ANNUAL INFORMATION FORM

For the Year Ended December 31, 2021

Dated as at March 25, 2022

Suite 501 -543 Granville Street

Vancouver, British Columbia V6C 1X8

Canada

Tel: 604.688.6390

Fax: 604.688.1157

Email: info@EMXroyalty.com

Website: www.EMXroyalty.com

TABLE OF CONTENTS

| PRELIMINARY NOTES | 4 |

| Date of Information | 4 |

| Currency and Exchange Rates | 4 |

| Glossary, Conversions, and Abbreviations | 4 |

| | |

| FORWARD-LOOKING INFORMATION | 10 |

| | |

| CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF INFERRED, INDICATED AND MEASURED RESOURCES | 12 |

| | |

| CORPORATE STRUCTURE | 13 |

| Name, Address and Incorporation | 13 |

| Inter-corporate Relationships | 13 |

| | |

| DESCRIPTION OF THE BUSINESS | 15 |

| Overview | 15 |

| RISKS AND UNCERTAINTIES | 18 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 25 |

| Three Year History | 25 |

| Financial Year Ended December 31, 2019 | 25 |

| Financial Year Ended December 31, 2020 | 27 |

| Financial Year Ended December 31, 2021 | 29 |

| | |

| MINERAL PROPERTIES | 32 |

| Introduction | 32 |

| Mineral Properties Overview | 33 |

| Producing Royalties | 34 |

| Caserones, Chile | 34 |

| Timok, Serbia | 34 |

| Leeville, Nevada | 35 |

| Gediktepe, Turkey | 35 |

| Balya, Turkey | 36 |

| Advanced Royalty Projects | 36 |

| Gold Bar South, Nevada | 36 |

| Diablillos, Argentina | 37 |

| Berenguela, Peru | 37 |

| Challacolla, Chile | 37 |

| Yenipazar, Turkey | 37 |

| Akarca, Turkey | 38 |

| Sisorta, Turkey | 38 |

| Viscaria, Sweden | 38 |

| Kaukua, Finland | 38 |

| Exploration Royalty & Royalty Generation Projects | 39 |

| Investments | 39 |

| Rawhide | 39 |

| Qualified Persons | 40 |

| | |

| TECHNICAL INFORMATION | 40 |

| Caserones Royalty | 40 |

| Timok Royalty | 52 |

| Gediktepe Royalty | 59 |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form ("AIF") is as of December 31, 2021.

Currency and Exchange Rates

In this AIF, all references to "Canadian dollars" and to "C$" are to Canadian dollars, references to "U.S. dollars" and to "US$" are to United States dollars. The Bank of Canada noon buying rates for the purchase of one United States dollar using Canadian dollars were as follows for the indicated periods:

YEAR ENDED DECEMBER 31 |

| 2021 | 2020 | 2019 |

End of period | 1.2697 | 1.2741 | 1.2988 |

High for the period | 1.2926 | 1.4529 | 1.3600 |

Low for the period | 1.2046 | 1.2718 | 1.2988 |

Average for the period | 1.2535 | 1.3411 | 1.3269 |

The Bank of Canada noon buying rate on March 25, 2022, for the purchase of one United States dollar using Canadian dollars was C$1.2502 (one Canadian dollar on that date equalled US$0.7999).

Glossary, Conversions, and Abbreviations

Glossary of Geological and Mining Terms

Assay: a quantitative chemical analysis of an ore, mineral or concentrate to determine the amount of specific elements.

Breccia: a coarse-grained clastic rock, composed of broken rock fragments held together by a mineral cement or in a fine-grained matrix.

CIM: Canadian Institute of Mining and Metallurgy Classification System.

Dacite: an igneous extrusive rock with a felsic (silica rich) chemical composition that is the extrusive equivalent of a granodiorite.

Doré: a mixture of predominantly gold and silver produced by a mine, usually in a bar form, before separation and refining into gold and silver by a refinery.

Epithermal: a hydrothermal mineral deposit formed within about 1 kilometer of the Earth's surface and in the temperature range of 50oC to 200oC.

Formation: a persistent body of igneous, sedimentary, or metamorphic rock, having easily recognizable boundaries that can be traced in the field without recourse to detailed paleontologic or petrologic analysis, and large enough to be represented on a geologic map as a practical or convenient unit for mapping and description.

Granodiorite: a group of plutonic rocks intermediate in composition between quartz diorite and quartz monzonite.

Hydrothermal: of or pertaining to hot water, to the action of hot water, or to the products of this action, such as a mineral deposit precipitated from a hot aqueous solution, with or without demonstrable association with igneous processes.

Igneous rock: rock that is magmatic in origin.

Indicated mineral resource: is defined in NI 43-101 as that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and test information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Inferred mineral resource: is defined in NI 43-101 as that part of a mineral resource for which the quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

JORC Code: means the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia.

Kriging: a weighted, moving-average interpolation method in which the set of weights assigned to samples minimizes the estimation variance, which is computed as a function of the variogram model and locations of the samples relative to each other, and to the point or block being estimated.

Leach: to dissolve minerals or metals out of ore with chemicals.

Measured mineral resource: is defined in NI 43-101 as that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Meta: a prefix that, when used with the name of a sedimentary or igneous rock, indicates that the rock has been metamorphosed.

Metamorphic rock: rock which has been changed from igneous or sedimentary rock through heat and pressure into a new form of rock.

Mineral reserve: is defined in NI 43-101 as the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined.

Mineral resource: is defined in NI 43-101 as a concentration or occurrence (deposit) of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge.

Net smelter return royalty or NSR royalty: a type of royalty based on a percentage of the proceeds, net of smelting, refining and transportation costs and penalties, from the sale of metals extracted from concentrate and doré by the smelter or refinery.

NI 43-101: National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators, which sets standards for all public disclosure made of scientific and technical information concerning mineral projects.

Oxide: a compound of ore that has been subjected to weathering and alteration as a result of exposure to oxygen for a long period of time.

PERC Code: means the Pan-European Code for Reporting of Exploration Results, Mineral Resources and Reserves prepared by the Pan-European Reserves and Resources Reporting Committee.

Plutonic: intrusive igneous rock that is crystallized from magma slowly cooling below the surface of the Earth.

Porphyry: igneous rock consisting of large-grained crystals dispersed in a fine-grained matrix or groundmass.

Probable mineral reserve: is defined in NI 43-101 as the economically mineable part of an indicated and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

Proven mineral reserve: is defined in NI 43-101 as the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Pyroclastic: pertaining to clastic rock material formed by volcanic explosion or aerial expulsion from a volcanic vent; also, pertaining to rock texture of explosive origin.

Schist: a strongly foliated crystalline rock, which readily splits into sheets or slabs as a result of the planar alignment of the constituent crystals. The constituent minerals are commonly specified (e.g. "quartz-muscovite-chlorite schist").

SEDAR: System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators.

Silicification: the introduction of, or replacement by, silica, generally resulting in the formation of fine-grained quartz, chalcedony, or opal, which may fill pores and replace existing minerals.

Strata: layers of sedimentary rock with internally consistent characteristics that distinguish them from other layers.

