EMX Royalty Corporation

Management's Discussion and Analysis

Nine Months Ended September 30, 2024

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

General

This Management's Discussion and Analysis ("MD&A") for EMX Royalty Corporation, (the "Company", or "EMX") has been prepared based on information known to management as of November 6, 2024. This MD&A is intended to help the reader understand the consolidated financial statements and should be read in conjunction with the condensed consolidated interim financial statements of the Company for the nine months ended September 30, 2024 prepared in accordance with IFRS Accounting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). All dollar amounts included therein and in the following MD&A are in United States dollars except where noted.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management's expectations. Readers are encouraged to read the "Forward-Looking Information and Cautionary Statement" at the end of this MD&A. Additional information related to the Company, including our Annual Information Form and Form 40-F, are available on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov, respectively. These documents contain descriptions of certain of EMX's producing royalties as well as summaries of the Company's advanced royalties and royalty generation assets. For additional information, please see our website at www.emxroyalty.com.

Overview

EMX Royalty Corporation is in the business of organically generating royalties derived from a portfolio of mineral property interests. The Company augments royalty generation with royalty acquisitions and strategic investments. EMX's royalty and mineral property portfolio consists of 269 properties in North America, Europe, Türkiye, Latin America, Morocco and Australia. The Company's portfolio is comprised of the following:

| | | | | |

| Producing Royalties | 6 |

| Advanced Royalties | 11 |

| Exploration Royalties | 127 |

| Royalty Generation Properties | 125 |

| |

The Company's common shares are listed on the TSX Venture Exchange and the NYSE American Exchange under the symbol "EMX", and also trade on the Frankfurt Stock Exchange under the symbol "6E9".

Strategy

EMX's strategy is to provide our shareholders and other stakeholders exposure to exploration success and commodity upside through successful implementation of our royalty business. The Company believes in having a strong, balanced exposure to precious and base metals with an emphasis on gold and copper. The three key components of the Company's business strategy are summarized as:

•Royalty Acquisition. The purchase of royalty interests allows EMX to acquire assets that range from producing mines to development projects. In conjunction with the acquisition of producing and pre-production royalties in the base metals, precious metals, and battery metals sectors, the Company will also consider other cash flowing royalty acquisition opportunities, including the energy sector.

•Royalty Generation and Project Evaluation. EMX's more than 20-year track record of successful exploration initiatives has developed into an avenue to organically generate mineral property royalty interests. The strategy is to leverage in-country geological expertise to acquire prospective properties on open ground, and to build value through low-cost work programs and targeting. These properties are sold or optioned to partner companies for retained royalty interests, advance minimum royalty ("AMR") payments and annual advance royalty ("AAR") payments, project milestone payments, and other consideration that may include equity interests. Pre-production payments provide early-stage cash flows to EMX, while the operating companies build value through exploration and development. EMX participates in project upside optionality at no additional cost, with the potential for future royalty payments upon the commencement of production.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 2 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

•Strategic Investment. An important complement to EMX's royalty generation and royalty acquisition initiatives comes primarily from strategic equity investments in companies with what EMX considers to be under-valued mineral assets that have upside exploration or development potential. Exit strategies can include equity sales, royalty positions, or a combination of both.

EMX has a combination of producing royalties, advanced royalty projects, and early-stage exploration royalty properties providing shareholders exposure to immediate cash flow, near-term development of mines, and long-term exposure to class leading discoveries. Unlike other royalty companies, EMX has focused a significant portion of its expertise and capital toward organically generating royalties. We believe putting people on the ground generating opportunities and partnering with major and junior companies is where EMX can generate the highest return for our shareholders. This diversified approach towards the royalty business provides a foundation for supporting EMX's growth and increasing shareholder value over the long term.

Highlights

In Q3 2024, EMX continued on a strong uptrend due to robust royalty production and strong metal prices. When excluding the one-time Timok catch-up payment from Q3 2023, the Company had meaningful growth in adjusted royalty revenue1 and GEOs1 sold relative to 2023 three month and nine month comparative periods. Strong performance during the quarter was marked from Caserones, Gediktepe, and Leeville. EMX continued to invest capital generating and acquiring royalties around the world while our partners invested significant capital to expand operations at existing mines, advance towards the development of new mines (e.g. updated PEA for Parks-Salyer), and explore for new opportunities (e.g. Diablillos targets).

Summary of Financial Highlights for the three and nine months ended September 30, 2024 and 2023:1,2

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | |

| Statement of Income (Loss) | | | | | | | |

Revenue and other income2 | $ | 7,027 | | | $ | 12,925 | | | $ | 19,272 | | | $ | 19,075 | |

| General and administrative costs | (1,537) | | | (1,364) | | | (5,379) | | | (4,662) | |

| Royalty generation and project evaluation costs, net | (3,090) | | | (3,505) | | | (8,931) | | | (8,527) | |

| Income (loss) from operations | (151) | | | 5,433 | | | (2,426) | | | 1,356 | |

| Net income (loss) | $ | 1,194 | | | $ | 2,441 | | | $ | (5,055) | | | $ | (6,007) | |

| | | | | | | |

| Statement of Cash Flows | | | | | | | |

| Cash flows from operating activities | $ | (187) | | | $ | 7,122 | | | $ | 326 | | | $ | 2,787 | |

| Cash flows from investing activities | 2,076 | | | 4,645 | | | 2,409 | | | 4,588 | |

| Cash flows from financing activities | $ | (1,794) | | | $ | (5) | | | $ | (1,745) | | | $ | (1,511) | |

| | | | | | | |

Non-IFRS Financial Measures1,2 | | | | | | | |

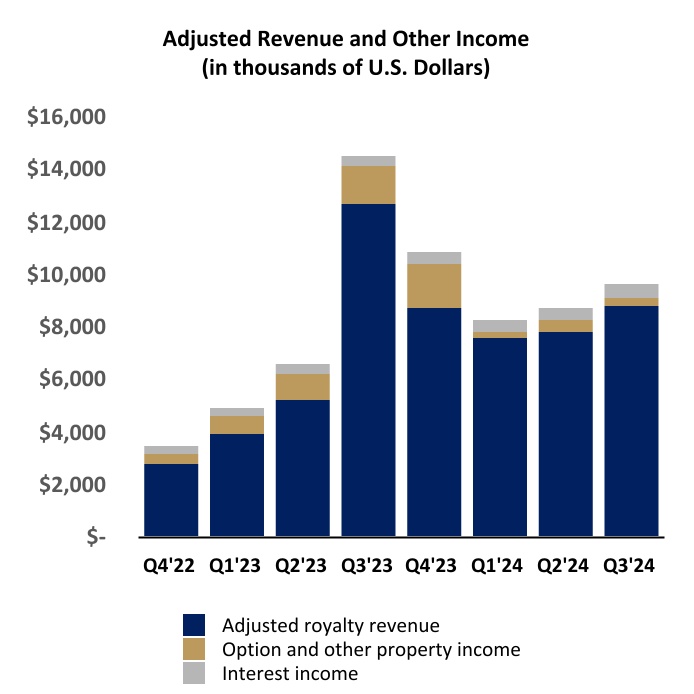

| Adjusted revenue and other income | $ | 9,660 | | | $ | 14,527 | | | $ | 26,711 | | | $ | 26,108 | |

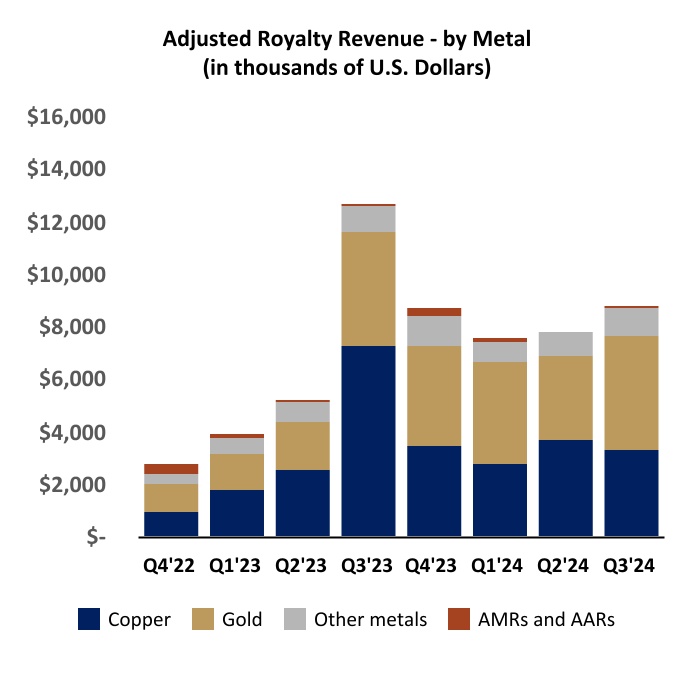

| Adjusted royalty revenue | $ | 8,817 | | | $ | 12,744 | | | $ | 24,310 | | | $ | 21,951 | |

