- MOS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

The Mosaic Company (MOS) 8-KRegulation FD Disclosure

Filed: 5 May 10, 12:00am

UBS Global Agricultural Chemicals and Seed Conference Jim Prokopanko, President and Chief Executive Officer May 5, 2010 |

Good afternoon-everyone. I’m delighted to have the opportunity to speak with you today about Mosaic, the outstanding long-term outlook for the crop nutrient industry and our strong market position in both Potash and Phosphates. We’d like to thank Don Carson for coverage of the sector and sponsoring this conference. Following a year of challenging economic events and considerable uncertainty, I’m happy to say 2010 has already presented dramatic improvement. We have already experienced tangible evidence of a return to normal activity and expect continued improvements in demand for our products. Mosaic is uniquely positioned as a leading supplier of both potash and phosphate products needed by grain and oilseed producers worldwide. This unique paring of nutrients will benefit our customers and shareholders and help the world produce the food it needs. |

Slide 2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and the effects of the current economic and financial turmoil; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation; difficulties or delays in receiving, or increased costs of, necessary governmental permits or approvals; the effectiveness of our processes for managing our strategic priorities; adverse weather conditions affecting operations in Central Florida or the Gulf Coast of the United States, including potential hurricanes or excess rainfall; actual costs of asset retirement, environmental remediation, reclamation or other environmental regulation differing from management’s current estimates; accidents and other disruptions involving Mosaic’s operations, including brine inflows at its Esterhazy, Saskatchewan potash mine and other potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. |

Before I proceed, I need to remind you that our presentation contains forward-looking statements. The remarks I make are based on information and understandings we believe to be accurate as of today’s date, May 5, 2010. Actual results are likely to differ from those set forth in the forward-looking statements. |

Slide 3 Strategic Focus Deliver value for shareholders Focus on Potash and Phosphate • Grow Potash • Strengthen Phosphate Maintain a strong balance sheet |

At Mosaic, our focus is on shareholder value creation, driven by the unquestionable long-term demand for our products. Our mission is to help the world grow the food it needs. As a global leader in crop nutrients, Mosaic will benefit from the expanding worldwide need for food, feed and fuel. We are executing well on our strategy. At the core of our strategy is a plan to extend our resource base and invest in the growth of both phosphate and potash. In Potash, we are growing through top line growth by pursuing brownfield expansions. In Phosphates, we are focusing on growing the value of our business and maintaining our position as one of the lowest cost phosphate producers in the world. Our expansive global distribution network, aligned with our North American production assets, provides us access to the largest global markets on a counter seasonal basis. Over time, the combination of two strong product lines has produced great returns for our shareholders. Compared to single nutrient focused companies, our balanced portfolio in phosphates and potash gives us steadier sales volumes and cash flow in periods where demand for one nutrient may be greater than for another. Both our Phosphates and Potash segments have generated robust results over the past few years. Supported by our strong balance sheet, with a cash balance in excess of two billion dollars, we have the financial flexibility required to expand our global profile in potash and phosphates and are actively pursuing opportunities to do so. |

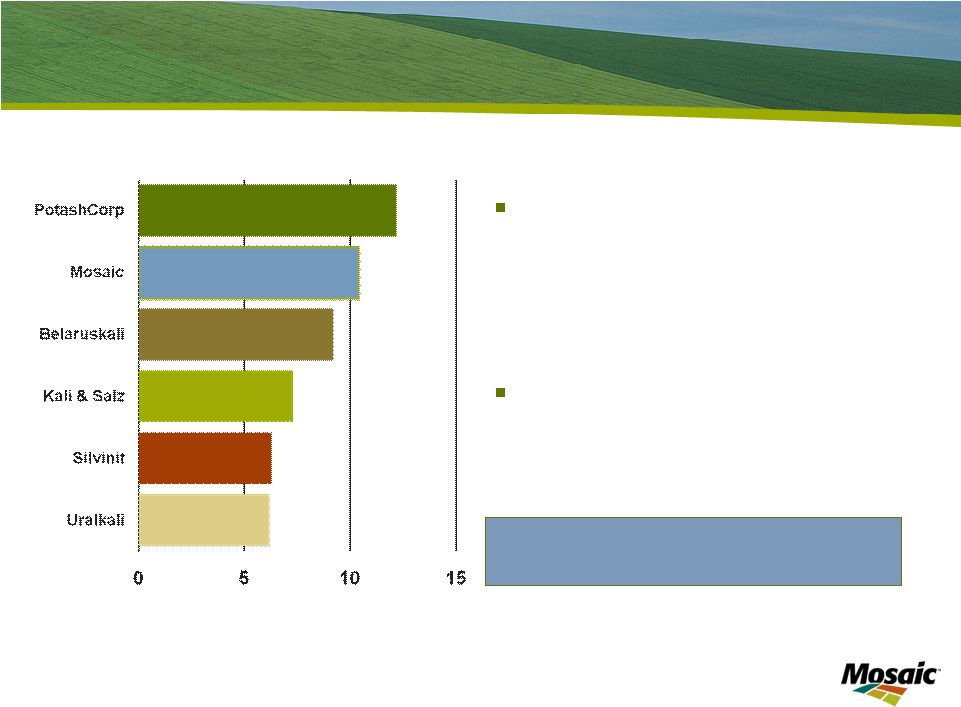

Slide 4 Leading Global Potash Producer Mosaic MOP production share • 10% Global • 41% North America • Five mines Competitive industry position World capacity approximates 74 million tonnes (all potash products) Mil tonnes •Potash Fertilizer Capacity Source: Fertecon / Mosaic |

