Contact:

Matthew S. Stadler

Executive Vice President

Chief Financial Officer

Cohen & Steers, Inc.

Tel (212) 446-9168

COHEN & STEERS REPORTS THIRD QUARTER 2017 DILUTED EPS OF $0.53, OR $0.55, AS ADJUSTED

| |

| • | Ending AUM of $61.5 billion |

| |

| • | Net inflows of $1.4 billion; annualized organic growth rate of 9.2% |

| |

| • | Operating margin of 42.5% |

NEW YORK, NY, October 18, 2017—Cohen & Steers, Inc. (NYSE: CNS) reported earnings of $0.53 per diluted share for the quarter ended September 30, 2017, compared with $0.51 per diluted share for the quarter ended September 30, 2016 and $0.50 per diluted share for the quarter ended June 30, 2017. Adjusted earnings per diluted share were $0.55 for the quarter ended September 30, 2017, compared with $0.51 per diluted share for the quarter ended September 30, 2016 and $0.50 per diluted share for the quarter ended June 30, 2017.

Financial Highlights (Unaudited)

|

| | | | | | | | | | | |

| For the Periods | | | | | |

| (in thousands, except percentages and per share data) | Three Months Ended |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 |

| U.S. GAAP | | | | | |

| Revenue | $ | 96,354 |

| | $ | 92,812 |

| | $ | 94,388 |

|

| Expenses | $ | 55,381 |

| | $ | 55,455 |

| | $ | 57,175 |

|

| Operating income | $ | 40,973 |

| | $ | 37,357 |

| | $ | 37,213 |

|

| Operating margin | 42.5 | % | | 40.3 | % | | 39.4 | % |

| Non-operating income | $ | 2,327 |

| | $ | 261 |

| | $ | 1,356 |

|

| Net income attributable to common stockholders | $ | 25,082 |

| | $ | 23,474 |

| | $ | 23,877 |

|

| Diluted earnings per share | $ | 0.53 |

| | $ | 0.50 |

| | $ | 0.51 |

|

| | | | | | |

As Adjusted (1) | | | | | |

| Net income attributable to common stockholders | $ | 25,651 |

| | $ | 23,415 |

| | $ | 23,626 |

|

| Diluted earnings per share | $ | 0.55 |

| | $ | 0.50 |

| | $ | 0.51 |

|

| |

| (1) | The ”As Adjusted” financial measures represent non-GAAP financial measures. Please refer to the “Non-GAAP Reconciliation” on pages 18-19 of this release for a reconciliation to the most directly comparable U.S. GAAP financial measures. |

U.S. GAAP

This section discusses the financial results of the Company as presented in accordance with U.S. GAAP.

Revenue

Revenue for the third quarter of 2017 was $96.4 million, an increase of $3.6 million from $92.8 million for the second quarter of 2017. Higher average assets under management and one more day in the quarter resulted in the following changes in investment advisory and administration fees:

| |

• | Institutional account revenue increased $1.1 million to $26.0 million; |

| |

| • | Open-end fund revenue increased $2.2 million to $42.6 million; and |

| |

| • | Closed-end fund revenue increased $380,000 to $20.0 million. |

Expenses

Expenses for the third quarter of 2017 were $55.4 million, compared with $55.5 million for the second quarter of 2017. The change was primarily due to:

| |

| • | Increased employee compensation and benefits of $1.5 million, primarily due to increases in incentive compensation and severance costs aggregating to approximately $1.3 million; |

| |

| • | Lower general and administrative expenses of $837,000, primarily due to a refund of foreign withholding tax related to prior years of approximately $950,000; and |

| |

| • | Lower distribution and service fees of $582,000, primarily due to a shift in the composition of assets under management to lower cost share classes. |

Operating Margin

Operating margin was 42.5% for the third quarter of 2017, compared with 40.3% for the second quarter of 2017.

Non-operating Income

Non-operating income for the third quarter of 2017 was $2.3 million, compared with $261,000 for the second quarter of 2017. The change was primarily attributable to earnings from the Company’s seed investments, including unrealized gains of approximately $1.1 million and the associated interest and dividend income of approximately $551,000.

Income Taxes

The effective tax rate for the third quarter of 2017 was 41.2%, compared with 38.4% for the second quarter of 2017. The effective tax rate for the third quarter included discrete items, partially offset by the cumulative effect of a change in the Company’s estimated effective tax rate for the year to 38.6%.

As Adjusted

The term “As Adjusted” is used to identify non-GAAP financial information in the discussion below. Please refer to the “Non-GAAP Reconciliation” on pages 18-19 of this release for a reconciliation to the most directly comparable U.S. GAAP financial measures.

Revenue

Revenue, as adjusted, for the third quarter of 2017 was $96.5 million, compared with $92.9 million for the second quarter of 2017. Revenue, as adjusted, includes investment advisory and administration fees attributable to the Company’s consolidated seed investments.

Expenses

Total operating expenses, as adjusted, for the third quarter of 2017 were $56.0 million, compared with $55.4 million for the second quarter of 2017. Total operating expenses, as adjusted, excludes general and administrative expenses attributable to the Company’s consolidated seed investments, employee compensation and benefits related to the accelerated vesting of certain restricted stock units during the quarter, and a refund of foreign withholding tax for prior years.

Operating Margin

Operating margin, as adjusted, was 41.9% for the third quarter of 2017, compared with 40.3% for the second quarter of 2017.

Non-Operating Income

Non-operating income, as adjusted, for the third quarter of 2017 was $471,000, compared with $325,000 for the second quarter of 2017. Non-operating income, as adjusted, excludes the results from the Company's seed investments.

Income Taxes

The effective tax rate, as adjusted, for the third quarter of 2017 was 37.3%, compared with 38.0% for the second quarter of 2017. The effective tax rate, as adjusted, excludes discrete items recorded during the quarter and the tax effects of other non-GAAP adjustments, as well as the cumulative effect of a change in the Company’s estimated effective tax rate, as adjusted, for the year to 37.75%.

Assets Under Management Highlights (Unaudited)

September 30, 2017 Compared with June 30, 2017

|

| | | | | | | | | | |

| (in millions) | As of | | |

| By Investment Vehicle | September 30, 2017 | | June 30, 2017 | | % Change |

| Institutional accounts | $ | 29,631 |

| | $ | 29,457 |

| | 0.6 | % |

| Open-end funds | 22,516 |

| | 21,613 |

| | 4.2 | % |

| Closed-end funds | 9,374 |

| | 9,367 |

| | 0.1 | % |

| Total | $ | 61,521 |

| | $ | 60,437 |

| | 1.8 | % |

| | | | | | |

| By Investment Strategy | | | | | |

| U.S. real estate | $ | 28,233 |

| | $ | 28,896 |

| | (2.3 | %) |

| Preferred securities | 12,709 |

| | 11,749 |

| | 8.2 | % |

| Global/international real estate | 10,445 |

| | 10,121 |

| | 3.2 | % |

| Global listed infrastructure | 6,771 |

| | 6,394 |

| | 5.9 | % |

| Other | 3,363 |

| | 3,277 |

| | 2.6 | % |

| Total | $ | 61,521 |

| | $ | 60,437 |

| | 1.8 | % |

Assets under management were $61.5 billion as of September 30, 2017, an increase of $1.1 billion from $60.4 billion at June 30, 2017. The increase from June 30, 2017 was attributable to net inflows of $1.4 billion and market appreciation of $719 million, partially offset by distributions of $1.0 billion.