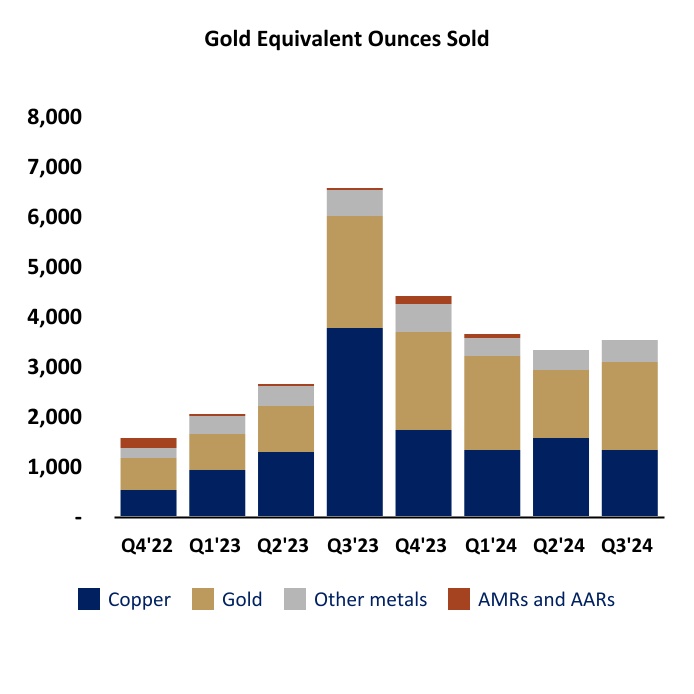

| GEOs sold | 3,560 | | | 6,608 | | | 10,607 | | | 11,358 | |

| Adjusted cash flows from operating activities | $ | 1,760 | | | $ | 8,863 | | | $ | 5,762 | | | $ | 7,880 | |

| | | | | | | |

| Adjusted EBITDA | $ | 5,071 | | | $ | 10,168 | | | $ | 12,933 | | | $ | 13,390 | |

| | | | | | | |

| Statement of Financial Position | | | | | | | |

| Cash and cash equivalents | | | | | $ | 21,673 | | | $ | 22,669 | |

Working capital1 | | | | | $ | 41,825 | | | $ | 35,196 | |

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

2 Included in Q3 2023 and Q3 YTD 2023 is $6,676,000 and $4,783,000 in catch-up payments from the Timok royalty that relate to prior periods.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 3 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Non-IFRS Financial Measures1:

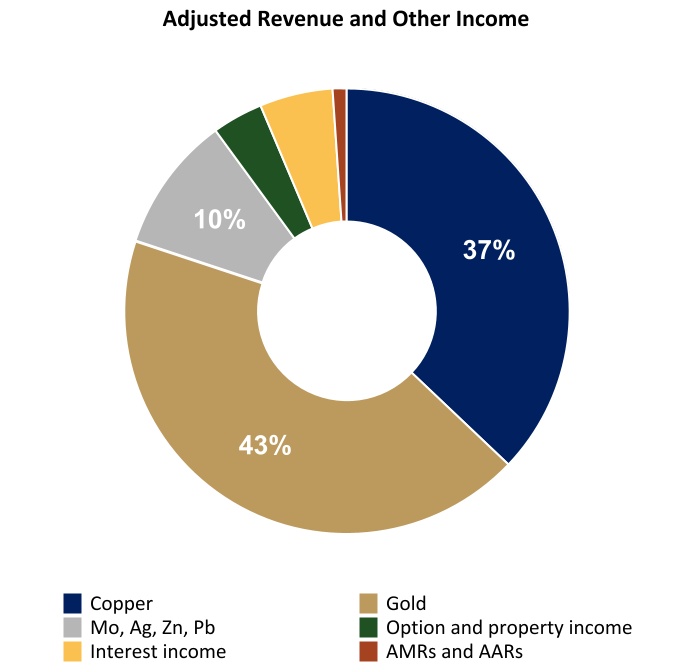

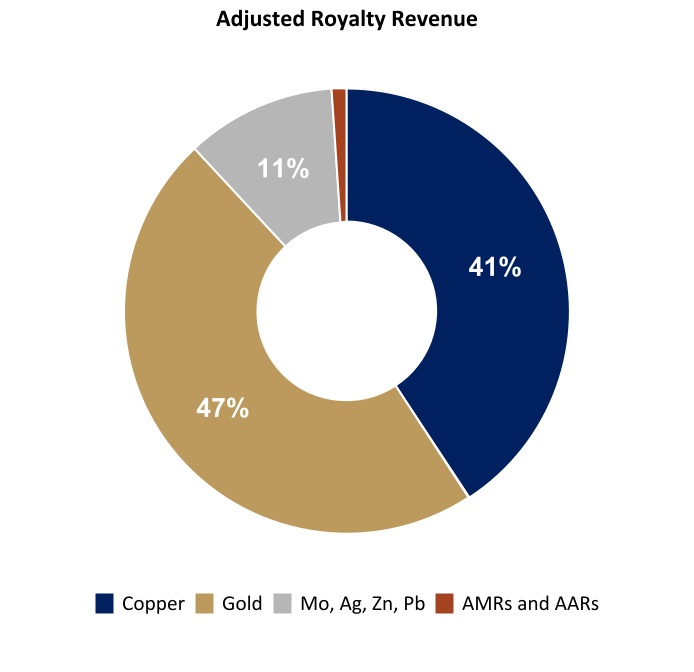

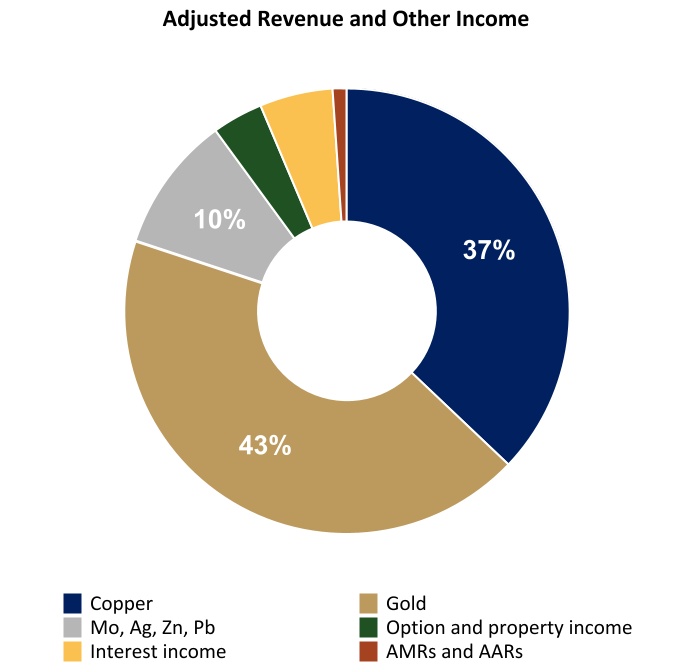

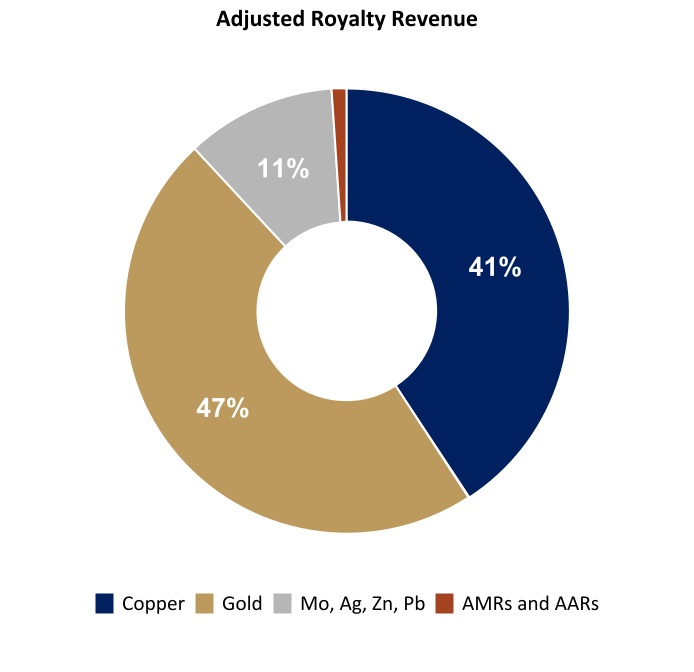

The Company had adjusted revenue and other income and adjusted royalty revenue by metal of the following:

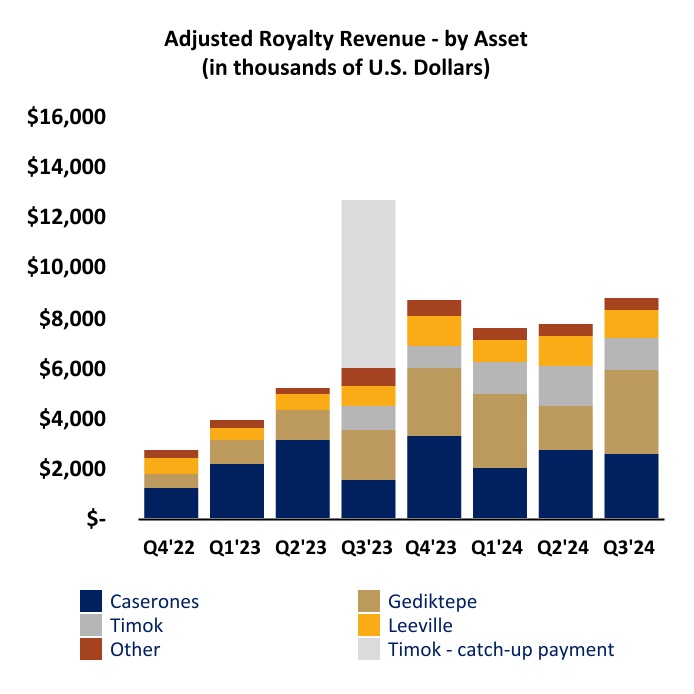

The Company had adjusted royalty revenue by asset and by GEOs of the following:

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 4 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Outlook

The Company previously announced 2024 guidance of GEOs sales of 11,000 to 14,000, adjusted royalty revenue of $22,000,000 to $27,500,000 and option and other property income of $2,000,000 to $3,000,000. The Company is currently on pace to achieve the upper end of its annual guidance for GEOs sold, and exceed adjusted royalty revenue, while aiming for the lower end of our option and other property income guidance.

