QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on May 13, 2004.

Registration No. 333-114043

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WORLDSPAN TECHNOLOGIES INC.

(Exact name of Registrant as specified in its charter)

Delaware

(State or Other Jurisdiction

of Incorporation or Organization) | | 7374

(Primary Standard Industrial

Classification Code Number) | | 75-3125716

(I.R.S. Employer

Identification No.) |

300 Galleria Parkway, N.W.

Atlanta, Georgia 30339

(770) 563-7400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) |

Jeffrey C. Smith, Esq.

General Counsel

Worldspan, L.P.

300 Galleria Parkway, N.W.

Atlanta, Georgia 30339

(770) 563-7400

(Name, address including zip code, and telephone number, including area code, of agent for service) |

With copies to: |

G. Daniel O'Donnell, Esq.

Geraldine A. Sinatra, Esq.

Dechert LLP

4000 Bell Atlantic Tower

1717 Arch Street

Philadelphia, Pennsylvania 19103

(215) 994-4000 | | Kirk A. Davenport, Esq.

Latham & Watkins LLP

885 Third Avenue

Suite 1000

New York, New York 10022

(212) 906-1284 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

| | Proposed Maximum

Aggregate Offering

Price(1)

| | Amount of

Registration Fee(3)

|

|---|

|

| Common Stock, par value $.01 per share | | $745,000,000(2) | | $94,391.50 |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes the aggregate value offered if the underwriters exercise the option to purchase shares of Common Stock to cover over-allotments, if any.

- (3)

- A registration fee of $39,910.50 was previously paid in connection with the initial filing of this Registration Statement. An additional registration fee of $54,481.00 is being paid in connection with this filing, based on an increase in the maximum aggregate offering price of $745,000,000. The total registration fee is $94,391.50

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2004

Preliminary prospectus

Shares

Worldspan Technologies Inc.

Common Stock

$ per share

We are selling shares of our Common Stock.

This is the initial public offering of our Common Stock. We currently expect the initial public offering price to be between $ and $ per share. We intend to apply to list our Common Stock on the New York Stock Exchange under the symbol "WS".

Investing in our Common Stock involves risks. See "Risk Factors" beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share

| | Total

|

|---|

| Public Offering Price | | $ | | | $ | |

| Underwriting Discounts and Commissions | | $ | | | $ | |

| Proceeds to Worldspan Technologies Inc. (before expenses) | | $ | | | $ | |

The selling stockholders have granted the underwriters a 45-day option to purchase up to additional shares to cover any over-allotments. All of the shares of Common Stock subject to the over-allotment option will be sold by the selling stockholders. We will not receive any of the proceeds from any shares of Common Stock sold by the selling stockholders.

The underwriters expect to deliver the shares on or about , 2004.

Lehman Brothers |

|

JPMorgan |

|

Goldman, Sachs & Co. |

|

UBS Investment Bank |

CIBC World Markets |

|

RBC Capital Markets |

, 2004

TABLE OF CONTENTS

| | Page

|

|---|

Prospectus Summary |

|

1 |

| Risk Factors | | 10 |

| Forward-Looking Statements | | 24 |

| Industry and Market Data | | 24 |

| Use of Proceeds | | 25 |

| Dividend Policy | | 25 |

| Capitalization | | 26 |

| Dilution | | 27 |

| Unaudited Pro Forma Condensed Consolidated Financial Statements | | 29 |

| Selected Historical Financial Data | | 39 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 41 |

| Business | | 63 |

Management |

|

80 |

| Certain Relationships and Related Transactions | | 96 |

| Principal and Selling Stockholders | | 100 |

| Description of Capital Stock | | 102 |

| Shares Eligible for Future Sale | | 104 |

Material United States Tax Consequences to Non-U.S. Holders of

Common Stock | | 106 |

| Underwriting | | 108 |

| Legal Matters | | 112 |

| Experts | | 112 |

| Where You Can Find More Information | | 112 |

| Index to Combined Financial Statements | | F-1 |

Until , 2004 (25 days after the date of this prospectus), all dealers that buy, sell or trade our Common Stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

i

PROSPECTUS SUMMARY

This following summary highlights certain significant aspects of our business and this offering, but you should read this entire prospectus, including the financial data and related notes, before making an investment decision. References in this prospectus to "WTI" refer to Worldspan Technologies Inc. References in this prospectus to "we," "us," "our" and "our company" refer to WTI and its consolidated subsidiaries unless otherwise specified. References in this prospectus to "Worldspan" refer to Worldspan, L.P. References in this prospectus to the "Acquisition" refer to the acquisition by WTI, formerly named Travel Transaction Processing Corporation, through its wholly-owned subsidiaries, of the general partnership interests and limited partnership interest of Worldspan. WTI is a holding company with no business operations. WTI owns all of the partnership interests in Worldspan, our wholly-owned subsidiary through which we conduct all our business operations. References in this prospectus to the "Transactions" refer to the Acquisition, our new senior credit facility and this offering. You should carefully consider the information set forth under the heading "Risk Factors."

Worldspan Technologies Inc.

We are a leading provider of mission-critical transaction processing and information technology services to the global travel industry. We are the second largest transaction processor for travel agencies in the United States (the world's largest travel market) and the largest processor globally for online travel agencies as measured by transactions. In 2003, we processed over 65% of online airline transactions made in the United States and processed by a global distribution system, or GDS. We provide subscribers (including traditional travel agencies, online travel agencies and corporate travel departments) with real-time access to schedule, price, availability and other travel information and the ability to process reservations and issue tickets for the products and services of approximately 800 travel suppliers (such as airlines, hotels, car rental companies, tour companies and cruise lines) throughout the world. During the year ended December 31, 2003, we processed approximately 193 million transactions. We also provide information technology services to the travel industry, primarily airline internal reservation systems, flight operations technology and software development.

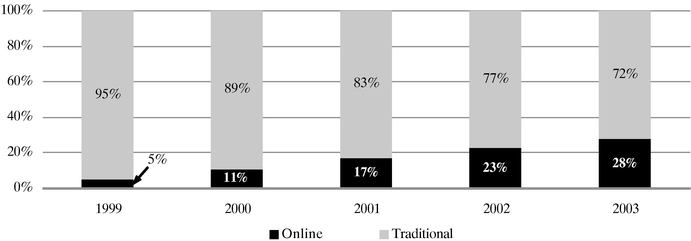

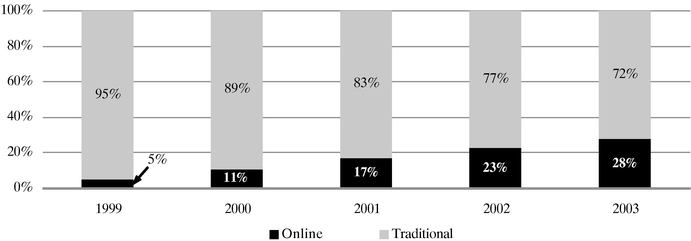

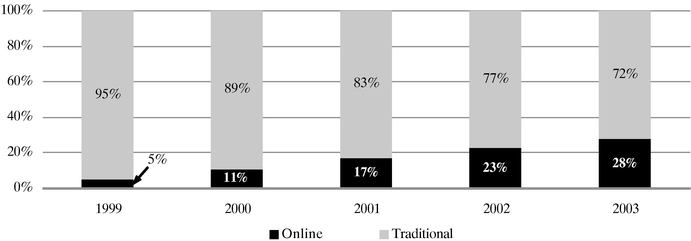

In recent years, the travel industry has been marked by the emergence and growth of the Internet as a travel distribution channel. The growth in use of the Internet has led to the establishment of online travel agencies that provide a link between the consumer and the travel supplier, typically through a GDS. In 2003, airline transactions generated through online travel agencies accounted for approximately 28% of all airline transactions in the United States processed by a GDS, up from approximately 23% in 2002 and approximately 17% in 2001. Between 1999 and 2003, the number of airline transactions in the United States generated through online travel agencies and processed by a GDS increased at a compound annual growth rate of 40.5% and an annual growth rate of 14.1% for the most recent year. The chart below illustrates airline transactions generated through online and traditional travel agencies in the United States and processed by a GDS.(1)

- (1)

- MIDT airline transactions data for Worldspan, Amadeus, Galileo and Sabre.

