1 Outlook for Brazil Dr. Michael R. Rahm Vice President – Market and Strategic Analysis (with an assist from Mosaic’s Sao Paulo team) Sixth CRU-GPCA Fertilizer Convention InterContinental Dubai Festival City, UAE September 16, 2015

2 Safe Harbor This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

3 Topics and Take-Aways An Agricultural Powerhouse - A large, diverse and rapidly growing agricultural sector (abundant land and favorable climate) - Soybeans and second crop corn are the main engines of growth - Production increases are mostly from more planted area (and world-class yields) - Large areas of land still are available to bring into production - Brazil-to-China soybean pipeline to grow despite economic slowdowns on both ends - Headwinds today (e.g. credit availability, exchange rate volatility and economic/political uncertainties) - But a weak real and relatively high crop prices are expected to sustain positive trends Implications for Plant Nutrient Demand - Brazilian soils require large plant nutrient applications - So there is a strong correlation between crop production and plant nutrient use - Demand scenarios assume more moderate growth in crop production (2%-4% vs. 5+%) - Plant nutrient use is projected to increase to 16-18 mmt in 2020 - Total product shipments are forecast to climb to 36-41 mmt in 2020 - Product mix trends are expected to continue - These scenarios are greater than current ANDA forecasts

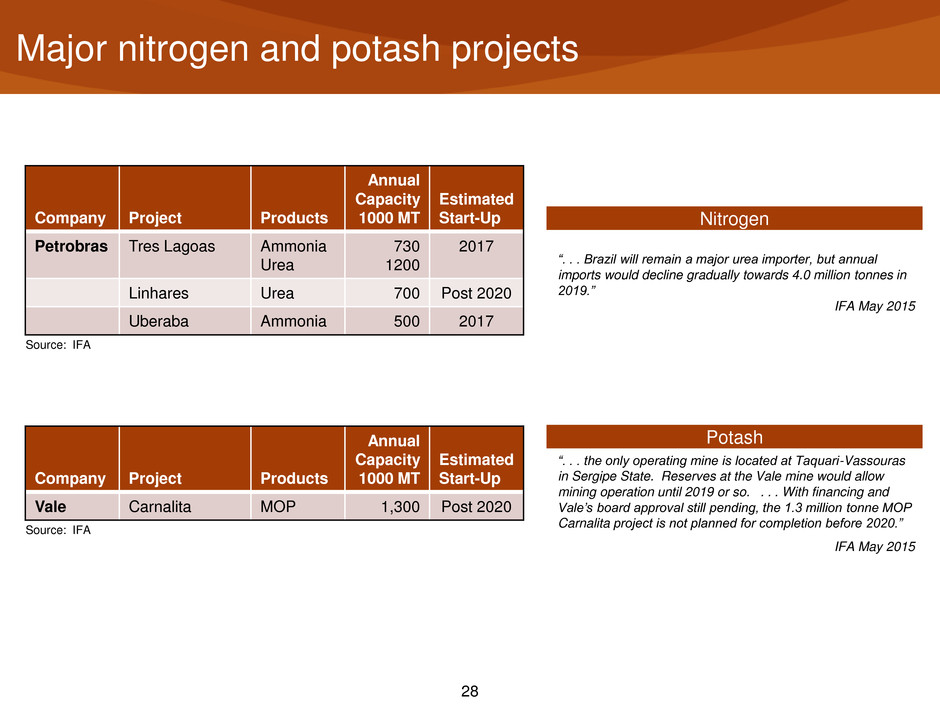

4 Topics and Take-Aways Plant Nutrient Production and Imports - Imports currently account for ~80% of nutrient and ~75% of product shipments - Import shares have trended upward since 2000 and have accelerated recently - Several N, P and K projects are under construction or development today - Economic and political uncertainties may delay completion of some projects - Urea imports are expected to remain flat - MAP/DAP imports are expected to increase slightly - MOP imports are expected to increase significantly Plant Nutrient Distribution Trends - From low analysis to high analysis products - From 50 kg bags to big bags to bulk distribution - From south/southeast to north/northwest - From many small to fewer large distributors - From few to more transportation and logistical options

5 An Agricultural Powerhouse

6 A large and diverse agricultural sector Soybeans: Second largest producer Corn: Third largest producer Sugar Cane: Sugar: Largest producer Ethanol: Second largest producer Coffee: Largest producer Source: USDA

7 A large and diverse agricultural sector Cotton: Fifth largest producer Oranges: Largest juice producer Cattle: Second largest producer Source: USDA

