|

| | |

QUARTERLY FINANCIAL SUPPLEMENTAL – MARCH 31, 2018 | |

|

| | |

| PAGE NO. | | TABLE OF CONTENTS |

| | | |

| 3 | | Earnings Press Release |

| 7 | | Corporate Profile |

| 8 | | Contact Information |

| 9 | | Important Notes Including Non-GAAP Disclosures |

| 11 | | Consolidated Balance Sheets |

| 12 | | Consolidated Statements of Operations for the Three Months Ended March 31, 2018 |

| 13 | | Funds from Operations for the Three Months Ended March 31, 2018 |

| 14 | | Adjusted Funds From Operations and Other Financial Information for the Three Months Ended March 31, 2018 |

| 15 | | Market Capitalization as of March 31, 2018 |

| 15 | | Ratio of Debt to Total Undepreciated Assets as of March 31, 2018 |

| 15 | | Ratio of Company Share of Net Debt to EBITDA as of March 31, 2018 |

| 16 | | Same Property Net Operating Income for the Three Months Ended March 31, 2018 |

| 17 | | Net Operating Income by Quarter |

| 18 | | Consolidated Joint Venture Summary as of March 31, 2018 |

| 19 | | Summary of Outstanding Debt as of March 31, 2018 |

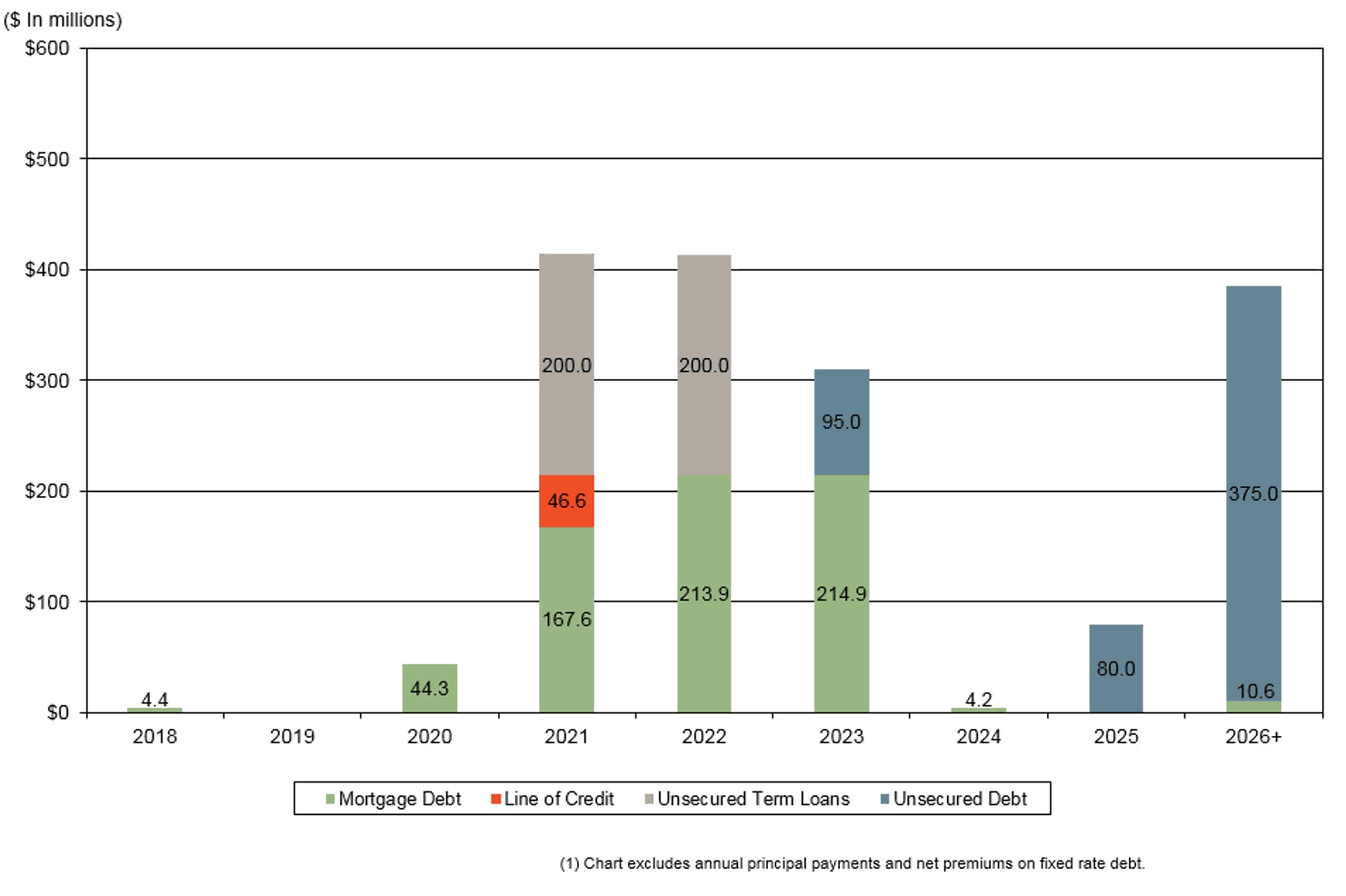

| 20 | | Maturity Schedule of Outstanding Debt as of March 31, 2018 |

| 22 | | Unsecured Public Debt Covenants |

| 23 | | Top 10 Retail Tenants by Total Gross Leasable Area |

| 24 | | Top 25 Tenants by Annualized Base Rent |

| 25 | | Retail Leasing Spreads |

| 26 | | Lease Expirations – Operating Portfolio |

| 27 | | Lease Expirations – Retail Anchor Tenants |

| 28 | | Lease Expirations – Retail Shops |

| 29 | | Lease Expirations – Office Tenants and Other |

| 30 | | Development Projects Under Construction |

| 31 | | Under Construction Redevelopment, Reposition, and Repurpose Projects |

| 32 | | Redevelopment, Reposition, and Repurpose Opportunities |

| 33 | | 2018 Property Dispositions |

| 34 | | Geographic Diversification – Annualized Base Rent by Region and State |

| 35 | | Operating Retail Portfolio Summary Report |

| 40 | | Operating Office Properties and Other |

| 41 | | Components of Net Asset Value |

| 42 | | Earnings Guidance – 2018 |

|

| |

| p. 2 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

PRESS RELEASE

|

|

| Contact Information: |

| Dan Sink |

| EVP & CFO |

| (317) 577-5609 |

| dsink@kiterealty.com |

Kite Realty Group Trust Reports First Quarter 2018 Operating Results

Indianapolis, Ind., April 25, 2018 - Kite Realty Group Trust (NYSE: KRG) (the “Company”) announced today its operating results for the first quarter ended March 31, 2018. Financial statements, exhibits, and reconciliations of non-GAAP measures attached to this release include the details of the Company’s results.

First Quarter Highlights

| |

| • | Net loss attributable to common shareholders of $17.9 million, or $0.21 per common share, which included a $24.1 million non-cash charge due to the impairment of an operating property. |

| |

| • | Funds From Operations of the Operating Partnership (“FFO”), as defined by NAREIT, of $43.5 million, or $0.51 per diluted common share. |

| |

| • | Increased Same-Property Net Operating Income (“NOI”) 1.5% compared to the same period in the prior year. |

| |

| • | Generated aggregate rent spreads on 58 comparable new and renewal leases of 2.3%, or 8.2% excluding one new anchor tenant that did not require the Company to spend any capital and one strategic anchor renewal. |

| |

| • | Generated $63.0 million in gross proceeds from the disposition of two non-core shopping centers and used these proceeds to pay down the Company’s revolving line of credit. |

| |

| • | Completed one Redevelopment, Repurpose and Reposition (“3-R”) project, Burnt Store Marketplace (Punta Gorda, FL), with a projected annualized return of 11.5% on incurred costs of $8.9 million. |

| |

| • | Subsequent to quarter end, recast the Company’s unsecured revolving credit facility, increasing the size by $100 million to $600 million and extending the maturity date. |

“We started 2018 with another quarter of strong operations and execution on our stated objectives,” said John Kite, Chairman and Chief Executive Officer. “We were able to meet our asset disposition goal in the first quarter and continue to look to market select assets to further reduce leverage. We generated another high return on a completed 3-R project and are working to deliver on our remaining initiatives, including our Big Box Surge.”

|

| |

| p. 3 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

Financial & Portfolio Results

Financial Results

Net loss attributable to common shareholders for the three months ended March 31, 2018, was $17.9 million, compared to net income of $5,000 for the same period in 2017. First quarter 2018 results included a $24.1 million charge for an operating property impairment due to changes during the quarter in facts and circumstances underlying the Company’s expected future hold period of this property.

For the three months ended March 31, 2018, FFO, as defined by NAREIT, was $43.5 million, or $0.51 per diluted common share, compared to $43.9 million, or $0.51 per diluted common share, for the same period in the prior year.

Portfolio Operations

As of March 31, 2018, the Company owned interests in 115 operating and redevelopment properties totaling approximately 22.5 million square feet and 2 development projects currently under construction totaling 0.7 million square feet. The owned gross leasable area in the Company’s retail operating portfolio was 94.6% leased as of March 31, 2018, and the Company’s total portfolio was 94.2% leased.

