Investor Relations Contacts: | Analyst Coverage: |

| |

Daniel R. Sink, Chief Financial Officer | Cantor Fitzgerald |

Kite Realty Group Trust | Mr. Philip J. Martin |

30 South Meridian Street, Suite 1100 | (312) 469-7485 |

Indianapolis, IN 46204 | pmartin@cantor.com |

(317) 577-5609 | |

dsink@kiterealty.com | Goldman, Sachs & Co. |

| Mr. Dennis Maloney |

The Ruth Group | (212) 902-4351 |

Stephanie Carrington | dennis.maloney@gs.com |

(646) 536-7017 | |

| Harris Nesbitt |

Transfer Agent: | Mr. Paul E. Adornato, CFA |

| (212) 885-4170 |

LaSalle Bank, National Association | paul.adornato@harrisnesbitt.com |

135 South LaSalle Street | |

Chicago, IL 60603-3499 | Lehman Brothers |

(312) 904-2000 | Mr. David Harris |

| (212) 526-1790 |

Stock Specialist: | dharris4@lehman.com |

| |

Van der Moolen Specialists USA, LLC | Raymond James |

45 Broadway | Mr. Paul Puryear |

32nd Floor | (727) 567-2253 |

New York, NY 10006 | paul.puryear@raymondjames.com |

(646) 576-2707 | |

| Stifel, Nicholas & Company, Inc. |

| Mr. David M. Fick, CPA |

| (410) 454-5018 |

| dmfick@stifel.com |

| |

| Wachovia Securities |

| Mr. Jeffrey J. Donnelly, CFA |

| (617) 603-4262 |

| jeff.donnelly@wachovia.com |

IMPORTANT NOTES

Interim Information

This Quarterly Financial Supplement contains historical information of Kite Realty Group Trust (the “Company” or “KRG”) and is intended to supplement the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2006, which should be read in conjunction with this package. The supplemental information is unaudited, although it reflects all adjustments which, in the opinion of management, are necessary for a fair presentation of operating results for the interim periods.

Forward-Looking Statements

This supplemental information package contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to:

| • | national and local economic, business, real estate and other market conditions; |

| • | the ability of tenants to pay rent; |

| • | the competitive environment in which the Company operates; |

| • | financing risks; |

| • | property ownership and management risks; |

| • | the level and volatility of interest rates; |

| • | financial stability of tenants; |

| • | the Company’s ability to maintain its status as a REIT for federal income tax purposes; |

| • | acquisition, disposition, development and joint venture risks; |

| • | potential environmental and other liabilities; |

| • | other factors affecting the real estate industry generally; and |

| • | other risks identified in reports the Company files with the Securities and Exchange Commission (the “SEC”) or in other documents that it publicly disseminates. Including, in particular, the section tittled “Risk Factors ”, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005 and in on quarterly agents on Form 10-Q. |

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Funds From Operations

Funds from Operations (“FFO”) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. We calculate FFO in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts (NAREIT), which we refer to as the White Paper. The White Paper defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Given the nature of our business as a real estate owner and operator, we believe that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance such as gains (or losses) from sales of property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO should not be considered as an alternative to net income (determined in accordance with generally accepted accounting principles (“GAAP”)) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to fund our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do.

Net Operating Income

Net operating income (“NOI”) is provided here as a supplemental measure of operating performance. NOI is defined as property revenues less property operating expenses, excluding depreciation and amortization, interest expense and other items. We believe that this presentation of NOI is helpful to investors as a measure of its operational performance because it is widely used in the real estate industry to measure the performance of real estate assets without regard to various items included in net income that do not relate to or are not indicative of operating performance, such as depreciation and amortization, which can vary depending upon accounting methods and book value of assets. We also believe NOI helps our investors to meaningfully compare the results of our operating performance from period to period by removing the impact of our capital structure (primarily interest expense on our outstanding indebtedness) and depreciation of our basis in our assets from our operating results. NOI should not, however, be considered as an alternative to net income (calculated in accordance with GAAP) as an indicator of our financial performance.

Basis for Presentation

Kite Realty Group Trust commenced operations on August 16, 2004 upon completion of its initial public offering. Prior to that date, the entities that owned the properties and service companies that we acquired as part of our formation transactions were under the common control of Al Kite, John Kite and Paul Kite (the “Principals”). Certain line items in the accompanying financial information in the period beginning August 16, 2004 may not be comparable to prior periods due to acquisitions, including the purchase of minority partner and joint venture interests of the properties previously accounted for under the equity method.

|

p. 5 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

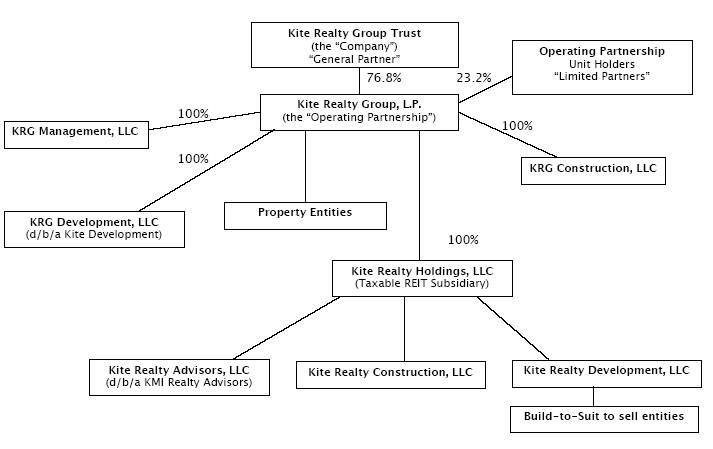

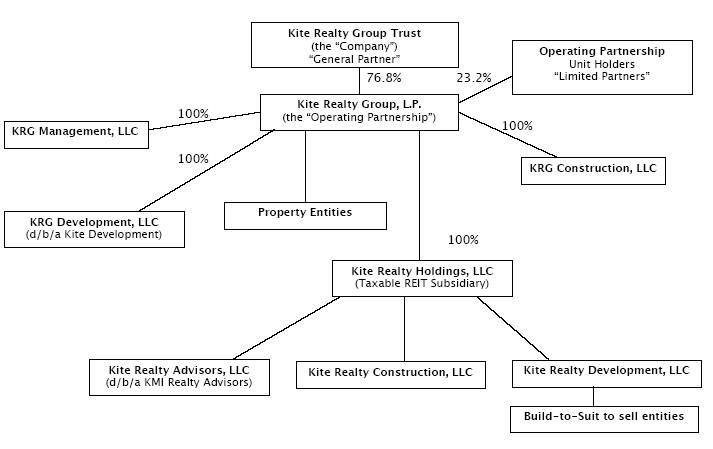

CORPORATE STRUCTURE CHART – MARCH 31, 2006

|

p. 6 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

CONDENSED CONSOLIDATED BALANCE SHEETS

| | March 31, 2006 | | December 31, 2005 | |

| |

|

| |

|

| |

| | (Unaudited) | | (Unaudited) | |

Assets: | | | | | | | |

Investment properties, at cost: | | | | | | | |

Land | | $ | 172,211,722 | | $ | 172,509,684 | |

Land held for development | | | 53,293,610 | | | 51,340,820 | |

Buildings and improvements | | | 485,808,204 | | | 485,129,649 | |

Furniture, equipment and other | | | 5,384,093 | | | 5,675,980 | |

Construction in progress and other | | | 85,558,803 | | | 65,903,868 | |

| |

|

| |

|

| |

| | | 802,256,432 | | | 780,560,001 | |

Less: accumulated depreciation | | | (47,194,381 | ) | | (41,825,911 | ) |

| |

|

| |

|

| |

| | | 755,062,051 | | | 738,734,090 | |

Cash and cash equivalents | | | 9,560,171 | | | 15,208,835 | |

Tenant receivables, including accrued straight-line rent, net of allowance for bad debts | | | 12,954,605 | | | 11,302,923 | |

Other receivables | | | 6,865,736 | | | 6,082,511 | |

Investments in unconsolidated entities, at equity | | | 1,191,443 | | | 1,303,919 | |

Escrow deposits | | | 5,466,752 | | | 6,718,198 | |

Deferred costs, net | | | 17,532,778 | | | 17,380,288 | |

Prepaid and other assets | | | 2,603,042 | | | 2,499,042 | |

| |

|

| |

|

| |

Total Assets | | $ | 811,236,578 | | $ | 799,229,806 | |

| |

|

| |

|

| |

Liabilities and Shareholders’ Equity: | | | | | | | |

Mortgage and other indebtedness | | $ | 390,950,748 | | $ | 375,245,837 | |

Cash distributions and losses in excess of net investment in unconsolidated entities, at equity | | | 53,551 | | | — | |

Accounts payable and accrued expenses | | | 31,530,388 | | | 30,642,822 | |

Deferred revenue | | | 25,210,889 | | | 25,369,152 | |

Minority interest | | | 4,748,825 | | | 4,847,801 | |

| |

|

| |

|

| |

Total liabilities | | | 452,494,401 | | | 436,105,612 | |

Commitments and Contingencies | | | | | | | |

Limited Partners’ interests in operating partnership | | | 83,228,186 | | | 84,244,814 | |

Shareholders’ Equity: | | | | | | | |

Preferred shares, $.01 par value, 40,000,000 shares authorized, no shares issued and outstanding | | | — | | | — | |

Common shares, $.01 par value, 200,000,000 shares authorized, 28,583,414 shares and 28,555,187 shares issued and outstanding at March 31, 2006 and December 31, 2005, respectively | | | 285,834 | | | 285,552 | |

