Exhibit 99.1

Labopharm Information Circular 2011

ANNUAL MEETING

May 4, 2011 at 11:00 a.m.

Hotel Omni Mont-Royal

1050 Sherbrooke Street West

Montreal, Quebec

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the Annual Meeting of Shareholders (the “Meeting”) of Labopharm Inc. (the “Corporation” or “Labopharm”) will be held at the Hotel Omni Mont-Royal, 1050 Sherbrooke Street West, Montreal, Quebec, Canada on May 4, 2011 at 11:00 a.m. (Montreal time), for the purposes to:

| (a) | receive Labopharm’s Audited Consolidated Financial Statements for the fiscal year ended December 31, 2010 and the auditors’ report thereon; |

| (b) | elect seven directors for the ensuing year; |

| (c) | appoint the auditors and authorize the directors to fix their remuneration; |

| (d) | consider, and if deemed advisable, adopting a resolution to amend the Stock Option Plan of the Corporation as to fix a maximum number of securities issuable upon exercise of stock options; and |

| (e) | transact such other business as may properly come before the Meeting. |

Shareholders of the Corporation whose common shares are listed in the Corporation’s register in their name, the name of a broker or other intermediary, or the name of a duly authorized agent, on March 21, 2011 at 5:00 p.m. (Montreal time), are entitled to receive notice of the Meeting of and to cast one vote per common share held.

On the record date for the Meeting, namely, March 21, 2011, 71,571,641 common shares of the Corporation were outstanding and eligible to be voted at the Meeting.

DATED at Laval, Quebec, this 21st day of March, 2011.

By order of the Board of Directors,

/s/ Mark A. D’Souza

President and Chief Executive Officer

Registered Shareholders may exercise their rights by attending the Meeting or by completing a form of proxy. Should you be unable to attend the Meeting in person, kindly complete, date and sign the enclosed form of proxy and return it in the envelope provided at your earliest convenience. to be valid, proxies must reach the office of Computershare Trust Company of Canada, 1500 University Street, Suite 700, Montreal, Quebec, H3A 3S8, no later than at the close of business on May 2, 2011 or the second to last business day preceding the date of any adjournment to the meeting. Your common shares will be voted in accordance with your instructions as indicated on the form of proxy.

For more information on the procedure to be followed by Shareholders who received a voting instruction form, please refer to “Beneficial Owners” in Section 1 of the Circular and the instructions received from your broker.

TABLE OF CONTENTS

SECTION 1 - VOTING INFORMATION | | | 2 | |

| | 1.1 | | Solicitation of Proxies | | | 2 | |

| | 1.2 | | Voting rights and Principal Holders Thereof | | | 2 | |

| | 1.3 | | Registered shareholders | | | 3 | |

| | 1.4 | | Beneficial owner | | | 3 | |

SECTION 2 - BUSINESS OF THE MEETING | | | 4 | |

| | 2.1 | | Receipt of the Audited Consolidated Financial Statements and the auditors’ report hereon | | | 4 | |

| | 2.2 | | Election of Directors | | | 5 | |

| | 2.3 | | Appointment of auditors | | | 5 | |

| | 2.4 | | Amendment to stock option plan | | | 6 | |

SECTION 3 - INFORMATION ON BOARD NOMINEES | | | 6 | |

SECTION 4 - STATEMENT OF EXECUTIVE COMPENSATION | | | 9 | |

| | 4.1 | | Compensation Discussion and Analysis | | | 9 | |

| | 4.2 | | Information on the compensation of the named executive officers | | | 15 | |

| | 4.3 | | Information on the Compensation of the Directors | | | 19 | |

| | 4.4 | | Description of the stock option plan | | | 22 | |

| | 4.5 | | Securities Authorized for Issuance under Equity Compensation Plans | | | 24 | |

SECTION 5 - ADDITIONAL INFORMATION | | | 24 | |

| | 5.1 | | Statement of Corporate Governance Practices | | | 24 | |

| | 5.2 | | Indebtedness of Directors, Executive Officers and Senior Officers | | | 24 | |

| | 5.3 | | Material transactions | | | 24 | |

| | 5.4 | | Liability Insurance | | | 25 | |

| | 5.5 | | Other Business | | | 25 | |

| | 5.6 | | Additional Information | | | 25 | |

| | 5.7 | | Shareholder Nominees for 2012 Annual Meeting | | | 25 | |

| | 5.8 | | Shareholder proposals for the 2012 annual Meeting | | | 25 | |

| | 5.9 | | Approval of the Information Circular | | | 25 | |

MANAGEMENT PROXY CIRCULAR FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 4, 2011 |

SECTION 1 - VOTING INFORMATION

| 1.1 | SOLICITATION OF PROXIES |

This Management Proxy Circular (the “Circular”) is provided in connection with the solicitation by the management of Labopharm Inc. of proxies for use at our 2011 Annual Meeting of Shareholders (the “Meeting”) to be held at the time and place and for the purposes set forth in the Notice of Annual Meeting of Shareholders (the “Notice of Meeting”) and, if adjourned, at any reconvening thereof.

As used in the Circular, all references to “Labopharm”, the “Corporation”, “we”, “us”, “our” or similar terms are to Labopharm Inc.

Except as otherwise indicated, the information contained in the Circular is given as of March 18, 2011. Any information, policies or rules posted on our website as described in the Circular (including Schedules A and B) does not form part of, and shall not be deemed to be incorporated by reference into the Circular, unless expressly otherwise indicated.

The solicitation will be made primarily by mail. However, our employees or mandataries designated by us may also solicit proxies by telephone or in writing. The cost of the solicitation will be borne by us.

| 1.2 | VOTING RIGHTS AND PRINCIPAL HOLDERS THEREOF |

As at March 21, 2011, we had 71,571,641 of our common shares (the “Shares”) issued and outstanding. Shareholders are entitled to cast one vote per Share held.

At the Meeting and if adjourned, at any reconvening thereof, each shareholder is entitled to exercise the votes attached to the Shares registered in his or her name at the close of business on March 21, 2011, which is the record date that has been set for the Meeting.

To the knowledge of our directors and officers and according to the latest data available, no person, company or other entity has held or exercised control or direction over 10% or more of issued and outstanding Shares of Labopharm.

We and the Fonds de solidarité des travailleurs du Québec (F.T.Q.) (“FSTQ”) entered into an agreement on May 29, 2001 (the “FSTQ Agreement”) pursuant to which: (i) as long as FSTQ holds 5% or more of the issued and outstanding Shares, FSTQ has the right to designate two nominees to represent it on our board of directors (the “Board”); (ii) as long as FSTQ holds 1% or more and less than 5% of the issued and outstanding Shares, FSTQ has the right to designate one nominee to represent it on our Board; and (iii) the FSTQ Agreement will be in force as long as FSTQ holds 1% or more of the issued and outstanding Shares.

As at the date of the Circular, to the knowledge of our directors and officers, FSTQ held 1,355,087 Shares representing approximately 1.89% of all issued and outstanding Shares. Consequently, FSTQ is entitled under the FSTQ Agreement to designate one nominee for election to the Board.

| 1.3 | REGISTERED SHAREHOLDERS |

Shareholders whose Shares are registered in their name in the Corporation’s register are registered shareholders. Registered Shareholders of the Corporation may vote in person at the Meeting, or may complete, sign and return the enclosed form of proxy. This form of proxy authorizes a proxyholder to represent and vote on behalf of a registered shareholder at the Meeting.

Appointment of Proxyholders

The proxyholders already designated in the form of proxy are directors or officers of Labopharm. If a registered shareholder wishes to appoint as his or her proxyholder to represent him or her at the Meeting a person other than those whose names are printed on the form of proxy, he or she may do so by striking out the names appearing thereon and inserting such other person’s name in the blank space provided. If the registered shareholder is not a natural person, the form of proxy must be signed by a duly authorized officer or agent of said registered shareholder. A proxyholder need not be a Shareholder of the Corporation.

To be valid, any proxy to be used at the Meeting must be received no later than the close of business on May 2, 2011 by our transfer agent and registrar, Computershare Trust Company of Canada (“Computershare”).

Voting by Proxy

The proxyholder named in the form of proxy will exercise the voting rights attached to the Shares in accordance with the instructions given by the registered Shareholder.

In the absence of instructions, designated proxyholders will exercise the voting rights attached to the Shares as follows:

| • | FOR the election of each of the director nominees for the ensuing year; |

| • | FOR the appointment of Ernst & Young llp as auditors of the Corporation for the ensuing year and authorizing the directors to fix their remuneration; and |

| • | FOR the proposed amendment to the Stock Option Plan as to fix a maximum number of securities issuable following upon exercise of stock options (Resolution 2011-1). |

The enclosed form of proxy confers upon the proxyholder a discretionary power in respect of amendments to the matters set forth in the Notice of Meeting and regarding all other matters which may properly be brought before the Meeting and, if adjourned, at any reconvening thereof. As at the date of the Circular, our Management is not aware of any such changes or other matters that may come before the Meeting. If, however, such amendments or other matters do properly come before the Meeting or if adjourned, at any reconvening thereof, the Shares represented by the form of proxy will be voted at the discretion of the proxyholder.