Let’s first talk about our Potash segment. Mosaic is one of the world’s top producers of potash with an estimated 10% of global market share. Potash is produced in only 12 countries in the world, and agricultural giants such as China, India and Brazil depend on imports. |

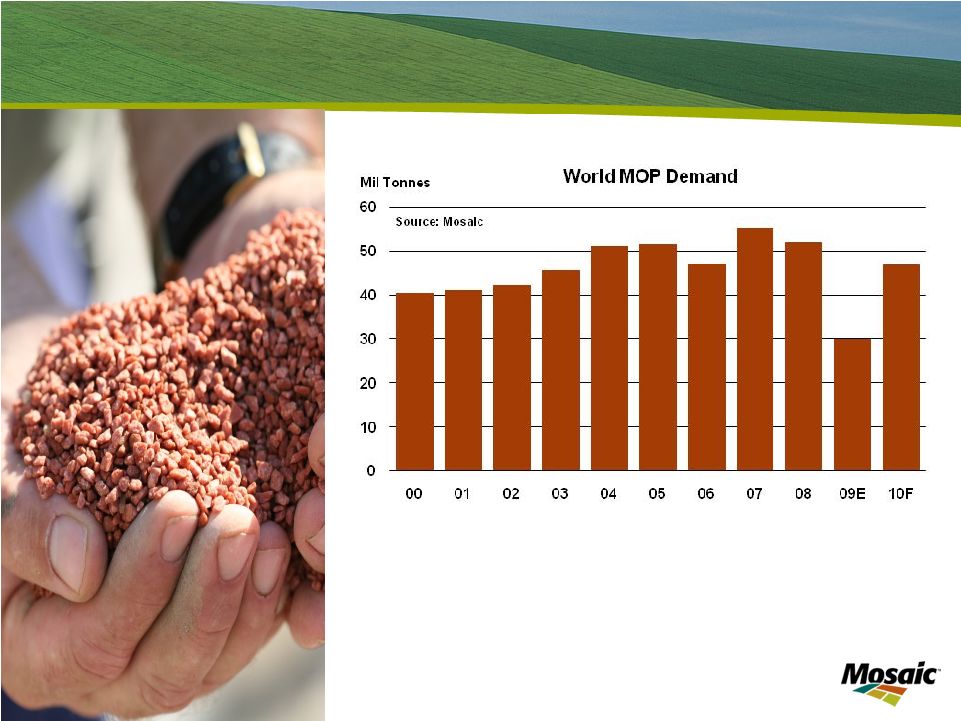

Slide 5 Rebounding Potash Demand |

Following the well documented drop in potash demand last year, we have seen a sharp rebound this spring season and expect continued strength through the remainder of this year. The nutritional value of potash is critical to optimize crop yields and increase food production. We believe this nutrient has been under-applied historically. Early this calendar year, North American potash shipments surged, exports climbed, inventories dropped and we ramped up production. We expect to operate our plants at high operating rates during the 2010/11 fertilizer year to meet projected demand. We are now in the midst of the North American spring season with demand back to near normal levels. Brazilian potash orders will commence soon with typical shipping periods from July through August. As of last Friday, the price of MOP, FOB Midwest warehouse is $395 - $405 per short ton, a respectable price, well balanced to farm economics, that will generate healthy margins. We forecast that global MOP shipments will increase to about 47 million tonnes in calendar 2010 compared to about 30 million tonnes in calendar 2009. Longer term, we expect potash demand to grow between 3% and 3.5% annually. |

