UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2005

Commission file number 001-32327

The Mosaic Company

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-0891589 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3033 Campus Drive

Suite E490

Plymouth, Minnesota 55441

(800) 918-8270

(Address and zip code of principal executive offices and registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class

| | Name of each exchange on which registered

|

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

7.50% Mandatory Convertible Preferred Shares | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of November 30, 2004, the aggregate market value of the registrant’s voting common stock held by non-affiliates was approximately $2.2 billion based upon the closing price of these shares on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock: 380,793,787 shares of Common Stock, par value $0.01 per share and 5,458,955 shares of Class B Common Stock, par value $0.01 per share as of July 29, 2005.

DOCUMENTS INCORPORATED BY REFERENCE

| 1. | Portions of the registrant’s Annual Report to Stockholders for the fiscal year ended May 31, 2005 (Part I and Part II). |

| 2. | Portions of the registrant’s definitive proxy statement to be issued in conjunction with the 2005 Annual Meeting of Stockholders (Part III) |

2005 FORM 10-K CONTENTS

-1-

PART I.

Item 1. Business.

COMPANY PROFILE

The Mosaic Company is one of the world’s leading producers of phosphate and potash crop nutrients and animal feed ingredients. It is a Delaware corporation that was incorporated on January 23, 2004 in order to serve as the parent company of the business that was formed through the business combination (Combination) of IMC Global Inc. and the fertilizer businesses of Cargill, Incorporated on October 22, 2004. In this report:

| | • | | “Mosaic” means The Mosaic Company. |

| | • | | “We,” “us” and “our” mean Mosaic and may also include Mosaic and its direct and indirect subsidiaries as a group. |

| | • | | IMC Global Inc. is referred to as “IMC”. |

| | • | | “Cargill” means Cargill, Incorporated and may also include its direct and indirect subsidiaries other than us. |

| | • | | “Cargill Crop Nutrition” or “CCN” means the fertilizer businesses of Cargill other than its retail fertilizer businesses. |

| | • | | References in this report to a particular fiscal year are to the year ended May 31 of that year. |

We have included a glossary of industry terms at the end of this description of our business on page 26.

Our Businesses

We conduct our business through wholly and majority owned subsidiaries as well as businesses in which we own less than a majority or a non-controlling equity interest. We are organized into four business segments that are engaged in producing, blending and distributing crop nutrient and animal feed products around the world.

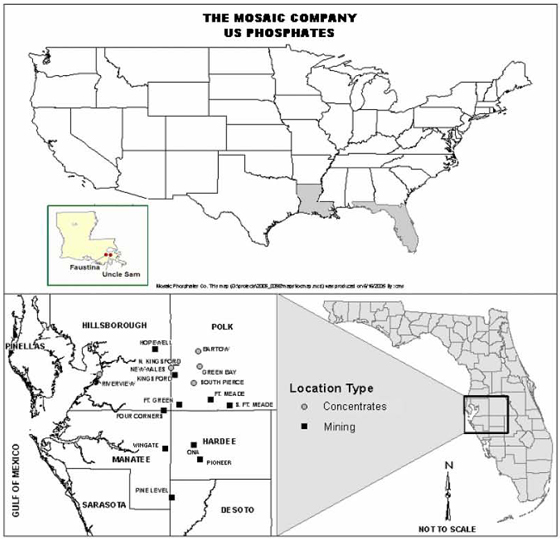

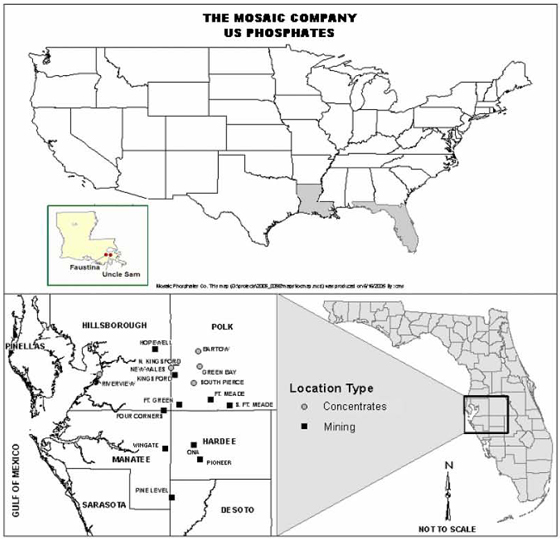

Our Phosphates business segment, which we refer to as Phosphates, owns and operates mines and concentrates plants in Florida that produce phosphate fertilizer and feed phosphate, and concentrates plants in Louisiana that produce phosphate fertilizer. Phosphate fertilizer and feed phosphate are sold internationally and throughout North America. Phosphates also includes North American phosphate distribution activities for ourselves and for unrelated parties.

Our Potash business segment,which we refer to as Potash, mines and processes potash in Canada and the United States. We have four mines in Canada within the Province of Saskatchewan and two in the United States located in New Mexico and Michigan. Each mine has related facilities that refine the mined potash. Potash is sold internationally and throughout North America, principally as fertilizer. Potash also includes North American potash distribution activities for ourselves and unrelated parties and our own potash export activities.

Our Offshore business segment, which we refer to as Offshore, consists of sales offices, fertilizer blending and bagging facilities, port terminals and warehouses in several countries as well as production facilities in Brazil and China. Our operations in Brazil make us the second largest producer and distributor of blended fertilizers in the country. The Brazilian operations include a one-third ownership in Fertifos S.A., which we refer to as Fertifos. Fertifos, in turn, owns 55.8 percent of Fosfertil S.A., which we refer to as Fosfertil. Fosfertil operates phosphate and nitrogen processing plants in Brazil. In China, we have a 35 percent equity ownership in a diammonium phosphate (DAP) granulation plant near Kunming in Yunnan Province.

Our Nitrogen business segment, which we refer to as Nitrogen, includes activities related to the North American distribution of nitrogen products which are marketed for Saskferco Products Inc. (Saskferco), a Saskatchewan-based corporation, as well as nitrogen products purchased from third parties, and sold primarily through our owned or leased distribution facilities. Nitrogen also includes results from our 50 percent ownership interest in Saskferco. Saskferco produces anhydrous ammonia, granular urea, feed grade urea and urea ammonium nitrate (UAN) solution for shipment to nitrogen fertilizer customers in Canada and the northern tier of the United States.

-2-

Strategy

We are one of the world’s largest producers of phosphate and potash fertilizer and related products, and also distribute nitrogen based products. We are an industry leader characterized by broad diversification, global reach, and market expertise.

Our vision is to become the global leader in nourishing crops and delivering distinctive value to world agriculture and to all we touch. We have a business strategy in place intended to achieve our vision.

The key elements of our strategy are as follows:

| | • | | Become the industry’s most efficient producer by operating as a low cost and high margin player in each of our business segments: Phosphates, Potash, Offshore and Nitrogen. |

| | • | | Maintain a balanced portfolio of products and services to better serve customers, in North America and internationally, and provide more consistent returns for shareholders. |

| | • | | Generate strong cash flow to meet capital expenditure requirements and strengthen our balance sheet by paying down debt. |

| | • | | Successfully harvest merger synergies, including generating $145.0 million in pre-tax run-rate savings by May 2007. A continued focus on cost reductions, especially for the Phosphate segment, including capturing synergies by the end of fiscal year 2006 of $90 to $110 million on an annual run rate basis. To capture these synergies, we estimate capital expenditures ranging from $80 million to $100 million, in addition to operating expenses. |

| | • | | Stake out a leadership position in environmental stewardship and corporate citizenship, including building upon our predecessor organizations’ past successful records. |

Markets

Nitrogen, phosphorus and potassium are the three primary crop nutrients required for plant growth. Nitrogen is required for the formation of chlorophyll – the green substance that powers photosynthesis – and also is an essential element in amino acids, the building blocks for plant protein. Phosphorus plays a key role in photosynthesis, respiration, energy storage and transfer, cell division and other important plant processes and is particularly important for early root development and seed formation. Potassium is critical for plant metabolism and helps plants break down carbohydrates, resist or recover from diseases and efficiently utilize water. There are no substitutes for nitrogen, phosphorus and potassium.

