UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2011

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-32327

The Mosaic Company

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-1026454 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3033 Campus Drive

Suite E490

Plymouth, Minnesota 55441

(800) 918-8270

(Address and zip code of principal executive offices and registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | |

| | | Title of each class | | Name of each exchange on which

registered | | |

| | Common Stock, par value $0.01 per share | | New York Stock Exchange | | |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1)��has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 30, 2010, the aggregate market value of the registrant’s voting common stock held by non-affiliates was approximately $10.81 billion based upon the closing price of these shares on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock: 275,825,158 shares of Common Stock, 57,768,374 shares of Class A Common Stock and 112,991,398 shares of Class B Common Stock, each par value $0.01 per share, as of July 15, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

| 1. | Portions of the registrant’s Annual Report to Stockholders for the fiscal year ended May 31, 2011 (Part I and Part II) |

| 2. | Portions of the registrant’s definitive proxy statement to be delivered in conjunction with the 2011 Annual Meeting of Stockholders (Part III) |

2011 FORM 10-K CONTENTS

PART I.

Item 1. Business.

OVERVIEW

The Mosaic Company is one of the world’s leading producers and marketers of concentrated phosphate and potash crop nutrients for the global agriculture industry. Through our broad product offering, we are a single source supplier of phosphate- and potash-based crop nutrients and animal feed ingredients. We serve customers in approximately 40 countries. We mine phosphate rock in Florida and process rock into finished phosphate products at facilities in Florida and Louisiana. We mine potash in Saskatchewan, New Mexico and Michigan. We have other production, blending or distribution operations in Brazil, China, India, Argentina, and Chile, and recently made a strategic equity investment in a new phosphate rock mine in Peru. Our operations include the top four nutrient-consuming countries in the world.

The Mosaic Company is a Delaware corporation that was incorporated in March 2004 and serves as the parent company of the business that was formed through the October 2004 combination of IMC Global Inc. and the fertilizer businesses of Cargill, Incorporated. We are publicly traded on the New York Stock Exchange under the ticker symbol “MOS” and are headquartered in Plymouth, Minnesota.

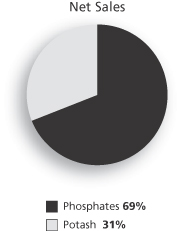

We conduct our business through wholly and majority-owned subsidiaries as well as businesses in which we own less than a majority or a non-controlling interest. We are organized into two reportable business segments: Phosphates and Potash. The following chart shows the respective contributions to fiscal 2011 sales volumes, net sales and operating earnings for each of these business segments and Corporate, Eliminations and Other:

Phosphates Segment—We are the largest integrated phosphate producer in the world and one of the largest producers of phosphate-based animal feed ingredients in the United States. We sell phosphate-based crop nutrients and animal feed ingredients throughout North America and internationally. Our Phosphates segment also includes our North American and international distribution activities. Our distribution activities include sales offices, port terminals and warehouses in the United States, Canada, and several other key international countries. In addition, the international distribution activities include blending, bagging and production facilities in Brazil, China, India, Argentina and Chile. We accounted for approximately 13% of estimated global production and 57% of estimated North American production of concentrated phosphate crop nutrients during fiscal 2011.

1

Potash Segment—We are the third-largest producer of potash in the world. We sell potash throughout North America and internationally, principally as fertilizer, but also for use in industrial applications and, to a lesser degree, as animal feed ingredients. We accounted for approximately 12% of estimated global potash production and 38% of estimated North American potash production during fiscal 2011.

Corporate, Eliminations and Other—Other net sales and operating earnings in the charts above include sales of nitrogen products and the results of our corporate operations.

As used in this report:

| | • | | “Mosaic” means The Mosaic Company, both before and after the Merger described below under “Cargill Transaction”; |

| | • | | “GNS” means the company known as GNS II (U.S.) Corp. until it was renamed The Mosaic Company in connection with the Merger; |

| | • | | “MOS Holdings” means the company known as The Mosaic Company until it was renamed MOS Holdings Inc. in connection with the Merger; |

| | • | | “we”, “us”, and “our” refer to Mosaic and its direct and indirect subsidiaries, individually or in any combination; |

| | • | | “IMC” means IMC Global Inc.; |

| | • | | “Cargill” means Cargill, Incorporated and its direct and indirect subsidiaries, individually or in any combination; |

| | • | | “Cargill Crop Nutrition” means the crop nutrient business we acquired from Cargill in the Combination; |

| | • | | “Combination” means the October 22, 2004 combination of IMC and Cargill Crop Nutrition; |

| | • | | “Cargill Transaction” means the transactions described below under “Cargill Transaction”; |

| | • | | “Merger” means the Merger described below under “Cargill Transaction”; |

| | • | | references in this report to a particular fiscal year are to the twelve months ended May 31 of that year; and |

| | • | | “tonne” or “tonnes” means a metric tonne or tonnes of 2,205 pounds each unless we specifically state that we mean short or long tons. |

Cargill Transaction

On May 25, 2011, we consummated the first in a series of transactions intended to result in the split-off and orderly distribution of Cargill’s approximately 64% equity interest in us through a series of public offerings (the “Cargill Transaction”). These transactions included the following:

| | • | | A Merger (the “Merger”) between a subsidiary of GNS and MOS Holdings that had the effect of recapitalizing our prior Common Stock and making GNS the parent company of MOS Holdings. Prior to the Merger, GNS was a wholly-owned subsidiary of the company then known as The Mosaic |

2

| | Company. In the Merger, all of the outstanding stock of MOS Holdings was converted, on a one-for-one basis, into GNS stock. In connection with the Merger, the company formerly known as The Mosaic Company was renamed MOS Holdings Inc. and GNS was renamed The Mosaic Company. Following the Merger, our common stock continues to trade under the ticker symbol MOS. |

| | • | | Cargill conducted a split-off (the “Split-off”) in which it exchanged approximately 178.3 million of our shares that it received in the Merger for shares of Cargill stock held by certain Cargill stockholders (the “Exchanging Cargill Stockholders”). |

| | • | | Cargill also exchanged all of the remaining 107.5 million of our shares that it received in the Merger with certain debt holders of Cargill (the “Exchanging Cargill Debt Holders”) for Cargill debt (the “Debt Exchange”). As of May 25, 2011, Cargill no longer owned any outstanding shares of Mosaic. |

| | • | | Certain of the Exchanging Cargill Stockholders (the “MAC Trusts”) and the Exchanging Cargill Debt Holders (collectively, the “Selling Stockholders”) then sold an aggregate of 115.0 million shares of our Common Stock that they received in the Split-off and the Debt Exchange in an underwritten secondary public offering (the initial “Formation Offering”). |

Pursuant to a ruling from the U.S. Internal Revenue Service, the Merger, Split-off and Debt Exchange are expected to be tax-free to Cargill, Mosaic and their respective shareholders.

We have agreed to conduct a series of additional Formation Offerings, if necessary, within 15 months after the Split-off to provide for the sale of an additional 42.0 million of the shares of our stock received by the MAC Trusts in the Split-off.

All other shares of our stock received by the Exchanging Cargill Stockholders and not sold in the Formation Offerings (approximately 129.0 million shares in the aggregate) are generally subject to transfer restrictions and will be released in three equal annual installments beginning on the two and one- half year anniversary of the Split-off. We would, at the request of the MAC Trusts or at our own election, register certain of our shares for sale in a secondary offering that could occur each year after the second anniversary of the Split-off, with the first such offering occurring not earlier than twelve months after the last of the Formation Offerings and certain other primary or secondary offerings.

Following 180 days after the four-and-a-half year anniversary of the Split-off, the MAC Trusts have two rights to request that we file a registration statement under the Securities Act of 1933, pursuant to which the MAC Trusts could sell any remaining shares received in the Split-off.

