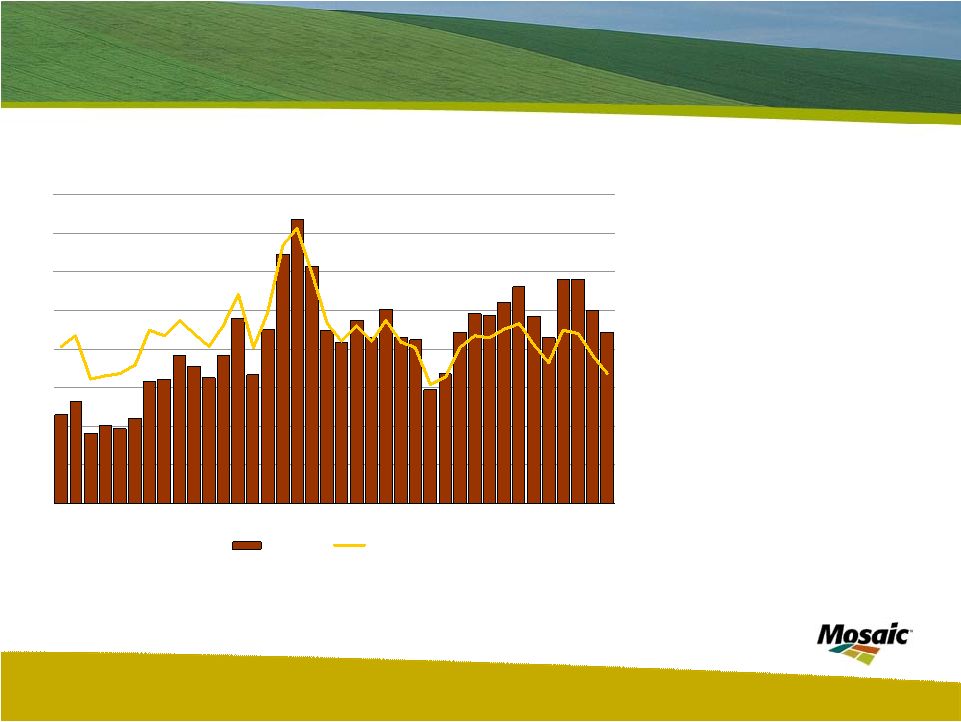

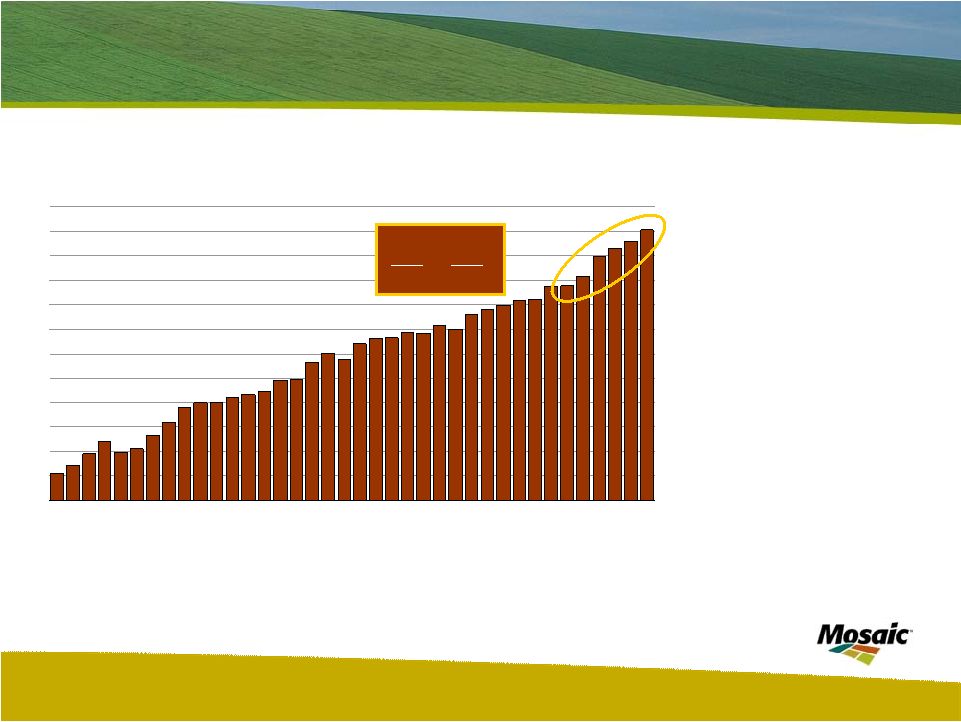

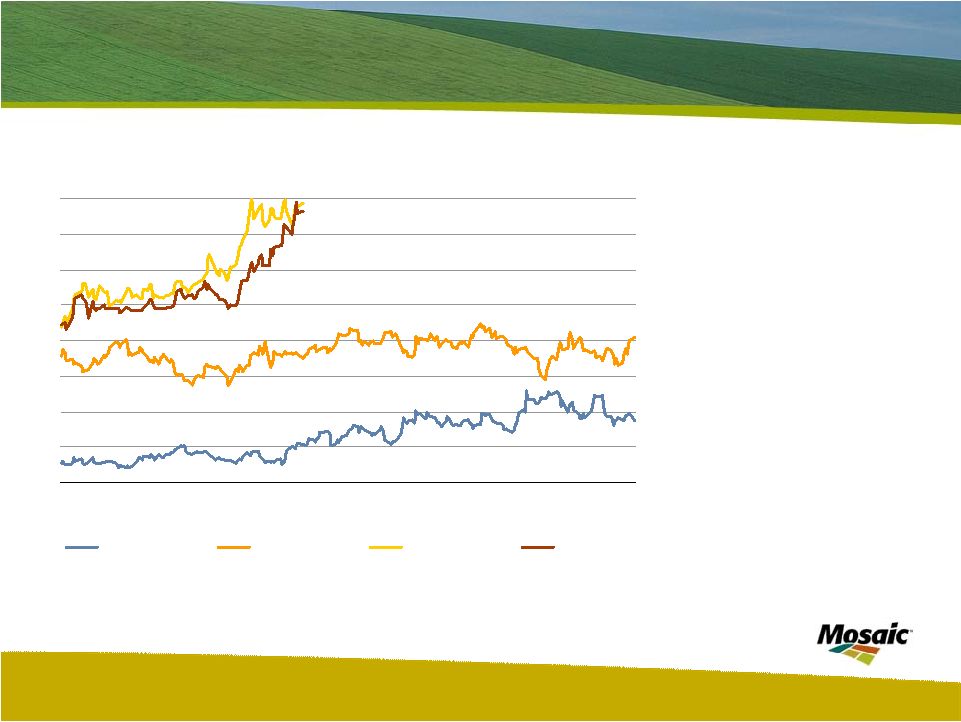

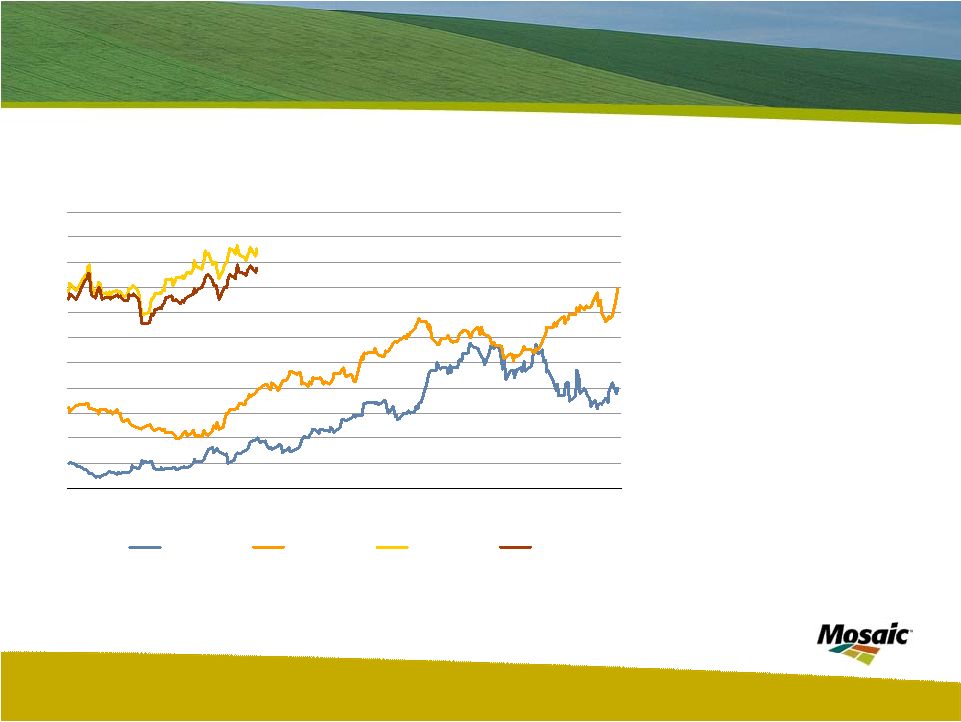

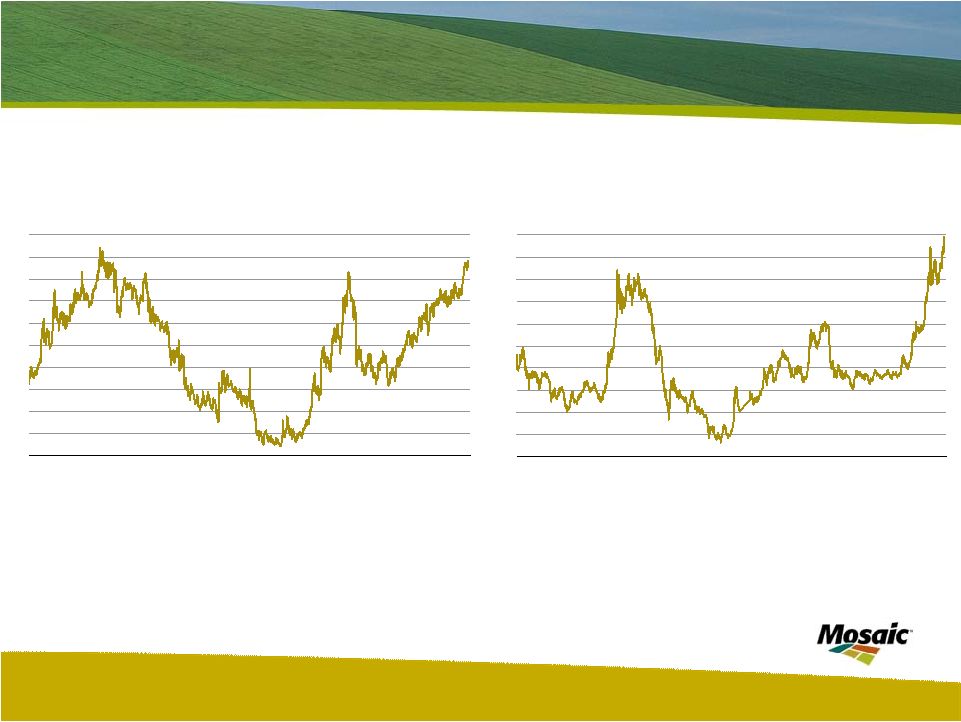

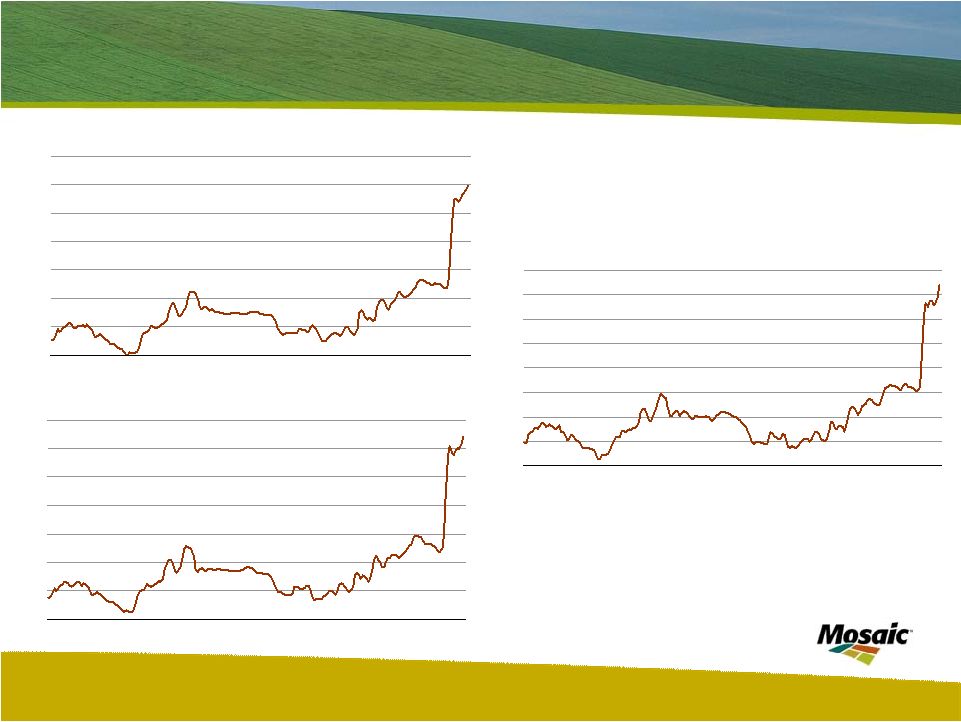