Institutional Accounts

Assets under management in institutional accounts were $29.6 billion as of September 30, 2017, an increase of 0.6% from $29.5 billion at June 30, 2017. The change from June 30, 2017 was due to the following:

| |

| • | Net outflows of $275 million from Japan subadvised accounts, including $274 million from U.S. real estate; |

| |

| • | Distributions from Japan subadvised accounts of $731 million, including $686 million from U.S. real estate; |

| |

| • | Net outflows of $221 million from subadvised accounts excluding Japan, including $147 million from large cap value (included in "Other" in the table above) and $125 million from global listed infrastructure, partially offset by net inflows of $27 million into preferred securities; |

| |

| • | Net inflows of $1.0 billion from advised accounts, including $401 million into global listed infrastructure, $302 million into preferred securities and $153 million into real assets multi-strategy (included in "Other" in the table above); |

| |

| • | Market appreciation of $363 million, including $174 million from global/international real estate, $78 million from global listed infrastructure and $33 million from preferred securities; and |

| |

| • | Net transfers of $16 million into advised accounts from open-end funds. |

Open-end Funds

Assets under management in open-end funds were $22.5 billion as of September 30, 2017, an increase of 4.2% from $21.6 billion at June 30, 2017. The change from June 30, 2017 was due to the following:

| |

| • | Net inflows of $869 million, including $564 million into preferred securities and $291 million into U.S. real estate; |

| |

| • | Market appreciation of $227 million, including $136 million from preferred securities and $45 million from global/international real estate; |

| |

| • | Distributions of $177 million, including $104 million from preferred securities and $71 million from U.S. real estate; and |

| |

| • | Net transfers of $16 million from open-end funds into institutional advised accounts. |

Closed-end Funds

Assets under management in closed-end funds were $9.4 billion at both September 30, 2017 and June 30, 2017 as market appreciation of $129 million was offset by distributions of $122 million.

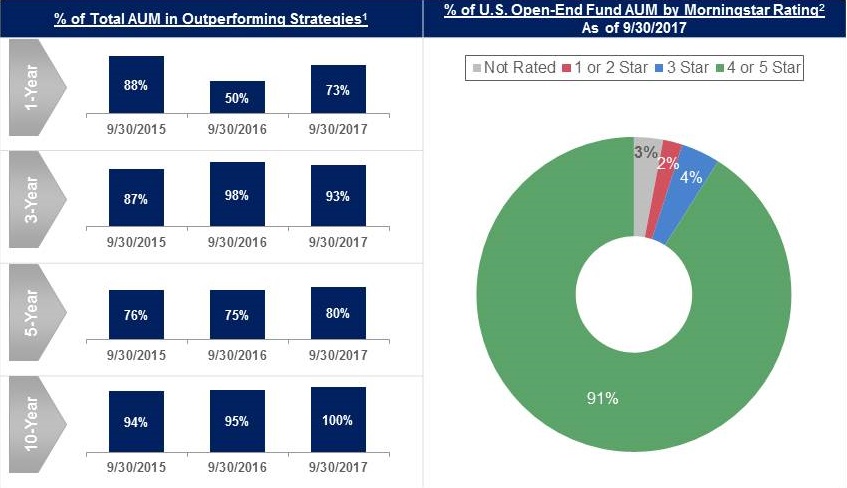

Investment Performance as of September 30, 2017

| |

| (1) | Past performance is no guarantee of future results. Outperformance is determined by annualized investment performance of all accounts in each investment strategy measured gross of fees and net of withholding taxes in comparison to the performance of each account’s reference benchmark measured net of withholding taxes, where applicable. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers. |

| |

| (2) | © 2017 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Morningstar calculates its ratings based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. Past performance is no guarantee of future results. Based on independent rating by Morningstar, Inc. of investment performance of each Cohen & Steers-sponsored open-end U.S.-registered mutual fund for all share classes for the overall period as of September 30, 2017. Overall Morningstar rating is a weighted average based on the 3-year, 5-year and 10-year Morningstar rating. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers. |

Balance Sheet Information

As of September 30, 2017, cash, cash equivalents and seed investments were $261 million. As of September 30, 2017, stockholders’ equity was $309 million and the Company had no debt.

Conference Call Information

Cohen & Steers will host a conference call tomorrow, October 19, 2017 at 9:00 a.m. (ET) to discuss the Company’s third quarter results. Investors and analysts can access the live conference call by dialing 800-659-2165 (U.S.) or +1-303-223-4361 (international); passcode: 21860071. Participants should plan to register at least 10 minutes before the conference call begins. The presentation that will be reviewed as part of the conference call is available on the Company’s website at www.cohenandsteers.com under “Company - Press Releases.”

A replay of the call will be available for two weeks starting at approximately 11:00 a.m. (ET) on October 19, 2017 and can be accessed at 800-633-8284 (U.S.) or +1-402-977-9140 (international); passcode: 21860071. Internet access to the webcast, which includes audio (listen-only), will be available on the Company’s website at www.cohenandsteers.com under “Company - Investor Relations.” The webcast will be archived on the website for one month.

About Cohen & Steers

Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Hong Kong, Tokyo and Seattle.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect management’s current views with respect to, among other things, the Company’s operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these forward-looking statements. The Company believes that these factors include, but are not limited to, the risks described in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 (the Form 10-K), which is accessible on the Securities and Exchange Commission’s website at www.sec.gov and on the Company’s website at www.cohenandsteers.com. These factors are not exhaustive and should be read in conjunction with the other cautionary statements that are included in the Company’s Form 10-K and other filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