In addition, the MAC Trusts and each other Cargill stockholder that participated in the Split-off, who, to Cargill’s knowledge at the time of closing, was reasonably expected to, or be part of a group of stockholders that was reasonably expected to, beneficially own 5% or more of the voting power for the election of our directors following the Split-off (a “Significant Stockholder”), has become a party to a governance agreement (the “Governance Agreement”). Under the Governance Agreement, each Significant Stockholder is subject to certain transfer, voting and standstill restrictions. In addition, each Significant Stockholder has agreed that, until the earlier of the third anniversary of the closing of the Merger and the date on which such stockholder, together with certain of such stockholder’s permitted transferees, beneficially owns less than 10% of the total voting power for the election of our board of directors, such stockholder will, among other things, vote its shares of (i) Class A Common Stock (other than with respect to the election of directors and with respect to a proposal to convert the Class B Common Stock into Class A Common Stock or Common Stock (or a combination thereof)) at all meetings of our stockholders in accordance with our board of directors’ recommendation with respect to each matter, so long as holders of a majority of the voting securities owned by all holders, other than the Significant Stockholders, who have submitted proxies to us in respect of such meeting have authorized their securities represented by such proxies to be voted in accordance with our board of directors’ recommendation on such

3

matter, and (ii) Class B Common Stock (other than with respect to the election of directors and with respect to a proposal to convert the Class B Common Stock into Class A Common Stock or Common Stock (or a combination thereof)) at all meetings of our stockholders in a manner that is proportionate to the manner in which all holders, other than the Significant Stockholders, who have submitted proxies to us in respect of such meeting have authorized their securities represented by such proxies to be voted.

We have agreed that, among other things, and subject to certain exceptions, we will not engage in certain prohibited acts (“Prohibited Acts”) for a period ending two years after the Merger and that we will indemnify Cargill for certain taxes and tax-related losses imposed on Cargill if we engage in a Prohibited Act or in the event we are in breach of representations or warranties made in support of the tax-free nature of the Merger, Split-off and Debt Exchange, if our Prohibited Act or breach causes the Merger, Split-off and/or Debt Exchange to fail to qualify as tax-free transactions.

We expect the Cargill Transaction to benefit us by improving our long-term strategic and financial flexibility, as well as greatly increasing the liquidity of our common stock. The Cargill Transaction resulted in no change to the total number of our outstanding shares, the economic rights of our shares or earnings per share. The Cargill Transaction also is not expected to have a material impact on our underlying financial performance or current business operations.

We have included additional information about the Cargill Transaction, including additional information regarding Prohibited Acts and the indemnity to Cargill we refer to above, in Note 2 of our Consolidated Financial Statements, which information is incorporated herein by reference, and the principal transaction documents related to the Cargill Transaction are incorporated by reference as exhibits to this report.

The Hardee County Extension of the South Fort Meade Mine

In July 2010, the United States District Court for the Middle District of Florida (the “Jacksonville District Court”) issued a preliminary injunction (the “First Preliminary Injunction”) that prevented us from extending the mining at our South Fort Meade, Florida, phosphate rock mine into Hardee County (the “Hardee County Extension”). The First Preliminary Injunction was issued in a lawsuit brought by several non-governmental organizations challenging the U.S. Army Corps of Engineers’ (the “Corps”) actions in granting a permit (the “Hardee County Extension Permit”) to us for the mining of wetlands in the Hardee County Extension.

In response to the First Preliminary Injunction, we were forced to indefinitely close the South Fort Meade mine. We subsequently entered into a partial settlement (the “Partial Settlement”) with the plaintiffs that allowed us to commence mining in a limited area of the Hardee County Extension (“Phase I”) from December 2010 until June 2011 at a reduced operating rate.

In April 2011, the Eleventh Circuit Court of Appeals vacated the First Preliminary Injunction effective July 7, 2011.

On April 19, 2011, we notified the Jacksonville District Court that we planned to conduct uplands-only mining (i.e.,non-wetlands) in an area (“Phase II”) at our South Fort Meade mine. Uplands-only mining does not require a federal permit, the Jacksonville District Court and the plaintiffs had previously indicated that uplands mining is permissible and the Corps notified the Jacksonville District Court that it had no objection to our uplands-only mining contingency plan because no federal permit is required to mine uplands. Our mining plan contemplated that we would mine an estimated 2.4 million tonnes of phosphate rock from Phase II during a period ranging from approximately June 2011 into July 2012.

On July 8, 2011, the Jacksonville District Court issued a second preliminary injunction (the “Second Preliminary Injunction”) again preventing us from mining the Hardee County Extension, including uplands in Phase II.

4

Although the South Fort Meade mine is one of our two largest phosphate rock mines, as a result of our successful execution of mitigation measures, the indefinite closure of the South Fort Meade mine for most of the first six months of fiscal 2011 and reduced operating rate at the mine for the remainder of the fiscal year did not significantly impact our sales volumes for fiscal 2011 although it did adversely affect our gross margin.

In response to the Second Preliminary Injunction, we have stopped mining in the Hardee County Extension. For fiscal 2012, we believe we will be able to continue to support planned finished phosphate production levels through a continuation of our mitigation activities although the Second Preliminary Injunction could increase fiscal 2012 costs substantially, principally if we need to purchase incremental levels of phosphate rock in the second half of fiscal 2012. The degree to which we are able to successfully mitigate the effects of the Second Preliminary Injunction in the longer-term remains uncertain.

We believe that the plaintiffs’ claims in this case are without merit and that the Second Preliminary Injunction is not supported by the facts or the law. We intend to vigorously defend the Corps’ issuance of the Hardee County Extension Permit and our rights to mine the Hardee County Extension.

We have included additional information about the Hardee County Extension in this report in Part I, Item IA, “Risk Factors,” in our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“Management’s Analysis”) that is incorporated by reference in this report in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 22 to our Consolidated Financial Statements that are incorporated by reference in this report in Part II, Item 8, “Financial Statements and Supplementary Data.”

Other Business Developments during Fiscal 2011

During fiscal 2011, we continued to execute on our strategic priorities. At the core of our strategy is a plan to extend our resource base and invest in the growth of both phosphates and potash. In the Phosphates segment, we are focusing on diversifying our phosphate rock sources, growing the value of our business and maintaining our position as one of the lowest cost phosphate producers in the world. In the Potash segment, we are growing by investing in brownfield expansions. Our global distribution network improves the access of our North American production assets to the global markets for our products and helps balance the seasonality of our business. In fiscal 2011 the steps we took to execute our strategic priorities included the following:

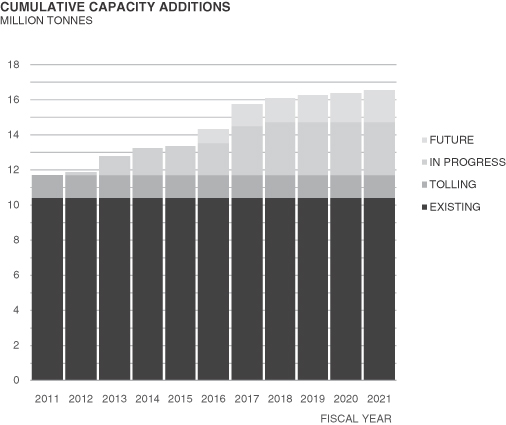

| | • | | We continued the expansion of capacity in our Potash segment, in line with our view of the long-term fundamentals of that business. The planned brownfield expansions over the next decade are expected to increase our annual proven peaking capacity for finished product by approximately five million tonnes. We have completed the first of our planned expansions with the other remaining projects progressing as planned. We are positioning our expansion projects so that we are able to bring the additional capacity on line when market demand warrants. |

| | • | | We diversified our phosphate rock sources in alignment with our strategy. In the first quarter of fiscal 2011, we acquired a 35% economic interest in a joint venture, with subsidiaries of Vale S.A. (“Vale”) and Mitsui & Co., Ltd., that owns the recently opened phosphate rock mine (the “Miski Mayo Mine”) in the Bayovar region of Peru for $385 million. Phosphate rock production started at the Miski Mayo Mine and shipments began in the first quarter of fiscal 2011. The Miski Mayo Mine’s annual production capacity is expected to be 3.9 million tonnes when fully operational. |

| | • | | We completed the sale of our 20.1% interest in Fosfertil S.A. to Vale in the second quarter of fiscal 2011 for proceeds of $1 billion which resulted in a pre-tax gain of $685.6 million. The tax impact of this transaction was $126.1 million and was included in our provision for income taxes as of May 31, 2011. |

| | • | | On January 13, 2011, we redeemed the remaining $455.4 million aggregate principal amount of our 7-3/8% senior notes due December 2014. We expect that annual interest expense will be reduced by approximately $34 million due to the redemption. We recorded a pre-tax charge of approximately $19 million primarily related to the call premium and the write-off of unamortized fees. |

