Kite Realty Group Trust

September 2008

DISCLAIMER

This presentation may include certain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. These forward-

looking statements include, but are not limited to, our plans, objectives, expectations

and intentions and other statements contained in this document that are not historical

facts and statements identified by words such as “expects”, “anticipates”, “intends”,

“plans”, “believes”, “seeks”, “estimates” or words of similar meaning. These

statements are based on our current beliefs or expectations and are inherently subject

to significant uncertainties and changes in circumstances, many of which are beyond

our control. Actual results may differ materially from these expectations due to

changes in global political, economic, business, competitive, market and regulatory

risk factors. Information concerning risk factors that could affect Kite Realty Group

Trust’s actual results is contained in the Company’s reports filed from time to time with

the Securities and Exchange Commission, including its 2007 Annual Report on Form

10-K and its quarterly reports on Form 10-Q. Kite Realty Group Trust does not

undertake any obligation to update any forward-looking statements contained in this

document, as a result of new information, future events or otherwise.

2

COMPANY OVERVIEW

Balance Sheet Management

Continue to Manage Debt Maturities

Execute Capital Plan

Development

Complete Current Development Pipeline

78% pre-leased or committed

Commence construction of Visible Shadow

Pipeline

Internal Growth

Operational Efficiencies

Minimize existing Vacancy

PRIMARY OBJECTIVES FOR THE COMPANY

3

Consumer Behavior

Nationwide consumption levels will fluctuate, but a portion of the consumer’s

behavior is derived from necessity. Grocery-anchored centers and value-oriented

retailers such as Target and Wal-Mart will continue to create shopping center traffic.

COMPANY OVERVIEW

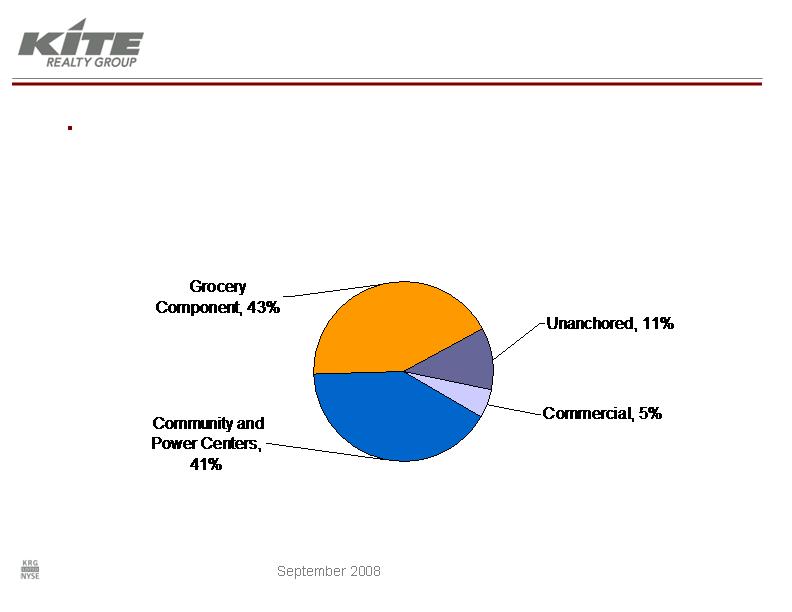

Information as of June 30, 2008

(1) Includes Projected Total GLA for properties in the Current Development/Redevelopment Pipeline. Total GLA includes owned GLA,

square footage attributable to non-owned outlot structures on land that the Company owns, and non-owned anchor space that

currently exists or is under construction.