Same-property NOI, which includes 102 operating properties, increased 1.5% in the first quarter compared to the same period in the prior year. The leased percentage of properties included in the same-property pool was 94.6% at March 31, 2018, compared to 95.1% in the same period in the prior year, while the economic occupancy percentage for the same periods were 93.3% and 94.0%, respectively.

The Company executed leases on 65 individual spaces totaling 417,830 square feet during the first quarter of 2018, including 58 comparable new and renewal leases for 391,348 square feet. Cash rent spreads on comparable new and renewal leases executed in the quarter were (2.2%) and 3.1%, respectively, for a blended cash rent spread of 2.3%. Excluding one new anchor tenant lease that did not require the Company to expend any capital and one strategic anchor renewal, new and renewal leases were 16.5% and 7.0%, respectively, for a blended cash rent spread of 8.2%. The blended leasing spread on a GAAP basis, which includes periodic contractual rent increases over the term of the lease, was 5.3%.

Several tenants opened in the first quarter, including the following anchors: Aldi at Bolton Plaza (Jacksonville, FL), Nordstrom Rack at Portofino Shopping Center (Houston, TX) and Skechers Outlet at Eastern Beltway (Las Vegas, NV).

The Company is making progress on its anchor space repositioning efforts (“Big Box Surge”). Gander Outdoors is taking the 30,045 square-foot space formerly occupied by Gander Mountain at Bayport Commons (Tampa, FL), and Party City is taking the 11,072 square-foot space formerly occupied by Home Consignment at Centennial Gateway (Las Vegas, NV).

|

| |

| p. 4 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

Capital Recycling

In the first quarter, we completed the sale of two non-core operating properties: Trussville Promenade in Birmingham, Alabama, and Memorial Commons in Goldsboro, North Carolina. These sales generated $63.0 million in gross proceeds, which were used to pay down the Company’s revolving line of credit.

Balance Sheet

We continue to strengthen our balance sheet, as we have reduced our Net Debt to EBITDA from 6.92x at the end of the fourth quarter of 2017 to 6.76x. We currently have only $48.7 million of term maturities through 2020, and our debt portfolio has a weighted average maturity of 5.3 years.

Subsequent to quarter end, the Company successfully recast its unsecured revolving credit facility, increasing the size by $100 million to $600 million, extending the maturity date to April 22, 2022 (which can be further extended by up to two six month periods, subject to certain conditions), lowering the leverage pricing across the grid, and changing the definition of the capitalization rate from 6.75% to 6.50%, which increases total asset value and available borrowing capacity. Additional details are available in the Form 8-K filed by the Company on April 25, 2018.

Development and Redevelopment

During the quarter, we completed construction on one 3-R project, Burnt Store Marketplace (Punta Gorda, FL). We invested $8.9 million into this asset to demolish and rebuild the 45,000 square-foot Publix and upgrade the center for a projected annualized return of 11.5%.

The Company’s 3-R program currently includes six projects under various stages of construction, with estimated combined costs ranging from $61.5 to $66.5 million and an estimated combined annualized return ranging from 8.0% to 9.0%.

2018 Earnings Guidance

The Company maintains its guidance for 2018 FFO, as defined by NAREIT, in a range of $1.98 to $2.04 per diluted common share. Please refer to the full list of guidance assumptions on page 43 of the Company’s first quarter supplemental.

|

| | | | | | |

| Guidance Range for Full Year 2018 | Low | High |

| Consolidated net income/(loss) per diluted common share | $ | (0.02) | | $ | 0.04 | |

| Add: Depreciation, amortization and other | 1.72 | | 1.72 | |

| Add: Impairment Charge | | 0.28 | | | 0.28 | |

| FFO, as defined by NAREIT, per diluted common share | $ | 1.98 | | $ | 2.04 | |

Earnings Conference Call

The Company will conduct a conference call to discuss its financial results on Thursday, April 26, 2018, at 12:00 p.m. Eastern Time. A live webcast of the conference call will be available online on the Company’s corporate website at www.kiterealty.com. The dial-in numbers are (844) 309-0605 for domestic callers and (574) 990-9933 for international callers (passcode 7895509). In addition, a webcast replay link will be available on the corporate website

|

| |

| p. 5 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

About Kite Realty Group Trust

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust (REIT) that provides communities with convenient and beneficial shopping experiences. We connect consumers to tenants in desirable markets through our diverse portfolio of high-quality community, neighborhood, and lifestyle centers. Using operational, development, and redevelopment expertise, we continuously optimize our portfolio to maximize value and return to our shareholders. For more information, please visit our website at kiterealty.com.

Safe Harbor

Certain statements in this document that are not historical fact may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to: national and local economic, business, real estate and other market conditions, particularly in light of low growth in the U.S. economy as well as economic uncertainty caused by fluctuations in the prices of oil and other energy sources and inflationary trends or outlook; financing risks, including the availability of, and costs associated with, sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the Company operates; acquisition, disposition, development and joint venture risks; property ownership and management risks; the Company’s ability to maintain its status as a real estate investment trust for federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property the Company owns; the impact of online retail competition and the perception that such competition has on the value of shopping center assets; risks related to the geographical concentration of the Company’s properties in Florida, Indiana and Texas; insurance costs and coverage; risks associated with cybersecurity attacks and the loss of confidential information and other business interruptions; and other factors affecting the real estate industry generally. The Company refers you to the documents filed by the Company from time to time with the SEC, specifically the section titled “Risk Factors” in the Company’s and the Operating Partnership’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which discuss these and other factors that could adversely affect the Company’s results. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

|

| |

| p. 6 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

General Description

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust (REIT) engaged primarily in the ownership and operation, acquisition, development and redevelopment of high-quality neighborhood and community shopping centers in select markets in the United States. As of March 31, 2018, we owned interests in 115 operating and redevelopment properties totaling approximately 22.5 million square feet and two development projects currently under construction.

Our strategy is to maximize the cash flow of our operating properties, successfully complete the construction and lease-up of our redevelopment and development portfolio, and identify additional opportunities to acquire or dispose of properties to further strengthen the Company. New investments are focused in the shopping center sector primarily in markets where we believe we can leverage our existing infrastructure and relationships to generate attractive risk-adjusted returns or otherwise in desirable trade areas. Dispositions are generally designed to increase the quality of our portfolio and to strengthen the Company’s balance sheet.

Company Highlights as of March 31, 2018

|

| | | | | | | |

| | | # of Properties | Total GLA /NRA1 | Owned GLA /NRA1 |

| Operating Retail Properties | | 104 |

| 20,628,137 |

| 14,517,597 |

|

| Operating Office Properties and Other | | 4 |

| 496,728 |

| 496,728 |

|

| Redevelopment Properties | | 7 |

| 1,351,172 |

| 1,067,331 |

|

| Total Operating and Redevelopment Properties | | 115 |

| 22,476,037 |

| 16,081,656 |

|

| Development Projects | | 2 |

| 682,460 |

| 160,960 |

|

| Total All Properties | | 117 |

| 23,158,497 |

| 16,242,616 |

|

| | | Retail | Office & Other | Total |

Operating Properties – Leased Percentage1 | | 94.6% | 82.5% | 94.2% |

| States | | | | 19 |

Stock Listing: New York Stock Exchange symbol: KRG

|

| |

| ____________________ |

| 1 | Excludes square footage of structures located on land owned by the company and ground leased to tenants. |

|

| |

| p. 7 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

Corporate Office

30 South Meridian Street, Suite 1100

Indianapolis, IN 46204

(888) 577-5600

(317) 577-5600

www.kiterealty.com

|

| | | | |

| Investor Relations Contact: | | Analyst Coverage: | | Analyst Coverage: |

| | | | | |

| Daniel R. Sink | | Robert W. Baird & Co. | | DA Davidson |

| EVP & CFO | | Mr. RJ Milligan | | Mr. James O. Lykins |

| Kite Realty Group Trust | (813) 273-8252 | (503) 603-3041 |

| 30 South Meridian Street, Suite 1100 | | rjmilligan@rwbaird.com | | jlykins@dadco.com |

| Indianapolis, IN 46204 | | | | |

| (317) 577-5609 | | Bank of America/Merrill Lynch | | Hilliard Lyons |

| dsink@kiterealty.com | | Mr. Jeffrey Spector/Mr. Craig Schmidt | | Ms. Carol L. Kemple |

| | | (646) 855-1363/(646) 855-3640 | | (502) 588-1839 |

| Transfer Agent: | | jeff.spector@baml.com | | ckemple@hilliard.com |

| | | craig.schmidt@baml.com | | |

| Broadridge Financial Solutions | | | | KeyBanc Capital Markets |

| Ms. Kristen Tartaglione | | Barclays | | Mr. Jordan Sadler/Mr. Todd Thomas |

2 Journal Square, 7th Floor | | Mr. Ross Smotrich/Ms. Linda Tsai | | (917) 368-2280/(917) 368-2286 |

| Jersey City, NJ 07306 | | (212) 526-2306/(212) 526-9937 | | tthomas@keybanccm.com |

