Contact:

Matthew S. Stadler

Executive Vice President

Chief Financial Officer

Cohen & Steers, Inc.

Tel (212) 446-9168

COHEN & STEERS REPORTS RESULTS FOR THE FOURTH QUARTER AND YEAR ENDED DECEMBER 31, 2018

| |

| • | Diluted EPS of $0.54 ($0.56 as adjusted) for the fourth quarter |

| |

| • | Diluted EPS of $2.40 for the full year |

| |

| • | Operating margin of 36.5% (36.8% as adjusted) for the fourth quarter |

| |

| • | Ending AUM of $54.8 billion; average AUM of $57.6 billion for the fourth quarter |

| |

| • | Net outflows of $1.2 billion for the fourth quarter |

NEW YORK, NY, January 23, 2019—Cohen & Steers, Inc. (NYSE: CNS) reported its operating results for the fourth quarter and year ended December 31, 2018.

|

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| | | | | | | | | | | |

| (in thousands, except percentages and per share data) | Three Months Ended | | Year Ended | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | December 31, 2018 | | December 31, 2017 | |

| U.S. GAAP | | | | | | | | | | |

Revenue (1) | $ | 93,906 |

| | $ | 98,331 |

| | $ | 99,454 |

| | $ | 381,111 |

| | $ | 378,696 |

| |

Expenses (1) | $ | 59,597 |

| | $ | 59,108 |

| | $ | 58,566 |

| | $ | 234,073 |

| | $ | 223,950 |

| |

| Operating income (loss) | $ | 34,309 |

| | $ | 39,223 |

| | $ | 40,888 |

| | $ | 147,038 |

| | $ | 154,746 |

| |

| Non-operating income (loss) | $ | (3,329 | ) | | $ | 1,047 |

| | $ | 2,839 |

| | $ | (3,259 | ) | | $ | 5,654 |

| |

Net income attributable to common stockholders (2) | $ | 25,561 |

| | $ | 30,790 |

| | $ | 20,398 |

| | $ | 113,896 |

| | $ | 91,939 |

| |

| Diluted earnings per share | $ | 0.54 |

| | $ | 0.65 |

| | $ | 0.43 |

| | $ | 2.40 |

| | $ | 1.96 |

| |

Operating margin (1) | 36.5 | % | | 39.9 | % | | 41.1 | % | | 38.6 | % | | 40.9 | % | |

| | | | | | | | | | | |

As Adjusted (3) | | | | | | | | | | |

Net income attributable to common stockholders (2) | $ | 26,703 |

| | $ | 30,272 |

| | $ | 26,055 |

| | $ | 113,849 |

| | $ | 97,037 |

| |

| Diluted earnings per share | $ | 0.56 |

| | $ | 0.64 |

| | $ | 0.55 |

| | $ | 2.40 |

| | $ | 2.07 |

| |

| Operating margin | 36.8 | % | | 40.2 | % | | 41.5 | % | | 39.1 | % | | 40.9 | % | |

_________________________

(1) The presentation for the quarter and year ended December 31, 2017 has been recast to reflect the Company's adoption of the new revenue recognition accounting standard on January 1, 2018. (2) Net income for the third and fourth quarters and year ended December 31, 2018 reflected the lower U.S. federal statutory tax rate of 21% due to the Tax Cuts and Jobs Act. (3) The “As Adjusted” amounts represent non-GAAP financial measures. Refer to pages 19-20 for reconciliations to the most directly comparable U.S. GAAP financial measures. | |

U.S. GAAP

This section discusses the financial results of the Company as presented in accordance with U.S. GAAP.

Revenue

Revenue for the fourth quarter of 2018 was $93.9 million, a decrease of 4.5% from $98.3 million for the third quarter of 2018, primarily due to lower average assets under management in the quarter. Investment advisory and administration fee changes were as follows:

| |

| • | Institutional account revenue decreased $1.4 million to $24.5 million; |

| |

| • | Open-end fund revenue decreased $1.8 million to $40.6 million; and |

| |

| • | Closed-end fund revenue decreased $762,000 to $19.1 million. |

Revenue for the year ended December 31, 2018 was $381.1 million, an increase of 0.6% from $378.7 million for the year ended December 31, 2017.

Expenses

Expenses for the fourth quarter of 2018 were $59.6 million, an increase of 0.8% from $59.1 million for the third quarter of 2018. The change was primarily due to:

| |

| • | Higher employee compensation and benefits of $1.4 million, primarily due to severance expenses; |

| |

| • | Lower distribution and service fees of $1.7 million, primarily due to lower average assets under management in U.S. open-end funds combined with the reversal of previously accrued revenue sharing and sub-transfer agent fees on certain assets that were not charged by one of the Company's intermediaries; and |

| |

| • | Higher general and administrative expenses of $840,000, primarily due to higher professional fees, travel and entertainment expenses as well as higher hosted and sponsored conferences. |

Expenses for the year ended December 31, 2018 were $234.1 million, an increase of 4.5% from $224.0 million for the year ended December 31, 2017.

Operating Margin

Operating margin was 36.5% for the fourth quarter of 2018, compared with 39.9% for the third quarter of 2018.

Operating margin was 38.6% for the year ended December 31, 2018, compared with 40.9% for the year ended December 31, 2017.

Non-operating Income (Loss)

Non-operating loss for the fourth quarter of 2018 was $3.3 million, compared with non-operating income of $1.0 million for the third quarter of 2018 and is comprised of the following:

| |

| • | Interest and dividend income of $3.0 million for the fourth quarter of 2018, which included interest on corporate cash of $1.2 million, interest and dividend income of $1.6 million attributable to consolidated funds and $216,000 from other seed investments. Interest and dividend income of $2.7 million for the third quarter of 2018, which included $1.1 million of interest on corporate cash and interest and dividend income of $1.4 million from consolidated funds and $273,000 from other seed investments; |

| |

| • | Net loss from investments of $9.6 million for the fourth quarter of 2018, which included net realized and unrealized losses of $6.3 million attributable to consolidated funds and net unrealized losses of $3.3 million from other seed investments. Net gain from investments of $413,000 for the third quarter of 2018, which included net realized and unrealized gains from consolidated funds of $135,000 and net realized and unrealized gains of $278,000 from other seed investments; |

| |

| • | Foreign currency gains of $3.3 million for the fourth quarter of 2018, which included net gains of $2.1 million attributable to consolidated funds and net gains of $1.1 million attributable to U.S. dollar-denominated assets and liabilities held by certain foreign subsidiaries. Foreign currency losses of $2.1 million for the third quarter of 2018, which included $2.4 million of net losses attributable to consolidated funds, partially offset by net gains of $217,000 attributable to U.S. dollar-denominated assets and liabilities held by certain foreign subsidiaries; and |

| |

| • | Net loss attributable to redeemable noncontrolling interests of $263,000 for the fourth quarter of 2018, compared with $1.1 million for the third quarter of 2018. Net (income) loss attributable to redeemable noncontrolling interests represent third-party interests in consolidated funds. |

Non-operating loss for the year ended December 31, 2018 was $3.3 million, compared with non-operating income of $5.7 million for the year ended December 31, 2017.

Income Taxes

The effective tax rate for the fourth quarter of 2018 was 18.19%, compared with 25.50% for the third quarter of 2018. The effective tax rate for the fourth quarter of 2018 differed from the U.S. federal statutory rate of 21% primarily due to the reversal of certain liabilities associated with unrecognized tax benefits, partially offset by state and local taxes. The effective tax rate for the third quarter of 2018 differed from the U.S. federal statutory rate of 21% primarily due to state and local taxes.

The effective tax rate for the year ended December 31, 2018 was 23.12%, compared with 42.50% for the year ended December 31, 2017. The effective tax rate for the year ended December 31, 2018 differed from the U.S. federal statutory rate of 21% primarily due to state, local and foreign taxes, partially offset by the reversal of certain liabilities associated with unrecognized tax benefits and the delivery of restricted stock units. The effective tax rate for the year ended December 31, 2017 differed from the U.S. federal statutory rate of 35% primarily due to tax charges associated with the enactment of the Tax Cuts and Jobs Act on December 22, 2017 and remeasurement of deferred and other tax balances, partially offset by the reversal of certain liabilities associated with unrecognized tax benefits.

As Adjusted

The term “As Adjusted” is used to identify non-GAAP financial information in the discussion below. Refer to pages 19-20 for reconciliations to the most directly comparable U.S. GAAP financial measures.