Strike: the direction, or course or bearing of a vein or rock formation measured on a level surface.

Strip (or stripping) ratio: the tonnage or volume of waste material that must be removed to allow the mining of one tonne of ore in an open pit.

Sulfides or sulphides: compounds of sulfur (or sulphur) with other metallic elements.

Tailing: material rejected from a mill after the recoverable valuable minerals have been extracted.

Vein: sheet-like body of minerals formed by fracture filling or replacement of host rock.

Conversions

Linear Measurements | | |

1 inch | = | 2.54 centimeters |

1 foot | = | 0.3048 meter |

1 yard | = | 0.9144 meter |

1 mile | = | 1.609 kilometers |

Area Measurements | | |

1 acre | = | 0.4047 hectare |

1 hectare | = | 2.471 acres |

1 square mile | = | 640 acres or 259 hectares or 2.590 square kilometers |

Units of Weight | | |

1 short ton | = | 2000 pounds or 0.893 long ton |

1 long ton | = | 2240 pounds or 1.12 short tons |

1 metric tonne | = | 2204.62 pounds or 1.1023 short tons |

1 pound (16 oz.) | = | 0.454 kilograms or 14.5833 troy ounces |

1 troy oz. | = | 31.1035 grams |

1 troy oz. per short ton | = | 34.2857 grams per metric ton |

Analytical

Analytical | percent | grams per metric tonne | troy oz per short ton |

1% | 1% | 10,000 | 291.667 |

1 gram/tonne | 0.0001% | 1 | 0.029167 |

1 troy oz./short ton | 0.003429% | 34.2857 | 1 |

10 ppb | nil | 0.01 | 0.00029 |

100 ppm | 0.01 | 100 | 2.917 |

Temperature

Degrees Fahrenheit | = | (°C x 1.8) + 32 |

Degrees Celsius | = | (°F - 32) x 0.556 |

Frequently Used Abbreviations and Symbols |

AA | atomic absorption spectrometry |

AAR | annual advance royalty |

AMR | advance minimum royalty |

Ag | silver |

As | arsenic |

Au | gold |

°C | degrees Celsius (centigrade) |

cm | centimeter |

C.P.G. | Certified Professional Geologist |

CSAMT | Controlled source audio-frequency magnetotellurics |

Cu | copper |

F | fluorine |

FS | feasibility study |

°F | degrees Fahrenheit |

g | gram(s) |

g/t | grams per tonne |

Hg | mercury |

HSE | high sulphidation epithermal |

ICP AES | inductively coupled plasma atomic emission spectroscopy |

ICP MS | inductively coupled plasma mass spectroscopy |

ICP MS/AAS | inductively coupled plasma mass spectroscopy/atomic absorption spectroscopy |

IOCG | iron-oxide-copper-gold |

IP | induced polarization |

IPO | Initial Public Offering |

JORC | Joint Ore Reserves Committee |

JV | joint venture |

kg | kilogram |

km | kilometer |

m | meter(s) |

Ma | million years ago |

Mn | manganese |

Mo | molybdenum |

Mt | million tonnes |

n | number or count |

NSR | net smelter returns |

oz | troy ounce |

opt | ounce per short ton |

oz/ton | ounce per short ton |

oz/tonne | ounce per metric tonne |

Pb | lead |

Pd | palladium |

PEA | preliminary economic assessment |

PFS | pre-feasibility study |

PGE | platinum group element |

ppb | parts per billion |

ppm | parts per million |

Pt | platinum |

Q1, Q2, Q3, Q4 | first, second, third and fourth financial quarters |

QA | quality assurance |

QC | quality control |

sq | square |

Sb | antimony |

Tl | thallium |

VMS | volcanogenic massive sulfide |

Zn | zinc |

FORWARD-LOOKING INFORMATION

This AIF may contain "forward-looking statements" that reflect the Company's current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, operating costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic plans, completion of transactions, market prices for metals or other statements that are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning mineral resource estimates may also be deemed to constitute "forward-looking statements" to the extent that they involve estimates of the mineralization that will be encountered if the property is developed.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as "expects", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategy", "goals", "objectives", "potential", "possible" or variations thereof or stating that certain actions, events, conditions or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect:

• the Company's ability to achieve production at any of its mineral properties;

• estimated capital costs, operating costs, production and economic returns;

• estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying the Company's resource and reserve estimates;

• the Company's expected ability to develop adequate infrastructure at a reasonable cost;

• assumptions that all necessary permits and governmental approvals will be obtained;

• assumptions made in the interpretation of drill results, the geology, grade and continuity of the Company's mineral deposits;

• the Company's expectations regarding demand for equipment, skilled labor and services needed for exploration and development of mineral properties; and

• the Company's activities will not be adversely disrupted or impeded by development, operating or regulatory risks.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

• uncertainty of whether there will ever be production at the Company's mineral exploration and development properties;

• uncertainty of estimates of capital costs, operating costs, production and economic returns;

• uncertainties relating to the assumptions underlying the Company's resource and reserve estimates, such as metal pricing, metallurgy, mineability, marketability and operating and capital costs;

• risks related to the Company's ability to commence production and generate material revenues or obtain adequate financing for its planned exploration and development activities;

• risks related to the Company's ability to finance the development of its mineral properties through external financing, joint ventures or other strategic alliances, the sale of property interests or otherwise;

• risks related to the third parties on which the Company depends for its exploration and development activities;

• dependence on cooperation of joint venture partners in exploration and development of properties;

• credit, liquidity, interest rate and currency risks;

• risks related to market events and general economic conditions;

• uncertainty related to inferred mineral resources;

• risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of the Company's mineral deposits;

• risks related to lack of adequate infrastructure;

• mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in development, construction or production;

• the risk that permits and governmental approvals necessary to develop and operate mines on the Company's properties will not be available on a timely basis or at all;

• commodity price fluctuations;

• risks related to governmental regulation and permits, including environmental regulation;

• risks related to the need for reclamation activities on the Company's properties and uncertainty of cost estimates related thereto;

• uncertainty related to title to the Company's mineral properties;

• uncertainty as to the outcome of potential litigation;

• risks related to increases in demand for equipment, skilled labor and services needed for exploration and development of mineral properties, and related cost increases;

• increased competition in the mining industry;

• the Company's need to attract and retain qualified management and technical personnel;

• risks related to hedging arrangements or the lack thereof;

• uncertainty as to the Company's ability to acquire additional commercially mineable mineral rights;

• risks related to the integration of potential new acquisitions into the Company's existing operations;

• risks related to unknown liabilities in connection with acquisitions;

• risks related to conflicts of interest of some of the directors of the Company;

• risks related to global climate change;

• risks related to adverse publicity from non-governmental organizations;

• risks related to political uncertainty or instability in countries where the Company's mineral properties are located;

• uncertainty as to the Company's passive foreign investment company ("PFIC") status;

• uncertainty as to the Company's status as a "foreign private issuer" and "emerging growth company" in future years;

• uncertainty as to the Company's ability to maintain the adequacy of internal control over financial reporting; and

• risks related to regulatory and legal compliance and increased costs relating thereto.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors.

