SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.___)

Filed by the RegistrantT

Filed by a Party other than the Registrant£

Check the appropriate box:

£ Preliminary Proxy Statement

T Definitive Proxy Statement

£ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

£ Definitive Additional Materials

£ Soliciting Material Pursuant to 240.14a-12

MMRGLOBAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

T No fee required.

£ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

______________________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

______________________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

______________________________________________________________________________________________

(5) Total fee paid:

______________________________________________________________________________________________

£ Fee paid previously with preliminary materials.

£ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

______________________________________________________________________________________________

(3) Filing Party:

______________________________________________________________________________________________

(4) Date Filed:

______________________________________________________________________________________________

Note: PDF provided as a courtesy

April 29, 2011

To Our Stockholders:

You are cordially invited to attend the 2011 Annual Meeting of Stockholders of MMRGlobal, Inc. to be held on June 15, 2011 at 10:30 a.m. Pacific Time at the Beverly Wilshire, A Four Seasons Hotel, (the "Annual Meeting"), located at 9500 Wilshire Boulevard, Beverly Hills, California 90212.

The matters expected to be acted upon at the meeting are described in the following Notice of the 2011 Annual Meeting of Stockholders and Proxy Statement.

For this year, we have elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission's "notice and access" rules. These rules allow us to make our stockholders aware of the availability of our proxy materials by sending a Notice of Internet Availability of Proxy Materials, which provides instructions for how to access the full set of proxy materials through the Internet or make a request to have printed proxy materials delivered by mail. We believe compliance with these rules will allow us to provide our stockholders with the materials they need to make informed decisions, lower the costs of printing and delivering those materials, and significantly reduce the environmental impact of our Annual Meeting.

It is important that you use this opportunity to take part in the affairs of your Company by voting on the business to come before this meeting. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible using one of the voting methods we have provided to you. Please review the voting instructions described in the accompanying Proxy Statement. Returning the Proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

If your shares are held in the name of a broker, trust, bank or other nominee, you will need proof of ownership to be admitted to the meeting, as described under "How can I attend the Annual Meeting?," beginning on page 7 of this Proxy Statement.

Thank you for your interest in MMRGlobal, Inc.

Sincerely,

/s/ Robert H. Lorsch

Robert H. Lorsch

Chairman, President and Chief Executive Officer

4401 Wilshire Blvd., Suite 200

Los Angeles, California 90010

NOTICE OF THE 2011 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of MMRGlobal, Inc.:

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of stockholders of MMRGlobal, Inc., a Delaware corporation, will be held on June 15, 2011 at 10:30 a.m. Pacific Time at the Beverly Wilshire, A Four Seasons Hotel, located at 9500 Wilshire Boulevard, Beverly Hills, California 90212, to consider and vote upon the following proposals:

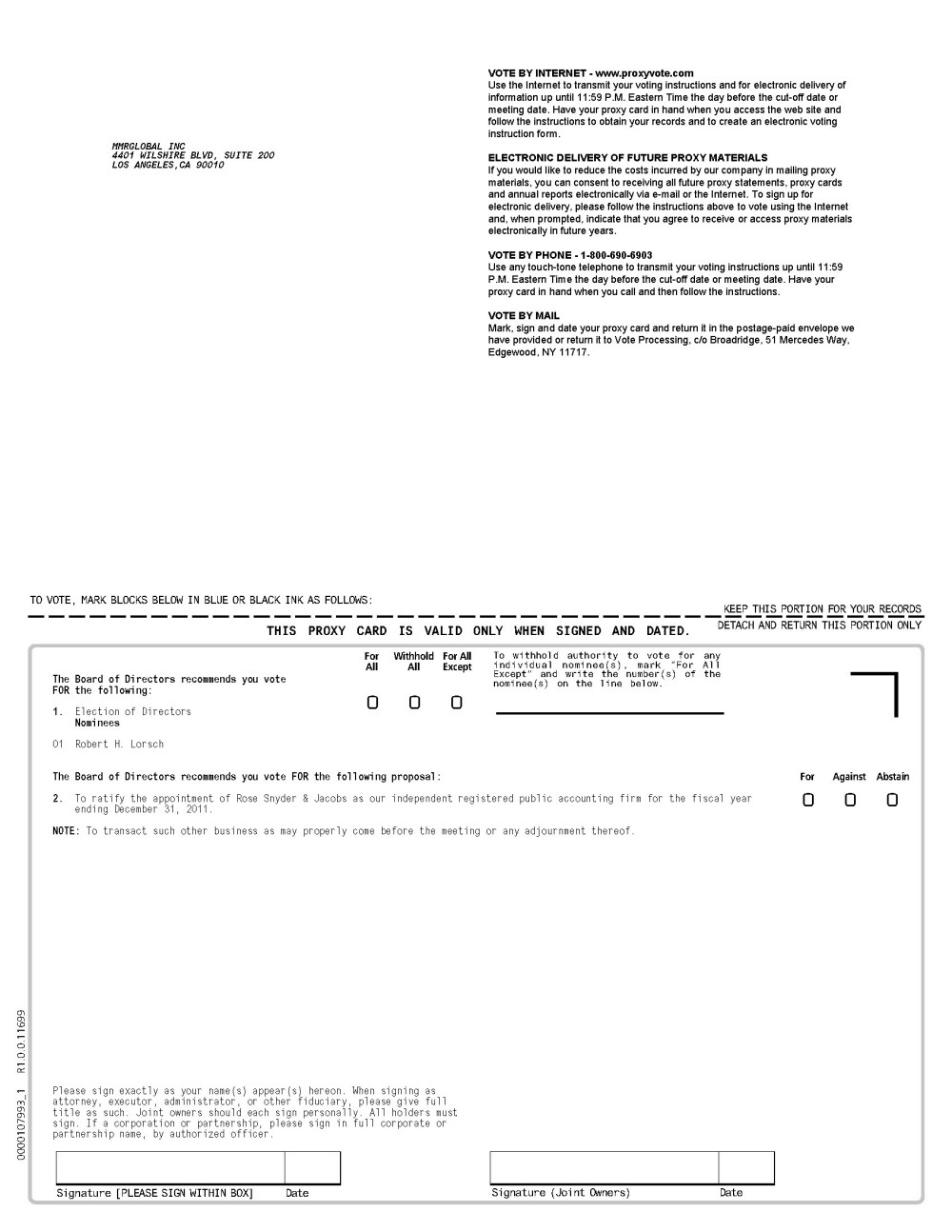

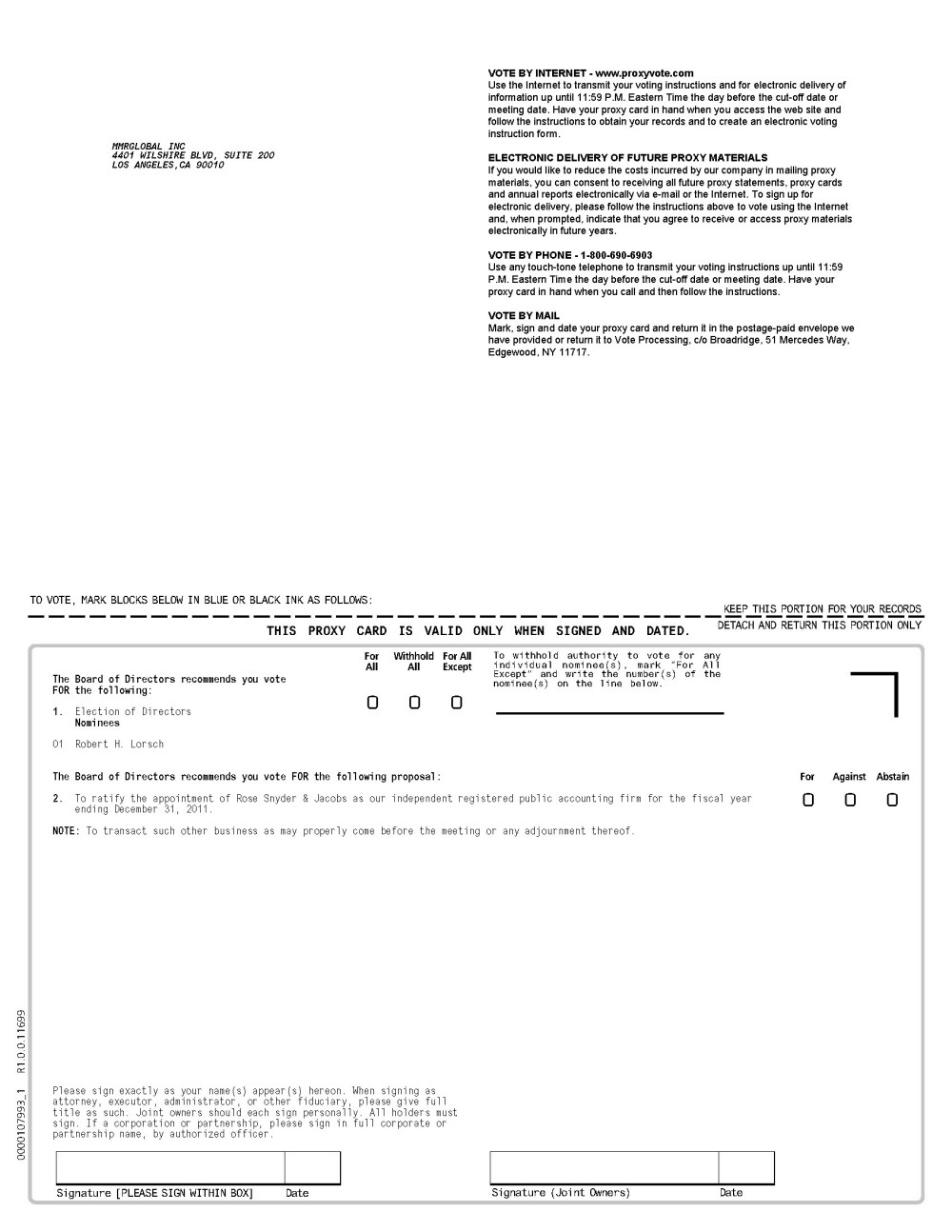

1. To elect one (1) Class II director to serve for a term of three (3) years expiring upon the 2014 Annual Meeting of Stockholders;

2. To ratify the appointment of Rose Snyder & Jacobs as our independent registered public accounting firm for the fiscal year ending December 31, 2011; and

3. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The proposals and other related matters are more fully described in the Proxy Statement accompanying this notice.

Stockholders of record at the close of business on April 19, 2011 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. As of that date, 245,629,010 shares of our Common Stock were outstanding and entitled to vote. All stockholders are cordially invited to attend the Annual Meeting in person.

By Order of the Board of Directors,

/s/ Robert H. Lorsch

Robert H. Lorsch

Chairman, President and Chief Executive Officer

Los Angeles, California

April 29, 2011

Any stockholder present at the Annual Meeting may withdraw his or her proxy and votein person on each matter brought before the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 15, 2011

The Proxy Statement and Annual Report for the year ended December 31, 2010 are available under "Investor Relations" on our Internet website athttp://www.MMRGlobal.com.

YOUR VOTE IS IMPORTANT.

For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled "How to Vote" in the accompanying Proxy Statement or, if you requested printed proxy materials, your enclosed proxy card.

4401 Wilshire Blvd., Suite 200

Los Angeles, California 90010

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

EXPLANATORY NOTE

As used in this Proxy Statement, unless otherwise indicated, the terms "Company," "we," "us," and "our" refer to MMRGlobal, Inc. (formerly MMR Information Systems, Inc., formerly Favrille, Inc.). On February 9, 2009, we changed our legal entity name from Favrille, Inc. to MMR Information Systems, Inc. On June 16, 2010, we changed our legal entity name from MMR Information Systems, Inc. to MMRGlobal, Inc., which we believe more accurately reflects the nature of our operations. The term "Favrille" refers to Favrille, Inc. prior to giving effect to the Merger, as explained below, unless the context requires otherwise.

On January 27, 2009, we completed a business combination with MyMedicalRecords, Inc. (formerly MyMedicalRecords.com, Inc.), a private Delaware corporation, or MMR, that resulted in MMR becoming a wholly-owned subsidiary of our Company and our Company's new operating business as of January 27, 2009. The closing of the business combination, which we refer to as the Merger, resulted in a change of control of our Company.

4401 Wilshire Blvd., Suite 200

Los Angeles, California 90010

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

Questions and Answers about the Annual Meeting and Voting

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors of MMRGlobal, Inc., a Delaware corporation, (the "Board" or "Board of Directors"), of proxies to be voted at our Annual Meeting and at any adjournment or postponement.

You are invited to attend our Annual Meeting on June 15, 2011, beginning at 10:30 a.m., Pacific Time. The Meeting will be held at the Beverly Wilshire, A Four Seasons Hotel, located at 9500 Wilshire Boulevard, Beverly Hills, California 90212.

Stockholders will be admitted to the Annual Meeting beginning at 10:00 a.m., Pacific Time.

The Notice of Annual Meeting and Notice of Internet Availability of Proxy Materials are being mailed on or about April 29, 2011.

Important Notice Regarding the Availability of Proxy Materials

Under rules issued by the Securities and Exchange Commission, or the SEC, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On May 3, 2011, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, containing instructions on how to access our proxy materials, including our Proxy Statement and our Annual Report for the fiscal year ended December 31, 2010, (the "Annual Report")each of which is available under "Investor Relations" on our website athttp://www.MMRGlobal.com.

This process is designed to expedite our stockholders' receipt of our proxy materials, decrease the cost of our Annual Meeting, and help conserve natural resources. However, if you would prefer to receive printed copies of the proxy materials via mail, please follow the instructions included in the Notice. Otherwise, you will continue to receive a Notice and form of Proxy via the mail with instructions on how to access our Annual Report and Proxy Statements via the Internet.

What am I being asked to vote upon?

Proposal No. 1: Directors are elected by a plurality of votes cast, so the nominee who receives the most votes will be elected. Abstentions and broker non-votes will not be taken into account in determining the election of directors.

Proposal No. 2: Ratification of the independent registered public accounting firm will require an affirmative vote of a majority of shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal. Because the ratification of the independent registered public accounting firm is a discretionary matter, broker non-votes will not result for this item.

Our Board of Directors is asking for your proxy for use at the Annual Meeting. All shares of our Common Stock represented by any properly executed proxy that is not revoked will be voted at the Annual Meeting in accordance with the instructions indicated in such proxy. Although management does not know of any other matter to be acted upon at the Annual Meeting, shares represented by valid proxies will be voted by the persons named on the proxy card in accordance with their best judgment with respect to any other matters that may properly come before the Annual Meeting. A stockholder giving a proxy may revoke his, her or its proxy in the manner described below.

- 2 -

How can I attend the Annual Meeting?

Stockholders must present a form of personal photo identification in order to be admitted to the Annual Meeting. If you hold your shares in street name, you also will need proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or a letter from your nominee are examples of acceptable proof of ownership.