Revocation of Proxies

A person giving a proxy may revoke it at any time including, if the Meeting is adjourned, at any reconvening thereof, unless the proxy has already been used. A proxy may be revoked by a written notice executed by the shareholder or by his or her attorney authorized in writing or, if the shareholder is a corporation, by an officer or an attorney thereof duly authorized and sent to our Corporate Secretary. The authority conferred upon the proxyholder may also be revoked if the shareholder attends the Meeting in person and makes a request to that effect.

Confidentiality of Votes

To protect the confidential nature of voting by proxy, the votes exercised by proxy are received and compiled for the Meeting by Computershare, the Corporation’s registrar and transfer agent. Computershare submits a copy of a form of proxy to the Corporation only when a registered shareholder clearly wishes to express a personal opinion to management, or when necessary to comply with legal requirements.

Beneficial owners are shareholders whose Shares are held in their name by a nominee, such as a broker, other Intermediary or a duly authorized agent. Consequently, these Shares are not registered under their beneficial owners name in the Corporation’s register.

Beneficial owners will receive (or will have received) from their nominees either a request for voting instructions for the number of Shares held by them. The nominees’ voting instructions will contain instructions relating to signature and return of the document and these instructions should be read carefully and followed by the beneficial owner to ensure that their Shares are accordingly voted at the Meeting.

To vote in person at the Meeting, beneficial owners must:

| • | insert their own name as proxyholder in the space provided for this purpose on the voting instruction form; |

| • | not otherwise complete the form as their vote will be taken at the Meeting; |

| • | present themselves at the Meeting to a representative of Computershare; and |

| • | return the voting instruction form following the procedure indicated on the form. |

The voting instruction form authorizes proxyholders to represent beneficial owners and vote on their behalf at the Meeting. Brokers, other Canadian intermediaries and their duly authorized agents are prohibited from exercising the voting rights attached to the Shares on behalf of beneficial owners unless they are specifically instructed to do so by the beneficial owner.

Appointment of Proxyholders

The proxyholders already designated in the voting instruction form are directors or officers of Labopharm. If a beneficial owner wishes to appoint as his or her proxyholder to represent him or her at the Meeting a person other than those whose names are printed on the voting instruction form, he or she may do so by striking out the names appearing thereon and inserting such other person’s name in the blank space provided. If the beneficial owner is not a natural person, the voting instruction form must be signed by a duly authorized officer or agent of said beneficial owner. A proxyholder need not be a Shareholder of the Corporation. To be valid, the voting instruction form must be returned following the procedure indicated on the form.

Voting by Instruction Form

The proxyholder named in the voting instruction form will exercise the voting rights attached to the Shares in accordance with the instructions given by the beneficial owner.

In the absence of instructions, designated proxyholders will exercise the voting rights attached to the Shares as follows:

| • | FOR the election of each of the director nominees for the ensuing year; |

| • | FOR the appointment of Ernst & Young llp as auditors of the Corporation for the ensuing year and authorizing the directors to fix their remuneration; and |

| • | FOR the proposed resolution as to amend the Stock Option Plan as to fix a maximum number of securities issuable upon exercise of stock options. (Resolution 2011-1). |

The enclosed voting instructions form confers upon the proxyholder a discretionary power in respect of amendments to the matters set forth in the Notice of Meeting and regarding all other matters which may properly be brought before the Meeting and if adjourned, at any reconvening thereof. As at the date of the Circular, our Management is not aware of any such changes or other matters that may come before the Meeting. If, however, such amendments or other matters do properly come before the Meeting or if adjourned, at any reconvening thereof, the Shares represented by the form of proxy will be voted at the discretion of the proxyholder.

Revocation of Voting Instructions

Beneficial owners may revoke their voting instructions by following their broker or any other intermediary’s instructions.

Confidentiality of Votes

To protect the confidential nature of voting by beneficial owners, the votes exercised by voting instruction form are compiled and transmitted by the intermediaries to Computershare, the Corporation’s registrar and transfer agent.

SECTION 2 - BUSINESS OF THE MEETING

| 2.1 | RECEIPT OF THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS AND THE AUDITORS’ REPORT HEREON |

The Audited Consolidated Financial Statements of the Corporation for the fiscal year ended December 31, 2010 and the auditors’ report thereon are an integral part of the 2010 Annual Report of the Corporation, which is available on its website (www.labopharm.com), on the SEDAR website (www.sedar.com) and on the EDGAR website (www.sec.gov/edgar.shtml).

Our Annual Report and Financial Statements will be presented at the Meeting. The approval of the shareholders with respect thereto is not required.

The articles of incorporation of the Corporation provide for the election of a minimum of three and a maximum of 25 directors. The Board of the Corporation has set to seven the number of directors to be elected. All directors elected at the Meeting will hold office until their resignation or the election or appointment of their replacement, or until the close of the next Annual Meeting of the Shareholders of the Corporation.

Directors will be elected individually. We have no reason to believe that any of such persons will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy or voting instructions form reserve the right to vote for another nominee of their choice.

The name of each individual recommended by our Corporate Governance and Nominating Committee as a nominee director, their career profiles and the number of Shares which each nominee directly or indirectly held as beneficial owner or over which he or she exercised control or direction as at the date of the Circular are provided in Section 3 of the Circular.

| 2.3 | APPOINTMENT OF AUDITORS |

At the Meeting, our Shareholders will be called upon to appoint auditors. The Board recommends voting FOR the appointment of Ernst & Young llp as auditors of the Corporation to hold office until the next annual meeting of shareholders and to authorize the directors to establish the remuneration of the auditors so appointed.

The resolution regarding the appointment of the auditors must be adopted by a majority of the votes cast by the shareholders present or represented by proxy and entitled to vote at the Meeting.

Auditors’ Fees

In 2004, we adopted an Audit Committee Pre-Approval Policy for Audit and Non-Audit Services, as amended in 2010, which includes specific policies and procedures for the engagement of non-audit services. Such policy is available on our website (www.labopharm.com).

Ernst & Young llp have been acting as our auditors since July 2002. In addition to performing the audit of our consolidated financial statements, Ernst & Young llp provided other services to us and they billed us the following fees in respect of each of our two most recently completed fiscal years:

| Fees | | Fiscal year ended December 31, 2010 ($) | | | Fiscal year ended December 31, 2009 ($) | |

Audit Fees(1) | | | 463,772 | | | | 500,102 | |

Audit-Related Fees(2) | | | 50,732 | | | | 3,903 | |

Tax Fees(3) | | | 188,556 | | | | 52,667 | |

All other Fees(4) | | | 45,236 | | | | 7,596 | |

| Total: | | | 748,295 | | | | 564,268 | |

| (1) | Refers to the aggregate fees billed by our external auditors for audit services. |

| (2) | Refers to the aggregate fees billed for professional services rendered by our external auditors for regulatory review. |

| (3) | Refers to the aggregate fees billed for professional services rendered by our external auditors for tax compliance, tax advice and tax planning. |

| (4) | Refers to the various language translation services provided by our external auditors. |

| 2.4 | AMENDMENT TO STOCK OPTION PLAN |

On March 18, 2011, the Board, including independent directors of the Corporation, unanimously approved the amendment to the Stock Option Plan in order to change the maximum number of Shares issuable under the Stock Option Plan from a variable number of Shares representing 9.9% of the total number of issued and outstanding Shares at any given time to a fixed number of 7,085,592 Shares, which represents 9.9% of the issued and outstanding Shares on March 14, 2011.

Following this amendment, future Shares issued by the Corporation pursuant to the exercise of options, equity financings or otherwise will not automatically increase the number of Shares issuable under the Stock Option Plan.

At the Meeting, shareholders will be asked to consider and, if deemed advisable, adopting the following resolutions approving the amendment to the Stock Option Plan (“Resolution 2011-1”):

“NOW THEREFORE, on resolution duly made and seconded, BE IT RESOLVED:

| • | THAT the Corporation’s Stock Option Plan, as amended and approved by the Board on March 18, 2011, be and is hereby ratified and approved, so as to change the maximum number of Shares issuable under the Stock Option Plan from a variable number representing 9.9% of the total number of issued and outstanding shares at any given time to fixed number of 7,085,592 Shares, which represents 9.9% of the issued and outstanding Shares on March 14, 2011; |

| • | THAT any director or officer of the Corporation be and he/she is hereby authorized, for and on behalf of the Corporation, to sign and deliver all the documents and perform other acts that this director or this officer may deem necessary or advantageous, for the purpose of giving full effect to the terms of this resolution 2011-1, his/her signature to said documents or the performance of such acts being the evidence of the present decision.” |

Resolution 2011-1 does not increase the maximum number of options that can be granted under the Stock Option Plan. Resolution 2011-1 sets a fixed number of Shares that can be issued pursuant to options granted under the Stock Option Plan. To be adopted, Resolution 2011-1 must be approved by a majority of votes cast by shareholders of the Corporation who vote in person or by proxy at the Meeting.

The Board recommends that shareholders approve the amendment to the Stock Option Plan by voting FOR Resolution 2011-1. Unless instructed to vote against Resolution 2011-1, the persons named in the enclosed form of proxy intend to vote FOR the adoption of Resolution 2011-1.

For more information on our Stock Option Plan and other amendments adopted by the Board on March 18, 2011 for which shareholders’ approval is not required, please refer to “Description of Stock Option Plan” in Section 4 of the Circular.

