Contact:

Matthew S. Stadler

Executive Vice President

Chief Financial Officer

Cohen & Steers, Inc.

Tel (212) 446-9168

COHEN & STEERS REPORTS RESULTS FOR THIRD QUARTER 2020

•Diluted EPS of $0.66 ($0.67, as adjusted)

•Operating margin of 39.0% (39.6%, as adjusted)

•AUM of $70.5 billion; average AUM of $69.8 billion

•Net inflows of $2.3 billion

NEW YORK, NY, October 21, 2020—Cohen & Steers, Inc. (NYSE: CNS) today reported its operating results for the quarter ended September 30, 2020.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| (in thousands, except percentages and per share data) | Three Months Ended | | | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | |

| U.S. GAAP | | | | | | |

| Revenue | $ | 111,159 | | | $ | 94,087 | | | $ | 104,965 | | |

| Expenses | $ | 67,852 | | | $ | 58,792 | | | $ | 64,832 | | |

| Operating income (loss) | $ | 43,307 | | | $ | 35,295 | | | $ | 40,133 | | |

| Non-operating income (loss) | $ | 3,231 | | | $ | 7,953 | | | $ | 6,617 | | |

| Net income attributable to common stockholders | $ | 31,904 | | | $ | 28,520 | | | $ | 34,017 | | |

| Diluted earnings per share | $ | 0.66 | | | $ | 0.59 | | | $ | 0.70 | | |

| Operating margin | 39.0 | % | | 37.5 | % | | 38.2 | % | |

| | | | | | |

As Adjusted (1) | | | | | | |

| Net income attributable to common stockholders | $ | 32,616 | | | $ | 26,154 | | | $ | 31,257 | | |

| Diluted earnings per share | $ | 0.67 | | | $ | 0.54 | | | $ | 0.65 | | |

| Operating margin | 39.6 | % | | 37.7 | % | | 38.8 | % | |

_________________________

(1) The “As Adjusted” amounts represent non-GAAP financial measures. Refer to pages 18-19 for reconciliations to the most directly comparable U.S. GAAP financial measures. | | | | | | |

U.S. GAAP

This section discusses the financial results of the Company as presented in accordance with U.S. GAAP.

Revenue

Revenue for the third quarter of 2020 was $111.2 million, an increase of $17.1 million, or 18.1% from $94.1 million for the second quarter of 2020. The change was primarily due to an increase in investment advisory and administration fees of $16.5 million, primarily attributable to higher average assets under management in all three investment vehicles and one more day in the quarter, as well as the recognition of $5.2 million of performance fees from certain institutional accounts. Changes to investment advisory and administration fee revenue by investment vehicle were as follows:

•Institutional account revenue increased $8.3 million to $32.9 million;

•Open-end fund revenue increased $7.0 million to $51.6 million; and

•Closed-end fund revenue increased $1.2 million to $18.7 million.

Expenses

Expenses for the third quarter of 2020 were $67.9 million, an increase of $9.1 million, or 15.4% from $58.8 million for the second quarter of 2020. The change was primarily due to:

•Higher employee compensation and benefits of $6.7 million, primarily due to higher incentive compensation of $6.1 million which increased consistent with revenue growth;

•Higher distribution and services fees of $2.1 million, primarily due to higher average assets under management in U.S. open-end funds; and

•Higher general and administrative expenses of $280,000, primarily due to $310,000 of costs associated with the ongoing initial offering of a closed-end fund.

Operating Margin

Operating margin was 39.0% for the third quarter of 2020, compared with 37.5% for the second quarter of 2020. Operating margin represents the ratio of operating income to revenue.

Non-operating Income (Loss)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Three Months Ended | | | | | | | | | | | |

| September 30, 2020 | | | | | | June 30, 2020 | | | | | |

| Seed Investments | | Other | | Total | | Seed Investments | | Other | | Total | |

| Interest and dividend income—net | $ | 574 | | | $ | 120 | | | $ | 694 | | | $ | 604 | | | $ | 289 | | | $ | 893 | | |

| Gain (loss) from investments—net | 3,279 | | | — | | | 3,279 | | | 7,317 | | | — | | | 7,317 | | |

| Foreign currency gains (losses)—net | 108 | | | (850) | | | (742) | | | (225) | | | (32) | | | (257) | | |

| Total non-operating income (loss) | $ | 3,961 | | (1) | $ | (730) | | | $ | 3,231 | | | $ | 7,696 | | (1) | $ | 257 | | | $ | 7,953 | | |

_________________________

(1) Seed investments included net income of $2.1 million and $3.6 million attributable to third-party interests for the three months ended September 30, 2020 and June 30, 2020, respectively. | | | | | | | | | | | | |

| | | | | | | | | | | | |

Income Taxes

The effective tax rate for the third quarter of 2020 was 28.2%, compared with 28.0% for the second quarter of 2020. The effective tax rate for the third and second quarters of 2020 differed from the U.S. federal statutory rate of 21.0% primarily due to state, local and foreign taxes as well as the effect of certain permanent differences, the most significant of which related to limitations on the deductibility of executive compensation.

As Adjusted

The term “As Adjusted” is used to identify non-GAAP financial information in the discussion below. Refer to pages 18-19 for reconciliations to the most directly comparable U.S. GAAP financial measures.

Revenue

Revenue, as adjusted, for the third quarter of 2020 was $111.4 million, compared with $94.0 million for the second quarter of 2020.

Revenue, as adjusted, excluded the consolidation of certain of the Company's seed investments for both periods.

Expenses

Expenses, as adjusted, for the third quarter of 2020 were $67.3 million, compared with $58.6 million for the second quarter of 2020.

Expenses, as adjusted, excluded the following:

•The consolidation of certain of the Company's seed investments for both periods;

•Amounts related to the accelerated vesting of certain restricted stock units for the third quarter of 2020; and

•Costs associated with the ongoing initial offering of a closed-end fund for the third quarter of 2020.

Operating Margin

Operating margin, as adjusted, for the third quarter of 2020 was 39.6%, compared with 37.7% for the second quarter of 2020.

Non-operating Income

Non-operating income, as adjusted, for the third quarter of 2020 was $502,000, compared with $140,000 for the second quarter of 2020.

Non-operating income, as adjusted, excluded the following for both periods:

•Results from the Company's seed investments; and

•Net foreign currency exchange gains and losses associated with U.S. dollar-denominated assets held by certain foreign subsidiaries.

Income Taxes

The effective tax rate, as adjusted, for the third quarter of 2020 was 27.0%, compared with 26.5% for the second quarter of 2020.

The effective tax rate, as adjusted, excluded the tax effects associated with non-GAAP adjustments as well as discrete items for both periods.