Please note that no cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Only holders of record of our Common Stock at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting. At the close of business on April 19, 2011, the Company had 245,629,010 outstanding shares of Common Stock. Each holder of record of Common Stock on the Record Date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, BNY Mellon Shareowner Services, you are considered, for those shares, to be the "stockholder of record." The Notice and proxy card documents for the Annual Meeting have been sent directly to you by Broadridge, the Company's proxy services provider.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the "beneficial owner" of shares held in street name. A Notice and separate proxy card has been forwarded to you by your broker, bank or other holder of record who is considered, for those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction card included in the mailing.

How do I vote?

You may vote using any of the following methods:

You can vote by mail using the proxy card which was separately mailed to you. Be sure to complete, sign and date the proxy card or voting instruction card and return it in the prepaid envelope. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the person named on the proxy card will vote the shares represented by that proxy as recommended by the Board of Directors for all matters other than the election of directors.

If you are a stockholder of record, and the prepaid envelope is missing, please mail your completed proxy card to MMRGlobal, Inc., 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010.

You can vote by proxy over the Internet by following the instructions provided to you on the proxy card. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 14, 2011 by visitingwww.proxyvote.com and following the instructions. Our Internet voting procedures are designed to authenticate stockholders by using individual control numbers, which are located on the proxy card. If you vote by Internet, you do not need to return your proxy card.

- In person at the Annual Meeting

All stockholders may vote in person at the Annual Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person as your representative. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspectors of election with your ballot to be able to vote at the Annual Meeting.

- 3 -

Your vote is important. You can save us the expense of a second mailing by voting promptly.

What can I do if I change my mind after I vote my shares?

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. A proxy may be revoked by filing with the Company at the Company's principal executive office, 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the answer to the previous question.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting.

What shares are included on the proxy card?

If you are a stockholder of record you will receive only one proxy card for all the shares (including Restricted Shares) you hold:

• | in certificate form; and |

• | in book-entry form. |

If you are a beneficial owner, you will receive voting instructions, and information regarding the householding, or consolidation, of your vote, from your bank, broker or other holder of record.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., Pacific Time, at our principal executive office at 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010, by contacting Herlyn Eslit, of the Company.

What are the voting requirements to elect the Directors and to approve each of the proposals discussed in this Proxy Statement?

The presence of the holders of a majority of the voting power represented by the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is necessary to constitute a quorum for taking action at the meeting. Without a quorum, no corporate action can be taken at the Annual Meeting. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected for that slot. Only votes "for" or "against" affect the outcome. Abstentions are not counted for purposes of the election of directors.

Under the rules of the Financial Industry Regulatory Authority, member brokers generally may not vote shares held by them in street name for customers unless they are permitted to do so under the rules of any national securities exchange of which they are a member. While our Company is an OTCBB traded company, brokers generally are required to abide by the rules of the New York Stock Exchange (the "NYSE"). Under rules of the NYSE, a member broker who holds shares in street name for customers has the authority to vote on certain items if it has transmitted proxy soliciting materials to the beneficial owner but has not received instructions from that owner. However, the NYSE rules do not permit member brokers who do not receive instructions regarding the election of

- 4 -

directors to vote on the election of our directors. The NYSE rules do permit member brokers who do not receive instructions to vote on the ratification of auditors.

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement.

If you have returned your signed and completed proxy card and other matters are properly presented at the Annual Meeting for consideration, the designated proxy appointed by the Board of Directors (the person named in your proxy card if you are a share-holder of record) will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing, mailing and electronic distribution or hosting of this Proxy Statement, the proxy and any additional information furnished to stockholders.

Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our Common Stock, beneficially owned by others to forward to such beneficial owners.

The Company will reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram, email or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

Who will count the vote?

Representatives of Broadridge Financial Solutions will tabulate the votes and act as inspectors of election.

When is the deadline for stockholder proposals to be included in the Company's 2012 Annual Meeting?

Pursuant to Securities and Exchange Commission ("SEC") Rule 14a-8, proposals that stockholders wish to include in the Company's Proxy Statement and form of proxy for the Company's 2012 annual meeting of stockholders must be received by the Company at its principal executive office at 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010, no later than December 30, 2011 and must satisfy the conditions established by the SEC for such proposals. Pursuant to SEC Rule 14a-4, if the Company has not received notice by March 13, 2012 of any matter a stockholder intends to propose for a vote at the 2012 annual meeting of stockholders, then a proxy solicited by the Board of Directors may be voted on such matter in the discretion of the proxy holder, without discussion of the matter in the Proxy Statement soliciting such proxy and without such matter appearing as a separate item on the proxy card. Additionally, proposals that stockholders wish to present at the Company's 2012 annual meeting of stockholders (but not included in the Company's related Proxy Statement and form of proxy) must be received by the Company at its principal executive office at 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010, not before February 15, 2012 and no later than March 16, 2012 and must satisfy the conditions for such proposals set forth in the Company's Amended and Restated Bylaws (the "Bylaws"). Stockholders are advised to review the Company's Bylaws, which contain requirements with respect to advance notice of stockholder proposals and director nominations.

What is the process for stockholders to communicate with the Board of Directors?

The Company provides an informal process for stockholders to send communications to the Board of Directors. Stockholders who wish to contact the Board of Directors or any of its members may do so by writing to MMRGlobal, Inc. at 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010. Correspondence directed to an individual director is referred, unopened, to that member. Correspondence not directed to a particular director is referred, unopened, to the Chairman of the Board, who then bears the responsibility of providing copies of the correspondence to all directors, as he deems appropriate.

- 5 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of April 19, 2011, by:

- each of our current directors;

- each of our current executive officers named in the Summary Compensation Table; and

- all of our current directors and executive officers as a group.

In addition, we are presenting a sub-table of each Stockholder (persons or entities) that owns more than 5% ("5% Stockholders") of the outstanding shares of common stock.

| | | | | | | Number of Shares of Common | | | |

Name and Address of Beneficial Owner(1)

| | | | | | Stock Beneficially Owned (2)

| | | Percentage

|

| Directors and Named Executive Officers | | | | | | | | | |

| Robert H Lorsch (3) | | | | | | 61,716,041 | | | 25.1% |

| Jack Zwissig (4) | | | | | | 3,768,002 | | | 1.5% |

| Hector Barreto (5) | | | | | | 4,149,911 | | | 1.7% |

| Doug Helm (6) | | | | | | 1,710,277 | | | * |

| Bernie Stolar (7) | | | | | | 3,818,195 | | | 1.6% |

| Naj Allana (8) | | | | | | 3,256,045 | | | 1.3% |

| Ingrid Safranek (9) | | | | | | 1,648,973 | | | * |

| Sunil Singhal (10) | | | | | | 1,000,000 | | | * |

| Rich Teich (11) | | | | | | 2,733,405 | | | 1.1% |

| All Executive Officers and Directors as a group | | | | | | 83,800,850 | | | 34.1% |

| (9 Persons) (12) | | | | | | | | | |

| | | | | | | | | | |

| 5% Stockholders | | | | | | | | | |

| RHL Group (13) | | | | | | 45,783,954 | | | 18.6% |

| Robert H Lorsch (14) | | | | | | 15,932,087 | | | 6.5% |

| David Loftus (15) | | | | | | 23,921,569 | | | 9.7% |

| Sherry Hackett (16) | | | | | | 15,377,778 | | | 6.3% |

(1) | The business address of each director and executive officer listed is c/o MMRGlobal, Inc., 4401 Wilshire Blvd., Suite 200, Los Angeles, CA 90010. |

