NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

AND

MANAGEMENT INFORMATION CIRCULAR

| Date: | Thursday, June 30, 2022 |

| |

| Time: | 10:30 a.m. (Vancouver time) |

| |

| Place: | To be conducted by Teleconference |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON THURSDAY, JUNE 30, 2022 |

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "Meeting") of the holders ("Shareholders") of common shares ("Shares") of EMX Royalty Corporation (the "Company") will be held by teleconference on Thursday, June 30, 2022, at 10:30 a.m. (Vancouver time), for the following purposes (which are further described in the Company's information circular ("Circular") and available on the Company's website at www. https://www.emxroyalty.com and on SEDAR at www.sedar.com):

1. Receive and consider the Report of the Directors to the Shareholders. See "Particulars of Matters to be Acted Upon - Report of Directors" in the Circular;

2. Receive the Company's audited financial statements for the year ended December 31, 2021 together with the auditor's report thereon. See "Particulars of Matters to be Acted Upon - Financial Statements, Auditor's Report and Management Discussion & Analysis" in the Circular;

3. Set the number of directors for the ensuing year at six. See "Particulars of Matters to be Acted Upon - Set Number of Directors to be Elected" in the Circular;

4. Elect directors for the ensuing year. See "Particulars of Matters to be Acted Upon - Election of Directors" in the Circular;

5. Appoint Davidson & Company LLP as the Company's auditor for the ensuing year and authorize the directors to approve the remuneration to be paid to the auditor. See "Particulars of Matters to be Acted Upon - Appointment and Remuneration of an Auditor" in the Circular;

6. Ratify and approve the Company's Stock Option Plan. See "Particulars of Matters to be Acted Upon - Ratification of Stock Option Plan" in the Circular; and

7. Transact such other business as may properly come before the Meeting.

IMPORTANT NOTICE

Shareholders wishing to attend the Meeting need to use the following dial-in numbers as applicable:

North America: 1-877-385-4099 (Toll-Free in Canada and United States)

International: +1 403-232-0994 (Connection charges may apply)

*Participant Access Code: 3507562#

The Board of Directors has fixed Wednesday, May 18, 2022, as the Record Date for determining the Shareholders entitled to receive notice of and vote at the Meeting. Only Shareholders of record at the close of business on the Record Date will be entitled to vote at the Meeting.

Shareholders are requested to read the Circular and to complete and return the enclosed Proxy (or Voting Instruction Form, a "VIF") in accordance with its instructions. To be valid, all Proxies must be returned to the offices of the Company's Registrar and Transfer Agent, Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, Canada. Unregistered Shareholders must return their completed VIFs in accordance with the instructions given by their financial institution or other intermediary that sent it to them. Proxies and VIFs must be received no later than 10:30 a.m. (Vancouver time) on Tuesday, June 28, 2022.

These securityholder materials are being sent to both registered and non-registered owners of the securities (Shares). If you are a non-registered owner, and the issuer or its agent has sent these materials directly to you, your name and address and information about your holdings of securities (Shares), have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send these materials to you directly, the Company (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

As permitted by the "Notice and Access" provisions of the Canadian securities administrators, the Circular is available on the Company's website at www.EMXRoyalty.com/investors/annual-general-meeting-proxy-materials and under the Company's profile on SEDAR at www.sedar.com and has not been mailed to Shareholders. Shareholders may request, free of charge, a paper copy of the Circular (and the audited financial statements and related Management's Discussion & Analysis for the Company's last financial year and any documents referred to in the Circular) and further information on Notice and Access by contacting the Company as follows:

e-mail:

rocio@EMXRoyalty.com

| telephone:

(+1) 604-688-6390

(collect calls accepted) | fax:

(+1) 604-688-1157 | mail:

Suite 501, 543 Granville Street

Vancouver, British Columbia V6C 1X8

Canada |

Requests for paper copies of the Circular (and any other related documents) must be received no later than Monday, June 20, 2022, in order for Shareholders to receive paper copies of such documents and return their completed Proxies or VIFs by the deadline for submission of 10:30 a.m. (Vancouver time) on Tuesday, June 28, 2022.

DATED this 19th day of May 2022.

ON BEHALF OF THE BOARD OF DIRECTORS

(signed) Rocio Echegaray

Rocio Echegaray

Corporate Secretary

MANAGEMENT INFORMATION CIRCULAR as at the Record Date of Wednesday, May 18, 2022 and in Canadian dollars (except as otherwise indicated) |

PERSONS MAKING THIS SOLICITATION OF PROXIES

This Management Information Circular (the "Circular") is furnished in connection with the solicitation by the management of EMX Royalty Corporation (the "Company") of proxies ("Proxies") from registered holders and voting instruction forms ("VIFs") from the beneficial holders ("Shareholders") of the Company's common shares ("Shares") in respect of the annual general meeting of Shareholders (the "Meeting") to be held on the date and time for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders (the "Notice of Meeting").

Although it is expected that the solicitation of Proxies and VIFs will be primarily by mail, Proxies and VIFs may also be solicited personally or by telephone, facsimile, or other solicitation services. The costs of the solicitation of Proxies and VIFs will be borne by the Company.

None of the directors of the Company have informed the Company's management in writing that they intend to oppose the approval of any of the matters set out in the Notice of Meeting.

CONDUCT OF MEETING

To mitigate risks to the health and safety of our communities, Shareholders, and other stakeholders related to the COVID-19 pandemic, the Company is conducting the Meeting by telephone conference. Registered Shareholders and validly appointed proxyholders may attend the Meeting by calling

North America: 1-877-385-4099 (Toll-Free in Canada and United States)

or

International: 1-403-232-0994 (Connection charges may apply)

All callers will be prompted to enter the following Participant Access Code: 3507562# upon entering either of the teleconference dial-in numbers.

GENERAL PROXY INFORMATION

Notice and Access

In accordance with National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian securities administrators ("NI 54-101"), the Company has sent the Notice of Meeting and the Proxy or VIF, but not this Circular, directly to its Registered Shareholders (as defined below). Instead of mailing this Circular to Shareholders, the Company has posted the Circular on its website at www.EMXRoyalty.com pursuant to the "Notice and Access" procedures of NI 54-101. This Circular is also available under the Company's profile on SEDAR at www.sedar.com. Shareholders may request a paper copy of this Circular be sent to them by contacting the Company as set out under "Additional Information" at the end of this Circular.

Pursuant to NI 54-101, arrangements have been made with brokerage houses and clearing agencies, custodians, nominees, fiduciaries, banks, trust companies, trustees and their agents, nominees and other intermediaries ("Intermediaries") to forward the Notice of Meeting and a VIF to the unregistered (beneficial) Shareholders whose Shares are held by Intermediaries if such Shareholders have consented to allow their addresses to be provided to the Company ("NOBOs"). The Company may reimburse the Intermediaries for reasonable fees and disbursements incurred by them in doing so.

The Company does not intend to pay Intermediaries to forward the Notice of Meeting and a VIF to those beneficial Shareholders that have refused to allow their address to be provided to the Company ("OBOs"). Accordingly, OBOs will not receive the Notice of Meeting and a VIF unless their respective Intermediaries assume the cost of forwarding such documents to them.

Registered Shareholders

Only persons registered as Shareholders in the Company's Central Security Register maintained by its registrar and transfer agent ("Registered Shareholders") or duly appointed proxyholders of Registered Shareholders ("Proxyholders") will be recognized or may make motions or vote at the Meeting.

Beneficial Shareholders

The information set forth in this section is of significant importance as many Shareholders do not hold Shares in their own name.

If Shares are listed in an account statement provided to a Shareholder (a "Beneficial Shareholder") by a broker, those Shares, in all likelihood, will not be registered in the Shareholder's name. It is more likely that such Shares will be registered under the name of an Intermediary. Shares held by Intermediaries on behalf of a broker's client can only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, Intermediaries are prohibited from voting Shares for the Beneficial Shareholders. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate party well in advance of the Meeting.

