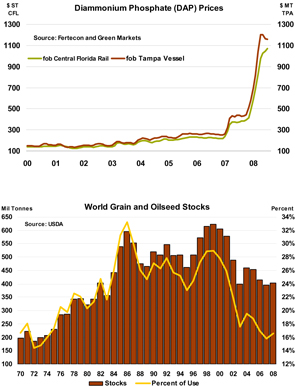

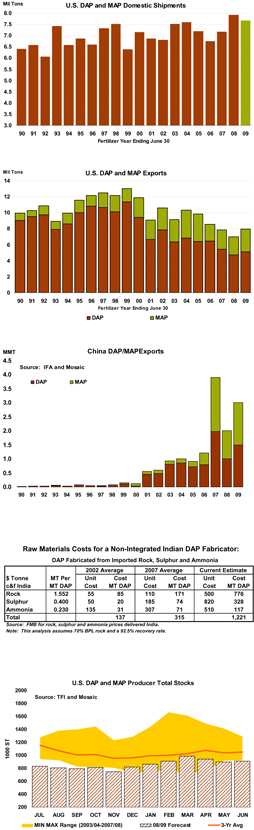

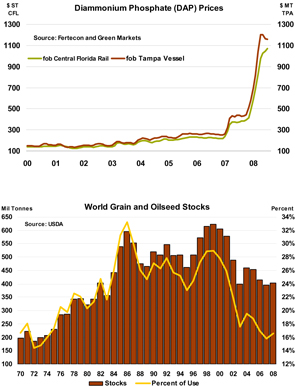

Certain statements contained herein constitute “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995. Although we believe the assumptions made in connection with the forward-looking statements are reasonable, they do involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of The Mosaic Company, or industry results generally, to be materially different from those contemplated or projected, forecasted, estimated or budgeted (whether express or implied) by such statements. These risks and uncertainties include but are not limited to the predictability of fertilizer, raw material, energy and transportation markets subject to competitive market pressures; changes in foreign currency and exchange rates; international trade risks; changes in governmental policy, including but not limited to governmental activities to address rising food and crop nutrient prices; changes in environmental and other governmental regulation; adverse weather conditions affecting operations in central Florida or the Gulf Coast of the United States, including potential hurricanes or excess rainfall; actual costs of asset retirement, environmental remediation, reclamation and other environmental regulation differing from management’s current estimates; accidents and other disruptions involving our operations, including brine inflows at our Esterhazy, Saskatchewan potash mine and other potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. | | Fundamentals Forecast to Tighten • Phosphate prices have stabilized or declined slightly following the end of the spring application season and just ahead of peak summer shipments to key importing countries such as Brazil and India. This seasonal lull appears to be a calm before the storm. Based on our handicapping of potential developments, fundamentals are forecast to strengthen significantly during the next six months. • The same factors that have driven prices to record levels during the first half of this year – namely strong demand prospects, a big expected drop in Chinese exports and higher raw material costs – are expected to tighten the phosphate market even further during the second half of the year. Positive Demand Prospects • Recent increases in agricultural commodity prices continue to under-gird a strong phosphate demand outlook worldwide. For example, the 2009 new crop prices for corn, soybeans and wheat climbed to $6.55 per bushel, $14.79 per bushel and $9.40 per bushel, respectively, at the end of June. • Despite steep increases in crop input costs, farm economics remain highly profitable for most crops in most regions of the world. That is expected to keep phosphate demand growing at the higher rates of the past few years. • Record prices and production will just stop rather than reverse the decline in global grain and oilseed stocks this decade. In fact, the latest USDA statistics show that inventories of the 16 leading grain and oilseed crops will increase only 7.4 million tonnes this year (total grain and oilseed use is projected to total 2.56 billion tonnes in 2008/09!). • U.S. phosphate use is forecast to increase 2% to 3% in 2008/09 given the prospect of a rebound in corn acreage to at least the mid-90 million acre range next spring. The latest USDA estimates indicate that U.S. corn stocks will plummet to less than 675 million bushels by the end of the 2008/09 crop year due to a smaller 2008 crop and continued strong demand from both domestic and offshore buyers. USDA right now is evaluating whether to release CRP acres for the 2009 planting season. • As a result, U.S. DAP/MAP shipments are forecast to remain at high levels in 2008/09. In fact, shipments are projected to total 7.7 million tons, the second highest level in recent history but down about 3% or 260,000 tons from 2007/08. • U.S. DAP/MAP shipments climbed to a record 7.9 million tons in 2007/08, an increase of 10% or more than 700,000 tons from a year earlier. U.S. phosphate use, however, likely declined about 2% due mostly to the drop in planted corn acreage. Producers no doubt shipped more product into the pipeline than was used in 2007/08, but some restocking was needed given the hard flushing of the system during the two previous years. |