Bull or Bear? The Great Debate Rahm vs. Jung Mosaic AgCollege Orlando, FL January 13, 2015 Dr. Michael R. Rahm Vice President Market and Strategic Analysis Andy Jung Director Market and Strategic Analysis

Safe Harbor Statement 2 This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Northern Promise Joint Venture, the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Northern Promise Joint Venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the future success of current plans for the Northern Promise Joint Venture and any future changes in those plans; difficulties with realization of the benefits of the transactions with CF, including the risks that the acquired assets may not be integrated successfully or that the cost or capital savings from the transactions may not be fully realized or may take longer to realize than expected, or the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida phosphate assets acquisition, or the costs of the Northern Promise Joint Venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

Bull or Bear? The Great Debate Rahm vs. Jung This course pits two Mosaic analysts in three informal and somewhat irreverent debates about the agricultural commodity, phosphate and potash outlooks. Based on a coin toss, one analyst will argue the bull case while the other will argue the bear case, with the audience ultimately deciding the most convincing and winning argument. Course Description

Debate 1 Agricultural Commodity Outlook

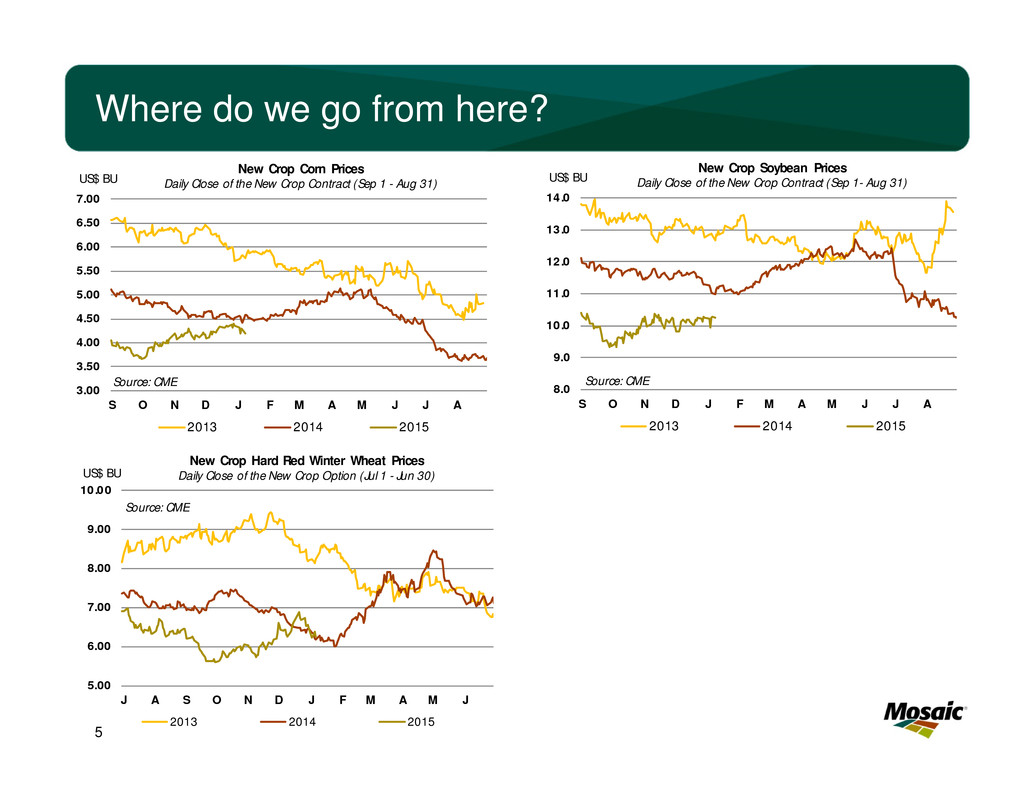

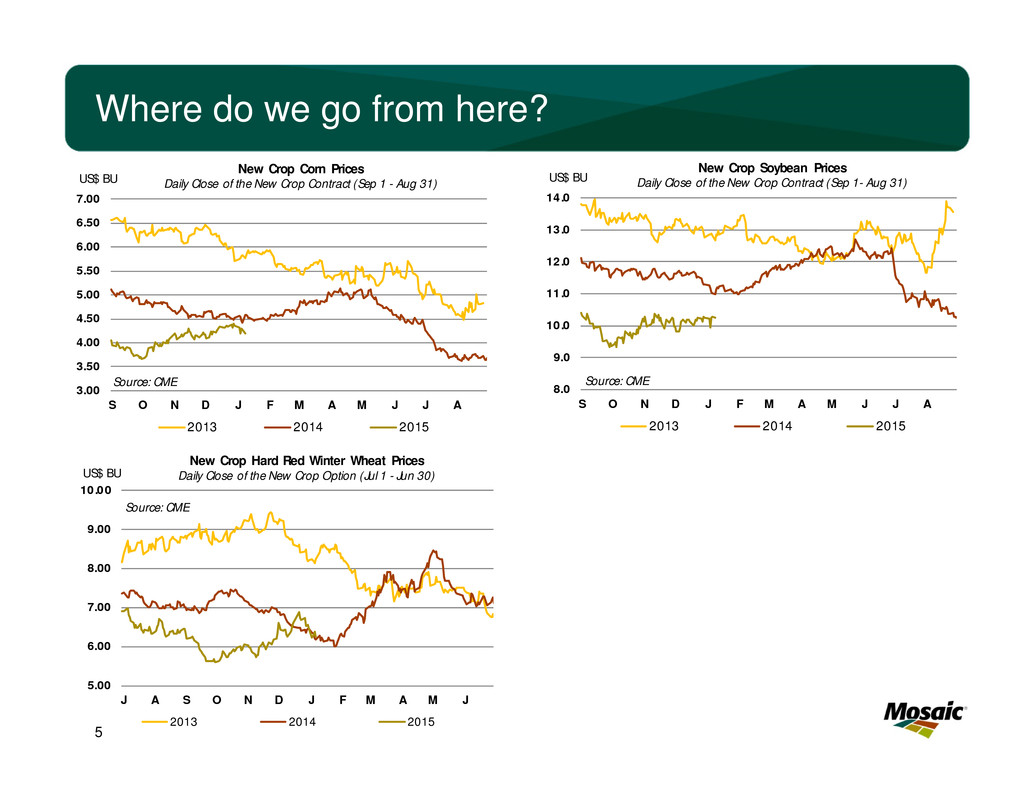

Where do we go from here? 5 3.00 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 S O N D J F M A M J J A US$ BU New Crop Corn Prices Daily Close of the New Crop Contract (Sep 1 - Aug 31) 2013 2014 2015 Source: CME 8.0 9.0 10.0 11.0 12.0 13.0 14.0 S O N D J F M A M J J A US$ BU New Crop Soybean Prices Daily Close of the New Crop Contract (Sep 1- Aug 31) 2013 2014 2015 Source: CME 5.00 6.00 7.00 8.00 9.00 10.00 J A S O N D J F M A M J US$ BU New Crop Hard Red Winter Wheat Prices Daily Close of the New Crop Option (Jul 1 - Jun 30) 2013 2014 2015 Source: CME

The Bull Case: Markets are Looking Ahead Not Back (Six Minutes)

Markets are Looking Ahead Not Back 1. It’s a demand-pull story 2. And it’s a demand-pull story with a few supply kickers and risks 3. Look beyond the stock build 4. Farmers aren’t selling 5. Agricultural commodities will remain attractive investments 7

It’s a demand-pull story 8 1,800 2,000 2,200 2,400 2,600 2,800 3,000 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14F Mil Tonnes World Grain & Oilseed Use Source: USDA and Mosaic Record harvests but also record demand. Highly profitable feed economics and strong feed demand. U.S. exports especially soybean sales off to a fast start. Don’t worry about biofuels just yet. - U.S. refining and distribution system calibrated to E10. - U.S. Renewable Fuel Standard (RFS) or blending mandate is under pressure but likely will stay in place. 85 95 105 115 125 135 145 155 165 175 Jan '10 Jan '11 Jan '12 Jan '13 Jan '14 Jan '15 CTS/ LB Live Cattle Daily Close of Nearby Futures Contract Source: CME 80 85 90 95 100 105 110 115 120 Jan '10 Jan '11 Jan '12 Jan '13 Jan '14 Jan '15 CTS/ LB Broilers (Dressed 'A', N.Y.) Daily Cash Price Source: CME 1000 M T Corn 12,615 11,415 11% 13,503 -7% Soybeans 29,751 25,031 19% 18,507 61% W heat 13,772 19,419 -29% 16,680 -17% 1000 M T Corn 12,615 44,452 28% 33% Soybeans 29,751 47,899 62% 33% W heat 13,772 25,174 55% 58% Source: USDA Corn and soybeans m arketing year: Sep-Aug. W heat: Jun-M ay. U.S. Cum ulative Exports Prior M arketing YTD % Change Last Yr 7-Yr Olym pic Avg % Change 7-Yr Avg Current M arketing YTD % of Yr Com plete % of Forecast USDA Forecast M arketing YTD Through January 1, 2015