The Company's forward-looking statements are based on the beliefs, expectations and opinions of management on the date of this AIF, and the Company does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

More information about the Company including its recent financial reports is available on SEDAR at www.sedar.com. The Company's Annual Report on Form 40-F, including the recent financial reports, is available on SEC's EDGAR website at www.sec.gov and on the Company's website at www.EMXroyalty.com.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF INFERRED,

INDICATED AND MEASURED RESOURCES

Canadian standards, including National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101"), differ significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC"), and resource information contained in this AIF may not be comparable to similar information disclosed by United States companies. In particular, and without limiting the generality of the foregoing, the term "resource" does not equate to the term "reserves." Under United States standards as set forth in the SEC's Industry Guide 7, Description of Property by Corporations Engaged or to be Engaged in Significant Mining Operations, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

This AIF may use the terms "Inferred", "Indicated", and "Measured" mineral resources. EMX advises investors that although these terms are recognized and required by Canadian regulations under NI 43-101, the SEC does not recognize these terms under Industry Guide 7. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in the measured and indicated resource categories will ever be converted into reserves.

U.S. Investors are further cautioned that inferred resources have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. An inferred resource is that part of a mineral resource for which quantity and grade are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply, but not verify, geological and grade continuity. It is hoped that the majority of inferred resources could be upgraded to indicated resources with continued exploration. Inferred resources must not be included in an economic analysis, production schedule, or estimated mine life in publicly disclosed pre-feasibility or feasibility studies, or in the life of mine plans and cash flow models of developed mines. Inferred mineral resources can only be used in economic studies as provided under NI 43-101. U.S. investors are cautioned not to assume that any part or all of an inferred resource exists or is economically or legally mineable.

On October 31, 2018, the SEC adopted amendments to modernize the property disclosure requirements for mining issuers, and related guidance, which are currently set forth in Item 102 of Regulation S-K under the United States Securities Act of 1933 and the Securities Exchange Act of 1934, and in Industry Guide 7. The amendments consolidate mining property disclosure requirements by relocating them to a new subpart of Regulation S-K (Subpart 1300). The amendments more closely align disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards. However, while EMX files its reports under the Multijurisdictional Disclosure System (MJDS), it will not be subject to the new disclosure rules under Subpart 1300, but if EMX loses the ability to file reports or registration statements under the MJDS, EMX will be required to file reports compliant with Subpart 1300 which will result in increased costs.

CORPORATE STRUCTURE

Name, Address and Incorporation

EMX Royalty Corporation (the "Company" or "EMX") is a British Columbia company incorporated in Alberta on May 13, 1996 as Marchwell Capital Corp. and continued into British Columbia on September 21, 2004 and became subject to the Business Corporations Act (British Columbia).

On November 24, 2003, Marchwell underwent a reverse take-over by Southern European Exploration Ltd., which was incorporated in the Yukon Territory on August 21, 2001. On November 23, 2003, Marchwell changed its name to Eurasian Minerals Inc. On July 19, 2017, Eurasian changed its name to EMX Royalty Corporation to better reflect its business.

EMX is a reporting company under the securities legislation of British Columbia and Alberta. Its common shares without par value ("Common Shares") are listed on the TSX Venture Exchange ("TSX-V"), and the NYSE American Exchange ("NYSE American") under the symbol "EMX" and the Frankfurt Stock Exchange under the symbol "6E9".

The Company's corporate office is located at Suite 501, 543 Granville Street, Vancouver, British Columbia V6C 1X8, Canada and its telephone number is 604-688-6390. The Company's registered and records offices are located at Suite 704, 595 Howe Street, Vancouver, British Columbia V6C 2T5, Canada.

The Company's technical office is located at 10001 W. Titan Road, Littleton, Colorado 80125, United States of America, and its telephone number is 303-973-8585.

Inter-corporate Relationships

A majority of the Company's business is carried on through its various subsidiaries. The following table illustrates the Company's material subsidiaries, including their respective jurisdiction of incorporation and the percentage of votes attaching to all voting securities of each subsidiary that are beneficially owned, controlled or directed, directly or indirectly, by the Company:

Name | Place of Incorporation | Ownership Percentage |

Bullion Monarch Mining, Inc | Utah, USA | 100% |

EMX (USA) Services Corp. | Nevada, USA | 100% |

Bronco Creek Exploration Inc. | Arizona, USA | 100% |

EMX - NSW1 PTY LTD. | Australia | 100% |

EMX Broken Hill PTY LTD. | Australia | 100% |

Eurasia Madencilik Ltd. Sirketi | Turkey | 100% |

Eurasian Royalty Madencilik | Turkey | 100% |

EMX Scandinavia AB (formerly Eurasian Minerals Sweden AB) | Sweden | 100% |

Viad Royalties AB | Sweden | 100% |

EV Metals AB | Sweden | 100% |

EMX Finland OY | Finland | 100% |

EMX Norwegian Services AS | Norway | 100% |

Minera Tercero SpA | Chile | 50% |

| | | |

DESCRIPTION OF THE BUSINESS

Overview

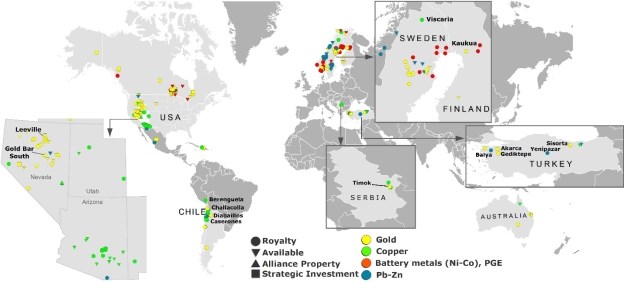

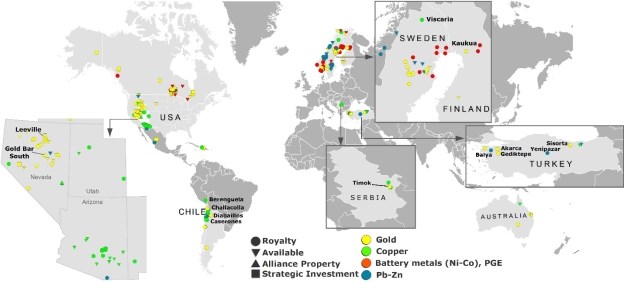

EMX is in the business of organically generating royalties derived from a portfolio of mineral property interests. The Company augments royalty generation with royalty acquisitions and strategic investments. EMX's portfolio mainly consists of royalty and mineral property assets in in North America, Europe, Turkey, Latin America and Australia.

The three key components of the Company's business strategy are summarized as:

- Royalty Generation. EMX's 18-year track record of successful exploration initiatives has developed into an avenue to organically generate mineral property royalty interests. The strategy is to leverage in-country geologic expertise to acquire prospective properties on open ground, and to build value through low-cost work programs and targeting. These properties are sold or optioned to partner companies for retained royalty interests, advance minimum royalty ("AMR") and annual advance royalty ("AAR") payments, project milestone payments, and other consideration that may include equity interests. Pre-production payments provide early-stage cash flows to EMX, while the operating companies build value through exploration and development. EMX participates in project upside optionality at no additional cost, with the potential for future royalty payments upon the commencement of production.