# # # #

|

| | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | | | |

| For the Periods | | | | | | | | | |

| (in thousands, except per share data) | | | | | | | | | |

| | | | | | | | | | |

| | Three Months Ended | | % Change From |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 | | June 30, 2017 | | September 30, 2016 |

| Revenue | | | | | | | | | |

| Investment advisory and administration fees | $ | 88,557 |

| | $ | 84,893 |

| | $ | 86,079 |

| | | | |

| Distribution and service fees | 5,070 |

| | 5,104 |

| | 5,296 |

| | | | |

| Portfolio consulting and other | 2,727 |

| | 2,815 |

| | 3,013 |

| | | | |

| Total revenue | 96,354 |

| | 92,812 |

| | 94,388 |

| | 3.8 | % | | 2.1 | % |

| Expenses | | | | | | | | | |

| Employee compensation and benefits | 31,886 |

| | 30,412 |

| | 30,951 |

| | | | |

| Distribution and service fees | 9,575 |

| | 10,157 |

| | 11,092 |

| | | | |

| General and administrative | 12,222 |

| | 13,059 |

| | 13,128 |

| | | | |

| Depreciation and amortization | 1,698 |

| | 1,827 |

| | 2,004 |

| | | | |

| Total expenses | 55,381 |

| | 55,455 |

| | 57,175 |

| | (0.1 | %) | | (3.1 | %) |

| Operating income | 40,973 |

| | 37,357 |

| | 37,213 |

| | 9.7 | % | | 10.1 | % |

| Non-operating income (loss) | | | | | | | | | |

| Interest and dividend income—net | 1,425 |

| | 786 |

| | 367 |

| | | | |

| Gains (losses) from seed investments—net | 912 |

| | (194 | ) | | 698 |

| | | | |

| Other gains (losses)—net | (10 | ) | | (331 | ) | | 291 |

| | | | |

| Total non-operating income (loss) | 2,327 |

| | 261 |

| | 1,356 |

| | 791.6 | % | | 71.6 | % |

| Income before provision for income taxes | 43,300 |

| | 37,618 |

| | 38,569 |

| | 15.1 | % | | 12.3 | % |

| Provision for income taxes | 17,562 |

| | 14,620 |

| | 14,738 |

| | | | |

| Net income | 25,738 |

| | 22,998 |

| | 23,831 |

| | 11.9 | % | | 8.0 | % |

| Less: Net (income) loss attributable to redeemable noncontrolling interest | (656 | ) | | 476 |

| | 46 |

| | | | |

| Net income attributable to common stockholders | $ | 25,082 |

| | $ | 23,474 |

| | $ | 23,877 |

| | 6.9 | % | | 5.0 | % |

| | | | | | | | | | |

| Earnings per share attributable to common stockholders | | | | | | | | | |

| Basic | $ | 0.54 |

| | $ | 0.51 |

| | $ | 0.52 |

| | 6.8 | % | | 4.2 | % |

| Diluted | $ | 0.53 |

| | $ | 0.50 |

| | $ | 0.51 |

| | 6.5 | % | | 3.9 | % |

| | | | | | | | | | |

| Dividends declared per share | | | | | | | | |

|

|

| Quarterly | $ | 0.28 |

| | $ | 0.28 |

| | $ | 0.26 |

| | — |

| | 7.7 | % |

| | | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | 46,386 |

| | 46,373 |

| | 45,999 |

| | | | |

| Diluted | 47,047 |

| | 46,902 |

| | 46,544 |

| | | | |

|

| | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | |

| For the Periods | | | | | |

| (in thousands, except per share data) | | | | | |

| | | | | | |

| | Nine Months Ended | | |

| | September 30, 2017 | | September 30, 2016 | | % Change |

| Revenue | | | | | |

| Investment advisory and administration fees | $ | 255,353 |

| | $ | 238,257 |

| | |

| Distribution and service fees | 15,220 |

| | 14,200 |

| | |

| Portfolio consulting and other | 8,279 |

| | 7,985 |

| | |

| Total revenue | 278,852 |

| | 260,442 |

| | 7.1 | % |

| Expenses | | | | | |

| Employee compensation and benefits | 91,681 |

| | 87,278 |

| | |

| Distribution and service fees | 29,512 |

| | 29,567 |

| | |

| General and administrative | 38,211 |

| | 38,352 |

| | |

| Depreciation and amortization | 5,590 |

| | 5,594 |

| | |

| Total expenses | 164,994 |

| | 160,791 |

| | 2.6 | % |

| Operating income | 113,858 |

| | 99,651 |

| | 14.3 | % |

| Non-operating income (loss) | | | | | |

| Interest and dividend income—net | 2,710 |

| | 1,467 |

| | |

| Gains (losses) from seed investments—net | 737 |

| | 4,703 |

| | |

| Other gains (losses)—net | (632 | ) | | 295 |

| | |

| Total non-operating income (loss) | 2,815 |

| | 6,465 |

| | (56.5 | %) |

| Income before provision for income taxes | 116,673 |

| | 106,116 |

| | 9.9 | % |

| Provision for income taxes | 44,993 |

| | 39,497 |

| | |

| Net income | 71,680 |

| | 66,619 |

| | 7.6 | % |

| Less: Net (income) loss attributable to redeemable noncontrolling interest | (139 | ) | | 149 |

| | |

| Net income attributable to common stockholders | $ | 71,541 |

| | $ | 66,768 |

| | 7.1 | % |

| | | | | | |

| Earnings per share attributable to common stockholders | | | | | |

| Basic | $ | 1.54 |

| | $ | 1.45 |

| | 6.2 | % |

| Diluted | $ | 1.53 |

| | $ | 1.44 |

| | 6.0 | % |

| | | | | | |

| Dividends declared per share | | | | | |

| Quarterly | $ | 0.84 |

| | $ | 0.78 |

| | 7.7 | % |

| | | | | | |

| Weighted average shares outstanding | | | | | |

| Basic | 46,335 |

| | 45,931 |

| | |

| Diluted | 46,858 |

| | 46,373 |

| | |

|

| | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | |

| By Investment Vehicle | | | | | | | | | |

| For the Periods | | | | | | | | | |

| (in millions) | | | | | | | | | |

| | Three Months Ended | | % Change From |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 | | June 30, 2017 | | September 30, 2016 |

| Institutional Accounts | | | | | | | | | |

| Assets under management, beginning of period | $ | 29,457 |

| | $ | 28,935 |

| | $ | 29,581 |

| | | | |

| Inflows | 1,677 |

| | 1,031 |

| | 1,612 |

| | | �� | |

| Outflows | (1,151 | ) | | (588 | ) | | (636 | ) | | | | |

| Net inflows (outflows) | 526 |

| | 443 |

| | 976 |

| | | | |

| Market appreciation (depreciation) | 363 |

| | 881 |

| | 219 |

| | | | |

| Distributions | (731 | ) | | (849 | ) | | (828 | ) | | | | |

| Transfers | 16 |

| | 47 |

| | — |

| | | | |

| Total increase (decrease) | 174 |

| | 522 |

| | 367 |

| | | | |

| Assets under management, end of period | $ | 29,631 |

| | $ | 29,457 |

| | $ | 29,948 |

| | 0.6 | % | | (1.1 | %) |

| Percentage of total assets under management | 48.2 | % | | 48.7 | % | | 49.5 | % | | | | |

| Average assets under management for period | $ | 29,659 |

| | $ | 29,219 |

| | $ | 30,138 |

| | 1.5 | % | | (1.6 | %) |

| | | | | | | | | | |

| Open-end Funds | | | | | | | | | |

| Assets under management, beginning of period | $ | 21,613 |

| | $ | 20,361 |

| | $ | 19,777 |

| | | | |

| Inflows | 2,297 |

| | 2,435 |

| | 2,592 |

| | | | |

| Outflows | (1,428 | ) | | (1,548 | ) | | (1,322 | ) | | | | |

| Net inflows (outflows) | 869 |

| | 887 |

| | 1,270 |

| | | | |

| Market appreciation (depreciation) | 227 |

| | 674 |

| | 275 |

| | | | |

| Distributions | (177 | ) | | (262 | ) | | (157 | ) | | | | |

| Transfers | (16 | ) | | (47 | ) | | — |

| | | | |

| Total increase (decrease) | 903 |

| | 1,252 |

| | 1,388 |

| | | | |

| Assets under management, end of period | $ | 22,516 |

| | $ | 21,613 |

| | $ | 21,165 |

| | 4.2 | % | | 6.4 | % |

| Percentage of total assets under management | 36.6 | % | | 35.8 | % | | 35.0 | % | | | | |

