Mosaic Analyst Day March 31, 2015

2 Safe Harbor This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the transactions with CF, including the risk that the cost or capital savings from the transactions may not be fully realized or may take longer to realize than expected, or the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida phosphate assets acquisition, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

Mosaic’s Strategic Momentum Jim Prokopanko President and CEO

Mosaic’s vision… To be the world’s leading crop nutrition company Since our last analyst day, 18 months ago, a lot has changed in our industry and at Mosaic—and those changes have put Mosaic in leadership positions

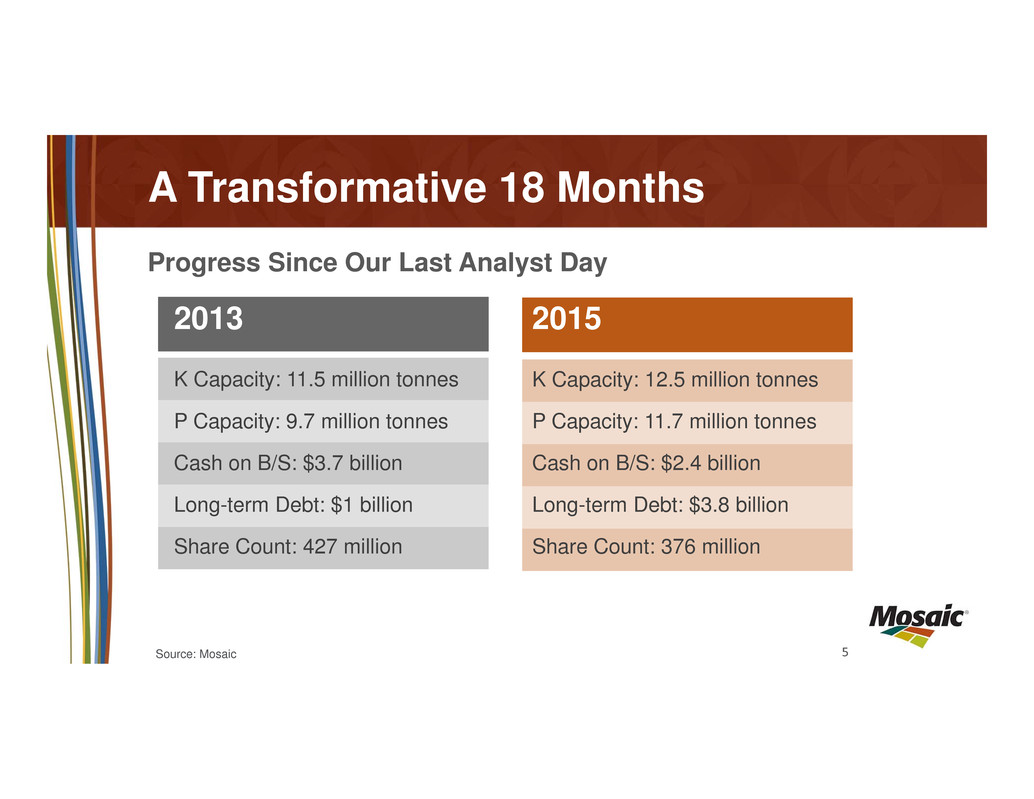

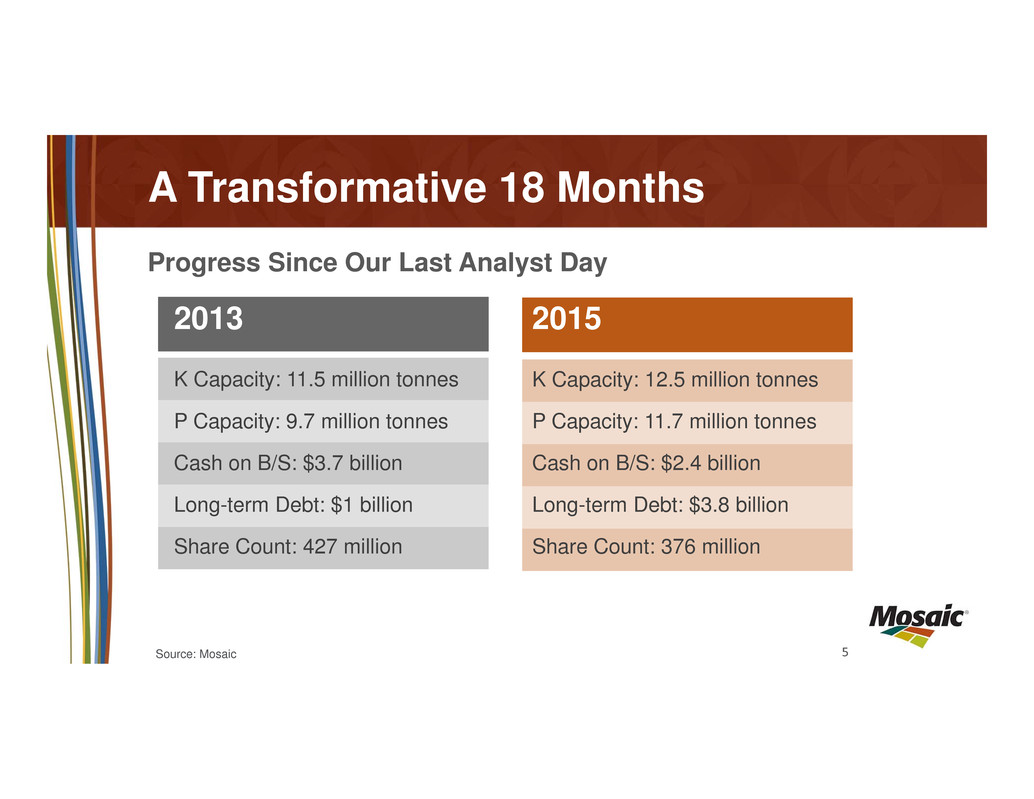

5 A Transformative 18 Months 2013 K Capacity: 11.5 million tonnes P Capacity: 9.7 million tonnes Cash on B/S: $3.7 billion Long-term Debt: $1 billion Share Count: 427 million 2015 K Capacity: 12.5 million tonnes P Capacity: 11.7 million tonnes Cash on B/S: $2.4 billion Long-term Debt: $3.8 billion Share Count: 376 million Progress Since Our Last Analyst Day Source: Mosaic

6 A Transformative 18 Months Cargill Shares Repurchased

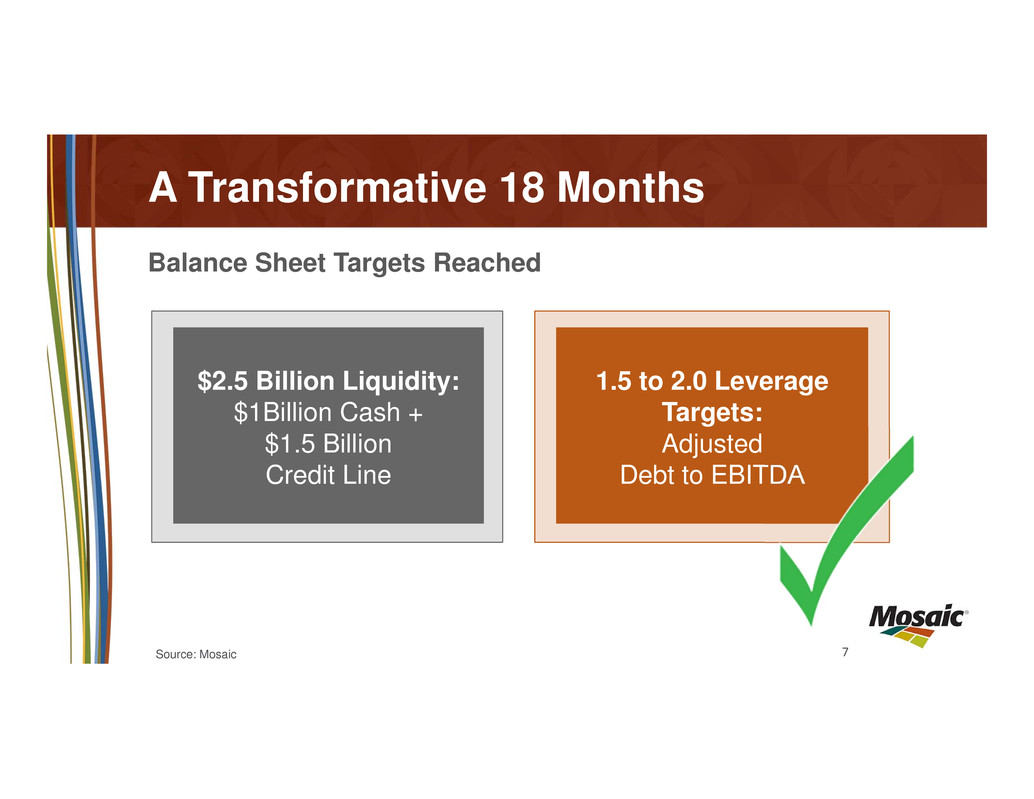

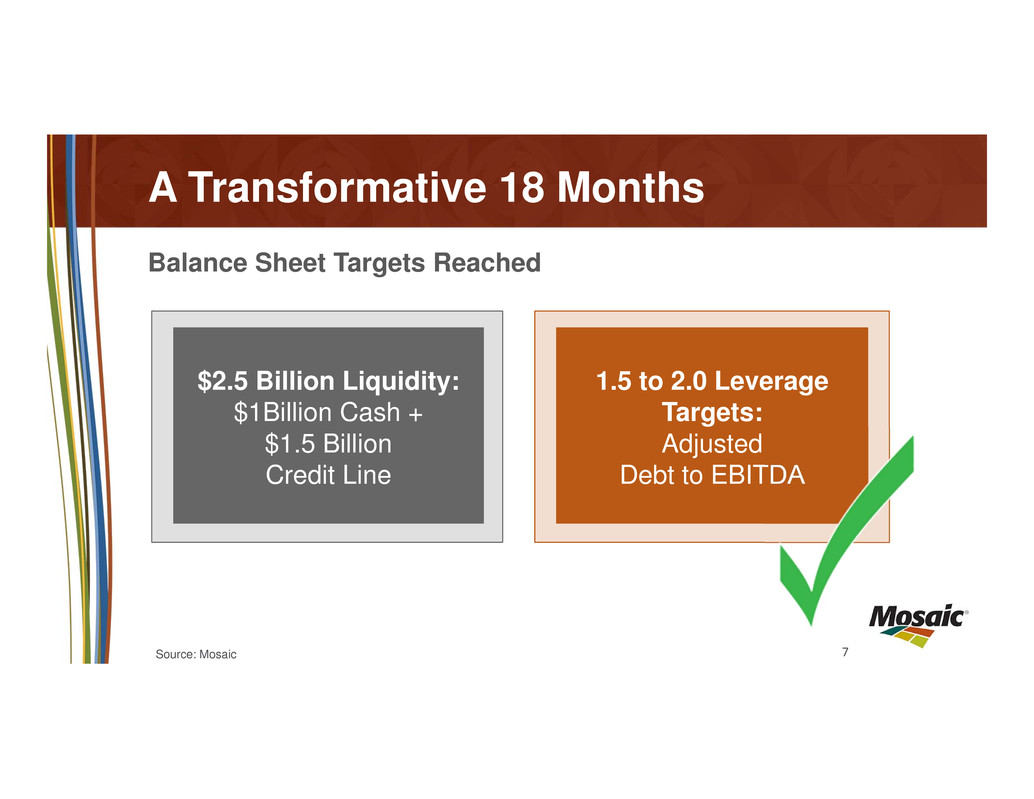

7 A Transformative 18 Months $2.5 Billion Liquidity: $1Billion Cash + $1.5 Billion Credit Line 1.5 to 2.0 Leverage Targets: Adjusted Debt to EBITDA Balance Sheet Targets Reached Source: Mosaic

8 A Transformative 18 Months

9 A Transformative 18 Months CF Industries Phosphate Business Acquisition

10 A Transformative 18 Months ADM Day 1 ADM Distribution Acquisition in Brazil and Paraguay

11 A Transformative 18 Months Rebalanced Portfolio, Exited Underperforming Businesses

12 A Transformative 18 Months Successful Proving Runs at Colonsay and Esterhazy K2

13 A Transformative 18 Months Continued New Product Innovation

14 A Transformative 18 Months Increased Transparency

15 A Transformative 18 Months Esterhazy K3 Expansion On Schedule and On Budget

16 A Transformative 18 Months Ma'aden Joint Venture - Rapidly Advancing

17 A Transformative 18 Months MicroEssentials® Capacity Expansion On Schedule and On Budget

18 A Transformative 18 Months Committed To Low-cost Operation; Cost-saving Initiatives Ahead of Schedule

19 A Transformative 18 Months Asset Optimization: Faustina Debottlenecking, Sulfur Melter, Transportation Assets

20 Many Moves, Providing Earnings Benefits EBITDA Earnings Leverage Without P&K Price Increases *Reconciliation in the appendix. EBITDA for future years is calculated based on expected earnings before interest, taxes, depreciation and amortization. $1,500 $2,000 $2,500 $3,000 $3,500 2014 2015E 2016E 2017E 2018E Source: Mosaic ($ Millions)

21 Leading with Purpose S u s t a i n a b i l i t y Products Emissions Co-Products Manufacturing Energy Waste M ining Raw Material Sourcing S h i p p i n g Nutrient Stewardship Innovation

22 Leading with Purpose Valuable, Deep Customer Relationships

23 Leading with Purpose Improved RIFR by 8% 14% Improvement over 2013 for Environmental Index Improved LTIFR by more than 17% Record Safety Performance Source: Mosaic

24 Leading with Purpose Sustainability Performance and Reporting

25 Leading with Purpose A Talented Workforce

26 Leading with Purpose Contributing to Global Food Security

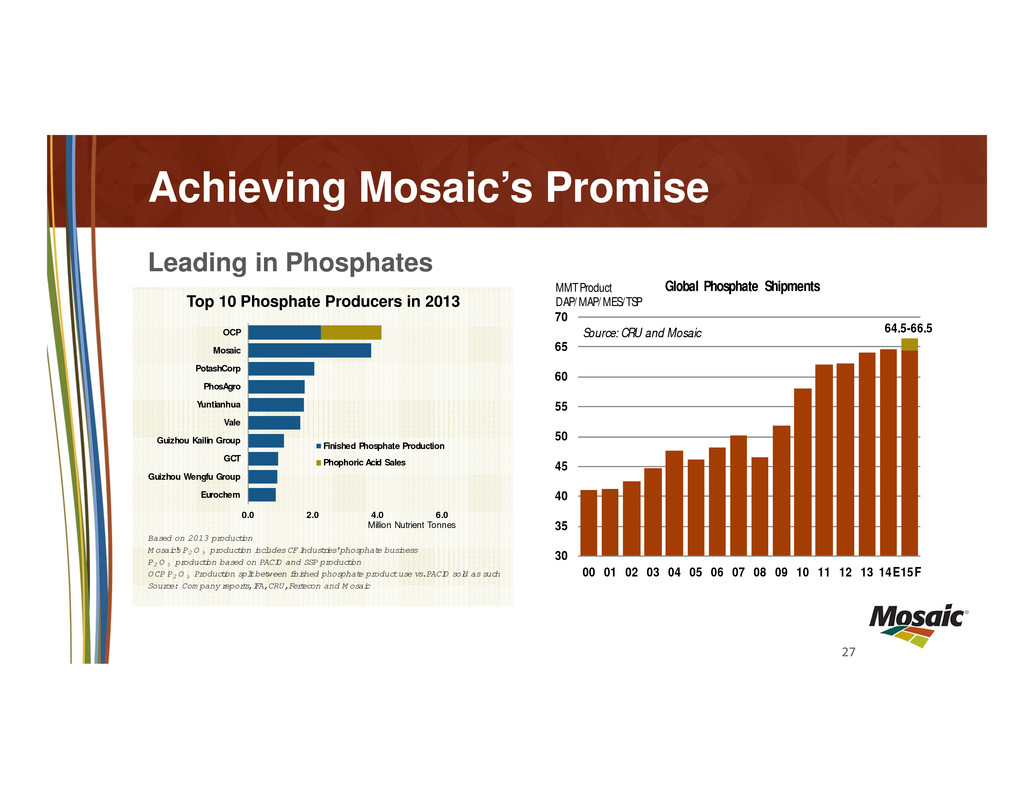

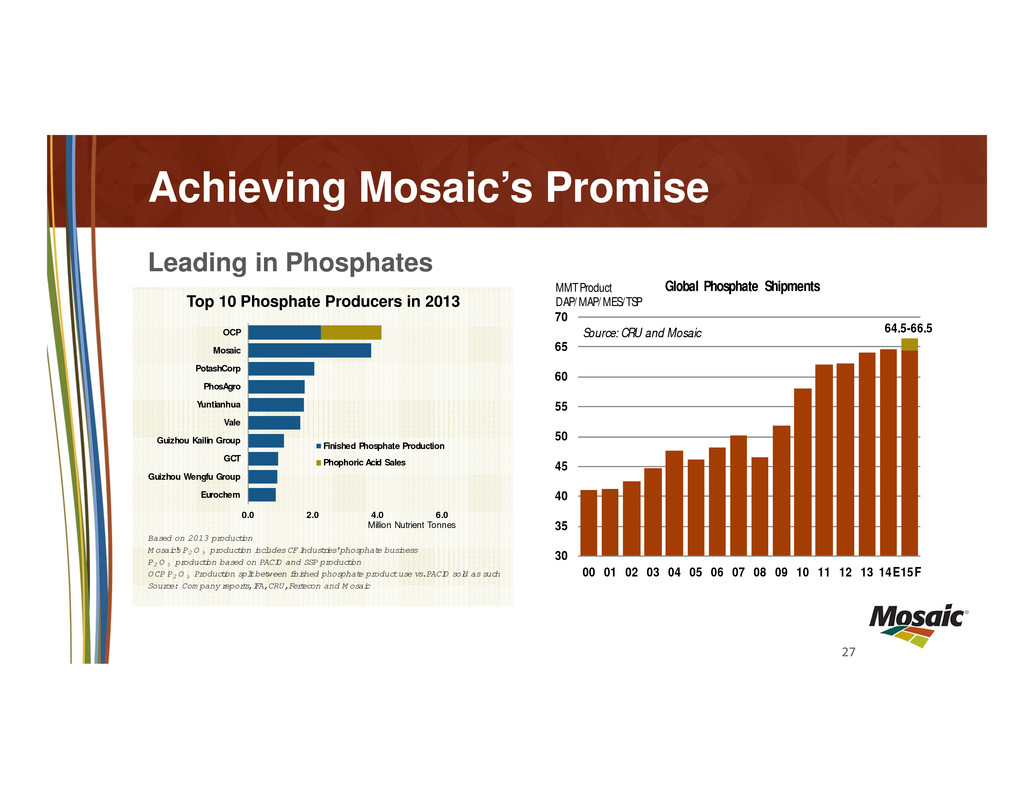

27 Achieving Mosaic’s Promise 64.5-66.5 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Phosphate ShipmentsMMT Product DAP/ MAP/ MES/TSP Source: CRU and Mosaic Top 10 Phosphate Producers in 2013 Based on 2013 production M osaic's P2 O 5 production includes CF Industries' phosphate business P2 O 5 production based on PACID and SSP production OCP P2 O 5 Production split between finished phosphate product use vs. PACID sold as such Source: Com pany reports, IFA, CRU, Fertecon and M osaic 0.0 2.0 4.0 6.0 OCP Mosaic PotashCorp PhosAgro Yuntianhua Vale Guizhou Kailin Group GCT Guizhou Wengfu Group Eurochem Million Nutrient Tonnes Finished Phosphate Production Phophoric Acid Sales Leading in Phosphates

28 Achieving Mosaic’s Promise Delivering Value Through Innovation

29 Achieving Mosaic’s Promise 2013 Actuals: $133/tonne 2014 Actuals: $112/tonne Q4’14 Actuals: $91/tonne Q4’14 Excluding Brine: $74/tonne Potash Production Cash Costs • Three world-class mines • Rationalized assets • Belle Plaine and Colonsay expansions completed • Esterhazy K3 on track Optimizing Potash Source: Mosaic

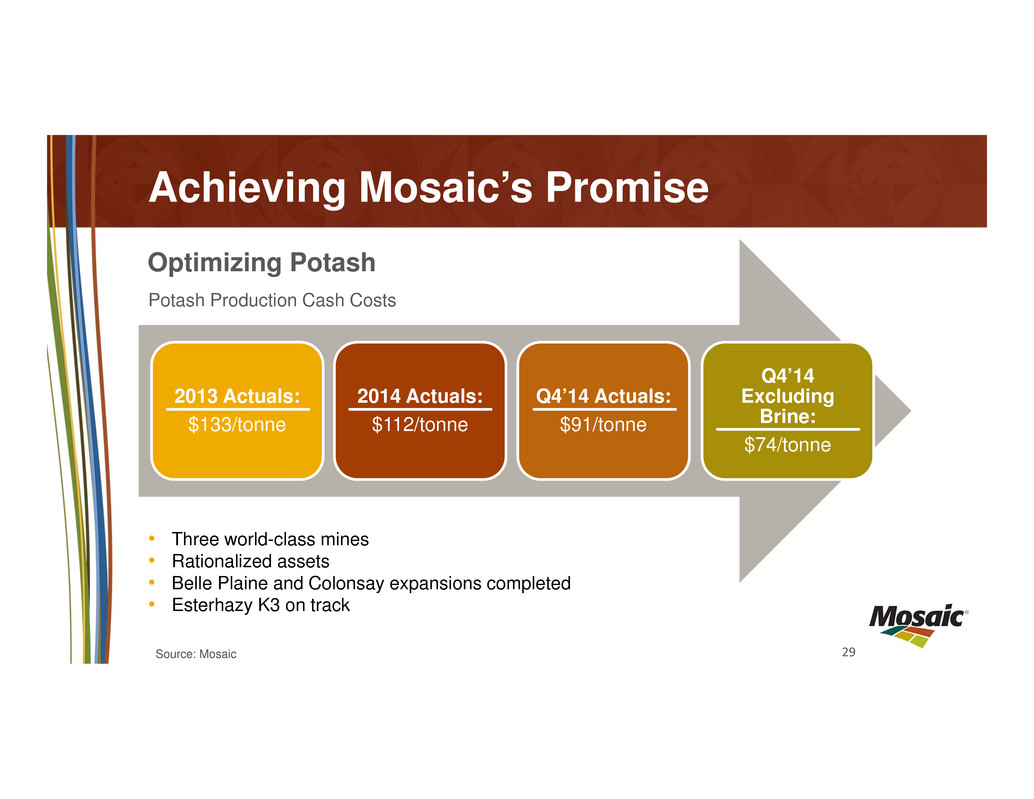

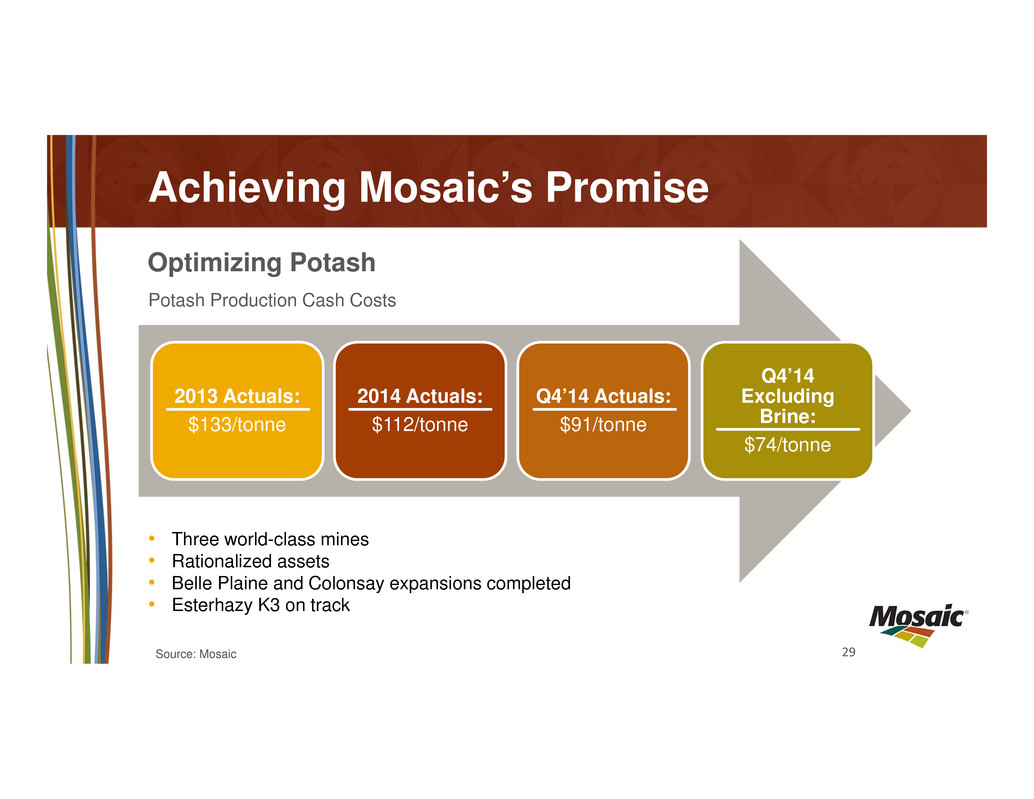

30 Achieving Mosaic’s Promise Distribution Strength

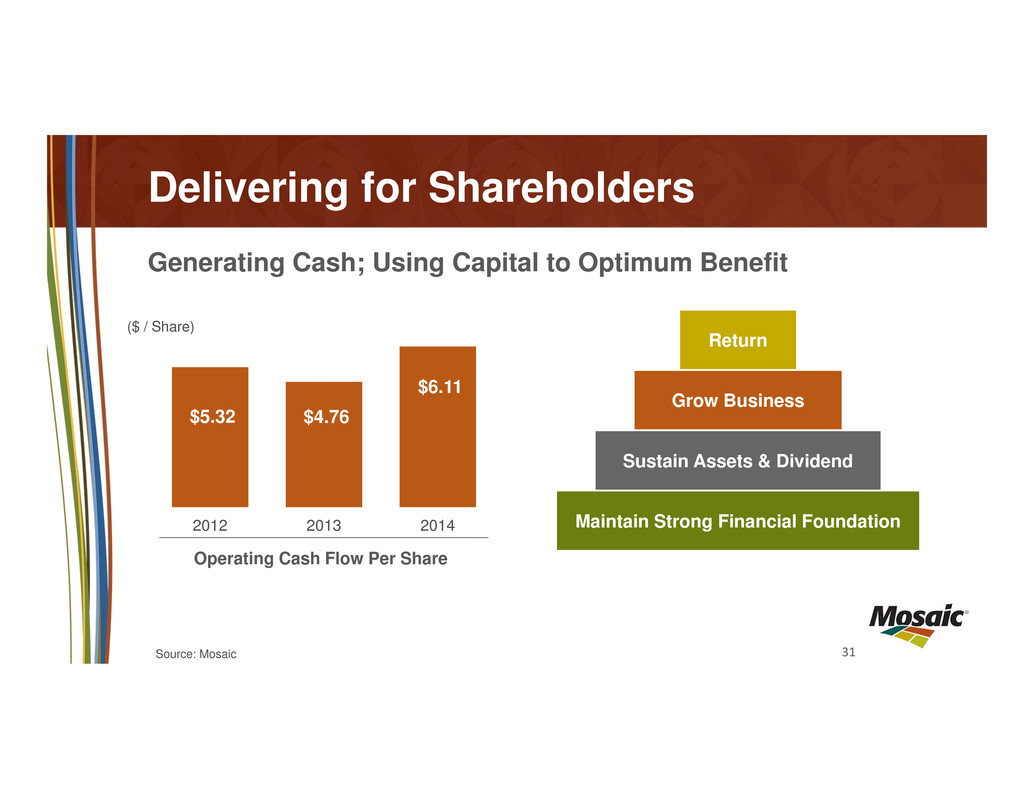

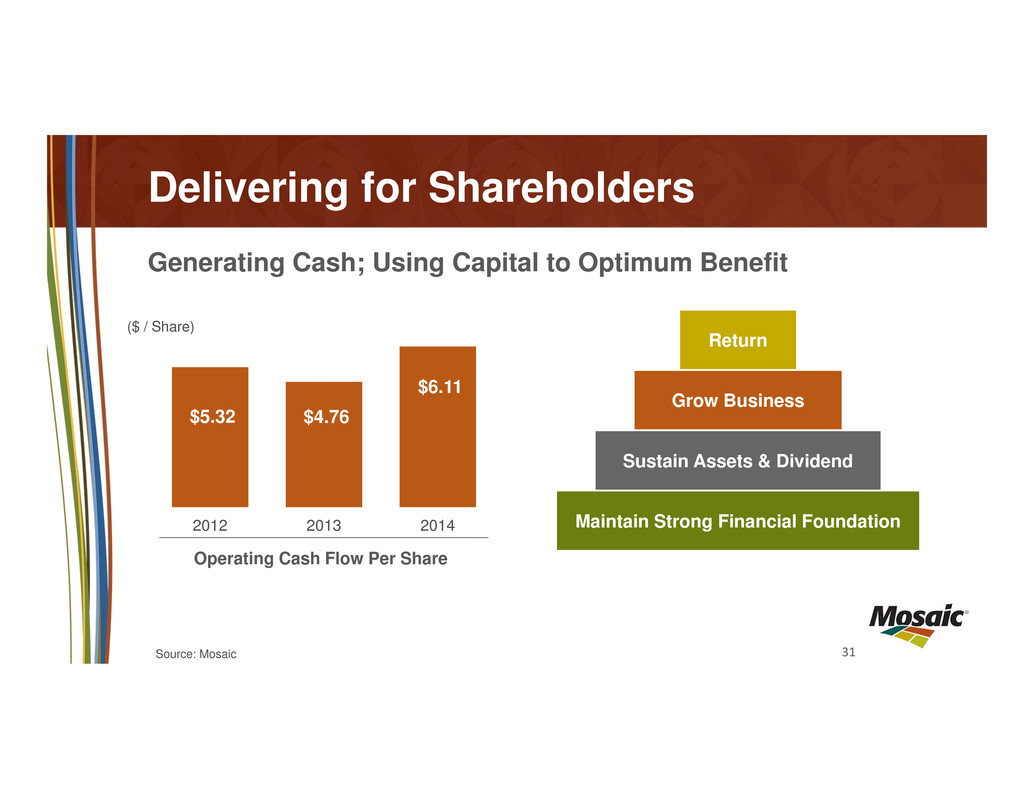

31 Delivering for Shareholders $5.32 $4.76 $6.11 2012 2013 2014 Operating Cash Flow Per Share Maintain Strong Financial Foundation Sustain Assets & Dividend Grow Business Return Generating Cash; Using Capital to Optimum Benefit ($ / Share) Source: Mosaic

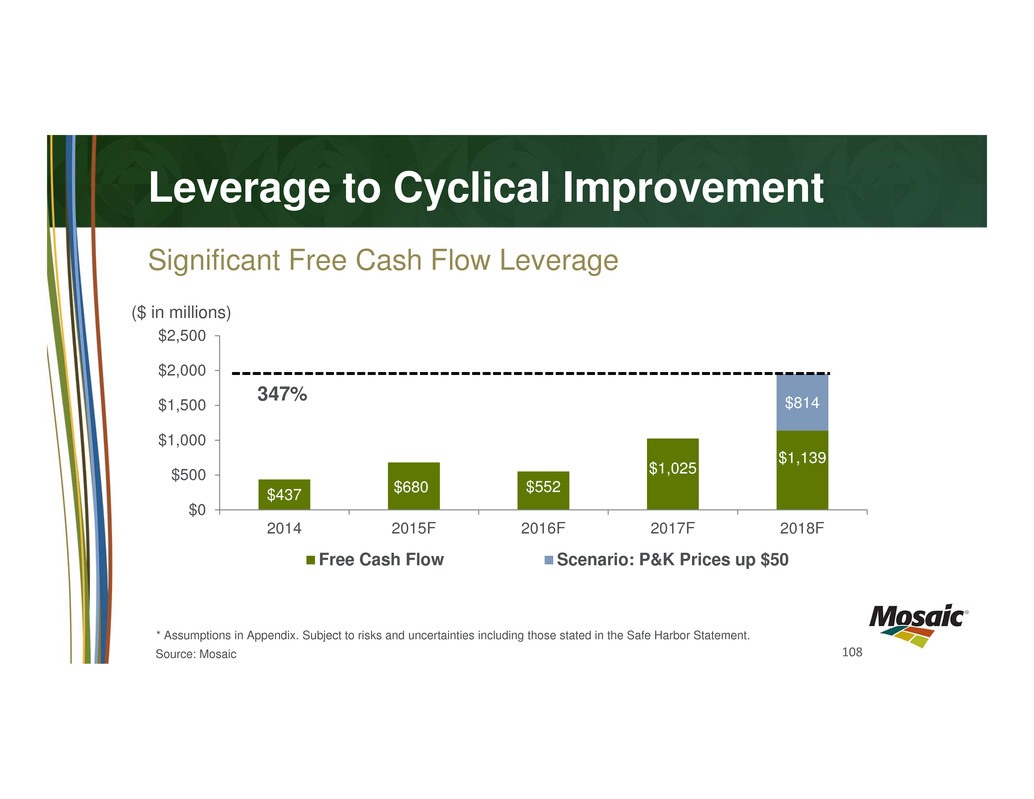

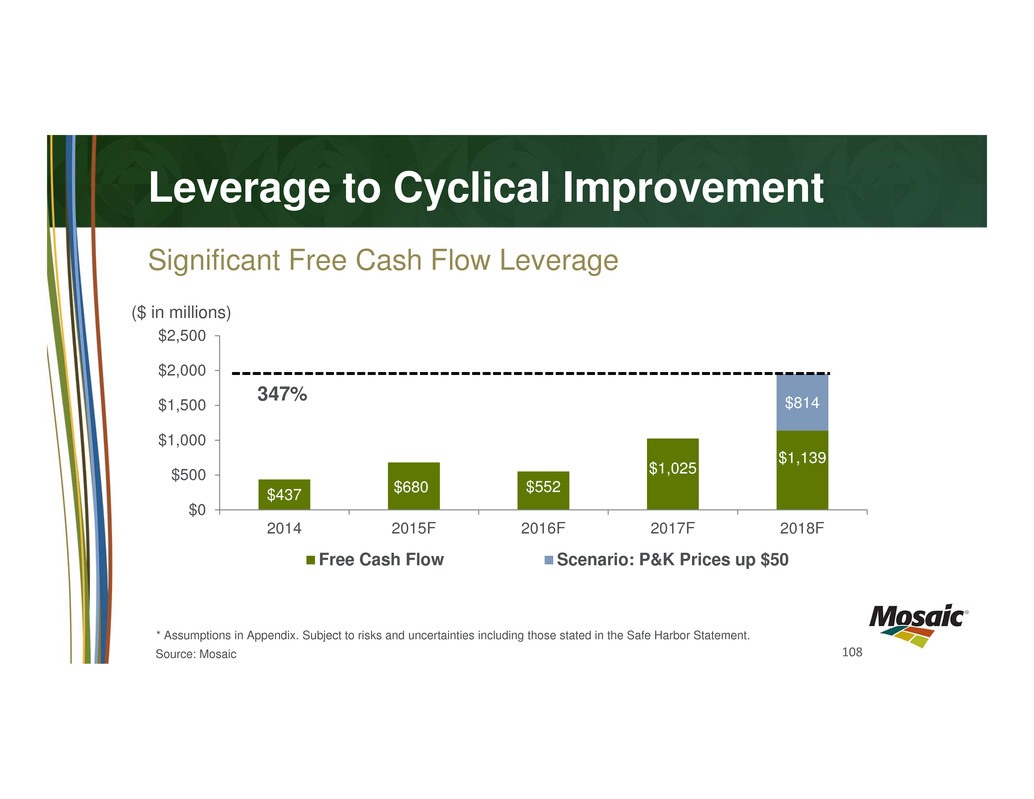

32 Delivering for Shareholders $437 $680 $552 $1,025 $1,139 $814 $0 $500 $1,000 $1,500 $2,000 $2,500 2014 2015F 2016F 2017F 2018F Free Cash Flow Scenario: P&K Prices up $50 347% ($ Millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