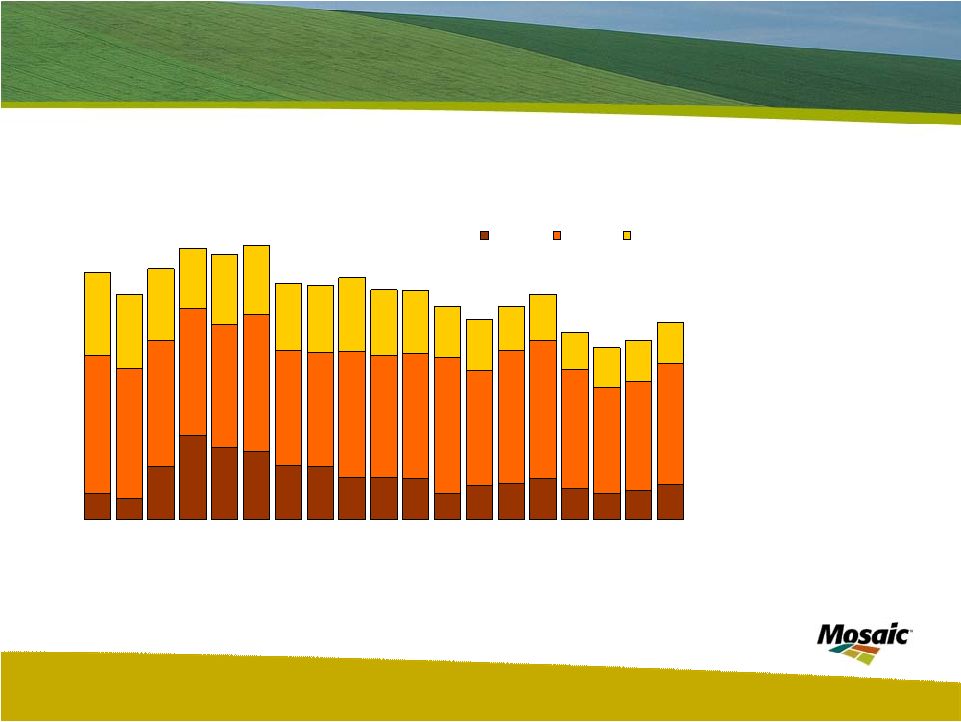

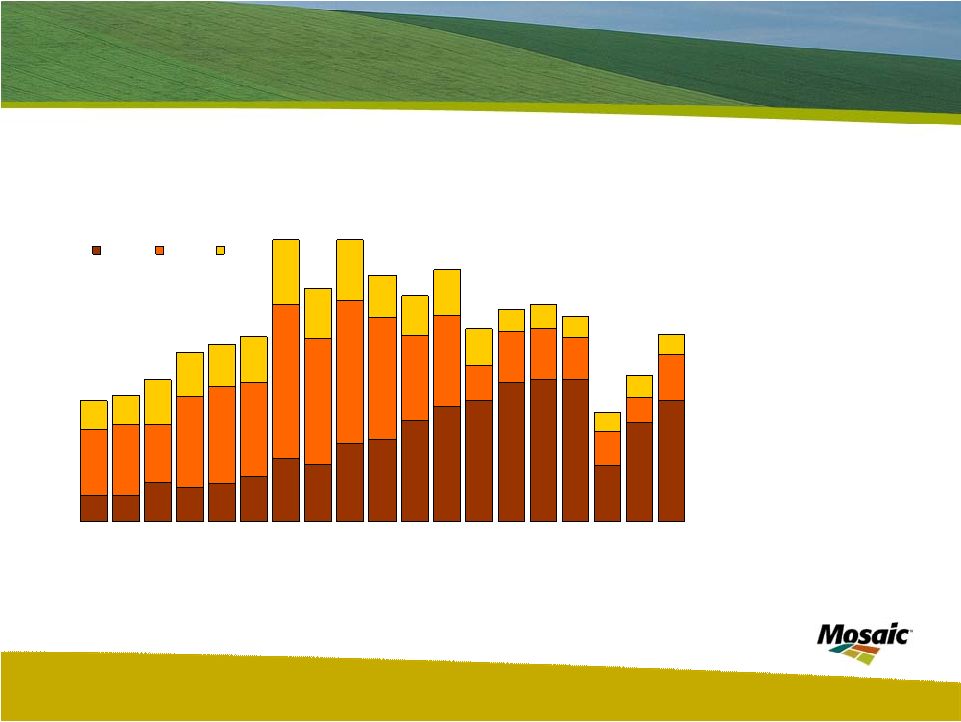

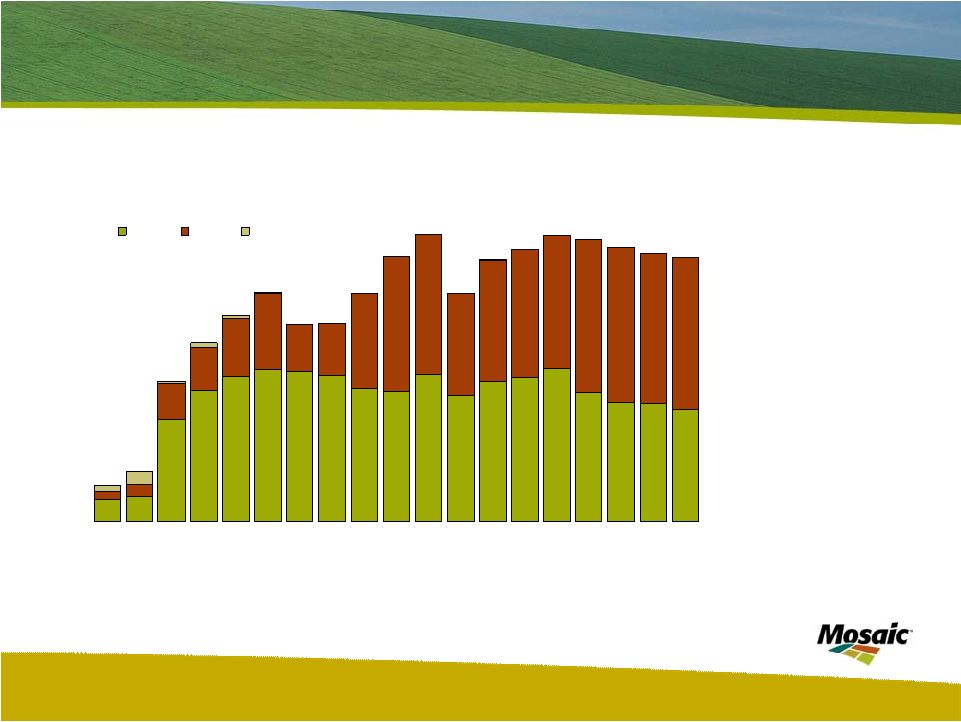

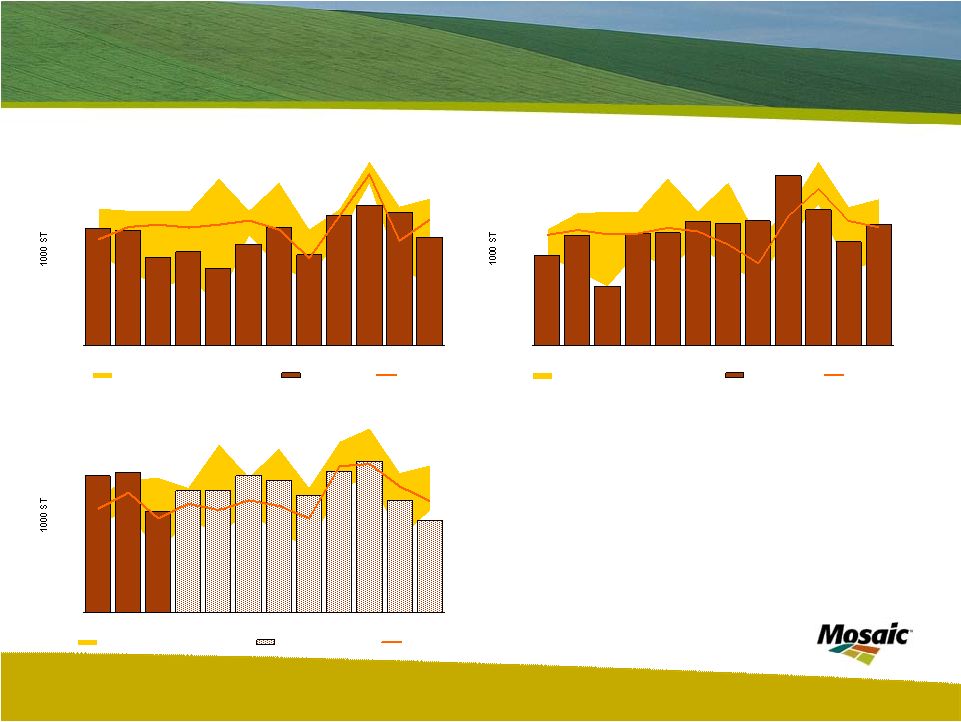

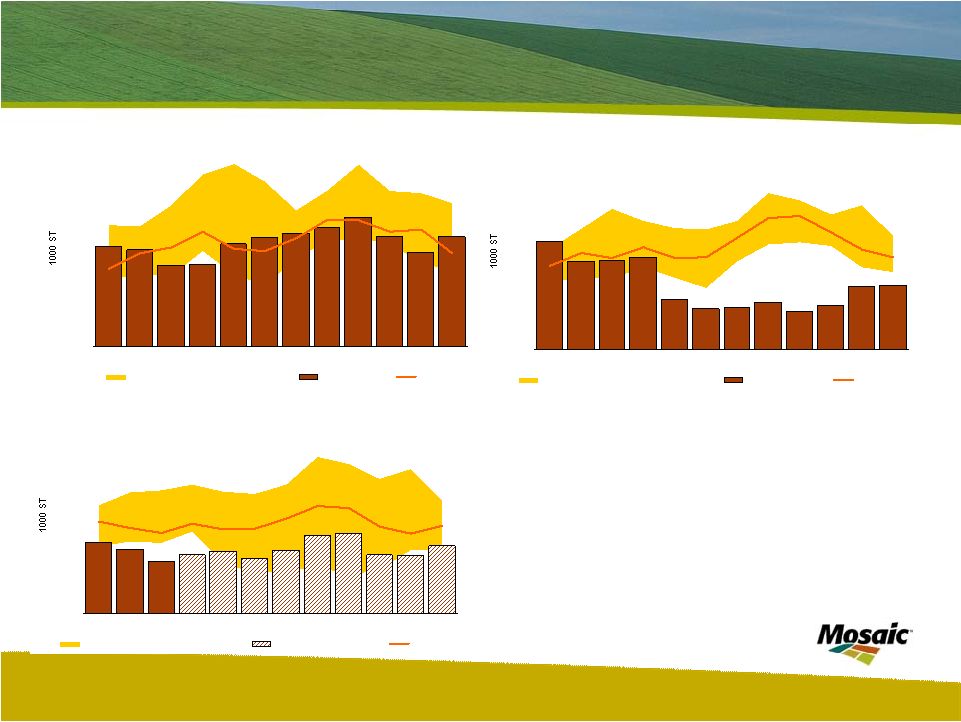

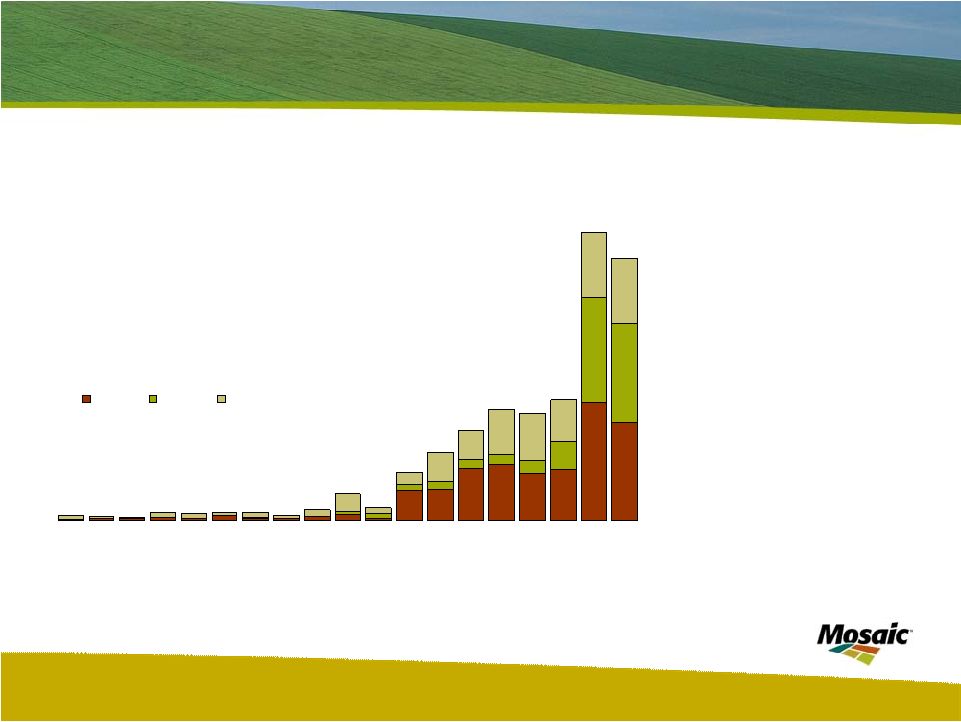