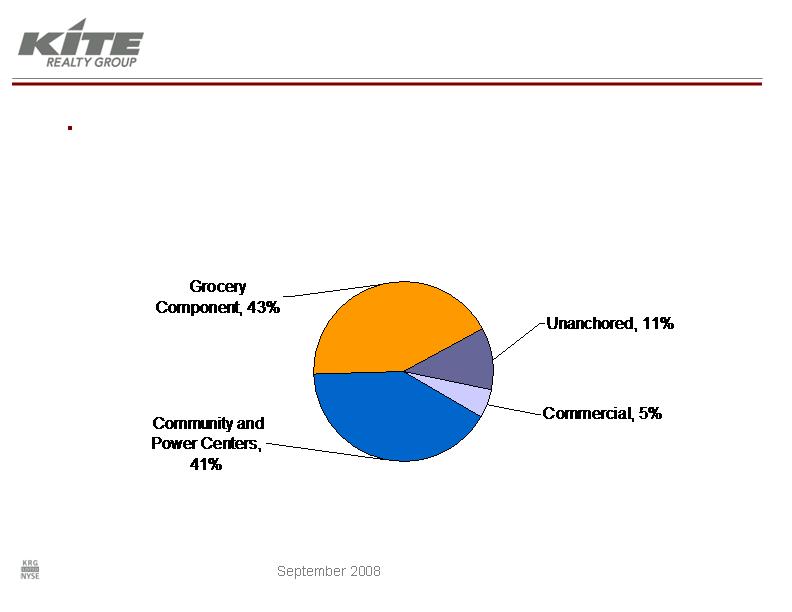

Property Type Allocation by Projected Total GLA 1

4

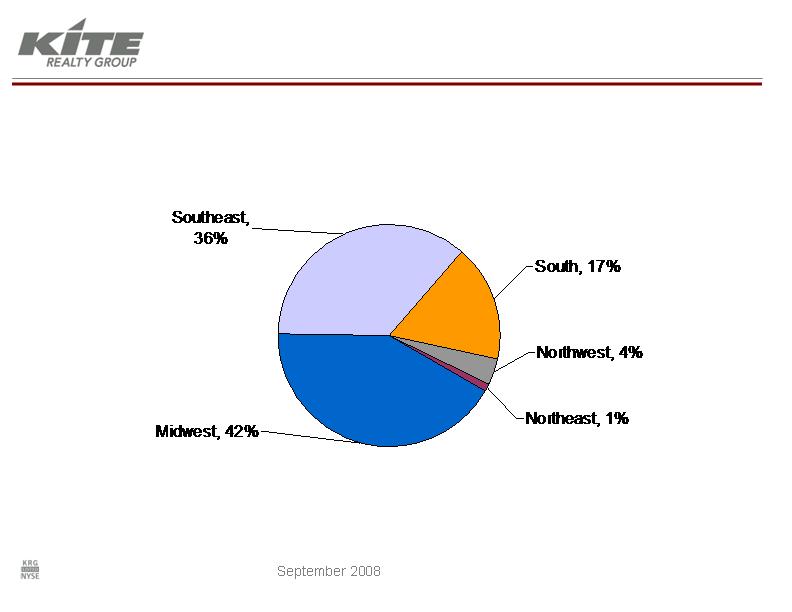

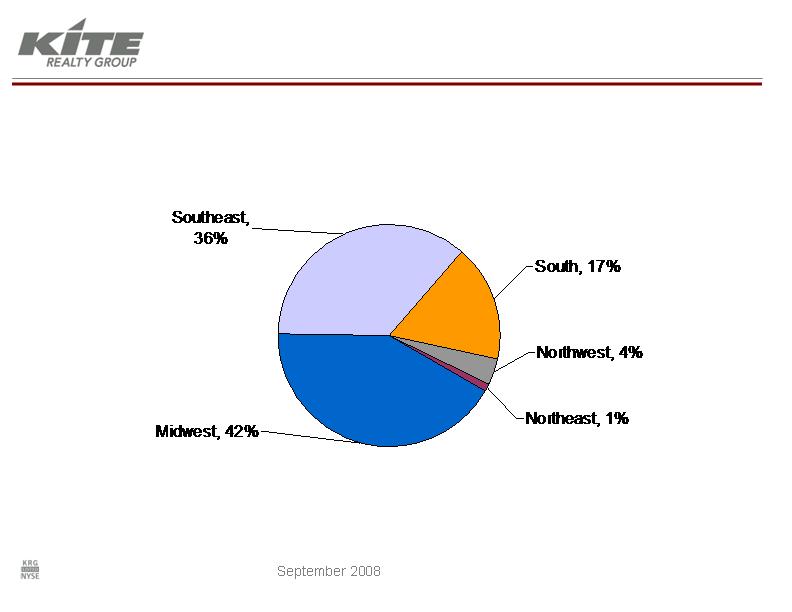

(1) Total GLA includes owned GLA, square footage attributable to non-owned outlot structures on land that the Company owns

and non-owned anchor space that currently exists or is under construction.