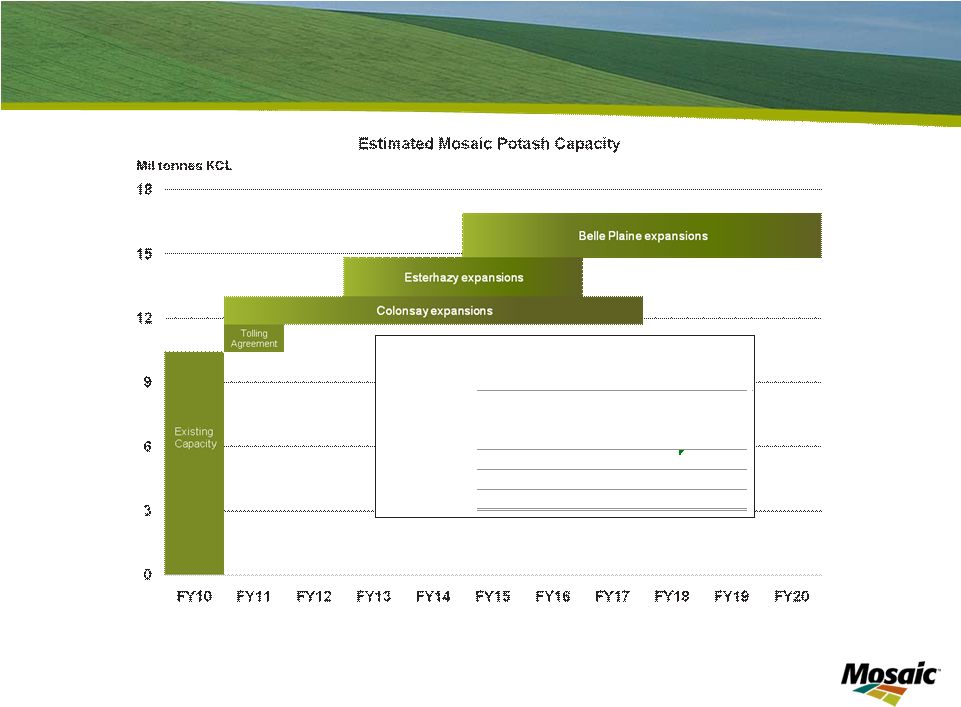

Slide 6 Growth Opportunities - Our Potash Expansions Note: The projected annual capacity includes up to an approximate 1.3 million tonnes that under a third party tolling agreement at our Esterhazy, Saskatchewan potash mine that will revert to us when the tolling agreement expires. Current Capacity Tolling Agreement Expansions Estimated Future Capacity Esterhazy 4.0 1.3 1.8 7.1 Belle Plaine 2.8 2.0 4.8 Colonsay 1.8 1.3 3.1 8.6 1.3 5.1 15.0 US Mines 1.8 1.8 Total 10.4 1.3 5.1 16.8 |

The world will need substantially more potash this decade. Mosaic has the capacity to meet the increasing demands from the agricultural market. We currently own enough mineral reserves to run our potash mines for over 100 years. In addition, we think the best way to provide additional potash is through brownfield expansions at existing mine sites. Our ongoing expansions are expected to increase annual capacity by over five million tonnes by 2020, ensuring that we will maintain our position as one of the premier potash companies in the world. Our expansion program consists of nearly a dozen discrete, multi-year projects at our three Canadian mine sites, and we can adjust the pace of these projects in response to supply/demand dynamics. We have made great progress on a number of these projects. The first phases at Colonsay and Esterhazy are wrapping up. These two projects will add about 300 thousand tonnes of annual capacity, starting in fiscal 2011. We will be ready to bring these tonnes on line if market demand warrants. We are mindful of the threat of new entrants in this industry and we take these threats seriously. Time will tell whether these threats become reality. As a well established, large player in this industry, we believe we are well positioned to bring on new brownfield expansions more economically than greenfield capacity. We certainly know our markets and customers better than a new entrant would. In addition, we produce up to 1.3 million tonnes annually for a third party under a tolling agreement. As many of you know the expiration date for this agreement is the subject of a dispute currently pending before the Saskatchewan courts. Based upon our estimates, we believe this capacity could revert to Mosaic as early as the end of this calendar year. And, as a reminder, this production capacity of 1.3 million tonnes will revert to Mosaic at no cost. |

Slide 7 Expansions Improve Mosaic’s Cost Structure |

The global potash industry has a relatively flat cost curve. This chart shows estimated cost per tonne for all major potash producers. Mosaic’s potash cost structure is competitive and will improve as our expansions come on line. The expected increase in sales and production volumes will leverage the existing assets at our three Canadian mines – thereby driving lower per tonne costs. Our industry leadership position, together with our investments to expand capacity, places us in a strong competitive position to leverage the growth of this market. |

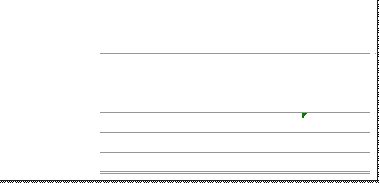

Slide 8 World’s Largest Integrated Phosphate Producer World’s largest capacity of finished phosphate fertilizer Mosaic U.S. phosphate production share 13% Globally 57% U.S. World scale & efficient operations World capacity approximates 80 million tonnes (DAP/MAP/TSP) •Phosphate Fertilizer Capacity Mil tonnes Source: Fertecon / Mosaic |

Now, let’s turn to our Phosphates segment. Our substantial asset base and geographic reach are unmatched in the industry. As the largest vertically integrated producer in the world, our Phosphates business possesses its own attractive set of attributes. We have substantial company- owned rock reserves, granulation capacity, and a worldwide supply chain and distribution network. |