Assets Under Management

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | As of | | | | | |

| September 30,

2020 | | June 30,

2020 | | % Change | |

| By Investment Vehicle | | | | | | |

| Institutional accounts | $ | 30,380 | | | $ | 28,867 | | | 5.2 | % | |

| Open-end funds | 31,404 | | | 28,921 | | | 8.6 | % | |

| Closed-end funds | 8,719 | | | 8,539 | | | 2.1 | % | |

| Total | $ | 70,503 | | | $ | 66,327 | | | 6.3 | % | |

| | | | | | |

| By Investment Strategy | | | | | | |

| U.S. real estate | $ | 29,610 | | | $ | 28,119 | | | 5.3 | % | |

| Preferred securities | 19,010 | | | 17,116 | | | 11.1 | % | |

| Global/international real estate | 13,863 | | | 12,659 | | | 9.5 | % | |

| Global listed infrastructure | 6,299 | | | 6,768 | | | (6.9 | %) | |

| Other | 1,721 | | | 1,665 | | | 3.4 | % | |

| Total | $ | 70,503 | | | $ | 66,327 | | | 6.3 | % | |

| | | | | | |

Assets under management at September 30, 2020 were $70.5 billion, an increase of 6.3% from $66.3 billion at June 30, 2020. The increase was driven by net inflows of $2.3 billion and market appreciation of $2.6 billion, partially offset by distributions of $724 million.

Institutional Accounts

Assets under management in institutional accounts at September 30, 2020 were $30.4 billion, an increase of 5.2% from $28.9 billion at June 30, 2020. The change was primarily due to the following:

•Advisory:

◦Net inflows of $106 million, including $325 million into U.S. real estate and $226 million into global/international real estate, partially offset by net outflows of $460 million from global listed infrastructure, which included a $506 million termination from a single client; and

◦Market appreciation of $736 million, including $376 million from global/international real estate, $142 million from preferred securities and $138 million from U.S. real estate.

•Japan subadvisory:

◦Net inflows of $294 million, including $309 million into U.S. real estate;

◦Market appreciation of $345 million, including $221 million from U.S. real estate and $108 million from global/international real estate; and

◦Distributions of $359 million, including $350 million from U.S. real estate.

•Subadvisory excluding Japan:

◦Net inflows of $199 million, including $276 million into global/international real estate, partially offset by net outflows of $66 million from global listed infrastructure; and

◦Market appreciation of $192 million, including $142 million from global/international real estate.

Open-end Funds

Assets under management in open-end funds at September 30, 2020 were $31.4 billion, an increase of 8.6% from $28.9 billion at June 30, 2020. The change was primarily due to the following:

•Net inflows of $1.6 billion, including $1.2 billion into preferred securities and $420 million into U.S. real estate;

•Market appreciation of $1.1 billion, including $583 million from preferred securities and $400 million from U.S. real estate; and

•Distributions of $239 million, including $149 million from preferred securities and $87 million from U.S. real estate.

Closed-end Funds

Assets under management in closed-end funds at September 30, 2020 were $8.7 billion, an increase of 2.1% from $8.5 billion at June 30, 2020. The increase was primarily the result of market appreciation of $257 million, partially offset by distributions of $126 million.

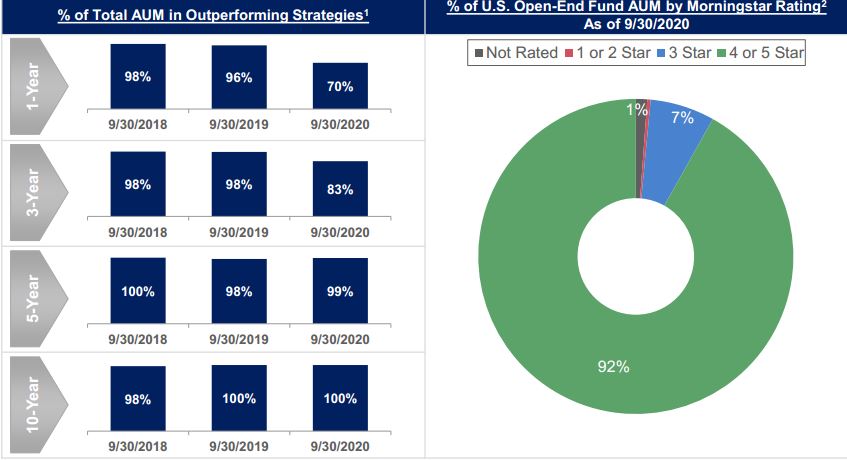

Investment Performance at September 30, 2020

_________________________

(1) Past performance is no guarantee of future results. Outperformance is determined by comparing the annualized investment performance of each investment strategy to the performance of specified reference benchmarks. Investment performance in excess of the performance of the benchmark is considered outperformance. The investment performance calculation of each investment strategy is based on all active accounts and investment models pursuing similar investment objectives. For accounts, actual investment performance is measured gross of fees and net of withholding taxes. For investment models, for which actual investment performance does not exist, the investment performance of a composite of accounts pursuing comparable investment objectives is used as a proxy for actual investment performance. The performance of the specified reference benchmark for each account and investment model is measured net of withholding taxes, where applicable. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers.

(2) © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Morningstar calculates its ratings based on a risk-adjusted return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. Past performance is no guarantee of future results. Based on independent rating by Morningstar, Inc. of investment performance of each Cohen & Steers-sponsored open-end U.S.-registered mutual fund for all share classes for the overall period at September 30, 2020. Overall Morningstar rating is a weighted average based on the 3-year, 5-year and 10-year Morningstar rating. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages. This is not investment advice and may not be construed as sales or marketing material for any financial product or service sponsored or provided by Cohen & Steers.

Balance Sheet Information

As of September 30, 2020, cash, cash equivalents, U.S. Treasury securities and seed investments were $201.9 million. As of September 30, 2020, stockholders' equity was $235.8 million and the Company had no debt.

Conference Call Information

Cohen & Steers will host a conference call tomorrow, October 22, 2020 at 10:00 a.m. (ET) to discuss the Company's third quarter results. Investors and analysts can access the live conference call by dialing 800-894-8917 (U.S.) or +1-212-231-2920 (international); passcode: 21970758. Participants should plan to register at least 10 minutes before the conference call begins. The accompanying presentation will be available on the Company's website at www.cohenandsteers.com under “Company—Investor Relations—Press Releases.”

A replay of the call will be available for two weeks starting at approximately 12:00 p.m. (ET) on October 22, 2020 and can be accessed at 800-633-8284 (U.S.) or +1-402-977-9140 (international); passcode: 21970758. Internet access to the webcast, which includes audio (listen-only), will be available on the Company's website at www.cohenandsteers.com under “Company—Investor Relations—Overview.” The webcast will be archived on the website for one month.

