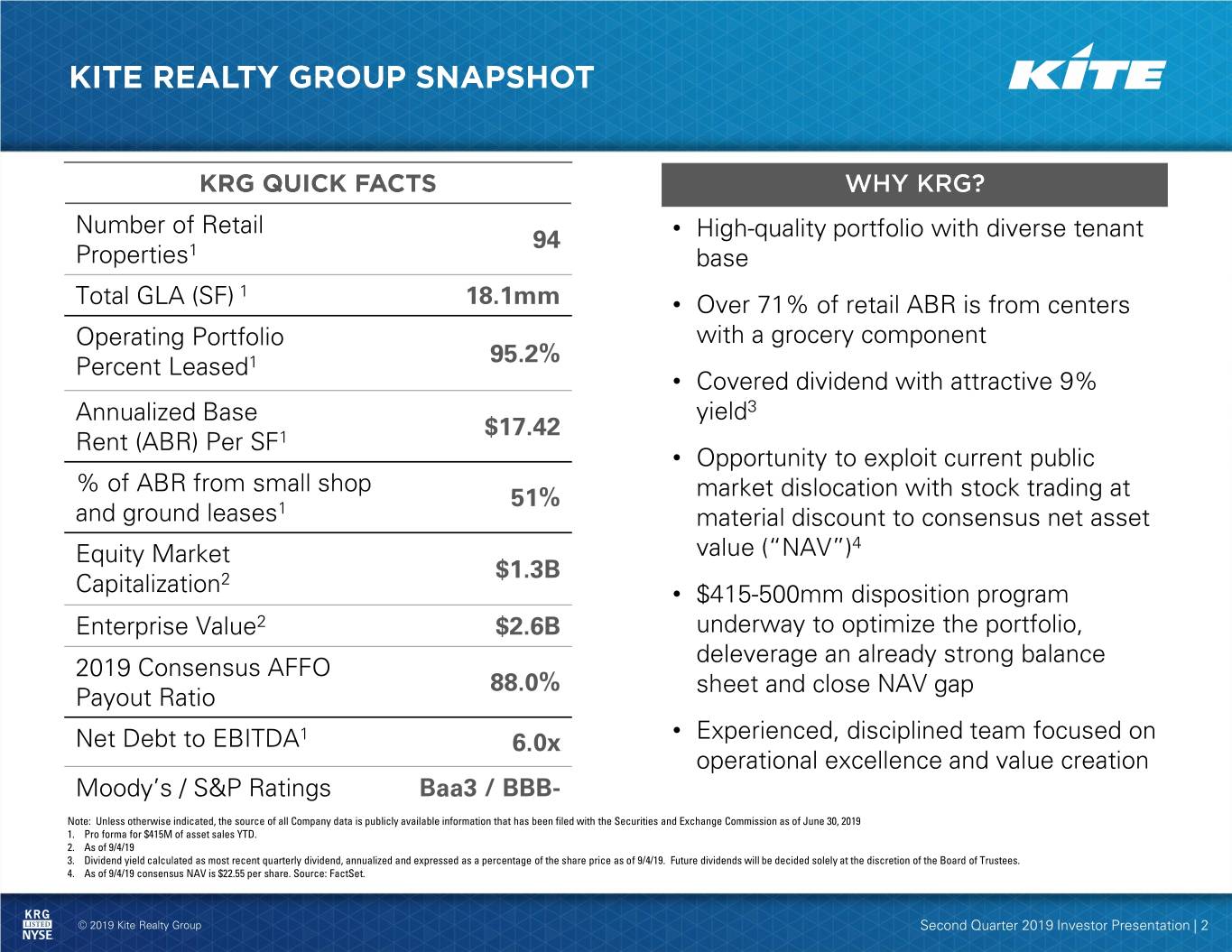

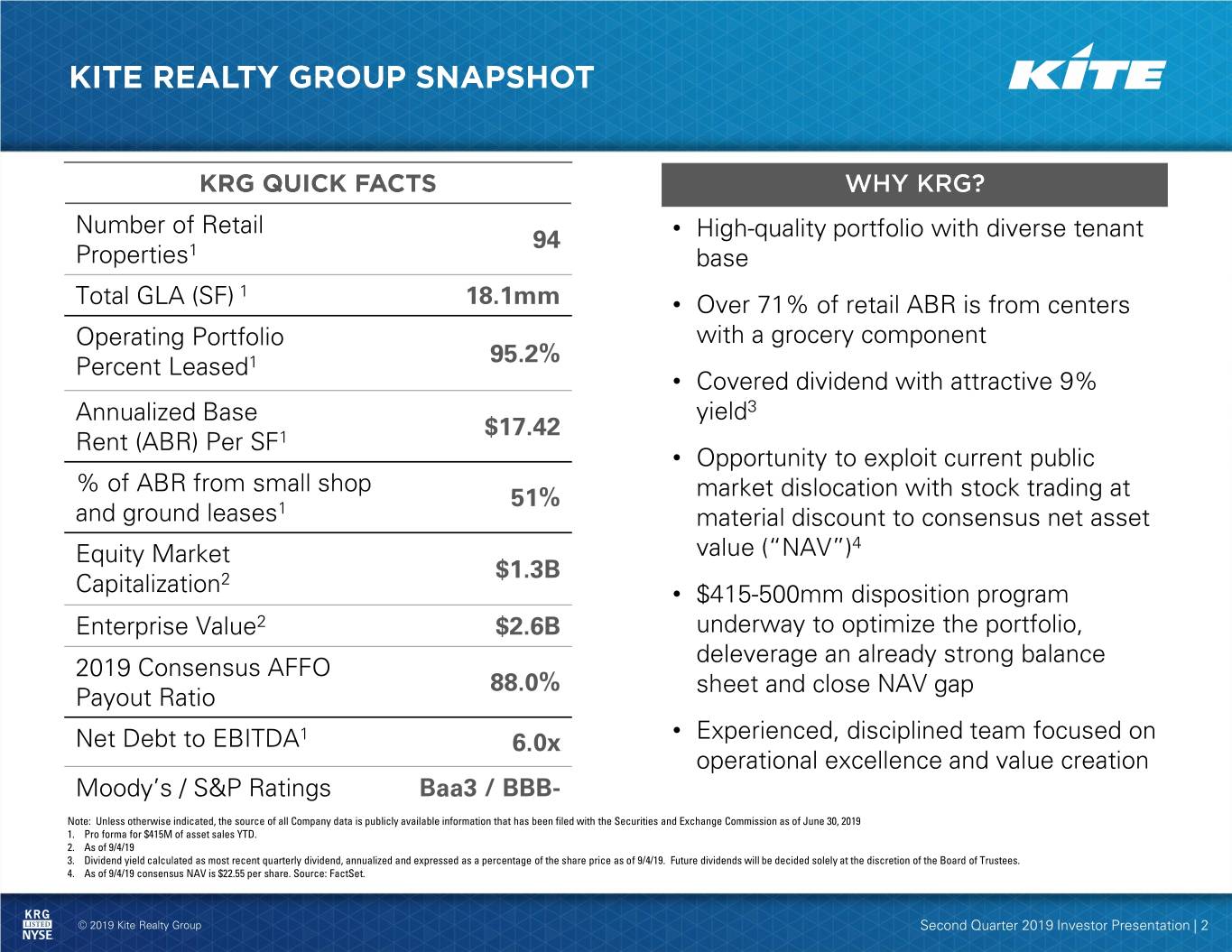

Number of Retail 94 • High-quality portfolio with diverse tenant Properties1 base 1 Total GLA (SF) 18.1mm • Over 71% of retail ABR is from centers Operating Portfolio with a grocery component 95.2% Percent Leased1 • Covered dividend with attractive 9% Annualized Base yield3 $17.42 Rent (ABR) Per SF1 • Opportunity to exploit current public % of ABR from small shop 51% market dislocation with stock trading at and ground leases1 material discount to consensus net asset Equity Market value (“NAV”)4 2 $1.3B Capitalization • $415-500mm disposition program Enterprise Value2 $2.6B underway to optimize the portfolio, deleverage an already strong balance 2019 Consensus AFFO 88.0% sheet and close NAV gap Payout Ratio Net Debt to EBITDA1 6.0x • Experienced, disciplined team focused on operational excellence and value creation Moody’s / S&P Ratings Baa3 / BBB- Note: Unless otherwise indicated, the source of all Company data is publicly available information that has been filed with the Securities and Exchange Commission as of June 30, 2019 1. Pro forma for $415M of asset sales YTD. 2. As of 9/4/19 3. Dividend yield calculated as most recent quarterly dividend, annualized and expressed as a percentage of the share price as of 9/4/19. Future dividends will be decided solely at the discretion of the Board of Trustees. 4. As of 9/4/19 consensus NAV is $22.55 per share. Source: FactSet. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 2

Note: Demographic data source: STI: Popstats based on estimated 2018 data on a 5-mile radius from KRG market assets, per the US Census Bureau, weighted by ABR Population Growth 2018 – 2023. Pro forma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 3

Average Q2 2019 Average Q2 2019 Average Q2 2019 Household Income Household Income Household Income Average Q2 2019 Average Q2 2019 Average Q2 2019 Population Population Population 1. STI: Popstats based on estimated 2018 data on a 5-mile radius from the U.S. Census Bureau, weighted by ABR. Property classification based on definition by Green Street Advisors. In summary: Neighborhood Center: Convenience-oriented center often anchored by a grocery Community Center: Larger center with general merchandise or convenience-oriented offerings Power Center: Category-dominant anchors, including discount, off-price, and wholesale clubs with minimal small shop tenants 2. Pro forma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 4

