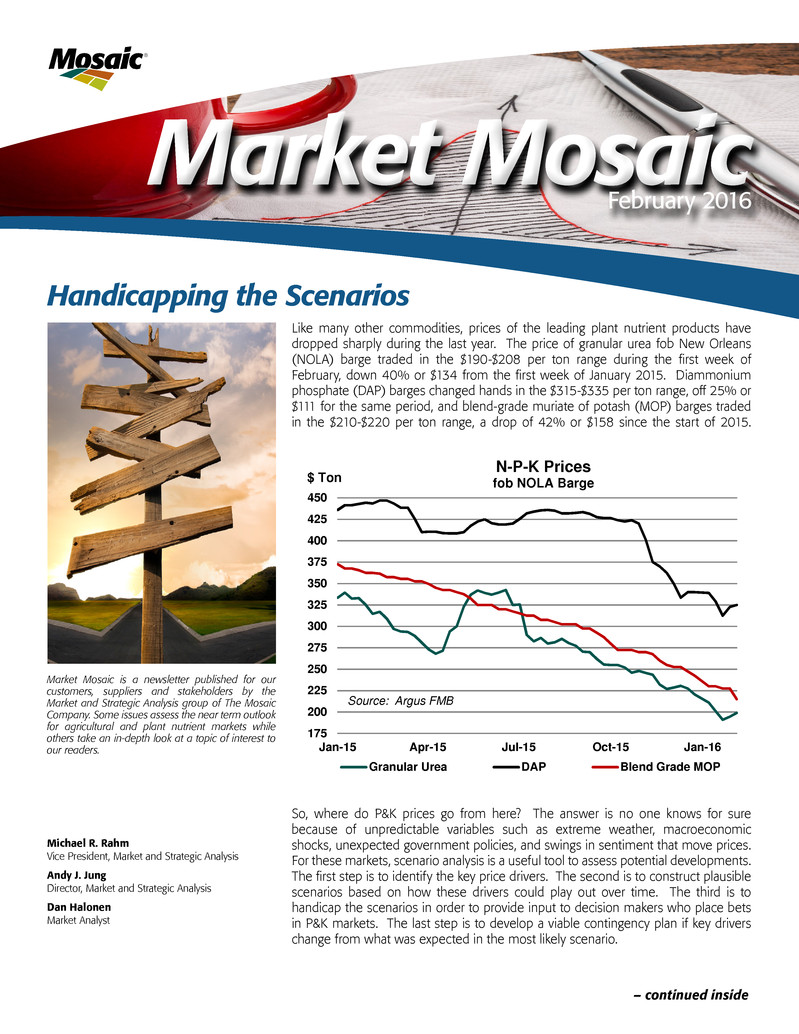

Michael R. Rahm Vice President, Market and Strategic Analysis Andy J. Jung Director, Market and Strategic Analysis Dan Halonen Market Analyst Market Mosaic is a newsletter published for our customers, suppliers and stakeholders by the Market and Strategic Analysis group of The Mosaic Company. Some issues assess the near term outlook for agricultural and plant nutrient markets while others take an in-depth look at a topic of interest to our readers. Handicapping the Scenarios – continued inside Like many other commodities, prices of the leading plant nutrient products have dropped sharply during the last year. The price of granular urea fob New Orleans (NOLA) barge traded in the $190-$208 per ton range during the first week of February, down 40% or $134 from the first week of January 2015. Diammonium phosphate (DAP) barges changed hands in the $315-$335 per ton range, off 25% or $111 for the same period, and blend-grade muriate of potash (MOP) barges traded in the $210-$220 per ton range, a drop of 42% or $158 since the start of 2015. So, where do P&K prices go from here? The answer is no one knows for sure because of unpredictable variables such as extreme weather, macroeconomic shocks, unexpected government policies, and swings in sentiment that move prices. For these markets, scenario analysis is a useful tool to assess potential developments. The first step is to identify the key price drivers. The second is to construct plausible scenarios based on how these drivers could play out over time. The third is to handicap the scenarios in order to provide input to decision makers who place bets in P&K markets. The last step is to develop a viable contingency plan if key drivers change from what was expected in the most likely scenario. Market Mosaic February 2016 ® 175 200 225 250 275 300 325 350 375 400 425 450 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 $ Ton Source: Argus FMB N-P-K Prices fob NOLA Barge Granular Urea DAP Blend Grade MOP

Three scenarios are described and handicapped in this issue of Market Mosaic: An Uptick, Another Step Down, and A Rebound. Each scenario depicts what you would have to believe for P&K prices to move in these directions. That obviously is the easy part. Handicapping them is the tough part, and everyone has their homemade system of analysis as well as hunches for assigning a likelihood to each scenario. From our handicapping shop, the most likely scenario (.60 probability) is a moderate uptick in P&K prices from today’s seasonally low values once demand hits the market during the next few months. Another step down in prices