About Cohen & Steers

Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong and Tokyo.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect management's current views with respect to, among other things, the Company's operations and financial performance. You can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "may," "should," "seeks," "predicts," "intends," "plans," "estimates," "anticipates" or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these forward-looking statements. The Company believes that these factors include, but are not limited to, the risks described in the Risk Factors section of the Company's Annual Report on Form 10-K for the year ended December 31, 2019 (the Form 10-K) and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020 (the First and Second Quarter 10-Qs), each of which is accessible on the Securities and Exchange Commission's website at www.sec.gov and on the Company's website at www.cohenandsteers.com. These factors are not exhaustive and should be read in conjunction with the other cautionary statements that are included in the Company's Form 10-K, First and Second Quarter 10-Qs, and other filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

# # # #

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | | | | | | | |

| | | | | | | | | | |

| (in thousands, except per share data) | | | | | | | | | | |

| | | | | | | | | | |

| Three Months Ended | | | | | | % Change From | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | June 30,

2020 | | September 30,

2019 | |

| Revenue | | | | | | | | | | |

| Investment advisory and administration fees | $ | 103,160 | | | $ | 86,648 | | | $ | 96,763 | | | | | | |

| Distribution and service fees | 7,572 | | | 6,930 | | | 7,681 | | | | | | |

| Other | 427 | | | 509 | | | 521 | | | | | | |

| Total revenue | 111,159 | | | 94,087 | | | 104,965 | | | 18.1 | % | | 5.9 | % | |

| Expenses | | | | | | | | | | |

| Employee compensation and benefits | 41,060 | | | 34,320 | | | 37,877 | | | | | | |

| Distribution and service fees | 14,642 | | | 12,518 | | | 14,142 | | | | | | |

| General and administrative | 11,006 | | | 10,726 | | | 11,713 | | | | | | |

| Depreciation and amortization | 1,144 | | | 1,228 | | | 1,100 | | | | | | |

| Total expenses | 67,852 | | | 58,792 | | | 64,832 | | | 15.4 | % | | 4.7 | % | |

| Operating income (loss) | 43,307 | | | 35,295 | | | 40,133 | | | 22.7 | % | | 7.9 | % | |

| Non-operating income (loss) | | | | | | | | | | |

| Interest and dividend income—net | 694 | | | 893 | | | 1,713 | | | | | | |

| Gain (loss) from investments—net | 3,279 | | | 7,317 | | | 4,472 | | | | | | |

| Foreign currency gains (losses)—net | (742) | | | (257) | | | 432 | | | | | | |

| Total non-operating income (loss) | 3,231 | | | 7,953 | | | 6,617 | | | (59.4 | %) | | (51.2 | %) | |

| Income before provision for income taxes | 46,538 | | | 43,248 | | | 46,750 | | | 7.6 | % | | (0.5 | %) | |

| Provision for income taxes | 12,532 | | | 11,086 | | | 10,352 | | | | | | |

| Net income | 34,006 | | | 32,162 | | | 36,398 | | | 5.7 | % | | (6.6 | %) | |

| Less: Net (income) loss attributable to redeemable noncontrolling interests | (2,102) | | | (3,642) | | | (2,381) | | | | | | |

| Net income attributable to common stockholders | $ | 31,904 | | | $ | 28,520 | | | $ | 34,017 | | | 11.9 | % | | (6.2 | %) | |

| | | | | | | | | | |

| Earnings per share attributable to common stockholders | | | | | | | | | | |

| Basic | $ | 0.67 | | | $ | 0.60 | | | $ | 0.72 | | | 11.8 | % | | (7.3 | %) | |

| Diluted | $ | 0.66 | | | $ | 0.59 | | | $ | 0.70 | | | 11.6 | % | | (6.7 | %) | |

| | | | | | | | | | |

| Dividends declared per share | $ | 0.39 | | | $ | 0.39 | | | $ | 0.36 | | | — | % | | 8.3 | % | |

| | | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | | |

| Basic | 47,855 | | | 47,826 | | | 47,316 | | | | | | |

| Diluted | 48,681 | | | 48,572 | | | 48,412 | | | | | | |

_________________________

* Not meaningful. | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Condensed Consolidated Statements of Operations (Unaudited) | | | | | | |

| (in thousands, except per share data) | | | | | | |

| | | | | | |

| Nine Months Ended | | | | | |

| September 30,

2020 | | September 30,

2019 | | % Change | |

| Revenue | | | | | | |

| Investment advisory and administration fees | $ | 287,097 | | | $ | 277,421 | | | | |

| Distribution and service fees | 22,285 | | | 22,072 | | | | |

| Other | 1,694 | | | 1,490 | | | | |

| Total revenue | 311,076 | | | 300,983 | | | 3.4 | % | |

| Expenses | | | | | | |

| Employee compensation and benefits | 113,997 | | | 108,438 | | | | |

| Distribution and service fees | 41,264 | | | 40,866 | | | | |

| General and administrative | 45,320 | | | 34,690 | | | | |

| Depreciation and amortization | 3,524 | | | 3,317 | | | | |

| Total expenses | 204,105 | | | 187,311 | | | 9.0 | % | |

| Operating income (loss) | 106,971 | | | 113,672 | | | (5.9 | %) | |

| Non-operating income (loss) | | | | | | |

| Interest and dividend income—net | 2,736 | | | 5,174 | | | | |

| Gain (loss) from investments—net | (11,431) | | | 20,210 | | | | |

| Foreign currency gains (losses)—net | 36 | | | 679 | | | | |

| Total non-operating income (loss) | (8,659) | | | 26,063 | | | * | |

| Income before provision for income taxes | 98,312 | | | 139,735 | | | (29.6 | %) | |

| Provision for income taxes | 24,076 | | | 30,711 | | | | |

| Net income | 74,236 | | | 109,024 | | | (31.9 | %) | |

| Less: Net (income) loss attributable to redeemable noncontrolling interests | 6,760 | | | (11,131) | | | | |

| Net income attributable to common stockholders | $ | 80,996 | | | $ | 97,893 | | | (17.3 | %) | |

| | | | | | |

| Earnings per share attributable to common stockholders | | | | | | |

| Basic | $ | 1.70 | | | $ | 2.07 | | | (18.2 | %) | |

| Diluted | $ | 1.67 | | | $ | 2.03 | | | (18.1 | %) | |

| | | | | | |

| Dividends declared per share | $ | 1.17 | | | $ | 1.08 | | | 8.3 | % | |

| | | | | | |

| Weighted average shares outstanding | | | | | | |

| Basic | 47,778 | | | 47,256 | | | | |

| Diluted | 48,588 | | | 48,118 | | | | |

_________________________

* Not meaningful. | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management | | | | | | | | | | |

| By Investment Vehicle | | | | | | | | | | |

| | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| Three Months Ended | | | | | | % Change From | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | June 30,

