Michael R. Rahm Vice President, Market and Strategic Analysis Andy J. Jung Director, Market and Strategic Analysis Josh Paula Market Analysis Manager Dan Halonen Market Analyst Market Mosaic is a quarterly newsletter published for our customers, suppliers and stakeholders by the Market and Strategic Analysis group of The Mosaic Company. Some issues assess the near term outlook for agricultural and plant nutrient markets while others take and in-depth look at a topic of interest to our readers. This issue provides a deep- dive analysis of the global potash market. Our next two issues will include similar deep-dive analyses of agricultural commodity and phosphate markets. Potash Deep-Dive Analysis – continued inside This issue takes an in-depth look at recent potash market developments as well as prospects for the next five years. We begin by providing a postmortem of the 2015- 16 price collapse. Our conclusion is that a combination of three factors proved lethal to potash prices: the extraordinarily large build of channel inventories in 2014 and subsequent declines in global shipments in 2015 and 2016; a slug of new brownfield capacity commissioned from 2013 to 2015; and lower industry costs driven largely by the depreciation of key potash currencies. We then highlight the rapid and significant adjustments that we see taking place in response to lower prices. Producers have permanently closed several high-cost operations and are running low-cost facilities at steady rates in order to reduce unit costs and compete profitably in this new market environment. Distributors continue to destock elevated channel inventories, and lower prices are building a larger demand base. As a result, the global market is coming into balance during the second half of 2016. The rebound of spot prices in the Americas as well as higher prices in recent Southeast Asian tenders provide the best evidence. Another good barometer of the combined impact of these adjustments is a large projected drawdown of North American producer stocks during the second half of this year. Finally, we share our outlook for 2017, which looks constructive due to solid on-farm demand worldwide, a rebound in global shipments, and restructured operations by several leading producers. Beyond next year, we see no chronic supply/demand imbalance. In fact, we project that the global operating rate will remain stable during the next five years as a result of steady demand growth, restructured operations, and likely delays and slower ramp-ups of the much anticipated greenfield projects in Canada and Russia. Even the latest CRU forecasts are in line with this view. 2015-16 Price Collapse: A Post Mortem Collapse is about the only way to describe the drop in spot prices at two of the most liquid and transparent price discovery points. The New Orleans (NOLA) barge price plunged 54% from a peak of $413 per tonne in September 2014 to $190 per tonne in July 2016. This price has begun to recover and was trading in the $232 per tonne range at the end of October, up 22% from the summer low but still off 44% from the 2014 peak. The Brazil vessel price