Plants utilize large quantities of the three primary nutrients and soils quickly become depleted if these nutrients are not replenished after each harvest. As a result, farmers apply nitrogen, phosphorus and potassium to their land each year in order to replace the nutrients removed by crops and maintain soil fertility. The three primary nutrients are contained in more than a dozen widely used commercial fertilizer products just like carbohydrates, protein and fat are found in a variety of foods. The form of these fertilizer products differs significantly from gas to liquid to solid granules.

Each primary nutrient is a unique commodity and represents a separate market. The production of each primary nutrient utilizes different raw materials and processes. Nitrogen fertilizer is manufactured from a hydrocarbon feedstock such as natural gas. Phosphorus fertilizer is produced from phosphate rock, a mineral ore found in both marine sedimentary deposits as well as igneous formations. Potassium fertilizer also is produced from a mineral ore that is contained either in deposits below the surface of the earth or in natural brines such as those from the Dead Sea or the Great Salt Lake.

The natural resources required for the production of these nutrients are concentrated in different regions of the world. As a result, nutrient markets are global markets, and international trade accounts for a relatively high percentage of world use. In addition, fundamentals may differ markedly between nutrient markets depending on changes in relative raw materials costs as well as other factors such as economic, agricultural, industrial and trade policies in importing and exporting countries.

-3-

Population and income growth are the fundamental drivers of nutrient demand. Developing countries, particularly those in Asia and Latin America, are forecast to account for nearly all of the growth in world nutrient demand during the foreseeable future. Rapid per capita income growth in countries such as China and India is boosting food demand and ultimately nutrient use. Most developed regions such as North America and Europe are mature nutrient markets.

Nutrient markets are global commodity markets and industry players compete based on delivered cost and to a lesser extent on differentiated customer service. Cost is a function of ore quality, mining and chemical processing technologies, raw materials sourcing, transportation rates, logistical infrastructure and operating practices and efficiencies.

Business Combinations

On October 22, 2004, a subsidiary of ours was merged into IMC, resulting in IMC becoming a subsidiary of Mosaic, and Cargill contributed its fertilizer businesses to us. Immediately following the Combination, our stock was held as follows:

| | • | | Cargill owned approximately 66.5 percent of our outstanding common stock and all 5,458,955 shares of our Class B common stock (Class B Common Stock); and |

| | • | | The remaining 33.5 percent of our outstanding common stock and all 2,750,000 shares of our 7.50 percent Mandatory Convertible Preferred Shares were publicly held. |

We have included a detailed description of the Combination, including the accounting treatment and proforma financial information, in Note 5 of our consolidated financial statements in our annual report to stockholders.

Prior to October 19, 2004, IMC indirectly owned 51.6 percent of the partnership interests in Phosphate Resource Partners Limited Partnership and the remaining 48.4 percent of the partnership interests were publicly held. Phosphate Resource Partners Limited Partnership is sometimes referred to in this report as PLP. On October 19, 2004, PLP was merged into a subsidiary of IMC and the publicly held partnership interests were exchanged for IMC common stock. The IMC common stock issued in the PLP merger was exchanged for our common stock in the Combination. We have included in Note 5 of our consolidated financial statements in our annual report to stockholders a description of the PLP merger. This information is incorporated by reference in this report in Part II, Item 8, “Financial Statements and Supplementary Data.”

In addition, during our fiscal year ended May 31, 2005, Phosphates operated primarily through two separate legal entities. Mosaic Fertilizer, LLC included most of our Phosphate operations that were acquired from Cargill, and Mosaic Phosphates Company included most of our Phosphate operations that were acquired from IMC. On July 29, 2005, we combined these two entities by merging Mosaic Phosphates Company into Mosaic Fertilizer, LLC, which we refer to as the Phosphates Combination. The Phosphates Combination is an important step towards simplifying our internal structure in a manner that facilitates achieving synergies from the Combination.

Other Developments

We have included additional information about developments in our business during the fiscal year in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of our annual report to stockholders, particularly under “Introduction.” This information is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

-4-

Financial Information about our Operating Segments and Operations by Geographic Areas

We have included financial information on our operating segments and our operations by geographic area in Note 26 of our consolidated financial statements in our annual report to stockholders. This information is incorporated by reference in this report in Part II, Item 8, “Financial Statements and Supplementary Data.”

Information Available on our Website

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments thereto, filed with the United States Securities and Exchange Commission, which we refer to in this report as the SEC, pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder are made available free of charge on our website, (www.mosaicco.com), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information contained on our website is not being incorporated in this report.

Basis of Information in our Financial Statements and this Report

Under generally accepted accounting principles, our financial statements that are included in our annual report to stockholders and information that was derived from the audited financial statements generally include the combined operations of the businesses acquired from CCN and IMC beginning October 23, 2004, but for periods prior to October 23, 2004 include only the businesses acquired from CCN and exclude the businesses acquired from IMC. We have included in Note 5 of our consolidated financial statements in our annual report to stockholders proforma financial information in accordance with rules of the SEC, that shows the proforma combined results of operations of CCN and IMC for the entire periods presented. The operating and statistical measures in the remainder of Part I, Item 1, of this report generally reflect operations of the combined businesses on a proforma basis for the entire periods presented. These operating and statistical measures include information primarily related to unit volumes for production, sales and raw materials purchases.

BUSINESS UNIT INFORMATION

The discussion below of our business unit operations should be read in conjunction with the following information that we have included in our annual report to stockholders:

| | • | | The Management’s Discussion and Analysis of Financial Condition and Results of Operations section of our annual report to stockholders. This information is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| | • | | The financial statements and supplementary financial information, particularly the proforma financial information in Note 5 of the notes to our consolidated financial statements. This information is incorporated by reference in this report in Part II, Item 8, “Financial Statements and Supplementary Data.” |

Throughout the business unit information below, we measure units of production, sales and raw materials in tonnes. When we use the word “tonne” or “tonnes,” we mean a metric tonne or tonnes of 2,205 pounds each unless we specifically state than we mean short or long ton(s).

Phosphates

We are the largest producer of high analysis or concentrated phosphate fertilizer and animal feed ingredients in the world. We have capacity to produce approximately 5.6 million tonnes of phosphoric acid (P2O5) per year, or about 13 percent of world capacity and 49 percent of U.S. capacity. Our phosphoric acid is produced by reacting finely ground phosphate rock with sulphuric acid. It is the key building block for the production of high analysis or concentrated phosphate fertilizer and animal feed products, and is the most comprehensive measure of phosphate capacity and production. Our phosphoric acid production totaled approximately 4.9 million tonnes during the fiscal year ended May 31, 2005, accounting for approximately 15 percent of global production and 47 percent of U.S. phosphoric acid output last year. The following map shows the locations of each of our phosphate mines and concentrates plants in the United States:

-5-

Our principal phosphate fertilizer products are:

| | • | | Diammonium Phosphate (DAP). DAP is the most widely used high-analysis phosphate fertilizer worldwide. DAP is produced by combining phosphoric acid with anhydrous ammonia. This initial reaction creates a slurry that is then pumped into a granulation plant where it is reacted with additional ammonia to produce DAP. DAP is a solid granular product. |

| | • | | Monoammonium Phosphate (MAP). MAP is the second most widely used high-analysis phosphate fertilizer and the fastest growing phosphate product worldwide. MAP also is produced by first combining phosphoric acid with anhydrous ammonia in a reaction vessel. The resulting slurry is then pumped into the granulation plant where it is reacted with additional phosphoric acid to produce MAP. MAP also is a solid granular product. |

| | • | | Triple Superphosphate (TSP). TSP is the third most widely used high-analysis phosphate fertilizer worldwide. Unlike DAP and MAP, it contains no nitrogen and is used mostly on crops such as legumes that require little or no nitrogen. TSP is produced by reacting or neutralizing phosphoric acid with additional high-grade phosphate rock and then granulating the resulting slurry into a solid fertilizer product. |

-6-

Our DAP and MAP products include MicroEssentials™, which is a value-added DAP or MAP product that features a patented process that creates very thin platelets of sulphur on the product. We sometimes refer to MicroEssentials™ in this report as ME. Over time, these sulphur platelets break down in the soil and are absorbed by plants. In addition, micronutrients such as boron, copper, manganese, and zinc can be added in separate but parallel processes.

Our concentrated phosphate products are marketed worldwide to crop nutrient manufacturers, distributors and retailers.