2020 | | September 30,

2019 | |

| Institutional Accounts | | | | | | | | | | |

| Assets under management, beginning of period | $ | 28,867 | | | $ | 25,045 | | | $ | 29,602 | | | | | | |

| Inflows | 1,936 | | | 1,904 | | | 1,158 | | | | | | |

| Outflows | (1,337) | | | (523) | | | (646) | | | | | | |

| Net inflows (outflows) | 599 | | | 1,381 | | | 512 | | | | | | |

| Market appreciation (depreciation) | 1,273 | | | 2,775 | | | 1,723 | | | | | | |

| Distributions | (359) | | | (334) | | | (304) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 1,513 | | | 3,822 | | | 1,931 | | | | | | |

| Assets under management, end of period | $ | 30,380 | | | $ | 28,867 | | | $ | 31,533 | | | 5.2 | % | | (3.7 | %) | |

| Percentage of total assets under management | 43.1 | % | | 43.5 | % | | 44.5 | % | | | | | |

| Average assets under management | $ | 30,325 | | | $ | 27,111 | | | $ | 30,515 | | | 11.9 | % | | (0.6 | %) | |

| | | | | | | | | | |

| Open-end Funds | | | | | | | | | | |

| Assets under management, beginning of period | $ | 28,921 | | | $ | 24,561 | | | $ | 27,563 | | | | | | |

| Inflows | 4,020 | | | 5,163 | | | 2,794 | | | | | | |

| Outflows | (2,398) | | | (3,124) | | | (2,178) | | | | | | |

| Net inflows (outflows) | 1,622 | | | 2,039 | | | 616 | | | | | | |

| Market appreciation (depreciation) | 1,100 | | | 2,898 | | | 1,632 | | | | | | |

| Distributions | (239) | | | (577) | | | (213) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 2,483 | | | 4,360 | | | 2,035 | | | | | | |

| Assets under management, end of period | $ | 31,404 | | | $ | 28,921 | | | $ | 29,598 | | | 8.6 | % | | 6.1 | % | |

| Percentage of total assets under management | 44.5 | % | | 43.6 | % | | 41.8 | % | | | | | |

| Average assets under management | $ | 30,694 | | | $ | 26,799 | | | $ | 28,548 | | | 14.5 | % | | 7.5 | % | |

| | | | | | | | | | |

| Closed-end Funds | | | | | | | | | | |

| Assets under management, beginning of period | $ | 8,539 | | | $ | 7,763 | | | $ | 9,436 | | | | | | |

| Inflows | 50 | | | 1 | | | 2 | | | | | | |

| Outflows | (1) | | | — | | | — | | | | | | |

| Net inflows (outflows) | 49 | | | 1 | | | 2 | | | | | | |

| Market appreciation (depreciation) | 257 | | | 903 | | | 396 | | | | | | |

| Distributions | (126) | | | (128) | | | (127) | | | | | | |

| Total increase (decrease) | 180 | | | 776 | | | 271 | | | | | | |

| Assets under management, end of period | $ | 8,719 | | | $ | 8,539 | | | $ | 9,707 | | | 2.1 | % | | (10.2 | %) | |

| Percentage of total assets under management | 12.4 | % | | 12.9 | % | | 13.7 | % | | | | | |

| Average assets under management | $ | 8,777 | | | $ | 8,322 | | | $ | 9,580 | | | 5.5 | % | | (8.4 | %) | |

| | | | | | | | | | |

| Total | | | | | | | | | | |

| Assets under management, beginning of period | $ | 66,327 | | | $ | 57,369 | | | $ | 66,601 | | | | | | |

| Inflows | 6,006 | | | 7,068 | | | 3,954 | | | | | | |

| Outflows | (3,736) | | | (3,647) | | | (2,824) | | | | | | |

| Net inflows (outflows) | 2,270 | | | 3,421 | | | 1,130 | | | | | | |

| Market appreciation (depreciation) | 2,630 | | | 6,576 | | | 3,751 | | | | | | |

| Distributions | (724) | | | (1,039) | | | (644) | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 4,176 | | | 8,958 | | | 4,237 | | | | | | |

| Assets under management, end of period | $ | 70,503 | | | $ | 66,327 | | | $ | 70,838 | | | 6.3 | % | | (0.5 | %) | |

| Average assets under management | $ | 69,796 | | | $ | 62,232 | | | $ | 68,643 | | | 12.2 | % | | 1.7 | % | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management | | | | | | |

| By Investment Vehicle | | | | | | |

| | | | | | |

| (in millions) | | | | | | |

| Nine Months Ended | | | | | |

| September 30,

2020 | | September 30, 2019 | | % Change | |

| Institutional Accounts | | | | | | |

| Assets under management, beginning of period | $ | 31,813 | | | $ | 27,148 | | | | |

| Inflows | 6,103 | | | 2,962 | | | | |

| Outflows | (3,321) | | | (4,007) | | | | |

| Net inflows (outflows) | 2,782 | | | (1,045) | | | | |

| Market appreciation (depreciation) | (3,206) | | | 6,423 | | | | |

| Distributions | (1,009) | | | (998) | | | | |

| Transfers | — | | | 5 | | | | |

| Total increase (decrease) | (1,433) | | | 4,385 | | | | |

| Assets under management, end of period | $ | 30,380 | | | $ | 31,533 | | | (3.7 | %) | |

| Percentage of total assets under management | 43.1 | % | | 44.5 | % | | | |

| Average assets under management | $ | 29,159 | | | $ | 29,975 | | | (2.7 | %) | |

| | | | | | |

| Open-end Funds | | | | | | |

| Assets under management, beginning of period | $ | 30,725 | | | $ | 22,295 | | | | |

| Inflows | 13,560 | | | 8,896 | | | | |

| Outflows | (9,832) | | | (5,707) | | | | |

| Net inflows (outflows) | 3,728 | | | 3,189 | | | | |

| Market appreciation (depreciation) | (2,006) | | | 5,349 | | | | |

| Distributions | (1,043) | | | (1,230) | | | | |

| Transfers | — | | | (5) | | | | |

| Total increase (decrease) | 679 | | | 7,303 | | | | |

| Assets under management, end of period | $ | 31,404 | | | $ | 29,598 | | | 6.1 | % | |

| Percentage of total assets under management | 44.5 | % | | 41.8 | % | | | |

| Average assets under management | $ | 29,137 | | | $ | 26,767 | | | 8.9 | % | |

| | | | | | |

| Closed-end Funds | | | | | | |

| Assets under management, beginning of period | $ | 9,644 | | | $ | 8,410 | | | | |

| Inflows | 454 | | | 2 | | | | |

| Outflows | (89) | | | — | | | | |

| Net inflows (outflows) | 365 | | | 2 | | | | |

| Market appreciation (depreciation) | (908) | | | 1,676 | | | | |

| Distributions | (382) | | | (381) | | | | |

| Total increase (decrease) | (925) | | | 1,297 | | | | |

| Assets under management, end of period | $ | 8,719 | | | $ | 9,707 | | | (10.2 | %) | |

| Percentage of total assets under management | 12.4 | % | | 13.7 | % | | | |

| Average assets under management | $ | 8,795 | | | $ | 9,301 | | | (5.4 | %) | |

| | | | | | |

| Total | | | | | | |

| Assets under management, beginning of period | $ | 72,182 | | | $ | 57,853 | | | | |

| Inflows | 20,117 | | | 11,860 | | | | |

| Outflows | (13,242) | | | (9,714) | | | | |

| Net inflows (outflows) | 6,875 | | | 2,146 | | | | |

| Market appreciation (depreciation) | (6,120) | | | 13,448 | | | | |

| Distributions | (2,434) | | | (2,609) | | | | |

| | | | | | |

| | | | | | |

| Total increase (decrease) | (1,679) | | | 12,985 | | | | |

| Assets under management, end of period | $ | 70,503 | | | $ | 70,838 | | | (0.5 | %) | |

| Average assets under management | $ | 67,091 | | | $ | 66,043 | | | 1.6 | % | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management - Institutional Accounts | | | | | | | | | | |

| By Account Type | | | | | | | | | | |

| | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| Three Months Ended | | | | | | % Change From | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | June 30,