The Company is excited about the prospect for continued growth in the portfolio for 2024 and the coming years. The driver for near and long term growth in cash flow will come from the large deposits at Caserones in Chile and Timok in Serbia. At Caserones, Lundin has initiated an exploration program which is intended to expand mineral resources and mineral reserves while at the same time looking to increase throughput at the plant. At Timok, Zijin Mining Group Co. continues to increase its production rates in the upper zone copper-gold deposit while developing the lower zone, which we believe will be one of the more important block cave development projects in the world. Zijin also highlighted a recently discovered exploration target south of the Cukaru Peki mine and within EMX’s royalty footprint. Analysis of recent satellite imagery over the Brestovac license, which contains the Cukaru Peki Mine and is covered by EMX's royalty, shows substantial development of new drill pads with numerous drill rigs visible in the images in the southeast corner of the license.

In terms of other producing royalty assets, the Company expects Gediktepe, Leeville, and Gold Bar South to mirror what occurred in 2023. In Türkiye, Gediktepe continues to perform well and is ahead of its production forecast for 2024 (as of the end of Q3) and production rates at Balya North continued to increase in Q3. New and compelling exploration results were announced at the Viscaria copper-iron-silver development project in Q3 and the new owner/operator of Gediktepe highlighted potential for additional oxide gold and polymetallic sulfide mineralization beyond the currently defined resources. We are also excited about the advancement of Diablillos in Argentina by AbraSilver Resource Corp. where the company continues to expand the mineral resource. These developments are all examples of the remarkable optionality that exists through EMX’s global royalty portfolio.

EMX believes it is well positioned to identify and pursue new royalty and investment opportunities, while further filling a pipeline of royalty generation properties heading into 2025. As the Company continues to generate revenues from its producing royalty assets and from other option, advance royalty and pre-production payments across its global asset portfolio, various opportunities for capital redeployment will be evaluated. Such opportunities may include the direct acquisition of royalties, continued organic generation of royalties through partner funded projects, purchase of strategic investments, share buybacks through the Normal Course Issuer Bid or debt repayment. Through the astute allocation of capital, EMX will seek to build upon its recent years of success and continue creating value for shareholders into the future.

Corporate Updates

Appointment of Stefan Wenger as Chief Financial Officer

During the three months ended September 30, 2024 ("Q3 2024"), the Company announced the appointment of Mr. Stefan L. Wenger as Chief Financial Officer effective October 1, 2024. Mr. Wenger was previously the Chief Financial Officer and Treasurer of Royal Gold, Inc., one of the mining industry’s leading royalty companies, from 2006 to 2018.

Credit Agreement with Franco-Nevada Corporation

In August 2024, the Company entered into a $35,000,000 credit agreement with Franco Nevada Corporation with a maturity date of July 1, 2029. Upon closing, the Company used the proceeds of the loan to repay the outstanding balance of the Sprott Credit Facility and for general working capital purposes.

Normal Course Issuer Bid

During Q3 2024 the Company repurchased and returned to treasury 692,189 common shares at a cost of $1,223,000. The Company then cancelled, pursuant to the Company's Normal Course Issuer Bid, 684,253 common shares. Subsequent to period end, the Company repurchased 2,156,754 shares for a total cost of $3,322,000.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 5 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Investment Updates

As at September 30, 2024, the Company had marketable securities of $1,588,000 (December 31, 2023 - $4,001,000), and $7,843,000 (December 31, 2023 - $6,372,000) in private investments. The Company will continue to generate cash flow by selling certain of its investments when appropriate.

Producing Royalty Updates

Caserones

The Company’s effective share of the royalty revenue in Caserones totaled $2,633,000 for the three months ended September 30, 2024 (Q3 2023 - $1,602,000). Pursuant to the conditions within the royalty agreement, the operator is not obligated to provide actual results prior to the release of our quarterly financial statements. As such, on a quarterly basis, revenue is estimated by the Company based on a life of mine model provided by the operator and may differ from actual, resulting in adjustments to subsequent period revenues. Included in the quarterly revenue was a true up of $412,500 (Q3 2023 - $111,000) due to a higher than expected revenue in the prior quarter. The true up in the current period was mainly driven by positive provisional pricing adjustments on prior period concentrate sales, higher than estimated sales and higher than estimated realized copper prices.

The Company received royalty distributions of $1,947,000, net of Chilean taxes in Q3 2024 (Q3 2023 - $1,741,000). The payments received were based upon copper and molybdenum sales in Q2 2024.

Timok

EMX earned $1,236,000 in royalty revenue from the Timok royalty property in Q3 2024 (Q3 2023 - $7,689,000). The higher earned revenue in Q3 2023 reflected $6,676,000 from “catch up” payments received in 2023 that were retroactive to the commencement of production in 2021. Highlighted by additional disclosures by Zijin made in their 2024 Interim Report, which was released on September 27, 2024, Zijin reported markedly increased levels of copper and gold production at Timok in the first half of 2024, including 90,008 tonnes of copper and 2,894 kilograms of gold produced from Timok’s Cukaru Peki Mine. This aligns with the record Q2 royalty revenues of $1,586,000 reported by EMX in its Q2 MD&A filings. On page 7 of its 2024 Interim Report, Zijin also stated that the combined Serbia Zijin Copper and Serbia Zijin Mining projects (which includes Zijin’s Bor operations as well as the Cukaru Peki Mine) now have a capacity to produce 450,000 tonnes of copper on an annual basis. This is a marked increase compared with previous years.

Zijin has previously announced that the throughput of its processing plant at Cukaru Peki is being expanded from 12,000 tonnes per day to 15,000 tonnes per day. The expansion of capacity and production at Cukaru Peki is part of an ongoing effort by Zijin to de-bottleneck its operations in Serbia, and by doing so, will unlock additional potential in the greater district. In addition to the ongoing production from the Upper Zone at Cukaru Peki, Zijin is also working to develop the underlying Lower Zone porphyry copper-gold deposit. The Lower Zone at Cukaru Peki will be developed through block caving, and EMX believes that the Cukaru Peki Mine will become one of the more important block cave development projects in the world.

On page 6 of the Interim Report, Zijin also highlighted high grade copper-gold exploration potential at its “MG Zone” in the “southern part of the Cukaru Peki Copper and Gold Mine”. We do not yet know whether Zijin’s exploration efforts will be successful or whether any discovery would fall within EMX’s royalty properties and become material to EMX. However, it is notable that a discussion of the newly described MG Zone appeared in the Interim Report.

Gediktepe

EMX earned $3,353,000 in royalty revenue from the Gediktepe Mine in Q3 2024 (Q3 2023 - $1,955,000). In Q3, ACG Metals Ltd. (“ACG”; LON:ACG) completed its acquisition of the Gediktepe Mine from Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya”), the previous operator. The acquisition closed on September 3, 2024 with ACG making an $84 million payment to Lidya and granting Lidya a 30% interest in ACG. ACG also committed to providing funding for the construction of the sulfide expansion project at Gediktepe in addition to other considerations.

Doré production increased in each of the months of July and August from the levels seen in Q2, with over 5,000 ounces of gold produced in doré during the month of August alone (awaiting September production results). Coupled with higher gold prices, the Q3 payment is expected to exceed the payments received from Q2 production.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 6 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

As a subsequent event, ACG updated its corporate presentation in October, and highlighted additional exploration and discovery potential at Gediktepe for both oxide gold and polymetallic styles of sulfide mineralization. ACG proposes 2026 as the start date for sulfide production at Gediktepe (see ACG Investor Presentation, October, 2024).

Leeville

EMX earned $1,112,000 in royalty revenue from Leeville in Q3 2024 (Q3 2023 - $773,000). The Leeville payments for Q3 2024 continued on a strong uptrend due to robust production and high gold prices.

Balya

EMX earned $344,000 in royalty revenue from the Balya property in Q3 2024 (Q3 2023 - $568,000). The royalty revenues from Q3 production exceeded the $195,000 and $311,000 payments received in Q1 and Q2, respectively. This reflected the higher production rates reported in Q3, as well as slightly higher metal prices.

Gold Bar South

EMX earned $104,000 in royalty revenue from the Gold Bar South royalty property in Q3 2024 (Q3 2023 - $59,000).

Pre-Production and Royalty Generation Updates

EMX continues to fund and support its generative programs to build long term value and organically create royalties at low cost. Key examples of organically generated royalty assets that are being advanced by well-funded partners include the Balya royalty in Türkiye (producing), and the Park-Salyer (advanced project) and Peake (exploration project) royalties in Arizona. The generative programs also lead to recognition of other investment and royalty purchase opportunities in the jurisdictions in which we operate. Examples include assets such as the Timok royalty in Serbia (producing asset), the Viscaria royalty in Sweden (pending development) and the Kaukua royalty in Finland (advanced project). These generative programs and the scope and scale of the organic royalty portfolio distinguish EMX from its royalty company peers.

During Q3 2024, the Company’s royalty business was active in North America, South America, Europe, Türkiye, Australia and Morocco. The Company incurred $3,090,000 in net royalty generation and project evaluation costs in Q3 2024 compared to $3,505,000 in Q3 2023. These costs include exploration related activities, technical services and management oversight, project marketing, land and legal costs, as well as third party due diligence for acquisitions. Included in revenue and other income are option, advance royalty, and other pre-production payments from partnered royalty generation projects.

During the three months ended September 30, 2024 and 2023, the Company recognized the following adjusted revenue and other income1 from generative and non-generative activities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Generative Revenue | | Generative Revenue | | Total |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Adjusted royalty revenue1 | $ | 8,782 | | | $ | 12,645 | | | $ | 35 | | | $ | 98 | | | $ | 8,817 | | | $ | 12,743 | |

| Option and other property income | - | | | - | | | 310 | | | 1,409 | | | 310 | | | 1,409 | |

| Interest income | 533 | | | 374 | | | - | | | - | | | 533 | | | 374 | |

| $ | 9,315 | | | $ | 13,019 | | | $ | 345 | | | $ | 1,507 | | | $ | 9,660 | | | $ | 14,526 | |

For the purposes of the disclosure above, non-generative revenue includes revenue from producing and acquired assets. Generative revenue includes all other types of revenue and other income generated by the Company.

