Filed by Pacific Ethanol, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6 under

the Securities Exchange Act of 1934

Subject Company: Aventine Renewable Energy Holdings, Inc.

(Commission File No. 001-32922)

This filing relates to a proposed business combination involving Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc.

1 Leading Producer and Marketer of Low - Carbon Renewable Fuels Strong Long - term Demand for Ethanol Pacific Ethanol Corporate Overview: Q4 & FY 2014 Differentiated Business Model & Diversified Revenue Streams

2 2 Statements contained in this communication that refer to Pacific Ethanol’s estimated or anticipated future results or other n on - historical expressions of fact are forward - looking statements that reflect Pacific Ethanol’s current perspective of existing trends and inf ormation as of the date of this communication. Forward looking statements generally will be accompanied by words such as “anticipate,” “believe, ” “ plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,” “guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “p redict,” “project,” or other similar words, phrases or expressions. Such forward - looking statements include, but are not limited to, the ability of Pac ific Ethanol to timely and successfully execute on, and the effects of, its initiatives to improve plant efficiencies and increase yields, diversify fe edstock, diversify its revenue streams, and produce advanced biofuels; market conditions, including the supply of and demand for ethanol and co - product s, as well as margins, commodity prices, and export conditions; the timing and effects of the re - adoption and implementation by the California Air Resources Board of a Low - Carbon Fuel Standard; Pacific Ethanol’s projections concerning certain expenses, including capital expenditures; the amount and timing of Pacific Ethanol’s utilization of its tax assets; statements about the benefits of the Aventine merger, including fu tur e financial and operating results, Pacific Ethanol’s or Aventine’s plans, objectives, expectations and intentions and the expected timing of com pletion of the transaction. It is important to note that Pacific Ethanol’s goals and expectations are not predictions of actual performance. Ac tual results may differ materially from Pacific Ethanol’s current expectations depending upon a number of factors affecting Pacific Ethanol’s busines s, Aventine’s business and risks associated with merger transactions. These factors include, among others, adverse economic and market conditions, i ncl uding for ethanol and its co - products; raw material costs, including ethanol production input costs; changes in governmental regulations and polic ies; and insufficient capital resources. These factors also include, among others, the inherent uncertainty associated with financial projections; res tructuring in connection with, and successful closing of, the Aventine merger; subsequent integration of Aventine and the ability to recogn ize the anticipated synergies and benefits of the Aventine merger; the ability to obtain required regulatory approvals for the transaction (inclu din g the approval of antitrust authorities necessary to complete the acquisition), the timing of obtaining such approvals and the risk that such a ppr ovals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; th e a bility to obtain the requisite Pacific Ethanol and Aventine stockholder approvals; the risk that a condition to closing the Aventine merger may no t b e satisfied on a timely basis or at all; the failure of the proposed transaction to close for any other reason; risks relating to the value of th e Pacific Ethanol shares to be issued in the transaction; the anticipated size of the markets and continued demand for Pacific Ethanol’s and Aventine’s p rod ucts; the impact of competitive products and pricing; the risks and uncertainties normally incident to the ethanol production and marketing indus tri es; the difficulty of predicting the timing or outcome of pending or future litigation or government investigations; changes in generally accepted acc ounting principles; costs and efforts to defend or enforce intellectual property rights; successful compliance with governmental regulations appl ica ble to Pacific Ethanol’s and Aventine’s facilities, products and/or businesses; changes in the laws and regulations; changes in tax laws or int erpretations that could increase Pacific Ethanol’s consolidated tax liabilities; the loss of key senior management or staff; and such other ris ks and uncertainties detailed in Pacific Ethanol’s periodic public filings with the Securities and Exchange Commission, including but not limited to Pacific Ethanol’s “Risk Factors” section contained in Pacific Ethanol’s Form 10 - Q filed with the Securities and Exchange Commission on November 12, 2014 and from time to time in Pacific Ethanol’s other investor communications. Except as expressly required by law, Pacific Ethanol disclaims an y i ntent or obligation to update or revise these forward - looking statements. Cautionary statements