As provided for NI 54-101, the Company has elected to obtain a list of its NOBOs from Intermediaries and deliver proxy-related materials directly to its NOBOs. As a result, NOBOs can expect to receive a scannable VIF instead of a Proxy. A VIF enables a Shareholder to provide instructions to the registered holder of its Shares as to how those Shares are to be voted at the Meeting and allows the Registered Shareholder of those Shares to provide a Proxy voting the Shares in accordance with those instructions. VIFs should be completed and returned in accordance with its instructions. As indicated in the VIF, Internet voting is also allowed. The results of the VIFs received from NOBOs will be tabulated and appropriate instructions respecting voting of Shares to be represented at the Meeting will be provided to the Registered Shareholders.

The forms of VIF requesting voting instructions supplied to Beneficial Shareholders are substantially similar to the Proxy provided directly to the Registered Shareholders by the Company, however, their purpose is limited to instructing the Registered Shareholder how to vote on behalf of the Beneficial Shareholder. A VIF has its own return instructions, which should be carefully followed by Beneficial Shareholders to ensure their Shares are voted at the Meeting.

Most brokers now delegate responsibility for obtaining voting instructions from OBOs to Broadridge Investor Communications in Canada and the United States of America. Broadridge prepares a machine-readable VIF, mails the VIF and other proxy materials for the Meeting to OBOs and asks them to return the VIF to Broadridge. It then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting.

A Beneficial Shareholder may use their VIF to vote their own Shares directly at the Meeting if the Beneficial Shareholder inserts their own name as the name of the person to represent them at the Meeting. The VIF must be returned to Computershare, Broadridge or other Intermediary that provided the VIF well in advance of the Meeting to have the Shares voted. Beneficial Shareholders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.

Shareholders with any questions respecting the voting of Shares held through a broker or other Intermediary should contact that broker or other Intermediary for assistance.

United States Shareholders

This solicitation of Proxies and VIFs and the transactions contemplated in this Circular involve securities of an issuer incorporated and located in the province of British Columbia, Canada and are being effected in accordance with the corporate and securities laws of British Columbia. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended, are not applicable to the Company or this solicitation. Shareholders should be aware that disclosure and proxy solicitation requirements under the securities laws of British Columbia differ from the disclosure and proxy solicitation requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business Corporations Act (British Columbia), some of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign corporation or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign corporation and its officers and directors to subject themselves to a judgment by a United States court.

Appointment of Proxyholders and Completion and Revocation of Proxies and VIFs

Since only Registered Shareholders and Proxyholders will be recognized or may make motions or vote at the Meeting, Shareholders may wish to appoint Proxyholders to represent them at the Meeting as follows.

The persons named (the "Management Designees") in the Proxy or VIF have been selected by the Company's board of directors (the "Board") and have agreed to represent, as Proxyholder, the Shareholders appointing them.

A Shareholder has the right to designate a person (who need not be a Shareholder and, for a VIF, can be the appointing Shareholder) other than the Management Designees as their Proxyholder to represent them at the Meeting. Such right may be exercised by inserting in the space provided for that purpose on the Proxy or VIF the name of the person to be designated and by deleting therefrom the names of the Management Designees or, if the Shareholder is a Registered Shareholder, by completing another proper form of Proxy and delivering the Proxy or VIF in accordance with its instructions. Such Shareholder should notify the nominee of the appointment, obtain the nominee's consent to act as Proxyholder and provide instructions on how their Shares are to be voted. The nominee should bring personal identification with them to the Meeting.

A Shareholder may indicate the manner in which the Proxyholders are to vote on behalf of the Shareholder, if a poll is held, by marking an "X" in the appropriate space of the Proxy. If both spaces are left blank, the Proxy will be voted as recommended by management for any matter requiring a "For" or "Against" vote, and in favour of the matter for any matter requiring a "For" or "Withhold" vote.

The Proxy, when properly signed, confers discretionary authority with respect to amendments or variations to the matters identified in the Notice of Meeting. As of the date of this Circular, the Company's management is not aware that any amendments or variations are to be presented at the Meeting. If any amendments or variations to such matters should properly come before the Meeting, the Proxies hereby solicited will be voted as recommended by management.

To be valid, the Proxy or VIF must be dated and executed by the Shareholder or an attorney authorized in writing, with proof of such authorization attached (where an attorney executed the Proxy or VIF). The completed Proxy or VIF must then be returned in accordance with its instructions. Proxies (but not VIFs, unless the VIF has Computershare's name and address on the top right corner of the first page) and proof of authorization can also be delivered to the Company's transfer agent:

Computershare Investor Services Inc. (Attn: Proxy Department)

| Fax: | 1-866-249-7775 (within North America)

(+1) 416-263-9524 (outside North America) |

| | |

| Mail: | 8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1, Canada

(toll-free information line: 1-800-564-6253) |

| | |

| Courier: | 3rd Floor, 510 Burrard Street, Vancouver, British Columbia V6C 3B9, Canada |

at least forty-eight (48) hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. Proxies and VIFs received after that time may be accepted or rejected by the Chairman of the Meeting at the Chairman's discretion, and the Chairman is under no obligation to accept or reject late Proxies.

A Proxy may be revoked by a Shareholder depositing an instrument in writing (which includes a Proxy bearing a later date) executed by the Shareholder or by their authorized attorney in writing, or, if the Shareholder is a corporation, under its corporate seal by an officer or attorney thereof duly authorized, to:

| Computershare: | As set out above |

| | |

| or the Company: | EMX Royalty Corporation

Attn: Rocio Echegaray |

| Mail: | Suite 501, 543 Granville Street

Vancouver, British Columbia, V6C 1X8

Canada |

| Fax: | (+1) 604-688-1157 |

| | |

| or the Registered office: | Northwest Law Group

Attn: Michael F. Provenzano |

| Mail: | Suite 704, Box 35

595 Howe Street

Vancouver, British Columbia, V6C 2T5

Canada |

| Fax: | 1-866-687-5792 |

at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or by depositing the instrument in writing with the Chairman of such Meeting, prior to the commencement of the Meeting or any adjournment thereof. VIFs may only be revoked in accordance with their specific instructions.

Voting

The Meeting will be conducted by a teleconference. Shareholders will not be able to attend the Meeting in person. Only Registered Shareholders and duly appointed Proxyholders can virtually attend, make motions and vote at the Meeting.

At the Meeting, each Registered Shareholder and each Proxyholder representing a registered or unregistered Shareholder will have one vote, unless a poll is required (if the number of Shares represented by Proxies and VIFs that are to be voted against a motion is greater than 5% of the votes that could be cast at the Meeting) or requested by a Shareholder, Proxyholder or the Chairman of the Meeting, whereupon each such Shareholder and Proxyholder is entitled to one vote for each Share held or represented, respectively.

To approve a motion proposed at the Meeting a majority of greater than 50% of the votes cast will be required (an "ordinary resolution") unless the motion requires a "special resolution" in which case a majority of 66-2/3% of the votes cast will be required.

RECORD DATE AND QUORUM

The Board has fixed the record date for the Meeting as the close of business on Wednesday, May 18, 2022 (the "Record Date"). Shareholders of record as of the Record Date are entitled to receive notice of the Meeting and to vote their Shares at the Meeting.

The Company's Articles provide that the quorum for the transaction of business at any meeting of Shareholders is two Shareholders present in person or represented by Proxy.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue an unlimited number of Shares, which are the only securities entitled to be voted at the Meeting. As of the Record Date, the Company had 109,383,127 Shares issued and outstanding. Shareholders are entitled to one vote for each Share held.

To the knowledge of the Company's directors and executive officers, no one beneficially owned or exercised control or direction over, directly or indirectly, voting securities carrying 10% or more of the voting rights attached to the Shares as of the Record Date except as indicated below:

| Name | Number of Shares

Owned or Controlled

on the Record Date | Percentage of

Outstanding

Shares |

| Paul H. Stephens | 11,340,450 | 10.367% |

STATEMENT OF EXECUTIVE COMPENSATION

Unless otherwise noted the following information is for the Company's last completed financial year ended December 31, 2021, and, since the Company has subsidiaries, is prepared on a consolidated basis.

Named Executive Officers

For the purposes of this Circular, a Named Executive Officer ("NEO") means each of the following individuals during the most recently completed financial year:

(a) the Company's chief executive officer ("CEO");

(b) the Company's chief financial officer ("CFO"); and

(c) each of the Company's three most highly compensated executive officers, or individuals acting in a similar capacity, other than the CEO and CFO, if their individual total compensation (excluding the value of any pension) was more than $150,000 for that financial year.