| (201) 714-8094 | | ross.smotrich@barclays.com | | jsadler@keybanccm.com |

| | | linda.tsai@barclays.com | | |

| Stock Specialist: | | | | Raymond James |

| | | BTIG | | Mr. Paul Puryear/Mr. Collin Mings |

| GTS | | Mr. Michael Gorman | | (727) 567-2253/(727) 567-2585 |

| 545 Madison Avenue | | (212) 738-6138 | | paul.puryear@raymondjames.com |

| 15th Floor | | mgorman@btig.com | | collin.mings@raymondjames.com |

| New York, NY 10022 | | | | |

| (212) 715-2830 | | Capital One Securities, Inc. | | Sandler O’Neill |

| | | Mr. Christopher Lucas | | Mr. Alexander Goldfarb |

| | | (571) 633-8151 | | (212) 466-7937 |

| | | christopher.lucas@capitalone.com | | agoldfarb@sandleroneill.com |

| | | | | |

| | | Citigroup Global Markets | | Wells Fargo Securities, LLC |

| | | Mr. Michael Bilerman/Ms. Christy McElroy | | Mr. Jeffrey J. Donnelly, CFA /Ms. Tamara Fique |

| | | (212) 816-1383/(212) 816-6981 | | (617) 603-4262/(443) 263-6568 |

| | | michael.bilerman@citigroup.com | | jeff.donnelly@wellsfargo.com |

| | | christy.mcelroy@citigroup.com | | tamara.fique@wellsfargo.com |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| |

| p. 8 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

IMPORTANT NOTES INCLUDING NON-GAAP DISCLOSURES | |

Interim Information

This Quarterly Financial Supplemental contains historical information of Kite Realty Group Trust (“the Company” or “KRG”) and is intended to supplement the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 to be filed on or about May 4, 2018, which should be read in conjunction with this supplement. The supplemental information is unaudited, although it reflects all adjustments which, in the opinion of management, are necessary for a fair presentation of operating results for the interim periods.

Forward-Looking Statements

This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to:

| |

| • | national and local economic, business, real estate and other market conditions, particularly in light of low growth in the U.S. economy as well as economic uncertainty caused by fluctuations in the prices of oil and other energy sources and inflationary trends or outlook; |

| |

| • | financing risks, including the availability of, and costs associated with, sources of liquidity; |

| |

| • | our ability to refinance, or extend the maturity dates of, our indebtedness; |

| |

| • | the level and volatility of interest rates; |

| |

| • | the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; |

| |

| • | the competitive environment in which the Company operates; |

| |

| • | acquisition, disposition, development and joint venture risks; |

| |

| • | property ownership and management risks; |

| |

| • | our ability to maintain our status as a real estate investment trust for federal income tax purposes; |

| |

| • | potential environmental and other liabilities; |

| |

| • | impairment in the value of real estate property the Company owns; |

| |

| • | the impact of online retail and the perception that such retail has on the value of shopping center assets; |

| |

| • | risks related to the geographical concentration of our properties in Florida, Indiana and Texas; |

| |

| • | insurance costs and coverage; |

| |

| • | risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; |

| |

| • | other factors affecting the real estate industry generally; and |

| |

| • | other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form |

10-K for the fiscal year ended December 31, 2017, and in our quarterly reports on Form 10-Q.

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Disclosures

Funds from Operations

Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts ("NAREIT"). The NAREIT white paper defines FFO as net income (determined in accordance with GAAP), excluding gains (or losses) from sales and impairments of depreciated property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to satisfy our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation of net income (computed in accordance with GAAP) to FFO is included elsewhere in this Financial Supplement.

|

| |

| p. 9 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

IMPORTANT NOTES INCLUDING NON-GAAP DISCLOSURES (CONTINUED) | |

Adjusted Funds from Operations

Adjusted Funds From Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. AFFO modifies FFO, as adjusted for certain cash and non-cash transactions not included in FFO. AFFO should not be considered an alternative to net income as an indication of the company's performance or as an alternative to cash flow as a measure of liquidity or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance. The Company’s computation of AFFO may differ from the methodology for calculating AFFO used by other REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net income (computed in accordance with GAAP) to AFFO is included elsewhere in this Financial Supplement.

Net Operating Income and Same Property Net Operating Income

The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and certain corporate level expenses. The Company believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impairment, if any.

The Company also uses same property NOI ("Same Property NOI"), a non-GAAP financial measure, to evaluate the performance of our properties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales, straight-line rent revenue, lease termination fees, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. The Company believes that Same Property NOI is helpful to investors as a measure of our operating performance because it includes only the NOI of properties that have been owned and fully operational for the full quarters presented. The Company believes such presentation eliminates disparities in net income due to the acquisition or disposition of properties during the particular quarters presented and thus provides a more consistent comparison of our properties. The year-to-date results represent the sum of the individual quarters, as reported.

NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and therefore may not be comparable to such other REITs.

When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the inclusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and the Company begins recapturing space from tenants. For the quarter ended March 31, 2018, the Company excluded seven redevelopment properties and the recently completed Northdale Promenade and Burnt Store Marketplace redevelopments from the same property pool that met these criteria and were owned in both comparable periods.

Earnings Before Interest Expense, Income Tax Expense, Depreciation and Amortization (EBITDA)

The Company defines EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income tax expense of taxable REIT subsidiary. For informational purposes, the Company has also provided Adjusted EBITDA, which the Company defines as EBITDA less (i) EBITDA from unconsolidated entities, (ii) gains on sales of operating properties or impairment charges, (iii) other income and expense, (iv) noncontrolling interest EBITDA and (v) other non-recurring activity or items impacting comparability from period to period. Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. Net Debt to Adjusted EBITDA is the Company's share of net debt divided by Annualized Adjusted EBITDA. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to Adjusted EBITDA, as calculated by us, are not comparable to EBITDA and EBITDA-related measures reported by other REITs that do not define EBITDA and EBITDA-related measures exactly as we do. EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated from operating activities in accordance with GAAP, and should not be considered alternatives to net income as an indicator of performance or as alternatives to cash flows from operating activities as an indicator of liquidity.

Considering the nature of our business as a real estate owner and operator, the Company believes that EBITDA, Adjusted EBITDA and the ratio of Net Debt to Adjusted EBITDA are helpful to investors in measuring our operational performance because they exclude various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, the Company has also provided Annualized Adjusted EBITDA, adjusted as described above. The Company believes this supplemental information provides a meaningful measure of our operating performance. The Company believes presenting EBITDA and the related measures in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results.

|

| |

| p. 10 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

CONSOLIDATED BALANCE SHEETS (UNAUDITED) | |

|

| | | | | | | | |

| ($ in thousands) | | | | |

| | | March 31,

2018 | | December 31,

2017 |

| Assets: | | | | |

| Investment properties, at cost | | $ | 3,865,567 |

| | $ | 3,957,884 |

|

| Less: accumulated depreciation | | (671,384 | ) | | (664,614 | ) |

| | | 3,194,183 |

| | 3,293,270 |

|

| Cash and cash equivalents | | 28,753 |

| | 24,082 |

|

| Tenant and other receivables, including accrued straight-line rent of $32,182 and $31,747 respectively, net of allowance for uncollectible accounts | | 57,172 |

| | 58,328 |

|

| Restricted cash and escrow deposits | | 9,795 |

| | 8,094 |

|

| Deferred costs and intangibles, net | | 108,612 |

| | 112,359 |

|

| Prepaid and other assets | | 20,342 |

| | 16,365 |

|

| Total Assets | | $ | 3,418,857 |

| | $ | 3,512,498 |

|

| Liabilities and Shareholders’ Equity: | | | | |

|

| Mortgage and other indebtedness, net | | $ | 1,650,547 |

| | $ | 1,699,239 |

|

| Accounts payable and accrued expenses | | 102,851 |

| | 78,482 |

|

| Deferred revenue and other liabilities | | 90,940 |

| | 96,564 |

|

| Total Liabilities | | 1,844,338 |

| | 1,874,285 |

|

| Commitments and contingencies | | | | |

|

| Limited Partners’ interests in the Operating Partnership and other redeemable noncontrolling interests | | 48,834 |

| | 72,104 |

|

| Shareholders’ Equity: | | | | |

|

| Kite Realty Group Trust Shareholders’ Equity: | | | | |

|

| Common Shares, $.01 par value, 225,000,000 shares authorized, 83,675,982 and 83,606,068 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | | 837 |

| | 836 |

|

| Additional paid in capital | | 2,073,316 |

| | 2,071,418 |

|

| Accumulated other comprehensive income | | 5,147 |

| | 2,990 |

|

| Accumulated deficit | | (554,313 | ) | | (509,833 | ) |

| Total Kite Realty Group Trust Shareholders’ Equity | | 1,524,987 |

| | 1,565,411 |

|

| Noncontrolling Interests | | 698 |

| | 698 |

|

| Total Equity | | 1,525,685 |

| | 1,566,109 |

|

| Total Liabilities and Equity | | $ | 3,418,857 |

| | $ | 3,512,498 |

|

|

| |

| p. 11 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) | |

|

| | | | | | | | | |

| ($ in thousands, except per share data) | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2018 | | 2017 | |