Revenue

Revenue, as adjusted, for the fourth quarter of 2018 was $93.6 million, compared with $98.2 million for the third quarter of 2018. Revenue, as adjusted, for the year ended December 31, 2018 was $380.4 million, compared with $378.3 million for the year ended December 31, 2017.

Revenue, as adjusted, excluded investment advisory and administration fees attributable to the consolidation of certain of the Company’s seed investments for all periods presented.

Expenses

Expenses, as adjusted, for the fourth quarter of 2018 were $59.2 million, compared with $58.7 million for the third quarter of 2018. Expenses, as adjusted, for the year ended December 31, 2018 were $231.8 million, compared with $223.7 million for the year ended December 31, 2017.

Expenses, as adjusted, excluded the following:

| |

| • | General and administrative expenses attributable to the consolidation of certain of the Company's seed investments for all periods presented; |

| |

| • | Employee compensation and benefits related to the accelerated vesting of certain restricted stock units due to a retirement for the year ended December 31, 2017; |

| |

| • | Expenses incurred associated with the evaluation of a potential business transaction that the Company did not pursue for the year ended December 31, 2018; and |

| |

| • | Refunds of foreign withholding taxes recorded for the year ended December 31, 2017. |

Operating Margin

Operating margin, as adjusted, for the fourth quarter of 2018 was 36.8%, compared with 40.2% for the third quarter of 2018. Operating margin, as adjusted, for the year ended December 31, 2018 was 39.1%, compared with 40.9% for the year ended December 31, 2017.

Non-operating Income

Non-operating income, as adjusted, for the fourth quarter of 2018 was $1.2 million, compared with $1.1 million for the third quarter of 2018. Non-operating income, as adjusted, for the year ended December 31, 2018 was $3.7 million, compared with $1.2 million for the year ended December 31, 2017.

Non-operating income (loss), as adjusted, excluded the following:

| |

| • | Amounts attributable to the consolidation of certain of the Company's seed investments for all periods presented; |

| |

| • | Results from the Company's seed investments for all periods presented; and |

| |

| • | Net foreign currency exchange gains associated with U.S. dollar-denominated assets and liabilities held by certain foreign subsidiaries for both the third and fourth quarters of 2018 and the year ended December 31, 2018. |

Income Taxes

The effective tax rate, as adjusted, was 25.25% for both the third and fourth quarters of 2018. The effective tax rate, as adjusted, for the year ended December 31, 2018 was 25.25%, compared with 37.75% for the year ended December 31, 2017.

The effective tax rate, as adjusted, excluded the following:

| |

| • | Tax effects related to the Tax Cuts and Jobs Act for the years ended December 31, 2018 and 2017; |

| |

| • | The reversal of certain liabilities associated with unrecognized tax benefits for the fourth quarter of 2018 as well as for the years ended December 31, 2018 and 2017; |

| |

| • | Tax effects related to the delivery of restricted stock units for the years ended December 31, 2018 and 2017; |

| |

| • | Tax effects related to the non-GAAP adjustments for all periods presented; and |

| |

| • | Other tax-related items for the fourth quarter of 2018 as well as for the years ended December 31, 2018 and 2017. |

|

| | | | | | | | | | | |

| Assets Under Management Highlights (Unaudited) | | | | | | |

| (in millions) | As of | | | |

| By Investment Vehicle | December 31, 2018 | | September 30, 2018 | | % Change | |

| Institutional accounts | $ | 25,712 |

| | $ | 27,723 |

| | (7.3 | %) | |

| Open-end funds | 20,699 |

| | 23,277 |

| | (11.1 | %) | |

| Closed-end funds | 8,410 |

| | 9,084 |

| | (7.4 | %) | |

| Total | $ | 54,821 |

| | $ | 60,084 |

| | (8.8 | %) | |

| | | | | | | |

| By Investment Strategy | | | | | | |

| U.S. real estate | $ | 23,158 |

| | $ | 25,592 |

| | (9.5 | %) | |

| Preferred securities | 11,868 |

| | 13,147 |

| | (9.7 | %) | |

| Global/international real estate | 10,856 |

| | 11,614 |

| | (6.5 | %) | |

| Global listed infrastructure | 6,483 |

| | 6,982 |

| | (7.1 | %) | |

| Other | 2,456 |

| | 2,749 |

| | (10.7 | %) | |

| Total | $ | 54,821 |

| | $ | 60,084 |

| | (8.8 | %) | |

| | | | | | | |

Assets under management at December 31, 2018 were $54.8 billion, a decrease of $5.3 billion from $60.1 billion at September 30, 2018. The decrease from September 30, 2018 was attributable to net outflows of $1.2 billion, market depreciation of $3.2 billion and distributions of $842 million.

Institutional Accounts

Assets under management in institutional accounts at December 31, 2018 were $25.7 billion, a decrease of 7.3% from $27.7 billion at September 30, 2018. The change from September 30, 2018 was due to the following:

| |

| ◦ | Net inflows of $300 million from advised accounts, including $333 million into preferred securities, partially offset by net outflows of $40 million from global/international real estate; and |

| |

| ◦ | Market depreciation of $662 million, including $197 million from U.S. real estate, $164 million from global/international real estate and $117 million from global listed infrastructure. |

| |

| ◦ | Net outflows of $304 million from Japan subadvised accounts, including $252 million from U.S. real estate; |

| |

| ◦ | Market depreciation of $446 million, including $327 million from U.S. real estate; and |

| |

| ◦ | Distributions from Japan subadvised accounts of $363 million, including $339 million from U.S. real estate. |

| |

| • | Subadvisory excluding Japan: |

| |

| ◦ | Net outflows of $185 million from subadvised accounts excluding Japan, including $71 million from global/international real estate and $65 million from U.S. real estate; and |

| |

| ◦ | Market depreciation of $351 million, including $177 million from global/international real estate and $59 million from large cap value (included in "Other" in the table above). |

Open-end Funds

Assets under management in open-end funds at December 31, 2018 were $20.7 billion, a decrease of 11.1% from $23.3 billion at September 30, 2018. The change from September 30, 2018 was due to the following:

| |

| • | Net outflows of $1.0 billion, including $979 million from preferred securities; |

| |

| • | Market depreciation of $1.2 billion, including $782 million from U.S. real estate and $278 million from preferred securities; and |

| |

| • | Distributions of $351 million, including $196 million from U.S. real estate and $108 million from preferred securities. |

Closed-end Funds

Assets under management in closed-end funds at December 31, 2018 were $8.4 billion, a decrease of 7.4% from $9.1 billion at September 30, 2018. The decrease was primarily the result of market depreciation of $546 million and distributions of $128 million.

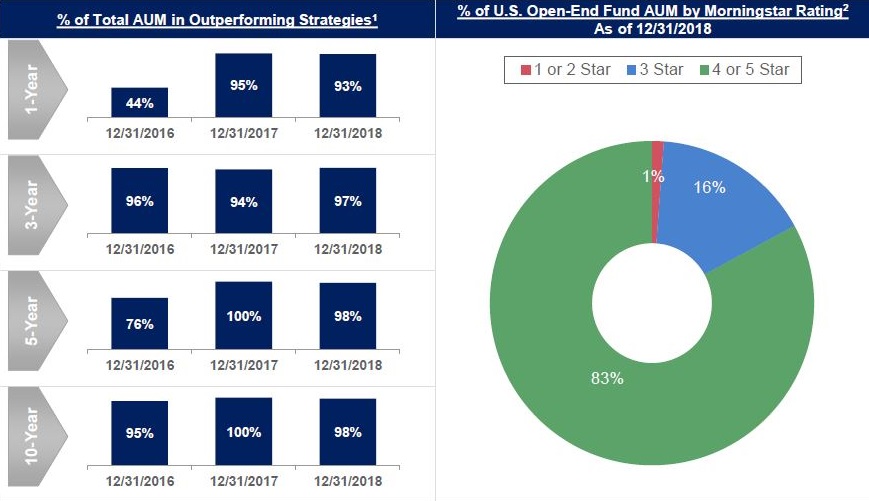

Investment Performance as of December 31, 2018

_________________________

| |

| (1) | Past performance is no guarantee of future results. Outperformance is determined by annualized investment performance of all accounts in each investment strategy measured gross of fees and net of withholding taxes in comparison to the performance of each account's reference benchmark measured net of withholding taxes, where applicable. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers. |

| |

| (2) | © 2019 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Morningstar calculates its ratings based on a risk-adjusted return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. Past performance is no guarantee of future results. Based on independent rating by Morningstar, Inc. of investment performance of each Cohen & Steers-sponsored open-end U.S.-registered mutual fund for all share classes for the overall period as of December 31, 2018. Overall Morningstar rating is a weighted average based on the 3-year, 5-year and 10-year Morningstar rating. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers. |

Balance Sheet Information

As of December 31, 2018, cash, cash equivalents, U.S. treasuries and seed investments were $213 million. As of December 31, 2018, stockholders' equity was $223 million and the Company had no debt. During the fourth quarter of 2018, a quarterly dividend of $0.33 per share and a special dividend of $2.50 per share, totaling $132.3 million were paid.