- Royalty Acquisition. The purchase of royalty interests allows EMX to acquire assets that range from producing mines to development projects. In conjunction with the acquisition of producing and pre-production royalties in the base metals, precious metals, and battery metals sectors, the Company will also consider other cash flowing royalty acquisition opportunities including the energy sector.

- Strategic Investment. An important complement to EMX's royalty generation and royalty acquisition initiatives comes from strategic investments in companies with under-valued mineral assets that have upside exploration or development potential. Exit strategies can include equity sales, royalty positions, or a combination of both.

EMX has a combination of producing royalties, advanced royalty projects and early-stage exploration royalty properties providing shareholder's exposure to immediate cash flow, near-term development of mines, and long-term exposure to world class discoveries. Unlike other royalty companies, EMX has focused a significant portion of its expertise and capital toward organically generating royalties. EMX believe putting people on the ground generating ideas and partnering with major and junior companies is where EMX can generate the highest return for our shareholders. This diversified approach towards the royalty business provides a foundation for supporting EMX's growth and increasing shareholder value over the long term.

Specialized Skill and Knowledge

All aspects of EMX business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, finance, accounting and law.

Competitive Conditions

Competition in the mineral exploration and royalty industry is intense. EMX competes with other companies, many of which have greater financial resources and technical facilities, for the acquisition and exploration of royalty and mineral property interests, as well as for the recruitment and retention of qualified employees and consultants.

Raw Materials (Components)

Other than water and electrical or mechanical power - all of which are readily available on or near its properties - EMX does not require any raw materials with which to carry out its business.

Intangible Property

EMX does not have any need for nor does it use any brand names, circulation lists, patents, copyrights, trademarks, franchises, licenses, software (other than commercially available software), subscription lists or other intellectual property in its business.

Business Cycle & Seasonality

EMX's business model is diversified in order to address impacts from commodity prices and business cycles, however, its business is not seasonal.

Economic Dependence

EMX's business is not substantially dependent on any contract such as a contract to sell the major part of its products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Renegotiation or Termination of Contracts

It is not expected that EMX's business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Environmental Protection

All phases of EMX's exploration are subject to environmental regulation in the various jurisdictions in which it operates.

Environmental legislation is evolving in a manner which requires stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. While manageable, EMX expects this evolution (which affects most mineral exploration and royalty companies) might result in increased costs.

Employees

At its financial year ended December 31, 2021, EMX had 40 employees and consultants working at various locations throughout the world.

Foreign Operations

EMX's mineral property interests are located in the North America, Fennoscandia, Australia, and Latin America, as well as in areas traditionally considered to be risky from a political or economic perspective, including Serbia, Turkey, and Haiti.

Bankruptcy Reorganizations

There has not been any voluntary or involuntary bankruptcy, receivership or similar proceedings against EMX within the three most recently completed financial years or the current financial year.

Material Reorganizations

Except as disclosed under the heading "Three Year History", there has not been any material reorganization of EMX or its subsidiaries within the three most recently completed financial years or the current financial year.

Social or Environmental Policies

EMX has implemented various social policies that are fundamental to its operations, such as policies regarding its relationship with the communities where the Company operates.

EMX is committed to the implementation of a comprehensive Health, Safety, Environment, Labor and Community Policy and Stakeholder Engagement Strategy (the "Policies"). EMX ensures these Policies are made known to all its managers, staff, contractors and exploration and joint venture partners, and that the requirements contained therein are adequately planned, resourced implemented and monitored wherever EMX is actively managing the project and where EMX has obtained a formal commitment from its exploration and joint venture partners to adopt the same Policies.

1. Environmental Policy

The Company believes that good environmental management at every project it manages, whether in the exploration phase, feasibility stage, project construction or mine site operation, requires proactive health and safety procedures, transparent interaction with local communities and implementation of prudent expenditures and business performance standards that constitutes the foundation for successful exploration and subsequent development if the results warrant it.

EMX will develop and implement appropriate standard operating procedures for different stages of its ground technical surveys, prospecting and evaluation and development work which procedures will be designed to meet all applicable environmental requirements and best environmental practices in the mineral exploration industry.

2. Community Relations, Communication and Notification Policy

Proactive interaction with the stakeholders on whom the Company's exploration and development programs may impact is considered an important part of the long-term investment that the Company is planning in its exploration programs in North America, Turkey, Europe, Haiti, Australia, and the Asia-Pacific region.

- EMX recognizes that from the inception of exploration activities or a new field work program, and as the exploration project progresses towards development, it will be important to:

- communicate and proactively engage with all local communities and other stakeholders that may be affected by its exploration programs;

- inform and obtain a consensus with the full range of stakeholders that may be impacted upon by exploration, evaluation and development; and

- identify any vulnerable or marginalized groups within the affected communities (e.g., women, elders or handicapped) and ensure they are also reached by above information disclosure and consultation activities.

In these respects, EMX will work actively and transparently with governmental authorities, other elected parties, non-governmental organizations, and the communities themselves to ensure that the communities are aware of the activities of the Company, and that the impact and benefits of such activities are a benefit to the communities.

When detailed or advanced exploration activities, including drilling, evaluation and other such programs, are implemented, the Company will endeavor to identify how the impacts of such work on communities can best be managed, and how benefits can best be provided to communities through its activities. This will be undertaken in consultation with the affected communities.

3. Labour, Health and Safety Policy

The health and safety of its employees, contractors, affected communities and any other role players that may participate and be affected by the activities of EMX are crucial to the long-term success of the Company.

The Company will establish and maintain a constructive work-management relationship, promote the fair treatment, non-discrimination, and equal opportunity of workers in accordance with Performance Standards 2, Labor and Working Conditions of the International Finance Corporation, a member of the World Bank Group.

Every effort will be made through training, regular reviews and briefings, and other procedures to ensure that best practice labour, health and safety and good international industry practices are implemented and maintained by EMX, including prompt and in-depth accident and incident investigation and the implementation of the conclusions thereof. The Company will take measures to prevent any child labour or forced labour.

The Company's aim is at all times to achieve zero lost-time injuries and fatalities.

4. Development Stage Environmental and Social Management Policy

EMX will communicate and consult with local communities and stakeholders with a view to fostering mutual understanding and shared benefits through the promotion and maintenance of open and constructive dialogue and working relationships.

RISKS AND UNCERTAINTIES

Investment in the Common Shares involves a significant degree of risk and should be considered speculative due to the nature of EMX's business and the present stage of its development. Prospective investors should carefully review the following factors together with other information contained in this AIF before making an investment decision.

Mineral Property Exploration Risks

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored ultimately become producing mines. The main operating risks include ensuring ownership of and access to mineral properties by confirmation that royalty agreements, option agreements, claims and leases are in good standing and obtaining permits for exploration activities, mine development, and mining operations.

EMX is currently earning an interest in some of its properties through option agreements and acquisition of title to the properties is only completed when the option conditions have been met. These conditions generally include making property payments, incurring exploration expenditures on the properties and can include the satisfactory completion of pre-feasibility or other studies. If the Company does not satisfactorily complete these option conditions in the time frame laid out in the option agreements, the Company's title to the related property will not vest and the Company will have to write-off any previously capitalized costs related to that property.