| Revenue: | | | | | |

| Minimum rent | | $ | 68,965 |

| | $ | 68,946 |

| |

| Tenant reimbursements | | 18,373 |

| | 18,570 |

| |

| Other property related revenue | | 1,063 |

| | 2,596 |

| |

| Fee income | | 1,362 |

| | — |

| |

| Total revenue | | 89,763 |

| | 90,112 |

| |

| Expenses: | | |

| | |

| |

| Property operating | | 12,470 |

| | 12,953 |

| |

| Real estate taxes | | 10,754 |

| | 10,330 |

| |

| General, administrative, and other | | 5,945 |

| | 5,470 |

| |

| Depreciation and amortization | | 38,556 |

| | 45,830 |

| |

| Impairment charge | | 24,070 |

| | 7,411 |

| |

| Total expenses | | 91,795 |

| | 81,994 |

| |

| Operating (loss) income | | (2,032 | ) | | 8,118 |

| |

| Interest expense | | (16,337 | ) | | (16,445 | ) | |

| Income tax benefit of taxable REIT subsidiary | | 23 |

| | 33 |

| |

| Other expense, net | | (151 | ) | | (139 | ) | |

| Loss from continuing operations | | (18,497 | ) | | (8,433 | ) | |

| Gains on sales of operating properties | | 500 |

| | 8,870 |

| |

| Net (loss) income | | (17,997 | ) | | 437 |

| |

| Net loss (income) attributable to noncontrolling interests | | 80 |

| | (432 | ) | |

| Net (loss) income attributable to Kite Realty Group Trust common shareholders | | $ | (17,917 | ) | | $ | 5 |

| |

| | | | | | |

| (Loss) income per common share - basic and diluted | | $ | (0.21 | ) | | $ | 0.00 |

| |

| | | | | | |

| Weighted average common shares outstanding - basic | | 83,629,669 |

| | 83,565,325 |

| |

| Weighted average common shares outstanding - diluted | | 83,629,669 |

| | 83,643,608 |

| |

| Cash dividends declared per common share | | $ | 0.3175 |

| | $ | 0.3025 |

| |

|

| |

| p. 12 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | | | | | | | | |

| ($ in thousands, except per share data) | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2018 | | 2017 | |

| Funds From Operations ("FFO") | | | | | |

| Consolidated net (loss) income | | $ | (17,997 | ) | | $ | 437 |

| |

| Less: net income attributable to noncontrolling interests in properties | | (351 | ) | | (432 | ) | |

| Less: gains on sales of operating properties | | (500 | ) | | (8,870 | ) | |

| Add: impairment charge | | 24,070 |

| | 7,411 |

| |

| Add: depreciation and amortization of consolidated entities, net of noncontrolling interests | | 38,278 |

| | 45,366 |

| |

FFO of the Operating Partnership1 | | 43,500 |

| | 43,912 |

| |

| Less: Limited Partners' interests in FFO | | (1,022 | ) | | (989 | ) | |

FFO attributable to Kite Realty Group Trust common shareholders1 | | $ | 42,478 |

| | $ | 42,923 |

| |

| FFO, as defined by NAREIT, per share of the Operating Partnership - basic | | $ | 0.51 |

| | $ | 0.51 |

| |

| FFO, as defined by NAREIT, per share of the Operating Partnership - diluted | | $ | 0.51 |

| | $ | 0.51 |

| |

| | | | | | |

| | | | | | |

| Weighted average common shares outstanding - basic | | 83,629,669 |

| | 83,565,325 |

| |

| Weighted average common shares outstanding - diluted | | 83,668,918 |

| | 83,643,608 |

| |

| Weighted average common shares and units outstanding - basic | | 85,642,329 |

| | 85,529,910 |

| |

| Weighted average common shares and units outstanding - diluted | | 85,681,578 |

| | 85,608,193 |

| |

| | | | | | |

| FFO, as defined by NAREIT, per diluted share | | | | | |

| Consolidated net (loss) income | | $ | (0.21 | ) | | $ | 0.01 |

| |

| Less: net income attributable to noncontrolling interests in properties | | — |

| | (0.01 | ) | |

| Less: gains on sales of operating properties | | (0.01 | ) | | (0.10 | ) | |

| Add: impairment charge | | 0.28 |

| | 0.08 |

| |

| Add: depreciation and amortization of consolidated entities, net of noncontrolling interests | | 0.45 |

| | 0.53 |

| |

FFO, as defined by NAREIT, of the Operating Partnership per diluted share1 | | $ | 0.51 |

| | $ | 0.51 |

| |

| | | | | | |

|

| |

| ____________________ |

| 1 | “FFO of the Operating Partnership" measures 100% of the operating performance of the Operating Partnership’s real estate properties. “FFO attributable to Kite Realty Group Trust common shareholders” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership. |

|

| |

| p. 13 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

ADJUSTED FUNDS FROM OPERATIONS AND OTHER FINANCIAL INFORMATION | |

|

| | | | | | | | | |

| ($ in thousands) | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2018 | | 2017 | |

| Reconciliation of FFO, as adjusted, to Adjusted Funds from Operations (AFFO) | | |

| | |

| |

| FFO, as defined by NAREIT, of the Operating Partnership | | $ | 43,500 |

| | $ | 43,912 |

| |

| Add: | | |

| | |

| |

| Depreciation of non-real estate assets | | 277 |

| | 471 |

| |

| Amortization of deferred financing costs | | 660 |

| | 682 |

| |

| Non-cash compensation expense | | 1,186 |

| | 1,195 |

| |

| Less: | | |

| | |

| |

| Straight-line rent | | 951 |

| | 1,321 |

| |

| Market rent amortization income | | 2,576 |

| | 850 |

| |

| Amortization of debt premium | | 990 |

| | 773 |

| |

Other cash and non-cash adjustments1 | | — |

| | 866 |

| |

Capital expenditures2: | | | | | |

Maintenance capital expenditures3 | | 721 |

| | 873 |

| |

| Revenue enhancing tenant improvements – retail | | 2,793 |

| | 6,554 |

| |

| Revenue enhancing tenant improvements – office | | — |

| | — |

| |

| External lease commissions | | 450 |

| | 620 |

| |

| Total AFFO of the Operating Partnership | | $ | 37,142 |

| | $ | 34,403 |

| |

| | | | | | |

| Other Financial Information: | | | | | |

| Scheduled debt principal payments | | $ | 1,530 |

| | $ | 1,115 |

| |

| Capitalized interest cost | | $ | 434 |

| | $ | 742 |

| |

| Mark to market lease amount in Deferred revenue and other liabilities on consolidated balance sheet | | $ | 76,600 |

| | $ | 93,290 |

| |

Acreage of undeveloped, vacant land in the operating portfolio4 | | 46.9 |

| | | |

|

| | | | | | | | |

| | | March 31,

2018 | | December 31,

2017 |

| Investment Properties, at Cost: | | |

| | |

|

Land, building and improvements4 | | $ | 3,781,646 |

| | $ | 3,873,149 |

|

| Furniture, equipment and other | | 8,757 |

| | 8,453 |

|

| Land held for development | | 31,142 |

| | 31,142 |

|

| Construction in progress | | 44,022 |

| | 45,140 |

|

| Total | | $ | 3,865,567 |

| | $ | 3,957,884 |

|

|

| |

| ____________________ |

| 1 | Reflects a non-cash termination fee for the quarter ended March 31, 2017. |

| 2 | Excludes landlord work, tenant improvements and leasing commissions relating to development and 3-R projects. |

| 3 | A portion of these capital improvements are reimbursed by tenants and are revenue producing. |

| 4 | Includes undeveloped vacant land with a book value of $21.0 million at March 31, 2018. |

|

| |

| p. 14 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

MARKET CAPITALIZATION AS OF MARCH 31, 2018 | |

|

| | | | | | | | | | |

| ($ in thousands) | | | | | |

| | Percent of Total Equity | | Total Market Capitalization | | Percent of Total Market Capitalization |

| Equity Capitalization: | | | | | |

| Total Common Shares Outstanding | 97.6 | % | | 83,675,982 |

| | |

| Operating Partnership ("OP") Units Outstanding | 2.4 | % | | 2,066,849 |

| | |

| Combined Common Shares and OP Units | 100.0 | % | | 85,742,831 |

| | |

| Market Price of Common Shares | | | $ | 15.23 |

| | |

| Total Equity Capitalization | | | 1,305,863 |

| | 45 | % |

| Debt Capitalization: | | | |

| | |

| Company Consolidated Outstanding Debt | | | 1,650,547 |

| | |

| Plus: Debt Premium and Issuance Costs, net | | | 1,742 |

| | |

| Plus: Company Share of Unconsolidated Joint Venture Debt | | | 4,168 |

| | |

Less: Partner Share of Consolidated Joint Venture Debt1 | | | (13,373 | ) | | |

| Company Share of Outstanding Debt | | | 1,643,084 |

| | |

| Less: Cash, Cash Equivalents, and Restricted Cash | | | (38,548 | ) | | |

| Total Net Debt Capitalization | | | 1,604,536 |

| | 55 | % |

| Total Enterprise Value | | | $ | 2,910,399 |

| | 100 | % |

| | | | | | |

RATIO OF DEBT TO TOTAL UNDEPRECIATED ASSETS AS OF MARCH 31, 2018 |

| Consolidated Undepreciated Real Estate Assets | | | $ | 3,865,567 |

| | |

| Company Share of Unconsolidated Real Estate Assets | | | 6,934 |

| | |

| | | | 3,872,501 |

| | |

| Total Debt Capitalization | | | 1,617,909 |

| | |

| Ratio of Debt to Total Undepreciated Real Estate Assets | | | 41.8 | % | | |

| | | | | | |

RATIO OF COMPANY SHARE OF NET DEBT TO EBITDA AS OF MARCH 31, 2018 |

| Company's Consolidated Debt & Share of Unconsolidated Debt | | | $ | 1,643,084 |