Conference Call Information

Cohen & Steers will host a conference call tomorrow January 24, 2019 at 9:00 a.m. (ET) to discuss the Company’s fourth quarter and full year results. Investors and analysts can access the live conference call by dialing 800-786-5819 (U.S.) or +1-212-231-2939 (international); passcode: 21914641. Participants should plan to register at least 10 minutes before the conference call begins. The presentation that will be reviewed as part of the conference call is available on the Company’s website at www.cohenandsteers.com under “Company—Investor Relations—Press Releases.”

A replay of the call will be available for two weeks starting at approximately 11:00 a.m. (ET) on January 24, 2019 and can be accessed at 800-633-8284 (U.S.) or +1-402-977-9140 (international); passcode: 21914641. Internet access to the webcast, which includes audio (listen-only), will be available on the Company's website at www.cohenandsteers.com under “Company—Investor Relations—Overview.” The webcast will be archived on the website for one month.

About Cohen & Steers

Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Hong Kong, Tokyo and Seattle.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company's current views with respect to, among other things, the Company's operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these forward-looking statements. The Company believes that these factors include, but are not limited to, the risks described in the Risk Factors section of the Company's Annual Report on Form 10-K for the year ended December 31, 2017 (the Form 10-K), which is accessible on the Securities and Exchange Commission's website at www.sec.gov and on the Company's website at www.cohenandsteers.com. These factors are not exhaustive and should be read in conjunction with the other cautionary statements that are included in the Company's Form 10-K and other filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

# # # #

|

| | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | | | | |

| For the Periods | | | | | | | | | | |

| (in thousands, except per share data) | | | | | | | | | | |

| | | | | | | | | | | |

| | Three Months Ended (1) | | % Change From | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | September 30, 2018 | | December 31, 2017 | |

| Revenue | | | | | | | | | | |

| Investment advisory and administration fees | $ | 84,222 |

| | $ | 88,150 |

| | $ | 88,647 |

| | | | | |

| Distribution and service fees | 6,982 |

| | 7,451 |

| | 7,880 |

| | | | | |

| Portfolio consulting and other | 2,702 |

| | 2,730 |

| | 2,927 |

| | | | | |

| Total revenue | 93,906 |

| | 98,331 |

| | 99,454 |

| | (4.5 | %) | | (5.6 | %) | |

| Expenses | | | | | | | | | | |

| Employee compensation and benefits | 34,504 |

| | 33,126 |

| | 32,395 |

| | | | | |

| Distribution and service fees | 11,551 |

| | 13,210 |

| | 13,613 |

| | | | | |

| General and administrative | 12,474 |

| | 11,634 |

| | 11,486 |

| | | | | |

| Depreciation and amortization | 1,068 |

| | 1,138 |

| | 1,072 |

| | | | | |

| Total expenses | 59,597 |

| | 59,108 |

| | 58,566 |

| | 0.8 | % | | 1.8 | % | |

| Operating income (loss) | 34,309 |

| | 39,223 |

| | 40,888 |

| | (12.5 | %) | | (16.1 | %) | |

| Non-operating income (loss) | | | | | | | | | | |

| Interest and dividend income—net | 2,992 |

| | 2,747 |

| | 1,623 |

| | | | | |

| Gain (loss) from investments—net | (9,572 | ) | | 413 |

| | 1,283 |

| | | | | |

| Foreign currency gains (losses)—net | 3,251 |

| | (2,113 | ) | | (67 | ) | | | | | |

| Total non-operating income (loss) | (3,329 | ) | | 1,047 |

| | 2,839 |

| | * |

| | * |

| |

| Income before provision for income taxes | 30,980 |

| | 40,270 |

| | 43,727 |

| | (23.1 | %) | | (29.2 | %) | |

| Provision for income taxes | 5,682 |

| | 10,539 |

| | 22,921 |

| | | | | |

| Net income | 25,298 |

| | 29,731 |

| | 20,806 |

| | (14.9 | %) | | 21.6 | % | |

| Less: Net (income) loss attributable to redeemable noncontrolling interests | 263 |

| | 1,059 |

| | (408 | ) | | | | | |

| Net income attributable to common stockholders | $ | 25,561 |

| | $ | 30,790 |

| | $ | 20,398 |

| | (17.0 | %) | | 25.3 | % | |

| | | | | | | | | | | |

| Earnings per share attributable to common stockholders | | | | | | | | | | |

| Basic | $ | 0.55 |

| | $ | 0.66 |

| | $ | 0.44 |

| | (17.0 | %) | | 24.1 | % | |

| Diluted | $ | 0.54 |

| | $ | 0.65 |

| | $ | 0.43 |

| | (17.0 | %) | | 24.6 | % | |

| | | | | | | | | | | |

| Dividends declared per share | | | | | | | | | | |

| Quarterly | $ | 0.33 |

| | $ | 0.33 |

| | $ | 0.28 |

| | — | % | | 17.9 | % | |

| Special | $ | 2.50 |

| | $ | — |

| | $ | 1.00 |

| | * |

| | 150.0 | % | |

| | | | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | | |

| Basic | 46,842 |

| | 46,830 |

| | 46,407 |

| | | | | |

| Diluted | 47,562 |

| | 47,524 |

| | 47,300 |

| | | | | |

_________________________

* Not meaningful. (1) The presentation for the fourth quarter of 2017 has been recast to reflect the Company's adoption of the new revenue recognition accounting standard on January 1, 2018. In addition, certain prior period amounts have been reclassified to conform with the current period presentation. Amounts reclassified had no impact on net income and diluted earnings per share for all historical periods presented.

|

|

| | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | |

| For the Periods | | | | | | |

| (in thousands, except per share data) | | | | | | |

| | | | | | | |

| | Year Ended (1) | | | |

| | December 31, 2018 | | December 31, 2017 | | % Change | |

| Revenue | | | | | | |

| Investment advisory and administration fees | $ | 341,226 |

| | $ | 336,743 |

| | | |

| Distribution and service fees | 29,090 |

| | 30,747 |

| | | |

| Portfolio consulting and other | 10,795 |

| | 11,206 |

| | | |

| Total revenue | 381,111 |

| | 378,696 |

| | 0.6 | % | |

| Expenses | | | | | | |

| Employee compensation and benefits | 131,292 |

| | 124,076 |

| | | |

| Distribution and service fees | 50,043 |

| | 53,338 |

| | | |

| General and administrative | 48,265 |

| | 42,219 |

| | | |

| Depreciation and amortization | 4,473 |

| | 4,317 |

| | | |

| Total expenses | 234,073 |

| | 223,950 |

| | 4.5 | % | |

| Operating income (loss) | 147,038 |

| | 154,746 |

| | (5.0 | %) | |

| Non-operating income (loss) | | | | | | |

| Interest and dividend income—net | 10,426 |

| | 4,333 |

| | | |

| Gain (loss) from investments—net | (14,264 | ) | | 2,020 |

| | | |

| Foreign currency gains (losses)—net | 579 |

| | (699 | ) | | | |

| Total non-operating income (loss) | (3,259 | ) | | 5,654 |

| | * |

| |

| Income before provision for income taxes | 143,779 |

| | 160,400 |

| | (10.4 | %) | |

| Provision for income taxes | 34,257 |

| | 67,914 |

| | | |

| Net income | 109,522 |

| | 92,486 |

| | 18.4 | % | |

| Less: Net (income) loss attributable to redeemable noncontrolling interests | 4,374 |