Leading with Execution Joc O’Rourke Chief Operating Officer

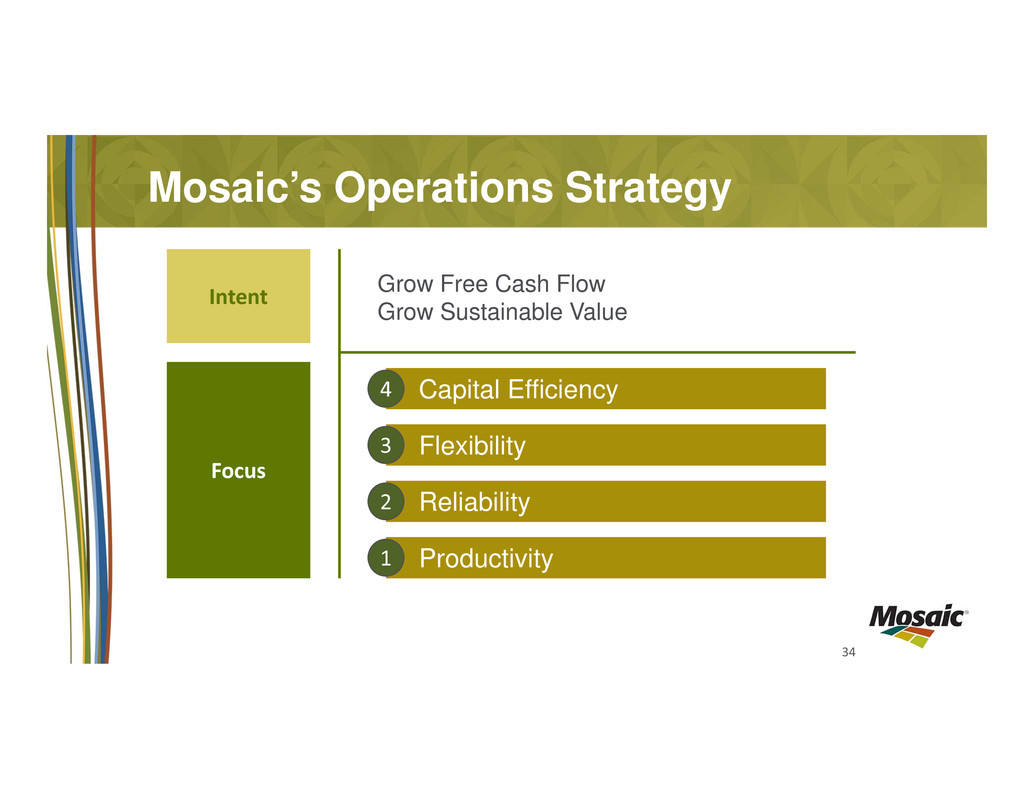

34 Mosaic’s Operations Strategy Focus Intent Grow Free Cash Flow Grow Sustainable Value Flexibility Productivity Reliability Capital Efficiency 1 2 3 4

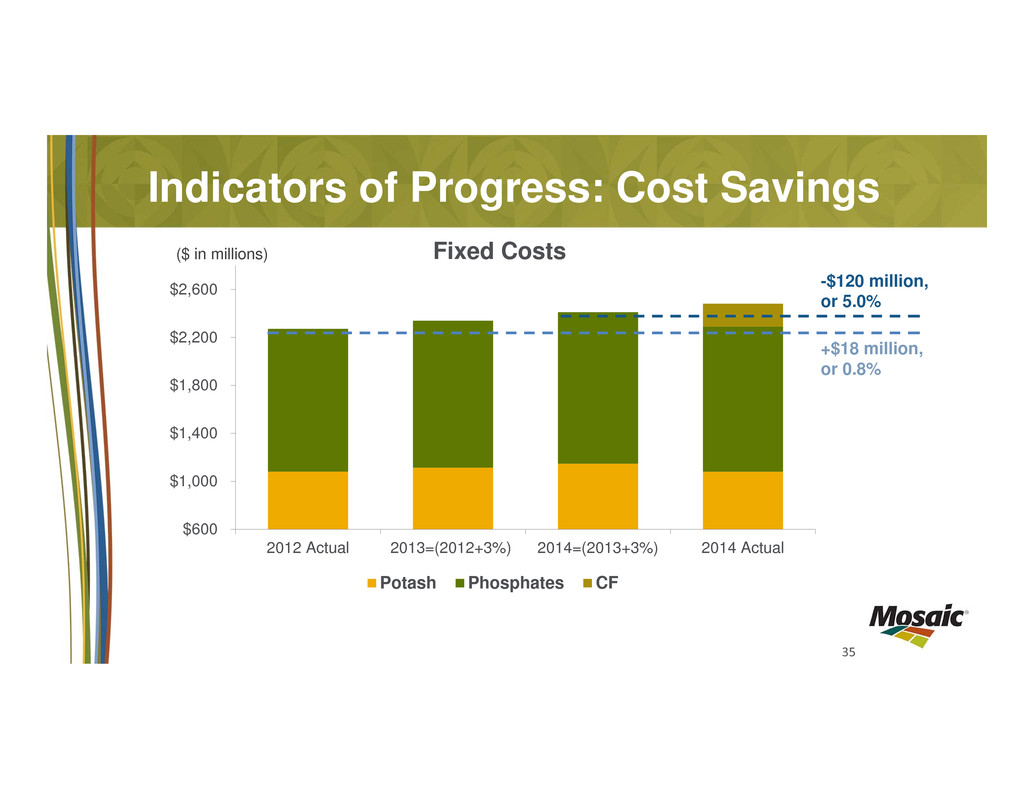

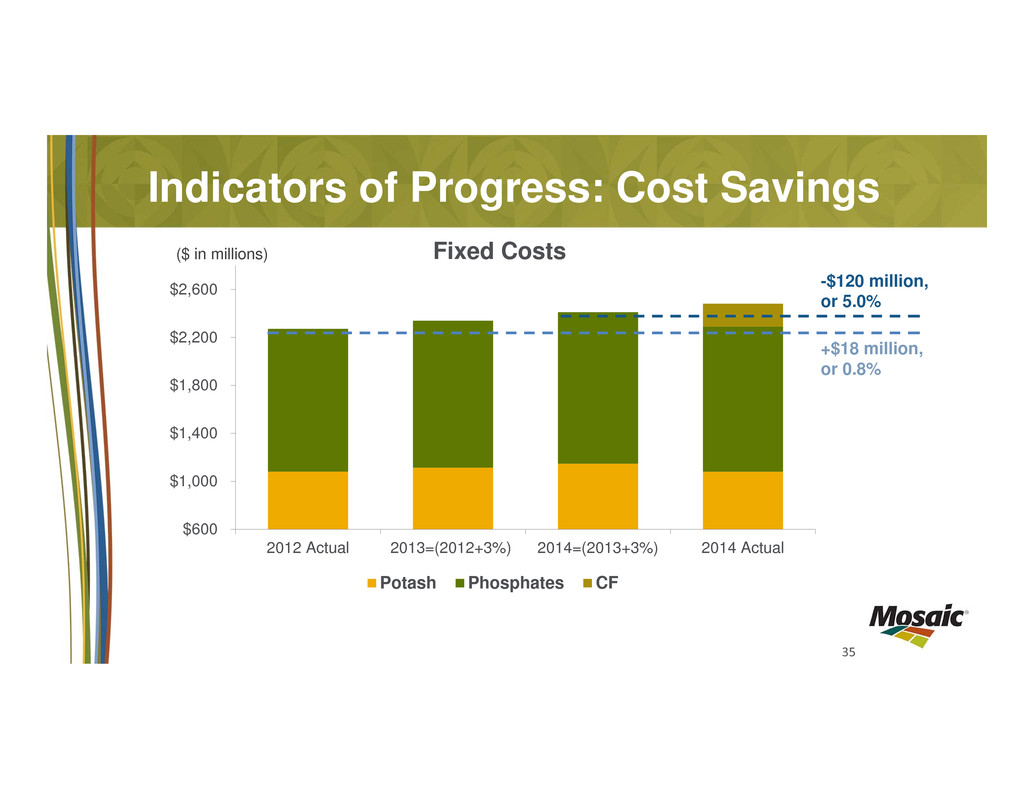

35 Indicators of Progress: Cost Savings $600 $1,000 $1,400 $1,800 $2,200 $2,600 2012 Actual 2013=(2012+3%) 2014=(2013+3%) 2014 Actual ($ in millions) Fixed Costs Potash Phosphates CF -$120 million, or 5.0% +$18 million, or 0.8%

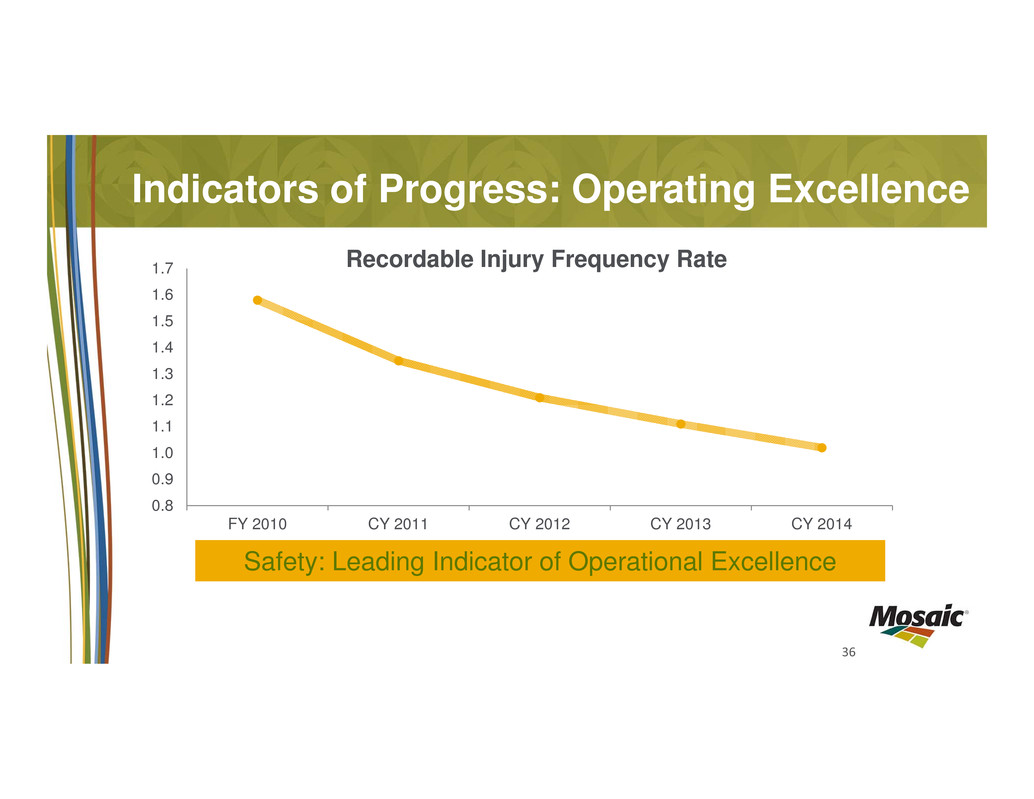

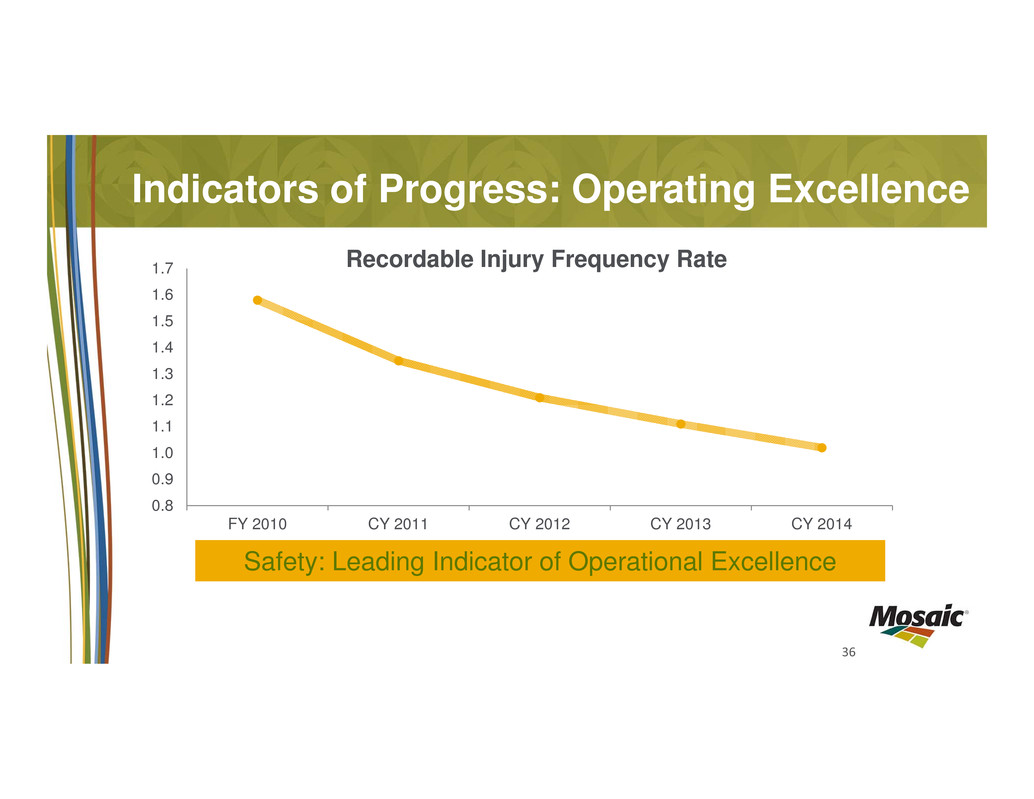

36 Indicators of Progress: Operating Excellence 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 FY 2010 CY 2011 CY 2012 CY 2013 CY 2014 Recordable Injury Frequency Rate Safety: Leading Indicator of Operational Excellence

Phosphates in Depth

38 Phosphates: Cost Curve M o s a i c - F L M o s a i c - U n c l e S a m & F a u s t i n a 0 100 200 300 400 500 600 700 800 900 1000 0 5 10 15 20 25 30 35 40 45 ($/Tonne) Million Tonnes 2014 Phosphoric Acid Industry FOB Plant Source: CRU and Mosaic

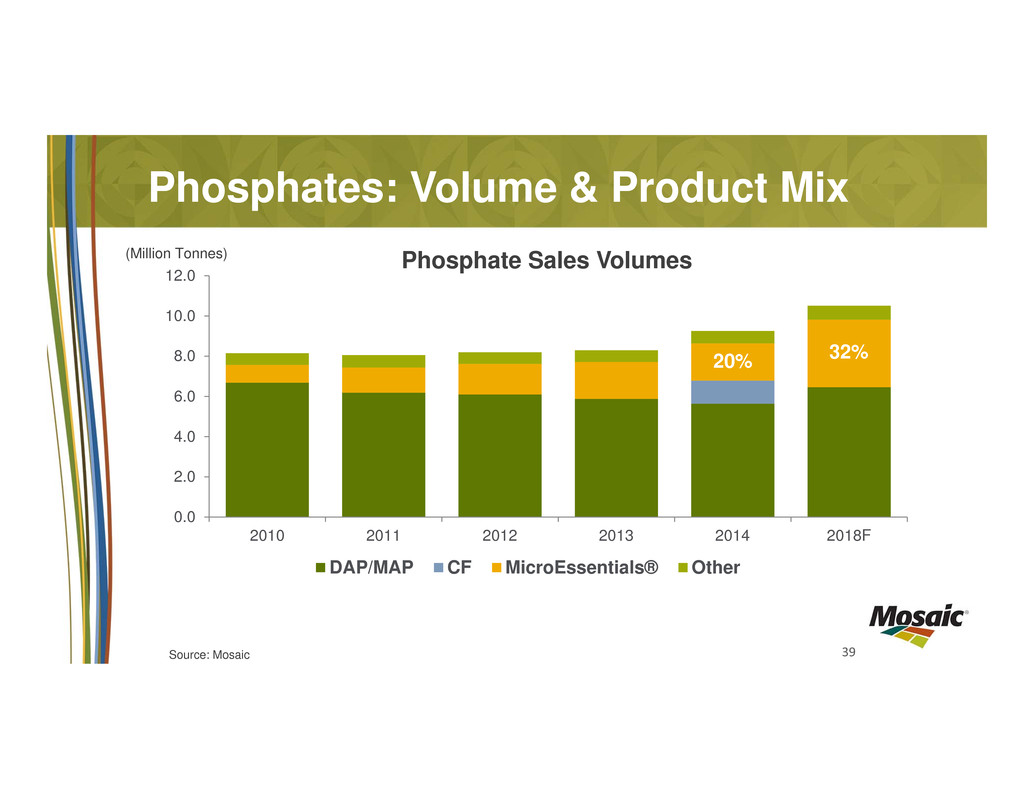

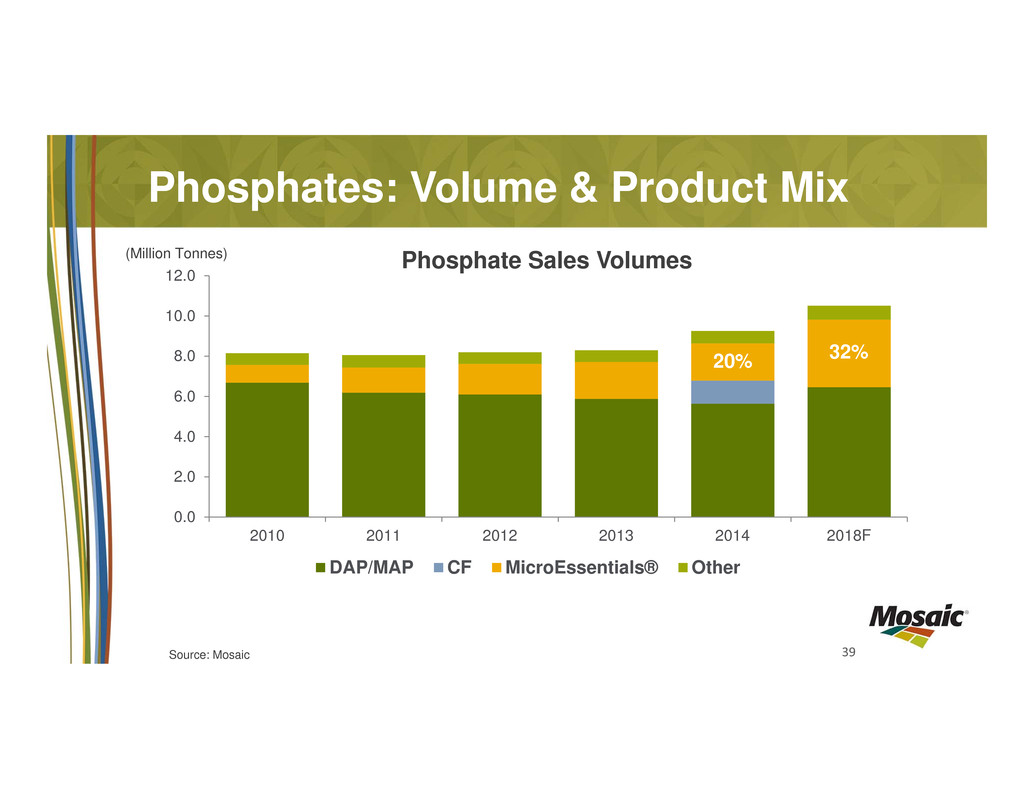

39 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2010 2011 2012 2013 2014 2018F Phosphate Sales Volumes DAP/MAP CF MicroEssentials® Other Phosphates: Volume & Product Mix 20% 32% (Million Tonnes) Source: Mosaic

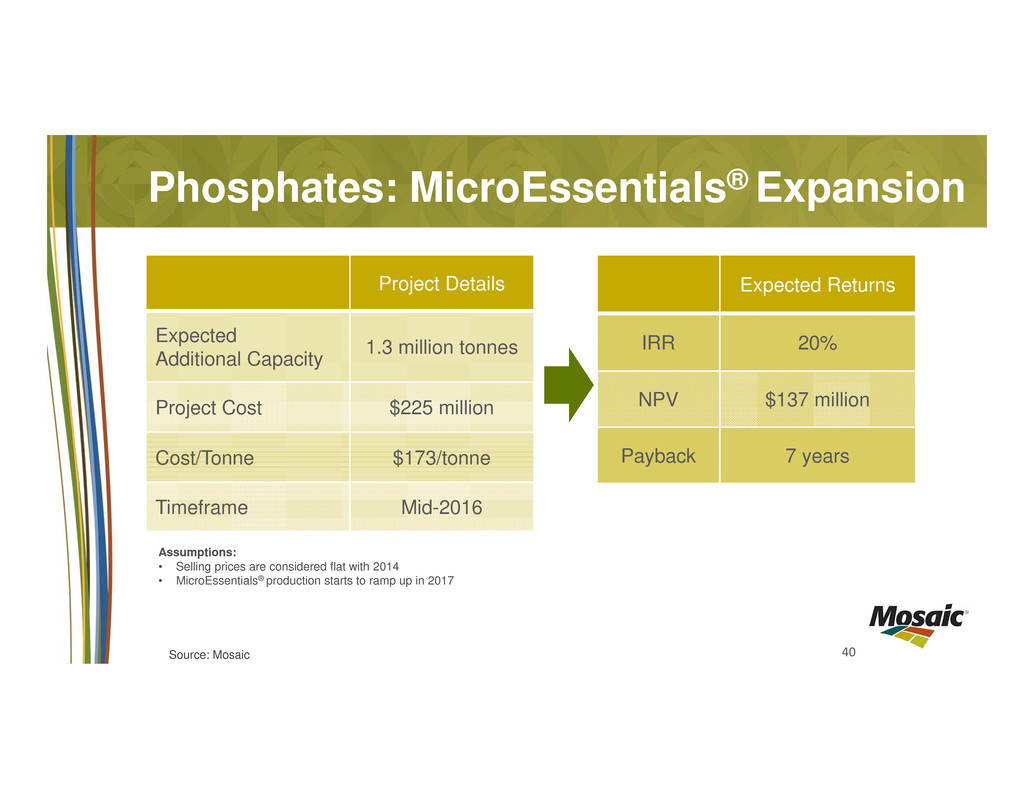

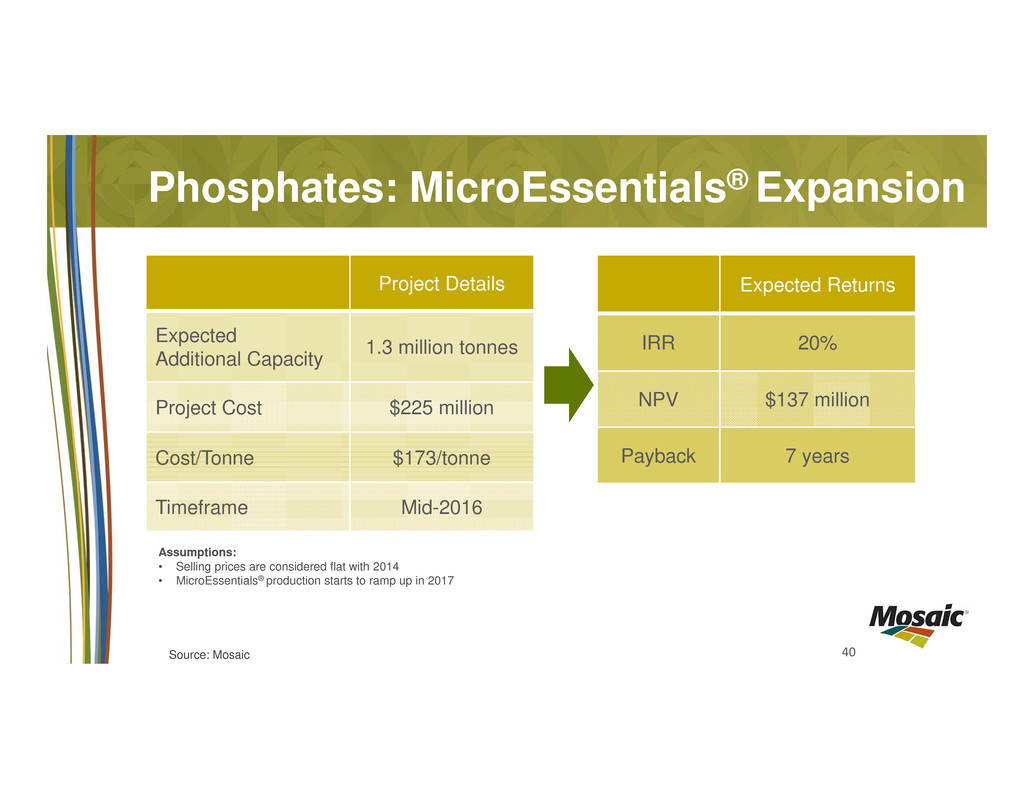

40 Phosphates: MicroEssentials® Expansion Assumptions: • Selling prices are considered flat with 2014 • MicroEssentials® production starts to ramp up in 2017 Project Details Expected Additional Capacity 1.3 million tonnes Project Cost $225 million Cost/Tonne $173/tonne Timeframe Mid-2016 Expected Returns IRR 20% NPV $137 million Payback 7 years Source: Mosaic

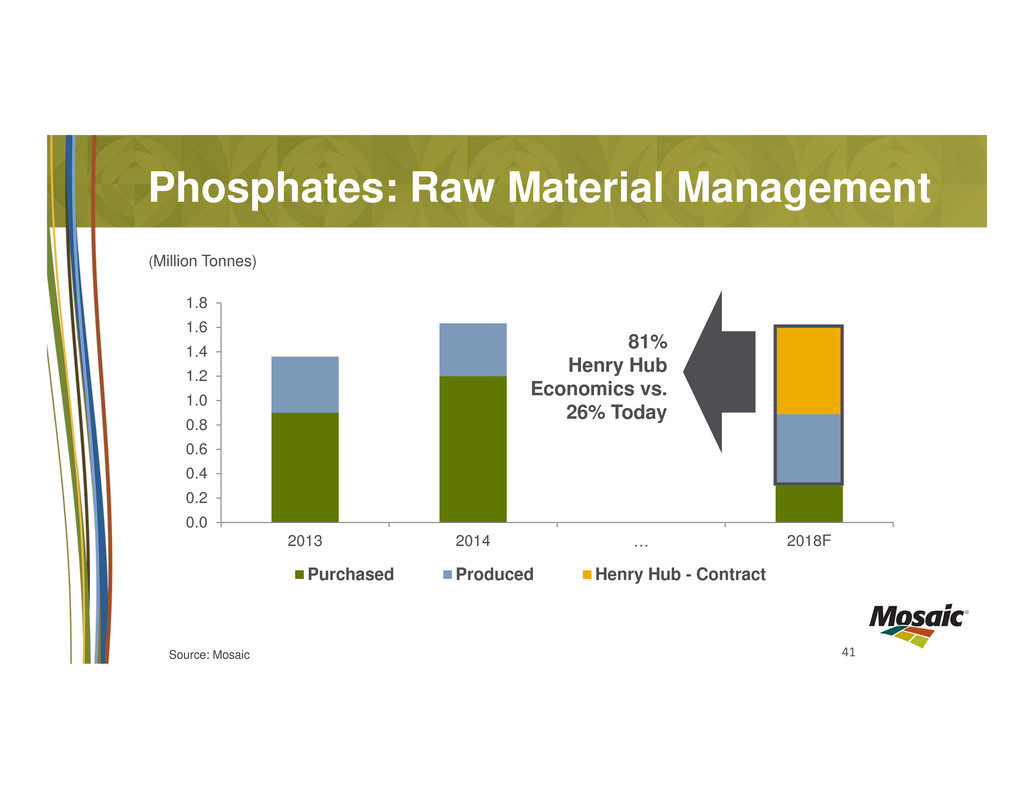

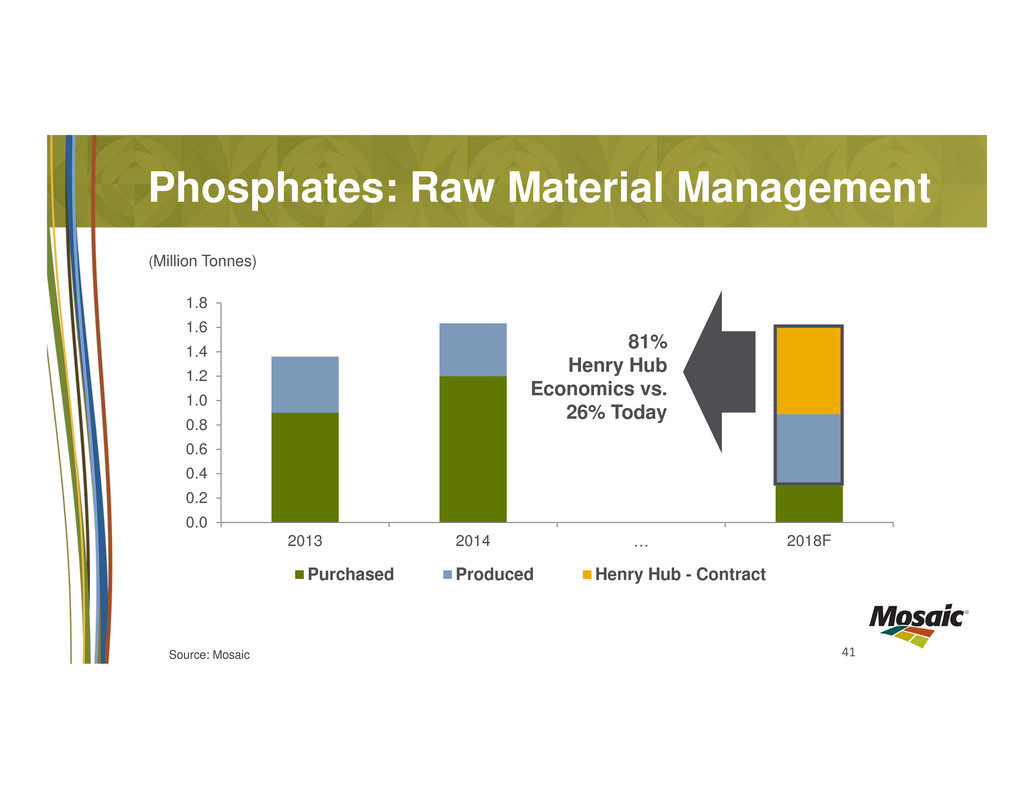

41 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2013 2014 … 2018F Purchased Produced Henry Hub - Contract Phosphates: Raw Material Management (Million Tonnes) 81% Henry Hub Economics vs. 26% Today Source: Mosaic

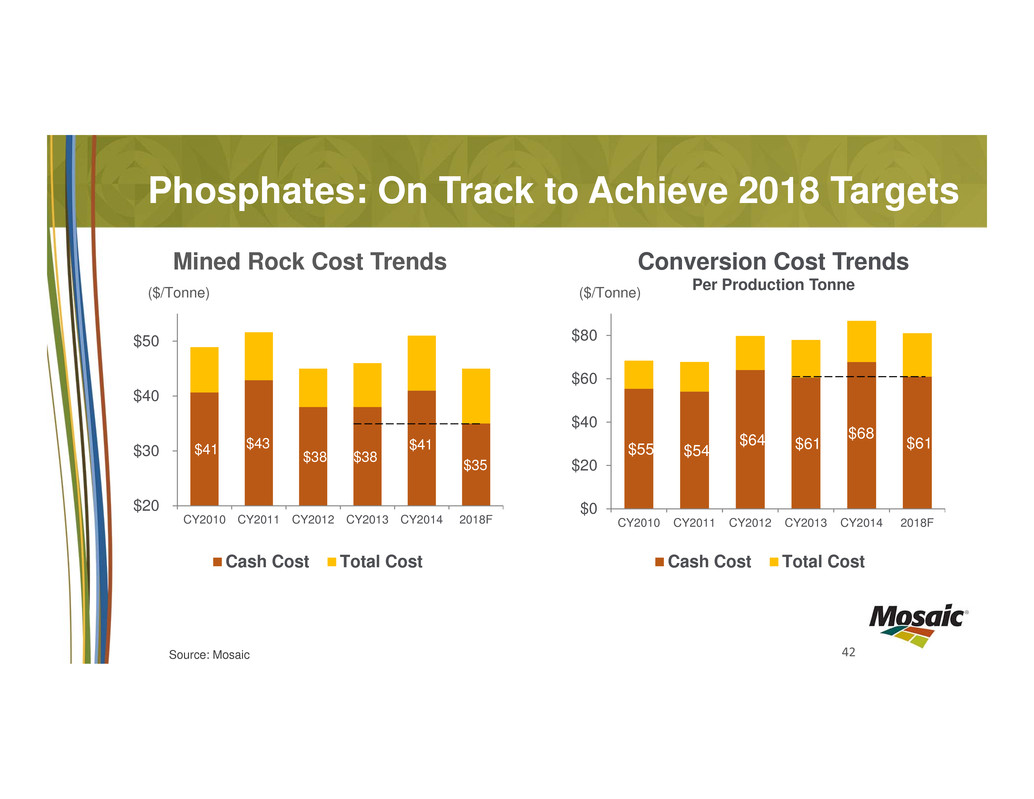

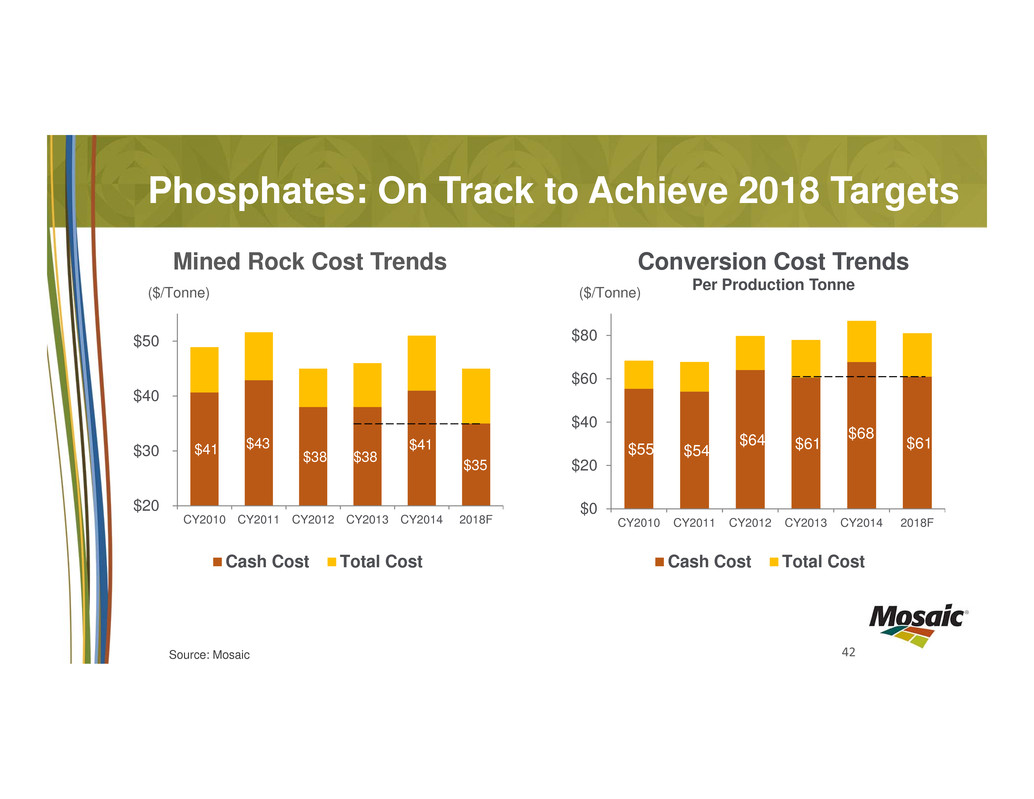

42 $41 $43 $38 $38 $41 $35 $20 $30 $40 $50 CY2010 CY2011 CY2012 CY2013 CY2014 2018F Cash Cost Total Cost ($/Tonne) Phosphates: On Track to Achieve 2018 Targets Mined Rock Cost Trends Conversion Cost Trends Per Production Tonne $55 $54 $64 $61 $68 $61 $0 $20 $40 $60 $80 CY2010 CY2011 CY2012 CY2013 CY2014 2018F Cash Cost Total Cost ($/Tonne) Source: Mosaic