(2) Includes Projected Total GLA for properties in the Current Development, Redevelopment, and Visible Shadow Pipelines.

Projected Total GLA Including Pipelines 1,2

GEOGRAPHIC DIVERSIFICATION

COMPANY OVERVIEW

Information as of June 30, 2008

5

6

(1) As of September 8, 2008.

Information as of June 30, 2008 except as noted

COMPANY OVERVIEW

STRONG TENANT DIVERSITY

% of Portfolio

S&P

Annualized Base Rent

Credit Rating

1

1

Lowe's Home Improvement

3.4%

A+

2

PetSmart

2.7%

BB

3

Publix

2.4%

n/a

4

Marsh Supermarkets

2.2%

n/a

5

Circuit City

2.1%

n/a

6

Bed Bath & Beyond

1.8%

BBB

7

Office Depot

1.8%

BB+

8

Staples

1.6%

BBB

9

Dick's Sporting Goods

1.6%

n/a

10

Ross Dress for Less

1.6%

BBB

Total

21.2%

Top 10 Retail Tenants by Base Rent

GROWTH STRATEGY

STRONG UPSIDE

Only 20% occupied

Growth source for late 2008 and 2009

LOW RISK PROFILE

78% leased or committed

64% funded

Execute small shop leases and build out tenant spaces

EMBEDDED GROWTH: CURRENT DEVELOPMENTS

Information as of June 30, 2008

7

GROWTH STRATEGY

A CASE STUDY: RIVERS EDGE SHOPPING CENTER

Location: Keystone-Castleton, the most heavily traveled retail corridor in

Indianapolis

Competitive Advantage: Off-market pricing, long-standing relationships

Capitalization: Partially funded by proceeds from non-core, net-lease asset sale

Leasing Upside: 20% vacant plus below market rents in place

Development Upside: Maximize site with potential additional GLA

Asset Management Upside: Improve access, visibility

Risk Mitigation: Potential double digit returns through repositioning while in-place