1

We have executed an alternative strategy with regard to the online travel agency channel. Unlike our primary competitors, we do not own an online travel agency that competes with travel suppliers or travel agencies. Instead, we have developed strategic relationships with online travel agencies to provide them with transaction processing, mission-critical technology and services, and access to our aggregated travel information, which enable online travel agencies to operate effectively and efficiently. As a result of this strategy, we have entered into long-term contracts with Expedia, Orbitz and Priceline, which are three of the five largest online travel agencies in the world. In addition, we have an agreement with Hotwire, another leading online travel agency, to process its airline transactions and have converted all of its airline transactions from Sabre, its previous provider, to us since March 2003.

Business Segments

We operate in two business segments: electronic travel distribution and information technology services, which represented approximately 90% and 10%, respectively, of our revenues in the year ended December 31, 2003.

Electronic Travel Distribution

We are the second largest transaction processor for travel agencies in the United States (the world's largest travel market) and the largest processor globally for online travel agencies as measured by transactions. The GDS industry is a core component of the worldwide travel industry and is organized around two major sets of customers: travel suppliers and travel agencies. Suppliers of travel and travel-related products and services (such as airlines, car rental companies and hotels) utilize GDSs as a means of selling tickets and generating sales. Travel agencies (including traditional travel agencies, online travel agencies and corporate travel departments) utilize GDSs to search schedule, price, availability and other travel information and to process transactions on behalf of consumers. GDSs provide travel agencies with a single, expansive source of travel information, allowing travel agencies to search and process tens of thousands of itinerary and pricing options across multiple travel suppliers within seconds.

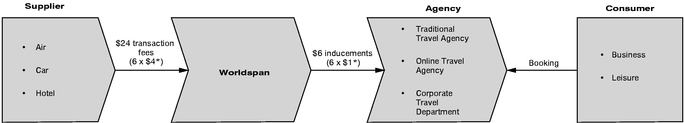

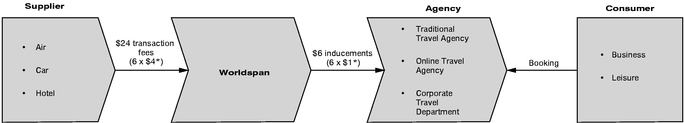

Through our GDS, we provide approximately 16,000 traditional travel agency locations in over 70 countries and approximately 50 online travel agencies, including four of the largest online travel agencies, with access to the inventory, reservations and ticketing of travel suppliers, including approximately 465 airlines, 225 hotel chains and 35 car rental companies throughout the world. As compensation for performing these services, we generally charge the travel supplier a fee for every transaction we process. For example, for a roundtrip ticket with one connection each way, a three night hotel stay and a three day car rental, we charge the respective travel suppliers one transaction fee for each segment of the airline ticket, one transaction fee for the hotel stay and one transaction fee for the car rental for a total of six transaction fees. The value of the travel purchase or the length of stay has no impact on our transaction fee.

Information Technology Services

We provide a comprehensive suite of information technology services to airlines, including: (i) internal reservation system services; (ii) flight operations technology services; and (iii) software development and licensing services, which include custom development and integration. We provide some of these services to several airlines, including Delta and Northwest. We have also developed other products and services to meet the needs of airlines, which we sell on a subscription basis. These products and services include Worldspan Rapid RepriceSM, Electronic Ticketing, e-Pricing® and Fares and Pricing.

2

Competitive Strengths

We believe the following strengths will allow us to continue to grow our market position and enhance our operating profitability and cash flow:

- •

- Market Leading Transaction Processor for Online Travel Agencies. In 2003, we processed over 65% of online airline transactions made in the United States and processed by a GDS. Our leadership in the online travel agency channel began in 1995 when Microsoft chose us as its transaction processing partner when it was developing Expedia as an online travel agency. In addition, we have executed a strategy of developing contractual relationships with online travel agencies, rather than owning an online travel agency like our primary competitors. As a result, we process online transactions for Expedia, Hotwire, Orbitz and Priceline, four of the six largest online travel agencies in the world.

- •

- Well Positioned to Take Advantage of the Shift to the Online Travel Agency Channel. An increasing number of travel transactions are being made online. In 2003, airline transactions generated through online travel agencies accounted for approximately 28% of all airline transactions in the United States processed by a GDS, up from approximately 23% in 2002 and approximately 17% in 2001. Our relationships with four of the six largest online travel agencies in the world have positioned us well to take advantage of this shift.

- •

- Neutrality. Unlike our competitors, we have intentionally not pursued a strategy of vertical integration and instead have forged strategic partnerships with leading online travel agencies. As the shift towards the online travel agency channel continues, we believe the traditional travel agencies will increasingly view the GDS-owned online travel agencies as competitive to their core business. As a result, our neutrality gives us an opportunity to capture additional business from both online and traditional travel agencies.

- •

- Robust Technology Capabilities. Our use of Internet and server-based technologies has allowed us to provide travel suppliers and online and traditional travel agencies with products and services that enable custom applications, reduce operating costs, increase productivity and enhance the customer experience. In addition, as a result of a new agreement with IBM, we believe that we will be able to increase our processing and computer capabilities without a significant increase in associated software and hardware costs.

- •

- Proven Business Model with Strong Cash Flow Generation. Our ability to leverage our cost structure, grow transaction volumes, enlarge our customer base, and incur moderate ongoing capital expenditure and working capital requirements, enables us to generate significant net cash from operations. From 1999 through 2003, we generated $946 million of net cash from operations, which primarily enabled us to distribute $715 million to our founding airlines from 1999 through the closing of the Acquisition.

Business Strategy

We intend to continue to strengthen our market leadership position, maximize profitability and enhance cash flow through the following strategies:

- •

- Continue to Increase Our Share and the Number of Online Travel Agency Transactions. While we processed over 65% of online airline transactions made in the United States and processed by a GDS in 2003, we believe there are still opportunities to increase our number of transactions and our market share in the online travel agency channel. Our primary competitors own online travel agencies, and we believe that the channel conflict inherent in our primary competitors' strategy leaves us well positioned to compete for the business of independent online travel agencies.

- •

- Increase Our Global Penetration of the Traditional Travel Agency Channel. We have historically focused on selected geographic markets where our founding airlines had significant operations. We believe we have the opportunity to obtain new traditional travel agencies both in and outside

3

the United States, particularly in Europe, Asia, Australia, South America and Latin America, where we have not previously concentrated and where travel reservations are not generally made using current Internet technologies. In addition, we intend to expand the number of transactions we process for traditional travel agencies in the United States.