dropped 43% from a high-water mark of $382 per tonne in November 2014 to a low of $218 per tonne in June 2016. This price also has begun to rebound and was trading in the $235 per tonne range at the end of October, up 8% from the low last June but 38% less than the peak two years ago. Market Mosaic November 2016 ® 175 200 225 250 275 300 325 350 375 400 425 Jan-14 Jul-14 Dec-14 Jul-15 Dec-15 Jun-16 $ Tonne Source: Argus FMB Potash Prices fob NOLA Barge c&f Brazil Vessel

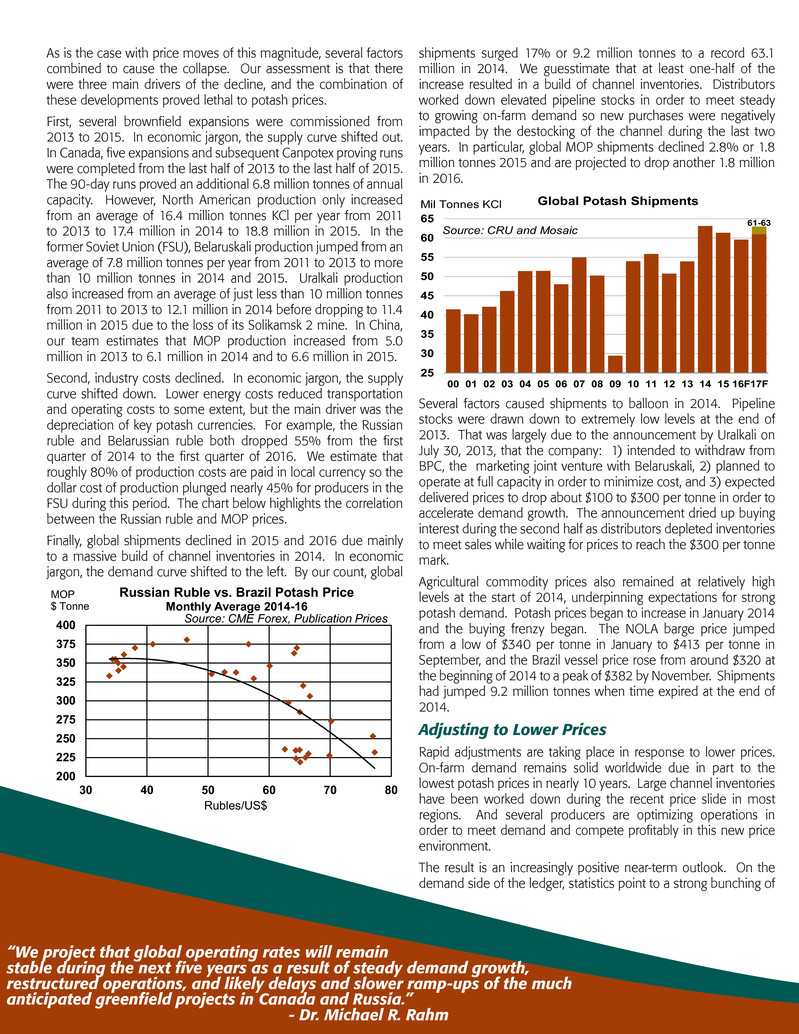

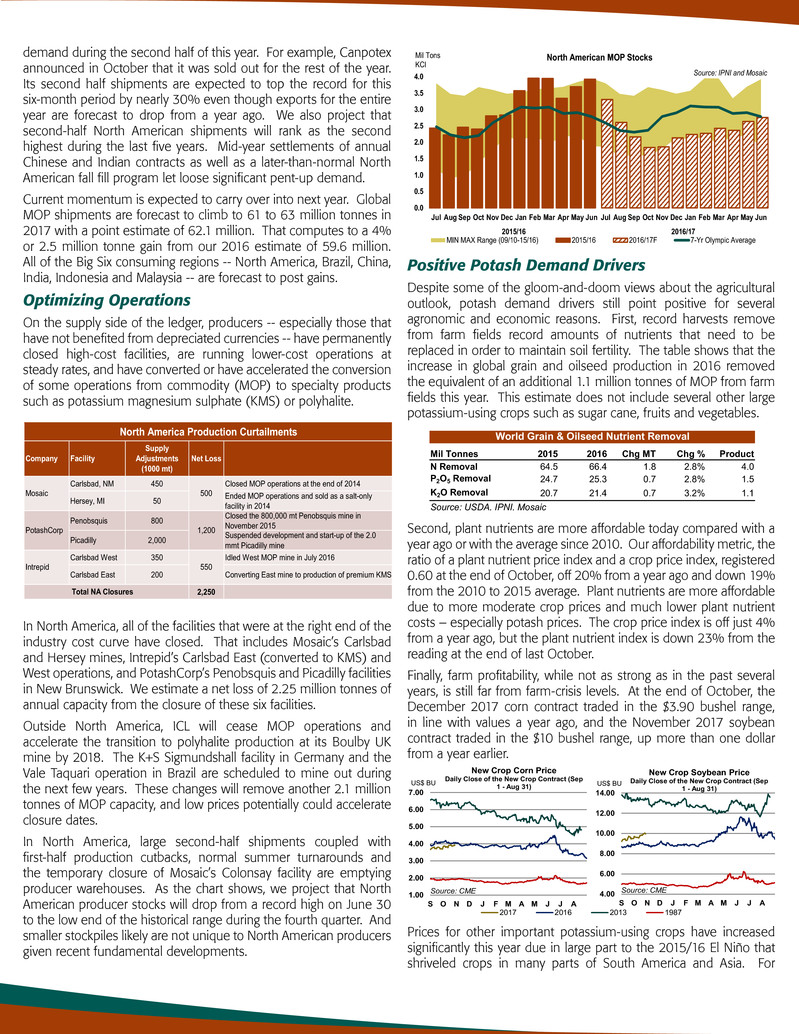

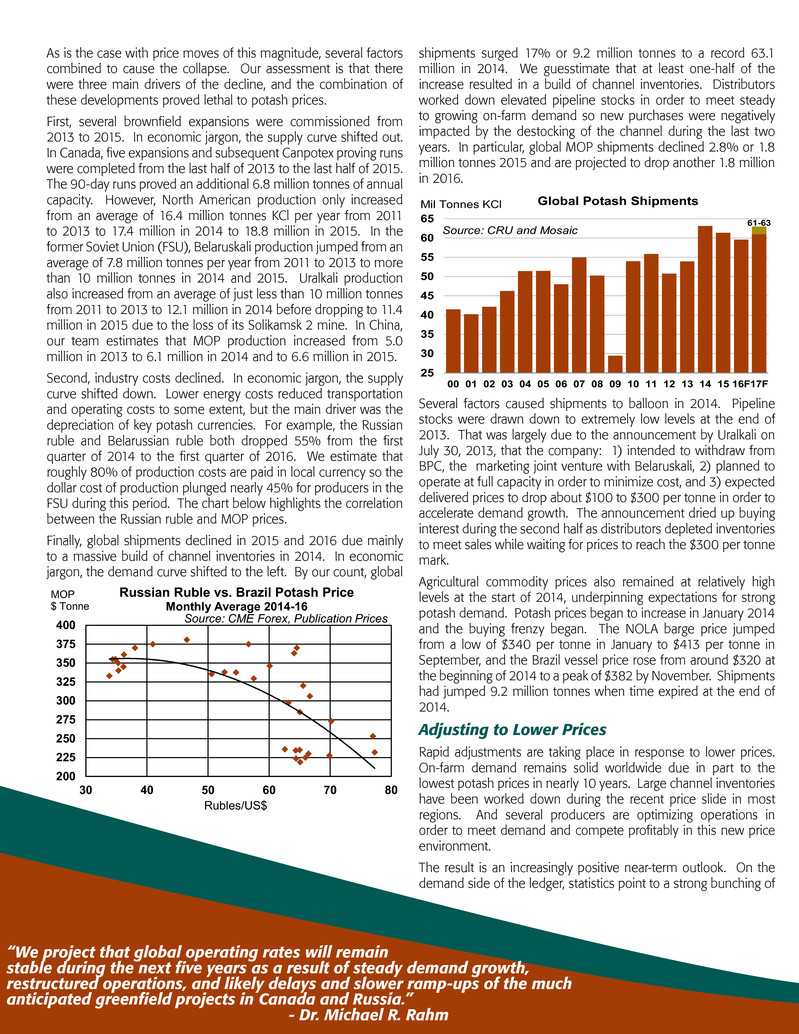

As is the case with price moves of this magnitude, several factors combined to cause the collapse. Our assessment is that there were three main drivers of the decline, and the combination of these developments proved lethal to potash prices. First, several brownfield expansions were commissioned from 2013 to 2015. In economic jargon, the supply curve shifted out. In Canada, five expansions and subsequent Canpotex proving runs were completed from the last half of 2013 to the last half of 2015. The 90-day runs proved an additional 6.8 million tonnes of annual capacity. However, North American production only increased from an average of 16.4 million tonnes KCl per year from 2011 to 2013 to 17.4 million in 2014 to 18.8 million in 2015. In the former Soviet Union (FSU), Belaruskali production jumped from an average of 7.8 million tonnes per year from 2011 to 2013 to more than 10 million tonnes in 2014 and 2015. Uralkali production also increased from an average of just less than 10 million tonnes from 2011 to 2013 to 12.1 million in 2014 before dropping to 11.4 million in 2015 due to the loss of its Solikamsk 2 mine. In China, our team estimates that MOP production increased from 5.0 million in 2013 to 6.1 million in 2014 and to 6.6 million in 2015. Second, industry costs declined. In economic jargon, the supply curve shifted down. Lower energy costs reduced transportation and operating costs to some extent, but the main driver was the depreciation of key potash currencies. For example, the Russian ruble and Belarussian ruble both dropped 55% from the first quarter of 2014 to the first quarter of 2016. We estimate that roughly 80% of production costs are paid in local currency so the dollar cost of production plunged nearly 45% for producers in the FSU during this period. The chart below highlights the correlation between the Russian ruble and MOP prices. Finally, global shipments declined in 2015 and 2016 due mainly to a massive build of channel inventories in 2014. In economic jargon, the demand curve shifted to the left. By our count, global shipments surged 17% or 9.2 million tonnes to a record 63.1 million in 2014. We guesstimate that at least one-half of the increase resulted in a build of channel inventories. Distributors worked down elevated pipeline stocks in order to meet steady to growing on-farm demand so new purchases were negatively impacted by the destocking of the channel during the last two years. In particular, global MOP shipments declined 2.8% or 1.8 million tonnes 2015 and are projected