or series of capital stock which is junior to the series A preferred stock upon voluntary or involuntary liquidation, dissolution or winding-up. |

| · | The holders of the series A preferred stock have no voting rights. However, so long as any shares of series A preferred stock are outstanding, the Company shall not, without the affirmative approval of the holders of 75% of the outstanding shares of series A preferred stock then outstanding, (a) alter or change adversely the powers, preferences or rights given to the series A preferred stock or alter or amend the certificate of designation, (b) authorize or create any class of stock ranking as to dividends or distribution of assets upon liquidation senior to or otherwise pari passu with the series A preferred stock, or any of preferred stock possessing greater voting rights or the right to convert at a more favorable price than the series A preferred stock, (c) amend our articles of incorporation or other charter documents in breach of any of the provisions thereof, (d) increase the authorized number of shares of series A preferred stock, or (e) enter into any agreement with respect to the foregoing |

| (c) | Warrants |

The warrants have terms of five years, and expire December 3, 2012. The warrants provide a cashless exercise feature; however, the holders of the warrants may not make a cashless exercise prior to December 17, 2008 and thereafter the holders may make a cashless exercise only if the underlying shares are not covered by an effective registration statement.

| (d) | Securities Purchase Agreement |

Pursuant to the securities purchase agreement relating to the issuance of the 3% convertible notes, in addition to the foregoing:

| · | On January 22, 2008, we restates our articles of incorporation to change our corporate name to China Carbon Graphite Group, Inc., change our authorized capital stock to 120,000,000 shares of capital stock, of which 20,000,000 shares are shares of preferred stock, par value $.001 per share, and 100,000,000 shares are shares of common stock, par value $.001 per share. The restated articles included a statement of designations of the rights, preferences, privileges and limitations of the holders of the series A preferred stock. |

| · | The Company agreed that, within 90 days after the closing on December 17, 2007, it would have appointed such number of independent directors that would result in a majority of the directors being independent directors and the Company would have an audit committee composed solely of at least three independent directors and a compensation committee would have a majority of independent directors. The Company is required to pay liquidated damages (i) if the Company fails to have a majority of independent directors 90 days after the closing or (ii) thereafter, if the Company subsequently fails to meet these requirements for a period of 60 days for an excused reason, as defined in the purchase agreement, or 75 days for a reason which is not an excused reason. Liquidated damages are payable in cash or additional shares of series A preferred stock, with the series A preferred stock being valued at the market price of the shares of common stock issuable upon conversion of the series A preferred stock. The liquidated damages are computed in an amount equal to 12% per annum of the purchase price, with a maximum of $144,000. Liquidated damages through September 30, 2008 have been waived. |

| · | The Company and XingGuang entered into a registration rights agreement pursuant to which the Company is required to have a registration statement filed with the SEC by March 16, 2008 (subsequently extended to November 16, 2008) and declared effective by the SEC not later than August 13, 2008 (subsequently extended to December 16, 2008). We are required to pay liquidated damages at the rate of 200 shares of series A preferred stock for each day after August 13, 2008 (subsequently extended to December 16, 2008) that the registration statement is not declared effective or for any period that we fail to keep the registration statement effective, up to a maximum of 100,000 shares. The number of shares of series A preferred stock issuable pursuant to the liquidated damages provision is subject to reduction based on the maximum number of shares that can be registered under the applicable SEC guidelines. |

15

| · | XingGuang has a right of refusal on future financings. |

| (e) | Cancellation of common stock |

In connection with the acquisition of Talent, the Company entered buy-back agreement with the then majority stockholder. See Note 1 (a). The Company agreed to pay a purchase price of $700,000 for the shares, payable in installments of $350,000 on each of March 31, 2008 and June 30, 2008. The Company placed 1,000,000 of the shares of common stock in escrow, and the shares are subject to release from escrow. The payments were made in the six months ended June 30, 2008, and the 1,000,000 shares were returned to the Company and cancelled.