- •

- Capitalize on the Shift by Corporate Travel Departments to Online Travel Services. We believe there will be a substantial opportunity to capitalize on the trend of corporate travel departments toward making bookings for business travel through online services. We are well positioned to benefit from this trend, as Expedia and Orbitz, two of our largest online travel agency customers, have entered the corporate travel market.

- •

- Increase Hospitality and Destination Services Transactions. We intend to increase our transaction revenues from hospitality and destination services, which include car, hotel, tour, cruise and rail transactions. We derived approximately 8% of our transaction fee revenues for the year ended December 31, 2003 from hospitality and destination services transactions. We expect these future transactions to increase in number, largely as a result of the emergence of the Internet and online travel agencies as a means of facilitating travel commerce.

- •

- Expand Information Technology Services Business. We intend to expand our existing information technology services business. We believe airlines and other travel suppliers have been and will be increasingly outsourcing non-core technology functionalities due to the desire to focus on their core travel business, to better manage fixed costs and to leverage the technology of information technology service providers.

- •

- Continue to Reduce Costs. Since the Acquisition, we have executed several strategic cost reduction initiatives. We believe additional opportunities exist to reduce costs and improve profitability. We plan to improve our cost structure by streamlining our programming and processing systems and reducing our network and data center costs, among other initiatives.

Summary Risks

You should consider carefully the following important risks:

- •

- Our revenues are highly dependent on the level of travel activity and are therefore highly subject to declines or disruptions to travel, particularly with respect to airlines that participate in our GDS. The travel industry is susceptible to safety and security concerns, including acts of terrorism and war and global epidemics such as SARS. In 2003, our revenues were adversely affected by the war in Iraq and the SARS epidemic, both of which resulted in the cancellation of a significant number of flights and travel bookings and a decrease in new travel bookings.

- •

- We depend on a relatively small number of airlines for a significant portion of our revenues and the loss of any of our major airline relationships would harm us. In 2003, our five largest airline customers represented 54% of our revenues.

- •

- We seek to obtain as our customers traditional travel agencies, online travel agencies, corporate travel departments and travel suppliers. We face significant competition in each of these areas. We also face significant competition with respect to our information technology services from other companies offering internal reservation systems and related technology.

- •

- Travel suppliers, particularly airlines, are aggressively seeking ways to reduce distribution costs and, through the use of the Internet and otherwise, are seeking to decrease their reliance on GDSs including us. Several airlines have entered into direct supplier agreements with Orbitz and have established their own travel distribution websites. We may not always have access to the lowest prices that travel suppliers offer through these alternative channels.

- •

- We are highly dependent on a small number of large online travel agencies, and the success of our business depends on continuing these relationships. In 2003, Expedia, Hotwire, Orbitz and Priceline represented approximately 43% of our total transactions, with Expedia representing

4

over 20% of our total transactions. Under our agreements with these agencies, the agencies have a variety of termination rights and other rights to reduce their business with Worldspan. For example, Expedia informed us in May 2004 that it intends to exercise its right to move a portion of its transactions to another GDS provider.

- •

- In connection with our acquisition of the outstanding general partnership interests and limited partnership interest of Worldspan in June 2003, we incurred substantial indebtedness. As a result of the interest expense associated with this indebtedness combined with other events as described above, our net income in 2003 was significantly lower than 2002.

Please see the section entitled "Risk Factors" for information on these and other risks related to our business and this offering.

Our Corporate Structure and History

We were formed in March 2003 by Citigroup Venture Capital Equity Partners, L.P. , or CVC, and Ontario Teachers' Pension Plan Board, or OTPP, for the purpose of acquiring all of the general partnership interests and indirectly acquiring all of the limited partnership interest of Worldspan. Worldspan was founded in 1990 by Delta Air Lines, or Delta, Northwest Airlines, or Northwest, and Trans World Airlines, Inc., or TWA. Affiliates of these three airlines (and later American Airlines, or American, following its acquisition of TWA's assets) held ownership stakes in Worldspan from its formation until we acquired it in 2003. We refer to American, Delta and Northwest in this prospectus as our founding airlines. On June 30, 2003, we acquired 100% of the outstanding general partnership interests and limited partnership interest of Worldspan from affiliates of our founding airlines for an aggregate consideration of $901.5 million and agreed to provide credits to Delta and Northwest totalling up to $250.0 million structured over nine years in exchange for the agreement of those airlines to continue using Worldspan for information technology services.

Our principal executive offices are located at 300 Galleria Parkway, N.W., Atlanta, Georgia 30339, and our telephone number is (770) 563-7400. Our website ishttp://www.worldspan.com. The website and the information included therein are not part of this prospectus.

Equity Sponsors

CVC is a private equity fund managed by Citigroup Venture Capital Ltd., one of the industry's oldest private equity firms. Citigroup Venture Capital Ltd. was established in 1968, and manages funds in excess of $6.0 billion. Citigroup Venture Capital is a leading technology and travel investor, sponsoring such industry leading names as Fairchild Semiconductor, Intersil, ChipPAC, AMI Semiconductor, Federal Express and People Express.

OTPP, with approximately C$75.7 billion in net assets at December 31, 2003, is one of the largest pension plans in Canada. OTPP's private equity arm was established in 1991. The private equity arm has completed more than 100 transactions in a wide range of industries having participated in many management buy-outs in Canada, the United States and Europe, including The Yellow Pages Group Co. and Shoppers Drug Mart Corporation. With a portfolio valued at C$4.5 billion as of December 31, 2003, OTPP's private equity arm is one of Canada's largest private equity investors.

5

The Offering

| Common Stock offered by us | | | | shares of Common Stock |

Common Stock to be outstanding after this offering: |

|

|

|

shares of Common Stock |

| | | 11,000,000 | | shares of Class B Convertible Common Stock |

| | Total | | | | shares of common stock |

Use of Proceeds |

|

We intend to use the net proceeds of this offering, along with borrowings under our new senior credit facility, to repay our existing senior term loan, redeem a portion of our senior notes, redeem our subordinated seller notes, prepay credits to be provided to Delta and Northwest pursuant to a service agreement with each of them, redeem our Series A Preferred Stock, terminate our advisory fee with CVC and prepay the special dividend due on our Class B Convertible Common Stock. |

Voting Rights |

|

Holders of Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders. |

|

|

Holders of Class B Convertible Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders, other than the election of directors. |

Conversion Rights |

|

Shares of each class of common stock are convertible on a one-to-one basis into shares of the other class of common stock at the option of the holder. |

Other Rights |

|

Except as to voting rights, each class of common stock has the same rights. |

Risk Factors |

|

For a discussion of certain risks that should be considered in connection with an investment in our Common Stock, see "Risk Factors." |

Proposed New York Stock Exchange Symbol |

|

"WS". |

The number of shares of Common Stock and Class B Convertible Common Stock to be outstanding after this offering excludes:

- •

- 3,787,000 shares of Common Stock subject to options outstanding as of March 31, 2004, at a weighted average exercise price of $4.55 per share; and

- •

- 2,213,000 additional shares of Common Stock reserved for issuance under our stock incentive plan, as of March 31, 2004.

Except as otherwise indicated, all information in this prospectus assumes:

- •

- an initial public offering price of $ per share, the mid-point of the filing range set forth on the cover of this prospectus;

- •

- a one-for reverse stock split of our common stock, which will be effected prior to the completion of this offering;

- •

- the redemption of all outstanding shares of our Series A Preferred Stock;

- •

- no exercise of the underwriters' over-allotment option; and

- •

- our merger with and into a wholly-owned subsidiary of ours in order to affect the recapitalization of our capital stock concurrently with the completion of this offering.