to drop another 1.8 million in 2016. Several factors caused shipments to balloon in 2014. Pipeline stocks were drawn down to extremely low levels at the end of 2013. That was largely due to the announcement by Uralkali on July 30, 2013, that the company: 1) intended to withdraw from BPC, the marketing joint venture with Belaruskali, 2) planned to operate at full capacity in order to minimize cost, and 3) expected delivered prices to drop about $100 to $300 per tonne in order to accelerate demand growth. The announcement dried up buying interest during the second half as distributors depleted inventories to meet sales while waiting for prices to reach the $300 per tonne mark. Agricultural commodity prices also remained at relatively high levels at the start of 2014, underpinning expectations for strong potash demand. Potash prices began to increase in January 2014 and the buying frenzy began. The NOLA barge price jumped from a low of $340 per tonne in January to $413 per tonne in September, and the Brazil vessel price rose from around $320 at the beginning of 2014 to a peak of $382 by November. Shipments had jumped 9.2 million tonnes when time expired at the end of 2014. Adjusting to Lower Prices Rapid adjustments are taking place in response to lower prices. On-farm demand remains solid worldwide due in part to the lowest potash prices in nearly 10 years. Large channel inventories have been worked down during the recent price slide in most regions. And several producers are optimizing operations in order to meet demand and compete profitably in this new price environment. The result is an increasingly positive near-term outlook. On the demand side of the ledger, statistics point to a strong bunching of “We project that global operating rates will remain stable during the next five years as a result of steady demand growth, restructured operations, and likely delays and slower ramp-ups of the much anticipated greenfield projects in Canada and Russia.” - Dr. Michael R. Rahm 200 225 250 275 300 325 350 375 400 30 40 50 60 70 80 MOP $ Tonne Rubles/US$ Russian Ruble vs. Brazil Potash Price Monthly Average 2014-16 Source: CME Forex, Publication Prices 61-63 25 30 35 40 45 50 55 60 65 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F17F Global Potash ShipmentsMil Tonnes KCl Source: CRU and Mosaic

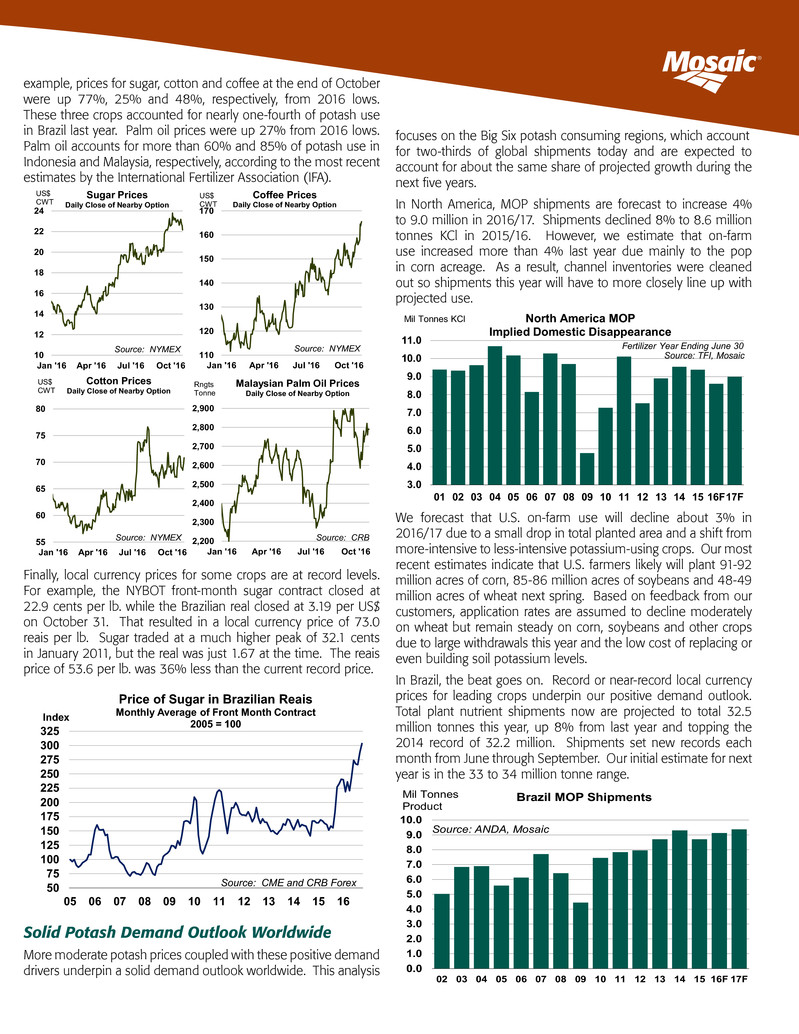

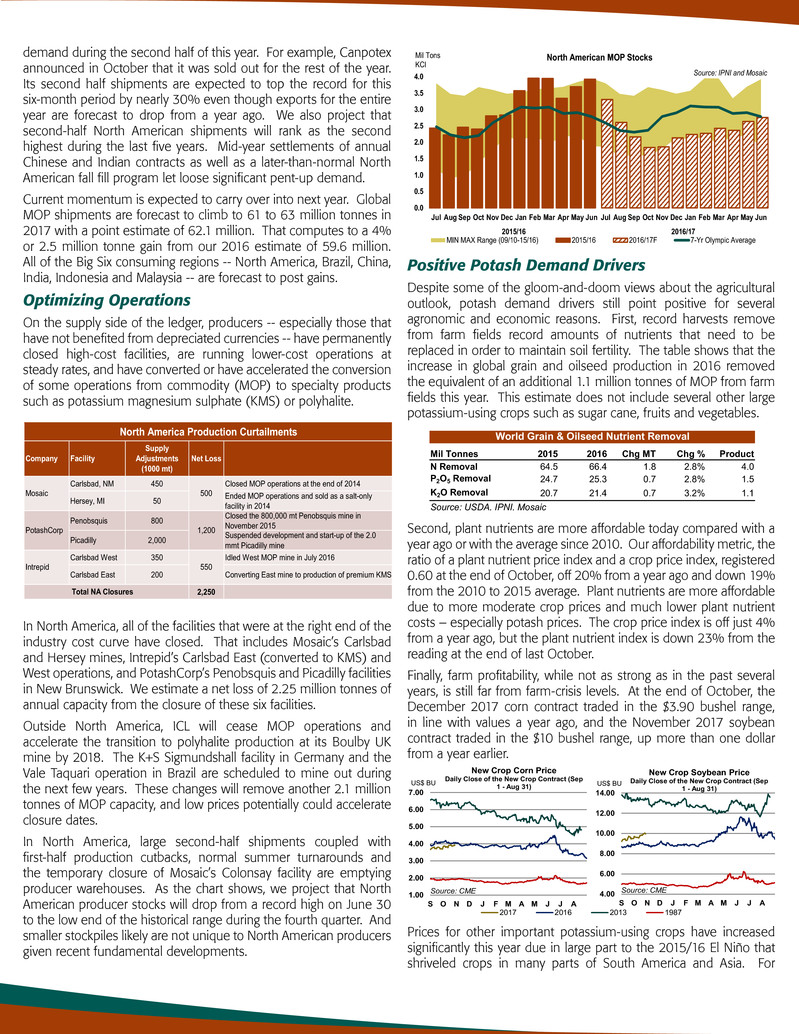

demand during the second half of this year. For example, Canpotex announced in October that it was sold out for the rest of the year. Its second half shipments are expected to top the record for this six-month period by nearly 30% even though exports for the entire year are forecast to drop from a year ago. We also project that second-half North American shipments will rank as the second highest during the last five years. Mid-year settlements of annual Chinese and Indian contracts as well as a later-than-normal North American fall fill program let loose significant pent-up demand. Current momentum is expected to carry over into next year. Global MOP shipments are forecast to climb to 61 to 63 million tonnes