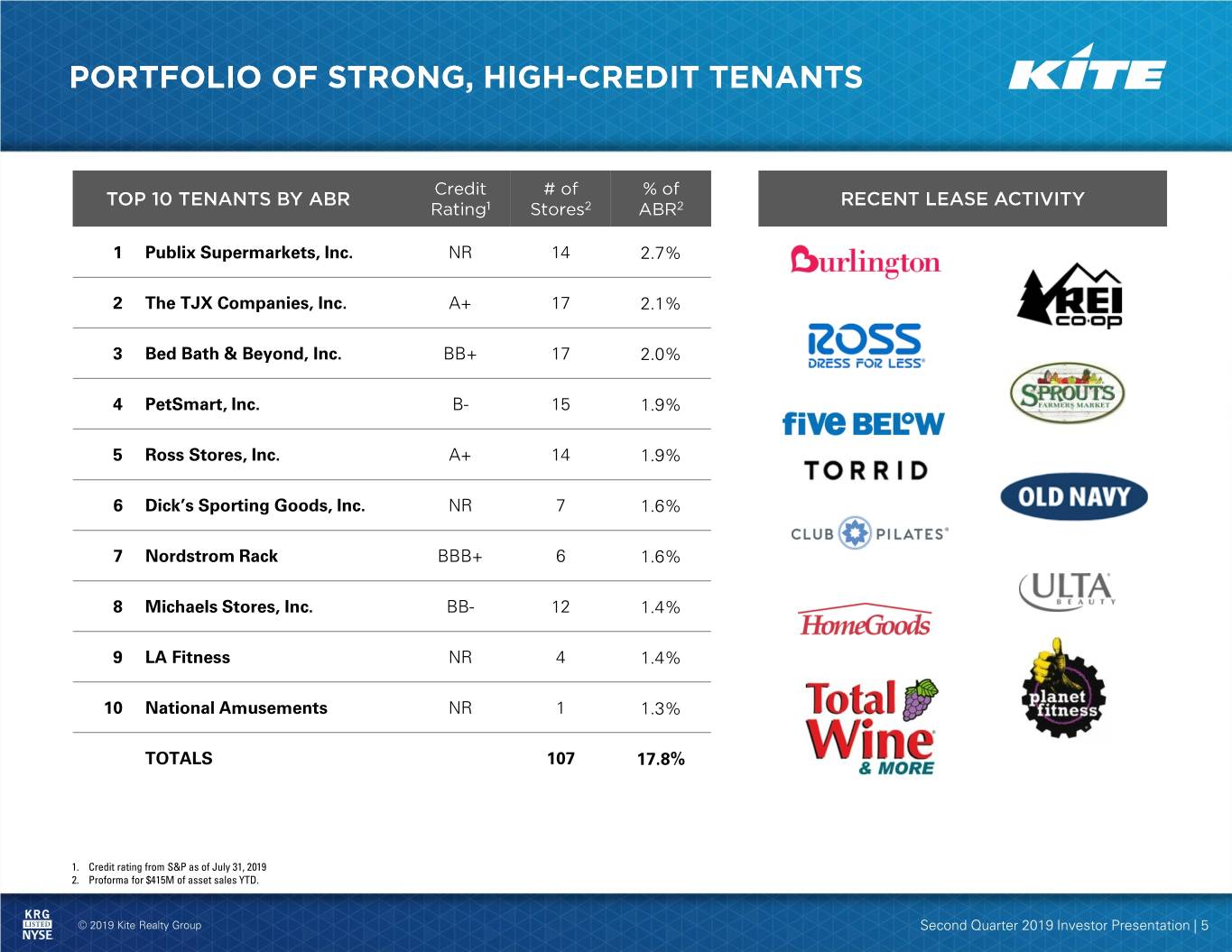

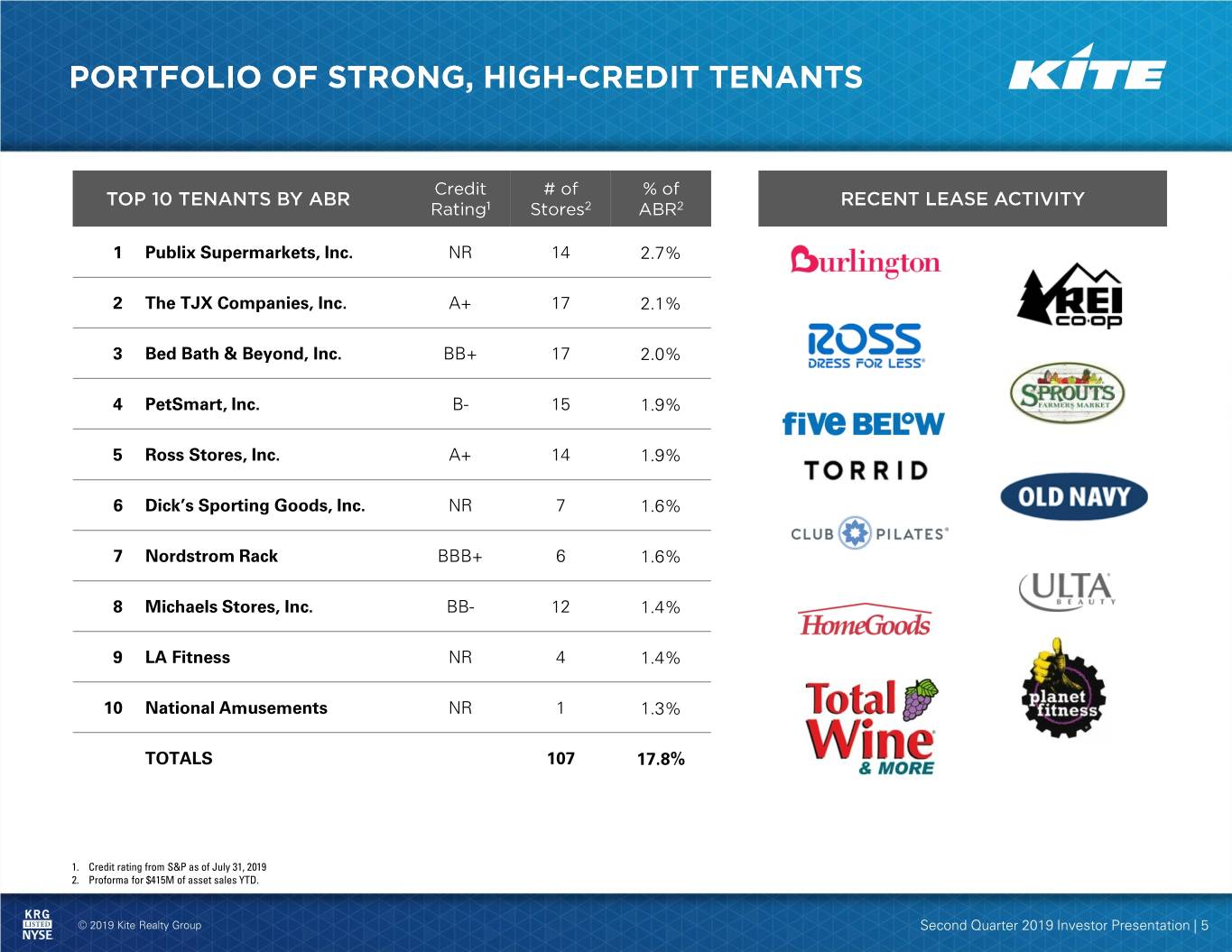

1 Publix Supermarkets, Inc. NR 14 2.7% 2 The TJX Companies, Inc. A+ 17 2.1% 3 Bed Bath & Beyond, Inc. BB+ 17 2.0% 4 PetSmart, Inc. B- 15 1.9% 5 Ross Stores, Inc. A+ 14 1.9% 6 Dick’s Sporting Goods, Inc. NR 7 1.6% 7 Nordstrom Rack BBB+ 6 1.6% 8 Michaels Stores, Inc. BB- 12 1.4% 9 LA Fitness NR 4 1.4% 10 National Amusements NR 1 1.3% TOTALS 107 17.8% 1. Credit rating from S&P as of July 31, 2019 2. Proforma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 5

• At $14.73 per share, KRG would trade at a 35% discount to consensus NAV of $22.55 per share1 • While the entire retail sector has been under pressure for several years, the retail peer group2 trades at an average NAV discount of 18% to consensus as compared to KRG’s 35% to consensus discount1 AKR 3% 28.90 6.00% 49% FRT 3% 27.12 6.25% 46% KIM 5% 25.47 6.50% 42% REG 8% 23.95 6.75% 38% ROIC 9% 22.55 7.00% 35% SITC 10% 21.22 7.25% 31% BRX 16% 19.99 7.50% 26% WRI 19% RPT 19% 18.84 7.75% 22% UE 23% 17.76 8.00% 17% RPAI 31% 16.75 8.25% 12% CDR 57% Average 18% KRG1 35% 1. Based on information provided from FactSet and share price as of 9/4/2019. 2. Peer group includes: AKR, BRX, CDR, FRT, KIM, REG, ROIC, RPAI, RPT, SITC, UE, and WRI © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 7

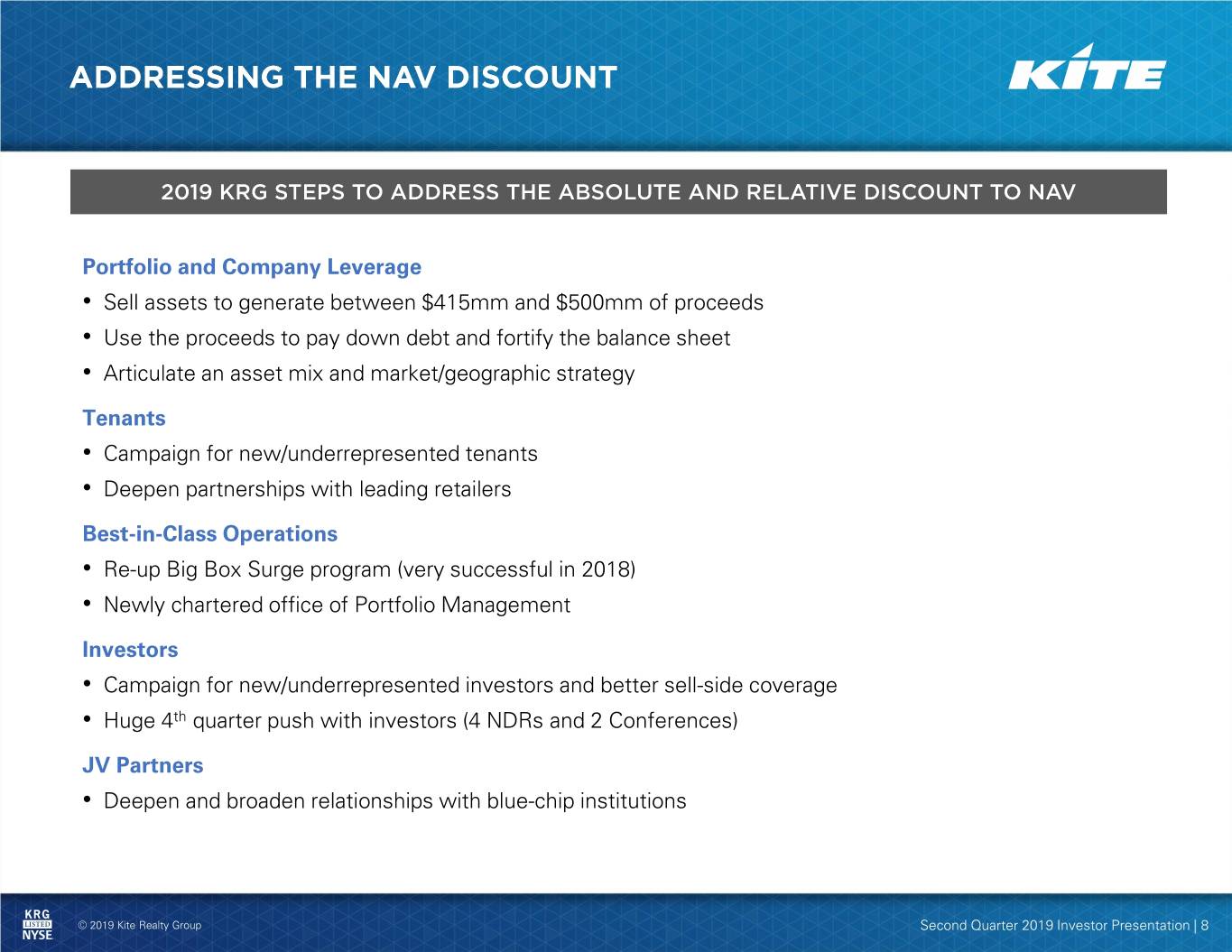

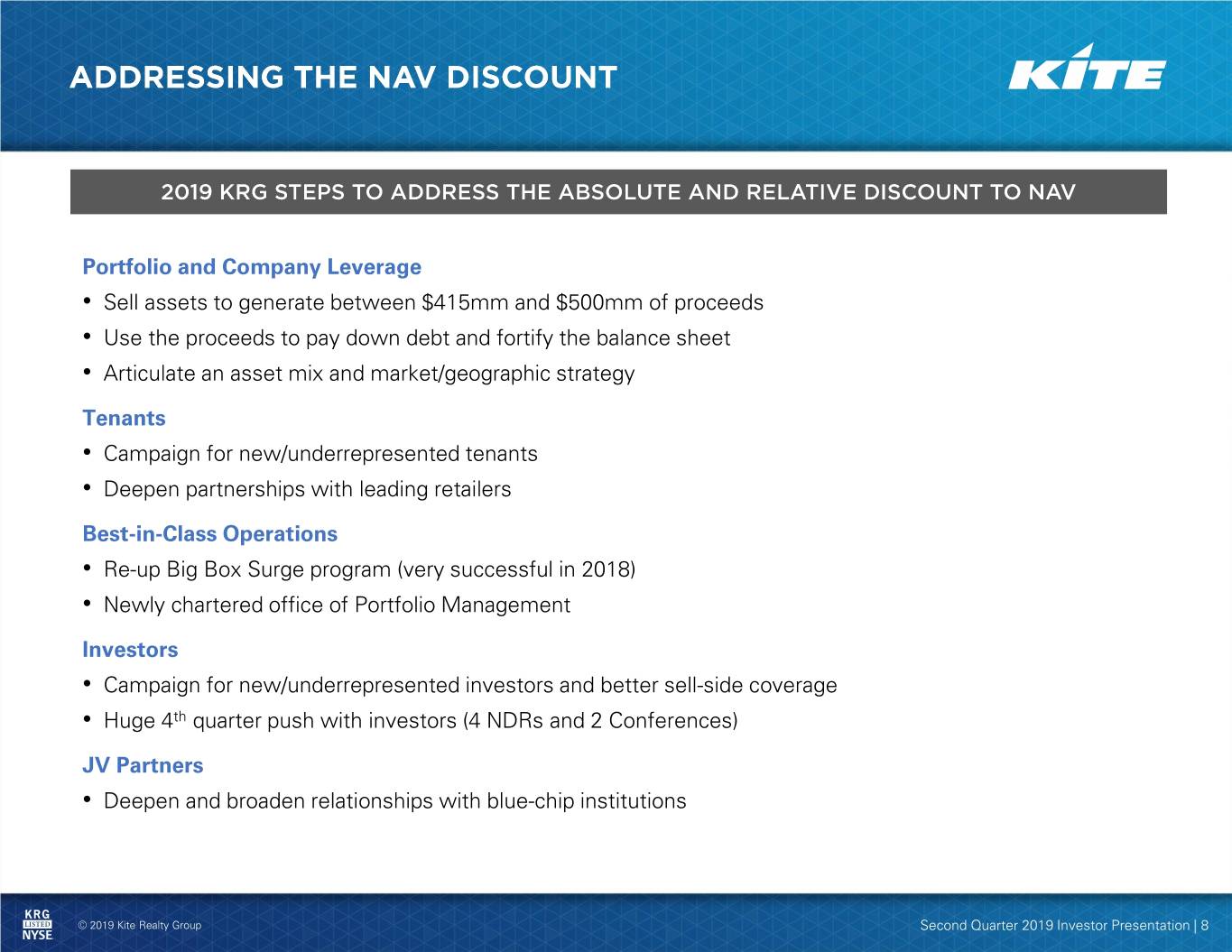

Portfolio and Company Leverage • Sell assets to generate between $415mm and $500mm of proceeds • Use the proceeds to pay down debt and fortify the balance sheet • Articulate an asset mix and market/geographic strategy Tenants • Campaign for new/underrepresented tenants • Deepen partnerships with leading retailers Best-in-Class Operations • Re-up Big Box Surge program (very successful in 2018) • Newly chartered office of Portfolio Management Investors • Campaign for new/underrepresented investors and better sell-side coverage • Huge 4th quarter push with investors (4 NDRs and 2 Conferences) JV Partners • Deepen and broaden relationships with blue-chip institutions © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 8