SECTION 3 - INFORMATION ON BOARD NOMINEES

In accordance with our Corporate Governance Rules which are more fully described in our Statement of Corporate Governance Practices, attached hereto as Schedule A, the Corporate Governance and Nominating Committee, which reports to the Board, annually reviews the composition of our Board with respect to the independence, skills, experience and expertise of its members and draws up, for purposes of review and approval by the Board, a list of nominees to be proposed as directors of our Corporation, subject to the requirements of the FSTQ Agreement.

The Corporate Governance and Nominating Committee has recommended, and this recommendation was approved by the Board, that the seven individuals listed in the table below be proposed as nominees for election to the Board at the Meeting. Mr. Jacques L. Roy is FSTQ’s nominee for election to the Board pursuant to the FSTQ Agreement. All nominees are currently directors of the Corporation.

The name of each nominee director, the year in which each nominee became a director of Labopharm, their career profile and the number of Shares which each nominee held as beneficial owner or over which he or she exercised control or director as of the date of the Circular, are provided in the following table:

Name and residence | Career profile(1) | Number of Shares held directly or indirectly as beneficial owner |

Santo J. Costa (a) North Carolina, United States Independent Director since 2006 | Mr. Costa is Chairman of the Board of Labopharm and is currently Of Counsel with Smith, Anderson, Blount, Dorsett, Mitchell and Jernigan, L.L.P., of Raleigh, North Carolina specializing in corporate law for healthcare companies. From June 2001 to August 2007 he was Of Counsel with the law firm Williams, Mullen, Maupin, Taylor. Previously, Mr. Costa held the role of Vice Chairman and before that, President and Chief Operating Officer of Quintiles Transnational Corporation. Prior to joining Quintiles, Mr. Costa held the positions of General Counsel and Senior Vice-President Administration with Glaxo Inc., US Area Counsel with Merrell Dow Pharmaceuticals and Food & Drug Counsel with Norwich Eaton Pharmaceuticals. Mr. Costa is an Adjunct Professor in the clinical research program at the Campbell University School of Pharmacy. | 31,500 |

Julia R. Brown (B) California, United States Independent Director since 2006 | Mrs. Brown is Strategic Advisor to the life science industry since 2003 and a certified director. She serves on the board of CONNECT, an organization that fosters innovation, entrepreneurship and the formation of new companies. In May 2010, she was appointed to the board of Corporate Directors Forum, a San Diego organization dedicated to making boards more effective. She is Chair of the Board of Trustees of the University of California, San Diego Foundation and a member of the CleanTECH San Diego board. Mrs. Brown has an extensive and diverse background in the life-sciences industry. From 2000 to 2003, Mrs. Brown was Executive Vice President of Amylin Pharmaceuticals, Inc. where she served as Advisor to the CEO until 2008. Previously, she was Executive Vice President of Dura Pharmaceuticals from 1995-1999 and spent more than 25 years with Eli Lilly and Company in progressively more senior roles. In December 2010, Ms. Brown received CONNECT's award for "Distinguished Contribution to the Life Science Industry". She is a graduate of Louisiana Tech University where she studied microbiology and biochemistry. | 20,000 |

Mark A. D’Souza Quebec, Canada Non-Independent Director since 2011 | Mr. Mark A. D’Souza was appointed as President and Chief Executive Officer of Labopharm effective March 14, 2011, replacing Mr. James R. Howard-Tripp. Mr. D’Souza joined Labopharm as Chief Financial Officer in September 2006 and brings to Labopharm a strong knowledge of financial management and extensive international and public company expertise. Prior to joining Labopharm, Mr. D’Souza served as Vice President, Finance with Quebecor Media Inc., having spent 9 years with the Quebecor Group in a number of domestic and international assignments, with corporate responsibilities for budgeting and reporting, corporate finance, investor relations, tax planning, risk management, purchasing and human resources. Prior to joining Quebecor he was the Finance Director of the Société Générale de Financement du Québec and has held corporate finance positions at the Royal Bank of Canada and the Union Bank of Switzerland (Canada). Mr. D’Souza is a member of the Quebec bar and began his career as a lawyer with the law firm Hemens Harris and Associates. Mr. D’Souza holds an MBA from the École des Hautes Études Commerciales (1989) and an LLL (1981) from the University of Montreal. | 19,000 |

Richard J. MacKay(a) Québec, Canada Independent Director since 1995 | Mr. MacKay is Chairman of the Advisory Board of Valeo Pharma Inc. From 1976 to 2009, he was President and Chief Executive Officer of Stiefel Canada Inc. Mr. MacKay has a vast experience in management and sales in the pharmaceutical industry, particularly in Asia and North America. Mr. MacKay is a former Chairman of the Board of the Pharmaceutical Manufacturers Association of Canada (now Canada's Research-Based Pharmaceutical Companies (Rx&D)), and a former director of the Nonprescription Drug Manufacturer of Canada (now Consumer Health Products Canada) and the Canadian Dermatology Foundation. Mr. MacKay graduated of Sir George Williams University (now Concordia University) and recipient of advanced business diplomas from both Harvard University and École des Hautes Études Commerciales (now HEC Montreal). | 211,971 |

Name and residence | Career profile(1) | Number of Shares held directly or indirectly as beneficial owner |

Frédéric Porte(C) Québec, Canada Independent Director since 1998 | Mr. Porte is the founder and President of Medipress Management Inc., a company offering strategic and financial planning in the health care sector and is also a venture partner of Genesys Capital, a venture capital organization. In 1981, he founded L’Actualité Médicale Inc., a publishing company the assets of which were sold in 1985. In 1987, he founded and was President of Clinidata Inc., a medical and pharmaceutical software company, which was purchased by Hoechst Marion Roussel (now Sanofi-Aventis S.A.) in 1994. Mr. Porte holds a Diplôme d’études approfondies (D.E.A.) in social and economic information from L’Université Paris-Sorbonne in France, as well as a degree in Business Administration and Finance from L’École Supérieure de Commerce in Lyon, France. | 145,000 |

Jacques L. Roy(B) (C) Québec, Canada Independent Director since 2001 | Mr. Roy is consultant and has over 25 years of experience working in the fields of finance, venture capital and mergers and acquisitions. From May 2005 to January 2007 he was Vice-President, Finance and Corporate Development with Omega Laboratories Limited Investment and from March 2004 to April 2005 Manager - Life Sciences with FSTQ. Throughout the course of his career, Mr. Roy has served on the board of directors of more than 15 companies (including various life sciences companies) as well as on the audit committee of a number of such companies. Mr. Roy holds a Bachelor of Commerce degree (B.Comm.) from McGill University | 1,000 (2) |

Rachel R. Selisker(B) (C) North Carolina, United States Independent Director since 2008 | Ms. Selisker is President of Seamark Advisors LLC, a consulting firm providing financial consulting services to the healthcare industry. She is a Certified Public Accountant and a senior financial executive with diverse advisory experience in the healthcare industry. She also serves as a member of the board of directors of several other corporations and organizations, including Wake Technical Community College Foundation. She was from March 2006 to May 2007, Chief Financial Officer of AAIPharma, Inc. From January 2001 to March 2006, she served as Managing Director of the Raleigh, North Carolina offices of Thompson Clive & Partners Inc., a venture capital firm based in London. Prior to joining Thompson Clive, Ms. Selisker served from July 1987 to February 2000 as Chief Financial Officer, and from February 2000 to January 2001 as Senior Vice President, Global Shared Services, of Quintiles Transnational Corp., at that time, a publicly held pharmaceutical services organization providing development, sales and other professional services to pharmaceutical, biotechnology and healthcare companies on a worldwide basis. | - |

(1) | For more information regarding the public corporations on whose boards our nominees currently serve as directors, please refer to Schedule A “Statement of Corporate Governance Practices” of the Circular. |

| (2) | Mr. Roy is FSTQ’s nominee pursuant to the FSTQ Agreement. As at the date of the Circular, to our knowledge based upon information provided by FSTQ, FSTQ held 1,355,087 Shares of the Corporation. |

| (A) | Member of the Corporate Governance and Nominating Committee. |

| (B) | Member of the Compensation Committee. |

| (C) | Member of the Audit Committee. |

To the knowledge of Labopharm, no director nominee is, at the date of the Circular, or has been, during the 10 years prior to the date of the Circular, a director, chief executive officer or chief financial officer of any company, including Labopharm, that while the nominee was acting in such capacity, or after the nominee ceased to act in such capacity, and as a result of an event which occurred while the nominee was performing his or her duties, was the subject of one of the following orders that was in effect for more than 30 consecutive days, namely, any cease trade or similar order or any order that denied it access to any exemption under securities legislation.