Additional paid in capital and other | | | 288,206,406 | | | 288,976,563 | |

Unearned compensation | | | — | | | (808,015 | ) |

Other comprehensive income | | | 610,371 | | | 427,057 | |

Accumulated deficit | | | (13,588,620 | ) | | (10,001,777 | ) |

| |

|

| |

|

| |

Total shareholders’ equity | | | 275,513,991 | | | 278,879,380 | |

| |

|

| |

|

| |

Total Liabilities and Shareholders’ Equity | | $ | 811,236,578 | | $ | 799,229,806 | |

| |

|

| |

|

| |

|

p. 7 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

CONSOLIDATED STATEMENTS OF OPERATIONS – THREE MONTHS (UNAUDITED)

| | Three Months Ended March 31, | |

| |

| |

| | 2006 | | 2005 | |

| |

|

| |

|

| |

Revenue: | | | | | | | |

Minimum rent | | $ | 15,734,672 | | $ | 12,530,628 | |

Tenant reimbursements | | | 3,695,873 | | | 2,623,188 | |

Other property related revenue | | | 1,051,701 | | | 948,500 | |

Construction and service fee revenue | | | 7,896,936 | | | 3,088,976 | |

Other income, net | | | 53,876 | | | 12,564 | |

| |

|

| |

|

| |

Total revenue | | | 28,433,058 | | | 19,203,856 | |

Expenses: | | | | | | | |

Property operating | | | 3,034,174 | | | 2,728,090 | |

Real estate taxes | | | 2,506,914 | | | 1,498,381 | |

Cost of construction and services | | | 7,185,364 | | | 2,908,384 | |

General, administrative, and other | | | 1,343,537 | | | 1,232,269 | |

Depreciation and amortization | | | 7,522,235 | | | 4,819,333 | |

| |

|

| |

|

| |

Total expenses | | | 21,592,224 | | | 13,186,457 | |

| |

|

| |

|

| |

Operating income | | | 6,840,834 | | | 6,017,399 | |

Interest expense | | | 4,569,992 | | | 3,758,434 | |

Income tax expense of taxable REIT subsidiary | | | 13,287 | | | — | |

Minority interest income | | | (37,524 | ) | | (41,019 | ) |

Equity in earnings of unconsolidated entities | | | 87,973 | | | 75,795 | |

| |

|

| |

|

| |

Income from continuing operations | | | 2,308,004 | | | 2,293,741 | |

Operating income from discontinued operations | | | — | | | 306,009 | |

Limited partners’ interest in operating partnership | | | (535,457 | ) | | (785,090 | ) |

| |

|

| |

|

| |

Net income | | $ | 1,772,547 | | $ | 1,814,660 | |

| |

|

| |

|

| |

Income per common share – basic: | | | | | | | |

Continuing operations | | $ | 0.06 | | $ | 0.08 | |

Discontinued operations | | | — | | | 0.01 | |

| |

|

| |

|

| |

| | $ | 0.06 | | $ | 0.09 | |

| |

|

| |

|

| |

Income per common share - diluted: | | | | | | | |

Continuing operations | | $ | 0.06 | | $ | 0.08 | |

Discontinued operations | | | — | | | 0.01 | |

| |

|

| |

|

| |

| | $ | 0.06 | | $ | 0.09 | |

| |

|

| |

|

| |

Weighted average common shares outstanding - basic | | | 28,571,440 | | | 19,148,267 | |

| |

|

| |

|

| |

Weighted average common shares outstanding - diluted | | | 28,704,563 | | | 19,231,484 | |

| |

|

| |

|

| |

Dividends declared per common share | | $ | 0.1875 | | $ | 0.1875 | |

| |

|

| |

|

| |

|

p. 8 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

FUNDS FROM OPERATIONS AND OTHER FINANCIAL INFORMATION – THREE MONTHS

| | Three Months Ended March 31, | |

| |

| |

| | 2006 | | 2005 | |

| |

|

| |

|

| |

Funds From Operations: | | | | | | | |

Net income | | $ | 1,772,547 | | $ | 1,814,660 | |

Add Limited Partners’ interests | | | 535,457 | | | 785,090 | |

Add depreciation and amortization of consolidated entities and discontinued operations, net of minority interest | | | 7,428,693 | | | 4,913,703 | |

Add depreciation and amortization of unconsolidated entities | | | 102,019 | | | 68,212 | |

| |

|

| |

|

| |

Funds From Operations of the Kite Portfolio | | | 9,838,716 | | | 7,581,665 | |

Less Limited Partners’ interests | | | (2,271,952 | ) | | (2,289,562 | ) |

| |

|

| |

|

| |

Funds From Operations allocable to the Company | | $ | 7,566,764 | | $ | 5,292,103 | |

| |

|

| |

|

| |

Basic FFO per share of the Kite Portfolio | | $ | 0.26 | | $ | 0.28 | |

| |

|

| |

|

| |

Diluted FFO per share of the Kite Portfolio | | $ | 0.26 | | $ | 0.28 | |

| |

|

| |

|

| |

Basic weighted average Common Shares outstanding | | | 28,571,440 | | | 19,148,267 | |

| |

|

| |

|

| |

Diluted weighted average Common Shares outstanding | | | 28,704,563 | | | 19,231,484 | |

| |

|

| |

|

| |

Basic weighted average Common Shares and Units outstanding | | | 37,190,104 | | | 27,432,527 | |

| |

|

| |

|

| |

Diluted weighted average Common Shares and Units outstanding | | | 37,323,227 | | | 27,515,745 | |

| |

|

| |

|

| |

Other Financial Information: | | | | | | | |

Recurring Capital Expenditures 1 | | | | | | | |

Tenant improvements | | $ | 1,109,500 | 2 | $ | -0- | |

Leasing commissions | | | 273,850 | 3 | | 36,677 | |

Capital improvements | | | 19,707 | | | 7,085 | |

Scheduled debt principal payments | | | 631,274 | | | 618,759 | |

Straight line rent | | | 422,303 | | | 339,222 | |

Market rent amortization income from acquired leases | | | 877,836 | | | 938,029 | |

Market debt adjustment | | | 107,714 | | | 359,386 | |

Capitalized Interest | | | 1,395,645 | | | 380,198 | |

|

1 | Excludes tenant improvements and leasing commissions relating to development projects and first generation space. |

2 | Of this amount, $988,153 represents tenant improvements for Shoe Pavilion at Galleria Plaza and 24 Hour Fitness at Cedar Hill Village. |

3 | Of this amount, $198,404 represents leasing commissions for Shoe Pavilion at Galleria Plaza and 24 Hour Fitness at Cedar Hill Village. |

|

p. 9 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

MARKET CAPITALIZATION AS OF MARCH 31, 2006

| | Percent of

Total Equity | | Total

Market

Capitalization | | Percent of

Total Market

Capitalization | |

| |

|

| |

|

| |

|

| |

Equity Capitalization: | | | | | | | | | | |

Total Common Shares Outstanding | | | 76.8 | % | $ | 28,583,414 | | | | |

Operating Partnership (“OP”) Units | | | 23.2 | % | | 8,618,664 | | | | |

| |

|

| |

|

| | | | |

Combined Common Shares and OP Units | | | 100.0 | % | | 37,202,078 | | | | |

| |

|

| | | | | | | |

Market Price at March 31, 2006 | | | | | $ | 15.95 | | | | |

| | | | |

|

| | | | |

Total Equity Capitalization | | | | | $ | 593,373,151 | | | 60 | % |

Debt Capitalization: | | | | | | | | | | |

Company Outstanding Debt | | | | | $ | 390,950,748 | | | | |

Pro-rata Share of Joint Venture Debt | | | | | | 8,518,086 | | | | |

| | | | |

|

| | | | |

Total Debt Capitalization | | | | | | 399,468,834 | | | 40 | % |

| | | | |

|

| |

|

| |

Total Market Capitalization | | | | | $ | 992,841,985 | | | 100 | % |

| | | | |

|

| |

|

| |

|

p. 10 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

NET OPERATING INCOME BY QUARTER

| | Three Months Ended | | Twelve Months

Ended

December 31, 2005 | |

| |

| | |

| | March 31,

2006 | | December 31,

2005 | | September 30,

2005 | | June 30,

2005 | | March 31,

2005 | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Revenue: | | | | | | | | | | | | | | | | | | | |

Minimum rent | | $ | 15,734,672 | | $ | 14,931,419 | | $ | 14,176,125 | | $ | 13,346,461 | | $ | 12,530,627 | | $ | 54,984,632 | |

Tenant reimbursements | | | 3,695,873 | | | 4,054,644 | | | 2,401,869 | | | 2,871,856 | | | 2,623,188 | | | 11,951,557 | |

Other property related revenue | | | 1,051,701 | | | 2,027,454 | | | 2,409,900 | | | 407,589 | | | 948,500 | | | 5,793,443 | |

Other income, net | | | 53,876 | | | 65,205 | | | 57,759 | | | 79,894 | | | 12,564 | | | 215,422 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 20,536,122 | | | 21,078,722 | | | 19,045,653 | | | 16,705,800 | | | 16,114,879 | | | 72,945,054 | |

Expenses: | | | | | | | | | | | | | | | | | | | |

Property operating | | | 3,034,174 | | | 4,230,328 | | | 2,933,662 | | | 2,451,266 | | | 2,728,089 | | | 12,343,345 | |

Real estate taxes | | | 2,506,914 | | | 2,480,709 | | | 1,604,623 | | | 1,874,849 | | | 1,498,382 | | | 7,458,563 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 5,541,088 | | | 6,711,037 | | | 4,538,285 | | | 4,326,115 | | | 4,226,471 | | | 19,801,908 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net Operating Income – Properties | | | 14,995,034 | | | 14,367,685 | | | 14,507,368 | | | 12,379,685 | | | 11,888,408 | | | 53,143,146 | |

Other Income (Expense): | | | | | | | | | | | | | | | | | | | |

Construction and service fee revenue1 | | | 7,896,936 | | | 12,823,385 | | | 4,916,773 | | | 5,590,667 | | | 3,088,976 | | | 26,419,801 | |

Cost of construction and services1 | | | (7,185,364 | ) | | (10,203,260 | ) | | (4,320,679 | ) | | (4,390,955 | ) | | (2,908,384 | ) | | (21,823,278 | ) |

General, administrative, and other | | | (1,343,537 | ) | | (1,706,050 | ) | | (1,112,314 | ) | | (1,277,102 | ) | | (1,232,269 | ) | | (5,327,735 | ) |