| (f) | Deemed Preferred Stock Dividend |

Upon filing of the Company’s amended and restated articles of incorporation on January 22, 2008, $1,200,000 of convertible notes were automatically converted to 1,200,499 shares of preferred stock convertible into 1,200,499 shares of common stock at a conversion price of $1.00 per share and included detachable warrants to purchase 3,000,000 shares of the common stock at $1.20 and 3,000,000 shares at $2.00 per share. At December 17, 2007, the fair value of the warrants used to calculate the intrinsic value of the conversion option was estimated at $3,831,900 and was computed using the Black-Scholes option-pricing model based on the assumed issuance of the warrants on the date the notes were issued. Variables used in the option-pricing model include (1) risk-free interest rate at the date of grant (3.5%), (2) expected warrant life of 5 years, (3) expected volatility of 100%, and (4) 0% expected dividend. The Company used the market price of its common stock at December 17, 2007, $0.95 per share, and computed the effective preferred stock conversion price to be $0.24 per share. The resulting intrinsic value of the conversion feature was $854,300 reported as a dividend.

As the series A preferred stock does not provide for redemption by the Company or have a finite life, upon the conversion to preferred stock, a one-time preferred stock deemed dividend of $854,300 was recognized immediately as a non-cash charge during the three months ended March 31, 2008. The deemed preferred stock dividend of $854,300 has been recorded as additional paid-in capital and a reduction to retained earnings.

9. | Notes Payable |

As of September 30, 2008 and December 31, 2007, notes payable consist of the following:

| September 30, 2008 | December 31, 2007 | ||||||

| Bank loans dated July 14, 2008, due May 6, 2009 with an interest rate of 9.711%, interest payable monthly, secured by property and equipment and land use rights | $ | 656,446 | $ | - | |||

| Bank loans dated July 14, 2008, due May 25, 2009 with an interest rate of 9.711%, interest payable monthly, secured by property and equipment and land use rights | 1,167,014 | - | |||||

| Bank loans dated July 14, 2008, due June 15, 2009 with an interest rate of 9.711%, interest payable monthly, secured by property and equipment and land use rights | 1,167,014 | - | |||||

| Bank loans dated July 14, 2008, due July 1, 2009 with an interest rate of 9.711%, interest payable monthly, secured by property and equipment and land use rights | 1,167,014 | - | |||||

| Bank loans dated July 14, 2008, due July 13, 2009 with an interest rate of 9.711%, interest payable monthly, secured by property and equipment and land use rights | 729,385 | - | |||||

| Bank loans dated June 12, 2007, due June 10, 2008 with an interest rate of 8.541%, interest payable monthly, secured by property and equipment and land use rights | - | 683,611 | |||||

| Other loan dated June 22, 2007, due June 20, 2008 with an interest rate of 7.227%, interest payable quarterly, secured by equipment and land use rights | - | 5,332,167 | |||||

| Notes payable to former principal shareholders pursuant to buy-back agreements in relation to the reverse acquisition, see Note 1. | - | 700,000 | |||||

| $ | 4,886,873 | $ | 6,715,778 | ||||

10. | Loans from Shareholder |

On September 30, 2008 and December 31, 2007, the Company had loans from CEO Dengyong Jin amounting to $4,800,453 and $4,543,648, respectively. The advances do not bear interest and are unsecured and due on demand.

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

The following discussion of the results of our operations and financial condition should be read in conjunction with our financial statements and the related notes, which appear elsewhere. Statements contained in this Form 10-Q include forward-looking statements that are subject to risks and uncertainties. In particular, statements in this Form 10-Q that state our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are “forward-looking statements.” Forward-looking statements are subject to risks, uncertainties and other factors, including, but not limited to, those identified under “Risk Factors,” in our Form 10-KSB for the year ended December 31, 2007 and those described in “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in the Form 10-KSB and this Form 10-Q, and those described in any other filings by us with the Securities and Exchange Commission, as well as general economic conditions and economic conditions affecting the market for graphite electrode, fine grain graphite and high purity graphite, our ability to develop a higher purity graphite electrode, including our ability to obtain the necessary funding for such efforts, any one or more of which could cause actual results to differ materially from those stated in such statements. In addition, such statements could be affected by risks and uncertainties related to the ability to conduct business in China, product demand, our ability to develop products using the most current technology, our ability to raise any financing which we may require for our operations, competition, government regulations and requirements, pricing and development difficulties, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form 10-Q.