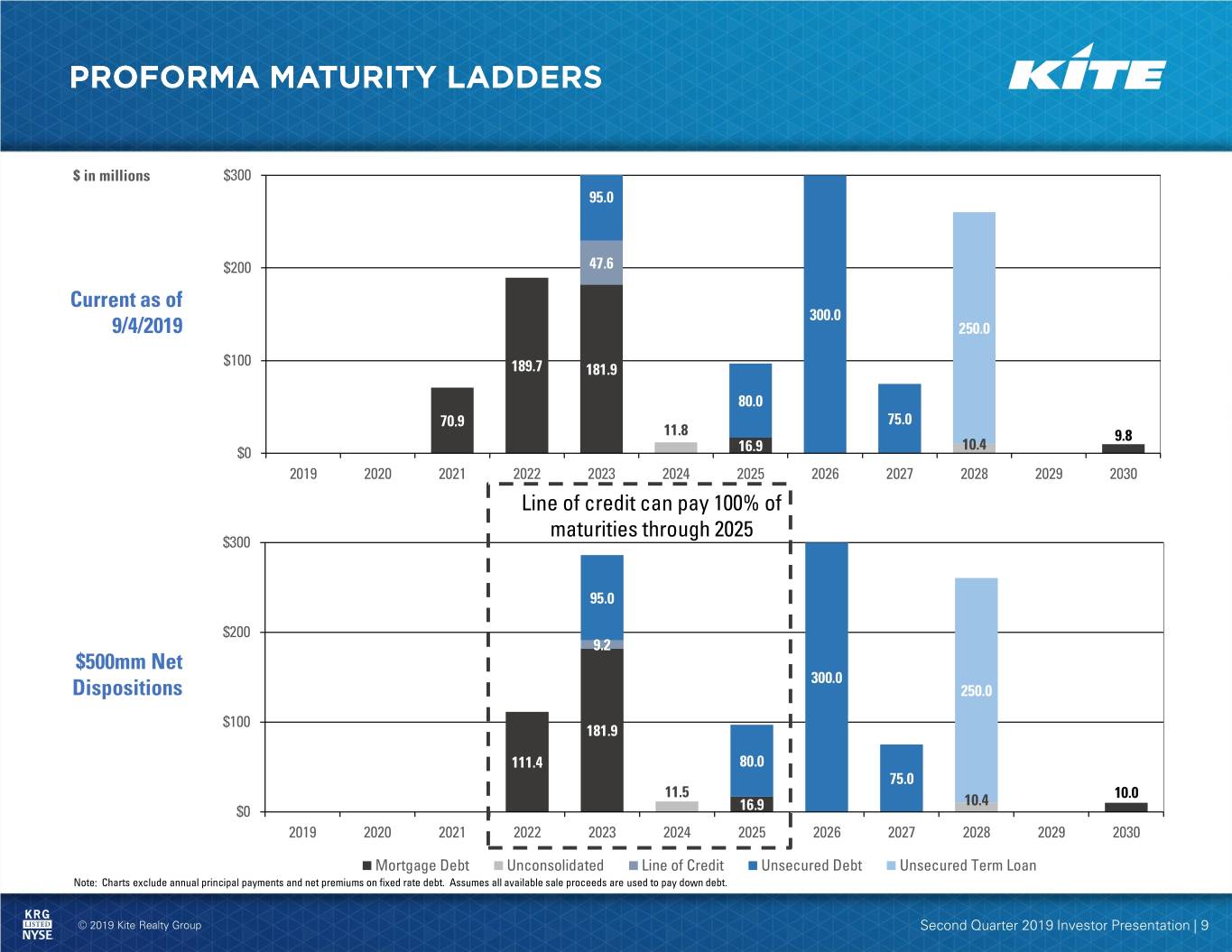

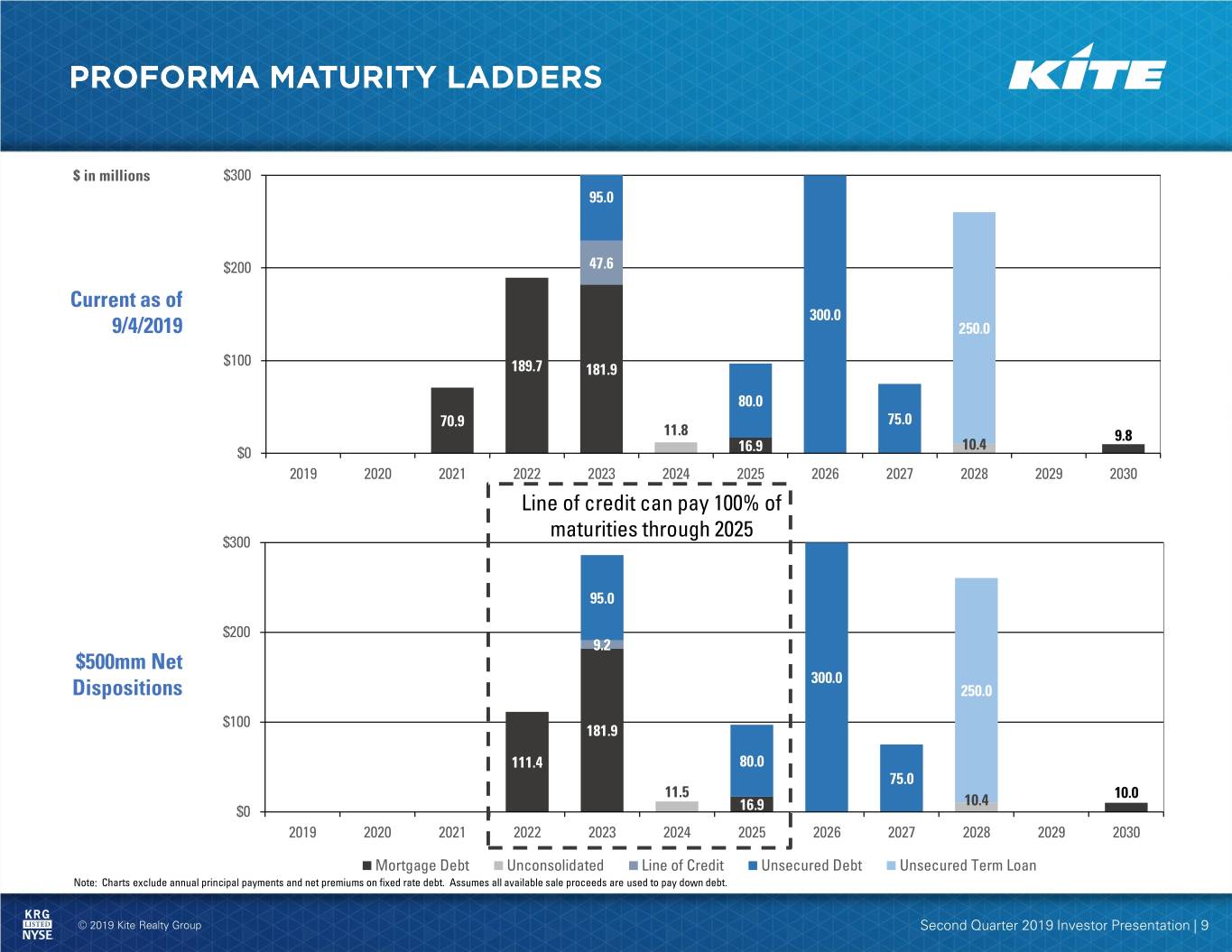

$ in millions $300 95.0 $200 47.6 Current as of 300.0 9/4/2019 250.0 $100 189.7 181.9 80.0 70.9 75.0 11.8 9.8 10.4 $0 16.9 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Line of credit can pay 100% of maturities through 2025 $300 95.0 $200 9.2 $500mm Net 300.0 Dispositions 250.0 $100 181.9 111.4 80.0 75.0 11.5 10.4 10.0 $0 16.9 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Mortgage Debt Unconsolidated Line of Credit Unsecured Debt Unsecured Term Loan Note: Charts exclude annual principal payments and net premiums on fixed rate debt. Assumes all available sale proceeds are used to pay down debt. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 9

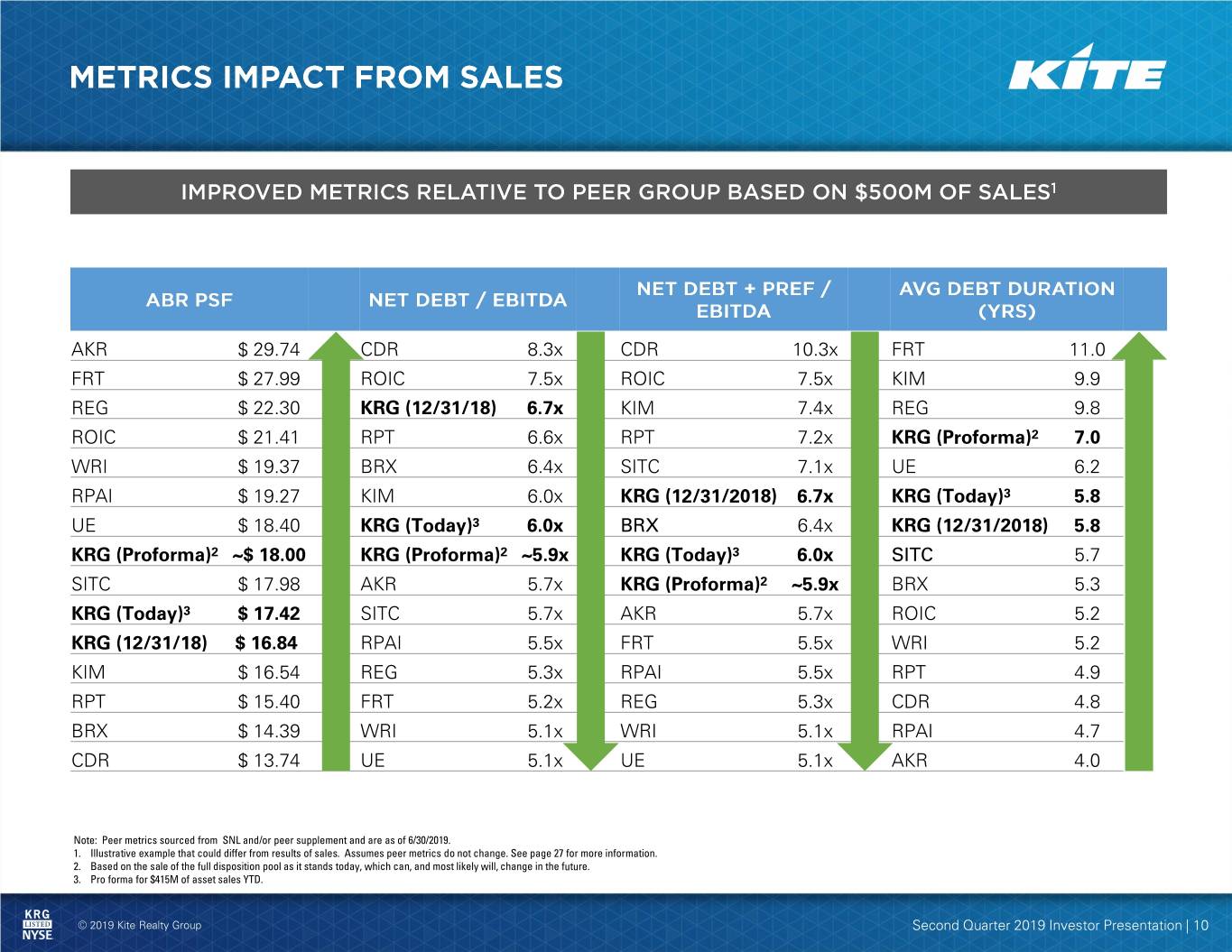

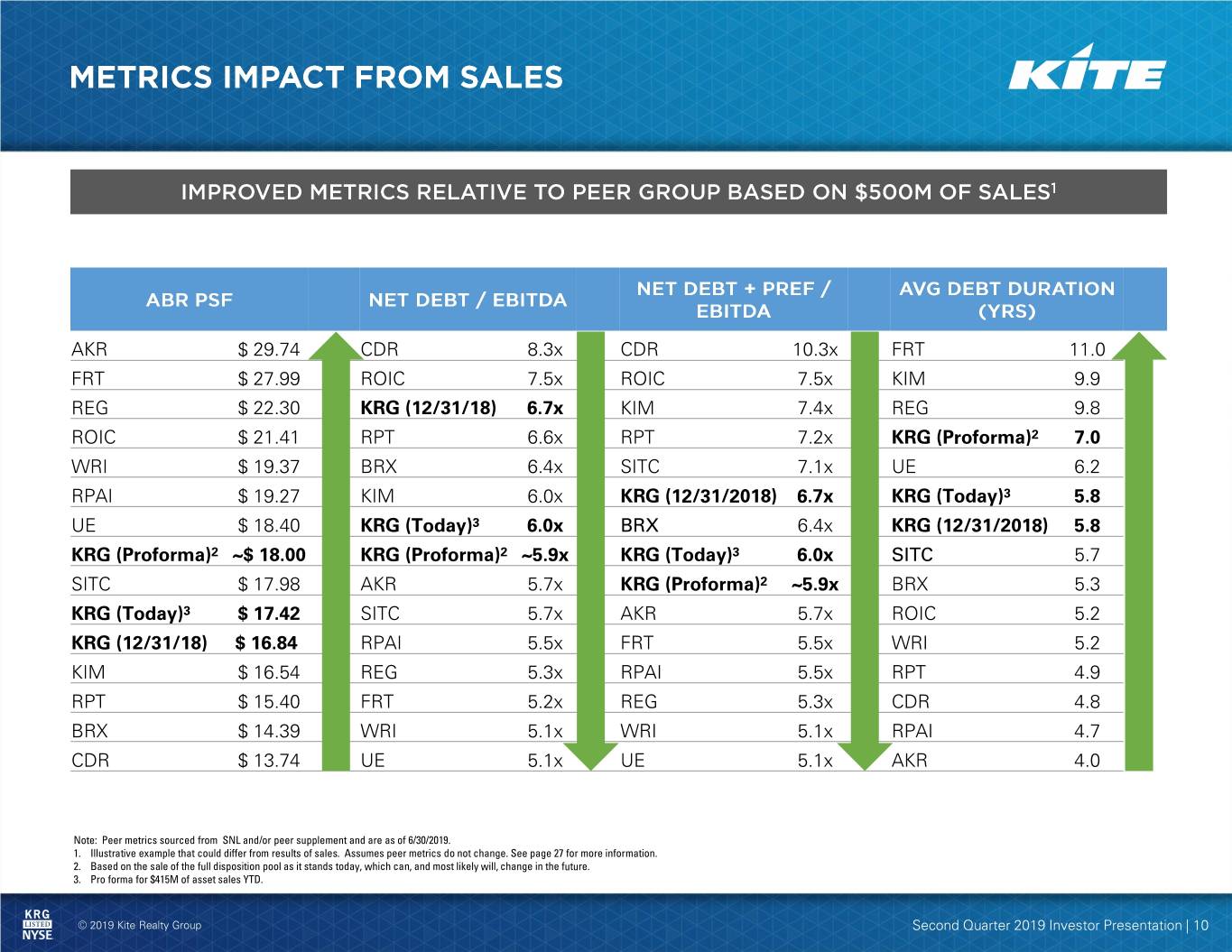

AKR $ 29.74 CDR 8.3x CDR 10.3x FRT 11.0 FRT $ 27.99 ROIC 7.5x ROIC 7.5x KIM 9.9 REG $ 22.30 KRG (12/31/18) 6.7x KIM 7.4x REG 9.8 ROIC $ 21.41 RPT 6.6x RPT 7.2x KRG (Proforma)2 7.0 WRI $ 19.37 BRX 6.4x SITC 7.1x UE 6.2 RPAI $ 19.27 KIM 6.0x KRG (12/31/2018) 6.7x KRG (Today)3 5.8 UE $ 18.40 KRG (Today)3 6.0x BRX 6.4x KRG (12/31/2018) 5.8 KRG (Proforma)2 ~$ 18.00 KRG (Proforma)2 ~5.9x KRG (Today)3 6.0x SITC 5.7 SITC $ 17.98 AKR 5.7x KRG (Proforma)2 ~5.9x BRX 5.3 KRG (Today)3 $ 17.42 SITC 5.7x AKR 5.7x ROIC 5.2 KRG (12/31/18) $ 16.84 RPAI 5.5x FRT 5.5x WRI 5.2 KIM $ 16.54 REG 5.3x RPAI 5.5x RPT 4.9 RPT $ 15.40 FRT 5.2x REG 5.3x CDR 4.8 BRX $ 14.39 WRI 5.1x WRI 5.1x RPAI 4.7 CDR $ 13.74 UE 5.1x UE 5.1x AKR 4.0 Note: Peer metrics sourced from SNL and/or peer supplement and are as of 6/30/2019. 1. Illustrative example that could differ from results of sales. Assumes peer metrics do not change. See page 27 for more information. 2. Based on the sale of the full disposition pool as it stands today, which can, and most likely will, change in the future. 3. Pro forma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 10