is possible but looks less likely (.20 probability), especially given the large declines that have occurred and our assessment of the supply and demand outlook. A rebound in prices also is possible but less likely (.20 probability) absent a weather shock and quick turnarounds of other key drivers. Place your bets! An Uptick PP&K prices in this scenario are projected to tick up and hold from today’s seasonally low values largely as a result of significant demand expected to hit markets during the next few months. In addition, this scenario assumes that global financial markets will settle down soon. As a consequence, key P&K currencies as well as energy prices are expected to stabilize or even strengthen a bit. Raw materials costs also are assumed to remain about flat, and no new capacity is expected online this year. Steady and strong demand, however, is the key feature of this scenario. Demand prospects are expected to remain positive for sound economic and agronomic reasons. The combination of moderate crop prices, large declines in plant nutrient and fuel costs, and record P&K removal during the last three years underpins demand. We think our plant nutrient affordability metric provides the most concise and compelling evidence for this view. This metric is the ratio of an index of domestic urea, DAP and MOP prices and an index of corn, wheat and soybean futures prices. Large declines in NPK prices coupled with more moderate drops in crop prices have significantly improved affordability. For example, this metric registered .61 during the first week of February, down 29% from .86 a year earlier and off 15% from the five-year average of .72. The drop has resulted from the plant nutrient index declining faster than the crop price index. The plant nutrient index is down 34% while the crop price index is off just 7% from readouts a year ago. This scenario assumes that agricultural commodity prices will continue to trade in a relatively narrow channel with 2016 new crop corn, soybean and wheat prices trading in the $4/$9/$5 per bushel range, respectively. Unlike energy and metals markets, we see no structural imbalance in agricultural commodity markets. Corn is not oil – farmers can’t frack it. And soybeans are not iron ore. The Chinese can stop building skyscrapers but they cannot stop eating. The recent declines in agricultural prices simply have resulted from a string of outstanding harvests rather than a chronic imbalance caused by a game-changing technological breakthrough or a macroeconomic development. Global grain and oilseed stocks expand and prices decrease when yields exceed trend. Conversely, inventories