Look beyond the stock build 9 15.0% 17.5% 20.0% 22.5% 25.0% 27.5% 30.0% 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13E14F Global Grain & Oilseed Stocks as a Percent of Use Source: USDA 606 580 494 407 469 463 426 438 513 570 549 537 520 582 625 350 400 450 500 550 600 650 700 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Mil Tonnes World Grain & Oilseed Stocks USDA Mosaic 2015/ 16 Range Mosaic Medium Scenarios Source: USDA and Mosaic 2015/16 Grain and Oilseed Scenario Assum ptions Low M edium High Harvested Area Change 0.00% 0.00% 0.00% Yield Deviation from Trend * Largest Negative At Trend Largest Positive Dem and Growth 1.75% 2.00% 2.25% * Trend yield for 2000/01 to 2013/14 crop years. Grain and oilseed stocks have increased but so has use. As a result, stocks as a percent of use still remain at low levels. If yield and demand equal trend in 2015/16, then global grain and oilseed inventories would drop next year and the stocks-to- use percentage would fall to 19.7%. Source: Mosaic

Farmers aren’t selling 10 6% 8% 10% 12% 14% 16% 18% 20% 22% 0 20 40 60 80 100 120 140 160 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14F Debt:Asset Ratio Bil $ U.S. Net Cash Income Government Payments Market Debt:Asset Ratio Source: USDA Some farmers have invested in additional storage capacity and have the capability to store a bumper crop rather than dump some of it on the market at harvest. U.S. farmers generally are in solid financial shape after several years of elevated net cash farm income.

The Bear Case: Just a Dead Cat Bounce (Six Minutes)

Just a Dead Cat Bounce 1. Fundamentals don’t lie - and will prevail 2. Big crops in big fields in South America 3. A strong dollar drives lower commodity prices 4. Biofuels are at risk 5. Something will spook the speculative herd 12

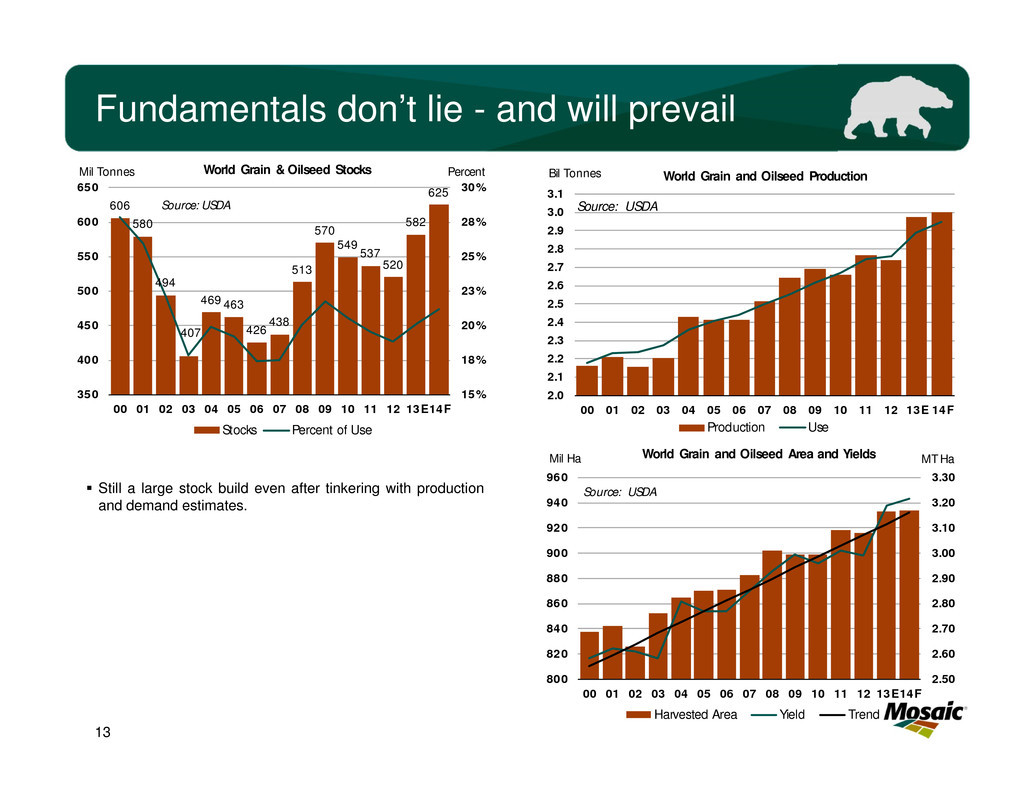

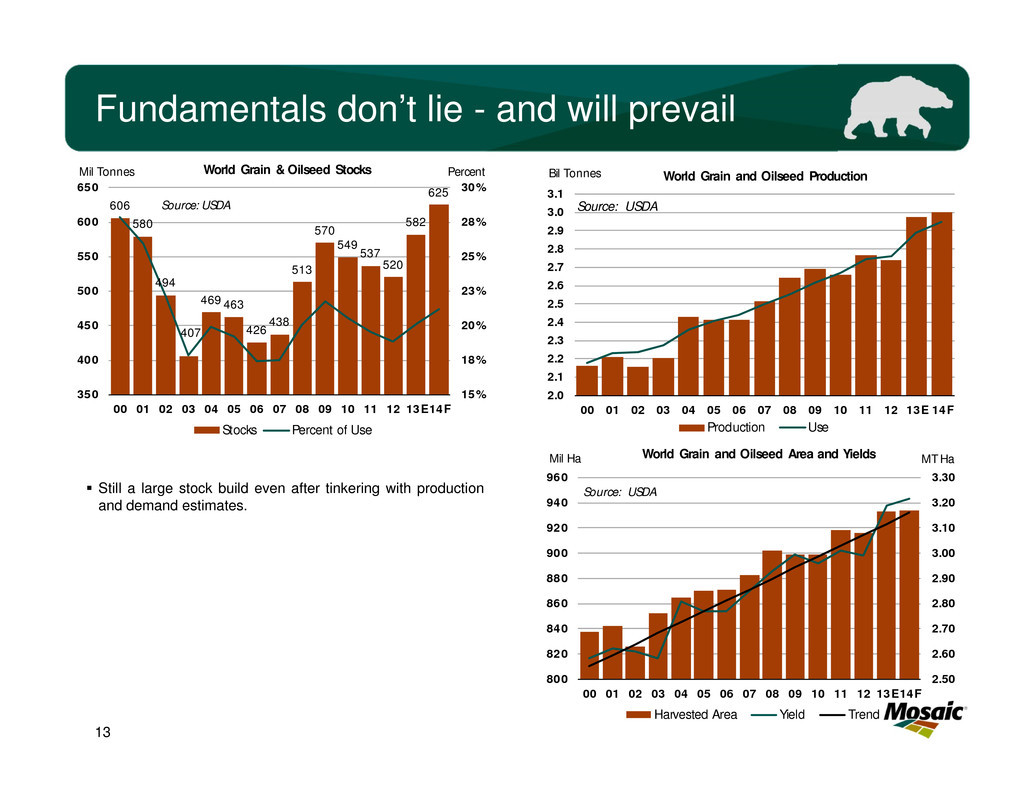

Fundamentals don’t lie - and will prevail 13 606 580 494 407 469 463 426 438 513 570 549 537 520 582 625 15% 18% 20% 23% 25% 28% 30% 350 400 450 500 550 600 650 00 01 02 03 04 05 06 07 08 09 10 11 12 13E14F PercentMil Tonnes World Grain & Oilseed Stocks Stocks Percent of Use Source: USDA 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 3.0 3.1 00 01 02 03 04 05 06 07 08 09 10 11 12 13E 14F Bil Tonnes World Grain and Oilseed Production Production Use Source: USDA Still a large stock build even after tinkering with production and demand estimates. 2.50 2.60 2.70 2.80 2.90 3.00 3.10 3.20 3.30 800 820 840 860 880 900 920 940 960 00 01 02 03 04 05 06 07 08 09 10 11 12 13E14F MT HaMil Ha World Grain and Oilseed Area and Yields Harvested Area Yield Trend Source: USDA