(2) | This table is based upon information supplied by officers, directors, principal stockholders, and Schedules 13D and 13G filed with the SEC. Beneficial ownership is determined in accordance with the rules of the SEC. Applicable percentage ownership is based on 245,629,010 shares of common stock outstanding as of April 19, 2011. Shares of common stock subject to options, warrants and convertible notes exercisable or convertible within 90 days after December 31, 2010, are deemed outstanding for computing the ownership percentage of the person holding such options, warrants or notes, but are not deemed outstanding for computing the ownership percentage of any other person. Except as otherwise noted, we believe that each of the stockholders named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to applicable community property laws. |

(3) | Consists of (i) 15,932,087 shares of common stock held directly by Mr. Lorsch and 45,783,954 shares of common stock held directly by The RHL Group, which is wholly owned and controlled by Mr. Lorsch, and Mr. Lorsch also has voting and/or investment power over such shares. (ii) a fully vested warrant held by The RHL Group, to purchase 12,054,062 shares of common stock, and (iii) stock options held by Mr. Lorsch to purchase 10,033,333 shares of common stock that are vested and exercisable within 90 days after December 31, 2010. |

(4) | Includes 2,103,493 shares subject to options exercisable within 90 days after December 31, 2010. |

(5) | Includes 2,148,998 shares subject to options exercisable within 90 days after December 31, 2010. |

(6) | Includes 542,152 shares subject to options exercisable within 90 days after December 31, 2010. |

(7) | Includes 2,077,738 shares subject to options exercisable within 90 days after December 31, 2010. |

(8) | Includes 285,556 shares subject to options exercisable within 90 days after December 31, 2010. |

(9) | Includes 1,123,973 shares subject to options exercisable within 90 days after December 31, 2010. |

(10) | Includes a fully vested warrant to purchase 1,000,000 shares of common stock within 90 days after December 31, 2010. |

(11) | Includes 1,010,713 shares subject to options exercisable within 90 days after December 31, 2010. |

(12) | Includes 32,380,019 shares subject to options and warrants exercisable within 90 days after December 31, 2010. |

(13) | Includes a fully vested warrant to purchase 12,054,062 shares of common stock within 90 days after December 31, 2010. |

(14) | Includes 10,033,333 shares subject to options exercisable within 90 days after December 31, 2010. |

(15) | Includes a fully vested warrant to purchase 1,650,000 shares of common stock within 90 days after December 31, 2010. |

(16) | Includes a fully vested warrant to purchase 1,650,000 shares of common stock within 90 days after December 31, 2010. |

- 6 -

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of the copies of Section 16(a) forms reports furnished to us during the fiscal year ended December 31, 2010, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available in the Corporate Governance section under "Investor Relations" on our website atwww.MMRGlobal.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related Party Transactions

Our Board of Directors adopted a related party transaction policy, under which all related party transactions shall be presented to the disinterested directors of the Board for review and approval in advance of such transactions. If it is not feasible to obtain advance approval of a related party transaction, such transaction shall be subject to the ratification of the disinterested directors of the Board, and the Company may enter into such transaction prior to obtaining the approval of the disinterested directors only if the terms of such transaction allow it to be rescinded at no cost to the Company in the event it is not ratified by the disinterested directors of the Board.

Other than compensation agreements and other arrangements with our executive officers and directors and the transactions described below, during our last two fiscal years, there has not been, and there is not currently proposed, any transaction or series of similar transactions to which we were or will be a party in which the amount involved exceeded or will exceed the lesser of $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years and in which any of our directors, nominees for director, executive officers, holders of more than five percent of any class of our voting securities or any member of the immediate family of the foregoing persons had or will have a direct or indirect material interest.

Our President, Chairman and Chief Executive Officer, Robert H. Lorsch, is also the Chief Executive Officer of The RHL Group, Inc. and owns all of the capital stock of The RHL Group, Inc. Mr. Lorsch directly, and indirectly through The RHL Group, Inc., beneficially owns approximately 25.5.0% our total outstanding voting stock. The RHL Group, Inc. has loaned money to MMR pursuant to a secured note.

The RHL Group is an investment holding company which provides consulting, operational and technical services to the Company, which we refer to as the RHL Services. As part of the RHL Services, the RHL Group provides the Company with unrestricted access to its internal business and relationship contact database of more than 10,000 persons and entities, which includes clients of the RHL Group and other individuals which may hold value to the Company. The RHL Group also provides infrastructure support to the Company, including allowing the Company unlimited access to its facilities, equipment, and data, information management and server systems. In addition to allowing the Company the use of its office support personnel, the RHL Group also has consented to allow the Company to utilize the full-time services of Mr. Lorsch as the Company's President, Chairman and Chief Executive Officer, which requires substantial time and energy away from his required duties as the RHL Group's Chairman and Chief Executive Officer. In addition, the RHL Group has made its President, Kira Reed, available as the Company's spokesperson. Ms. Reed, who is Mr. Lorsch's spouse, also manages the Company's social networking activities.

The RHL Group, Inc. also has a consulting arrangement with us. A copy of the consulting agreement is filed as an Exhibit in our current report on Form 8-K filed with the SEC on May 4, 2009. The consulting agreement provides for a monthly fee of $25,000 plus the reimbursement of certain expenses, including medial insurance.

From August 2008 through May 1, 2009 we occupied space pursuant to a sublease from Robert H. Lorsch, for which we paid $3,000 per month plus utilities. Although the initial lease term expired on April 15, 2009, the lease was renewed on a month-to-month basis to

- 7 -

cover the period until we moved into our new office space on May 1, 2009. Starting in May we ceased leasing space from Mr. Lorsch and moved to a commercially-rented building not related to Mr. Lorsch in any way.

During the quarter ended December 31, 2009, a vendor began providing website development services to the Company. This same vendor rents a piece of property from Ms. Reed and pays $3,000 per month.

We have consulting agreements with our current directors Hector V. Barreto, Jr. and Bernard Stolar pursuant to which Mr. Barreto and Mr. Stolar provide marketing and strategic planning advice and actively seek strategic partnerships and alliances with other entities to market our products. Under the terms of these agreements, we pay Mr. Barreto and Mr. Stolar $50,000 a year payable monthly, and commissions equal to 1% of all revenue generated through their efforts. The agreement with Mr. Barreto is effective until August 2009 and the agreement with Mr. Stolar is effective until November 2009. In the past, both Mr. Barreto and Mr. Stolar have received shares of our common stock as consideration for deferral of payment. Each agreement will automatically renew each successive year until terminated by either party upon 30 days prior written notice. Neither agreement has been terminated or is expected to be terminated in the near future.

MMR also has a consulting agreement, as amended, with The Rebensdorf Group, Inc., or TRGI, which is owned by George Rebensdorf, a former director of the Company. Mr. Rebensdorf also serves as TRGI's Chief Executive Officer. Pursuant to the agreement, TRGI provides financial advisory services and assists in negotiations in connection with our efforts to raise funds through private placement transactions. In addition to the initial retainer fee of $30,000 we paid upon execution of the original letter agreement, we have agreed to pay TRGI: (a) a $4,167 monthly retainer (commencing May 1, 2009); (b) for transactions with parties introduced by TRGI, a success fee equal to 8% of the value (payable 4% in cash, 4% in warrants); (c) for material assistance in closing transactions with parties not introduced by TRGI, an advisory fee equal to 2% of the value (payable in cash); and (d) an annual grant of 100,000 options, vesting monthly over two-years from the grant date, with an exercise price equal to fair market value on the grant date. Payment of the monthly retainer may be deferred, in which case it would be payable to TRGI pro rata upon payment of any other deferred management or consulting fees. The letter agreement, as amended, is effective until terminated by either party, with or without cause, upon 10 days prior written notice.