shrink and prices increase when yields drop below trend. The latest estimates released by the USDA on February 9 show that yields in 2015/16 were in line with trend. Not surprisingly, global grain and oilseed inventories are forecast to increase slightly this crop year. However, inventories are projected to build in China and decline in the rest of the world. The same holds true for corn. “Unlike energy and metals markets, we see no structural imbalance in agricultural commodity markets. Corn is not oil – farmers can’t frack it. And soybeans are not iron ore. The Chinese can stop building skyscrapers but they cannot stop eating.” - Dr. Michael R. Rahm 0.50 0.60 0.70 0.80 0.90 1.00 10 11 12 13 14 15 16 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average 2010-14 Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic 10% 11% 12% 13% 14% 15% 16% 17% 18% 40 50 60 70 80 90 100 110 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15F PercentMil Tonnes World Less China Corn Stocks Stocks Percent of Use Source: USDA

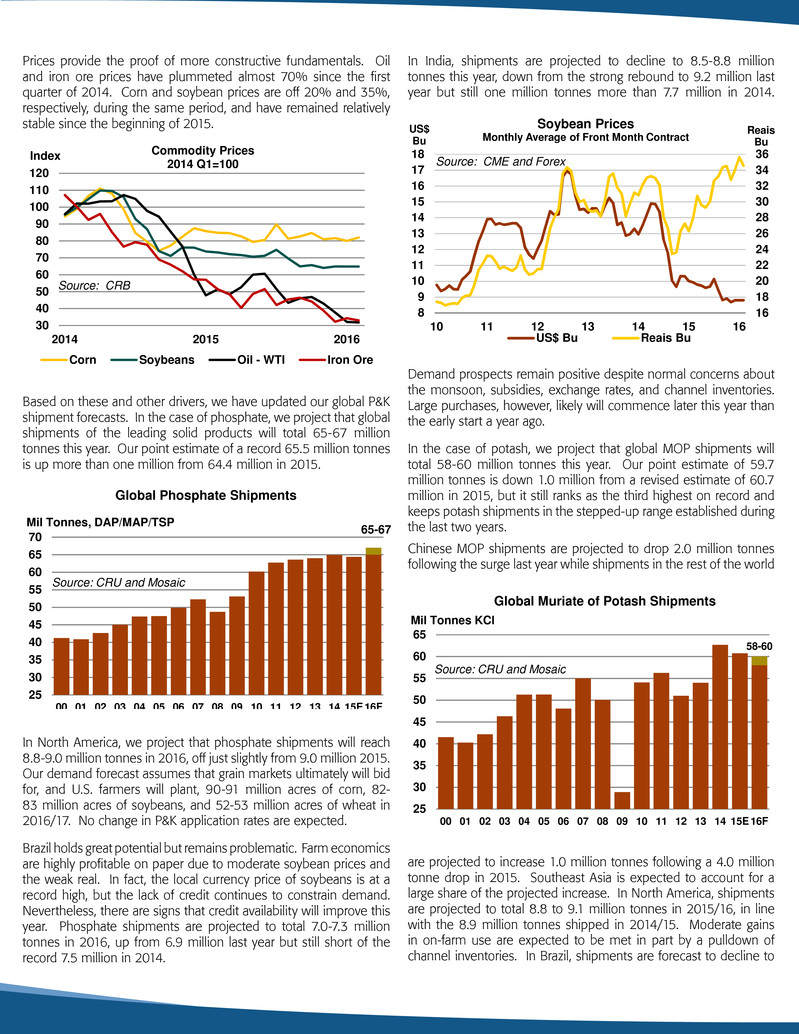

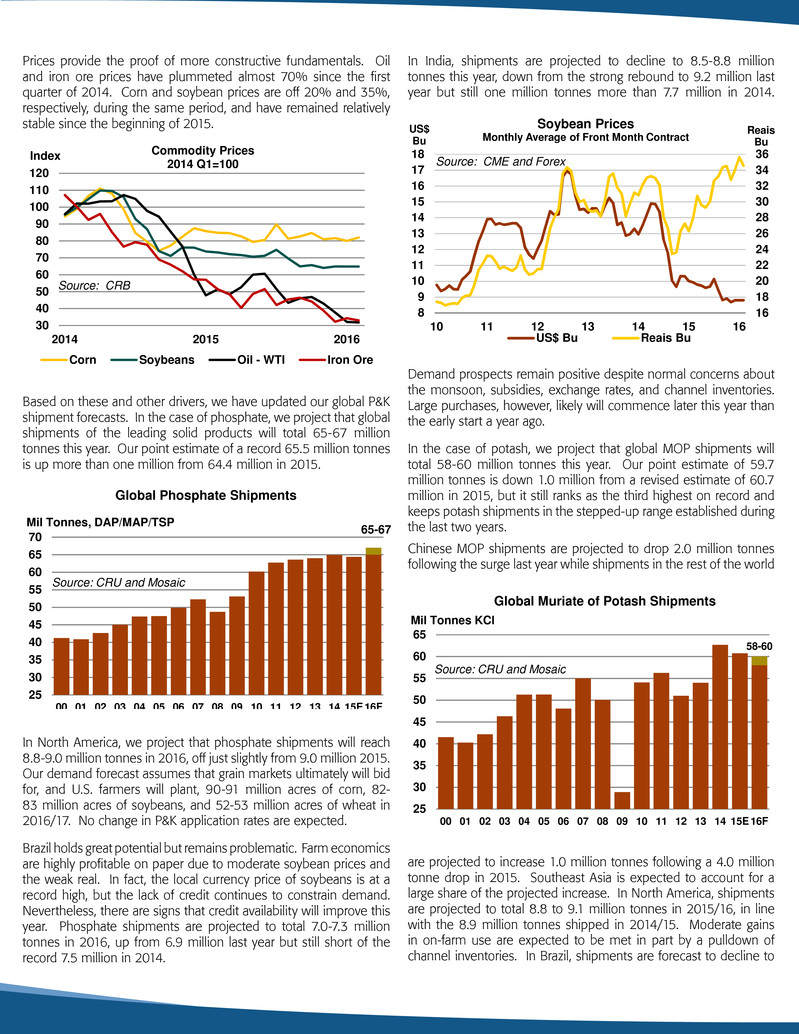

Prices provide the proof of more constructive fundamentals. Oil and iron ore prices have plummeted almost 70% since the first quarter of 2014. Corn and soybean prices are off 20% and 35%, respectively, during the same period, and have remained relatively stable since the beginning of 2015. Based on these and other drivers, we have updated our global P&K shipment forecasts. In the case of phosphate, we project that global shipments of the leading solid products will total 65-67 million tonnes this year. Our point estimate of a record 65.5 million tonnes is up more than one million from 64.4 million in 2015. In North America, we project that phosphate shipments will reach 8.8-9.0 million tonnes in 2016, off just slightly from 9.0 million 2015. Our demand forecast assumes that grain markets ultimately will bid for, and U.S. farmers will plant, 90-91 million acres of corn, 82- 83 million acres of soybeans, and 52-53 million acres of wheat in 2016/17. No change in P&K application rates are expected. Brazil holds great potential but remains problematic. Farm economics are highly profitable on paper due to moderate soybean prices and the weak real. In fact, the local currency price of soybeans is at a record high, but the lack of credit continues to constrain demand. Nevertheless, there are signs that credit availability will improve this year. Phosphate shipments are projected to total 7.0-7.3 million tonnes in 2016, up from 6.9 million last year but still short of the record 7.5 million in 2014. In