Exhibit 99

Market Analysis and Strategic Planning

analysis@mosaicco.com

Potash Outlook

Still struggling to keep up with demand

July 30, 2008

Certain statements contained herein constitute “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995. Although we believe the assumptions made in connection with the forward-looking statements are reasonable, they do involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of The Mosaic Company, or industry results generally, to be materially different from those contemplated or projected, forecasted, estimated or budgeted (whether express or implied) by such statements.

These risks and uncertainties include but are not limited to the predictability of fertilizer, raw material, energy and transportation markets subject to competitive market pressures; changes in foreign currency and exchange rates; international trade risks; changes in governmental policy, including but not limited to governmental activities to address rising food and crop nutrient prices; changes in environmental and other governmental regulation; adverse weather conditions affecting operations in central Florida or the Gulf Coast of the United States, including potential hurricanes or excess rainfall; actual costs of asset retirement, environmental remediation, reclamation and other environmental regulation differing from management’s current estimates; accidents and other disruptions involving our operations, including brine inflows at our Esterhazy, Saskatchewan potash mine and other potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

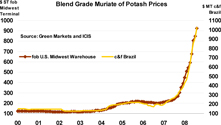

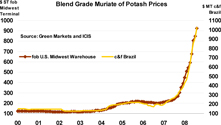

Strong and Steady Offshore Demand

| • | | The potash market remains extremely tight as mines continue to struggle to keep up with surging demand. Prices took another large step up this summer and likely will move to levels that are required to ration some demand and allocate available supplies to their highest value uses. |

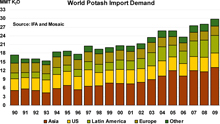

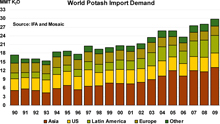

| • | | After jumping 16% in 2007, world import demand is projected to increase another 2% in 2008 — despite the fact that Chinese imports plunged 51 percent during the first half of the year and are projected to drop more than 30 percent for the entire year. |

• | | Demand prospects next year look even better given the likelihood of timely settlements of record volume contracts with Chinese customers and continued strong demand in other key importing countries. In fact, import demand is forecast to climb another 7% to almost 30 million tonnes K2O in 2009 (or 50 million tonnes KCL). World import demand is up 45% or more than nine million tonnes K2O this decade (or 15 million tonnes KCL). |

| • | | Higher grain and oilseed prices and profitable farm economics for many potash-intensive crops such as palm oil, rice and soybeans have stoked demand in large importing countries in Asia and Latin America. Brazil imported 6.7 million tonnes of potash (KCL) in 2007, up 32 percent from the lower level of 2006, and imports are forecast to increase another seven percent or almost one-half million tonnes to 7.2 million tonnes in 2008. Imports during the first half of 2008 totaled 3.7 million tonnes, up 22 percent or more than 660,000 tonnes from the same period a year ago. |

| • | | The latest statistics from the Fertilizer Association of India (FAI) show that India has stepped up potash imports this year. It is no coincidence that India is growing a bin-buster crop due to more intensive and balanced nutrient use along with a little help from Mother Nature. India imported almost 2.8 million tonnes of potash (KCL) during the first half of 2008, up a whopping 92 percent or 1.3 million tonnes from the first half of 2007. Imports for the entire year are projected to climb to 4.9 million tonnes. |

| • | | Chinese potash imports are projected to decline to 6.4 million tonnes KCL in 2008, down from a record 9.4 million tonnes last year. However, 2.5 million of the 3.0 million tonne decline took place during the first half of this year. The sharp drop in imports this year coupled with improving demand prospects is expected to deplete the Chinese pipeline by year end. As a result, we project that China will import near record volumes next year. |

• | | The latest statistics from the International Plant Nutrition Institute (IPNI) show that Canadian offshore exports increased six percent to a record 7.0 million tons K2O (or approximately 10.4 million tonnes KCL) in 2007/08. Offshore shipments are projected to increase another nine percent to 7.7 million tons K2O (or about 11.4 million tonnes KCL) in 2008/09. |