In addition, Phosphates is one of the largest producers and marketers of phosphate and potash-based animal feed ingredients in the world. We operate feed phosphate plants at our New Wales and Riverview facilities in Florida. The combined capacity of these facilities is one million tonnes per year. We market our feed phosphate under the leading brand names of Biofos®, Dynafos®, Monofos® and Multifos®. Phosphates also sources MicroGran® urea from Saskferco and potassium raw materials from Potash and markets Dyna-K®, Dyna-K White® and Dynamate® as potassium-based animal feed ingredients.

Our main phosphate fertilizer and feed phosphate facilities are located in central Florida and Louisiana. Annual capacities and production volumes by plant are listed in the table below for the fiscal year ended May 31, 2005.

| | | | | | | | | | | | | | | | |

Facility

| | Phosphoric Acid

| | DAP/MAP/ME

| | Phosphate Animal Feed

Ingredients

| | Triple Superphosphate

|

| | | Capacity

(1000

tonnes)

| | Production

(1000

tonnes)

| | Capacity

(1000

tonnes)

| | Production

(1000

tonnes)

| | Capacity

(1000

tonnes)

| | Production

(1000

tonnes)

| | Capacity

(1000

tonnes)

| | Production

(1000

tonnes)

|

Florida: | | | | | | | | | | | | | | | | |

New Wales | | 1,720 | | 1,532 | | 3,880 | | 3,157 | | 750 | | 664 | | — | | — |

Bartow | | 950 | | 906 | | 2,270 | | 1,956 | | — | | — | | — | | — |

Riverview | | 860 | | 756 | | 1,900 | | 1,385 | | 250 | | 221 | | — | | — |

Green Bay | | 640 | | 504 | | 1,310 | | 998 | | — | | — | | — | | — |

South Pierce | | 550 | | 465 | | — | | — | | — | | — | | 730 | | 623 |

| | | | | | | | |

Louisiana | | | | | | | | | | | | | | | | |

Uncle Sam | | 870 | | 735 | | — | | — | | — | | — | | — | | — |

Faustina | | — | | — | | 1,900 | | 1,549 | | — | | — | | — | | — |

Total | | 5,590 | | 4,898 | | 11,260 | | 9,045 | | 1,000 | | 885 | | 730 | | 623 |

The phosphoric acid from Uncle Sam is shipped to Faustina where it is used to produce DAP and MAP. The Faustina plant also manufactures ammonia.

Our Riverview facility is subject to the mortgage granted under our senior secured credit facility. Our senior secured credit facility is described under “Capital Resources and Liquidity” in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of our annual report to stockholders. This information is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our phosphate fertilizer (DAP/MAP/ME/TSP) capacity of 12.0 million tonnes last year accounted for approximately 17 percent of global capacity and 58 percent of U.S. phosphate fertilizer capacity. Our production of 9.7 million tonnes of phosphate fertilizer accounted for roughly 21 percent of world output and 61 percent of U.S. production.

The principal raw materials used in the production of concentrated phosphates are phosphate rock, sulphur and ammonia.

-7-

Phosphate Rock

Phosphate rock is the key mineral used to produce phosphate fertilizer and feed phosphate. We are one of the world’s leading miners of phosphate rock with annual capacity of approximately 23.7 million tonnes. Our rock production was approximately 20.9 million tonnes in the fiscal year ended May 31, 2005 and accounted for approximately 14 percent of global output and 55 percent of U.S. production. From time to time, we also purchase phosphate rock from unrelated parties.

All of our phosphate mines and related mining operations are located in central Florida. We currently operate seven mines at Four Corners, South Fort Meade, Fort Green, Kingsford, Hookers Prairie, Wingate and Hopewell, one idle mine at Fort Meade, and three planned future mines at Ona, Pine Level and Pioneer. The Kingsford mine will be mined out and closed in September 2005.

The phosphate deposits of Florida are of sedimentary origin and are part of a phosphate-bearing province that extends from southern Florida north along the Atlantic coast into southern Virginia. Our active phosphate mines are primarily in what is known as the Bone Valley Member of the Peace River Formation in the Central Florida Phosphate District, having their origin from reworking of the host Hawthorn Group of middle Miocene age. The southern portions of the Four Corners, Fort Green and Wingate mines are in what is referred to as the Undifferentiated Peace River Formation, in which our future Ona, Pine Level and Pioneer mines would also be located. Phosphate mining has been conducted in the Central Florida Phosphate District since the late 1800’s. The potentially mineable portion of the Central Florida Phosphate District encompasses an area approximately 80 miles in length in a north-south direction and approximately 40 miles in width.

Except at the Wingate mine, we extract phosphate ore using large surface mining machines that we own called “draglines.” Prior to extracting the ore, the draglines must first remove a 10 to 50 foot layer of sandy overburden. At the Wingate mine, we utilize dredges to strip the overburden and mine the ore. We then process the ore at beneficiation plants that we own at each active mine where the ore goes through washing, screening, sizing and flotation processes designed to separate the phosphate rock from sands, clays and other foreign materials. Prior to commencing operations at any of our planned future mines, such as Ona, Pine Level and Pioneer, we would need to acquire new draglines or move existing draglines to the mines and, unless the beneficiation plant at an existing mine were used, construct a beneficiation plant.

The following table shows rock production volume and grade for each of our active phosphate mines for the past three fiscal years:

| | | | | | | | | | | | | | | | | | | | |

| | | | | 2005

| | 2004

| | 2003

|

| | | Capacity

Tonnes

| | Production

Tonnes

| | Average

BPL

| | %

P2O5

| | Production

Tonnes

| | Average

BPL

| | %

P2O5

| | Production

Tonnes

| | Average

BPL

| | %

P2O5

|

| | | (1000 tonnes) | | (1000 tonnes) | | | | | | (1000 tonnes) | | | | | | (1000 tonnes) | | | | |

Four Corners | | 6,710 | | 6,033 | | 61.4 | | 28.1 | | 6,745 | | 61.5 | | 28.1 | | 7,356 | | 63.5 | | 29.1 |

South Fort Meade | | 5,605 | | 4,856 | | 64.2 | | 29.4 | | 5,227 | | 65.7 | | 30.1 | | 4,449 | | 65.1 | | 29.8 |

Fort Green | | 4,900 | | 4,859 | | 60.5 | | 27.7 | | 4,870 | | 61.2 | | 28.0 | | 3,730 | | 63.3 | | 29.0 |

Kingsford | | 2,720 | | 2,520 | | 66.9 | | 30.6 | | 2,418 | | 66.1 | | 30.2 | | 3,037 | | 65.8 | | 30.1 |

Hookers Prairie | | 2,090 | | 1,753 | | 62.9 | | 28.8 | | 2,091 | | 64.8 | | 29.7 | | 1,795 | | 63.9 | | 29.2 |

Wingate | | 1,089 | | 358 | | 64.5 | | 29.5 | | — | | — | | — | | — | | — | | — |

Hopewell | | 620 | | 544 | | 67.3 | | 30.8 | | 745 | | 68.6 | | 31.4 | | 731 | | 66.7 | | 30.5 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Total | | 23,734 | | 20,923 | | 62.8 | | 28.8 | | 22,096 | | 63.5 | | 29.1 | | 21,098 | | 64.3 | | 29.4 |

Although we sell approximately two million tonnes of mined phosphate rock per year to another crop nutrient manufacturer under a contract that IMC terminated effective October 1, 2007, we primarily use phosphate rock

-8-

internally in the production of our concentrated phosphates. We used internally approximately 19 million, 21 million and 19 million tonnes representing 92 percent, 92 percent and 86 percent, respectively, of total rock tonnes shipped for each of the fiscal years ended May 31, 2005, 2004 and 2003, respectively.

Reserves

We estimate our phosphate rock reserves based upon exploration core drilling as well as technical and economic analyses to determine that reserves can be economically mined. Proven (measured) reserves are those resources of sufficient concentration to meet minimum physical, chemical and economic criteria related to our current product standards and mining and production practices. Our estimates of probable (indicated) reserves are based on information similar to that used for proven reserves, but sites for drilling are farther apart or are otherwise less adequately spaced than for proven reserves, although the degree of assurance is high enough to assume continuity between such sites. Proven reserves are determined using a minimum drill hole spacing of two sites per 40 acre block. Probable reserves have less than two drill holes per 40 acre block, but geological data provides a high degree of assurance that continuity exists between sites.

