The Mosaic Company Capital Management Philosophy May 13, 2013 Larry Stranghoener, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations Exhibit 99.1 |

2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of the numeric water quality standards for the discharge of nutrients into Florida waterways or possible efforts to reduce the flow of excess nutrients into the Mississippi River basin or the Gulf of Mexico; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of the Company’s processes for managing its strategic priorities; the ability of Mosaic, Ma’aden and SABIC to agree upon definitive agreements relating to the prospective joint venture for the Wa’ad Al Shamal Phosphate Project, the final terms of any such definitive agreements, the ability of the joint venture to obtain project financing in acceptable amounts and upon acceptable terms, the future success of current plans for the joint venture and any future changes in those plans; adverse weather conditions affecting operations in Central Florida or the Mississippi River basin or the Gulf Coast of the United States, and including potential hurricanes, excess rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, or Canadian resources taxes and royalties; other accidents and disruptions involving Mosaic’s operations, including brine inflows at Mosaic’s Esterhazy, Saskatchewan potash mine, potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. |

3 • Key Balance Sheet Targets • Cash Use Priorities • Capital Return Philosophy • Cargill Split-off Primer Agenda Agenda |

4 Key Balance Sheet Targets Our primary objective is to maintain a solid investment grade rating and financial flexibility. Contingent Capital Long term Target Cash Committed Lines $ in billions multiple 0 1 2 Liquidity 0 1 2 Adjusted Debt / EBITDA |

5 Surplus Cash Balance Estimated Cash Balance $ 3,700 Foreign Cash (950) Liquidity Buffer (750) Surplus Cash Balance $ 2,000 Mosaic expects to have approximately $2 billion in surplus cash at May 31, 2013. Foreign Cash – Expected to be used to fund non-U.S. investments over the next 4 years. $ in millions, approximate |

6 Surplus Cash & Debt Capacity $2 billion of Surplus Cash $3 billion of Debt Capacity Share Repurchases ARO Escrow Strategic Investments |

7 Cash Use Priorities |

8 Sustaining Capital & Dividends* Sustaining capital of about $700 million Expected to remain flat over next few years $1.00 per share dividend expected to grow as earnings grow over time $ in billions Mosaic’s sustaining capital investment and dividends are expected to grow over time. $0.0 $0.5 $1.0 $1.5 2013 * The declaration and payment of any future dividends is subject to approval by Mosaic’s Board of Directors. There can be no assurance that the Company’s Board of Directors will declare future dividends. |

9 Investing for Growth $ in billions The company expects to generate appropriate risk-adjusted returns for each investment. * Not fully approved investments $0.0 $0.5 $1.0 $1.5 2013 2014 2015 2016 Potash Mines Ma'aden JV Ammonia Plant* International & Supply Chain* Calendar year |

10 Capital Return Philosophy Disciplined approach to return meaningful capital via share repurchases Capital Return History Near Term • • Post A-Share Resolution • $ in billions Calendar year ? $0.0 $0.5 $1.0 $1.5 2008 2009 2010 2011 2012 2013 Dividends Repurchases Favor share repurchases Preservation of capital to maintain flexibility for future share repurchases over next 12-24 months Favor share repurchases over special dividends Mix of opportunistic buy-back and time-period averaging • |

11 Cargill Split-off Primer 129 million Class A restricted shares outstanding No discussions with MAC Trusts until after May 26, 2013 Seller intentions uncertain Agreements contemplate secondary offering Contractual agreement may be modified Common Shares # of shares November 26, 2013 43mm November 26, 2014 43mm November 26, 2015 43mm 1 Back-end shares split between MAC Trusts and other Cargill shareholders; Potential for early lock-up release for marketed offering May 26 – October 26, prior to each lock-up expiration Restricted repurchase capabilities since Split-off Contractual repurchase restrictions lapse November 26, 2013 Intention to use repurchases as a means to return surplus cash over time once allowed • • • Class A Shares • • • • • Remaining share release dates 1 |

12 Summary • Committed to investment grade rating and strong liquidity buffer • Approximately $5 billion of surplus cash and debt capacity • Expect our recurring dividend per share to grow in line with earnings growth • Expect to fund our planned capital expenditures with foreign cash and operating cash • Favor repurchases over dividends to deploy our surplus cash • Repurchases will be both opportunistic and time-averaged • Expect to meet our updated liquidity and leverage targets within the next 12 to 24 months • Continue to favor investing for shareholder value creation over share repurchases |

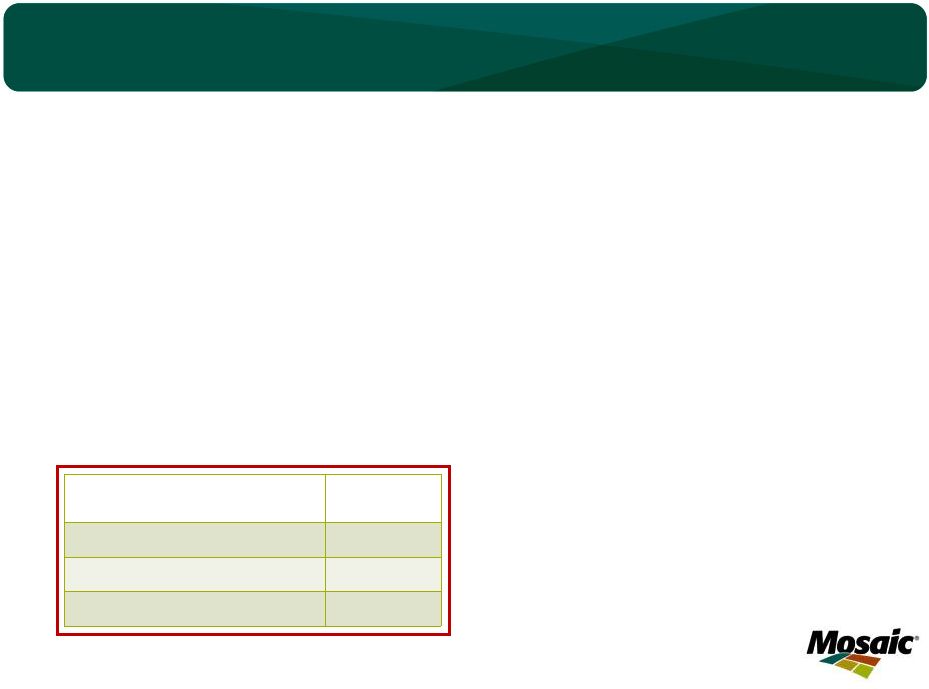

13 Selected Non-GAAP Financial Measures and Reconciliations As of May 31, 2012 US$ Millions Short Term Debt 43 $ Long Term Debt 1,011 Unfunded Pension Obligations 89 Lease Obligations (Annual Rental Expense x 6) 480 Total Adjusted Debt * 1,623 $ * Estimated based on written description of rating agency methodology EBITDA 5-Year Average 3,034 $ US$ Millions FY12 FY11 FY10 FY09 FY08 Net earnings 1,930 $ 2,515 $ 827 $ 2,350 $ 2,083 $ + Interest (income) expense, net (19) 5 50 43 91 + Income tax expense 711 753 347 649 715 + Depreciation, depletion & amortization 508 447 445 361 358 EBITDA 3,130 $ 3,720 $ 1,669 $ 3,403 $ 3,247 $ |

|