6

Summary Historical and Pro Forma Financial Information

The following table sets forth our summary historical and unaudited pro forma as adjusted consolidated financial data for the periods ended and the dates indicated. We have derived the summary historical consolidated financial data as of December 31, 2003 and for the fiscal years ended December 31, 2001 and 2002, and for the six months ended June 30, 2003 and December 31, 2003 from our audited financial statements and related notes included elsewhere in this prospectus. We have derived the summary historical consolidated financial data as of March 31, 2004 and for the three months ended March 31, 2003 and 2004 from our unaudited financial statements and related notes included elsewhere in this prospectus. The unaudited pro forma as adjusted consolidated financial data gives effect to the Transactions and assumptions described in "Unaudited Pro Forma Condensed Consolidated Financial Statements" and the accompanying notes as if each had occurred at the beginning of the period indicated below. The summary historical and unaudited pro forma as adjusted consolidated financial data set forth below are not necessarily indicative of the results of future operations and should be read in conjunction with the discussion under the headings "Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Unaudited Pro Forma Condensed Consolidated Financial Statements" and the historical consolidated financial statements and accompanying notes included elsewhere in this prospectus.

Worldspan was acquired on June 30, 2003 in a business combination accounted for under the purchase method of accounting. Accordingly, the financial data set forth below includes a predecessor basis and a successor basis. As a result of the Acquisition, Worldspan's assets and liabilities were adjusted to their estimated fair values. In addition, our statements of operations for the successor basis include interest expense resulting from indebtedness incurred to finance the Acquisition and amortization of intangible assets related to the Acquisition. Therefore, our successor basis financial data generally is not comparable to our predecessor basis financial data.

| | Predecessor Basis

| |

| |

| |

|

|---|

| | Successor Basis

| |

|

|---|

| | Year Ended

December 31,

| |

| |

| | Pro Forma

Three Months

Ended

March 31,

2004

|

|---|

| | Three Months

Ended

March 31,

2003

| | Six months

Ended

June 30,

2003

| | Six months

Ended

December 31,

2003

| | Three Months

Ended

March 31,

2004

|

|---|

| | 2001

| | 2002

|

|---|

| |

| |

| | (unaudited)

| | (dollars in thousands

except per share data)

| | (unaudited)

| | (unaudited)

|

|---|

| Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | |

| | Electronic travel distribution | | $ | 762,304 | | $ | 807,095 | | $ | 206,944 | | $ | 414,933 | | $ | 396,488 | | $ | 232,539 | | $ | 232,539 |

| | Information technology services | | | 126,049 | | | 107,774 | | | 27,401 | | | 52,539 | | | 32,974 | | | 15,992 | | | 18,719 |

| | |

| |

| |

| |

| |

| |

| |

|

| Total revenues | | | 888,353 | | | 914,869 | | | 234,345 | | | 467,472 | | | 429,462 | | | 248,531 | | | 251,258 |

| Total operating expenses | | | 807,775 | | | 802,902 | | | 207,091 | | | 417,969 | | | 421,312 | | | 221,235 | | | 221,010 |

| Operating income | | | 80,578 | | | 111,967 | | | 27,254 | | | 49,503 | | | 8,150 | | | 27,296 | | | 30,248 |

| Interest expense | | | 6,515 | | | 5,481 | | | 1,368 | | | 2,756 | | | 25,481 | | | 13,160 | | | 7,275 |

| Net income (loss) | | | 63,169 | | | 104,819 | | | 25,302 | | | 28,414 | | | (18,990 | ) | | 13,691 | | | 22,528 |

| Net (loss) income available to common stockholders | | | — | | | — | | | — | | | — | | | (34,990 | ) | | 5,291 | | | |

| Net (loss) income available to Class B Convertible Common Stock and Common Stock stockholders | | | — | | | — | | | — | | | — | | | (35,440 | ) | | 5,291 | | | |

| Basic net (loss) income per Class B Convertible Common Stock | | | — | | | — | | | — | | | — | | $ | (0.34 | ) | $ | 0.06 | | | |

| Basic net (loss) income per Common Stock | | | — | | | — | | | — | | | — | | $ | (0.39 | ) | $ | 0.06 | | | |

| Diluted net (loss) income per Class B Convertible Common Stock | | | — | | | — | | | — | | | — | | $ | (0.34 | ) | $ | 0.06 | | | |

| Diluted net (loss) income per Common Stock | | | — | | | — | | | — | | | — | | $ | (0.39 | ) | $ | 0.06 | | | |

7

| | As of March 31, 2004

| |

|---|

| | Actual

| | Pro Forma

As Adjusted

| |

|---|

| |

| | (unaudited)

| |

|---|

| Balance Sheet Data: | | | | | | | |

| Cash and cash equivalents | | $ | 33,087 | | $ | 26,231 | |

| Working capital (deficit)(1) | | | (22,459 | ) | | (77,065 | ) |

| Property and equipment | | | 137,406 | | | 137,406 | |

| Total assets | | | 1,138,907 | | | 1,284,521 | |

| Total debt(2) | | | 539,642 | | | 454,152 | |

| Series A preferred stock subject to mandatory redemption | | | 344,734 | | | — | |

| Stockholders' equity (deficit) | | | (25 | ) | | 577,096 | |

8

| | Predecessor Basis

| |

| |

| |

|

|---|

| | Successor Basis

| |

|

|---|

| | Year Ended

December 31,

| |

| |

| |

|

|---|

| |

| | Six months

Ended

June 30,

2003

| | Six months

Ended

December 31,

2003

| |

| | Pro Forma

Three Months

Ended

March 31, 2004

|

|---|

| | Three Months

Ended

March 31, 2003

| | Three Months

Ended

March 31, 2004

|

|---|

| | 2001

| | 2002

|

|---|

| |

| |

| | (unaudited)

| | (dollars in thousands)

| | (unaudited)

| | (unaudited)

|

|---|

| Other Data: | | | | | | | | | | | | | | | | | | | | | |

| Total transactions using the Worldspan system:(3) | | | | | | | | | | | | | | | | | | | | | |

| | Online (in thousands) | | | 54,790 | | | 75,896 | | | 21,773 | | | 45,058 | | | 45,201 | | | 26,189 | | | 26,189 |

| | Traditional (in thousands) | | | 140,774 | | | 116,279 | | | 27,246 | | | 54,063 | | | 48,556 | | | 29,222 | | | 29,222 |

| | |

| |

| |

| |

| |

| |

| |

|

| Total transactions (in thousands) | | | 195,564 | | | 192,175 | | | 49,019 | | | 99,121 | | | 93,757 | | | 55,411 | | | 55,411 |

| Depreciation and amortization | | $ | 83,425 | | $ | 79,215 | | $ | 17,146 | | $ | 32,322 | | $ | 52,955 | | $ | 25,063 | | $ | 25,063 |

| Capital expenditures(4) | | | 56,653 | | | 56,484 | | | 19,317 | | | 22,840 | | | 29,490 | | | 23,781 | | | 23,781 |

| Distributions | | | 175,000 | | | 100,000 | | | 60,000 | | | 110,000 | | | — | | | — | | | — |

- (1)

- Working capital is calculated as current assets (including cash and cash equivalents) minus current liabilities.