Overview

Reference in this Form 10-Q to “we,” “us,” “our” and words of like import refer to the Company, its subsidiaries and its variable interest entity, Xinghe Xingyong Carbon Co., Ltd. (“Xingyong”). For periods prior to December 17, 2007, these terms refer to Xingyong.

Prior to December 17, 2007, we were a pubic reporting blind pool company. On December 17, 2007, we executed and completed the transactions contemplated by the agreement with Sincere Investment (PTC) Ltd. whereby Talent International Investment Limited (“Talent”), a British Virgin Islands corporation, became our wholly-owned subsidiary. Talent is the sole stockholder of Xinghe Yongle Carbon Co., Ltd. (“Yongle”), a company organized under the laws of the PRC. Yongle is a party to a series of contractual arrangements with Xingyong, as described below.

Xingyong was organized under the laws of the PRC in 2002. Xingyong’s business was formerly operated as a state-owned enterprise. The business was reorganized under the laws of the PRC as a limited liability company named Xinghe Xingye Carbon Co., Ltd. In December 2001, Mr. Dengyong Jin organized Xingyong to acquire the business of Xinghe Xingye Carbon Co., Ltd. by paying RMB 55,600,000 (approximately US$7,900,000). Mr. Jin funded RMB 33,750,000 (approximately US$4,800,000) and the company obtained bank loans in the amount of RMB 21,950,000 (approximately US$3,100,000).

From December 2001 until the reverse acquisition on December 17, 2007, our business was conducted by Xingyong, and this discussion relates to the business, financial condition and results of operations of Xingyong for all periods prior to December 17, 2007, and thereafter reflect the financial condition of the Company, its subsidiaries and Xingyong, which is a variable interest entity whose financial statements are consolidated with ours pursuant to FIN 46. We develop, manufacture and market graphite products. Our main products include graphite electrode, fine grain graphite and high purity graphite. We produce all of our products in China. Our products are generally used either as a component in other products, as an element of a facility or in the manufacturing process of other products. We sell our products to distributors who sell to producers in both the domestic Chinese market and the international market. We also sell graphite electrodes directly to domestic end users.

Although our products are sold in the international market, substantially all of our sales are to Chinese firms that may, in turn, sell the products in the international market. We believe that our products are not subject to export restrictions.

In accordance with the relevant Chinese rules and regulations on management of foreign exchange, the foreign currency generated from sales of our products outside of China is brought into China and sold to designated banks instead of depositing it in banks out of the PRC without authorization. In addition, we have to buy foreign currency from designated banks upon the strength of commercial bills when paying current expenditures with foreign currency. All of our transactions undertaken in the PRC are denominated in RMB, which must be converted into other currencies before remittance out of China. Both the conversion of RMB into foreign currencies and the remittance of foreign currencies abroad require the approval of the Chinese government.

17

Our principal raw materials are coal asphalt, asphalt coke, metallurgy coke, needle coke, metallurgy coke power, quartzose sand, coal, petroleum coke and calcined coke, all of which are carbon rich and used in manufacturing graphite with a high degree of purity. We purchase most of our raw materials from domestic Chinese suppliers. Because we do not have any long-term contracts for raw materials, any changes in prices of raw material will affect the price at which we can sell our product. Our raw materials are subject to rapid and significant price fluctuations. In times of increasing prices, we need to try to fix the price at which we purchases raw materials in order to avoid increases in costs which we cannot recoup through increases in sales prices. Similarly, in times of decreasing prices, we may have purchased raw materials at prices which are high in terms of the price at which we can sell our products, which also can impair our margins.

The laws of the PRC give the government broad power to fix and adjust prices. Although the government has not imposed price controls on our raw materials or on our products, it is possible that such controls may be implemented in the future. Since most of our sales are made to domestic companies, our gross margins can be affected by any price controls imposed by the government of the PRC. Our margins can be severely impacted in price controls are placed on the price at which we can sell products without any regulation of the prices at which we can purchase raw materials in the PRC. If the government places controls on both the price at which we purchase raw materials and the price at which we can sell our products, significant components in determining our margins would be determined by government policy.