| | |

| Less: Cash, Cash Equivalents, and Restricted Cash | | (38,548 | ) | | |

| | | | 1,604,536 |

| | |

| Q1 2018 EBITDA, Annualized: | | | | | |

| - Consolidated EBITDA | $ | 242,376 |

| | | | |

| - Unconsolidated EBITDA | 136 |

| | | | |

- Minority interest EBITDA 1 | (1,404 | ) | | | | |

- Pro-forma adjustments 2 | (3,613 | ) | | 237,495 |

| | |

| Ratio of Company Share of Net Debt to EBITDA | |

| | 6.76x |

| | |

| | | | | | |

|

| | | | | |

| ____________________ | | | | |

| 1 | See page 18 for details |

| 2 | Relates to current quarter GAAP operating income, annualized, for properties sold during the quarter. |

|

| |

| p. 15 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

SAME PROPERTY NET OPERATING INCOME (NOI) | |

|

| | | | | | | | | | |

| ($ in thousands) | | | | | | |

| | Three Months Ended March 31, | |

| | 2018 | | 2017 | | % Change | |

Number of properties for the quarter1 | 102 |

| | 102 |

| | | |

| | | | | | | |

| Leased percentage at period end | 94.6 | % | | 95.1 | % | | | |

Economic Occupancy percentage2 | 93.3 | % | | 94.0 | % | | | |

| | | | | | | |

| Minimum rent | $ | 57,653 |

| | $ | 57,128 |

| | | |

| Tenant recoveries | 16,682 |

| | 16,317 |

| | | |

| Other income | 271 |

| | 284 |

| | | |

| | 74,606 |

| | 73,729 |

| | | |

| | | | | | | |

| Property operating expenses | (10,672 | ) | | (10,517 | ) | | | |

| Bad debt expense | (364 | ) | | (598 | ) | | | |

| Real estate taxes | (9,947 | ) | | (9,771 | ) | | | |

| | (20,983 | ) | | (20,886 | ) | | | |

Same Property NOI3 | $ | 53,623 |

| | $ | 52,843 |

| | 1.5% | |

| | | | | | | |

| Reconciliation of Same Property NOI to Most Directly Comparable GAAP Measure: | | | | | | |

| Net operating income - same properties | $ | 53,623 |

| | $ | 52,843 |

| | | |

Net operating income - non-same activity4 | 11,554 |

| | 13,987 |

| | | |

| Other income (expense), net | 1,234 |

| | (107 | ) | | | |

| General, administrative and other | (5,945 | ) | | (5,470 | ) | | | |

| Impairment charge | (24,070 | ) | | (7,411 | ) | | | |

| Depreciation and amortization expense | (38,556 | ) | | (45,830 | ) | | | |

| Interest expense | (16,337 | ) | | (16,445 | ) | | | |

| Gains on sales of operating properties | 500 |

| | 8,870 |

| | | |

| Net loss (income) attributable to noncontrolling interests | 80 |

| | (432 | ) | | | |

| Net (loss) income attributable to common shareholders | $ | (17,917 | ) | | $ | 5 |

| | | |

|

| |

| ____________________ |

| 1 | Same Property NOI excludes seven properties in redevelopment, the recently completed Northdale Promenade, Burnt Store Marketplace, and Parkside Town Commons - Phase II, as well as office properties (Thirty South Meridian and Eddy Street Commons). |

| 2 | Excludes leases that are signed but for which tenants have not yet commenced the payment of cash rent. Calculated as a weighted average based on the timing of cash rent commencement and expiration during the period. |

| 3 | Same Property NOI excludes net gains from outlot sales, straight-line rent revenue, lease termination fees, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. |

| 4 | Includes non-cash activity across the portfolio as well as net operating income from properties not included in the same property pool. |

|

| |

| p. 16 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

NET OPERATING INCOME BY QUARTER | |

|

| | | | | | | | | | | | | | | | | | | | |

| ($ in thousands) | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31,

2018 | | December 31, 2017 | | September 30, 2017 | | June 30,

2017 | | March 31, 2017 |

| Revenue: | | | | | | | | | | |

Minimum rent1 | | $ | 68,965 |

| | $ | 68,518 |

| | $ | 67,585 |

| | $ | 68,395 |

| | $ | 68,946 |

|

| Tenant reimbursements | | 18,373 |

| | 18,252 |

| | 17,657 |

| | 18,521 |

| | 18,570 |

|

Other property related revenue2 | | 434 |

| | 358 |

| | 1,252 |

| | 5,267 |

| | 1,858 |

|

| Overage rent | | 148 |

| | 780 |

| | 82 |

| | 16 |

| | 266 |

|

Parking revenue, net3 | | 67 |

| | 218 |

| | 138 |

| | 137 |

| | 81 |

|

| | | 87,987 |

| | 88,126 |

| | 86,714 |

| | 92,336 |

| | 89,721 |

|

| Expenses: | | | | | | | | | | |

Property operating - Recoverable4 | | 10,235 |

| | 10,018 |

| | 9,533 |

| | 9,386 |

| | 10,376 |

|

Property operating - Non-Recoverable4 | | 1,984 |

| | 2,417 |

| | 2,053 |

| | 2,573 |

| | 2,318 |

|

| Real estate taxes | | 10,591 |

| | 10,638 |

| | 10,675 |

| | 11,095 |

| | 10,198 |

|

| | | 22,810 |

| | 23,073 |

| | 22,261 |

| | 23,054 |

| | 22,892 |

|

| Net Operating Income - Properties | | 65,177 |

| | 65,053 |

| | 64,453 |

| | 69,282 |

| | 66,829 |

|

| Other (Expenses) Income: | | | | | | | | | | |

| General, administrative, and other | | (5,945 | ) | | (5,360 | ) | | (5,431 | ) | | (5,488 | ) | | (5,470 | ) |

| Fee income | | 1,362 |

| | 377 |

| | — |

| | — |

| | — |

|

| | | (4,583 | ) | | (4,983 | ) | | (5,431 | ) | | (5,488 | ) | | (5,470 | ) |

| Earnings Before Interest, Taxes, Depreciation and Amortization | | 60,594 |

| | 60,070 |

| | 59,022 |

| | 63,794 |

| | 61,359 |

|

| Impairment charge | | (24,070 | ) | | — |

| | — |

| | — |

| | (7,411 | ) |

| Depreciation and amortization | | (38,556 | ) | | (40,758 | ) | | (42,793 | ) | | (42,710 | ) | | (45,830 | ) |

| Interest expense | | (16,337 | ) | | (16,452 | ) | | (16,372 | ) | | (16,433 | ) | | (16,445 | ) |

| Income tax benefit (expense) of taxable REIT subsidiary | | 23 |

| | 36 |

| | 33 |

| | (3 | ) | | 33 |

|

| Other expense, net | | (151 | ) | | (101 | ) | | (94 | ) | | (80 | ) | | (139 | ) |

| (Loss) Income From Continuing Operations | | (18,497 | ) | | 2,795 |

| | (204 | ) | | 4,568 |

| | (8,433 | ) |

| Gains on sales of operating properties | | 500 |

| | — |

| | — |

| | 6,290 |

| | 8,870 |

|

| Net (loss) income | | (17,997 | ) | | 2,795 |

| | (204 | ) | | 10,858 |

| | 437 |

|

| Less: Net loss (income) attributable to noncontrolling interests | | 80 |

| | (486 | ) | | (418 | ) | | (678 | ) | | (432 | ) |

| Net (loss) income attributable to Kite Realty Group Trust | | $ | (17,917 | ) | | $ | 2,309 |

| | $ | (622 | ) | | $ | 10,180 |

| | $ | 5 |

|

| NOI/Revenue | | 74.1 | % | | 73.8 | % | | 74.3 | % | | 75.0 | % | | 74.5 | % |

Recovery Ratios5 | | | | | | | | | | |

| - Retail Properties | | 90.5 | % | | 90.9 | % | | 89.9 | % | | 93.1 | % | | 92.0 | % |

| - Consolidated | | 88.2 | % | | 88.4 | % | | 87.4 | % | | 90.4 | % | | 90.3 | % |

|

| |

| ____________________ |

| 1 | Minimum rent includes $5.0 million in ground lease-related revenue for the three months ended March 31, 2018. |

| 2 | Other property related revenue for the three months ended March 31, 2018 includes $0.1 million of lease termination income. |

| 3 | Parking revenue, net represents the net operating results of the Eddy Street Parking Garage and the Union Station Parking Garage. In the three months ended March 31, 2018, this amount was calculated as revenue of $487,000 less real estate taxes and property operating expenses of $162,000 and $253,000, respectively. |

| 4 | Recoverable expenses include total management fee expense (or recurring G&A expense of $1.3 million) allocable to the property operations in the three months ended March 31, 2018, a portion of which is recoverable. Non-recoverable expenses primarily include bad debt provision, ground rent, professional fees, and operating costs for Lake Lofts at Deerwood. |

| 5 | “Recovery Ratio” is computed by dividing tenant reimbursements by the sum of recoverable property operating expense and real estate tax expense. |

|

| |

| p. 17 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

CONSOLIDATED JOINT VENTURE SUMMARY - MARCH 31, 2018 | |

($ in thousands)