| Average assets under management for period | $ | 22,159 |

| | $ | 21,093 |

| | $ | 20,863 |

| | 5.1 | % | | 6.2 | % |

| | | | | | | | | | |

| Closed-end Funds | | | | | | | | | |

| Assets under management, beginning of period | $ | 9,367 |

| | $ | 9,218 |

| | $ | 9,391 |

| | | | |

| Inflows | — |

| | — |

| | — |

| | | | |

| Outflows | — |

| | — |

| | — |

| | | | |

| Net inflows (outflows) | — |

| | — |

| | — |

| | | | |

| Market appreciation (depreciation) | 129 |

| | 271 |

| | 115 |

| | | | |

| Distributions | (122 | ) | | (122 | ) | | (122 | ) | | | | |

| Total increase (decrease) | 7 |

| | 149 |

| | (7 | ) | | | | |

| Assets under management, end of period | $ | 9,374 |

| | $ | 9,367 |

| | $ | 9,384 |

| | 0.1 | % | | (0.1 | %) |

| Percentage of total assets under management | 15.2 | % | | 15.5 | % | | 15.5 | % | | | | |

| Average assets under management for period | $ | 9,428 |

| | $ | 9,345 |

| | $ | 9,516 |

| | 0.9 | % | | (0.9 | %) |

| | | | | | | | | | |

| Total | | | | | | | | | |

| Assets under management, beginning of period | $ | 60,437 |

| | $ | 58,514 |

| | $ | 58,749 |

| | | | |

| Inflows | 3,974 |

| | 3,466 |

| | 4,204 |

| | | | |

| Outflows | (2,579 | ) | | (2,136 | ) | | (1,958 | ) | | | | |

| Net inflows (outflows) | 1,395 |

| | 1,330 |

| | 2,246 |

| | | | |

| Market appreciation (depreciation) | 719 |

| | 1,826 |

| | 609 |

| | | | |

| Distributions | (1,030 | ) | | (1,233 | ) | | (1,107 | ) | | | | |

| Total increase (decrease) | 1,084 |

| | 1,923 |

| | 1,748 |

| | | | |

| Assets under management, end of period | $ | 61,521 |

| | $ | 60,437 |

| | $ | 60,497 |

| | 1.8 | % | | 1.7 | % |

| Average assets under management for period | $ | 61,246 |

| | $ | 59,657 |

| | $ | 60,517 |

| | 2.7 | % | | 1.2 | % |

|

| | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | |

| Assets Under Management (Unaudited) | | | | | |

| By Investment Vehicle | | | | | |

| For the Periods | | | | | |

| (in millions) | | | | | |

| | Nine Months Ended | | |

| | September 30, 2017 | | September 30, 2016 | | % Change |

| Institutional Accounts | | | | | |

| Assets under management, beginning of period | $ | 28,659 |

| | $ | 26,105 |

| | |

| Inflows | 3,552 |

| | 5,010 |

| | |

| Outflows | (2,268 | ) | | (1,705 | ) | | |

| Net inflows (outflows) | 1,284 |

| | 3,305 |

| | |

| Market appreciation (depreciation) | 1,887 |

| | 2,771 |

| | |

| Distributions | (2,391 | ) | | (2,233 | ) | | |

| Transfers | 192 |

| | — |

| | |

| Total increase (decrease) | 972 |

| | 3,843 |

| | |

| Assets under management, end of period | $ | 29,631 |

| | $ | 29,948 |

| | (1.1 | %) |

| Percentage of total assets under management | 48.2 | % | | 49.5 | % | | |

| Average assets under management for period | $ | 29,302 |

| | $ | 27,998 |

| | 4.7 | % |

| | | | | | |

| Open-end Funds | | | | | |

| Assets under management, beginning of period | $ | 19,576 |

| | $ | 17,460 |

| | |

| Inflows | 7,048 |

| | 7,007 |

| | |

| Outflows | (4,702 | ) | | (4,262 | ) | | |

| Net inflows (outflows) | 2,346 |

| | 2,745 |

| | |

| Market appreciation (depreciation) | 1,399 |

| | 1,625 |

| | |

| Distributions | (613 | ) | | (665 | ) | | |

| Transfers | (192 | ) | | — |

| | |

| Total increase (decrease) | 2,940 |

| | 3,705 |

| | |

| Assets under management, end of period | $ | 22,516 |

| | $ | 21,165 |

| | 6.4 | % |

| Percentage of total assets under management | 36.6 | % | | 35.0 | % | | |

| Average assets under management for period | $ | 21,132 |

| | $ | 18,892 |

| | 11.9 | % |

| | | | | | |

| Closed-end Funds | | | | | |

| Assets under management, beginning of period | $ | 8,963 |

| | $ | 9,029 |

| | |

| Inflows | — |

| | — |

| | |

| Outflows | — |

| | (86 | ) | | |

| Net inflows (outflows) | — |

| | (86 | ) | | |

| Market appreciation (depreciation) | 777 |

| | 808 |

| | |

| Distributions | (366 | ) | | (367 | ) | | |

| Total increase (decrease) | 411 |

| | 355 |

| | |

| Assets under management, end of period | $ | 9,374 |

| | $ | 9,384 |

| | (0.1 | %) |

| Percentage of total assets under management | 15.2 | % | | 15.5 | % | | |

| Average assets under management for period | $ | 9,308 |

| | $ | 9,141 |

| | 1.8 | % |

| | | | | | |

| Total | | | | | |

| Assets under management, beginning of period | $ | 57,198 |

| | $ | 52,594 |

| | |

| Inflows | 10,600 |

| | 12,017 |

| | |

| Outflows | (6,970 | ) | | (6,053 | ) | | |

| Net inflows (outflows) | 3,630 |

| | 5,964 |

| | |

| Market appreciation (depreciation) | 4,063 |

| | 5,204 |

| | |

| Distributions | (3,370 | ) | | (3,265 | ) | | |

| Total increase (decrease) | 4,323 |

| | 7,903 |

| | |

| Assets under management, end of period | $ | 61,521 |

| | $ | 60,497 |

| | 1.7 | % |

| Average assets under management for period | $ | 59,742 |

| | $ | 56,031 |

| | 6.6 | % |

|

| | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | |

| Assets Under Management - Institutional Accounts (Unaudited) | | | | | | |

| By Account Type | | | | | | | | | |

| For the Periods | | | | | | | | | |

| (in millions) | | | | | | | | | |

| | Three Months Ended | | % Change From |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 | | June 30, 2017 | | September 30, 2016 |