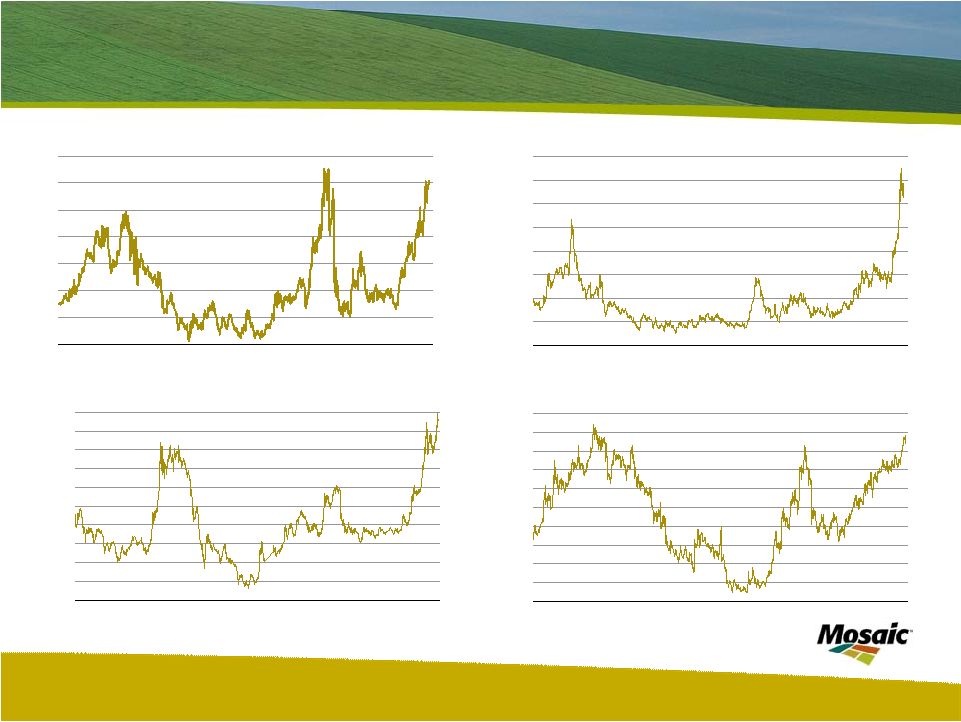

Market Analysis & Strategic Planning 12 November 7, 2007 Impact of the weak dollar Soybean Prices Monthly Average of CBOT Daily Nearby Close 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 97 98 99 00 01 02 03 04 05 06 