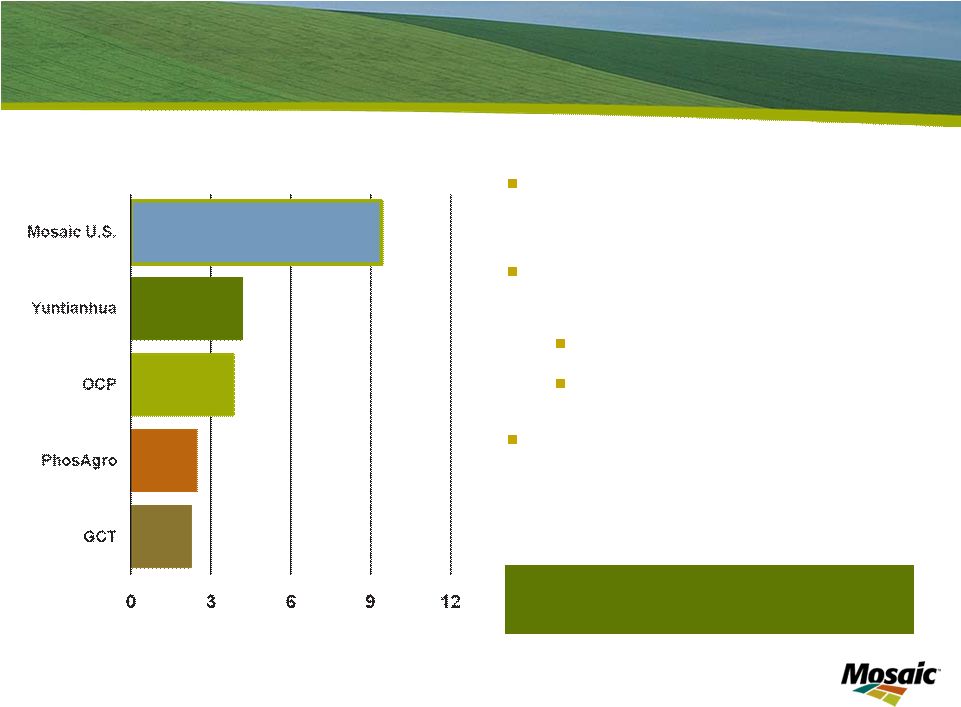

Slide 9 Phosphate Demand Recovery |

Phosphate fundamentals remain constructive and we expect the phosphate market to remain snug for several years. Strong demand has driven down North American producer stocks --despite an increase in operating rates. We project stocks to continue to drop during the remainder of the current fertilizer year and remain at low levels throughout the 2010/11 fertilizer year. We sense growing concern about the Ma’aden project. By our estimate, DAP production at this facility will ramp up in late 2011. We forecast that this supply will be needed to match demand that is growing at a 2 to 2.5 percent annual compound rate. In March, PhosChem signed a multi-year contract with customers in India for 6 million tonnes of DAP. This large baseload contract provides Mosaic the opportunity to optimize production rates and thereby improve profitability. Prices bottomed a few months ago and, after rising significantly early this year, appear to have stabilized in the upper-$400 range. As of last Friday, prevailing market DAP selling prices were in the $470 range per tonne FOB Tampa. And, while raw material costs are higher than historical levels, they are down from peak pricing in the last cycle. |

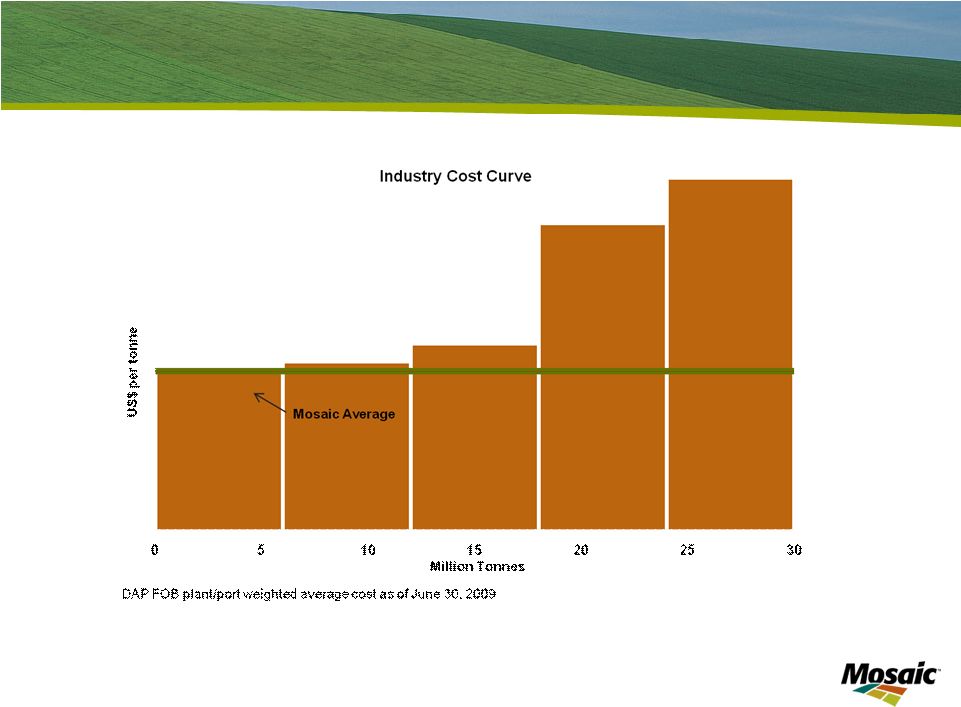

Slide10 Industry Leading Cost Structure in Phosphate |

Unlike the potash industry, the phosphate industry cost curve is steeper – and you can see that Mosaic is one of the world’s low cost producers. We are working on a number of operational fronts to improve and secure that position, as I will discuss further. |

Slide 11 Phosphate Strategic Priorities Strengthen our competitive position Leverage scale and location Low cost rock Cost advantaged sulfur, competitive ammonia Procurement leverage Operational excellence Maintenance practices Capital deployment Energy use and co-generation capacity Improve coordination of sales and operation planning Extend phosphate reserves |

In order to strengthen our competitive advantage, we are focusing on three strategic priorities: First, we are working on several initiatives to leverage our scale and geographic location. We have a strong competitive position due to low rock and conversion costs as well as preferential geographic access to sulfur and ammonia. We are also working to better leverage our procurement processes. Next, we are focused on improving our operations. We are implementing improved processes for maintenance, capital deployment, energy use and co-generation capacity. In addition, our global sales and operations teams are working closely to improve production planning. Finally, we continue work to secure the mineral resource base for our U.S. operations and to obtain advantaged access to rock reserves elsewhere in the world. We recently announced an investment in the Bayovar rock mine which will give us additional flexibility and diversifies our reserve position. All of these initiatives are intended to drive stronger cash flow and returns on capital from our Phosphates segment. |