The market prices for precious, base, and other metals can be volatile and there is no assurance that a profitable market will exist for a production decision to be made or for the ultimate sale of the metals even if commercial quantities of precious and other metals are discovered or are being mined, respectively.

Unknown Defects or Impairments in EMX's Royalty or Streaming Interests

Unknown defects in or disputes relating to the royalty and streaming interests EMX holds or acquires may prevent EMX from realizing the anticipated benefits from its royalty and stream interests, and could have a material adverse effect on EMX's business, results of operations, cash flows and financial condition. It is also possible that material changes could occur that may adversely affect management's estimate of the carrying value of EMX's royalty and stream interests and could result in impairment charges. While EMX seeks to confirm the existence, validity, enforceability, terms and geographic extent of the royalty and stream interests EMX acquires, there can be no assurance that disputes over these and other matters will not arise. Confirming these matters, as well as the title to a mining property on which EMX holds or seeks to acquire a royalty or stream interest, is a complex matter, and is subject to the application of the laws of each jurisdiction to the circumstances of each parcel of a mining property and to the documents reflecting the royalty or stream interest. Similarly, royalty and stream interests in many jurisdictions are contractual in nature, rather than interests in land, and therefore may be subject to change of control, bankruptcy or the insolvency of operators. EMX often does not have the protection of security interests over property that EMX could liquidate to recover all or part of EMX's investment in a royalty or stream interest. Even if EMX retains its royalty and stream interests in a mining project after any change of control, bankruptcy or insolvency of the operator, the project may end up under the control of a new operator, who may or may not operate the project in a similar manner to the current operator, which may negatively impact EMX.

Operators' Interpretation of EMX's Royalty and Stream Interests; Unfulfilled Contractual Obligations

EMX's royalty and stream interests generally are subject to uncertainties and complexities arising from the application of contract and property laws in the jurisdictions where the mining projects are located. Operators and other parties to the agreements governing EMX's royalty and stream interests may interpret EMX's interests in a manner adverse to the Company or otherwise may not abide by their contractual obligations, and EMX could be forced to take legal action to enforce its contractual rights. EMX may not be successful in enforcing its contractual rights, and EMX's revenues relating to any challenged royalty or stream interests may be delayed, curtailed or eliminated during any such dispute or if EMX's position is not upheld, which could have a material adverse effect on its business, results of operations, cash flows and financial condition. Disputes could arise challenging, among other things:

- the existence or geographic extent of the royalty or stream interest;

- methods for calculating the royalty or stream interest, including whether certain operator costs may properly be deducted from gross proceeds when calculating royalties determined on a net basis;

- third party claims to the same royalty interest or to the property on which EMX has a royalty or stream interest;

- various rights of the operator or third parties in or to the royalty or stream interest;

- production and other thresholds and caps applicable to payments of royalty or stream interests;

- the obligation of an operator to make payments on royalty and stream interests; and

- various defects or ambiguities in the agreement governing a royalty and stream interest.

Revenue and Royalty Risks

EMX cannot accurately or reliably predict future revenues or operating results of an area mining activity. Management expects future revenues from the Timok Project in Serbia, Leeville royalty property in Nevada, Caserones royalty in Chile, and Gediktepe royalty in Turkey, to fluctuate depending on the level of future production and metal prices. For the Leeville property, there is also a risk that the operator may cease to operate in the Company’s area of interest. Accordingly, there can be no assurance that royalty payments will continue or materialize and be received by the Company from either property.

EMX also earns or is due additional revenues including stages option payments, advanced annual royalty payments, management or operator fees, and anti-dilution provisions within various property agreements. There is a risk that any of these payments will be received, and timing of any receipts may fluctuate. Further, certain payments may be dependent on milestone conditions, or the value may be based on certain market conditions including metal prices, or the market price of equity interests received. At the time of entering into an agreement, management cannot reasonably estimate the value of these future receipts.

Royalty Operation and Exploration Funding Risk

EMX's strategy is to seek exploration partners through options to fund exploration and project development. The main risk of this strategy is that the funding parties may not be able to raise sufficient capital to satisfy exploration and other expenditure terms in a particular option agreement. As a result, exploration and development of one or more of the Company's property interests may be delayed depending on whether EMX can find another party or has enough capital resources to fund the exploration and development on its own.

Fluctuating Metal Prices

Factors beyond the control of the Company have a direct effect on global metal prices, which can and have fluctuated widely, and there is no assurance that a profitable market will exist for a production decision to be made or for the ultimate sale of the metals even if commercial quantities of precious and other metals are discovered on any of EMX's properties and the properties on which it holds royalties. Consequently, the economic viability of any of these exploration projects and EMX's or the operator's ability to finance the development of its projects cannot be accurately predicted and may be adversely affected by fluctuations in metal prices.

Extensive Governmental Regulation and Permitting Requirements Risks

Exploration, development and mining of minerals are subject to extensive laws and regulations at various governmental levels governing the acquisition of the mining interests, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. In addition, the current and future operations, from exploration through development activities and production, require permits, licenses and approvals from some of these governmental authorities. EMX has, and believes the operators of properties on which it holds royalty interests have, obtained all government licenses, permits and approvals necessary for the operation of its business to date. However, additional licenses, permits and approvals may be required. The failure to obtain any licenses, permits or approvals that may be required or the revocation of existing ones would have a material and adverse effect on EMX, its business and results of operations.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities requiring EMX's or the project operator's operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. EMX and such operators may be required to compensate those suffering loss or damage by reason of their mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Any such events could have a material and adverse effect on EMX and its business and could result in EMX not meeting its business objectives.

Foreign Countries and Political Risks

The Company operates in and holds royalties on properties in countries with varied political and economic environments. As such, it is subject to certain risks, including currency fluctuations and possible political or economic instability which may result in the impairment or loss of mineral concessions or other mineral rights, opposition from environmental or other non-governmental organizations, and mineral exploration and mining activities may be affected in varying degrees by political stability and government regulations relating to the mineral exploration and mining industry. Any changes in regulations or shifts in political attitudes are beyond the control of the Company and may adversely affect its business. Exploration and development may be affected in varying degrees by government regulations with respect to restrictions on future exploitation and production, price controls, export controls, foreign exchange controls, income taxes, expropriation of property, environmental legislation and mine and site safety.

Notwithstanding any progress in restructuring political institutions or economic conditions, the present administration, or successor governments, of some countries in which EMX operates or holds royalty interests may not be able to sustain any progress. If any negative changes occur in the political or economic environment of these countries, it may have an adverse effect on the Company's operations in those countries. The Company does not carry political risk insurance.

Impact and Risks of Epidemics

All of EMX's royalty properties and royalty generation operations are subject to the risk of emerging infectious diseases, including COVID-19, or the threat of outbreaks of viruses or other contagions through the mining operations and exploration properties to which EMX's royalty interests and potential royalty interests relate. In addition, EMX's own operations are exposed to infectious disease risks. Accordingly, any outbreak or threat of an outbreak of a virus or other contagions or epidemic disease could have a material adverse effect on EMX, its business, results from operations and financial condition.