| | (547 | ) | | | |

| Net income attributable to common stockholders | $ | 113,896 |

| | $ | 91,939 |

| | 23.9 | % | |

| | | | | | | |

| Earnings per share attributable to common stockholders | | | | | | |

| Basic | $ | 2.43 |

| | $ | 1.98 |

| | 22.7 | % | |

| Diluted | $ | 2.40 |

| | $ | 1.96 |

| | 22.8 | % | |

| | | | | | | |

| Dividends declared per share | | | | | | |

| Quarterly | $ | 1.32 |

| | $ | 1.12 |

| | 17.9 | % | |

| Special | $ | 2.50 |

| | $ | 1.00 |

| | 150.0 | % | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | |

| Basic | 46,794 |

| | 46,353 |

| | | |

| Diluted | 47,381 |

| | 46,979 |

| | | |

_________________________

(1) The presentation for the year ended December 31, 2017 has been recast to reflect the Company's adoption of the new revenue recognition accounting standard on January 1, 2018. In addition, certain prior period amounts have been reclassified to conform with the current period presentation. Amounts reclassified had no impact on net income and diluted earnings per share for all historical periods presented. |

|

| | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | | |

| By Investment Vehicle | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| | Three Months Ended | | % Change From | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | September 30, 2018 | | December 31, 2017 | |

| Institutional Accounts | | | | | | | | | | |

| Assets under management, beginning of period | $ | 27,723 |

| | $ | 28,316 |

| | $ | 29,631 |

| | | | | |

| Inflows | 936 |

| | 383 |

| | 411 |

| | | | | |

| Outflows | (1,125 | ) | | (884 | ) | | (999 | ) | | | | | |

| Net inflows (outflows) | (189 | ) | | (501 | ) | | (588 | ) | | | | | |

| Market appreciation (depreciation) | (1,459 | ) | | 341 |

| | 980 |

| | | | | |

| Distributions | (363 | ) | | (433 | ) | | (627 | ) | | | | | |

| Total increase (decrease) | (2,011 | ) | | (593 | ) | | (235 | ) | | | | | |

| Assets under management, end of period | $ | 25,712 |

| | $ | 27,723 |

| | $ | 29,396 |

| | (7.3 | %) | | (12.5 | %) | |

| Percentage of total assets under management | 46.9 | % | | 46.1 | % | | 47.3 | % | | | | | |

| Average assets under management | $ | 26,454 |

| | $ | 27,992 |

| | $ | 29,478 |

| | (5.5 | %) | | (10.3 | %) | |

| | | | | | | | | | | |

| Open-end Funds | | | | | | | | | | |

| Assets under management, beginning of period | $ | 23,277 |

| | $ | 22,827 |

| | $ | 22,516 |

| | | | | |

| Inflows | 2,309 |

| | 2,000 |

| | 2,654 |

| | | | | |

| Outflows | (3,309 | ) | | (1,575 | ) | | (1,839 | ) | | | | | |

| Net inflows (outflows) | (1,000 | ) | | 425 |

| | 815 |

| | | | | |

| Market appreciation (depreciation) | (1,227 | ) | | 266 |

| | 548 |

| | | | | |

| Distributions | (351 | ) | | (241 | ) | | (575 | ) | | | | | |

| Total increase (decrease) | (2,578 | ) | | 450 |

| | 788 |

| | | | | |

| Assets under management, end of period | $ | 20,699 |

| | $ | 23,277 |

| | $ | 23,304 |

| | (11.1 | %) | | (11.2 | %) | |

| Percentage of total assets under management | 37.8 | % |

| 38.7 | % | | 37.5 | % | | | | | |

| Average assets under management | $ | 22,301 |

| | $ | 23,245 |

| | $ | 23,080 |

| | (4.1 | %) | | (3.4 | %) | |

| | | | | | | | | | | |

| Closed-end Funds | | | | | | | | | | |

| Assets under management, beginning of period | $ | 9,084 |

| | $ | 9,061 |

| | $ | 9,374 |

| | | | | |

| Inflows | — |

| | — |

| | — |

| | | | | |

| Outflows | — |

| | — |

| | — |

| | | | | |

| Net inflows (outflows) | — |

| | — |

| | — |

| | | | | |

| Market appreciation (depreciation) | (546 | ) | | 151 |

| | 172 |

| | | | | |

| Distributions | (128 | ) | | (128 | ) | | (140 | ) | | | | | |

| Total increase (decrease) | (674 | ) | | 23 |

| | 32 |

| | | | | |

| Assets under management, end of period | $ | 8,410 |

| | $ | 9,084 |

| | $ | 9,406 |

| | (7.4 | %) | | (10.6 | %) | |

| Percentage of total assets under management | 15.3 | % | | 15.1 | % | | 15.1 | % | | | | | |

| Average assets under management | $ | 8,815 |

| | $ | 9,177 |

| | $ | 9,444 |

| | (3.9 | %) | | (6.7 | %) | |

| | | | | | | | | | | |

| Total | | | | | | | | | | |

| Assets under management, beginning of period | $ | 60,084 |

| | $ | 60,204 |

| | $ | 61,521 |

| | | | | |

| Inflows | 3,245 |

| | 2,383 |

| | 3,065 |

| | | | | |

| Outflows | (4,434 | ) | | (2,459 | ) | | (2,838 | ) | | | | | |

| Net inflows (outflows) | (1,189 | ) | | (76 | ) | | 227 |

| | | | | |

| Market appreciation (depreciation) | (3,232 | ) | | 758 |

| | 1,700 |

| | | | | |

| Distributions | (842 | ) | | (802 | ) | | (1,342 | ) | | | | | |

| Total increase (decrease) | (5,263 | ) | | (120 | ) | | 585 |

| | | | | |

| Assets under management, end of period | $ | 54,821 |

| | $ | 60,084 |

| | $ | 62,106 |

| | (8.8 | %) | | (11.7 | %) | |

| Average assets under management | $ | 57,570 |

| | $ | 60,414 |

| | $ | 62,002 |

| | (4.7 | %) | | (7.1 | %) | |

| | | | | | | | | | | |

|

| | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management (Unaudited) | | | | | | |

| By Investment Vehicle | | | | | | |

| For the Periods | | | | | | |

| (in millions) | | | | | | |

| | Year Ended | | | |

| | December 31, 2018 | | December 31, 2017 | | % Change | |

| Institutional Accounts | | | | | | |

| Assets under management, beginning of period | $ | 29,396 |

| | $ | 28,659 |

| | | |

| Inflows | 2,814 |

| | 3,963 |

| | | |

| Outflows | (3,558 | ) | | (3,267 | ) | | | |

| Net inflows (outflows) | (744 | ) | | 696 |

| | | |

| Market appreciation (depreciation) | (1,010 | ) | | 2,867 |

| | | |

| Distributions | (1,962 | ) | | (3,018 | ) | | | |

| Transfers | 32 |

| | 192 |

| | | |

| Total increase (decrease) | (3,684 | ) | | 737 |

| | | |

| Assets under management, end of period | $ | 25,712 |

| | $ | 29,396 |

| | (12.5 | %) | |

| Percentage of total assets under management | 46.9 | % | | 47.3 | % | | | |

| Average assets under management | $ | 27,408 |

| | $ | 29,346 |

| | (6.6 | %) | |

| | | | | | | |

| Open-end Funds | | | | | | |

| Assets under management, beginning of period | $ | 23,304 |

| | $ | 19,576 |

| | | |

| Inflows | 8,963 |

| | 9,702 |

| | | |

| Outflows | (9,411 | ) | | (6,541 | ) | | | |

| Net inflows (outflows) | (448 | ) | | 3,161 |

| | | |

| Market appreciation (depreciation) | (1,014 | ) | | 1,947 |

| | | |

| Distributions | (1,111 | ) | | (1,188 | ) | | | |

| Transfers | (32 | ) | | (192 | ) | | | |

| Total increase (decrease) | (2,605 | ) | | 3,728 |

| | | |

| Assets under management, end of period | $ | 20,699 |

| | $ | 23,304 |

| | (11.2 | %) | |

| Percentage of total assets under management | 37.8 | % | | 37.5 | % | | | |

| Average assets under management | $ | 22,548 |

| | $ | 21,623 |

| | 4.3 | % | |

| | | | | | | |

| Closed-end Funds | | | | | | |

| Assets under management, beginning of period | $ | 9,406 |

| | $ | 8,963 |

| | | |

| Inflows | 12 |

| | — |

| | | |

| Outflows | — |

| | — |

| | | |

| Net inflows (outflows) | 12 |

| | — |

| | | |

| Market appreciation (depreciation) | (496 | ) | | 949 |

| | | |

| Distributions | (512 | ) | | (506 | ) | | | |

| Total increase (decrease) | (996 | ) | | 443 |

| | | |

| Assets under management, end of period | $ | 8,410 |

| | $ | 9,406 |

| | (10.6 | %) | |

| Percentage of total assets under management | 15.3 | % | | 15.1 | % | | | |

| Average assets under management | $ | 9,012 |

| | $ | 9,343 |

| | (3.5 | %) | |

| | | | | | | |

| Total | | | | | | |

| Assets under management, beginning of period | $ | 62,106 |

| | $ | 57,198 |

| | | |

| Inflows | 11,789 |

| | 13,665 |

| | | |

| Outflows | (12,969 | ) | | (9,808 | ) | | | |

| Net inflows (outflows) | (1,180 | ) | | 3,857 |

| | | |

| Market appreciation (depreciation) | (2,520 | ) | | 5,763 |

| | | |

| Distributions | (3,585 | ) | | (4,712 | ) | | | |

| Total increase (decrease) | (7,285 | ) | | 4,908 |

| | | |

| Assets under management, end of period | $ | 54,821 |

| | $ | 62,106 |

| | (11.7 | %) | |

| Average assets under management | $ | 58,968 |

| | $ | 60,312 |

| | (2.2 | %) | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management - Institutional Accounts (Unaudited) | | | | | | | |