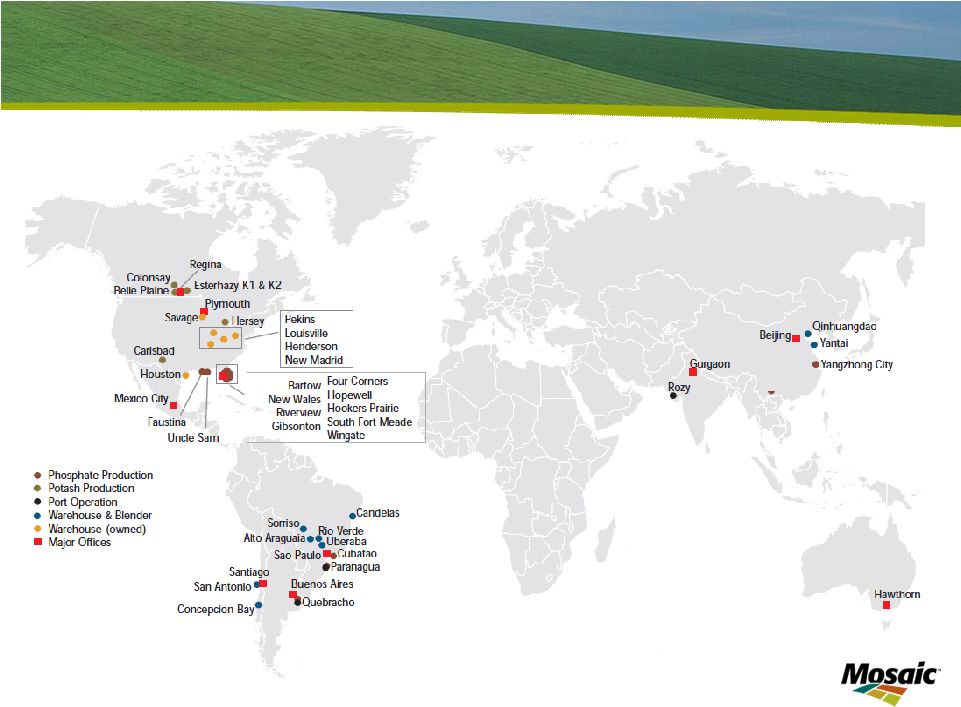

Slide 12 Distribution Assets Aligned with Global Demand |

Mosaic also has a distribution network without peer in our industry – allowing us to move our products where and when needed, efficiently and cost-effectively. Our industry leading North American distribution capabilities are bolstered by strong networks in prime growth regions such as Asia and Latin America where we combine production assets, blending and bagging facilities, ports and other capabilities. This global network is especially valuable in balancing seasonal demand patterns. It allows us to run our North American production plants more efficiently as we can ship products to key regions around the world as needed. We are also taking steps to further align our global distribution network with our North American production assets. Our strategic priorities in Phosphates focus on growing the value of our business and maintaining our position as one of the lowest cost phosphate producers in the world. |

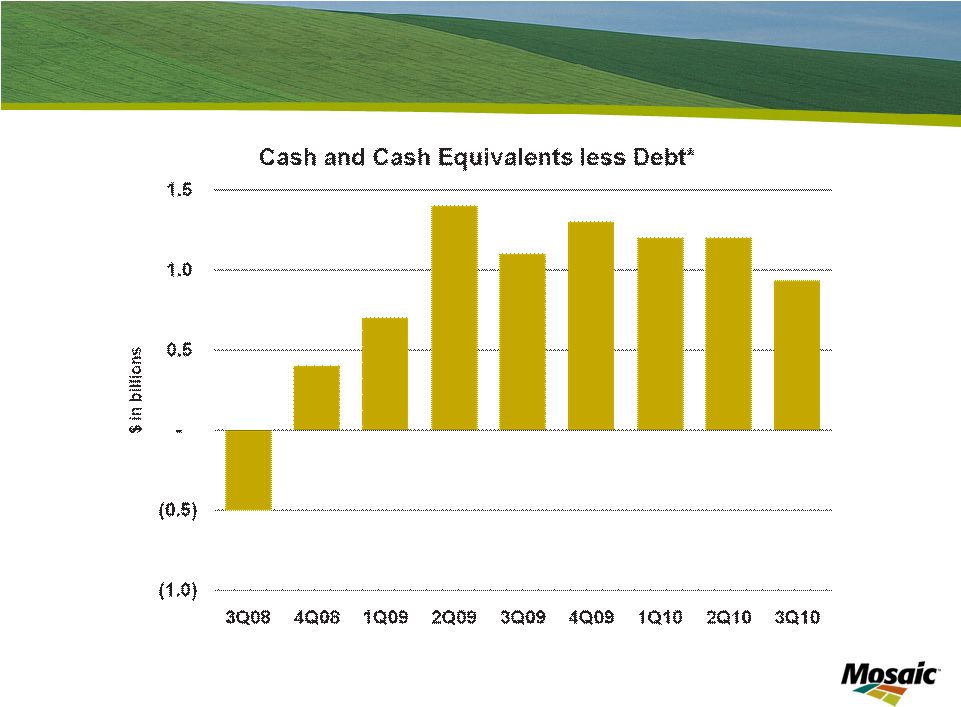

Strong Financial Position * See appendix for reconciliation of Cash and Cash Equivalents less Debt |