The transaction whereby we acquired Talent is accounted for as a reverse acquisition. The exchange of our stock for the stock of Talent is considered to be capital transactions in substance, rather than a business combination. That is, the acquisition is equivalent to the acquisition by Talent of us, with the issuance of stock by Talent for the net monetary assets of Achievers. This transaction is accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the acquisition is identical to that resulting from a reverse acquisition. Under reverse takeover accounting, our historical financial statements are those of Talent, which is treated as the acquiring party for accounting purposes. Since Talent and Yongle were not engaged in any business activities, our financial statements for periods prior to the closing of the reverse acquisition reflect only business of Xingyong. The financial statements reflect the recapitalization of the stockholders’ equity as if the transactions occurred as of the beginning of the first period presented.

Prior to December 17, 2007, we did not have the expenses of a public company. As a result, since December 17, 2007 we have incurred, and we are continuing to incur, significantly greater legal, accounting and other professional expenses relating to our status as a public company and compliance with SEC rules, including the development and implementation of internal controls.

Our internal financial statements are maintained in RMB. The financial statements included in this Form 10-Q are expressed in United States dollars. The translation adjustments in expressing the financial statements in United States dollars is shown on the statements of operation as a translation adjustment, and the cumulative translation adjustment is shown as an element of stockholders’ equity.

Although we do not believe that our operations for the nine months ended September 30, 2008 were affected by the current economic conditions, these conditions, together with problems that our customers and potential customers may have in obtaining credit, in a reduction in demand for capital expenditures generally and our products in particular as well as delays in payments from our customers. The uncertainty of current economy could also adversely impact our ability to obtain financing for working capital, capacity expansion and other long term development plans.

Critical Accounting Policies and Estimates

Use of Estimates

The discussion and analysis of our financial condition and results of operations is based upon our financial statements that have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities. On an on-going basis, we evaluate our estimates including the allowance for doubtful accounts, the salability and recoverability of our products, income taxes and contingencies. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

18

Variable Interest Entity

Pursuant to Financial Accounting Standards Board Interpretation No. 46 (Revised), “Consolidation of Variable Interest Entities - an Interpretation of ARB No. 51” (“FIN 46R”) we are required to include in our consolidated financial statements the financial statements of variable interest entities. FIN 46R requires a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of loss for the variable interest entity or is entitled to receive a majority of the variable interest entity’s residual returns. Variable interest entities are those entities in which we, through contractual arrangements, bear the risk of, and enjoy the rewards normally associated with ownership of the entity, and therefore we are the primary beneficiary of the entity.

Xingyong is considered a variable interest entity (“VIE”), and we are the primary beneficiary. On December 17, 2007, we entered into agreements with the Xingyong pursuant to which we shall receive the benefit of the Xingyong’s net income. In accordance with these agreements, Xingyong shall pay consulting fees equal to 80% to 100% of its net income to our wholly-owned foreign subsidiary, Yongle, and Yongle shall supply the technology and administrative services needed to service Xingyong. Xingyong is owned by Mr. Jin, who is Yongle’s and our chief executive officer.

The accounts of Xingyong are consolidated in the accompanying financial statements pursuant to FIN 46R. As a VIE, Xingyong’s sales are included in our total sales, its income from operations is consolidated with our, and our net income includes all of Xingyong net income. We do not have any non-controlling interest and accordingly, did not subtract any net income in calculating the net income attributable to us. Because of the contractual arrangements, we have pecuniary interest in Xingyong that require consolidation of our financial statements and Xingyong’s financial statements.

Revenue Recognition

We recognize revenue in accordance with Staff Accounting Bulletin No. 104, Revenue Recognition, which states that revenue should be recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the service has been rendered; (3) the selling price is fixed or determinable; and (4) collection of the resulting receivable is reasonably assured. Sales represent the invoiced value of goods, net of value added tax (“VAT”), if any, and are recognized upon delivery of goods and passage of title. Pursuant to China’s VAT rules and regulations, as an ordinary VAT taxpayer we are subject to a tax rate of 17% (“output VAT”). The output VAT is payable after offsetting VAT paid by us on purchases (“input VAT”). We have been granted an exemption from VAT by the Xinghe County People’s Government and Xinghe Tax Authority on some products for which an exchange agreement is in place for raw materials and fuel.