In connection with the execution of an addendum to the letter agreement with TRGI on May 21, 2009, we granted Mr. Rebensdorf stock options to acquire 100,000 shares of our common stock at an exercise price of $0.179 per share, which options vest monthly over 2 years and expire on May 21, 2014.

We also have an oral agreement with our current director Jack Zwissig to provide individual executive coaching services to our management team. Mr. Zwissig receives compensation in the form of stock as determined by our Board of Directors commensurate with the services performed. The agreement with Mr. Zwissig is on a month-to-month basis and continues until terminated by either party.

We incurred $50,000 and $55,868 during the years ended December 31, 2010 and 2009, respectively, toward marketing consulting services from Bernard Stolar, a director. We included $54,359 and $106,388 in related party payables as of December 31, 2010, and 2009, respectively, in connection with these services.

We also incurred $50,000 each year during the years ended December 31, 2010 and 2009, toward marketing consulting services from Hector Barreto, a director. We included in related party payables as of December 31, 2010 and 2009 of $31,075 and $23,500, respectively, in connection to these services. Additionally, on January 21, 2010, we granted to Mr. Barreto 50,000 shares of common stock, valued at $5,500 as consideration for sales and marketing services. In the first quarter of 2009, we entered into an agreement with The Latino Coalition, a non-profit organization in which Mr. Barreto is also the Chairman, to market our product to its members. We paid $4,000 during the year ended December 31, 2009 to The Latino Coalition for services. We did not pay any amounts to the Latino Coalition in 2010.

We also incurred $178,552 and $34,133 during the years ended December 31, 2010 and 2009, respectively, for finder's fees and consulting services from George Rebensdorf, a former director of the Company. We included in related party payables as of December 31, 2010 and 2009 of $40,703 and $56,633, respectively, in connection with these services.

We contract with a significant vendor for the development and maintenance of the software applications necessary to run our MyMedicalRecords PHR, MyESafeDepositBox and MyMedicalRecords Pro products. Our outside developer supports our software development needs through a team of software engineers, programmers, quality control personnel and testers, who work with our internal product development team on all aspects of application development, design, integration and support of our products. This vendor is also a stockholder. For the year ended December 31, 2010 and 2009, the total expenses relating to this stockholder amounted

- 8 -

to $291,027 and $92,475, respectively. In addition, we capitalized $152,335 of software development costs for the year ended December 31, 2010. As of December 31, 2010, and 2009, the total amounts due to the stockholder and included in related party payables amounted to $784,278 and $617,796, respectively.

On January 6, 2010, we entered into a settlement agreement with an MMR-Asia investor to provide for full and final settlement of any and all claims pertaining to any license rights for MMR-Asia to market, sell and sublicense MMRGlobal and MMR products and services. As part of this settlement agreement, we granted 1,388,889 shares of common stock to the investor.

We incurred costs of $203,771 and $322,082 during the years ended December 31, 2010 and 2009, respectively, toward consulting services from Audit Prep Services, LLC. Michael T. Psomas, member of Audit Prep Services, LLC, is a stockholder of MMRGlobal. we included in related party payables at December 31, 2010 and 2009, of $47,316 and $64,568, respectively, due to Audit Prep Services, LLC. Additionally, on February 11, 2010, we granted to Mr. Psomas 674,000 shares of common stock, valued at $60,660 in consideration for amounts due to Audit Prep Services, LLC at the time of issuance.

On September 15, 2009, we entered into a five year agreement with E-Mail Frequency, LLC and David Loftus, Managing Partner of E-Mail Frequency, LLC, a significant stockholder of the Company. We will license an existing 80 million person direct marketing database of street addresses, cellular phone numbers, e-mail addresses and other comprehensive data with E-Mail Frequency. The agreement allows us to market, through the use of the Database, our MyMedicalRecords Personal Health Record, MyEsafeDepositBox virtual vault, and MMRPro document management system to physicians and their patients. Under the terms of the Agreement, we paid $250,000 to David Loftus as a one-time consulting fee in the form of 2,777,778 shares of our common stock. We recorded the $250,000 one-time licensee fee as a prepaid consulting fee and included in the prepaid expenses and other current assets as of December 31, 2009, less amortization of $12,500 included in operating expensed for the year ended December 31, 2009. Amortization expense for the year ended December 31, 2010 was $50,000. In addition, we incurred a total of $76,181 during the year ended December 31, 2010, toward business development services from E-Mail Frequency and Mr. Loftus. We did not incur any such expenses during the same periods in 2009. Furthermore, Mr. Loftus is a value-added-reseller of MMRPro systems and during the second quarter of 2010, Mr. Loftus purchased four MMRPro systems. We recognized revenues of $63,655 for the year ended December 31, 2010 from these sales. We included in related party payables at December 31, 2010, and 2009 of $19,103 and $50,577, respectively, with respect to these services. Furthermore, on January 6, 2010, we entered into a 12% Convertible Promissory Note with Mr. Loftus for a principal amount totaling $400,000 and warrants to purchase our common stock, both of which Mr. Loftus immediately converted and exercised, respectively, into shares of our common stock, for a total 8,860,606 shares of our common stock. On July 26, 2010 and September 21, 2010, we entered into 6% Convertible Promissory Notes with Mr. Loftus for a total principal amount of $450,000 and warrants to purchase our common stock, which is still outstanding as of December 31, 2010.

The securities above were issued to each of the foregoing in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933, as amended, and the rules promulgated thereunder. At the time of their issuance, the securities granted above were restricted securities for purposes of the Securities Act and the certificates representing such securities bear legends to that effect, unless a legal opinion has been issued for the removal of such legends. The exercise/conversion prices of the securities described above were equal to the closing price of our common stock as of the date of grant.

Director Independence

Although our common stock is no longer listed on the NASDAQ Global Market, our Board of Directors determined that each of the following directors would be deemed "independent" under NASDAQ Stock Market LLC rules: Messrs. Barreto, Helm, Stolar and Zwissig. These persons represent a majority of our Board of Directors. Mr. Lorsch, the Chairman of the Board and our President and Chief Executive Officer would not be deemed independent. Messrs. Stolar and Barreto are members of our Audit Committee but would not be deemed to be independent under the more stringent independence requirements for Audit Committee members set forth in NASDAQ Listing Rule 5605(2). Mr. Stolar is Chairman of the Audit Committee.

- 9 -

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is divided into three classes, with each class serving a staggered three-year term. None of the individuals designated by MMR or Favrille were members of the board of directors of Favrille immediately prior to the Merger.

On April 25, 2011, Mr. Rebensdorf, the Company's sole Class II director, resigned from his position on the Board. There were no disagreements between the Company and Mr. Rebensdorf which led to Mr. Robensdorf's decision to resign from the Board.