|

| | | | | | | | | | | | | | |

| Ownership | | | | | | | |

Joint Venture Entity | Location (MSA) | Owned GLA | KRG Ownership % | | Current KRG Economic Ownership%1 | | |

| Delray Marketplace | Delray, FL |

| 260,255 |

| 50% | | 98% | | |

| Pan Am Plaza | Indianapolis, IN |

| — |

| 85% | | 85% | | |

| Crossing at Killingly Commons | Killingly, CT |

| 208,929 |

| 55% | | 90% | | |

Territory Portfolio2 | Las Vegas, NV |

| 847,690 |

| 78% | | 94% | | |

| Balance Sheet | | Current Partner Economic Ownership % | | | | | |

| Joint Venture Entity | Debt Balance | Partner Share of Debt | | Redeemable Noncontrolling Interest | | |

| Delray Marketplace | $ | 56,850 |

| 2% | $ | 1,138 |

| | $ | — |

| | |

| Pan Am Plaza | — |

| 15% | — |

| | — |

| | |

| Crossing at Killingly Commons | 33,000 |

| 10% | 3,300 |

| | 10,070 |

| | |

Territory Portfolio2 | 148,940 |

| 6% | 8,935 |

| | — |

| | |

| Total | $ | 238,790 |

| | $ | 13,373 |

| | $ | 10,070 |

| | |

| Income Statement | | | | | |

| Joint Venture Entity | Quarterly Minority Interest | | Annualized Minority Interest | |

| Delray Marketplace | | | $ | — |

| | $ | — |

| | KRG has an 8% cumulative preferred return |

| Pan Am Plaza | | | — |

| | — |

| | Project currently in Land Held For Development |

| Crossing at Killingly Commons | | | 132 |

| | 528 |

| | Partner receives a fixed annual preferred payment of 5.5% on $9.6 million |

Territory Portfolio2 | | | 219 |

| | 876 |

| | Partner receives a fixed annual preferred payment of 4% on $21.9 million |

| Total | | | $ | 351 |

| | $ | 1,404 |

| | |

|

| | | | | | | |

| ____________________ |

| 1 | Economic ownership % represents the Company's share of cash flow. |

| 2 | Joint Venture includes six operating properties located in Las Vegas, Nevada. Our partner has elected to redeem its remaining interest of $21.9 million of its interest for cash. The Company can determine the timing of the closing of this transaction, but it must occur before November 8, 2018. |

|

| |

| p. 18 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

SUMMARY OF OUTSTANDING DEBT AS OF March 31, 2018 | |

|

| | | | | | | | | | | | | |

| ($ in thousands) | | | | | | | |

TOTAL OUTSTANDING DEBT1 | | | | | | |

| | Outstanding Amount | | Ratio | | Weighted Average

Interest Rate | | Weighted Average

Maturity (in years) |

| Fixed Rate Debt | $ | 1,477,467 |

| | 89 | % | | 4.11 | % | | 5.5 |

|

| Variable Rate Debt | 174,822 |

| | 11 | % | | 3.38 | % | | 3.9 |

|

| Net Debt Premiums and Issuance Costs, Net | (1,742 | ) | | N/A |

| | N/A |

| | N/A |

|

| Total Consolidated Debt | 1,650,547 |

| | 100 | % | | 4.04 | % | | 5.3 |

|

KRG Share of Unconsolidated Debt2 | 4,168 |

| | — | % | | 4.38 | % | 6.3 |

| 6.3 |

|

| Total | $ | 1,654,715 |

| | 100 | % | | 4.04 | % | | 5.3 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| SCHEDULE OF MATURITIES BY YEAR | | | | | | | | |

| | | Secured Debt | | | | | | | | |

Scheduled Principal

Payments | | Term

Maturities | | Unsecured

Debt3 | | Total Consolidated Debt | | Total Unconsolidated Debt | | Total Outstanding Debt |

| 2018 | | $ | 4,106 |

| | $ | 4,254 |

| | $ | — |

| | $ | 8,360 |

| | $ | — |

| | $ | 8,360 |

|

| 2019 | | 5,974 |

| | — |

| | — |

| | 5,974 |

| | — |

| | 5,974 |

|

| 2020 | | 5,919 |

| | 42,339 |

| | — |

| | 48,258 |

| | 100 |

| | 48,358 |

|

| 2021 | | 4,625 |

| | 159,875 |

| | 246,600 |

| | 411,100 |

| | 245 |

| | 411,345 |

|

| 2022 | | 1,113 |

| | 205,208 |

| | 200,000 |

| | 406,321 |

| | 258 |

| | 406,579 |

|

| 2023 | | 806 |

| | 214,940 |

| | 95,000 |

| | 310,746 |

| | 270 |

| | 311,016 |

|

| 2024 | | 854 |

| | — |

| | — |

| | 854 |

| | 3,295 |

| | 4,149 |

|

| 2025 | | 904 |

| | — |

| | 80,000 |

| | 80,904 |

| | — |

| | 80,904 |

|

| 2026 And Beyond | | 4,672 |

| | 100 |

| | 375,000 |

| | 379,772 |

| | — |

| | 379,772 |

|

| Net Debt Premiums and Issuance Cost, Net | | (1,742 | ) | | — |

| | — |

| | (1,742 | ) | | — |

| | (1,742 | ) |

| Total | | $ | 27,231 |

| | $ | 626,716 |

| | $ | 996,600 |

| | $ | 1,650,547 |

| | $ | 4,168 |

| | $ | 1,654,715 |

|

|

| |

| 1 | Fixed rate debt includes, and variable rate date excludes, the portion of such debt that has been hedged by interest rate derivatives. As of March 31,2018, $385.2 million in variable rate debt is hedged for a weighted average 3.0 years. |

| 2 | Unconsolidated debt is a variable rate construction loan. |

| 3 | This presentation reflects the Company's exercise of its option to extend the maturity date by one year to July 28, 2021 for the Company's unsecured credit facility. |

|

| |

| p. 19 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

MATURITY SCHEDULE OF OUTSTANDING DEBT AS OF March 31, 2018 | |

|

| | | | | | | | | | | | |

| ($ in thousands) | | | | | | | | | |

| Property | Lender | | Interest Rate1 | | Maturity Date | | Balance as of

March 31, 2018 | | % of Total Outstanding |

| | | | | | | | | | |

| | | | | | | | | | |

| Whitehall Pike | CMBS | | 6.71 | % | | 7/5/2018 | | 4,413 |

| | |

| 2018 Debt Maturities | | | | | | | 4,413 |

| | 0.3 | % |

| | | | | | | | | | |

| 2019 Debt Maturities | | | | | | | — |

| | — | % |

| | | | | | | | | | |

| Fishers Station | Old National Bank | | LIBOR + 225 |

| | 1/4/2020 | | 6,474 |

| | |

| Lake City Commons/12th Street Plaza/University Town Center II | CMBS | | 5.7 | % | | 9/1/2020 | | 20,699 |