2020 | | September 30,

2019 | |

| Advisory | | | | | | | | | | |

| Assets under management, beginning of period | $ | 15,251 | | | $ | 13,048 | | | $ | 14,099 | | | | | | |

| Inflows | 1,142 | | | 1,103 | | | 567 | | | | | | |

| Outflows | (1,036) | | | (252) | | | (126) | | | | | | |

| Net inflows (outflows) | 106 | | | 851 | | | 441 | | | | | | |

| Market appreciation (depreciation) | 736 | | | 1,352 | | | 703 | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 842 | | | 2,203 | | | 1,144 | | | | | | |

| Assets under management, end of period | $ | 16,093 | | | $ | 15,251 | | | $ | 15,243 | | | 5.5 | % | | 5.6 | % | |

| Percentage of institutional assets under management | 53.0 | % | | 52.8 | % | | 48.3 | % | | | | | |

| Average assets under management | $ | 16,209 | | | $ | 14,366 | | | $ | 14,666 | | | 12.8 | % | | 10.5 | % | |

| | | | | | | | | | |

| Japan Subadvisory | | | | | | | | | | |

| Assets under management, beginning of period | $ | 8,736 | | | $ | 7,792 | | | $ | 9,846 | | | | | | |

| Inflows | 390 | | | 418 | | | 289 | | | | | | |

| Outflows | (96) | | | (100) | | | (280) | | | | | | |

| Net inflows (outflows) | 294 | | | 318 | | | 9 | | | | | | |

| Market appreciation (depreciation) | 345 | | | 960 | | | 754 | | | | | | |

| Distributions | (359) | | | (334) | | | (304) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 280 | | | 944 | | | 459 | | | | | | |

| Assets under management, end of period | $ | 9,016 | | | $ | 8,736 | | | $ | 10,305 | | | 3.2 | % | | (12.5 | %) | |

| Percentage of institutional assets under management | 29.7 | % | | 30.3 | % | | 32.7 | % | | | | | |

| Average assets under management | $ | 8,968 | | | $ | 8,128 | | | $ | 10,009 | | | 10.3 | % | | (10.4 | %) | |

| | | | | | | | | | |

| Subadvisory Excluding Japan | | | | | | | | | | |

| Assets under management, beginning of period | $ | 4,880 | | | $ | 4,205 | | | $ | 5,657 | | | | | | |

| Inflows | 404 | | | 383 | | | 302 | | | | | | |

| Outflows | (205) | | | (171) | | | (240) | | | | | | |

| Net inflows (outflows) | 199 | | | 212 | | | 62 | | | | | | |

| Market appreciation (depreciation) | 192 | | | 463 | | | 266 | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 391 | | | 675 | | | 328 | | | | | | |

| Assets under management, end of period | $ | 5,271 | | | $ | 4,880 | | | $ | 5,985 | | | 8.0 | % | | (11.9 | %) | |

| Percentage of institutional assets under management | 17.4 | % | | 16.9 | % | | 19.0 | % | | | | | |

| Average assets under management | $ | 5,148 | | | $ | 4,617 | | | $ | 5,840 | | | 11.5 | % | | (11.8 | %) | |

| | | | | | | | | | |

| Total Institutional Accounts | | | | | | | | | | |

| Assets under management, beginning of period | $ | 28,867 | | | $ | 25,045 | | | $ | 29,602 | | | | | | |

| Inflows | 1,936 | | | 1,904 | | | 1,158 | | | | | | |

| Outflows | (1,337) | | | (523) | | | (646) | | | | | | |

| Net inflows (outflows) | 599 | | | 1,381 | | | 512 | | | | | | |

| Market appreciation (depreciation) | 1,273 | | | 2,775 | | | 1,723 | | | | | | |

| Distributions | (359) | | | (334) | | | (304) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 1,513 | | | 3,822 | | | 1,931 | | | | | | |

| Assets under management, end of period | $ | 30,380 | | | $ | 28,867 | | | $ | 31,533 | | | 5.2 | % | | (3.7 | %) | |

| Average assets under management | $ | 30,325 | | | $ | 27,111 | | | $ | 30,515 | | | 11.9 | % | | (0.6 | %) | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management - Institutional Accounts | | | | | | |

| By Account Type | | | | | | |

| | | | | | |

| (in millions) | | | | | | |

| Nine Months Ended | | | | | |

| September 30,

2020 | | September 30, 2019 | | % Change | |

| Advisory | | | | | | |

| Assets under management, beginning of period | $ | 15,669 | | | $ | 12,065 | | | | |

| Inflows | 3,679 | | | 1,580 | | | | |

| Outflows | (2,025) | | | (1,104) | | | | |

| Net inflows (outflows) | 1,654 | | | 476 | | | | |

| Market appreciation (depreciation) | (1,230) | | | 2,697 | | | | |

| Transfers | — | | | 5 | | | | |

| Total increase (decrease) | 424 | | | 3,178 | | | | |

| Assets under management, end of period | $ | 16,093 | | | $ | 15,243 | | | 5.6 | % | |

| Percentage of institutional assets under management | 53.0 | % | | 48.3 | % | | | |

| Average assets under management | $ | 15,141 | | | $ | 13,896 | | | 9.0 | % | |

| | | | | | |

| Japan Subadvisory | | | | | | |

| Assets under management, beginning of period | $ | 10,323 | | | $ | 9,288 | | | | |

| Inflows | 1,366 | | | 388 | | | | |

| Outflows | (474) | | | (863) | | | | |

| Net inflows (outflows) | 892 | | | (475) | | | | |

| Market appreciation (depreciation) | (1,190) | | | 2,490 | | | | |

| Distributions | (1,009) | | | (998) | | | | |

| | | | | | |

| Total increase (decrease) | (1,307) | | | 1,017 | | | | |

| Assets under management, end of period | $ | 9,016 | | | $ | 10,305 | | | (12.5 | %) | |