8 A large and diverse agricultural sector 2014 Production Global Share Production Global Rank Export Global Share Export Global Rank Main Market Sugar 22% 1 46% 1 China Ethanol 27% 2 55% 1 USA Soybeans 30% 2 39% 1 China Soybean Meal 15% 4 22% 2 Europe Corn 8% 3 8% 2 Japan Rice 2% 9 2% 8 Venezuela Orange Juice 55% 1 77% 1 Europe Coffee 36% 1 29% 1 USA Cotton 6% 5 11% 5 South Korea Pork 3% 4 8% 4 Russia Poultry 15% 3 34% 1 Saudi Arabia Beef 16% 2 19% 1 Russia Source: USDA

9 Strong positive trends with tailwinds and headwinds Source: CONAB and projections from FIESP Outlook - 20 40 60 80 100 120 140 160 180 200 220 240 2000 2002 2004 2006 2008 2010 2012 2014 2016F 2018F 2020F Mil Tonnes Brazil Grain and Oilseed Production Soybeans Summer Corn Second Crop Corn Wheat Cotton Others Mil Tonnes 2000 2014 Change CAGR Soybeans 38.43 96.20 57.77 7% Summer Corn 35.83 30.31 -5.53 -1% Second Crop Corn 6.46 54.00 47.54 16% Wheat 3.19 7.00 3.80 6% Cotton 1.52 2.32 .80 3% Other 14.83 19.02 4.19 2% Total 100.27 208.84 108.57 5% Grain and oilseed production has increased more than 5% per year since 2000 Soybeans and second crop corn accounted for 97% of the increase during this period Headwinds today, but the weak real and still relatively high soybean and corn prices are expected to sustain positive production trends

10 Increases from both harvested area and yields The increase in grain and oilseed production has come from both additional harvested area and higher yields Soybeans accounted for 84% of the increase in harvested area from 2000 to 2014 Second crop corn accounted for another 11% 20 25 30 35 40 45 50 55 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Ha Brazil Harvested Area Leading Grain and Oilseed Crops Source: USDA 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 00 01 02 03 04 05 6 07 08 09 10 11 12 13 14 MT Ha Brazil Average Yield Leading Grain and Oilseed Crops Source: USDA Soybeans 17.6 84% Corn 2.3 11% Other 1.0 5% Change in Brazil Harvested Area 2000-2014 20.9 Million Hectares Source: USDA

11 Increases in soybean production mostly from more area Increases in harvested area have accounted for nearly four-fifths of the gain in soybean production since 2000 Harvested area has more than doubled since 2000 Brazil soybean yields have trended upward and rank at world-class levels This differs from global trends (i.e. ~90% of production increase from yield gains) 5 10 15 20 25 30 35 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil HA Brazil Soybean Area Source: USDA 2.00 2.25 2.50 2.75 3.00 3.25 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 MT HA Br zil Soybean Yield Source: USDA Area Increase 79% Yield Gain 21% Change in Brazil Soybean Production 2000-2014 Source: USDA

12 Large areas of land available to bring into production Pasture 200 million hectares 59% of arable land Urban Area 2.1 million hectares Planted Area 79.7 million hectares Or 22% of arable land Arable land 340 million hectares Total Area 850 million hectares Source: Conab and IBGE Crop Mil Ha Soybeans 31.9 Corn 15.7 Sugar Cane 9.0 Reforestation 5.7 Edible Beans 3.1 Rice 2.3 Coffee 2.4 Wheat 2.5 Other 7.3 Total 79.7 Nearly 60 million hectares of arable land not in pastures or planted to crops today Some of the 200 million hectares of pasture could be converted to crop production Available Land