- (2)

- Includes senior notes, term loan, seller notes and assets acquired under capital leases.

- (3)

- We designate each travel agency for which we process transactions as traditional or online based on management's belief as to whether a travel agency is traditional or online. The historical transaction data set forth above reflects the designations which were in effect for each period presented. We evaluate the classification of our travel agencies on a monthly basis and reclassify them as appropriate. Upon a reclassification of a travel agency, all transactions for such travel agency are correspondingly reclassified for all historical and subsequent periods. Accordingly, to the extent we change a designation for a travel agency, the transactions for such travel agency may be reflected in different categories at different times. Based on a recent evaluation of the classifications, we generated total online transactions of 55,753 and 77,021 for the years ended December 31, 2001, and 2002, 20,370 for the three months ended March 31, 2003, 45,432 for the six months ended June 30, 2003 and 45,201 for the six months ended December 31, 2003.

- (4)

- The following table summarizes capital expenditures for the periods indicated:

| | Predecessor Basis

| |

| |

|

|---|

| | Successor Basis

|

|---|

| | Year Ended December 31,

| |

| |

|

|---|

| |

| | Six Months

Ended

June 30,

2003

| | Six Months

Ended

December 31,

2003

| |

|

|---|

| | Three Months

Ended

March 31, 2003

| | Three Months

Ended

March 31, 2004

|

|---|

| | 2001

| | 2002

|

|---|

| |

| |

| | (unaudited)

| | (dollars in thousands)

| | (unaudited)

|

|---|

| Purchase of property and equipment | | $ | 22,337 | | $ | 12,375 | | $ | 7,574 | | $ | 4,236 | | $ | 15,961 | | $ | 2,862 |

| Assets acquired under capital leases | | | 30,703 | | | 41,053 | | | 10,707 | | | 17,237 | | | 12,134 | | | 20,919 |

| Capitalized software for internal use | | | 3,613 | | | 3,056 | | | 1,036 | | | 1,367 | | | 1,395 | | | — |

| | |

| |

| |

| |

| |

| |

|

| Total capital expenditures | | $ | 56,653 | | $ | 56,484 | | $ | 19,317 | | $ | 22,840 | | $ | 29,490 | | $ | 23,781 |

| | |

| |

| |

| |

| |

| |

|

9

RISK FACTORS

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding whether to invest in our Common Stock. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In such case, you may lose all or part of your original investment.

Risks Relating To Our Business

Dependence on Travel Industry in General and Airline Industry in Particular—Our revenues are highly dependent on the travel industry, and particularly on the airlines, and a substantial decrease in travel bookings could adversely affect our business and operating results.

Substantially all of our revenues are derived from airlines, hotel operators, car rental companies and other suppliers in the travel industry. Our revenues increase and decrease with the level of travel activity and are therefore highly subject to declines in or disruptions to travel. In particular, because a significant portion of our revenues are derived from transaction fees generated by airline bookings and airline outsourcing services, our revenues and earnings are especially sensitive to events that affect airline travel, the airlines that participate in our GDS and the airlines that obtain travel information technology services from us. Our business could also be adversely affected by a reduction in bookings on the airlines that participate in our GDS as a result of those airlines losing business for other reasons, including losing market share to other airlines, such as low-cost carriers, that do not participate in our GDS. In addition, travel expenditures are seasonal and are sensitive to business and personal discretionary spending levels and tend to decline during general economic downturns, which could also reduce our revenues and profits.

The downturn in the commercial airline market, together with the terrorist attacks of September 11, 2001, the global economic downturn, SARS and the war and continuing conflict in Iraq, have adversely affected the financial condition of many commercial airlines and other travel suppliers. Several major airlines are experiencing liquidity problems, some have sought bankruptcy protection and still others may consider bankruptcy relief. A substantial portion of our revenues are derived from transaction fees received directly from airlines and from the sale of products and services directly to airlines. If an airline declared bankruptcy, we may be unable to collect our outstanding accounts receivable from the airline. In addition, the bankruptcy of the airline might result in reduced transaction fees and other revenues from the airline or a rejection by the airline of some or all of our agreements with it, all of which could have a material adverse effect on our business, financial condition and results of operations.

Susceptibility to Terrorism and War—Acts of terrorism and war could have an adverse effect on the travel industry, which in turn could adversely affect our business and operating results.

Travel is sensitive to safety and security concerns, and thus declines after occurrences of, and fears of future incidents of, terrorism and hostilities that affect the safety, security and confidence of travelers. For example, the start of the war in Iraq in March 2003 and the continuing conflict and the terrorist attacks of September 11, 2001, which included attacks on the World Trade Center and the Pentagon using hijacked commercial aircraft, resulted in the cancellation of a significant number of flights and travel bookings and a decrease in new travel bookings. Future revenues may be reduced by similar and/or other acts of terrorism or war. The effects of these events could include, among other things, a protracted decrease in demand for air travel due to fears regarding additional acts of terrorism, military and governmental responses to acts of terrorism and a perceived inconvenience in traveling by air and increased costs and reduced operations by airlines due, in part, to new safety and security directives adopted by the Federal Aviation Administration or other governmental agencies. As an example, escalation of the U.S. Government's terrorist security alert level to code orange or higher may adversely impact demand for air travel. These effects, depending on their scope and duration,

10

which we cannot predict, could significantly impact our business, financial condition and results of operations.

Competition—We operate in highly competitive markets, and we may not be able to compete effectively.

In our electronic travel distribution segment, we compete primarily against other large and well-established GDSs, including those operated by Amadeus, Galileo and Sabre, each of which may have greater financial, technical and other resources than we have. These greater resources may allow our competitors to better finance more strategic transactions and more research and development than us and it could allow them to offer more or better products and services for less than we can. Competition among GDSs to attract and retain travel agencies is intense. In competitive markets, we and other GDSs offer discounts, incentive payments and other inducements to travel agencies if productivity or transaction volume growth targets are achieved. In order to compete effectively, we may need to increase inducements, increase spending on marketing or product development, make significant investments to purchase strategic assets or take other costly actions. Although expansion of the use of these inducements could adversely affect our profitability, our failure to continue to provide inducements could result in the loss of some travel agency customers. If we were to lose a significant portion of our current base of travel agencies to a competing GDS or if we were forced to increase the amounts of these inducements significantly, our business, financial condition and results of operations could be materially adversely affected. In addition, we face competition in the travel agency market from travel suppliers and new types of travel distribution companies that seek to bypass GDSs and distribute directly to travel agencies or consumers.

In our information technology services segment, there are several organizations offering internal reservation system and related technology services to the airlines, with our main competitors being Amadeus, EDS, Navitaire, Sabre and Unisys/SITA. This segment is highly competitive and the competitors are highly aggressive. If we cannot compete effectively to keep and grow this segment of business, we risk losing customers and economies of scale which could have a negative impact on our operating results.

Factors affecting the competitive success of GDSs include the timeliness, reliability and scope of the information offered, the reliability and ease of use of the GDS, the fees charged and inducements paid to travel agencies, the transaction fees charged to travel suppliers and the range of products and services available to travel suppliers and travel agencies. We believe that we compete effectively with respect to each of these factors. In addition, deregulation of the GDS industry in the U.S. will likely increase competition between the GDSs. Increased competition could require us to increase spending on marketing or product development, decrease our transaction fees and other revenues, increase inducement payments or take other actions that could have a material adverse effect on our business, financial condition and results of operations.