| Japan Subadvisory | | | | | | | | | |

| Assets under management, beginning of period | $ | 13,227 |

| | $ | 13,390 |

| | $ | 14,852 |

| | | | |

| Inflows | 352 |

| | 582 |

| | 1,084 |

| | | | |

| Outflows | (627 | ) | | (253 | ) | | (96 | ) | | | | |

| Net inflows (outflows) | (275 | ) | | 329 |

| | 988 |

| | | | |

| Market appreciation (depreciation) | 54 |

| | 357 |

| | (68 | ) | | | | |

| Distributions | (731 | ) | | (849 | ) | | (828 | ) | | | | |

| Total increase (decrease) | (952 | ) | | (163 | ) | | 92 |

| | | | |

| Assets under management, end of period | $ | 12,275 |

| | $ | 13,227 |

| | $ | 14,944 |

| | (7.2 | %) | | (17.9 | %) |

| Percentage of institutional assets under management | 41.4 | % | | 44.9 | % | | 49.9 | % | | | | |

| Average assets under management for period | $ | 12,625 |

| | $ | 13,271 |

| | $ | 15,025 |

| | (4.9 | %) | | (16.0 | %) |

| | | | | | | | | | |

| Subadvisory Excluding Japan | | | | | | | | | |

| Assets under management, beginning of period | $ | 6,356 |

| | $ | 6,128 |

| | $ | 5,782 |

| | | | |

| Inflows | 161 |

| | 168 |

| | 374 |

| | | | |

| Outflows | (382 | ) | | (176 | ) | | (223 | ) | | | | |

| Net inflows (outflows) | (221 | ) | | (8 | ) | | 151 |

| | | | |

| Market appreciation (depreciation) | 125 |

| | 236 |

| | 115 |

| | | | |

| Total increase (decrease) | (96 | ) | | 228 |

| | 266 |

| | | | |

| Assets under management, end of period | $ | 6,260 |

| | $ | 6,356 |

| | $ | 6,048 |

| | (1.5 | %) | | 3.5 | % |

| Percentage of institutional assets under management | 21.1 | % | | 21.6 | % | | 20.2 | % | | | | |

| Average assets under management for period | $ | 6,351 |

| | $ | 6,276 |

| | $ | 5,979 |

| | 1.2 | % | | 6.2 | % |

| | | | | | | | | | |

| Advisory | | | | | | | | | |

| Assets under management, beginning of period | $ | 9,874 |

| | $ | 9,417 |

| | $ | 8,947 |

| | | | |

| Inflows | 1,164 |

| | 281 |

| | 154 |

| | | | |

| Outflows | (142 | ) | | (159 | ) | | (317 | ) | | | | |

| Net inflows (outflows) | 1,022 |

| | 122 |

| | (163 | ) | | | | |

| Market appreciation (depreciation) | 184 |

| | 288 |

| | 172 |

| | | | |

| Transfers | 16 |

| | 47 |

| | — |

| | | | |

| Total increase (decrease) | 1,222 |

| | 457 |

| | 9 |

| | | | |

| Assets under management, end of period | $ | 11,096 |

| | $ | 9,874 |

| | $ | 8,956 |

| | 12.4 | % | | 23.9 | % |

| Percentage of institutional assets under management | 37.4 | % | | 33.5 | % | | 29.9 | % | | | | |

| Average assets under management for period | $ | 10,683 |

| | $ | 9,672 |

| | $ | 9,134 |

| | 10.5 | % | | 17.0 | % |

| | | | | | | | | | |

| Total Institutional Accounts | | | | | | | | | |

| Assets under management, beginning of period | $ | 29,457 |

| | $ | 28,935 |

| | $ | 29,581 |

| | | | |

| Inflows | 1,677 |

| | 1,031 |

| | 1,612 |

| | | | |

| Outflows | (1,151 | ) | | (588 | ) | | (636 | ) | | | | |

| Net inflows (outflows) | 526 |

| | 443 |

| | 976 |

| | | | |

| Market appreciation (depreciation) | 363 |

| | 881 |

| | 219 |

| | | | |

| Distributions | (731 | ) | | (849 | ) | | (828 | ) | | | | |

| Transfers | 16 |

| | 47 |

| | — |

| | | | |

| Total increase (decrease) | 174 |

| | 522 |

| | 367 |

| | | | |

| Assets under management, end of period | $ | 29,631 |

| | $ | 29,457 |

| | $ | 29,948 |

| | 0.6 | % | | (1.1 | %) |

| Average assets under management for period | $ | 29,659 |

| | $ | 29,219 |

| | $ | 30,138 |

| | 1.5 | % | | (1.6 | %) |

|

| | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | |

| Assets Under Management - Institutional Accounts (Unaudited) | | | |

| By Account Type | | | | | |

| For the Periods | | | | | |

| (in millions) | | | | | |

| | Nine Months Ended | | |

| | September 30, 2017 | | September 30, 2016 | | % Change |

| Japan Subadvisory | | | | | |

| Assets under management, beginning of period | $ | 13,699 |

| | $ | 13,112 |

| | |

| Inflows | 1,345 |

| | 2,858 |

| | |

| Outflows | (985 | ) | | (165 | ) | | |

| Net inflows (outflows) | 360 |

| | 2,693 |

| | |

| Market appreciation (depreciation) | 607 |

| | 1,372 |

| | |

| Distributions | (2,391 | ) | | (2,233 | ) | | |

| Total increase (decrease) | (1,424 | ) | | 1,832 |

| | |

| Assets under management, end of period | $ | 12,275 |

| | $ | 14,944 |

| | (17.9 | %) |

| Percentage of institutional assets under management | 41.4 | % | | 49.9 | % | | |

| Average assets under management for period | $ | 13,131 |

| | $ | 13,949 |

| | (5.9 | %) |

| | | | | | |

| Subadvisory Excluding Japan | | | | | |

| Assets under management, beginning of period | $ | 5,892 |

| | $ | 5,428 |

| | |

| Inflows | 514 |

| | 709 |

| | |

| Outflows | (701 | ) | | (638 | ) | | |

| Net inflows (outflows) | (187 | ) | | 71 |

| | |

| Market appreciation (depreciation) | 555 |

| | 549 |

| | |

| Total increase (decrease) | 368 |

| | 620 |

| | |

| Assets under management, end of period | $ | 6,260 |

| | $ | 6,048 |

| | 3.5 | % |

| Percentage of institutional assets under management | 21.1 | % | | 20.2 | % | | |

| Average assets under management for period | $ | 6,224 |

| | $ | 5,609 |

| | 11.0 | % |

| | | | | | |

| Advisory | | | | | |

| Assets under management, beginning of period | $ | 9,068 |

| | $ | 7,565 |

| | |

| Inflows | 1,693 |

| | 1,443 |

| | |

| Outflows | (582 | ) | | (902 | ) | | |

| Net inflows (outflows) | 1,111 |

| | 541 |

| | |

| Market appreciation (depreciation) | 725 |

| | 850 |

| | |

| Transfers | 192 |

| | — |

| | |

| Total increase (decrease) | 2,028 |

| | 1,391 |

| | |

| Assets under management, end of period | $ | 11,096 |

| | $ | 8,956 |

| | 23.9 | % |

| Percentage of institutional assets under management | 37.4 | % | | 29.9 | % | | |