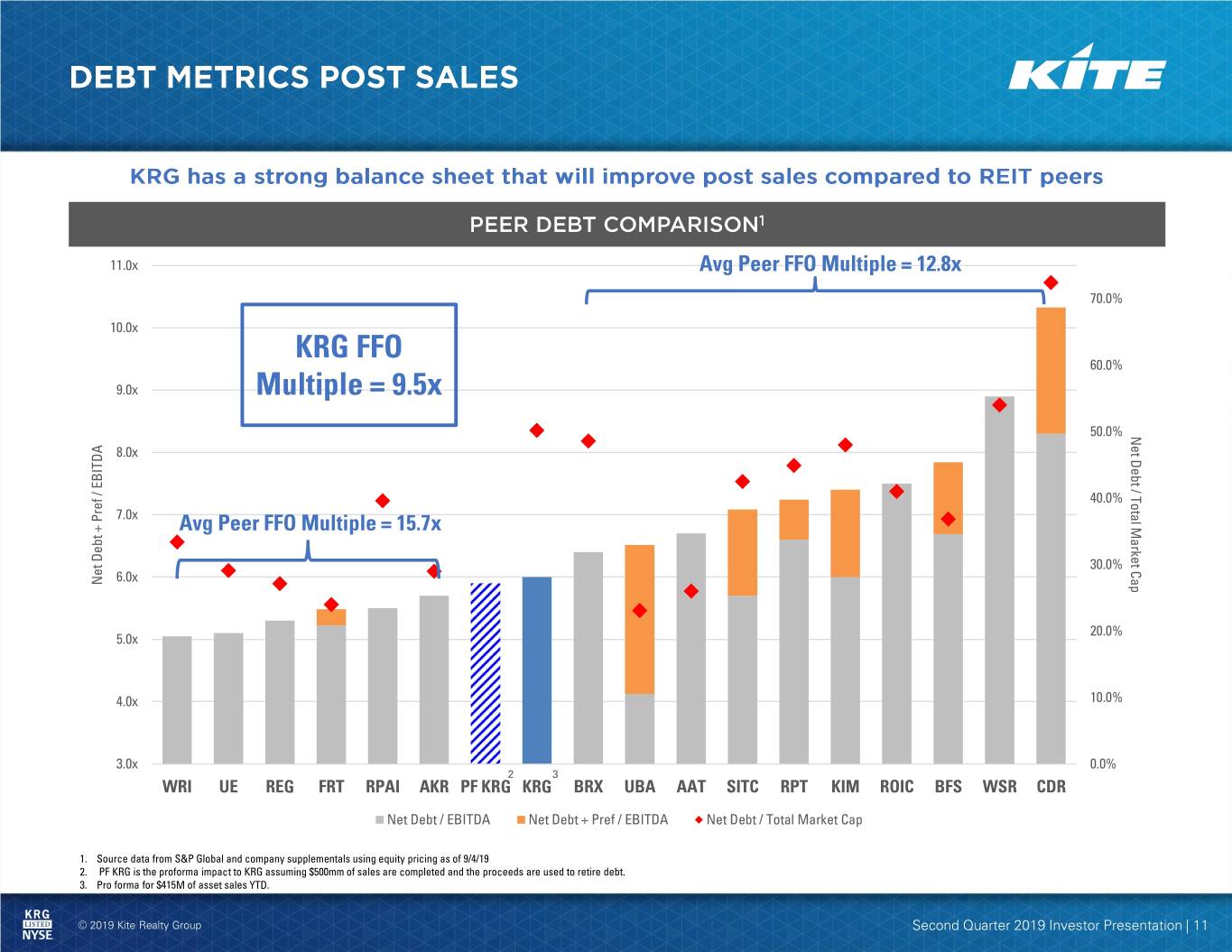

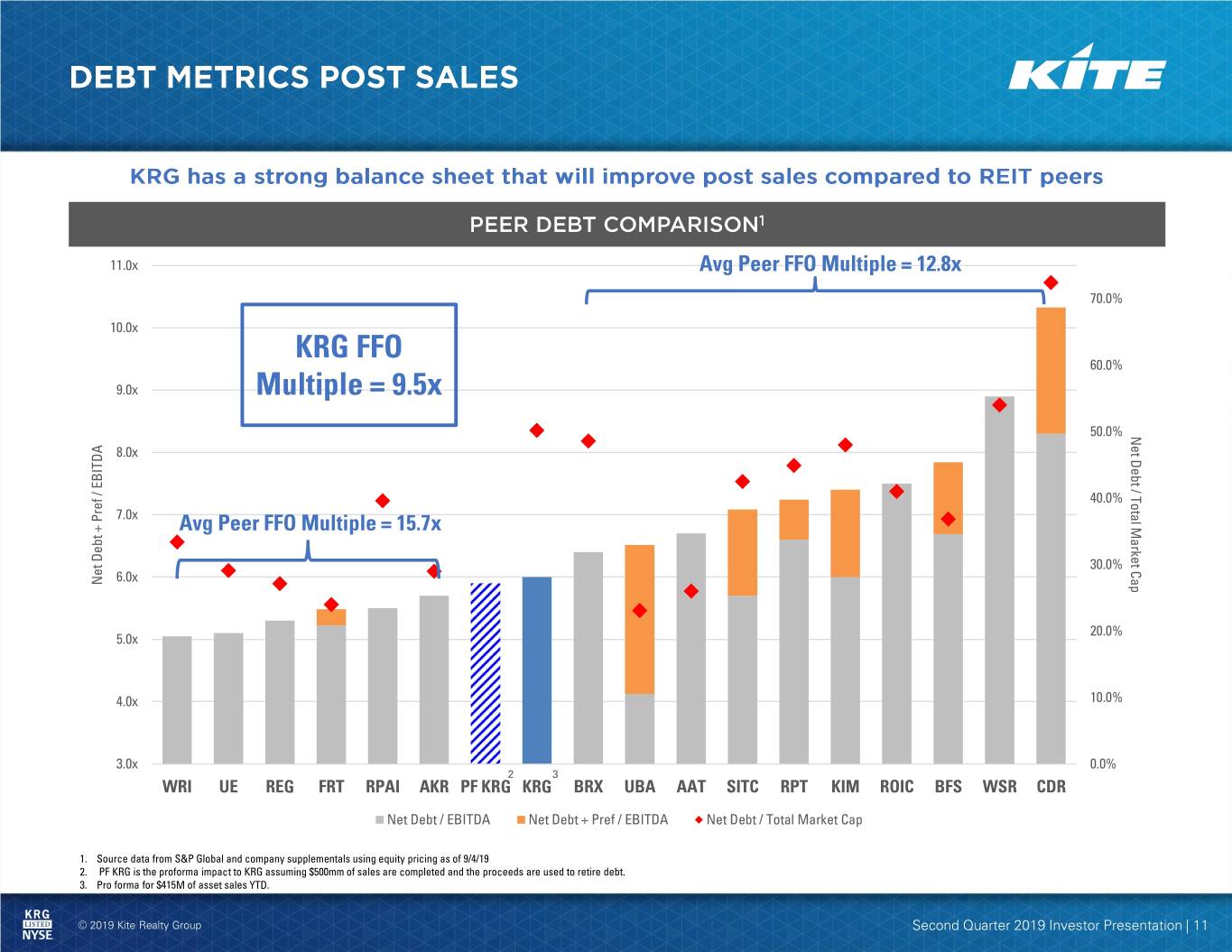

11.0x Avg Peer FFO Multiple = 12.8x 70.0% 10.0x KRG FFO 60.0% 9.0x Multiple = 9.5x 50.0% Market Net Total Debt Cap / 8.0x 40.0% 7.0x Avg Peer FFO Multiple = 15.7x 30.0% 6.0x Net Debt + Pref / / +EBITDA DebtNetPref 20.0% 5.0x 4.0x 10.0% 3.0x 0.0% 2 3 WRI UE REG FRT RPAI AKR PF KRG KRG BRX UBA AAT SITC RPT KIM ROIC BFS WSR CDR Net Debt / EBITDA Net Debt + Pref / EBITDA Net Debt / Total Market Cap 1. Source data from S&P Global and company supplementals using equity pricing as of 9/4/19 2. PF KRG is the proforma impact to KRG assuming $500mm of sales are completed and the proceeds are used to retire debt. 3. Pro forma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 11

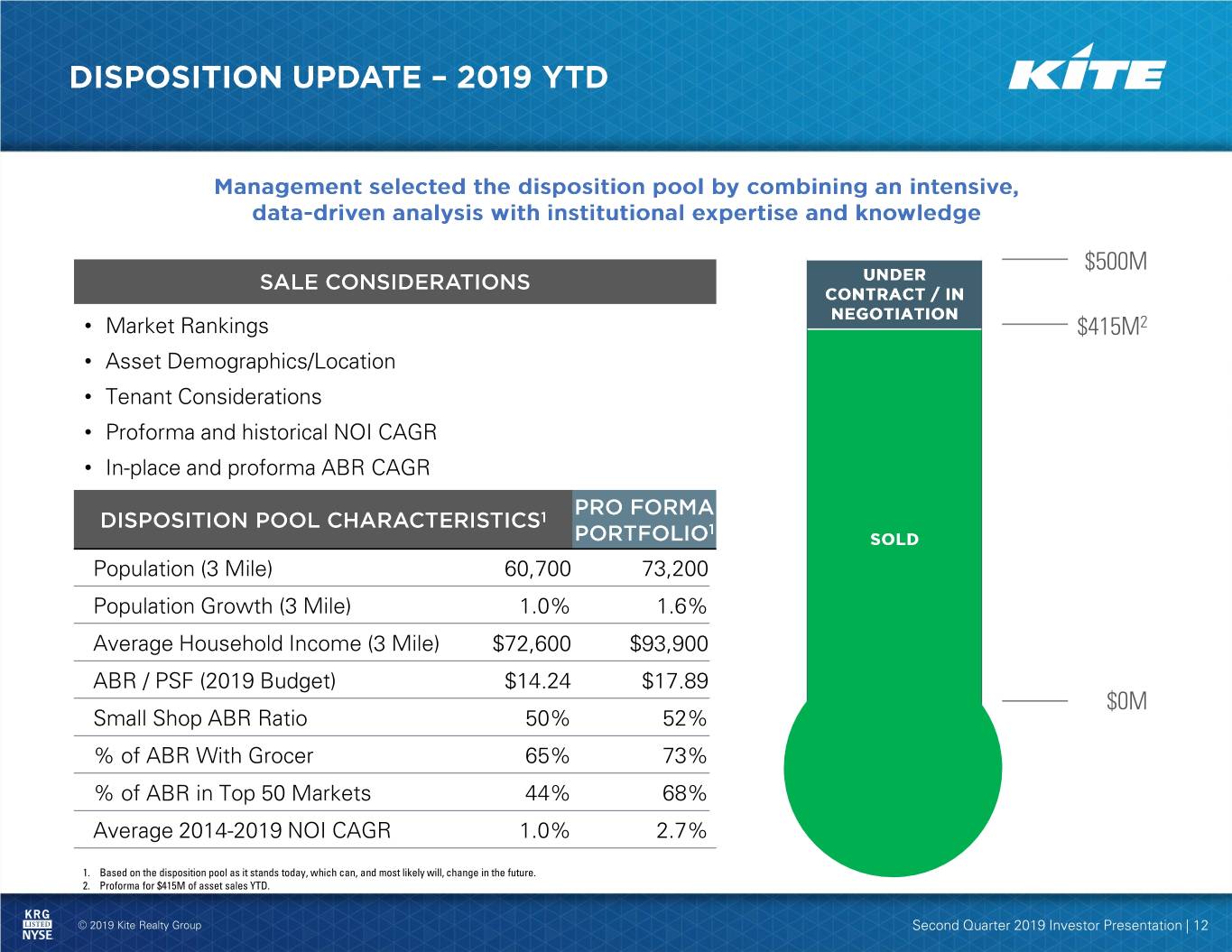

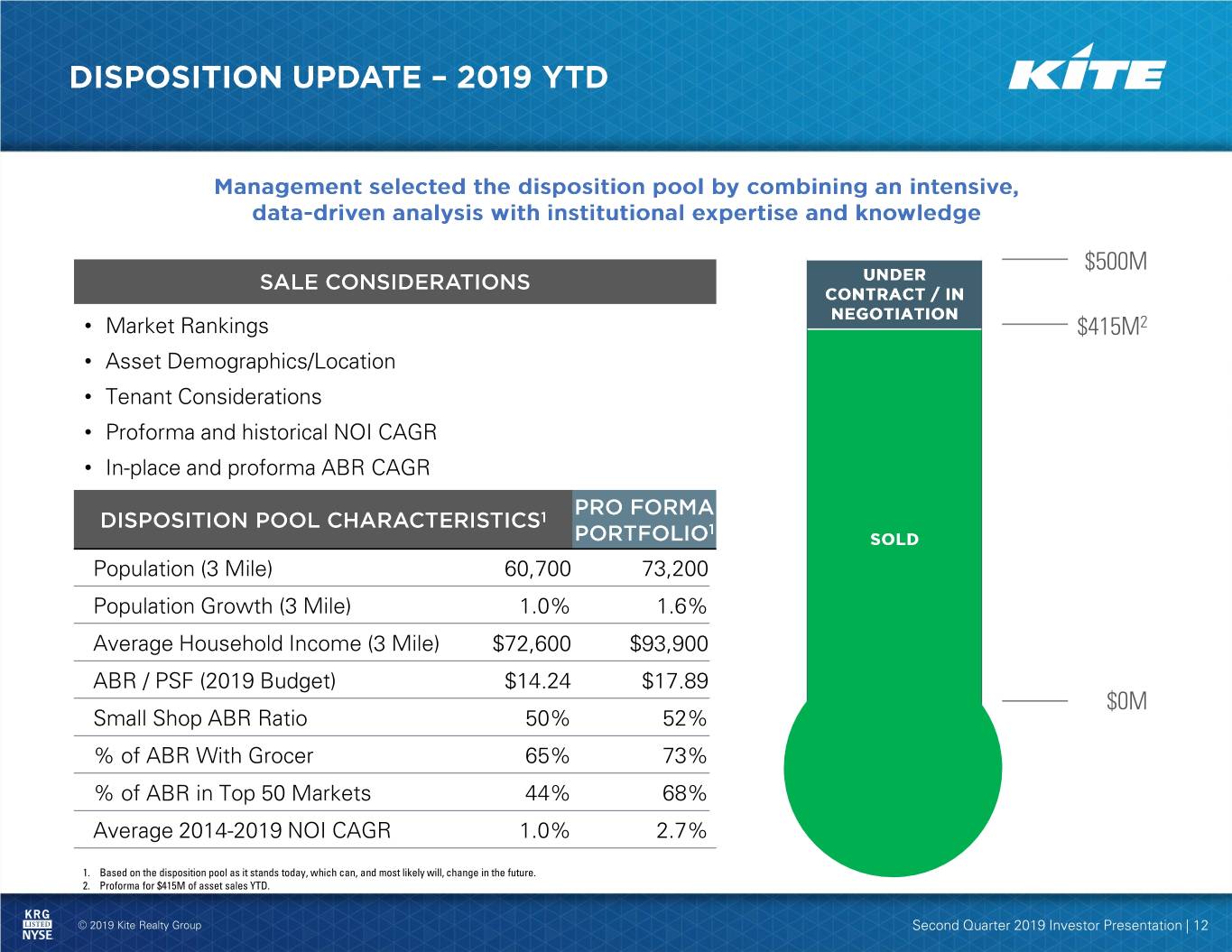

$500M • Market Rankings $415M2 • Asset Demographics/Location • Tenant Considerations • Proforma and historical NOI CAGR • In-place and proforma ABR CAGR Population (3 Mile) 60,700 73,200 Population Growth (3 Mile) 1.0% 1.6% Average Household Income (3 Mile) $72,600 $93,900 ABR / PSF (2019 Budget) $14.24 $17.89 $0M Small Shop ABR Ratio 50% 52% % of ABR With Grocer 65% 73% % of ABR in Top 50 Markets 44% 68% Average 2014-2019 NOI CAGR 1.0% 2.7% 1. Based on the disposition pool as it stands today, which can, and most likely will, change in the future. 2. Proforma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 12