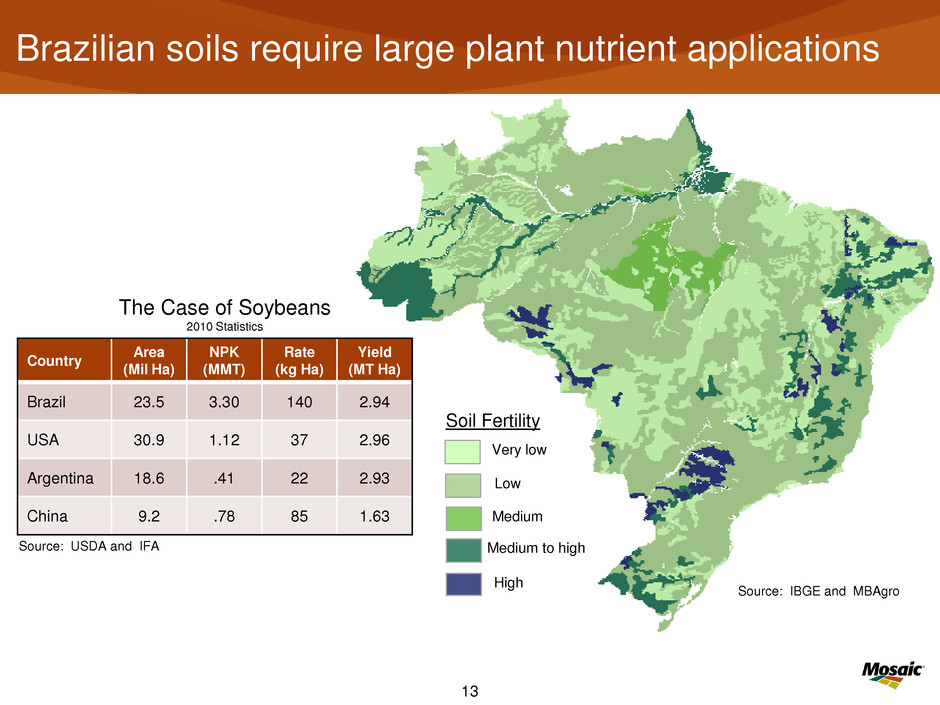

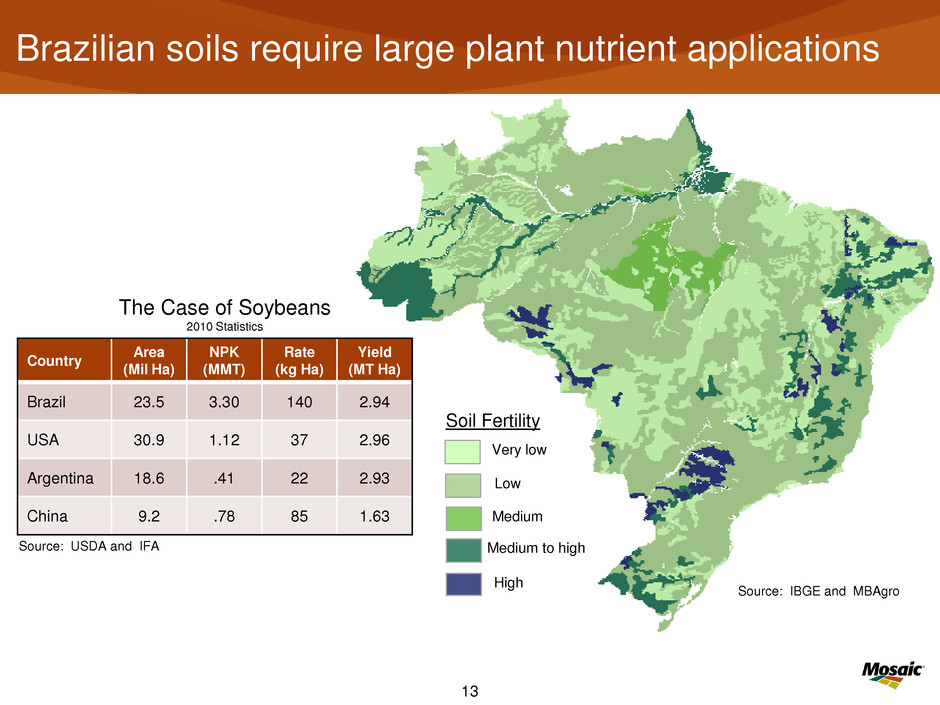

13 Brazilian soils require large plant nutrient applications Source: USDA and IFA High Low Very low Medium Medium to high Soil Fertility The Case of Soybeans 2010 Statistics Country Area (Mil Ha) NPK (MMT) Rate (kg Ha) Yield (MT Ha) Brazil 23.5 3.30 140 2.94 USA 30.9 1.12 37 2.96 Argentina 18.6 .41 22 2.93 China 9.2 .78 85 1.63 Source: IBGE and MBAgro

