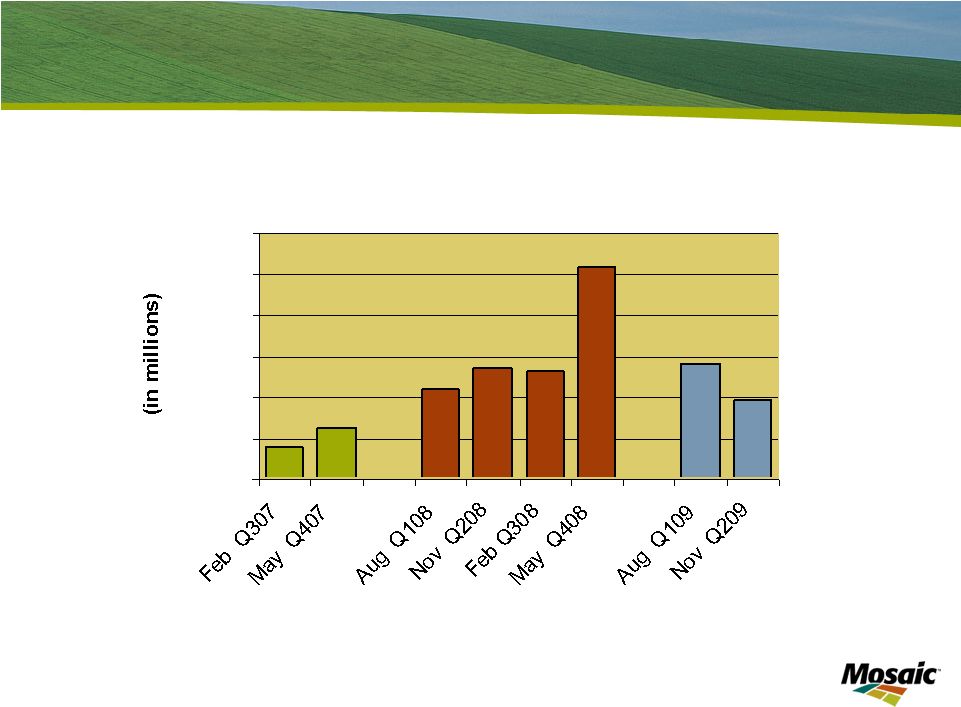

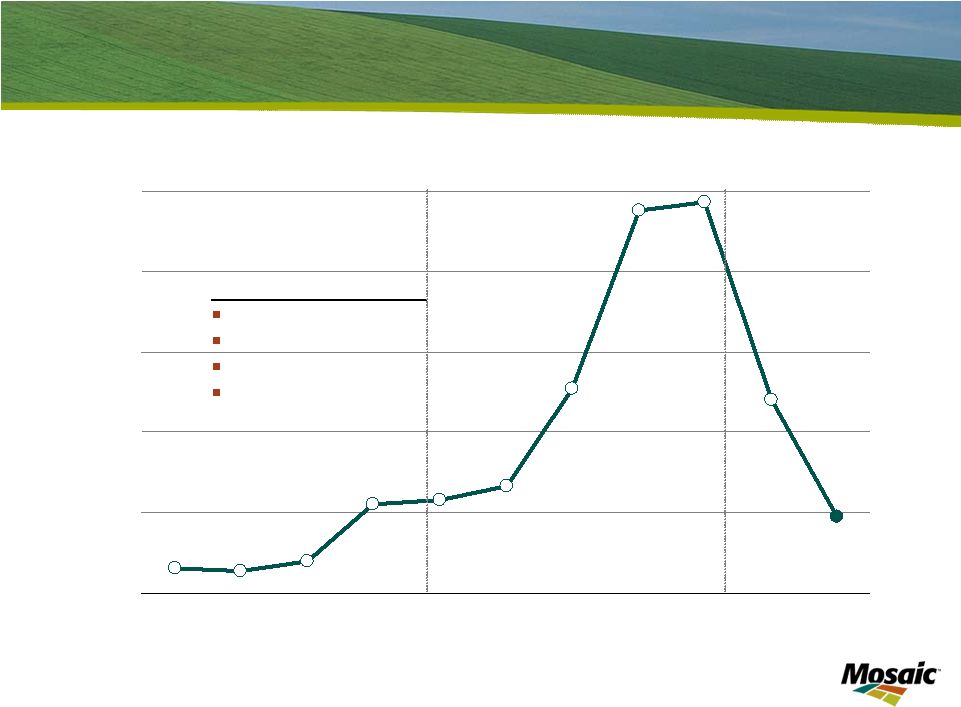

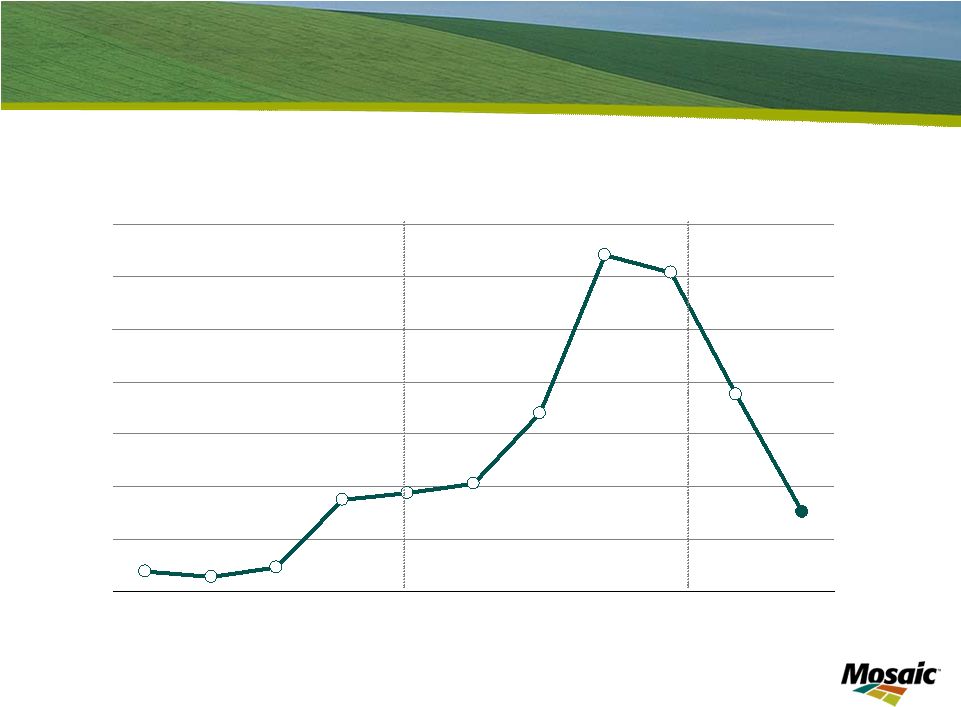

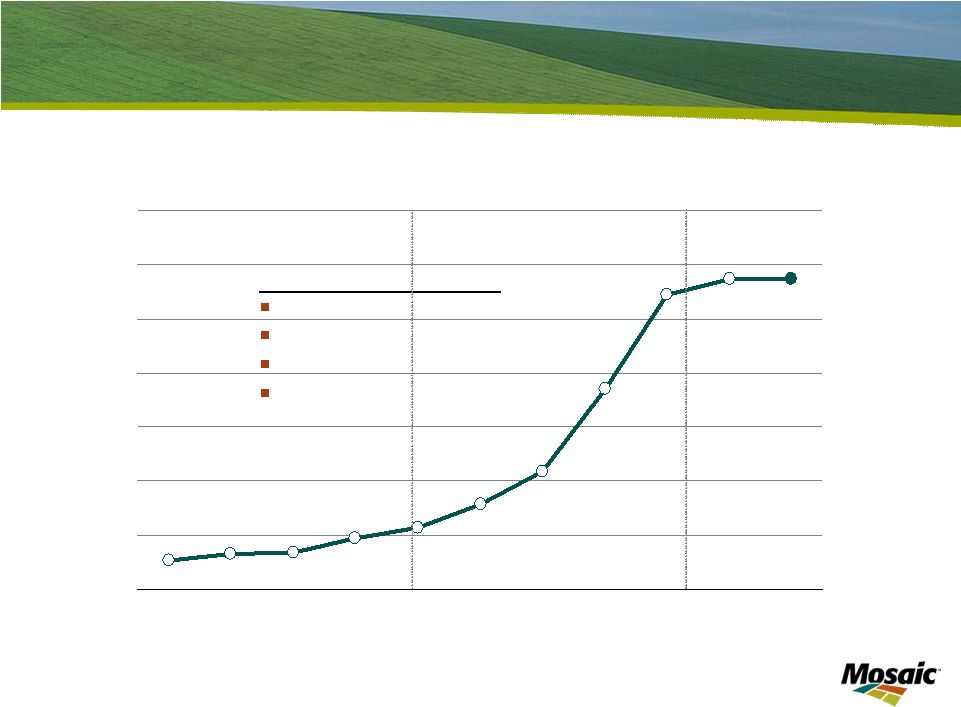

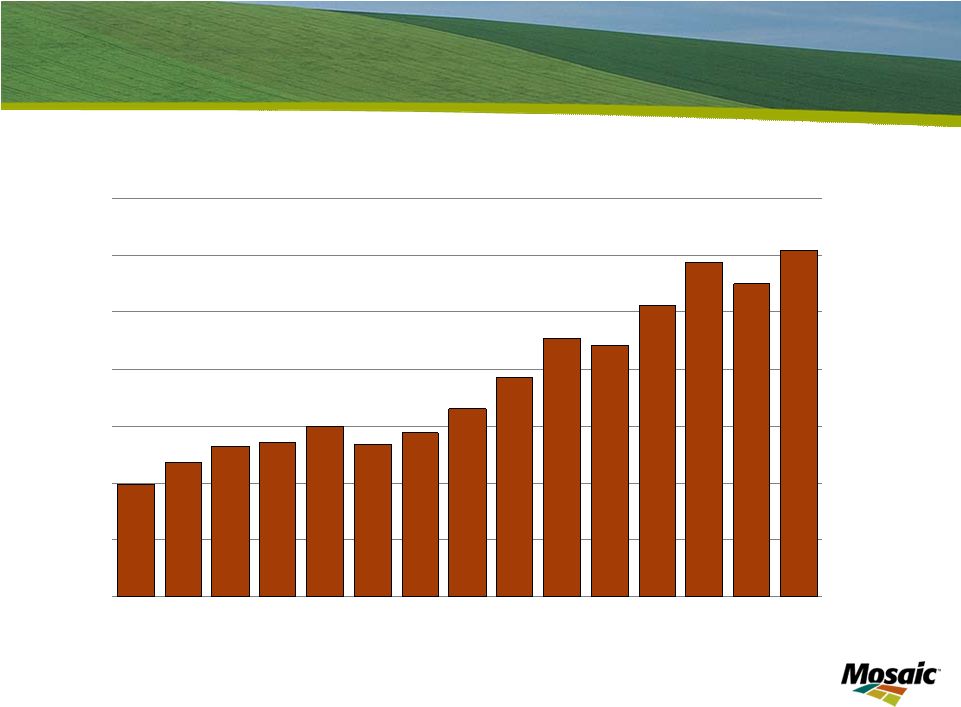

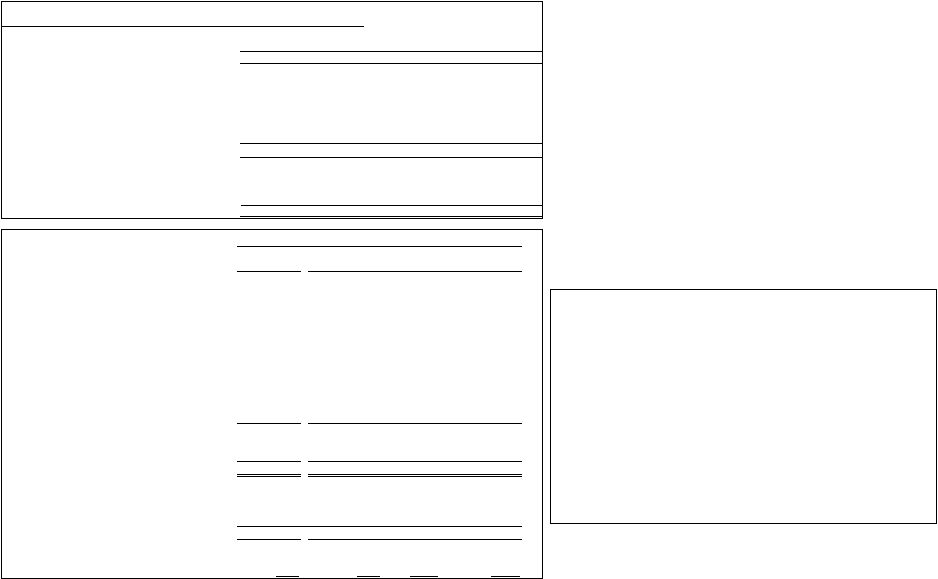

Appendix: Non-GAAP Financial Measure Reconciliation Return on Invested Capital Our return on invested capital (“ROIC”) is a measure of value creation and how effectively we allocate capital in our core operations. We believe ROIC is a metric that is most closely correlated with stockholder value. We also use ROIC as part of our initial capital spending and potential acquisition review processes to ensure that each capital dollar spent achieves a certain hurdle rate of return. There are limitations in the use of ROIC due to the subjective nature of items excluded by management in calculating ROIC. This non-GAAP measure is provided as supplemental information and should not be considered in lieu of the GAAP measures. Management uses ROIC to measure how effectively we are allocating capital, and therefore, management believes this information is useful to investors. We define ROIC as follows: • Numerator (net operating profit after taxes): + Operating earnings - Taxes at effective tax rate on operating earnings + Equity in net earnings of nonconsolidated companies - Minority interest in consolidated companies = Net operating profit after taxes • Denominator (average invested capital, trailing five point average): + Total Assets Less Non-interest bearing liabilities: Accounts payable Trade accounts payable due to Cargill, Inc. and affiliates Cargill prepayments and accrued liabilities Accrued liabilities Deferred income tax liabilities - current Deferred income tax liabilities – noncurrent Other noncurrent liabilities Total non-interest bearing liabilities - Minority interest in consolidated companies = Invested capital ROIC: Net operating profit after taxes / Average invested capital We had ROIC of 2.3%, 8.0%, 30.2% and 36.5% for fiscal 2006, 2007 and 2008 and the twelve months ended November 30, 2008, respectively. The reconciliations to the most comparable U.S. GAAP measurements for the numerator and denominator are as follows (in millions and unaudited): |