The following table sets forth Phosphates’ proven and probable reserves as of May 31, 2005:

| | | | | | | | | |

Mine

| | Mineable Acres(a)

| | Reserve Tonnes

| | | Average BPL(d)

| | % P2O5

|

| | | | | (in millions)(b)(c) | | | | | |

Active Mines | | | | | | | | | |

Four Corners | | 14,806 | | 81.0 | | | 63.8 | | 29.20 |

South Fort Meade | | 12,321 | | 83.4 | | | 63.8 | | 29.20 |

Fort Green | | 7,273 | | 65.6 | (e) | | 61.8 | | 28.28 |

Kingsford | | 136 | | 0.7 | (f) | | 65.4 | | 29.93 |

Hookers Prairie | | 679 | | 5.4 | | | 63.4 | | 29.01 |

Wingate | | 631 | | 6.5 | | | 66.8 | | 30.57 |

Hopewell | | 571 | | 3.2 | (f) | | 67.9 | | 31.07 |

Total Active Mines | | 36,417 | | 245.8 | | | 63.4 | | 29.01 |

| | | | |

Inactive Mine | | | | | | | | | |

Fort Meade | | 3,311 | | 17.9 | | | 66.1 | | 30.25 |

| | | | |

Future Mines | | | | | | | | | |

Ona | | 9,483 | | 77.0 | (e) | | 64.3 | | 29.43 |

Pine Level | | 24,586 | | 148.0 | (g) | | 64.8 | | 29.65 |

Pioneer | | 9,491 | | 76.9 | | | 66.8 | | 30.57 |

Total Future Mines | | 43,560 | | 301.9 | | | 65.2 | | 29.84 |

| | |

| |

|

| |

| |

|

Total Mines | | 83,288 | | 565.6 | | | 64.4 | | 29.47 |

| (a) | Mineable acres reflect that part of the total deeded or controlled acreage that is fully accessible for mining; is free of surface or subsurface encumbrance, legal setbacks, wetland preserves and other legal restrictions that preclude permittable access for mining; is believed by us to be permittable; and meet specified minimum physical, economic and chemical criteria related to current mining and production practices. Mineable acres exclude mined out acreage. We announced in July 2005 that our Kingsford mine will be closed in September 2005 as a result of the depletion of the economic phosphate reserves. All reported reserves are within the mineable acres. |

| (b) | Reserve estimates are generally established by our personnel without a third party review. However, prior to the Combination, IMC retained an independent third party to prepare annual valuation analyses, primarily for tax purposes, that include valuations of the reserves consistent with the information shown in the table above. In addition, as part of CCN’s due diligence assessments of mining properties and phosphate reserves, CCN retained consultants to conduct analyses in connection with its acquisitions of |

-9-

| | the Wingate and Pioneer mines. We have taken these valuations and analyses into account in developing our calculations of reserves. The reserve estimates have been prepared in accordance with the standards set forth in Industry Guide 7 promulgated by the Securities and Exchange Commission. |

| (c) | Of the reserves shown, approximately 538.9 million tonnes are proven reserves, while 0.5 million tonnes at Ona and 26.2 million tonnes at Pine Level are probable reserves. |

| (d) | BPL ranges from 50 percent to 78 percent. |

| (e) | Approximately 40.3 million tonnes shown for Fort Green and 2.7 million tonnes shown for Ona are subject to a purchase money mortgage with an outstanding principal balance of $1.5 million as of May 31, 2005. |

| (f) | We purchased approximately 0.4 million tonnes shown for Kingsford and 2.0 million tonnes shown for Hopewell in December 2002 pursuant to agreements that provide for future payment of royalties of $78,000 per month through December 1, 2009 (which payments may be accelerated if production from such reserves exceeds 237,000 tonnes per calendar quarter). In addition, as part of this purchase, we purchased two clay settling ponds for payments of $63,000 per month through December 1, 2008 and lease certain plant and equipment for payments of $46,000 per month through December 1, 2009. |

| (g) | In connection with the sale of certain of the surface rights related to approximately 48.9 million tonnes of the reported Pine Level reserves, we agreed not to mine such reserves until at least 2014. Our current mining plans do not contemplate mining such reserves until at least that time. In addition, in connection with the purchase of approximately 99.3 million tonnes of the reported Pine Level reserves, we have agreed to (i) pay royalties of between $0.50 and $0.90 per ton of rock mined based on future levels of DAP margins, (ii) pay to the seller lost income from the loss of surface use to the extent we use the property for mining related purposes before January 1, 2015 and (iii) re-convey to the seller fee title to unminable portions of the property after a development order is issued in connection with the Development of Regional Impact process. |

We generally own the reserves shown in the table above, with the only significant exceptions being approximately 6.6 million tonnes shown for the Fort Green mine, the reserves referred to in Note (f) to the above table, and the South Fort Meade reserves:

| | • | | The 6.6 million tonnes for the Fort Green mine are under a lease that we have the right to extend through 2014 and for which we have prepaid substantially all royalties. |

| | • | | Our rights to the reserves referred to in Note (f) to the above table are held pursuant to mineral rights that expire in 2012, except for a portion that expire in 2017. |

| | • | | We own the above ground assets of the South Fort Meade mine, including the beneficiation plant, rail track and clay settling areas. A limited partnership, the South Ft. Meade Partnership, L.P., which we refer to as SFMP, owns all of the mineable acres shown in the table for the South Fort Meade mine. SFMP capital was comprised of approximately 35 percent equity and 65 percent debt. |

| | • | | We own 35 percent of the SFMP equity with financial investors owning the remaining 65 percent. SFMP is included as a consolidated subsidiary in our financial statements for the fiscal year ended May 31, 2005. |

| | • | | In addition to the equity, several financial investors purchased $76 million of debt instruments issued by SFMP to fund the acquisition of the land and mineral reserves. |

| | • | | A third entity, South Ft. Meade Land Management, Inc., which we refer to as SFMLM, owns and manages orange groves and other agricultural assets on the land. SFMLM is a wholly owned subsidiary of ours. SFMLM also has entered into an agricultural lease with SFMP and pays SFMP rental income for the land that it uses for agricultural purposes or subleases to local farmers or ranchers. |

| | • | | We have a long-term mineral lease with SFMP. This lease expires on December 31, 2025 or such date that we have completed mining and reclamation obligations associated with the leased property. |

-10-

| | Lease provisions include royalty payments and a commitment to give mining priority to the South Fort Meade phosphate reserves. We pay the partnership a royalty on each tonne mined and shipped from the areas that we lease from it. Royalty payments to SFMP total approximately $15 million annually at current production rates. |

| | • | | Through its arrangements with us, SFMP also earns income from mineral lease payments, agricultural lease payments and interest income and uses those proceeds to service debt and pay dividends to its equity owners. |

| | • | | The U.S. government owns the mineral rights beneath approximately 680 acres shown in the table above for the South Fort Meade mine. The surface rights to this land are owned by SFMP. We control the rights to mine these reserves under a mining lease agreement and pay royalties on the tonnage extracted. Royalties on the approved leases equal approximately five percent of the six-month rolling average mining cost of production when mining these reserves. Phosphate rock tonnage produced within the lease area to date is approximately 654,000 tonnes with corresponding royalties of approximately $742,000. |

In light of the long-term nature of our rights to our reserves, we expect to be able to mine all reported reserves that are not currently owned prior to termination or expiration of our rights.

Sulphur

We use sulphur at our New Wales, Bartow, Riverview, Green Bay, South Pierce, and Uncle Sam concentrates plants to produce sulphuric acid primarily for use in our production of phosphoric acid. We purchased approximately five million tonnes of sulphur in the fiscal year ended May 31, 2005. We purchase most of this sulphur directly or indirectly from North American oil and gas producers who are required to remove or recover sulphur during the refining process. We operate two ocean-going barges that transport molten sulphur from refineries located in the Gulf of Mexico to phosphate plants in Florida. We also own and operate a sulphur terminal in Houston, Texas.

We also own a 50 percent equity interest in Gulf Sulphur Services Ltd., LLLP (Gulf Services) which is operated by our joint venture partner. Gulf Services has a large sulphur transportation and terminaling business in the Gulf of Mexico, and handles these functions for a substantial portion of our Florida sulphur volume. Our Louisiana operations are served by truck, rail and barge from nearby refineries. Although sulphur is readily available from many different suppliers and can be transported to our phosphate facilities by a variety of means, sulphur is an important raw material used in our business that has in the past been and may in the future be the subject of volatile pricing and availability, and alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to current transportation or terminaling facilities. Changes in the price of sulphur or disruptions to sulphur transportation or terminaling facilities could have a material impact on our business.