| By Account Type | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| | Three Months Ended | | % Change From | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | September 30, 2018 | | December 31, 2017 | |

| Advisory | | | | | | | | | | |

| Assets under management, beginning of period | $ | 12,427 |

| | $ | 12,149 |

| | $ | 11,096 |

| | | | | |

| Inflows | 859 |

| | 303 |

| | 129 |

| | | | | |

| Outflows | (559 | ) | | (155 | ) | | (286 | ) | | | | | |

| Net inflows (outflows) | 300 |

| | 148 |

| | (157 | ) | | | | | |

| Market appreciation (depreciation) | (662 | ) | | 130 |

| | 402 |

| | | | | |

| Total increase (decrease) | (362 | ) | | 278 |

| | 245 |

| | | | | |

| Assets under management, end of period | $ | 12,065 |

| | $ | 12,427 |

| | $ | 11,341 |

| | (2.9 | %) | | 6.4 | % | |

| Percentage of institutional assets under management | 46.9 | % | | 44.8 | % | | 38.6 | % | | | | | |

| Average assets under management | $ | 12,128 |

| | $ | 12,303 |

| | $ | 11,271 |

| | (1.4 | %) | | 7.6 | % | |

| | | | | | | | | | | |

| Japan Subadvisory | | | | | | | | | | |

| Assets under management, beginning of period | $ | 9,248 |

| | $ | 9,849 |

| | $ | 12,275 |

| | | | | |

| Inflows | 6 |

| | 35 |

| | 66 |

| | | | | |

| Outflows | (310 | ) | | (349 | ) | | (560 | ) | | | | | |

| Net inflows (outflows) | (304 | ) | | (314 | ) | | (494 | ) | | | | | |

| Market appreciation (depreciation) | (446 | ) | | 146 |

| | 304 |

| | | | | |

| Distributions | (363 | ) | | (433 | ) | | (627 | ) | | | | | |

| Total increase (decrease) | (1,113 | ) | | (601 | ) | | (817 | ) | | | | | |

| Assets under management, end of period | $ | 8,135 |

| | $ | 9,248 |

| | $ | 11,458 |

| | (12.0 | %) | | (29.0 | %) | |

| Percentage of institutional assets under management | 31.6 | % | | 33.4 | % | | 39.0 | % | | | | | |

| Average assets under management | $ | 8,536 |

| | $ | 9,426 |

| | $ | 11,790 |

| | (9.4 | %) | | (27.6 | %) | |

| | | | | | | | | | | |

| Subadvisory Excluding Japan | | | | | | | | | | |

| Assets under management, beginning of period | $ | 6,048 |

| | $ | 6,318 |

| | $ | 6,260 |

| | | | | |

| Inflows | 71 |

| | 45 |

| | 216 |

| | | | | |

| Outflows | (256 | ) | | (380 | ) | | (153 | ) | | | | | |

| Net inflows (outflows) | (185 | ) | | (335 | ) | | 63 |

| | | | | |

| Market appreciation (depreciation) | (351 | ) | | 65 |

| | 274 |

| | | | | |

| Total increase (decrease) | (536 | ) | | (270 | ) | | 337 |

| | | | | |

| Assets under management, end of period | $ | 5,512 |

| | $ | 6,048 |

| | $ | 6,597 |

| | (8.9 | %) | | (16.4 | %) | |

| Percentage of institutional assets under management | 21.4 | % | | 21.8 | % | | 22.4 | % | | | | | |

| Average assets under management | $ | 5,790 |

| | $ | 6,263 |

| | $ | 6,417 |

| | (7.6 | %) | | (9.8 | %) | |

| | | | | | | | | | | |

| Total Institutional Accounts | | | | | | | | | | |

| Assets under management, beginning of period | $ | 27,723 |

| | $ | 28,316 |

| | $ | 29,631 |

| | | | | |

| Inflows | 936 |

| | 383 |

| | 411 |

| | | | | |

| Outflows | (1,125 | ) | | (884 | ) | | (999 | ) | | | | | |

| Net inflows (outflows) | (189 | ) | | (501 | ) | | (588 | ) | | | | | |

| Market appreciation (depreciation) | (1,459 | ) | | 341 |

| | 980 |

| | | | | |

| Distributions | (363 | ) | | (433 | ) | | (627 | ) | | | | | |

| Total increase (decrease) | (2,011 | ) | | (593 | ) | | (235 | ) | | | | | |

| Assets under management, end of period | $ | 25,712 |

| | $ | 27,723 |

| | $ | 29,396 |

| | (7.3 | %) | | (12.5 | %) | |

| Average assets under management | $ | 26,454 |

| | $ | 27,992 |

| | $ | 29,478 |

| | (5.5 | %) | | (10.3 | %) | |

| | | | | | | | | | | |

|

| | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management - Institutional Accounts (Unaudited) | | | |

| By Account Type | | | | | | |

| For the Periods | | | | | | |

| (in millions) | | | | | | |

| | Year Ended | | | |

| | December 31, 2018 | | December 31, 2017 | | % Change | |

| Advisory | | | | | | |

| Assets under management, beginning of period | $ | 11,341 |

| | $ | 9,068 |

| | | |

| Inflows | 2,101 |

| | 1,822 |

| | | |

| Outflows | (925 | ) | | (868 | ) | | | |

| Net inflows (outflows) | 1,176 |

| | 954 |

| | | |

| Market appreciation (depreciation) | (484 | ) | | 1,127 |

| | | |

| Transfers | 32 |

| | 192 |

| | | |

| Total increase (decrease) | 724 |

| | 2,273 |

| | | |

| Assets under management, end of period | $ | 12,065 |

| | $ | 11,341 |

| | 6.4 | % | |

| Percentage of institutional assets under management | 46.9 | % | | 38.6 | % | | | |

| Average assets under management | $ | 11,804 |

| | $ | 10,280 |

| | 14.8 | % | |

| | | | | | | |

| Japan Subadvisory | | | | | | |

| Assets under management, beginning of period | $ | 11,458 |

| | $ | 13,699 |

| | | |

| Inflows | 144 |

| | 1,411 |

| | | |

| Outflows | (1,250 | ) | | (1,545 | ) | | | |

| Net inflows (outflows) | (1,106 | ) | | (134 | ) | | | |

| Market appreciation (depreciation) | (255 | ) | | 911 |

| | | |

| Distributions | (1,962 | ) | | (3,018 | ) | | | |

| Total increase (decrease) | (3,323 | ) | | (2,241 | ) | | | |

| Assets under management, end of period | $ | 8,135 |

| | $ | 11,458 |

| | (29.0 | %) | |

| Percentage of institutional assets under management | 31.6 | % | | 39.0 | % | | | |

| Average assets under management | $ | 9,408 |

| | $ | 12,793 |

| | (26.5 | %) | |

| | | | | | | |

| Subadvisory Excluding Japan | | | | | | |

| Assets under management, beginning of period | $ | 6,597 |

| | $ | 5,892 |

| | | |

| Inflows | 569 |

| | 730 |

| | | |

| Outflows | (1,383 | ) | | (854 | ) | | | |

| Net inflows (outflows) | (814 | ) | | (124 | ) | | | |

| Market appreciation (depreciation) | (271 | ) | | 829 |

| | | |

| Total increase (decrease) | (1,085 | ) | | 705 |

| | | |

| Assets under management, end of period | $ | 5,512 |

| | $ | 6,597 |

| | (16.4 | %) | |

| Percentage of institutional assets under management | 21.4 | % | | 22.4 | % | | | |