5

| | • | | On April 26, 2011, we entered into a new unsecured five-year revolving credit facility of up to $750 million (the “Mosaic Credit Facility”). The revolving credit facility is available for revolving credit loans, swing line loans of up to $20 million and letters of credit of up to $300 million. The Mosaic Credit Facility replaces a prior unsecured credit facility that consisted of a revolving facility of up to $500 million, swing line loans of up to $20 million and letters of credit of up to $200 million (the “Prior Credit Facility”). The Prior Credit Facility was terminated contemporaneously with our entry into the Mosaic Credit Facility. We entered into the Mosaic Credit Facility to reduce interest rates and unused commitment fees, improve other terms compared to the Prior Credit Facility, and to avoid any potential conflict with the terms of the Prior Credit Facility in connection with the consummation of the Cargill Transaction. |

| | • | | On May 2, 2011, we notified Potash Corporation of Saskatchewan Inc. (“PCS”) that we had satisfied our obligation to produce potash from our Esterhazy, Saskatchewan, mine under a tolling agreement (the “Tolling Agreement”). Under the agreement, we have provided PCS with potash from the Esterhazy mine at cost for forty years. In recent years, PCS has elected to receive approximately one million tonnes per year under the agreement. We and PCS are currently in litigation (the “Tolling Agreement Dispute”) concerning our respective rights and obligations under the agreement. Pursuant to a court order in the Tolling Agreement Dispute, we are continuing to supply potash under the terms of the Tolling Agreement until trial begins, currently scheduled for January 2012. In the event that PCS does not prevail after trial on the merits of its underlying claim, PCS has agreed to pay monetary damages to us for the loss we suffer as a result of the court’s order. |

We have included additional information about these and other developments in our business during fiscal 2011 in our Management’s Analysis and in the Notes to our Consolidated Financial Statements.

BUSINESS SEGMENT INFORMATION

The discussion below of our business segment operations should be read in conjunction with the following information that we have included in this report:

| | • | | The risk factors discussed in this report in Part I, Item 1A, “Risk Factors.” |

| | • | | Our Management’s Analysis. |

| | • | | The financial statements and supplementary financial information in our Consolidated Financial Statements (“Consolidated Financial Statements”). This information is incorporated by reference in this report in Part II, Item 8, “Financial Statements and Supplementary Data.” |

Phosphates Segment

OurPhosphates business segment owns and operates mines and production facilities in Florida which produce concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and processing plants in Louisiana which produce concentrated phosphate crop nutrients. Our Phosphates segment’s results include our North American distribution activities and the consolidated results of Phosphate Chemicals Export Association, Inc. (“PhosChem”), a U.S. Webb-Pomerene Act association of phosphate producers which exports concentrated phosphate crop nutrient products around the world for us and PhosChem’s other member.

U.S. Phosphate Crop Nutrients and Animal Feed Ingredients

We are the largest producer of concentrated phosphate crop nutrients and animal feed ingredients in the world. Our U.S. phosphates operations have capacity to produce approximately 4.4 million tonnes of phosphoric acid (“P2O5”) per year, or about 9% of world capacity and about 45% of North American capacity. Phosphoric acid is

6

produced by reacting finely ground phosphate rock with sulfuric acid. Phosphoric acid is the key building block for the production of high analysis or concentrated phosphate crop nutrients and animal feed products, and is the most comprehensive measure of phosphate capacity and production and a commonly used benchmark in our industry. Our U.S. phosphoric acid production totaled approximately 3.9 million tonnes during fiscal 2011 and accounted for approximately 10% of estimated global production and 46% of estimated North American output during fiscal 2011.

Our phosphate crop nutrient products are marketed worldwide to crop nutrient manufacturers, distributors and retailers. Our principal phosphate crop nutrient products are:

| | • | | Diammonium Phosphate (“DAP”). DAP is the most widely used high-analysis phosphate crop nutrient worldwide. DAP is produced by combining phosphoric acid with anhydrous ammonia. This initial reaction creates a slurry that is then pumped into a granulation plant where it is reacted with additional ammonia to produce DAP. DAP is a solid granular product. |

| | • | | Monoammonium Phosphate (“MAP”). MAP is the second most widely used high-analysis phosphate crop nutrient and the fastest growing phosphate product worldwide. MAP is also produced by first combining phosphoric acid with anhydrous ammonia. The resulting slurry is then pumped into the granulation plant where it is reacted with additional phosphoric acid to produce MAP. MAP is a solid granular product, but requires less ammonia and more sulfur than DAP. |

| | • | | MicroEssentials® is a value-added ammoniated phosphate product that is enhanced through a patented process that creates very thin platelets of sulfur and other micronutrients, such as zinc, on the granulated product. The patented process incorporates both the sulfate and elemental forms of sulfur, providing season long availability to crops. |

In addition, our Phosphates segment is one of the largest producers and marketers of phosphate-based animal feed ingredients in the world. Production of our animal feed ingredients products is located at our New Wales, Florida facility. We market our feed phosphate primarily under the leading brand names of Biofos® and Multifos®.

7

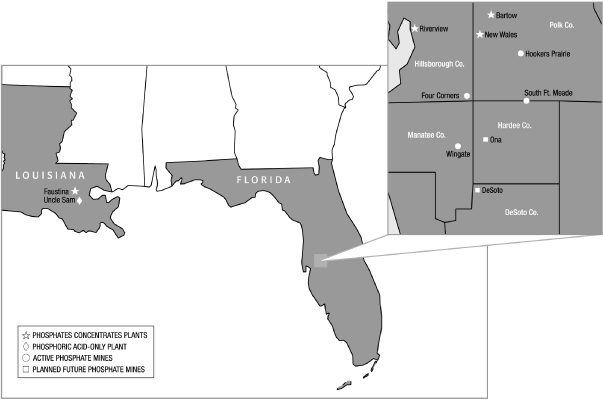

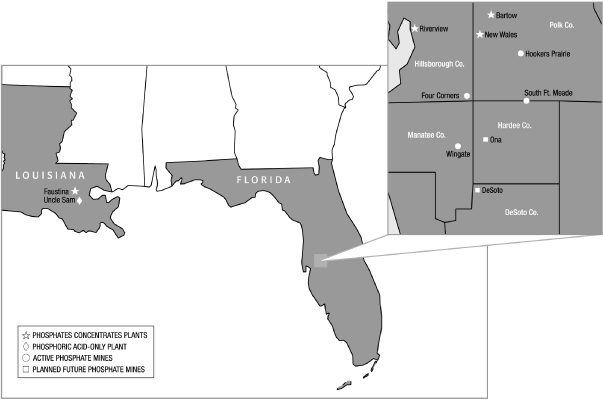

Our primary phosphate crop nutrient production facilities are located in central Florida and Louisiana. The following map shows the locations of each of our phosphate concentrates plants in the United States and the locations of each of our active and planned future phosphate mines in Florida:

Annual capacity by plant as of May 31, 2011 and production volumes by plant for fiscal 2011 are listed below:

| | | | | | | | | | | | | | | | |

| (tonnes in millions) | | Phosphoric Acid | | | Processed

Phosphate (a)/DAP/MAP/

MicroEssentials® /Feed

Phosphate | |

Facility | | Operational

Capacity (b) | | | Production | | | Operational

Capacity (b) | | | Production

| |

Florida: | | | | | | | | | | | | | | | | |

Bartow | | | 1.0 | | | | 0.9 | | | | 2.1 | | | | 2.1 | |

New Wales | | | 1.7 | | | | 1.6 | | | | 4.2 | | | | 3.3 | |

Riverview | | | 0.9 | | | | 0.8 | | | | 1.7 | | | | 1.7 | |

| | | | | | | | | | | | | | | | |

| | | 3.6 | | | | 3.3 | | | | 8.0 | | | | 7.1 | |

Louisiana: | | | | | | | | | | | | | | | | |

Faustina | | | - | | | | - | | | | 1.7 | | | | 1.3 | |

Uncle Sam | | | 0.8 | | | | 0.6 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

| | | 0.8 | | | | 0.6 | | | | 1.7 | | | | 1.3 | |

| | | | | | | | | | | | | | | | |

Total | | | 4.4 | | | | 3.9 | | | | 9.7 | | | | 8.4 | |

| | | | | | | | | | | | | | | | |

| (a) | Our effective capacity to produce processed phosphates has been less than our operational capacity stated in the table above, except to the extent we purchase phosphoric acid. |

8

| (b) | Actual operating rates vary from those shown in the above table due to factors that include among others the level of demand for our products, maintenance and turnaround time, accidents, mechanical failure, product mix, and other operating conditions. |

The phosphoric acid produced at Uncle Sam is shipped to Faustina, where it is used to produce DAP and MAP. Our Faustina plant also manufactures ammonia that is mostly consumed in our concentrate plants.