Depreciation and amortization | | | (7,522,235 | ) | | (6,175,623 | ) | | (5,439,606 | ) | | (5,356,576 | ) | | (4,819,331 | ) | | (21,791,136 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | (8,154,200 | ) | | (5,261,548 | ) | | (5,955,826 | ) | | (5,433,966 | ) | | (5,871,008 | ) | | (22,522,348 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Earnings Before Interest and Taxes | | | 6,840,834 | | | 9,106,137 | | | 8,551,542 | | | 6,945,719 | | | 6,017,400 | | | 30,620,798 | |

Interest expense | | | 4,569,992 | | | 4,411,460 | | | 5,176,657 | | | 4,742,869 | | | 3,758,435 | | | 18,089,421 | |

Income tax expense of taxable REIT subsidiary | | | 13,287 | | | 809,178 | | | 232,285 | | | — | | | — | | | 1,041,463 | |

Minority interest income | | | (37,524 | ) | | (550,599 | ) | | (623,574 | ) | | (51,930 | ) | | (41,019 | ) | | (1,267,122 | ) |

Equity in earnings (loss) of unconsolidated entities | | | 87,973 | | | (26,225 | ) | | 76,385 | | | 126,556 | | | 75,795 | | | 252,511 | |

Limited partners’ interests in operating partnership | | | (535,457 | ) | | (2,883,132 | ) | | (881,407 | ) | | (779,669 | ) | | (785,090 | ) | | (5,329,298 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Income From Continuing Operations | | | 1,772,547 | | | 425,543 | | | 1,714,004 | | | 1,497,807 | | | 1,508,651 | | | 5,146,005 | |

Operating income from discontinued operations | | | — | | | 250,055 | | | 268,237 | | | 253,132 | | | 306,009 | | | 1,077,433 | |

Gain on sale of operating property | | | — | | | 7,212,402 | | | — | | | — | | | — | | | 7,212,402 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net income | | $ | 1,772,547 | | $ | 7,888,000 | | $ | 1,982,241 | | $ | 1,750,939 | | $ | 1,814,660 | | $ | 13,435,840 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

1 | Three months and twelve months ended December 31, 2005 include proceeds and costs from sale of a merchant building activity (before minority interest) of $5.65 million and $4.1 million, respectively. |

|

p. 11 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SUMMARY OF OUTSTANDING DEBT1

TOTAL DEBT OUTSTANDING AS OF MARCH 31, 2006

| | Outstanding

Amount | | Ratio | | Weighted

Average Interest

Rate | | Weighted

Average Maturity

(in years) | |

| |

|

| |

|

| |

|

| |

|

| |

Fixed Rate Debt: | | | | | | | | | | | | | |

Consolidated | | $ | 203,810 | | | 52 | % | | 6.04 | % | | 7.3 | |

Unconsolidated | | | 8,518 | | | 2 | % | | 6.61 | % | | 6.2 | |

Floating Rate Debt (Hedged) 2 | | | 65,000 | | | 16 | % | | 5.48 | % | | 1.0 | |

| |

|

| |

|

| |

|

| |

|

| |

Total Fixed Rate Debt | | | 277,328 | | | 70 | % | | 5.92 | % | | 5.8 | |

Variable Rate Debt:3 | | | | | | | | | | | | | |

Construction Loans | | | 57,415 | | | 14 | % | | 6.48 | % | | 1.1 | |

Other Variable | | | 127,133 | | | 32 | % | | 6.30 | % | | 1.3 | |

Floating Rate Debt (Hedged) 2 | | | (65,000 | ) | | -16 | % | | -6.18 | % | | -1.0 | |

| |

|

| |

|

| |

|

| |

|

| |

Total Variable Rate Debt | | | 119,548 | | | 30 | % | | 6.45 | % | | 1.3 | |

Net Premiums | | | 2,593 | | | N/A | | | N/A | | | N/A | |

| |

|

| |

|

| |

|

| |

|

| |

Total | | $ | 399,469 | | | 100 | % | | 6.08 | % | | 4.5 | |

| |

|

| |

|

| |

|

| |

|

| |

SCHEDULE OF MATURITIES BY YEAR AS OF MARCH 31, 2006

| | | | Secured

Revolving Credit

Facility | | Construction

Loans | | Total

Consolidated

Outstanding Debt | | KRG Share Of

Unconsolidated

Mortgage Debt | | Total

Consolidated and Unconsolidated

Debt | |

| | Mortgage Debt | | | | | | |

| |

| | | | | | |

| | Annual Maturity | | Term Maturities | | | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

2006 | | $ | 1,835 | | $ | 16,500 | | $ | 0 | | $ | 20,747 | | $ | 39,082 | | $ | 143 | | $ | 39,225 | |

2007 | | | 2,703 | | | 0 | | | 105,550 | | | 23,582 | | | 131,835 | | | 205 | | | 132,040 | |

2008 | | | 2,652 | | | 8,292 | | | 0 | | | 13,086 | | | 24,030 | | | 218 | | | 24,248 | |

2009 | | | 2,801 | | | 27,452 | | | 0 | | | 0 | | | 30,253 | | | 2,211 | | | 32,464 | |

2010 | | | 3,023 | | | 0 | | | 0 | | | 0 | | | 3,023 | | | 97 | | | 3,120 | |

2011 | | | 2,873 | | | 19,655 | | | 0 | | | 0 | | | 22,528 | | | 103 | | | 22,631 | |

2012 | | | 2,349 | | | 35,356 | | | 0 | | | 0 | | | 37,705 | | | 110 | | | 37,815 | |

2013 | | | 2,252 | | | 4,027 | | | 0 | | | 0 | | | 6,279 | | | 5,431 | | | 11,710 | |

2014 | | | 1,861 | | | 27,567 | | | 0 | | | 0 | | | 29,428 | | | 0 | | | 29,428 | |

2015 | | | 1,390 | | | 38,301 | | | 0 | | | 0 | | | 39,691 | | | 0 | | | 39,691 | |

2016 and beyond | | | 3,646 | | | 20,858 | | | 0 | | | 0 | | | 24,504 | | | 0 | | | 24,504 | |

Net Premiums | | | 0 | | | 0 | | | 0 | | | 0 | | | 2,593 | | | 0 | | | 2,593 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | $ | 27,385 | | $ | 198,008 | | $ | 105,550 | | $ | 57,415 | | $ | 390,951 | | $ | 8,518 | | $ | 399,469 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

1 Dollars in thousands. |

2 These debt obligations are hedged by interest rate swap agreements. |

3 Variable Rate Debt% net of swap transactions: |

- Construction | | | 11 | % | $ | 42,415 | | |

- Other Variable | | | 19 | % | | 77,133 | | (Includes debt on acquisition land held for development) |

| |

|

| |

|

| | |

| | | 30 | % | $ | 119,548 | | |

|

p. 12 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SCHEDULE OF OUTSTANDING DEBT1

CONSOLIDATED DEBT AS OF MARCH 31, 2006

Fixed Rate Debt: | | Lender/Servicer | | Interest Rate | | Maturity Date | | Balance as of

March 31, 2006 | | Monthly Debt

Service as of

March 31, 2006 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

50th & 12th | | | Wachovia Bank | | | 5.67 | % | | 11/11/14 | | $ | 4,622 | | $ | 27 | |

176th & Meridian | | | Wachovia Bank | | | 5.67 | % | | 11/11/14 | | | 4,198 | | | 25 | |

Boulevard Crossing | | | Wachovia Bank | | | 5.11 | % | | 12/11/09 | | | 12,439 | | | 69 | |

Centre at Panola, Phase I | | | JP Morgan Chase | | | 6.78 | % | | 1/1/22 | | | 4,275 | | | 37 | |

Cool Creek Commons | | | Lehman Brothers Bank | | | 5.88 | % | | 4/11/16 | | | 18,000 | | | 91 | |

Corner Shops, The | | | Sun Life Assurance Co. | | | 7.65 | % | | 7/1/11 | | | 1,850 | | | 17 | |

Fox Lake Crossing | | | Wachovia Bank | | | 5.16 | % | | 7/1/12 | | | 12,076 | | | 69 | |

Indian River Square | | | Wachovia Bank | | | 5.42 | % | | 6/11/15 | | | 13,300 | | | 56 | |

Indiana State Motor Pool | | | Old National | | | 5.38 | % | | 3/24/08 | | | 4,064 | | | 17 | |

International Speedway Square | | | Lehman Brothers Bank | | | 7.17 | % | | 3/11/11 | | | 19,629 | | | 139 | |

Plaza at Cedar Hill | | | GECC | | | 7.38 | % | | 2/1/12 | | | 26,911 | | | 193 | |

Plaza Volente | | | Wachovia Bank | | | 5.42 | % | | 6/11/15 | | | 28,680 | | | 121 | |

Preston Commons | | | Wachovia Bank | | | 5.90 | % | | 3/11/13 | | | 4,574 | | | 28 | |

Ridge Plaza | | | Wachovia Bank | | | 5.15 | % | | 10/11/09 | | | 16,666 | | | 93 | |

Thirty South | | | CS First Boston | | | 6.09 | % | | 1/11/14 | | | 22,905 | | | 142 | |

Whitehall Pike | | | Banc One Capital Funding | | | 6.71 | % | | 7/5/2018 | | | 9,621 | | | 77 | |

| | | | | | | | | | |

|

| |

|

| |

Subtotal | | | | | | | | | | | $ | 203,810 | | $ | 1,201 | |

| | | | | | | | | | |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Floating Rate Debt (Hedged): | | Lender | | Interest Rate | | Maturity Date | | Balance as of

March 31, 2006 | | Monthly Debt

Service as of

March 31, 2006 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Collateral Pool Properties2 | | | KeyBank | | | 5.65 | % | | 8/1/2007 | | | 35,000 | | | 165 | |

Collateral Pool Properties2 | | | KeyBank | | | 5.38 | % | | 8/1/2007 | | | 15,000 | | | 67 | |