Compensation Discussion and Analysis

The Compensation Committee of the Board is responsible for ensuring that the Company has appropriate procedures for reviewing executive compensation and making recommendations to the Board with respect to the compensation of the Company's executive officers. The Compensation Committee seeks to ensure that total compensation paid to all executive officers is fair and reasonable and is consistent with the Company's compensation philosophy.

The Compensation Committee is also responsible for recommending compensation for the directors, stock options grants to the directors, officers, employees, and consultants pursuant to the Company's Stock Option Plan (the "Option Plan") and issuances of Shares to directors and officers pursuant to the Company's Restricted Share Unit ("RSU") Plan (the "RSU Plan").

Compensation Committee

The Compensation Committee is composed of Brian K. Levet (Chairman), Brian E. Bayley and Henrik K. B. Lundin, each of whom the Board has determined is independent (outside and non-management). The Board is satisfied that the composition of the Compensation Committee ensures an objective process for determining compensation. Each of the members of the Compensation Committee has skills and direct experience relevant to his responsibilities as a member of the Compensation Committee as follows:

Brian K. Levet: has over 36 years of diversified executive and management experience in mineral exploration, project start-up and mine development and operation. Mr. Levet held various executive and management positions at Newmont Mining Corporation from 1983 to December 2010. Before Newmont, Mr. Levet started out with Rio Tinto Rhodesia and Zimbabwe Iron and Steel Corporation after earning a B.Sc. in Geology from the University of London (Derby College of Technology). He is recognized within the mining industry for exploration expertise and team leadership that resulted in a number of major discoveries, including the Batu Hijau and Elang copper-gold deposits in Indonesia, the North Lanut gold deposit in North Sualwesi, Indonesia, and the McPhillamys gold deposit in New South Wales, Australia.

Brian E. Bayley: is Executive Chairman of Earlston Investments Corp., a private merchant bank. Mr. Bayley is knowledgeable in areas of asset backed lending, corporate restructuring, natural resources and real estate. From June 2003 to July 2013, Mr. Bayley held various positions including CEO and President and director of Quest Capital Corp., a predecessor corporation to Sprott Resource Lending Corp. (a publicly traded resource lending corporation). Prior to his positions with Quest Capital Corp., Mr. Bayley worked with the Vancouver Stock Exchange (now the TSX Venture Exchange (the "TSX-V")). Mr. Bayley has held active senior management positions in both private and public natural resource companies. He has over 34 years of public issuer experience both as a director and officer and continues to serve as a director and officer for several private and public companies. Mr. Bayley holds an MBA from Queen's University.

Henrik Lundin: has considerable global experience in the natural resource sector. He has strong understanding of the technical and business side of the oil and gas industry. Formerly, Mr. Lundin held the position of COO of TAG Oil Ltd and was responsible for the global operations of TAG Oil and lead the farm-in / farm-out processes in Australia and New Zealand. Mr. Lundin has a B.Sc. (Petroleum Engineering) degree from the Colorado School of Mines in Golden, Colorado.

Compensation Decision-Making Process

The Company's compensation program design and decision-making process involves the CEO and executive team members, the Compensation Committee and the Board, with the benefit of advice from the Compensation Committee's independent executive compensation experts.

As outlined in the flowchart below, the Compensation Committee makes recommendations with respect to executive compensation to the Board. In doing so, the Compensation Committee seeks advice from independent executive compensation experts, as well as soliciting input from other Board members and the Company's executive team.

CEO & Executive Team - Reviews and analyzes current compensation strategy.

- Reviews input from the independent executive compensation experts provided to the Compensation Committee.

- Provides recommendations regarding compensation strategies and compensation, including a review by the CEO of performance and compensation of other executives.

- Assists the Compensation Committee in discharging its duties by:

- Proposing near-term corporate objectives and associated targets as part of the Company's short-term incentives and determining achievements relative to such objectives.

- Proposing changes to the Company's long-term equity-based compensation programs.

|

| Compensation Committee - Reviews, assesses, and makes recommendations to the Board with respect to compensation-related matters, including:

- The compensation philosophy, strategy, policies, and programs to ensure continued alignment with the Company's strategic objectives, shareholders and peer group.

- The goals and objectives of the CEO and their compensation levels based on the Compensation Committee's evaluation of their performance relative to such goals and objectives.

- The compensation of other executives of the Company based on recommendations from the CEO.

|

| Board of Directors - Reviews recommendations from the Compensation Committee.

- Considers the Company's objectives, strategy, peer group and other relevant factors.

- Approves compensation philosophy, strategy, policies and programs, incentive compensation plans, corporate objectives, executive compensation, independent director compensation and related matters.

|

|

Independent Executive Compensation Experts - Provides the Compensation Committee with independent advice on compensation-related matters, including:

- Compensation philosophy and strategy.

- Development of a peer group of companies that reflects the Company's current size and stage of development.

- Executive and independent director compensation levels relative to the peer group.

- Industry practices regarding short-term and long-term incentive compensation programs.

- Review and advise on management-prepared materials and recommendations.

- Compensation governance matters, including providing guidance on best practices in the governance of compensation and related trends in the mining industry.

See Independent Compensation Advisor below for additional details. |

| - The compensation of independent directors.

- The compensation disclosure in the Company's information circular.

- Compensation governance matters and best practices.

- Considers comparative data, benchmarking and the advice of its independent compensation advisor.

- Administers and interprets the Company's long-term equity-based compensation plans.

- Assesses and provides oversight to the executive team regarding material risks relating to the Company's compensation programs.

| | |

In making its recommendations, the Compensation Committee is guided by competitive market practice for companies at the Company's size and stage of development but is driven by the Company's particular circumstances and what the Compensation Committee concludes is appropriate for the Company's executive group in light of the applicable risks and competitive employment environment.

Independent Compensation Advisor

In November 2016, the Compensation Committee retained Lane Caputo Compensation Inc. as an independent compensation advisor to review and make recommendations regarding the Company's compensation arrangements for its executive team and non-executive directors and to recommend required changes to align pay elements and strategy with both current market practices and the Company's business strategy. The report containing Lane Caputo's recommendations was used by the Compensation Committee to guide and assist it in establishing short- term equity incentive and long-term equity incentive programs ("STIP" and "LTIP") and compensation levels.

In 2019, Lane Caputo assisted the Compensation Committee with assessing and modifying the Company's variable pay programs.

In 2020, as part of the Company's regular compensation review process, Lane Caputo reviewed the Company's compensation program for continued alignment with current market practices, the Company's business strategy and Shareholder return.

In addition to the regular review of the Company's compensation program for continued alignment with current market practices, the Company's business strategy and Shareholder return in 2021, Lane Caputo provided the Compensation Committee with an assessment of the Company's approach to risk within its executive compensation program. This assessment included a review of the Company's compensation and governance policies used to mitigate risk and a detailed sensitivity analysis of potential payouts from the Company's incentive programs.

Lane Caputo also provides ongoing support to the Compensation Committee in the assessment of corporate performance as it relates to the vesting of RSU awards.

The fees charged by Lane Caputo during the Company's 2021 and 2020 financial years were as follows:

| Nature of Fee | 2021 | 2020 |

| Executive Compensation-Related Fees | $49,611 | $37,516 |

| All Other Fees | Nil | Nil |

Compensation Governance and Risk Management

Under the direction of the Board, the Compensation Committee evaluates the potential risks associated with Company's compensation policies and practices. As part of its mandate in 2021, Lane Caputo provided the Compensation Committee with an assessment of the Company's approach to risk within its executive compensation program that included a review of the Company's compensation and governance policies used to mitigate risk and a detailed sensitivity analysis of potential payouts from the Company's incentive programs. The Compensation Committee has not identified any risks arising from the Company's compensation policies and practices which would have a material adverse effect on the Company.

As outlined below in "Compensation Philosophy and Objectives", the Compensation Committee evaluates and recommends to the Board compensation strategies which align each NEO's goals with those of the Shareholders and other stakeholders to ensure the Company's short-term and long-term goals are met without exposing the Company to unnecessary risk. The Compensation Committee considers a mix of base salary, short term incentives and long-term incentives to attract high caliber executives sufficient to encourage behaviour that leads to creation of long-term value while limiting incentives that might promote inappropriate risk-taking.