As a result of such resignation, on April 26, 2011, as reported on the Company's Current Report on Form 8-K filed April 27, 2011, Mr. Lorsch elected to resign as a Class III director of the Company and Chairman of the Board and was immediately thereafter appointed by remaining directors, pursuant to the Company's Amended and Restated Certificate of Incorporation, as amended, and Amended and Restated Bylaws (collectively, the "Organizational Documents"), as a Class II director of the Company and Chairman of the Board, filling a previously vacant Class II Board seat. Concurrently therewith, the Board adopted resolutions, pursuant to the Organizational Documents, reducing the number of directors of the Company from seven (7) to five (5). Consequently, Mr. Lorsch will run as the sole Class II director nominee for reelection to the Board at the Annual Meeting . As of the date hereof, the Board is comprised as follows:

As previously discussed, our stockholders will be voting on the election of one (1) Class II director. The sole nominee up for election as a Class II director is Mr. Lorsch. The Class II director to be elected will hold office until his successor is duly elected and qualified, or until such director's earlier death, resignation or removal. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Mr. Lorsch. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board of Directors may propose. Mr. Lorsch has agreed to serve if elected and the Board has no reason to believe he will be unable to serve.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. The nominee receiving the highest number of votes of shares entitled to vote for them, up to the number of directors to be elected, will be elected.

The names of the nominee and our current directors with unexpired terms, their ages as of the Record Date, and certain information about them are stated below:

Name | Age | Principal Occupation |

Robert H. Lorsch | 61 | President and Chief Executive Officer of MMRGlobal, Inc. |

Hector V. Barreto, Jr. | 49 | Owner of the consulting company Barreto Associates |

Douglas H. Helm | 69 | President and Managing Member of Helm Consulting Group LLC |

Bernard Stolar | 64 | Consultant to the video games industry and a marketing and strategic planning advisor for our wholly-owned subsidiary, MMR |

Jack Zwissig | 62 | Chief Executive Officer of Zwissig and Associates |

- 10 -

Robert H. Lorsch, Chairman of the Board; President and Chief Executive Officer.Since 2005, Mr. Lorsch has served as the Chairman, President and Chief Executive Officer of MMR and has continued to hold such positions with the Company following the Merger. He is also Chairman and Chief Executive Officer of The RHL Group, Inc., a private equity and business management consulting firm Mr. Lorsch formed in April 1998. In 1994, he co-founded SmarTalk TeleServices, Inc., leading the company through a successful public offering in 1996 and building it into one of the largest providers of prepaid telecommunications products and services. Mr. Lorsch served as its Chairman and Chief Executive Officer until February 1998, following which SmarTalk moved its headquarters from Los Angeles to Dublin, Ohio with different management following its acquisition of ConQuest Telecommunication Services Corp. The combined company's assets subsequently were liquidated and sold to AT&T in March 1999. In 1986, Mr. Lorsch founded the Lorsch Creative Network, a consulting company that developed marketing, advertising and interactive sales promotions campaigns for nationally and internationally recognized clients. In 1998 Lorsch Creative Network became The RHL Group, Inc. In addition, Mr. Lorsch served on the Personal Health Record Steering Committee of the Healthcare Information and Management Systems Society from 2006 to 2007. Mr. Lorsch is a Member of the Board of Trustees of the California Science Center where the Robert H. Lorsch Family Pavilion stands as a gateway to the Science Center. He is also a Member of the Board of Governors, Cedars-Sinai Medical Center; Member of the Board and of the Executive Committee of D.A.R.E. America; and Member of the Board of the Sheriff's Youth Foundation, and has received numerous honors and awards, including D.A.R.E. America's "Future of America Award"; the Muscular Dystrophy Association's "Humanitarian of the Year Award"; and the Starlight Children's Foundation's "Golden Wish Award." Mr. Lorsch was also awarded the Private Sector Initiatives Citation, or C-Flag, from the White House during the Reagan Administration for his commitment to raising millions of dollars for financing state and local earthquake preparedness education. Following the Merger, Mr. Lorsch continues to serve as Chairman of the Board of MMR and acts as its President and Chief Executive Officer.

We believe that Mr. Lorsch's qualifications to continue to serve on our Board of Directors include his 40 years' experience as chief executive officer of various successful corporations he founded, his knowledge of business management consulting, his experience as a member of numerous organizational committees, his position as our current President and Chief Executive Officer and his direct responsibility for all areas of our operations.

Hector V. Barreto, Jr., Director. Since July 2006, Mr. Barreto has been the owner of the consulting company Barreto Associates. Mr. Barreto has also worked as a marketing and strategic planning advisor for our wholly-owned subsidiary MMR since August 2006. Prior to forming Barreto Associates, Mr. Barreto was unanimously approved by the U.S. Senate in July 2001 to serve as the Administrator of the Small Business Administration, a position he held until July 2006. From October 1995 until his appointment to the Small Business Administration in July 2001, Mr. Barreto worked as a broker dealer specializing in retirement plans for TELACU/Barreto Financial Services. Mr. Barreto is a former commissioner of the California Commission for Economic Development and is the Chairman of The Latino Coalition, a non-profit, non-partisan organization based in Washington D.C. Prior to the Merger, Mr. Barreto served as a director of MMR. Mr. Barreto received a B.A. in Business Administration from Rockhurst University.

We believe that Mr. Barreto's qualifications to continue to serve on our Board of Directors include his consulting experience, his knowledge of marketing and strategic planning, and his 5 years of experience as the Administrator of the Small Business Administration.

Douglas H. Helm, Director. Mr. Helm is the managing member of Helm Consulting Group LLC, a global consultancy firm. From 2002 to 2009 he was associated with Employers Direct Corporation, Agoura Hills, CA, serving in various capacities including marketing consultant, Vice President and Chief Marketing & Sales Officer of Employers Direct Insurance Company and Chief Operating Officer of its benefit subsidiary, Plenary Insurance Services, until its sale in October 2009. Mr. Helm has over 40 years of experience in insurance and information services and has worked internationally in Russia, China and Europe. Mr. Helm majored in Labor Economics at the University of Washington and received a J.D. from Northwestern School of Law in 1973. Mr. Helm is a member of the Oregon State Bar.

We believe that Mr. Helm's qualifications to continue to serve on our Board of Directors include his 40 years of experience in insurance and information services, his experience in marketing and consulting, his experience in the positions he has gained as vice president, chief marketing & sales officer and chief operating officer, and his legal background.

Bernard Stolar, Director. Mr. Stolar currently serves as a consultant to the video games industry and is a marketing and strategic planning advisor for our wholly-owned subsidiary, MMR. From February 2007 to September 2008, Mr. Stolar served as Games Industry Evangelist for Google, Inc., where his responsibilities included building in-game advertising. From February 2006 until its purchase by Google, Inc. in February 2007, Mr. Stolar was the Chairman of the Board of Adscape Media. Prior to this, from January 2002 to November 2002, Mr. Stolar was President and Chief Operating Officer of BAM! Entertainment, where he helped transform the company from a content provider for hand-held electronics into a developer and marketer of interactive entertainment for next generation video game consoles. From January 2000 until the division was sold in April 2001, Mr. Stolar served as President of Mattel

- 11 -

Interactive, where he was responsible for all of Mattel's software, on-line and computer-enhanced toys. Mr. Stolar also served as President and Chief Operating Officer of Sega of America, Inc. from June 1996 to October 1999 and as an Executive Vice President with Sony Computer Entertainment of America from 1994 to June 1996. Following the Merger, Mr. Stolar continues to serve as a director of MMR, a position he has held since 2005.

We believe that Mr. Stolar's qualifications to continue to serve on our Board of Directors include his marketing and strategic planning experience, his experience as chairman of the board of Adscape Media, and his experience as president and chief operating officer of various companies.

Jack Zwissig, Director. Mr. Zwissig has served as Chief Executive Officer of Zwissig and Associates, a consulting and executive leadership training firm that primarily concentrates on the designing and implementing of corporate culture change, including Mergers and acquisitions. Throughout his tenure as head of Zwissig and Associates, Mr. Zwissig has offered consulting, marketing and advertising services to some of America's leading corporations and has led numerous corporate teambuilding workshops and seminars, both in the U.S. and abroad. Prior to the Merger, Mr. Zwissig served as a director of MMR. Mr. Zwissig received a B.S. in Marketing and Management and a M.B.A. from Santa Clara University.