We produced approximately 7.9 million tonnes of concentrated phosphate crop nutrients for fiscal 2011 and accounted for roughly 13% of estimated world output and 57% of estimated North American production.

Phosphate Rock

Phosphate rock is the key mineral used to produce phosphate crop nutrients and feed phosphate. Our phosphate rock production totaled approximately 11.5 million tonnes in fiscal 2011 and accounted for approximately 6% of estimated world production and 43% of estimated North American production. We are the world’s second largest miner of phosphate rock and currently operate four mines with a combined annual capacity of approximately 15.9 million tonnes. Production of one tonne of DAP requires between 1.6 and 1.7 tonnes of phosphate rock.

All of our wholly owned phosphate mines and related mining operations are located in central Florida. During fiscal 2011, we operated five active mines: Four Corners, South Fort Meade, Hookers Prairie, Wingate and Hopewell. The Hopewell mine’s reserves were exhausted in January 2011. We plan to develop two large mines at Ona and at DeSoto to replace mines that will be depleted at various times during the next decade.

The phosphate deposits of Florida are of sedimentary origin and are part of a phosphate-bearing province that extends from southern Florida north along the Atlantic coast into southern Virginia. Our active phosphate mines are primarily located in what is known as the Bone Valley Member of the Peace River Formation in the Central Florida Phosphate District. The southern portions of the Four Corners and Wingate mines are in what is referred to as the Undifferentiated Peace River Formation, in which our future Ona and DeSoto mines would also be located. Phosphate mining has been conducted in the Central Florida Phosphate District since the late 1800’s. The potentially mineable portion of the district encompasses an area approximately 80 miles in length in a north-south direction and approximately 40 miles in width.

We extract phosphate ore using large surface mining machines that we own called “draglines.” Prior to extracting the ore, the draglines must first remove a 10 to 50 foot layer of sandy overburden. At our Wingate mine, we also utilize dredges to remove the overburden and mine the ore. We then process the ore at beneficiation plants that we own at each active mine where the ore goes through washing, screening, sizing and flotation processes designed to separate the phosphate rock from sands, clays and other foreign materials. Prior to commencing operations at any of our planned future mines, we would need to acquire new draglines or move existing draglines to the mines and, unless the beneficiation plant at an existing mine were used, construct a beneficiation plant.

9

The following table shows, for each of our phosphate mines, annual capacity as of May 31, 2011 and rock production volume and grade for the past three fiscal years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (tonnes in millions) | | Annual

Operational

Capacity (a) | | | 2011 | | | 2010 | | | 2009 | |

Facility | | | Production | | | Average

BPL (b) | | | %

P2O5 (c) | | | Production | | | Average

BPL (b) | | | %

P2O5 (c) | | | Production | | | Average

BPL (b) | | | %

P2O5 (c) | |

Four Corners | | | 6.5 | | | | 6.7 | | | | 65.5 | | | | 30.0 | | | | 5.6 | | | | 66.4 | | | | 30.4 | | | | 5.1 | | | | 64.9 | | | | 29.7 | |

South Fort Meade (d) | | | 6.0 | | | | 1.8 | | | | 63.7 | | | | 29.2 | | | | 4.3 | | | | 63.0 | | | | 28.8 | | | | 5.1 | | | | 61.9 | | | | 28.3 | |

Hookers Prairie | | | 2.0 | | | | 1.8 | | | | 65.8 | | | | 30.1 | | | | 1.8 | | | | 64.8 | | | | 29.7 | | | | 1.6 | | | | 64.8 | | | | 29.7 | |

Wingate | | | 1.4 | | | | 1.0 | | | �� | 64.6 | | | | 29.6 | | | | 1.1 | | | | 65.0 | | | | 29.7 | | | | 0.9 | | | | 65.5 | | | | 30.0 | |

Hopewell (e) | | | - | | | | 0.2 | | | | 66.5 | | | | 30.4 | | | | 0.5 | | | | 68.7 | | | | 31.4 | | | | 0.5 | | | | 70.9 | | | | 32.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 15.9 | | | | 11.5 | | | | 65.2 | | | | 29.8 | | | | 13.3 | | | | 65.0 | | | | 29.8 | | | | 13.2 | | | | 64.0 | | | | 29.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Actual operating rates vary from those shown in the above table due to factors that include among others the level of demand for our products, the quality of the reserves, the nature of the geologic formations we are mining at any particular time, maintenance and turnaround time, accidents, mechanical failure, weather conditions, and other operating conditions, as well as the effect of recent initiatives intended to improve operational excellence. |

| (b) | Bone Phosphate of Lime (“BPL”) is a traditional reference to the amount (by weight percentage) of calcium phosphate contained in phosphate rock or a phosphate ore body. A higher BPL corresponds to a higher percentage of calcium phosphate. |

| (c) | The percent of P2O5 in the above table represents a measure of the phosphate content in phosphate rock or a phosphate ore body. A higher percentage corresponds to a higher percentage of phosphate content in phosphate rock or a phosphate ore body. |

| (d) | Production at the South Fort Meade mine for fiscal 2011 reflects the temporary shutdown during most of the first six months of fiscal 2011 and subsequent reduced production level for the remainder of fiscal 2011 at the South Fort Meade mine as a result of the First Preliminary Injunction and Partial Settlement. |

| (e) | The Hopewell mine’s reserves were exhausted in January 2011. |

We also purchase phosphate rock from time to time. The level of our purchases of phosphate rock in the future will depend upon, among other factors, our phosphate rock mining plans, the status of our permits including the Hardee County Extension Permit, our need for additional phosphate rock to allow us to operate our concentrates plants at or near full capacity, the quality and level of impurities in the phosphate rock that we mine, and our development or acquisition of additional phosphate rock deposits and mines. Depending on product mix and tonnage requirements, our need for purchased phosphate rock could increase in the future in order to meet product specifications, particularly as we develop our proposed Ona and DeSoto mines. Our investment in the Miski Mayo Joint Venture and related commercial offtake supply agreement to purchase a share of the phosphate rock from the Miski Mayo Mine reduces our purchases of phosphate rock from other suppliers.

Reserves

We estimate our phosphate rock reserves based upon exploration core drilling as well as technical and economic analyses to determine that reserves can be economically mined. Proven (measured) reserves are those resources of sufficient concentration to meet minimum physical, chemical and economic criteria related to our current product standards and mining and production practices. Our estimates of probable (indicated) reserves are based on information similar to that used for proven reserves, but sites for drilling are farther apart or are otherwise less adequately spaced than for proven reserves, although the degree of assurance is high enough to assume continuity between such sites. Proven reserves are determined using a minimum drill hole spacing of two sites per 40 acre block. Probable reserves have less than two drill holes per 40 acre block, but geological data provides a high degree of assurance that continuity exists between sites.

10

The following table sets forth our proven and probable phosphate reserves as of May 31, 2011:

| | | | | | | | | | | | |

| (tonnes in millions) | | Reserve Tonnes (a) (b) (c) | | | Average BPL (d) | | | % P2O5 | |

Active Mines | | | | | | | | | | | | |

Four Corners | | | 53.6 | | | | 65.9 | | | | 30.2 | |

South Fort Meade | | | 53.8 | (e) | | | 64.2 | | | | 29.4 | |

Hookers Prairie | | | 5.7 | (e), (f) | | | 65.5 | | | | 30.0 | |

Wingate | | | 36.5 | | | | 63.5 | | | | 29.1 | |

| | | | | | | | | | | | |

Total Active Mines | | | 149.6 | | | | 64.7 | | | | 29.6 | |

Future Mining | | | | | | | | | | | | |

Ona | | | 245.5 | | | | 63.5 | | | | 29.0 | |

DeSoto | | | 148.0 | (g) | | | 64.8 | | | | 29.7 | |

| | | | | | | | | | | | |

Total Future Mining | | | 393.5 | | | | 64.0 | | | | 29.3 | |

| | | | | | | | | | | | |

Total Mining | | | 543.1 | | | | 64.2 | | | | 29.4 | |

| | | | | | | | | | | | |

| (a) | Reserves are in areas that are fully accessible for mining; free of surface or subsurface encumbrance, legal setbacks, wetland preserves and other legal restrictions that preclude permittable access for mining; believed by us to be permittable; and meet specified minimum physical, economic and chemical criteria related to current mining and production practices. |

| (b) | Reserve estimates are generally established by our personnel without a third party review. There has been no third party review of reserve estimates within the last five years, except that in fiscal 2008, we engaged a third party to review the recoverable reserves at our Wingate mine’s Tract 2 pursuant to contractual requirements related to our acquisition of these reserves. The reserve estimates have been prepared in accordance with the standards set forth in Industry Guide 7 promulgated by the United States Securities and Exchange Commission (“SEC”). |