To the knowledge of Labopharm, no director nominee is, at the date of the Circular, or has been, in the 10 years prior to the date of the Circular, a director or executive officer of any company, including Labopharm, that while the nominee was acting in such capacity or within a year of the nominee ceasing to act in such capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or became subject to, or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets, except for:

| • | Mr. Santo J. Costa was the non executive chairman of the board of Argomed, Inc., a privately held company, until he resigned from such position on August 2, 2002. On the day Mr. Costa resigned from his position, Argomed, Inc. filed for bankruptcy under the laws of the United States. Mr. Santo J. Costa was also a director of DigiScript Inc., a privately held company, until he resigned from such position on August 18, 2008. On August 25, 2008, after his resignation, DigiScript Inc. filed a voluntary petition under Chapter 11 of the United States Bankruptcy Code. |

| • | Mr. Frédéric Porte was elected director of Avance Pharma Inc. in October 2004 and resigned from such position in January 2005. In June 2005, Avance Pharma Inc. instituted proceedings under the Companies’ Creditors Arrangement Act (Canada). Mr. Porte is currently Chairman of the Board of Directors of Ambrilia Biopharma Inc. ("Ambrilia") an issuer listed on the Toronto Stock Exchange. On July 31, 2009, Ambrilia obtained Court protection from its creditors under the Companies’ Creditors Arrangement Act (Canada). Ambrilia is still under Court protection at this time. Also on July 31, 2009, The Investment Industry Regulatory Organization of Canada (IIROC) halted the trading of the shares of Ambrilia pending delisting review. IIROC announced on August 6, 2009 the resumption of the trading of Ambrilia’s shares on the Toronto Stock Exchange. On February 4, 2011, the Toronto Stock Exchange decided to delist the common shares of Ambrilia at the close of market on March 4, 2011. |

| • | In connection with his functions at FSTQ, Mr. Jacques L. Roy was elected director of LBL Skysystems Corporation (“LBL”) on February 6, 2003. On September 27, 2005, LBL was declared bankrupt pursuant to the Bankruptcy and Insolvency Act (Canada). |

In addition, to the knowledge of Labopharm, no director nominee has, in the 10 years prior to the date of the Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to, or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the nominee.

Furthermore, to the knowledge of Labopharm, no director nominee has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority, or has entered into a settlement agreement with a securities regulatory authority, or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered material to a reasonable investor in deciding whether to vote for a nominee.

Board Interlocks

As at the date of the Circular, no members of the Board served together on the boards of other reporting issuers.

SECTION 4 - STATEMENT OF EXECUTIVE COMPENSATION

| 4.1 | COMPENSATION DISCUSSION AND ANALYSIS |

This section discusses the Corporation’s executive compensation policies and programs primarily as they relate to the President and Chief Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers (the “Named Executive Officers”), and the directors of the Corporation. The Compensation Committee of the Corporation has reviewed and discussed with management the disclosure contained in this section and, based on such review and discussion, it has recommended to the Board of the Corporation that this discussion and analysis of our compensation policies and programs be included in the Circular.

Mandate and Composition of our Compensation Committee

The Compensation Committee is responsible for reviewing and recommending to the Board the compensation of our directors and senior executive officers. The mandate of the Committee is primarily to ensure that our executive compensation policies and programs are supportive of business strategies, competitive in the markets in which the Corporation competes for human resources and supportive of the long term interests of the Corporation and its shareholders. The Board has adopted a formal Charter for the Compensation Committee that forms part of our Corporate Governance Rules, a copy of which is available on our website (www.labopharm.com).

Since the Corporation’s last annual meeting of shareholders held on May 5, 2010, the Compensation Committee has been composed of three directors, all of whom are independent directors as defined in the standards established by the Canadian Securities Administrators (the “CSA”), namely: Julia R. Brown, who is the chair, Rachel R. Selisker and Jacques L. Roy. The Board of the Corporation believes that these directors have the knowledge, experience and background to fulfill their mandate.

Compensation Philosophy

Our executive compensation policies and programs are designed to attract, retain and motivate leadership talent. Our executive compensation also aims at:

| • | Linking a significant portion of each executive’s total compensation directly to the attainment of individual and team-based objectives that are intended to promote the development of the Corporation and to create value for shareholders; |

| • | Incenting executives to improve overall Corporation performance through short and long-term reward programs; and |

| • | Providing long-term incentive opportunities to ensure that management’s interests are aligned with those of the shareholders through Share price performance. |

Compensation Decision Making Process

The Compensation Committee reviews and recommends annually to the Board the compensation of the Named Executive Officers and other executives. In reviewing executive compensation, the Compensation Committee will rely primarily on:

| • | A benchmarking analysis of Labopharm’s executive compensation against the median of a peer group conducted by an independent external compensation consultant. This benchmarking exercise reviews base salary, short-term cash compensation and long-term incentives offered to the Named Executive Officers and compares them to what is being offered by the Corporation’s peer group for similar positions. This assessment is not meant to establish limits within which compensation must be fixed, but rather to assess the competitiveness of the Corporation’s compensation in order to attain the Corporation’s underlying compensation objectives described above; |

| • | A performance evaluation of the President and Chief Executive Officer, to determine if changes to his compensation are appropriate, based on the various considerations described below; and |

| • | The President and Chief Executive Officer’s analysis of the performance and contribution of the other Named Executive Officers and recommendations on any changes to their compensation. The Compensation Committee gives considerable weight to the President and Chief Executive Officer’s evaluation of other Named Executive Officers, because of his direct knowledge of each Named Executive Officer’s performance and contribution. No other Named Executive Officer has any input into executive compensation decision. |

Independent Compensation Consultant

The Compensation Committee has the authority to retain the services of independent external consultants who provide it with necessary information on market trends and best practices regarding compensation policies and programs as well as the competitiveness of the Corporation’s executive compensation. The Compensation Committee is thus kept well informed so that it can make sound decisions that can also take into account factors other than the information and recommendations of the external consultants.

For fiscal 2010, the Compensation Committee retained the services of Radford, an Aon Hewitt Company (“Radford”), as its independent compensation consultant to assist it in reviewing the competitiveness and appropriateness of the Corporation’s compensation programs.

The services of Radford in 2010 mainly involved assisting the Compensation Committee in reviewing the Corporation’s compensation philosophy, identifying a market comparator group of peer companies, reviewing the Corporation’s executive compensation levels relative to the Corporation’s peers, providing information on evolving market practices and governance trends, and developing recommendations covering salary, bonus and long-term incentive compensation for executive compensation.

The Compensation Committee reviews and pre-approves all fees and terms of service for consulting services provided by its independent compensation consultant. These fees paid to Radford during fiscal 2009 and 2010 were as follows:

| Type of fee | Fiscal 2010 fees ($) | Fiscal 2009 fees ($) | Percentage of fees for both fiscal (%) |

Fees for Compensation Committee mandates | 36,039 | 32,339(1) | 100(2) |

| Other fees | - | - | 0 |

| (1) | Amounts paid in US dollars are converted into Canadian dollars using the prevailing exchange rate as at the date of the invoice. |

| (2) | Radford is an Aon Hewitt Company. No other fees were paid to Aon Hewitt. |

Benchmark

The Compensation Committee believes that maintaining competitive executive compensation is essential to meet the Corporation’s compensation objective of attracting, retaining and motivating a strong executive team. In order to ensure that the Corporation’s executive compensation is and remains competitive, the Compensation Committee benchmarks executive compensation annually in relation to that offer by the companies in the Corporation’s peer group (the “Peer Group”).

Because the Corporation competes for talent in Canada and in the United States, the Corporation uses a Peer Group composed of Canadian and U.S. biotechnology companies. The composition of the Peer Group is recommended by Radford and approved by the Compensation Committee on an annual basis in order to ensure that the companies forming part thereof are comparable to the Corporation. The following criteria were used to establish our Peer Group:

| • | Companies competing with us in our markets for human resources; |

| • | Companies that are comparable to us in size and complexity based on various metrics such as the number of employees, revenues, research and development expenses, and market capitalization; and |

| • | Companies with a pharmaceutical product on the market or in the later stages of clinical trials working towards bringing such product to the market |

Based on these criteria, our Peer Group is currently composed of the following companies.

| | | 2010 | | Market |

| Company | Number of Employees | Revenues in million of $US Dollars | R & D Expense in million of $US Dollars | Capitalization(1) in million of $US Dollars |

| | | | | |

| Canadian Peers | | | | |

| Aeterna Zentaris Inc. | 99 | 63.2 | 44.2 | 104.8 |

| Cardiome Pharma Corp. | 84 | 52.1 | 29.0 | 350.5 |

| Nuvo Reasearch Inc. | 72 | 8.4 | 8.2 | 79.3 |

| Paladin Labs Inc. | 115 | 104.7 | 6.9 | 505.7 |

| QLT Inc. | 142 | 42.1 | 28.6 | 290.1 |

| Theratechnologies Inc. | 98 | 18.8 | 21.2 | 302.6 |

| Transition Therapeutics Inc. | 36 | 2.4 | 16.8 | 62.2 |

| | | | | |

| U.S. Peers | | | | |

| Adolor Corporation | 114 | 37.4 | 43.9 | 57.5 |

| Alexza Pharmaceuticals, Inc. | 90 | 9.5 | 39.8 | 65.6 |

| Cadence Pharmaceuticals, Inc. | 90 | 0.0 | 19.5 | 443.9 |

| Columbia Laboratories, Inc. | 62 | 32.2 | 8.6 | 115.3 |

| Cypress Bioscience, Inc. | 150 | 27.3 | 12.0 | 155.1 |

| Depomed, Inc. | 73 | 57.7 | 34.9 | 256.0 |

| DURECT Corporation | 127 | 24.3 | 34.6 | 237.2 |

| GTx, Inc. | 120 | 14.7 | 32.3 | 122.7 |

| Inspire Pharmaceuticals, Inc. | 240 | 92.2 | 51.1 | 602.1 |

| Momenta Pharmaceuticals, Inc. | 176 | 20.2 | 60.6 | 699.5 |

| Nektar Therapeutics | 335 | 71.9 | 95.1 | 1,419.4 |

| NeurogesX, Inc. | 45 | 2.0 | 11.2 | 129.0 |

| Pain Therapeutics, Inc. | 27 | 20.6 | 21.1 | 301.0 |

| PenWest Pharmaceuticals Co. | 39 | 20.8 | 12.4 | 159.1 |

| POZEN Inc. | 31 | 32.2 | 22.5 | 213.2 |

| Progenics Pharmaceuticals, Inc. | 204 | 49.0 | 49.8 | 161.1 |

| | | | | |

| Labopharm Inc. | 130 | 23.4 | 12.1 | 84.5 |

| (1) | As of October 22, 2010. Canadian peer’s financial data is expressed in $US, converted at a rate of US$0.9523 per $1.00. |