Market Thesis • KRG’s long-term goal is to have at least 80% of its NOI generated from 15-20 focus markets that meet certain data-driven criteria • Assets outside of the 15-20 focus markets will generally be located in extremely productive submarkets (e.g. Naples) or will be assets that demonstrate the ability to achieve focus market returns (e.g. Eddy Street Commons) (“SAM Portfolio1”) • Upon completion of KRG’s disposition program, approximately 70% of KRG’s NOI will be from either the 15-20 focus markets or SAM portfolio Market Criteria • Top 50 Markets as ranked by Green Street • Rational going-in capitalization rates for high-quality assets in best submarkets relative to KRG’s cost of capital • Attractive spread between going-in capitalization rates and risk-adjusted IRRs • Above average in purchasing power growth • Likely beneficiaries of secular and macro trends such as internet penetration, employer and population migration patterns, political landscape and barriers to entry • Ability to gain scale as retail real estate is still a local business 1. “SAM” = Strategic Assets and Markets. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 13

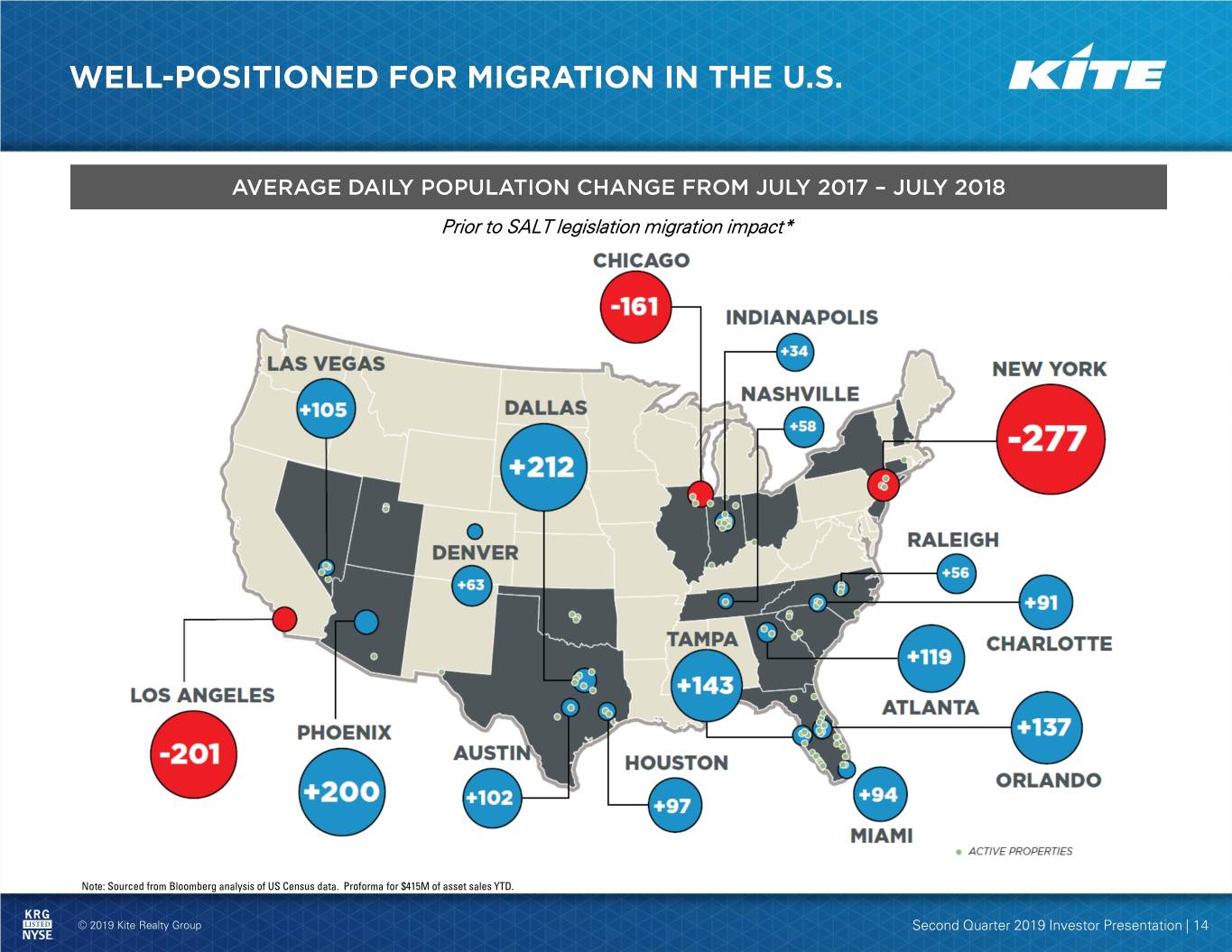

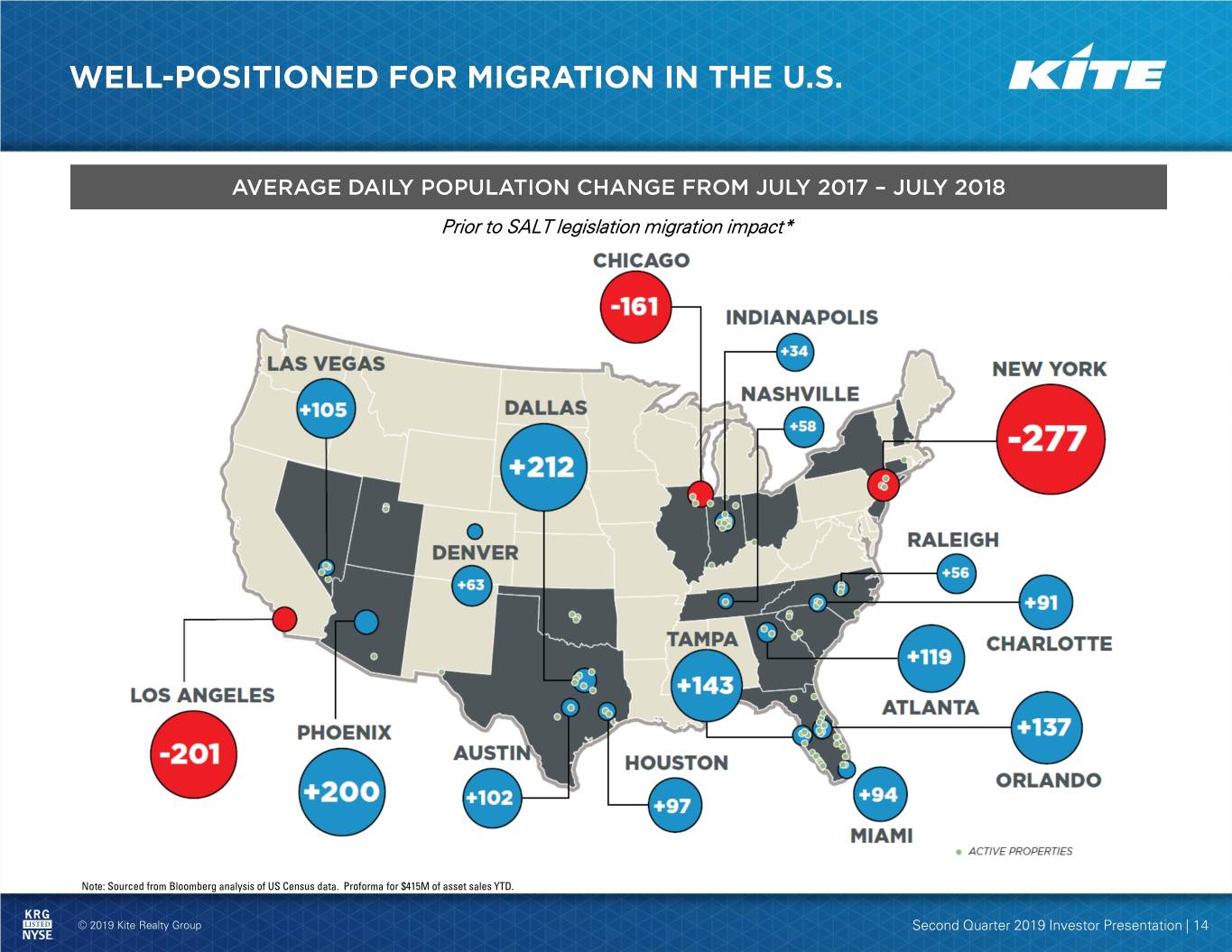

Prior to SALT legislation migration impact* Note: Sourced from Bloomberg analysis of US Census data. Proforma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 14