rents provide smooth transition

SELECTIVE ACQUISITIONS

8

GROWTH STRATEGY

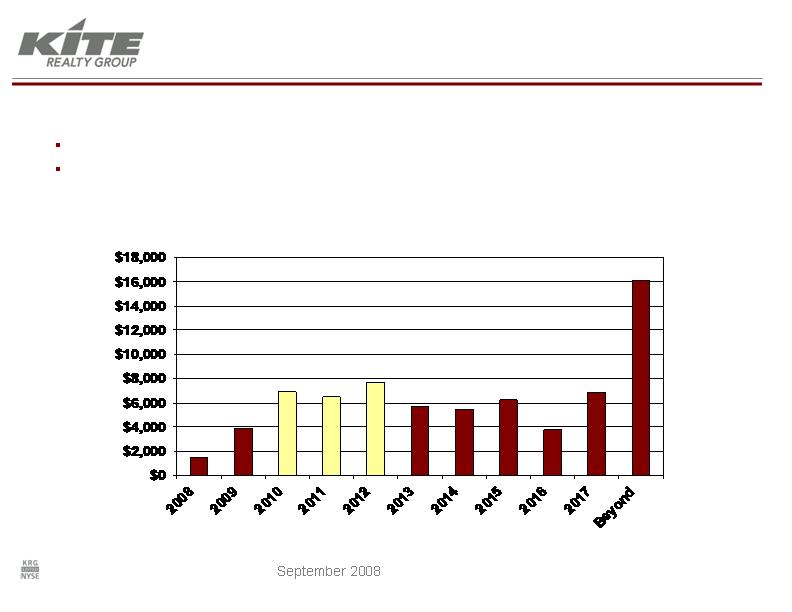

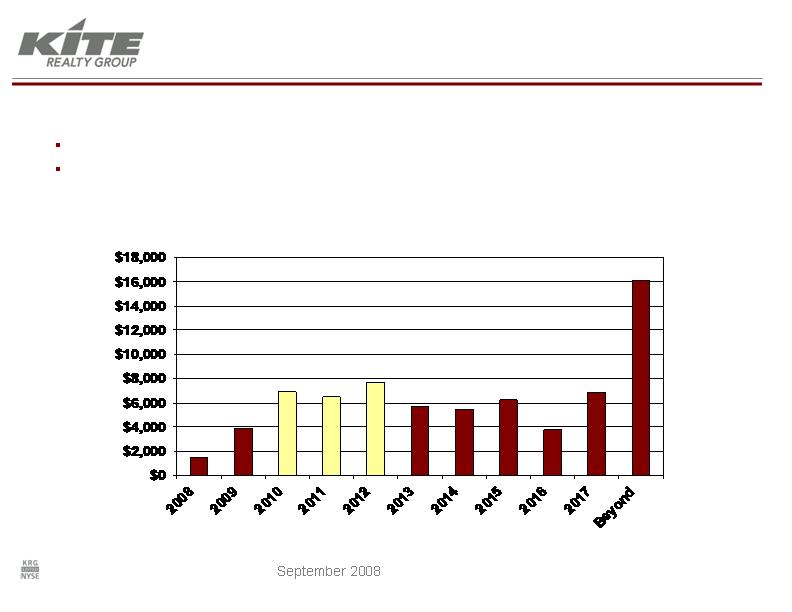

Nearly 30 percent ($21 million) of annualized base rent expires from 2010 to 2012

During the years 2010 through 2012, 550,000 square feet per year will expire

(compared to 250,000 per year for the years 2008 and 2009)

POTENTIAL SAME STORE GROWTH VIA LEASE EXPIRATIONS

Dollars in thousands

Annual Base Rent Expiring Per Year

Information as of June 30, 2008

9

GROWTH STRATEGY

Existing Vacancy

Operating retail portfolio is 93.0% leased

Negotiating lease for 23,000 square foot junior anchor space vacated in

early 2008 - represents 0.5% increase in occupancy

Operational Efficiencies

Leveraging bargaining power with national providers

Maintain class-A properties while managing to the CAM caps

Controlling variable costs – insurance and real estate taxes

Ancillary Income

3rd Party Construction and Service Fee Revenue

Leveraging our in-house construction company to generate FFO

Utilize current infrastructure to attract 3rd party contracts

Merchant building as a source of capital

EMPHASIZING INTERNAL GROWTH

Information as of June 30, 2008

10

PEER GROUP COMPARISON

11

(1)

Source: FirstCall estimates as of September 8, 2008.

Assuming a peer group average multiple of 12.3x, our stock is trading

at a 33% discount

Share Price

Consensus

Company

9/5/2008

Estimate

1

Multiple

Federal Realty

$75.88

$3.89

19.5x

Acadia Realty Trust

$23.50

$1.34

17.5x

Equity One, Inc

$20.70

$1.37

15.1x

Kimco Realty Corporation

$37.81

$2.71

14.0x

Regency Centers Corp

$61.67

$4.55

13.6x

Weingarten Realty

$33.34

$3.16

10.6x

Cedar Shopping Centers

$13.02

$1.24

10.5x

Inland Real Estate Corp

$15.02

$1.46

10.3x

Ramco Gershenson

$22.89

$2.49

9.2x

Developers Diversified

$35.18

$3.89

9.0x

Average

12.9x

Kite Realty Group

$11.63

$1.26

9.2x

Priced with Average Multiple

$16.28

12.9x

Current Discount

-40.0%

PEER GROUP COMPARISON

Our dividend yield remains attractive

12

(1)

Source: Company filings.

Share

Current

Price

Annual

Company

9/5/2008

Dividend

1

Yield

Ramco Gershenson

$22.89

$1.85

8.1%

Developers Diversified

$35.18

$2.76

7.8%

Kite Realty Group

$11.63

$0.82

7.1%

Cedar Shopping Centers

$13.02

$0.90

6.9%

Inland Real Estate Corp

$15.02

$0.98

6.5%

Weingarten Realty

$33.34

$2.10

6.3%

Equity One, Inc

$20.70

$1.20

5.8%

Regency Centers Corp

$61.67

$2.90

4.7%

Kimco Realty Corporation

$37.81

$1.76

4.7%

Acadia Realty Trust

$23.50

$0.84

3.6%

Federal Realty

$75.88

$2.60

3.4%

DEVELOPMENT & REDEVELOPMENT PIPELINE

(1)

Includes owned GLA, plus square footage attributable to non-owned outlot structures and non-owned outlot anchor space.

(2)

Held in a joint venture entity.