Discretion and Judgment

The Compensation Committee reviews compensation practices at peer companies to ensure that total compensation offered to our senior executives is competitive. Consequently, the Committee will generally aim to offer to the Corporation’s Named Executive Officers compensation packages that, as a whole, are within a reasonable range of the 50th percentile for a comparable position within the Peer Group. The Compensation Committee, however, exercises discretion and judgment in determining compensation, carefully considering other factors in its review such as the experience, responsibilities, length of service and performance of an Named Executive Officer before finalizing its compensation decision and recommendation to the Board. The Committee also takes into consideration the Corporation’s financial performance, budgetary constraints and restrictions or limitations on the availability of certain compensation components.

Elements of our Compensation Programs

The Corporation’s executive compensation policies and programs are designed so as to constitute adequate reward for services and incentive for executive officers to promote the development of the Corporation and increase shareholder value. The Corporation’s compensation strategy is therefore weighted towards various pay-for-performance components.

Our compensation mix facilitates the furtherance of the Corporation’s objectives by allowing adjustments to be made to the overall structure of compensation schemes and/or individual packages in order to promote the achievement of certain team-based or personal objectives or to take into consideration other factors such as seniority, experience, skills and performance.

Concretely, this means that certain components of compensation may be higher than the median of the Peer Group in some cases while other components are lower in order to better address such objectives and factors.

The main components of the Corporation’s compensation mix consist of:

Base salary makes up the fixed portion of total compensation and is meant to attract and retain executive officers. Base salaries are reviewed in the first quarter of every fiscal year. In defining base salary, the Compensation Committee will give considerable weight to the competitiveness of the base salary offered in comparison to the market median of the Peer Group for a comparable position. The Compensation Committee will also consider evolving trends in the market and then determine if adjustments are necessary based on the scope of each Named Executive Officer’s responsibilities relative to other members of the executive team, his or her experience in similar positions, the length of service with the Corporation, his or her geographical location and internal equity. Increases in salary from one year to the other, if any, are also subject to budgetary constraints and other financial considerations.

After having reviewed and analyzed the salaries paid to presidents and chief executive officers occupying similar positions and performing similar functions at companies within the Peer Group, the Compensation Committee will make a recommendation to the Board for approval of the base salary of the President and Chief Executive Officer. For other Named Executive Officers, the President and Chief Executive Officer will generally make a recommendation for each Named Executive Officer to the Compensation Committee, and the Committee will then recommend to the Board a proposed base salary for each individual.

For more information on the base salaries paid to the Named Executive Officers please refer to the section “Information on the Compensation of the Named Executives Officers” of the Circular.

| (ii) | Short-Term Incentive Plan - Bonus Awards |

Our short term incentive plan provides for an annual, variable, cash incentive designed to motivate participants to achieve corporate objectives and to reward exceptional performance and contribution. All our employees, including the Named Executive Officers are eligible to receive an annual bonus award. Payments, if any, are based on the Corporation’s overall performance as compared to corporate objectives defined by the Compensation Committee and approved by the Board, as well as individual performance.

The Corporation’s short term incentive plan is based on a “team” approach under which executives at the same level of general responsibility receive the same target bonus opportunity. Under our plan, the President and Chief Executive Officer is eligible to receive a bonus of up to 60% of his annual base salary, while other Named Executive Officers are eligible to a bonus of up to 40% of their base salary. This makes the potential bonus payment in line with the 50th percentile for each Named Executive Officer when compared to the Peer Group. The Committee believes that this encourages achievement of objectives and rewards high performance.

Corporate Objectives

Annually, the Compensation Committee reviews and recommends to the Board the approval of the Corporation’s corporate objectives for that fiscal year. Because the Corporation is in a developmental stage, these corporate objectives are generally defined in terms of progress towards established objectives which may enhance the overall performance, profitability and long term growth of the Corporation, such as achieving certain financial targets, concluding important contracts or partnerships, realizing advances in our research and development programs, and obtaining favourable clinical results or regulatory approval of a product. Each objective is then weighted according to its importance and criticality.

The following table provides a list of the 2010 objectives adopted by the Board. For fiscal 2010, 70% of the Corporation’s corporate objectives related to product-oriented goals, while the balance of 30% related to financial and business development goals

OBJECTIVES(1) | | WEIGHTING |

• Approval and successful commercialization of the Corporation’s once-daily trazodone formulation OleptroTM in the United States | | 20% financial 20% regulatory Total: 40% |

• Build the OleptroTM launch readiness | | 20% |

• Increase Tramadol product unit sales outside of the United States | | 10% |

• Increase overall revenue | | 10% |

• Further advance and develop the Corporation’s pipeline of product candidates | | 10% |

• Achieving certain financial targets, such as increasing liquidity to support the Corporation’s business plan and continue to improve cost management: | | 10% |

| (1) | Certain objectives mentioned in this table also comprise key achievements or targets that are confidential. These confidential achievements or targets represent approximately 50% of the Corporation’s total corporate objectives and were viewed by the Compensation Committee and the Board as being challenging to management but realistically achievable. |

Individual contribution

President and Chief Executive Officer

For fiscal 2010, the individual performance of the President and Chief Executive Officer was closely linked to the realization of the Corporation’s corporate objectives and the good stewardship of the Corporation in general. As a result, 100% of our President and Chief Executive Officer’s personal objectives were assessed on the achievement of the Corporation’s corporate objectives.

Other Named Executives Officers

For fiscal 2010, the individual performance of other Named Executive Officers was established at the discretion of the President and Chief Executive Officer and was the result of the assessment of their leadership behaviours and their ability to adhere to and instill the organization’s values, as well as their individual contribution to the achievement of the corporate objectives.

Calculation of Bonus Payouts

Bonus payouts under our short term incentive plan are calculated using a formula pursuant to which bonus payouts in any given year are dependent upon the Named Executive Officer’s target bonus, a Corporation multiplier which is intended to reflect Corporation performance in meeting corporate objectives established by the Compensation Committee, and an individual multiplier which rates individual performance and contribution.

For more information on bonus awarded to our Named Executive Officers, please refer to the section “Information on the Compensation of the Named Executives Officers” of the Circular.

All Named Executive Officers are eligible to receive stock option grants. We believe that stock options provide value in three ways:

| • | by closely aligning management interests with those of shareholders vis-à-vis share price performance; |

| • | by acting as a means to attract high potential executives in competition to larger, more established companies; and |

| • | by having long-term retention value. |

When, upon the recommendation of the Compensation Committee, the Board grants options, it follows competitive long-term incentive compensation practices such that the size and value of these grants are intended to place our Named Executive Officers in a competitive position as compared to the estimated value of the options granted to executives occupying similar positions and performing similar functions at companies within the Peer Group.

When the Compensation Committee recommends to the Board the size of new grants to each Named Executive Officer, it considers several factors which are benchmarked with similar positions in the Peer Group, including the number of shares underlying the grant, the size of the grant as a percentage of all grants, the long term incentive value of the grant based on a Black-Sholes valuation, and the level of potential ownership in the Corporation the grant represents. The Compensation Committee also takes into account the number and term of previously granted options and gives careful consideration to the overall dilution created by equity grants as measured by the size of the equity pool of shares reserved for options granted when compared to the total number of shares outstanding.

Options granted by the Board upon the recommendation of the Compensation Committee to our Named Executive Officers normally vest as follows:

| • | one-third on the date of the grant; |

| • | an additional one-third on the first anniversary of the date of the grant; and |

| • | the remainder on the second anniversary of the date of the grant. |

For more information on options granted to the Named Executive Officers please refer to the section “Information on the Compensation of the Named Executives Officers” of this section of the Circular.

The Corporation does not offer pension benefits to its executives. Perquisites and personal benefits are provided to executive officers based on competitive practices, business needs and specific circumstances.

| 4.2 | INFORMATION ON THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS |

In February 2011, the Compensation Committee examined the results obtained for the Corporation as a whole relative to the corporate objectives set at the beginning of fiscal 2010 and approved the compensation payable to the Named Executive Officers based on the level of achievement of the corporate objectives and each one’s individual contribution. It then recommended that the Board approve it. The following section of the Circular presents the compensation paid to the Named Executive Officers for fiscal 2010 for each of the main components of the Corporation’s compensation mix.