| Average assets under management | $ | 6,196 |

| | $ | 6,273 |

| | (1.2 | %) | |

| | | | | | | |

| Total Institutional Accounts | | | | | | |

| Assets under management, beginning of period | $ | 29,396 |

| | $ | 28,659 |

| | | |

| Inflows | 2,814 |

| | 3,963 |

| | | |

| Outflows | (3,558 | ) | | (3,267 | ) | | | |

| Net inflows (outflows) | (744 | ) | | 696 |

| | | |

| Market appreciation (depreciation) | (1,010 | ) | | 2,867 |

| | | |

| Distributions | (1,962 | ) | | (3,018 | ) | | | |

| Transfers | 32 |

| | 192 |

| | | |

| Total increase (decrease) | (3,684 | ) | | 737 |

| | | |

| Assets under management, end of period | $ | 25,712 |

| | $ | 29,396 |

| | (12.5 | %) | |

| Average assets under management | $ | 27,408 |

| | $ | 29,346 |

| | (6.6 | %) | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | | |

| By Investment Strategy | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| | Three Months Ended | | % Change From | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | September 30, 2018 | | December 31, 2017 | |

| U.S. Real Estate | | | | | | | | | | |

| Assets under management, beginning of period | $ | 25,592 |

| | $ | 25,837 |

| | $ | 28,233 |

| | | | | |

| Inflows | 1,126 |

| | 1,008 |

| | 1,166 |

| | | | | |

| Outflows | (1,419 | ) | | (1,024 | ) | | (1,549 | ) | | | | | |

| Net inflows (outflows) | (293 | ) | | (16 | ) | | (383 | ) | | | | | |

| Market appreciation (depreciation) | (1,526 | ) | | 380 |

| | 753 |

| | | | | |

| Distributions | (576 | ) | | (575 | ) | | (1,023 | ) | | | | | |

| Transfers | (39 | ) | | (34 | ) | | — |

| | | | | |

| Total increase (decrease) | (2,434 | ) | | (245 | ) | | (653 | ) | | | | | |

| Assets under management, end of period | $ | 23,158 |

| | $ | 25,592 |

| | $ | 27,580 |

| | (9.5 | %) | | (16.0 | %) | |

| Percentage of total assets under management | 42.2 | % | | 42.6 | % | | 44.4 | % | | | | | |

| Average assets under management | $ | 24,481 |

| | $ | 25,807 |

| | $ | 28,085 |

| | (5.1 | %) | | (12.8 | %) | |

| | | | | | | | | | | |

| Preferred Securities | | | | | | | | | | |

| Assets under management, beginning of period | $ | 13,147 |

| | $ | 12,932 |

| | $ | 12,709 |

| | | | | |

| Inflows | 1,303 |

| | 980 |

| | 1,138 |

| | | | | |

| Outflows | (1,980 | ) | | (808 | ) | | (808 | ) | | | | | |

| Net inflows (outflows) | (677 | ) | | 172 |

| | 330 |

| | | | | |

| Market appreciation (depreciation) | (488 | ) | | 151 |

| | 138 |

| | | | | |

| Distributions | (137 | ) | | (142 | ) | | (159 | ) | | | | | |

| Transfers | 23 |

| | 34 |

| | — |

| | | | | |

| Total increase (decrease) | (1,279 | ) | | 215 |

| | 309 |

| | | | | |

| Assets under management, end of period | $ | 11,868 |

| | $ | 13,147 |

| | $ | 13,018 |

| | (9.7 | %) | | (8.8 | %) | |

| Percentage of total assets under management | 21.6 | % | | 21.9 | % | | 21.0 | % | | | | | |

| Average assets under management | $ | 12,719 |

| | $ | 13,086 |

| | $ | 12,932 |

| | (2.8 | %) | | (1.6 | %) | |

| | | | | | | | | | | |

| Global/International Real Estate | | | | | | | | | | |

| Assets under management, beginning of period | $ | 11,614 |

| | $ | 11,674 |

| | $ | 10,445 |

| | | | | |

| Inflows | 644 |

| | 199 |

| | 555 |

| | | | | |

| Outflows | (814 | ) | | (298 | ) | | (315 | ) | | | | | |

| Net inflows (outflows) | (170 | ) | | (99 | ) | | 240 |

| | | | | |

| Market appreciation (depreciation) | (530 | ) | | 64 |

| | 487 |

| | | | | |

| Distributions | (58 | ) | | (25 | ) | | (64 | ) | | | | | |

| Total increase (decrease) | (758 | ) | | (60 | ) | | 663 |

| | | | | |

| Assets under management, end of period | $ | 10,856 |

| | $ | 11,614 |

| | $ | 11,108 |

| | (6.5 | %) | | (2.3 | %) | |

| Percentage of total assets under management | 19.8 | % | | 19.3 | % | | 17.9 | % | | | | | |

| Average assets under management | $ | 10,970 |

| | $ | 11,674 |

| | $ | 10,729 |

| | (6.0 | %) | | 2.2 | % | |

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management (Unaudited) | | | | | | | | | | |

| By Investment Strategy - continued | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| | Three Months Ended | | % Change From | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | September 30, 2018 | | December 31, 2017 | |

| Global Listed Infrastructure | | | | | | | | | | |

| Assets under management, beginning of period | $ | 6,982 |

| | $ | 6,909 |

| | $ | 6,771 |

| | | | | |

| Inflows | 136 |

| | 93 |

| | 153 |

| | | | | |

| Outflows | (161 | ) | | (77 | ) | | (79 | ) | | | | | |

| Net inflows (outflows) | (25 | ) | | 16 |

| | 74 |

| | | | | |

| Market appreciation (depreciation) | (423 | ) | | 105 |

| | 154 |

| | | | | |

| Distributions | (51 | ) | | (48 | ) | | (67 | ) | | | | | |

| Total increase (decrease) | (499 | ) | | 73 |

| | 161 |

| | | | | |

| Assets under management, end of period | $ | 6,483 |

| | $ | 6,982 |

| | $ | 6,932 |

| | (7.1 | %) | | (6.5 | %) | |

| Percentage of total assets under management | 11.8 | % | | 11.6 | % | | 11.2 | % | | | | | |

| Average assets under management | $ | 6,795 |

| | $ | 7,023 |

| | $ | 6,845 |

| | (3.2 | %) | | (0.7 | %) | |

| | | | | | | | | | | |

| Other | | | | | | | | | | |

| Assets under management, beginning of period | $ | 2,749 |

| | $ | 2,852 |

| | $ | 3,363 |

| | | | | |

| Inflows | 36 |

| | 103 |

| | 53 |

| | | | | |

| Outflows | (60 | ) | | (252 | ) | | (87 | ) | | | | | |

| Net inflows (outflows) | (24 | ) | | (149 | ) | | (34 | ) | | | | | |

| Market appreciation (depreciation) | (265 | ) | | 58 |

| | 168 |

| | | | | |

| Distributions | (20 | ) | | (12 | ) | | (29 | ) | | | | | |

| Transfers | 16 |

| | — |

| | — |

| | | | | |

| Total increase (decrease) | (293 | ) | | (103 | ) | | 105 |

| | | | | |

| Assets under management, end of period | $ | 2,456 |

| | $ | 2,749 |

| | $ | 3,468 |

| | (10.7 | %) | | (29.2 | %) | |

| Percentage of total assets under management | 4.5 | % | | 4.6 | % | | 5.6 | % | | | | | |

| Average assets under management | $ | 2,605 |

| | $ | 2,824 |

| | $ | 3,411 |

| | (7.8 | %) | | (23.6 | %) | |

| | | | | | | | | | | |

| Total | | | | | | | | | | |

| Assets under management, beginning of period | $ | 60,084 |

| | $ | 60,204 |

| | $ | 61,521 |

| | | | | |

| Inflows | 3,245 |

| | 2,383 |

| | 3,065 |

| | | | | |

| Outflows | (4,434 | ) | | (2,459 | ) | | (2,838 | ) | | | | | |

| Net inflows (outflows) | (1,189 | ) | | (76 | ) | | 227 |

| | | | | |

| Market appreciation (depreciation) | (3,232 | ) | | 758 |

| | 1,700 |

| | | | | |

| Distributions | (842 | ) | | (802 | ) | | (1,342 | ) | | | | | |

| Total increase (decrease) | (5,263 | ) | | (120 | ) | | 585 |

| | | | | |

| Assets under management, end of period | $ | 54,821 |

| | $ | 60,084 |

| | $ | 62,106 |

| | (8.8 | %) | | (11.7 | %) | |

| Average assets under management | $ | 57,570 |

| | $ | 60,414 |

| | $ | 62,002 |

| | (4.7 | %) | | (7.1 | %) | |

| | | | | | | | | | | |

|

| | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management (Unaudited) | | | | | | |