(3)

Percent Committed includes leases under negotiation for which the company has a signed non-binding letter of intent.

(4)

The Company is the master developer for this project, and its share of Phase I estimated project costs is approximately $35 million.

Information as of June 30, 2008

13

Project

MSA

Projected Total

GLA

1

% Leased /

Committed

3

Total Est. Cost

(000s)

Anchor Tenants

Bayport Commons

2

Tampa, FL

286,000

91.0%

$27,600

Target (non-owned), Michael’s, Best Buy,

PetSmart

Cobblestone Plaza

2

Ft. Lauderdale, FL

163,600

75.1%

$47,000

Whole Foods Market, Staples

South Elgin Commons I

Chicago, IL

45,000

100.0%

$9,200

LA Fitness

Beacon Hill Phase Il

2

Crown Point, IN

19,160

33.4%

$5,000

Strack & VanTil's (non-owned), Walgreens (non-

owned)

Spring Mill Medical II

2

Indianapolis, IN

41,000

100.0%

$8,500

Medical Practice Groups

Eddy Street Commons I

4

South Bend, IN

465,000

61.2%

$35,000

Follette Bookstore, retail, office

Gateway Shopping Ctr

2

Seattle, WA

298,600

84.5%

$28,000

Ross Dress for Less, Rite Aid, PetSmart,

Kohl’s (non-owned), Winco (non-owned)

Sub-Total

1,318,360

77.5%

$160,300

Redevelopments

Glendale Town Center

Indianapolis, IN

685,000

93.9%

$15,000

Target (non-owned), Lowe’s (non-owned),

Macy’s, Staples

Shops at Eagle Creek

Naples, FL

72,271

55.3%

$3,500

Staples

Rivers Edge Shopping Ctr

Indianapolis, IN

110,896

79.0%

$5,000

Pending

Bolton Plaza

Jacksonville, FL

172,938

18.6%

TBD

Pending

Sub-Total

1,041,105

$23,500

2,359,465

$183,800

Total Current Development and

Redevelopment

VISIBLE SHADOW PIPELINE

(1)

Total Estimated Cost and Estimated Total GLA based on preliminary siteplans.

(2)

Acquired in a joint venture with Prudential Real Estate Investors. KRG’s ownership interest will change to 20% upon commencement of construction.

(3)

Held in a joint venture entity.

Information as of June 30, 2008

14

Project

KRG % Owned

MSA

Est. Total

GLA

1

Est. Total

Cost

1

(000s)

Potential Tenancy

Parkside Town Commons

2

40%

Raleigh, NC

1,500,000

$148,000

Frank Theatres, Discount Dept.

Stores, Jr. Boxes, Restaurants

Delray Marketplace

3

50%

Delray Beach, FL

318,000

$100,000

Publix, Frank Theatres, Jr.

Boxes, Shops, Restaurants

Maple Valley

100%

Seattle, WA

156,000

$36,000

Hardware Store, Drug Store,

Shops, Restaurants

Broadstone Station (Apex)

100%

Raleigh, NC

345,000

$25,600

Super Wal-Mart (non-owned), Jr.

Boxes, Pad sales

South Elgin Commons II

100%

Chicago, IL

263,000

$17,000

Jr. Boxes, SuperTarget (non-

owned)

Total Visible Shadow Pipeline

2,582,000

$326,600

DEVELOPMENT PIPELINE

A CASE STUDY IN RISK MITIGATION: EDDY STREET COMMONS

15

DEVELOPMENT PIPELINE

A CASE STUDY IN RISK MITIGATION: EDDY STREET COMMONS

$200 million mixed-use development next to the University of Notre Dame in South

Bend, IN will be completed in phases

$35 million Phase I, which will include retail and office, was only recently added to the

Current Development Pipeline. Phase I will also include a $35 million multi-family

component that will be developed and operated by a third party.