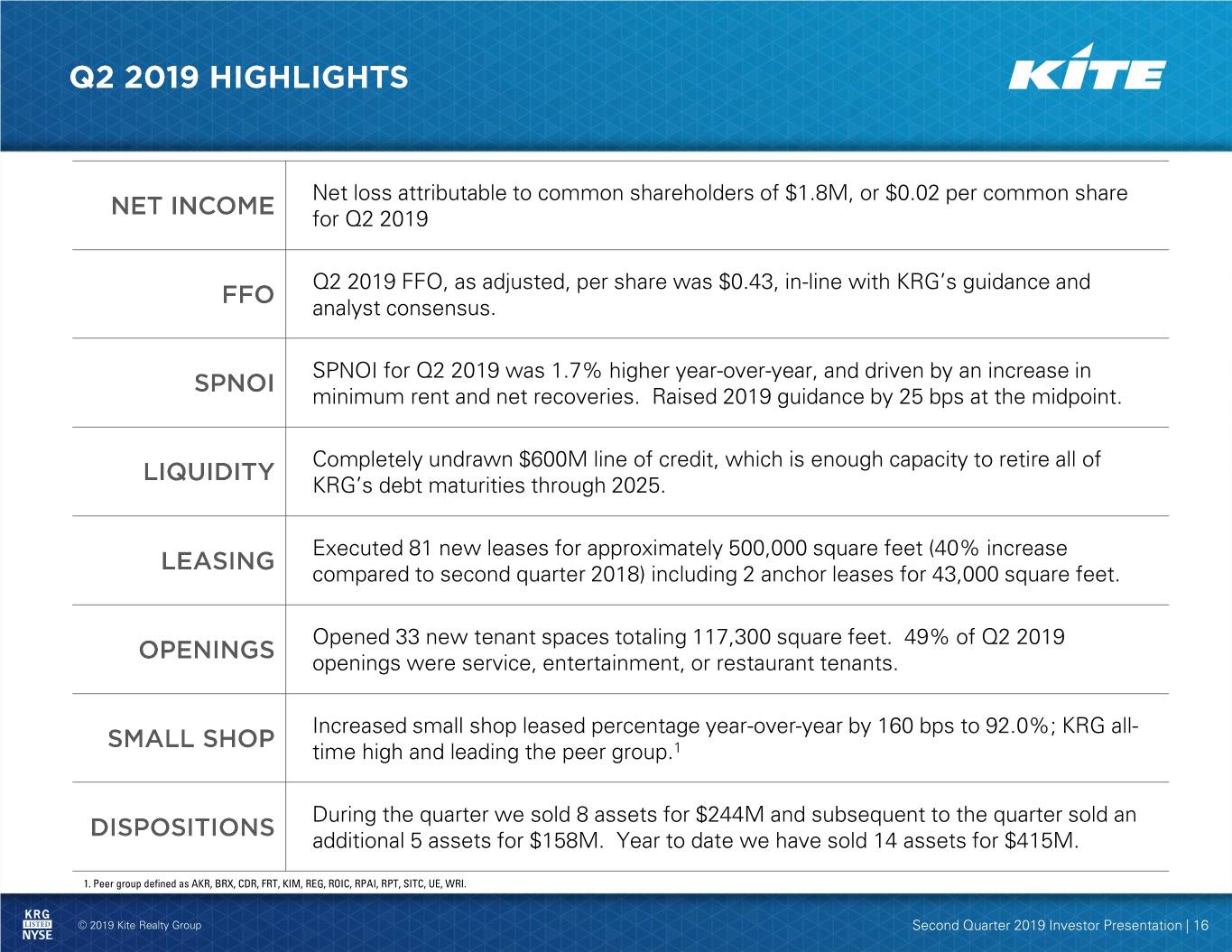

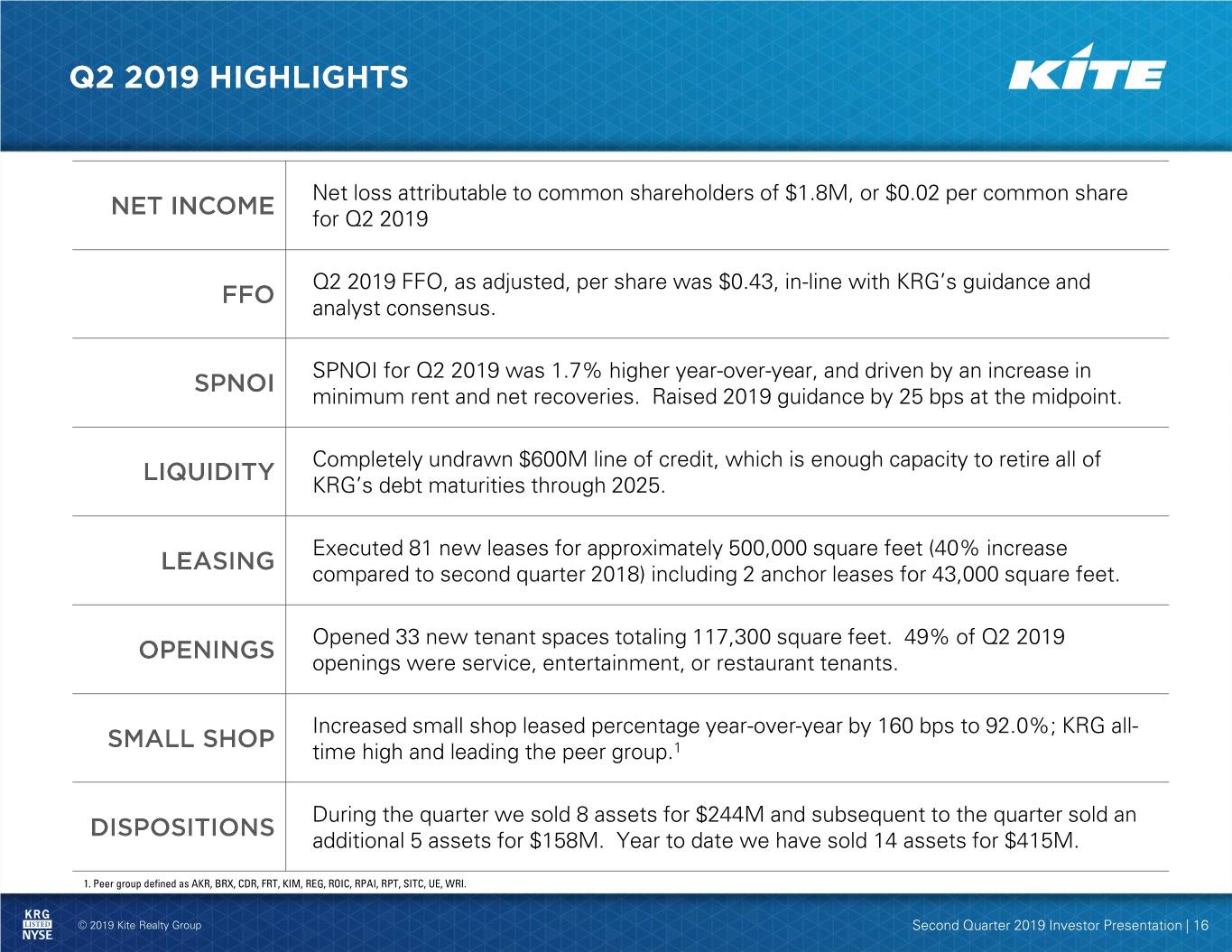

Net loss attributable to common shareholders of $1.8M, or $0.02 per common share for Q2 2019 Q2 2019 FFO, as adjusted, per share was $0.43, in-line with KRG’s guidance and analyst consensus. SPNOI for Q2 2019 was 1.7% higher year-over-year, and driven by an increase in minimum rent and net recoveries. Raised 2019 guidance by 25 bps at the midpoint. Completely undrawn $600M line of credit, which is enough capacity to retire all of KRG’s debt maturities through 2025. Executed 81 new leases for approximately 500,000 square feet (40% increase compared to second quarter 2018) including 2 anchor leases for 43,000 square feet. Opened 33 new tenant spaces totaling 117,300 square feet. 49% of Q2 2019 openings were service, entertainment, or restaurant tenants. Increased small shop leased percentage year-over-year by 160 bps to 92.0%; KRG all- time high and leading the peer group.1 During the quarter we sold 8 assets for $244M and subsequent to the quarter sold an additional 5 assets for $158M. Year to date we have sold 14 assets for $415M. 1. Peer group defined as AKR, BRX, CDR, FRT, KIM, REG, ROIC, RPAI, RPT, SITC, UE, WRI. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 16

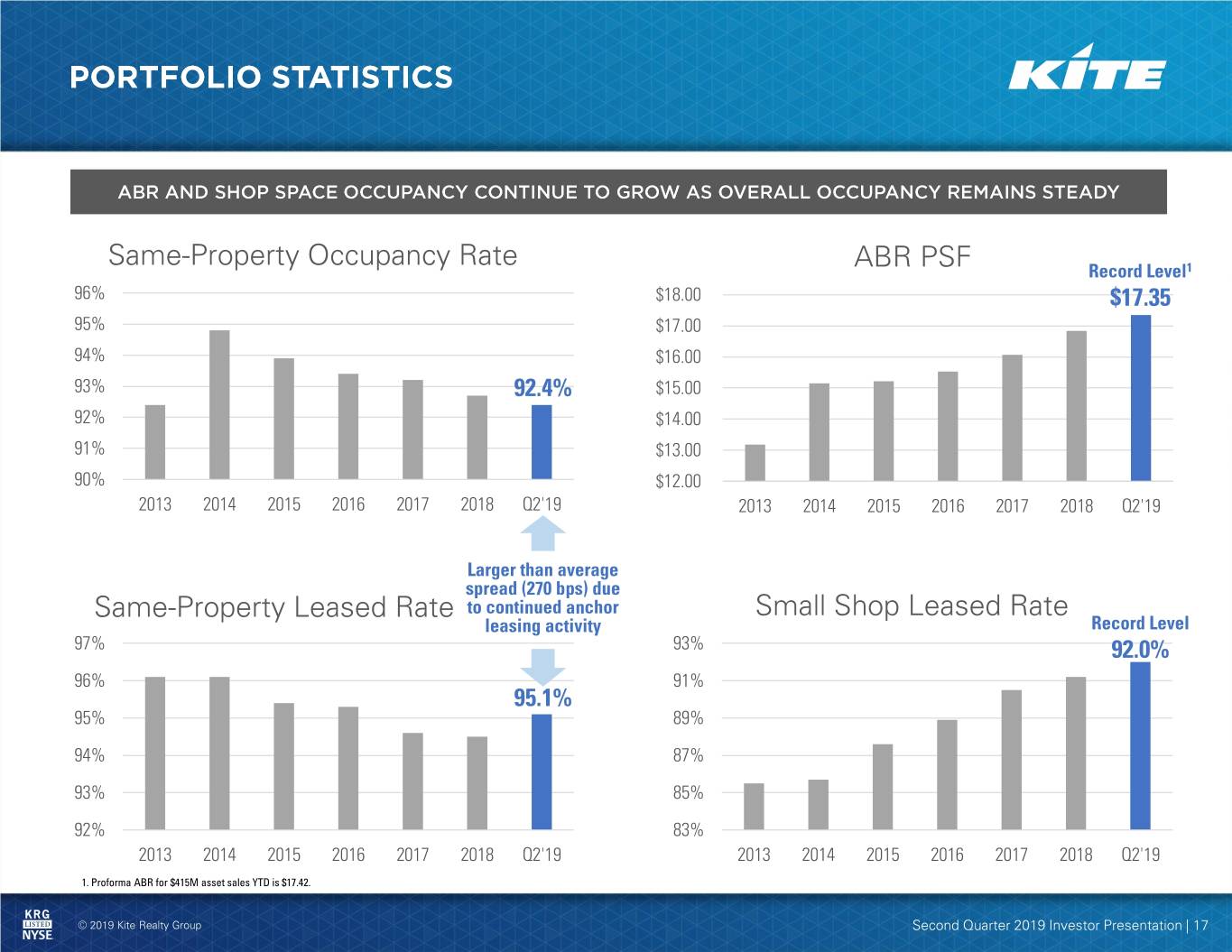

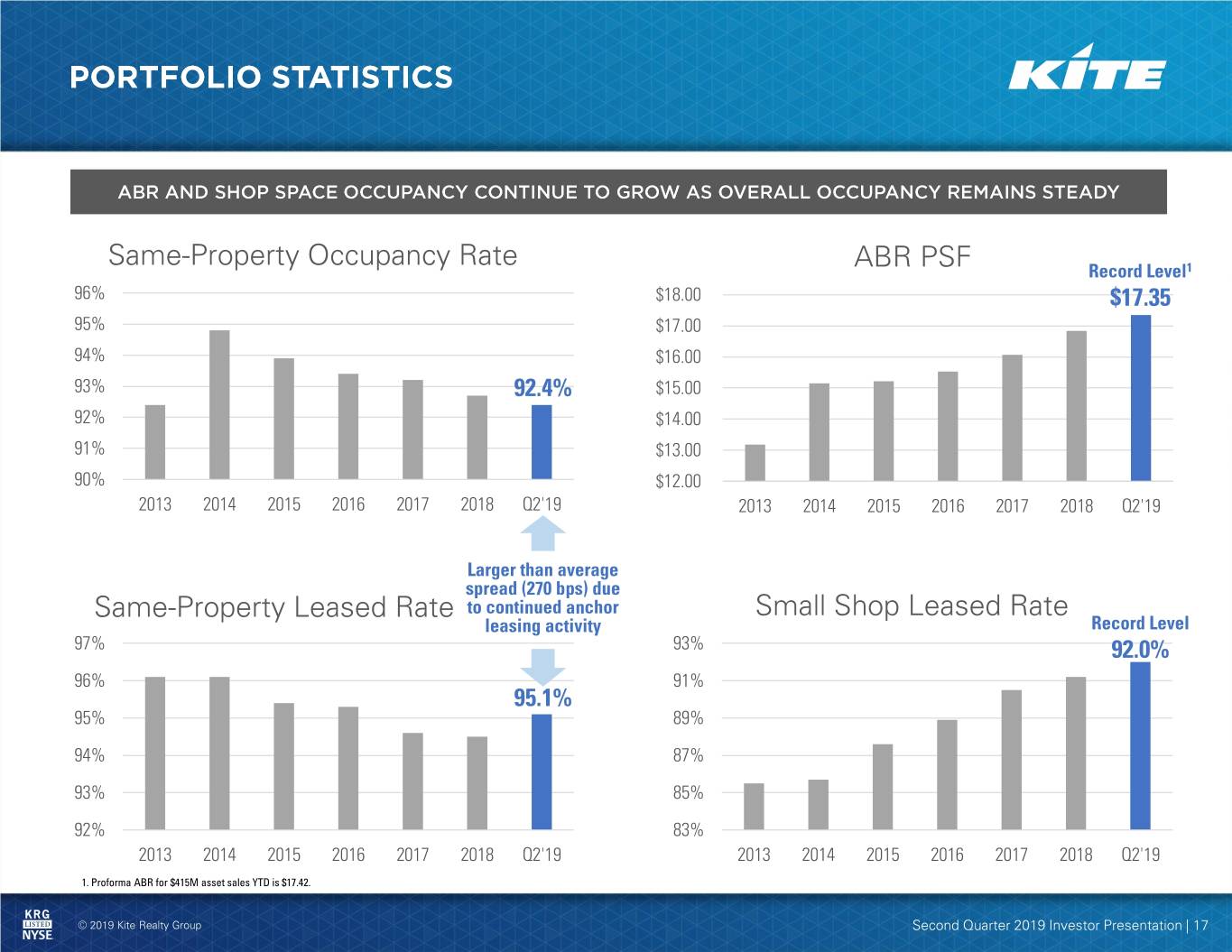

Same-Property Occupancy Rate ABR PSF Record Level1 96% $18.00 $17.35 95% $17.00 94% $16.00 93% 92.4% $15.00 92% $14.00 91% $13.00 90% $12.00 2013 2014 2015 2016 2017 2018 Q2'19 2013 2014 2015 2016 2017 2018 Q2'19 Larger than average spread (270 bps) due Same-Property Leased Rate to continued anchor Small Shop Leased Rate leasing activity Record Level 97% 93% 92.0% 96% 91% 95.1% 95% 89% 94% 87% 93% 85% 92% 83% 2013 2014 2015 2016 2017 2018 Q2'19 2013 2014 2015 2016 2017 2018 Q2'19 1. Proforma ABR for $415M asset sales YTD is $17.42. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 17

Annualized NOI Coming Online $10.0 $9.1 $8.6 $8.0 $6.9 $6.0 $5.1 $4.0 NOI ($, millions) ($, NOI $2.0 $1.6 $0.0 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 18

Sporting Goods Office Supplies 3.4% 1.5% Electronics & Books Services, 4.6% Entertainment Home Improvement Goods 25.1% 9.7% Soft Goods 9.7% Restaurants 17.2% Discount Retailers 13.3% Grocer, Specialty Stores 15.5% 1. Over 71% of retail ABR is from centers with a grocery component © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 19

• High performance business as usual in terms of increasing value across the portfolio • Extreme focus on re-tenanting anchors with Big Box Surge initiative • Continue to cultivate redevelopment opportunities so they are “shovel ready” when Big Box Surge is complete and capital becomes available • Swiftly execute disposition program while environment is receptive and attractive pricing • Set the foundation for outsized earnings growth in 2021 and beyond © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 21

• $1.6mm of additional cash NOI from in-process development and redevelopment projects • Continue to identify redevelopment opportunities to enhance portfolio quality • Undertaking a portfolio optimization strategy in 2019 • ABR of new leases executed in Q2 is 25.1% higher than the ABR for the operating retail portfolio • Embedded average contractual rent bumps of ~1.5% • Fixed CAM recovery initiative to increase current operating portfolio from 35% today to 50% in the future • Big Box Surge Initiative – executed 2 anchor leases in Q2 2019 • Small shop leased at 92.0% • Economic occupancy (92.1%) is 300 basis points below leased rate, which equates to over $9M of NOI • Attractive NOI Margin: 74.2% in Q2 2019 • Opportunity Areas: Operating expense savings, overage rent and ancillary income © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 22