As we have discussed, our overall strategy is to capitalize on attractive long-term agriculture fundamentals by investing in and reengineering our potash and phosphate businesses. Through the ups and downs of the markets we serve, we have created long term value through sound capital allocation decisions. Our strong cash flow has allowed us to build one of the strongest balance sheets in the industry despite the recent economic downturn. We have demonstrated our willingness and ability to make investments, to divest non-strategic assets and to return cash to shareholders, as appropriate. The sale of our Fosfertil investment is proceeding. The estimated $900 million of net cash proceeds will be partially offset by the $385 million investment in Bayovar that we expect to make in the coming months. |

Business Outlook |

| Now I will give you a few thoughts on the outlook for the agricultural markets. |

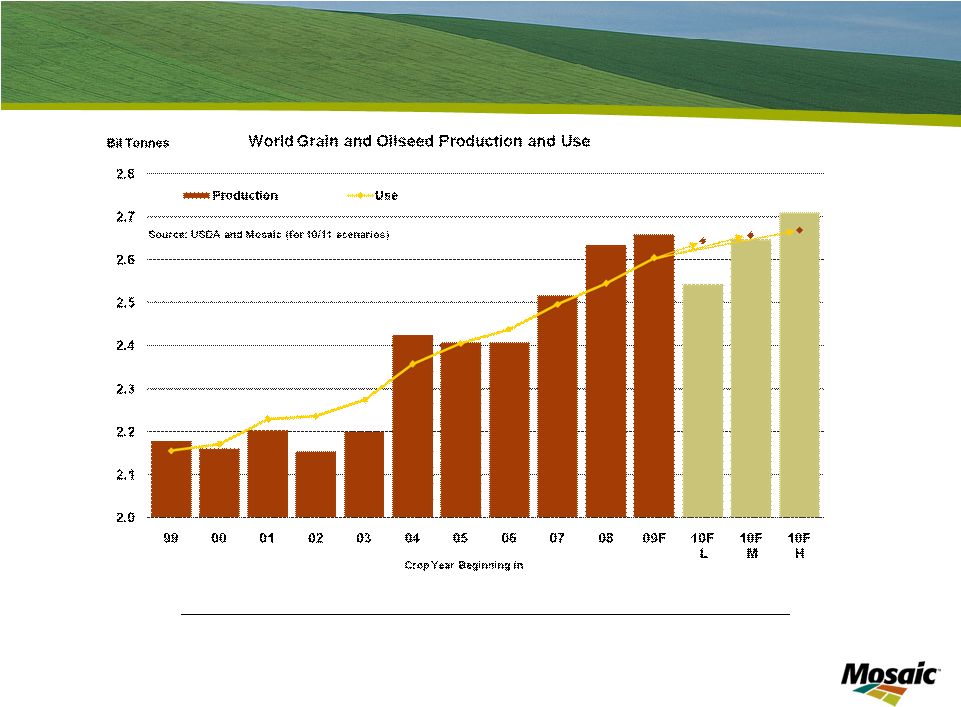

Slide 15 Growing Grain & Oilseed Use 2010/11 Scenario Assumptions Low Medium High Change in Harvested Area -0.5% -0.5% -0.5% Yield (Deviation from 10-year Trend) Largest Negative 0 Largest Positive Demand Growth 0.0% 1.0% 2.0% |

Long term agricultural fundamentals continue to look positive. The overall food security story has not changed. Economic development, improving diets, weather and political instability will continue to stress the global food supply. To meet food and fuel demands, grain production will need to increase substantially. Improved farming practices, including proper application of crop nutrients, is vital to grow the food the world needs. Here we show the increase in grain and oilseed production and use over the past decade. As you can see, use has grown slowly, but consistently. History has proven that economic slowdowns don’t have a large negative impact on food consumption – people need to eat regardless of the economic climate. The most recent global economic downturn was no exception. On the production side, we have seen significant increases over the past two years. This growth has come from increased harvested land and above trend yields. However we need to continue this above trend growth just to stay even with projected use. |