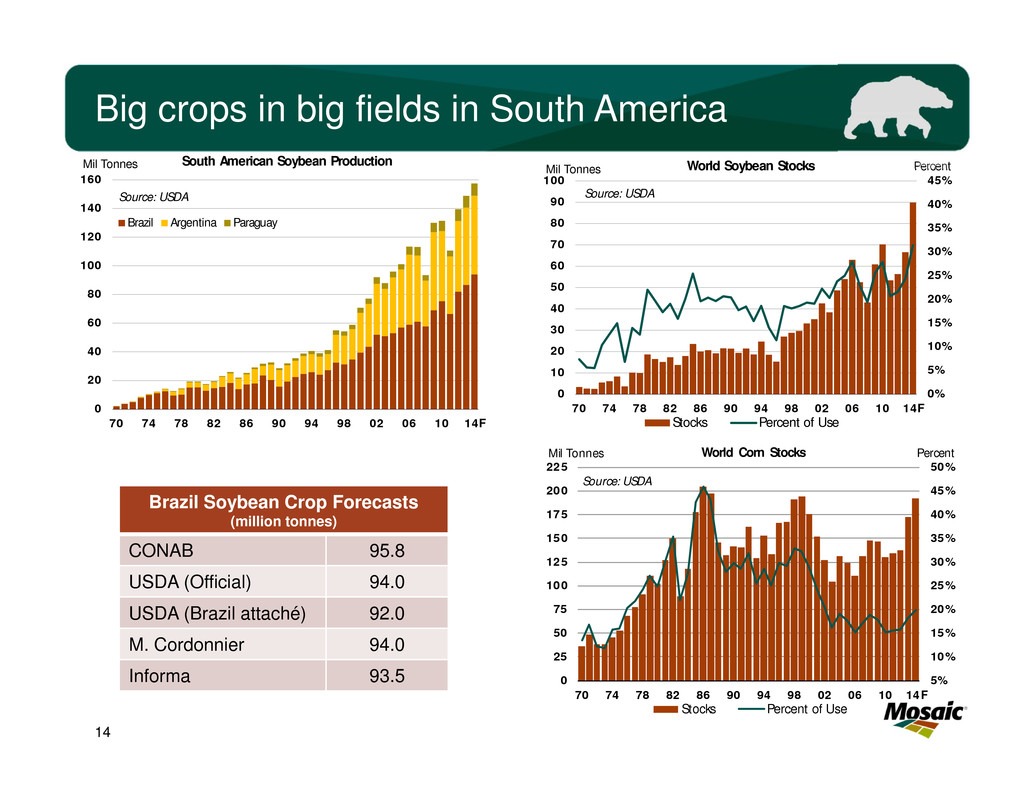

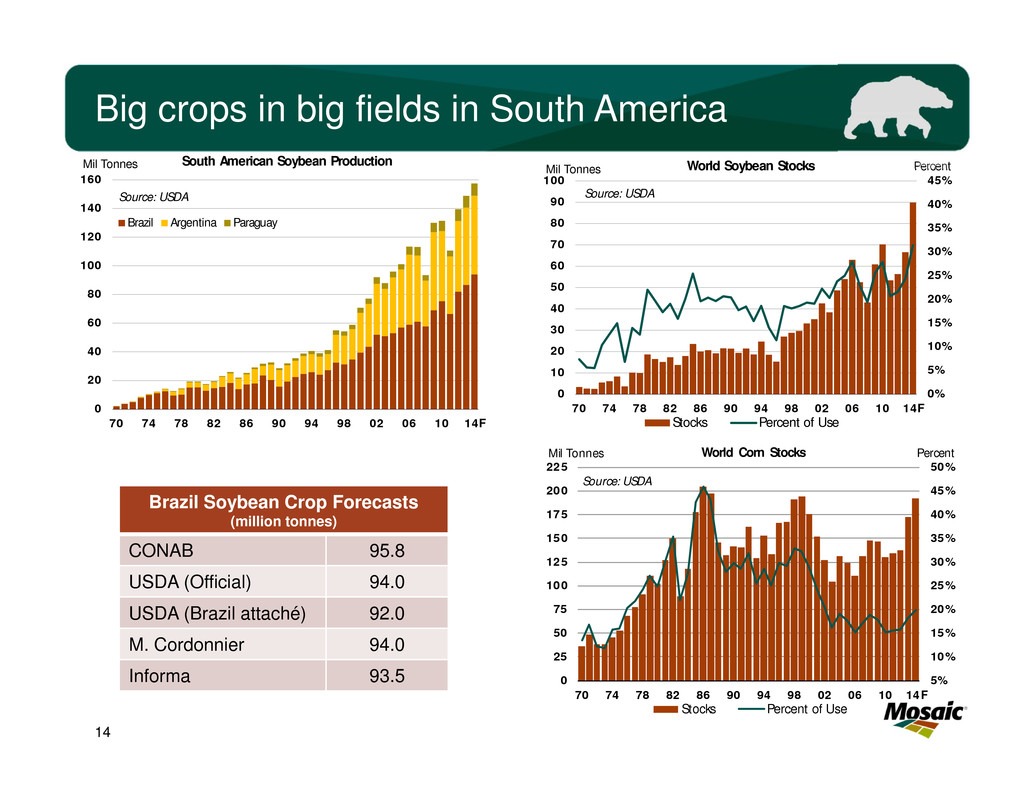

Big crops in big fields in South America 14 0 20 40 60 80 100 120 140 160 70 74 78 82 86 90 94 98 02 06 10 14F Mil Tonnes South American Soybean Production Brazil Argentina Paraguay Source: USDA 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 0 10 20 30 40 50 60 70 80 90 100 70 74 78 82 86 90 94 98 02 06 10 14F PercentMil Tonnes World Soybean Stocks Stocks Percent of Use Source: USDA 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0 25 50 75 100 125 150 175 200 225 70 74 78 82 86 90 94 98 02 06 10 14F PercentMil Tonnes World Corn Stocks Stocks Percent of Use Source: USDA Brazil Soybean Crop Forecasts (million tonnes) CONAB 95.8 USDA (Official) 94.0 USDA (Brazil attaché) 92.0 M. Cordonnier 94.0 Informa 93.5