Base Salary

In February 2010, the Compensation Committee recommended that increases in base salaries for each Named Executive Officer should be targeted at 2.7%, consistent with the recommendation of Radford, its independent compensation consultant, based on review of our Peer Group and considering experience and individual contribution. The increases that were provided to the Named Executive Officers in 2010 result in base salaries that approximate the median, being the 50th percentile, of the Corporation’s Peer Group.

Annual Bonus Awards

President and Chief Executive Officer

For fiscal 2010, although we were gratified with significant progress made on many of our corporate objectives fixed at the beginning of the fiscal year and identified hereinabove as well as other valuable accomplishments in product development, certain expectations linked to these objectives, particularly the revenue generated by the commercialization of OleptroTM for fiscal 2010 were below the Corporation’s expectations, the Compensation Committee therefore recommended to the Board not to pay an annual bonus to Mr. James R. Howard-Tripp.

Other Named Executive Officers

For fiscal 2010, upon recommendation from the President and Chief Executive Officer and to recognize the individual contribution of our Named Executive Officers in the significant progress and achievement of certain corporate objectives, the Compensation Committee recommended to the Board that annual bonuses be granted to our Named Executive Officers. These corporate objectives were:

| • | Approval and successful commercialization of the Corporation’s once-daily trazodone formulation OleptroTM in the United States: |

| | • | On February 3, 2010, the U.S. Food and Drug Administration approved our once-daily trazodone product - OleptroTM. |

| | • | On May 20, 2010 we completed our joint venture agreement with Gruppo Angelini for the commercialization of OleptroTM in the United States. OleptroTM was launched in the United States on August 10, 2010 by Angelini Labopharm. |

Specific financial targets for the determination of bonuses are confidential, as they represent competitive, sensitive information. These confidential achievements or targets represent approximately 50% of the Corporation’s total corporate objectives. If disclosed, it would be prejudicial to the Corporation as it would allow competitors to know the strategic plans of the Corporation. These objectives are viewed by the Compensation Committee and the Board as set at a challenging level.

For more information on annual bonuses paid for each Named Executive Officers, please refer to the Summary Compensation Table below.

Option Grants

In 2009, the Compensation Committee reviewed, with the assistance of its independent compensation consultant, the effectiveness of the Corporation’s equity-based compensation to Named Executive Officers. This assessment was carried out by comparing the competitiveness of the Corporation’s long term incentive grants to the Peer Group using several comparison methods. For 2010, this analysis showed that long term compensation to the Corporation’s Named Executive Officers was below the median of the Peer Group in terms of levels of executive ownership and retention value.

Although the option grants were limited in 2010 given the pool constraints that the Corporation faced, the Compensation Committee is committed to providing grant level that approximates the 50th percentile in order to better continue to align management’s motivation with shareholders’ interests.

All options were granted for fiscal 2010 at an exercise price equal to the closing price of the Corporation’s Shares on the date of the grant with a vesting period over two years in accordance with the Corporation’s Plan.

Summary Compensation Table - Named Executive Officers

The following table is presented pursuant to Canadian securities legislation. It details the total compensation paid by Labopharm and its subsidiaries to each of the Named Executive Officers during the past three fiscal years.

Summary Compensation Table

Name and principal position | Year | Salary ($) | Option-based awards(1)(2) ($) | Non-equity incentive plan compensation | Pension value ($) | All other compensation (4) ($) | Total compensation ($) |

Annual incentive plans(3) ($) | Long-term incentive plans ($) |

James R. Howard-Tripp President and Chief Executive Officer(5) | 2010 | 534,280 | | 136,917 | - | - | - | - | 671,197 |

| 2009 | 520,235 | | 354,250 | - | - | - | - | 874,485 |

| 2008 | 520,235 | | 539,500 | 185,938 | - | - | - | 1,245,673 |

Mark A. D’Souza Senior Vice-President and Chief Financial Officer(6) | 2010 | 319,022 | | 68,459 | 62,127 | - | - | - | 449,608 |

| 2009 | 310,635 | | 119,900 | - | - | - | - | 430,535 |

| 2008 | 310,635 | | 166,000 | 74,975 | - | - | - | 551,610 |

Mary Anne Heino(7) President, Angelini Labopharm, LLC | 2010 | 328,398 | (8) | 68,459 | 62,100 | - | - | - | 458,957 |

| 2009 | 354,402 | (8) | 98,100 | - | - | - | - | | 452,502 |

| 2008 | 331,135 | (8) | 166,000 | 81,458 | - | - | 53,323 | (8)(9) | 631,916 |

Damon C. Smith Senior Vice-President, Research & Development | 2010 | 314,544 | | 68,459 | 61,255 | - | - | - | | 444,258 |

| 2009 | 306,275 | | 98,100 | - | - | - | - | | 404,375 |

| 2008 | 306,275 | | 199,200 | 57,654 | - | - | - | | 571,185 |

Gregory M.C. Orleski Vice-President, Business Development | 2010 | 275,000 | | - | 55,000 | - | - | - | 330,000 |

| 2009 | 275,000 | | 54,500 | - | - | - | - | 329,500 |

| 2008 | 271,827 | (10) | 74,000 | 40,871 | - | - | - | 386,692 |

| (1) | The fair value of options granted was estimated at the date of grant using the Black-Scholes option pricing model based on the grant date closing price on the TSX of the Corporation’s Shares ($1.14 for 2010, $1.46 for 2009, and $2.57 for 2008) and the following weighted average assumptions: |

| For the years ended December 31, | 2010 | 2009 | 2008 |

| Expected volatility | 82.41% | 100% | 77% |

| Expected life | 6.0 years | 5.0 years | 5.0 years |

| Risk-free interest rate | 2.99% | 1.85% | 3.44% |

| Dividend yield | n/a | n/a | n/a |

| | In developing the estimate of expected life, the Corporation has assumed that its recent historical stock option exercise experience is a relevant indicator of future exercise patterns. The Corporation based its determination of expected volatility on the historical market volatility of its Shares. |

| (2) | On March 11, 2011, the Board granted 350,000 options to Mr. Mark A. D’Souza. |

| (3) | The compensation under the annual incentive plans was earned for the reference year and is payable early in the following year. Amounts payable in a currency other than Canadian dollar are converted at the December 31 exchange rate for the reference year. |

| (4) | Perquisites that do not exceed $50,000 or 10% of salary are not included in this column. |

| (5) | Mr. James R. Howard-Tripp ceased to be President and Chief Executive Officer and director of the Corporation effective as of March 14, 2011. The provisions of the Stock Option Plan will continue to apply to any outstanding unexercised stock options, vested and unvested, held by Mr. James R. Howard-Tripp on March 14, 2011. However, his options shall expire 24 months immediately following March 14, 2011. |

| (6) | Effective on March 14, 2011, Mr. Mark A. D’Souza replaced Mr. James R. Howard-Tripp as President and Chief Executive Officer and director of the Corporation. |

| (7) | Ms. Mary Anne Heino was Senior Vice-President, Sales and Marketing of the Corporation from February 2007 to January 25, 2011. Ms. Heino received a salary of US$318,883 for fiscal ended December 31, 2010 and of US$ 310,500 for fiscals ended December 31, 2009 and December 31, 2008. |

| (8) | Amounts in US dollars are converted into Canadian dollars using an average exchange rate over the period of US$1.00 to $1.03088 in 2010, US$1.00 to $1.14139 in 2009 and US$1.00 to $1.06646 in 2008. The variation in the base salary of Ms. Heino between the years 2008 and 2009 is due to changes in exchange rates. |

| (9) | Represents the US$50,000 balance of Ms. Heino’s signing bonus which was paid in fiscal 2008. |

| (10) | Mr. Gregory M.C. Orleski was appointed as Vice-President, Business Development on January 10, 2008. |

Stock Options Granted to Named Executive Officers

The aggregate number of Shares underlying the options granted during the fiscal year ended December 31, 2010 to all of our employees and directors was 967,900 at prices ranging from $1.32 to $1.59 per Share, of which a total of 342,294 options were granted to our Named Executive Officers.