As part of the annual review of the compensation packages of the Company's NEOs, the Compensation Committee identifies, and if necessary, changes, strategies to mitigate risks. The Committee considers several factors as part of this review including retention of key employees, competitive salaries within the context of peer companies, short term incentives linked to specific goals as discussed below and long-term incentives (stock options and RSUs) which link executive pay to real value creation and long-term share appreciation.

Minimum Share Ownership Guidelines

To further align the interests of executives with those of Shareholders, on May 14, 2021 the Board adopted the Share Ownership Policy that outlines the following minimum share ownership guidelines to which the Company's NEOs are subject:

| Principal Position | Minimum Share Ownership Guideline |

| President & CEO | 3x Base Salary |

| Other NEOs | 1x Base Salary |

For the purposes of this policy, the value of the Shares held by an NEO is determined based on the closing price of the Shares on the TSX-V on January 2nd of the current calendar year. NEOs have three years from the later of the effective date of the policy or the date they assumed such role with the Company to satisfy the minimum ownership requirements and must subsequently continue to satisfy such requirements for the duration of their tenure as NEOs.

While compliance with the Share Ownership Policy will be first determined on May 14, 2024, all of the NEOs are currently in compliance.

Compensation Hedging

No NEO or director is permitted to purchase financial instruments, including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Incentive Compensation Clawback Policy

The Board has adopted the Incentive Compensation Clawback Policy which provides for the full or partial forfeiture and recoupment of performance-based compensation awarded and outstanding or paid to an NEO subsequent to a material restatement of previously issued financial statements of the Company, required by applicable securities laws and directly resulting or arising from the negligence, fraud or willful misconduct of any such NEO, the result of which is that any performance-based compensation provided to any such executive officer would have been a lower amount had it been calculated based on such restated results. For the purposes of this policy, performance-based compensation includes incentive compensation awarded or paid in any form, including cash or equity-based, whether vested or unvested. This policy applies to all performance-based compensation awards issued to any executive at the Vice-President level or above (including each NEO).

Compensation Philosophy and Objectives

The philosophy used by and the objectives of the Compensation Committee and the Board in determining compensation is that the compensation should:

(i) assist the Company in attracting and retaining high caliber executives;

(ii) align the interests of executives with those of the Shareholders;

(iii) reflect the executive's performance, expertise, responsibilities and length of service to the Company; and

(iv) reflect the Company's current state of development, performance and financial status.

Elements of the Compensation Program & Competitive Positioning

The compensation of the Company's NEOs is comprised primarily of:

(i) base salary;

(ii) annual short-term incentives in the form of cash bonuses based on quantifiable corporate and personal goals and objectives that are tied to the overall success of the Company and that are closely aligned with the Company's business;

(iii) long-term incentives in the form of stock grants, RSU grants under the RSU Plan and stock option grants under the Option Plan are recommended by the Compensation Committee and approved by the Board; and

(iv) benefits related to health and retirement savings plans, such as United States 401(k) retirement plans.

Given the foregoing philosophy and the skillsets required to execute the Company's complex business strategy, the Company has adopted a compensation program whereby NEOs' base salaries are targeted at the 75th percentile of the peer group. The Company may choose to pay above or below target levels to reflect each incumbent's relative experience or performance versus the market or to reflect competitive market pressures for a given skill set.

Incentives have been established to maintain total cash compensation (salary and bonus) at the 75th percentile of the market when performance is at target levels with sufficient leverage to achieve top quartile levels of cash compensation for high levels of corporate and individual performance. In an effort to manage cash flow and provide additional Shareholder alignment, the Company may consider paying annual incentives in RSUs, rather than cash.

The number of stock options and RSUs granted annually to each executive position is targeted at median levels in the peer group and should be sufficient, when combined with each executive's other elements of compensation, to allow total direct compensation to achieve upper quartile positioning only in the case of superior share price performance.

As part of its mandate in 2016, Lane Caputo developed a peer group of mining companies against which it benchmarked the compensation competitiveness of the Company's executive team members and non-executive directors. That peer group was updated as part of the 2021 compensation review process to reflect the Company's current business strategy, size and stage of development. The 20 companies in the updated peer group developed for the most recent review were:

| Altius Minerals Corp. | Integra Resources Corp. | Nova Royalty Corp. |

| Anglo Pacific Group plc | Josemaria Resources Inc. | Probe Metals Inc. |

| Corvus Gold Inc. | Liberty Gold Corp. | Regulus Resources Inc. |

| Elemental Royalties Corp. | Marathon Gold Corp. | Sabina Gold & Silver Corp. |

| Fury Gold Mines Ltd. | Maverix Metals Inc. | Vox Royalty Corp. |

| Gold Royalty Corp. | Metalla Royalty & Streaming Ltd. | Wallbridge Mining Company Ltd. |

| Gold Standard Ventures Corp. | Nomad Royalty Corp. | |

While this peer group provides a proxy for the broader marketplace in which the Company competes for executive talent, the Company's relatively unique business model, an analysis of the nine royalty and streaming companies in the peer group, the most directly relevant comparators to the Company, provided additional context for the compensation practices of royalty and streaming companies against the peer group and the broader mining industry.

Elements of Compensation

The Company's compensation program consists primarily of base salary, short-term incentives and long-term incentives. The following table summarizes the compensation elements, the earning criteria and the outcome received by the NEO:

Element of

Compensation | Type of

Compensation | Pay

Elements | Performance Criteria | Performance

Period |

| Base Salary | Fixed | Cash | Individual contribution and competencies and

prior relevant experience | Annual |

| Short-Term Incentives | Variable | Cash,

RSUs | Achievement of annual financial and

operational objectives | Annual |

| Long-Term Incentives | Variable | Stock

Options, RSUs | Passage of time and performance the achievement of long-term financial,

operational, and share price objectives | Five years

(Stock Options)

Three year

(RSUs) |

Compensation Committee Decisions for 2021

(i) Base Salary

Salary levels for all NEOs have not changed since 2017, at which time David M. Cole, CEO, voluntarily decreased his annual cash salary from US$ 400,000 to US$ 325,000.

(ii) Annual and Short-Term Incentives

In 2020, a structured incentive program based on quantifiable corporate and personal goals and objectives that are tied to the overall success of the Company and closely aligned with the Company's business strategy was established. The Compensation Committee and the NEOs and other executive officers developed meaningful, yet attainable, targets for several key performance indicators, measured over a one year period.

The Compensation Committee met in March 2022 to assess the Company's performance relative to such performance measures based upon financial and operating results for the year ended December 31, 2021. The results of that assessment are as follows:

| Key Performance Indicator | Weighting | Target

Performance | Exceptional

Performance | Actual

Performance |

| Operational Efficiency | Exploration capital spent by partners | 30% | US$15 million | US$20 million | US$23.2 million |

| Ongoing partnership agreements | 15% | 16 | 21 | 19 |

| New partnership agreements | 15% | 20 | 25 | 25 |

| Operational Effectiveness | Use the Company's influence to progress optimisation of the Rawhide investment | 10% | Exit 2021 with Life of Mine of two years | Exit 2021 with Life of Mine of three years | Not achieved |

| Key Performance Indicator | Weighting | Target

Performance | Exceptional

Performance | Actual

Performance |

| Corporate Development | Identification of opportunities that

meet the Company's investment criteria (with

endorsement by the Board) | 10% | Three opportunities negotiated and

consummated | Five opportunities negotiated and

consummated | Three opportunities negotiated and

consummated |

| Financial Management | Revenue & Other Income | 10% | CA$7 million | CA$10 million | CA$12.4 million |

| Environmental, Social & Governance | Develop a sustainability strategy

endorsed by the Board | 10% | Implementation of ESG Initiatives | Draft ESG Framework | ESG Framework |

Based on the scorecard outlined above, the Compensation Committee assessed the Company's overall corporate performance in 2021 at 162% of target. These performance results were applied to each executive's associated short-term incentive targets to determine their respective annual cash bonus:

Name & Principal

Position | Short-Term Incentive Targets | Actual Incentive

Earned

(% of Base Salary) |

Minimum

(% of Base Salary) | Target

(% of Base Salary) | Maximum

(% of Base Salary) |

David M. Cole

President & CEO | 0% | 25% | 35% | 29% |

Douglas L. Reed

CFO | 0% | 15% | 25% | 20% |

Michael D. Winn

Executive Chairman | 0% | 25% | 35% | 29% |

Christina Cepeliauskas

CAO* | 0% | 15% | 25% | 20% |

* Chief Administrative Officer ("CAO")

(iii) Long-term Incentives

In April 2021, the Compensation Committee recommended, and the Board approved, the settlement of the 2018 RSU Awards, the vesting of which were subject to following criteria:

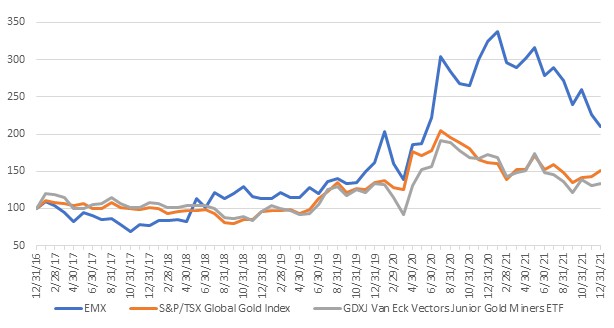

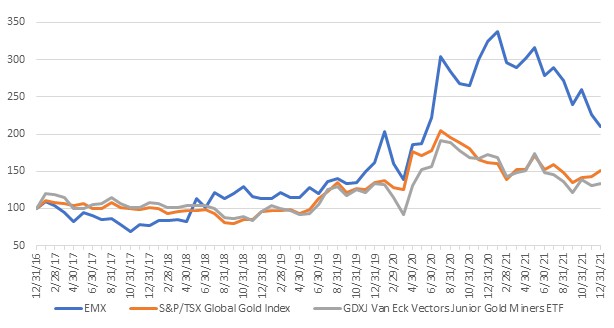

- 50% of the RSU award was subject to the Company's Total Shareholder Return ("TSR") performance relative to the S&P / Global Gold Index; and

- 50% of the award was subject to the Company achieving cash flow neutrality in three years from January 1, 2018.

While the Company did not achieve cash flow neutrality during the performance period, the Company's TSR of 60% over the performance period positioned at the 100th percentile of the S&P / Global Gold Index constituents, resulting in the following awards vesting with plan participants:

| Name and Principal Position | Target Number of

RSUs granted | Performance factor | Number of RSUs

Vested |

| David M. Cole, President & CEO | 100,000 | 100% | 100,000 |

| Douglas L. Reed, CFO | N/A | 100% | N/A |

| Michael D. Winn, Executive Chairman | N/A | 100% | N/A |

| Christina Cepeliauskas, CAO | 30,000 | 100% | 30,000 |

To assist in the payment of associated income taxes, 70% of each award outlined above was settled by the issuance of Shares, with the remainder of the award settled by a cash payment equivalent to the closing value of 30% of the corresponding Shares on December 31, 2020.

In April 2021, the Compensation Committee recommended, and the Board approved, the following RSU awards:

| Name and Principal Position | Number of RSUs awarded |

| David M. Cole, President & CEO | 80,000 |

| Douglas L. Reed, CFO | 40,000 |

| Michael D. Winn, Executive Chairman | 60,000 |

| Christina Cepeliauskas, CAO | 30,000 |

For the RSUs to vest, the RSU holder must satisfy performance criteria set for each award by the Compensation Committee. For the 2021 awards, the performance criteria were as follows:

- 25% of the RSU award is subject to the Company's TSR performance relative to the S&P / Global Gold Index.

- 25% of the RSU award is subject to the Company's TSR performance relative to a group of 18 royalty and mining peers (the "TSR Peer Group") as follows:

| Abitibi Royalties Inc. | Josemaria Resources Inc. | Polymet Mining Corp. |

| Altius Minerals Corp. | Maverix Metals Inc | Premier Gold Mines Ltd. |

| Anglo Pacific Group plc | Metalla Royalty & Streaming Ltd. | Sailfish Royalty Corp. |

| Corvus Gold Inc. | Nexa Resources SA | Sandfire Resources America Inc. |

| Hudbay Minerals Inc. | NGEx Minerals Ltd. | Strategic Metals Ltd. |

| Jervois Mining Ltd | Osisko Gold Royalties Ltd. | Trilogy Metals Inc. |

The following payout multiple will apply to the 50% portion of each RSU award subject to the Company's relative TSR performance:

- Below-median Performance (49th percentile): 0% of RSUs vest

- Median Performance (50th percentile): 100% of RSUs vest

- Upper Quartile Performance (75th percentile): 200% of RSUs vest

Linear interpolation will be applied to determine percentage RSU vesting for relative TSR performance between the performance achievement levels shown, with performance multiplier capped at 200% of target.

As seen from the payout multiplier schedule above, the Company's TSR must equal at least the median performance of the S&P / Global Gold Index and the TSR Peer Group for any value to vest with RSU holders. As the vesting of 50% of the RSUs awarded to the executive team is contingent upon relative TSR performance, executive rewards are tied heavily to Shareholder value creation. RSU awards vest at the end of the three-year performance measurement period (known as "cliff-vesting") to generate sufficient long-term incentive.

In April 2021, the Compensation Committee recommended, and the Board approved, the following stock option grants:

Name and

Principal Position | Number of Shares issuable

under stock options granted | Exercise Price

($ per share) | Expiry

Date |

| David M. Cole, President & CEO | 150,000 | 4.11 | May 6, 2026 |

| Douglas L. Reed, CFO | 70,000 | 4.11 | May 6, 2026 |

| Michael D. Winn, Executive Chairman | 100,000 | 3.66 | August 19, 2026 |

| Christina Cepeliauskas, CAO | 55,000 | 4.11 | May 6, 2026 |

Summary Compensation Table

The following table contains a summary of the compensation paid to the NEOs during the last three financial years.

Name

& Principal

position | Year

| Salary

($) | Share-

based

Awards(4)

($) | Option-

based

Awards

($) | Non-equity incentive

Plan compensation | Pension

Value

($) | All Other

Compensation

($) | Total

Compensation

($) |

Annual

Incentive

Plans(5)

$) | Long

Term

Incentive

Plans

($) |

David M. Cole

President & CEO

| 2021 | 407,388(1) | 483,600 | 290,557(6) | 118,142(1) | Nil | 14,541(1) | Nil | 1,153,027 |

| 2020 | 435,844(2) | 217,600 | 228,579(7) | 149,277(2) | Nil | 14,856(2) | Nil | 1,046,156 |

| 2019 | 428,903(3) | 92,857 | 173,066(8) | 91,946(3) | Nil | 14,848 | Nil | 801,620 |

Douglas L. Reed

CFO(12)

| 2021 | 200,000 | 241,800 | 135,593(6) | 40,000(1) | Nil | Nil | Nil | 536,793 |

| 2020 | 150,000 | 108,800 | 107,567(7) | 51,093(2) | Nil | Nil | Nil | 417,460 |

| 2019 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Michael D. Winn

Executive

Chairman | 2021 | 313,375(1)(9) | 362,700 | 148,390(6) | 90,879(1) | Nil | Nil | Nil | 794,443 |

| 2020 | 195,571(2) | 217,600 | 171,434(7) | 81,302(2) | Nil | Nil | 33,526(2) | 699,433 |

| 2019 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Name

& Principal

position | Year

| Salary

($) | Share-

based

Awards(4)

($) | Option-

based

Awards

($) | Non-equity incentive

Plan compensation | Pension

Value

($) | All Other

Compensation

($) | Total

Compensation

($) |

Annual

Incentive

Plans(5)

$) | Long

Term

Incentive

Plans

($) |

Christina

Cepeliauskas

CAO(13) | 2021 | 130,000(10) | 181,350 | 106,538(6) | 26,000(1) | Nil | Nil | Nil | 383,438 |

| 2020 | 103,260 | 81,600 | 87,398(7) | 30,655(2) | Nil | Nil | Nil | 302,913 |

| 2019 | 86,250(11) | 55,886 | 64,900(8) | 56,233(3) | Nil | Nil | Nil | 263,269 |

(1) Paid in United States dollars and converted to Canadian dollars at the average rate for the year ended on December 31, 2021 at C$1.2535 = US$1.00

(2) Paid in United States dollars and converted to Canadian dollars at the average rate for the year ended on December 31, 2020 at C$1.3411 = US$1.00

(3) Paid in United States dollars and converted to Canadian dollars at the average rate for the year ended on December 31, 2019 at C$1.3197 = US$1.00

(4) Certain Share-based compensation relates to a long-term RSU incentive plan and calculated based on RSUs awarded in the current year grant and represents the number of RSUs awarded but not yet vested. Actual RSUs vested may vary as each RSU entitles the holder to acquire, for nil cost, between zero and 1.75 Shares, subject to the achievement of certain performance conditions. Value disclosed is based on the International Financial Reporting Standards ("IFRS") requirements for calculating the estimated value to be vested over the three-year vesting period for financial statement presentation purposes.