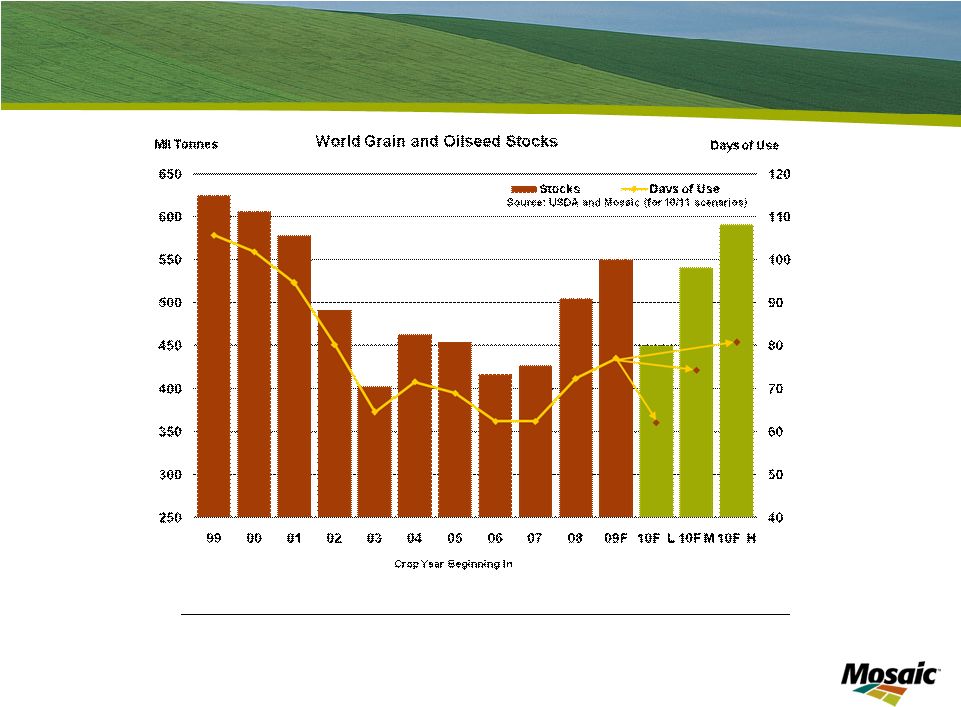

Slide 16 More Cushion but Stocks Still Not at Secure Levels 2010/11 Scenario Assumptions Low Medium High Change in Harvested Area -0.5% -0.5% -0.5% Yield (Deviation from 10-year Trend) Largest Negative 0 Largest Positive Demand Growth 0.0% 1.0% 2.0% |

Back-to-back bumper crops have built global grain and oilseed stocks and calmed agricultural markets. Over the past couple of years, supply has responded to higher prices and good weather. Our base forecast assumes a trend yield and a slight decrease in harvested area. We expect the stock to use ratio to remain at a relatively low level. We believe global grain and oilseed stocks still are not at a secure enough level to withstand weather or other shocks over a period of time. If crops continue above trend yields, stocks will continue to increase. However, weather or other shocks have the potential to draw down stocks significantly. |

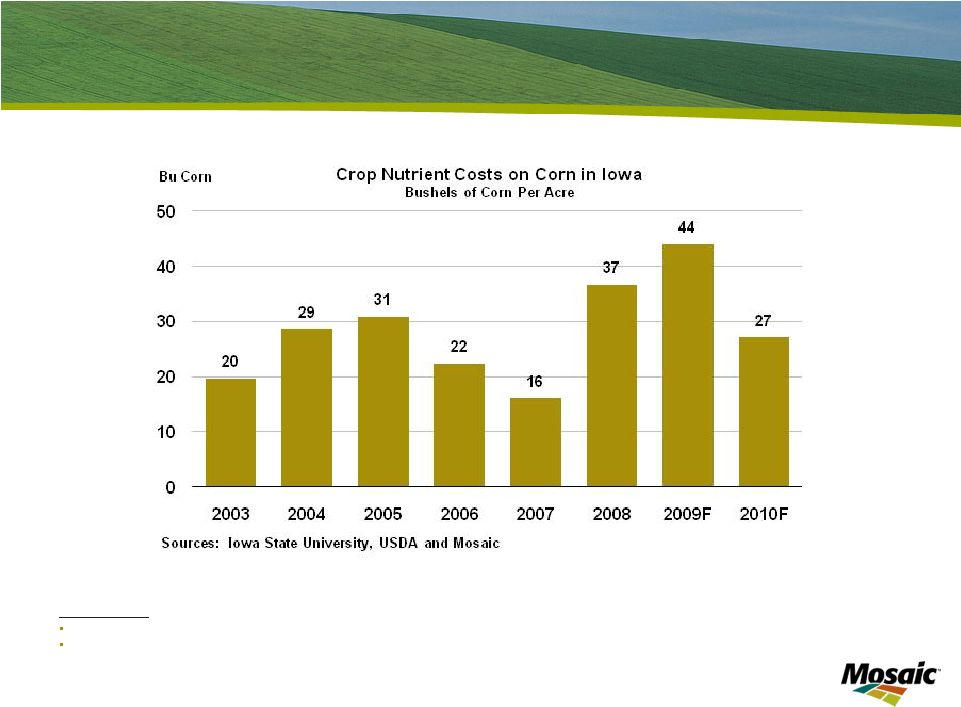

Slide 17 Farm Economics Key assumptions Iowa State University application rate recommendations Fertilizer prices for 2003 - 2009 are from USDA. 2010 fertilizer prices are based on current spot wholesale prices |

Farmer economics remain healthy despite the recent downward trend in grain markets. Grain prices remain at relatively high levels as compared to historical prices. At the same time, input prices have fallen from their high levels of the last two years. This has allowed farmers to remain profitable. The graph shows the number of bushels of corn that a farmer would have to sell in order to pay for crop nutrients. This indicates that the cost of crop nutrients, relative to grain prices, has declined to levels closer to the historic range. |