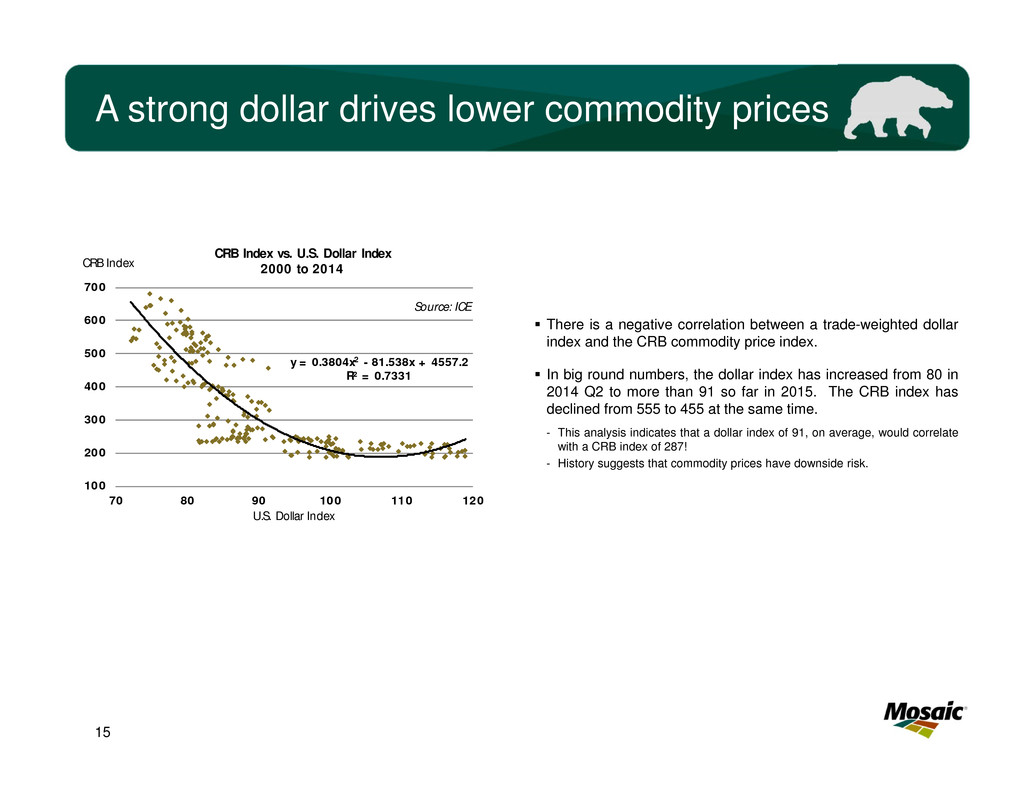

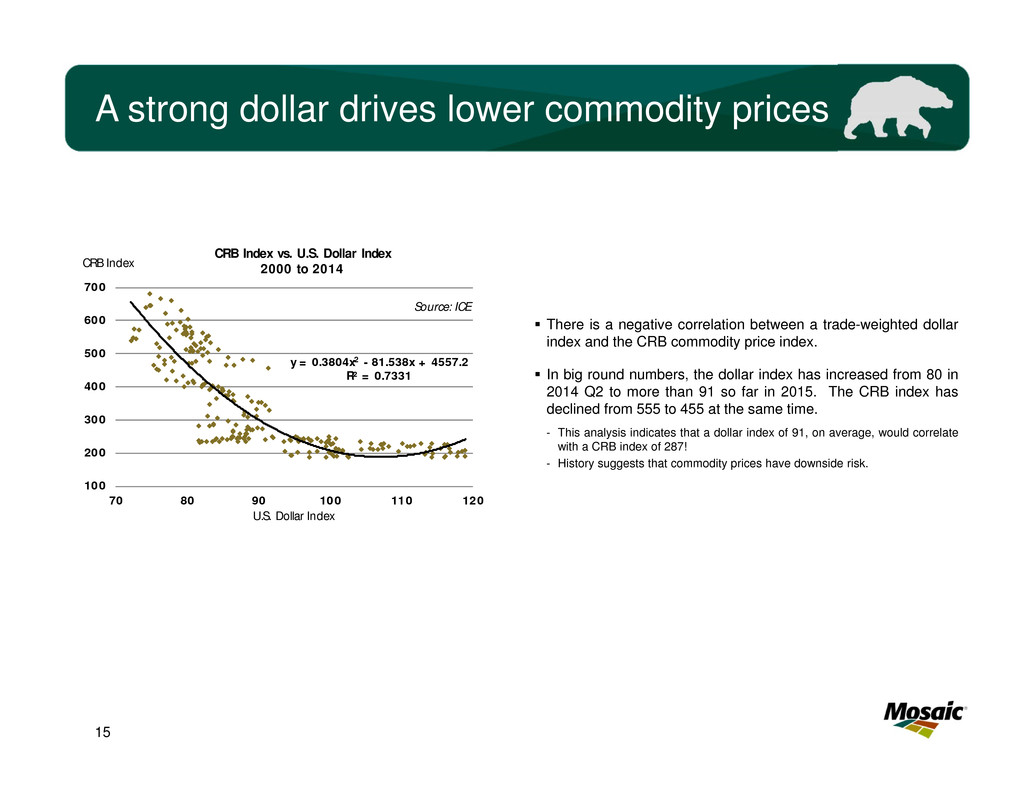

A strong dollar drives lower commodity prices 15 y = 0.3804x2 - 81.538x + 4557.2 R² = 0.7331 100 200 300 400 500 600 700 70 80 90 100 110 120 CRB Index U.S. Dollar Index CRB Index vs. U.S. Dollar Index 2000 to 2014 Source: ICE There is a negative correlation between a trade-weighted dollar index and the CRB commodity price index. In big round numbers, the dollar index has increased from 80 in 2014 Q2 to more than 91 so far in 2015. The CRB index has declined from 555 to 455 at the same time. - This analysis indicates that a dollar index of 91, on average, would correlate with a CRB index of 287! - History suggests that commodity prices have downside risk.

Biofuels are at risk 16 0 20 40 60 80 100 120 140 160 00 02 04 06 08 10 12 14 $ BBL WTI Global Spot Crude Oil Cash Prices Source: NYMEX 0% 7% 14% 21% 28% 35% 42% 49% 0 2 4 6 8 10 12 14 70 74 78 82 86 90 94 98 02 06 10 14 Pct of Total Bil Bu U.S. Corn Use Corn Use Ethanol Grind Ethanol Pct of Total Source: USDA U.S. ethanol demand has hit the blend wall so additional corn demand growth is needed for use to keep pace with expected yield gains over time. Alternatively, fewer acres will be required to meet projected demand as long as yields continue to trend upward. The collapse of oil prices has turned blending margins negative and likely will erode political support for biofuels. Although oil refiners and gasoline blenders have calibrated operations for E10, they will invest to reconfigure operations if they expect that oil prices will drop to and at stay at levels low enough to generate a return on investment.

Your Vote

After those compelling arguments, are you an agricultural commodity bull or bear? 18 1 2 0%0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1.Bullish 2.Bearish 30

Debate 2 Phosphate Outlook

Where do we go from here? 20 100 200 300 400 500 600 05 06 07 08 09 10 11 12 13 14 15 $ ST Weekly DAP Prices NOLA Barge Source: Green Markets 200 300 400 500 600 700 05 06 07 08 09 10 11 12 13 14 15 $ MT Weekly DAP Prices fob Tampa Source: Fertecon

The Bear Case: It’s Just Supply and Demand (Six Minutes)

It’s Just Supply and Demand 1. The BEAR won the agricultural commodity debate 2. Demand risks still exist 3. Plenty of phosphate from China 4. Other new capacity eventually will start-up or run better this year 5. Ammonia prices will drop even further 22

Demand risks still exist 23 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Mil Tonnes India DAP/ MAP/ TSP Imports DAP MAP TSP Souce: CRU, IFA, Mosaic First-half demand prospects look solid: - Underpinned by the strong harvest rally. - $4 corn and $10 soybeans are no threat to demand. - Ongoing concerns about logistics and shipping delays. But second-half demand will hinge on the size of the 2015 harvest and the level of 2016 crop prices. What About the Second-Half Demand?Will India Come Through? 0.0 2.0 4.0 6.0 8.0 10.0 12.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15F Mil Tons Product North America DAP/ MAP/ MES/ TSP Shipments Source: TFI, IFA and Mosaic Fertilizer Year Ending June 30 India is expected to account for roughly one-half of the projected increase in shipments this year – the market is banking on India. Still subsidy and rupee risks for import economics to work.

Plenty of phosphate from China 24 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 95 97 99 01 03 05 07 09 11 13 Mil Tonnes China DAP/ MAP/ TSP Exports Actual Forecast Source: Fertecon, China Customs, Mosaic Recent changes in China’s export tax are expected to facilitate large and more orderly exports in 2015. The government did away with low and high tax windows and simply will tax DAP and MAP exports at a flat rate of RMB100 or about $16 per tonne in 2015. Product TSP/SSP NPKs M OP/SOP The export tariffs take effect on January 1, 2015 Value-added tax rate not yet confirm ed Urea DAP/M AP 5% 5% NPs 5% High Tax (Jan 1-M ay 15, Oct 16-Dec 31) 15% + 50 RM B/m t Low Tax (M ay 16-Oct 15) 50 RM B/m t 600 RM B/m t 600 RM B/m t 2015 Tax 2014 Tax 80 RM B/m t 30% 100 RM B/m t High Tax (Jan 1-M ay 15, Oct 16-Dec 31) 15% + 50 RM B/m t Low Tax (M ay 16-Oct 15) 50 RM B/m t 30% High Tax (Jan 1-Jun 30, Nov 1-Dec 31) Low Tax (Jul 1-Oct 31) 15% + 40 RM B/m t 40 RM B/m t Chinese Export Tariffs Exports likely totaled 7.3-7.5 million tonnes in 2014, up more than 2.0 million tonnes from 2013. China exported 6.9 million tonnes of DAP/MAP/TSP during the first 11 months of 2014 and reached more distant destinations: - Exports to India totaled 1.4 million tonnes, off 24% from last year. - Exports to Brazil totaled 1.2 million tonnes, up 135% from last year. - Exports to the United States totaled 247,000 tonnes vs. zero last year. Source: China Customs

Ammonia prices will drop further 25 100 200 300 400 500 600 700 800 05 06 07 08 09 10 11 12 13 14 15 $ MT Ammonia Prices c&f Tampa Source: Fertecon $545 $655 $625 A poor NA fall application season. Fewer production disruptions this year. Lower oil prices (European natural gas prices tied to oil prices). Lower U.S. natural gas prices. The China factor – record shattering urea exports in 2014.