Comprehensive Income

We have adopted Statements of Financial Accounting Standards (“SFAS”) No. 130, “Reporting Comprehensive Income,” which establishes standards for reporting and presentation of comprehensive income (loss) and its components in a full set of general-purpose financial statements. We have chosen to report comprehensive income (loss) in the statements of operations and comprehensive income.

Income Taxes

We account for income taxes under the provisions of SFAS No. 109, “Accounting for Income Taxes,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. With the approvals of the Xinghe County Government, we received a 100% tax holiday from enterprise income taxes from 2003 through and including 2007.

19

On March 16, 2007, China’s parliament, the National People’s Congress, adopted the Enterprise Income Tax Law, which will take effect on January 1, 2008. The new income tax law sets unified income tax rate for domestic and foreign companies at 25 percent except a 15 percent corporate income tax rate for qualified high and new technology enterprises. In accordance with this new income tax law, low preferential tax rate in accordance with both the tax laws and administrative regulations prior to the promulgation of this Law shall gradually become subject to the new tax rate within five years after the implementation of this law.

We have been recognized as a high technology and science company by the Ministry of Science and Technology of the People’s Republic of China. The Xing He District Local Tax Authority in the Nei Monggol province granted us a tax holiday from 100% of Enterprises Income Tax for additional three years - from 2008 through 2010. Following expiration of the three year period, based on the present tax law, we will be subject to a corporation income tax rate of 15% effective in 2011.

Inventories

Inventories are stated at the lower of cost, determined on a weighted average basis, and net realizable value. Work in progress and finished goods are composed of direct material, direct labor and a portion of manufacturing overhead. Net realizable value is the estimated selling price, in the ordinary course of business, less estimated costs to complete and dispose. Management believes that there was no obsolete inventory as of September 30, 2008.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Major expenditures for betterments and renewals are capitalized while ordinary repairs and maintenance costs are expensed as incurred. Depreciation and amortization is provided using the straight-line method over the estimated useful life of the assets after taking into account the estimated residual value.

There is no private ownership of land in China. All land ownership is held by the government of China, its agencies and collectives. Land use rights are obtained from government, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of China (State Land Administration Bureau) upon payment of the required transfer fee. We own the land use right for 2,356,209 square feet, of which 290,626 square feet is occupied by our facilities, for a term of 50 years, beginning from issuance date of the certificates granting the land use right in 2002. We record the property subject to land use rights as intangible property.

Each intangible asset is reviewed periodically or more often if circumstances dictate, to determine whether its carrying value has become impaired. We consider assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. We also re-evaluate the amortization periods to determine whether subsequent events and circumstances warrant revised estimates of useful lives.

Research and development

Research and development costs are expensed as incurred, and are included in general and administrative expenses. These costs primarily consist of cost of material used and salaries paid for the development of our products and fees paid to third parties. Our total research and development expense through September 30, 2008 has not been significant.

Value added tax

Enterprises or individuals who sell products, engage in repair and maintenance or import and export goods in the PRC are subject to a value added tax in accordance with Chinese laws. The value added tax standard rate is 17% of the gross sales price. A credit is available whereby VAT paid on the purchases of semi-finished products, raw materials used in the production of the Company’s finished products, and payment of freight expenses can be used to offset the VAT due on sales of the finished product. The amount of VAT liability is determined by applying the applicable tax rate to the invoiced amount of goods sold (output VAT) less VAT paid on purchases made with the relevant supporting invoices (input VAT). Under the commercial practice of the PRC, the Company paid VAT and business tax based on tax invoices issued. The tax invoices may be issued subsequent to the date on which revenue is recognized, and there may be a considerable delay between the date on which the revenue is recognized and the date on which the tax invoice is issued. In the event that the PRC tax authorities dispute the date of which revenue is recognized for tax purposes, the PRC tax office has the right to assess a penalty, which can range from zero to five times the amount of the taxes that are determined to be late or deficient. In the event that a tax penalty is assessed on late or deficient payments, the penalty will be expensed as a period expense if and when a determination has been made by the taxing authorities that a penalty is due.