in 2017 with a point estimate of 62.1 million. That computes to a 4% or 2.5 million tonne gain from our 2016 estimate of 59.6 million. All of the Big Six consuming regions -- North America, Brazil, China, India, Indonesia and Malaysia -- are forecast to post gains. Optimizing Operations On the supply side of the ledger, producers -- especially those that have not benefited from depreciated currencies -- have permanently closed high-cost facilities, are running lower-cost operations at steady rates, and have converted or have accelerated the conversion of some operations from commodity (MOP) to specialty products such as potassium magnesium sulphate (KMS) or polyhalite. In North America, all of the facilities that were at the right end of the industry cost curve have closed. That includes Mosaic’s Carlsbad and Hersey mines, Intrepid’s Carlsbad East (converted to KMS) and West operations, and PotashCorp’s Penobsquis and Picadilly facilities in New Brunswick. We estimate a net loss of 2.25 million tonnes of annual capacity from the closure of these six facilities. Outside North America, ICL will cease MOP operations and accelerate the transition to polyhalite production at its Boulby UK mine by 2018. The K+S Sigmundshall facility in Germany and the Vale Taquari operation in Brazil are scheduled to mine out during the next few years. These changes will remove another 2.1 million tonnes of MOP capacity, and low prices potentially could accelerate closure dates. In North America, large second-half shipments coupled with first-half production cutbacks, normal summer turnarounds and the temporary closure of Mosaic’s Colonsay facility are emptying producer warehouses. As the chart shows, we project that North American producer stocks will drop from a record high on June 30 to the low end of the historical range during the fourth quarter. And smaller stockpiles likely are not unique to North American producers given recent fundamental developments. Positive Potash Demand Drivers Despite some of the gloom-and-doom views about the agricultural outlook, potash demand drivers still point positive for several agronomic and economic reasons. First, record harvests remove from farm fields record amounts of nutrients that need to be replaced in order to maintain soil fertility. The table shows that the increase in global grain and oilseed production in 2016 removed the equivalent of an additional 1.1 million tonnes of MOP from farm fields this year. This estimate does not include several other large potassium-using crops such as sugar cane, fruits and vegetables. Second, plant nutrients are more affordable today compared with a year ago or with the average since 2010. Our affordability metric, the ratio of a plant nutrient price index and a crop price index, registered 0.60 at the end of October, off 20% from a year ago and down 19% from the 2010 to 2015 average. Plant nutrients are more affordable due to more moderate crop prices and much lower plant nutrient costs – especially potash prices. The crop price index is off just 4% from a year ago, but the plant nutrient index is down 23% from the reading