The Bull Case: Something’s Happening Here (Six Minutes)

Something’s Happening Here 1. The BULL won the agricultural commodity debate 2. Bank on India to lead a strong demand rebound 3. Supply changes are tightening the market 4. There are homes for Chinese tonnage 5. Don’t expect much relief from lower raw materials costs 27

Bank on India to lead a strong demand rebound 28 64.5-66.5 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Phosphate ShipmentsMMT Product DAP/ MAP/ MES/TSP Source: CRU and Mosaic 0.0 2.0 4.0 6.0 8.0 10.0 12.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Mil Tonnes India DAP Shipments Source: FAI, Mosaic Fertilizer Year Ending March 31 India is expected to account for roughly one-half of the projected 1.7 million tonne increase in shipments this year: - Farm economics remain profitable given additional increases in minimum support prices (MSP) for major crops. - The distribution channel looks bone dry. - The windfall from lower oil prices eases pressure on the government to further cut P&K subsidies in order to achieve budget deficit goals. - The windfall also provides a window for the government to address the imbalance in nutrient use. The bottom line is that the government is expected to make import economics work because India needs to import more phosphate this year than in the past few years. 0.50 0.75 1.00 1.25 1.50 1.75 05 06 07 08 09 10 11 12 13 14 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic M o r e A f f o r d a b l e L e s s A ffordabl e

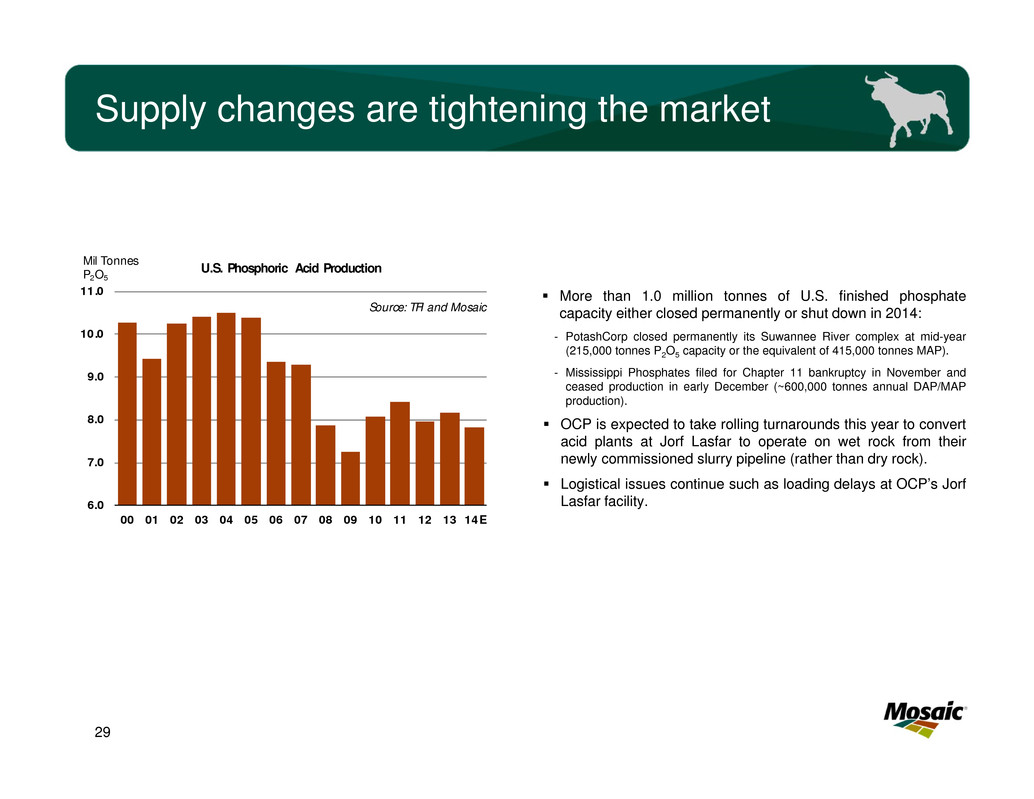

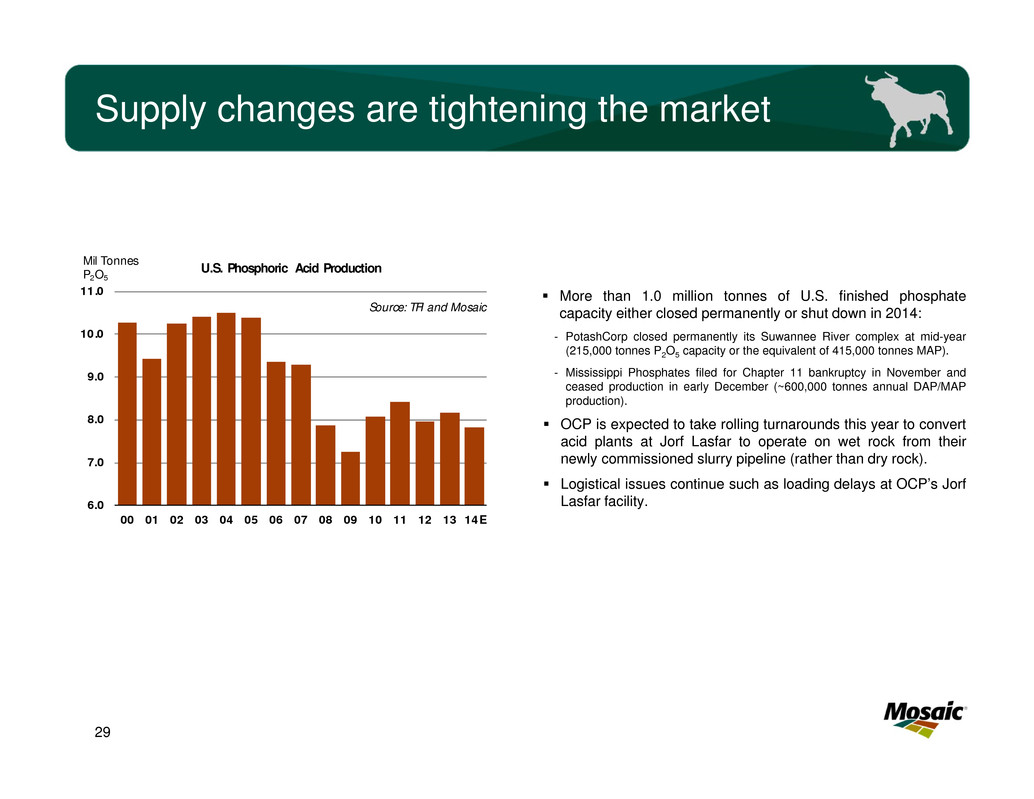

Supply changes are tightening the market 29 More than 1.0 million tonnes of U.S. finished phosphate capacity either closed permanently or shut down in 2014: - PotashCorp closed permanently its Suwannee River complex at mid-year (215,000 tonnes P2O5 capacity or the equivalent of 415,000 tonnes MAP). - Mississippi Phosphates filed for Chapter 11 bankruptcy in November and ceased production in early December (~600,000 tonnes annual DAP/MAP production). OCP is expected to take rolling turnarounds this year to convert acid plants at Jorf Lasfar to operate on wet rock from their newly commissioned slurry pipeline (rather than dry rock). Logistical issues continue such as loading delays at OCP’s Jorf Lasfar facility.6.0 7.0 8.0 9.0 10.0 11.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E Mil Tonnes P2O5 U.S. Phosphoric Acid Production Source: TFI and Mosaic

There are homes for Chinese tonnage 30 0 5 10 15 20 25 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F China Phosphate ShipmentsMMT Product DAP/ MAP/ MES/TSP Source: CRU and Mosaic At home: - Phosphate shipments have doubled since the middle of the last decade and continue to grow at moderate rates. - Growth is fueled by an increase in overall phosphate use as well as the substitution of high-analysis for low-analysis products. In India if demand increases as expected. - The new export tax policy should facilitate a more orderly flow of exports and result in less volatility.

Your Vote

After those compelling arguments, are you a phosphate bull or bear? 32 1 2 0%0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1.Bullish 2.Bearish 30

Debate 3 Potash Outlook

Where do we go from here? 34 100 200 300 400 500 600 700 05 06 07 08 09 10 11 12 13 14 15 $ MT MOP Prices Standard Grade c&f SE Asia Source: FMB 100 200 300 400 500 600 700 05 06 07 08 09 10 11 12 13 14 15 $ MT MOP Prices Blend Grade c&f Brazil Source: FMB 100 200 300 400 500 600 700 05 06 07 08 09 10 11 12 13 14 15 $ ST MOP Prices Blend Grade fob U.S. Midwest Warehouse Source: Green Markets

The Bull Case: It’s Demand, Stupid (Six Minutes)

It’s Demand, Stupid 1. The BULL won the agricultural commodity debate 2. Demand growth is back on track 3. Producer cupboards are low if not bare 4. The potential loss of Solikamsk 2 tightens the market 5. Logistics still are a complicating factor in North America 36