Collateral Pool Properties3 | | | LaSalle Bank | | | 5.19 | % | | 5/1/2006 | | | 15,000 | | | 65 | |

| | | | | | | | | | |

|

| |

|

| |

Subtotal | | | | | | | | | | | $ | 65,000 | | $ | 297 | |

| | | | | | | | | | |

|

| |

|

| |

TOTAL CONSOLIDATED FIXED RATE DEBT | | | | | | | | $ | 268,810 | | $ | 1,498 | |

| | | | | | | | | | |

|

| |

|

| |

TOTAL NET PREMIUMS | | | | | | | | | | | $ | 2,593 | | | | |

| | | | | | | | | | |

|

| | | | |

| | | | | | | | | | | | | | | | |

Variable Rate Debt:

Mortgages | | Lender | | Interest Rate4 | | Maturity Date | | Balance as of March 31, 2006 | | | | |

| |

|

| |

|

| |

|

| |

|

| | | | |

Fishers Station Shops5 | | | National City Bank | | | LIBOR + 275 | | | 9/1/2008 | | | 5,083 | | | | |

Sunland Towne Center | | | Key Bank | | | LIBOR + 185 | | | 5/10/2006 | | | 16,500 | | | | |

| |

|

| |

|

| |

|

| |

|

| | | | |

Subtotal | | | | | | | | | | | $ | 21,583 | | | | |

| | | | | | | | | | |

|

| | | | |

|

1 | Dollars in thousands. |

2 | The Company entered into $35 million and $15 million fixed rate swap agreements which are designated as hedges against the revolving credit facility. |

3 | The Company transferred a $15 million fixed rate swap agreement which was designated as a hedge against the Cool Creek Commons construction loan to revolving credit facility. |

4 | At March 31, 2006, one-month LIBOR and Prime interest rates were 4.83% and 7.75%, respectively. |

5 | The Company has a 25% interest in this property. This loan is guaranteed by Kite Realty Group, LP. |

|

p. 13 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SCHEDULE OF OUTSTANDING DEBT ( CONTINUED)1

Variable Rate Debt: Construction Loans | | Servicer | | Interest Rate 2 | | Maturity Date | | Total

Commitment | | Balance as of

March 31, 2006 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Beacon Hill Shopping Center3 | | | Fifth Third Bank | | | LIBOR + 150 | | | 9/30/07 | | $ | 34,800 | | $ | 5,608 | |

Estero Town Center4 | | | Wachovia Bank | | | LIBOR + 165 | | | 4/1/08 | | | 20,460 | | | 7,925 | |

Geist Pavilion | | | The National Bank of Indianapolis and Busey Bank | | | LIBOR + 165 | | | 5/1/07 | | | 10,057 | | | 8,286 | |

Red Bank Commons | | | Huntington Bank | | | LIBOR + 165 | | | 4/1/07 | | | 4,960 | | | 4,621 | |

Naperville Marsh | | | LaSalle Bank | | | LIBOR + 165 | | | 6/30/06 | | | 11,650 | | | 11,622 | |

Naperville Marketplace | | | LaSalle Bank | | | LIBOR + 175 | | | 6/30/07 | | | 14,400 | | | 5,067 | |

Sandifur Plaza5 | | | LaSalle Bank | | | LIBOR + 165 | | | 12/31/06 | | | 5,500 | | | 1,239 | |

Tarpon Springs Plaza | | | Wachovia Bank | | | LIBOR + 175 | | | 4/1/08 | | | 20,000 | | | 5,161 | |

Traders Point II | | | Huntington Bank | | | LIBOR + 165 | | | 6/28/06 | | | 9,587 | | | 7,886 | |

| | | | | | | | | | |

|

| |

|

| |

Subtotal | | | | | | | | | | | $ | 131,414 | | $ | 57,415 | |

| | | | | | | | | | |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Line of Credit | | Lender | | Interest Rate 2 | | Maturity Date | | Total Available as

of March 31, 2006 | | Balance as of

March 31, 2006 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Collateral Pool Properties: 6,7,8,9 | | | Wachovia Bank | | | LIBOR + 135 | | | 8/31/07 | | $ | 126,530 | | $ | 105,550 | |

| | | | |

|

| |

|

| |

|

| |

|

| |

Floating Rate Debt (Hedged) | | | | | | | | | | | | | | | | |

Collateral Pool Properties7 | | | KeyBank | | | LIBOR + 135 | | | 8/1/07 | | | | | | (35,000 | ) |

Collateral Pool Properties7 | | | KeyBank | | | LIBOR + 135 | | | 8/1/07 | | | | | | (15,000 | ) |

Collateral Pool Properties4 | | | LaSalle Bank | | | LIBOR + 135 | | | 5/1/06 | | | | | | (15,000 | ) |

| | | | | | | | | | | | | |

|

| |

Subtotal | | | | | | | | | | | | | | $ | (65,000 | ) |

| | | | | | | | | | | | | |

|

| |

Total Consolidated Variable Rate Debt | | | | | | | | | | | $ | 119,548 | |

| | | | | | | | | | | | | |

|

| |

TOTAL DEBT PER CONSOLIDATED BALANCE SHEET | | | | | | | | | | | $ | 390,951 | |

| | | | | | | | | | | | | |

|

| |

|

1 | Dollars in thousands. |

2 | At March 31, 2006, one-month LIBOR and Prime interest rates were 4.83% and 7.75%, respectively. |

3 | The Company has a preferred return then a 50% interest. This loan is guaranteed by Kite Realty Group, LP. |

4 | The Company has a preferred return then a 40% interest. This loan is guaranteed by Kite Realty Group, LP. |

5 | The Company has a 80% interest in the Walgreens and 95% in the shops. This loan is guaranteed by Kite Realty Group, LP. |

6 | There are currently fifteen properties encumbered under the line of credit and thirty-four unencumbered properties and available to expand borrowings under the line. The major unencumbered properties include: 50 S. Morton, Bolton Plaza, Centre at Panola Phase II, Circuit City Plaza, Fishers Station Marsh, Frisco Bridges, Greyhound Commons, Martinsville Shops, Shops at Otty, Sunland II, Traders Point, Wal-Mart Plaza, Weston Park. |

7 | The Company entered into a $35 million and $15 million fixed rate swap agreement which is designated as a hedge against the line of credit. |

8 | The total amount available for borrowing under the line is $126,530 of which $105,550 was outstanding at March 31, 2006. |

9 | The Company transferred a $15 million fixed rate swap agreement which was designated as a hedge against the Cool Creek construction loan to the revolving credit facility. |

|

p. 14 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SCHEDULE OF OUTSTANDING DEBT ( CONTINUED)1

UNCONSOLIDATED DEBT AS OF MARCH 31, 2006 2

| | Lender | | Interest Rate | | Maturity Date | | Balance as of

March 31, 2006 | | Monthly Debt

Service as of

March 31, 2006 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Fixed Rate | | | | | | | | | | | | | | | | |

The Centre | | | Sun Life | | | 6.99 | % | | 6/1/2009 | | $ | 4,113 | | $ | 40 | |

Spring Mill Medical | | | LaSalle Bank | | | 6.45 | % | | 9/1/2013 | | | 12,100 | | | 78 | |

| | | | |

|

| |

|

| |

|

| |

|

| |

TOTAL UNCONSOLIDATED DEBT | | | | | | | | | | | $ | 16,213 | | $ | 118 | |

| | | | | | | | | | |

|

| |

|

| |

JOINT VENTURE PARTNERS’ SHARE OF TOTAL UNCONSOLIDATED DEBT | | | | | | | | | | | | (7,695 | ) | | | |

| | | | | | | | | | |

|

| | | | |

KRG’s SHARE OF TOTAL UNCONSOLIDATED DEBT | | | | | | | | | | | $ | 8,518 | | | | |

| | | | | | | | | | |

|

| | | | |

TOTAL KRG CONSOLIDATED DEBT | | | | | | | | | | | $ | 390,951 | | | | |

TOTAL KRG UNCONSOLIDATED DEBT | | | | | | | | | | | | 8,518 | | | | |

| | | | | | | | | | |

|

| | | | |

TOTAL KRG DEBT | | | | | | | | | | | $ | 399,469 | | | | |

| | | | | | | | | | |

|

| | | | |

|

1 | Dollars in thousands. |

2 | The Company owns a 50% interest in Spring Mill Medical and a 60% interest in The Centre. |

|

p. 15 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

JOINT VENTURE SUMMARY – UNCONSOLIDATED PROPERTIES

The Company owns the following two unconsolidated properties with joint venture partners:

Property | | Percentage Owned by the Company |

| |

|

The Centre | | 60% |

Spring Mill Medical | | 50% |

|

p. 16 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

CONDENSED COMBINED BALANCE SHEETS OF UNCONSOLIDATED PROPERTIES

(THE CENTRE AND SPRING MILL MEDICAL)

(Unaudited)

| | March 31, 2006 | | December 31, 2005 | |

| |

|

| |

|

| |

Assets: | | | | | | | |

Investment properties, at cost | | | | | | | |

Land | | $ | 2,552,075 | | $ | 2,552,075 | |

Buildings and improvements | | | 14,566,616 | | | 14,566,616 | |

Furniture and equipment | | | 10,581 | | | 3,290 | |

| |

|

| |

|

| |

| | | 17,129,272 | | | 17,121,981 | |

Less: accumulated depreciation | | | (2,908,256 | ) | | (2,793,109 | ) |

| |

|

| |

|

| |

| | | 14,221,016 | | | 14,328,872 | |

Cash and cash equivalents | | | 716,354 | | | 902,443 | |

Tenant receivables, including accrued straight line rent | | | 157,049 | | | 140,124 | |