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 7 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

During the three months ended September 30, 2024 and 2023, the Company had the following costs, revenue and realized losses on the sale of deal flow shares related to royalty generation activities:

| | | | | | | | | | | |

| Three months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | |

| Royalty generation and project evaluation costs, net (excluding generative revenue) | $ | 3,090 | | | $ | 3,505 | |

| Less: | | | |

| Technical support and project evaluation | (367) | | | (635) | |

| Total costs | $ | 2,723 | | | $ | 2,870 | |

| | | |

| Generative revenue | $ | 345 | | | $ | 1,507 | |

| Realized loss on the sale of deal flow shares | (226) | | | (76) | |

| Total | $ | 119 | | | $ | 1,431 | |

Realized losses on the sale of deal flow shares during the period are offset in the income statement by the reversal of unrealized losses that have been recognized over the course of the investment. Consequently, the impact on the income statement during the period is the net of realized gains and losses on the sale of investments and the unrealized gains and losses on the revaluation of investments. Deal flow shares are acquired at no cash cost to the Company and realized gains or losses reflect the difference between the fair value when received and cash proceeds received on sales which may be realized in different periods.

During the three months ended September 30, 2024 the Company recognized realized losses on the sale of deal flow shares of $226,000 (Q3 2023 - $76,000) offset by unrealized gains on the revaluation of deal flow investments of $1,721,000 (Q3 2023 - unrealized losses of $55,000). Gains and losses stated in the income statement also include non-deal flow investments.

Highlights from Q3 2024 include the following:

•Arizona Sonoran announced an updated mineral resource estimate (“MRE”) for the Cactus Project, which includes EMX’s Parks-Salyer royalty property. The updated MRE established Parks-Salyer (partially covered by EMX’s royalty) and MainSpring (not covered by EMX’s royalty) as one continuous deposit. The updated MRE provided the basis for ASCU's "standalone" NI 43-101 Preliminary Economic Assessment (“PEA”) that rescoped Parks-Salyer as an open pit operation resulting from the inclusion of the MainSpring property.

•In Argentina, Abrasilver announced Phase IV drill results that included silver mineralization previously classified as waste, as well as mineralization outside of the prefeasibility study ("PFS") open pit.

•Aftermath Silver reported metallurgical test work for the Berenguela polymetallic deposit (i.e., Ag-Cu-Mn) in Peru that yielded high purity battery grade manganese solely using hydrometallurgical processes.

•Canadian Gold's Phase 3 drill program at the historical Tartan Mine extended the Hanging Wall Zone along strike and down plunge, and at the Main Zone intersected a potentially new gold zone.

•In Arizona, South32 expects to invest $35 million in FY25 to conduct further exploration at the Peake prospect to test the potential for a continuous structural and lithology controlled system connecting the Taylor development project (lead-zinc-silver) and the copper enriched Peake mineralization.

•At the Selena polymetallic CRD exploration royalty property in Nevada, owner and operator Ridgeline Minerals entered into an earn-in agreement with a wholly-owned subsidiary of South32, whereby South32 can acquire up to an 80% interest in the Project for an aggregate spend of $20 million.

•For partnered properties in the western U.S., EMX received a total of approximately $152,000 in pre-production payments during the quarter.

•Gruvaktiebolaget Viscaria (“Viscaria”) continued to advance the Viscaria development project in Q3, and received its environmental permit to commence construction of its water treatment facility on the property. In parallel with the ongoing feasibility study, Viscaria announced “exceptional exploration results” in its September 24, 2024 News Release summarizing current near-mine exploration programs. Viscaria reported the discovery of multiple newly defined zones

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 8 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

of copper, iron and silver mineralization at depth below the existing mine infrastructure and currently defined resources. This included an intercept of 43.2m @ 1.12% copper and 31.35% iron in hole VDD24055 from depths of 1,107 to 1,150.2 meters (positioned just below the existing “Zone D” resources), and an intercept of 13.3m @ 2.42% copper and 4.96 g/t silver in drill hole VDD23116 from depths of 498.1 to 511.4 meters (adjacent to the “B Zone” resources)2. Viscara also reported the discovery of an entirely new zone of copper-silver mineralization that lies between the “A” and “B” Zones called the “ABBA” zone. Notably, Viscaria also reported a “350m-thick intersection of copper-mineralised rock” in drill hole VDD24115, for which assays are pending (see Viscaria News Release dated September 24, 2024).

•First Nordic Metals (“First Nordic”; TSX-V:FNM) (formerly Gold Line Resources) announced that it has completed its acquisition of the Oijärvi orogenic gold project in Finland from Agnico Eagle. The Oijärvi Project contains the Kylmäkangas gold deposit, with an indicated mineral resource estimate of 143,000 oz Au (1.07 million tonnes grading 4.1 g/t Au) and an inferred mineral resource estimate of 142,000 oz Au (1.63 million tonnes grading 2.7 g/t Au) according to disclosures made by First Nordic3. EMX holds a right to purchase a 1% NSR on the Kylmäkangas gold deposit for $1,000,000 at any time.

•Royalty generation programs continued in Europe, the Balkans, Morocco and in eastern Australia. EMX continued surface sampling programs in Morocco, the Balkans and in eastern Türkiye, and is in advance discussions regarding multiple partnership opportunities in those jurisdictions. Commercial terms were also agreed to with a partner company for several of EMX’s exploration assets in Queensland.

Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | |

| Financial results | | | | | | | |

| Revenue and other income | $ | 7,027 | | | $ | 12,925 | | | $ | 19,272 | | | $ | 19,075 | |

| Costs and expenses | (7,178) | | | (7,492) | | | (21,698) | | | (17,719) | |

| Income (loss) from operations | $ | (151) | | | $ | 5,433 | | | $ | (2,426) | | | $ | 1,356 | |

| Gains (losses) from other items | 1,377 | | | (918) | | | (2,013) | | | (3,581) | |

| Tax expense | (32) | | | (2,074) | | | (616) | | | (3,782) | |

| Net income (loss) | $ | 1,194 | | | $ | 2,441 | | | $ | (5,055) | | | $ | (6,007) | |

| | | | | | | |

| Non-IFRS Financial Measures4 | | | | | | | |

| Adjusted revenue and other income | $ | 9,660 | | | $ | 14,527 | | | $ | 26,711 | | | $ | 26,108 | |

| Adjusted royalty revenue | $ | 8,817 | | | $ | 12,744 | | | $ | 24,310 | | | $ | 21,951 | |

| GEOs sold | 3,560 | | | 6,608 | | | 10,607 | | | 11,358 | |

| Adjusted cash flows from operating activities | $ | 1,760 | | | $ | 8,863 | | | $ | 5,762 | | | $ | 7,880 | |

| | | | | | | |

| Adjusted EBITDA | $ | 5,071 | | | $ | 10,168 | | | $ | 12,933 | | | $ | 13,390 | |

Revenues and Other Income

The Company earns various sources of revenue and other income including royalty revenue, option revenue earned from mineral property agreements including execution payments, staged option payments, operator and management fees, gains related to the sale of mineral properties, interest, and dividend income.

2 True widths stated as “unknown”. Results reported by Viscaria according to PERC 2021 standards in “Exploration Results, PERC (2021) Reporting standard, Table 1” September 2024.

3 As reported in the 2022 Technical Report by ARFY Finland Oy entitled “Mineral Resource estimate NI 43-101 Technical Report – Kylmäkangas Gold Project”, authored by Eemeli Rantala, P.Geo for ARFY with an effective date of July 25, 2022 and filed on SEDAR+ by Gold Line Resources Ltd. (name later changed to First Nordic Metals). EMX has not performed sufficient work to verify the published data reported above, but EMX believes this information is considered reliable and relevant.

4 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 9 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

During the three and nine months ended September 30, 2024 and 2023, the Company had the following sources of revenues and other income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Royalty revenue | $ | 6,184 | | | $ | 11,142 | | | $ | 16,871 | | | $ | 14,918 | |

| Option and other property income | 310 | | | 1,409 | | | 990 | | | 3,109 | |

| Interest income | 533 | | | 374 | | | 1,411 | | | 1,048 | |

| Total | 7,027 | | | 12,925 | | | 19,272 | | | 19,075 | |

| | | | | | | |

Non-IFRS Financial Measures5 | | | | | | | |

| Adjusted revenue and other income | $ | 9,660 | | | $ | 14,527 | | | $ | 26,711 | | | $ | 26,108 | |

During the three and nine months ended September 30, 2024 and 2023, the Company had royalty revenues from the following sources:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | |

| Timok | $ | 1,236 | | | $ | 7,689 | | | $ | 4,089 | | | $ | 7,689 | |

| Gediktepe | 3,353 | | | 1,955 | | | 8,149 | | | 4,056 | |

| Leeville | 1,112 | | | 773 | | | 3,163 | | | 1,971 | |

| Balya | 344 | | | 568 | | | 852 | | | 730 | |

| Gold Bar South | 104 | | | 59 | | | 346 | | | 193 | |

| Advanced royalty payments | 35 | | | 98 | | | 272 | | | 279 | |

| Total | $ | 6,184 | | | $ | 11,142 | | | $ | 16,871 | | | $ | 14,918 | |

| | | | | | | |

Non-IFRS Financial Measures5 | | | | | | | |

| Adjusted royalty revenue | $ | 8,817 | | | $ | 12,744 | | | $ | 24,310 | | | $ | 21,951 | |

Royalty revenue for the three months ended September 30, 2024 decreased by $4,958,000 or 44% when compared to the same period in 2023. Included in the 2023 balance was $6,676,000 in catch-up payments from the Timok royalty related to prior years, and Q2 YTD 2023. Excluding the catch-up payments, royalty revenue for the three months ended September 30, 2024 increased by $1,718,000 or 38% when compared to the same period in 2023.