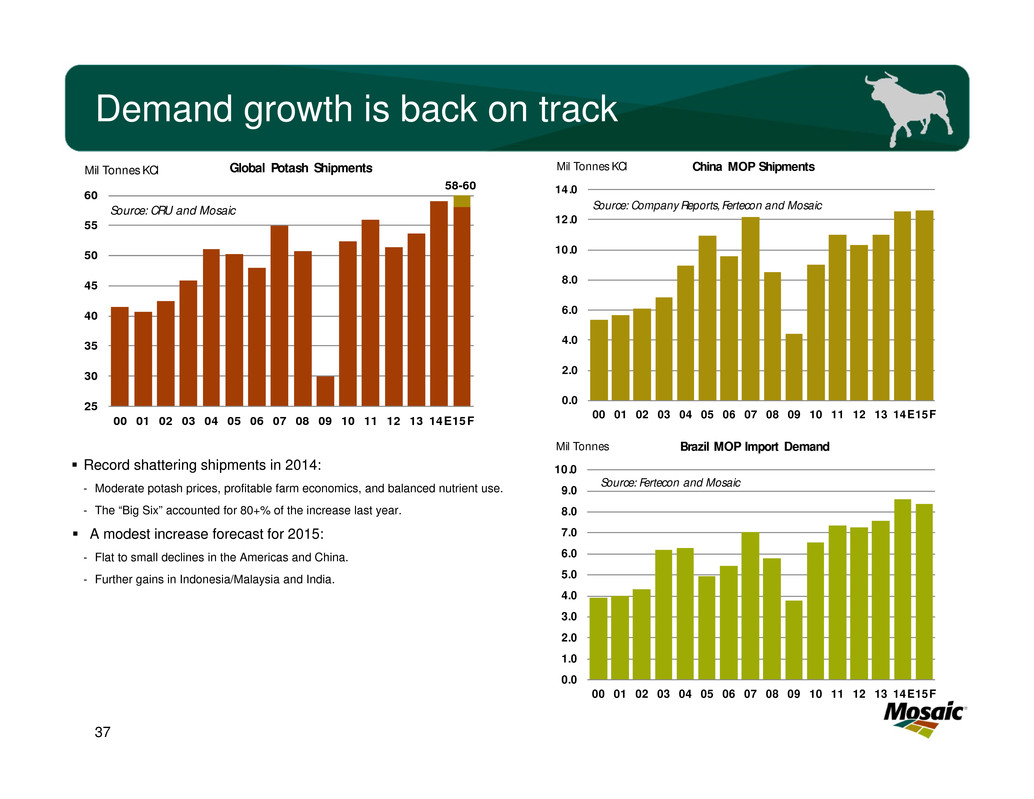

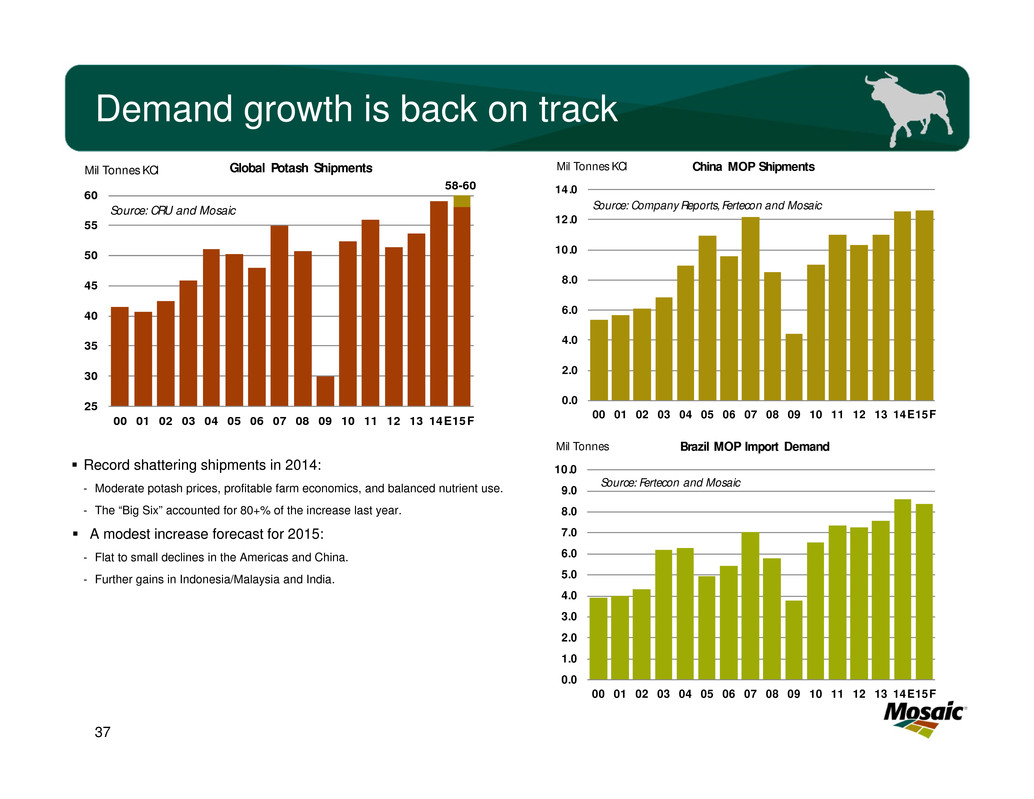

Demand growth is back on track 37 58-60 25 30 35 40 45 50 55 60 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Potash ShipmentsMil Tonnes KCl Source: CRU and Mosaic Record shattering shipments in 2014: - Moderate potash prices, profitable farm economics, and balanced nutrient use. - The “Big Six” accounted for 80+% of the increase last year. A modest increase forecast for 2015: - Flat to small declines in the Americas and China. - Further gains in Indonesia/Malaysia and India. 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Mil Tonnes Brazil MOP Import Demand Source: Fertecon and Mosaic 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Mil Tonnes KCl China MOP Shipments Source: Company Reports, Fertecon and Mosaic