3 3 Additional Information This communication is being made partially in respect of the proposed merger between Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. In connection with the proposed merger, Pacific Ethanol has filed with the Securities and Exchange Commission a registration statement on Form S - 4 that includes a preliminary joint proxy statement of Pacific Ethanol and Aventine that also constitutes a prospectus of Pacific Ethanol. Upon effectiveness of the registration statement, a defin iti ve joint proxy statement/prospectus will be delivered to the stockholders of Pacific Ethanol and Aventine. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval. Investors and security holders will be able to obtain free copies of the registration statement and the definitive joint prox y statement/prospectus (when available) and other documents filed with the Securities and Exchange Commission by Pacific Ethanol through the website maintained by the Securities and Exchange Commission at http://www.sec.gov . Copies of the documents filed with the Securities and Exchange Commission by Pacific Ethanol will be available free of charge on Pacific Ethanol’s internet website at www.pacificethanol.com or by contacting Pacific Ethanol’s investor relations agency, LHA, at (415) 433 - 3777. Pacific Ethanol, Aventine, their respective directors and certain of their executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Pacific Ethanol is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the Securities and Exchange Commission on April 28, 2014. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the definitive joint proxy statement/prospectus filed with the above - referenced registration statement on Form S - 4 and other relevant materials to be filed with the Securities and Exchange Commission when they become available. A more complete description will be available in the registration statement and the definitive joint proxy statement/prospect us.

4 4 Financial Highlights Full Year 2014 Results: Net sales were $1.1B Total gallons sold was 513.2M Gross profit was $108.5M Operating income was $91.4M Adjusted EBITDA was $95.0M Fourth Quarter 2014 Results: Net sales were $256.2M Total gallons sold was 134.6M Gross profit was $18.4M Operating income was $13.6M Adjusted EBITDA was $16.3M In 2014, significantly reduced d ebt & increased liquidity ending year with $62M in cash & $114M in working capital

5 5 2014 Accomplishments Restarted Madera, CA plant in Q2 2014 Committed $16M in CAPEX plant projects to increase efficiencies & yields Commissioned installation of corn oil separation technology; expected to be completed by end of Q1 for Madera & beginning of Q2 for Boardman Contracted to sell CO 2 generated from Boardman plant in 2015 Announced construction of a 3.5MW cogeneration project at Stockton Received award of $3M for Sorghum Feedstock Development Program

6 6 Repurchased plant ownership interest, now at 96% Established Strong Foundation for Growth 2014 initiatives have strengthened our balance sheet and improved liquidity Reduced cost of borrowing and enhanced liquidity Reduced overall debt balances • Eliminated parent company debt • Significantly reduced plant debt Strong balance sheet provides platform to grow the business through plant improvements and acquisitions

7 7 Aventine Merger Agreement Highlights On Dec. 31, 2014 Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. announced a definitive merger agreement under which Pacific Ethanol is to acquire all of the outstanding shares of Aventine in a stock - for - stock merger. Connects Destination & Origin Market Strategies, Providing Synergies in Production & Marketing Expands Marketing Reach into New Markets & Extends Co - product Mix Increases Combined Annual Production Capacity to 515 MGY with Marketing Volume to 800 MGY

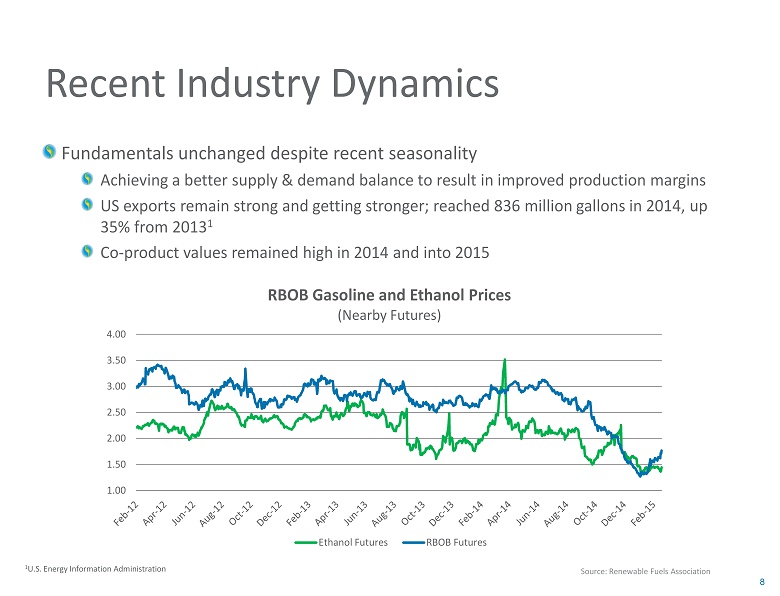

8 8 Recent Industry Dynamics Fundamentals unchanged despite recent seasonality Achieving a better supply & demand balance to result in improved production margins US exports remain strong and getting stronger; reached 836 million gallons in 2014, up 35% from 2013 1 Co - product values remained high in 2014 and into 2015 Source: Renewable Fuels Association 1 U.S. Energy Information Administration 1.00 1.50 2.00 2.50 3.00 3.50 4.00 RBOB Gasoline and Ethanol Prices (Nearby Futures) Ethanol Futures RBOB Futures