07 08 US$ Bu 6 8 10 12 14 16 18 20 22 24 26 28 30 32 Reais Bu US$ Bu Brazilian Reais Bu MAP Prices c&f Brazil 100 150 200 250 300 350 400 450 500 550 600 00 01 02 03 04 05 06 07 08 US$ MT 200 300 400 500 600 700 800 900 1000 1100 1200 Brazil R$ MT US$ Brazil R$ Source: The Market A stronger real, however, has cushioned some of the increases in phosphate prices. For example, the c&f price of MAP peaked at R757 per tonne in August 2004. That was the result of a MAP c&f price of $252 per tonne and an exchange rate of R3.0 per US$. Today the c&f price of MAP is in the R950 per tonne range or up about 25% from the peak in 2004. The c&f price of MAP has more than doubled, but part of the increase was offset by the strengthening of the real. A stronger real has offset part of the increase in soybean prices. The real price of soybeans peaked in early 2004 at just less than R30 per bushel. In round numbers, that was the result of $10 per bushel soybeans and an exchange rate of R3 per US$. Today, soybean prices are roughly $10 per bushel, but the real has strengthened to less than R1.8 per US$. A key question is whether a CBOT price of $10 per bushel or R18 per bushel is sufficient to incent Brazilian farmers to grow a soybean crop as large as the market wants this year. |