India, shipments are projected to decline to 8.5-8.8 million tonnes this year, down from the strong rebound to 9.2 million last year but still one million tonnes more than 7.7 million in 2014. Demand prospects remain positive despite normal concerns about the monsoon, subsidies, exchange rates, and channel inventories. Large purchases, however, likely will commence later this year than the early start a year ago. In the case of potash, we project that global MOP shipments will total 58-60 million tonnes this year. Our point estimate of 59.7 million tonnes is down 1.0 million from a revised estimate of 60.7 million in 2015, but it still ranks as the third highest on record and keeps potash shipments in the stepped-up range established during the last two years. Chinese MOP shipments are projected to drop 2.0 million tonnes following the surge last year while shipments in the rest of the world are projected to increase 1.0 million tonnes following a 4.0 million tonne drop in 2015. Southeast Asia is expected to account for a large share of the projected increase. In North America, shipments are projected to total 8.8 to 9.1 million tonnes in 2015/16, in line with the 8.9 million tonnes shipped in 2014/15. Moderate gains in on-farm use are expected to be met in part by a pulldown of channel inventories. In Brazil, shipments are forecast to decline to 16 18 20 22 24 26 28 30 32 34 36 8 9 10 11 12 13 14 15 16 17 18 10 11 12 13 14 15 16 Reais Bu US$ Bu Source: CME and Forex Soybean Prices Monthly Average of Front Month Contract US$ Bu Reais Bu 58-60 25 30 35 40 45 50 55 60 65 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E16F Global Muriate of Potash Shipments Source: CRU and Mosaic Mil Tonnes KCl 25 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E16F Global Phosphate Shipments Source: CRU and Mosaic Mil Tonnes, DAP/MAP/TSP 65-67 30 40 50 60 70 80 90 100 110 120 2014 2015 2016 Index Source: CRB Commodity Prices 2014 Q1=100 Corn Soybeans Oil - WTI Iron Ore

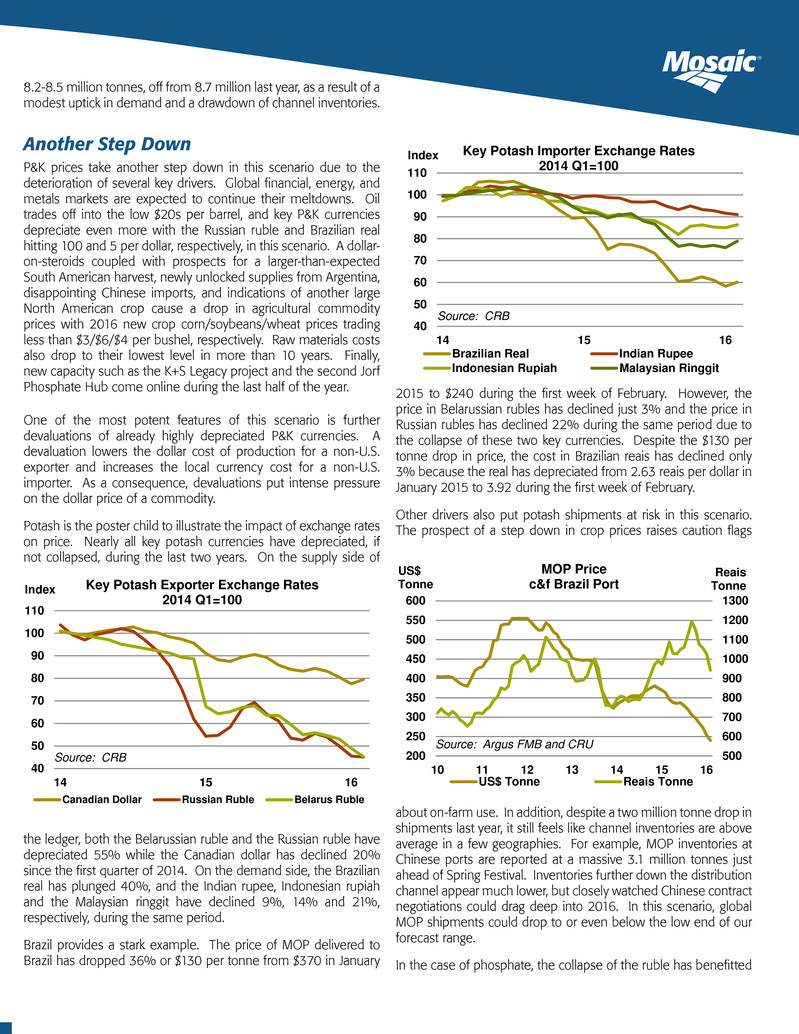

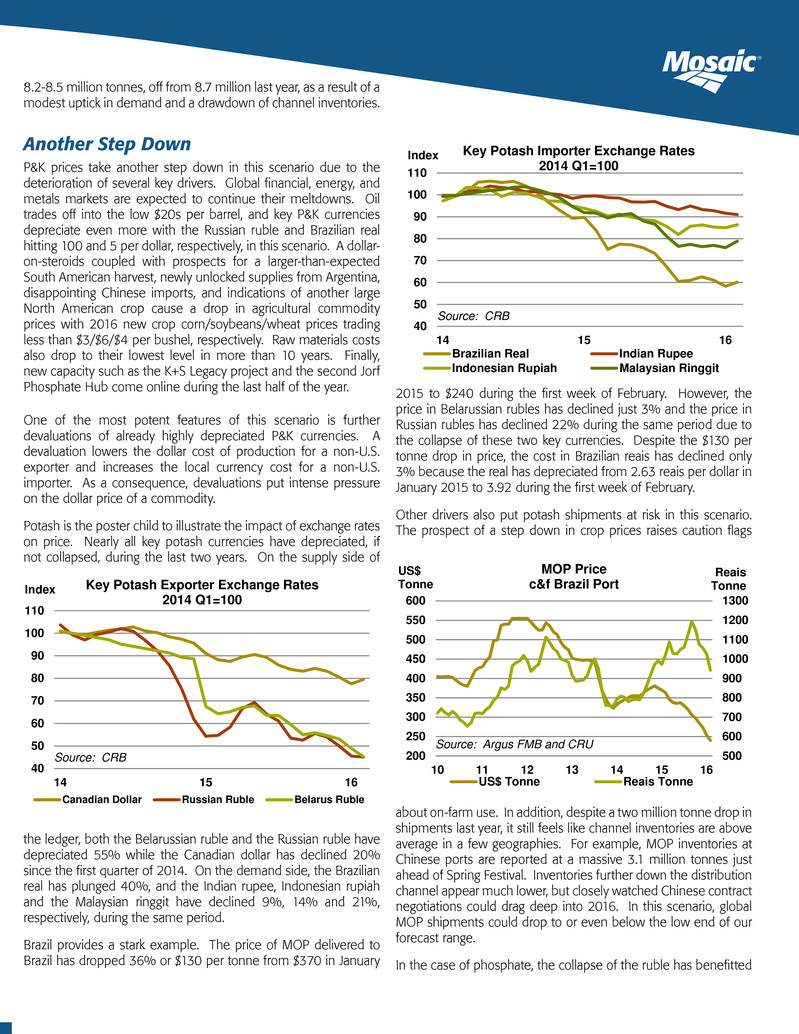

8.2-8.5 million tonnes, off from 8.7 million last year, as a result of a modest uptick in demand and a drawdown of channel inventories. Another Step Down P&K prices take another step down in this scenario due to the deterioration of several key drivers. Global financial, energy, and metals markets are expected to continue their meltdowns. Oil trades off into the low $20s per barrel, and key P&K currencies depreciate even more with the Russian ruble and Brazilian real hitting 100 and 5 per dollar, respectively, in this scenario. A dollar- on-steroids coupled with prospects for