at the end of last October. Finally, farm profitability, while not as strong as in the past several years, is still far from farm-crisis levels. At the end of October, the December 2017 corn contract traded in the $3.90 bushel range, in line with values a year ago, and the November 2017 soybean contract traded in the $10 bushel range, up more than one dollar from a year earlier. Prices for other important potassium-using crops have increased significantly this year due in large part to the 2015/16 El Niño that shriveled crops in many parts of South America and Asia. For Carlsbad, NM 450 Closed MOP operations at the end of 2014 Hersey, MI 50 Ended MOP operations and sold as a salt-only facility in 2014 Penobsquis 800 Closed the 800,000 mt Penobsquis mine in November 2015 Picadilly 2,000 Suspended development and start-up of the 2.0 mmt Picadilly mine Carlsbad West 350 Idled West MOP mine in July 2016 Carlsbad East 200 Converting East mine to production of premium KMS 2,250 North America Production Curtailments Mosaic 500 Total NA Closures Company Facility PotashCorp 1,200 Supply Adjustments (1000 mt) 550Intrepid Net Loss 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun 2015/16 2016/17 Mil Tons KCl North American MOP Stocks MIN MAX Range (09/10-15/16) 2015/16 2016/17F 7-Yr Olympic Average Source: IPNI and Mosaic 1.00 2.00 3.00 4.00 5.00 6.00 7.00 S O N D J F M A M J J A US$ BU New Crop Corn Price Daily Close of the New Crop Contract (Sep 1 - Aug 31) Source: CME 2017 2016 2013 1987 4.00 6.00 8.00 10.00 12.00 14.00 S O N D J F M A M J J A US$ BU New Crop Soybean Price Daily Close of the New Crop Contract (Sep 1 - Aug 31) Source: CME World Grain & Oilseed Nutrient Removal Mil Tonnes 2015 2016 Chg MT Chg % Product N Removal 64.5 66.4 1.8 2.8% 4.0 P2O5 Removal 24.7 25.3 0.7 2.8% 1.5 K2O Removal 20.7 21.4 0.7 3.2% 1.1 Source: USDA, IPNI, Mosaic

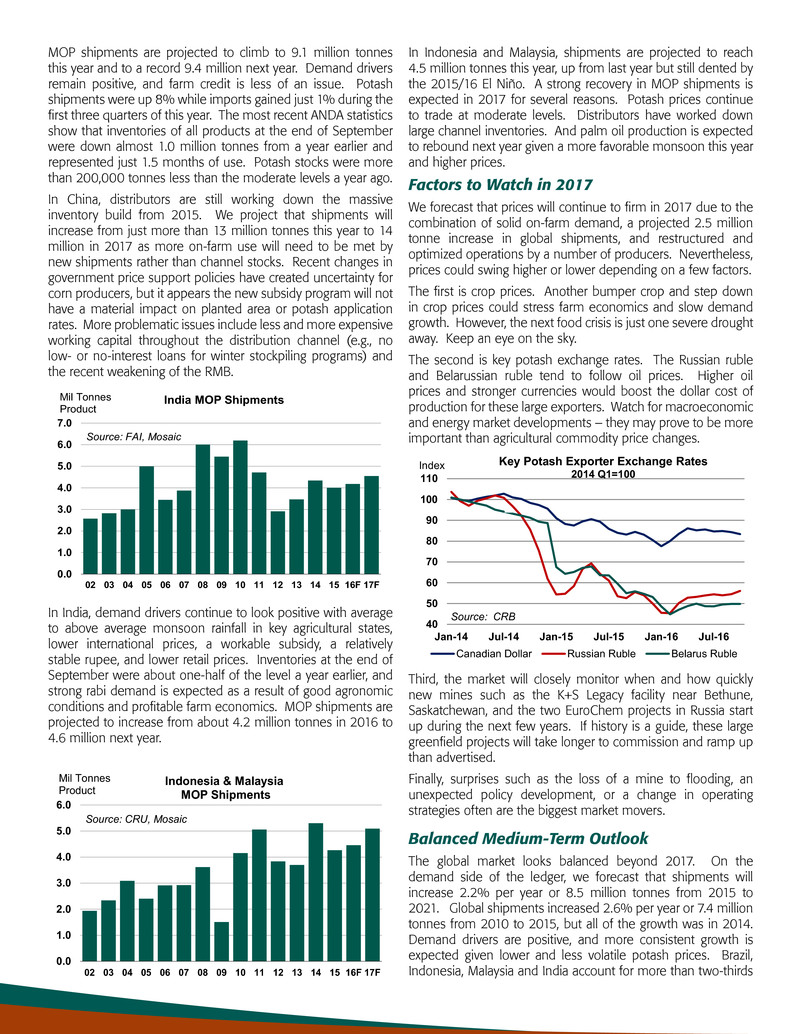

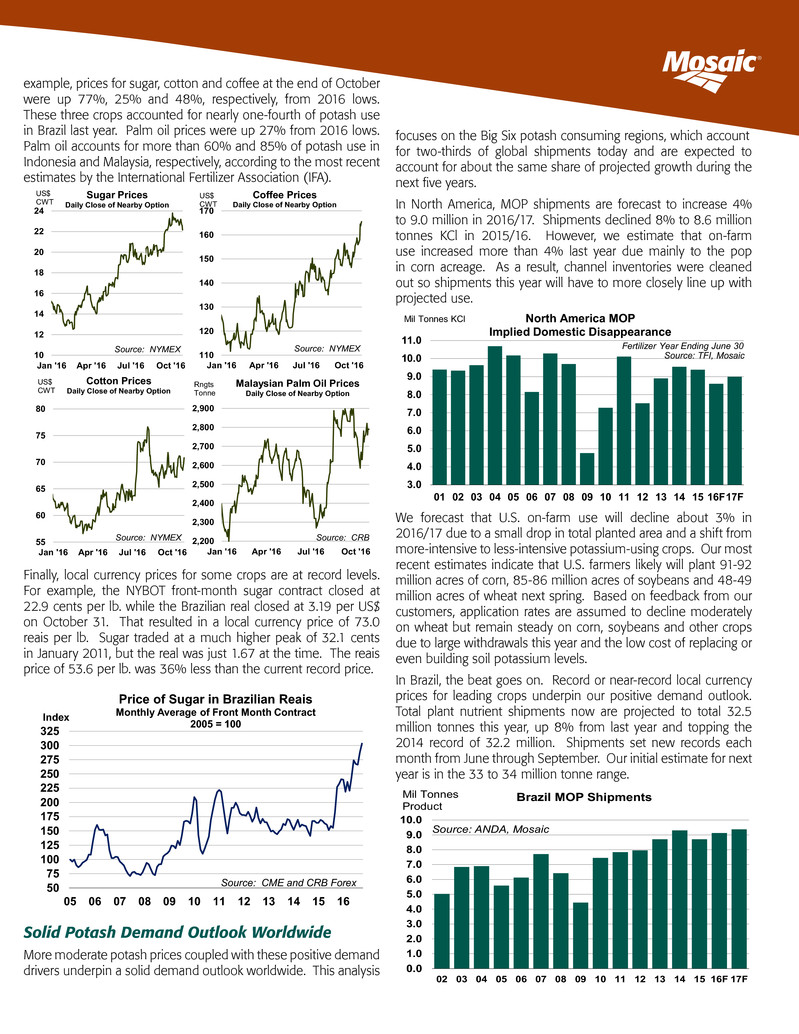

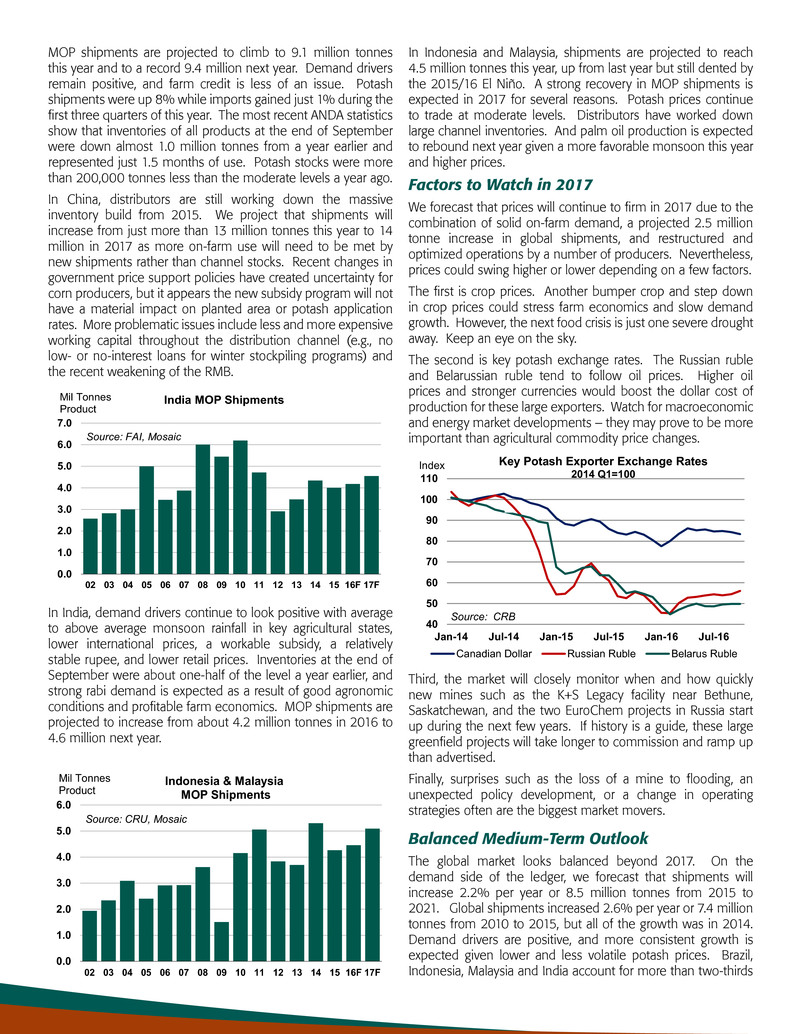

example, prices for sugar, cotton and coffee at the end of October were up 77%, 25% and 48%, respectively, from 2016 lows. These three crops accounted for nearly one-fourth of potash use in Brazil last year. Palm oil prices were up 27% from 2016 lows. Palm oil accounts for more than 60% and 85% of potash use in Indonesia and Malaysia, respectively, according to the most recent estimates by the International Fertilizer Association (IFA). Finally, local currency prices for some crops are at record levels. For example, the NYBOT front-month sugar contract closed at 22.9 cents per lb. while the Brazilian real closed at 3.19 per US$ on October 31. That resulted in a local currency price of 73.0 reais per lb. Sugar traded at a much higher peak of 32.1 cents in January 2011, but the real was just 1.67 at the time. The reais price of 53.6 per lb. was 36% less than the current record price. Solid Potash Demand Outlook Worldwide More moderate potash prices coupled with these positive demand drivers underpin a solid demand outlook worldwide. This analysis focuses on the Big Six potash consuming regions, which account for two-thirds of