| | |

| Thirty South | Associated Bank | | LIBOR + 205 |

| | 12/31/2020 | | 17,099 |

| | |

| 2020 Debt Maturities | | | | | | | 44,272 |

| | 2.7 | % |

| | | | | | | | | | |

| Waxahachie Crossing | CMBS | | 5.55 | % | | 3/1/2021 | | 7,750 |

| | |

| International Speedway Square | CMBS | | 5.77 | % | | 4/1/2021 | | 18,921 |

| | |

| Lima Marketplace | CMBS | | 5.8 | % | | 4/1/2021 | | 8,383 |

| | |

| Bell Oaks Centre | CMBS | | 5.59 | % | | 4/1/2021 | | 6,548 |

| | |

| Northcrest Shopping Center | CMBS | | 5.48 | % | | 5/1/2021 | | 15,780 |

| | |

| University Town Center | CMBS | | 5.48 | % | | 6/1/2021 | | 18,690 |

| | |

| Village at Bay Park | CMBS | | 5.58 | % | | 6/1/2021 | | 9,183 |

| | |

| Silver Springs Pointe | CMBS | | 5.03 | % | | 7/1/2021 | | 8,800 |

| | |

| Lake Mary Plaza | CMBS | | 5.1 | % | | 7/1/2021 | | 5,080 |

| | |

Unsecured Credit Facility2,3 | KeyBank (Admin. Agent) | | LIBOR + 135 |

| | 7/28/2021 | | 46,600 |

| | |

Unsecured Term Loan3 | KeyBank (Admin. Agent) | | LIBOR + 130 |

| | 7/28/2021 | | 200,000 |

| | |

| Bayport Commons | CMBS | | 5.44 | % | | 9/1/2021 | | 11,845 |

| | |

| Eddy Street Commons | CMBS | | 5.44 | % | | 9/1/2021 | | 22,978 |

| | |

| Four Property Pool Loan | CMBS | | 5.44 | % | | 9/1/2021 | | 33,607 |

| | |

| 2021 Debt Maturities | | | | | | | 414,165 |

| | 25.1 | % |

| | | | | | | | | | |

| Centre at Panola, Phase I | CMBS | | 6.78 | % | | 1/1/2022 | | 1,585 |

| | |

Delray Marketplace4 | Bank of America | | LIBOR + 160 |

| | 2/5/2022 | | 56,850 |

| | |

| Palm Coast Landing | CMBS | | 5 | % | | 3/1/2022 | | 22,189 |

| | |

| Bayonne Crossing | CMBS | | 4.33 | % | | 4/1/2022 | | 44,316 |

| | |

| Saxon Crossing | CMBS | | 4.65 | % | | 7/1/2022 | | 11,400 |

| | |

| Merrimack Village Center | CMBS | | 4.36 | % | | 7/6/2022 | | 5,445 |

| | |

| Shops at Moore | CMBS | | 4.29 | % | | 9/1/2022 | | 21,300 |

| | |

| Shops at Julington Creek | CMBS | | 4.6 | % | | 9/1/2022 | | 4,785 |

| | |

| Centre Point Commons | CMBS | | 4.34 | % | | 10/1/2022 | | 14,410 |

| | |

Unsecured Term Loan3 | KeyBank (Admin. Agent) | | LIBOR + 160 |

| | 10/26/2022 | | 200,000 |

| | |

| Miramar Square | CMBS | | 4.16 | % | | 12/1/2022 | | 31,625 |

| | |

| 2022 Debt Maturities | | | | | | | 413,905 |

| | 25.1 | % |

| See footnotes on next page | | | | | | | | | |

|

| |

| p. 20 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

MATURITY SCHEDULE OF OUTSTANDING DEBT AS OF March 31, 2018 (CONTINUED) | |

|

| | | | | | | | | | | | | | | |

| ($ in thousands) | | | | | | | | | |

| Property | Lender | | Interest Rate1 | | Maturity Date | | Balance as of

March 31, 2018 | | % of Total Outstanding |

| | | | | | | | | | |

Centennial Gateway / Eastgate5 | CMBS | | 3.81 | % | | 1/1/2023 | | 44,385 |

| | |

Crossing at Killingly Commons5 | Huntington Bank | | LIBOR + 170 |

| | 1/1/2023 | | 33,000 |

| | |

Centennial Center5 | CMBS | | 3.83 | % | | 1/6/2023 | | 70,455 |

| | |

Eastern Beltway5 | CMBS | | 3.83 | % | | 1/6/2023 | | 34,100 |

| | |

| The Corner | CMBS | | 4.10 | % | | 3/1/2023 | | 14,750 |

| | |

| Chapel Hill | CMBS | | 3.78 | % | | 4/1/2023 | | 18,250 |

| | |

| Senior Unsecured Note | Various | | 4.23 | % | | 9/10/2023 | | 95,000 |

| | |

| 2023 Debt Maturities | | | | | | | 309,940 |

| | 18.7 | % |

| | | | | | | | | | |

| 2024 Debt Maturities | | | | | | | — |

| | — | % |

| | | | | | | | | | |

| Senior Unsecured Note | Various | | 4.47 | % | | 9/10/2025 | | 80,000 |

| | |

| 2025 Debt Maturities | | | | | | | 80,000 |

| | 4.8 | % |

| | | | | | | | | | |

| Senior Unsecured Note | Various | | 4.00 | % | | 10/1/2026 | | 300,000 |

| | |

| Senior Unsecured Note | Various | | 4.57 | % | | 9/10/2027 | | 75,000 |

| | |

| Rampart Commons | CMBS | | 5.73 | % | | 6/10/2030 | | 10,594 |

| | |

| 2026 And Beyond Debt Maturities | | | | | | | 385,594 |

| | 23.2 | % |

| NET PREMIUMS ON ACQUIRED DEBT & ISSUANCE COSTS | | | | | | (1,742 | ) | | |

| TOTAL DEBT PER CONSOLIDATED BALANCE SHEET | | | | $ | 1,650,547 |

| | |

| | | | | | | | | | |

| Unconsolidated Debt | | | | | | | | |

Embassy Suites at University of Notre Dame6 | 1st Source Bank | | LIBOR + 250 |

| | 7/1/2024 | 4,168,000 |

| 4,168 |

| 4,168,000 |

| |

| TOTAL UNCONSOLIDATED DEBT | | | | | | 4,168 |

| | 0.3 | % |

| TOTAL CONSOLIDATED AND UNCONSOLIDATED DEBT | | | | | | $ | 1,654,715 |

| | 100.0 | % |

|

| |

| ____________________ |

| 1 | At March 29, 2018, one-month LIBOR was 1.88%. |

| 2 | Assumes Company exercises its option to extend the maturity date by one year. Subsequent to quarter end the company refinanced it's unsecured facilities. The rate on this facility was reduced to LIBOR + 115 and the extended loan maturity is April 22, 2023. |

| 3 | The Company has 98 unencumbered properties of which 91 are wholly owned and included in the unencumbered property pool of our unsecured facilities. |

| 4 | Property is held in a joint venture. The loan is guaranteed by Kite Realty Group, LP. See Joint Venture Summary on page 18 for additional detail. |

| 5 | Property is held in a joint venture. See Joint Venture Summary on page 18 for additional detail. |

| 6 | KRG's share of total loan commitment is $11.83 million. Beginning on July 1, 2019 the loan will convert to a fixed rate loan with an interest rate of 5.02%. On August 1, 2020 the loan will begin amortizing. |

|

| |

| p. 21 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| |

UNSECURED PUBLIC DEBT COVENANTS | |

|

| | | | | | |

| | March 31, 2018 | | Debt Covenant Threshold1 |

| | | | | |

| Total Debt to Undepreciated Assets | 41.1% | | <60% |

| | | | | |

| Secured Debt to Undepreciated Assets | 16.4% | | <40% |

| | | | | |

| Undepreciated Unencumbered Assets to Unsecured Debt | 262% | | >150% |

| | | | | |

| Debt Service Coverage | 3.4x | | >1.5x |

| | | | | |

| | | | | |

| Senior Unsecured Debt Ratings: | | | | |

| Moody's Investors Service | Baa3/Stable | | |

| Standard & Poor's Rating Services | BBB-/Stable | | |

| | | | | |

| | | | | |

| Liquidity ($ in thousands) | | | | |

| Cash and cash equivalents | | $ | 28,753 |

| | |

| Availability under unsecured credit facility | | 393,177 |

| | |

| | | $ | 421,930 |

| | |

| | | | | |

|

| | | | |

| ____________________ |

| 1 | For a complete listing of all Debt Covenants related to the Company's Senior Unsecured Notes, as well as definitions of the terms, refer to the Company's filings with the SEC. |

|

| |

| p. 22 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

TOP 10 RETAIL TENANTS BY TOTAL GROSS LEASABLE AREA (GLA) | |

As of March 31, 2018

This table includes the following:

| |

| • | Operating retail properties; |

| |

| • | Operating office properties; and |

| |

| • | Development/Redevelopment property tenants open for business or ground lease tenants who commenced paying rent as of March 31, 2018. |

|

| | | | | | | | | | | | | | | | | | | | | |

| Tenant | | Number of

Locations | | Total GLA | | Number of

Leases | | Company

Owned GLA | | Ground Lease GLA | | Number of Anchor

Owned Locations | | Anchor Owned GLA |

Walmart Stores, Inc.1 | | 13 |

| | 2,244,581 |

| | 5 |

| | — |

| | 811,956 |

| | 8 |

| | 1,432,625 |

|

| Target Corporation | | 15 |

| | 2,175,101 |

| | — |

| | — |

| | — |

| | 15 |

| | 2,175,101 |

|

| Lowe's Companies, Inc. | | 14 |

| | 2,072,666 |

| | 5 |

| | 128,997 |

| | 650,161 |

| | 9 |

| | 1,293,508 |

|

| Home Depot Inc. | | 6 |

| | 788,167 |

| | 1 |

| | — |

| | 131,858 |

| | 5 |

| | 656,309 |

|

| Kohl's Corporation | | 8 |

| | 694,386 |

| | 5 |

| | 184,516 |

| | 244,010 |

| | 3 |

| | 265,860 |

|

| Publix Super Markets, Inc. | | 14 |

| | 670,665 |

| | 14 |

| | 670,665 |

| | — |

| | — |

| | — |

|

The TJX Companies, Inc. 2 | | 21 |

| �� | 626,931 |

| | 21 |

| | 626,931 |

| | — |

| | — |

| | — |

|

Bed Bath & Beyond, Inc. 3 | | 19 |

| | 493,719 |

| | 19 |

| | 493,719 |

| | — |

| | — |

| | — |

|

| Ross Stores, Inc. | | 17 |

| | 488,707 |

| | 17 |

| | 488,707 |

| | — |

| | — |

| | — |

|

Dick's Sporting Goods, Inc.4 | | 8 |

| | 390,502 |

| | 8 |

| | 390,502 |

| | — |

| | — |

| | — |

|

| Total | | 135 |

| | 10,645,425 |

| | 95 |

| | 2,984,037 |

| | 1,837,985 |

| | 40 |

| | 5,823,403 |

|

|

| |

| ____________________ |

| 1 | Includes Sam's Club, which is owned by the same parent company. |

| 2 | Includes TJ Maxx (13), Home Goods (2) and Marshalls (6), all of which are owned by the same parent company. |

| 3 | Includes Bed Bath and Beyond (11), Buy Buy Baby (4), Christmas Tree Shops (1) and Cost Plus World Market (3), all of which are owned by the same parent company. |

| 4 | Includes Dick's Sporting Goods (7) and Golf Galaxy (1), both of which are owned by the same parent company. |

|

| |

| p. 23 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | |

TOP 25 TENANTS BY ANNUALIZED BASE RENT | |

As of March 31, 2018

($ in thousands, except per square foot data)