Other receivables | | | — | | | — | |

Deferred costs, net | | | 647,064 | | | 670,319 | |

Prepaid and other assets | | | 486 | | | — | |

| |

|

| |

|

| |

Total Assets | | $ | 15,741,969 | | $ | 16,041,758 | |

| |

|

| |

|

| |

Liabilities and Accumulated Equity (Deficit): | | | | | | | |

Mortgage and other indebtedness | | $ | 16,213,500 | | $ | 16,299,855 | |

Accounts payable and accrued expenses | | | 593,585 | | | 524,792 | |

Due to affiliate | | | — | | | — | |

| |

|

| |

|

| |

Total Liabilities | | | 16,807,085 | | | 16,824,647 | |

Accumulated equity (deficit) | | | (1,065,116 | ) | | (782,889 | ) |

| |

|

| |

|

| |

Total Liabilities and Accumulated Equity (Deficit) | | $ | 15,741,969 | | $ | 16,041,758 | |

| |

|

| |

|

| |

|

p. 17 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

CONDENSED COMBINED STATEMENTS OF OPERATIONS OF UNCONSOLIDATED PROPERTIES

(THE CENTRE AND SPRING MILL MEDICAL)

(Unaudited)

| | Three Months Ended March 31 | |

| |

| |

| | 2006 | | 2005 | |

| |

|

| |

|

| |

Total Revenue | | $ | 878,507 | | $ | 830,219 | |

Expenses: | | | | | | | |

Property operating and other | | | 201,282 | | | 233,972 | |

Real estate taxes | | | 61,319 | | | 55,674 | |

Depreciation and amortization | | | 133,239 | | | 131,814 | |

| |

|

| |

|

| |

Total expenses | | | 395,840 | | | 421,460 | |

| |

|

| |

|

| |

Operating income | | | 482,667 | | | 408,759 | |

Interest expense | | | 272,893 | | | 278,354 | |

| |

|

| |

|

| |

Net income | | $ | 209,774 | | $ | 130,405 | |

| |

|

| |

|

| |

|

p. 18 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

TOP 10 RETAIL TENANTS BY GROSS LEASEABLE AREA (GLA)

AS OF MARCH 31, 2006

This Table Includes The Following: |

| • | Operating Retail Properties |

| • | Operating Commercial Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

Tenant | | | Number of Locations | | | Total GLA | | | Number of Leases | | | Company Owned GLA | | | Number of Anchor Owned Locations | | | Anchor Owned GLA | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Lowe’s Home Improvement1 | | | 8 | | | 1,084,630 | | | 2 | | | 128,997 | | | 6 | | | 955,633 | |

Wal-Mart | | | 3 | | | 459,649 | | | 2 | | | 234,649 | | | 1 | | | 225,000 | |

Federated Department Stores | | | 1 | | | 237,455 | | | 1 | | | 237,455 | | | 0 | | | 0 | |

Marsh Supermarkets2 | | | 3 | | | 194,902 | | | 3 | | | 194,902 | | | 0 | | | 0 | |

Circuit City | | | 4 | | | 132,352 | | | 4 | | | 132,352 | | | 0 | | | 0 | |

Dominick’s | | | 2 | | | 131,613 | | | 2 | | | 131,613 | | | 0 | | | 0 | |

Publix | | | 3 | | | 129,357 | | | 3 | | | 129,357 | | | 0 | | | 0 | |

Dick’s Sporting Goods | | | 2 | | | 126,672 | | | 2 | | | 126,672 | | | 0 | | | 0 | |

Kmart | | | 1 | | | 110,875 | | | 1 | | | 110,875 | | | 0 | | | 0 | |

Burlington Coat Factory | | | 1 | | | 107,400 | | | 1 | | | 107,400 | | | 0 | | | 0 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 28 | | | 2,714,905 | | | 21 | | | 1,534,272 | | | 7 | | | 1,180,633 | |

|

1 | A ground lease with Lowe's was entered into during the first quarter of 2006. An estimated 165,000 square feet is included in Anchor Owned GLA to account for this property. |

2 | Includes the Marsh Supermarket at Naperville Marketplace, which is owned by a taxable REIT subsidiary and which KRG is marketing for sale. |

|

p. 19 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

TOP 25 TENANTS BY ANNUALIZED BASE RENT2

AS OF MARCH 31, 2006

This Table Includes The Following: |

| • | Operating Retail Properties |

| • | Operating Commercial Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

Tenant | | Type of Property | | Number of

Locations | | Leased

GLA/NRA | | % of Owned

GLA/NRA of

the Portfolio | | Annualized Base

Rent 1,2 | | Annualized

Base Rent per

Sq. Ft. | | % of Total

Portfolio

Annualized

Base Rent | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Circuit City | | | Retail | | | 4 | | | 132,352 | | | 2.6 | % | $ | 1,930,190 | | $ | 14.58 | | | 3.2 | % |

Lowe’s Home Improvement 6 | | | Retail | | | 2 | | | 128,997 | | | 2.5 | % | $ | 1,814,000 | | $ | 6.17 | | | 3.0 | % |

State of Indiana | | | Commercial | | | 3 | | | 210,393 | | | 4.1 | % | $ | 1,663,733 | | $ | 7.91 | | | 2.8 | % |

Eli Lilly | | | Commercial | | | 1 | | | 99,542 | | | 1.9 | % | $ | 1,642,443 | | $ | 16.50 | | | 2.7 | % |

Marsh Supermarkets 5 | | | Retail | | | 2 | | | 124,902 | | | 2.4 | % | $ | 1,633,958 | | $ | 13.08 | | | 2.7 | % |

Dominick’s | | | Retail | | | 2 | | | 131,613 | | | 2.6 | % | $ | 1,411,728 | | $ | 10.73 | | | 2.3 | % |

Dick’s Sporting Goods | | | Retail | | | 2 | | | 126,672 | | | 2.5 | % | $ | 1,220,000 | | $ | 9.63 | | | 2.0 | % |

HEB | | | Retail | | | 1 | | | 105,000 | | | 2.0 | % | $ | 1,155,000 | | $ | 11.00 | | | 1.9 | % |

Bed Bath & Beyond | | | Retail | | | 3 | | | 85,895 | | | 1.7 | % | $ | 1,056,866 | | $ | 12.30 | | | 1.8 | % |

Walgreen’s | | | Retail | | | 3 | | | 39,070 | | | 0.8 | % | $ | 1,031,023 | | $ | 26.39 | | | 1.7 | % |

Publix | | | Retail | | | 3 | | | 129,357 | | | 2.5 | % | $ | 989,361 | | $ | 7.65 | | | 1.6 | % |

Wal-Mart | | | Retail | | | 2 | | | 234,649 | | | 4.6 | % | $ | 930,927 | | $ | 3.97 | | | 1.5 | % |

Ross Stores | | | Retail | | | 3 | | | 87,656 | | | 1.7 | % | $ | 893,821 | | $ | 10.20 | | | 1.5 | % |

Office Depot | | | Retail | | | 3 | | | 84,372 | | | 1.6 | % | $ | 873,089 | | $ | 10.35 | | | 1.5 | % |

Kmart | | | Retail | | | 1 | | | 110,875 | | | 2.2 | % | $ | 850,379 | | $ | 7.67 | | | 1.4 | % |

University Medical Diagnostics Associates 3 | | | Commercial | | | 1 | | | 32,256 | | | 0.6 | % | $ | 844,402 | | $ | 26.18 | | | 1.4 | %3 |

Winn-Dixie 4 | | | Retail | | | 2 | | | 103,406 | | | 2.0 | % | $ | 806,266 | | $ | 7.80 | | | 1.3 | % |

Kerasotes 6 | | | Retail | | | 2 | | | 43,050 | | | 0.8 | % | $ | 776,496 | | $ | 8.92 | | | 1.3 | % |

A & P | | | Retail | | | 1 | | | 58,732 | | | 1.1 | % | $ | 763,516 | | $ | 13.00 | | | 1.3 | % |

Old Navy | | | Retail | | | 3 | | | 64,868 | | | 1.3 | % | $ | 737,412 | | $ | 11.37 | | | 1.2 | % |

Shoe Pavilion | | | Retail | | | 1 | | | 31,396 | | | 0.6 | % | $ | 722,108 | | $ | 23.00 | | | 1.2 | % |

City Securities | | | Commercial | | | 1 | | | 34,949 | | | 0.7 | % | $ | 694,900 | | $ | 19.88 | | | 1.2 | % |

Indiana University Healthcare Associates | | | Commercial | | | 1 | | | 31,175 | | | 0.6 | % | $ | 622,201 | | $ | 19.96 | | | 1.0 | %3 |

Bealls | | | Retail | | | 2 | | | 79,611 | | | 1.6 | % | $ | 576,000 | | $ | 7.24 | | | 1.0 | % |

Petsmart | | | Retail | | | 2 | | | 50,909 | | | 1.0 | % | $ | 537,095 | | $ | 10.55 | | | 0.9 | % |

| | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | | | | | | | 2,361,697 | | | 46.0 | % | $ | 26,176,914 | | $ | 11.08 | | | 43.4 | % |

|

1 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable tenant multiplied by 12. |

2 | Excludes tenants at development properties which are Build-to-Suits for sale. |

3 | Property held in unconsolidated joint venture. Annualized base rent is reflected at 100 percent. |

4 | In February 2005, Winn-Dixie Stores, Inc. filed a petition for Chapter 11 bankruptcy to reorganize its business operations. On February 28, 2006, Winn-Dixie announced plans to close its store at Shops at Eagle Creek but had not at that date rejected its lease at this property. In its announcement, Winn-Dixie included its store at Waterford Lakes on its list of stores that it intended to retain as of that date. |

5 | Excludes the Marsh Supermarket at Naperville Marketplace, which is owned by a taxable REIT subsidiary and which KRG is marketing for sale; however, the Company cannot presently determine whether it can sell this asset within the next twelve months. Also excludes the Marsh Supermarket at Geist Pavilion where the tenant has commenced payment of rent but has not opened for business. |

6 | Annualized Base Rent Per Sq. Ft. is adjusted to account for the estimated square footage attributed to non-owned ground lease structures. |

|

p. 20 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

LEASE EXPIRATIONS – OPERATING PORTFOLIO1

This Table Includes The Following: |

| • | Operating Retail Properties |

| • | Operating Commercial Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

| | Number of

Expiring

Leases 2 | | Expiring

GLA/NRA 3 | | % of Total

GLA/NRA

Expiring | | Expiring

Annualized

Base Rent 4 | | % of Total

Annualized

Base Rent | | Expiring

Annualized

Base Rent per

Sq. Ft. | | Expiring

Ground Lease

Revenue | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

2006 | | | 68 | | | 161,221 | | | 3.3 | % | $ | 1,633,037 | | | 2.9 | % | $ | 10.13 | | $ | 0 | |