| By Investment Strategy | | | | | | |

| For the Periods | | | | | | |

| (in millions) | | | | | | |

| | Year Ended | | | |

| | December 31, 2018 | | December 31, 2017 | | % Change | |

| U.S. Real Estate | | | | | | |

| Assets under management, beginning of period | $ | 27,580 |

| | $ | 28,927 |

| | | |

| Inflows | 4,488 |

| | 5,703 |

| | | |

| Outflows | (5,158 | ) | | (5,241 | ) | | | |

| Net inflows (outflows) | (670 | ) | | 462 |

| | | |

| Market appreciation (depreciation) | (959 | ) | | 1,895 |

| | | |

| Distributions | (2,561 | ) | | (3,694 | ) | | | |

| Transfers | (232 | ) | | (10 | ) | | | |

| Total increase (decrease) | (4,422 | ) | | (1,347 | ) | | | |

| Assets under management, end of period | $ | 23,158 |

| | $ | 27,580 |

| | (16.0 | %) | |

| Percentage of total assets under management | 42.2 | % | | 44.4 | % | | | |

| Average assets under management | $ | 25,052 |

| | $ | 28,622 |

| | (12.5 | %) | |

| | | | | | | |

| Preferred Securities | | | | | | |

| Assets under management, beginning of period | $ | 13,018 |

| | $ | 9,880 |

| | | |

| Inflows | 4,503 |

| | 5,168 |

| | | |

| Outflows | (4,723 | ) | | (2,635 | ) | | | |

| Net inflows (outflows) | (220 | ) | | 2,533 |

| | | |

| Market appreciation (depreciation) | (586 | ) | | 1,145 |

| | | |

| Distributions | (560 | ) | | (540 | ) | | | |

| Transfers | 216 |

| | — |

| | | |

| Total increase (decrease) | (1,150 | ) | | 3,138 |

| | | |

| Assets under management, end of period | $ | 11,868 |

| | $ | 13,018 |

| | (8.8 | %) | |

| Percentage of total assets under management | 21.6 | % | | 21.0 | % | | | |

| Average assets under management | $ | 12,939 |

| | $ | 11,644 |

| | 11.1 | % | |

| | | | | | | |

| Global/International Real Estate | | | | | | |

| Assets under management, beginning of period | $ | 11,108 |

| | $ | 9,403 |

| | | |

| Inflows | 1,975 |

| | 1,520 |

| | | |

| Outflows | (1,669 | ) | | (1,071 | ) | | | |

| Net inflows (outflows) | 306 |

| | 449 |

| | | |

| Market appreciation (depreciation) | (359 | ) | | 1,458 |

| | | |

| Distributions | (199 | ) | | (212 | ) | | | |

| Transfers | — |

| | 10 |

| | | |

| Total increase (decrease) | (252 | ) | | 1,705 |

| | | |

| Assets under management, end of period | $ | 10,856 |

| | $ | 11,108 |

| | (2.3 | %) | |

| Percentage of total assets under management | 19.8 | % | | 17.9 | % | | | |

| Average assets under management | $ | 11,180 |

| | $ | 10,258 |

| | 9.0 | % | |

| | | | | | | |

|

| | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management (Unaudited) | | | | | | |

| By Investment Strategy - continued | | | | | | |

| For the Periods | | | | | | |

| (in millions) | | | | | | |

| | Year Ended | | | |

| | December 31, 2018 | | December 31, 2017 | | % Change | |

| Global Listed Infrastructure | | | | | | |

| Assets under management, beginning of period | $ | 6,932 |

| | $ | 5,697 |

| | | |

| Inflows | 601 |

| | 872 |

| | | |

| Outflows | (448 | ) | | (376 | ) | | | |

| Net inflows (outflows) | 153 |

| | 496 |

| | | |

| Market appreciation (depreciation) | (403 | ) | | 935 |

| | | |

| Distributions | (199 | ) | | (196 | ) | | | |

| Total increase (decrease) | (449 | ) | | 1,235 |

| | | |

| Assets under management, end of period | $ | 6,483 |

| | $ | 6,932 |

| | (6.5 | %) | |

| Percentage of total assets under management | 11.8 | % | | 11.2 | % | | | |

| Average assets under management | $ | 6,882 |

| | $ | 6,473 |

| | 6.3 | % | |

| | | | | | | |

| Other | | | | | | |

| Assets under management, beginning of period | $ | 3,468 |

| | $ | 3,291 |

| | | |

| Inflows | 222 |

| | 402 |

| | | |

| Outflows | (971 | ) | | (485 | ) | | | |

| Net inflows (outflows) | (749 | ) | | (83 | ) | | | |

| Market appreciation (depreciation) | (213 | ) | | 330 |

| | | |

| Distributions | (66 | ) | | (70 | ) | | | |

| Transfers | 16 |

| | — |

| | | |

| Total increase (decrease) | (1,012 | ) | | 177 |

| | | |

| Assets under management, end of period | $ | 2,456 |

| | $ | 3,468 |

| | (29.2 | %) | |

| Percentage of total assets under management | 4.5 | % | | 5.6 | % | | | |

| Average assets under management | $ | 2,915 |

| | $ | 3,315 |

| | (12.1 | %) | |

| | | | | | | |

| Total | | | | | | |

| Assets under management, beginning of period | $ | 62,106 |

| | $ | 57,198 |

| | | |

| Inflows | 11,789 |

| | 13,665 |

| | | |

| Outflows | (12,969 | ) | | (9,808 | ) | | | |

| Net inflows (outflows) | (1,180 | ) | | 3,857 |

| | | |

| Market appreciation (depreciation) | (2,520 | ) | | 5,763 |

| | | |

| Distributions | (3,585 | ) | | (4,712 | ) | | | |

| Total increase (decrease) | (7,285 | ) | | 4,908 |

| | | |

| Assets under management, end of period | $ | 54,821 |

| | $ | 62,106 |

| | (11.7 | %) | |

| Average assets under management | $ | 58,968 |

| | $ | 60,312 |

| | (2.2 | %) | |

| | | | | | | |

Non-GAAP Reconciliations

Management believes that use of the following non-GAAP financial measures enhances the evaluation of the Company's results, as they provide greater transparency into the Company's operating performance. In addition, these non-GAAP financial measures are used to prepare the Company's internal management reports and are used by management in evaluating the Company's business.

While management believes that this non-GAAP financial information is useful in evaluating the Company's results and operating performance, this information should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with U.S. GAAP. |

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Net Income Attributable to Common Stockholders and U.S. GAAP Earnings per Share to Net Income Attributable to Common Stockholders, As Adjusted, and Earnings per Share, As Adjusted | |

| | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| | | | | | | | | | | |

| (in thousands, except per share data) | Three Months Ended | | Year Ended | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | December 31, 2018 | | December 31, 2017 | |