Ammonia

We use ammonia together with phosphoric acid to produce both DAP and MAP. We used approximately 1.5 million tonnes of ammonia in the fiscal year ended May 31, 2005. Our Florida ammonia needs are supplied by offshore producers, primarily under multi-year contracts. Ammonia for our New Wales and Riverview plants is terminaled through an ammonia facility at Port Sutton, Florida that we lease for a term expiring in 2013 which we may extend for up to five additional years. We also load railcars of ammonia to third parties at this facility. Pursuant to contract, a third party operates the Port Sutton ammonia facility. The agreement expires in 2013 but we may extend it for an unlimited number of additional five year terms, as long as the third party is entitled to operate the ammonia facility. Ammonia for our Bartow and Green Bay plants is terminaled through another ammonia facility owned and operated by a third party at Port Sutton, Florida pursuant to a contract that expires in June 2015. Ammonia is transported by pipeline from the terminals to our production facilities. We have long-term service agreements with the pipeline provider. We produce ammonia primarily for our own consumption at Faustina, Louisiana. Our annual production is 500,000 tonnes and from time to time we may sell surplus ammonia to unrelated parties. Although ammonia is readily available from many different suppliers and can be transported to our phosphates facilities by a variety of means, ammonia is an important raw material used in our business that has in the past been and may in the future be the subject of volatile pricing, and alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to existing transportation or terminaling facilities. Changes in the price of ammonia or disruptions to ammonia transportation or terminaling could have a material impact on our business.

-11-

Sales and Marketing

For a discussion of the Phosphate sales and marketing, see “Sales and Marketing Activities” later in this report.

Potash

We are one of the leading potash producers in the world. We estimate that we were the largest miner of potash during the calendar year ended 2004 based on published industry and company statistics. We mine and process potash in Canada and the United States and distribute potash in North America and internationally. The term “potash” applies generally to the common salts of potassium. Our potash products are marketed worldwide to crop nutrient manufacturers, distributors and retailers and are also used in the manufacture of mixed crop nutrients and, to a lesser extent, in animal feed ingredients. We also sell potash to customers for industrial use. In addition, our potash products are used for icemelter and water softener regenerant.

We operate four potash mines in Canada as well as two potash mines in the United States. Our current potash capacity, excluding tonnage produced at Esterhazy for Potash Corporation of Saskatchewan (PCS) pursuant to a contract described below, totaled 9.3 million tonnes of product per year and accounted for approximately 14 percent of world capacity and 35 percent of North American capacity in the fiscal year ended May 31, 2005. Production during the fiscal year ended May 31, 2005, excluding tonnage produced for PCS at Esterhazy, totaled 8.5 million tonnes and accounted for approximately 15 percent of world output and 42 percent of North American production.

The map below shows the location of each of our potash mines.

We own related facilities at each of the mines, which we refer to as refineries, which refine the mined potash.

-12-

The following table shows mined ore, average grade and finished product output by mine for the past three fiscal years:

Production for the Fiscal Year Ended May 31,

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2005

| | 2004

| | 2003

|

| | | Annual

Capacity(1)

| | Ore

Mined

(millions

of tonnes)

| | Grade % K2O

| | Product

(millions

of tonnes)

| | Annual

Capacity(1)

| | Ore

Mined

(millions

of tonnes)

| | Grade % K2O

| | Product

(millions

of tonnes)

| | Annual

Capacity(1)

| | Ore

Mined

(millions

of tonnes)

| | Grade % K2O

| | Product

(millions

of tonnes)

|

Canadian Mines | | | | | | | | | | | | | | | | | | | | | | | | |

Belle Plaine -MOP | | 2.8 | | 9.7 | | 18.0 | | 2.4 | | 2.8 | | 9.0 | | 18.0 | | 2.5 | | 2.7 | | 8.4 | | 18.0 | | 1.9 |

Colonsay - MOP | | 1.8 | | 3.8 | | 26.5 | | 1.5 | | 1.8 | | 3.4 | | 26.4 | | 1.4 | | 1.8 | | 3.3 | | 26.7 | | 1.3 |

Esterhazy -MOP | | 3.8 | | 11.7 | | 23.9 | | 4.0 | | 3.8 | | 10.7 | | 24.1 | | 3.7 | | 3.8 | | 9.4 | | 24.4 | | 3.3 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

sub - totals | | 8.4 | | 25.2 | | 22.0 | | 7.9 | | 8.4 | | 23.1 | | 22.1 | | 7.6 | | 8.3 | | 21.1 | | 22.2 | | 6.5 |

| | | | | | | | | | | | |

United States Mines | | | | | | | | | | | | | | | | | | | | | | | | |

Carlsbad - MOP | | 0.5 | | 3.7 | | 12.5 | | 0.5 | | 0.5 | | 3.2 | | 12.6 | | 0.4 | | 0.4 | | 3.6 | | 12.6 | | 0.3 |

Carlsbad -K-Mag | | 1.2 | | 3.3 | | 7.4 | | 0.9 | | 1.2 | | 3.1 | | 7.4 | | 0.6 | | 1.0 | | 3.6 | | 7.9 | | 0.8 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Carlsbad - Total | | 1.7 | | 7.0 | | 10.1 | | 1.4 | | 1.7 | | 6.3 | | 10.1 | | 1.0 | | 1.4 | | 7.2 | | 10.3 | | 1.1 |

Hersey - MOP | | 0.1 | | 0.3 | | 26.7 | | 0.1 | | 0.1 | | 0.3 | | 26.7 | | 0.1 | | 0.1 | | 0.3 | | 26.6 | | 0.1 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

sub-totals | | 1.8 | | 7.3 | | 10.7 | | 1.5 | | 1.8 | | 6.6 | | 10.8 | | 1.1 | | 1.5 | | 7.5 | | 10.8 | | 1.2 |

Totals | | 10.2 | | 32.5 | | 19.5 | | 9.4 | | 10.2 | | 29.7 | | 19.5 | | 8.7 | | 9.8 | | 28.6 | | 19.2 | | 7.7 |

Total excluding PCS | | 9.3 | | 29.8 | | | | 8.5 | | 9.3 | | 26.9 | | | | 7.8 | | 8.9 | | 25.9 | | | | 6.8 |

| (1) | millions of tonnes of finished product |

Reserves

Our estimates of our potash reserves and non-reserve potash mineralization are based on exploration drill hole data, seismic data and actual mining results over more than 35 years (more than 15 years in the case of Hersey). Proven reserves are estimated by identifying material in place that is delineated on at least two sides and material in place within a half-mile radius or distance from an existing sampled mine entry or exploration core hole. Probable reserves are estimated by identifying material in place within a one mile radius or distance from an existing sampled mine entry or exploration core hole. Historical extraction ratios from the many years of mining results are then applied to both types of material to estimate the proven and probable reserves. We believe that all reserves and non-reserve potash mineralization reported below are potentially recoverable using existing production shaft and refinery locations.

Our estimated recoverable potash reserves and non-reserve potash mineralization as of May 31, 2005 for each of our mines is as follows:

| | | | | | |

| | | Reserves (1)(2)

| | Potash Mineralization (1)(3)

|

| | | Millions of

Recoverable Tonnes

| | Average Grade

(% K2O)

| | Millions of Potentially Recoverable Tonnes

|

Canadian Mines | | | | | | |

Belle Plaine | | 686 | | 18.0 | | 1,921 |

Colonsay | | 260 | | 26.4 | | 166 |

Esterhazy | | 486 | | 24.5 | | 240 |

| | |

| |

| |

|

sub-totals | | 1,432 | | 21.7 | | 2,327 |

| | | |

United States Mines | | | | | | |

Carlsbad | | 101 | | 9.7 | | 0 |

Hersey | | 40 | | 26.7 | | 0 |

| | |

| |

| |

|

sub-totals | | 141 | | 14.6 | | 0 |

Totals | | 1,573 | | 21.1 | | 2,327 |

| (1) | There has been no third party review of reserve estimates within the last three years. The reserve estimates have been prepared in accordance with the standards set forth in Industry Guide 7 promulgated by the SEC. |

-13-

| (2) | Includes both proven and probable reserves. |

| (3) | The non-reserve potash mineralization reported in the table in some cases extends to the boundaries of the mineral rights we own or lease. Such boundaries are up to 14 miles from the closest existing sampled mine entry or exploration core hole. |

As discussed more fully below, we either own the reserves and mineralization shown above or lease them pursuant to mineral leases that generally remain in effect or are renewable at our option, or are long-term leases. Accordingly, we expect to be able to mine all reported reserves that are leased prior to termination or expiration of the existing leases.