Royalty revenue for the nine months ended September 30, 2024 increased by $1,953,000 or 13% when compared to the same period in 2023. Included in the 2023 balance was $4,783,000 in catch-up payments from the Timok royalty related to prior years. Excluding the catch-up payments, royalty revenue for the nine months ended September 30, 2024 increased by $6,736,000 or 66% when compared to the same period in 2023.

The majority of the increase was the result of higher production and metals prices from Gediktepe and Leeville, and the recognition of Timok revenue beginning in Q3 2023.

Adjusted revenue and other income5 and adjusted royalty revenue5 includes the Company's share of royalty revenue from the Company's effective royalty interest in the Caserones mine. The Company's share of royalty revenue from the Caserones mine for the three and nine months ended September 30, 2024 was $2,633,000 and $7,439,000, respectively (2023 - $1,602,000 and $7,033,000, respectively).

5 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 10 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

The percentage breakdown of the source of the Company's adjusted revenue and other income6 and adjusted royalty revenue6 for the nine months ended September 30, 2024 were as follows:

Option and other property income will fluctuate depending upon the Company’s deal flow and structure of property agreements relating to execution payments, staged option payments and operator and management fees. Execution and staged option payments can include the fair value of equity interests obtained in the respective partner and cash proceeds. Further, anti-dilution provisions in property agreements provided for additional equity received and are included in option and other property income. For the three and nine months ended September 30, 2024, included in option and other property income was $31,000 and $83,000, respectively, (2023 - $672,000 and $1,470,000, respectively) related to the fair value of share equity payments received, and $150,000 and $360,000, respectively, (2023 - $38,000 and $416,000, respectively) of various pre-production payments.

Royalty revenue from producing mines will fluctuate as a result of metal sold and prices received by the operators of the producing mines. Timing of additional advanced royalty payments related to other projects and included in royalty income can also fluctuate.

Interest income was earned on the cash balances the Company holds and interest accretion on the deferred compensation payments from Aftermath Silver Ltd., AbraSilver Resource Corp. and Scout Discoveries Corp.

6 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 11 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Cost and Expenses

Costs and expenses are comprised of expenditures incurred by the Company to carry out the royalty generation operations, the advancement of projects, and project evaluation as well as marketing and communications. Included in these costs is general and administrative costs ("G&A") for the three and nine months ended September 30, 2024 and 2023, comprised of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Salaries, consultants, and benefits | $ | 794 | | | $ | 594 | | | $ | 2,550 | | | $ | 2,195 | |

| Professional fees | 165 | | | 279 | | | 868 | | | 815 | |

| Investor relations and shareholder information | 142 | | | 148 | | | 480 | | | 589 | |

| Transfer agent and filing fees | 16 | | | 19 | | | 176 | | | 186 | |

| Administrative and office | 383 | | | 279 | | | 956 | | | 744 | |

| Travel | 37 | | | 45 | | | 111 | | | 133 | |

| Stamp taxes | - | | | - | | | 238 | | | - | |

| $ | 1,537 | | | $ | 1,364 | | | $ | 5,379 | | | $ | 4,662 | |

G&A costs of $1,537,000 and $5,379,000 were incurred for the three and nine months ended September 30, 2024, respectively compared to $1,364,000 and $4,662,000, respectively, in 2023. G&A expenditures will fluctuate from period to period depending on the level of activity and deal flow. Some of the changes in 2024 compared to 2023 are related to:

•Salaries, consultants, and benefits increased by $200,000 and $355,000, respectively in 2024 due to an increase in head count, personnel salaries and bonuses.

•Stamp taxes related to documentation processing in Chile. There was no comparative charges in the comparative period.

Royalty Generation and Project Evaluation Costs, Net of Recoveries

Net royalty generation and project evaluation costs increased from $8,527,000 during the nine months ended September 30, 2023 to $8,931,000 during the nine months ended September 30, 2024. Royalty generation costs include exploration related activities, technical services and management oversight, project marketing, land and legal costs, as well as third party due diligence for acquisitions. The increase can be attributed to an increase in property costs in Fennoscandia and South America, a decrease in recoveries in Fennoscandia and an increase in overall costs in Eastern Europe and Morocco.

These cost increases were offset by a $1,576,000 decrease in net expenditures in the USA. The decrease was primarily related to drilling costs that were incurred in 2023, through a former subsidiary of the Company, Scout Drilling LLC., in exchange for future royalty opportunities.

Not included in royalty generations and project evaluation costs, EMX earned $1,352,000 in generative revenue in the nine months ended September 30, 2024 (2023 - $3,388,000).

Depreciation, Depletion and Direct Royalty Taxes

Depreciation, depletion and direct royalty taxes for the nine months ended September 30, 2024 totaled $6,018,000 (2023 - $3,237,000). The increase was primarily attributable to depletion recognized on Gediktepe of $5,492,000 in the current period compared to $2,847,000 in the comparative period as a result of increased production from the mine.

Share-based Payments

During the nine months ended September 30, 2024 the Company recorded a total of $1,902,000 in aggregate share-based payments compared to $1,763,000 in 2023. The aggregate share-based payments relate to the annual grant of stock options and the fair value of restricted share units vesting during the period.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 12 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Other

•During the nine months ended September 30, 2024, the Company had an unrealized gain of $3,004,000 (2023 - loss of $869,000) related to the fair value adjustments of investments, and a realized loss of $2,253,000 (2023 - $420,000) for the sale of certain marketable securities held by the Company. The unrealized gains in the current period was attributed primarily to the realization of losses on the sale of marketable securities as well as the revaluation of the Company's investment in Scout Discoveries Corp. The Company will continue to sell marketable securities to generate cash where available but does not have control over market fluctuations.

•During the nine months ended September 30, 2024, the Company recognized equity income from its investment in an associated entity of $3,484,000 (2023 – $2,988,000). This related to the share of the Company’s net income derived in SLM California which holds the Caserones effective royalty interest.

•During the nine months ended September 30, 2024, the Company recognized finance expenses of $3,066,000 (2023 - $3,809,000) which consisted of interest accretion on the Sprott credit facility and the Franco-Nevada credit facility .

Taxes

During the nine months ended September 30, 2024, the Company recorded a deferred income tax recovery of $72,000 (2023 - expense of $3,446,000) and a current income tax expense of $544,000 (2023 - $336,000).

On December 31, 2023, legislative changes became effective in Türkiye for hyperinflation tax accounting.

Liquidity and Capital Resources

The Company considers items included in shareholders' equity as capital. The Company's objective when managing capital is to safeguard the Company's ability to continue as a going concern, so that it can continue to provide returns for shareholders and benefits for other stakeholders.

The condensed consolidated interim financial statements have been prepared using IFRS Accounting Standards applicable to a going concern, which assumes that the Company will be able to realize its assets, discharge its liabilities and continue in operation for the following twelve months. As at September 30, 2024, the Company had working capital of $41,825,000 (December 31, 2023 - deficit of $2,270,000).

The Company has continuing royalty revenue that will vary depending on royalty ounces received and the price of minerals, and other pre-production income. The Company also receives additional cash inflows from the recovery of expenditures from project partners, sale of investments, and investment income including dividends from investment in associated entity. The Company manages the capital structure and makes adjustments in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue new shares through public and/or private placements, sell assets, renegotiate terms of debt, or return capital to shareholders.

The Company is not subject to externally imposed capital requirements other than as disclosed for the Franco-Nevada Credit Facility.

Operating Activities

Cash provided by operating activities for the nine months ended September 30, 2024 was $326,000 (2023 - $2,787,000), and adjusted cash provided by operating activities1 for the period was $5,762,000 (2023 - $7,880,000) and represents expenditures primarily on royalty generation and general and administrative expenses for both periods, offset by royalty revenue received in the period. Adjusted cash provided by operating activities1 is adjusted for $5,436,000 (2023 - $5,093,000) in after-tax royalty distributions received from the Company's effective royalty interest at Caserones.

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 13 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Investing Activities

The total cash provided by investing activities during the nine months ended September 30, 2024 was $2,409,000 compared to $4,588,000 provided by investing activities during the comparative period. The net proceeds in the current period related primarily to the net proceeds on sales of fair value through profit and loss investments of $1,602,000 (2023 - $2,278,000), and dividends and distributions received of $5,574,000 (2023 - $5,255,000). This is partially offset by the purchase of additional equity investment related to the Company’s effective royalty interest in the Caserones mine for $4,742,000 (2023 - $3,517,000).

Financing Activities

The total cash used in financing activities for the nine months ended September 30, 2024 was $1,745,000 compared to $1,511,000 for the comparative period. During the period, the Company refinanced its $34,660,000 Sprott Credit Facility with a $35,000,000 credit facility with Franco-Nevada.

The net proceeds used in the current period primarily related to interest payments of $1,683,000 (2023 - $2,371,000) and the repurchase of $1,430,000 in shares through the Normal Course Issuer Bid program (2023 - $Nil). This was partially offset by the net cash proceeds from the exercise of options and settlement of RSUs of $1,512,000 (2023 - $860,000).

Related Party Transactions

The aggregate value of transactions and outstanding balances relating to key management personnel and directors for the nine months ended September 30, 2024 was as follows:

| | | | | | | | | | | | | | | | | |

| (In thousands of dollars) | Salary and fees | | Share-based

Payments | | Total |

| Management | $ | 730 | | | $ | 412 | | | $ | 1,142 | |

| Outside directors | 540 | | | 527 | | | 1,067 | |

| Seabord Management Corp.* | 206 | | | - | | | 206 | |

| Total | $ | 1,476 | | | $ | 939 | | | $ | 2,415 | |

*Seabord Management Corp. (“Seabord”) is a management services company partially owned by the Chief Accounting Officer ("CAO") the Company. Seabord provided accounting and administration staff, and office space to the Company. The CAO does not receive any direct compensation from Seabord in relation to services provided to the Company.