| Net income attributable to common stockholders, U.S. GAAP | $ | 25,561 |

| | $ | 30,790 |

| | $ | 20,398 |

| | $ | 113,896 |

| | $ | 91,939 |

| |

Deconsolidation (1) | 2,489 |

| | (63 | ) | | (1,216 | ) | | 3,392 |

| | (2,350 | ) | |

Results from seed investments (2) | 3,091 |

| | (551 | ) | | (471 | ) | | 2,160 |

| | (1,124 | ) | |

Accelerated vesting of restricted stock units (3) | — |

| | — |

| | 224 |

| | — |

| | 522 |

| |

General and administrative (4) | — |

| | — |

| | — |

| | 871 |

| | (1,018 | ) | |

Foreign currency exchange gain (5) | (1,100 | ) | | (217 | ) | | — |

| | (2,270 | ) | | — |

| |

Tax adjustments (6) | (3,338 | ) | | 313 |

| | 7,120 |

| | (4,200 | ) | | 9,068 |

| |

| Net income attributable to common stockholders, as adjusted | $ | 26,703 |

| | $ | 30,272 |

| | $ | 26,055 |

| | $ | 113,849 |

| | $ | 97,037 |

| |

| | | | | | | | | | | |

| Diluted weighted average shares outstanding | 47,562 |

| | 47,524 |

| | 47,300 |

| | 47,381 |

| | 46,979 |

| |

| Diluted earnings per share, U.S. GAAP | $ | 0.54 |

| | $ | 0.65 |

| | $ | 0.43 |

| | $ | 2.40 |

| | $ | 1.96 |

| |

Deconsolidation (1) | 0.05 |

| | — |

| * | (0.03 | ) | | 0.07 |

| | (0.05 | ) | |

Results from seed investments (2) | 0.06 |

| | (0.01 | ) | | (0.01 | ) | | 0.05 |

| | (0.02 | ) | |

Accelerated vesting of restricted stock units (3) | — |

| | — |

| | 0.01 |

| | — |

| | 0.01 |

| |

General and administrative (4) | — |

| | — |

| | — |

| | 0.02 |

| | (0.02 | ) | |

Foreign currency exchange gain (5) | (0.02 | ) | | (0.01 | ) | | — |

| | (0.05 | ) | | — |

| |

| Tax adjustments | (0.07 | ) | | 0.01 |

| | 0.15 |

| | (0.09 | ) | | 0.19 |

| |

| Diluted earnings per share, as adjusted | $ | 0.56 |

| | $ | 0.64 |

| | $ | 0.55 |

| | $ | 2.40 |

| | $ | 2.07 |

| |

_________________________

* Amounts round to less than $0.01 per share. (1) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. (2) Represents (i) dividend income and realized (gains) losses on seed investments in Company-sponsored funds, (ii) the Company's proportionate share of the results of operations of seed investments classified as equity method investments, including realized and unrealized (gains) losses, and (iii) realized and unrealized (gains) losses on unconsolidated seed investments. (3) Represents amounts related to the accelerated vesting of certain restricted stock units due to retirements. (4) Represents expenses associated with the evaluation of a potential business transaction that the Company did not pursue in the first quarter of 2018 and refunds of foreign withholding taxes in 2017. (5) Represents net foreign currency exchange gains associated with U.S. dollar-denominated assets and liabilities held by certain foreign subsidiaries. Prior year U.S. GAAP amounts have not been recast to conform with the current period presentation as the impact to results was not material. (6) Tax adjustments are summarized in the following table: | |

| (in thousands) | Three Months Ended | | Year Ended | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | December 31, 2018 | | December 31, 2017 | |

Transition tax liability in connection with the Tax Cuts and Jobs Act | $ | — |

| | $ | — |

| | $ | 8,432 |

| | $ | (123 | ) | | $ | 8,432 |

| |

| Remeasurement of deferred and other tax balances | — |

| | — |

| | 4,300 |

| | — |

| | 4,300 |

| |

Reversal of certain liabilities associated with unrecognized tax benefits | (2,758 | ) | | — |

| | (4,737 | ) | | (2,758 | ) | | (3,772 | ) | |

| Delivery of restricted stock units | — |

| | — |

| | — |

| | (947 | ) | | 49 |

| |

| Tax effect of non-GAAP adjustments | 9 |

| | 313 |

| | (49 | ) | | 217 |

| | 888 |

| |

| Other tax-related items | (589 | ) | | — |

| | (826 | ) | | (589 | ) | | (829 | ) | |

| Total tax adjustments | $ | (3,338 | ) | | $ | 313 |

| | $ | 7,120 |

| | $ | (4,200 | ) | | $ | 9,068 |

| |

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Operating Income and U.S. GAAP Operating Margin to Operating Income, As Adjusted, and Operating Margin, As Adjusted |

| | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| | | | | | | | | | | |

| (in thousands, except percentages) | Three Months Ended | | Year Ended | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | December 31, 2018 | | December 31, 2017 | |

Revenue, U.S. GAAP (1) | $ | 93,906 |

| | $ | 98,331 |

| | $ | 99,454 |

| | $ | 381,111 |

| | $ | 378,696 |

| |

Deconsolidation (2) | (269 | ) | | (180 | ) | | (148 | ) | | (694 | ) | | (403 | ) | |

| Revenue, as adjusted | $ | 93,637 |

| | $ | 98,151 |

| | $ | 99,306 |

| | $ | 380,417 |

| | $ | 378,293 |

| |

| | | | | | | | | | | |

Expenses, U.S. GAAP (1) | $ | 59,597 |

| | $ | 59,108 |

| | $ | 58,566 |

| | $ | 234,073 |

| | $ | 223,950 |

| |

Deconsolidation (2) | (437 | ) | | (373 | ) | | (274 | ) | | (1,408 | ) | | (789 | ) | |

Accelerated vesting of restricted stock units (3) | — |

| | — |

| | (224 | ) | | — |

| | (522 | ) | |

General and administrative (4) | — |

| | — |

| | — |

| | (871 | ) | | 1,018 |

| |

| Expenses, as adjusted | $ | 59,160 |

| | $ | 58,735 |

| | $ | 58,068 |

| | $ | 231,794 |

| | $ | 223,657 |

| |

| | | | | | | | | | | |

| Operating income, U.S. GAAP | $ | 34,309 |

| | $ | 39,223 |

| | $ | 40,888 |

| | $ | 147,038 |

| | $ | 154,746 |

| |

Deconsolidation (2) | 168 |

| | 193 |

| | 126 |

| | 714 |

| | 386 |

| |

Accelerated vesting of restricted stock units (3) | — |

| | — |

| | 224 |

| | — |

| | 522 |

| |

General and administrative (4) | — |

| | — |

| | — |

| | 871 |

| | (1,018 | ) | |

| Operating income, as adjusted | $ | 34,477 |

| | $ | 39,416 |

| | $ | 41,238 |

| | $ | 148,623 |

| | $ | 154,636 |

| |

| | | | | | | | | | | |

Operating margin, U.S. GAAP (1) | 36.5 | % | | 39.9 | % | | 41.1 | % | | 38.6 | % | | 40.9 | % | |

| Operating margin, as adjusted | 36.8 | % | | 40.2 | % | | 41.5 | % | | 39.1 | % | | 40.9 | % | |

_________________________

(1) The presentation for the quarter and year ended December 31, 2017 has been recast to reflect the Company's adoption of the new revenue recognition accounting standard on January 1, 2018. (2) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. (3) Represents amounts related to the accelerated vesting of certain restricted stock units due to retirements. (4) Represents expenses associated with the evaluation of a potential business transaction that the Company did not pursue in the first quarter of 2018 and refunds of foreign withholding taxes for the year ended December 31, 2017. | |

|

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Non-operating Income (Loss) to Non-operating Income (Loss), As Adjusted | |

| | | | | | | | | | | |

| For the Periods | | | | | | | | | | |

| | | | | | | | | | | |

| (in thousands) | Three Months Ended | | Year Ended | |

| | December 31, 2018 | | September 30, 2018 | | December 31, 2017 | | December 31, 2018 | | December 31, 2017 | |

| Non-operating income (loss), U.S. GAAP | $ | (3,329 | ) | | $ | 1,047 |

| | $ | 2,839 |

| | $ | (3,259 | ) | | $ | 5,654 |

| |

Deconsolidation (1) | 2,584 |

| | 803 |

| | (1,750 | ) | | 7,052 |

| | (3,283 | ) | |

Results from seed investments (2) | 3,091 |

| | (551 | ) | | (471 | ) | | 2,160 |

| | (1,124 | ) | |

Foreign currency exchange gain (3) | (1,100 | ) | | (217 | ) | | — |

| | (2,270 | ) | | — |

| |

| Non-operating income (loss), as adjusted | $ | 1,246 |

| | $ | 1,082 |

| | $ | 618 |

| | $ | 3,683 |

| | $ | 1,247 |

| |

_________________________

(1) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. (2) Represents (i) dividend income and realized (gains) losses on seed investments in Company-sponsored funds, (ii) the Company's proportionate share of the results of operations of seed investments classified as equity method investments, including realized and unrealized (gains) losses, and (iii) realized and unrealized (gains) losses on unconsolidated seed investments. (3) Represents net foreign currency exchange gains associated with U.S. dollar-denominated assets and liabilities held by certain foreign subsidiaries. Prior year U.S. GAAP amounts have not been recast to conform with the current period presentation as the impact to results was not material. |