Canadian Mines

We have three Canadian potash facilities containing four mines, all located in the southern half of the Province of Saskatchewan, including our mine at Belle Plaine, two interconnected shaft mines at Esterhazy and our mine at Colonsay.

Extensive potash deposits are found in the southern half of the Province of Saskatchewan. The potash ore is contained in a predominantly rock salt formation known as the Prairie Evaporites. The evaporite deposits are bounded by limestone formations and contain the potash beds. Three potash deposits of economic importance occur in the Province, the Esterhazy, Belle Plaine and Patience Lake members. The Patience Lake member is mined at Colonsay, and the Esterhazy member at Esterhazy. At Belle Plaine all three members are mined. The major potash members each contain several potash beds of different thicknesses and grades. The particular beds mined at Colonsay and Esterhazy have a mining height of 11 and 8 feet, respectively. At Belle Plaine several beds of different thicknesses are mined.

Our four potash mines in Canada produce muriate of potash exclusively. Esterhazy and Colonsay utilize shaft mining while Belle Plaine utilizes solution mining technology. Traditional potash shaft mining takes place underground at depths of over 3,000 feet where continuous mining machines cut out the ore face and load it on to conveyor belts. The ore is then crushed, moved to storage bins and then hoisted to refineries above ground. In contrast, our solution mining process involves heated water, which is pumped through a “cluster” to dissolve the potash in the ore beds at a depth of approximately 5,000 feet. A cluster consists of a series of boreholes drilled into the potash ore by a portable, all-weather, electric drilling rig. A separate distribution center at each cluster controls the brine flow. The solution containing dissolved potash and salt is pumped to a refinery where sodium chloride, a co-product of this process, is separated from the potash through the use of evaporation and crystallization techniques. Concurrently, solution is pumped into a 130 acre cooling pond where additional crystallization occurs and the resulting product is recovered via a floating dredge. Refined potash is dewatered, dried and sized. Our Canadian operations produce 17 different potash products, including industrial grades, many through proprietary processes.

Under a long-term contract with PCS, we mine and refine PCS reserves at the Esterhazy mine for a fee plus a pro rata share of production costs. The specified quantities of potash to be produced for PCS may, at the option of PCS, amount to an annual maximum of approximately 0.9 million tonnes and a minimum of approximately 0.45 million tonnes per year. The current contract extends through June 30, 2006 and is renewable at the option of PCS for four additional five-year periods, provided that PCS has not received all of its available reserves under the contract.

-14-

Our potash mineral rights in the Province of Saskatchewan consist of the following:

| | | | | | | | |

| | | Belle Plaine

| | Colonsay

| | Esterhazy

| | Total

|

Acres | | | | | | | | |

Owned in fee | | 12,733 | | 10,057 | | 109,205 | | 131,995 |

Leased from Province | | 47,840 | | 60,106 | | 70,614 | | 178,560 |

Leased from others | | — | | 320 | | 22,837 | | 23,157 |

| | |

| |

| |

| |

|

Total | | 60,573 | | 70,483 | | 202,656 | | 333,712 |

We believe that our mineral rights in Saskatchewan are sufficient to support current operations for more than a century. Leases are generally renewable at our option for successive terms, generally of 21 years each, except that certain of the acres shown above as “Leased from others” are leased under long-term leases with terms (including renewals at our option) that expire from 2094 to 2142. Royalties, established by regulation of the Province of Saskatchewan, amounted to $16.1 million in fiscal year 2005, $9.9 million in fiscal year 2004, and $7.5 million in fiscal year 2003.

The Belle Plaine and Colonsay facilities, including owned and leased mineral rights, respectively, are subject to the mortgage granted under our senior secured credit facility. Our senior secured credit facility is described under “Capital Resources and Liquidity” in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of our annual report to stockholders. This information is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Since December 1985, we have experienced an inflow of water into one of our two interconnected potash mines at Esterhazy, Saskatchewan. As a result, we have incurred expenditures, certain of which have been capitalized while others have been charged to expense, to control the inflow. Since the initial discovery of the inflow, we have been able to meet all sales obligations from production at the mines. We have considered alternatives to the operational methods employed at Esterhazy. However, the procedures we utilize to control the water inflow have proven successful to date, and we currently intend to continue conventional shaft mining. Despite the relative success of these measures, there can be no assurance that the amounts required for remedial efforts will not increase in future years or that the water inflow or remediation costs will not increase to a level which would cause us to change our mining process or abandon the mines. While shaft mining, in general, poses safety risks to employees, it is our opinion and that of our independent advisors that the water inflow at Esterhazy does not create an unacceptable or unmanageable risk to employees. The current operating approach and related risks are reviewed on a regular basis.

Our underground potash mine operations are presently insured against business interruption and risk from catastrophic perils, including collapse, floods and other property damage with the exception of flood coverage at Esterhazy. Due to the ongoing water inflow problem at Esterhazy, underground operations at this facility are currently not insurable for water incursion problems. Like other potash producers’ shaft mines, our Colonsay mine is also subject to the risks of inflow of water as a result of its shaft mining operations.

United States Mines

In the U.S., we have two potash facilities, including a shaft mine located in Carlsbad, New Mexico and a solution mine located in Hersey, Michigan.

Our potash mineral rights in the United States consist of the following:

| | | | | | |

| | | Carlsbad

| | Hersey

| | Total

|

Acres under control | | | | | | |

owned in fee | | — | | 581 | | 581 |

long term leases | | 65,635 | | 1,799 | | 67,434 |

| | |

| |

| |

|

Total under control | | 65,635 | | 2,380 | | 68,015 |

The Carlsbad ore reserves are of two types: (1) sylvinite, a mixture of potassium chloride and sodium chloride,

-15-

the same as the ore mined in Saskatchewan, and (2) langbeinite, a double sulfate of potassium and magnesium. These two types of potash reserves occur in a predominantly rock salt formation known as the Salado Formation. The McNutt Member of this formation consists of eleven units of economic importance, of which we mine three. The McNutt Member’s evaporite deposits are interlayered with anhydrite, polyhalite, potassium salts, clay, and minor amounts of sandstone and siltstone.

Continuous underground mining methods are utilized for the ore to be extracted. In the mining sections, drum type mining machines are used to cut the sylvinite and langbeinite ores from the face. Mining heights are as low as four and one-half feet. Ore from the continuous sections is loaded onto conveyors, transported to storage areas, and then hoisted to the surface for further processing at the refinery.

Two types of potash are produced at the Carlsbad refinery. Muriate of potash is the primary source of potassium for the crop nutrient industry. Double sulfate of potash magnesia is the second type of potash marketed under our brand name K-Mag® brand, and contains significant amounts of sulphur, potassium and magnesium, with low levels of chloride.

At the Carlsbad facility, we mine and refine potash from 65,635 acres of mineral rights. We control these reserves pursuant to either (i) various leases from the U.S. government that, in general, continue in effect at our option (subject to readjustment by the U.S. government every 20 years) or (ii) leases from the State of New Mexico that continue as long as we continue to produce from them. These reserves contain an estimated total of 101 million tonnes of potash mineralization (calculated after estimated extraction losses) in three mining beds evaluated at thickness ranging from 4.5 feet to in excess of 11 feet. At average refinery rates, these ore reserves are estimated to be sufficient to yield 5.0 million tonnes of concentrates from sylvinite with an average grade of approximately 60 percent K2O and 18.0 million tonnes of langbeinite concentrates with an average grade of approximately 22 percent K2O. At projected rates of production, we estimate that Carlsbad’s reserves of sylvinite and langbeinite are sufficient to support operations for more than 10 years and 15 years, respectively.

At Hersey, Michigan, we operate a solution mining facility which produces salt and potash. Mining occurs in the Michigan Basin in a predominantly rock salt formation called the Salina Group Evaporite. This formation is a clean salt deposit with interlayered beds of sylvinite and carbonate. At the Hersey facility, our mineral rights consist of 581 acres owned in fee and 1,799 acres controlled under leases that, in general, continue in effect at our option as long as we continue our operations at Hersey. These lands contain an estimated 40 million tonnes of potash mineralization contained in two beds ranging in thickness from 14 to 30 feet. We estimate that these reserves are sufficient to yield 17.1 million tonnes of concentrates from sylvinite with an average grade of 63 percent K2O. At current rates of production, we estimate that these reserves are sufficient to support operations for more than 115 years.