The current novel Coronavirus (COVID-19 and its variants) health pandemic is significantly impacting the global economy and commodity and financial markets. The full extent and impact of the COVID-19 pandemic is unknown and to date has included extreme volatility in financial markets, a slowdown in economic activity, extreme volatility in commodity prices (including gold, silver, palladium and oil and gas) and has raised the prospect of an extended global recession. As efforts are undertaken to slow the spread of the COVID-19 pandemic, the operation and development of mining projects may be impacted. If the operation or development of one or more of the properties in which the Company holds a royalty, stream or other interest and from which it receives or expects to receive revenue is suspended, it may have an adverse impact on the Company's profitability, financial condition and the trading price of the Company's securities. The broader impact of the COVID-19 pandemic on investors, businesses, the global economy or financial and commodity markets may also have a material adverse impact on the Company's profitability, results of operations, financial conditions and the trading price of the Company's securities. The Company continues to monitor the situation and the impact COVID-19 may have on its business.

Financing and Share Price Fluctuation Risks

EMX has limited financial resources and has no assurance that additional funding will be available for further exploration and development of its projects. Further exploration and development of one or more of the Company's projects may be dependent upon the Company's ability to obtain financing through equity or debt financing or other means. Failure to obtain this financing could result in delay or indefinite postponement of further exploration and development of EMX's projects which could result in the loss of one or more of its properties.

The securities markets can experience a high degree of price and volume volatility, and the market price of securities of many companies, particularly those considered to be development stage companies such as EMX, may experience wide fluctuations in share prices which will not necessarily be related to their operating performance, underlying asset values or prospects. There can be no assurance that share price fluctuations will not occur in the future, and if they do occur, there may be a severe impact on the Company's ability to raise additional funds through equity issues.

Competition

EMX competes with many companies that have substantially greater financial and technical resources for project acquisition and development, as well as for the recruitment and retention of qualified employees.

Return on Investment Risk

Investors cannot expect to receive a dividend on an investment in the Common Shares in the foreseeable future, if at all.

No Assurance of Titles or Borders

The acquisition of the right to explore for and exploit mineral properties is a very detailed and time consuming process. There can be no guarantee that the Company has acquired title to any such surface or mineral rights or that such rights will be obtained in the future. To the extent they are obtained, titles to the Company's surface or mineral properties may be challenged or impugned and title insurance is generally not available. The Company's surface or mineral properties may be subject to prior unregistered agreements, transfers or claims and title may be affected by, among other things, undetected defects. Such third-party claims and defects could have a material adverse impact on the Company's operations.

Currency Risks

The Company's equity financings are sourced in Canadian dollars but much of its expenditures are in local currencies or U.S. dollars. At this time, there are no currency hedges in place. Therefore, a weakening of the Canadian dollar against the U.S. dollar or local currencies could have an adverse impact on the amount of funds available and work conducted.

Insured and Uninsured Risks

In the course of exploration, development and operation of mineral properties, the Company is subject to a number of risks and hazards in general, including adverse environmental conditions, operational accidents, labour disputes, unusual or unexpected geological conditions, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, and earthquakes. Such occurrences could result in damage to the Company's property or facilities and equipment, personal injury or death, environmental damage to properties of the Company or others, delays, monetary losses and possible legal liability.

Although the Company may maintain insurance to protect against certain risks in such amounts as it considers reasonable, its insurance may not cover all the potential risks associated with its operations. The Company may also be unable to maintain insurance to cover these risks at economically feasible premiums or for other reasons. Should such liabilities arise, they could reduce or eliminate future profitability and result in increased costs, have a material adverse effect on the Company's results and result in the decline in value of the securities of the Company.

Some work is carried out through independent consultants and the Company requires all consultants to carry their own insurance to cover any potential liabilities as a result of their work for the Company.

Environmental Risks and Hazards

The activities of the Company are subject to environmental regulations issued and enforced by government agencies. Environmental legislation is evolving in a manner that will require stricter standards and enforcement and involve increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There can be no assurance that future changes in environmental regulation, if any, will not adversely affect the Company's operations. Environmental hazards may exist on properties in which the Company holds interests which are unknown to the Company at present.

Changes in Climate Conditions

A number of governments have introduced or are moving to introduce climate change legislation and treaties at the international, national, state or provincial, and local levels. Regulation relating to emission levels (such as carbon taxes) and energy efficiency is becoming more stringent. If the current regulatory trend continues, this may result in increased costs at some or all of the Company's operations. In addition, the physical risks of climate change may also have an adverse effect on the Company's operations. Extreme weather events have the potential to disrupt operations at the Company's properties and may require the Company to make additional expenditures to mitigate the impact of such events.

Key Personnel Risk

EMX's success is dependent upon the performance of key personnel working in management and administrative capacities or as consultants. The loss of the services of key personnel could have a material and adverse effect on the Company, its business and results of operations.

Conflicts of Interest

In accordance with the corporate laws of British Columbia, the directors and officers of a corporation are required to act honestly, in good faith and in the best interests of the Company. EMX's directors and officers may serve as directors or officers of other companies or have significant shareholdings in other resource industry companies and, to the extent that such other companies may participate in ventures in which the Company may participate, such directors and officers may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. If such a conflict of interest arises at a meeting of the Company's directors, a director with such a conflict will abstain from voting for or against the approval of such participation or such terms.

Passive Foreign Investment Company

United States ("U.S.") in Common Shares should be aware that based on current business plans and financial expectations, EMX currently expects that it will be classified as a passive foreign investment company ("PFIC") under United States tax laws for the financial year ending December 31, 2021 and expects to be a PFIC in future tax years. If EMX is a PFIC for any tax year during a U.S. shareholder's ownership of Common Shares, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, or any so-called "excess distribution" received on its Common Shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the U.S. shareholder makes a timely and effective "qualified electing fund" election ("QEF Election") or a "mark-to-market" election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of EMX's net capital gain and ordinary earnings for any year in which EMX is a PFIC, whether or not EMX distributes any amounts to its shareholders.

For each tax year that EMX qualifies as a PFIC, EMX intends to: (a) make available to U.S. shareholders, upon their written request, a "PFIC Annual Information Statement" as described in United States Treasury Regulation Section 1.1295-1(g) (or any successor Treasury Regulation) and (b) upon written request, use commercially reasonable efforts to provide all additional information that such U.S. shareholder is required to obtain in connection with maintaining such QEF Election with regard to EMX. EMX may elect to provide such information on its website www.EMXRoyalty.com. Each U.S. investor should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership and disposition of Common Shares.

Corporate Governance and Public Disclosure Regulations

The Company is subject to changing rules and regulations promulgated by a number of United States and Canadian governmental and self-regulated organizations, including the U.S. Securities and Exchange Commission, the British Columbia and Alberta Securities Commissions, the NYSE American and the TSX-Venture exchanges. These rules and regulations continue to evolve in scope and complexity and many new requirements have been created, making compliance more difficult and uncertain. The Company's efforts to comply with the new rules and regulations have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Internal Controls over Financial Reporting

Applicable securities laws require an annual assessment by management of the effectiveness of the Company's internal control over financial reporting. The Company may in the future fail to achieve and maintain the adequacy of its internal control over financial reporting, as such standards are modified, supplemented, or amended from time to time, and the Company may not be able to ensure that it can conclude on an ongoing basis that it has effective internal control over financial reporting.