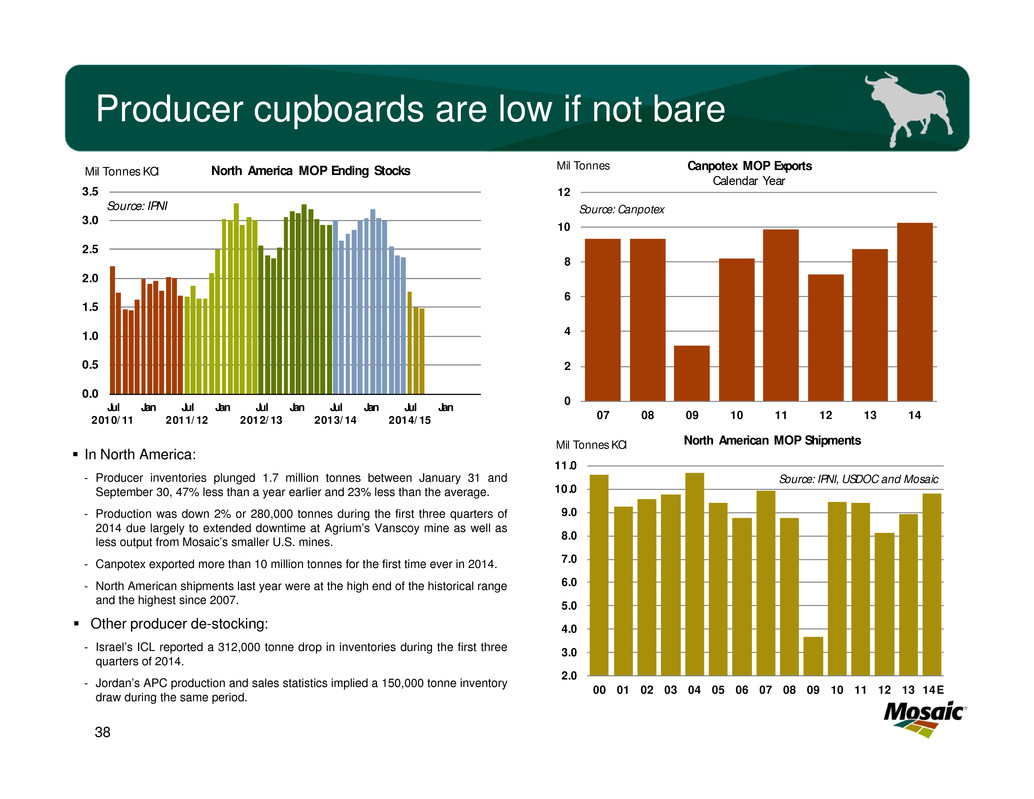

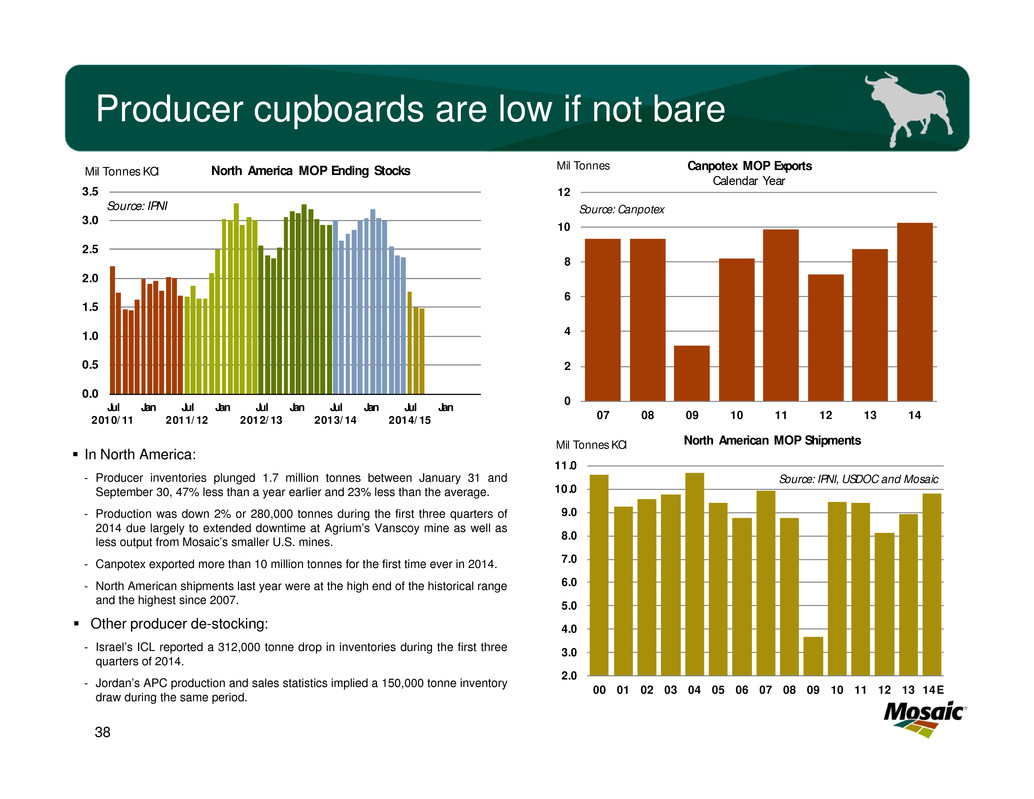

Producer cupboards are low if not bare 38 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 Jul 2010/ 11 Jan Jul 2011/ 12 Jan Jul 2012/ 13 Jan Jul 2013/ 14 Jan Jul 2014/ 15 Jan Mil Tonnes KCl North America MOP Ending Stocks Source: IPNI In North America: - Producer inventories plunged 1.7 million tonnes between January 31 and September 30, 47% less than a year earlier and 23% less than the average. - Production was down 2% or 280,000 tonnes during the first three quarters of 2014 due largely to extended downtime at Agrium’s Vanscoy mine as well as less output from Mosaic’s smaller U.S. mines. - Canpotex exported more than 10 million tonnes for the first time ever in 2014. - North American shipments last year were at the high end of the historical range and the highest since 2007. Other producer de-stocking: - Israel’s ICL reported a 312,000 tonne drop in inventories during the first three quarters of 2014. - Jordan’s APC production and sales statistics implied a 150,000 tonne inventory draw during the same period. 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E Mil Tonnes KCl North American MOP Shipments Source: IPNI, USDOC and Mosaic 0 2 4 6 8 10 12 07 08 09 10 11 12 13 14 Mil Tonnes Canpotex MOP Exports Calendar Year Source: Canpotex

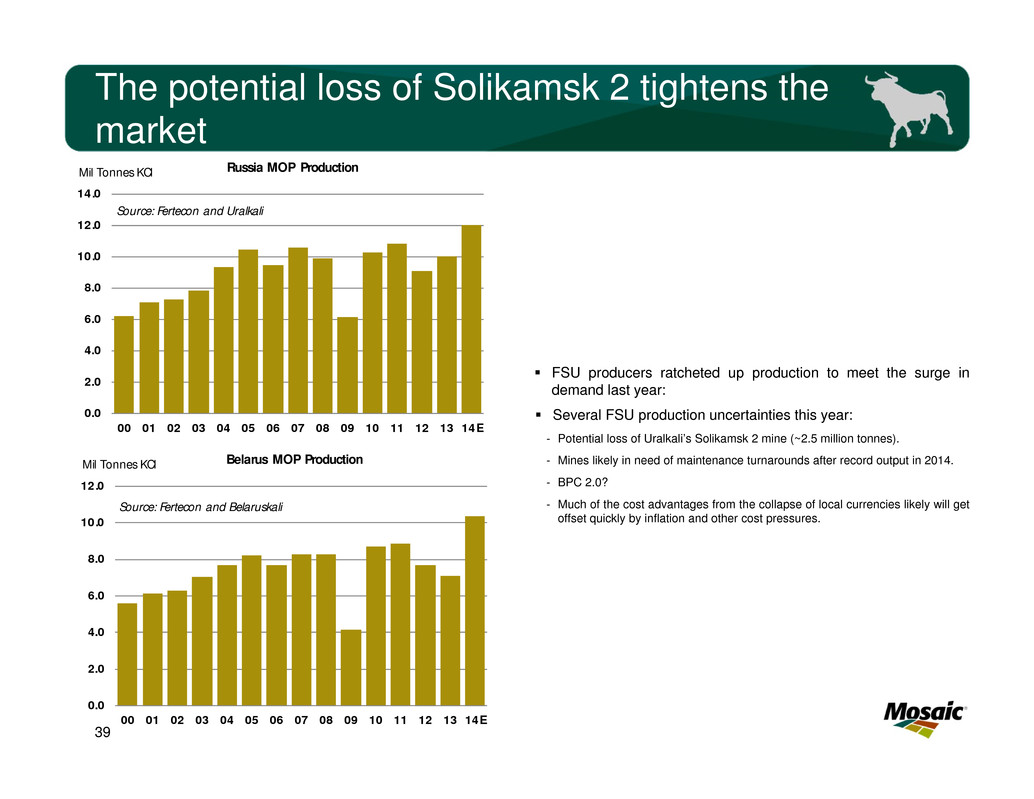

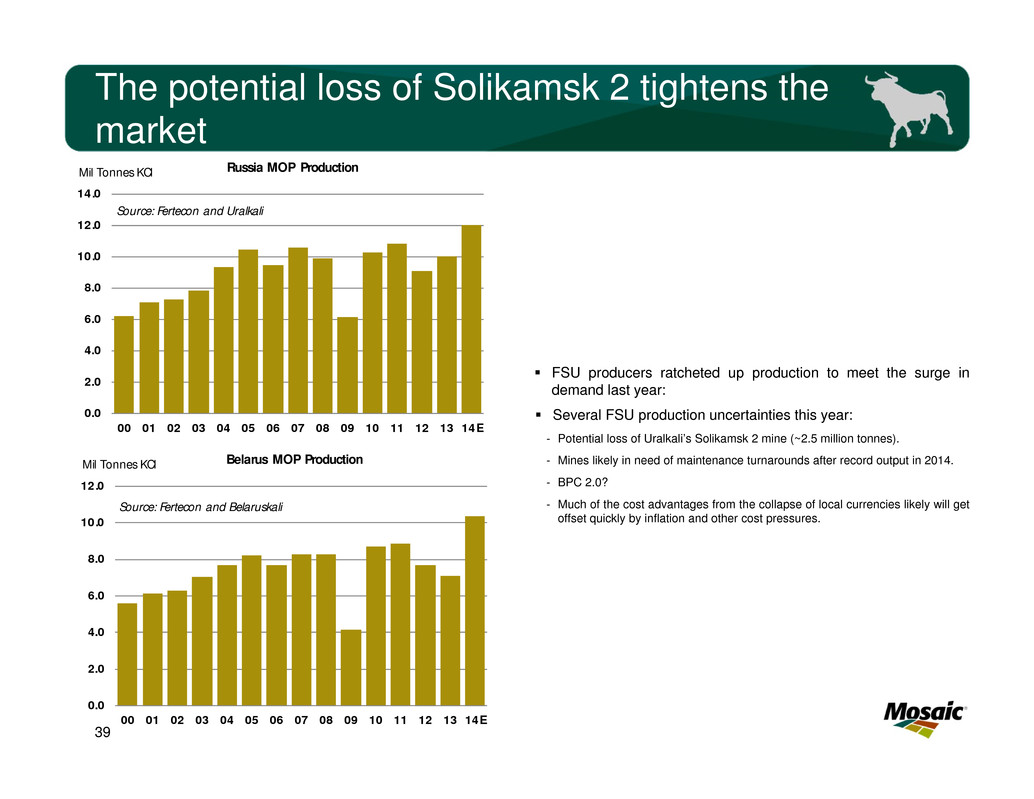

The potential loss of Solikamsk 2 tightens the market 39 0.0 2.0 4.0 6.0 8.0 10.0 12.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E Mil Tonnes KCl Belarus MOP Production Source: Fertecon and Belaruskali 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E Mil Tonnes KCl Russia MOP Production Source: Fertecon and Uralkali FSU producers ratcheted up production to meet the surge in demand last year: Several FSU production uncertainties this year: - Potential loss of Uralkali’s Solikamsk 2 mine (~2.5 million tonnes). - Mines likely in need of maintenance turnarounds after record output in 2014. - BPC 2.0? - Much of the cost advantages from the collapse of local currencies likely will get offset quickly by inflation and other cost pressures.