| Average assets under management for period | $ | 9,947 |

| | $ | 8,440 |

| | 17.9 | % |

| | | | | | |

| Total Institutional Accounts | | | | | |

| Assets under management, beginning of period | $ | 28,659 |

| | $ | 26,105 |

| | |

| Inflows | 3,552 |

| | 5,010 |

| | |

| Outflows | (2,268 | ) | | (1,705 | ) | | |

| Net inflows (outflows) | 1,284 |

| | 3,305 |

| | |

| Market appreciation (depreciation) | 1,887 |

| | 2,771 |

| | |

| Distributions | (2,391 | ) | | (2,233 | ) | | |

| Transfers | 192 |

| | — |

| | |

| Total increase (decrease) | 972 |

| | 3,843 |

| | |

| Assets under management, end of period | $ | 29,631 |

| | $ | 29,948 |

| | (1.1 | %) |

| Average assets under management for period | $ | 29,302 |

| | $ | 27,998 |

| | 4.7 | % |

|

| | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | |

| By Investment Strategy | | | | | | | | | |

| For the Periods | | | | | | | | | |

| (in millions) | | | | | | | | | |

| | Three Months Ended | | % Change From |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 | | June 30, 2017 | | September 30, 2016 |

| U.S. Real Estate | | | | | | | | | |

| Assets under management, beginning of period | $ | 28,896 |

| | $ | 28,719 |

| | $ | 30,981 |

| | | | |

| Inflows | 1,491 |

| | 1,605 |

| | 2,141 |

| | | | |

| Outflows | (1,403 | ) | | (1,132 | ) | | (722 | ) | | | | |

| Net inflows (outflows) | 88 |

| | 473 |

| | 1,419 |

| | | | |

| Market appreciation (depreciation) | 62 |

| | 682 |

| | (135 | ) | | | | |

| Distributions | (803 | ) | | (978 | ) | | (890 | ) | | | | |

| Transfers | (10 | ) | | — |

| | (127 | ) | | | | |

| Total increase (decrease) | (663 | ) | | 177 |

| | 267 |

|

| | | |

| Assets under management, end of period | $ | 28,233 |

| | $ | 28,896 |

| | $ | 31,248 |

| | (2.3 | %) | | (9.6 | %) |

| Percentage of total assets under management | 45.9 | % | | 47.8 | % | | 51.7 | % | | | | |

| Average assets under management for period | $ | 28,573 |

| | $ | 28,898 |

| | $ | 31,552 |

| | (1.1 | %) | | (9.4 | %) |

| | | | | | | | | | |

| Preferred Securities | | | | | | | | | |

| Assets under management, beginning of period | $ | 11,749 |

| | $ | 10,560 |

| | $ | 9,082 |

| | | | |

| Inflows | 1,501 |

| | 1,430 |

| | 1,611 |

| | | | |

| Outflows | (606 | ) | | (535 | ) | | (435 | ) | | | | |

| Net inflows (outflows) | 895 |

| | 895 |

| | 1,176 |

| | | | |

| Market appreciation (depreciation) | 198 |

| | 420 |

| | 297 |

| | | | |

| Distributions | (133 | ) | | (126 | ) | | (115 | ) | | | | |

| Total increase (decrease) | 960 |

| | 1,189 |

| | 1,358 |

| | | | |

| Assets under management, end of period | $ | 12,709 |

| | $ | 11,749 |

| | $ | 10,440 |

| | 8.2 | % | | 21.7 | % |

| Percentage of total assets under management | 20.7 | % | | 19.4 | % | | 17.3 | % | | | | |

| Average assets under management for period | $ | 12,258 |

| | $ | 11,125 |

| | $ | 9,937 |

| | 10.2 | % | | 23.4 | % |

| | | | | | | | | | |

| Global/International Real Estate | | | | | | | | | |

| Assets under management, beginning of period | $ | 10,121 |

| | $ | 9,785 |

| | $ | 9,984 |

| | | | |

| Inflows | 351 |

| | 225 |

| | 231 |

| | | | |

| Outflows | (215 | ) | | (341 | ) | | (554 | ) | | | | |

| Net inflows (outflows) | 136 |

| | (116 | ) | | (323 | ) | | | | |

| Market appreciation (depreciation) | 221 |

| | 516 |

| | 314 |

| | | | |

| Distributions | (43 | ) | | (64 | ) | | (46 | ) | | | | |

| Transfers | 10 |

| | — |

| | 127 |

| | | | |

| Total increase (decrease) | 324 |

| | 336 |

| | 72 |

| | | | |

| Assets under management, end of period | $ | 10,445 |

| | $ | 10,121 |

| | $ | 10,056 |

| | 3.2 | % | | 3.9 | % |

| Percentage of total assets under management | 17.0 | % | | 16.7 | % | | 16.6 | % | | | | |

| Average assets under management for period | $ | 10,360 |

| | $ | 10,022 |

| | $ | 10,256 |

| | 3.4 | % | | 1.0 | % |

|

| | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | |

| By Investment Strategy - continued | | | | | | | | | |

| For the Periods | | | | | | | | | |

| (in millions) | | | | | | | | | |

| | Three Months Ended | | % Change From |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 | | June 30, 2017 | | September 30, 2016 |

| Global Listed Infrastructure | | | | | | | | | |

| Assets under management, beginning of period | $ | 6,394 |

| | $ | 6,204 |

| | $ | 5,760 |

| | | | |

| Inflows | 441 |

| | 121 |

| | 141 |

| | | | |

| Outflows | (168 | ) | | (88 | ) | | (77 | ) | | | | |

| Net inflows (outflows) | 273 |

| | 33 |

| | 64 |

| | | | |

| Market appreciation (depreciation) | 146 |

| | 202 |

| | 80 |

| | | | |

| Distributions | (42 | ) | | (45 | ) | | (42 | ) | | | | |

| Total increase (decrease) | 377 |

| | 190 |

| | 102 |

| | | | |

| Assets under management, end of period | $ | 6,771 |

| | $ | 6,394 |

| | $ | 5,862 |

| | 5.9 | % | | 15.5 | % |

| Percentage of total assets under management | 11.0 | % | | 10.6 | % | | 9.7 | % | | | | |