The aggregate value of transactions and outstanding balances relating to key management personnel and directors for the nine months ended September 30, 2023 was as follows:

| | | | | | | | | | | | | | | | | |

| (In thousands of dollars) | Salary and fees | | Share-based

Payments | | Total |

| Management | $ | 670 | | | $ | 423 | | | $ | 1,093 | |

| Outside directors | 493 | | | 428 | | | 921 | |

| Seabord Management Corp.* | 227 | | | - | | | 227 | |

| Total | $ | 1,390 | | | $ | 851 | | | $ | 2,241 | |

*Seabord Management Corp. (“Seabord”) is a management services company partially owned by the Chief Accounting Officer ("CAO") the Company. Seabord provided accounting and administration staff, and office space to the Company. The CAO does not receive any direct compensation from Seabord in relation to services provided to the Company.

Included in accounts receivable as at September 30, 2024 is $15 (December 31, 2023 - $Nil) owed from key management personnel.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 14 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Quarterly Information1

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of dollars, except per share amounts) | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 |

| | | | | | | |

| Financial results | | | | | | | |

| Revenue and other income | $ | 7,027 | | | $ | 6,005 | | | $ | 6,240 | | | $ | 7,546 | |

| Costs and expenses | (7,178) | | | (6,842) | | | (7,678) | | | (5,955) | |

| Income (loss) from operations | $ | (151) | | | $ | (837) | | | $ | (1,438) | | | $ | 1,591 | |

| Net income (loss) for the period | $ | 1,194 | | | $ | (4,022) | | | $ | (2,227) | | | $ | 1,372 | |

| Basic earnings (loss) per share | 10.45 | | | (35.57) | | | (0.02) | | | 0.01 | |

| Diluted earnings (loss) per share | $ | 10.45 | | | $ | (35.57) | | | $ | (0.02) | | | $ | 0.01 | |

| | | | | | | |

Non-IFRS Financial Measures1 | | | | | | | |

| Adjusted revenue and other income | $ | 9,660 | | | $ | 8,758 | | | $ | 8,293 | | | $ | 10,921 | |

| Adjusted royalty revenue | $ | 8,817 | | | $ | 7,836 | | | $ | 7,657 | | | $ | 8,744 | |

| GEOs sold | 3,560 | | | 3,352 | | | 3,696 | | | 4,424 | |

| Adjusted cash flows from operating activities | $ | 1,760 | | | $ | 1,341 | | | $ | 2,661 | | | $ | 6,192 | |

| | | | | | | |

| Adjusted EBITDA | $ | 5,071 | | | $ | 4,639 | | | $ | 3,223 | | | $ | 7,278 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of dollars, except per share amounts) | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| | | | | | | |

| Financial results | | | | | | | |

| Revenue and other income | $ | 12,925 | | | $ | 3,408 | | | $ | 2,742 | | | $ | 2,288 | |

| Costs and expenses | (7,492) | | | (4,688) | | | (5,539) | | | (5,721) | |

| Income (loss) from operations | $ | 5,433 | | | $ | (1,280) | | | $ | (2,797) | | | $ | (3,433) | |

| Net income (loss) for the period | $ | 2,443 | | | $ | (4,722) | | | $ | (3,726) | | | $ | 951 | |

| Basic earnings (loss) per share | 0.02 | | | (0.04) | | | (0.03) | | | 0.01 | |

| Diluted earnings (loss) per share | $ | 0.02 | | | $ | (0.04) | | | $ | (0.03) | | | $ | 0.01 | |

| | | | | | | |

Non-IFRS Financial Measures1 | | | | | | | |

| Adjusted revenue and other income | $ | 14,527 | | | $ | 6,614 | | | $ | 4,968 | | | $ | 3,535 | |

| Adjusted royalty revenue | $ | 12,744 | | | $ | 5,265 | | | $ | 3,943 | | | $ | 2,793 | |

| GEOs sold | 6,608 | | | 2,662 | | | 2,088 | | | 1,615 | |

| Adjusted cash flows from operating activities | $ | 8,863 | | | $ | 1,452 | | | $ | (2,435) | | | $ | 4,093 | |

| | | | | | | |

| Adjusted EBITDA | $ | 10,168 | | | $ | 2,848 | | | $ | 374 | | | $ | (978) | |

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 15 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Royalty Portfolio Review

EMX's royalty and royalty generation portfolio totals 269 projects on six continents. The following is a summary of the portfolio that includes producing, advanced, and exploration project royalties. There are three material royalties covering the Caserones Mine in Chile, the Timok Mine in Serbia, and the Gediktepe Mine in Türkiye. See EMX’s Annual Information Form (“AIF”) for the year ended December 31, 2023 which is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile and the Company’s website (www.EMXroyalty.com) for more information on the Caserones, Timok, and Gediktepe royalty properties. In addition, the Leeville and Balya royalty properties are important to the Company, for current as well as projected future royalty cash flows.

Appendix A includes a comprehensive table of EMX's royalty assets. Please see EMX's AIF for the year ended December 31, 2023 for a summary of resource and reserve statements for key royalty assets. For additional details on EMX's royalty and royalty generation portfolio, including specifics on the royalty terms, please refer to the Company's website (www.EMXroyalty.com) as well as the Company's AIF and financial statements for the year ended December 31, 2023.

Producing Royalties

| | | | | | | | | | | | | | | | | |

| Asset | Location | Operator | Commodity | Stage | Royalty Interest |

| Caserones | Chile | Lundin Mining Corporation | Copper (Molybdenum) | Producing | Effective 0.8306% NSR |

| Timok | Serbia | Zijin Mining Group Co, Ltd. | Copper-Gold | Producing - Upper Zone

Developing - Lower Zone | 0.3625% NSR |

| Gediktepe | Türkiye | ACG Metals Ltd. | Gold, Polymetallic | Producing - Oxide phase | 10% NSR on oxide zone and 2% NSR on sulfide zone |

| Leeville | Nevada | Nevada Gold Mines LLC | Gold | Producing | 1.0% GSR |

| Balya | Türkiye | Esan Eczacibaşi Endüstriyel Hammaddeler San. Ve Tic. A.Ş. | Zinc-Lead-Silver | Producing | 4.0% NSR |

| Gold Bar South | Nevada | McEwen Mining Inc. | Gold | Producing | 1% NSR |

Significant Updates

Caserones, Chile - The Caserones open pit mine is developed on a porphyry copper (molybdenum) deposit in the Atacama Region of Chile’s Andean Cordillera. EMX holds an (effective) 0.8306% NSR royalty interest covering the Caserones mine, as well as other nearby exploration targets, within a mineral concession package totalling approximately 17,000 hectares. The mine is owned by SCM Minera Lumina Copper Chile (“SCM MLCC” or “MLCC”). Lundin Mining Corporation (TSX: LUN) ("Lundin") acquired a 51% controlling interest in MLCC from JX Nippon and certain JX Nippon subsidiaries in July 2023, and a further 19% in Q2 2024 (see discussion below). Caserones produces copper and molybdenum concentrates from a conventional crusher, mill, and flotation plant, as well as copper cathodes from a dump leach and solvent extraction and electrowinning plant. See EMX’s 2023 AIF for more information on the Caserones Royalty Property.

In Q3 2024, Lundin announced it had closed the option to acquire the additional 19% equity interest in the Caserones operating company (i.e., SCM MLCC) from JX Advanced Metals Corporation (previously JX Nippon) (see Lundin news release dated July 2, 2024). The cash consideration for the Call Option Exercise was $350 million which brought Lundin’s ownership interest to 70%. The option exercise closed on July 2, 2024.

Also in Q3 2024, Lundin announced Q2 2024 results that included an updated 2024 copper production guidance range for Caserones that increased to 124,000 - 135,000 tonnes from 120,000 - 130,000 tonnes (see Lundin news release dated July 30, 2024). Caserones produced 29,775 tonnes of copper and 714 tonnes of molybdenum on a 100% basis in the three months ended June 30, 2024. Concentrate production was impacted by extended mill maintenance and weather events, while recoveries were also temporarily reduced by changes in the mining sequence and flotation circuit disruptions. Lundin also highlighted exploration activities at Caserones, which included drilling in the lower portion of the mineral resource in search of higher-grade copper breccia bodies.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 16 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

In August, Lundin announced the failure of collective bargaining with one of three unions in its workforce and the gradual reduction of operations to about 50% of capacity (see Lundin news release dated August 12, 2024). The strike was resolved on August 24, 2024 and Lundin commenced the gradual ramp-up back to full production.

The Company’s effective share of the royalty revenue in Caserones totaled $2,633,000 for Q3 2024 (Q3 2023 - $1,602,000). The Company's effective royalty distribution totaled $1,947,000 for Q3 2024 (Q3 2023 - $1,741,000). These payments were based upon copper and molybdenum mine production from Q1 2024. The royalty distribution payments to EMX were after payment of Chilean taxes of approximately 27%.

Timok, Serbia - EMX’s Timok Royalty is located in the Bor Mining District of Serbia and covers the Cukaru Peki copper-gold deposit. Cukaru Peki consists of a high-level body of high-grade, epithermal-style copper-gold mineralization referred to as the “Upper Zone”, and a deeper body of porphyry-style copper-gold mineralization known as the “Lower Zone”. Zijin is currently producing copper and gold from the Upper Zone deposit at Cukaru Peki, while concurrently developing the Lower Zone. EMX’s royalty covers both the Upper and Lower Zones. The Cukaru Peki deposits and operations are summarized in Zijin’s annual reports and in various Zijin disclosures. See EMX’s 2023 AIF for more information on the Timok Royalty Property.