2007 | | | 82 | | | 257,875 | | | 5.3 | % | $ | 3,434,250 | | | 6.0 | % | $ | 13.32 | | $ | 800,000 | |

2008 | | | 44 | | | 440,321 | | | 9.0 | % | $ | 3,262,267 | | | 5.7 | % | $ | 7.41 | | $ | 0 | |

2009 | | | 58 | | | 204,763 | | | 4.2 | % | $ | 3,118,861 | | | 5.4 | % | $ | 15.23 | | $ | 0 | |

2010 | | | 68 | | | 428,668 | | | 8.8 | % | $ | 5,305,396 | | | 9.3 | % | $ | 12.38 | | $ | 0 | |

2011 | | | 45 | | | 605,284 | | | 12.3 | % | $ | 5,645,983 | | | 9.9 | % | $ | 9.33 | | $ | 0 | |

2012 | | | 33 | | | 269,439 | | | 5.5 | % | $ | 3,712,571 | | | 6.5 | % | $ | 13.78 | | $ | 85,000 | |

2013 | | | 19 | | | 183,068 | | | 3.7 | % | $ | 2,591,954 | | | 4.5 | % | $ | 14.16 | | $ | 0 | |

2014 | | | 32 | | | 308,415 | | | 6.3 | % | $ | 3,944,596 | | | 6.9 | % | $ | 12.79 | | $ | 427,900 | |

2015 | | | 41 | | | 598,729 | | | 12.3 | % | $ | 7,078,432 | | | 12.3 | % | $ | 11.82 | | $ | 251,500 | |

Beyond | | | 47 | | | 1,431,336 | | | 29.3 | % | $ | 17,566,457 | | | 30.5 | % | $ | 12.27 | | $ | 1,456,480 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 537 | | | 4,889,119 | | | 100.0 | % | $ | 57,293,804 | | | 100.0 | % | $ | 11.72 | | $ | 3,020,880 | |

|

1 | Excludes tenants at development properties which are Build-to-Suits for sale. |

2 | Lease expiration table reflects rents in place as of March 31, 2006 and does not include option periods; 2006 expirations include month-to-month tenants. This column also excludes ground leases. |

3 | Expiring GLA excludes square footage for non-owned ground lease structures. |

4 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable tenant multiplied by 12. Excludes ground lease revenue. |

|

p. 21 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

LEASE EXPIRATIONS –RETAIL ANCHOR TENANTS 1

This Table Includes The Following: |

| • | Operating Retail Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

| | Number of

Expiring

Leases 2 | | Expiring

GLA 3 | | % of Total

GLA Expiring | | Expiring

Annualized

Base Rent 4 | | % of Total

Annualized

Base Rent | | Expiring

Annualized

Base Rent

per Sq. Ft. | | Expiring

Ground Lease

Revenue | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

2006 | | | 1 | | | 34,212 | | | 0.7 | % | $ | 18,000 | | | 0.0 | % | $ | 0.53 | | $ | 0 | |

2007 | | | 7 | | | 104,126 | | | 2.1 | % | $ | 817,276 | | | 1.4 | % | $ | 7.85 | | $ | 800,000 | |

2008 | | | 3 | | | 342,049 | | | 7.0 | % | $ | 1,441,077 | | | 2.5 | % | $ | 4.21 | | $ | 0 | |

2009 | | | 3 | | | 69,389 | | | 1.4 | % | $ | 669,318 | | | 1.2 | % | $ | 9.65 | | $ | 0 | |

2010 | | | 11 | | | 284,459 | | | 5.8 | % | $ | 2,611,106 | | | 4.6 | % | $ | 9.18 | | $ | 0 | |

2011 | | | 7 | | | 407,087 | | | 8.3 | % | $ | 2,089,946 | | | 3.7 | % | $ | 5.13 | | $ | 0 | |

2012 | | | 5 | | | 135,399 | | | 2.8 | % | $ | 1,172,103 | | | 2.1 | % | $ | 8.66 | | $ | 0 | |

2013 | | | 1 | | | 11,960 | | | 0.2 | % | $ | 161,460 | | | 0.3 | % | $ | 13.50 | | $ | 0 | |

2014 | | | 5 | | | 91,602 | | | 1.9 | % | $ | 983,243 | | | 1.7 | % | $ | 10.73 | | $ | 0 | |

2015 | | | 13 | | | 462,074 | | | 9.5 | % | $ | 4,313,053 | | | 7.5 | % | $ | 9.33 | | $ | 0 | |

Beyond | | | 30 | | | 1,312,063 | | | 26.8 | % | $ | 14,962,976 | | | 26.1 | % | $ | 11.40 | | $ | 1,040,000 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 86 | | | 3,254,420 | | | 66.5 | % | $ | 29,239,558 | | | 51.1 | % | $ | 8.98 | | $ | 1,840,000 | |

|

1 | Retail anchor tenants are defined as tenants which occupy 10,000 square feet or more. Excludes tenants at development properties which are Build to Suits for sale. |

2 | Lease expiration table reflects rents in place as of March 31, 2006 and does not include option periods; 2006 expirations include month-to-month tenants. This column also excludes ground leases. |

3 | Expiring GLA excludes square footage for non-owned ground lease structures. |

4 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable property multiplied by 12. Excludes ground lease revenue. |

|

p. 22 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

LEASE EXPIRATIONS – RETAIL SHOPS

This Table Includes The Following: |

| • | Operating Retail Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

| | Number of

Expiring

Leases1 | | Expiring

GLA2 | | % of Total

GLA Expiring | | Expiring

Annualized

Base Rent3 | | % of Total

Annualized

Base Rent | | Expiring

Annualized

Base Rent

per Sq. Ft. | | Expiring

Ground Lease

Revenue | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

2006 | | | 66 | | | 126,009 | | | 2.6 | % | $ | 1,614,787 | | | 2.8 | % | $ | 12.81 | | $ | 0 | |

2007 | | | 73 | | | 149,794 | | | 3.1 | % | $ | 2,539,614 | | | 4.4 | % | $ | 16.95 | | $ | 0 | |

2008 | | | 40 | | | 90,307 | | | 1.9 | % | $ | 1,661,252 | | | 2.9 | % | $ | 18.40 | | $ | 0 | |

2009 | | | 55 | | | 135,374 | | | 2.7 | % | $ | 2,449,543 | | | 4.3 | % | $ | 18.09 | | $ | 0 | |

2010 | | | 56 | | | 135,331 | | | 2.7 | % | $ | 2,514,511 | | | 4.4 | % | $ | 18.58 | | $ | 0 | |

2011 | | | 35 | | | 98,655 | | | 2.0 | % | $ | 1,913,594 | | | 3.3 | % | $ | 19.40 | | $ | 0 | |

2012 | | | 26 | | | 96,988 | | | 2.0 | % | $ | 1,949,760 | | | 3.4 | % | $ | 20.10 | | $ | 85,000 | |

2013 | | | 14 | | | 42,754 | | | 0.9 | % | $ | 840,863 | | | 1.5 | % | $ | 19.67 | | $ | 0 | |

2014 | | | 25 | | | 66,864 | | | 1.4 | % | $ | 1,573,003 | | | 2.8 | % | $ | 23.53 | | $ | 427,900 | |

2015 | | | 25 | | | 87,091 | | | 1.8 | % | $ | 1,901,075 | | | 3.3 | % | $ | 21.83 | | $ | 251,500 | |

Beyond | | | 15 | | | 55,842 | | | 1.1 | % | $ | 1,136,878 | | | 2.0 | % | $ | 20.36 | | $ | 416,480 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 430 | | | 1,085,009 | | | 22.2 | % | $ | 20,094,880 | | | 35.1 | % | $ | 18.52 | | $ | 1,180,880 | |

|

1 | Lease expiration table reflects rents in place as of March 31, 2006 and does not include option periods; 2006 expirations include month-to-month tenants. This column also excludes ground leases. |

2 | Expiring GLA excludes square footage for non-owned ground lease structures. |

3 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable property multiplied by 12. Excludes ground lease revenue. |

|

p. 23 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

LEASE EXPIRATIONS – COMMERCIAL TENANTS

This Table Includes The Following: |

| • | Operating Commercial Properties |

| • | Development Property Tenants open for business as of March 31, 2006 |

| | Number of

Expiring

Leases1 | | Expiring

NRA | | % of Total

NRA Expiring | | Expiring

Annualized

Base Rent2 | | % of Total

Annualized

Base Rent | | Expiring

Annualized

Base Rent

per Sq. Ft. | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

2006 | | | 1 | | | 1,000 | | | 0.0 | % | $ | 250 | | | 0.0 | % | $ | 0.25 | |

2007 | | | 2 | | | 3,955 | | | 0.1 | % | $ | 77,360 | | | 0.1 | % | $ | 19.56 | |

2008 | | | 1 | | | 7,965 | | | 0.2 | % | $ | 159,938 | | | 0.3 | % | $ | 20.08 | |

2009 | | | 0 | | | 0 | | | 0.0 | % | $ | 0 | | | 0.0 | % | $ | 0.00 | |

2010 | | | 1 | | | 8,878 | | | 0.2 | % | $ | 179,780 | | | 0.3 | % | $ | 20.25 | |

2011 | | | 3 | | | 99,542 | | | 2.0 | % | $ | 1,642,443 | | | 2.9 | % | $ | 16.50 | |

2012 | | | 2 | | | 37,052 | | | 0.8 | % | $ | 590,708 | | | 1.0 | % | $ | 15.94 | |

2013 | | | 4 | | | 128,354 | | | 2.6 | % | $ | 1,589,631 | | | 2.8 | % | $ | 12.38 | |

2014 | | | 2 | | | 149,949 | | | 3.1 | % | $ | 1,388,350 | | | 2.4 | % | $ | 9.26 | |