9 California Low - Carbon Fuel Standard The world’s first greenhouse gas standard for transportation fuels CARB evaluating re - adoption of the Low - Carbon Fuel Standard (LCFS) with a decision expected in the summer of 2015 ⁻ Original bill requires a 10% reduction in carbon intensity by 2020 CARB evaluating extending the program through 2030 and applying aggressive new carbon intensity reduction targets for the final 10 years. As more efficient, higher octane E15 fuel blends enter the market, Pacific Ethanol is well equipped to meet the demand Pacific Ethanol produces among the lowest carbon intensity ethanol of any commercially available transportation fuel, and receives a premium for its fuel sold in California Source: Biofuels Digest

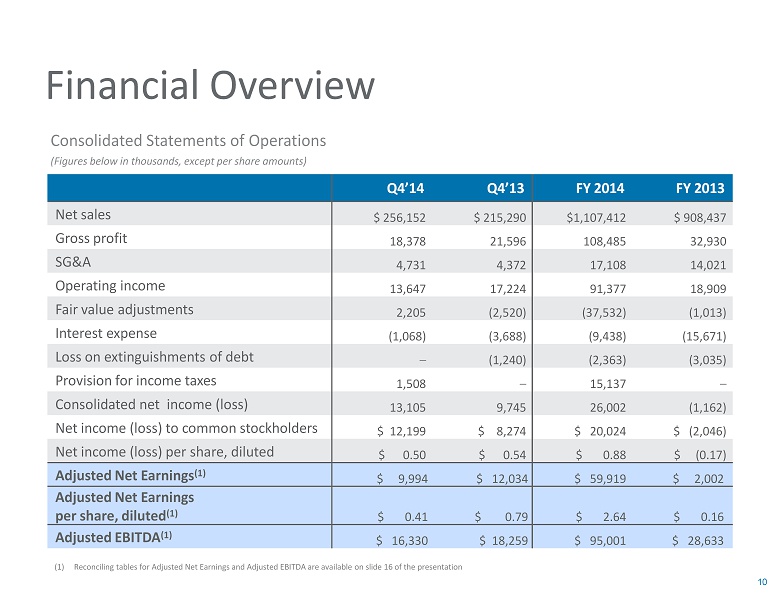

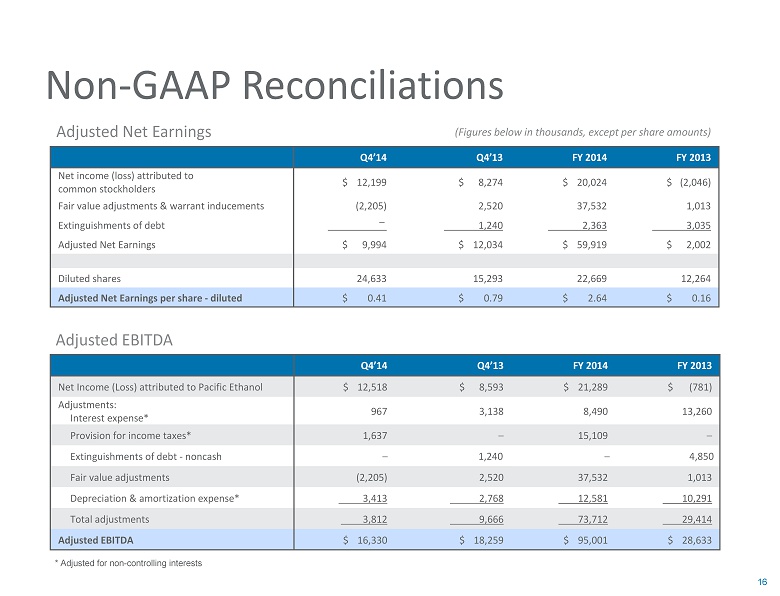

10 10 Q4’14 Q4’13 FY 2014 FY 2013 Net sales $ 256,152 $ 215,290 $1,107,412 $ 908,437 Gross profit 18,378 21,596 108,485 32,930 SG&A 4,731 4,372 17,108 14,021 Operating income 13,647 17,224 91,377 18,909 Fair value adjustments 2,205 (2,520) (37,532) (1,013) Interest expense (1,068) (3,688) (9,438) (15,671) Loss on extinguishments of