EMX executed an amended and restated royalty agreement on September 1, 2023 for its Timok Royalty property with Zijin, whereby the Timok Royalty will consist of a 0.3625% NSR royalty that is uncapped and cannot be repurchased or reduced. The royalty covers Zijin’s Brestovac exploration permit area (including the Cukaru Peki Mining licenses), as well as portions of Zijin’s Jasikovo-Durlan Potak exploration license north of the currently active Bor Mine. The Company is currently receiving quarterly royalty payments from Zijin for copper and gold production from the Cukaru Peki Mine.

EMX earned $1,236,000 in royalty revenue from the Timok royalty in Q3 2024 (Q3 2023 - $$7,689,000).

Gediktepe, Türkiye - The Gediktepe VMS polymetallic deposit is located in western Türkiye. The Gediktepe Royalties consist of: (i) an uncapped 10% NSR royalty over metals produced from the “oxide zone” (predominantly gold and silver) after cumulative production of 10,000 gold-equivalent oxide ounces; and (ii) an uncapped 2% NSR royalty over metals produced from the “sulfide zone” (predominantly copper, zinc, lead, silver and gold), payable after cumulative production of 25,000 gold-equivalent sulfide ounces (gold-equivalent as referenced from an underlying 2019 Share Purchase Agreement). The Gediktepe Royalties were acquired as part of the SSR royalty portfolio transaction in 2021, and are being advanced by operator ACG Metals Limited who acquired the property from Lidya Madencilik Anayi ve Ticaret A.S. (“Lidya”), a private Turkish company in 2024. EMX is credited with royalty payments on a monthly basis for gold and silver production from the Gediktepe Mine. See EMX’s 2023 AIF for more information on the Gediktepe Royalty Property.

EMX earned $3,353,000 in royalty revenue from oxide zone production from the Gediktepe Mine in Q3 2024 (Q3 2023 - $1,955,000).

Leeville, Nevada - The Leeville 1% gross smelter return ("GSR") royalty covers portions of West Leeville, Carlin East, Four Corners, Turf, Rita K, and other underground gold mining operations and deposits in the Northern Carlin Trend of Nevada (the "Leeville Royalty"). The Leeville Royalty property is included in the Nevada Gold Mines LLC ("NGM") Barrick-Newmont Nevada joint venture. Leeville Royalty property mineral resource and mineral reserve estimates as well as life of mine plans are not available to EMX from NGM.

EMX earned $1,112,000 in royalty revenue from Leeville in Q3 2024 (Q3 2023 - $773,000).

Balya, Türkiye - The Balya royalty property is located in the historic Balya lead-zinc-silver mining district in northwestern Türkiye. EMX holds an uncapped 4% NSR royalty on the "Balya North Deposit", which is operated by Esan Eczacibaşi Endüstriyel Hammaddeler San. Ve Tic. A.Ş. ("Esan"), a private Turkish company. Esan operates a lead-zinc mine and flotation mill on the property immediately adjacent to EMX's Balya North royalty property. The initial phases of mining at Balya North commenced in late 2021, and production is now sourced from multiple underground working faces and mine levels with production rates increasing in Q3 2024.

EMX earned $344,000 in royalty revenue from the Balya property in Q3 2024 (Q3 2023 - $568,000).

Gold Bar South, Nevada - EMX’s Gold Bar South 1% NSR royalty property, operated by McEwen, covers a sediment-hosted, oxide gold deposit situated approximately 5.6 kilometers southeast of McEwen’s Gold Bar open pit mining operation in north-central Nevada.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 17 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

EMX earned $104,000 in royalty revenue in Q3 2024 (Q3 2023 - $59,000) from Gold Bar South.

Advanced Royalty Projects

| | | | | | | | | | | | | | | | | |

| Asset | Location | Operator | Commodity | Stage | Royalty Interest |

| Diablillos | Argentina | AbraSilver Resource Corp | Silver-Gold | Resource Development | 1% NSR |

| Berenguela | Peru | Aftermath Silver Ltd | Copper-Silver-Manganese-Zinc | Resource Development | 1% -1.25% NSR |

| Challacollo | Chile | Aftermath Silver Ltd | Silver-Gold | Resource Development | 2% NSR |

| San Marcial | Mexico | GR Silver Mining Ltd | Silver-Gold-Zinc-Lead | Resource Development | 0.75% NSR |

| Parks-Salyer | USA | Arizona Sonoran Copper | Copper | Resource Development | 1.5% NSR |

| Tartan Lake | Canada | Canadian Gold Corp. | Gold | Resource Development | 2.0% NSR |

| Yenipazar | Türkiye | Virtus Madencilik | Gold -Silver-Zinc-Copper-Lead | Feasibility | 6%-10% NPI |

| Akarca | Türkiye | Çiftay İnşaat Taahhüt ve Ticaret A.Ş. | Gold-Silver | Resource Development | 1%-3% NSR |

| Sisorta | Türkiye | Bahar Madencilik Sinayi ve Ticaret Ltd Sti | Gold | Under Construction | 3.5%-5% NSR |

| Viscaria | Sweden | Gruvaktiebolaget Viscaria | Copper-Iron | Development Permitting | 0.5% to 1% NSR |

| Kaukua | Finland | GT Resources Inc. | PGE-Nickel-Copper | Resource Development | 2% NSR |

Significant Updates

Diablillos, Argentina - Diablillos is a PFS stage high sulfidation silver-gold project located in the Puna region of Salta Province, Argentina that is owned and operated by AbraSilver Resource Corp. (TSX-V: ABRA) ("Abrasilver"). There are multiple mineralized zones, including the Oculto and JAC deposits. In addition to EMX’s NSR royalty, there is a $7,000,000 payment due to EMX upon the earlier of commencement of commercial production or July 31, 2025.

During Q3, AbraSilver announced drill results from its 20,000 meter Phase IV exploration program that included (see AbraSilver news releases dated July 22, and August 19, 2024):

•Mineralized intercepts within the conceptual PFS open pit boundary that had been classified as waste (e.g., DDH 24-003 with 33 meters (69-102 m) @ 87 g/t Ag);

•High-grade infill intercepts within Inferred Resource mineralization (i.e., DDH 24-004 with 33.4 meters (110.0-143.4 m) @ 245 g/t Ag); and

•Intercepts outside of the conceptual PFS open pit boundary at JAC (e.g., DDH 24-018 with a high-grade silver intercept of 31.5 meters (117.5-149.0 m) @ 277 g/t Ag), as well as above the main zone of mineralization at Oculto Northeast (e.g., DDH 24-011 with 21.0 meters (114-135 m) @ 131.3 g/t Ag and 0.36 g/t Au).

The above intercepts are in oxides and the true widths are estimated as 80% of the reported interval lengths.

AbraSilver also announced results of a TITAN geophysical survey at the Diablillos Porphyry Complex, which is located approximately 3.5 kilometers northeast of the Oculto deposit (see AbraSilver news release dated September 30, 2024). The TITAN survey identified significant resistivity anomalies extending to depths of over one kilometer beneath a) shallow historical drill holes that intersected low grade copper mineralization and b) surface sampling which assayed with highly anomalous gold and molybdenum in the Cerro Blanco area. A follow-up deep drilling program is planned for Q4.

Finally, AbraSilver announced the completion of the Environmental Impact Assessment (the “EIA”) for Diablillos, which marked an important step in advancing the project (see AbraSilver news release dated September 4, 2024). The EIA includes

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 18 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

environmental baseline studies, air quality, hydrological modelling, flora and fauna characterization and impact evaluation, along with mitigation, controls and benefits analysis from construction to final closure.

Berenguela, Peru - The Berenguela project, located in the Puno region of southeastern Peru, is a resource stage polymetallic (Cu-Ag-Mn) carbonate replacement-style deposit being advanced by Aftermath Silver Ltd (TSX-V: AAG; OTCQB: AAGFF) (“Aftermath”). Aftermath is earning 100% project interest per a definitive acquisition agreement originally executed with SSR Mining. EMX’s sliding scale royalty interest (i.e., 1-1.25% NSR based on metal prices) and earn-in payments (i.e., totaling $8,750,000) were acquired in 2021 as part of the SSR royalty portfolio transaction.

Aftermath reported results from metallurgical test work in Q3 2024 that focused on the extraction of battery grade manganese sulphate monohydrate from composite samples (see Aftermath news releases dated July 11, and July 23, 2024). The test work produced battery grade (99.9%) manganese sulphate crystals, assaying between 32.4% and 32.9% manganese (high-purity manganese sulphate monohydrate or HPMSM). These results are within the purity specifications of most MnSO4 consumers. Manganese recoveries were approximately 95%. The test work solely involved hydrometallurgical processes with no electrowinning required for purification.

Aftermath also commenced a follow-up diamond drill campaign of 4,000 meters focused on three objectives (see Aftermath news release dated September 4, 2024): a) upgrade inferred to measured or indicated resources at the western and northern margins of the known mineralization, b) further define the mineralization between the western and central areas, and c) drill untested areas in the southeast zone where historical drilling encountered higher copper grades.

Parks-Salyer, Arizona - EMX’s Parks-Salyer royalty property is located approximately one kilometer southwest of the historical Sacaton copper mine in central Arizona and is controlled and operated by Arizona Sonoran Copper Company, Inc. (TSX: ASCU) (“ASCU”). The Parks-Salyer deposit together with the Cactus deposit (open pit and underground) and historical stockpiles are collectively known as the Cactus Project by ASCU. EMX retains a 1.5% NSR royalty covering 158 acres of the eastern portion of the Parks-Salyer deposit. One percent of the royalty can be bought down for $500,000. The Company receives ongoing AAR payments.

In Q3 2024, ASCU announced results from an updated mineral resource estimate (“MRE”) for the Cactus Project, which includes Parks-Salyer (see ASCU news release dated July 16, 2024). The updated MRE included recent drill results that targeted shallow mineralization at the MainSpring property (not covered by EMX’s royalty), which is adjacent to the south of Parks-Salyer (partially covered by EMX’s royalty). This drilling, and the updated MRE that resulted, established Parks-Salyer and MainSpring as one continuous deposit amenable to open pit mining.