| Percentage of institutional assets under management | 29.7 | % | | 32.7 | % | | | |

| Average assets under management | $ | 8,897 | | | $ | 9,893 | | | (10.1 | %) | |

| | | | | | |

| Subadvisory Excluding Japan | | | | | | |

| Assets under management, beginning of period | $ | 5,821 | | | $ | 5,795 | | | | |

| Inflows | 1,058 | | | 994 | | | | |

| Outflows | (822) | | | (2,040) | | | | |

| Net inflows (outflows) | 236 | | | (1,046) | | | | |

| Market appreciation (depreciation) | (786) | | | 1,236 | | | | |

| | | | | | |

| Total increase (decrease) | (550) | | | 190 | | | | |

| Assets under management, end of period | $ | 5,271 | | | $ | 5,985 | | | (11.9 | %) | |

| Percentage of institutional assets under management | 17.4 | % | | 19.0 | % | | | |

| Average assets under management | $ | 5,121 | | | $ | 6,186 | | | (17.2 | %) | |

| | | | | | |

| Total Institutional Accounts | | | | | | |

| Assets under management, beginning of period | $ | 31,813 | | | $ | 27,148 | | | | |

| Inflows | 6,103 | | | 2,962 | | | | |

| Outflows | (3,321) | | | (4,007) | | | | |

| Net inflows (outflows) | 2,782 | | | (1,045) | | | | |

| Market appreciation (depreciation) | (3,206) | | | 6,423 | | | | |

| Distributions | (1,009) | | | (998) | | | | |

| Transfers | — | | | 5 | | | | |

| Total increase (decrease) | (1,433) | | | 4,385 | | | | |

| Assets under management, end of period | $ | 30,380 | | | $ | 31,533 | | | (3.7 | %) | |

| Average assets under management | $ | 29,159 | | | $ | 29,975 | | | (2.7 | %) | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management | | | | | | | | | | |

| By Investment Strategy | | | | | | | | | | |

| | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| Three Months Ended | | | | | | % Change From | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | June 30,

2020 | | September 30,

2019 | |

| U.S. Real Estate | | | | | | | | | | |

| Assets under management, beginning of period | $ | 28,119 | | | $ | 23,794 | | | $ | 28,841 | | | | | | |

| Inflows | 2,827 | | | 3,596 | | | 1,638 | | | | | | |

| Outflows | (1,733) | | | (1,522) | | | (1,519) | | | | | | |

| Net inflows (outflows) | 1,094 | | | 2,074 | | | 119 | | | | | | |

| Market appreciation (depreciation) | 882 | | | 3,035 | | | 2,436 | | | | | | |

| Distributions | (485) | | | (784) | | | (413) | | | | | | |

| Transfers | — | | | — | | | (19) | | | | | | |

| Total increase (decrease) | 1,491 | | | 4,325 | | | 2,123 | | | | | | |

| Assets under management, end of period | $ | 29,610 | | | $ | 28,119 | | | $ | 30,964 | | | 5.3 | % | | (4.4 | %) | |

| Percentage of total assets under management | 42.0 | % | | 42.4 | % | | 43.7 | % | | | | | |

| Average assets under management | $ | 29,442 | | | $ | 25,642 | | | $ | 29,862 | | | 14.8 | % | | (1.4 | %) | |

| | | | | | | | | | |

| Preferred Securities | | | | | | | | | | |

| Assets under management, beginning of period | $ | 17,116 | | | $ | 14,872 | | | $ | 15,735 | | | | | | |

| Inflows | 2,167 | | | 2,075 | | | 1,371 | | | | | | |

| Outflows | (941) | | | (1,319) | | | (732) | | | | | | |

| Net inflows (outflows) | 1,226 | | | 756 | | | 639 | | | | | | |

| Market appreciation (depreciation) | 844 | | | 1,653 | | | 510 | | | | | | |

| Distributions | (176) | | | (165) | | | (154) | | | | | | |

| Transfers | — | | | — | | | 19 | | | | | | |

| Total increase (decrease) | 1,894 | | | 2,244 | | | 1,014 | | | | | | |

| Assets under management, end of period | $ | 19,010 | | | $ | 17,116 | | | $ | 16,749 | | | 11.1 | % | | 13.5 | % | |

| Percentage of total assets under management | 27.0 | % | | 25.8 | % | | 23.6 | % | | | | | |

| Average assets under management | $ | 18,255 | | | $ | 16,422 | | | $ | 16,268 | | | 11.2 | % | | 12.2 | % | |

| | | | | | | | | | |

| Global/International Real Estate | | | | | | | | | | |

| Assets under management, beginning of period | $ | 12,659 | | | $ | 11,005 | | | $ | 12,196 | | | | | | |

| Inflows | 851 | | | 1,108 | | | 672 | | | | | | |

| Outflows | (379) | | | (482) | | | (349) | | | | | | |

| Net inflows (outflows) | 472 | | | 626 | | | 323 | | | | | | |

| Market appreciation (depreciation) | 740 | | | 1,059 | | | 638 | | | | | | |

| Distributions | (8) | | | (31) | | | (16) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 1,204 | | | 1,654 | | | 945 | | | | | | |

| Assets under management, end of period | $ | 13,863 | | | $ | 12,659 | | | $ | 13,141 | | | 9.5 | % | | 5.5 | % | |

| Percentage of total assets under management | 19.7 | % | | 19.1 | % | | 18.6 | % | | | | | |

| Average assets under management | $ | 13,520 | | | $ | 11,799 | | | $ | 12,633 | | | 14.6 | % | | 7.0 | % | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | | | | | |

| Assets Under Management | | | | | | | | | | |

| By Investment Strategy - continued | | | | | | | | | | |

| | | | | | | | | | |

| (in millions) | | | | | | | | | | |

| Three Months Ended | | | | | | % Change From | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | | June 30,

2020 | | September 30,

2019 | |

| Global Listed Infrastructure | | | | | | | | | | |

| Assets under management, beginning of period | $ | 6,768 | | | $ | 6,175 | | | $ | 7,544 | | | | | | |

| Inflows | 139 | | | 252 | | | 212 | | | | | | |

| Outflows | (655) | | | (279) | | | (92) | | | | | | |

| Net inflows (outflows) | (516) | | | (27) | | | 120 | | | | | | |

| Market appreciation (depreciation) | 93 | | | 670 | | | 159 | | | | | | |

| Distributions | (46) | | | (50) | | | (49) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | (469) | | | 593 | | | 230 | | | | | | |

| Assets under management, end of period | $ | 6,299 | | | $ | 6,768 | | | $ | 7,774 | | | (6.9 | %) | | (19.0 | %) | |

| Percentage of total assets under management | 8.9 | % | | 10.2 | % | | 11.0 | % | | | | | |

| Average assets under management | $ | 6,839 | | | $ | 6,763 | | | $ | 7,650 | | | 1.1 | % | | (10.6 | %) | |