Three goals were set and accomplished before significant capital was spent:

One, the land was fully entitled with a planned unit development designation

Two, Tax Increment Financing (TIF) and other municipal incentives totaling

$35M were funded

Three, final deal structure with the University of Notre Dame was completed and

Kite acquired and ground leases separate parcels

Joint venture arrangements for multi-family and hotel components will be utilized to

mitigate risk and maximize expertise

Additional land for residential units can be acquired from the University at our

discretion and will be based solely on residential market demand

Information as of June 30, 2008

16

DEVELOPMENT PIPELINE

A CASE STUDY IN RISK MITIGATION: EDDY STREET COMMONS

Phase I – Retail, Office, Multi-family, Parking Garage

17

STRONG DEMOGRAPHICS

DEVELOPMENT SUCCESS NOT DEPENDENT ON GROWTH

Source: Applied Geographic Solutions

$488M

$190M

Expenditure Potential

$466M

$186M

Expenditure Potential

$84,716

$87,910

Average HH Income

$77,007

$77,012

Average HH Income

2.3%

2.8%

Projected Annual Growth

1.8%

1.8%

Projected Annual Growth

133,272

51,023

2012 Est. Population

136,673

54,416

2012 Est. Population

118,951

44,549

2007 Est. Population

124,977

49,691

2007 Est. Population

5 Mile

3 Mile

Development Pipeline

5 Mile

3 Mile

Operating Portfolio

Radius

Radius

Operating Portfolio vs. Development Pipeline

Portfolio Demographic Comparison

18

EXECUTE ON STRATEGY TO ENSURE CAPITAL AVAILABILITY

CAPITAL PLAN

Information as of June 30, 2008

Credit Facility and Cash:

Unsecured Term Loan:

Potential Asset Sales:

Targeted Asset Transfer to JVs:

Targeted Liquidity Level:

$44 million

$55 million funded

$5 million in negotiation

$25 million

$30 to $35 million

$75 to $100 million

19

MANAGING DEBT MATURITIES

AGGRESSIVE REFINANCING, SOLID EXECUTION

Information as of June 30, 2008

2009 Consolidated Debt Maturities:

Construction Loans with Existing Extension Options:

Negotiating Extensions/Mini Perms:

Q4 2009 Maturities:

New Construction Loan:

$136 million of debt maturities with relationship

construction lenders

Only $28 million of secured loan maturities in late 2009

$190 million

$75 million

$57 million

$49 million

$9 million

20

COMMITTED MANAGEMENT

Senior management owns approximately 23 percent of the

Company and has acquired over 400,000 shares and 800,000

units since the IPO at a cost of approximately $21M

0.2%

9 years

EVP & CFO

Dan Sink

23.2%

8.2%

18 years

President & CEO

John Kite

4.1%

14 years

Sr. EVP & COO

Tom McGowan

10.7%

48 years

Chairman

Al Kite

Ownership 1

Tenure with

Company

(1) As of August 25, 2008, and includes units of Operating Partnership.

21

OPERATING METRICS

For the Three Months Ended June 30, 2008

2.7x

2.6x

Fixed Charge Coverage 2

7.2%

4.8%

G&A / Revenue from Rental

Properties

94.9%

93.5%

Portfolio % Leased

71%

66%

FFO Payout %

70.2%

73.2%

NOI / Revenue

Selected

Peer Group

Average 1

KRG

(1)

Peer Group consists of KIM, DDR, AKR, REG and RPT.

(2)

Defined as EBITDA divided by Interest Expense plus Preferred Dividends.

22

A SOLID FOUNDATION

Healthy pay-out ratio

Strong fixed charge coverage

Capital available for development

pipeline

‘A’ locations

High occupancy

Diverse tenant mix with

conservative exposure

IN CONCLUSION

A CLEAR STRATEGY

2008 – 2012 Growth initiatives

Shadow pipeline

Internal growth

Good real estate wins

23

CORPORATE PROFILE

Kite Realty Group Trust is a full-service, vertically integrated real estate

investment trust engaged primarily in the ownership, operation, management,

leasing, acquisition, construction, expansion, and development of high quality

neighborhood and community shopping centers in selected growth markets in

the United States. The Company owns interests in a portfolio of operating retail

properties, retail properties under development, operating commercial

properties, a related parking garage, commercial property under development

and parcels of land that may be used for future development of retail or

commercial properties.

Our strategy is to maximize the cash flow of its operating properties,

successfully complete the construction and lease-up of the development

portfolio and identify additional growth opportunities in the form of new

developments and acquisitions. A significant volume of growth opportunity is

sourced through the extensive network of tenant, corporate and institutional

relationships that have been established over the last four decades. Current

investments are focused in the development and acquisition of high quality, well

located shopping centers.

24