| Average assets under management for period | $ | 6,758 |

| | $ | 6,347 |

| | $ | 5,854 |

| | 6.5 | % | | 15.4 | % |

| | | | | | | | | | |

| Other | | | | | | | | | |

| Assets under management, beginning of period | $ | 3,277 |

| | $ | 3,246 |

| | $ | 2,942 |

| | | | |

| Inflows | 190 |

| | 85 |

| | 80 |

| | | | |

| Outflows | (187 | ) | | (40 | ) | | (170 | ) | | | | |

| Net inflows (outflows) | 3 |

| | 45 |

| | (90 | ) | | | | |

| Market appreciation (depreciation) | 92 |

| | 6 |

| | 53 |

| | | | |

| Distributions | (9 | ) | | (20 | ) | | (14 | ) | | | | |

| Total increase (decrease) | 86 |

| | 31 |

| | (51 | ) | | | | |

| Assets under management, end of period | $ | 3,363 |

| | $ | 3,277 |

| | $ | 2,891 |

| | 2.6 | % | | 16.3 | % |

| Percentage of total assets under management | 5.5 | % | | 5.4 | % | | 4.8 | % | | | | |

| Average assets under management for period | $ | 3,297 |

| | $ | 3,265 |

| | $ | 2,918 |

| | 1.0 | % | | 13.0 | % |

| | | | | | | | | | |

| Total | | | | | | | | | |

| Assets under management, beginning of period | $ | 60,437 |

| | $ | 58,514 |

| | $ | 58,749 |

| | | | |

| Inflows | 3,974 |

| | 3,466 |

| | 4,204 |

| | | | |

| Outflows | (2,579 | ) | | (2,136 | ) | | (1,958 | ) | | | | |

| Net inflows (outflows) | 1,395 |

| | 1,330 |

| | 2,246 |

| | | | |

| Market appreciation (depreciation) | 719 |

| | 1,826 |

| | 609 |

| | | | |

| Distributions | (1,030 | ) | | (1,233 | ) | | (1,107 | ) | | | | |

| Total increase (decrease) | 1,084 |

| | 1,923 |

| | 1,748 |

| | | | |

| Assets under management, end of period | $ | 61,521 |

| | $ | 60,437 |

| | $ | 60,497 |

| | 1.8 | % | | 1.7 | % |

| Average assets under management for period | $ | 61,246 |

| | $ | 59,657 |

| | $ | 60,517 |

| | 2.7 | % | | 1.2 | % |

|

| | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | |

| Assets Under Management (Unaudited) | | | | | |

| By Investment Strategy | | | | | |

| For the Periods | | | | | |

| (in millions) | | | | | |

| | Nine Months Ended | | |

| | September 30, 2017 | | September 30, 2016 | | % Change |

| U.S. Real Estate | | | | | |

| Assets under management, beginning of period | $ | 28,927 |

| | $ | 27,814 |

| | |

| Inflows | 4,537 |

| | 5,930 |

| | |

| Outflows | (3,692 | ) | | (2,526 | ) | | |

| Net inflows (outflows) | 845 |

| | 3,404 |

| | |

| Market appreciation (depreciation) | 1,142 |

| | 2,769 |

| | |

| Distributions | (2,671 | ) | | (2,612 | ) | | |

| Transfers | (10 | ) | | (127 | ) | | |

| Total increase (decrease) | (694 | ) | | 3,434 |

| | |

| Assets under management, end of period | $ | 28,233 |

| | $ | 31,248 |

| | (9.6 | %) |

| Percentage of total assets under management | 45.9 | % | | 51.7 | % | | |

| Average assets under management for period | $ | 28,803 |

| | $ | 29,278 |

| | (1.6 | %) |

| | | | | | |

| Preferred Securities | | | | | |

| Assets under management, beginning of period | $ | 9,880 |

| | $ | 7,705 |

| | |

| Inflows | 4,030 |

| | 3,903 |

| | |

| Outflows | (1,827 | ) | | (1,447 | ) | | |

| Net inflows (outflows) | 2,203 |

| | 2,456 |

| | |

| Market appreciation (depreciation) | 1,007 |

| | 610 |

| | |

| Distributions | (381 | ) | | (331 | ) | | |

| Total increase (decrease) | 2,829 |

| | 2,735 |

| | |

| Assets under management, end of period | $ | 12,709 |

| | $ | 10,440 |

| | 21.7 | % |

| Percentage of total assets under management | 20.7 | % | | 17.3 | % | | |

| Average assets under management for period | $ | 11,210 |

| | $ | 8,773 |

| | 27.8 | % |

| | | | | | |

| Global/International Real Estate | | | | | |

| Assets under management, beginning of period | $ | 9,403 |

| | $ | 9,476 |

| | |

| Inflows | 965 |

| | 1,193 |

| | |

| Outflows | (756 | ) | | (1,512 | ) | | |

| Net inflows (outflows) | 209 |

| | (319 | ) | | |

| Market appreciation (depreciation) | 971 |

| | 926 |

| | |

| Distributions | (148 | ) | | (154 | ) | | |

| Transfers | 10 |

| | 127 |

| | |

| Total increase (decrease) | 1,042 |

| | 580 |

| | |

| Assets under management, end of period | $ | 10,445 |

| | $ | 10,056 |

| | 3.9 | % |

| Percentage of total assets under management | 17.0 | % | | 16.6 | % | | |

| Average assets under management for period | $ | 10,099 |

| | $ | 9,869 |

| | 2.3 | % |

|

| | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | |

| Assets Under Management (Unaudited) | | | | | |

| By Investment Strategy - continued | | | | | |

| For the Periods | | | | | |

| (in millions) | | | | | |

| | Nine Months Ended | | |

| | September 30, 2017 | | September 30, 2016 | | % Change |

| Global Listed Infrastructure | | | | | |

| Assets under management, beginning of period | $ | 5,697 |

| | $ | 5,147 |

| | |

| Inflows | 719 |

| | 477 |

| | |

| Outflows | (297 | ) | | (304 | ) | | |

| Net inflows (outflows) | 422 |

| | 173 |

| | |

| Market appreciation (depreciation) | 781 |

| | 670 |

| | |

| Distributions | (129 | ) | | (128 | ) | | |

| Total increase (decrease) | 1,074 |

| | 715 |

| | |

| Assets under management, end of period | $ | 6,771 |

| | $ | 5,862 |

| | 15.5 | % |

| Percentage of total assets under management | 11.0 | % | | 9.7 | % | | |

| Average assets under management for period | $ | 6,347 |

| | $ | 5,449 |

| | 16.5 | % |

| | | | | | |

| Other | | | | | |

| Assets under management, beginning of period | $ | 3,291 |

| | $ | 2,452 |

| | |

| Inflows | 349 |

| | 514 |

| | |

| Outflows | (398 | ) | | (264 | ) | | |

| Net inflows (outflows) | (49 | ) | | 250 |

| | |

| Market appreciation (depreciation) | 162 |

| | 229 |

| | |

| Distributions | (41 | ) | | (40 | ) | | |

| Total increase (decrease) | 72 |

| | 439 |

| | |

| Assets under management, end of period | $ | 3,363 |

| | $ | 2,891 |

| | 16.3 | % |

| Percentage of total assets under management | 5.5 | % | | 4.8 | % | | |

| Average assets under management for period | $ | 3,283 |

| | $ | 2,662 |

| | 23.3 | % |

| | | | | | |

| Total | | | | | |

| Assets under management, beginning of period | $ | 57,198 |

| | $ | 52,594 |

| | |

| Inflows | 10,600 |

| | 12,017 |

| | |

| Outflows | (6,970 | ) | | (6,053 | ) | | |

| Net inflows (outflows) | 3,630 |

| | 5,964 |

| | |

| Market appreciation (depreciation) | 4,063 |

| | 5,204 |

| | |

| Distributions | (3,370 | ) | | (3,265 | ) | | |

| Total increase (decrease) | 4,323 |

| | 7,903 |

| | |

| Assets under management, end of period | $ | 61,521 |

| | $ | 60,497 |

| | 1.7 | % |

| Average assets under management for period | $ | 59,742 |

| | $ | 56,031 |

| | 6.6 | % |

Non-GAAP Reconciliation

Management believes that use of the following non-GAAP financial measures enhances the evaluation of the Company’s results, as they provide greater transparency into the Company’s operating performance. In addition, these non-GAAP financial measures are used to prepare the Company’s internal management reports and are used by management in evaluating the Company's business.