| | | | | | | | | | |

| Other | | | | | | | | | | |

| Assets under management, beginning of period | $ | 1,665 | | | $ | 1,523 | | | $ | 2,285 | | | | | | |

| Inflows | 22 | | | 37 | | | 61 | | | | | | |

| Outflows | (28) | | | (45) | | | (132) | | | | | | |

| Net inflows (outflows) | (6) | | | (8) | | | (71) | | | | | | |

| Market appreciation (depreciation) | 71 | | | 159 | | | 8 | | | | | | |

| Distributions | (9) | | | (9) | | | (12) | | | | | | |

| | | | | | | | | | |

| Total increase (decrease) | 56 | | | 142 | | | (75) | | | | | | |

| Assets under management, end of period | $ | 1,721 | | | $ | 1,665 | | | $ | 2,210 | | | 3.4 | % | | (22.1 | %) | |

| Percentage of total assets under management | 2.4 | % | | 2.5 | % | | 3.1 | % | | | | | |

| Average assets under management | $ | 1,740 | | | $ | 1,606 | | | $ | 2,230 | | | 8.3 | % | | (22.0 | %) | |

| | | | | | | | | | |

| Total | | | | | | | | | | |

| Assets under management, beginning of period | $ | 66,327 | | | $ | 57,369 | | | $ | 66,601 | | | | | | |

| Inflows | 6,006 | | | 7,068 | | | 3,954 | | | | | | |

| Outflows | (3,736) | | | (3,647) | | | (2,824) | | | | | | |

| Net inflows (outflows) | 2,270 | | | 3,421 | | | 1,130 | | | | | | |

| Market appreciation (depreciation) | 2,630 | | | 6,576 | | | 3,751 | | | | | | |

| Distributions | (724) | | | (1,039) | | | (644) | | | | | | |

| Total increase (decrease) | 4,176 | | | 8,958 | | | 4,237 | | | | | | |

| Assets under management, end of period | $ | 70,503 | | | $ | 66,327 | | | $ | 70,838 | | | 6.3 | % | | (0.5 | %) | |

| Average assets under management | $ | 69,796 | | | $ | 62,232 | | | $ | 68,643 | | | 12.2 | % | | 1.7 | % | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management | | | | | | |

| By Investment Strategy | | | | | | |

| | | | | | |

| (in millions) | | | | | | |

| Nine Months Ended | | | | | |

| September 30,

2020 | | September 30,

2019 | | % Change | |

| U.S. Real Estate | | | | | | |

| Assets under management, beginning of period | $ | 31,024 | | | $ | 24,627 | | | | |

| Inflows | 8,910 | | | 4,893 | | | | |

| Outflows | (5,186) | | | (4,008) | | | | |

| Net inflows (outflows) | 3,724 | | | 885 | | | | |

| Market appreciation (depreciation) | (3,460) | | | 7,335 | | | | |

| Distributions | (1,709) | | | (1,885) | | | | |

| Transfers | 31 | | | 2 | | | | |

| Total increase (decrease) | (1,414) | | | 6,337 | | | | |

| Assets under management, end of period | $ | 29,610 | | | $ | 30,964 | | | (4.4 | %) | |

| Percentage of total assets under management | 42.0 | % | | 43.7 | % | | | |

| Average assets under management | $ | 28,223 | | | $ | 28,586 | | | (1.3 | %) | |

| | | | | | |

| Preferred Securities | | | | | | |

| Assets under management, beginning of period | $ | 17,581 | | | $ | 13,068 | | | | |

| Inflows | 6,698 | | | 4,406 | | | | |

| Outflows | (4,836) | | | (2,274) | | | | |

| Net inflows (outflows) | 1,862 | | | 2,132 | | | | |

| Market appreciation (depreciation) | 102 | | | 1,966 | | | | |

| Distributions | (504) | | | (436) | | | | |

| Transfers | (31) | | | 19 | | | | |

| Total increase (decrease) | 1,429 | | | 3,681 | | | | |

| Assets under management, end of period | $ | 19,010 | | | $ | 16,749 | | | 13.5 | % | |

| Percentage of total assets under management | 27.0 | % | | 23.6 | % | | | |

| Average assets under management | $ | 17,331 | | | $ | 15,232 | | | 13.8 | % | |

| | | | | | |

| Global/International Real Estate | | | | | | |

| Assets under management, beginning of period | $ | 13,509 | | | $ | 11,047 | | | | |

| Inflows | 3,706 | | | 1,912 | | | | |

| Outflows | (1,759) | | | (2,226) | | | | |

| Net inflows (outflows) | 1,947 | | | (314) | | | | |

| Market appreciation (depreciation) | (1,546) | | | 2,502 | | | | |

| Distributions | (47) | | | (94) | | | | |

| | | | | | |

| Total increase (decrease) | 354 | | | 2,094 | | | | |

| Assets under management, end of period | $ | 13,863 | | | $ | 13,141 | | | 5.5 | % | |

| Percentage of total assets under management | 19.7 | % | | 18.6 | % | | | |

| Average assets under management | $ | 12,722 | | | $ | 12,532 | | | 1.5 | % | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cohen & Steers, Inc. and Subsidiaries | | | | | | |

| Assets Under Management | | | | | | |

| By Investment Strategy - continued | | | | | | |

| | | | | | |

| (in millions) | | | | | | |

| Nine Months Ended | | | | | |

| September 30,

2020 | | September 30,

2019 | | % Change | |

| Global Listed Infrastructure | | | | | | |

| Assets under management, beginning of period | $ | 8,076 | | | $ | 6,517 | | | | |

| Inflows | 681 | | | 494 | | | | |

| Outflows | (1,323) | | | (414) | | | | |

| Net inflows (outflows) | (642) | | | 80 | | | | |

| Market appreciation (depreciation) | (985) | | | 1,326 | | | | |

| Distributions | (150) | | | (149) | | | | |

| Total increase (decrease) | (1,777) | | | 1,257 | | | | |

| Assets under management, end of period | $ | 6,299 | | | $ | 7,774 | | | (19.0 | %) | |

| Percentage of total assets under management | 8.9 | % | | 11.0 | % | | | |

| Average assets under management | $ | 7,082 | | | $ | 7,383 | | | (4.1 | %) | |

| | | | | | |

| Other | | | | | | |

| Assets under management, beginning of period | $ | 1,992 | | | $ | 2,594 | | | | |

| Inflows | 122 | | | 155 | | | | |

| Outflows | (138) | | | (792) | | | | |

| Net inflows (outflows) | (16) | | | (637) | | | | |

| Market appreciation (depreciation) | (231) | | | 319 | | | | |

| Distributions | (24) | | | (45) | | | | |

| Transfers | — | | | (21) | | | | |

| Total increase (decrease) | (271) | | | (384) | | | | |

| Assets under management, end of period | $ | 1,721 | | | $ | 2,210 | | | (22.1 | %) | |