2015 | | | 3 | | | 49,564 | | | 1.0 | % | $ | 864,304 | | | 1.5 | % | $ | 17.44 | |

Beyond | | | 2 | | | 63,431 | | | 1.3 | % | $ | 1,466,603 | | | 2.6 | % | $ | 23.12 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 21 | | | 549,690 | | | 11.3 | % | $ | 7,959,366 | | | 13.9 | % | $ | 14.48 | |

|

1 | Lease expiration table reflects rents in place as of March 31, 2006 and does not include option periods; 2006 expirations include month-to-month tenants. This column also excludes ground leases. |

2 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable property multiplied by 12. |

|

p. 24 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SUMMARY RETAIL PORTFOLIO STATISTICS

(INCLUDES JOINT VENTURE PROPERTIES)

Retail Portfolio | | 3/31/06 | | 12/31/05 | | 9/30/05 | | 6/30/05 | | 3/31/05 | |

| |

| |

| |

| |

| |

| |

Company Owned GLA1 – Operating Retail | | | 4,532,104 | | | 4,497,658 | | | 4,175,813 | | | 3,923,243 | | | 3,611,708 | |

Total GLA1 – Operating Retail | | | 6,650,386 | | | 6,160,940 | | | 5,685,320 | | | 5,356,973 | | | 4,806,438 | |

Projected Company Owned GLA Under Development 2 | | | 696,896 | | | 690,161 | | | 628,100 | | | 946,700 | | | 854,300 | |

Projected Total GLA Under Development | | | 1,579,358 | | | 1,823,561 | | | 1,772,825 | | | 1,927,802 | | | 1,736,402 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Number of Operating Retail Properties | | | 42 | | | 40 | | | 37 | | | 36 | | | 33 | |

Number of Retail Properties Under Development | | | 12 | | | 14 | | | 13 | | | 12 | | | 10 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Percentage Leased – Operating Retail | | | 94.8 | % | | 95.3 | % | | 95.6 | % | | 93.8 | % | | 93.8 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Annualized Base Rent & Ground Lease Revenue - Retail Properties3 | | $ | 51,480,775 | | $ | 50,059,285 | | $ | 46,701,031 | | $ | 41,304,284 | | $ | 38,076,654 | |

|

1 | “Company Owned GLA” represents gross leasable area that is owned by the Company. “Total GLA” includes Company Owned GLA, plus square footage attributable to non-owned outlot structures on land that is owned by the Company and ground leased to tenants, plus non-owned anchor space. |

2 | “Projected Company Owned GLA Under Development” represents gross leaseable area under development that is projected to be owned by the Company. “Projected Total GLA” includes Projected Company Owned GLA, plus projected square footage attributable to non-owned outlot structures on land that is owned by the Company and ground leased to tenants, plus non-owned anchor space that is existing or under construction. |

3 | Annualized base rent represents the monthly contractual rent for March 2006 for each applicable tenant multiplied by 12. |

|

p. 25 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

SUMMARY COMMERCIAL PORTFOLIO STATISTICS

(INCLUDES JOINT VENTURE PROPERTIES)

Commercial Portfolio | | 3/31/06 | | 12/31/05 | | 9/30/05 | | 6/30/05 | | 3/31/05 | |

| |

| |

| |

| |

| |

| |

Company Owned Net Rentable Area (NRA)1 | | | 562,652 | | | 562,652 | | | 662,652 | | | 662,652 | | | 662,652 | |

NRA under Development | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Number of Operating Commercial Properties | | | 5 | | | 5 | | | 6 | | | 6 | | | 6 | |

Number of Commercial Properties under Development | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Percentage Leased – Operating Commercial Properties | | | 97.7 | % | | 97.3 | % | | 97.7 | % | | 97.7 | % | | 97.7 | % |

Percentage Leased – Commercial Properties under Development | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Annualized Base Rent – Commercial Properties 2,3 | | $ | 7,959,366 | | $ | 7,909,489 | | $ | 9,624,510 | | $ | 9,624,510 | | $ | 9,681,386 | |

|

1 | “Company Owned NRA” does not include square footage of Union Station Parking Garage, a detached parking garage supporting the Thirty South property that includes 851 parking spaces. It is operated by Denison Parking, a third party, pursuant to a lease of the entire property. |

2 | “Annualized Base Rent” does not include approximately $500,000 in annualized income attributable to the Union Station Parking Garage. |

3 | Annualized Base rent includes $779,621 from KRG and Subsidiaries as of March 31, 2006. |

|

p. 26 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

DEVELOPMENT PIPELINE

AS OF MARCH 31, 2006

2005 Deliveries/

2006 Stabilizations | | MSA | | Type of

Property | | Opening

Date1 | | Projected

Owned GLA2 | | Projected

Total GLA3 | | Percent of

Owned GLA

Occupied 10 | | Percent of

Owned GLA

Pre-Leased/

Committed5 | | Total

Estimated

Project

Cost4 | | Cost

Incurred

as of

March 31,

20064 | | Major Tenants

and Non-owned

Anchors | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Indiana | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Traders Point II | | Indianapolis, IN | | | Retail | | | Q2 2005 | | | 46,600 | | | 50,200 | | | 46.0 | % | | 53.8 | % | $ | 10,650 | | $ | 8,942 | | Anchored by Traders Point I | |

Geist Pavilion | | Indianapolis, IN | | | Retail | | | Q1 2005 | | | 64,300 | | | 64,300 | | | 58.3 | % | | 86.9 | % | | 11,971 | | | 10,963 | | Marsh Supermarket, Party Tree | |

| | | | | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

Subtotal | | | | | | | | | | | | 110,900 | | | 114,500 | | | 53.2 | % | | 73.0 | % | $ | 22,621 | | $ | 19,905 | | | | |

| | | | | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

2006-2007

Deliveries | | MSA | | Type of

Property | | Opening

Date1 | | Projected

Owned

GLA2 | | Projected

Total

GLA3 | | Percent of

Owned

GLA

Occupied | | Percent of

Owned

GLA

Pre-Leased/

Committed5 | | Total

Estimated

Project Cost4 | | Cost

Incurred

as of

March 31,

20064 | | Major Tenants and Non-owned Anchors | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Florida | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tarpon Springs Plaza | | Naples, FL | | | Retail | | | Q1 2007 | | | 81,500 | | | 273,300 | | | 0.0 | % | | 97.9 | % | $ | 21,500 | | $ | 10,780 | | Target (non-owned) | |

Estero Town Commons 6,7,9 | | Naples, FL | | | Retail | | | Q3 2006 | | | 25,600 | | | 206,600 | | | 0.0 | % | | 89.8 | % | | 20,000 | | | 11,930 | | Lowe’s Home Improvement | |

Indiana | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Beacon Hill Shopping Center 7,9 | | Crown Point, IN | | | Retail | | | Q3 2006 | | | 56,000 | | | 161,000 | | | 0.0 | % | | 10.6 | % | | 17,000 | | | 11,430 | | Strack & VanTil’s (non-owned) | |

Zionsville Place | | Indianapolis, IN | | | Retail | | | Q2 2006 | | | 37,400 | | | 42,400 | | | 0.0 | % | | 17.1 | % | | 9,000 | | | 3,644 | | Small shops, garden-style office | |

Stoney Creek Commons II | | Indianapolis, IN | | | Retail | | | Q3 2006 | | | 49,330 | | | 214,530 | | | 0.0 | % | | 100.0 | % | | 6,000 | | | 3,385 | | HH Gregg, Office Depot | |

Bridgewater Marketplace I | | Indianapolis, IN | | | Retail | | | Q3 2006 | | | 41,031 | | | 51,031 | | | 0.0 | % | | 38.7 | % | | 15,000 | | | 4,228 | | Walgreen’s (build-to-suit for sale) | |

Illinois | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Naperville Marketplace 8 | | Chicago, IL | | | Retail | | | Q3 2005 | | | 170,000 | | | 170,000 | | | 41.2 | % | | 70.8 | % | | 30,500 | | | 22,226 | | Marsh Supermarket, TJ Maxx | |

Oregon | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cornelius Gateway Build-to-Suit For Sale7,9 | | Portland, OR | | | Retail | | | Q2 2006 | | | 21,300 | | | 36,100 | | | 0.0 | % | | 11.7 | % | | 5,400 | | | 3,983 | | Walgreen’s (non-owned) | |

Washington | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sandifur Plaza Build-to-Suit for Sale 6,7,9 | | Tri-Cities, WA | | | Retail | | | Q4 2006 | | | 27,400 | | | 27,400 | | | 0.0 | % | | 75.9 | % | | 6,400 | | | 1,960 | | Walgreen’s | |

Gateway Shopping Center - Phase I & II 6,7,9,11 | | Seattle, WA | | | Retail | | | Q1 2007 | | | 76,522 | | | 282,522 | | | 0.0 | % | | 39.4 | % | | 24,300 | | | 8,319 | | Kohl’s (non-owned), Winco (non-owned) | |

| | | | | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

Subtotal | | | | | | | | | | | | 585,083 | | | 1,464,883 | | | 11.9 | % | | 66.7 | % | $ | 155,170 | | $ | 81,885 | | | | |

| | | | | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

Total | | | | | | | | | | | | 696,983 | | | 1,579,383 | | | 18.5 | % | | 67.5 | % | $ | 177,721 | | $ | 101,790 | | | | |

| | | | | | | | | | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

|

1 | Opening Date is defined as the first date a tenant is open for business or a ground lease payment is made. |

2 | Projected Owned GLA represents gross leasable area that we project will be owned by us. It excludes square footage that we project will be attributable to non-owned outlot structures on land that is owned by us and that we expect to ground lease to tenants. It also excludes non-owned anchor space. |

3 | Projected Total GLA includes Projected Owned GLA, projected square footage attributable to non-owned outlot structures on land that is owned by us, and non-owned anchor space that is currently existing or under construction. |