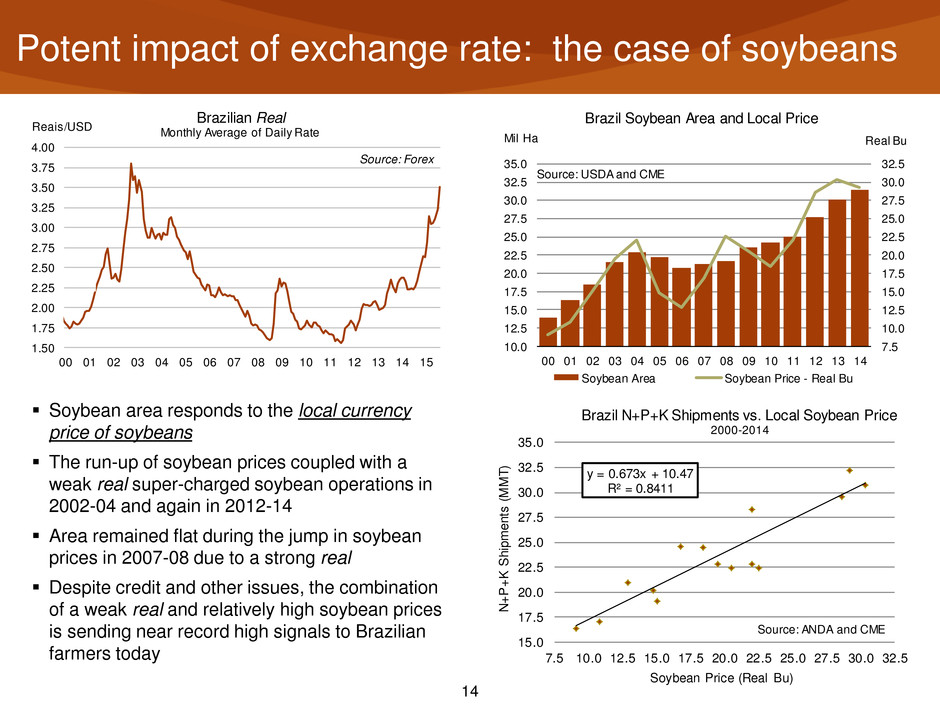

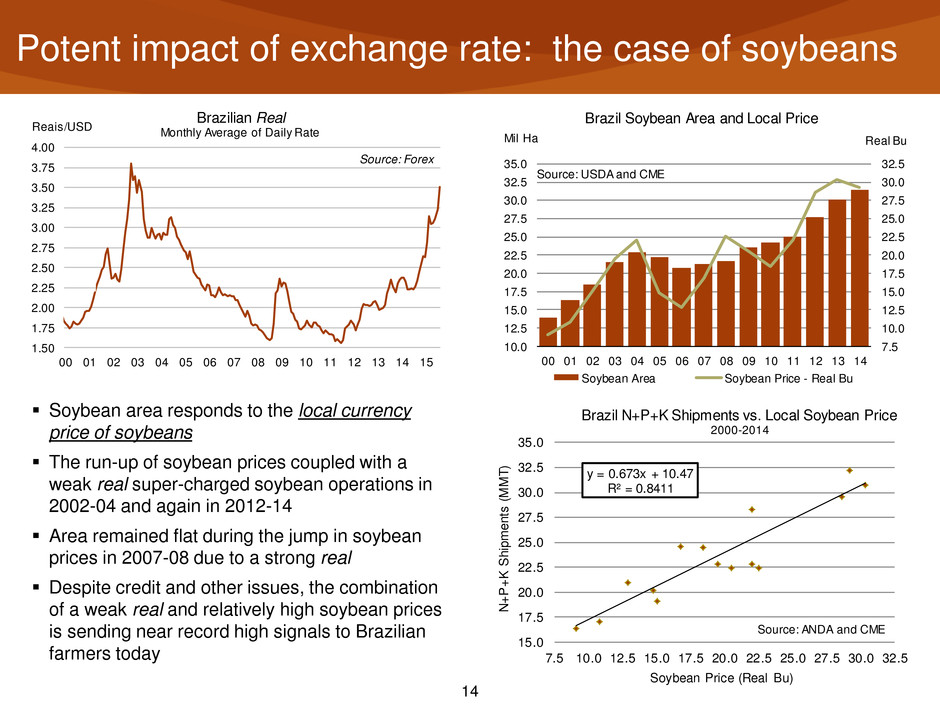

14 Potent impact of exchange rate: the case of soybeans Soybean area responds to the local currency price of soybeans The run-up of soybean prices coupled with a weak real super-charged soybean operations in 2002-04 and again in 2012-14 Area remained flat during the jump in soybean prices in 2007-08 due to a strong real Despite credit and other issues, the combination of a weak real and relatively high soybean prices is sending near record high signals to Brazilian farmers today 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 35.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Real BuMil Ha Brazil Soybean Area and Local Price Soybean Area Soybean Price - Real Bu Source: USDA and CME y = 0.673x + 10.47 R² = 0.8411 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 35.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 N+ P+ K Sh ip m en ts (M M T) Soybean Price (Real Bu) Brazil N+P+K Shipments vs. Local Soybean Price 2000-2014 Source: ANDA and CME 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 00 01 02 03 04 5 06 07 08 09 10 11 12 13 14 15 Reais/USD Brazili n Real Monthly Average of Daily Rate Source: Forex