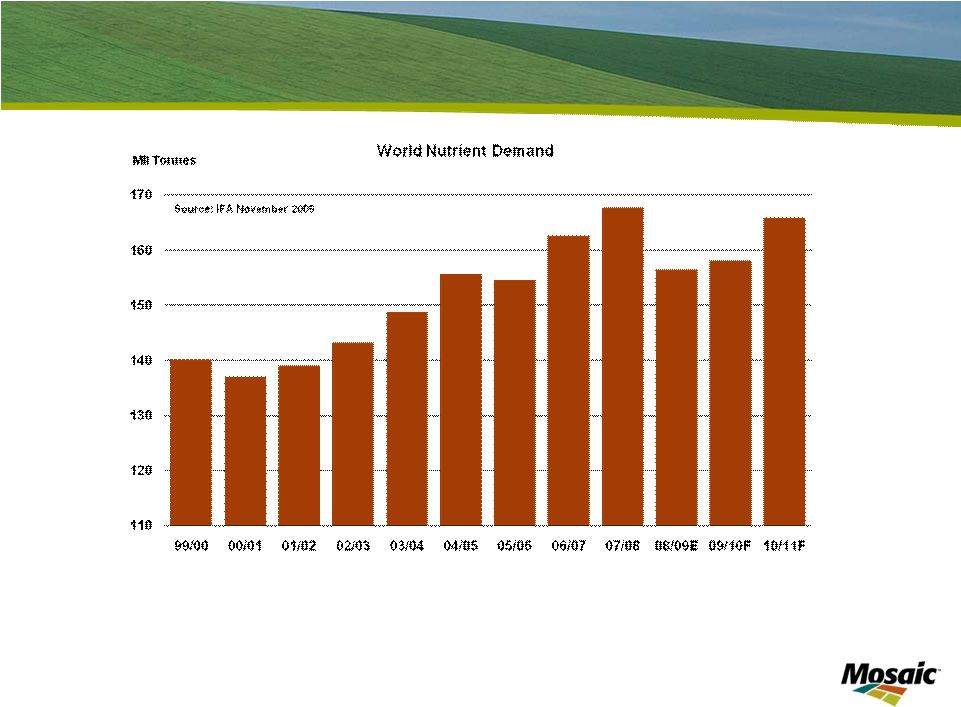

Slide 18 Growth Expected to Resume |

Following the drop in nutrient use in 2008 and 2009, we expect use to rebound significantly this year. By the 2013/14 fertilizer year, the International Fertilizer Industry Association projects crop nutrient use to increase 11% over the peak 2007/08 period. There has been a lot of debate about the potential effects of nutrient under-application on yields. With the increased use of GMO seeds and improved application technology, some have thought this would mean less demand for nutrients. However, the science of agronomy and plant production has not changed, plants still need balanced nutrition to develop properly. To obtain higher yields, crops will need increased nutrient application rates. Every plant and crop harvested removes vital and necessary nutrients from the soil. These nutrients must be replaced in order to maintain productivity of the farm field. There is no alchemy in agronomy. Most profitable farmers have lower costs per unit of production because they attain higher crop yields while controlling total costs. Farmers recognize proper soil fertility is the foundation on which high yields are built. As world demand for increased yields stresses the food supply, adequate and balanced soil fertility will continue to be a high priority. |

Slide 19 Focus on value creation Global leader with vertically integrated operations Potash growth projects at attractive capital costs Phosphate growth options in rock reserves and acquisitions Positive agricultural market outlook Key Takeaways |

In closing, I will emphasize a few key points about Mosaic. First, we are successfully executing our strategic plan, focusing on long term value creation. Second, we are an established industry leader with vertically integrated operations, a strong balance sheet and a broad international presence. Our global scale is unmatched due to our strength in both potash and phosphates. Next, we are making significant investments to grow our capacity in Potash at competitive costs. In addition, we are strengthening our Phosphates business by leveraging our scale, improving efficiencies at our plants and mines, and extending our reserve base. Finally, the long term agricultural outlook is positive. After a difficult 2009, crop nutrient demand has returned to normal. We remain confident in Mosaic’s long-term outlook. Agricultural fundamentals remain positive because of continued global demand for food and fuel. Mosaic is uniquely positioned as a leading supplier of both potash and phosphate products needed by agricultural producers worldwide. |

Thank you |

Thank you for your time this afternoon. I appreciate you listening to Mosaic’s story and our outlook for the future. Before I open the floor to questions, I’d like to mention that UBS is hosting a potash tour at our Colonsay site on May 26 . Contact Don Carson if you are interested. Now I’d be happy to take questions. th |

Slide 21 Appendix: Cash and Cash Equivalents Less Debt Reconciliation $ in billions Period Ended Cash and Cash Equivalents Short-Term Debt Current Maturities Long-Term Debt Total Debt Net (Debt) Cash February 29, 2008 1.1 0.2 - 1.4 1.7 (0.5) May 31, 2008 2.0 0.1 - 1.4 1.6 0.4 August 31, 2008 2.2 0.1 0.1 1.3 1.5 0.7 November 30, 2008 2.8 0.1 - 1.3 1.4 1.4 February 28, 2009 2.5 0.1 - 1.3 1.4 1.1 May 31, 2009 2.7 0.1 - 1.3 1.4 1.3 August 31, 2009 2.6 0.1 - 1.3 1.4 1.2 November 30, 2009 2.6 0.1 - 1.3 1.4 1.2 February 28, 2010 2.3 0.1 - 1.2 1.4 0.9 - Source: Cash and cash equivalents from 10Q/10K as filed. Total debt includes Short term debt, Current maturities of long-term debt, Long-term debt less current maturities and Long-term debt due to Cargill Inc and affiliates. |