The Hersey facility, including owned and leased mineral rights, is subject to the mortgage granted under our senior secured credit facility. Our senior secured credit facility is described under “Capital Resources and Liquidity” in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of our annual report to stockholders. This information is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Royalties for the U.S. operations, which are established by the U.S. Department of the Interior, Bureau of Land Management, in the case of the Carlsbad leases from the U.S. government, and pursuant to provisions set forth in the leases, in the case of the Carlsbad state leases and the Hersey leases, amounted to approximately $6.4 million in fiscal year 2005, $4.4 million in fiscal year 2004, and $4.5 million in fiscal year 2003, respectively.

Natural Gas

Natural gas is a significant raw material used in the potash solution mining process. The purchase, transportation and storage of natural gas amounted to approximately 14 percent of Potash’s production costs for 2005. Our two solution mines accounted for approximately 76 percent of Potash’s total natural gas requirements for potash production. We purchase a portion of our requirements through fixed price physical contracts and use forward contracts to fix the price of an additional portion of future purchases. The remainder of our requirements is purchased either on the domestic spot market or under short-term contracts.

-16-

Sales and Marketing

For a discussion of the Potash sales and marketing, see “Sales and Marketing Activities” later in this report.

Offshore

Offshore is comprised of port facilities, blending and distribution operations in several countries throughout the world and includes our ownership interest in production facilities in Brazil and China. Offshore serves as a market for Phosphate and Potash but also purchases and markets products from other suppliers worldwide. Offshore operates both bulk blending facilities and NPK plants to meet our customers’ needs. A NPK plant combines varying amounts of nitrogen, phosphorous and potassium into a single granule as compared to a bulk blending plant, which combines several products of different analysis to make a mixture. A NPK granule will consistently deliver all the nutrients to the plant uniformly without concern about segregation of the individual products.

Offshore markets fertilizer products and provides other ancillary services to wholesalers, cooperatives, independent retailers, and farmers in South America, Europe, and the Asia-Pacific regions through blending and bagging facilities, NPK plants, port terminals, warehouses and sales and technical offices.

Brazil

We are the second largest producer and distributor of blended fertilizers for agricultural use in Brazil. Our fertilizer operations, together with our investments in other Brazilian fertilizer companies allows us to be vertically integrated and gives us a significant presence in the Brazilian fertilizer market.

We operate bulk blending plants in eight locations in Brazil including two new bulk-blend plants constructed this year, at Sorriso in the Mato Grosso state and Rio Verde in the Goias state. We have a single superphosphate (SSP) plant, a NPK plant and a feed phosphate plant at Cubatao. Together these plants distribute approximately 2.3 million tonnes of fertilizer in Brazil, accounting for 10.5 percent of the 22.6 million tonne market in the calendar year 2004.

Our Brazilian operations include a 62.05 percent ownership interest in Fospar, S.A., which we refer to as Fospar, and a 45 percent ownership interest in IFC, S.A., which we refer to as IFC. Fospar operates two major assets located in Paranagua, including a SSP granulation plant and a deep-water fertilizer port and throughput warehouse terminal facility, which serves the state of Parana and the West Central Region of Brazil. IFC’s operations include a blending and storage facility in Cubatao.

We also own an approximate one-third ownership interest in Fertifos, S.A., which we refer to as Fertifos. Fertifos is a Brazilian holding company that controls 55.8 percent of Fosfertil, S.A., a Brazilian publicly traded company, which we refer to as Fosfertil. Fosfertil owns 100 percent of Ultrafertil, S.A. Fosfertil is the largest phosphate based fertilizer manufacturer in Brazil, operating a phosphate rock mine and a phosphate processing facility. Ultrafertil is a significant nitrogen company in Brazil that operates two nitrogen plants, a modern port facility at Santos, a phosphate rock mine and two smaller phosphate processing facilities. In addition to our ownership interest in these entities, we have an off-take agreement to purchase phosphate rock, finished nitrogen and phosphate products totaling approximately 510,000 tonnes from Fosfertil and Ultrafertil for use in our Brazilian bulk-blending operations.

-17-

Argentina

Our subsidiary, Mosaic Argentina S.A., supplies products and services to wholesale, retail and large farmer customers. We distribute approximately 360,000 tonnes of nitrogen, phosphate and blended fertilizers in Argentina. In addition, we provide agency services for Phosphates for sales to other importers.

Our largest asset is the port facility and warehouse in Quebracho, which is located near Rosario on the Parana River. In addition to supporting our own fertilizer operations, the facility also provides logistics services to third parties and provided throughput services for 300,000 tonnes of product for third parties in fiscal year 2005. We also lease space at Necochea and Bahia Blanca to serve customers in the southern region of Argentina.

In May 2005, we announced the expansion of our Quebracho facility with the construction of a new SSP plant that will produce up to 240,000 tonnes of GSSP per year. We expect the plant to be operational in the third quarter of fiscal year 2006.

China

Since the mid-1990s, CCN has developed and expanded its fertilizer distribution business in the world’s largest phosphate market through wholly owned businesses as well as through alliances with local strategic partners.

Yunnan Three Circles Sinochem Cargill Fertilizers Co., Ltd.

In 2000, CCN expanded its presence in China by investing in a state-of-the-art domestic phosphate granulation facility known as Yunnan Three Circles Sinochem Cargill Fertilizers Co., Ltd., which we refer to as Yunnan. Yunnan is a joint venture in which Mosaic owns a 35 percent equity stake. Yunnan’s phosphate granulation plant near Kunming in the Yunnan Province in south central China brings together our technical expertise and that of Yunnan Three Circles Chemical Co., with the importing capabilities of Sinochem, the local distribution network of Yantai Municipal Agricultural Means of Production, and the product quality and brand recognition of Cargill. In connection with the Combination, we were granted a five year royalty free trademark license which allows us to use Cargill’s brand to market our products. We are also building the Mosaic brand in China and elsewhere.

Yunnan commenced production in August 2002, and currently has an annual DAP production capacity of approximately 600,000 tonnes. The company began marketing DAP under the Cargill brand in February 2003.

Yunnan produces DAP for shipment to north and northwest China and Sinochem is among its largest customers. Phosphoric acid used in the production of DAP at Yunnan is purchased from Yunnan Three Circles Chemical Co. Ammonia used in production of DAP is sourced from local producers. Yunnan’s operation is limited by access to raw materials and railcar supply. Improvements to these logistics challenges, however, are expected in the coming years as local suppliers increase production capacities.

Bonded Warehouse Program

Acting as agents, we handle up to 800,000 tonnes of DAP annually through bonded warehouse programs. Chinese importers are able to purchase fertilizer products from strategically located bonded warehouses at Chinese ports. The bonded warehouse program is attractive to Chinese importers because it permits customers to purchase product on a just-in-time basis, reducing market risks from both large vessel purchases and long ocean voyages. As a customer and quality assurance service, we handle and manage the supply chain deliveries for fertilizer vessels until discharged in China, and also act as a bagging, warehousing and dispatch liaison in moving fertilizer products onto trucks or railcars. We operate bonded warehouses at five ports throughout mainland China.

Mosaic Fertilizers (Yantai) Co. Ltd.

Mosaic Fertilizers (Yantai) Co., Ltd., which we refer to as Yantai, owns and operates a 200,000 tonne per year bulk blending facility in the port of Yantai, China, which was recently upgraded in fiscal year 2004. We produce and sell bulk blend fertilizers tailored to specific soil and crop requirements and provide agricultural services mainly in the Shangdong Province of China. We also act as a sales agent for other Mosaic operations in China as well as for other foreign owned fertilizer plants. Our agency volume is approximately 30,000 tonnes per year. Primary raw materials for our blended fertilizer production are granular urea, DAP, MAP, SSP, and potash.

-18-

Jiangsu Mosaic Agricultural Means of Production Co. Ltd.

Jiangsu Mosaic Agricultural Means of Production Co. Ltd., which we refer to as Jiangsu, formed in fiscal year 2003, owns and operates a 170,000 tonne per year NPK compound fertilizer production facility in the Jiangsu Province of China. We own a 60 percent interest in Jiangsu.