15 The Brazil-to-China soybean pipeline to grow despite economic slowdowns on both ends China is the world’s largest soybean importer by a wide margin The current economic slowdown is not expected to threaten imports in 2015 (estimated at 75-80 million tonnes) Brazil and the United States are the dominant suppliers of soybeans to China Brazil overtook the United States as the largest exporter to China in 2013 China accounted for more than 70% of Brazil’s soybean exports in 2013 and 2014 China’s share has trended steadily upward and is up from less than 20% in 2000 The weak real enhances the competitiveness of Brazilian supplies on the global market today 15% 20% 25% 30% 35% 40% 45% 50% 55% 0 10 20 30 40 50 60 70 80 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes China Soybean Imports Brazil ROW Brazil Share Source: GTIS 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 5 10 15 20 25 30 35 40 45 50 00 01 02 03 04 5 06 07 08 09 10 11 12 13 14 Mil Tonnes Brazil Soybean Exports China ROW China Share Source: GTIS

16 Implications for Plant Nutrient Demand

17 Strong correlation between crop production and plant nutrient use (no soil alchemy!) Grain and oilseed production has increased 5.6% per year since 2000 Not surprisingly, plant nutrient use also has increased 5.6% per year Product shipments have increased at a slightly slower rate given the substitution of higher analysis products for lower analysis products y = 6.6926x - 21.541 R² = 0.9087 90 100 110 120 130 140 150 160 170 180 190 200 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 Cr op P ro du ct io n (M M T) N+P+K Shipments (MMT Product) Brazil N+P+K Shipments vs. Crop Production 2000-2014 Source: ANDA and USDA 75 90 105 120 135 150 165 180 195 210 225 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes Crops Mil Tonnes Product Brazil N+P+K Shipments and Crop Production N+P+K Shipments Crop Production Source: ANDA and USDA CAGR 2000-14 Grain & Oilseed Production 5.6% N+P+K Shipments (NT) 5.6% N+P+K Shipments (PT) 4.9% N Shipments (NT) 6.2% P Shipments (NT) 5.2% K Shipments (NT) 5.5% Source: USDA and ANDA

18 Strong correlation between crop production and plant nutrient use (no soil alchemy!) Assuming an average yield of 3.75 tonnes per hectare, this analysis suggests that roughly one- quarter of a tonne of plant nutrients or about one- half tonne of plant nutrient products (MOP, MAP and urea) are required for each hectare brought into production Robust growth in the 5%-6% range for all three major nutrients Brazil is a P&K market with phosphate and potash accounting for ~34% and ~38% of total nutrient use and nitrogen the remaining 28% Mosaic is a P&K company! 75 90 105 120 135 150 165 180 195 210 225 0.0 1.5 3.0 4.5 6.0 7.5 9.0 10.5 12.0 13.5 15.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes Crops Mil Tonnes Nutrients Brazil N+P+K Shipments and Crop Production N P K Crop Production Source: ANDA and USDA y = 14.152x - 3.4908 R² = 0.8962 90 100 110 120 130 140 150 160 170 180 190 200 6.0 7. .0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 Cr op P ro du ct io n (M M T) N+P+K Shipments (MMT Nutrient) Brazil N+P+K Shipments vs. Crop Production 2000-2014 Source: ANDA and USDA

19 Plant nutrient demand scenarios Demand scenarios are based on assumptions about grain and oilseed production and correlations with NPK use This analysis indicates that total nutrient use likely will increase from 14 million tonnes in 2014 to 16-18 million tonnes in 2020 Total product shipments are projected to climb to 36.7- 40.8 million tonnes in 2020, up from 32.2 million last year Forecasts exceed current ANDA projections 0 2 4 6 8 10 12 14 16 18 20 00 01 02 03 04 05 06 07 08 09 10 11 12 13 1415F 20F Mil Tonnes Nutrients Brazil N+P+K Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic Grain CAGR 2014-20 2020 Grain Production MMT 2020 N+P+K Shipments MMT Product 2020 N+P+K Shipments MMT Nutrient 2% 224 36.7 16.1 3% 237 38.7 17.0 4% 251 40.8 18.0 ANDA (1.4%) NA (216) 35.5 15.0

20 Nitrogen use by product 2000-14 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes Nutrient Brazil Nitrogen Shipments by Leading Products Urea DAP/MAP AMN AMS Source: ANDA and Mosaic Urea 53% AMN 13% AMS 20% DAP/MAP 13% NPK 1% Brazil Nitrogen Use - 2000 1.7 MMT N Urea 57% AMN 11% AMS 11% DAP/MAP 15% NPK 6% Brazil Nitrogen Use - 2014 3.9 MMT N Mil Tonnes Product 2000 2014 CAGR Ammonium Nitrate 0.71 1.26 4.2% Ammonium Sulphate 1.87 1.97 0.4% Urea 2.27 4.88 5.6%