(5) Under the terms of the STIP, the cash bonus calculated based on targets for several key performance indicators, measured over a one year period, may be paid out in Shares.

(6) The "grant date fair value" of options granted during the year ended December 31, 2021 was determined by using the Black-Scholes model, as described below, and the following weighted average assumptions: stock price - $4.11, exercise price - $4.11, an option life of 5 years, a risk-free interest rate of 0.91% and a volatility of 54.68%.

(7) The "grant date fair value" of options granted during the year ended December 31, 2020 was determined by using the Black-Scholes model, as described below, and the following weighted average assumptions: stock price - $2.62 exercise price - $2.62, an option life of 5 years, a risk-free interest rate of 0.38% and a volatility of 61.54%.

(8) The "grant date fair value" of options granted during the year ended December 31, 2019 was determined by using the Black-Scholes model, as described below, and the following weighted average assumptions: stock price - $1.70 exercise price - $1.70, an option life of 5 years, a risk-free interest rate of 1.33% and a volatility of 67.678%.

(9) Compensation has been attributed to the Corporation on the basis of the work commitments to the Corporation being 75%.

(10) Compensation has been attributed to the Corporation on the basis of the work commitments to the Corporation being 60%.

(11) Pursuant to a Management Services Agreement between the Corporation and Seabord Services Corp., Christina Cepeliauskas' remuneration was paid by Seabord. The amounts disclosed include compensation paid by Seabord for services rendered to the Corporation as a CAO and previously as CFO. Such compensation has been attributed to the Corporation on the basis of the work commitments to the Corporation. See "Management Contracts" for a description of the material terms of the Management Services Agreement.

(12) Douglas L. Reed was appointed CFO on July 1, 2020.

(13) Christina Cepeliauskas was appointed CAO on July 2020. Prior thereto she was the CFO.

The Company has calculated the "grant date fair value" amounts in the "Option-based Awards" column using the Black-Scholes model, a mathematical valuation model that ascribes a value to a stock option based on a number of factors in valuing the option-based awards, including the exercise price of the options, the price of the underlying security on the date the option was granted, and assumptions with respect to the volatility of the price of the underlying security and the risk-free rate of return. Calculating the value of stock options using this methodology is very different from a simple "in-the-money" value calculation. Stock options that are well "out-of-the-money" can still have a significant "grant date fair value" based on a Black-Scholes valuation. Accordingly, caution must be exercised in comparing grant date fair value amounts with cash compensation or an "in-the-money" option value calculation. The total compensation shown in the last column is the total of the compensation of each NEO reported in the other columns. The value of the "in-the-money" options currently held by each NEO (based on share price less option exercise price) is set forth in the "Value of Unexercised In-the-money Options" column of the "Outstanding Share-based and Option-based Awards held by NEOs" table below.

See "Employment and Consulting Agreements" for a description of the material terms of the employment and consulting agreements with the NEOs.

Incentive Plan Awards

Outstanding Share-Based and Option-Based Awards held by NEOs

The following table sets out, for each NEO, the incentive option-based and Share-based awards (in the form of RSUs) held as of December 31, 2021.

Name

| Option-based Awards | Share-based Awards |

Number of

Securities

Underlying

Unexercised

options

(vested-

unvested) | Option

Exercise

price

($ per

share) | Option

Expiration

date

(m/d/y) | Value of

unexercised

"in-the-

money"

options(1)

($) | Number of

shares or

units

of shares

that

have not

vested(5)

(#) | Market or

payout

value of

Share-based

awards that

have not

vested(1)

($) | Market or

payout

value of

shares

vested

but not

paid out(1)

($) |

David M. Cole

CEO | 150,000-- 0 | 4.11 | 05/06/2026 | 0 | 80,000(2) | 224,000 | N/A |

| 170,000-- 0 | 2.62 | 06/10/2025 | 30,600 | 80,000(3) | 224,000 | N/A |

| 180,000-- 0 | 1.70 | 06/06/2024 | 198,000 | 100,000(4) | 210,000 | N/A |

| 200,000-- 0 | 1.30 | 7/10/2023 | 300,000 | N/A | N/A | N/A |

| 200,000-- 0 | 1.20 | 8/28/2022 | 320,000 | N/A | N/A | N/A |

Douglas L. Reed

CFO | 70,000-- 0 | 4.11 | 05/06/2026 | 0 | 40,000(2) | 112,000 | N/A |

| 80,000-- 0 | 2.62 | 06/10/2025 | 14,400 | 40,0003) | 112,000 | N/A |

| 30,000-- 0 | 1.70 | 06/06/2024 | 33,000 | N/A | N/A | N/A |

| 30,000-- 0 | 1.30 | 8/10/2023 | 45,000 | N/A | N/A | N/A |

| 30,000-- 0 | 1.20 | 8/28/2022 | 48,000 | N/A | N/A | N/A |

Michael D. Winn

Executive Chairman | 100,000-- 0 | 3.66 | 08/19/2026 | 0 | 60,000(2) | 168,000 | N/A |

| 127,500-- 0 | 2.62 | 6/10/2025 | 22,950 | 80,0003) | 224,000 | N/A |

| 90,000-- 0 | 1.70 | 06/06/2024 | 99,000 | N/A | N/A | N/A |

| 100,000-- 0 | 1.30 | 8/10/2023 | 150,000 | N/A | N/A | N/A |

| 100,000-- 0 | 1.20 | 8/28/2022 | 160,000 | N/A | N/A | N/A |

Christina Cepeliauskas

CAO | 55,000-- 0 | 4.11 | 05/06/2026 | 0 | 30,000(2) | 84,000 | N/A |

| 65,000 - 0 | 2.62 | 06/10/2025 | 11,700 | 30,0003) | 84,000 | N/A |

| 67,500 - 0 | 1.70 | 06/06/2024 | 74,250 | 37,500(4) | 78,750 | N/A |

| 75,000 - 0 | 1.30 | 8/10/2023 | 112,500 | N/A | N/A | N/A |

| 75,000 - 0 | 1.20 | 8/28/2022 | 120,000 | N/A | N/A | N/A |

(1) The value of "in-the-money" options is the product of the number of Shares multiplied by the difference between the exercise price and the closing market price of the Shares on the financial year end. The closing price of the Shares on the TSX-V on December 31, 2021 was $2.80 per share.

(2) RSUs granted under the RSU Plan on May 6, 2021. The vesting date and payout date for RSUs granted on May 6, 2021, is January 1, 2024, subject to performance criteria.

(3) RSUs granted under the RSU Plan on June 10, 2020. The vesting date and payout date for RSUs granted on June 10, 2020, is January 1, 2023, subject to performance criteria.

(4) RSUs granted under the RSU Plan on January 24, 2019. The vesting date and payout date for RSUs granted on January 24, 2019, is January 1, 2022, subject to performance criteria. Subsequent to December 31, 2021, based on performance criteria, 75% of the awarded' RSUs vested.

(5) Certain Share-based compensation relates to a long-term RSU incentive plan and calculated based on RSUs awarded in the current year grant and represents the number of RSUs awarded but not yet vested. Actual RSUs vested may vary as each RSU entitles the holder to acquire, for nil cost, between zero and 1.75 Shares, subject to the achievement of certain performance conditions.