| (c) | Of the reserves shown, 515.3 million tonnes are proven reserves, while approximately 1.6 million tonnes at Ona and 26.2 million tonnes at DeSoto are probable reserves. |

| (d) | Average product BPL ranges from approximately 64% to 66%. |

| (e) | Approximately, 17.0 million of the tonnes shown for South Fort Meade have been reclassified from Hookers Prairie. |

| (f) | Of the tonnes shown at Hookers Prairie, our lease of 1.4 million tonnes requires us to pay royalties of $2.00 per short ton of the reserves that we mine. In addition, our lease of 1.4 million tonnes requires us to pay royalties between $1.25 to $1.35 per short ton that are generally credited against $250,000 advance royalties that we paid when we entered into the lease. |

| (g) | In connection with the sale in 1994 of certain of the surface rights related to approximately 48.9 million tonnes of the reported DeSoto reserves, we agreed not to mine such reserves until at least 2014. Our current mining plans do not contemplate mining these reserves until at least that time. In addition, in connection with the purchase in 1996 of approximately 99.1 million tonnes of the reported Desoto reserves, we agreed to (i) pay royalties of between $0.50 and $0.90 per ton of rock mined based on future levels of DAP margins, (ii) pay to the seller lost income from the loss of surface use to the extent we use the property for mining related purposes before January 1, 2015 and (iii) re-convey to the seller the lands which are not scheduled to be mined upon completion of the permitting process and the approval of the Development Order for the mine. |

We generally own the reserves shown for active mines in the table above, with the only significant exceptions being further described below:

| | • | | Of the tonnes shown for the Wingate mine, 1.6 million tonnes are under a lease that we have the right to extend through 2014 and for which we have prepaid substantially all royalties. |

11

| | • | | We hold the reserves for the Four Corners and Ona mines under leases that we have rights to extend to 2015 and 2022, respectively. |

| | • | | We own the above-ground assets of the South Fort Meade mine, including the beneficiation plant, rail track and clay settling areas. A limited partnership, South Ft. Meade Partnership, L.P. (“SFMP”), owns all of the mineable acres shown in the table for the South Fort Meade mine. |

| | • | | We currently have a 94% economic interest in the profits and losses of SFMP. SFMP is included as a consolidated subsidiary in our financial statements. |

| | • | | We have a long-term mineral lease with SFMP. This lease expires on December 31, 2025 or on the date that we have completed mining and reclamation obligations associated with the leased property. Lease provisions include royalty payments and a commitment to give mining priority to the South Fort Meade phosphate reserves. We pay the partnership a royalty on each tonne mined and shipped from the areas that we lease from it. Royalty payments to SFMP total approximately $4 million annually at current shipment rates. |

| | • | | Through its arrangements with us, SFMP also earns income from mineral lease payments, agricultural lease payments and interest income, and uses those proceeds primarily to pay dividends to its equity owners. |

| | • | | The surface rights to approximately 882 acres shown in the table above for the South Fort Meade Mine are owned by SFMP, while the U.S. government owns the mineral rights beneath. We control the rights to mine these reserves under a mining lease agreement and pay royalties on the tonnage extracted. Royalties on the approved leases equal approximately 5% of the six-month rolling average mining cost of production when mining these reserves. Under the lease, we paid $0.3 million in royalties to the U.S. government in fiscal 2011. |

In light of the long-term nature of our rights to our reserves, we expect to be able to mine all reported reserves that are not currently owned prior to termination or expiration of our rights. Additional information regarding permitting is included in Part I, Item 1A, “Risk Factors”, under “Environmental, Health and Safety Matters—Operating Requirements and Permitting” in our Management’s Analysis, and under “Phosphate Mine Permitting in Florida” in Note 22 of our Consolidated Financial Statements.

Sulfur

We use molten sulfur at our phosphates concentrates plants to produce sulfuric acid primarily for use in our production of phosphoric acid. We purchased approximately 3.5 million long tons of sulfur during fiscal 2011. We purchase most of this sulfur from North American oil and natural gas refiners who are required to remove or recover sulfur during the refining process. Production of one tonne of DAP requires approximately 0.4 long tons of sulfur. We procure our sulfur from multiple sources and receive it by truck or rail either direct to our phosphate plants or have it sent for gathering to terminals that are located on the US gulf coast.

We own and operate a sulfur terminal in Houston, Texas and lease a terminal in Tampa, Florida. We own two ocean-going barges and contract for operation of another ocean-going vessel that transport molten sulfur from the Texas terminals to Tampa and then onward by truck to our Florida phosphate plants. We also own a 50% equity interest in Gulf Sulphur Services Ltd., LLLP (“Gulf Sulphur Services”), which is operated by our joint venture partner. Gulf Sulphur Services has a large sulfur transportation and terminaling business in the Gulf of Mexico, and handles these functions for a substantial portion of our Florida sulfur volume. Gulf Sulphur Services’ capabilities include melting solid sulfur into the molten form that we use, which permits us to access sources of solid as well as molten sulfur. We further round out our sulfur logistic assets with a large fleet of leased railcars that supplement our marine sulfur logistic system. Our Louisiana operations are served by truck, rail and barge from nearby refineries.

12

Although sulfur is readily available from many different suppliers and can be transported to our phosphate facilities by a variety of means, sulfur is an important raw material used in our business that has in the past been and may in the future be the subject of volatile pricing and availability. Alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to current transportation or terminaling facilities. Changes in the price of sulfur or disruptions to sulfur transportation or terminaling facilities could have a material impact on our business. We have included a discussion of sulfur prices in our Management’s Analysis.

Ammonia

We use ammonia together with phosphoric acid to produce both DAP and MAP. We used approximately 1.7 million tonnes of ammonia during fiscal 2011. Production of one tonne of DAP requires approximately 0.2 tonnes of ammonia.

Our Florida ammonia needs are supplied by offshore producers, under multi-year and annual contracts. Ammonia for our New Wales and Riverview plants is terminaled through an ammonia facility at Port Sutton, Florida that we lease for a term expiring in 2013, which we may extend for up to five additional years. A third party operates the Port Sutton ammonia facility pursuant to an agreement that expires in 2013, which we may extend for an unlimited number of additional five year terms, as long as we or the other party is entitled to operate the ammonia facility. Ammonia for our Bartow plant is terminaled through another ammonia facility owned and operated by a third party at Port Sutton, Florida pursuant to an agreement that expires in calendar 2012. Ammonia is transported by pipeline from the terminals to our production facilities. The service agreements with the pipeline providers will expire at the end of calendar year 2011 for Bartow, New Wales and Riverview.

We produce ammonia at Faustina, Louisiana primarily for our own consumption. Our annual capacity is approximately 500,000 tonnes. From time to time we may sell surplus ammonia to unrelated parties.

Although ammonia is readily available from many different suppliers and can be transported to our phosphates facilities by a variety of means, ammonia is an important raw material used in our business that has in the past been and may in the future be the subject of volatile pricing, and alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to existing transportation or terminaling facilities. Changes in the price of ammonia or disruptions to ammonia transportation or terminaling could have a material impact on our business. We have included a discussion of ammonia prices in our Management’s Analysis.

Natural Gas

Natural gas is the primary raw material used to manufacture ammonia. At our Faustina facility, ammonia is manufactured on site. The majority of natural gas is purchased through firm delivery contracts based on published index-based prices and is sourced from Texas and Louisiana via pipelines interconnected to the Henry Hub. We use over-the-counter swap and option contracts to forward price portions of future gas purchases. The portions of gas purchases not forward priced are purchased at the index based prices or at domestic spot market prices under short-term contracts. We purchase approximately 14 MMbtu of natural gas per year for use in ammonia production at Faustina.

Because our ammonia requirements for our Florida operations are purchased rather than manufactured on site, we purchase approximately two MMbtu of natural gas per year in Florida only as a thermal fuel for various production processes.

Florida Land Holdings

We are a significant landowner in the State of Florida, which in the future is expected to return to its historical status as one of the fastest areas of population growth in the United States. We own land comprising

13

approximately 255,000 acres held in fee simple title in central Florida, and have the right to mine additional properties which contain phosphate rock reserves. Some of our land holdings are needed to operate our Phosphates business, while a portion of our land assets, such as reclaimed properties, are not related to our operations. As a general matter, more of our reclaimed property becomes available for uses other than for phosphate operations each year. Our land assets are generally comprised of concentrates plants, port facilities, phosphate mines and other property which we have acquired through our presence in Florida. We are currently taking initial steps as part of a long-term future land use strategy to optimize the value of our land assets. For example, during fiscal 2011 we began development of Streamsong, a destination resort and conference center, in certain areas of previously mined land as part of our long-term business strategy to maximize the value and utility of our extensive land holdings in Florida. The resort and conference center are expected to be completed in calendar 2013.