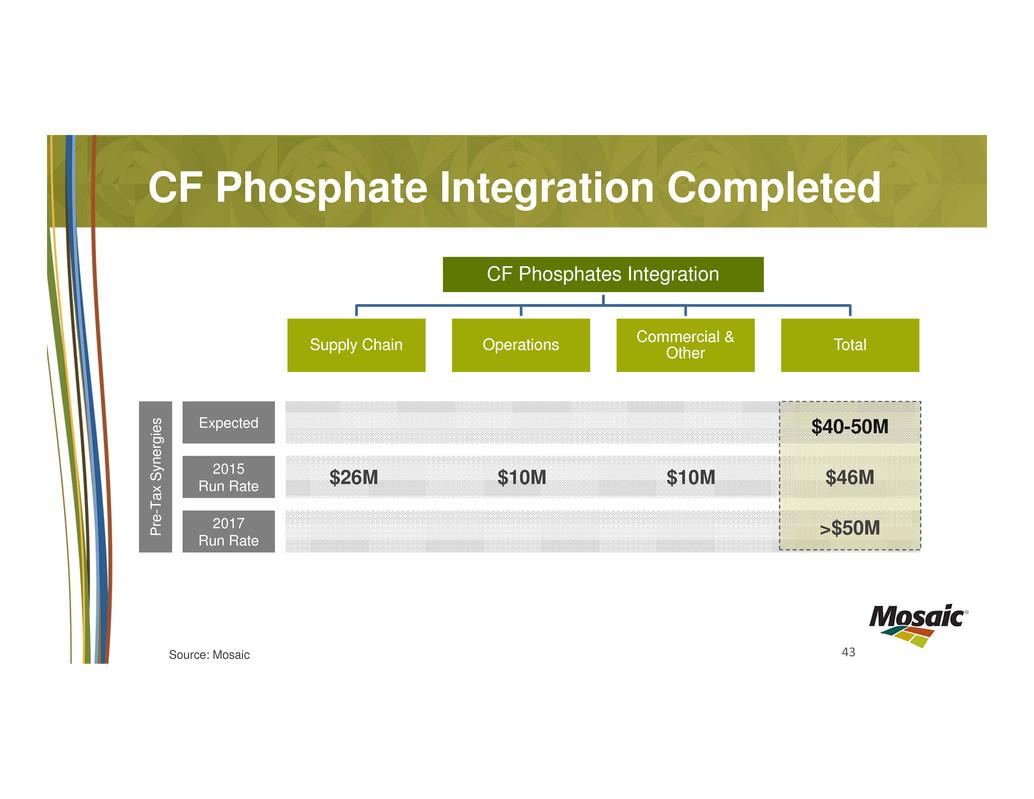

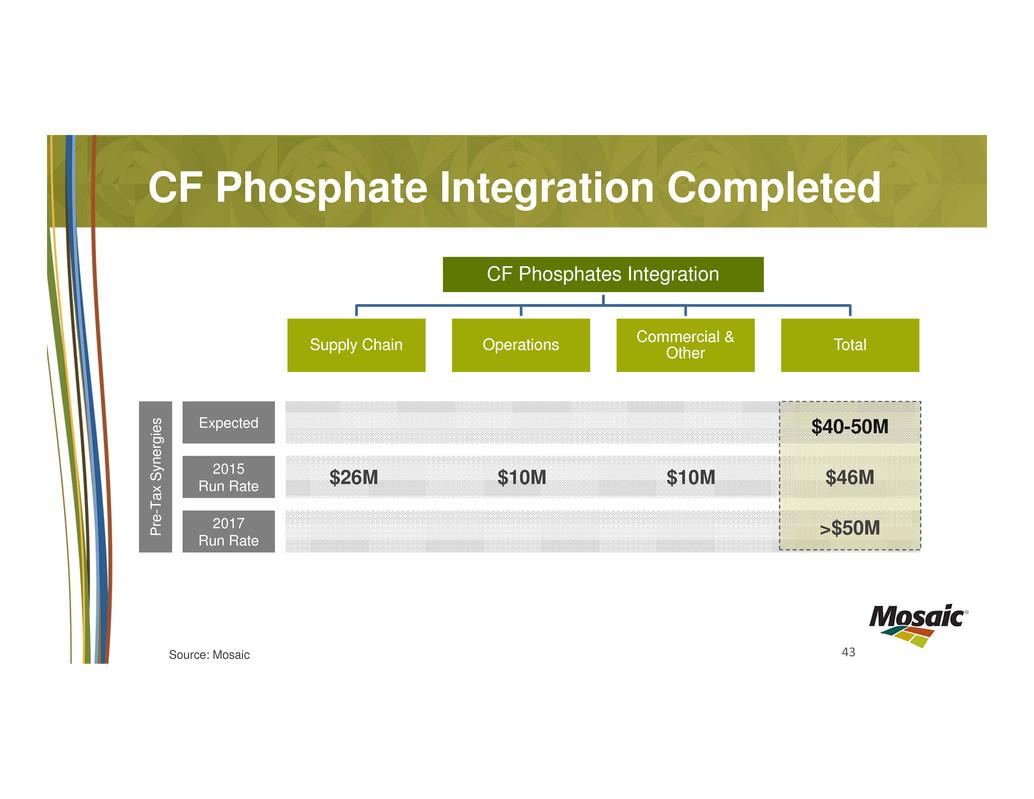

43 CF Phosphate Integration Completed CF Phosphates Integration Supply Chain Operations Commercial & Other Total Expected 2015 Run Rate P r e - T a x S y n e r g i e s 2017 Run Rate $26M $10M $10M $46M >$50M $40-50M Source: Mosaic

44 Phosphates: On Track to Achieve 2018 Targets $0 $50 $100 $150 $200 $250 $300 $350 $400 2010 2011 2012 2013 2014 2018F Sustaining CAPEX Depreciation Expense Step up as a result of CF acquisition Source: Mosaic ($ in millions)

Potash in Depth

46 Potash: Expansion Successes Expansion Esterhazy K2 Colonsay Belle Plaine Expected Tonnes 800,000 544,000 570,000 Proved Tonnes* 1,057,842 784,045 TBD Estimated Costs/Tonne $807 $1,331 $932 Actual Costs/Tonne $577 $927 TBD IRR 20% 13% TBD IRR Assumptions 1. $300 per metric tonne netback 2. 85% operating rate *Based on results of Canpotex proving run. Source: Mosaic

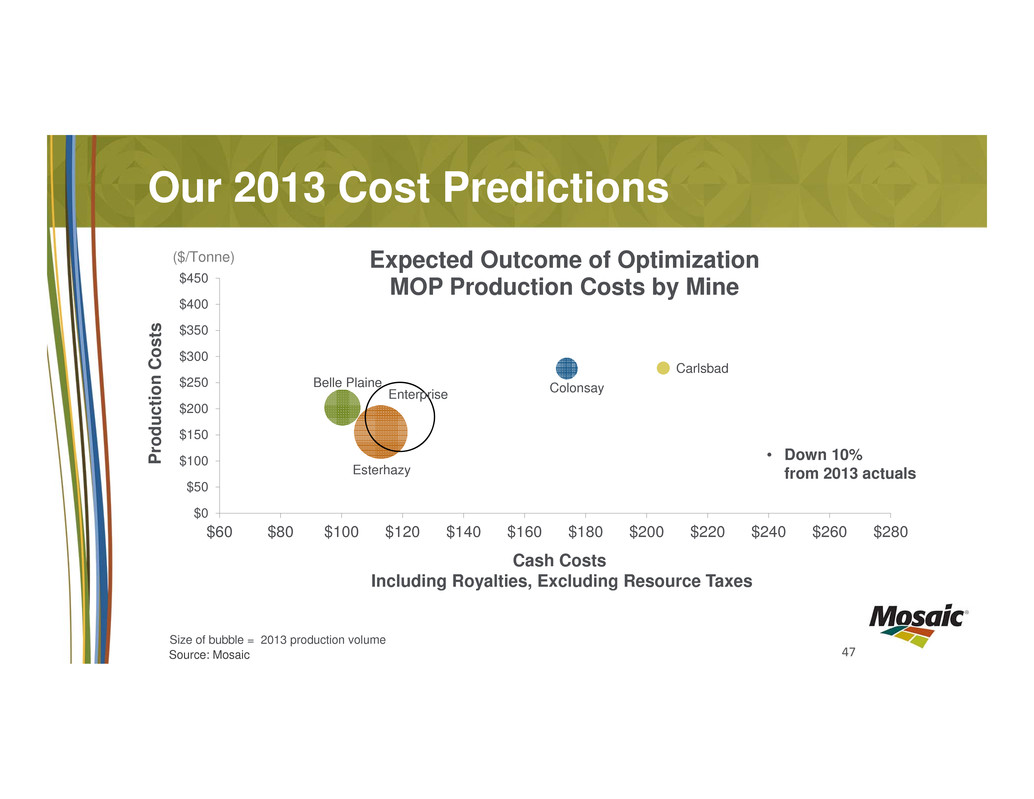

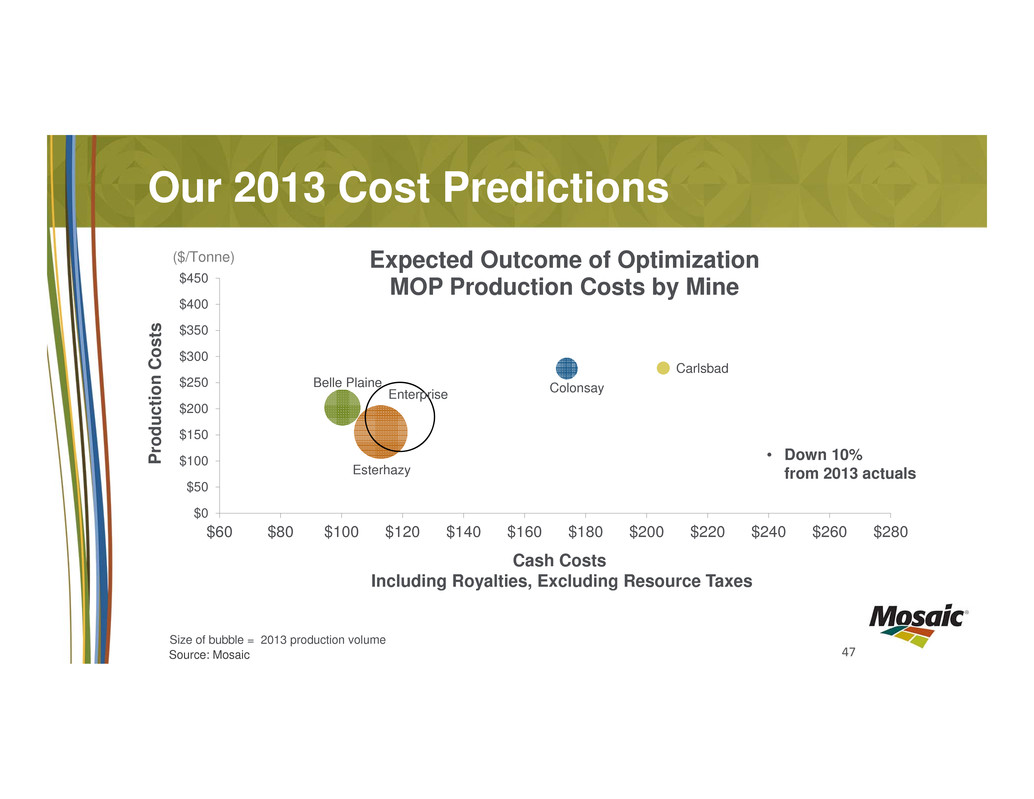

47 Esterhazy Belle Plaine Colonsay Carlsbad Enterprise $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 Expected Outcome of Optimization MOP Production Costs by Mine Our 2013 Cost Predictions • Down 10% from 2013 actuals Cash Costs Including Royalties, Excluding Resource Taxes P r o d u c t i o n C o s t s Size of bubble = 2013 production volume Source: Mosaic ($/Tonne)

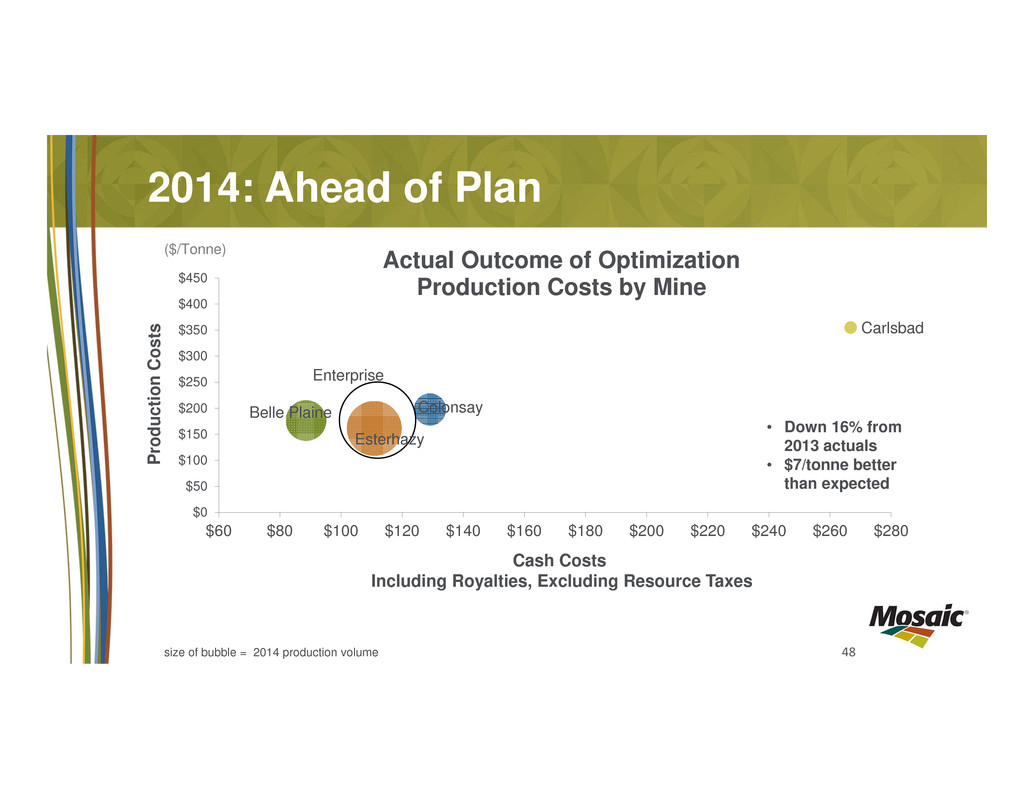

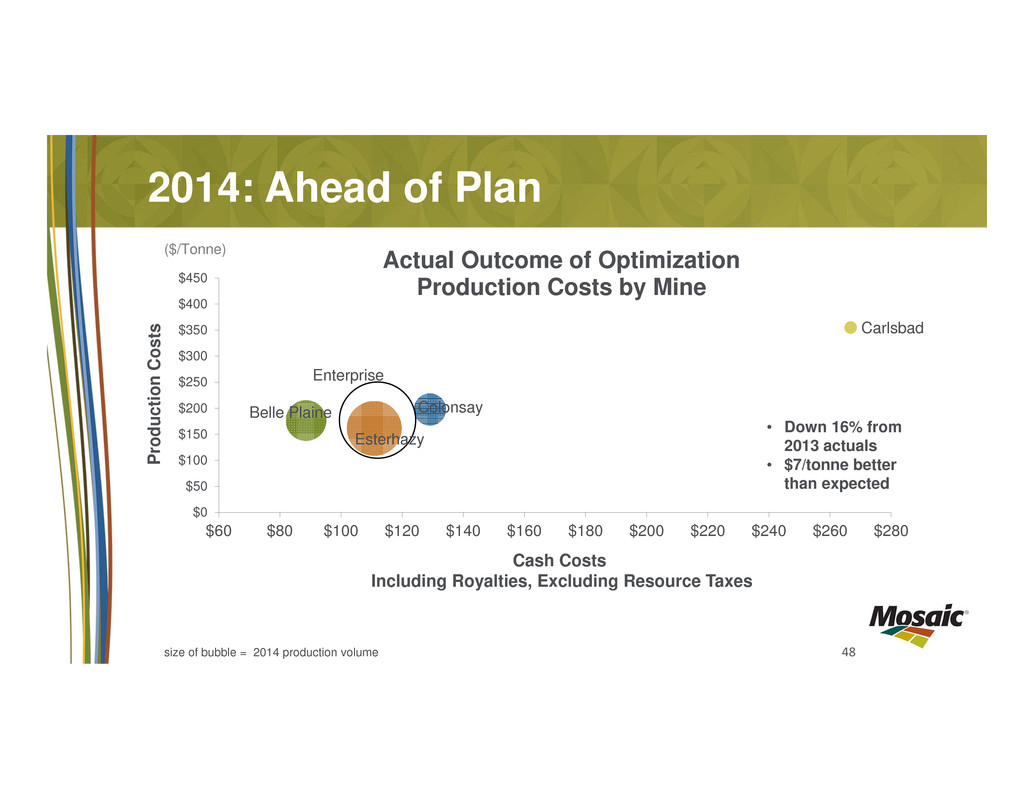

48 Esterhazy Belle Plaine Colonsay Carlsbad Enterprise $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 P r o d u c t i o n C o s t s Actual Outcome of Optimization Production Costs by Mine • Down 16% from 2013 actuals • $7/tonne better than expected Cash Costs Including Royalties, Excluding Resource Taxes 2014: Ahead of Plan size of bubble = 2014 production volume ($/Tonne)

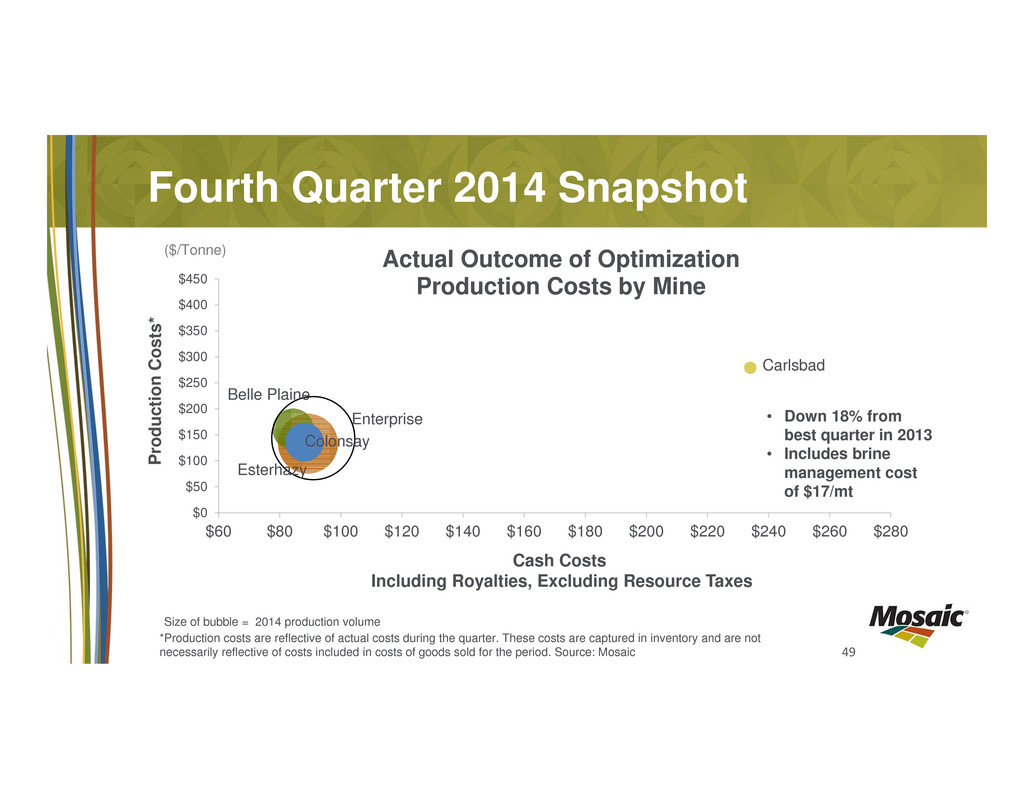

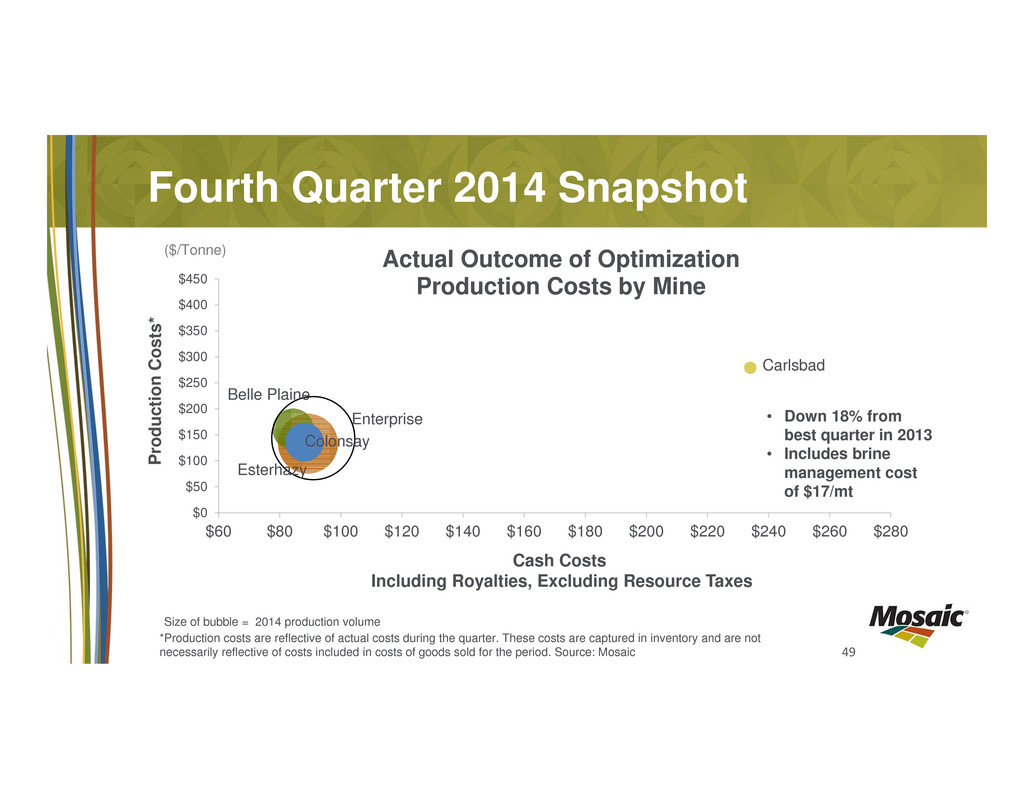

49 Esterhazy Belle Plaine Colonsay Carlsbad Enterprise $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 Actual Outcome of Optimization Production Costs by Mine • Down 18% from best quarter in 2013 • Includes brine management cost of $17/mt Cash Costs Including Royalties, Excluding Resource Taxes Fourth Quarter 2014 Snapshot Size of bubble = 2014 production volume *Production costs are reflective of actual costs during the quarter. These costs are captured in inventory and are not necessarily reflective of costs included in costs of goods sold for the period. Source: Mosaic P r o d u c t i o n C o s t s * ($/Tonne)

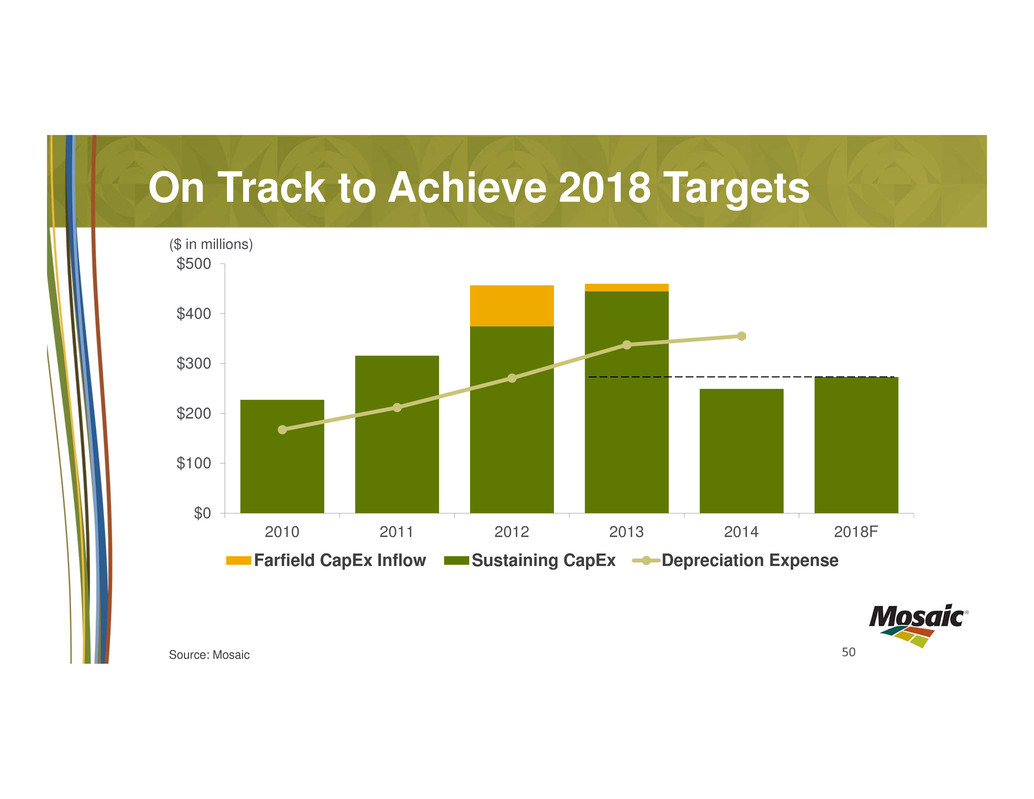

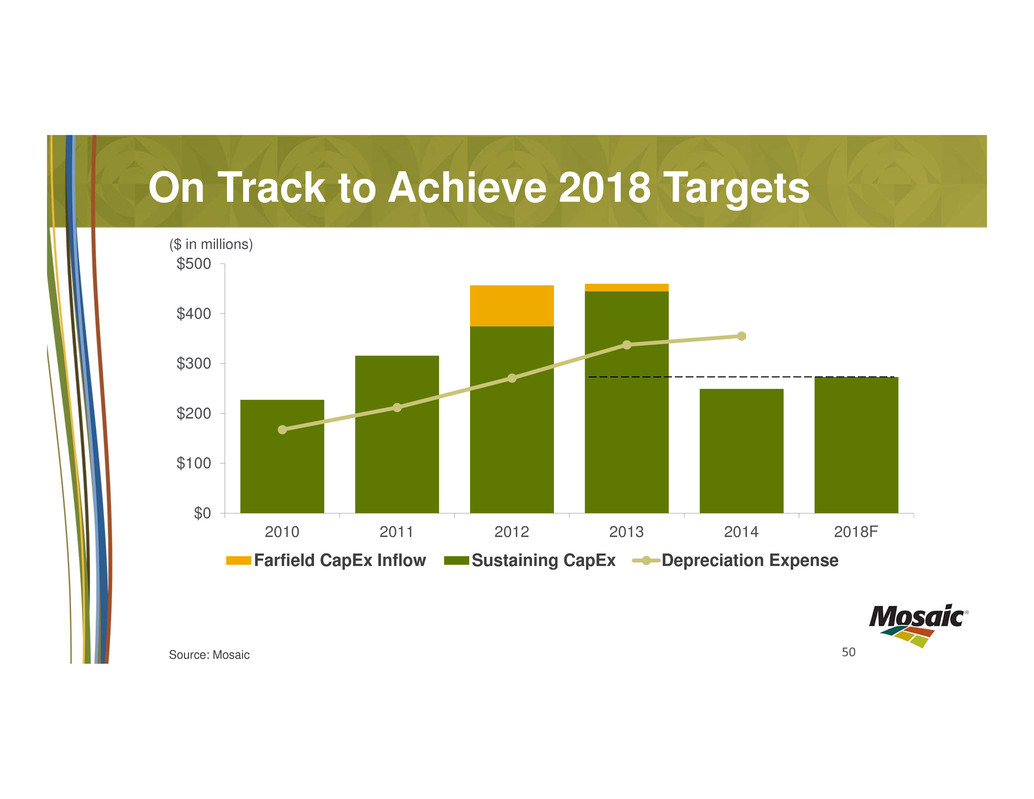

50 On Track to Achieve 2018 Targets $0 $100 $200 $300 $400 $500 2010 2011 2012 2013 2014 2018F Farfield CapEx Inflow Sustaining CapEx Depreciation Expense Source: Mosaic ($ in millions)

K3 Optionality

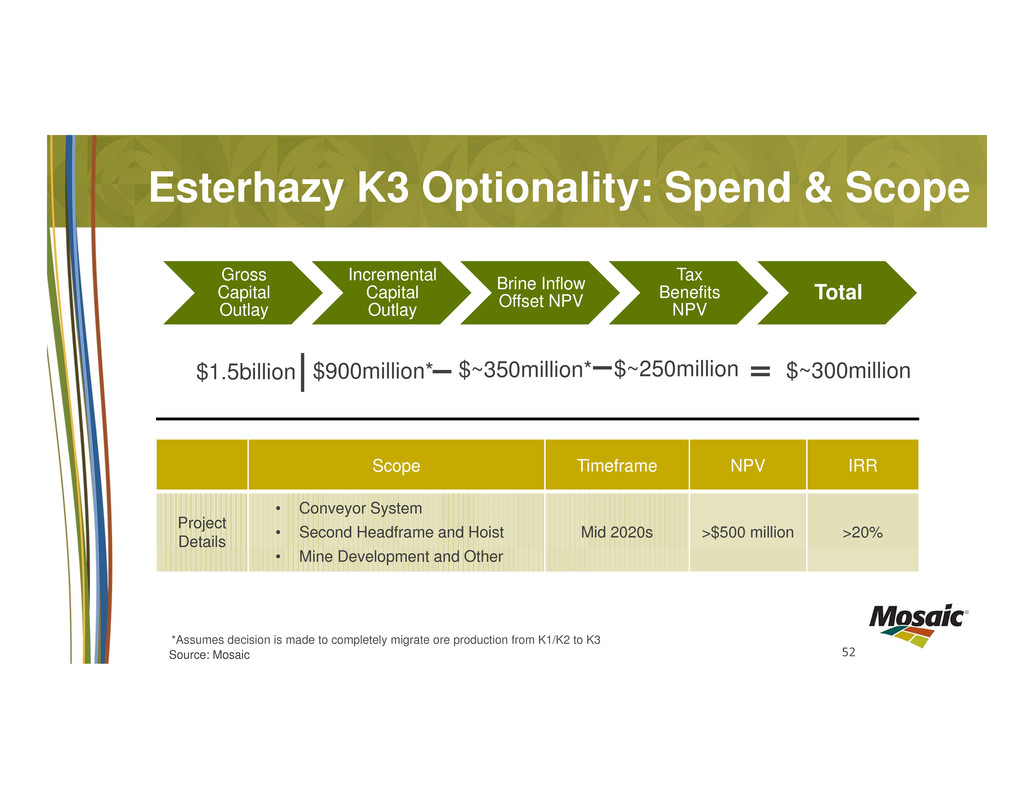

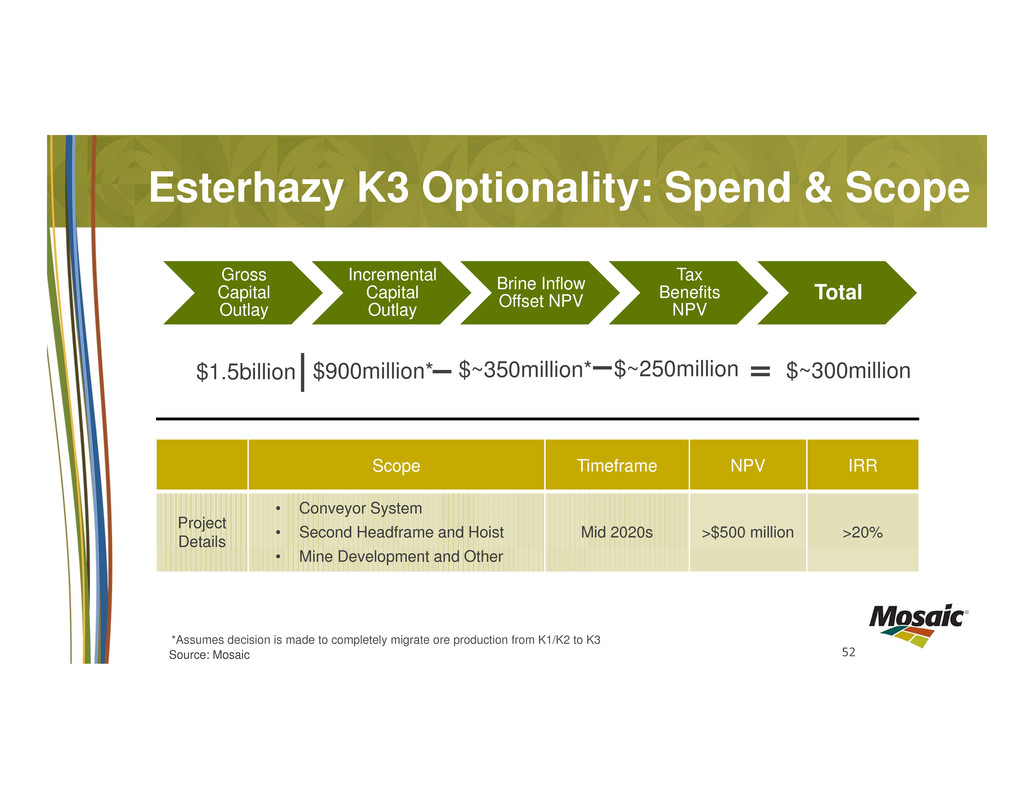

52 Esterhazy K3 Optionality: Spend & Scope Gross Capital Outlay Incremental Capital Outlay Brine Inflow Offset NPV Tax Benefits NPV Total Scope Timeframe NPV IRR Project Details • Conveyor System • Second Headframe and Hoist • Mine Development and Other Mid 2020s >$500 million >20% *Assumes decision is made to completely migrate ore production from K1/K2 to K3 $1.5billion $900million* $~250million $~300million$~350million* Source: Mosaic

53 Potash: K3 Optionality

54 Potash: K3 Optionality

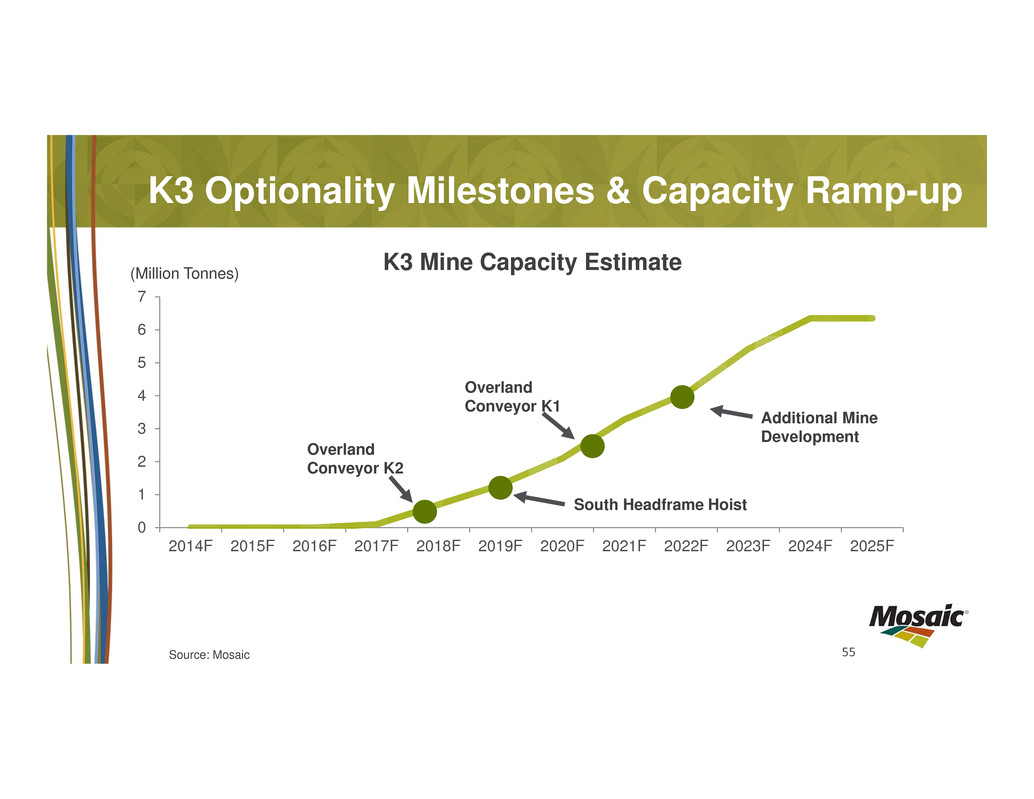

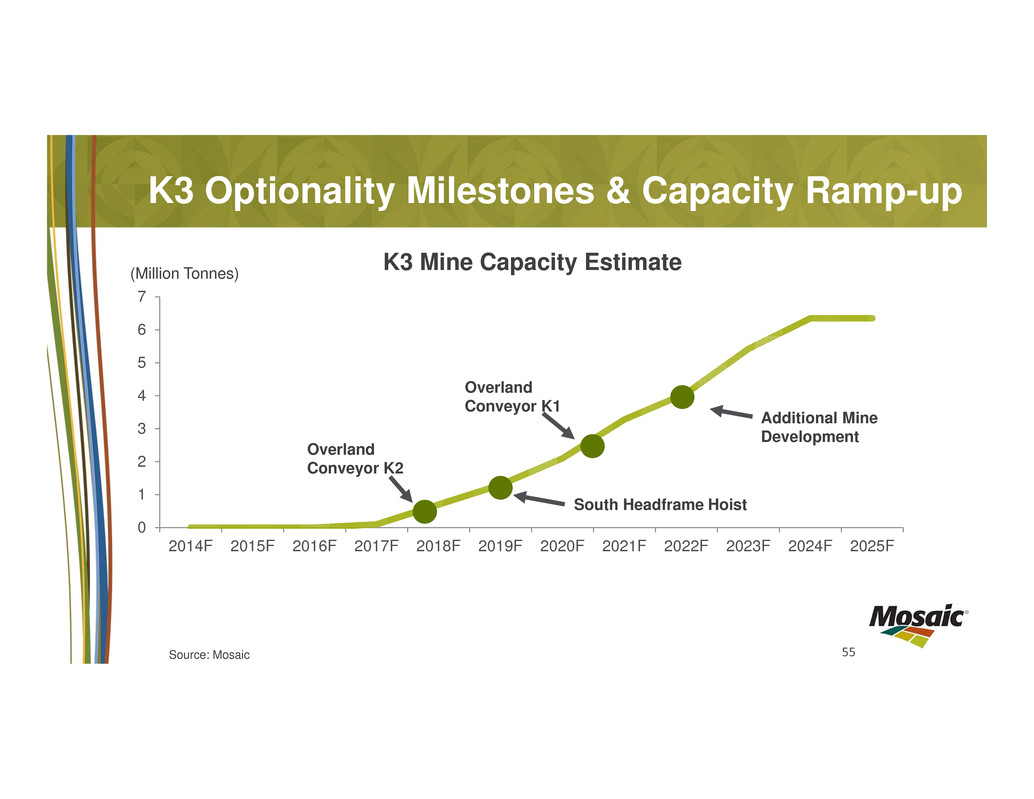

55 Overland Conveyor K1 0 1 2 3 4 5 6 7 2014F 2015F 2016F 2017F 2018F 2019F 2020F 2021F 2022F 2023F 2024F 2025F K3 Mine Capacity Estimate Additional Mine Development Overland Conveyor K2 South Headframe Hoist K3 Optionality Milestones & Capacity Ramp-up Source: Mosaic (Million Tonnes)