Value of Share-Based and Option-Based Awards Vested or Earned During the Year by NEOs

The following table sets forth, for each NEO, the values of all incentive plan award which vested or were earned during the last financial year ended December 31, 2021.

| Name & Position | Value vested during the year | Value earned during the year

Non-equity incentive plan

Compensation awards

($) |

Option-based

awards

($) | Share-based

awards (3)

($) |

David M. Cole

CEO | 290,557 (1) | 394,824 | Nil |

Douglas L. Reed

CFO | 135,593(1) | 142,729 | Nil |

Michael D. Winn

Executive Chairman | 148,390(2) | 254,897 | Nil |

Christina Cepeliauskas

CAO | 106,538(1) | 148,060 | Nil |

(1) The value of options vested during the year ended December 31, 2021 was determined by using the Black-Scholes model, as described above, and the following weighted average assumptions: stock price - $4.11, exercise price - $4.11, an option life of five years, a risk-free interest rate of 0.91% and a volatility of 54.68%.

(2) The value of options vested during the year ended December 31, 2021 was determined by using the Black-Scholes model, as described above, and the following weighted average assumptions: stock price - $3.51, exercise price - $3.66, an option life of five years, a risk-free interest rate of 0.81% and a volatility of 49.91%.

(3) Pursuant to the RSU Plan, the Company granted RSUs to officers, management, and consultants. All RSUs granted have defined performance criteria to be met before the issuance of Shares. The value disclosed is based on the IFRS requirements for calculating the estimated value to be vested over the three-year vesting period for financial statement presentation purposes. Actual RSUs vested may vary as each RSU entitles the holder to acquire, for nil cost, between zero and 1.75 Shares, subject to the achievement of certain performance conditions.

Employment and Consulting Agreements

Chief Executive Officer

The Company is a party to an employment agreement with David M. Cole, President and CEO of the Company, effective August 1, 2017. Under the agreement, Mr. Cole receives US$ 325,000 per year. The agreement may be terminated by the Company without reason by written notice and a lump sum payment equal to 24 months of salary and benefits. Mr. Cole may terminate the agreement for any reason upon two months written notice to the Company during which time he will continue to receive his usual remuneration and benefits.

If Mr. Cole's agreement is terminated or his duties and responsibilities are materially changed within six months following a change in control of the Company, he is entitled to receive a lump sum payment equal to 24 months of his salary and benefits and all unvested stock options and stock grants.

Other Named Executive Officers

The Company has not entered into written employment or consulting contracts with its other NEOs.

Pension Plan Benefits

For the officers and employees in the United States, the Company pays 4% of the annual salary each year to each officer's and employee's 401(k) retirement plan.

Termination and Change of Control Benefits

Other than described above under "Employment and Consulting Agreements", the Company does not have written contracts with any of its NEOs respecting the resignation, retirement or other termination of employment resulting from a change of control.

Director Compensation

The methodology used for determining the remuneration of directors is similar to that used for the remuneration of NEOs. Remuneration of committee chairs is determined based on their own merits and circumstances after being considered in light of prevailing economic conditions - both on a corporate level and on national and international levels - and industry norms for such remuneration. Levels of remuneration of directors, committee members and committee chairs are usually first informally discussed among the members of the Compensation Committee before being formally considered and approved by the Board.

In 2021, Board members were compensated for their services as directors through a combination of an annual fee and annual equity-based compensation in the form of options; independent directors are not compensated based on performance. Annual directors' fees are currently:

Principal Position | Annual Fee ($) |

Director (base) | 36,000 |

Audit Committee Chair | 10,000 |

Compensation Committee Chair | 7,500 |

Corporate Governance and Nominating Committee Chair | 5,000 |

The following table describes director compensation for non-executive directors for the year ended December 31, 2021.

Name | Fees(1)

Earned ($) | Awards | Non-equity Incentive plan Compensation ($) | Pension Value ($) | All other Compensation ($) | Total ($) |

Share-

based ($) | Option-

based(2) ($) |

Brian E. Bayley | 38,500 | 0 | 89,034 | 0 | 0 | 0 | 127,534 |

Brian K. Levet | 43,500 | 0 | 89,034 | 0 | 0 | 0 | 132,534 |

Sunny S. C. Lowe(3) | 18,000 | 0 | 148,390 | 0 | 0 | 0 | 166,390 |

Henrik K. B. Lundin(4) | 20,500 | 0 | 148,390 | 0 | 0 | 0 | 168,890 |

Larry M. Okada | 46,000 | 0 | 89,034 | 0 | 0 | 0 | 135,034 |

(1) Compensation paid as directors' fees.

(2) The grant date fair value of options granted during the year ended December 31, 2021 was determined by using the Black-Scholes model, as described below, and the following weighted average assumptions: stock price - $3.51, exercise price - $3.66, an option life of five years, a risk-free interest rate of 0.81% and a volatility of 50%.

(3) Sunny S. C. Lowe Joined the Board on June 30, 2021.

(4) Henrik K. B. Lundin Joined the Board on June 30, 2021.

The Company has calculated the "grant date fair value" amounts in the "Option-based Awards" column using the Black-Scholes model, a mathematical valuation model that ascribes a value to a stock option based on a number of factors in valuing the option-based awards, including the exercise price of the options, the price of the underlying security on the date the option was granted, and assumptions with respect to the volatility of the price of the underlying security and the risk-free rate of return. Calculating the value of stock options using this methodology is very different from a simple "in-the-money" value calculation. Stock options that are well "out-of-the-money" can still have a significant "grant date fair value" based on a Black-Scholes valuation. Accordingly, caution must be exercised in comparing grant date fair value amounts with cash compensation or an "in-the-money" option value calculation. The total compensation shown in the last column is the total of the compensation of each director reported in the other columns. The value of the "in-the-money" options currently held by each director (based on share price less option exercise price) is set forth in the "Value of Unexercised in-the-money Options" column of the "Outstanding Share-based and Option-based Awards held by Directors" table below.

Minimum Share Ownership Guidelines

Under its Share Ownership Policy, the Company has adopted minimum share ownership guidelines that require non-executive directors to beneficially hold Shares equivalent to three times their annual director's fees.

For the purposes of this policy, the value of the Shares held by a non-executive director is determined based on the closing price of the Shares on the TSX-V on January 2nd of the current calendar year. Non-executive directors have three years from the later of the effective date of the policy or the date they assumed such role with the Company to satisfy the minimum ownership requirements and must subsequently continue to satisfy such requirements for the duration of their tenure as a non-executive director. Compliance with the Share Ownership Policy will be first determined on May 14, 2025.

Outstanding Share-based and Option-based Awards held by Directors

The following table sets out, for each non-executive director, the option-based awards (incentive stock options to purchase Shares) and Share-based awards (RSUs) held as of December 31, 2021

Name | Option-based Awards | Share-based Awards |

Number of Securities Underlying Unexercised options (vested-

unvested) | Option Exercise Price ($ per

share) | Option Expiration Date (m/d/y) | Value of unexercised "in-the-

money" options(1) ($) | Number

of

shares or

units of shares

that have not

vested (#) | Market or payout

value of Share-

based awards that have not

vested ($) | Market or payout

value of shares

vested but not

paid out ($) |

Brian E. Bayley | 60,000 - 0 65,000 - 0 67,500 - 0 75,000 - 0 75,000 - 0 | 3.66 2.62 1.70 1.30 1.20 | 08/19/2026 06/10/2025 06/06/2024 7/10/2023 8/28/2022 | 0 11,700 74,250 112,500 120,00 | Nil | Nil | Nil |

Brian K. Levet | 60,000 - 0 65,000 - 0 67,500 - 0 | 3.66 2.62 1.70 | 08/19/2026 06/10/2025 06/06/2024 | 0 11,700 74,250 | Nil | Nil | Nil |

Sunny S. C. Lowe | 100,000 - 0 | 3.66 | 08/19/2026 | 0 | Nil | Nil | Nil |

Henrik K. B. Lundin | 100,000 - 0 | 3.66 | 08/19/2026 | 0 | Nil | Nil | Nil |

Larry M. Okada | 60,000 - 0 65,000 - 0 67,500 - 0 75,000 - 0 75,000 - 0 | 3.66 2.62 1.70 1.30 1.20 | 08/19/2026 06/10/2025 06/06/2024 7/10/2023 8/28/2022 | 0 11,700 74,250 112,500 120,000 | Nil | Nil | Nil |

(1) The value of "in-the-money" options is the product of the number of Shares multiplied by the difference between the exercise price and the closing market price of the Shares on the financial year end. Options which were not vested at the financial year end are not included in this value. The closing price of the Shares on the TSX-V on December 31, 2021 was $2.80 per share.