21 Nitrogen demand scenarios 0 1 2 3 4 5 6 7 00 01 02 03 04 05 06 07 08 09 10 11 12 13 1415F 20F Mil Tonnes Nutrients Brazil Nitrogen Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic 0 1 2 3 4 5 6 7 0 1 2 3 04 05 06 07 08 09 10 11 12 13 14 20F Mil Tonnes Product Brazil Urea Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic Mil Tonnes Urea 2020 CAGR Low 5.6 2.2% Medium 5.9 3.2% High 6.3 4.2% Mil Tonnes N 2020 CAGR Low 4.5 2.5% Medium 4.8 3.5% High 5.0 4.5%

22 Phosphate use by product 2000-14 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes Nutrient Brazil Phosphate Shipments by Leading Products MAP SSP TSP DAP Source: ANDA and Mosaic DAP 3% MAP 43% TSP 17% SSP 35% NPK 2% Brazil Phosphate Use - 2000 2.3 MMT P2O5 DAP 7% MAP 45% TSP 18% SSP 22% NPK 8% Brazil Phosphate Use - 2014 4.8 MMT P2O5 Mil Tonnes Product 2000 2014 CAGR MAP 2.05 4.21 5.3% DAP .18 .74 10.8% TSP .94 1.85 5.0% SSP 4.36 5.23 1.3%

23 Phosphate demand scenarios 0 1 2 3 4 5 6 7 00 01 02 03 04 05 06 07 08 09 10 11 12 13 1415F 20F Mil Tonnes Nutrients Brazil Phosphate Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic 0 1 2 3 4 5 6 7 0 1 2 3 04 05 06 07 08 09 10 11 12 13 14 20F Mil Tonnes Product Brazil MAP+DAP Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic Mil Tonnes MAP+DAP 2020 CAGR Low 5.7 2.3% Medium 6.1 3.6% High 6.6 4.9% Mil Tonnes P2O5 2020 CAGR Low 5.5 2.3% Medium 5.8 3.3% High 6.1 4.3%

24 Potash shipments by product and demand scenarios 0 2 4 6 8 10 12 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 20F Mil Tonnes Product Brazil MOP Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic 0 1 2 3 4 5 6 7 00 01 02 03 04 05 06 07 08 09 10 11 12 13 1415F 20F Mil Tonnes Nutrients Brazil Potash Shipment Scenarios Actual High Low Medium Source: ANDA and Mosaic 0.0 1.0 2.0 3.0 4.0 5.0 6.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Mil Tonnes Nutrient Brazil Potash Shipments by Leading Products MOP Other Source: ANDA and Mosaic Mil Tonnes MOP 2020 CAGR Low 9.8 1.0% Medium 10.3 1.9% High 11.0 2.9%

25 Plant Nutrient Production and Imports

26 Increasingly dependent on imports Imports account for about three-quarters of total product shipments today Imports account for a slightly smaller share of total product shipments due mainly to the large amount of lower analysis SSP production 45% 50% 55% 60% 65% 70% 75% 80% 0 5 10 15 20 25 30 35 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Import Share Mil Tonnes Product Brazil N+P+K Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic 50% 55% 60% 65% 70% 75% 80% 85% 90% 0 2 4 6 8 10 12 14 16 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Import Share Mil Tonnes Nutrient Brazil N+P+K Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic Imports account for more than 80% of total nutrient shipments today, up from about 65% in 2000 This share has trended upward since 2000 and has accelerated with the faster demand growth in recent years These are shares of implied shipments, defined as production plus imports minus exports. Domestic supply is production minus exports.

27 Import shares by nutrient Imports account for ~80% of N shipments Imports account for ~60% of P shipments Imports account for 95+% of K shipments Shares have trended upward especially this decade 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Import Share Mil Tonnes Nutrient Brazil Nitrogen Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 0 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Import Share Mil Tonnes Nutrient Brazil Phosphate Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic 80.0% 82.5% 85.0% 87.5% 90.0% 92.5% 95.0 97.5 0.0 1.0 2.0 3.0 4.0 5.0 6 0 7.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Import Share Mil Tonnes Nutrient Brazil Potash Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic These are shares of implied shipments, defined as production plus imports minus exports. Domestic supply is production minus exports.