International Production

Our international operations include production in Brazil and Argentina. Our production facilities include plants that produce up to 800,000 tonnes per year of single superphosphate (“SSP”) and granulated SSP crop nutrients by mixing sulfuric acid with phosphate rock. We sold one of the SSP production facilities as described in Note 10 of our Consolidated Financial Statements.

Potash Segment

We are one of the leading potash producers in the world. We mine and process potash in Canada and the United States and sell potash in North America and internationally. The term “potash” applies generally to the common salts of potassium. Muriate of potash (“MOP”) is the primary source of potassium for the crop nutrient industry. Red MOP has traces of iron oxide. The granular and standard grade Red MOP products are well suited for direct fertilizer application and bulk blending. White MOP has a higher percent K20. White MOP, besides being well suited for the agricultural market, is used in many industrial applications.

Our potash products are marketed worldwide to crop nutrient manufacturers, distributors and retailers and are also used in the manufacture of mixed crop nutrients and, to a lesser extent, in animal feed ingredients. We also sell potash to customers for industrial use. In addition, our potash products are used for de-icing and as a water softener regenerant.

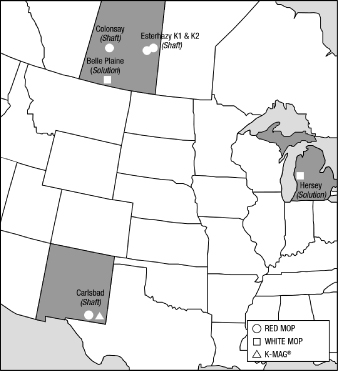

We operate three potash mines in Canada, including two shaft mines with a total of three production shafts and one solution mine, as well as two potash mines in the United States, including one shaft mine and one solution mine. We also own related refineries at each of the mines.

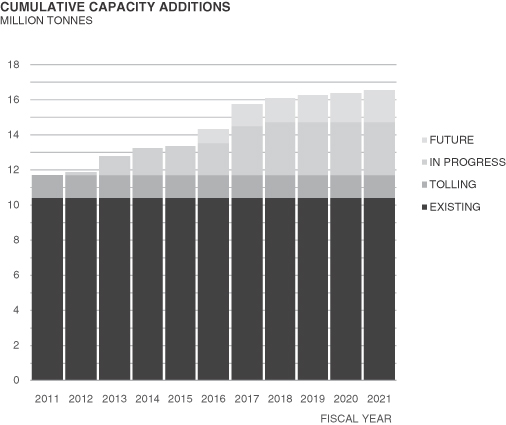

We have a long term potash capacity expansion plan in Saskatchewan, Canada in response to expected growth in global potash demand. We expect the total planned expansions to increase our annualized proven peaking capacity for finished product by approximately five million tonnes. The expansions are planned to occur over the next decade, with the first expansions already on line.

14

POTASH EXPANSION PROJECTS

| | | | | | |

(tonnes in millions) | | Annual

Planned Peaking

Capacity | | | Estimated

Completion

(Fiscal Year) |

Complete | | | | | | |

Colonsay (a) | | | 0.2 | | | - |

Esterhazy | | | 0.1 | | | - |

In progress | | | | | | |

Belle Plaine | | | 0.6 | | | 2012 |

Colonsay | | | 0.5 | | | 2013 |

Esterhazy | | | 1.7 | | | 2012-2017 |

Future | | | | | | |

Belle Plaine | | | 1.3 | | | 2016-19 |

Colonsay | | | 0.5 | | | 2016 |

| | | | | | |

| | | 4.9 | | | |

| | | | | | |

Tolling Agreement (b) | | | 1.3 | | | |

Peaking capacity as of May 31, 2011 | | | 10.3 | | | |

| | | | | | |

| | | 16.5 | | | |

| | | | | | |

| (a) | As of May 31, 2011, 0.1 million tonnes were placed in service and included in operational capacity |

| (b) | The status of the Tolling Agreement is discussed below under “Canadian Mines.” |

15

As shown in the table above, we have completed the first capacity expansions at our Esterhazy and Colonsay, Saskatchewan potash mines. In addition, we anticipate completing certain expansion projects at our Belle Plaine and Esterhazy, Saskatchewan potash mines in the second half of fiscal 2012. All other expansion projects are progressing as planned.

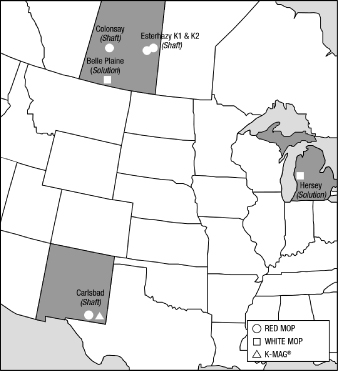

The map below shows the location of each of our potash mines.

Our current potash annualized proven peaking capacity, excluding tonnage produced at Esterhazy under the Tolling Agreement, totals 10.3 million tonnes of product per year and accounted for approximately 14% of world capacity and 37% of North American capacity. Production during fiscal 2011, excluding tonnage produced for a third party at Esterhazy, totaled 7.4 million tonnes and accounted for approximately 12% of estimated world production and 38% of estimated North American production.

16

The following table shows, for each of our potash mines, annual capacity as of May 31, 2011 and volume of mined ore, average grade and finished product output for the past three fiscal years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (tonnes in millions) | | | | | | | | 2011 | | | 2010 | | | 2009 | |

Facility | | Annualized

Proven

Peaking

Capacity (a)(b)(c) | | | Annual

Operational

Capacity (a)(b)(d) | | | Ore

Mined | | | Grade

% K2O (e) | | | Finished

Product | | | Ore

Mined | | | Grade

% K2O (e) | | | Finished

Product | | | Ore

Mined | | | Grade

% K2O (e) | | | Finished

Product | |

Canada | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Belle Plaine—MOP | | | 2.8 | | | | 2.3 | | | | 8.4 | | | | 18.0 | | | | 2.2 | | | | 5.7 | | | | 18.0 | | | | 1.5 | | | | 6.9 | | | | 18.0 | | | | 1.8 | |

Colonsay—MOP | | | 1.8 | | | | 1.6 | | | | 3.2 | | | | 25.0 | | | | 1.1 | | | | 2.2 | | | | 24.9 | | | | 0.8 | | | | 2.6 | | | | 26.6 | | | | 1.0 | |

Esterhazy—MOP | | | 5.3 | | | | 4.8 | | | | 11.8 | | | | 23.9 | | | | 3.9 | | | | 6.7 | | | | 24.1 | | | | 2.3 | | | | 8.3 | | | | 25.1 | | | | 3.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Canadian Total | | | 9.9 | | | | 8.7 | | | | 23.4 | | | | 21.9 | | | | 7.2 | | | | 14.6 | | | | 21.8 | | | | 4.6 | | | | 17.8 | | | | 22.6 | | | | 5.8 | |

United States | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Carlsbad—MOP | | | 0.5 | | | | 0.5 | | | | 3.0 | | | | 10.2 | | | | 0.3 | | | | 3.0 | | | | 11.2 | | | | 0.4 | | | | 2.5 | | | | 10.2 | | | | 0.2 | |

Carlsbad—K-Mag®(f) | | | 1.1 | | | | 1.0 | | | | 3.5 | | | | 5.1 | | | | 0.7 | | | | 2.7 | | | | 6.7 | | | | 0.6 | | | | 2.7 | | | | 6.4 | | | | 0.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Carlsbad Total | | | 1.6 | | | | 1.5 | | | | 6.5 | | | | 7.4 | | | | 1.0 | | | | 5.7 | | | | 9.1 | | | | 1.0 | | | | 5.2 | | | | 8.2 | | | | 0.8 | |

Hersey—MOP (g) | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 26.7 | | | | 0.1 | | | | 0.1 | | | | 26.7 | | | | - | | | | 0.2 | | | | 26.7 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