Value of Share-Based and Option-Based Awards Vested or Earned During the Year by Directors

The following table sets forth, for each non-executive director, the values of all incentive plan awards which vested or were earned during the last financial year ended December 31, 2021.

Name | Value vested during the year | Value earned during the year Non-equity incentive plan Compensation ($) |

Option-based Awards (1) ($) | Share-based Awards (2) ($) |

Brian E. Bayley | 89,034 | 0 | Nil |

Brian K. Levet | 89,034 | 0 | Nil |

Sunny S. C. Lowe (3) | 148,390 | 0 | Nil |

Henrik K. B. Lundin (4) | 148,390 | 0 | Nil |

Larry M. Okada | 89,034 | 0 | Nil |

(1) The grant date fair value of options granted during the year ended December 31, 2021 was determined by using the Black-Scholes model, as described below, and the following weighted average assumptions: stock price - $3.51, exercise price - $3.66, an option life of five years, a risk-free interest rate of 0.81% and a volatility of 50%.

(2) The value of a Share-based award is the product of the number of Shares issuable on the vesting date multiplied by the closing market price of the Shares on the vesting date.

(3) Sunny S. C. Lowe Joined the Board on June 30, 2021.

(4) Henrik K. B. Lundin Joined the Board on June 30, 2021.

Management Contracts

Pursuant to a management service agreement dated February 13, 2014, as amended August 1, 2020, between the Company and Seabord Services Corp. of Suite 501, 543 Granville Street, Vancouver, British Columbia, the Company pays $34,000 per month to Seabord in consideration of Seabord providing the services of the CFO, CAO, accounting and administration staff and office space to the Company.

Seabord is a private corporation partially owned by Douglas Reed, CFO, and Michael D. Winn, Executive Chairman.

Stock Option Plan

The Board established the Option Plan to attract and motivate the directors, officers and employees of the Company (and any of its subsidiaries), employees of any management corporation and consultants to the Company (collectively the "Optionees") and thereby advance the Company's interests by providing them an opportunity to acquire an equity interest in the Company through the exercise of stock options granted to them under the Option Plan.

Pursuant to the Option Plan, the Board, based on the recommendation of the Compensation Committee, may grant options to Optionees in consideration of them providing their services to the Company or a subsidiary. The number of Shares subject to each option is determined by the Board within the guidelines established by the Option Plan. The options enable the Optionees to purchase Shares at a price fixed pursuant to such guidelines. The options are exercisable by the Optionee giving the Company notice and payment of the exercise price for the number of Shares to be acquired.

The Option Plan authorizes the Board to grant stock options to the Optionees on the following terms:

1. The number of Shares available for issuance pursuant to outstanding options cannot exceed an aggregate of 10% of the outstanding Shares unless disinterested Shareholder approval has been obtained (such approval has not been obtained nor is it being sought at the Meeting).

2. The number of Shares issuable upon the exercise of options granted under the Option Plan during a 12 month period cannot exceed:

(a) 5% of the outstanding Shares by one Optionee unless disinterested Shareholder approval has been obtained (such approval has not been obtained nor is it being sought);

(b) 2% of the outstanding Shares, if the Optionee is a consultant; and

(c) 2% of the outstanding Shares by all Optionees providing investor relations services.

3. Unless the Option Plan has been approved by disinterested Shareholders (such approval has not been obtained nor is it being sought at the Meeting), options granted under the Option Plan, together with all of the Company's previously established and outstanding stock options, stock option plans, employee stock purchase plans or any other compensation or incentive mechanisms involving the issuance or potential issuance of Shares, shall not result, at any time, in:

(a) the number of Shares reserved for issuance pursuant to stock options granted to insiders exceeding 10% of the outstanding Shares at the time of granting; and

(b) the grant to insiders, within a 12 month period, of options to purchase that number of Shares exceeding 10% of the outstanding Shares.

4. The exercise price of the options cannot be set at less than the greater of $0.10 per Share and the closing trading price of the Shares on the day before the granting of the stock options. If the Optionee is subject to the tax laws of the United States of America and owns (determined in accordance with such laws) greater than 10% of the Shares, the exercise price shall be at least 110% of the price established as aforesaid.

5. The options may be exercisable for up to 10 years. If, however, an option expires during, or within five business days after, a trading black-out period imposed by the Company to restrict trades in the Company's securities then, notwithstanding any other provision of the Option Plan, the option shall expire 10 business days after the trading black-out period is lifted by the Company.

6. There are not any vesting requirements unless the Optionee is providing investor relations services to the Company, in which case the options must vest over at least 12 months with no more than one-quarter vesting in any three month period commencing not less than three months after granting. The Board may, however, impose additional vesting requirements and, subject to obtaining any required approval from the TSX-V and NYSE American, may authorize all unvested options to vest immediately. If there is a potential "change of control" of the Company due to a take-over bid being made for the Company or a similar event, all unvested options, subject to obtaining any required approval from the TSX-V and NYSE American, shall vest immediately.

7. The options can only be exercised by the Optionee (to the extent they have already vested) for so long as the Optionee is a director, officer or employee of, or consultant to, the Company or any subsidiary or is an employee of the Company's management corporation and within a period thereafter not exceeding the earlier of:

(a) the original expiry date;

(b) 90 days (or such longer period not exceeding the first anniversary of such cessation as the Board may determine) after ceasing to be a director, officer or employee of, or consultant to, the Company at the request of the Board or for the benefit of another director or officer unless the Optionee is subject to the tax laws of the United States of America, in which case the option will terminate on the earlier of the 90th day and the third month after the Optionee ceased to be an officer or employee; and

(c) if the Optionee dies, within one year from the Optionee's death.

If the Optionee is terminated "for cause", involuntarily removed or resigns (other than at the request of the Board or for the benefit of another director or officer) from any such positions, the option will terminate at the same time or such later date not exceeding the first anniversary of such cessation as may be reasonably determined by the Board.

8. All Shares issued upon the exercise of an option granted to a director, officer, promoter or significant shareholder (a person holding more than 10% of the outstanding Shares and who has elected or appointed or has the right to elect or appoint one or more directors or officers) shall be subject to a four month hold period from the time the option was granted.

9. The options are not assignable except to a wholly-owned holding corporation. If the option qualifies as an "incentive stock option" under the United States Internal Revenue Code, the option is not assignable to a holding corporation.

10. No financial assistance is available to Optionees under the Option Plan.

11. Any amendments to the Option Plan or outstanding stock options are subject to the approval of the TSX-V and NYSE American and, if required by either exchange or the Option Plan, of the Shareholders, possibly with only disinterested Shareholders being entitled to vote. Disinterested Shareholder approval must be obtained for the reduction of the exercise price of options (including the cancellation and re-issuance of options within a one year period so as to effectively reduce the exercise price) of options held by insiders or the extension of the exercise period of options held by insiders except where the Company has imposed a trading black-out. The amendment to an outstanding stock option will also require the consent of the Optionee.

12. Any reductions in the exercise price or extension of the exercise period are subject to the approval of the TSX-V and, for insiders or if required by the TSX-V or the Option Plan, of the Shareholders, possibly with only disinterested Shareholders being entitled to vote.

13. The Option Plan provides that Shareholder approval is required to amend the Option Plan to:

(a) increase the number of Shares reserved for issuance under the Option Plan (including a change from a fixed maximum number of Shares to a fixed maximum percentage of Shares); or

(b) change the manner of determining the exercise price if the exercise price would be less than the market price of the Shares on the date of grant under the new manner of exercise price determination.

14. Subject to the restrictions in the preceding paragraph, the Board may, in its discretion, and without obtaining Shareholder approval, amend, suspend or discontinue the Option Plan and, with the consent of adversely affected option holders, amend or discontinue any options granted under the Option Plan, at any time, to:

(a) make any amendment of a grammatical, typographical or administrative nature or to comply with the requirement of any regulatory authority; or

(b) amend the vesting provisions.