This table includes the following:

| |

| • | Operating retail properties; |

| |

| • | Operating office properties; and |

| |

| • | Development/Redevelopment property tenants open for business or ground lease tenants who commenced paying rent as of March 31, 2018. |

|

| | | | | | | | | | | | | | | | | | | |

| Tenant | | Number

of

Stores | | Leased GLA/NRA1 | | % of Total

GLA/NRA

of the

Portfolio | | Annualized

Base Rent2,3 | | Annualized

Base Rent

per Sq. Ft.3 | | % of Total

Portfolio

Annualized

Base Rent3 |

| Publix Super Markets, Inc. | | 14 | | 670,665 |

| | 2.8 | % | | $ | 6,739 |

| | $ | 10.05 |

| | 2.5 | % |

The TJX Companies, Inc.4 | | 21 | | 626,931 |

| | 2.6 | % | | 6,653 |

| | 10.61 |

| | 2.5 | % |

Bed Bath & Beyond, Inc.5 | | 19 | | 493,719 |

| | 2.1 | % | | 6,093 |

| | 12.34 |

| | 2.3 | % |

| PetSmart, Inc. | | 18 | | 371,735 |

| | 1.6 | % | | 5,656 |

| | 15.22 |

| | 2.1 | % |

| Ross Stores, Inc. | | 17 | | 488,707 |

| | 2.1 | % | | 5,542 |

| | 11.34 |

| | 2.1 | % |

| Lowe's Companies, Inc. | | 5 | | 128,997 |

| | 0.5 | % | | 5,204 |

| | 6.68 |

| | 1.9 | % |

Dick's Sporting Goods, Inc.6 | | 8 | | 390,502 |

| | 1.6 | % | | 4,212 |

| | 10.79 |

| | 1.6 | % |

| Nordstrom, Inc. / Nordstrom Rack (6) | | 6 | | 197,797 |

| | 0.8 | % | | 4,001 |

| | 20.23 |

| | 1.5 | % |

Ascena Retail Group7 | | 32 | | 198,882 |

| | 0.8 | % | | 3,988 |

| | 20.05 |

| | 1.5 | % |

| Michaels Stores, Inc. | | 14 | | 295,066 |

| | 1.2 | % | | 3,895 |

| | 13.20 |

| | 1.4 | % |

| Office Depot (8) / Office Max (5) | | 13 | | 269,230 |

| | 1.1 | % | | 3,684 |

| | 13.68 |

| | 1.4 | % |

| LA Fitness | | 5 | | 208,209 |

| | 0.9 | % | | 3,574 |

| | 17.16 |

| | 1.3 | % |

| Best Buy Co., Inc. | | 6 | | 213,604 |

| | 0.9 | % | | 3,084 |

| | 14.44 |

| | 1.1 | % |

| Kohl's Corporation | | 5 | | 184,516 |

| | 0.8 | % | | 2,927 |

| | 6.83 |

| | 1.1 | % |

| National Amusements | | 1 | | 80,000 |

| | 0.3 | % | | 2,898 |

| | 36.22 |

| | 1.1 | % |

| Mattress Firm Holdings Corp (17) / Sleepy's (5) | | 22 | | 101,361 |

| | 0.4 | % | | 2,841 |

| | 28.02 |

| | 1.1 | % |

| Petco Animal Supplies, Inc. | | 12 | | 167,455 |

| | 0.7 | % | | 2,819 |

| | 16.83 |

| | 1.0 | % |

Walmart Stores, Inc.8 | | 5 | | — |

| | — | % | | 2,652 |

| | 3.27 |

| | 1.0 | % |

| Ulta Beauty, Inc. | | 12 | | 127,451 |

| | 0.5 | % | | 2,559 |

| | 20.08 |

| | 0.9 | % |

| DSW Inc. | | 9 | | 175,133 |

| | 0.7 | % | | 2,491 |

| | 14.22 |

| | 0.9 | % |

| Stein Mart, Inc. | | 9 | | 307,222 |

| | 1.3 | % | | 2,381 |

| | 7.75 |

| | 0.9 | % |

| Frank Theatres | | 2 | | 122,224 |

| | 0.5 | % | | 2,311 |

| | 18.91 |

| | 0.9 | % |

| Hobby Lobby Stores, Inc. | | 5 | | 271,254 |

| | 1.1 | % | | 2,190 |

| | 8.07 |

| | 0.8 | % |

| Walgreens Boots Alliance, Inc. | | 4 | | 67,212 |

| | 0.3 | % | | 2,099 |

| | 31.23 |

| | 0.8 | % |

| The Gap / Old Navy (9) | | 9 | | 148,401 |

| | 0.6 | % | | 2,095 |

| | 14.11 |

| | 0.8 | % |

| TOTAL | | 273 | | 6,306,273 |

| | 26.2 | % | | $ | 92,587 |

| | $ | 11.56 |

| | 34.5 | % |

|

| |

| ____________________ |

| 1 | Excludes the estimated size of the structures located on land owned by the Company and ground leased to tenants. |

| 2 | Annualized base rent represents the monthly contractual rent for March 31, 2018 for each applicable tenant multiplied by 12. Annualized base rent does not include tenant reimbursements. |

| 3 | Annualized base rent and percent of total portfolio includes ground lease rent. |

| 4 | Includes TJ Maxx (13), Marshalls (6) and HomeGoods (2), all of which are owned by the same parent company. |

| 5 | Includes Bed Bath and Beyond (11), Buy Buy Baby (4) Christmas Tree Shops (1) and Cost Plus World Market (3), all of which are owned by the same parent company. |

| 6 | Includes Dick's Sporting Goods (7) and Golf Galaxy (1), both of which are owned by the same parent company. |

| 7 | Includes Ann Taylor (5), Catherines (1), Dress Barn (11), Lane Bryant (7), Justice Stores (4) and Maurices (4), all of which are owned by the same parent company. |

| 8 | Includes Sam's Club, which is owned by the same parent company. |

|

|

|

| |

| p. 24 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –3/31/18 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Comparable Space2,3 | |

Category | | Total Leases | Total Sq. Ft. | | Leases | | Sq. Ft. | | Prior Rent PSF4 | | New Rent PSF5,6 | | Cash Rent Spread | GAAP Rent Spread7 | TI, LL Work, Lease Commissions PSF8,9 |

New Leases - Q1, 20181 | | 20 |

| | 84,176 |

| | 13 | | 57,694 |

| | $ | 18.01 |

| | $ | 17.61 |

| | (2.2 | )% | (0.3 | )% | | $ | 15.49 |

| |

| New Leases - Q4, 2017 | | 48 |

| | 155,805 |

| | 19 | | 83,638 |

| | $ | 17.09 |

| | $ | 20.51 |

| | 20.0 | % | 29.7 | % | | $ | 74.23 |

| |

| New Leases - Q3, 2017 | | 39 |

| | 92,089 |

| | 18 | | 44,091 |

| | $ | 23.58 |

| | $ | 28.04 |

| | 18.9 | % | 24.9 | % | | $ | 49.06 |

| |

| New Leases - Q2, 2017 | | 51 |

| | 164,214 |

| | 23 | | 71,828 |

| | $ | 21.52 |

| | $ | 25.27 |

| | 17.4 | % | 28.1 | % | | $ | 58.67 |

| |

| | | | | | | | | | | | | | | | | | | |

Renewals - Q1, 20181 | | 45 |

| | 333,654 |

| | 45 | | 333,654 |

| | $ | 16.61 |

| | $ | 17.12 |

| | 3.1 | % | 6.6 | % | | $ | 0.97 |

| |

| Renewals - Q4, 2017 | | 83 |

| | 589,332 |

| | 83 | | 589,332 |

| | $ | 16.47 |

| | $ | 17.34 |

| | 5.3 | % | 8.8 | % | | $ | 0.73 |

| |

| Renewals - Q3, 2017 | | 47 |

| | 340,725 |

| | 47 | | 340,725 |

| | $ | 16.40 |

| | $ | 17.99 |

| | 9.7 | % | 16.4 | % | | $ | 1.63 |

| |

| Renewals - Q2, 2017 | | 45 |

| | 460,103 |

| | 45 | | 460,103 |

| | $ | 14.07 |

| | $ | 15.20 |

| | 8.0 | % | 11.3 | % | | $ | 2.42 |

| |

| | | | | | | | | | | | | | | | | | | |

Total - Q1, 20181 | | 65 |

| | 417,830 |

| | 58 | | 391,348 |

| | $ | 16.81 |

| | $ | 17.19 |

| | 2.3 | % | 5.3 | % | | $ | 3.11 |

| |

| Total - Q4, 2017 | | 131 |

| | 745,137 |

| | 102 | | 672,970 |

| | $ | 16.55 |

| | $ | 17.74 |

| | 7.2 | % | 11.2 | % | | $ | 9.86 |

| |

| Total - Q3, 2017 | | 86 |

| | 432,814 |

| | 65 | | 384,816 |

| | $ | 17.22 |

| | $ | 19.14 |

| | 11.1 | % | 17.0 | % | | $ | 7.06 |

| |

| Total - Q2, 2017 | | 96 |

| | 624,317 |

| | 68 | | 531,931 |

| | $ | 15.08 |

| | $ | 16.56 |

| | 9.8 | % | 13.9 | % | | $ | 10.02 |

| |

|