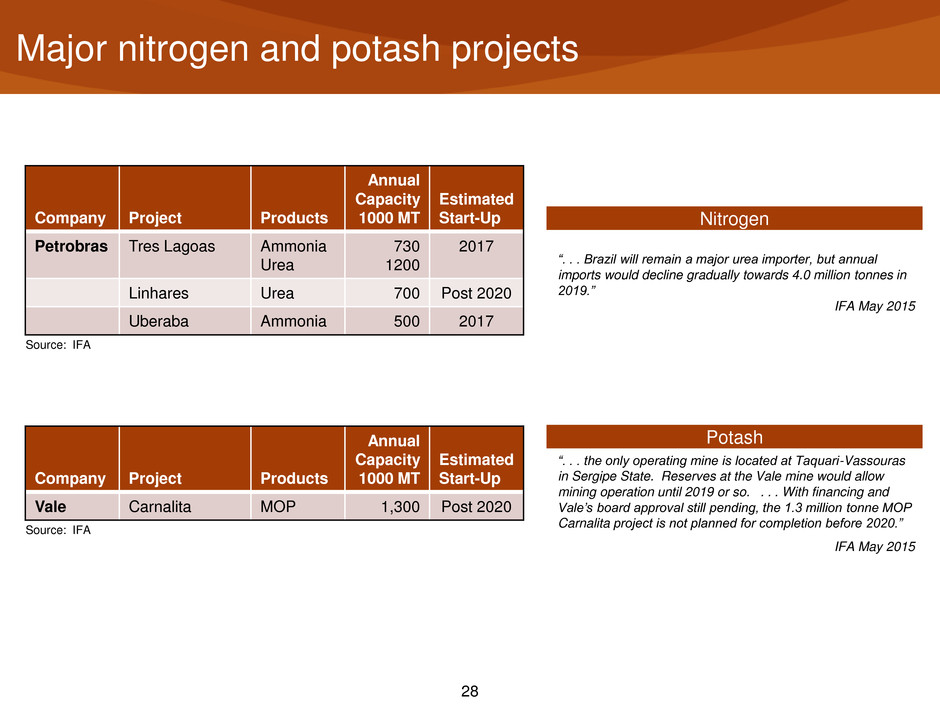

28 Major nitrogen and potash projects Company Project Products Annual Capacity 1000 MT Estimated Start-Up Vale Carnalita MOP 1,300 Post 2020 Source: IFA “. . . the only operating mine is located at Taquari-Vassouras in Sergipe State. Reserves at the Vale mine would allow mining operation until 2019 or so. . . . With financing and Vale’s board approval still pending, the 1.3 million tonne MOP Carnalita project is not planned for completion before 2020.” IFA May 2015 Potash Nitrogen “. . . Brazil will remain a major urea importer, but annual imports would decline gradually towards 4.0 million tonnes in 2019.” IFA May 2015 Company Project Products Annual Capacity 1000 MT Estimated Start-Up Petrobras Tres Lagoas Ammonia Urea 730 1200 2017 Linhares Urea 700 Post 2020 Uberaba Ammonia 500 2017 Source: IFA

29 Major phosphate projects Company Project Products Annual Capacity 1000 MT Estimated Start-Up Anglo Catalao (Ouvidor) Rock Acid (P2O5) MAP TSP 1,200 400 520 240 Post 2020 2018 2018 2018 Galvani Serra do Salitre Rock Acid (P2O5) MAP/NPK 1,200 200 350 2018 Santa Quiteria Rock Acid (P2O5) MAP/NPK 800 240 290 2019 Vale Salitre Patrocinio Rock Acid (P2O5) MAP TSP 1,100 560 780 330 2019 Post 2020 Post 2020 Post 2020 Source: IFA “. . . mining expansions are pursued by Vale, Anglo American and Galvani. All these developments are aimed to secure feedstock for downstream phosphate fertilizers. Assuming the completion of announced projects, Brazil’s P- fertilizer capacity (MAP, DAP, TSP, SSP and NPK) would reach 3.9 million tonnes P2O5 in 2019 compared with 3.2 million tonnes in 2014. As P-fertilizer demand in Brazil is projected to grow at an annual rate of 2.5%-3.0% between 2014 and 2019, annual imports of phosphate fertilizers will likely remain firm at 2.4- 2.6 million tonnes P2O5 over the next five years.” IFA May 2015 Phosphate

30 Key product imports for medium demand scenario 40% 50% 60% 70% 80% 90% 100% 0.0 1.0 2.0 3.0 4.0 5.0 6.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 20F Import Share Mil Tonnes Product Brazil Urea Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic 50% 55% 60% 65% 70% 75% 80% 85% 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 20F Import Share Mil Tonnes Product Brazil MAP+DAP Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic 82% 85% 88% 91 94 97 100% 0.0 2.0 4.0 6.0 8.0 10.0 12.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 20F Import Share Mil Tonnes Product Brazil MOP Shipments Domestic Supply Imports Import Share Source: ANDA and Mosaic Mil Tonnes Urea DAP+ MAP MOP 2014 Domestic Supply 0.8 1.2 0.5 2014 Imports 4.0 3.8 9.1 2014 Import Share 83% 76% 95% 2020 Domestic Supply 2.0 2.2 0.2 2020 Imports 3.9 4.0 10.2 2020 Import Share 66% 71% 98%