Future acquisitions may provide the Company with challenges in implementing the required processes, procedures, and controls in its acquired operations. Acquired corporations may not have disclosure controls and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to the Company.

No evaluation can provide complete assurance that the Company's internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of the Company's controls and procedures could also be limited by simple errors or faulty judgments. In addition, should the Company expand in the future, the challenges involved in implementing appropriate internal control over financial reporting will increase and will require that the Company continue to improve its internal control over financial reporting.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Financial Year Ended December 31, 2019

On February 15, 2019, EMX received 4,808,770 common shares of Norra Metals Corp. (TSX-V: NORA), representing a 9.9% equity stake in Norra. EMX acquired the shares pursuant to the sale of the Bleikvassli, Sagvoll and Meråker projects in Norway, and the Bastuträsk project in Sweden.

On February 20, 2019, EMX acquired 1,995,672 common shares (representing 2.63% of the outstanding shares) and warrants to purchase an additional 1,995,672 common shares of Norden Crown Metals until February 20, 2022, for C$0.15 per share. The warrants have expired without being exercised.

On February 28, 2019, EMX executed an agreement granting an option on the Røstvangen and Vakkerlien properties in Norway to Playfair Mining Ltd. The agreement provided EMX with share equity in Playfair, and upon Playfair's completion of the option terms and other considerations, a 9.9% interest in Playfair, a 3% NSR royalty on the projects, and advance royalty payments.

On April 1, 2019, EMX executed an agreement for the sale of 13 exploration licenses comprising EMX's Gold Line Project in central Sweden to Gold Line Resources Ltd. ("GLR"), a British Columbia company. The Agreement provided EMX with an initial 9.9% interest in GLR, advance royalty payments, and a 3% NSR royalty interest in the properties.

In an April 2, 2019, news release the Company announced that Nevsun Resources Ltd. had announced significant advancements at the Timok Project royalty property, including: (a) an updated high grade Upper Zone PFS, (b) commencement of an Upper Zone exploration decline, and (c) completing an initial inferred resource for the Lower Zone porphyry project. The Q1 2019 acquisition of Nevsun by Zijin Mining Group Co. Ltd. was also announced.

On April 10, 2019, EMX executed an option to purchase agreement for the sale of the Swift and Selena Carlin-style gold projects in Nevada to Ridgeline Minerals Corporation (TSX-V: RDG). The Agreement provided EMX with an initial 9.9% interest in a subsidiary of Ridgeline, and for each project a 3.25% production royalty and advance royalty and milestone payments.

On April 12, 2019, EMX received a US$2 million escrow distribution from the sale of the Malmyzh project, which in addition to the initial US$65.15 million payment in 2018, brought the total cash paid to EMX to US$67.15 million.

In an April 24, 2019, news release the Company announced a C$1.0 million strategic equity investment in Millrock Resources Inc. (TSX-V: MRO, OTCQX: MLRKF) through a private placement financing. In return, Millrock granted royalty interests to EMX on some of Millrock's properties in the Goodpaster Mining District of Alaska which hosts the Pogo high grade underground gold mine. The private placement funds were for the support of Millrock's programs in the Goodpaster District.

On April 25,2019, EMX acquired 7,142,857 common shares (representing 9.4% of the outstanding shares) and warrants to purchase an additional 7,142,857 common shares of Millrock until December 14, 2019 at C$0.14 per share; and then C$0.17 per share until December 14, 2020; and then C$0.20 per share until December 14, 2021.

On May 17, 2019, EMX executed a purchase agreement to acquire royalty interests from Corvus Gold Inc. in Alaska's Goodpaster mining district for C$350,000, and an equity investment of C$900,000 (equivalent to 500,000 shares) in Corvus through a private placement financing. EMX's acquisition of the Corvus royalty property interests complemented the Company's acquisition of Goodpaster royalty property interests from Millrock.

On August 14, 2019 the Company received C$636,000 as royalty and pre-production payments from properties in Turkey.

In an August 27, 2019, news release the Company provided an update regarding its exploration programs at the Queensland Gold project in northeastern Australia. The Queensland Gold property encompasses a 46,400-hectare area covering historic gold mines, gold occurrences, drill defined zones of gold mineralization, and multiple untested gold geochemical anomalies indicated by historic data sets.

On September 13, 2019, EMX executed purchase agreements for the sale of the Alanköy and Trab-23 projects in Turkey to Kar Mineral Madencilik İnşaat Turizm Sanayi ve Ticaret A.Ş., a privately-owned Turkish company. EMX received a gold bullion payment (or the cash equivalent) at closing, uncapped 2.5% NSR royalty interests on each project, AAR and milestone payments, and work commitments by Kar to advance the projects.

In a September 30, 2019, news release the Company announced that GLR had completed an oversubscribed private financing, having raised C$ 912,750. partner Gold Line Resources ("GLR"), a British Columbia Company, had completed an oversubscribed private financing, having raised C$912,750.

On October 22, 2019, EMX entered into a Term Sheet and Loan Agreement with Norden whereby the Company was to loan C$800,000 to Norden for one year.

On October 30, 2019, EMX acquired 791,000 common shares (representing 1.04% of the outstanding shares) of Norden. The acquisition was made pursuant to purchases through the facilities of the TSX-V at a price of C$0.05 per share (C$39,550 in total). The shares were acquired for investment purposes.

On November 14, 2019, the received C$776,000 (US$584,000) as pre-production payments from the Akarca and Sisorta royalty properties.

In December 2019, EMX acquired a 19.9% equity interest (18.9% on a fully diluted basis), in Rawhide Acquisition Holding LLC ("RAH"), a privately held Delaware company that owns the Rawhide gold-silver mining operation. The Rawhide mine is located approximately 50 miles from Fallon, Nevada, and is a fully permitted open pit heap leaching operation that produces gold and silver doré. RAH distributes 50% of its taxable income to the LLC members on a quarterly basis as a tax distribution. As well, RAH has historically made significant additional ordinary distributions to its members and may continue doing so given ongoing mining at the Rawhide and Regent open pits.

Financial Year Ended December 31, 2020

In January 2020 EMX completed the transfer of its Balya polymetallic royalty property in Turkey from Dedeman Madencilik San. ve Tic. A. Ş. to Esan Eczacibaşi Endüstriyel Hammaddeler San. ve Tic. A.Ş. a private Turkish company that operates 40 mines and eight processing plants, and is one of Turkey's leading producers of raw materials and base metals. Esan operates a lead-zinc mine and flotation mill on the property immediately adjacent to EMX's Balya royalty property. EMX retains a 4% NSR royalty on the property that is uncapped and cannot be repurchased. Dedeman commenced pilot-scale production in 2015; and reached an agreement to sell the property and mining facilities to Esan in late 2019. As part of the transaction, EMX executed a revised royalty agreement with Esan that provides for the blending of materials mined from the Esan property and EMX's royalty property and provides detailed guidelines regarding royalty payment calculations.