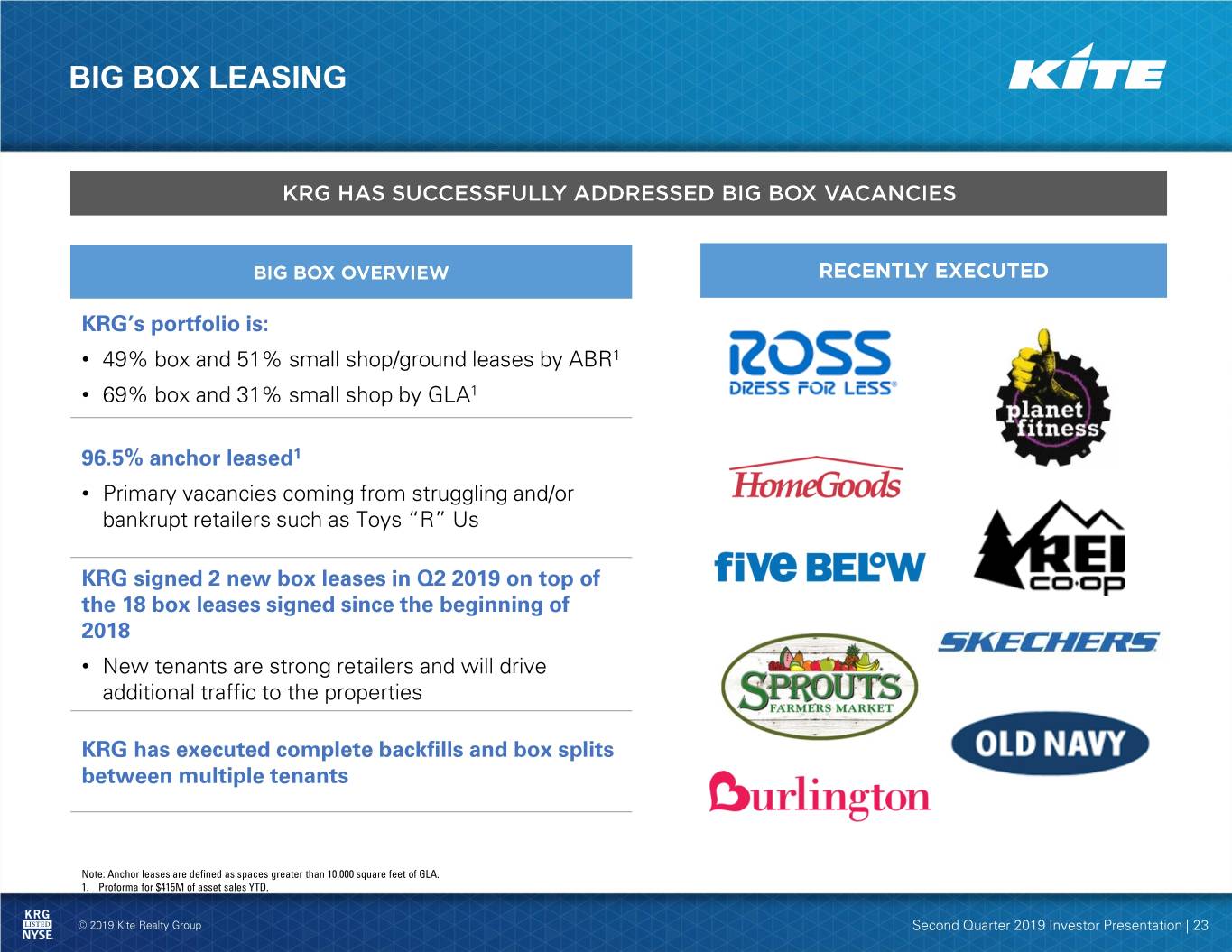

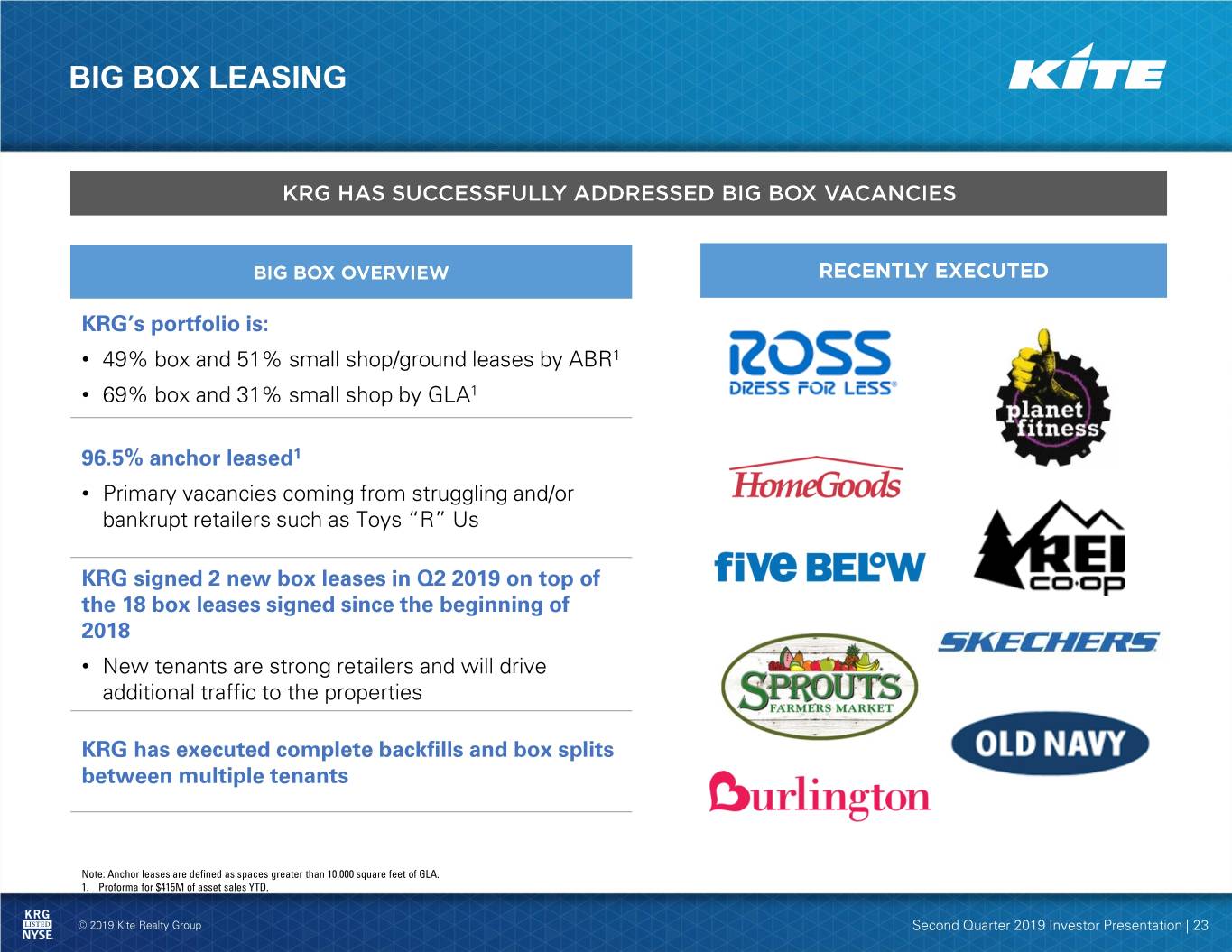

BIG BOX LEASING KRG’s portfolio is: • 49% box and 51% small shop/ground leases by ABR1 • 69% box and 31% small shop by GLA1 96.5% anchor leased1 • Primary vacancies coming from struggling and/or bankrupt retailers such as Toys “R” Us KRG signed 2 new box leases in Q2 2019 on top of the 18 box leases signed since the beginning of 2018 • New tenants are strong retailers and will drive additional traffic to the properties KRG has executed complete backfills and box splits between multiple tenants Note: Anchor leases are defined as spaces greater than 10,000 square feet of GLA. 1. Proforma for $415M of asset sales YTD. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 23

+ No loss of square footage + More demand for smaller spaces + Less capital required + Higher ABR psf + Higher return on capital + De-risk center as less NOI associated with one - Harder to lease as fewer tenants can take space tenant - Cost to split box - Loss of square feet • Converted 38k sf Babies “R” Us into Before After 2 spaces - 8.8k SF Five Below - 23.0k SF Old Navy • Cost of ~$150psf1 • Lost ~6k SF, but increase in ABR more than offset lost space • ABR went from ~$3.80 psf to ~$18.00 psf • Incremental yield on cost of ~11% 1. Excludes $10psf related to the buyout of the lease © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 24

Key actions taken: • Replaced a 17k SF GAP with a diverse lineup of lifestyle retailers • Filled 4.5k SF of vacant space with an expansion of restaurant and signing of service retailer • Relocated soft goods retailer to more appropriate location and backfilled with two new tenants Redevelopment not only added ABR & NOI… • ABR psf increase 39%1 • NOI increased 22%1 …but also de-risked the asset, thereby driving down the cap rate • Purchased at ~7% cap rate; current 3rd party estimate is sub-6% 1. 2019 budget versus 2016 actual © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 25

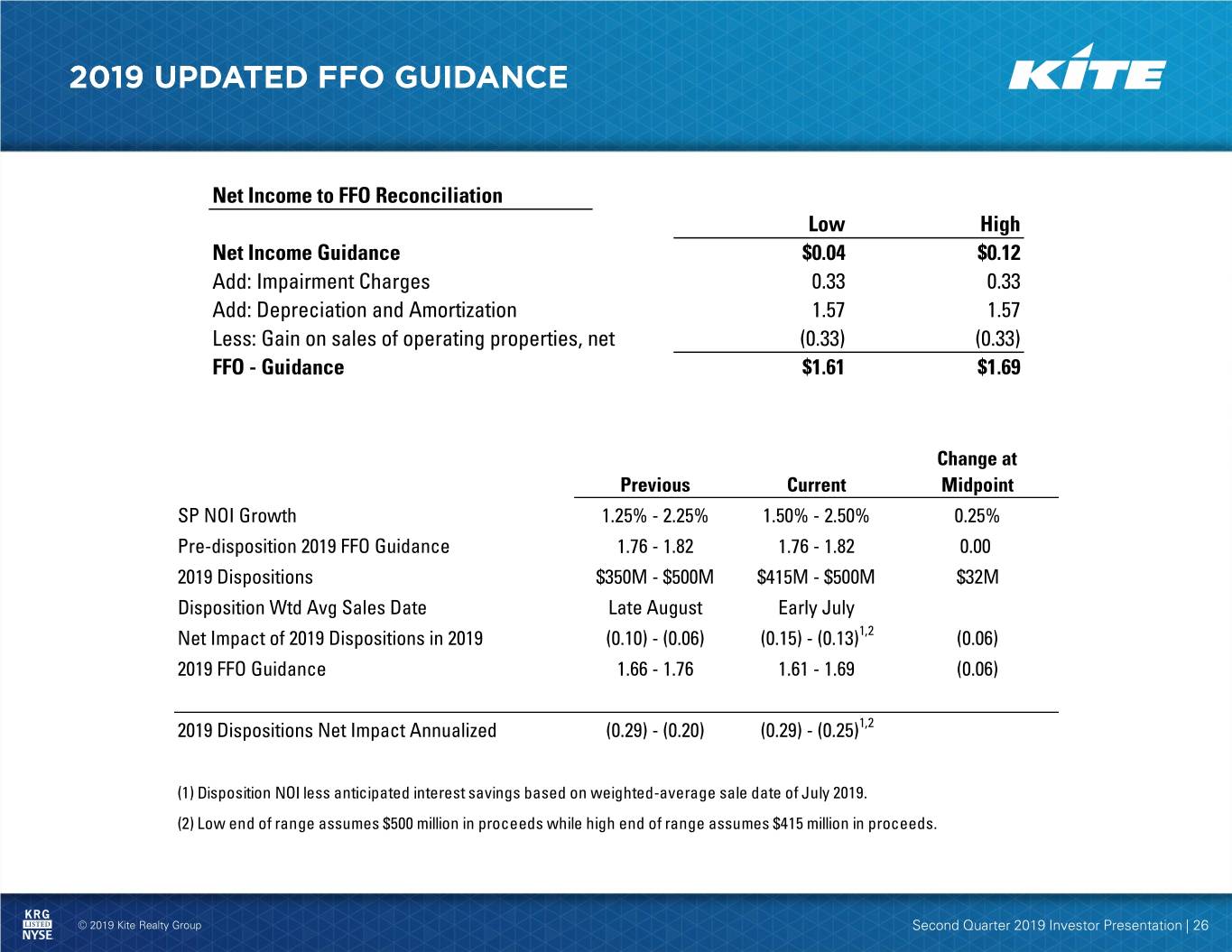

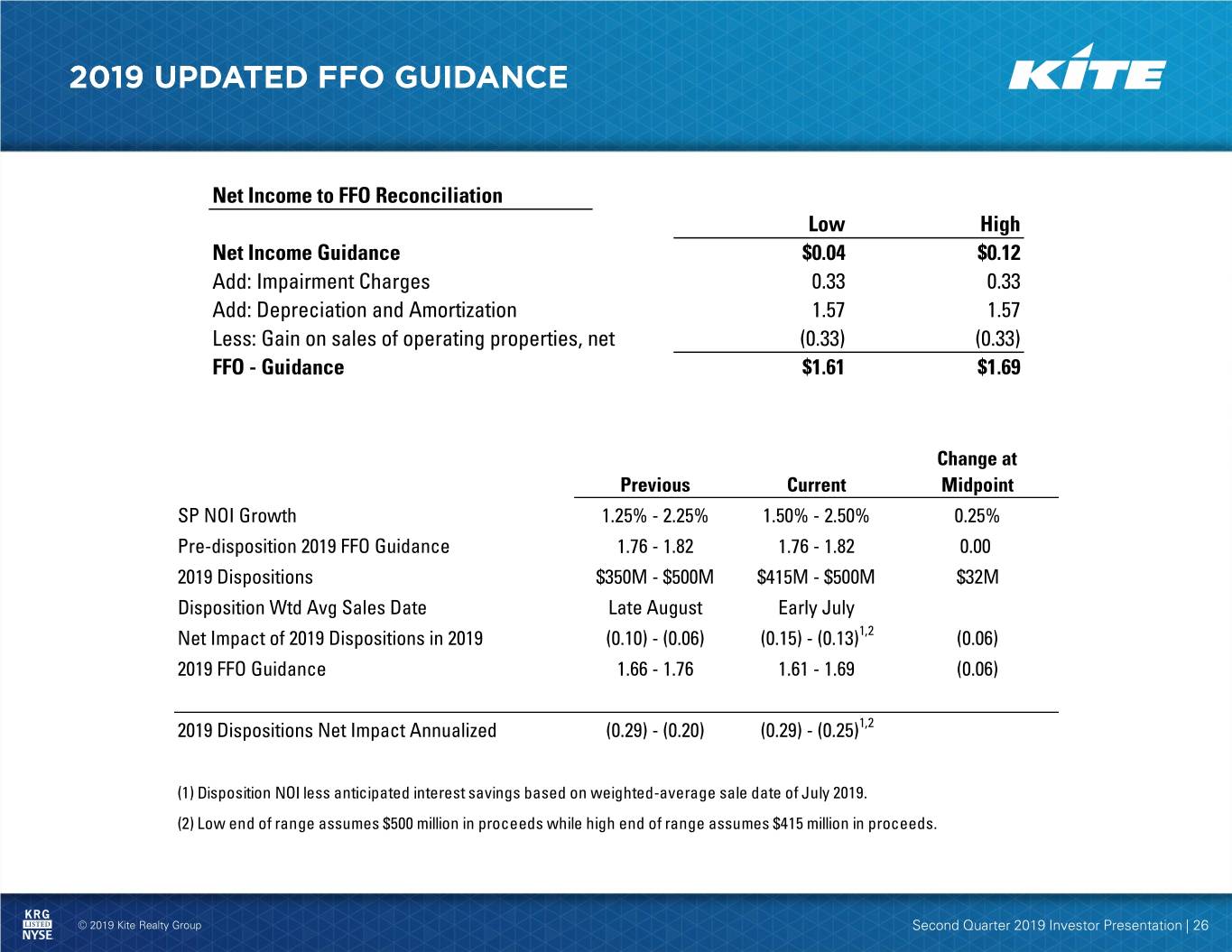

Net Income to FFO Reconciliation Low High Net Income Guidance $0.04 $0.12 Add: Impairment Charges 0.33 0.33 Add: Depreciation and Amortization 1.57 1.57 Less: Gain on sales of operating properties, net (0.33) (0.33) FFO - Guidance $1.61 $1.69 Change at Previous Current Midpoint SP NOI Growth 1.25% - 2.25% 1.50% - 2.50% 0.25% Pre-disposition 2019 FFO Guidance 1.76 - 1.82 1.76 - 1.82 0.00 2019 Dispositions $350M - $500M $415M - $500M $32M Disposition Wtd Avg Sales Date Late August Early July Net Impact of 2019 Dispositions in 2019 (0.10) - (0.06) (0.15) - (0.13)1,2 (0.06) 2019 FFO Guidance 1.66 - 1.76 1.61 - 1.69 (0.06) 2019 Dispositions Net Impact Annualized (0.29) - (0.20) (0.29) - (0.25)1,2 (1) Disposition NOI less anticipated interest savings based on weighted-average sale date of July 2019. (2) Low end of range assumes $500 million in proceeds while high end of range assumes $415 million in proceeds. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 26