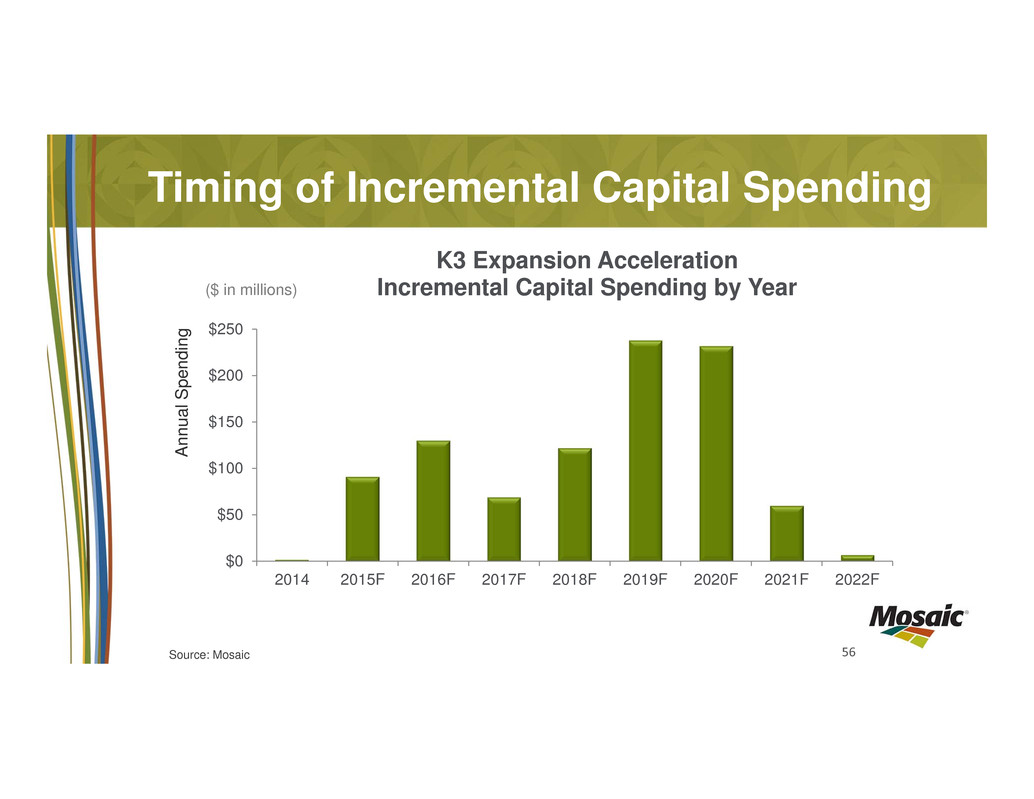

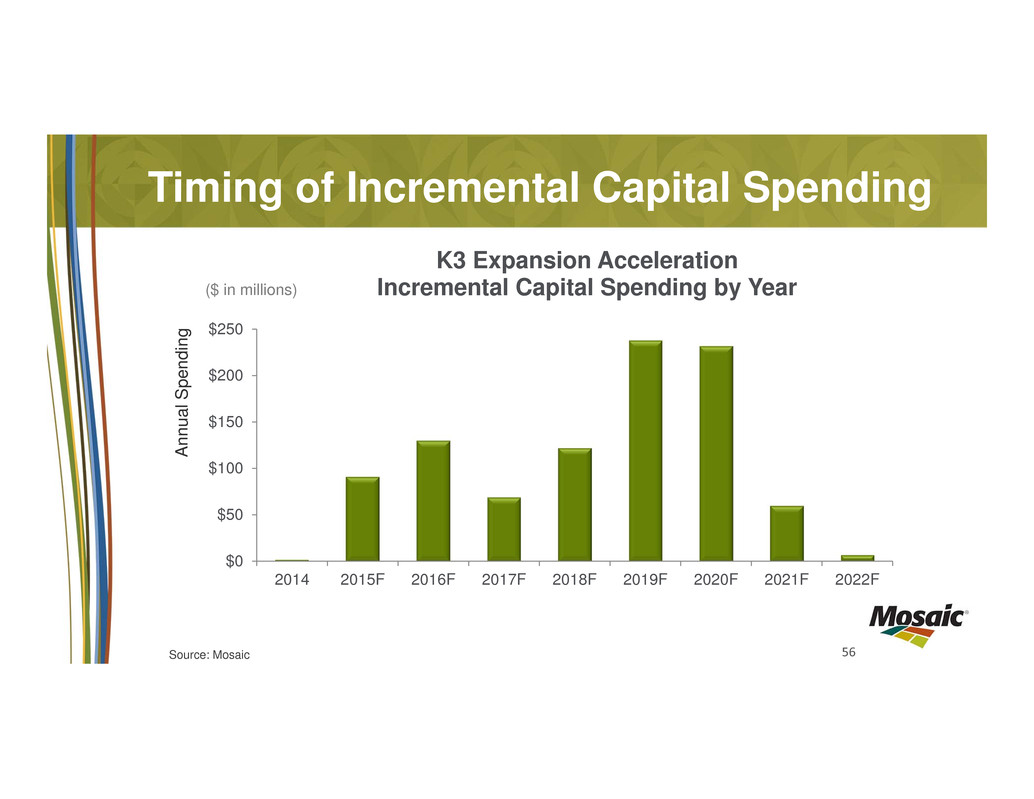

56 Timing of Incremental Capital Spending $0 $50 $100 $150 $200 $250 2014 2015F 2016F 2017F 2018F 2019F 2020F 2021F 2022F A n n u a l S p e n d i n g K3 Expansion Acceleration Incremental Capital Spending by Year($ in millions) Source: Mosaic

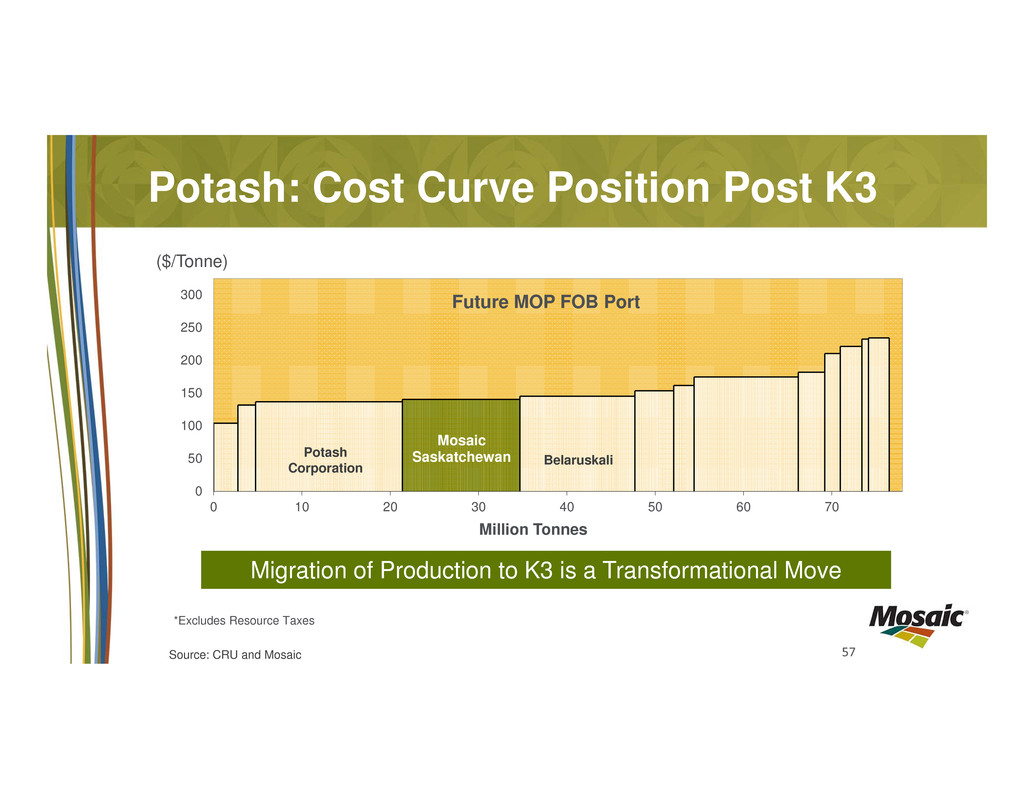

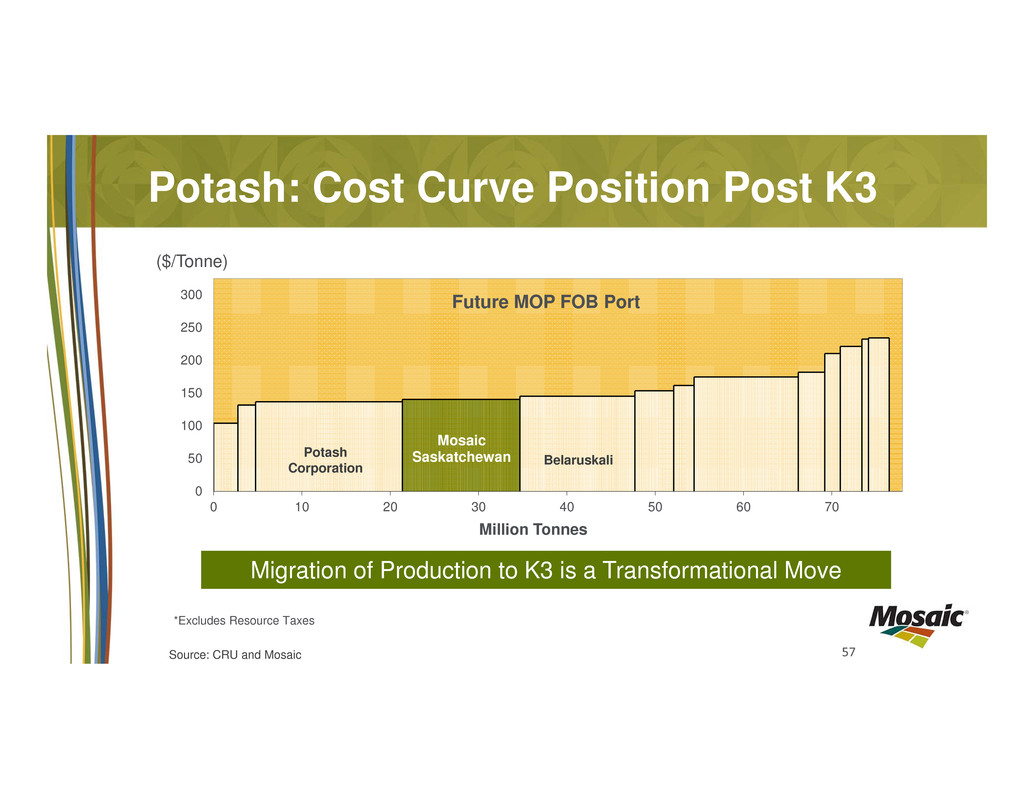

57 Potash: Cost Curve Position Post K3 Mosaic Saskatchewan 0 50 100 150 200 250 300 0 10 20 30 40 50 60 70 ($/Tonne) Million Tonnes Migration of Production to K3 is a Transformational Move Future MOP FOB Port Potash Corporation Belaruskali Source: CRU and Mosaic *Excludes Resource Taxes

58 Summary • Consistent Execution • Low-Cost Producer • Positioned to Deliver Value

Rick McLellan Senior Vice President, Commercial Secure Distribution

60 Agenda 1. Go to Market Strategy 2. Beyond Distribution 3. Value from Leadership

61 Mosaic’s Commercial Strategy Optimize Net Backs Higher Value Product Mix Earn Attractive Returns Help Optimize Operations Sell 20+ Million Tonnes of Product/Year

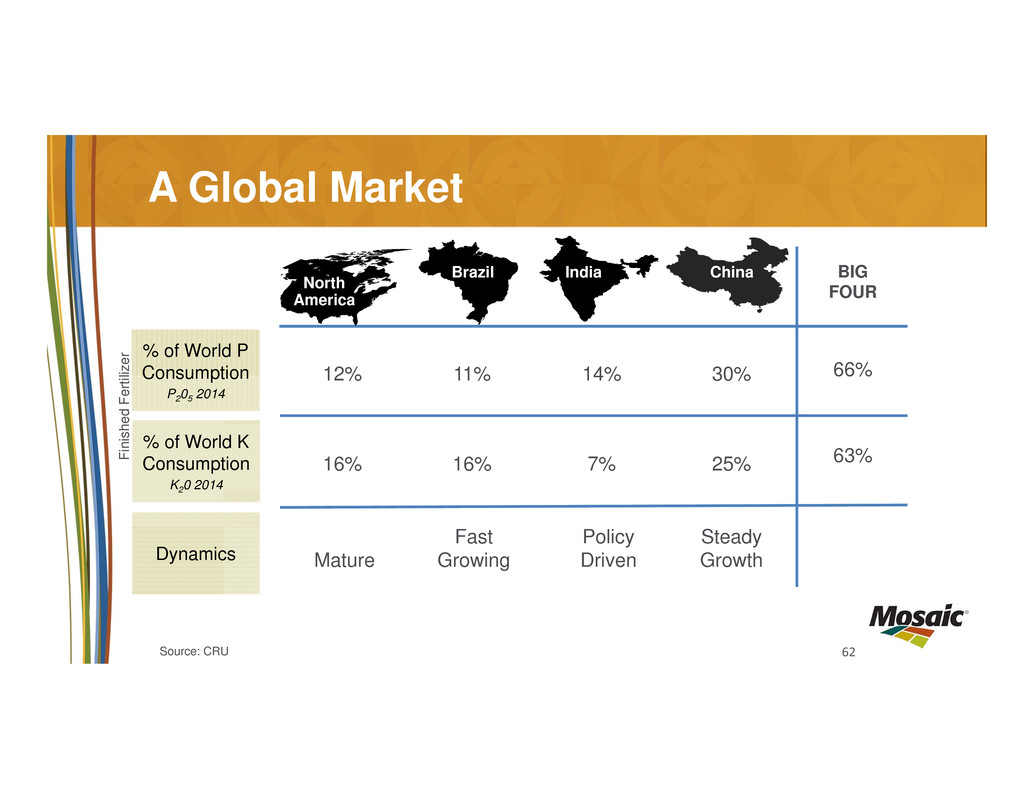

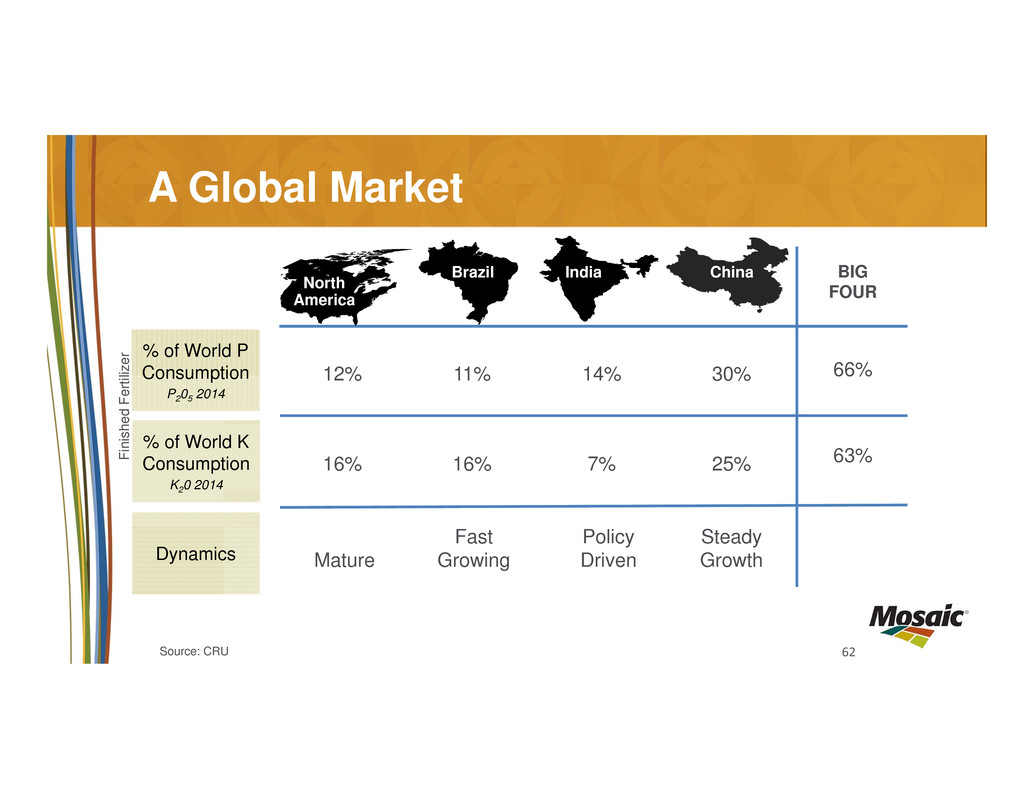

62 A Global Market 12% % of World P Consumption P205 2014 Mature Fast Growing Policy Driven Steady Growth Brazil India China 11% 14% 30% 16% 16% 7% 25%F i n i s h e d F e r t i l i z e r BIG FOUR 66% 63% % of World K Consumption K20 2014 Dynamics North America Source: CRU

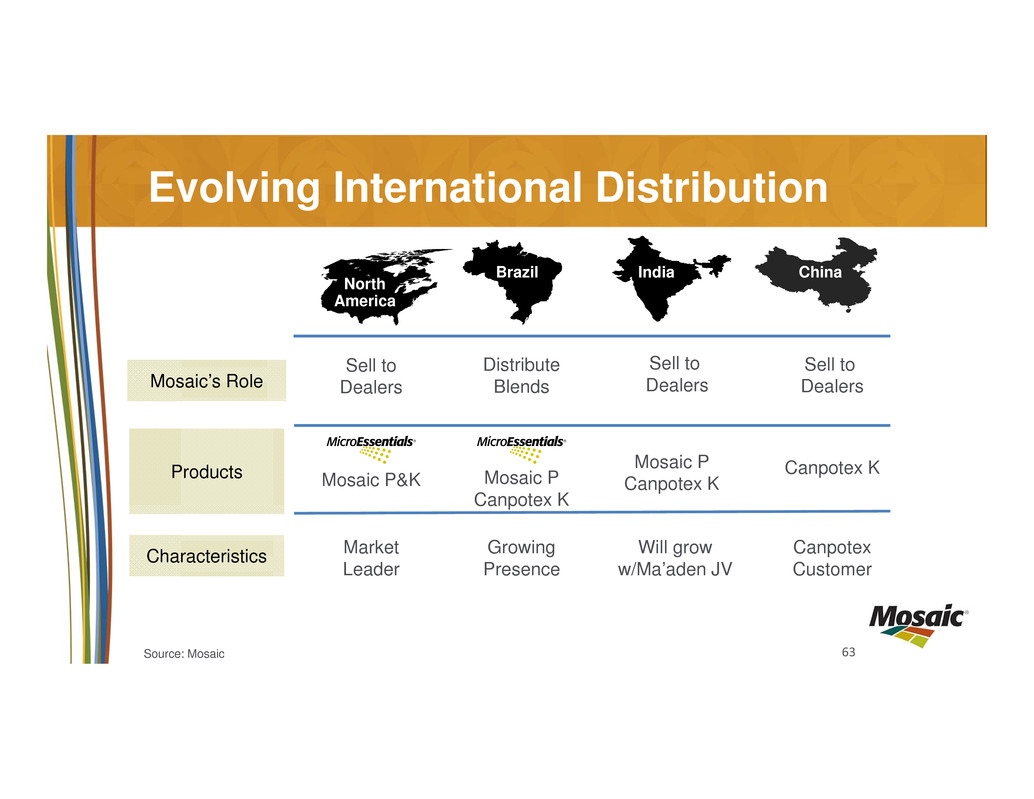

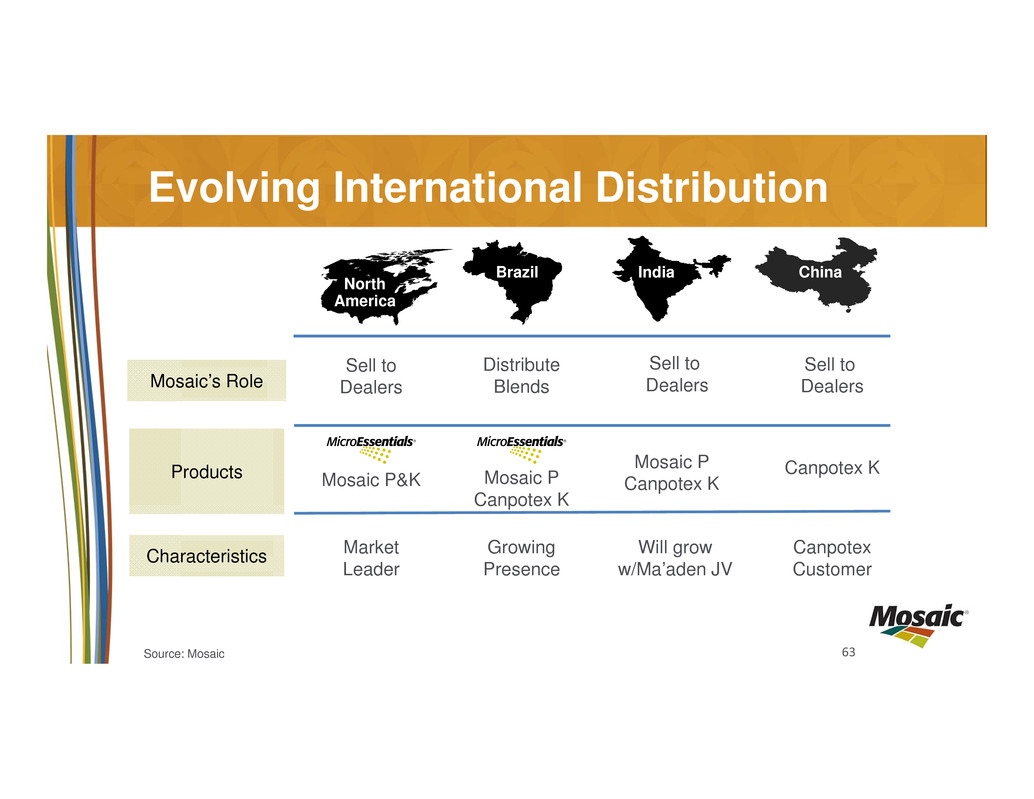

63 Evolving International Distribution Distribute Blends Sell to Dealers Sell to Dealers Sell to Dealers Mosaic P&K Mosaic P Canpotex K Mosaic P Canpotex K Canpotex K Market Leader Growing Presence Will grow w/Ma’aden JV Canpotex Customer Mosaic’s Role Brazil India China Products Characteristics North America Source: Mosaic

64 Portfolio Approach 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 With Premium Products Without Premium Products Top 5 Customers in North America 2.5x higher Tonnes Source: Mosaic

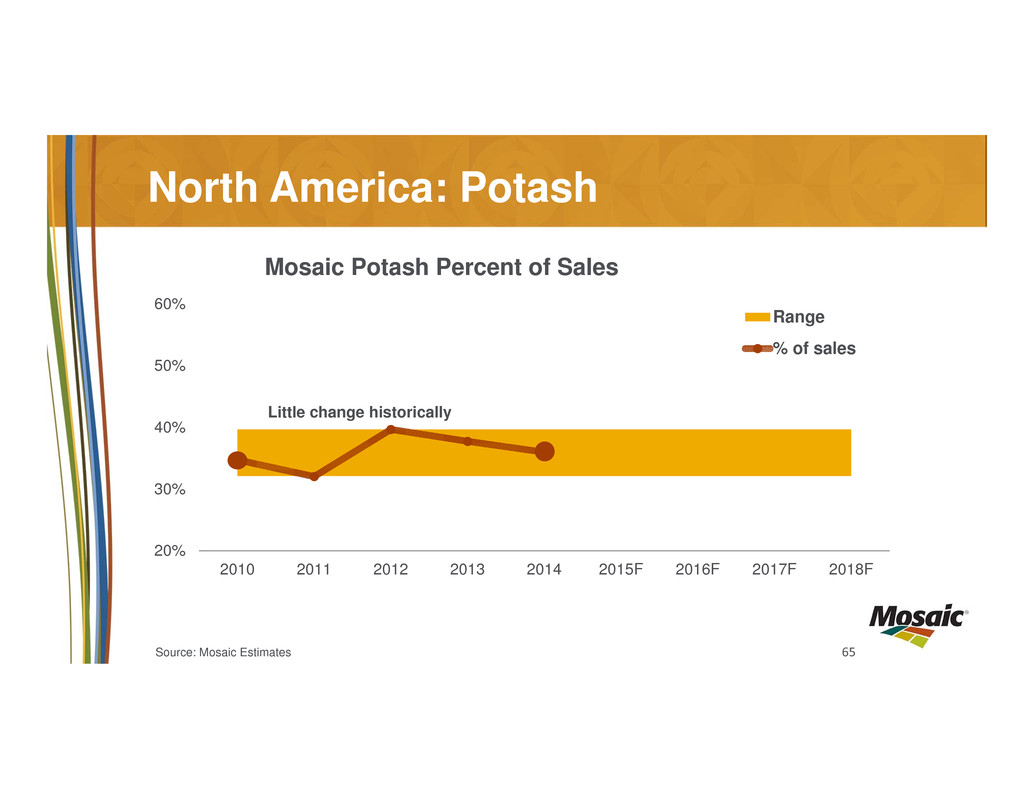

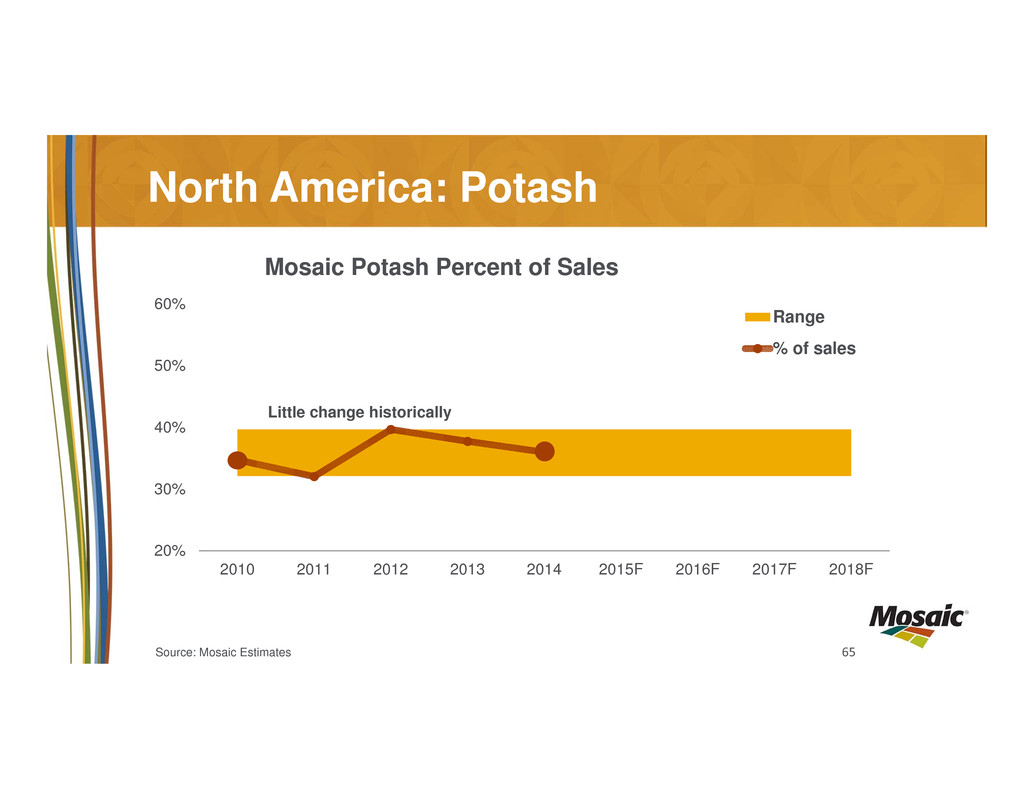

65Source: Mosaic Estimates North America: Potash 20% 30% 40% 50% 60% 2010 2011 2012 2013 2014 2015F 2016F 2017F 2018F Mosaic Potash Percent of Sales Range % of sales Little change historically

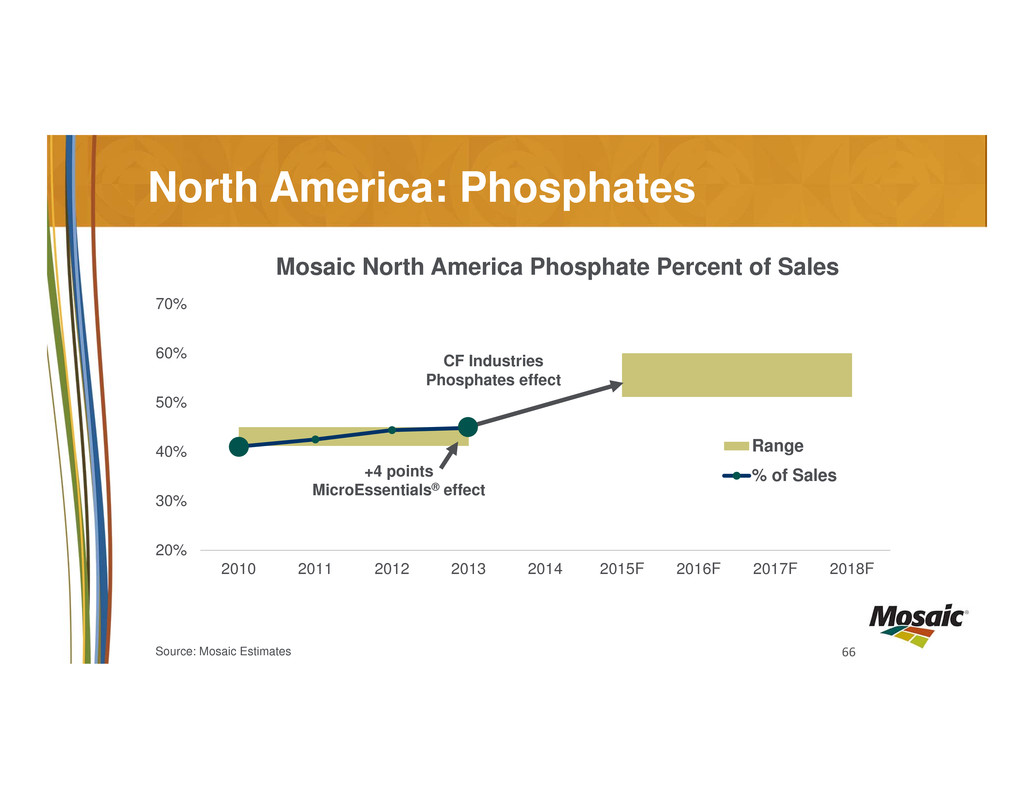

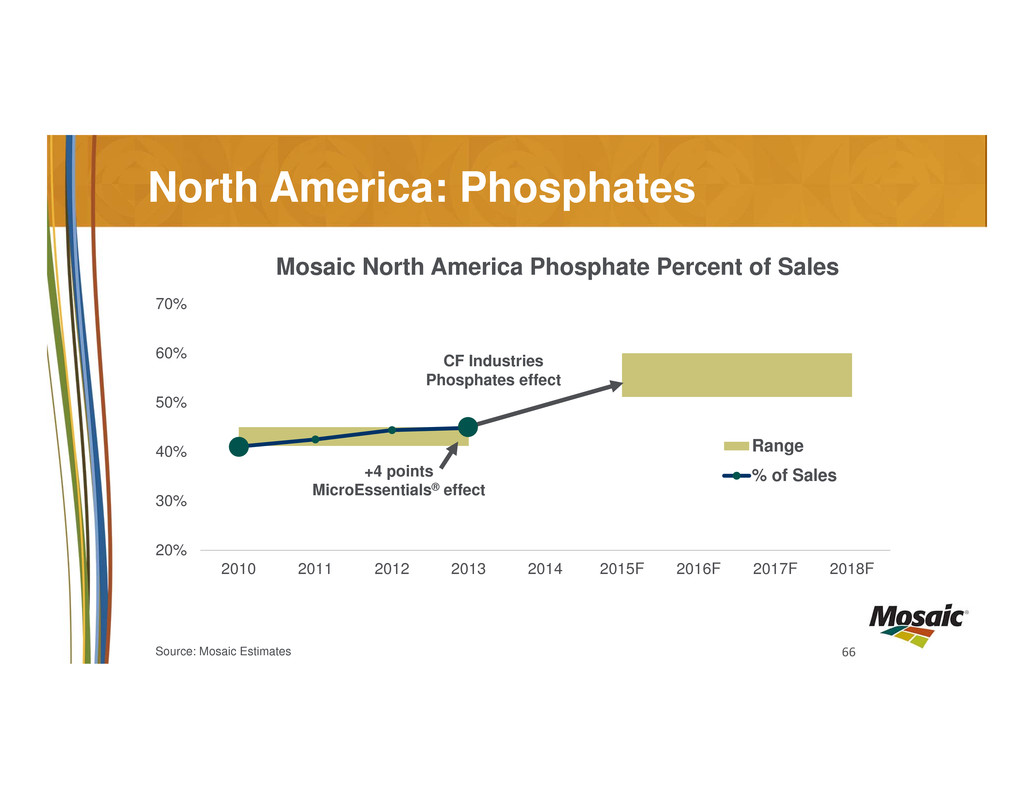

66 20% 30% 40% 50% 60% 70% 2010 2011 2012 2013 2014 2015F 2016F 2017F 2018F Mosaic North America Phosphate Percent of Sales Range % of Sales North America: Phosphates CF Industries Phosphates effect +4 points MicroEssentials® effect Source: Mosaic Estimates

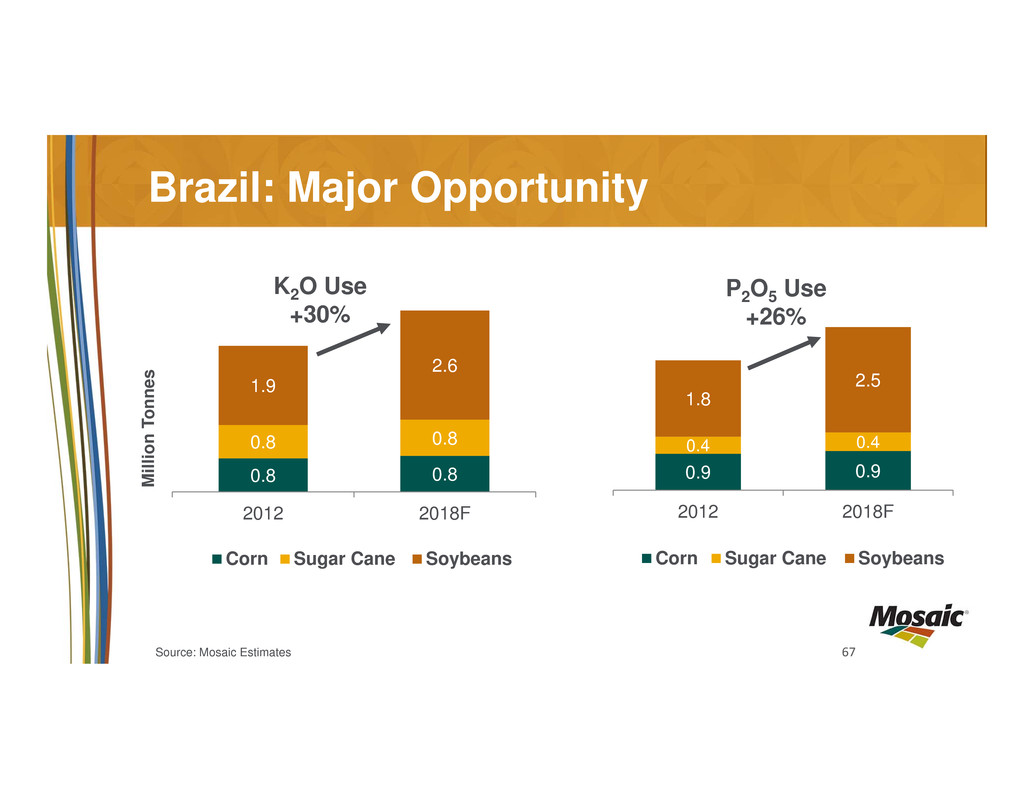

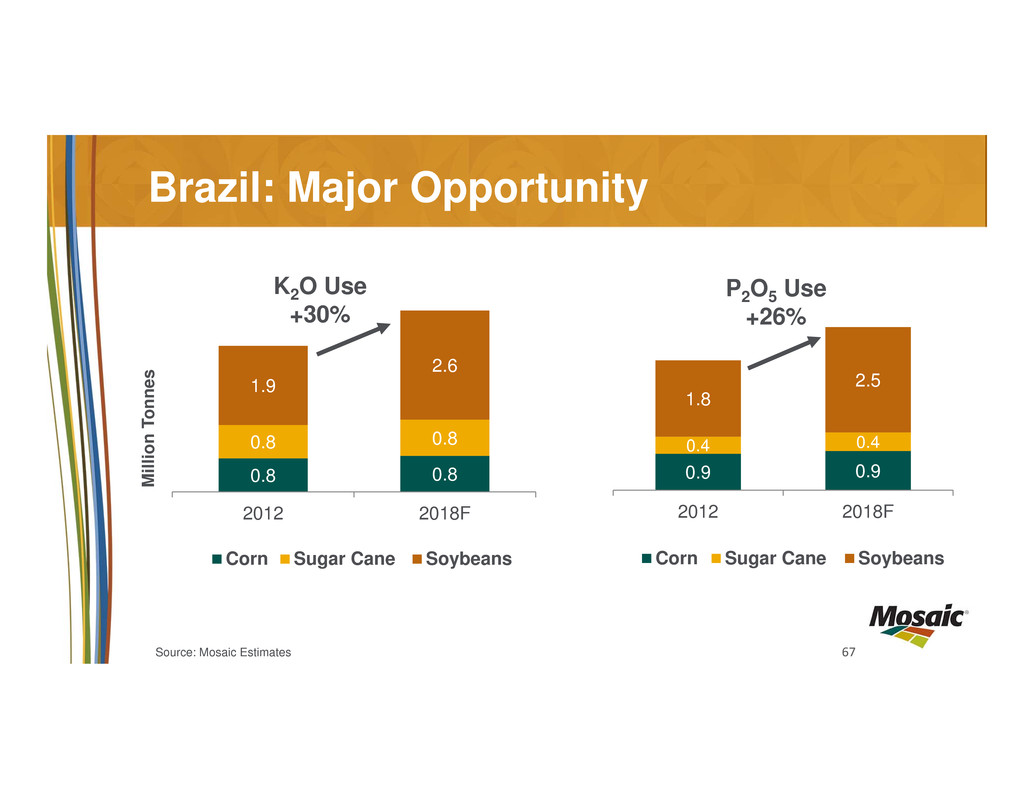

67 Brazil: Major Opportunity 0.8 0.8 0.8 0.8 1.9 2.6 2012 2018F Corn Sugar Cane Soybeans 0.9 0.9 0.4 0.4 1.8 2.5 2012 2018F Corn Sugar Cane Soybeans M i l l i o n T o n n e s K2O Use +30% P2O5 Use +26% Source: Mosaic Estimates