United States Total | | | 1.7 | | | | 1.6 | | | | 6.6 | | | | | | | | 1.1 | | | | 5.8 | | | | | | | | 1.0 | | | | 5.4 | | | | | | | | 0.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | 11.6 | | | | 10.3 | | | | 30.0 | | | | 18.8 | | | | 8.3 | | | | 20.4 | | | | 18.3 | | | | 5.6 | | | | 23.2 | | | | 19.4 | | | | 6.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total excluding toll

production (h) | | | 10.3 | | | | | | | | 27.2 | | | | | | | | 7.4 | | | | 19.3 | | | | | | | | 5.2 | | | | 20.9 | | | | | | | | 5.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (b) | Actual operating rates may vary from those shown in the above table due to factors that include among others the level of demand for our products, maintenance and turnaround time, the quality of the reserves and the nature of the geologic formations we are mining at any particular time, accidents, mechanical failure, product mix, and other operating conditions. |

| (c) | Represents full capacity assuming no turnaround or maintenance time. |

| (d) | Annual operational capacity is our estimated annual achievable production level. |

| (e) | Grade % K20 is a traditional reference to the percentage (by weight) of potassium oxide contained in the ore. A higher percentage corresponds to a higher percentage of potassium oxide in the ore. |

| (f) | K-Mag is a specialty product that we produce at our Carlsbad facility. |

| (g) | The Hersey facility also mines, processes and sells salt. |

| (h) | We toll produce MOP at our Esterhazy mine under the Tolling Agreement. |

Canadian Mines

We operate three Canadian potash facilities all located in the southern half of the Province of Saskatchewan, including our solution mine at Belle Plaine, two interconnected mine shafts at our Esterhazy shaft mine and our shaft mine at Colonsay.

Extensive potash deposits are found in the southern half of the Province of Saskatchewan. The potash ore is contained in a predominantly rock salt formation known as the Prairie Evaporites. The Prairie Evaporites deposits are bounded by limestone formations and contain the potash beds. Three potash deposits of economic importance occur in Saskatchewan: the Esterhazy, Belle Plaine and Patience Lake members. The Patience Lake member is mined at Colonsay, and the Esterhazy member at Esterhazy. At Belle Plaine all three members are mined. Each of the major potash members contains several potash beds of different thicknesses and grades. The particular beds mined at Colonsay and Esterhazy have a mining height of 11 and 8 feet, respectively. At Belle Plaine several beds of different thicknesses are mined.

Our potash mines in Canada produce MOP exclusively. Esterhazy and Colonsay utilize shaft mining while Belle Plaine utilizes solution mining technology. Traditional potash shaft mining takes place underground at depths of over 3,000 feet

17

where continuous mining machines cut out the ore face and load it onto conveyor belts. The ore is then crushed, moved to storage bins and hoisted to refineries above ground. In contrast, our solution mining process involves heated water, which is pumped through a “cluster” to dissolve the potash in the ore beds at a depth of approximately 5,400 feet. A cluster consists of a series of boreholes drilled into the potash ore by a portable, all-weather, electric drilling rig. A separate distribution center at each cluster controls the brine flow. The solution containing dissolved potash and salt is pumped to a refinery where sodium chloride, a co-product of this process, is separated from the potash through the use of evaporation and crystallization techniques. Concurrently, the solution is pumped into a 150 acre cooling pond where additional crystallization occurs and the resulting product is recovered via a floating dredge. Refined potash is dewatered, dried and sized. Our Canadian operations produce 15 different MOP products, including industrial grades, many through proprietary processes.

Under an agreement (the “Tolling Agreement”) with Potash Corporation of Saskatchewan Inc. (“PCS”), we mine and refine PCS’ potash reserves at our Esterhazy mine for a fee plus a pro rata share of operating and capital costs. The contract provides that PCS may elect to receive between 0.45 million and 1.3 million tonnes of potash per year. The contract provides for a term through December 31, 2011 as well as certain renewal terms at the option of PCS, but only to the extent PCS has not received all of its available reserves under the contract. Based on our then-current calculations, in May 2009, we informed PCS that we believed that approximately 1.5 million tonnes of potash remained to be delivered to PCS under the contract after April 30, 2009. PCS has filed a lawsuit against us contesting our basis and timing for termination of the contract and alleging damages based on our historical mining practices. We subsequently counterclaimed, alleging that PCS breached the Tolling Agreement by refusing to take delivery of approximately 0.9 million tonnes of potash that it ordered under the contract, primarily for delivery after April 30, 2009, due to the global financial and credit crisis. We believe PCS’ allegations are without merit. We have included a further description of the Tolling Agreement and the lawsuit under “Esterhazy Potash Mine Tolling Contract Dispute” in Notes 21 and 22 of our Consolidated Financial Statements. After expiration of our obligation to ship potash under the Tolling Agreement or during other periods to the extent we are not fully utilizing the capacity to satisfy our obligations under the contract, the productive capacity at our Esterhazy mine otherwise used to satisfy our obligations under the Tolling Agreement is available to us for sales to any of our customers at then-current market prices. Our potash mineral rights in the Province of Saskatchewan consist of the following:

| | | | | | | | | | | | | | | | |

| | | Belle Plaine | | | Colonsay | | | Esterhazy | | | Total | |

Acres under control | | | | | | | | | | | | | | | | |

Owned in fee | | | 13,851 | | | | 10,039 | | | | 109,196 | | | | 133,086 | |

Leased from Province | | | 51,568 | | | | 67,006 | | | | 193,000 | | | | 311,574 | |

Leased from others | | | - | | | | 320 | | | | 63,615 | | | | 63,935 | |

| | | | | | | | | | | | | | | | |

Total under control | | | 65,419 | | | | 77,365 | | | | 365,811 | | | | 508,595 | |

| | | | | | | | | | | | | | | | |

We believe that our mineral rights in Saskatchewan are sufficient to support current operations for more than a century. Leases are generally renewable at our option for successive terms, generally 21 years each, except that certain of the acres shown above as “Leased from others” are leased under long-term leases with terms (including renewals at our option) that expire from 2094 to 2142.

We pay Canadian resource taxes consisting of the Potash Production Tax and resource surcharge. The Potash Production Tax is a Saskatchewan provincial tax on potash production and consists of a base payment and a profits tax. We also pay a percentage of the value of resource sales from our Saskatchewan mines. In addition to the Canadian resource taxes, royalties are payable to the mineral owners in respect of potash reserves or production of potash. We have included a further discussion of the Canadian resource taxes and royalties in our Management’s Analysis.

Since December 1985, we have experienced an inflow of salt saturated brine into our Esterhazy mine. At various times since then, we have experienced new or substantially increased brine inflows at the Esterhazy mine. As a

18

result of these brine inflows, we incur expenditures, certain of which have been capitalized while others have been charged to expense, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), to control the inflow. It is possible that the costs of remedial efforts at Esterhazy may further increase in the future and that such an increase could be material, or, in the extreme scenario, that the brine inflows, risk to employees or remediation costs may increase to a level which would cause us to change our mining process or abandon the mine. See “Potash Net Sales and Gross Margin” in our Management’s Analysis and “Accidents occurring in the course of our operating activities could result in significant liabilities, interruptions or shutdowns of facilities or the need for significant safety or other expenditures” in Part I, Item 1A, “Risk Factors” in this report, both of which are incorporated herein by reference, for a discussion of costs, risks and other information relating to the brine inflows. We have begun construction of a new third shaft at the Esterhazy mine as part of our potash expansion plan and which is also intended to mitigate part of the risk from the inflow.

Due to the ongoing brine inflow problem at Esterhazy, underground operations at this facility are currently not insurable for water incursion problems. Like other potash producers’ shaft mines, our Colonsay, Saskatchewan, and Carlsbad, New Mexico, mines are also subject to the risks of inflow of water as a result of their shaft mining operations, but water inflow risks at these mines are included in our insurance coverage subject to deductibles, retentions and limits negotiated with our insurers.

United States Mines

In the United States, we have two potash facilities, including a shaft mine located in Carlsbad, New Mexico and a solution mine located in Hersey, Michigan.

Our potash mineral rights in the United States consist of the following:

| | | | | | | | | | | | |

| | | Carlsbad | | | Hersey | | | Total | |

Acres under control | | | | | | | | | | | | |

Owned in fee | | | - | | | | 581 | | | | 581 | |

Long-term leases | | | 73,781 | | | | 1,799 | | | | 75,580 | |

| | | | | | | | | | | | |

Total under control | | | 73,781 | | | | 2,380 | | | | 76,161 | |

| | | | | | | | | | | | |

The Carlsbad ore reserves are of two types: (1) sylvinite, a mixture of potassium chloride and sodium chloride that is the same as the ore mined in Saskatchewan, and (2) langbeinite, a double sulfate of potassium and magnesium. These two types of potash reserves occur in a predominantly rock salt formation known as the Salado Formation. The McNutt Member of this formation consists of eleven units of economic importance, of which we currently mine two. The McNutt Member’s evaporite deposits are interlayered with anhydrite, polyhalite, potassium salts, clay, and minor amounts of sandstone and siltstone.