debt – (1,240) (2,363) (3,035) Provision for income taxes 1,508 – 15,137 – Consolidated net income (loss) 13,105 9,745 26,002 (1,162) Net income (loss) to common stockholders $ 12,199 $ 8,274 $ 20,024 $ (2,046) Net income (loss) per share, diluted $ 0.50 $ 0.54 $ 0.88 $ (0.17) Adjusted Net Earnings (1) $ 9,994 $ 12,034 $ 59,919 $ 2,002 Adjusted Net Earnings per share, diluted (1) $ 0.41 $ 0.79 $ 2.64 $ 0.16 Adjusted EBITDA (1) $ 16,330 $ 18,259 $ 95,001 $ 28,633 Financial Overview (1) R econciling tables for Adjusted Net Earnings and Adjusted EBITDA are available on slide 16 of the presentation (Figures below in thousands, except per share amounts) Consolidated Statements of Operations

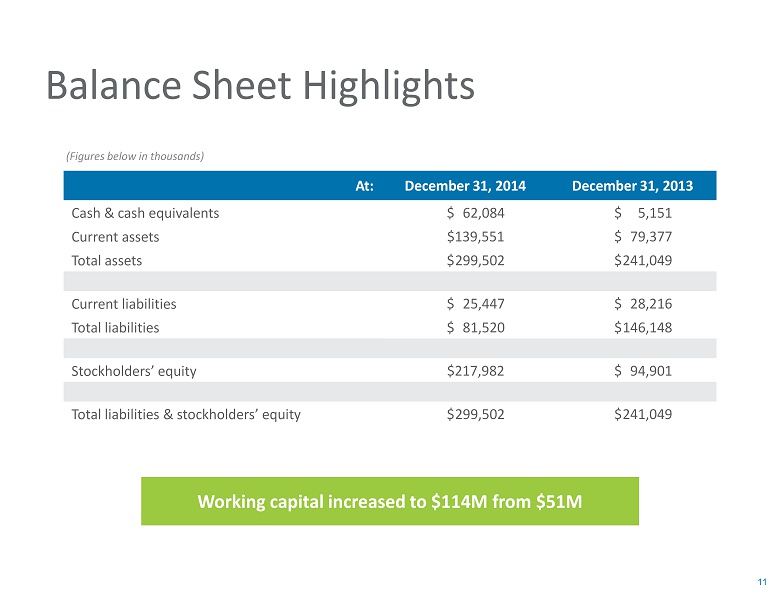

11 11 At: December 31, 2014 December 31, 2013 Cash & cash equivalents $ 62,084 $ 5,151 Current assets $139,551 $ 79,377 Total assets $ 299,502 $ 241,049 Current liabilities $ 25,447 $ 28,216 Total liabilities $ 81,520 $ 146,148 Stockholders’ equity $217,982 $ 94,901 Total liabilities & stockholders’ equity $ 299,502 $ 241,049 Balance Sheet Highlights (Figures below in thousands) Working capital increased to $114M from $ 51M