68 Fospar Expansion North Entrance Projects Ahead Mosaic’s Presence in Brazil & Paraguay North Entrance Fospar

69 Trucking Issues in Brazil

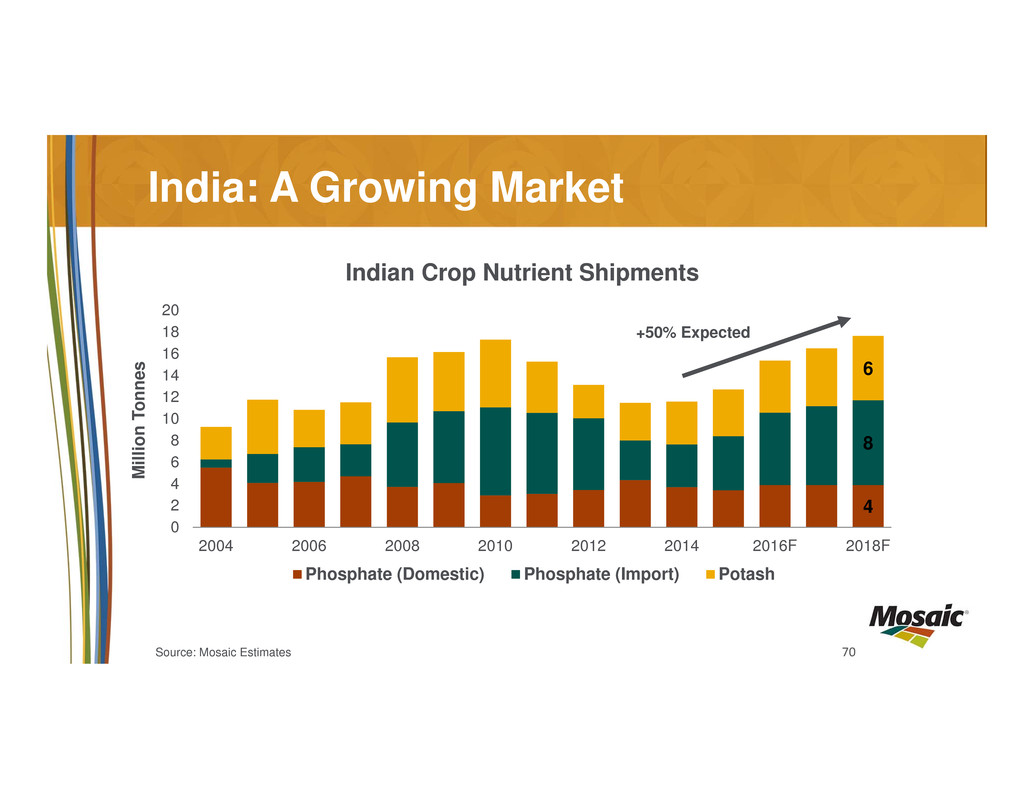

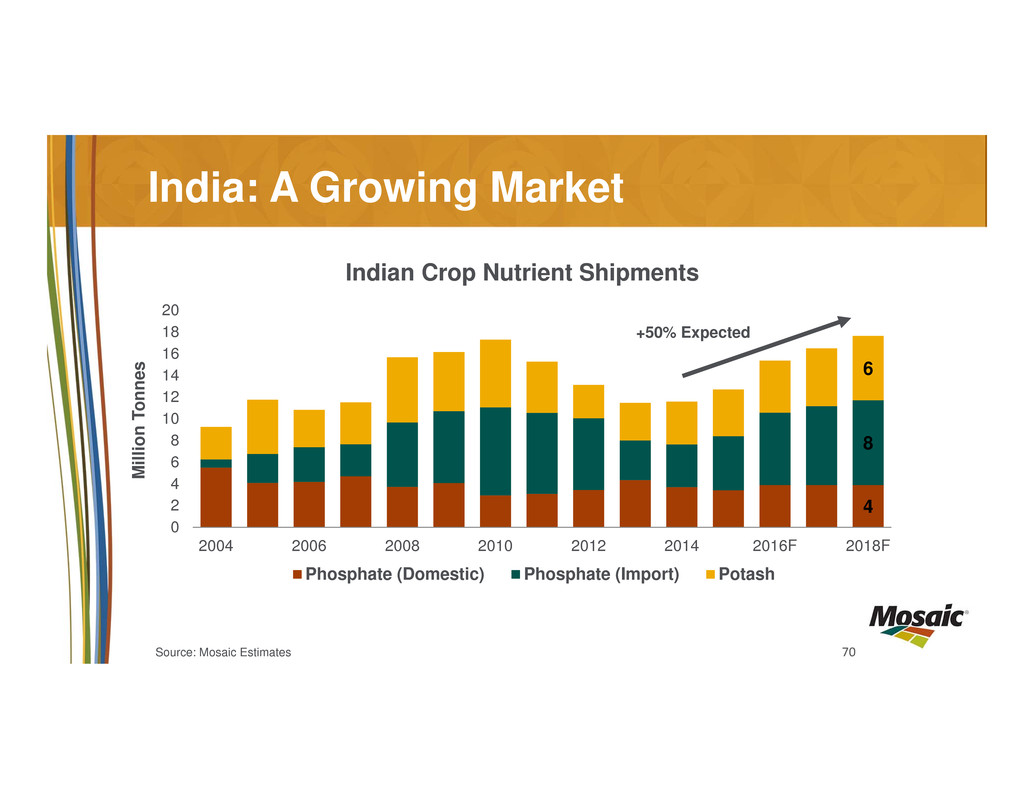

70 India: A Growing Market M i l l i o n T o n n e s 4 8 6 0 2 4 6 8 10 12 14 16 18 20 2004 2006 2008 2010 2012 2014 2016F 2018F Indian Crop Nutrient Shipments Phosphate (Domestic) Phosphate (Import) Potash +50% Expected Source: Mosaic Estimates

The Mosaic Brand

72 China: An Evolving Marketplace for Potash Industrial Producers NPK Producers Bulk Blenders Now: + Before: Canpotex Exclusive

73 Direct and Third-Party Distribution Mosaic’s In-Country Presence

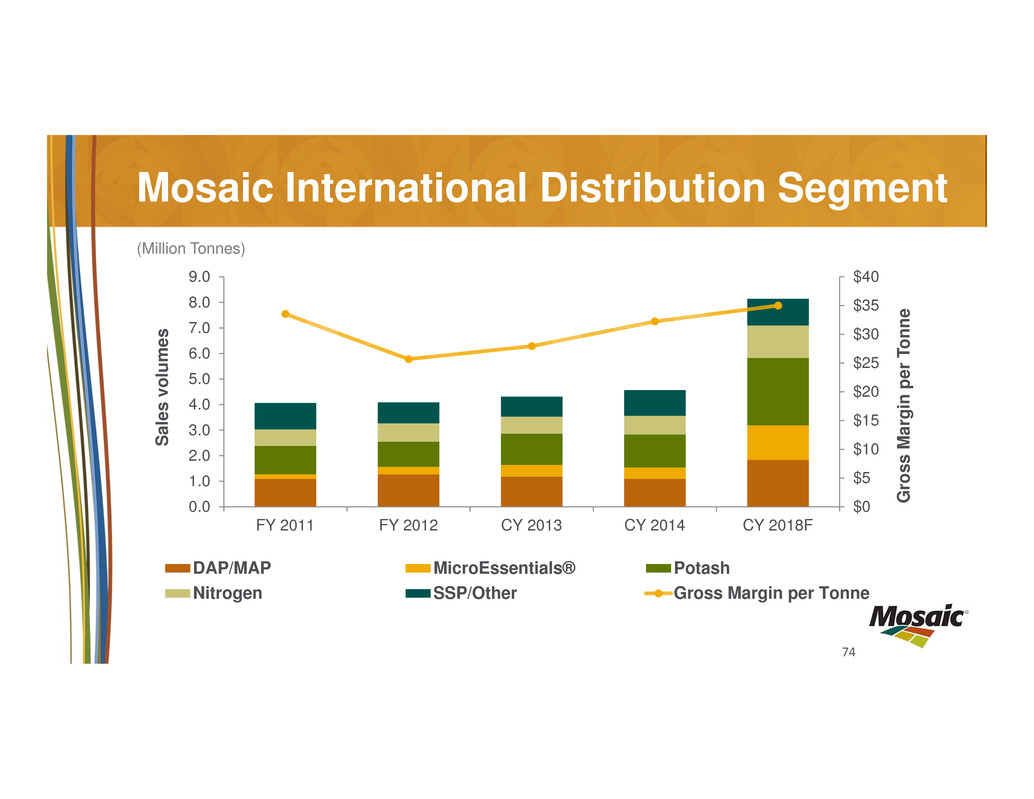

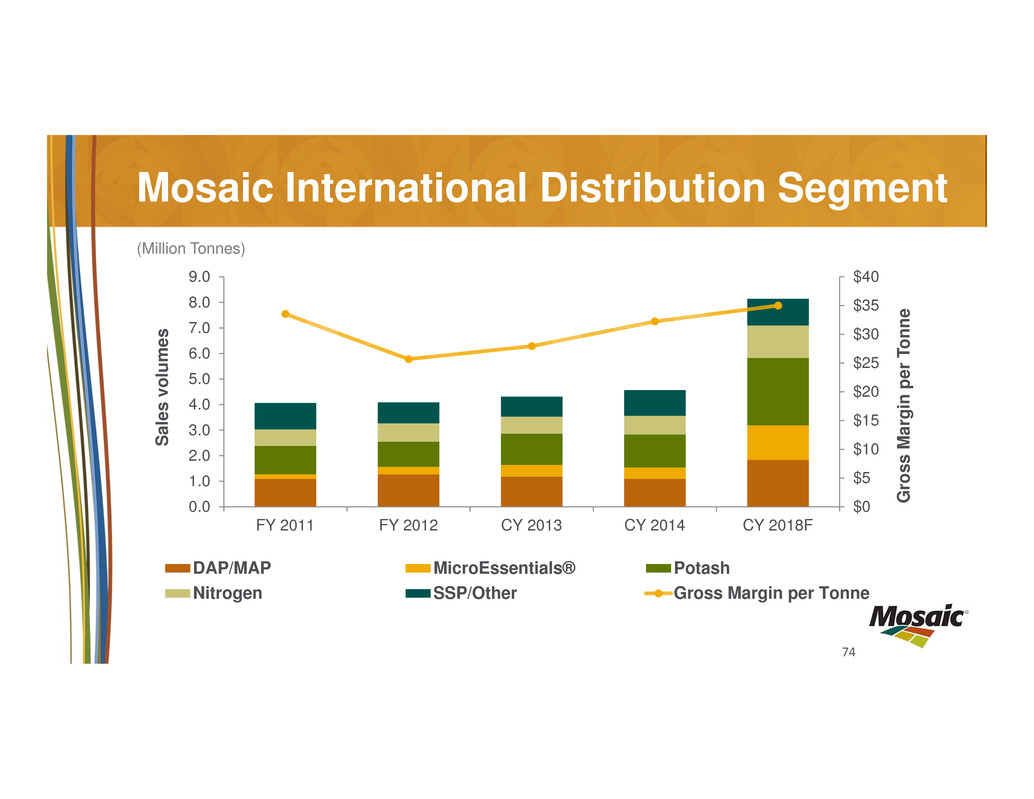

74 $0 $5 $10 $15 $20 $25 $30 $35 $40 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 FY 2011 FY 2012 CY 2013 CY 2014 CY 2018F G r o s s M a r g i n p e r T o n n e S a l e s v o l u m e s DAP/MAP MicroEssentials® Potash Nitrogen SSP/Other Gross Margin per Tonne Mosaic International Distribution Segment (Million Tonnes)

75 • Scale • Low Cost Profile • Diversity of Customers and Production Flexibility • Market Access • Intellectual Capital Production Discipline Innovation Lead Margin Leadership Mosaic: A Leader in Global Markets Mosaic’s Advantages:

Mosaic Analyst Day March 31, 2015

Rich Mack Executive Vice President and Chief Financial Officer Driving Value

78 Driving Value Mosaic’s Phosphates Business Valuation Considerations Brine Management Costs and Risk Mosaic’s Current Valuation Growth Outlook Free Cash Flow Growth Levers to Grow Value

79 Brine Management Costs and Risk Mosaic’s Current Valuation Growth Outlook Free Cash Flow Growth Levers to Grow Value The Investment Perspective Industry Valuation Mosaic’s Position Mosaic’s Phosphates Business Valuation Considerations +

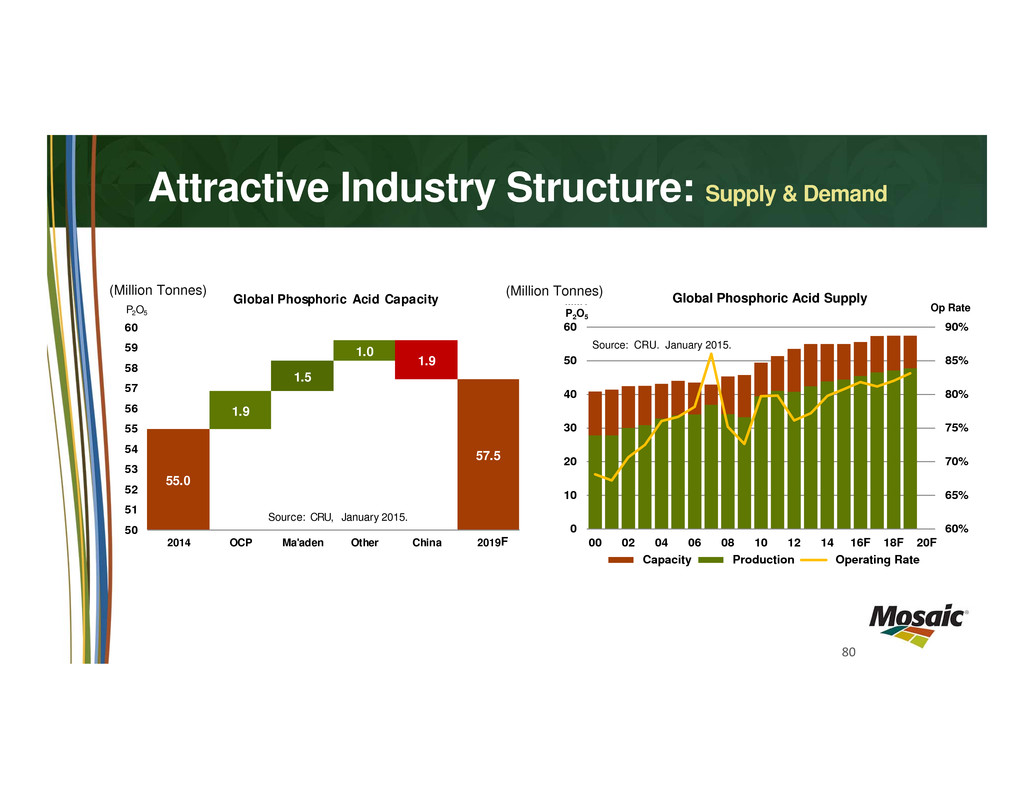

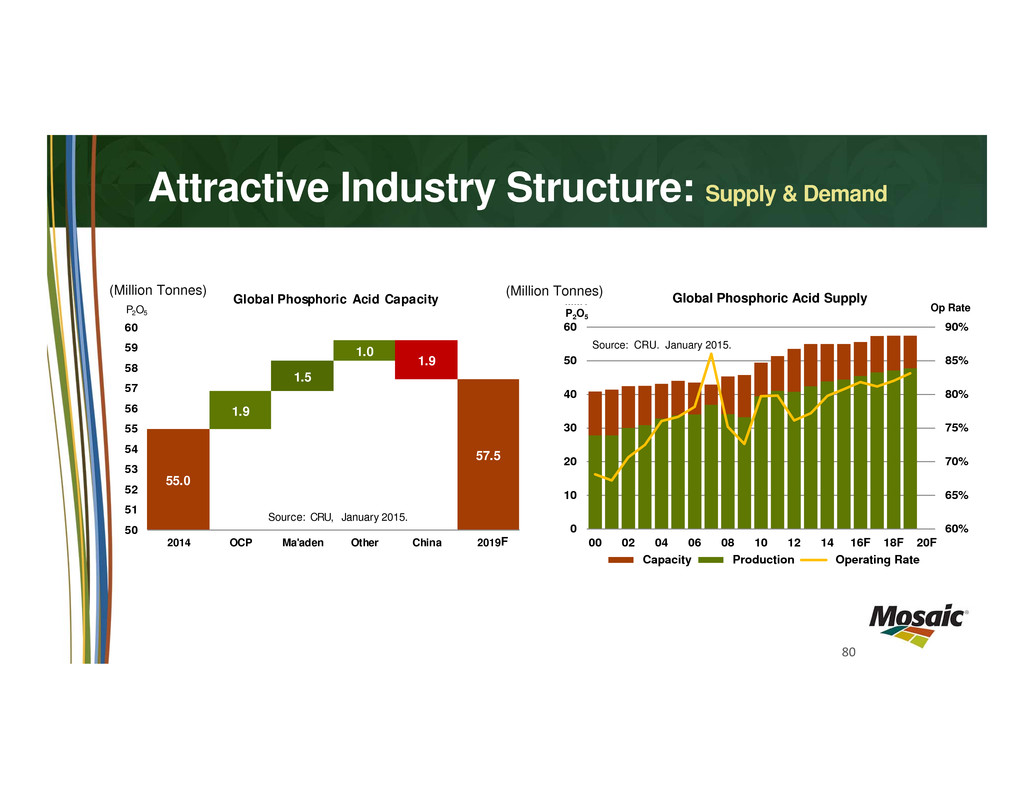

80 55.0 57.5 1.9 1.5 1.0 1.9 50 51 52 53 54 55 56 57 58 59 60 2014 OCP Ma'aden Other China 2019 MMT P2O5 Source: CRU, January 2015. Global Phosphoric Acid Capacity Attractive Industry Structure: Supply & Demand F 60% 65% 70% 75% 80% 85% 90% 0 10 20 30 40 50 60 00 02 04 06 08 10 12 14 16F 18F 20F Op RateMMTP2O5 Source: CRU. January 2015. Global Phosphoric Acid Supply Capacity Production Operating Rate (Million Tonnes) (Million Tonnes)

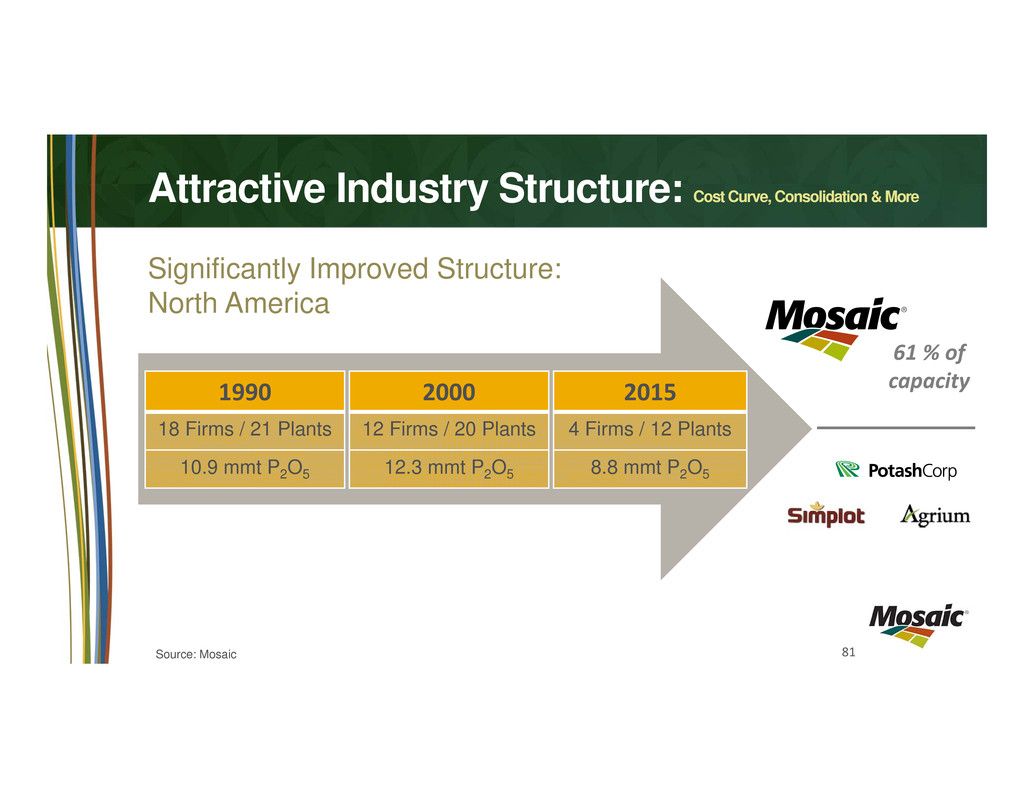

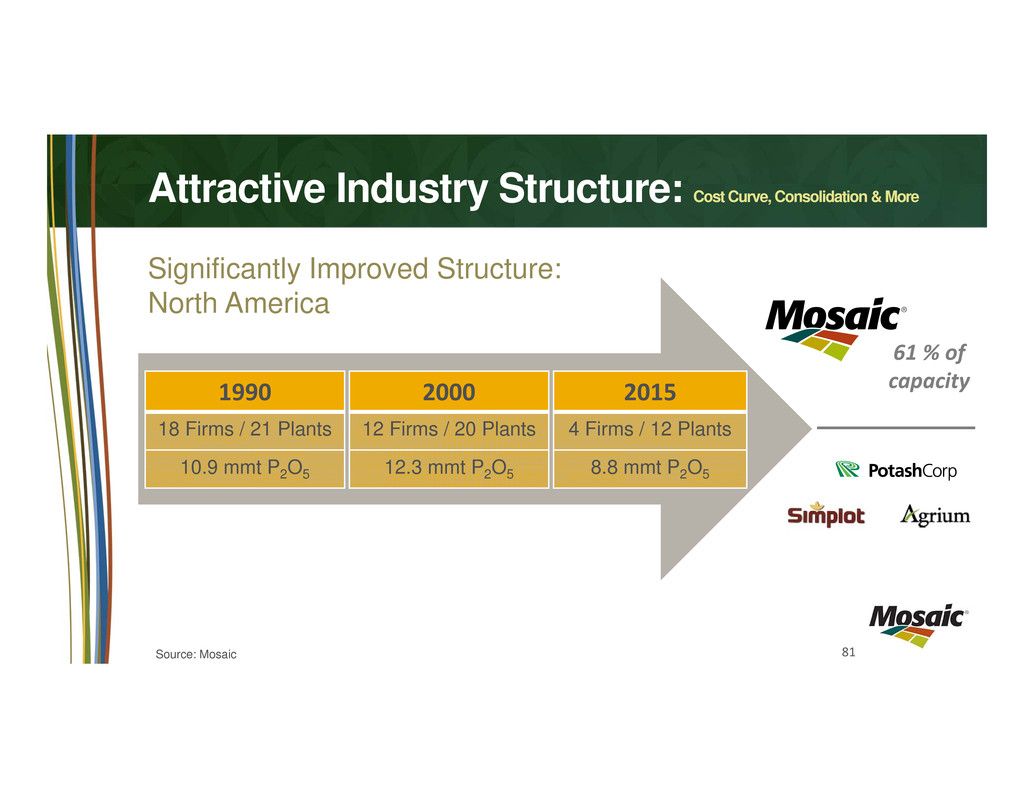

81 Attractive Industry Structure: Cost Curve, Consolidation & More Source: Mosaic Significantly Improved Structure: North America 1990 18 Firms / 21 Plants 10.9 mmt P2O5 2000 12 Firms / 20 Plants 12.3 mmt P2O5 2015 4 Firms / 12 Plants 8.8 mmt P2O5 61 % of capacity

82 Attractive Industry Structure: Cost Curve, Consolidation & More Significantly Improved Structure: Rest of the World +

83 Mosaic’s Position Leader in Global Markets • Scale • Low Cost Profile • Diversity of Customers and Production Flexibility • Market Access • Margin Leadership • Innovation Lead • Production Discipline Mosaic’s Advantages: • Intellectual Capital

84 Phosphates Segment Valuation Leadership Position Industry Structure Supply and Demand VALUATION

85 The Investment Perspective Mosaic’s phosphates business Valuation Considerations Brine Management Costs and Risk Mosaic’s current valuation Growth Outlook Free Cash Flow Growth Levers to Grow Value Mosaic Current Valuation Mosaic Phosphates Business

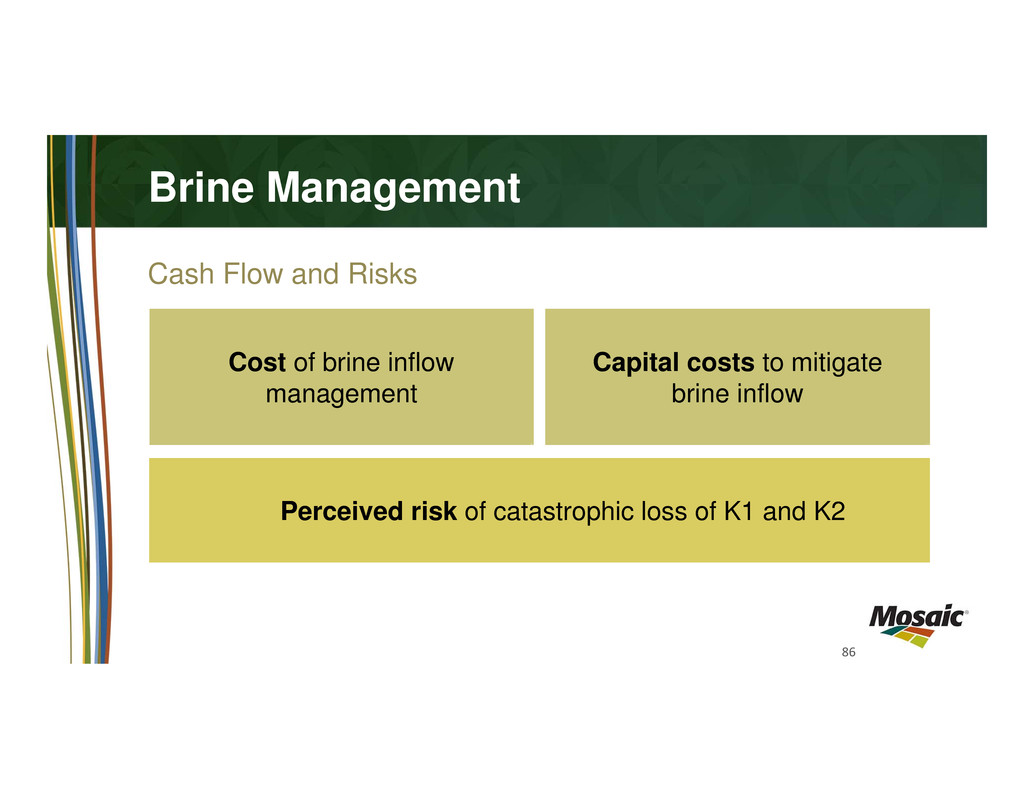

86 Perceived risk of catastrophic loss of K1 and K2 Cost of brine inflow management Capital costs to mitigate brine inflow Brine Management Cash Flow and Risks

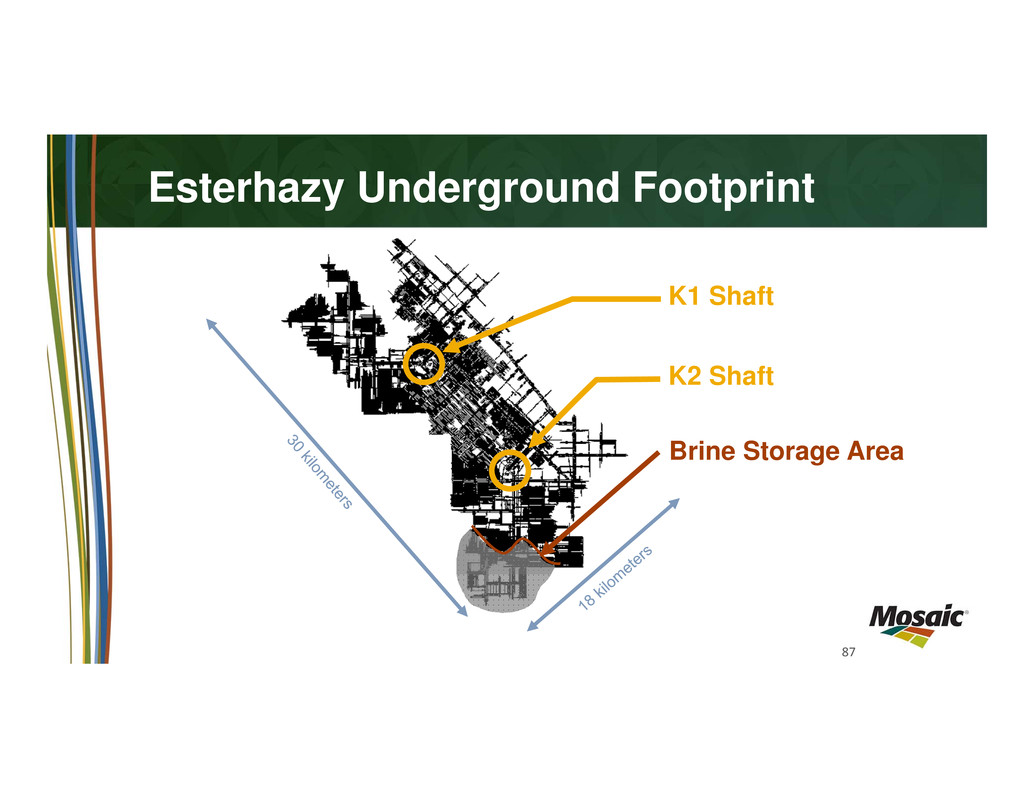

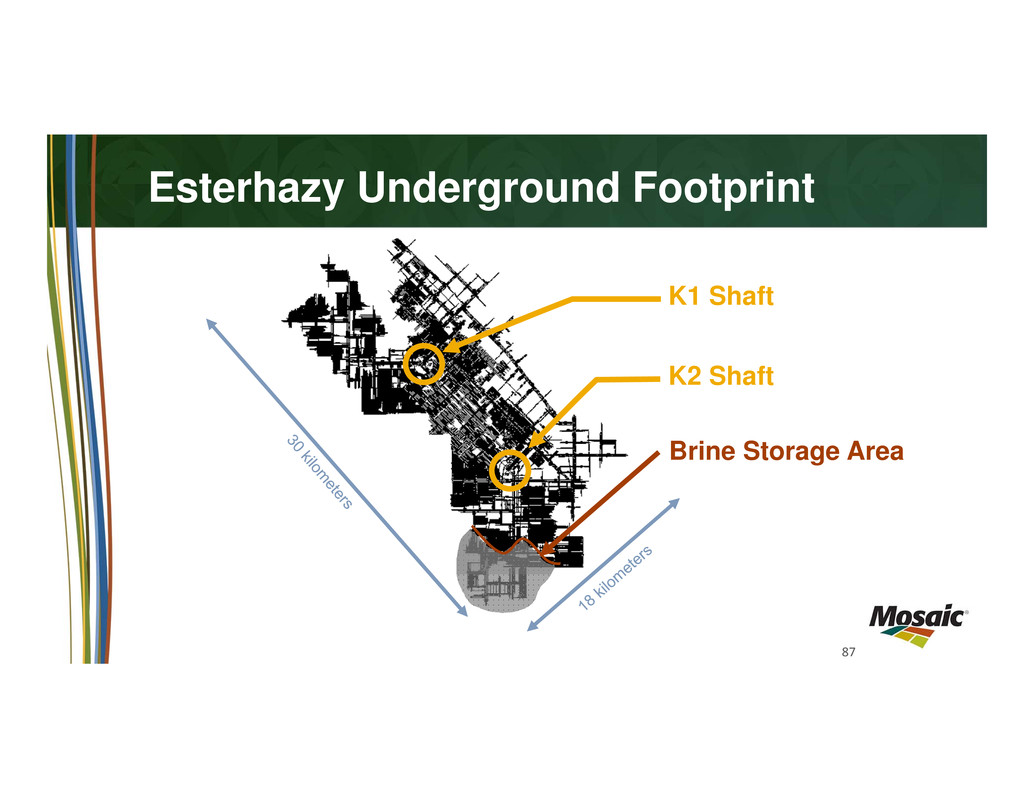

87 K2 Shaft Esterhazy Underground Footprint K1 Shaft Brine Storage Area

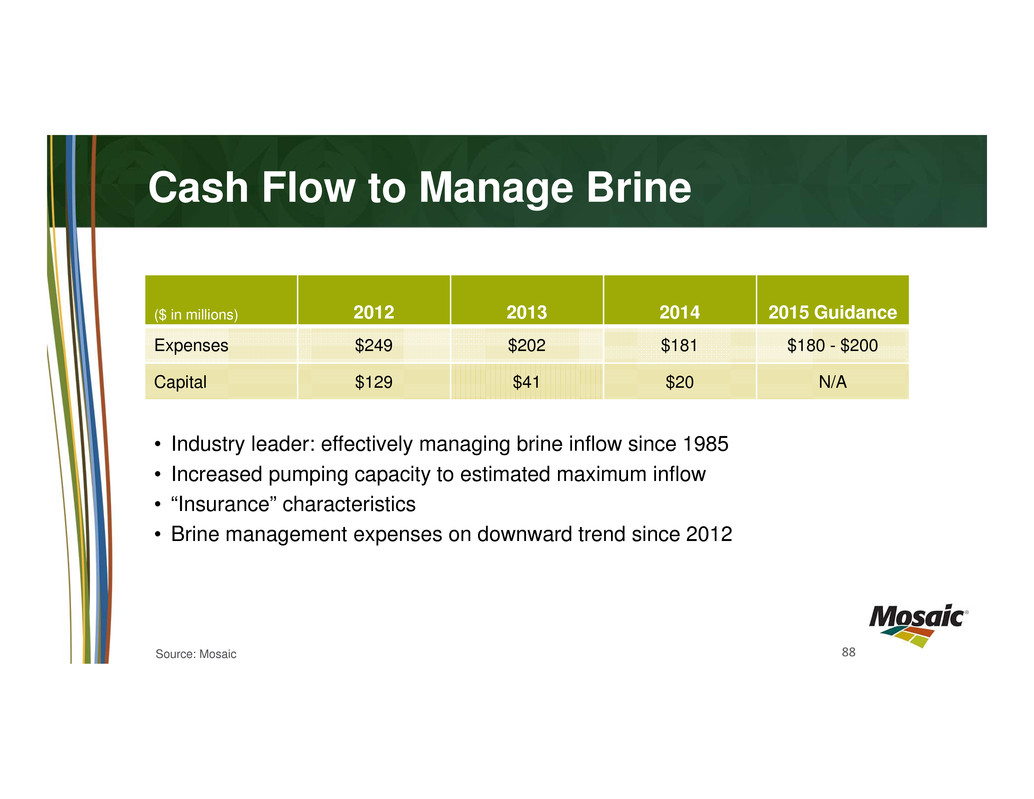

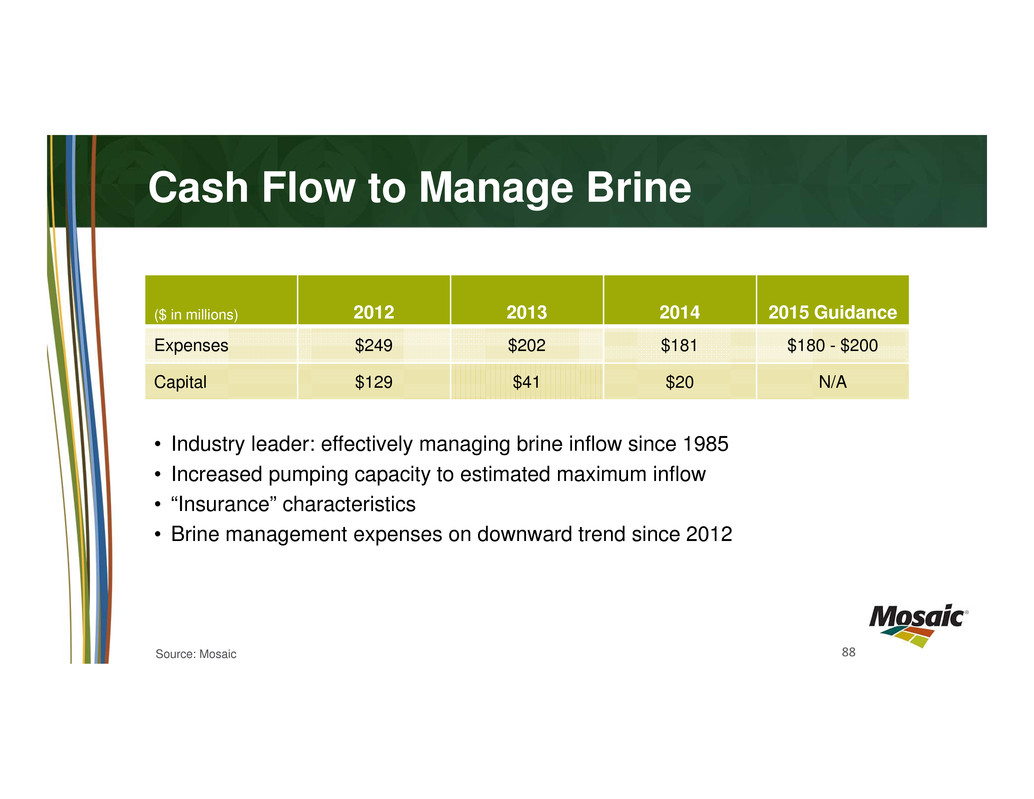

88 Cash Flow to Manage Brine ($ in millions) 2012 2013 2014 2015 Guidance Expenses $249 $202 $181 $180 - $200 Capital $129 $41 $20 N/A • Industry leader: effectively managing brine inflow since 1985 • Increased pumping capacity to estimated maximum inflow • “Insurance” characteristics • Brine management expenses on downward trend since 2012 Source: Mosaic