| Percentage of total assets under management | 2.4 | % | | 3.1 | % | | | |

| Average assets under management | $ | 1,733 | | | $ | 2,310 | | | (25.0 | %) | |

| | | | | | |

| Total | | | | | | |

| Assets under management, beginning of period | $ | 72,182 | | | $ | 57,853 | | | | |

| Inflows | 20,117 | | | 11,860 | | | | |

| Outflows | (13,242) | | | (9,714) | | | | |

| Net inflows (outflows) | 6,875 | | | 2,146 | | | | |

| Market appreciation (depreciation) | (6,120) | | | 13,448 | | | | |

| Distributions | (2,434) | | | (2,609) | | | | |

| Total increase (decrease) | (1,679) | | | 12,985 | | | | |

| Assets under management, end of period | $ | 70,503 | | | $ | 70,838 | | | (0.5 | %) | |

| Average assets under management | $ | 67,091 | | | $ | 66,043 | | | 1.6 | % | |

| | | | | | |

Non-GAAP Reconciliations

Management believes that use of the following non-GAAP financial measures enhances the evaluation of the Company's results, as they provide greater transparency into the Company's operating performance. In addition, these non-GAAP financial measures are used to prepare the Company's internal management reports and are used by management in evaluating the Company's business.

While management believes that this non-GAAP financial information is useful in evaluating the Company's results and operating performance, this information should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Net Income Attributable to Common Stockholders and U.S. GAAP Earnings per Share to Net Income Attributable to Common Stockholders, As Adjusted, and Earnings per Share, As Adjusted | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| (in thousands, except per share data) | Three Months Ended | | | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | |

| Net income attributable to common stockholders, U.S. GAAP | $ | 31,904 | | | $ | 28,520 | | | $ | 34,017 | | |

Seed investments (1) | (1,686) | | | (3,885) | | | (1,630) | | |

| Accelerated vesting of restricted stock units | 387 | | | — | | | 387 | | |

General and administrative (2) | 310 | | | — | | | — | | |

Foreign currency exchange (gains) losses—net (3) | 1,232 | | | (117) | | | (1,310) | | |

Tax adjustments (4) | 469 | | | 1,636 | | | (207) | | |

| Net income attributable to common stockholders, as adjusted | $ | 32,616 | | | $ | 26,154 | | | $ | 31,257 | | |

| | | | | | |

| Diluted weighted average shares outstanding | 48,681 | | | 48,572 | | | 48,412 | | |

| Diluted earnings per share, U.S. GAAP | $ | 0.66 | | | $ | 0.59 | | | $ | 0.70 | | |

Seed investments (1) | (0.04) | | | (0.08) | | | (0.03) | | |

| Accelerated vesting of restricted stock units | 0.01 | | | — | | | 0.01 | | |

General and administrative (2) | 0.01 | | | — | | | — | | |

Foreign currency exchange (gains) losses—net (3) | 0.02 | | | — | | * | (0.03) | | |

| Tax adjustments | 0.01 | | | 0.03 | | | — | | * |

| Diluted earnings per share, as adjusted | $ | 0.67 | | | $ | 0.54 | | | $ | 0.65 | | |

_________________________ * Amounts round to less than $0.01 per share. (1) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds as well as non-operating (income) loss from seed investments that were not consolidated. (2) Represents costs associated with the ongoing initial offering of a closed-end fund in the third quarter of 2020. (3) Represents net foreign currency exchange (gains) losses associated with U.S. dollar-denominated assets held by certain foreign subsidiaries. (4) Tax adjustments are summarized in the following table: | | | | | | |

| (in thousands) | Three Months Ended | | | | | |

| September 30,

2020 | | June 30,

2020 | | September 30, 2019 | |

| | | | | | |

| Discrete tax items | $ | 62 | | | $ | 13 | | | $ | (7) | | |

| Tax effect of non-GAAP adjustments | 407 | | | 1,623 | | | (200) | | |

| | | | | | |

| | | | | | |

| Total tax adjustments | $ | 469 | | | $ | 1,636 | | | $ | (207) | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Operating Income and U.S. GAAP Operating Margin to Operating Income, As Adjusted, and Operating Margin, As Adjusted | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| (in thousands, except percentages) | Three Months Ended | | | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | |

| Revenue, U.S. GAAP | $ | 111,159 | | | $ | 94,087 | | | $ | 104,965 | | |

Seed investments (1) | 275 | | | (60) | | | (99) | | |

| Revenue, as adjusted | $ | 111,434 | | | $ | 94,027 | | | $ | 104,866 | | |

| | | | | | |

| Expenses, U.S. GAAP | $ | 67,852 | | | $ | 58,792 | | | $ | 64,832 | | |

Seed investments (1) | 102 | | | (229) | | | (306) | | |

| Accelerated vesting of restricted stock units | (387) | | | — | | | (387) | | |

General and administrative (2) | (310) | | | — | | | — | | |

| Expenses, as adjusted | $ | 67,257 | | | $ | 58,563 | | | $ | 64,139 | | |

| | | | | | |

| Operating income, U.S. GAAP | $ | 43,307 | | | $ | 35,295 | | | $ | 40,133 | | |

Seed investments (1) | 173 | | | 169 | | | 207 | | |

| Accelerated vesting of restricted stock units | 387 | | | — | | | 387 | | |

General and administrative (2) | 310 | | | — | | | — | | |

| Operating income, as adjusted | $ | 44,177 | | | $ | 35,464 | | | $ | 40,727 | | |

| | | | | | |

| Operating margin, U.S. GAAP | 39.0 | % | | 37.5 | % | | 38.2 | % | |

| Operating margin, as adjusted | 39.6 | % | | 37.7 | % | | 38.8 | % | |

_________________________

(1) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds. (2) Represents costs associated with the ongoing initial offering of a closed-end fund in the third quarter of 2020. | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of U.S. GAAP Non-operating Income (Loss) to Non-operating Income (Loss), As Adjusted | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| (in thousands) | Three Months Ended | | | | | |

| September 30,

2020 | | June 30,

2020 | | September 30,

2019 | |

| Non-operating income (loss), U.S. GAAP | $ | 3,231 | | | $ | 7,953 | | | $ | 6,617 | | |

Seed investments (1) | (3,961) | | | (7,696) | | | (4,218) | | |

Foreign currency exchange (gains) losses—net (2) | 1,232 | | | (117) | | | (1,310) | | |

| Non-operating income (loss), as adjusted | $ | 502 | | | $ | 140 | | | $ | 1,089 | | |

_________________________

(1) Represents amounts related to the deconsolidation of seed investments in Company-sponsored funds as well as non-operating (income) loss from seed investments that were not consolidated. (2) Represents net foreign currency exchange (gains) losses associated with U.S. dollar-denominated assets held by certain foreign subsidiaries. | | | | | | |