On February 10, 2020, EMX entered into an agreement with Akkerman Exploration B.V., a private Netherlands company, to acquire a 2% NSR royalty on various exploration licenses totalling just over 1,000 hectares (the "Kaukua Royalty") in Finland. The Kaukua Royalty was acquired from Akkerman by EMX for C$125,000 and the issuance of 52,000 Common Shares. EMX's NSR royalty applies to all future mineral production from the Kaukua Royalty licenses. Palladium One can purchase 1% of the NSR royalty prior to the delivery of a "bankable feasibility study" for €1 million. The remaining 1% of the NSR royalty is uncapped and cannot be repurchased.

On February 13, 2020 the Company executed an option agreement for the Espedalen, Hosanger, and Sigdal nickel-copper-cobalt projects in Norway with Pursuit Minerals Limited, a publicly traded company listed on the Australian Securities Exchange, focused on battery metal assets in Fennoscandia. The Agreement provides EMX with an equity interest in Pursuit, a 3% NSR royalty on each project, and other considerations including AAR and milestone payments. Pursuit may also issue up to 9.9% of its issued and outstanding share capital to EMX as certain conditions are satisfied.

On February 14, 2020 EMX closed a US$ 3.79 million strategic investment in Ensero Holdings, Inc., a privately held Delaware corporation. EMX's investment in Ensero provides for positive cash flow to EMX from dividend and other payments totalling US$ 8.54 million over seven years and a 7.5% equity position, as well as the basis for a strategic alliance to identify mineral properties for acquisition, reclamation, and subsequent sale.

On February 27, 2020 the Company executed an agreement for the sale of the Tomtebo and Trollberget polymetallic projects in Sweden to District Metals Corp. The agreement provided EMX with an initial 9.9% equity interest in District, AAR payments, 2.5% NSR royalty interests in the projects, and other consideration.

On March 19, 2020 EMX entered into an agreement to purchase net smelter returns royalty interests covering 18 properties in Chile from Revelo Resources Corp. for US$ 1,162,000. The agreement included a provision for Revelo to repay a loan due to EMX totalling approximately US$ 369,907.

On March 30, 2020, the Company executed an option agreement for the Antelope gold project in Nevada with Hochschild Mining PLC. The Agreement provides EMX with work commitments and cash payments during Hochschild's earn-in period, and upon earn-in, a 4% NSR royalty, AAR payments, and milestone payments. Pursuant to the agreement, Hochschild can earn 100% interest in the project by: (a) making option payments totalling US$ 600,000; (b) completing US$ 1,500,000 in exploration expenditures before the fifth anniversary of the Agreement; and (c) reimbursing EMX the previous year's holding costs.

On April 6, 2020 the Company executed three separate option agreements for the Erickson Ridge, South Orogrande, and Robber Gulch gold projects in Idaho with Gold Lion Resources (NV) Inc., a subsidiary of Gold Lion Resources Inc. (CSE: GL). The agreements provide for share and cash payments to EMX, as well as work commitments during Gold Lion's earn-in period for each given project, and upon earn-in, a 3.5% net smelter return royalty, AAR payments, and milestone payments. Pursuant to each agreement, Gold Lion can exercise its option to earn 100% interest in a given project by: (a) making option payments totalling US$ 600,000 to EMX, (b) delivering a total of 950,000 shares of Gold Lion to EMX, and (c) completing US$ 1,500,000 in exploration expenditures before the fifth anniversary of the agreement.

On May 18, 2020 EMX executed an amendment to its Option Agreement with Sienna Resources Inc., originally signed in December 2017 for the Slättberg nickel-copper-cobalt-PGE (Ni-Cu-Co-PGE) project in southern Sweden. Under the amended agreement Sienna can earn a 100% interest in the Kuusamo Project in Finland, subject to a 3% NSR royalty to EMX by: (a) Issuing an additional 500,000 shares of Sienna to EMX upon execution of the amendment agreement; (b) Spending a minimum of C$ 250,000 on exploration and project advancement over the next two years; (c) Reimbursing EMX for its acquisition costs and expenses related to the Kuusamo project; and (d) Issuing 1,500,000 additional shares of Sienna to EMX at the end of the two year option period. If Sienna satisfies the conditions of the option agreement and elects to acquire the project, EMX will receive AAR payments of US$ 25,000 commencing on the first anniversary of the option exercise date, with each AAR payment increasing by US$ 5,000 per year until reaching a cap of US$ 75,000 per year.

On June 4, 2020 the Company executed a purchase agreement to acquire a portfolio of royalty and property interests from Canadian prospector and entrepreneur Perry English for C$ 3 million. The portfolio consists of over 60 properties, including 52 projects optioned to third parties, of which 39 include provisions for NSR royalty interests. The portfolio may generate cash flow to EMX from option payments of more than C$ 2.5 million over the next three and a half years, as well as share-based payments valued at approximately C$ 800,000 using market prices current at the time of the transaction. Based on the valuation at the time of the transaction, EMX's investment will pay for itself, with the Company retaining upside from NSR royalty interests that range from 0.75% to 2.5% on the 39 optioned projects.

On August 11, 2020 EMX executed of an option agreement for the Løkken and Kjøli polymetallic projects in Norway and the Southern Gold Line properties in Sweden with New Dimension Resources ("NDR") (name changed to Capella Minerals Limited November 10, 2020, TSX-V: CMIL). The agreement provides EMX with up to a 9.9% equity interest in NDR (CMIL), AAR payments, 2.5% NSR royalty interests in the projects, and other consideration.

On September 4, 2020 the Company executed an exploration and option agreement for the Queensland Gold project in northeastern Australia with Many Peaks Gold Pty Ltd ("MPL"), a private Australian company. The agreement provides EMX with cash, work commitments, AAR payments, and a 2.5% NSR royalty interest in the project, as well as other consideration.

On October 21, 2020 EMX executed another amendment to its option agreement with Sienna Resources Inc., originally entered into in December, 2017. The amendment adds EMX's Bleka and Vekselmyr projects in southern Norway to the option agreement, whereby Sienna will enter a two-year option period to acquire 100% interest in the Norway projects by satisfying work commitments and making payments of cash and equity to EMX, with EMX retaining 3% net smelter returns royalty interests upon Sienna's earn-in. Sienna can earn a 100% interest in the Bleka and Vekselmyr projects by: (a) Issuing an additional 500,000 shares of Sienna to EMX upon execution of the amended Agreement; (b) Spending a minimum of C$ 250,000 per year on exploration on the projects over the next two years; (c) Reimbursing EMX for its acquisition costs and expenses related to the Bleka and Vekselmyr projects; and (d) Issuing 1,500,000 additional shares of Sienna to EMX at the end of the two-year option period. If Sienna satisfies the earn-in conditions of the agreement and elects to acquire the projects, EMX will receive AAR payments of US$ 25,000 for each property commencing on the first anniversary of the option exercise date, with each AAR payment increasing by US$ 5,000 per year until reaching a cap of US$ 75,000 per year.