The following table shows all awards to our Named Executive Officers outstanding at the end of the most recently completed fiscal year (December 31, 2010):

| | Option-based Awards | | Share-based Awards |

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested (#) |

James R. Howard-Tripp(2) | 250,000 325,000 325,000 120,000 | 6.98 2.57 1.46 1.59 | Feb. 15, 2014 Feb. 20, 2015 Feb. 25, 2016 Feb. 24, 2017 | - - - - | | - - - - | - - - - |

| Mark A. D’Souza | 110,000 11,700 100,000 110,000 60,000 | 8.40 7.33 2.57 1.46 1.59 | Sep. 7, 2011 May 11, 2014 Feb. 20, 2015 Feb. 25, 2016 Feb. 24, 2017 | - - - - - | | - - - - - | - - - - - |

| Mary Anne Heino | 100,000 100,000 90,000 60,000 | 6.98 2.57 1.46 1.59 | Feb. 15, 2014 Feb. 20, 2015 Feb. 25, 2016 Feb. 24, 2017 | - - - - | | - - - - | - - - - |

| Damon C. Smith | 70,000 120,000 90,000 60,000 | 6.98 2.57 1.46 1.59 | Feb. 15, 2014 Feb. 20, 2015 Feb. 25, 2016 Feb. 24, 2017 | - - - - | | - - - - | - - - - |

| Gregory M.C. Orleski | 100,000 50,000 | 1.21 1.46 | Feb. 25, 2015 Feb. 24, 2016 | - - | | - - | - - |

| (1) | The value of unexercised options at year-end is calculated by subtracting the option exercise price from the closing price of our Shares on the TSX on December 31, 2010 ($0.95) and multiplying the result by the number of Shares underlying an option. |

| (2) | Mr. James R. Howard-Tripp ceased to be President and Chief Executive Officer and director of the Corporation effective as of March 14, 2011. The provisions of the Stock Option Plan will continue to apply to any outstanding unexercised stock options, vested and unvested, held by Mr. James R. Howard-Tripp on March 14, 2011. However, his options shall expire 24 months immediately following March 14, 2011. |

Incentive Plan Awards - Value at Vesting or Value Earned During the Fiscal Year

The following table indicates the value of the awards at vesting or the value earned during the fiscal year ended December 31, 2010. For more information on the terms and conditions of the awards, please refer to section “Compensation of the Named Executive Officers” of the Circular.

| Name | Option-Based Awards-Value vested during the year ($) (1) | Share-Based Awards-Value vested during the year ($) | Non-equity Incentive Plan Compensation - Value earned during the year ($) |

| James R. Howard-Tripp | 0 | - | - |

| Mark A. D’Souza | 0 | - | - |

| Mary Anne Heino | 0 | - | - |

| Damon C. Smith | 0 | - | - |

| Gregory M.C. Orleski | 0 | - | - |

(1) | The amount represents the theoretical total value if the options had been exercised on the vesting date, established by calculating the difference between the closing price of the Common Shares of the Corporation on the TSX and the exercise price. On the vesting date, the share price was $0.95, while the exercise price of options varied between $6.98 and $1.59. |

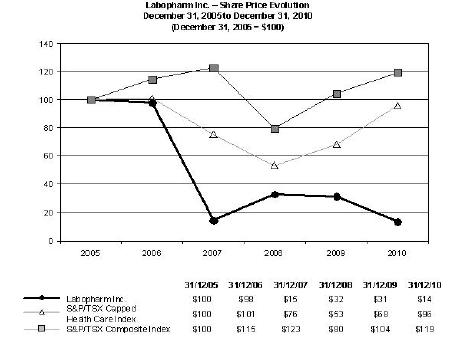

Performance Graph

The performance graph presented on the next page illustrates the cumulative total return of a $100 investment in Canadian dollars in our Shares, compared with the cumulative total return of the S&P/TSX Capped Health Care Index and the S&P/TSX Composite Index.

The year-end values of each investment are based on share appreciation plus dividends, if any, reinvested on the date they were paid. The calculations exclude brokerage fees and taxes. Total shareholder returns from each investment can be calculated from the year-end investment values shown below the graph.

The trend shown by the performance graph set forth above represents a marked decline in shareholder return between 2006 and 2008 mitigated by an increase at the end of fiscal 2008, a slight decline in 2009 and a sharp decline in 2010.

The trend shown in the above graph for total shareholder return does generally correspond to the trend in the total compensation paid to the Corporation’s Named Executive Officers. For the last three fiscal years, the total compensation paid to the Named Executive Officers went down 70%. As for base salary we see for the five-year period a stable increase in base salaries, with no increase in 2009. The base salaries were increased in 2010 in order to bring them up to the median of our Peer Group but an important decline can be observed in annual bonuses paid in the last fiscal years to our Named Executive Officers.

The trading price of Shares on the TSX and NASDAQ is subject to fluctuation based on several factors, many of which are outside control of the Corporation and some of which are disclosed and discussed under the heading “Item 3 - Risk Factors” in the Corporation’s Annual Report on Form 20-F for the period ended December 31, 2010.

As the Corporation’s shareholders have felt the impact of the reduced share prices in the past several fiscal years, so too have Labopharm’s Named Executive Officers and executives. Thus, for example, as at December 31, 2010, the outstanding vested stock options held by the Named Executive Officers had a negligible present value and thus an important portion of their executive packages has been significantly diminished in value.

Termination and Change of Control Benefits

As of the date of the Circular and pursuant to their respective employment agreements, in the event of a termination of employment (except where such termination is due to gross negligence of duty) or a change of control of the Corporation, Mr. Mark A. D’Souza, President and Chief Executive Officer is entitled to receive a cash payment in an amount equal to 24 months of his annual base salary and the bonus he is entitled to while Dr. Damon C. Smith, Senior Vice-President, Research and Development, is entitled to receive a cash payment in an amount equal to 18 months of his annual base salary and the bonus he is entitled to.

Our Named Executive Officers mentioned above would also be entitled to their insurance and health care benefits for the same period as above, and all of their unexercised stock options would fully vest and would be exercisable pursuant to the terms and conditions under which the stock options were granted except that the Named Executive Officer would be entitled to exercise such options until the expiry of the above-mentioned period. In addition, upon retirement of such Named Executive Officers, all options granted to them shall be exercisable until their original expiry date provided that certain conditions are met at that time.

At the end of fiscal 2010, Mr. James R. Howard-Tripp was President and Chief Executive Officer of the Corporation. Mr. Howard-Tripp’s employment with the Corporation ended effective as of March 14, 2011 and received a gross amount equivalent to $1,142,000 in lieu of severance representing his entitlement to receive a cash payment equal to 24 months of his annual base salary and other benefits.

Assuming that the triggering event would have taken place on the last business day of fiscal 2010, Mr. Mark A. D’Souza, then Senior Vice-president and Chief Financial Officer, would have received $478,533, plus the bonus he is entitled to, in the case of a change of control or termination of employment. Similarly, Ms. Mary Anne Heino and Dr. Damon C. Smith would have received $493,093 and $471,816 respectively plus the bonuses they are entitled to.

| 4.3 | INFORMATION ON THE COMPENSATION OF THE DIRECTORS |

Determining Directors Compensation

The current compensation regime applicable to directors of the Corporation is designed to:

| • | attract and retain highly qualified individuals to serve on the Corporation’s Board and its committees; |

| • | align the interests of the directors with the interests of the Corporation’s shareholders; and |

| • | reflect the responsibilities, commitment and risks involved in serving as a director of a public corporation in Canada and in the United States. |

The Compensation Committee regularly assesses the market competitiveness of our directors’ compensation, with the assistance of its compensation consultant, against publicly-traded Canadian and U.S. corporations in a Peer Group. For more information on the Corporation’s Peer Group, please refer to section “Benchmark” of this section of the Circular.

Based on a survey report performed by Radford, our director’s compensation package was reviewed in May 2010 to achieve a proper balance between cash and equity compensation by assessing the Corporation’s compensation practices against our Peer Group.

Changes were made on May 4, 2010 regarding the Committee Member Retainer (other than the chairperson) of the Compensation Committee which was adjusted to $9,000 annually. No other changes have been made to director compensation since May 8, 2008, date on which the Board compensation was adjusted by a 10% reduction ib the cash compensation to be paid to non-executive directors, as agreed upon the Board.

Retainers and Fees Paid to Directors

Our non-executive directors’ compensation is based exclusively on annual cash retainers and long term compensation in the form of stock options. Each director is also entitled to be reimbursed for the travelling costs incurred by him or her in order to attend meetings of the Corporation. The director who is also an executive of the Corporation receives no remuneration for serving as a director.

Annual Board and Committee retainers are paid to each non-executive director in quarterly installments, in arrears. According to the Corporation’s compensation policies applicable to non-executive directors, each non-executive director is entitled to the compensation set forth in the following table.

Type of Compensation | Annual Compensation(1) ($) |

| Board Chairman retainer (total compensation) | 85,500 |

| Board Retainer | 36,000 |

| Committee Chairperson | |

| | Audit | 18,000 |

| | Compensation | 18,000 |

| | Corporate Governance and Nominating | 13,500 |

| Committee Member Retainer (other than chairperson) | |

| | Audit | 9,000 |

| | Compensation | 9,000 |

| | Corporate Governance and Nominating | 6,750 |

| Meeting Attendance Fees | |

| | Board Meeting | - |

| | Committee Meeting | - |

| | (1) | These amounts are paid in US dollars for non-resident directors. |

During the fiscal year ended December 31, 2010, a total of $156,000 was earned by our Canadian directors and US$236,250 by our non-resident directors (excluding reimbursement of travel expenses).

| (ii) | Equity-based Compensation |

Unless otherwise determined by the Board, each non-executive director receives options to purchase Shares pursuant to our Stock Option Plan. Since May 4, 2010, each non-executive director receives annually 10,000 options to purchase Shares under our stock option plan. New incoming members to the Board also receive 20,000 options to purchase Shares upon joining the Board, with the exception of the Chairman of the Board who received 50,000 options upon joining the Board in March 2006. The Chairman of the Board further receives an additional annual grant of 5,000 options.

For fiscal 2010, Compensation Committee recommended that the annual grant of options to Directors be reduced by half from the preceding year. During the fiscal year ended December 31, 2010, we granted a total of 75,000 options to purchase Shares under our Stock Option Plan to our non-executive directors.