The combined Parks-Salyer/Mainspring resources, which have now been combined as the “new Parks-Salyer”, which are partially covered by EMX’s royalty, were reported as:

| | | | | | | | | | | | | | | | | | | | |

| Parks-Salyer Measured and Indicated Resources reported by Arizona Sonoran Copper Company as of July 11, 2024 |

| Mineralization Type | OP/UG | Ktons | CuT% | CuTsol%* | Total Cu Klbs | Cu Tsol Klbs |

| Leachable | Parks Salyer OP | 246,300 | 0.81 | 0.71 | 4,008,200 | 3,499,800 |

| Leachable | Parks Salyer U/G | 1,100 | 0.98 | 0.86 | 21,500 | 19,000 |

| | | |

| | |

| Primary | Parks Salyer OP | 91,300 | 0.44 | 0.04 | 796,100 | 81,400 |

| Primary | Parks Salyer U/G | 100 | 0.95 | 0.15 | 1,900.00 | 300 |

* Denotes Cu Tsol generated using sequential assaying to calculate the grade of soluble Cu

Notes:

1.Leachable copper grades are reported using sequential assaying to calculate the soluble copper grade. Primary copper grades are reported as total copper. Tons are reported as short tons.

2.Resources use a copper price of US$3.75/lb.

3.Technical and economic parameters defining mineral resource pit shells: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle.

4.Technical and economic parameters defining underground resources: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 19 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

5.Technical and economic parameters defining processing: Oxide heap leach (HL) processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, primary mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb.

6.Variable cut-off grades were reported depending on material type, associated potential processing method, and applicable royalties.

7.Mineral resources, which are not mineral reserves, do not have demonstrated economic viability.

8.Totals may not add up due to rounding.

All of the Mainspring mineral resource is in the inferred category, and totals 244,900 Ktons averaging 0.39% CuT as both leachable and primary mineralization.

EMX, as a royalty holder, does not have access to the data necessary to report the portion of mineral resources covered by its Parks-Salyer royalty property. However, in Q4 2022 ASCU reported to EMX that a total of 725.5 million pounds of contained copper (approximately 25% of the total contained copper from the 2022 total inferred mineral resource of 2,915 Mlbs contained copper) were covered by the EMX royalty. The Company notes that the footprint of the new Parks-Salyer deposit within EMX’s royalty property boundary has changed materially from the 2022 to the 2024 resource models due to the addition of the MainSpring property.

The updated Cactus Project MRE provided the basis for ASCU's "standalone" NI 43-101 Preliminary Economic Assessment (“PEA”) that superseded the previously released Pre-Feasibility Study (“PFS”) in all respects, and rescoped Parks-Salyer as an open pit operation resulting from the inclusion of the MainSpring property (see ASCU news releases dated August 7, and August 27, 2024 and technical report filed on SEDAR+ titled "NI 43-101 Technical Report Preliminary Economic Assessment of the Cactus Mine Project, Pinal County, Casa Grande Arizona" with an effective date of August 7, 2024 and filing date of August 23, 2024). The inclusion of MainSpring materially improved the economics and operations of the Cactus Project (i.e., new Parks-Salyer, Cactus East & West, and Stockpile), which will produce a total of 5.3 billion lbs (i.e., 2.7 million short tons) of LME Grade A Copper Cathodes via heap leaching and solvent extraction and electrowinning (“SXEW”) over a 31-year operating life of mine. Key performance indicators from the PEA include: a) an after-tax NPV(8) of US$2.032 billion, b) an internal rate of return (IRR) of 24%, and c) a payback period of 4.9 years.

New Parks-Salyer contributes 531 million short tons @ 0.530% CuT (i.e., total copper) of the 889 million short tons of feed material over the LoM. Overall, the Cactus Project will produce 86,000 short tons of copper cathodes annually. According to ASCU, the PEA scenario results in "a lower risk brownfield open pit mining operation with a long life and a streamlined permitting process on private land in Arizona with water rights and access to water from in-situ water wells". ASCU continues to work with its partner, Nuton Technologies, a Rio Tinto Venture, to advance the Cactus Project. As an event subsequent to Q3, ASCU announced the initiation of the Cactus Project PFS, which is anticipated "… to be completed in the second half of 2025" (see ASCU news release dated October 15, 2024).

Tartan Lake, Canada - Tartan Lake is a past producing, resource stage greenstone hosted gold deposit located near Flin Flon in Manitoba, Canada. EMX retains a 2% NSR royalty covering Tartan Lake, which is owned and operated by Canadian Gold Corp. (“CGC”) (TSX-V: CGC). CGC has an option to buyback each 1% of the NSR royalty for separate C$1,000,000 payments to EMX. The Tartan Lake Royalty Property hosts underground gold resources which are considered as historical by EMX.

CGC's Phase 3 drill program commenced in Q3 2024 to follow-up at the Hanging Wall and Main Zones (see CGC news release dated July 30, 2024). The first objective was to target the western limit of the Hanging Wall Zone, resulting in an intercept of 7.3 g/t gold over 7 meters (880-887 m), including 12.0 g/t gold over 3 meters in hole TLSZ24-29W2, which extended the zone west and down plunge (true width not reported) (see CGC news release dated October 16, 2024). Drilling at the Main Zone resulted in the discovery of a potentially new zone that returned 6.0 g/t gold over 3 meters (586-589 m), including 15.9 g/t gold over 1.0 meter (588-589 m) in hole TLSZ24-29W4 (true widths not reported). This new zone was intersected 475 meters below surface and is situated approximately 100 meters south and parallel to the Main Zone. Follow-up drilling is ongoing.

Sisorta, Türkiye - The Sisorta project consists of an oxide gold deposit with underlying copper and gold porphyry potential. EMX sold the project in 2016 to Bahar Madencilik Sinayi ve Ticaret Ltd Sti (“Bahar”), a privately owned Turkish company, retaining a royalty and advance royalty payment interests. The EMX royalties consist of a 3.5% NSR on any materials mined and processed on site at Sisorta, and a 5% NSR royalty on any materials shipped offsite for processing.

Bahar, which operates the nearby Altintepe gold mine, commenced development of the Sisorta project in 2022, and received a temporary environmental operating permit at the end of Q1. Bahar has since commissioned its ADR plant and is working toward

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 20 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

its first gold production. EMX is awaiting updates from Bahar’s activities in Q3 but has not received information on any gold production at the time of publication.

Viscaria, Sweden - EMX holds an effective 0.5% to 1.0% NSR royalty interest on the Viscaria copper (iron) project located in the Kiruna mining district of Sweden which is operated by Stockholm listed Gruvaktiebolaget Viscaria (“Viscaria”) (formerly Copperstone AB). The Viscaria deposit contains elements of both VMS and iron oxide-copper-gold (“IOCG”) styles of mineralization and was mined from 1983-1996 by a partnership between LKAB and Outokumpu OYJ. Significant mineral resources remain in the historical mining area, most of which are covered by EMX’s royalty footprint.

On May 6, 2024 the Land and Environment Court announced that Copperstone had been granted a permit under the Environmental Code for “mining and water operations” at the Viscaria mine (see Copperstone news release dated May 6, 2024). Receipt of this environmental permit represents a key milestone event for the advancement of the Viscaria project. Viscaria exercised the permit in September of 2024 to commence construction of its water treatment facility. Copperstone officially changed its name to Gruvaktiebolaget Viscaria (“Viscaria”) on May 22. Viscaria still anticipates reopening of the mine in 2026.

Exploration Royalty & Royalty Generation Projects

The Company has 127 exploration stage royalties and 125 royalty generation properties being advanced, and available for partnership (note, these totals do not include producing royalty or advanced royalty projects). A complete listing of the exploration stage royalties is included in Appendix A to this MD&A. The table below provides an overview of exploration royalties and royalty generation properties by country and commodity, followed by brief discussions of select project highlights.

| | | | | | | | | | | | | | | | | | | | | | | |

| Country | Exploration Royalty | | Royalty Generation Project |

| Precious Metals | | Base Metals | | Precious Metals | | Base Metals |

| | | | | | | |

| USA | 27 | | 12 | | 13 | | 24 |

| Canada | 33 | | 4 | | 12 | | 7 |

| Mexico | 2 | | - | | - | | - |

| Haiti | 5 | | 2 | | - | | - |

| Chile | 4 | | 3 | | 3 | | 7 |

| Argentina | 1 | | - | | - | | - |

| Sweden | 8 | | 10 | | 1 | | 8 |

| Finland | 2 | | - | | 5 | | 1 |

| Norway | - | | 10 | | 4 | | 14 |

| Serbia | 1 | | 1 | | - | | 2 |

| Morocco | - | | - | | 6 | | 12 |

| Türkiye | - | | 1 | | 2 | | 1 |

| Australia | 1 | | - | | 3 | | - |

| 84 | | 43 | | 49 | | 76 |

Summary of United States Portfolio

EMX’s western U.S. royalty generation portfolio consists of 76 total properties, which includes 39 royalty properties and 37 properties available for partnership. During Q3, partnered properties were advanced with two drill programs and other work programs. EMX continued to evaluate new copper and gold royalty generation opportunities, while dropping low priority projects. South32 retained the Copper Spring Designated Project and returned the remaining five properties in the portfolio to 100% EMX control.

Highlights of United States

Selena, Nevada - Ridgeline Minerals Corp. (TSX-V: RDG; OTCQB: RDGMF; FRA: 0GC0) (“Ridgeline”) owns and operates EMX’s Selena Royalty Property (3.25% production returns royalty) which hosts multiple polymetallic carbonate replacement deposit

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 21 |

Management's Discussion & Analysis