a larger-than-expected South American harvest, newly unlocked supplies from Argentina, disappointing Chinese imports, and indications of another large North American crop cause a drop in agricultural commodity prices with 2016 new crop corn/soybeans/wheat prices trading less than $3/$6/$4 per bushel, respectively. Raw materials costs also drop to their lowest level in more than 10 years. Finally, new capacity such as the K+S Legacy project and the second Jorf Phosphate Hub come online during the last half of the year. One of the most potent features of this scenario is further devaluations of already highly depreciated P&K currencies. A devaluation lowers the dollar cost of production for a non-U.S. exporter and increases the local currency cost for a non-U.S. importer. As a consequence, devaluations put intense pressure on the dollar price of a commodity. Potash is the poster child to illustrate the impact of exchange rates on price. Nearly all key potash currencies have depreciated, if not collapsed, during the last two years. On the supply side of the ledger, both the Belarussian ruble and the Russian ruble have depreciated 55% while the Canadian dollar has declined 20% since the first quarter of 2014. On the demand side, the Brazilian real has plunged 40%, and the Indian rupee, Indonesian rupiah and the Malaysian ringgit have declined 9%, 14% and 21%, respectively, during the same period. Brazil provides a stark example. The price of MOP delivered to Brazil has dropped 36% or $130 per tonne from $370 in January 2015 to $240 during the first week of February. However, the price in Belarussian rubles has declined just 3% and the price in Russian rubles has declined 22% during the same period due to the collapse of these two key currencies. Despite the $130 per tonne drop in price, the cost in Brazilian reais has declined only 3% because the real has depreciated from 2.63 reais per dollar in January 2015 to 3.92 during the first week of February. Other drivers also put potash shipments at risk in this scenario. The prospect of a step down in crop prices raises caution flags about on-farm use. In addition, despite a two million tonne drop in shipments last year, it still feels like channel inventories are above average in a few geographies. For example, MOP inventories at Chinese ports are reported at a massive 3.1 million tonnes just ahead of Spring Festival. Inventories further down the distribution channel appear much lower, but closely watched Chinese contract negotiations could drag deep into 2016. In this scenario, global MOP shipments could drop to or even below the low end of our forecast range. In