Director Compensation Table

The following table sets forth detailed amounts of compensation provided to each non-executive director1 of the Corporation for the fiscal year ended December 31, 2010.

| Name | Fees earned ($) | Option-based awards(1) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total ($) |

| Santo J. Costa | 88,140 | (2) | 14,241 | - | - | - | 102,381 |

| Julia R. Brown | 55,668 | (2) | 9,494 | - | - | - | 65,162 |

Richard J. MacKay(3) | 51,188 | | 9,494 | - | - | - | 60,682 |

| Frédéric Porte | 45,000 | | 9,494 | - | - | - | 54,494 |

Lawrence E. Posner(4) | 46,969 | (2) | 9,494 | - | - | - | 56,463 |

| Jacques L. Roy | 53,250 | | 9,494 | - | - | - | 62,744 |

Rachel R. Selisker(5) | 59,533 | (2) | 9,494 | - | - | - | 69,027 |

| (1) | The fair value of options granted was estimated at the date of grant using the Black-Scholes option pricing model based on the grant date closing price on the TSX of the Corporation’s Shares ($0.95 for 2010) and the following weighted average assumptions: |

| For the years ended December 31, | 2010 |

| Expected volatility | 82.08% |

| Expected life | 6.0 years |

| Risk-free interest rate | 3.38% |

| Dividend yield | n/a |

| | |

| | In developing the estimate of expected life, the Corporation has assumed that its recent historical stock option exercise experience is a relevant indicator of future exercise patterns. The Corporation based its determination of expected volatility on the historical market volatility of its shares. |

| (2) | Amounts in US dollars are converted into Canadian dollars using an average exchange rate over the period of US$1.00 to $1.03088. |

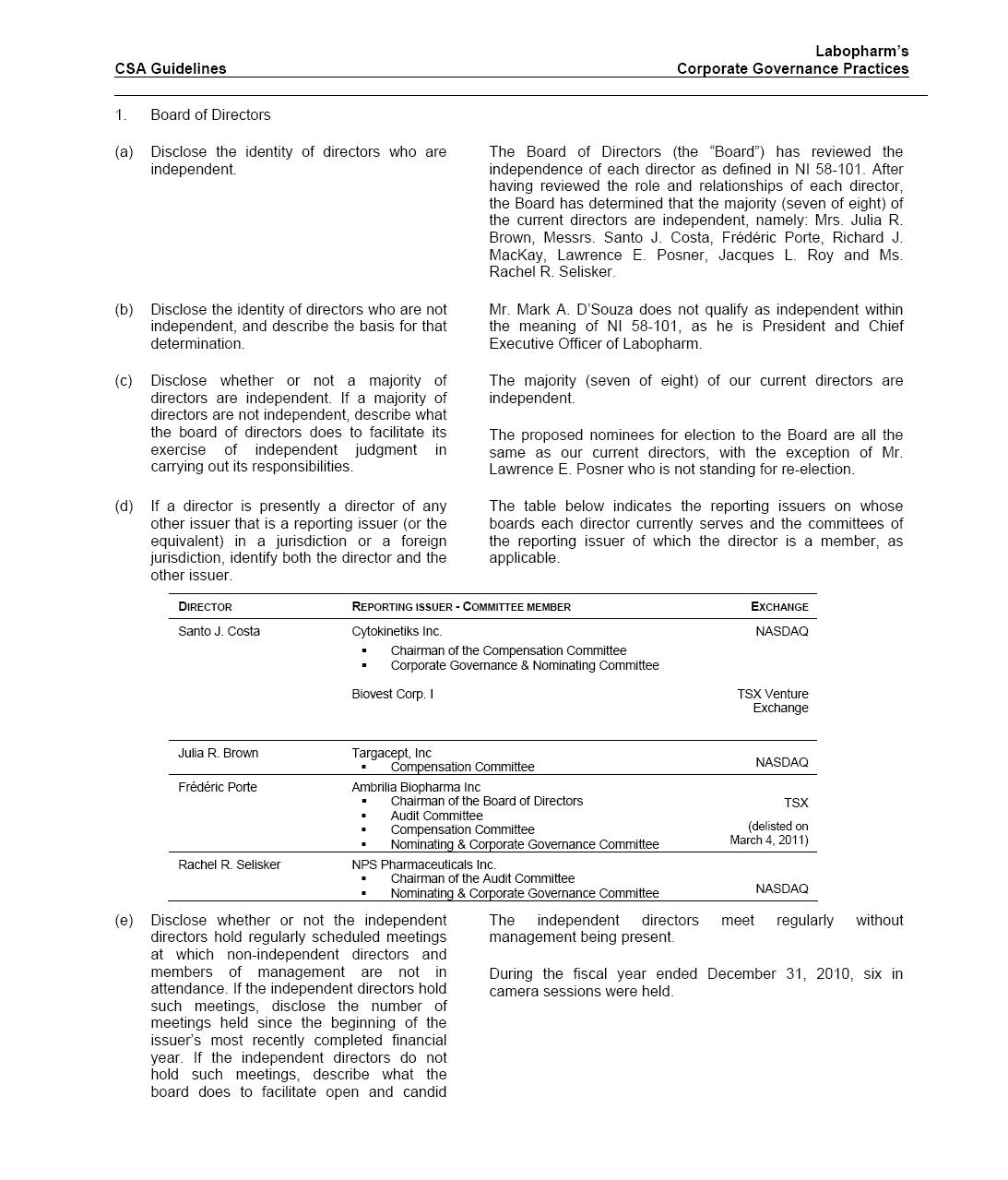

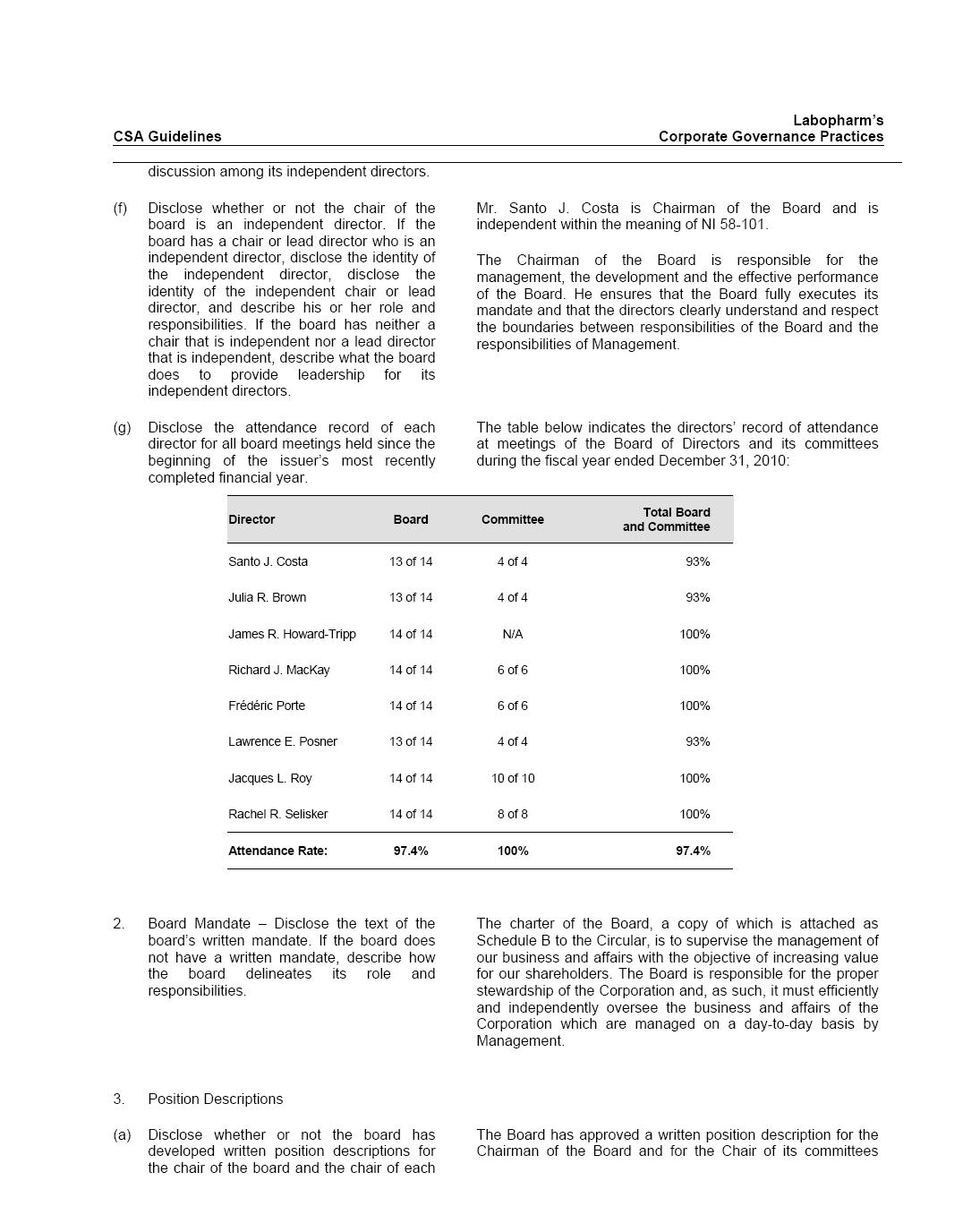

| (3) | Mr. MacKay was Chairman of the Corporate Governance and Nominating Committee until May 4, 2010, and remains a member of this Committee. He resigned as member of the Compensation Committee on May 4, 2010. |