The Bear Case: The “Bear” is the Bear Case (Six Minutes)

The “Bear” is the Bear Case 1. The BEAR won the agricultural commodity debate 2. Shipments could drop from last year’s record high 3. Exchange rates will keep FSU producers in high gear 4. Others will make up the potential loss of Solikamsk 2 5. Most of the logistical issues are behind us 41

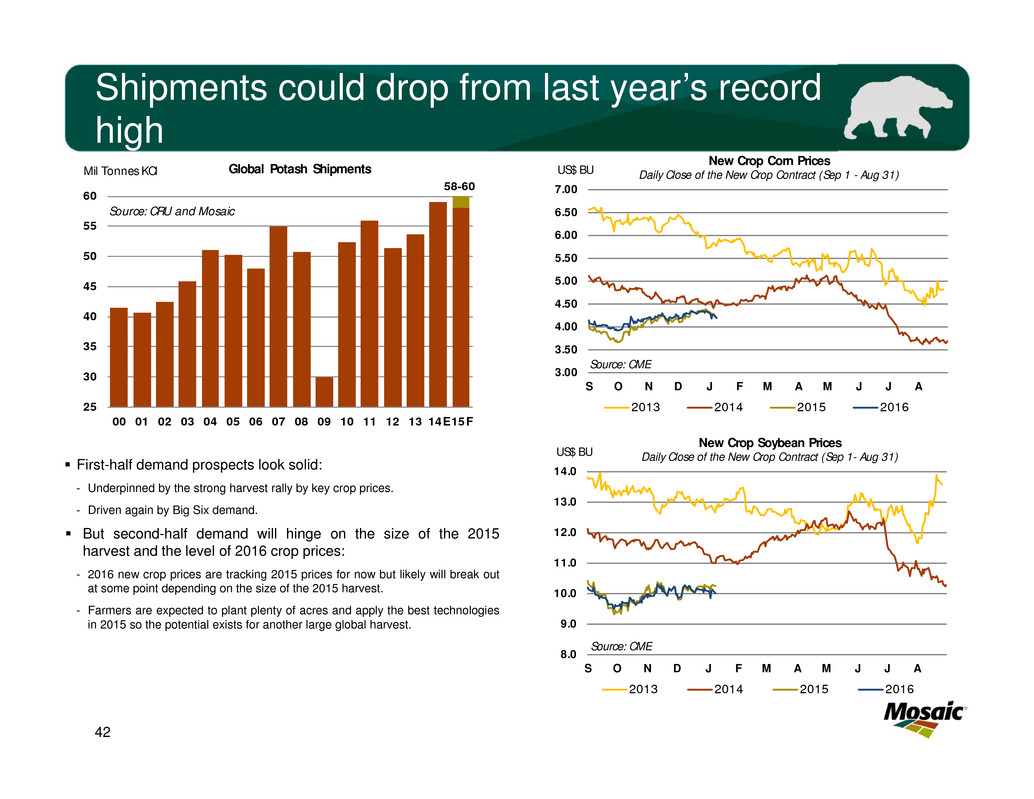

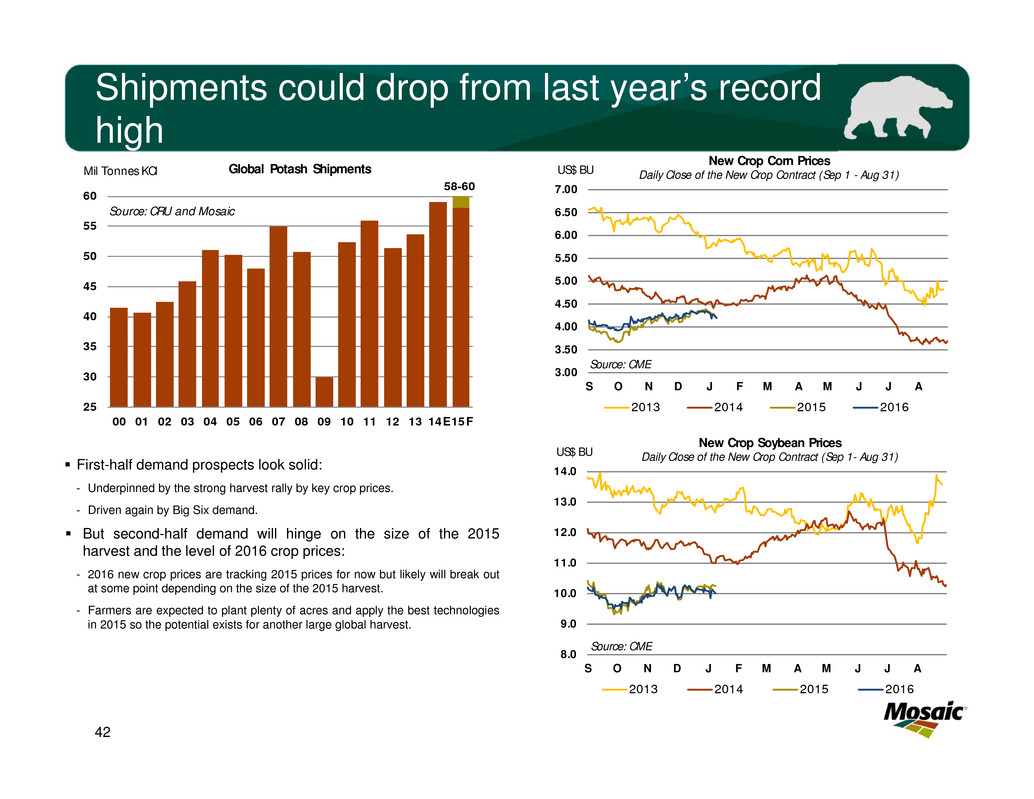

Shipments could drop from last year’s record high 42 58-60 25 30 35 40 45 50 55 60 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Potash ShipmentsMil Tonnes KCl Source: CRU and Mosaic First-half demand prospects look solid: - Underpinned by the strong harvest rally by key crop prices. - Driven again by Big Six demand. But second-half demand will hinge on the size of the 2015 harvest and the level of 2016 crop prices: - 2016 new crop prices are tracking 2015 prices for now but likely will break out at some point depending on the size of the 2015 harvest. - Farmers are expected to plant plenty of acres and apply the best technologies in 2015 so the potential exists for another large global harvest. 8.0 9.0 10.0 11.0 12.0 13.0 14.0 S O N D J F M A M J J A US$ BU New Crop Soybean Prices Daily Close of the New Crop Contract (Sep 1- Aug 31) 2013 2014 2015 2016 Source: CME 3.00 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 S O N D J F M A M J J A US$ BU New Crop Corn Prices Daily Close of the New Crop Contract (Sep 1 - Aug 31) 2013 2014 2015 2016 Source: CME

Exchange rates will keep FSU producers in high gear 43 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E Mil Tonnes KCl FSU MOP Production Source: Fertecon, Uralkali and Belaruskali The U.S. dollar has appreciated nearly 80% vs. Russian Ruble and about 8% vs. the Belarusian Ruble since mid-2014. The depreciation of local currencies has not yet been offset by higher inflation and other cost pressures. 500 1,500 2,500 3,500 4,500 5,500 6,500 7,500 8,500 9,500 10,500 11,500 20 25 30 35 40 45 50 55 60 65 70 75 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Belarusian Rubles per USD Russian Rubles per USD US Dollar vs. Russian and Belarus Ruble Monthly Average of Daily Rate Russian Ruble Belarusian Ruble Source: Forex

Others will make up the potential loss of Solikamsk 2 44 30 35 40 45 50 55 60 65 70 75 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E 15F MMT KCl Source: Company Reports, Fertecon and Mosaic Global Potash Capacity Assuming the Solikamsk 2 mine does not operate in 2015, we estimate that global capacity will remain flat at about 72 million tonnes KCl. - Uralkali may boost ore output at the Solikamsk 1&3 mines and refine it at the Solikamsk 2 mill so the net loss likely would be 1.0-1.5 million tonnes KCl. - Several North American brownfield expansions were completed last year and are online including projects at Mosaic’s Colonsay facility and Agrium’s Vanscoy mine. Assuming demand of ~60 million tonnes and no significant inventory change, a global operating rate of about 83% would be required to meet projected demand.

Your Vote

After those compelling arguments, are you a potash bull or bear? 46 1 2 0%0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1.Bullish 2.Bearish 30

This presentation and other products are available on the Mosaic website 47 http://www.mosaicco.com/resources/market_analysis.htm Mosaic Stakeholder Handbook Market Mosaic ▪ Market Alerts ▪ Past Presentations

Bull or Bear? The Great Debate Rahm vs. Jung Mosaic AgCollege Orlando, FL January 13, 2015 Dr. Michael R. Rahm Vice President Market and Strategic Analysis Andy Jung Director Market and Strategic Analysis Thank You for Your Business!