Travel Supplier Cost Savings—Travel supplier cost savings efforts may shift business away from us or cause us to reduce the fees we charge to suppliers or increase the inducements we offer to travel agencies, thereby adversely affecting our results of operations.

Travel suppliers, particularly airlines, are aggressively seeking ways to reduce distribution costs and, through the use of the Internet and otherwise, are seeking to decrease their reliance on global distribution systems including us. Travel suppliers have increasingly been providing direct access to their inventory through their own websites through travel agencies and through travel supplier joint ventures, which potentially bypass GDSs. See "Business—Competition." Some of these travel suppliers offer lower prices when their products and services are purchased directly from these supplier-related distribution channels. These lower prices are not always available to us. Some of these travel suppliers are also not providing their lowest fares to GDSs unless the GDS provides them with lower transaction fees. These practices may have the effect of diverting customers away from us to other distribution

11

channels, including websites, or of forcing us to reduce our transaction fees, which could have a material adverse effect on our business, financial condition and results of operations. Moreover, consolidation among travel suppliers, including airline mergers and alliances, may increase competition from these supplier-related distribution channels. In addition, some travel suppliers have reduced or eliminated commissions paid to both traditional and online travel agencies. The reduction or loss of commissions may cause travel agencies to become more dependent on other sources of revenues, such as traveler-paid service fees and GDS-paid inducements. We may have to increase inducement payments or incur other expenses in order to compete for travel agency business.

Fare Content Agreements—Our efforts to obtain more comprehensive content through airline fare content agreements may cause downward pressure on pricing and adversely affect our revenues and operating results.

In recent months, some airlines have differentiated the fare content that they provide to us and to our GDS competitors. Some fare content has been provided to GDSs at no additional charge under standard participation agreements, and other content, such as web fares, has been withheld unless the GDS agrees to provide discounts, payments or other benefits to the airline. We have recently entered into fare content agreements with Continental Airlines, Delta, Northwest and United Air Lines. Generally, in these agreements, the airlines commit (subject to the exceptions contained in the agreements) to provide travel agencies covered by the agreements in the territories covered by the agreements with substantially the same fare content (including web fares) it provides to the travel agencies of other GDSs in exchange for payments from us to each airline and subject to us keeping steady the average transaction fees paid by each airline for travel agency bookings in the territories covered by the agreements. Further, in February 2004, we executed a three-year fare content agreement with British Airways to provide access to virtually all of their published fares (including web fares) to some of our U.K. travel agencies. We believe that obtaining similar fare content from other major airline travel suppliers is important to our ability to compete, since other GDSs have also entered into fare content agreements with various airlines. Consequently, we plan to pursue agreements similar to these fare content agreements with some other major airlines. We expect that our fare content agreements will require us to make, in the aggregate, significant payments or other concessions to the participating airlines which could have a material adverse effect on our business, financial condition and results of operations in the future, including during the next three-year period. In addition, our fare content agreements are subject to several conditions, exceptions, term limitations and termination rights. There is no guarantee that the participating airlines will continue to provide their fare content to us to the same extent as they do at the current time. The loss or substantial reduction in the amount of fare content received from the participating airlines could negatively affect our business, financial condition and results of operations.

Dependence on Small Number of Airlines—We depend on a relatively small number of airlines for a significant portion of our revenues and the loss of any of our major airline relationships would harm our revenues and operating results.

We depend on a relatively small number of airlines for a significant portion of our revenues. Our five largest airline relationships represented an aggregate of approximately 54% of our total 2003 revenues, down from 56% in 2002, while our ten largest airline relationships represented an aggregate of approximately 66% of our total 2003 revenues, down from 68% in 2002. Our five largest airline relationships by total revenue in 2003 were with Delta, Northwest, United Air Lines, American and US Airways, representing 19%, 12%, 9%, 8% and 5% of our total 2003 revenues, respectively. In 2002, these carriers accounted for 20%, 14%, 7%, 9% and 6%, respectively. We expect to continue to depend upon a relatively small number of airlines for a significant portion of our revenues. In addition, although we expect to continue our relationships with these airlines, our airline contracts can be terminated on short notice. Because our major airline relationships represent such a large part of our

12

business, the loss of any of our major airline relationships, including due to the bankruptcy of an airline, could have a material negative impact on our business, financial condition and results of operations.

Dependence on Small Number of Online Travel Agencies—We are highly dependent on a small number of large online travel agencies, and the success of our business depends on continuing these relationships and the continued growth of online travel commerce.

In 2003, Expedia, Hotwire, Orbitz and Priceline represented approximately 43% of our total transactions, with Expedia representing over 20% of our total transactions. If we were to lose and not replace the transactions generated by any of these online travel agencies, our business, financial condition and results of operations would be materially adversely impacted. In addition, if other online travel agencies become more successful or new online travel agencies emerge and we lose online transaction volumes as a result, our business, financial condition (including the carrying value of certain intangibles) and results of operations could be materially adversely impacted.

While we have long-term contracts with Expedia, Orbitz and Priceline, these agencies have a variety of termination rights and other rights to reduce their business with Worldspan. Hotwire has the right to terminate its contract with us for any reason on 90 days advance notice. Expedia has the right to renegotiate the inducements payable to it by us every three years (with the next renegotiation right scheduled for July 2004), and it can terminate its contract with us if we cannot reach an agreement on inducements. In addition, Expedia informed us in May 2004 that it intends to exercise its right to move a portion of its transactions to another GDS provider. Although we currently continue to operate under these agreements, we cannot assure you that any travel agency will not attempt to terminate its agreement with us or otherwise move business to another GDS in the future. Any such termination or a significant reduction in transaction volumes would have a material adverse effect on our business, financial condition (including the carrying value of certain intangibles) and results of operations.

In addition, our growth strategy relies on the continuing growth in the travel industry of the Internet as a distribution channel. If consumers do not book significantly more travel online than they currently do today and if the use of the Internet as a medium of commerce for travel bookings does not continue to grow or grows more slowly than expected, our revenues and profit may be adversely affected. Consumers have historically relied on traditional travel agencies and travel suppliers and are accustomed to a high degree of human interaction in purchasing travel products and services. The success of our business is dependent on the number of consumers who use the Internet to make travel bookings increasing significantly.

Relationships with Our Founding Airlines—A significant portion of our current revenues are attributable to our founding airlines, and there is no guarantee that these airlines will continue to use our services to the same extent that they did when they owned us or that they will not indirectly compete with us.

Each of American, Delta and Northwest has important commercial relations with us, and, in 2003, revenues received from our founding airlines represented, in the aggregate, approximately 39% of our revenues. Approximately 79% of this revenue was from transaction fees and the balance was derived from information technology services provided to Delta and Northwest. Delta is the largest single travel supplier utilizing our GDS, as measured by transaction fee revenues, generating transaction fees that accounted for approximately 14% of our 2003 revenue, while Northwest and American represent approximately 9% and 8%, respectively. In addition, approximately 86% of our information technology services revenues, which represented approximately 10% of our total revenues in 2003, are derived from providing processing, software development and other services to Delta and Northwest. Although we believe that each founding airline will continue to distribute its travel services through our GDS and

13

that Delta and Northwest will continue to use our information technology services, there is no guarantee that our founding airlines will continue to use these services to the same extent as they did prior to the Acquisition or at all. In addition, although we have entered into noncompetition agreements with our founding airlines and each has agreed not to operate a GDS for three years after the Acquisition, there is no guarantee that our founding airlines will not indirectly compete with us in some or all of our markets, such as through supplier direct connections which could bypass our GDS. The loss or substantial reduction of fees from any of our founding airlines, or direct or indirect competition from any of our founding airlines, could negatively affect our business, financial condition and results of operations.