the case of phosphate, the collapse of the ruble has benefitted ® 40 50 60 70 80 90 100 110 14 15 16 Index Source: CRB Key Potash Exporter Exchange Rates 2014 Q1=100 Canadian Dollar Russian Ruble Belarus Ruble 500 600 700 800 900 1000 1100 1200 1300 200 250 300 350 400 450 500 550 600 10 11 12 13 14 15 16 Reais Tonne US$ Tonne Source: Argus FMB and CRU MOP Price c&f Brazil Port US$ Tonne Reais Tonne 40 50 60 70 80 90 100 110 14 15 16 Index Source: CRB Key Potash Importer Exchange Rates 2014 Q1=100 Brazilian Real Indian Rupee Indonesian Rupiah Malaysian Ringgit

Russian exporters, especially because phosphate prices held up through October 2015. More worrisome is the potential for a devaluation of the Chinese RMB. China has emerged as the largest exporter of the leading phosphate products, and a significant devaluation could more than offset the impact of the recently imposed VAT tax and lower costs for Chinese producers. A Rebound P&K prices rebound in this scenario as a result of a pop in crop prices and the beginning of a strong “the-crisis-is-over” recovery in global financial markets. Agricultural commodity prices rally due to steady demand growth, a smaller-than- expected Southern Hemisphere harvest, and growing concerns about a rapid transition from El Niño to La Niña and the corresponding higher odds of a North American drought this summer. In particular, 2016 new crop corn, soybean and wheat prices rally to $5/$11/$6 per bushel range, respectively. Global equity markets surge out of bear territory mainly on good news about the Chinese economy. The dollar weakens, and key P&K currencies strengthen more than a bit. Raw materials costs also inch up based on improved demand prospects. Sentiment suddenly turns positive. A pop in agricultural commodity prices is the trigger for this scenario. Agricultural commodities have been tarred with the same brush used on energy and metals, but fundamentals for most crops are more constructive than energy and metals fundamentals. As noted above, the world will gobble up the 2015/16 bumper crop, and stocks outside China are projected to decline this year. History has demonstrated that crop prices can turn quickly thanks in large part to Mother Nature. There clearly is a wide range of potential outcomes in 2016/17. Demand continues its steady march upward, and macroeconomic and political headwinds typically have little impact on food demand. Demand growth of 2% coupled with below trend yields would result in a material drawdown of global grain and oilseed stocks. So while not a high likelihood this year, a pop in agricultural commodity prices is not a zero probability