global shipments today and are expected to account for about the same share of projected growth during the next five years. In North America, MOP shipments are forecast to increase 4% to 9.0 million in 2016/17. Shipments declined 8% to 8.6 million tonnes KCl in 2015/16. However, we estimate that on-farm use increased more than 4% last year due mainly to the pop in corn acreage. As a result, channel inventories were cleaned out so shipments this year will have to more closely line up with projected use. We forecast that U.S. on-farm use will decline about 3% in 2016/17 due to a small drop in total planted area and a shift from more-intensive to less-intensive potassium-using crops. Our most recent estimates indicate that U.S. farmers likely will plant 91-92 million acres of corn, 85-86 million acres of soybeans and 48-49 million acres of wheat next spring. Based on feedback from our customers, application rates are assumed to decline moderately on wheat but remain steady on corn, soybeans and other crops due to large withdrawals this year and the low cost of replacing or even building soil potassium levels. In Brazil, the beat goes on. Record or near-record local currency prices for leading crops underpin our positive demand outlook. Total plant nutrient shipments now are projected to total 32.5 million tonnes this year, up 8% from last year and topping the 2014 record of 32.2 million. Shipments set new records each month from June through September. Our initial estimate for next year is in the 33 to 34 million tonne range. ® 50 75 100 125 150 175 200 225 250 275 300 325 05 06 07 08 09 10 11 12 13 14 15 16 Index Source: CME and CRB Forex Price of Sugar in Brazilian Reais Monthly Average of Front Month Contract 2005 = 100 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F 17F Mil Tonnes Product Brazil MOP Shipments Source: ANDA, Mosaic 10 12 14 16 18 20 22 24 Jan '16 Apr '16 Jul '16 Oct '16 US$ CWT Source: NYMEX Sugar Prices Daily Close of Nearby Option 55 60 65 70 75 80 Jan '16 Apr '16 Jul '16 Oct '16 US$ CWT Source: NYMEX Cotton Prices Daily Close of Nearby Option 2,200 2,300 2,400 2,500 2,600 2,700 2,800 2,900 Jan '16 Apr '16 Jul '16 Oct '16 Rngts Tonne Source: CRB Malaysian Palm Oil Prices Daily Close of Nearby Option 110 120 130 140 150 160 170 Jan '16 Apr '16 Jul '16 Oct '16 US$ CWT Source: NYMEX Coffee Prices Daily Close of Nearby Option 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F17F Mil Tonnes KCl North America MOP Implied Domestic Disappearance Source: TFI, Mosaic Fertilizer Year Ending June 30

MOP shipments are projected to climb to 9.1 million tonnes this year and to a record 9.4 million next year. Demand drivers remain positive, and farm credit is less of an issue. Potash shipments were up 8% while imports gained just 1% during the first three quarters of this year. The most recent ANDA statistics show that inventories of all products at the end of September were down almost 1.0 million tonnes from a year earlier and represented just 1.5 months of use. Potash stocks were more than 200,000 tonnes less than the moderate levels a year ago. In China, distributors