Jiangsu is strategically located along the Yangtze River, produces and sells NPK compounds to customers in the seven China provinces along the Yangtze River and to customers in northern China through Cargill’s operations. Jiangsu uses urea, SSP, MAP, potash, ammonium chloride and other fertilizers in the production of its NPK compounds. Most of the raw materials are sourced locally.

Mosaic Fertilizers (Qinhuangdao) Co., Ltd.

Our subsidiary, Mosaic Fertilizers (Qinhuangdao) Co. Ltd., which we refer to as Qinhuangdao, owns and operates a 200,000 tonne per year bulk blending facility in the port of Qinhuangdao, China. The plant started production in March 2005. We produce and sell bulk blend fertilizers tailored to specific soil and crop requirements and provide agricultural services in the northeast, northwest and northern parts of China. We also act as a sales agent for other Mosaic operations in China as well as for other foreign owned fertilizer plants. Primary raw materials for our blended fertilizer production are granular urea, DAP, MAP, SSP, and potash.

India

Our Indian subsidiary, Mosaic India Private Ltd., operates distribution facilities and a deep-water port facility where we import fertilizers into India. We also serve as marketing agent for Phosphates in India. Our port facility is a marine terminal at Rozy, Jamnagar on the west coast of India and we are the wholesale distributor of the leading brand of DAP, still branded under the Cargill name, within the country.

We market approximately 575,000 tonnes of phosphate products per year in the Indian market to three customer segments, including national account customers who typically are large established fertilizer producers or marketers, a joint marketing program in which we jointly distribute fertilizer through a retail network owned by Tata Chemicals and under Tata Chemical’s brand name, and in-country distribution of branded fertilizers, mainly Cargill branded DAP, to farmers through a network of wholesale and retail distributors in the northern and western states of India. Our Rozy port operations has annual throughput of approximately 485,000 tonnes.

Thailand

Mosaic International Thailand Ltd., our wholly-owned Thai subsidiary, distributes fertilizer in Thailand through a 50,000 tonne warehouse and 240,000 tonne bulk blending facility at Sriracha, Thailand. We produce and sell approximately 170,000 tonnes of bulk blends and distribute another 100,000 tonnes of straight fertilizers in Thailand each year.

We market bulk blended products, ranging from standard blends to premium brands, to various segments in the Thai market. Materials for blending include urea, DAP, potash, ammonium sulphate and other micronutrients. These raw materials typically are imported from Australia, Canada, China, Indonesia, Malaysia, and the United States.

Chile

In Chile, we market bulk blended and straight fertilizer products to retail dealers with a small percentage of sales made directly to farmers. Our sales total approximately 260,000 tonnes per year, or 24 percent of the 1.1 million tonne market. Straight products such as urea, DAP, MAP and TSP account for approximately 55 percent of sales and bulk blends, tailored to meet specific soil and crop requirements, make up the rest. Most of our nitrogen products are imported from Argentina and Venezuela.

-19-

Our key assets in Chile include warehouse and bulk blending facilities at Conception Bay and San Antonio. Our Conception Bay facility mainly serves dealers in central Chile. We also lease warehouse space at the Lirquen port at Conception Bay, where straight materials are imported and bagged. The bulk blending plant at Conception Bay (also known as Cosmito) includes a 20,000 tonne warehouse. Our San Antonio facility serves retailers in northern Chile. We also lease a facility at Puerto Montt that includes a 15,000 tonne warehouse and bulk blender as well as several satellite warehouses to serve customers in the southern Chile.

Other Offshore Operations

In addition to our Offshore locations described above, we also maintain operations and/or sales offices in the Ukraine, France, Russia, Mexico, Australia, and Hong Kong.

Sales and Marketing

For a discussion of the Offshore sales and marketing, see “Sales and Marketing Activities” later in this report.

Nitrogen

Nitrogen consists of our equity in the net income of Saskferco Products Inc., which we refer to as Saskferco and our nitrogen sales and distribution activities. The distribution activities include marketing activities for Saskferco and the sales of nitrogen products purchased from unrelated parties. We are the exclusive marketing agent for nitrogen products produced by Saskferco. Saskferco is a world-scale and energy-efficient Saskatchewan based nitrogen corporation in which we have a 50 percent ownership interest.

Principal Products

Saskferco’s principal products include the following:

Anhydrous Ammonia. Anhydrous ammonia is a high analysis nitrogen product that is used both as a direct application fertilizer mostly in North America as well as the building block for most other nitrogen products, such as urea. Ammonia, a gas at normal temperatures and pressures, is stored and transported as a liquid either under pressure or in refrigerated vessels. Farmers inject ammonia into the soil as a gas. Ammonia is a low cost source of nitrogen in markets with well-developed distribution infrastructures and specialized application equipment. Rapidly escalating costs for regulatory compliance and liability insurance have diminished the advantage of ammonia over other nitrogen products during the past few years in North America.

Urea and Feed Grade Urea. Solid urea is the most widely used nitrogen product in the world. Urea solution first is produced by reacting anhydrous ammonia with carbon dioxide (CO2) at high pressure. We then form solid, granular urea using standard granulation processes. Granular urea often is physically mixed with phosphate and potash products to make blends that meet specific soil and crop requirements. We also produce a feed grade urea marketed under the MicroGran™ brand.

Urea Ammonium Nitrate (UAN) Solution. UAN solution is the most widely used liquid fertilizer worldwide. UAN solution is produced by combining urea solution, ammonium nitrate solution and water. It contains between 28 percent and 32 percent nitrogen. The distribution of UAN solution requires specialized infrastructure and equipment for the storage, transportation and application of liquid product.

Production and Properties

Saskferco’s nitrogen plant, located near Belle Plaine, Saskatchewan, has the capacity to produce approximately 1,860 tonnes of anhydrous ammonia, 2,850 tonnes of granular urea solution, and 650 tonnes of UAN liquid fertilizer solution per day. Saskferco produces granular urea, feed grade urea, 28 percent and 32 percent UAN solution and anhydrous ammonia for customers primarily in western Canada and the northern tier of the United States.

-20-

The growth in nitrogen demand in western Canada and northern tier states of the United States since 1992 has enabled us to market an increasing share of Saskferco’s output into core markets that are located within a few hundred miles of the facility.

Sales and Marketing

For a discussion of the Nitrogen sales and marketing, see “Sales and Marketing Activities” below.

SALES AND MARKETING ACTIVITIES

United States and Canada

Mosaic has a sales and marketing team that serves our Phosphate, Potash and Nitrogen business segments and sells products purchased from unrelated third parties. We sell to wholesalers, cooperatives, independent retailers and national accounts. To service the needs of our customers, we own and operate a network of warehouse distribution facilities strategically located along or near the Mississippi and Ohio Rivers as well as in other key geographic regions of the United States. From these facilities, we market nitrogen (typically in the form of urea or UAN solution), phosphate (typically in the form of DAP, MAP, MicroEssentials™ or TSP) and potash to customers who in turn resell the product to U.S. farmers.

We own the Port Cargill fertilizer operations in Savage, Minnesota, with approximately 94,000 tonnes of dry product storage capacity, as well as warehouse distribution facilities in Pekin, Illinois (dry storage capacity of approximately 65,000 tonnes), Louisville, Kentucky (both dry and liquid storage capacity of approximately 49,000 tonnes), Hendersonville, Kentucky (both dry and liquid storage capacity of approximately 77,000 tonnes), Melbourne, Kentucky (dry storage capacity of approximately 28,000 tons) and Houston, Texas (dry storage capacity of approximately 54,000 tonnes), which has a deep water berth providing access to the Gulf of Mexico. In addition, we are a 50 percent owner of River Bend Ag, LLC, a wholesale distribution company located in New Madrid, Missouri with storage capacity of approximately 23,000 tonnes for dry products and 20,000 tonnes for liquid products.

In addition to the geographically situated facilities that we own, our U.S. wholesale distribution operations also include leased distribution space or contractual throughput agreements for dry or liquid storage in other key geographical areas such as California, Florida, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Minnesota, Nebraska, New York, North Dakota, Ohio, Pennsylvania and Texas.

Our Canadian customers include independent dealers, national accounts and Cargill AgHorizons, a retail fertilizer business unit owned by Cargill that was not contributed to us in the Combination. We also lease a warehouse facility in Clavet, Saskatchewan and own a facility in Belle Plaine, Saskatchewan.

International