either. In the case of phosphate, recent price declines look more like seasonal variation rather than a cyclical downturn in this scenario. A potential rally in crop prices likely would boost global shipments to the upper end of our forecast range or about 67 million tonnes. Indian demand got back on track last year. India imported 6.25 million tonnes of DAP in 2015, up 65% or 2.5 million tonnes from 3.8 million in 2014. In this scenario, imports this year could easily exceed forecast assuming a normal monsoon, no radical change in subsidy policies, and a stable to slightly stronger rupee. A bounce back in Brazilian shipments also is expected in this scenario. Highly profitable farm economics coupled with an earlier release of credit could boost shipments into record territory. In the case of potash, higher crop prices also are expected to boost global MOP shipments to or beyond the upper end of our forecast range. On the supply side of the ledger, we have long maintained that operational capacity is far less than nameplate capacity for the global industry. In fact, our estimate of the maximum amount that the industry could produce this year is about 68 million tonnes MOP. In this scenario, the global industry would operate at 88% of true capacity. With no price pressure from currency devaluations, a demand rebound likely would pull up prices. Finally, we expect no major capacity additions including the K+S Legacy project will come on line and no disruptive Canpotex proving runs will take place in 2016. 0 750 1500 2250 3000 3750 4500 5250 6000 200 250 300 350 400 450 500 550 600 10 11 12 13 14 15 16 US$ Tonne Source: Argus FMB and CRU MOP Price c&f Brazil Port US$ Tonne 1000 Belarussian Rubles Tonne Bel Rubles Tonne 350 400 450 500 550 600 650 700 750 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E16F Mil Tonnes World Grain & Oilseed Stocks Actual/Estimate Mosaic Range Mosaic Medium Scenario Source: USDA and Mosaic

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture) and other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply agreement with CF, including the risk that the cost savings from the agreement may not be realized or that the price of natural gas or ammonia during the agreement’s term are at levels at which the pricing becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/ or available debt capacity to fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. The Mosaic Company Atria Corporate Center, Suite E490 3033 Campus Drive Plymouth, MN 55441 (800) 918-8270 (763) 577-2700 ® 4R Nutrient Stewardship W e S uppo r t & P r omo t e RIGHT SOURCE RIGHT RATE RIGHT TIME RIGHT PLACE