are still working down the massive inventory build from 2015. We project that shipments will increase from just more than 13 million tonnes this year to 14 million in 2017 as more on-farm use will need to be met by new shipments rather than channel stocks. Recent changes in government price support policies have created uncertainty for corn producers, but it appears the new subsidy program will not have a material impact on planted area or potash application rates. More problematic issues include less and more expensive working capital throughout the distribution channel (e.g., no low- or no-interest loans for winter stockpiling programs) and the recent weakening of the RMB. In India, demand drivers continue to look positive with average to above average monsoon rainfall in key agricultural states, lower international prices, a workable subsidy, a relatively stable rupee, and lower retail prices. Inventories at the end of September were about one-half of the level a year earlier, and strong rabi demand is expected as a result of good agronomic conditions and profitable farm economics. MOP shipments are projected to increase from about 4.2 million tonnes in 2016 to 4.6 million next year. In Indonesia and Malaysia, shipments are projected to reach 4.5 million tonnes this year, up from last year but still dented by the 2015/16 El Niño. A strong recovery in MOP shipments is expected in 2017 for several reasons. Potash prices continue to trade at moderate levels. Distributors have worked down large channel inventories. And palm oil production is expected to rebound next year given a more favorable monsoon this year and higher prices. Factors to Watch in 2017 We forecast that prices will continue to firm in 2017 due to the combination of solid on-farm demand, a projected 2.5 million tonne increase in global shipments, and restructured and optimized operations by a number of producers. Nevertheless, prices could swing higher or lower depending on a few factors. The first is crop prices. Another bumper crop and step down in crop prices could stress farm economics and slow demand growth. However, the next food crisis is just one severe drought away. Keep an eye on the sky. The second is key potash exchange rates. The Russian ruble and Belarussian ruble tend to follow oil prices. Higher oil prices and stronger currencies would boost the dollar cost of production for these large exporters. Watch for macroeconomic and energy market developments – they may prove to be more important than agricultural commodity price changes. Third, the market will closely monitor when and how quickly new mines such as the K+S Legacy facility near Bethune, Saskatchewan, and the two EuroChem projects in Russia start up during the next few years. If history is a guide, these large greenfield projects will take longer to commission and ramp up than advertised. Finally, surprises such as the loss of a mine to flooding, an unexpected policy development, or a change in operating strategies often are the biggest market movers. Balanced Medium-Term Outlook The global market looks balanced beyond 2017. On the demand side of the