For instance, the information technology services that we perform for Delta include computer functionality known as "PNR Sync." In 2003, Delta notified us that it intended to terminate PNR Sync. Following discussions with Delta relating to the mutual benefits of PNR Sync to Delta and us, we reached an agreement with Delta in December 2003 to continue to provide PNR Sync to Delta for a minimum three-year period at a fixed price and subject to several conditions, term limitations and termination rights. A termination of the PNR Sync functionality by Delta would represent a material adverse effect on our business, financial condition and results of operations. Additionally, in March 2004, Delta notified us that our GDS transaction fee pricing did not satisfy the conditions of our marketing support agreement with Delta. Delta indicated that, until we modify our GDS transaction fee pricing, it would suspend marketing support of us and the discount that Delta has provided to us for business travel. Pursuant to the agreement, we are working with Delta to review the relevant data and to resolve these issues.

Critical Systems—Our systems may suffer failures, capacity constraints and business interruptions, which could increase our operating costs, decrease our revenues and cause us to lose customers.

The reliability of our GDS is critical to the success of our business. Much of our computer and communications hardware is located in a single data center located near Atlanta, Georgia. Our systems might be damaged or interrupted by fire, flood, power loss, telecommunications failure, break-ins, earthquakes, terrorist attacks, war or similar events. Computer malfunctions, computer viruses, physical or electronic break-ins and similar disruptions might cause system interruptions and delays and loss of critical data and could significantly diminish our reputation and brand name and prevent us from providing services. Although we believe we have taken adequate steps to address these risks, we could be harmed by outages in, or unreliability of, the data center or computer systems.

In addition, we rely on several communications services companies in the United States and internationally to provide network connections between our data center and our travel agencies' access terminals and also our travel suppliers. In particular, we rely upon AT&T and SITA, which is owned by a consortium of airlines and other travel-related businesses, to maintain our data communications and to provide network services in the United States and in many countries served by us. We occasionally experience network interruptions and malfunctions that make our global distribution system or other data processing services unavailable or less usable. Any significant failure or inability of AT&T, SITA or other communications companies to provide and maintain network access could have a material adverse effect on our business, financial condition and results of operations.

Protection of Technology—We may not protect our technology effectively, which would allow competitors to duplicate our products and services. This could make it more difficult for us to compete with them.

Our success and ability to compete depend, in part, upon our technology. Among our significant assets are our software and other proprietary information and intellectual property rights. We rely on a combination of copyright, trademark and patent laws, trade secrets, confidentiality procedures and contractual provisions to protect these assets. Our software and related documentation, however, are

14

protected principally under trade secret and copyright laws, which afford only limited protection, and the laws of some foreign jurisdictions provide less protection for our proprietary rights than the laws of the United States. Unauthorized use and misuse of our intellectual property could have a material adverse effect on our business, financial condition and results of operations, and there can be no assurance that our legal remedies would adequately compensate us for the damages caused by unauthorized use.

In addition, licenses for a number of software products have been granted to us. Some of these licenses, individually and in the aggregate, are material to our business. Although we believe that the risk that we will lose any material license is remote, any loss could have a material adverse effect on our business, financial condition and results of operations.

Intellectual Property—Our products and services may infringe on claims of intellectual property rights of third parties, which could adversely affect our business and operating results.

We do not believe that any of our products, services or activities infringe upon the intellectual property rights of third parties in any material respect. There can be no assurance, however, that third parties will not claim infringement by us with respect to current or future products, services or activities. Any infringement claim, with or without merit, could result in substantial costs and diversion of management and financial resources, and a successful claim could effectively block our ability to use or license products and services in the United States or abroad or cost us money. Any infringement claim, therefore, could have a material adverse effect on our business, financial condition and results of operations.

Technological Change—Rapid technological changes may render our technology obsolete or decrease the attractiveness of our products and services to customers.

Our industry is subject to rapid technological change as travel suppliers, travel agencies and competitors create new and innovative products and services. Our ability to compete in our business and our future results will depend, in part, upon our ability to make timely, innovative and cost-effective enhancements and additions to our technology and to introduce new products and services that meet the demands of travel suppliers, travel agencies and other customers. The success of new products and services depends on several factors, including:

- •

- identifying the needs of travel suppliers, travel agencies and other customers;

- •

- developing and introducing effective new products and services in a timely and efficient manner;

- •

- managing the cost of new product development and operations;

- •

- differentiating new products and services from those of our competitors; and

- •

- achieving market acceptance of new products and services.

In addition, maintaining the flexibility to respond to technological and market changes may require substantial expenditures and lead time. There can be no assurance that we will successfully identify and develop new products or services in a timely manner, that products, technologies or services developed by others will not render our offerings obsolete or noncompetitive or that the technologies in which we focus our research and development investments will achieve acceptance in the marketplace.

Our technology infrastructure is largely fixed. As a result, in the event of a significant reduction in transaction volumes or revenues, technology costs would remain relatively constant. If a reduction continued for a prolonged period, our business, financial condition and results of operations could be materially adversely affected.

15

Regulatory Risks—Regulatory developments could limit our ability to compete by restricting our flexibility to respond to competitive conditions.

Changes and developments in the regulatory environment could have an adverse affect on our financial condition or results of operations, including by negatively impacting our transaction volume, transaction fees and by otherwise impacting the way we operate our business. GDSs are regulated by the U.S., the European Union ("E.U.") and other countries in which we operate. The U.S. Department of Transportation ("DOT") and the European Commission ("EC") are the relevant regulatory authorities in the U.S. and the E.U., respectively. Most of the regulating bodies have reexamined or are examining their GDS regulations and appear to be moving toward deregulation. Regulatory changes in the U.S., E.U. or other countries could have a material adverse effect on our business, financial condition and results of operations.

On January 31, 2004, most DOT rules governing GDSs were lifted. The remaining DOT rules will be phased out at the end of July 2004. The DOT rules no longer contain any rules that apply uniquely to GDSs that are owned or marketed by airlines. In addition, deregulation in the U.S. could create uncertainty as to established GDS business models. Discontinuance of the rules could facilitate efforts by the airlines to divert travel bookings to distribution channels that they own and control and could also facilitate movement of travel agencies from one GDS to another. In addition, elimination of the rule prohibiting discrimination in airline fees could affect transaction fee revenues.

E.U. regulations continue to address the participation of airline GDS owners in other GDSs. See "Business—GDS Industry Regulation."

The EC is engaged in a comprehensive review of its rules governing GDSs. It is unclear at this time when the EC will complete its review and what changes, if any, will be made to the E.U. rules. We could be unfairly and adversely affected if the E.U. rules are retained as to traditional global distribution systems used by travel agencies but are not applied to businesses providing comparable services, such as travel distribution websites owned by more than one airline. In addition, we could be adversely affected if changes to the rules, changes in interpretations of the rules, or new rules increase our cost of doing business, limit our ability to establish relationships with travel agencies, airlines, or others, impair the enforceability of existing agreements with travel agencies and other users of our system, prohibit or limit us from offering services or products, or limit our ability to establish or changes fees. Continued GDS regulation in the E.U. and elsewhere, while GDS regulations are being abolished in the U.S., could also create the operational challenge of supporting different products, services and business practices to conform to the different regulatory regimes.