Continuous underground mining methods are utilized to extract the ore. Drum type mining machines are used to cut the sylvinite and langbeinite ores from the face. Mined ore is then loaded onto conveyors, transported to storage areas, and then hoisted to the surface for further processing at our refinery.

Two types of potash are produced at the Carlsbad refinery. MOP is the primary source of potassium for the crop nutrient industry. Double sulfate of potash magnesia is the second type of potash, which we market under our brand name K-Mag®, and contains sulfur, potassium and magnesium, with low levels of chloride.

At the Carlsbad facility, we mine and refine potash from 73,781 acres of mineral rights. We control these reserves pursuant to either (i) leases from the U.S. government that, in general, continue in effect at our option (subject to readjustment by the U.S. government every 20 years) or (ii) leases from the State of New Mexico that

19

continue as long as we continue to produce from them. These reserves contain an estimated total of 260 million tonnes of potash mineralization (calculated after estimated extraction losses) in two mining beds evaluated at thicknesses ranging from 4.5 feet to in excess of 11 feet. At average refinery rates, these ore reserves are estimated to be sufficient to yield 15 million tonnes of concentrates from sylvinite with an average grade of approximately 60% K2O and 22 million tonnes of langbeinite concentrates with an average grade of approximately 22% K2O. At projected rates of production, we estimate that Carlsbad’s reserves of sylvinite and langbeinite are sufficient to support operations for approximately 32 years and 25 years, respectively.

At Hersey, Michigan, we operate a solution mining facility which produces salt and potash. Mining occurs in the Michigan Basin in a predominantly rock salt formation called the Salina Group Evaporite. This formation is a clean salt deposit with interlayered beds of sylvinite and carbonate. At the Hersey facility, our mineral rights consist of 581 acres owned in fee and 1,799 acres controlled under leases that, in general, continue in effect at our option as long as we continue our operations at Hersey. These lands contain an estimated 41 million tonnes of potash mineralization contained in two beds ranging in thickness from 14 to 30 feet.

Royalties for the U.S. operations amounted to approximately $13.2 million for fiscal 2011. These royalties are established by the U.S. Department of the Interior, Bureau of Land Management, in the case of the Carlsbad leases from the U.S. government, and pursuant to provisions set forth in the leases, in the case of the Carlsbad state leases and the Hersey leases.

Reserves

Our estimates below of our potash reserves and non-reserve potash mineralization are based on exploration drill hole data, seismic data and actual mining results over more than 35 years. Proven reserves are estimated by identifying material in place that is delineated on at least two sides and material in place within a half-mile radius or distance from an existing sampled mine entry or exploration core hole. Probable reserves are estimated by identifying material in place within a one mile radius from an existing sampled mine entry or exploration core hole. Historical extraction ratios from the many years of mining results are then applied to both types of material to estimate the proven and probable reserves. We believe that all reserves and non-reserve potash mineralization reported below are potentially recoverable using existing production shaft and refinery locations.

Our estimated recoverable potash reserves and non-reserve potash mineralization as of May 31, 2011 for each of our mines is as follows:

| | | | | | | | | | | | |

| (tonnes in millions) | | Reserves (a)(b) | | | Potash

Mineralization (a)(c) | |

Facility | | Recoverable

Tonnes | | | Average

Grade

(% K2O) | | | Potentially

Recoverable

Tonnes | |

Canada | | | | | | | | | | | | |

Belle Plaine | | | 792 | | | | 18.0 | | | | 2,327 | |

Colonsay | | | 239 | | | | 26.4 | | | | 228 | |

Esterhazy | | | 875 | | | | 24.5 | | | | 479 | |

| | | | | | | | | | | | |

sub-totals | | | 1,906 | | | | 22.0 | | | | 3,034 | |

United States | | | | | | | | | | | | |

Carlsbad | | | 260 | | | | 7.5 | | | | - | |

Hersey | | | 41 | | | | 26.7 | | | | - | |

| | | | | | | | | | | | |

sub-totals | | | 301 | | | | 10.1 | | | | - | |

| | | | | | | | | | | | |

Totals | | | 2,207 | | | | 20.4 | | | | 3,034 | |

| | | | | | | | | | | | |

20

| (a) | There has been no third party review of reserve estimates within the last five years. The reserve estimates have been prepared in accordance with the standards set forth in Industry Guide 7 promulgated by the SEC. |

| (b) | Includes 1.2 billion tonnes of proven reserves and 1.0 billion tonnes of probable reserves. |

| (c) | The non-reserve potash mineralization reported in the table in some cases extends to the boundaries of the mineral rights we own or lease. Such boundaries are up to 16 miles from the closest existing sampled mine entry or exploration core hole. Based on available geologic data, the non-reserve potash mineralization represents potash that we expect to mine in the future, but it may not meet all of the technical requirements for categorization as proven or probable reserves under Industry Guide 7. |

As discussed more fully above, we either own the reserves and mineralization shown above or lease them pursuant to mineral leases that generally remain in effect or are renewable at our option, or are long-term leases. Accordingly, we expect to be able to mine all reported reserves that are leased prior to termination or expiration of the existing leases.

Natural Gas

Natural gas is used at our potash solution mines as a fuel to produce steam and to dry potash products. The steam is used to generate electricity, in evaporation and crystallization processes and to provide thermal heat to the solution mining process. Our two solution mines accounted for approximately 77% of our Potash segment’s total natural gas requirements for potash production in fiscal 2011. At our shaft mines, natural gas is used as a fuel to heat fresh air supplied to the shaft mines and for drying potash products. Combined natural gas usage for both the solution and shaft mines approximated 15 MMbtu for fiscal 2011. We purchase our natural gas requirements on firm delivery index price-based physical contracts and on short term spot-priced physical contracts. Our Canadian operations purchase all of their physical gas in Saskatchewan via the TransGas pipeline system using AECO price indices as pricing references. The U.S. potash operations in Michigan and New Mexico purchase physical gas in their respective regional markets via the MichCon and El Paso Permian Basin market hubs as pricing references, respectively. We use financial derivative contracts to manage the price of portions of our future purchases.

SALES AND DISTRIBUTION ACTIVITIES

United States and Canada

We have a United States and Canada sales and marketing team that serves our business segments. We sell to wholesale distributors, retail chains, cooperatives, independent retailers and national accounts.

Customer service and the ability to effectively minimize the overall supply chain costs are key competitive factors in the crop nutrient and animal feed ingredients businesses. In addition to our production facilities, to service the needs of our customers, we own, lease or have contractual throughput or other arrangements at strategically located distribution warehouses along or near the Mississippi and Ohio Rivers as well as in other key agricultural regions of the United States and Canada. From these facilities, we market Mosaic produced phosphate and potash products for customers who in turn resell the product into the distribution channel or directly to farmers in the United States and Canada.

We own port facilities in Savage, Minnesota as well as warehouse distribution facilities in Pekin, Illinois, Louisville, Kentucky, Hendersonville, Kentucky, Melbourne, Kentucky and Houston, Texas which has a deep water berth providing access to the Gulf of Mexico.

In addition to the geographically situated facilities that we own, our U.S. distribution operations also include leased distribution space or contractual throughput agreements in other key geographical areas such as California, Florida, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Minnesota, Nebraska, New York, North Dakota, Pennsylvania and Texas.

21

Our Canadian customers include independent dealers and national accounts. We also lease and own warehouse facilities in Saskatchewan, Canada.

International

Outside of the United States and Canada, we market our Phosphates segment’s products through PhosChem, as well as our Phosphates segment’s own international distribution activities. During fiscal 2011, PhosChem marketed approximately 71% of our phosphate export sales volume. We administer PhosChem on behalf of PhosChem’s member companies. We estimate that PhosChem’s sales represent approximately 65% of total U.S. export volume of concentrated phosphates and 15% of global trade volume. The countries that account for the largest amount of PhosChem’s sales of concentrated phosphates include India, Australia, Brazil, Japan and Colombia. During fiscal 2011, PhosChem’s dry concentrated phosphates exports to Asia were 62% of total dry shipments by volume, with India representing 52% of PhosChem’s total dry concentrated phosphates export shipments.