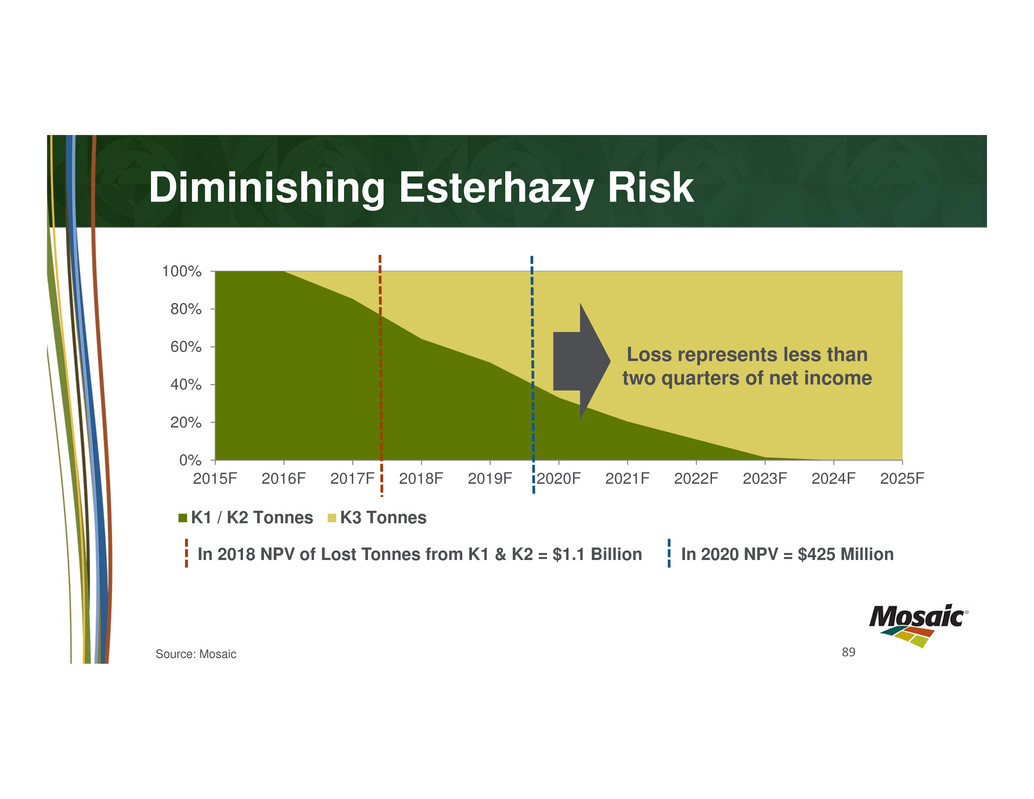

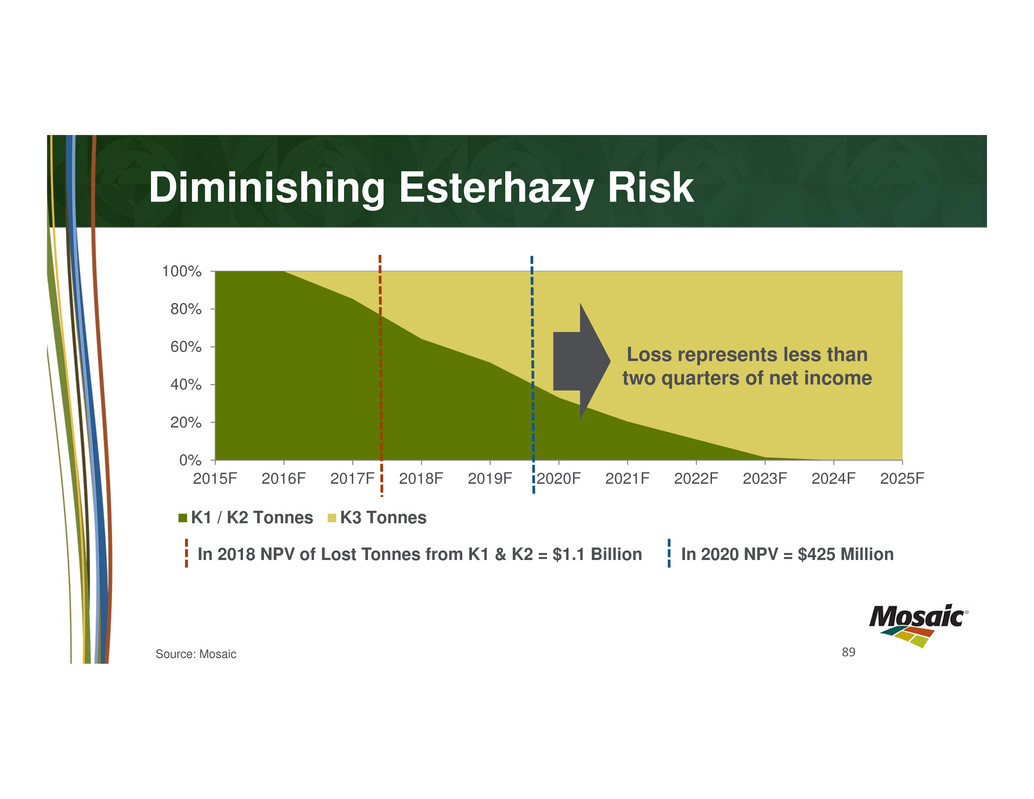

89 Diminishing Esterhazy Risk 0% 20% 40% 60% 80% 100% 2015F 2016F 2017F 2018F 2019F 2020F 2021F 2022F 2023F 2024F 2025F K1 / K2 Tonnes K3 Tonnes Loss represents less than two quarters of net income In 2018 NPV of Lost Tonnes from K1 & K2 = $1.1 Billion In 2020 NPV = $425 Million Source: Mosaic

90 The Investment Perspective Mosaic’s phosphates business Valuation Considerations Brine Management Costs and Risk Mosaic’s current valuation Growth Outlook Free Cash Flow Growth Levers to Grow Value Mosaic Current Valuation Mosaic Phosphates Business

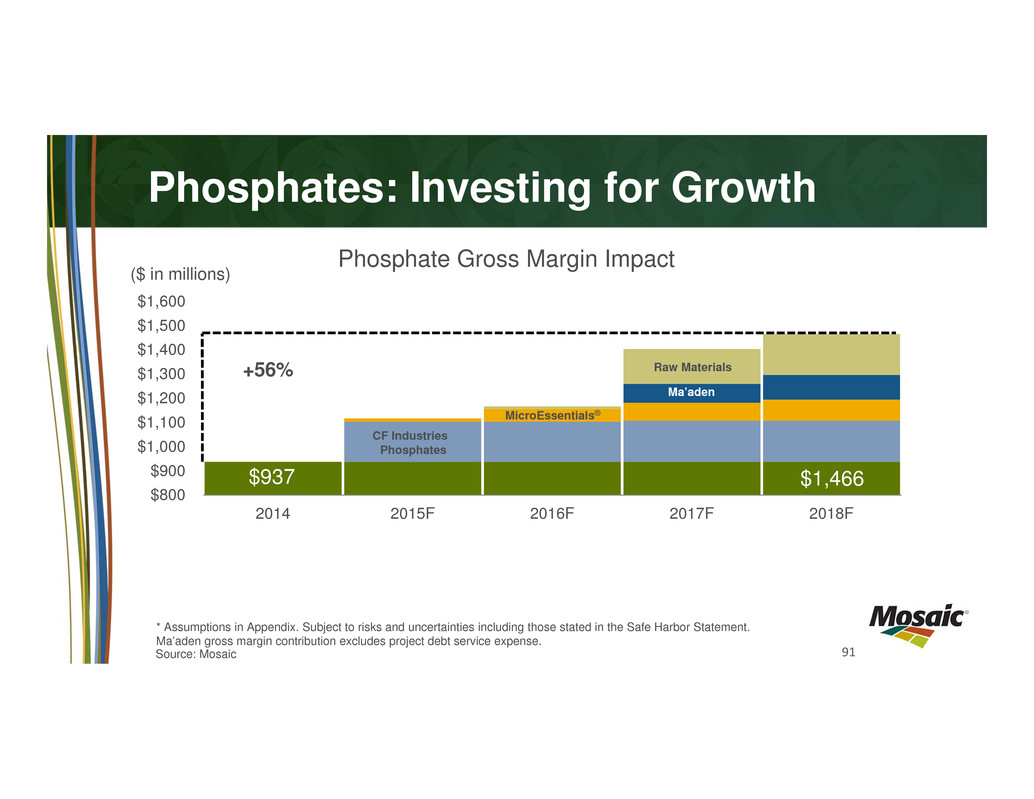

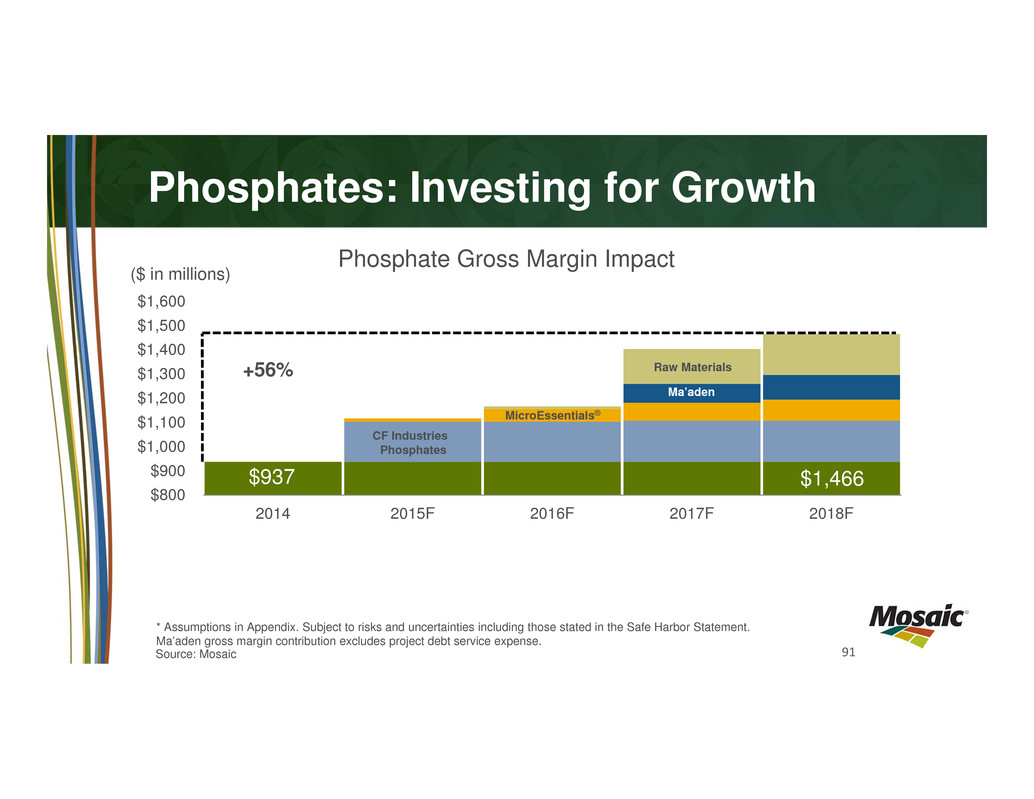

91 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 2014 2015F 2016F 2017F 2018F Phosphate Gross Margin Impact $1,466$937 ($ in millions) Phosphates: Investing for Growth * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Ma’aden gross margin contribution excludes project debt service expense. CF Industries Phosphates MicroEssentials® Ma’aden Raw Materials+56% Source: Mosaic

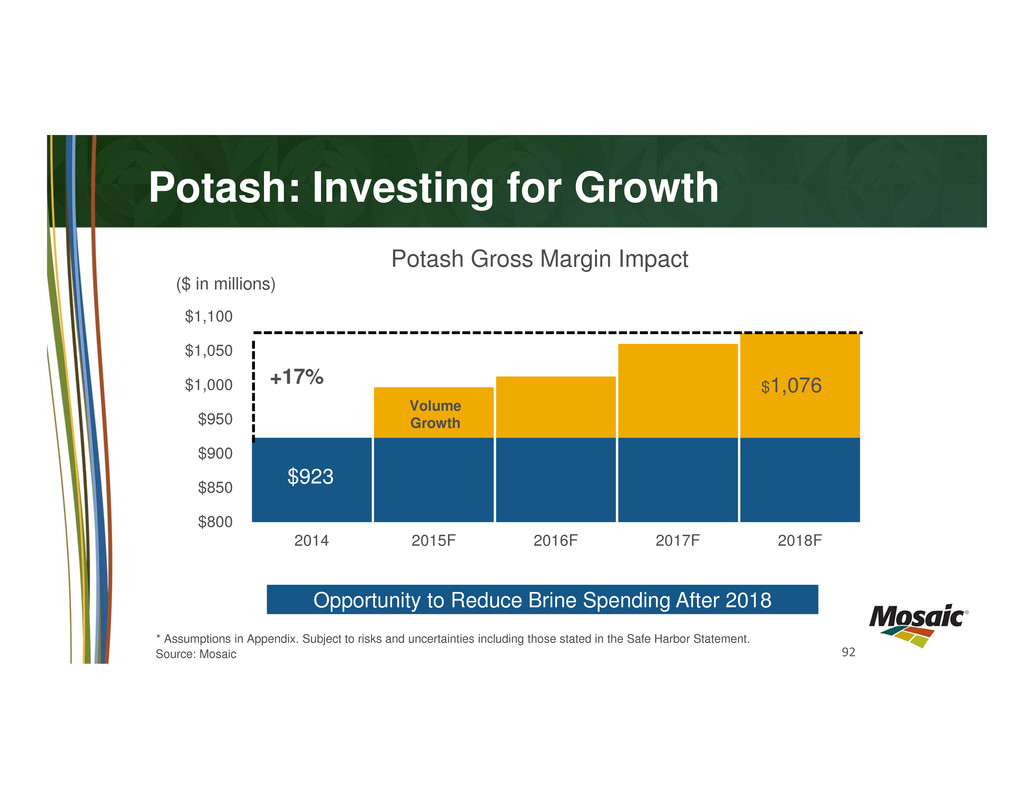

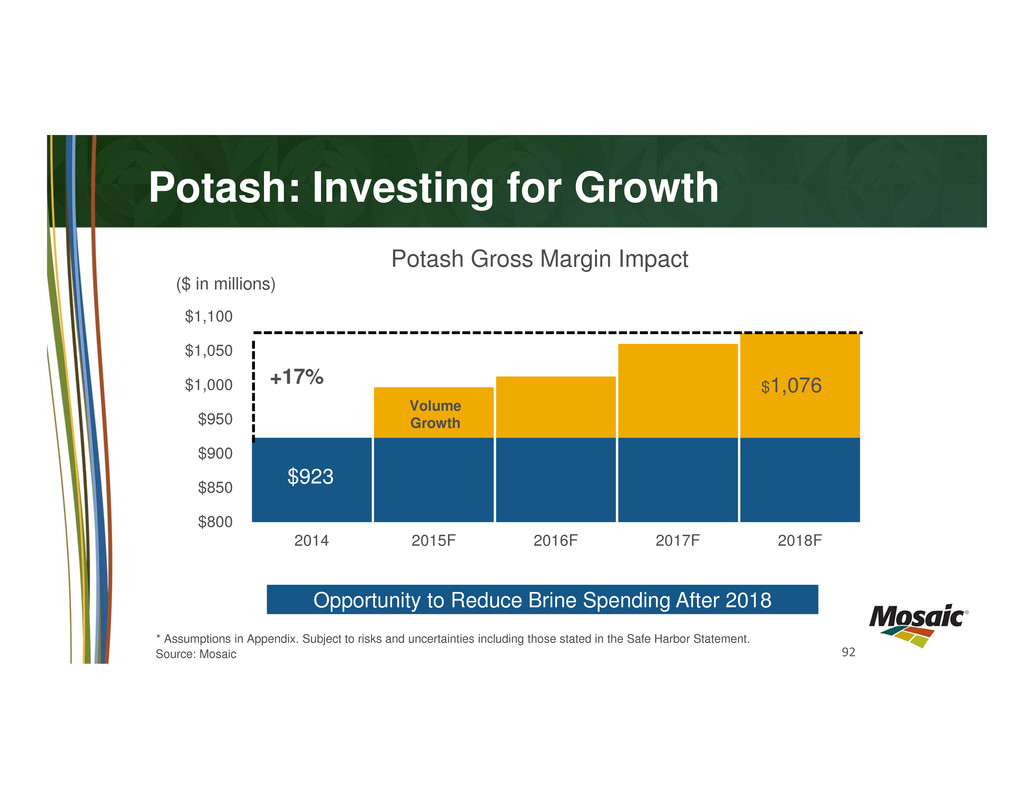

92 Potash: Investing for Growth $923 $800 $850 $900 $950 $1,000 $1,050 $1,100 2014 2015F 2016F 2017F 2018F Potash Gross Margin Impact $1,076 ($ in millions) Volume Growth +17% * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic Opportunity to Reduce Brine Spending After 2018

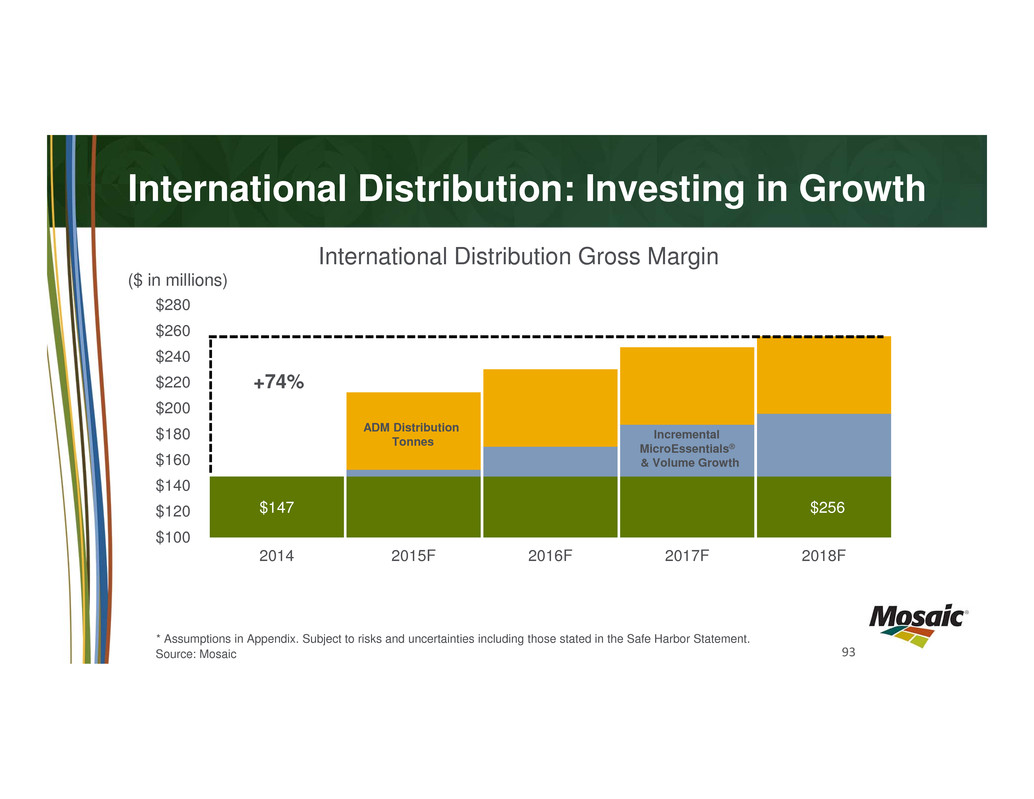

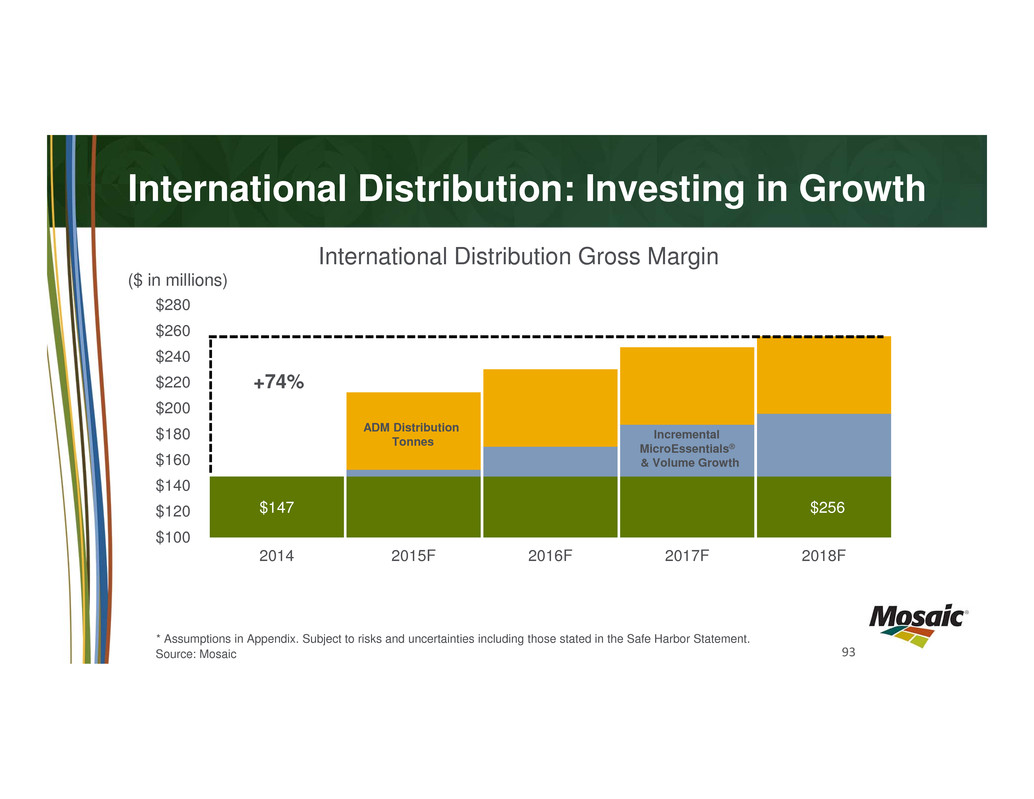

93 International Distribution: Investing in Growth $147 $256 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 2014 2015F 2016F 2017F 2018F International Distribution Gross Margin ($ in millions) Incremental MicroEssentials® & Volume Growth ADM Distribution Tonnes +74% * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

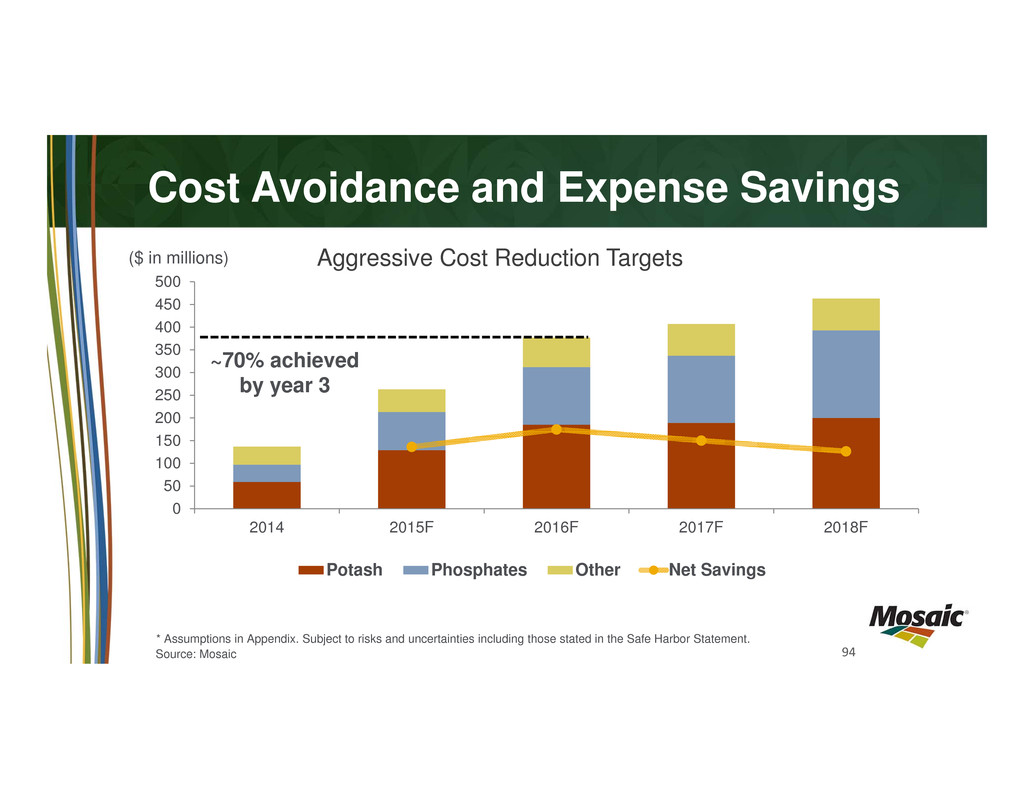

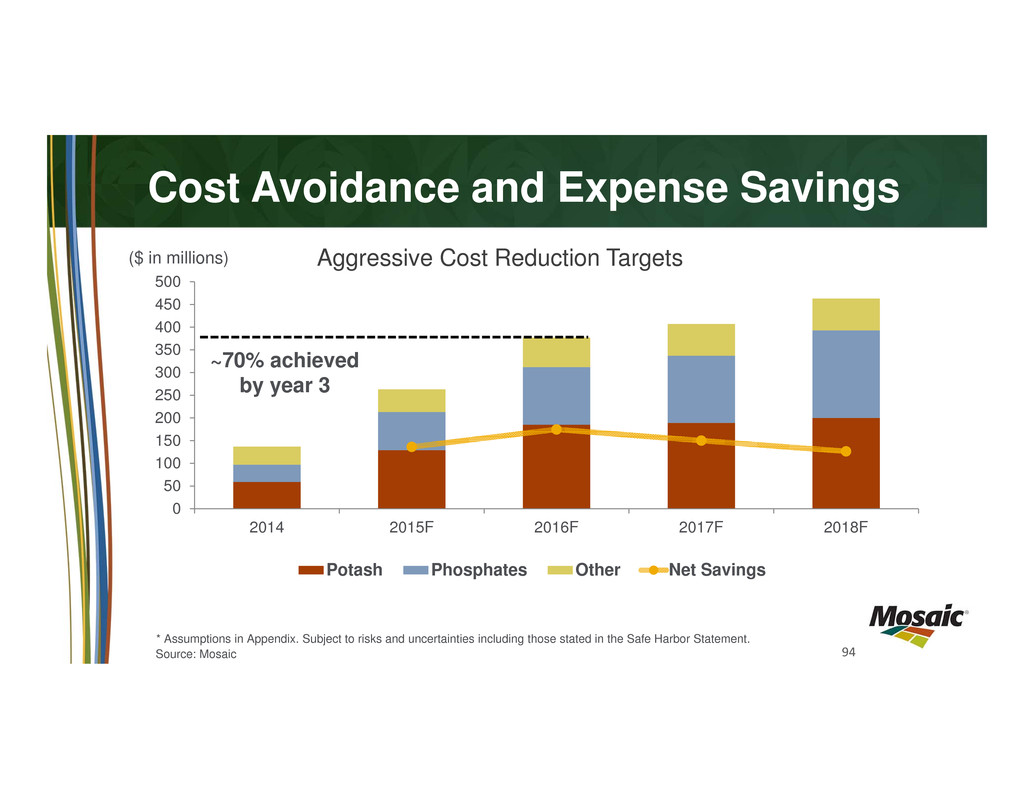

94 0 50 100 150 200 250 300 350 400 450 500 2014 2015F 2016F 2017F 2018F Potash Phosphates Other Net Savings Cost Avoidance and Expense Savings ~70% achieved by year 3 ($ in millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic Aggressive Cost Reduction Targets

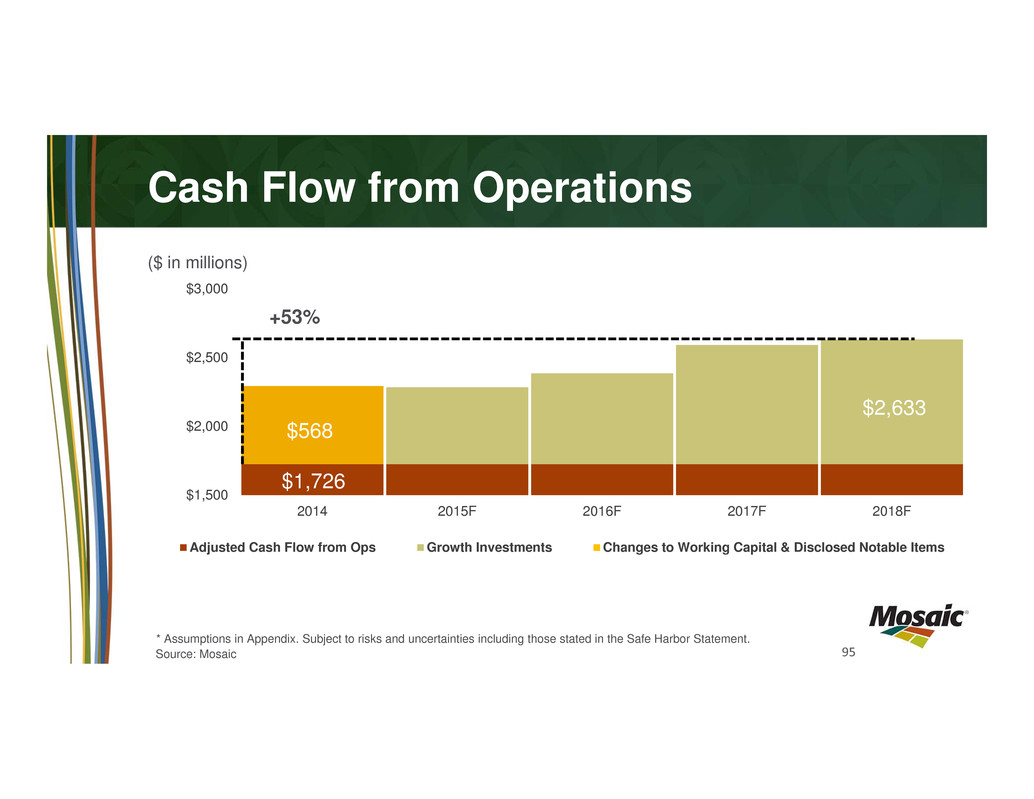

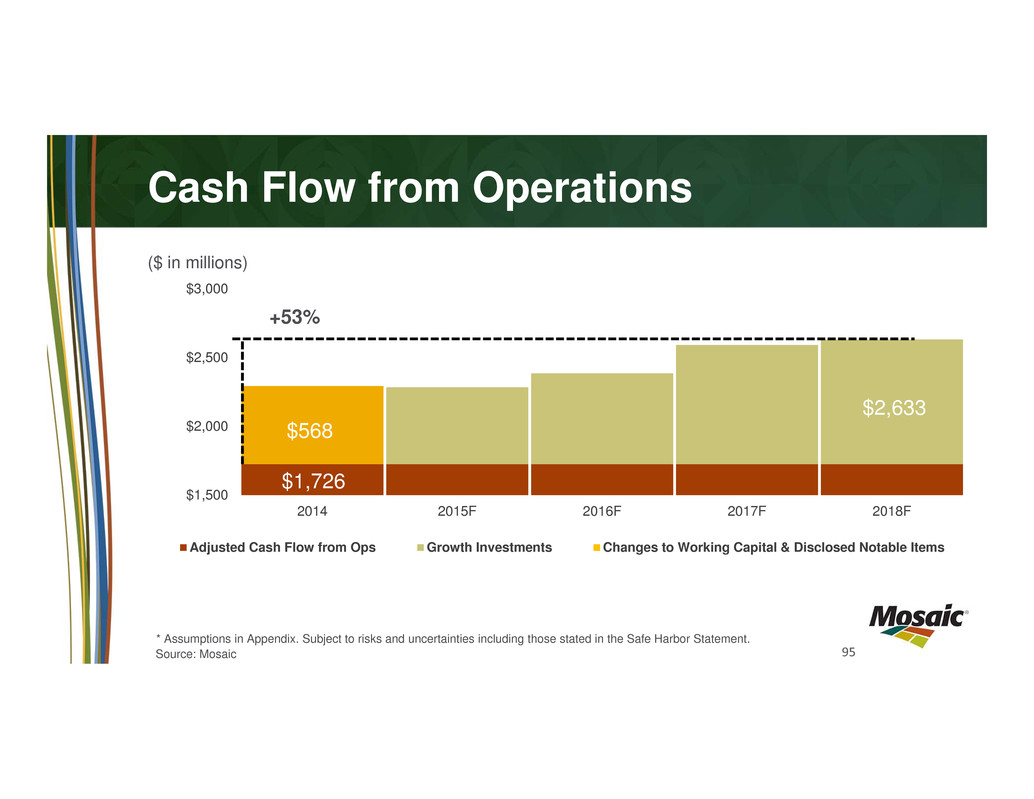

95 Cash Flow from Operations $1,726 $2,633 $568 $1,500 $2,000 $2,500 $3,000 2014 2015F 2016F 2017F 2018F Adjusted Cash Flow from Ops Growth Investments Changes to Working Capital & Disclosed Notable Items ($ in millions) +53% * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

96 The Investment Perspective Mosaic’s phosphates business Valuation Considerations Brine Management Costs and Risk Mosaic’s current valuation Growth Outlook Free Cash Flow Growth Levers to Grow Value Mosaic Current Valuation Mosaic Phosphates Business

97 Capital Priorities Maintain Strong Financial Foundation Sustain Assets Organic Growth Investments Return to Shareholders Source: Mosaic Sustain & Grow Dividend Strategic Investments Balanced Approach Strong Cash Generator Capital Management Targeting Growth Proven Track Record Dividend Increases Share Repurchases Additional Flexibility