We believe that Mr. Zwissig's qualifications to continue to serve on our Board of Directors include his 18 years of experience as chief executive officer of a consulting and executive leadership training firm, his knowledge of marketing and management, and his business background.

Company Management

Immediately after the Merger, Robert H. Lorsch was appointed President and Chief Executive Officer and Naj Allana was appointed Senior Vice President and Chief Financial Officer. On December 17, 2009, Ingrid Safranek was appointed Chief Financial Officer and Naj Allana became the Executive Vice President of Technology & Product Development. However, effective November 1, 2010, Mr. Allana resigned. On December 13, 2010, the Company hired Sunil Singhal as its Executive Vice President of Technology and Development.

Ingrid Safranek, Vice President of Finance and Chief Financial Officer. Ms. Safranek was appointed as the Chief Financial Officer on December 17, 2009. She has been a Certified Public Accountant in California since 2006. She worked for Deloitte & Touche, LLP from 2002 to 2006, where she was part of the audit teams for large and small, private and public clients such as Computer Sciences Corporation, Infonet (later acquired by British Telecom), Candle! Corporation (later acquired by IBM), Primedia, Inc., Gold Circle Entertainment, and the Performing Arts Center, among others. Ms. Safranek's focus was on the technology, media and entertainment industries. She also owned Goldstein Enterprises, a management consulting firm that served numerous clients by providing them with business practices analyses and software application development in order to streamline day-to-day operations and maximize efficiency. Among her clients as owner of Goldstein Enterprises are Nestle USA, Warner Bros. Studios and RJR Fashion Fabrics. Ms. Safranek received a B.A. in Business Economics with a minor in Accounting from U.C.L.A.

Sunil Singhal, Executive Vice President of Technology and Development. Mr. Singhal has over 25 years' experience in the IT products and services industry where he is recognized for strategically implementing innovative technologies. From 2005 until 2010, he was head of North American Sales in the Energy, Resources, and Utilities industry for Tata Consultancy Services (TCS). Prior to that, from 2001 to 2005, he was Co-founder and Chief Operating Officer, North America of Nihilent Technologies, which is the Company's technology partner. Mr. Singhal started his IT services career with Tata Consultancy Services in 1979 and was involved in products and tools development, project management, and business development until 1991. From 1991 to 2001, he held a series of senior technical, business development and executive management positions with entrepreneurial companies. These included International Informatics Solutions (now Xansa) as Technical Director and Member of the Board; IMRglobal Corp. (now CGI, Inc.) as Vice President of Southwest Region and Vice President of Northeast Region; and Hexaware Technologies, Inc. as Senior Vice President for Business Development. Throughout his career, Mr. Singhal has established long-term business relationships with clients in North America, the United Kingdom, Europe, India and Singapore. Mr. Singhal holds a Bachelor's degree in Electronics and Communication Engineering from the University of Roorkee (now IIT, Roorkee) and a Masters degree in Digital Electronics from NUFFIC/PII, Eindhoven in the Netherlands.

There are no family relationships between any director or executive officer and any other director or executive officer.

Legal Proceedings

- 12 -

To our knowledge, there have not been any material proceedings to which any of our directors, officers, or 5% or more beneficial owners of our common stock is a party adverse to us or has a material interest adverse to us.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF ROBERT H. LORSCH

PROPOSAL 2

RATIFICATION OF

INDEPENDENT REGISTEREDPUBLIC ACCOUNTING FIRM

Rose, Snyder & Jacobs, our independent registered public accounting firm for the fiscal year ended December 31, 2010, was recommended by the Audit Committee, and approved by the Board, to act in such capacity for the fiscal year ending December 31, 2011, subject to ratification by the stockholders.

As discussed in our proxy statement for the 2010 Annual Meeting, on December 22, 2009, the Company dismissed SingerLewak LLP, or Singer, as the Company's independent registered public accounting firm. This action was approved by the Audit Committee of the Board and subsequently ratified by the Board.

During the fiscal years ended December 31, 2007 and December 31, 2008, respectively, and in the subsequent interim periods ending September 30, 2009 and through December 22, 2009, there were no disagreements between the Company and Singer on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Singer, would have caused Singer to make reference to the subject matter of the disagreement in their reports on the financial statements for such years. We provided Singer with a copy of these disclosures, which were contained in a Current Report on Form 8-K, filed on December 23, 2009 and on an Amended Current Report on Form 8-K/A, filed on January 5, 2010, and requested that Singer furnish a letter addressed to the Securities and Exchange Commission stating whether Singer agrees with the statements made by us in regarding their dismissal and set forth above (the "Letter"). A copy of the Letter, dated January 5, 2010, from Singer to the Commission was attached as Exhibit 16.1 to the Amended Current Report on Form 8-K/A.

The Audit Committee has directed that management submit the selection of this independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Representatives of Rose, Snyder & Jacobs are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. Stockholder ratification of the selection of Rose, Snyder & Jacobs as the Company's independent registered public accounting firm is not required by the Bylaws or otherwise. However, the Board of Directors is submitting the selection of Rose, Snyder & Jacobs to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Board of Directors and the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board of Directors and the Audit Committee in their discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the voting power represented by the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Rose, Snyder & Jacobs. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. Broker non-votes are counted toward a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Principal Accountant Fees and Services

The following table represents aggregate fees billed for the fiscal years ended December 31, 2010 and 2009 by Rose, Snyder & Jacobs, and SingerLewak LLP, respectively. As previously discussed, on December 22, 2009, our Audit Committee elected to dismiss SingerLewak LLP and engage Rose, Snyder & Jacobs as our independent registered public accounting firm. Rose, Snyder & Jacobs performed the audit of our financial statements for the year ended December 31, 2010 and had no billings during the year ended December 31, 2009. All fees described below were approved by the Audit Committee pursuant to our pre-approval policy also discussed below.

Audit Fees -Total fees billed for audit services relating to the fiscal years ended 2010 and 2009 were $131,000 and $198,000, respectively.

- 13 -

Audit-Related Fees -Total fees billed for audit related services relating to the fiscal year ended 2010 and 2009 were $31,000 and $231,000, respectively.

Tax Fees- Tax fees billed for tax services relating to the fiscal years ended 2010 and 2009 were $0 and $0, respectively. These fees are for professional services rendered for tax compliance, tax consulting and transfer pricing study.

All Other Fees - Total fees billed for other services relating to the fiscal year ended 2010 and 2009 were $0 and $97,000, respectively.

Audit fees include the audit of the Company's annual financial statements presented in the Company's Annual Report on Form 10- K, reviews of interim financial statements presented in the Company's Quarterly Reports on Form 10-Q and accounting, reporting and disclosure consultations related to those audits, fees related to consents and reports in connection with regulatory filings and attestation services related to Sarbanes-Oxley compliance.