31 Plant Nutrient Distribution Trends

32 Profile Products - Bulk blends account for 75% of products delivered to end users - Bulk blends include N+P+K as well as key micro nutrients (many SKUs) Seasonality - First semester: 35%-40% of total shipments - Second semester: 60%-65% of total shipments Shipments today - By type • 40% in 50 kg bags • 55% in “big” or one tonne bags • 5% in bulk - By transportation mode • 95% delivered by truck • 5% delivered by rail Source: Mosaic Brazil

33 Slowly developing distribution trends From low analysis to high analysis products From bags to big bags to bulk distribution From south/southeast to north/northwest From many small to fewer large distributors From few to more transportation and logistical options

34 From south/southeast to north/northwest 4.60 M MT 28% 5.65 M MT 34% 4.46 M MT 27% 1.68 M MT 11% 2014 2000 8.77 M MT 27% 8.04 M MT 25% 10.53 M MT 33% 4.85 M MT 15% Source: ANDA Region 2000 2014 CAGR South 4.60 8.78 4.7% Midwest 4.46 10.53 6.3% Southeast 5.65 8.04 2.6% North/Northeast 1.68 4.85 7.9% Brazil Total 16.39 32.21 4.9%

35 From many small to fewer large distributors Source: SIACESP, press clippings. Recent Developments 1. Yara acquires: • Bunge (2012) • ODF Holdings (2013) • Galvani 60% equity stake (2014) 2. Mosaic acquires ADM (2014) 3. Heringer: • OCP acquires 10% stake (2014) • PCS acquires 10% stake (2015) 4. Further consolidation expected 2006 Imports 2014 Imports Largest importers Share on total Imports Yara 24% Mosaic (+ADM) 16% Fertipar 16% Heringer 14% São Luiz 2% Louis Dreyfus 2% Tocantins 2% Others 23% Total 100% Largest importers Share on total Imports Bunge 25% Fertipar 12% Heringer 11% Trevo 9% Mosaic 8% ADM 5% Peninsula 2% Others 28% Total 100% • 77 importers • Top 4: 70% • 98 importers • Top 4: 57%

36 From many small to fewer large distributors Importers Producers Blenders End Users Distributors • Mosaic • OCP • Yara • Ameropa • Anglo America • Petrobrás • Vale • Mosaic • Yara/Galvani • Mosaic • Yara • Heringer • Fertipar • Cooperatives • Retail Dealers • Trading Companies (Cargill, ADM, Bunge, LDC) • Farmers • Agroindustries • Megafarmers Looking for barter

37 From few to more transportation and logistical options Legend: Roadway (awarded) Railroad (awarded) Railroad (existing) Railroad (under study) Waterway (existing) Port Project MT MS TO GO BA PA Key Brazilian Agricultural Infrastrcture Projects 3x 3x MA More than 10 port terminal projects valued at $270 million with 70% in the northern region 30% of Brazilian road investments expected to improve access to the fastest- growing MATOPI region (confluence of States of Maranhão, Piaui and Tocantins PI MG SP PR RS SC $14.5 billion or 80% of the highway investment is targeted to reduce logistics costs in the center region of Brazil AM RO AP RR AC CE ES AL PE PB RN RJ Source: 5-year range plan released in January 2014 by Brazilian Ministry of Finance Cost reduction for both grain exports and input imports Cost reduction for grain exports and higher demand for inputs imports The Cerrado is the grain-producing and input-consuming region in Brazil Approximately US$435 billion in infrastructure investments either in public investments or in concessions during the next several years. 1 1 BR 163 (PA – MS) 2 2 BR 153 (GO – TO) 3 BR 060 (MG – GO) 4 4 BR 040 (MG – GO) 5 6 9 7 8 9 Itaqui - Açailândia 3 5 6 7 8 10 11 PR: North-South railroad 10 Rio Grande (RS) – Passo Fundo (RS) 11 Vitoria (ES) - Estrela D’oeste railroad Santos (SP) – Estrela D’oeste railroad Santos (SP) – Rondonopolis (MT) Lucas do Rio Verde (MT) – Campinorte (GO) Key Awarded Projects:

38 Outlook for Brazil Dr. Michael R. Rahm Vice President – Market and Strategic Analysis (with an assist from Mosaic’s Sao Paulo team) Sixth CRU-GPCA Fertilizer Convention InterContinental Dubai Festival City, UAE September 16, 2015 Thank You!