There are also GDS regulations in Canada, under the regulatory authority of the Canadian Department of Transport. On April 27, 2004, a significant number of these regulations were lifted. Amendments to the rules include eliminating the "obligated carrier" rule, which required larger airlines in Canada to participate equally in the GDSs, and elimination of the requirement that transaction fees charged by GDSs to airlines be non-discriminatory. Due to the elimination of the obligated carrier rule in Canada, Air Canada, the dominant Canadian airline, could choose distribution channels that it owns and controls or distribution through another GDS rather than through the Worldspan GDS.

Privacy and Data Protection—Our processing, storage, use and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights.

In our processing of travel transactions, we receive and store a large volume of personally identifiable data. This data is increasingly subject to legislation in numerous jurisdictions around the world, including the E.U. through its Data Protection Directive (and variations of this Directive in the E.U. Member States). This legislation is typically intended to protect the privacy of personal data that is collected, processed and transmitted in or from the governing jurisdiction. We could be adversely

16

affected if the legislation is expanded to require changes in our business practices or if governing jurisdictions interpret or implement their legislation in ways that negatively affect our business, financial condition and results of operations.

In addition, in the aftermath of the terrorist attacks of September 11, 2001, government agencies have been contemplating or developing initiatives to enhance national and aviation security, including the Transportation Security Administration's Computer-Assisted Passenger Prescreening System, known as CAPPS II. These initiatives may result in conflicting legal requirements with respect to data handling. As privacy and data protection has become a more sensitive issue, we may also incur legal defense costs and become exposed to potential liabilities as a result of differing views on the privacy of travel data. Travel businesses have also been subjected to investigations, lawsuits and adverse publicity due to allegedly improper disclosure of passenger information. For example, we were initially named as one of the defendants in a class action lawsuit arising from disclosures by Northwest of passenger data to a U.S. government agency. An amended and consolidated class action lawsuit was recently refiled in this case and we are no longer a named defendant in the matter. We are evaluating whether we have any future liability arising from this matter. While we do not believe that this matter is material, other privacy developments that are difficult to anticipate could impact our business, financial condition and results of operations.

Key Employees—Our ability to attract, train and retain executives and other qualified employees is crucial to results of operations and future growth.

We depend substantially on the continued services and performance of our key executives, senior management and skilled personnel, particularly our professionals with experience in our business and operations and the GDS industry, including: Rakesh Gangwal, our Chairman and Chief Executive Officer, Gregory O'Hara, our Executive Vice President—Corporate Planning and Development; Ninan Chacko, our Senior Vice President—e-Commerce and Product Planning; David A. Lauderdale, our Chief Technology Officer and Senior Vice President—Technical Operations; Michael B. Parks, our Senior Vice President and General Manager; Susan J. Powers, our Chief Information Officer and Senior Vice President—Worldwide Product Solutions; Jeffrey C. Smith, our General Counsel, Secretary and Senior Vice President—Human Resources; and Michael Wood, our Senior Vice President and Chief Financial Officer. We have entered into employment agreements with Messrs. Gangwal, O'Hara, Chacko and Wood to provide them with incentives to remain employed by us, all as more fully described in the section of this prospectus entitled "Management—Employment Agreements." However, we cannot assure you that any of these individuals will continue to be employed by us. The specialized skills needed by our business are time-consuming and difficult to acquire and in short supply, and this shortage is likely to continue. A lengthy period of time is required to hire and train replacement personnel when skilled personnel depart the company. An inability to hire, train and retain a sufficient number of qualified employees could materially hinder our business by, for example, delaying our ability to bring new products and services to market or impairing the success of our operations. Even if we are able to maintain our employee base, the resources needed to attract and retain such employees may adversely affect our profits, growth and operating margins.

Business Combinations and Strategic Investments—We may not successfully make and integrate business combinations and strategic investments.

We plan to continue to enter into business combinations, investments, joint ventures and other strategic alliances with other companies in order to maintain and grow revenue and market presence as well as to provide us with access to technology, products and services. Those transactions with other companies create risks such as difficulty in assimilating the technology, products and operations with our technology, products and operations; disruption of our ongoing business, including loss of management focus on existing businesses; impairment of relationships with existing executives,

17

employees, customers and business partners; and losses that may arise from equity investments. In the past, in an effort to secure new technologies or obtain unique content for our GDS, we have invested in a number of early-stage technology companies. Each of these investments has required senior management attention. Many of these companies have failed, and most of our investments have been written down. If we enter into such transactions in the future, we may issue shares of stock that dilute the interests of our other stockholders, expend cash, incur debt, assume contingent liabilities or create additional expenses related to amortizing other intangible assets with estimable useful lives, any of which might harm our business, financial condition or results of operations. In addition, we may not be able to identify suitable candidates for these transactions or obtain financing or otherwise make these transactions on acceptable terms.

Seasonality—Because our business is seasonal, our quarterly results will fluctuate.

The travel industry is seasonal in nature. Bookings, and thus transaction fee revenues charged for the use of our GDS, typically decrease each year in the fourth quarter, due to the early bookings by customers for travel during the holiday season and a decline in bookings for business travel during the holiday season. During 2002 and 2003, our transactions in the fourth quarter have averaged approximately 22% of total transactions for those years. Seasonality could cause our revenues to fluctuate significantly from quarter to quarter. Substantial fluctuations in our results of operations could have a material adverse effect on us.

Trade Barriers—We face trade barriers outside of the United States that limit our ability to compete.

Trade barriers erected by non-U.S. travel suppliers, which are sometimes government-owned, have on occasion interfered with our ability to offer our products and services in their markets or have denied us content or features that they give to our competitors. Those trade barriers make our products and services less attractive to travel agencies in those countries than products and services offered by other GDSs that have these capabilities and have restricted our ability to gain market share outside of the U.S. Competition and trade barriers in those countries could require us to increase inducements, reduce prices, increase spending on marketing or product development, withdraw from or not enter certain markets or otherwise take actions adverse to us.

International Operations—Our international operations are subject to other risks which may impede our ability to grow internationally.

Approximately 14% of our revenues during the twelve months ended December 31, 2003 were generated through our foreign subsidiaries. We face risks inherent in international operations, such as risks of:

- •

- currency exchange rate fluctuations;

- •

- local economic and political conditions, including conditions resulting from the continuing conflict in Iraq;

- •

- restrictive governmental actions (such as trade protection measures, privacy rules, consumer protection laws and restrictions on pricing or discounts);

- •

- changes in legal or regulatory requirements;

- •

- limitations on the repatriation of funds;

- •

- difficulty in obtaining distribution and support;

- •

- nationalization;

- •

- different accounting practices and potentially longer payment cycles;

18

- •

- seasonal reductions in business activity;

- •

- higher costs of doing business;

- •

- lack of, or the failure to implement, the appropriate infrastructure to support our technology;

- •

- lesser protection in some jurisdictions for our intellectual property;

- •

- disruptions of capital and trading markets;

- •

- laws and policies of the U.S. affecting trade, foreign investment and loans; and

- •

- foreign tax and other laws.

These risks may adversely affect our ability to conduct and grow business internationally, which could cause us to increase expenditures and costs, decrease our revenue growth or both.

Exchange Rate Fluctuations—Fluctuations in the exchange rate of the U.S. dollar and other foreign currencies could have a material adverse effect on our financial performance and results of operations.