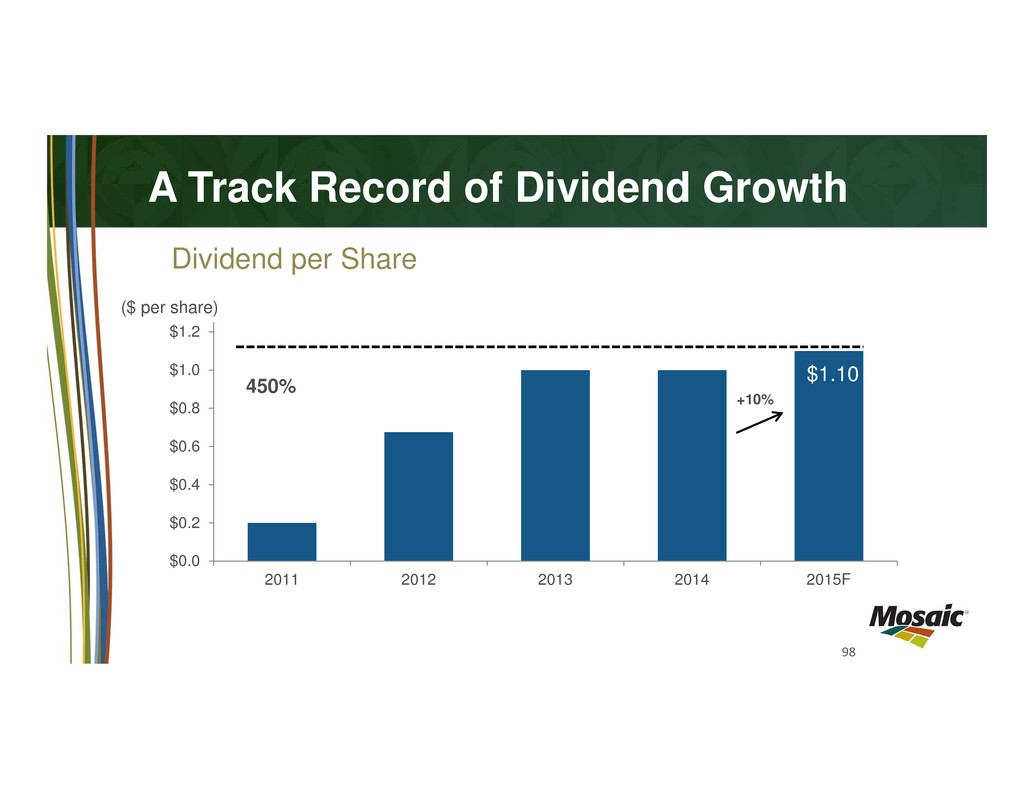

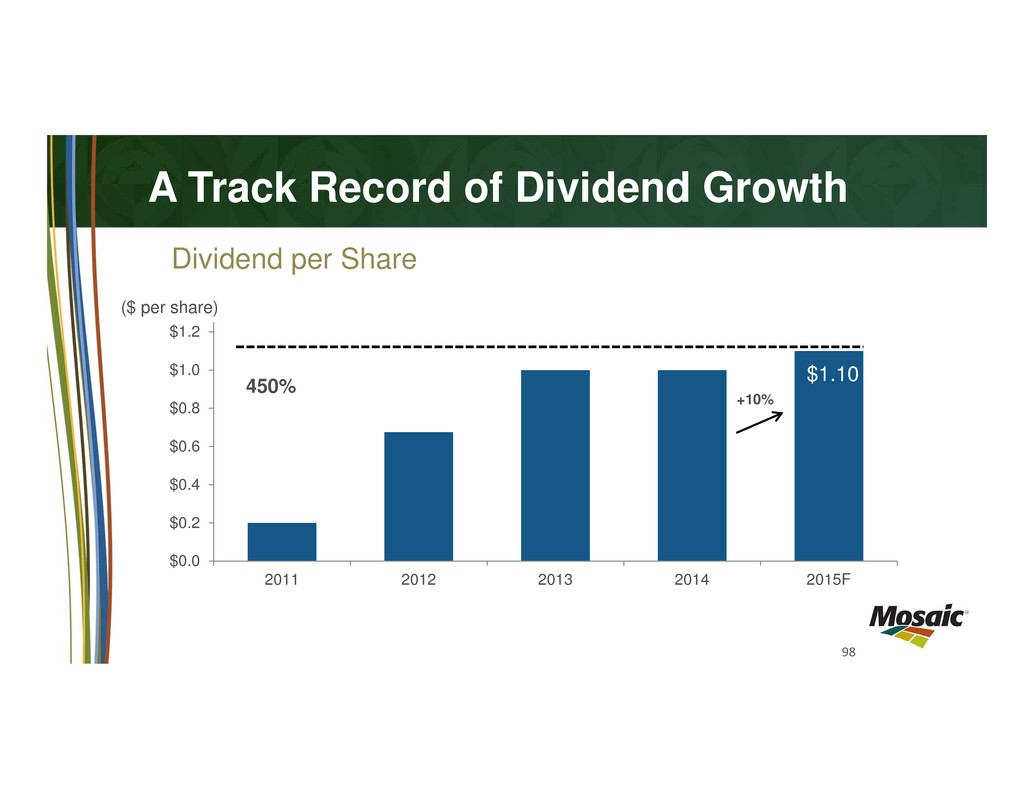

98 $1.10 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 2011 2012 2013 2014 2015F A Track Record of Dividend Growth ($ per share) Dividend per Share 450% +10%

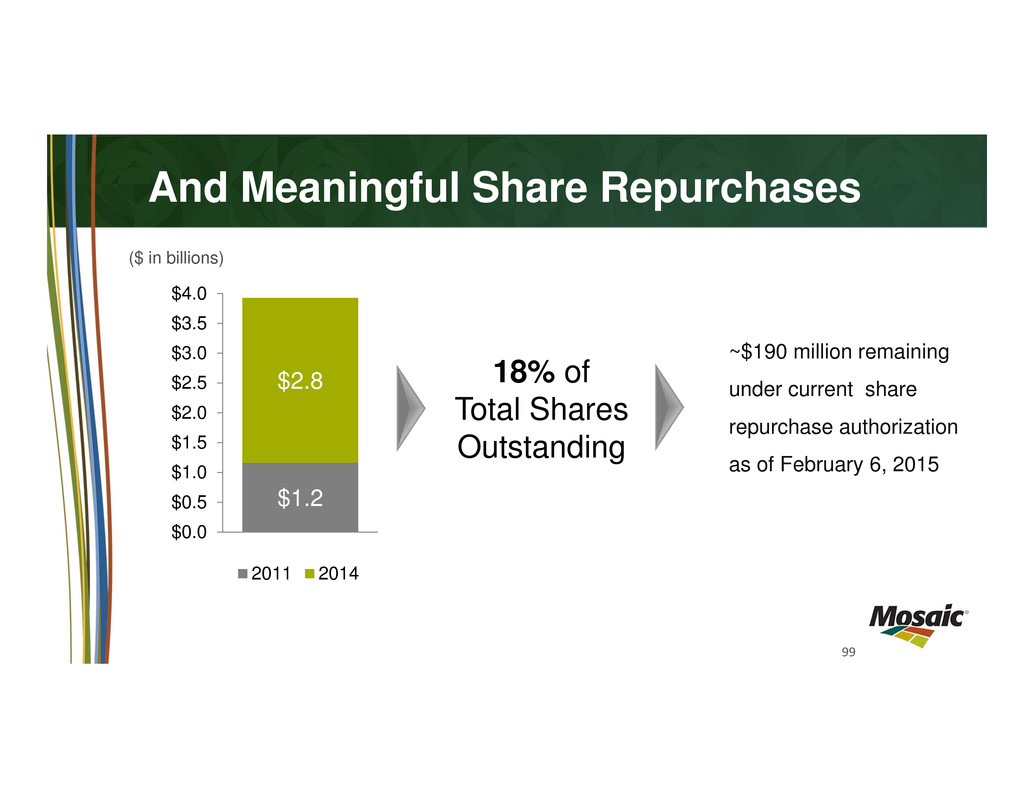

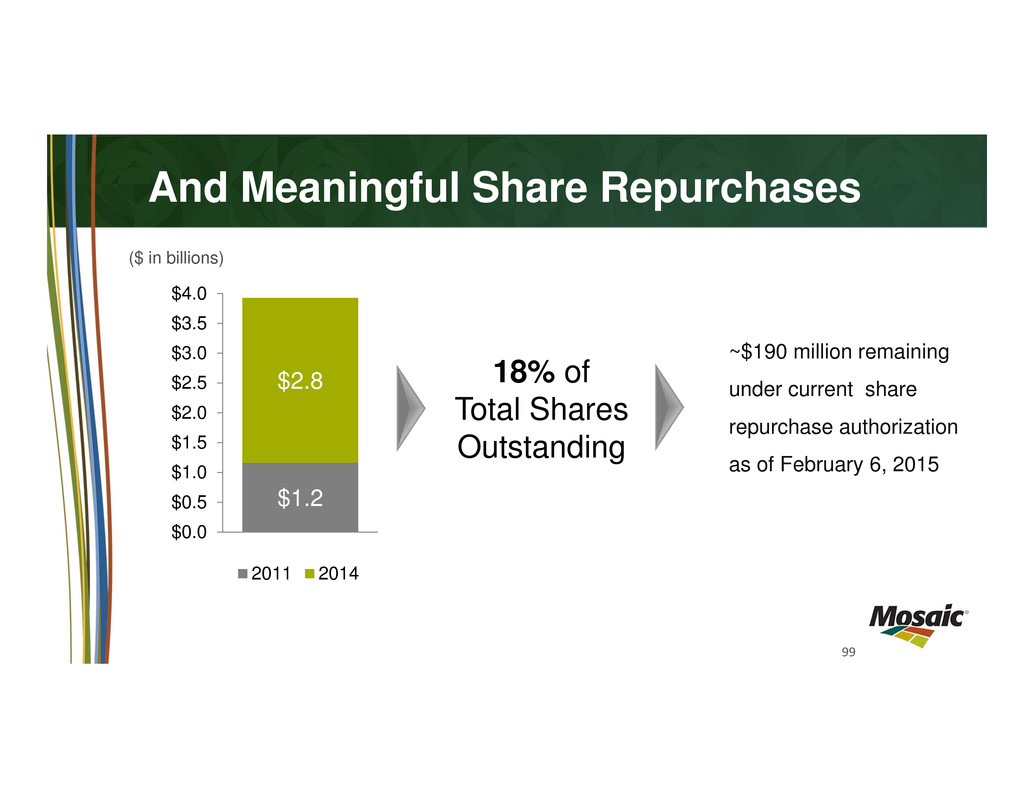

99 And Meaningful Share Repurchases $1.2 $2.8 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2011 2014 ~$190 million remaining under current share repurchase authorization as of February 6, 2015 18% of Total Shares Outstanding ($ in billions)

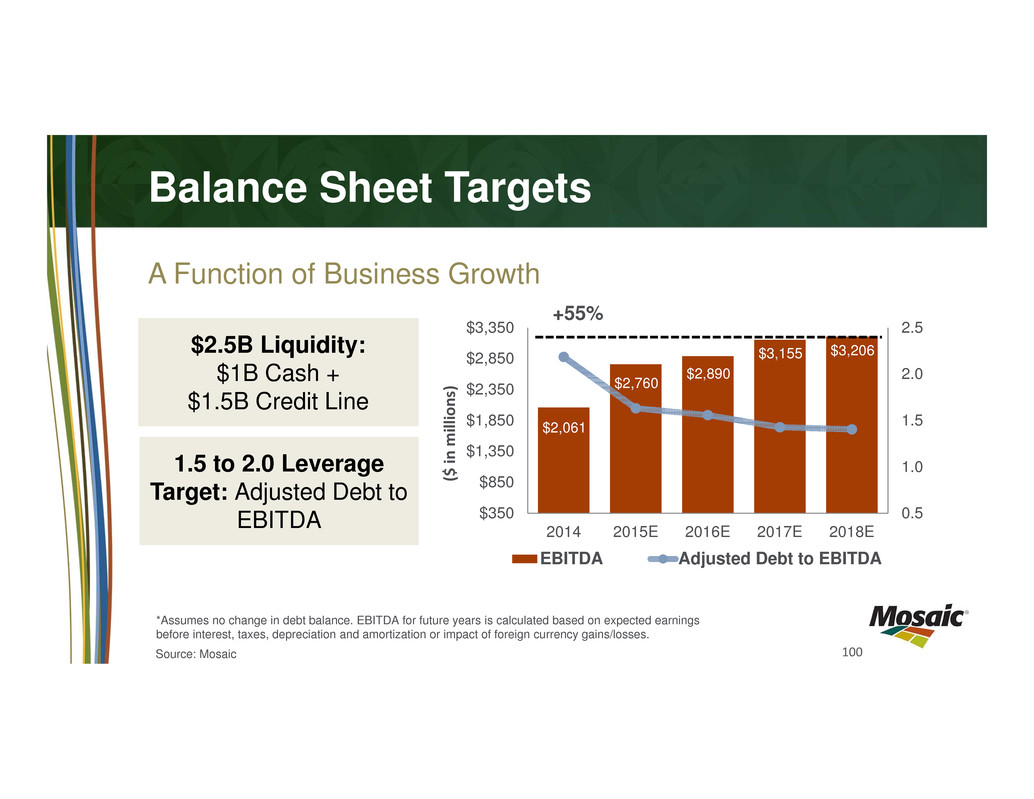

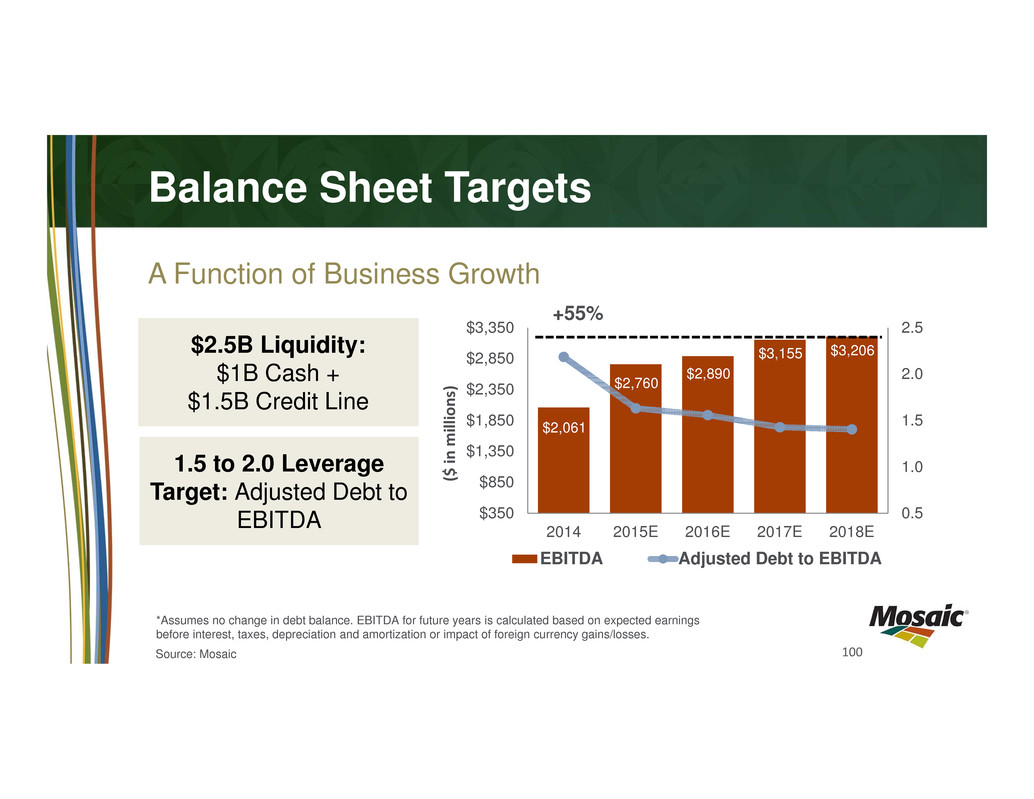

100 $2.5B Liquidity: $1B Cash + $1.5B Credit Line 1.5 to 2.0 Leverage Target: Adjusted Debt to EBITDA *Assumes no change in debt balance. EBITDA for future years is calculated based on expected earnings before interest, taxes, depreciation and amortization or impact of foreign currency gains/losses. $2,061 $2,760 $2,890 $3,155 $3,206 0.5 1.0 1.5 2.0 2.5 $350 $850 $1,350 $1,850 $2,350 $2,850 $3,350 2014 2015E 2016E 2017E 2018E EBITDA Adjusted Debt to EBITDA Balance Sheet Targets A Function of Business Growth +55% ( $ i n m i l l i o n s ) Source: Mosaic

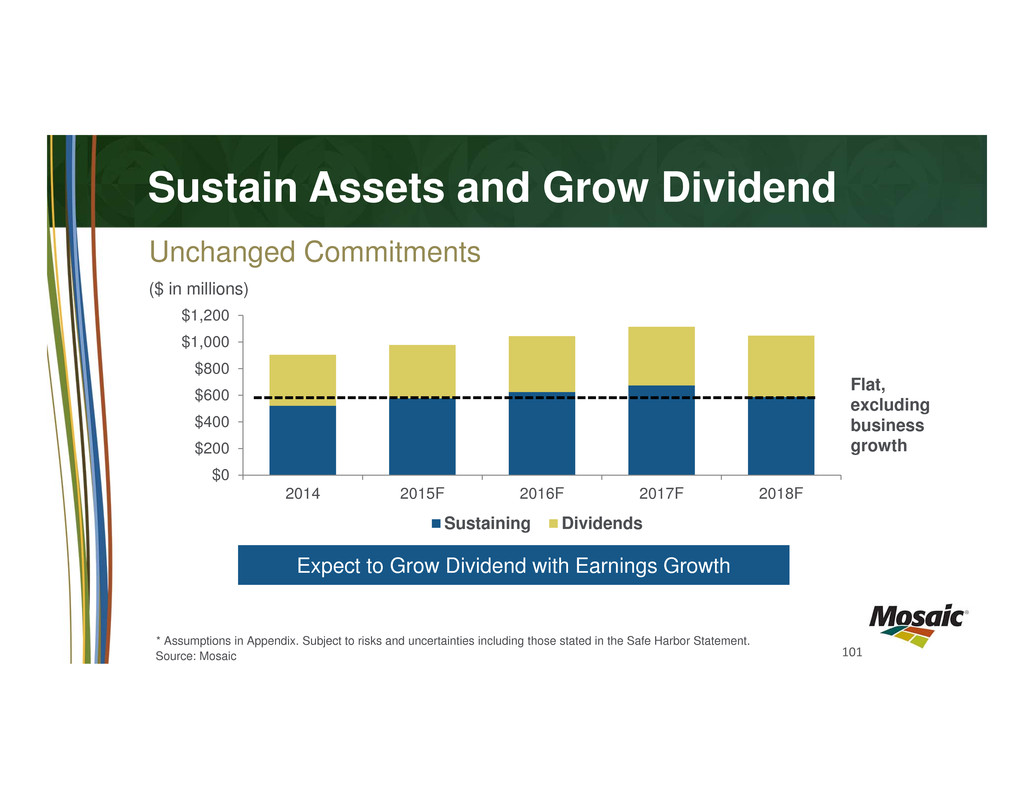

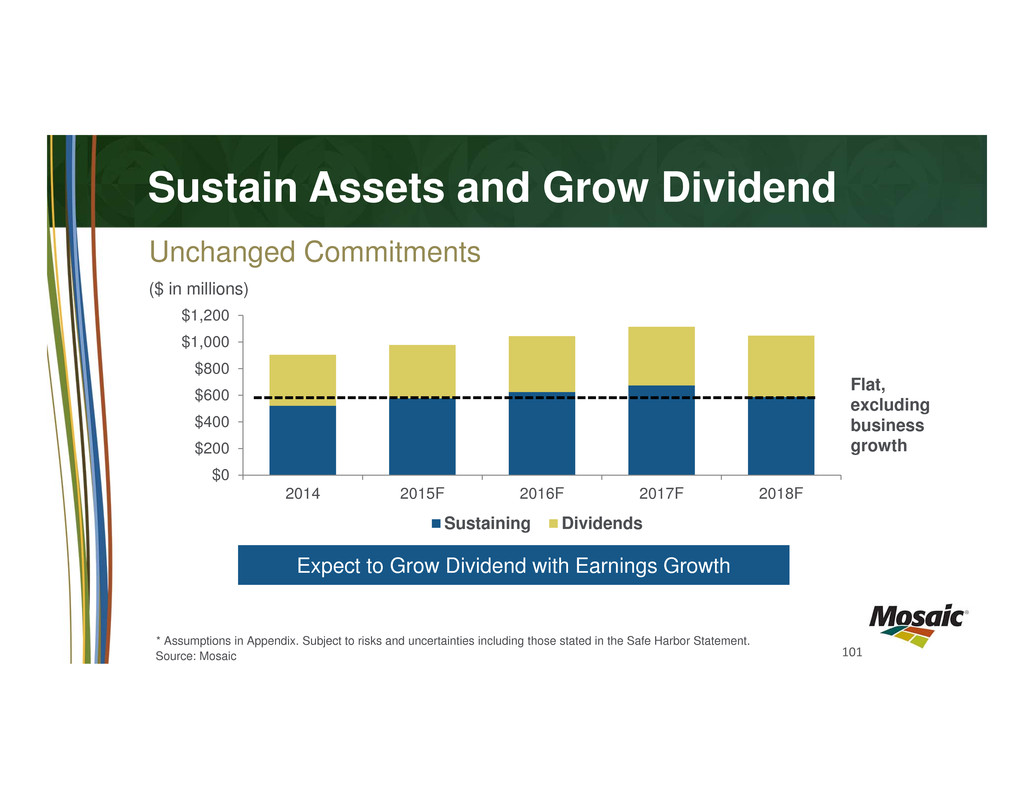

101 Expect to Grow Dividend with Earnings Growth Sustain Assets and Grow Dividend $0 $200 $400 $600 $800 $1,000 $1,200 2014 2015F 2016F 2017F 2018F Sustaining Dividends Flat, excluding business growth Unchanged Commitments ($ in millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

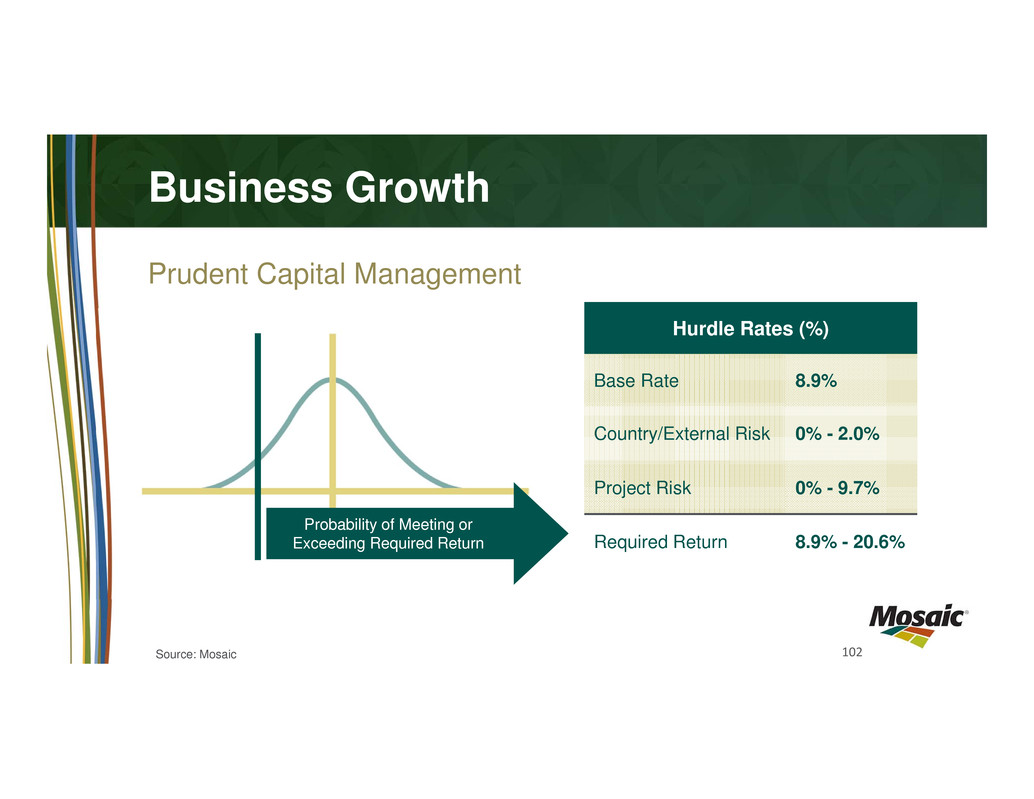

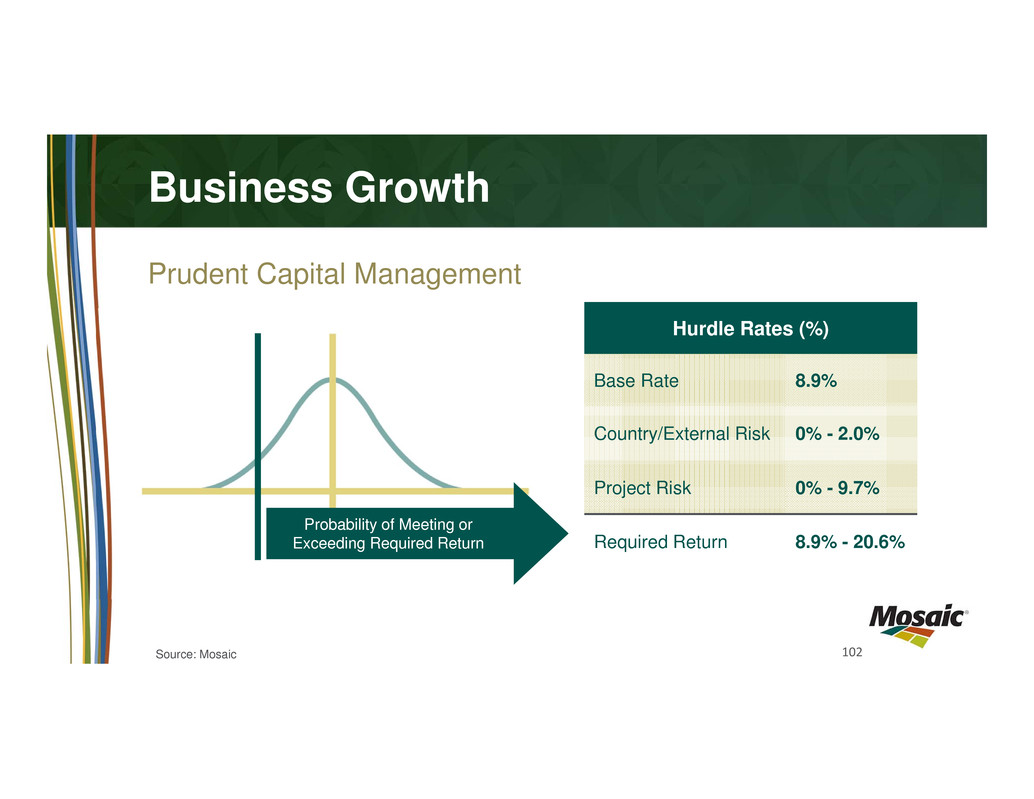

102 Probability of Meeting or Exceeding Required Return Business Growth Prudent Capital Management Hurdle Rates (%) Base Rate 8.9% Country/External Risk 0% - 2.0% Project Risk 0% - 9.7% Required Return 8.9% - 20.6% Source: Mosaic

103 Business Growth A Track Record of Success Organic Capital IRR Esterhazy K2 $645/tonne 20% Colonsay $923/tonne 13% MicroEssentials® $173/tonne 20% Strategic Capital IRR CF Phosphates $630/tonne 17% Ma’aden $900/tonne Low teens ADM $175/tonne 12% Source: Mosaic

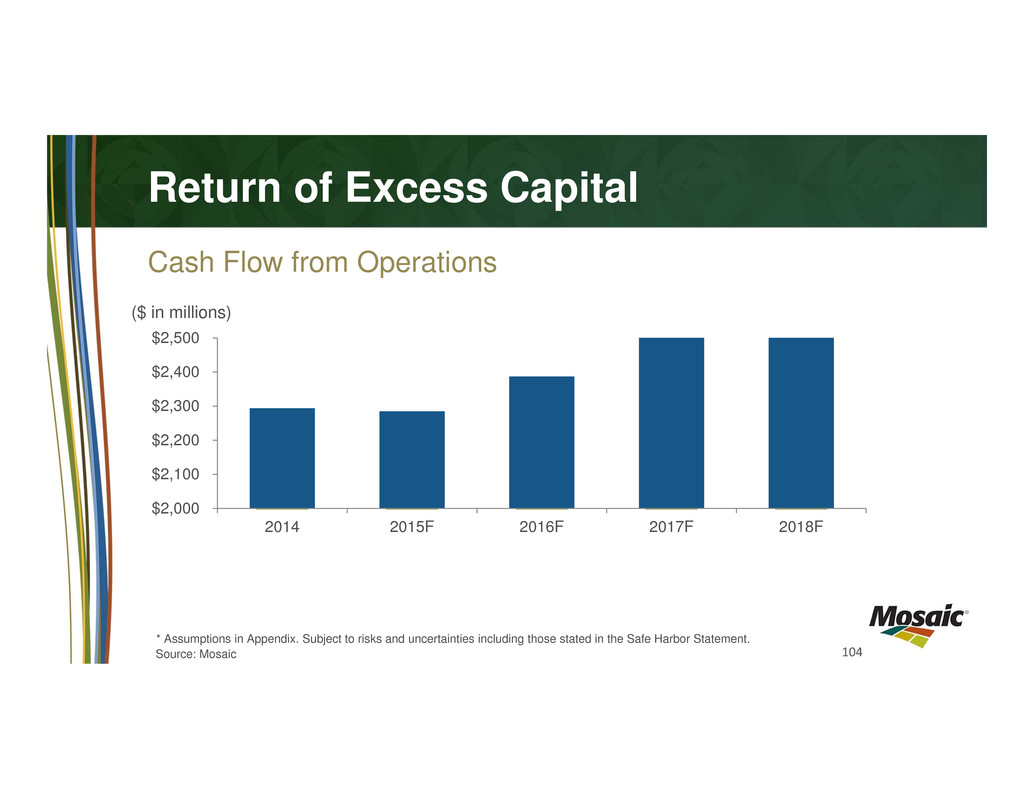

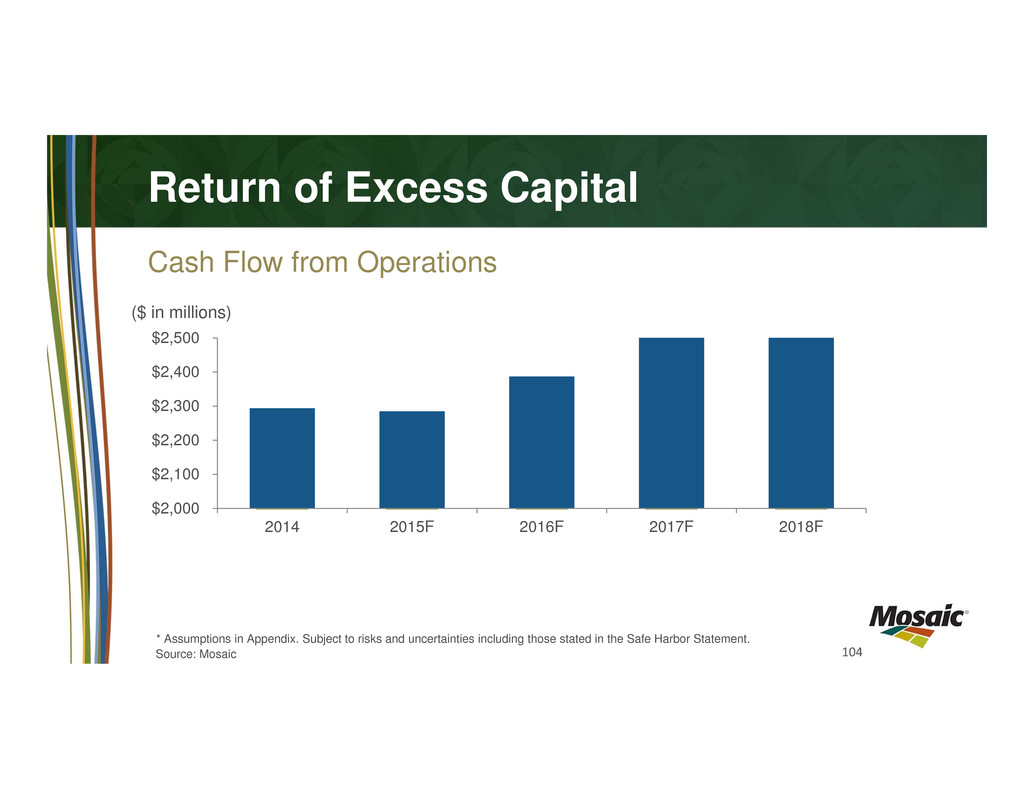

104 Return of Excess Capital $2,000 $2,100 $2,200 $2,300 $2,400 $2,500 2014 2015F 2016F 2017F 2018F Cash Flow from Operations ($ in millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

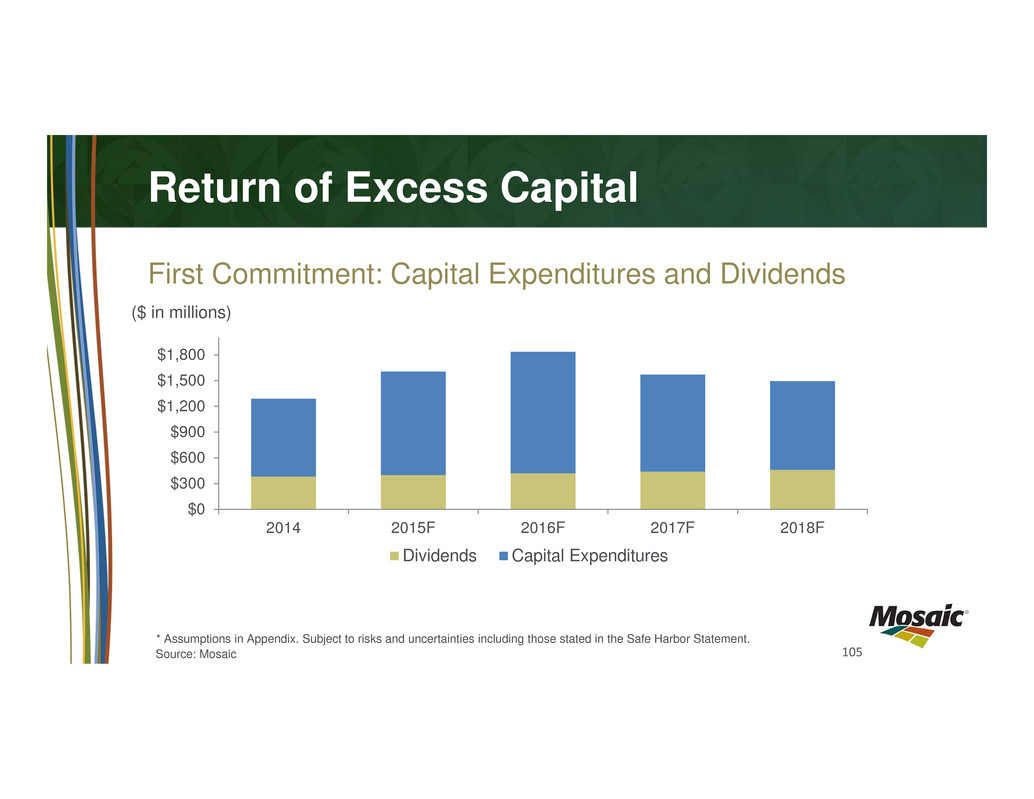

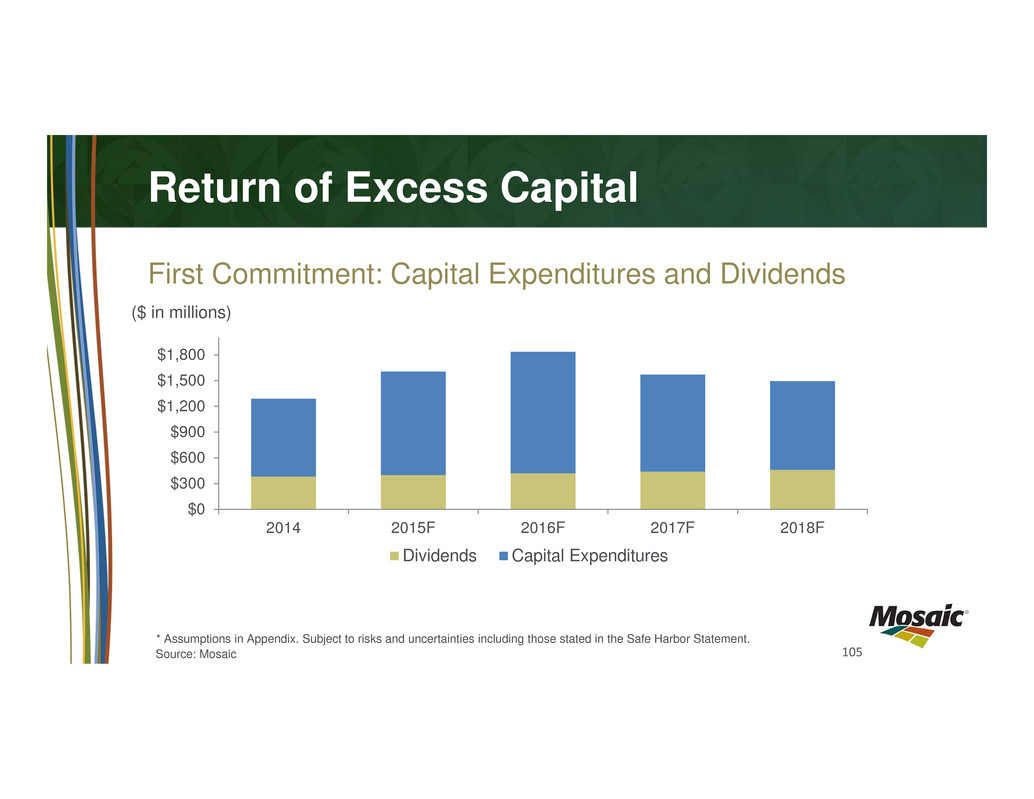

105 $0 $300 $600 $900 $1,200 $1,500 $1,800 2014 2015F 2016F 2017F 2018F Dividends Capital Expenditures Return of Excess Capital First Commitment: Capital Expenditures and Dividends ($ in millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