4 | Dollars in thousands. |

5 | Land parcels owned by the Company and ground leased to tenants. Includes leases under negotiation for approximately 128,431 square feet for which we have signed non-binding letters of intent plus an executed lease with Lowe’s Home Improvement. |

6 | Opening Date and Total Estimated Cost based on preliminary siteplan. |

7 | Owned in a joint venture. |

8 | A 70,000 square foot Marsh is owned by a taxable REIT subsidiary, opened in August, 2005, and is being marketed for sale. The projected opening for the remainder of the center is Q3 2006. |

9 | We own the following development properties through joint ventures: Cornelius Gateway (80%); Sandifur Plaza (Walgreen’s 80%; small shops 95%); Beacon Hill (preferred return, then 50%); Gateway Shopping Center (preferred return, then 50% until internal rate of return threshold is reached and then 25%); and Estero Town Commons (preferred return, then 40%) |

10 | Includes tenants that have taken possession of their space or have begun paying rent. |

11 | Phase two was acquired in April 2006, consisting of a 93,000 square foot non-owned anchor, 45,000 square feet of small shops and two outlots. |

|

p. 27 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

GEOGRAPHIC DIVERSIFICATION – OPERATING PORTFOLIO 1

AS OF MARCH 31, 2006

| | Number of

Operating

Properties | | Owned

GLA/NRA2 | | Percent of

Owned

GLA/NRA | | Total

Number of

Leases | | Annualized

Base Rent3 | | Percent of

Annualized

Base Rent | | Annualized

Base Rent

per Leased SF | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Indiana | | | 20 | | | 2,124,078 | | | 41.6 | % | | 215 | | $ | 22,400,791 | | | 39.7 | % | $ | 11.64 | |

• Retail – Mall | | | 1 | | | 579,189 | | | 11.4 | % | | 40 | | $ | 2,378,807 | | | 4.2 | % | $ | 5.25 | |

• Retail | | | 14 | | | 982,237 | | | 19.2 | % | | 154 | | $ | 12,062,618 | | | 21.4 | % | $ | 13.10 | |

• Commercial | | | 5 | | | 562,652 | | | 11.0 | % | | 21 | | $ | 7,959,366 | | | 14.1 | % | $ | 14.48 | |

Texas | | | 8 | | | 1,136,186 | | | 22.2 | % | | 96 | | $ | 13,788,332 | | | 24.4 | % | $ | 12.21 | |

Florida | | | 9 | | | 1,001,206 | | | 19.7 | % | | 118 | | $ | 9,485,934 | | | 16.8 | % | $ | 9.69 | |

Illinois | | | 2 | | | 231,770 | | | 4.6 | % | | 36 | | $ | 3,113,872 | | | 5.5 | % | $ | 14.16 | |

New Jersey | | | 1 | | | 115,088 | | | 2.3 | % | | 17 | | $ | 1,784,524 | | | 3.2 | % | $ | 15.99 | |

Georgia | | | 2 | | | 142,707 | | | 2.8 | % | | 28 | | $ | 1,608,318 | | | 2.9 | % | $ | 11.37 | |

Washington | | | 3 | | | 102,146 | | | 2.0 | % | | 26 | | $ | 1,747,869 | | | 3.1 | % | $ | 17.28 | |

Ohio | | | 1 | | | 231,730 | | | 4.6 | % | | 6 | | $ | 2,221,017 | | | 3.9 | % | $ | 9.58 | |

Oregon | | | 1 | | | 9,845 | | | 0.2 | % | | 7 | | $ | 268,603 | | | 0.5 | % | $ | 27.28 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | | 47 | | | 5,094,756 | | | 100.0 | % | | 549 | | $ | 56,419,260 | | | 100.0 | % | $ | 11.64 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

1 | Excludes tenants at development properties which are Build to Suits for sale. |

2 | Owned GLA/NRA represents gross leasable area or net leasable area owned by the Company. It does not include 24 parcels or outlots owned by the Company and ground leased to tenants, which contain 24 non-owned structures totaling approximately 324,319 square feet. It also excludes the square footage of Union Station Parking Garage. |

3 | Annualized Base Rent Revenue excludes $3,020,880 in annualized ground lease revenue attributable to parcels and outlots owned by the Company and ground leased to tenants. It also excludes approximately $500,000 in 2006 annualized minimum rent attributable to Union Station Parking Garage as well as the leases on properties classified as development properties. |

|

p. 28 | Kite Realty Group Supplemental Financial and Operating Statistics – 3/31/06 |

OPERATING RETAIL PROPERTIES – TABLE I

AS OF MARCH 31, 2006

Property 1,2 | | State | | MSA | | Year

Built/

Renovated | | Year Added

to Operating

Portfolio | | Acquired,

Redeveloped,

or Developed | | Total

GLA2 | | Owned

GLA2 | | Percentage

of

Owned GLA

Leased3 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

International Speedway Square | | FL | | Daytona | | 1999 | | 1999 | | Developed | | 233,901 | | 220,901 | | 98.2 | % |

King’s Lake Square | | FL | | Naples | | 1986 | | 2003 | | Acquired | | 85,497 | | 85,497 | | 97.5 | % |

Wal-Mart Plaza 4 | | FL | | Gainesville | | 1970 | | 2004 | | Acquired | | 177,826 | | 177,826 | | 100.0 | % |

Waterford Lakes | | FL | | Orlando | | 1997 | | 2004 | | Acquired | | 77,948 | | 77,948 | | 100.0 | % |

Shops at Eagle Creek | | FL | | Naples | | 1998 | | 2003 | | Acquired | | 75,944 | | 75,944 | | 91.9 | % |

Eagle Creek Lowe’s | | FL | | Naples | | 2006 | | 2006 | | Developed | | 165,000 | | 0 | | * | |

Circuit City Plaza | | FL | | Coral Springs | | 2004 | | 2004 | | Developed | | 435,906 | | 45,906 | | 97.1 | % |

Indian River Square | | FL | | Vero Beach | | 1997/2004 | | 2005 | | Acquired | | 379,246 | | 144,246 | | 100.0 | % |

Bolton Plaza | | FL | | Jacksonville | | 1986 | | 2005 | | Acquired | | 172,938 | | 172,938 | | 94.9 | % |

Centre at Panola | | GA | | Atlanta | | 2001 | | 2004 | | Acquired | | 73,079 | | 73,079 | | 100.0 | % |

Publix at Acworth | | GA | | Atlanta | | 1996 | | 2004 | | Acquired | | 69,628 | | 69,628 | | 98.3 | % |

Silver Glen Crossing | | IL | | Chicago | | 2002 | | 2004 | | Acquired | | 138,224 | | 132,675 | | 96.0 | % |

Fox Lake Crossing | | IL | | Chicago | | 2002 | | 2005 | | Acquired | | 99,095 | | 99,095 | | 93.3 | % |

Glendale Mall | | IN | | Indianapolis | | 1958/2000 | | 1999 | | Redeveloped | | 724,026 | | 579,189 | | 78.3 | % |

Cool Creek Commons | | IN | | Indianapolis | | 2005 | | 2005 | | Developed | | 133,207 | | 120,678 | | 92.8 | % |

Boulevard Crossing | | IN | | Kokomo | | 2004 | | 2004 | | Developed | | 214,696 | | 112,696 | | 96.0 | % |

Traders Point | | IN | | Indianapolis | | 2005 | | 2005 | | Developed | | 328,278 | | 252,501 | | 94.8 | % |

Hamilton Crossing | | IN | | Indianapolis | | 1999 | | 2004 | | Acquired | | 87,424 | | 82,424 | | 100.0 | % |

Fishers Station 5 | | IN | | Indianapolis | | 1989 | | 2004 | | Acquired | | 114,457 | | 114,457 | | 84.4 | % |

Whitehall Pike | | IN | | Bloomington | | 1999 | | 1999 | | Developed | | 128,997 | | 128,997 | | 100.0 | % |

The Centre 6 | | IN | | Indianapolis | | 1986 | | 1986 | | Developed | | 80,689 | | 80,689 | | 88.5 | % |

The Corner Shops | | IN | | Indianapolis | | 1984/2003 | | 1984 | | Developed | | 42,545 | | 42,545 | | 100.0 | % |

Stoney Creek Commons I | | IN | | Indianapolis | | 2000 | | 2000 | | Developed | | 143,397 | | 0 | | * | |

Greyhound Commons | | IN | | Indianapolis | | 2005 | | 2005 | | Developed | | 153,187 | | 0 | | * | |

Weston Park Phase I | | IN | | Indianapolis | | 2005 | | 2005 | | Developed | | 12,200 | | 0 | | * | |

Red Bank Commons | | IN | | Evansville | | 2005 | | 2006 | | Developed | | 324,264 | | 34,264 | | 78.1 | % |

Martinsville Shops | | IN | | Martinsville | | 2005 | | 2005 | | Developed | | 10,986 | | 10,986 | | 100.0 | % |

50 South Morton | | IN | | Indianapolis | | 1999 | | 1999 | | Developed | | 2,000 | | 2,000 | | 100.0 | % |

Ridge Plaza | | NJ | | Oak Ridge | | 2002 | | 2003 | | Acquired | | 115,088 | | 115,088 | | 96.9 | % |

Eastgate Pavilion | | OH | | Cincinnati | | 1995 | | 2004 | | Acquired | | 231,730 | | 231,730 | | 100.0 | % |

Shops at Otty 7 | | OR | | Portland | | 2004 | | 2004 | | Developed | | 154,845 | | 9,845 | | 100.0 | % |

Plaza at Cedar Hill | | TX | | Dallas | | 2000 | | 2004 | | Acquired | | 299,783 | | 299,783 | | 100.0 | % |

Sunland Towne Centre | | TX | | El Paso | | 1996 | | 2004 | | Acquired | | 312,539 | | 307,563 | | 99.5 | % |

Galleria Plaza 8 | | TX | | Dallas | | 2002 | | 2004 | | Acquired | | 44,306 | | 44,306 | | 100.0 | % |

Cedar Hill Village | | TX | | Dallas | | 2002 | | 2004 | | Acquired | | 139,092 | | 44,262 | | 94.2 | % |