While management believes that this non-GAAP financial information is useful in evaluating the Company’s results and operating performance, this information should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with U.S. GAAP.

Reconciliation of U.S. GAAP Net Income Attributable to Common Stockholders and U.S. GAAP Earnings per Share to Net Income Attributable to Common Stockholders, As Adjusted, and Earnings per Share, As Adjusted

|

| | | | | | | | | | | |

| For the Periods | | | | | |

| | | | | | |

| (in thousands, except per share data) | Three Months Ended |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 |

| Net income attributable to common stockholders, U.S. GAAP | $ | 25,082 |

| | $ | 23,474 |

| | $ | 23,877 |

|

Accelerated vesting of restricted stock units (1) | $ | 298 |

| | $ | — |

| | $ | — |

|

Deconsolidation (2) | $ | (558 | ) | | $ | (264 | ) | | $ | 311 |

|

Results from seed investments (3) | $ | (521 | ) | | $ | (64 | ) | | $ | (1,234 | ) |

General and administrative (4) | $ | (950 | ) | | $ | — |

| | $ | — |

|

Tax adjustments (5) | $ | 2,300 |

| | $ | 269 |

| | $ | 672 |

|

| Net income attributable to common stockholders, as adjusted | $ | 25,651 |

| | $ | 23,415 |

| | $ | 23,626 |

|

| | | | | | |

| Diluted weighted average shares outstanding | 47,047 |

| | 46,902 |

| | 46,544 |

|

| Diluted earnings per share, U.S. GAAP | $ | 0.53 |

| | $ | 0.50 |

| | $ | 0.51 |

|

Accelerated vesting of restricted stock units (1) | $ | 0.01 |

| | $ | — |

| | $ | — |

|

Deconsolidation (2) | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | 0.01 |

|

Results from seed investments (3) | $ | (0.01 | ) | | $ | — |

| * | $ | (0.02 | ) |

General and administrative (4) | $ | (0.02 | ) | | $ | — |

| | $ | — |

|

Tax adjustments (5) | $ | 0.05 |

| | $ | 0.01 |

| | $ | 0.01 |

|

| Diluted earnings per share, as adjusted | $ | 0.55 |

| | $ | 0.50 |

| | $ | 0.51 |

|

| |

| (1) | Represents amounts related to the accelerated vesting of certain restricted stock units in the third quarter of 2017. |

| |

| (2) | Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. |

| |

| (3) | Represents dividend income and realized gains (losses) on the Company’s seed investments classified as available-for-sale, and the Company’s proportionate share of the results of operations of seed investments classified as equity method investments, including realized and unrealized gains (losses). |

| |

| (4) | Represents refund of foreign withholding tax. |

| |

| (5) | Represents discrete items recorded in each of the periods presented, if any, as well as the tax impact of non-GAAP adjustments. |

| |

| * | Amounts round to less than $0.01 per share. |

Reconciliation of U.S. GAAP Operating Income and U.S. GAAP Operating Margin to Operating Income, As Adjusted, and Operating Margin, As Adjusted

|

| | | | | | | | | | | |

| For the Periods | | | | | |

| | | | | | |

| (in thousands, except percentages) | Three Months Ended |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 |

| Revenue, U.S. GAAP | $ | 96,354 |

| | $ | 92,812 |

| | $ | 94,388 |

|

Deconsolidation (1) | $ | 98 |

| | $ | 50 |

| | $ | 31 |

|

| Revenue, as adjusted | $ | 96,452 |

| | $ | 92,862 |

| | $ | 94,419 |

|

| | | | | | |

| Expenses, U.S. GAAP | $ | 55,381 |

| | $ | 55,455 |

| | $ | 57,175 |

|

Deconsolidation (1) | $ | (23 | ) | | $ | (34 | ) | | $ | (54 | ) |

Accelerated vesting of restricted stock units (2) | $ | (298 | ) | | $ | — |

| | $ | — |

|

General and administrative (3) | $ | 950 |

| | $ | — |

| | $ | — |

|

| Expenses, as adjusted | $ | 56,010 |

| | $ | 55,421 |

| | $ | 57,121 |

|

| | | | | | |

| Operating income, U.S. GAAP | $ | 40,973 |

| | $ | 37,357 |

| | $ | 37,213 |

|

Deconsolidation (1) | $ | 121 |

| | $ | 84 |

| | $ | 85 |

|

Accelerated vesting of restricted stock units (2) | $ | 298 |

| | $ | — |

| | $ | — |

|

General and administrative (3) | $ | (950 | ) | | $ | — |

| | $ | — |

|

| Operating income, as adjusted | $ | 40,442 |

| | $ | 37,441 |

| | $ | 37,298 |

|

| | | | | | |

| Operating margin, U.S. GAAP | 42.5 | % | | 40.3 | % | | 39.4 | % |

| Operating margin, as adjusted | 41.9 | % | | 40.3 | % | | 39.5 | % |

Reconciliation of U.S. GAAP Non-operating Income (Loss) to Non-operating Income (Loss), As Adjusted

|

| | | | | | | | | | | |

| For the Periods | | | | | |

| | | | | | |

| (in thousands) | Three Months Ended |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 |

| Non-operating income (loss), U.S. GAAP | $ | 2,327 |

| | $ | 261 |

| | $ | 1,356 |

|

Deconsolidation (1) | $ | (1,335 | ) | | $ | 128 |

| | $ | 272 |

|

Results from seed investments (4) | $ | (521 | ) | | $ | (64 | ) | | $ | (1,234 | ) |

| Non-operating income (loss), as adjusted | $ | 471 |

| | $ | 325 |

| | $ | 394 |

|

_________________________

| |

| (1) | Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. |

| |

| (2) | Represents amounts related to the accelerated vesting of certain restricted stock units in the third quarter of 2017. |

| |

| (3) | Represents refund of foreign withholding tax. |

| |

| (4) | Represents dividend income and realized gains (losses) on the Company’s seed investments classified as available-for-sale, and the Company’s proportionate share of the results of operations of seed investments classified as equity method investments, including realized and unrealized gains (losses). |