20

RESULTS OF OPERATIONS

The following tables set forth information from our statements of operations for the nine months and three months ended September 30, 2008 and 2007, in dollars and as a percentage of sales:

Nine months ended September 30, | ||||||||||||||

2008 | 2007 | |||||||||||||

US Dollars | Percentage | US Dollars | Percentage | |||||||||||

| Sales | $ | 21,160,851 | 100.00 | % | $ | 18,799,732 | 100.00 | % | ||||||

| Cost of sales | 15,567,633 | 73.57 | % | 15,067,613 | 80.15 | % | ||||||||

| Gross margin | 5,593,218 | 26.43 | % | 3,732,119 | 19.85 | % | ||||||||

| Operating expenses | 1,064,339 | 5.03 | % | 664,285 | 3.53 | % | ||||||||

| Income from operations | 4,528,879 | 21.40 | % | 3,067,834 | 16.32 | % | ||||||||

| Other income | 224,705 | 1.06 | % | 286,779 | 1.53 | % | ||||||||

| Interest income | 910 | 0.00 | % | 377 | 0.00 | % | ||||||||

| Interest expense | (413,039 | ) | (1.95 | )% | (393,540 | ) | (2.09 | )% | ||||||

| Other expense | (11,431 | ) | (0.05 | )% | (18,458 | ) | (0.10 | )% | ||||||

| Income before income tax expense | 4,330,024 | 20.46 | % | 2,942,992 | 15.65 | % | ||||||||

| Provision for income taxes | - | 0.00 | % | - | 0.00 | % | ||||||||

| Net income | 4,330,024 | 20.46 | % | 2,942,992 | 15.65 | % | ||||||||

| Other comprehensive income | ||||||||||||||

| Foreign currency translation adjustment | 2,064,524 | 9.76 | % | 988,404 | 5.26 | % | ||||||||

| Comprehensive income | $ | 6,394,548 | 30.22 | % | $ | 3,931,396 | 20.91 | % | ||||||

Three months ended September 30, | ||||||||||||||

2008 | 2007 | |||||||||||||

US Dollars | Percentage | US Dollars | Percentage | |||||||||||

| Sales | $ | 7,509,072 | 100.00 | % | $ | 7,353,710 | 100.00 | % | ||||||

| Cost of sales | 5,384,214 | 71.70 | % | 5,967,498 | 81.15 | % | ||||||||

| Gross margin | 2,124,858 | 28.30 | % | 1,386,212 | 18.85 | % | ||||||||

| Operating expenses | 464,693 | 6.19 | % | 332,361 | 4.52 | % | ||||||||

| Income from operations | 1,660,165 | 22.11 | % | 1,053,851 | 14.33 | % | ||||||||

| Other income | 11,032 | 0.15 | % | 46,773 | 0.64 | % | ||||||||

| Interest income | 493 | 0.01 | % | 233 | - | % | ||||||||

| Interest expense | (143,482 | ) | (1.91 | )% | (61,213 | ) | (0.83 | )% | ||||||

| Other expense | (120 | ) | (0.00 | )% | (10,792 | ) | (0.15 | )% | ||||||

| Income before income tax expense | 1,528,088 | 20.35 | % | 1,028,852 | 13.99 | % | ||||||||

| Provision for income taxes | - | 0.00 | % | - | 0.00 | % | ||||||||

| Net income | 1,528,088 | 20.35 | % | 1,028,852 | 13.99 | % | ||||||||

| Other comprehensive income | ||||||||||||||

| Foreign currency translation adjustment | 84,634 | 1.13 | % | 363,683 | 4.95 | % | ||||||||

| Comprehensive income | $ | 1,612,722 | 21.48 | % | $ | 1,392,535 | 18.94 | % | ||||||