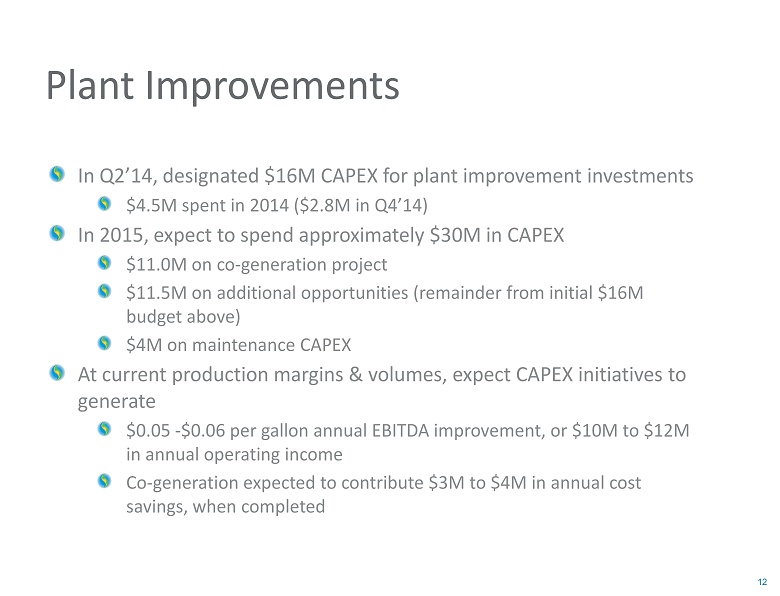

12 12 Plant Improvements In Q2’14, designated $16M CAPEX for plant improvement investments $4.5M spent in 2014 ($ 2.8M in Q4’14) In 2015, expect to spend approximately $30M in CAPEX $ 11.0M on co - generation project $ 11.5M on additional opportunities (remainder from initial $16M budget above) $4M on maintenance CAPEX At current production margins & volumes, expect CAPEX initiatives to generate $0.05 - $0.06 per gallon annual EBITDA improvement, or $10M to $12M in annual operating income Co - generation expected to contribute $3M to $4M in annual cost savings, when completed

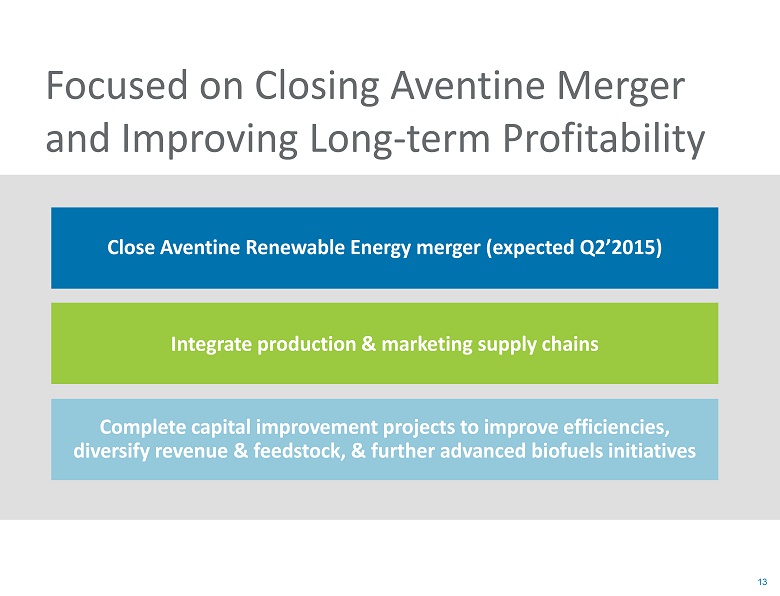

13 13 Close Aventine Renewable Energy merger (expected Q2’2015) Complete capital improvement projects to improve efficiencies, diversify revenue & feedstock, & further advanced biofuels initiatives Focused on Closing Aventine Merger and Improving Long - term Profitability Integrate production & marketing supply chains

14 Appendix Thank You

15 15 Use of Non - GAAP Measures Management believes that certain financial measures not in accordance with generally accepted accounting principles (“GAAP”) are useful measures of operations . The company defines Adjusted Net Earnings as unaudited earnings before fair value adjustments and warrant inducements and gain (loss) on extinguishments of debt. The company defines Adjusted EBITDA as unaudited earnings before interest, provision for income taxes, depreciation and amortization, fair value adjustments and warrant inducements and noncash gain (loss) on extinguishments of debt. Tables are provided at the end of this presentation that provide a reconciliation of Adjusted Net Earnings and Adjusted EBITDA to their most directly comparable GAAP measures. Management provides these non - GAAP measures so that investors will have the same financial information that management uses, which may assist investors in properly assessing the company’s performance on a period - over - period basis. Adjusted Net Earnings and Adjusted EBITDA are not measures of financial performance under GAAP, and should not be considered alternatives to net income (loss) or any other measure of performance under GAAP, or to cash flows from operating, investing or financing activities as an indicator of cash flows or as a measure of liquidity. Adjusted Net Earnings and Adjusted EBITDA have limitations as analytical tools and you should not consider these measures in isolation or as a substitute for analysis of the company’s results as reported under GAAP.

Adjusted Net Earnings per share - diluted $ 0.41 $ 0.79 $ 2.64 $ 0.16 _