ledger, we forecast that shipments will increase 2.2% per year or 8.5 million tonnes from 2015 to 2021. Global shipments increased 2.6% per year or 7.4 million tonnes from 2010 to 2015, but all of the growth was in 2014. Demand drivers are positive, and more consistent growth is expected given lower and less volatile potash prices. Brazil, Indonesia, Malaysia and India account for more than two-thirds 0.0 1.0 2.0 3.0 4.0 5.0 6.0 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F 17F Mil Tonnes Product Indonesia & Malaysia MOP Shipments Source: CRU, Mosaic 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F 17F Mil Tonnes Product India MOP Shipments Source: FAI, Mosaic 40 50 60 70 80 90 100 110 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Index Source: CRB Key Potash Exporter Exchange Rates 2014 Q1=100 Canadian Dollar Russian Ruble Belarus Ruble

of the projected gain, but other regions such as Africa and the FSU are expected to post significant increases as well. On the supply side of the ledger, global operational capacity is projected to increase 11.1 million tonnes from 69.1 million in 2015 to 80.2 million in 2021. Production required to meet projected demand is forecast to increase 8.5 million tonnes from 61.9 million in 2015 to 70.4 million in 2021. As a result, the global MOP operating rate is forecast to remain steady in the 88%-89% range during the forecast period. CRU for the first time published estimates of both nameplate and effective capacity in August 2016. CRU estimates of effective capacity and operating rates are not out of line with our estimates. CRU shows relatively steady and high operating rates of 86% to 88% of effective capacity during the next five years. This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) and other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of MWSPC to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for MWSPC and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply agreement with CF Industries, Inc., including the risk that the cost savings initially anticipated from the agreement may not be fully realized over its term or that the price of natural gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, carbon taxes or other greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the MWSPC, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events, sinkholes or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. Copyright © 2016. The Mosaic Company. All rights reserved.. The Mosaic Company Atria Corporate Center, Suite E490 3033 Campus Drive Plymouth, MN 55441 (800) 918-8270 (763) 577-2700 ® 65% 70% 75% 80% 85% 90% 95% 0 10 20 30 40 50 60 70 80 90 11 12 13 14 15 16F 17F 18F 19F 20F 21F Op RateMil Tonnes Source: CRU August 2016 Global Potash Supply and Demand MOP Capacity, Production and Operating Rate Capacity Production Operating Rate 0.2% 0.5% 1.6% 1.5% 2.9% 5.6% 6.1% 4.1% 0.0 0.5 1.0 1.5 2.0 2.5 China North America Other Asia/Oceania Europe/FSU Rest of World India Indonesia/Malaysia Brazil Mil Tonnes KCl (Percentage is CAGR) Change in Potash Shipments 2021F vs. 2015 Source: Mosaic and CRU August 2016