The Company's Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of Rose, Snyder & Jacobs, and has concluded that the provision of such services to the degree utilized is compatible with maintaining the independence of the Company's registered public accounting firm. All services provided by Rose, Snyder & Jacobs in 2010 were pre-approved by the Audit Committee after review of each of the services proposed for approval.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services ofIndependent Registered Public Accounting Firm

The Audit Committee has adopted a pre-approval policy for auditor services, including non-audit services, which allows the Chief Executive Officer and/or the Chief Financial Officer to engage the independent registered public accountants, on a case-by-case basis, to consult with our management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, Financial Accounting Standards Board or other regulatory or standard-setting bodies. In addition, the Audit Committee may periodically obtain from the independent registered public accountants estimates of anticipated fees for services in the defined categories of audit services, audit-related services, and tax services for a specified accounting period and pre-approve services in such categories up to specified amounts. Pre-approval may also be given as part of the Audit Committee's approval of the scope of the engagement of the independent registered public accounting firm or on an individual explicit case-by-case basis before the independent registered public accountants are engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee's members, but the decision must be reported to the full Audit Committee at its next scheduled meeting. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. All fees of Rose, Snyder & Jacobs for the year ended December 31, 2010 were pre-approved by the Audit Committee. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm and the fees for the services performed to date.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF

ROSE, SNYDER & JACOBS AS THE COMPANY'S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2011.

CORPORATE GOVERNANCE OF THE COMPANY

Corporate Governance Principles

We are committed to maintaining the highest standards of business conduct and corporate governance. We have adopted a Code of Business Conduct and Ethics for our directors, officers and employees. Our Certificate of Incorporation, Bylaws and the Board of Directors committee charters provide additional framework for our corporate governance principles.

Our business, property and affairs are managed under the direction of the Board of Directors. The Board of Directors selects the senior management team, which is charged with the day-to-day operations of the Company's business. Members of the Board of Directors are kept informed of the Company's business through discussions with the Chief Executive Officer, other senior officers and the Company's counsel, by reviewing materials requested by them or otherwise provided to them and by participating in meetings of the Board of Directors and its committees. Having selected the senior management team, the Board of Directors acts as an advisor and

- 14 -

counselor to senior management, monitors its performance and proposes or makes changes to the senior management team when it deems necessary or appropriate.

Board Leadership Structure and Role in Risk Oversight

Robert H. Lorsch holds the positions of Chairman, President, and Chief Executive Officer of the Company. He has held these positions since 2005, during which time he has served our Company well. We believe that it is in the best interests of our stockholders to have Mr. Lorsch serve as Chairman of the Board. Mr. Lorsch's combined role as Chairman and Chief Executive Officer allows for a clear focus for the chain of command to execute our Company's strategic plan. Pursuant to our bylaws, our Board of Directors determines how the powers of our Company shall be exercised and how our business shall be conducted. Thus, our Board of Directors has the necessary flexibility to determine whether the positions of Chairman and Chief Executive Officer should be held by the same person or by separate persons, based on our Company's leadership needs. Moreover, four of our five directors are deemed independent under the NASDAQ's listing rules. The independent directors and Mr. Lorsch effectively oversee our Company's management. Accordingly, we do not find it necessary to require our Chairman to be an independent director. Our corporate governance guidelines, along with Mr. Lorsch's track record in leading our Company for the last 5 years, ensure that our Company will continue to be served well with Mr. Lorsch serving as our Chairman, President, and Chief Executive Officer.

Our management is responsible for risk management on a day-to-day basis. Our Board of Directors oversees the risk management activities of management directly and through its committees by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices.

Board of Directors and Committee Meetings

The Board of Directors held 6meetings during the year ended December 31, 2010. The Board of Directors has an Audit Committee, which held 4 meetings during the year ended December 31, 2010, a Nominating and Corporate Governance Committee, which did not meet during the year ended December 31, 2010, an Executive Committee, which held 3 meetings during the year ended December 31, 2009, and a Compensation Committee, which held 1meetings during the year ended December 31, 2010. Each of the directors attended at least 75% of the aggregate number of meetings of both the Board of Directors and the committees on which he served, held during the period for which he was a director or committee member, respectively.

The Board of Directors has not adopted a formal policy on members' attendance at our Annual Meeting, although all members of the Board of Directors are invited to attend.

Committees of the Board of Directors

Audit Committee and Audit Committee Financial Expert

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee our corporate accounting and financial reporting processes and audits of our consolidated financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on our audit team, as required by law; reviews and approves or rejects transactions between the company and any related persons; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review the Company's annual audited consolidated financial statements and quarterly consolidated financial statements with management and the independent auditors.

The current members of the Audit Committee are Messrs. Barreto, Jr., Stolar and Zwissig. The Audit Committee has adopted a written charter that is available to stockholders from the "Investor Relations" page on our website atwww.mmrglobal.com.

Although the Company is traded on the OTC:BB, the Board of Directors reviews the Nasdaq listing rules' definition of independence for Audit Committee members on an annual basis. In light of compensation received for consulting services, our Board of Directors has determined that the current members of our Audit Committee are not independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing rules). Further, our Board of Directors has determined that, notwithstanding the experience and

- 15 -

education of our Audit Committee members, we do not have an "audit committee financial expert," as defined in applicable SEC rules. Given the size of our company and the familiarity of the Audit Committee members with our company, we believe it is not necessary to have such an expert at this time.

Report of the Audit Committee of the Board of Directors

The material in this report is not "soliciting material," is not deemed "filed" with the Commission, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, or the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2010 with management. The Audit Committee has discussed with the independent registered public accountants the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board, or PCAOB in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent registered public accountants required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the PCAOB in Rule 3600T and has discussed with the independent registered public accountants the independent registered public accountant's independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010.

Mr. Hector V. Barreto, Jr.

Mr. Jack Zwissig

Mr. Bernard Stolar

Nominating and Corporate Governance Committee

The Company has a separately designated standing Nominating and Corporate Governance Committee of the Board of Directors. The Nominating and Corporate Governance Committee has adopted a written charter that is available to stockholders from the "Investor Relations" page on our website atwww.MMRGlobal.com. The Nominating and Corporate Governance Committee is responsible for (i) the identification of qualified candidates to become members of the Board of Directors, (ii) the selection of candidates for recommendation to the Board of Directors as nominees for election as directors at the next annual meeting of stockholders, (iii) the selection of candidates for recommendation to the Board of Directors to fill any vacancies on the Board of Directors, (iv) the selection of a candidate for recommendation to the Board of Directors as the chairman of the Board, (v) making recommendations to the Board of Directors regarding the staffing of Board committees and the chairman of each committee; and (vi) analyzing and making recommendations to the Board of Directors regarding corporate governance matters applicable to the Company. The Nominating and Corporate Governance Committee is composed of three non-employee directors: Messrs. Helm, Zwissig. The Nominating and Corporate Governance Committee has recommended that it be composed of Messrs. Helm and Zwissig following the Annual Meeting.

Although the Company is traded on OTCBB, the Board of Directors reviews the NASDAQ listing rules' definition of independence for the Nominating and Corporate Governance Committee members on an annual basis. Each member of the Nominating and Corporate Governance Committee is independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing rules).

The Nominating and Corporate Governance Committee identifies director nominees through a combination of referrals, including by stockholders, existing members of the Board of Directors and management, and direct solicitations, where warranted. Once a candidate has been identified, the Nominating and Corporate Governance Committee reviews the individual's experience and background, and may discuss the proposed nominee with the source of the recommendation. The Nominating and Corporate Governance Committee usually believes it to be appropriate for committee members to interview the proposed nominee before making a final determination whether to recommend the individual as a nominee to the entire Board of Directors to stand for election to the Board.

We have adopted a formal process by which stockholders may recommend nominees to our board of directors. This information is available in the Corporate Governance section under "Investor Relations" on our website at www.mymedicalrecords.com. No material changes to this policy have been made since we provided disclosure regarding this policy in our Proxy Statement for the 2008 annual meeting of stockholders.

- 16 -