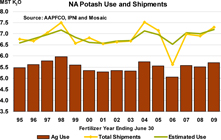

More corn acres boost NA demand outlook

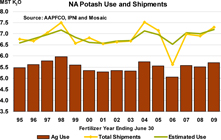

| • | | On the domestic front, potash demand and shipments declined slightly but remained at high levels in 2007/08. We estimate that U.S. agricultural use declined one to two percent due to the shift in acreage from corn to soybeans and wheat as well as steady application rates on major crops. |

• | | The latest statistics from IPNI and the U.S. Department of Commerce indicate that North American potash shipments or the total amount of potash pushed into the distribution pipeline by producers and importers dropped about one percent to 6.9 million tons K2O in 2007/08. |

| • | | North American potash use and shipments are forecast to increase moderately in 2008/09. We project that U.S. farmers will plant 94 to 95 million acres of corn next spring and will not cut potash application rates on the major crops. U.S. agricultural use is projected to increase about 3.0 to 3.5 percent. |

• | | North American shipments are forecast to increase 5.5 to 6.0 percent to about 7.3 million tons K2O in 2008/09 due to projected increases in U.S. and Canadian agricultural and industrial demand as well as a small restocking of a depleted distribution pipeline. |

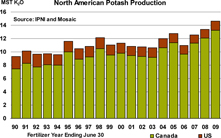

NA production sputters as producers step on the accelerator

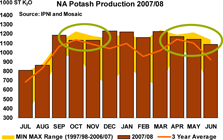

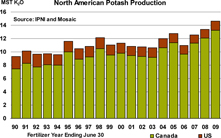

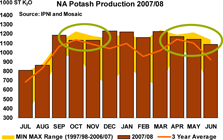

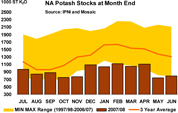

• | | IPNI statistics and estimates for non-KCL production show that North American potash output increased six percent to a record 13.4 million tons K2O in 2007/08. Mines sputtered, especially last fall and again this spring, as producers stepped on the accelerator in order to meet speeding demand. In particular, production in October, November, April and June barely exceeded the three year average for the month despite recent capacity expansions by all three producers. |

• | | Offshore and domestic demand totaled about 14.2 million tons K2O in 2007/08 (7.3 million tons of exports and 6.9 million tons of domestic shipments). The 800,000 tons difference between total demand and production was filled by offshore imports of approximately 450,000 tons K2O and a drawdown of producer stocks of about 350,000 tons. |

• | | North American demand is projected to total about 15.3 million tons K2O in 2008/09 (8.0 million tons of exports and 7.3 million tons of domestic shipments). We estimate that North American production will increase another 10 percent to 14.7 million tons K2O in 2008/09 due to the start-up of additional capacity this summer and more consistent operating rates at existing mines. Imports and further small declines in producer stocks are expected to fill the 600,000 ton K2O gap between demand and production. |

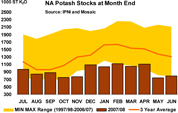

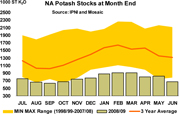

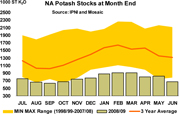

NA stocks projected to remain at extremely low levels

• | | Stocks held by producers at both on- and off-site facilities declined to just 791,000 tons K2O on June 30, 2008. That was less than six percent of total shipments and was the lowest percentage in recent history. Producer stocks are projected to remain at extremely low levels throughout the 2008/09 fertilizer year based on these demand and supply forecasts. Producers will have to manage supply chains with even lower stocks than last year or price will need to ration some demand. Either way, we expect that supply again will struggle to keep up with projected demand throughout the 2008/09 fertilizer year. |