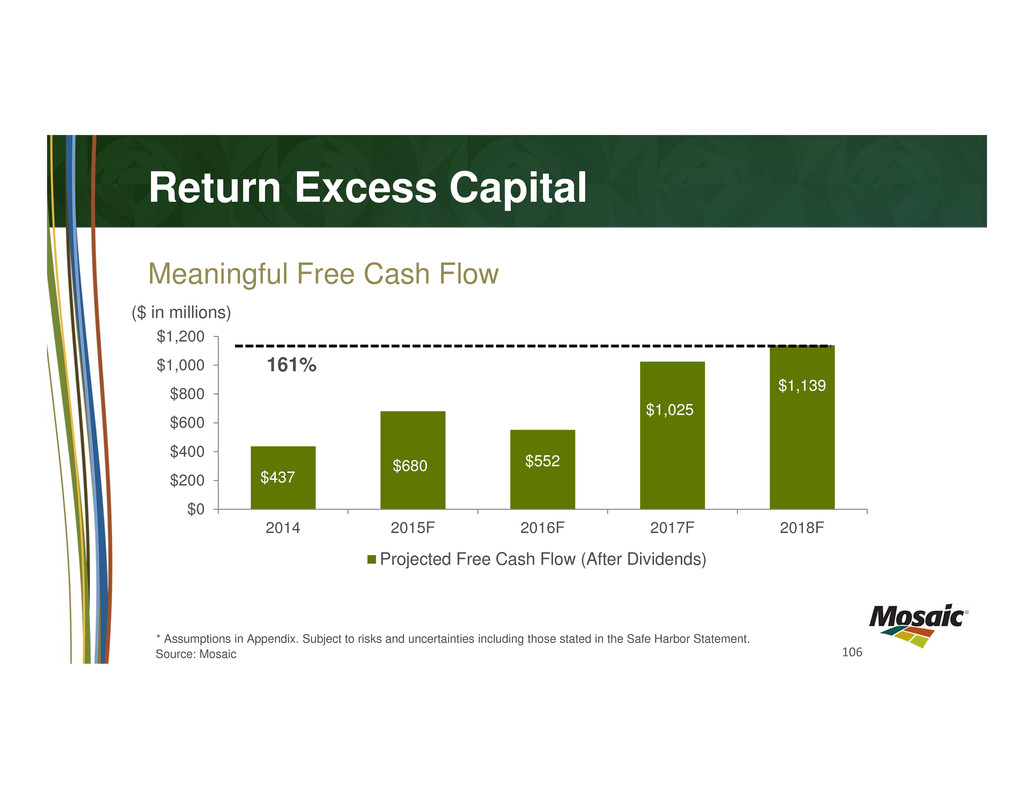

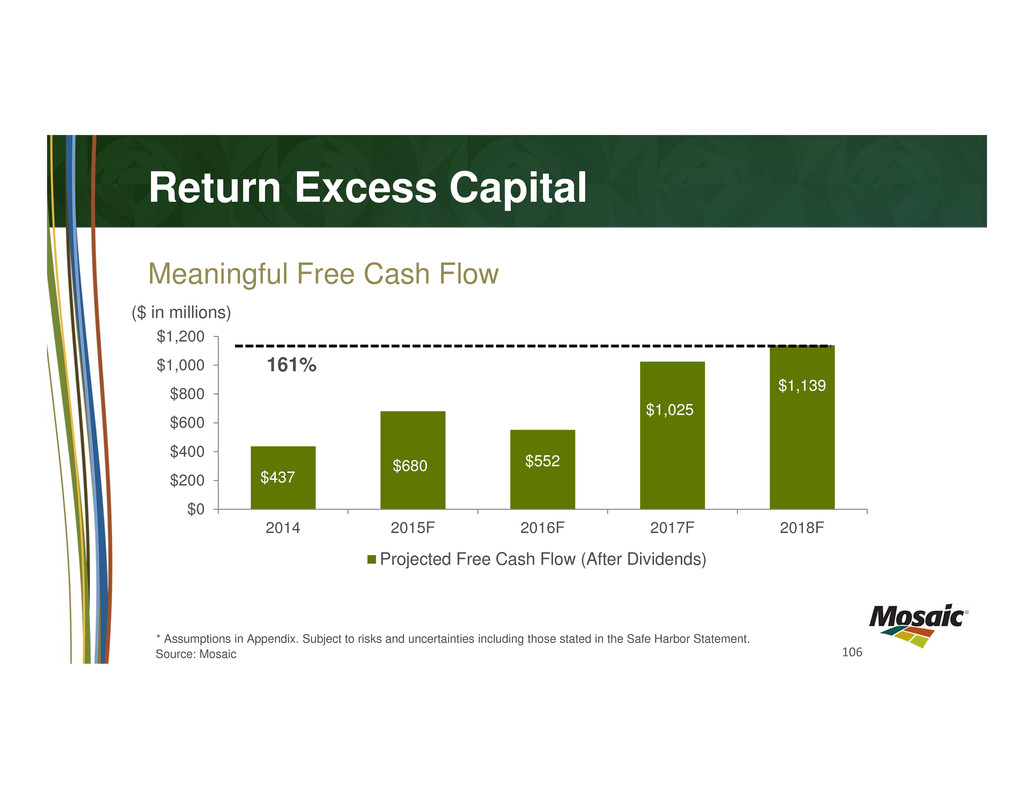

106 $437 $680 $552 $1,025 $1,139 $0 $200 $400 $600 $800 $1,000 $1,200 2014 2015F 2016F 2017F 2018F Projected Free Cash Flow (After Dividends) Return Excess Capital Meaningful Free Cash Flow 161% ($ in millions) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

107 Smart Capital Deployment Investment for Growth Shareholder Returns Capital Stewardship

108 $437 $680 $552 $1,025 $1,139 $814 $0 $500 $1,000 $1,500 $2,000 $2,500 2014 2015F 2016F 2017F 2018F Free Cash Flow Scenario: P&K Prices up $50 ($ in millions) 347% Leverage to Cyclical Improvement Significant Free Cash Flow Leverage * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. Source: Mosaic

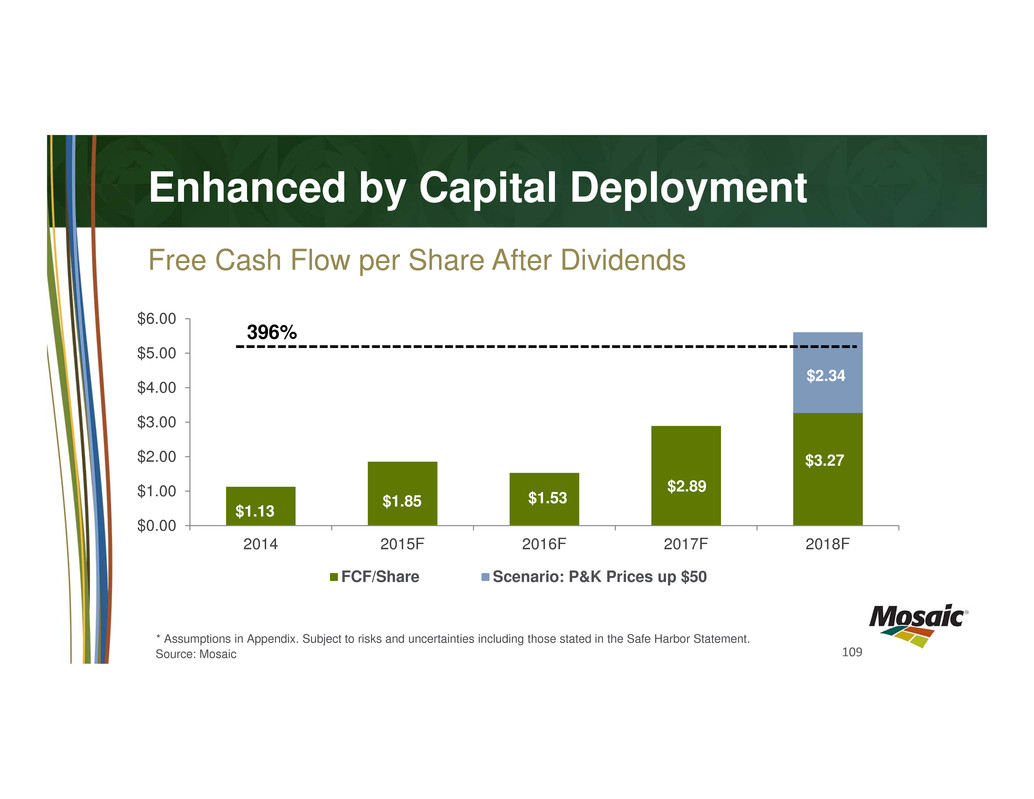

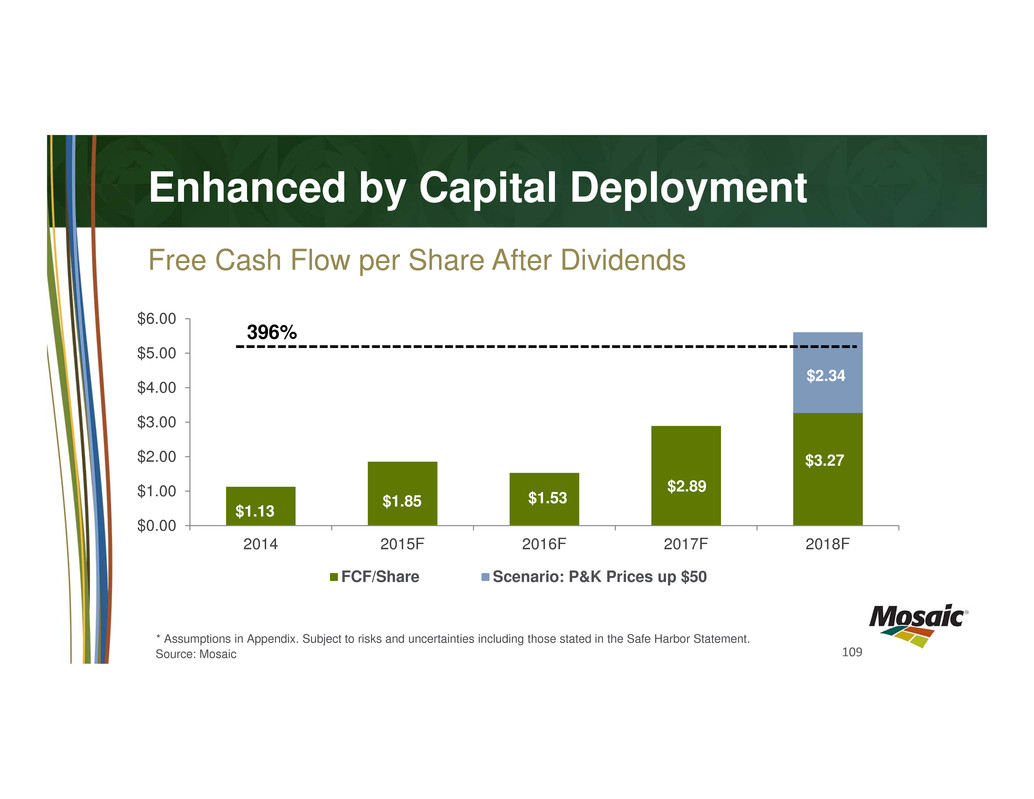

109 Enhanced by Capital Deployment Free Cash Flow per Share After Dividends * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. $1.13 $1.85 $1.53 $2.89 $3.27 $2.34 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 2014 2015F 2016F 2017F 2018F FCF/Share Scenario: P&K Prices up $50 396% Source: Mosaic

110 Summary • Undervalued Phosphates Business • Diminishing Brine Management Risk • Free Cash Flow Growth Potential • Balanced Capital Allocation • Positioned to Deliver Value

111 Mosaic Analyst Day March 31, 2015 Mosaic Analyst Day March 31, 2015

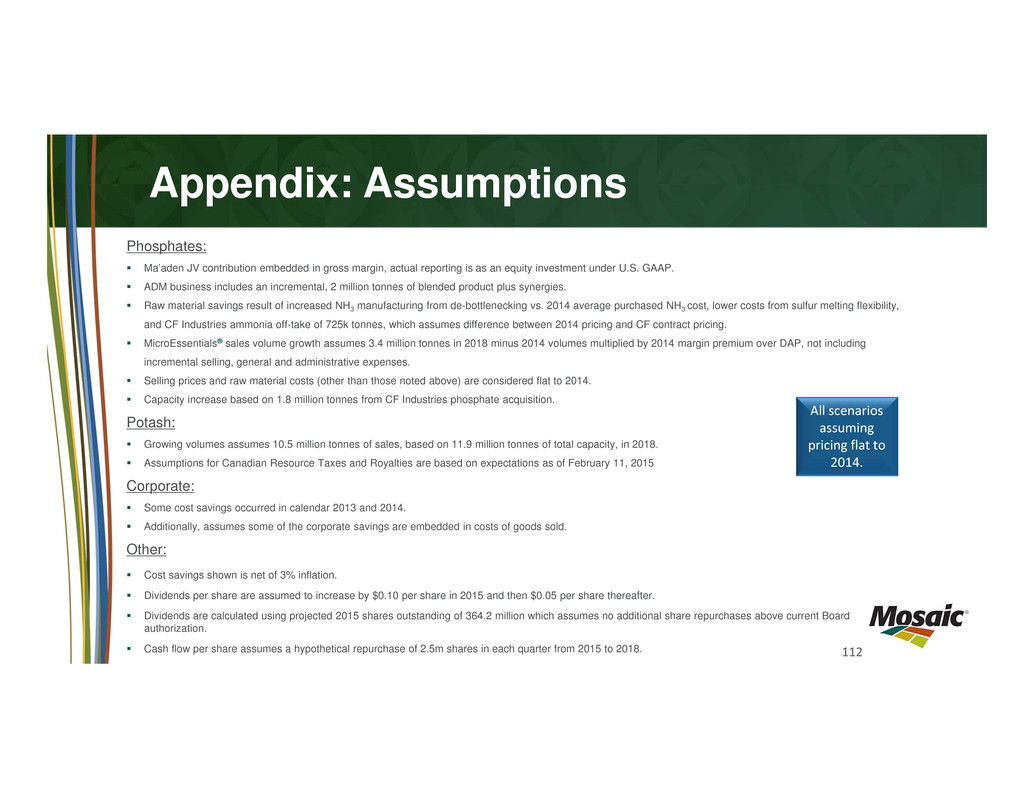

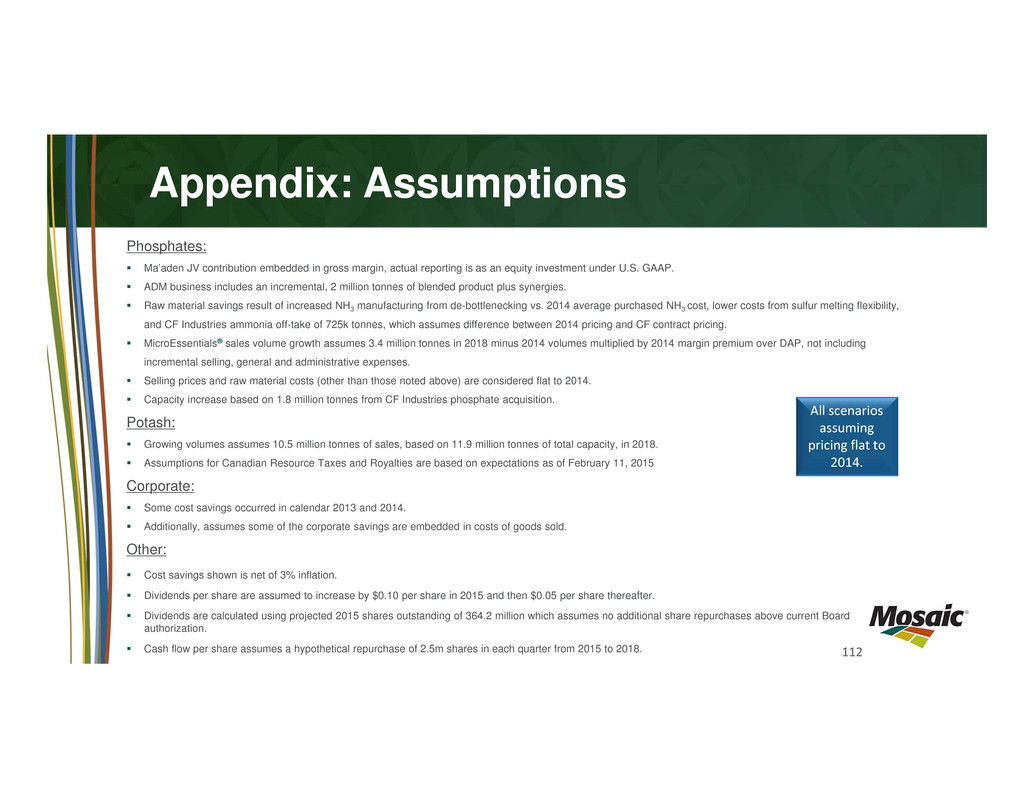

112 Phosphates: Ma’aden JV contribution embedded in gross margin, actual reporting is as an equity investment under U.S. GAAP. ADM business includes an incremental, 2 million tonnes of blended product plus synergies. Raw material savings result of increased NH3 manufacturing from de-bottlenecking vs. 2014 average purchased NH3 cost, lower costs from sulfur melting flexibility, and CF Industries ammonia off-take of 725k tonnes, which assumes difference between 2014 pricing and CF contract pricing. MicroEssentials® sales volume growth assumes 3.4 million tonnes in 2018 minus 2014 volumes multiplied by 2014 margin premium over DAP, not including incremental selling, general and administrative expenses. Selling prices and raw material costs (other than those noted above) are considered flat to 2014. Capacity increase based on 1.8 million tonnes from CF Industries phosphate acquisition. Potash: Growing volumes assumes 10.5 million tonnes of sales, based on 11.9 million tonnes of total capacity, in 2018. Assumptions for Canadian Resource Taxes and Royalties are based on expectations as of February 11, 2015 Corporate: Some cost savings occurred in calendar 2013 and 2014. Additionally, assumes some of the corporate savings are embedded in costs of goods sold. Other: Cost savings shown is net of 3% inflation. Dividends per share are assumed to increase by $0.10 per share in 2015 and then $0.05 per share thereafter. Dividends are calculated using projected 2015 shares outstanding of 364.2 million which assumes no additional share repurchases above current Board authorization. Cash flow per share assumes a hypothetical repurchase of 2.5m shares in each quarter from 2015 to 2018. Appendix: Assumptions All scenarios assuming pricing flat to 2014.

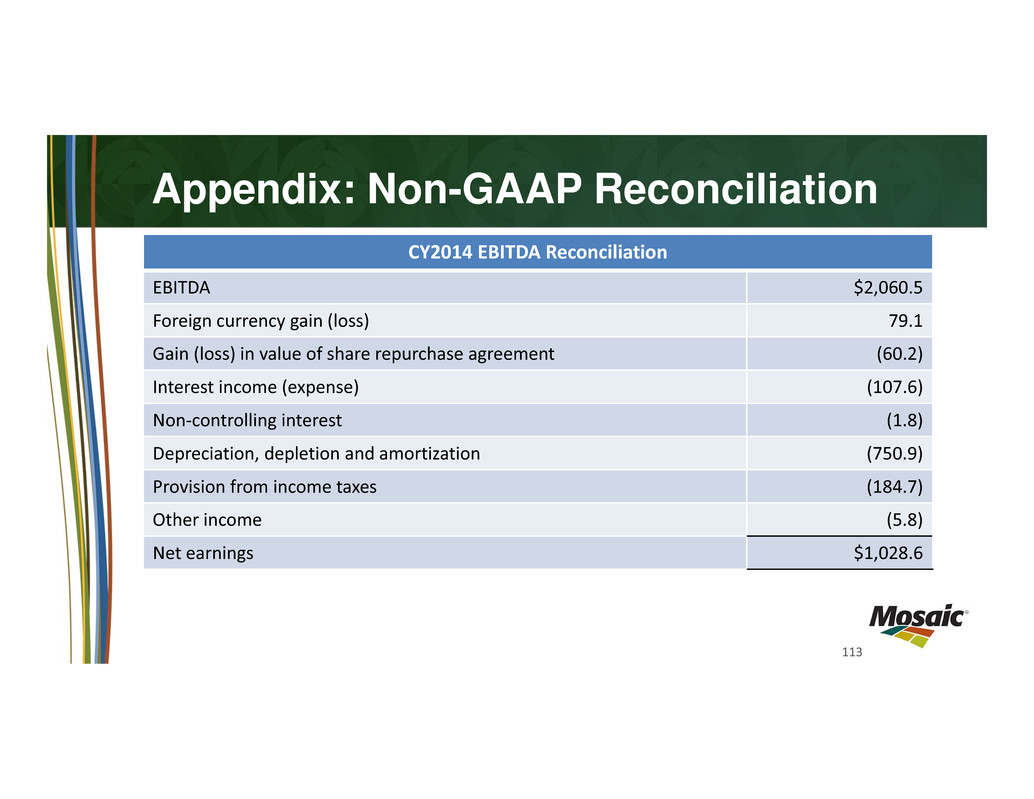

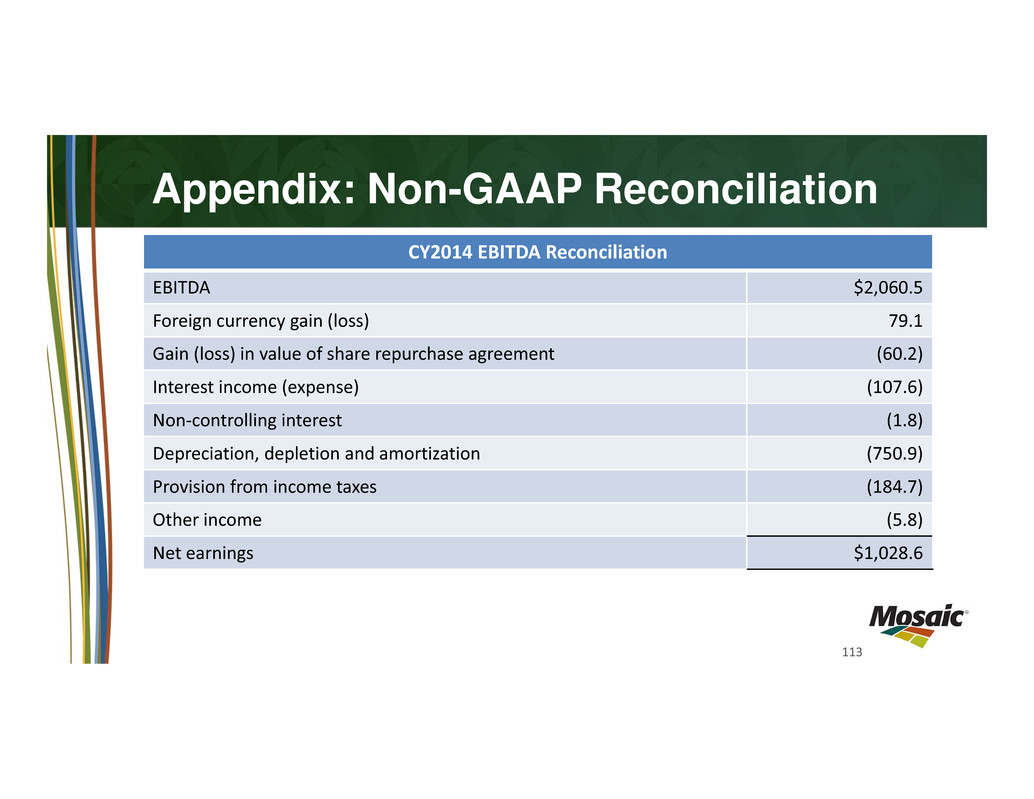

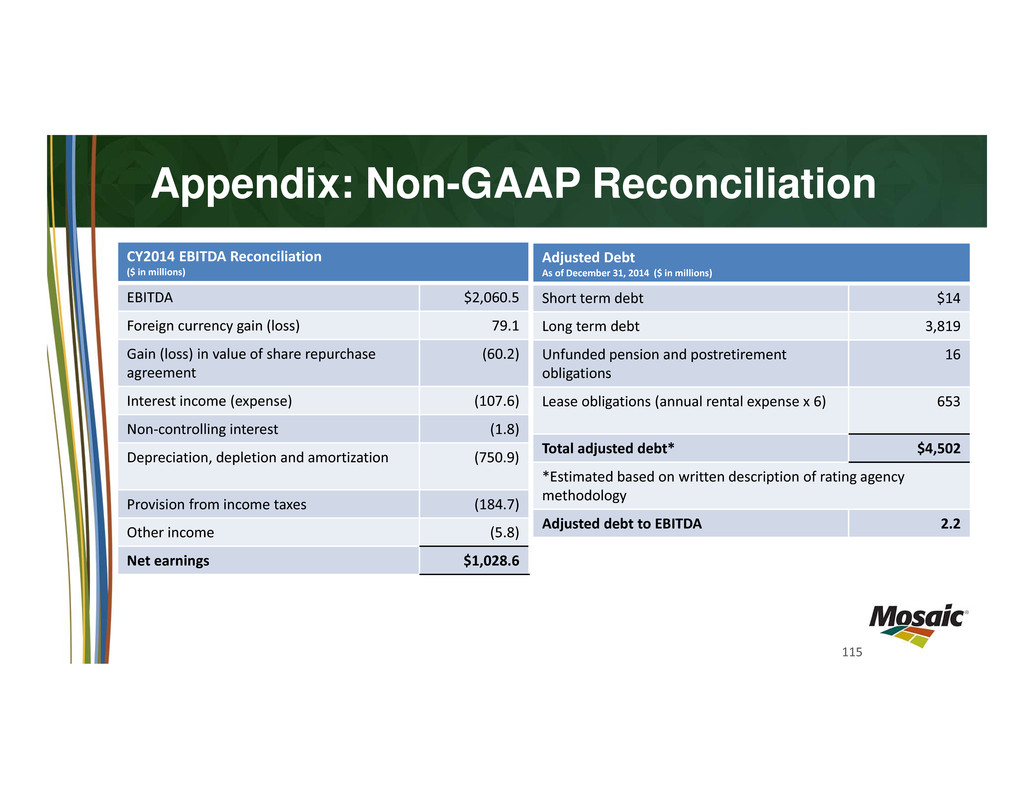

113 CY2014 EBITDA Reconciliation EBITDA $2,060.5 Foreign currency gain (loss) 79.1 Gain (loss) in value of share repurchase agreement (60.2) Interest income (expense) (107.6) Non‐controlling interest (1.8) Depreciation, depletion and amortization (750.9) Provision from income taxes (184.7) Other income (5.8) Net earnings $1,028.6 Appendix: Non-GAAP Reconciliation

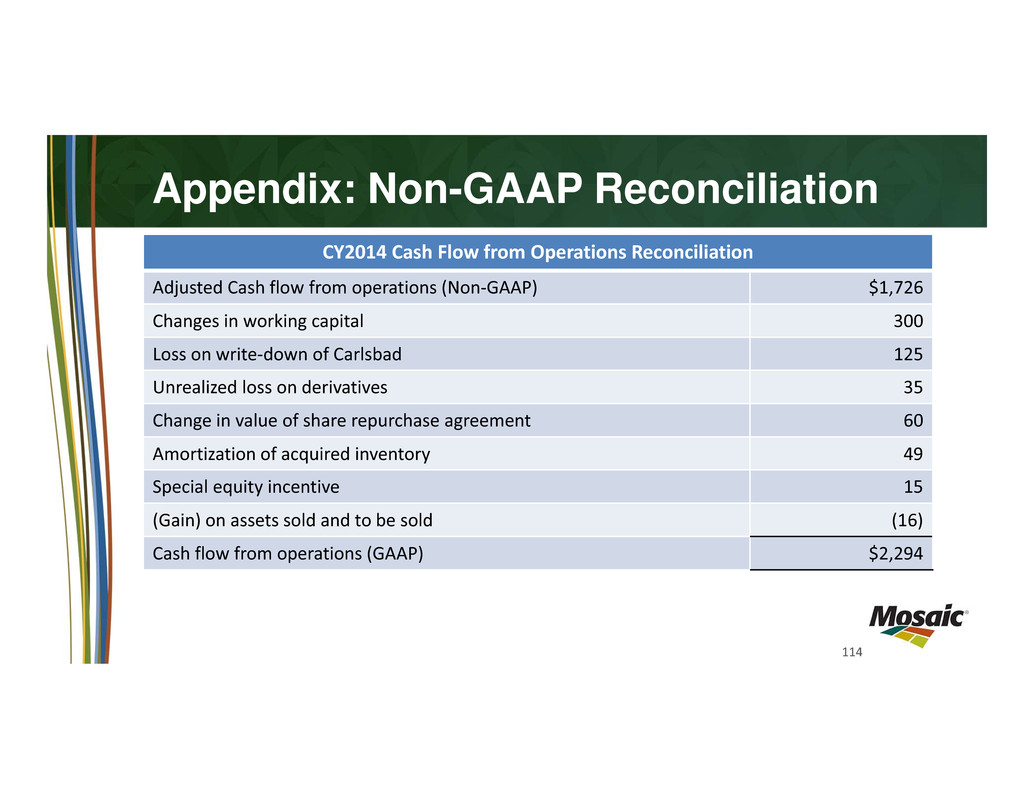

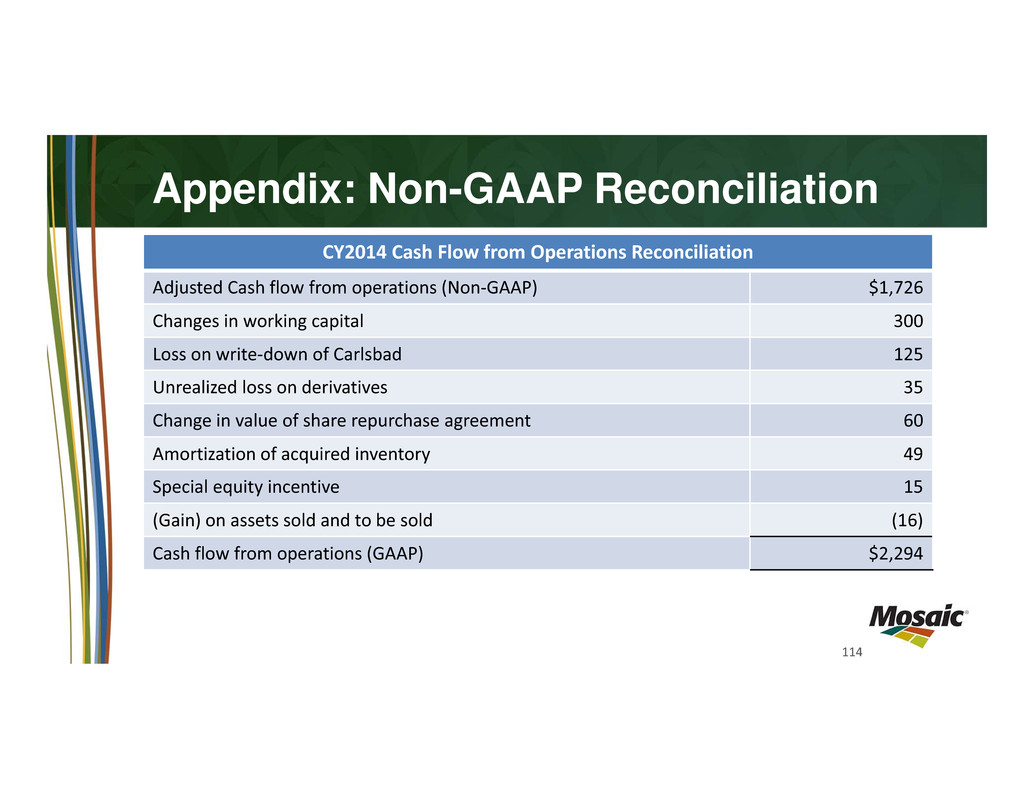

114 CY2014 Cash Flow from Operations Reconciliation Adjusted Cash flow from operations (Non‐GAAP) $1,726 Changes in working capital 300 Loss on write‐down of Carlsbad 125 Unrealized loss on derivatives 35 Change in value of share repurchase agreement 60 Amortization of acquired inventory 49 Special equity incentive 15 (Gain) on assets sold and to be sold (16) Cash flow from operations (GAAP) $2,294 Appendix: Non-GAAP Reconciliation

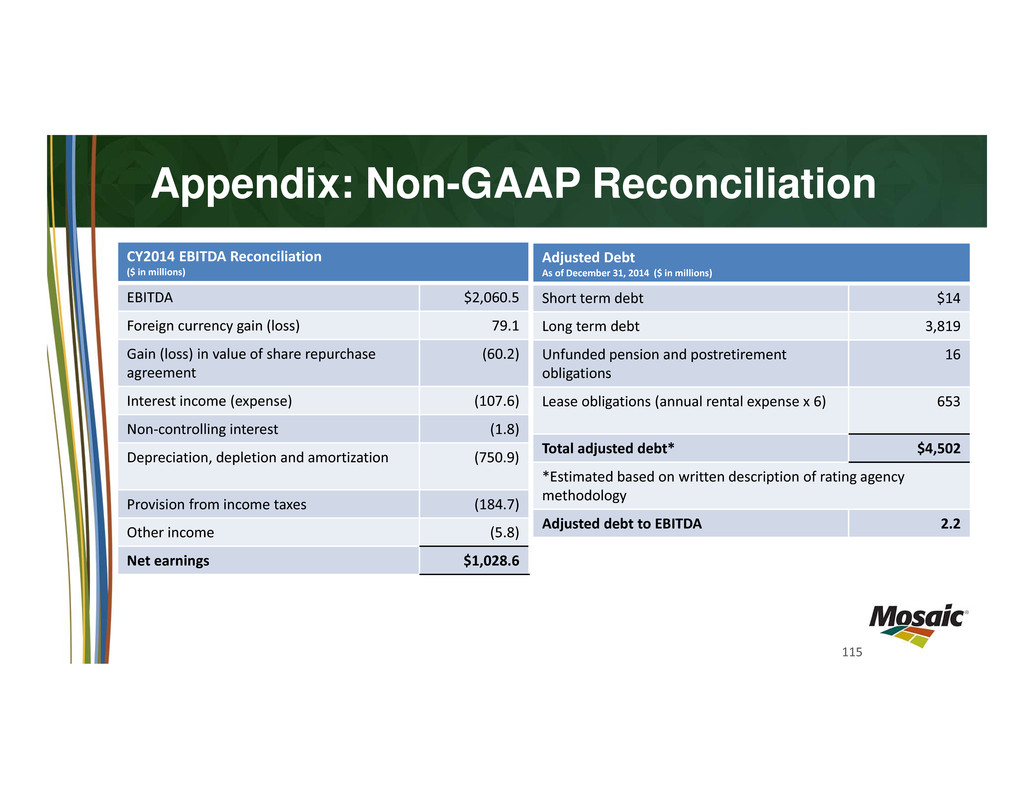

115 Appendix: Non-GAAP Reconciliation CY2014 EBITDA Reconciliation ($ in millions) EBITDA $2,060.5 Foreign currency gain (loss) 79.1 Gain (loss) in value of share repurchase agreement (60.2) Interest income (expense) (107.6) Non‐controlling interest (1.8) Depreciation, depletion and amortization (750.9) Provision from income taxes (184.7) Other income (5.8) Net earnings $1,028.6 Adjusted Debt As of December 31, 2014 ($ in millions) Short term debt $14 Long term debt 3,819 Unfunded pension and postretirement obligations 16 Lease obligations (annual rental expense x 6) 653 Total adjusted debt* $4,502 *Estimated based on written description of rating agency methodology Adjusted debt to EBITDA 2.2