Forward-Looking Statements This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to: • national and local economic, business, real estate and other market conditions, particularly in connection with low or negative growth in the U.S. economy as well as economic uncertainty; • financing risks, including the availability of, and costs associated with, sources of liquidity; • our ability to refinance, or extend the maturity dates of, our indebtedness; • the level and volatility of interest rates; • the financial stability of tenants, including their ability to pay rent and the risk of tenant insolvency and bankruptcy; • the competitive environment in which the Company operates; • acquisition, disposition, development and joint venture risks; • property ownership and management risks; • our ability to maintain our status as a real estate investment trust for federal income tax purposes; • potential environmental and other liabilities; • impairment in the value of real estate property the Company owns; • the actual and perceived impact of online retail on the value of shopping center assets; • risks related to the geographical concentration of our properties in Florida, Indiana and Texas; • insurance costs and coverage; • risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; • other factors affecting the real estate industry generally; and • other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, and in our quarterly reports on Form 10-Q. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 27

FUNDS FROM OPERATIONS Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts ("NAREIT"), as restated in 2018. The NAREIT white paper defines FFO as net income (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments, and after adjustments for unconsolidated partnerships and joint ventures. Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO (a) should not be considered as an alternative to net income (calculated in accordance with GAAP) for the purpose of measuring our financial performance, (b) is not an alternative to cash flow from operating activities (calculated in accordance with GAAP) as a measure of our liquidity, and (c) is not indicative of funds available to satisfy our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. For informational purposes, we have also provided FFO adjusted for loss on debt extinguishment. A reconciliation of net income (calculated in accordance with GAAP) to FFO is included elsewhere in this Financial Supplement. NET OPERATING INCOME AND SAME PROPERTY NET OPERATING INCOME The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and certain corporate level expenses. The Company believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company also uses same property NOI ("Same Property NOI"), a non-GAAP financial measure, to evaluate the performance of our properties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales, straight-line rent revenue, lease termination fees, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. The Company believes that Same Property NOI is helpful to investors as a measure of our operating performance because it includes only the NOI of properties that have been owned and fully operational for the full quarters presented. The Company believes such presentation eliminates disparities in net income due to the acquisition or disposition of properties during the particular quarters presented and thus provides a more consistent comparison of our properties. The year-to-date results represent the sum of the individual quarters, as reported. NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and therefore may not be comparable to such other REITs. When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the inclusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and the Company begins recapturing space from tenants. For the quarter ended June 30, 2019, the Company excluded four redevelopment properties and three recently completed redevelopments from the same property pool that met these criteria and were owned in both comparable periods. EARNINGS BEFORE INTEREST EXPENSE, INCOME TAX EXPENSE, DEPRECIATION AND AMORTIZATION (EBITDA) The Company defines EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income tax expense of taxable REIT subsidiary. For informational purposes, the Company has also provided Adjusted EBITDA, which the Company defines as EBITDA less (i) EBITDA from unconsolidated entities, (ii) gains on sales of operating properties or impairment charges, (iii) other income and expense, (iv) noncontrolling interest EBITDA and (v) other non-recurring activity or items impacting comparability from period to period. Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. Net Debt to Adjusted EBITDA is the Company's share of net debt divided by Annualized Adjusted EBITDA. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to Adjusted EBITDA, as calculated by us, are not comparable to EBITDA and EBITDA-related measures reported by other REITs that do not define EBITDA and EBITDA-related measures exactly as we do. EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated from operating activities in accordance with GAAP, and should not be considered alternatives to net income as an indicator of performance or as alternatives to cash flows from operating activities as an indicator of liquidity. Considering the nature of our business as a real estate owner and operator, the Company believes that EBITDA, Adjusted EBITDA and the ratio of Net Debt to Adjusted EBITDA are helpful to investors in measuring our operational performance because they exclude various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, the Company has also provided Annualized Adjusted EBITDA, adjusted as described above. The Company believes this supplemental information provides a meaningful measure of our operating performance. The Company believes presenting EBITDA and the related measures in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results. © 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 28

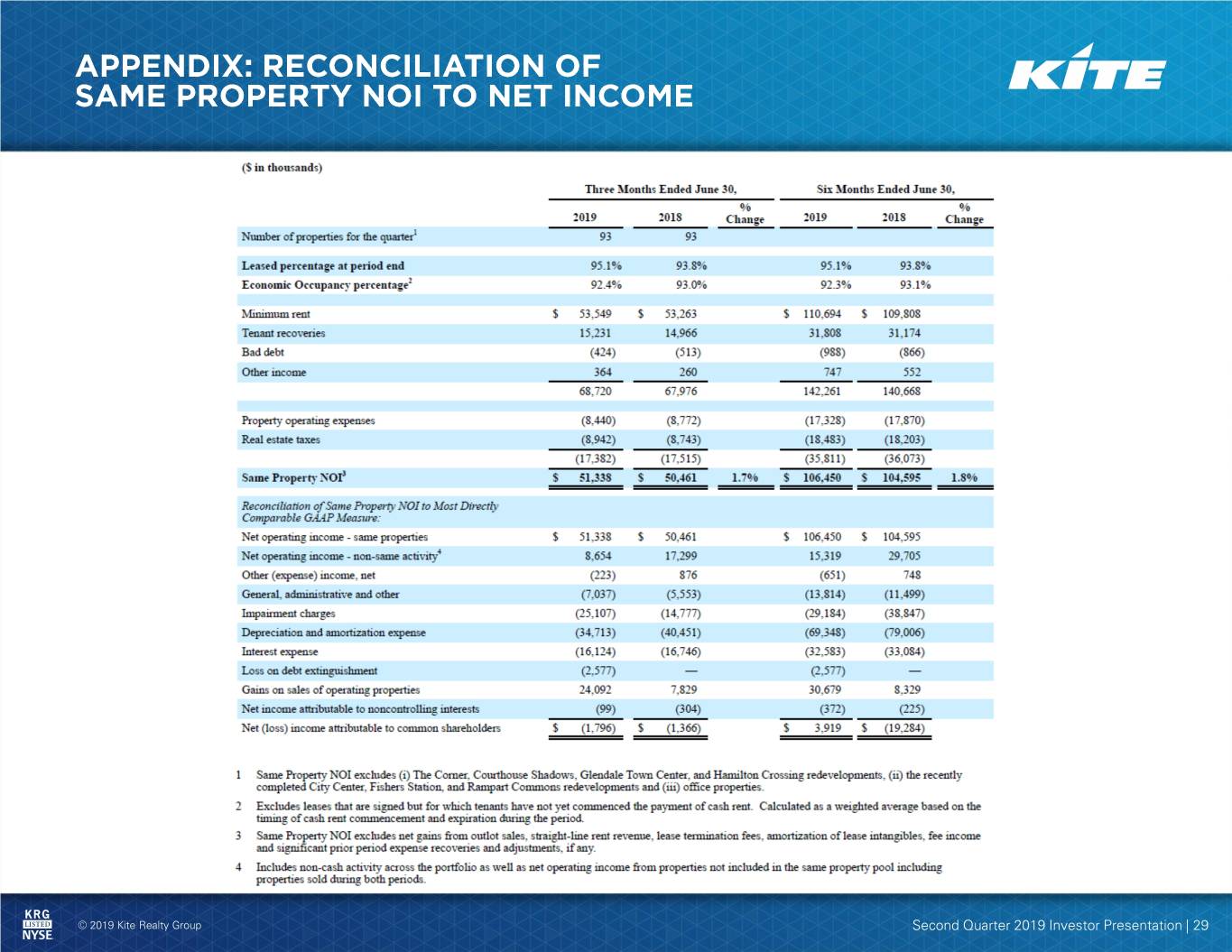

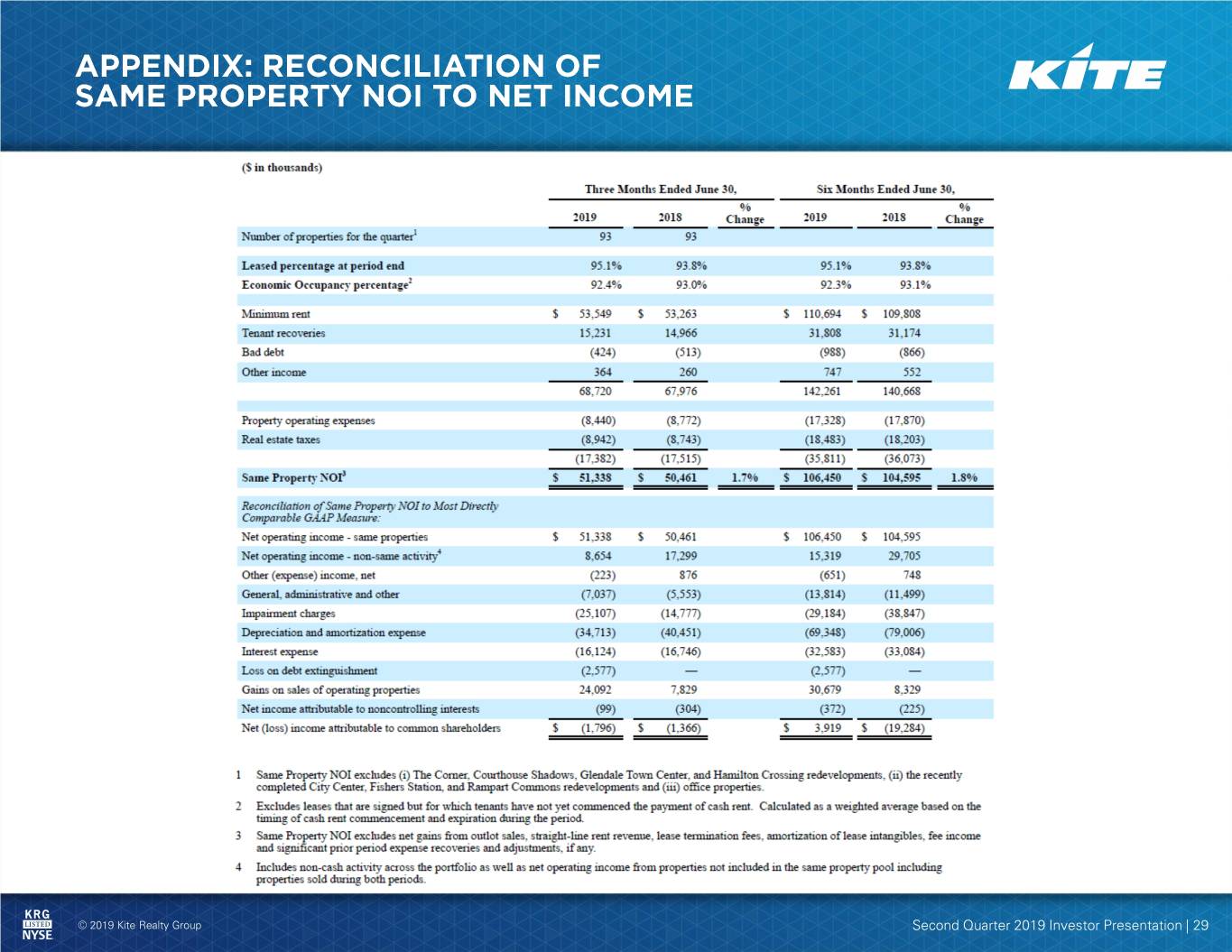

© 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 29

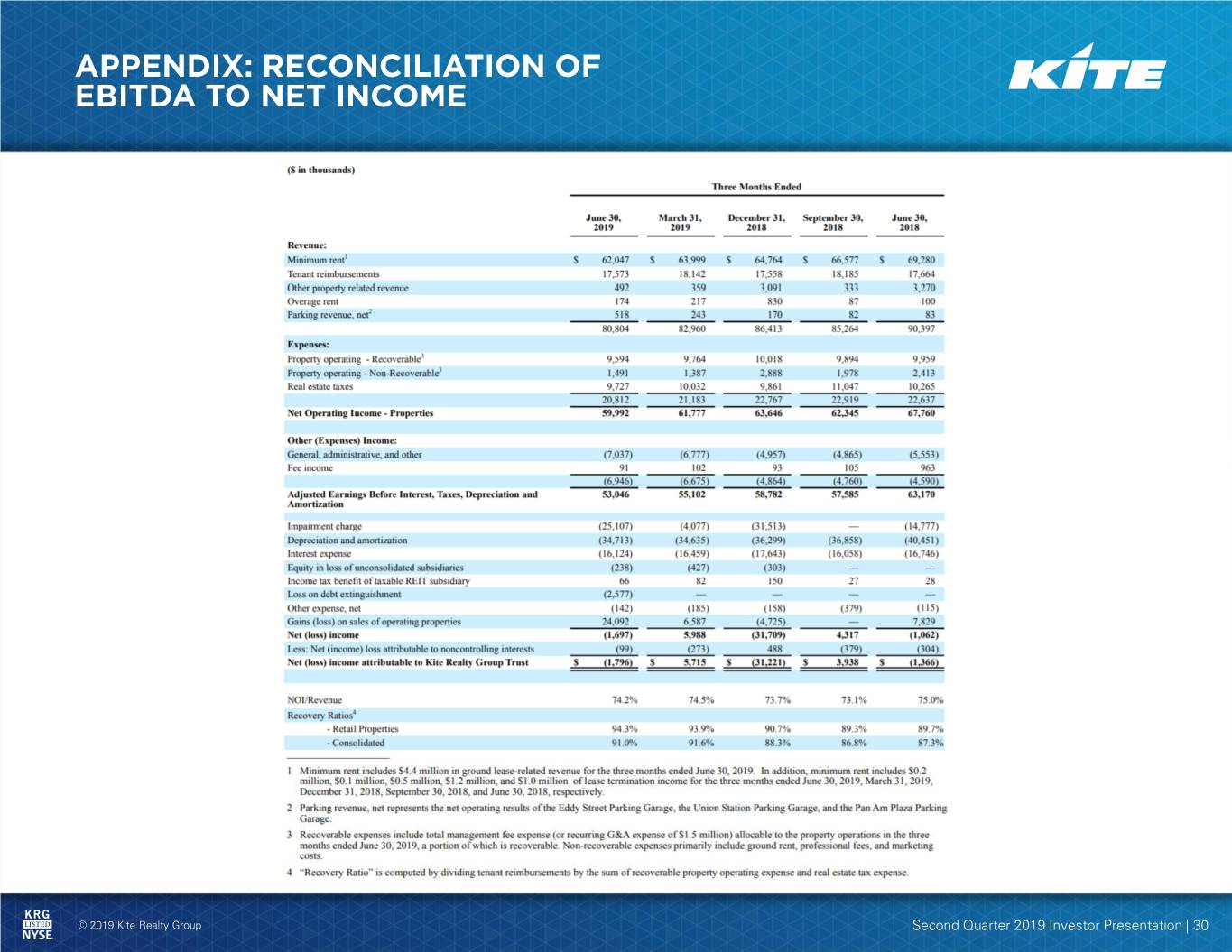

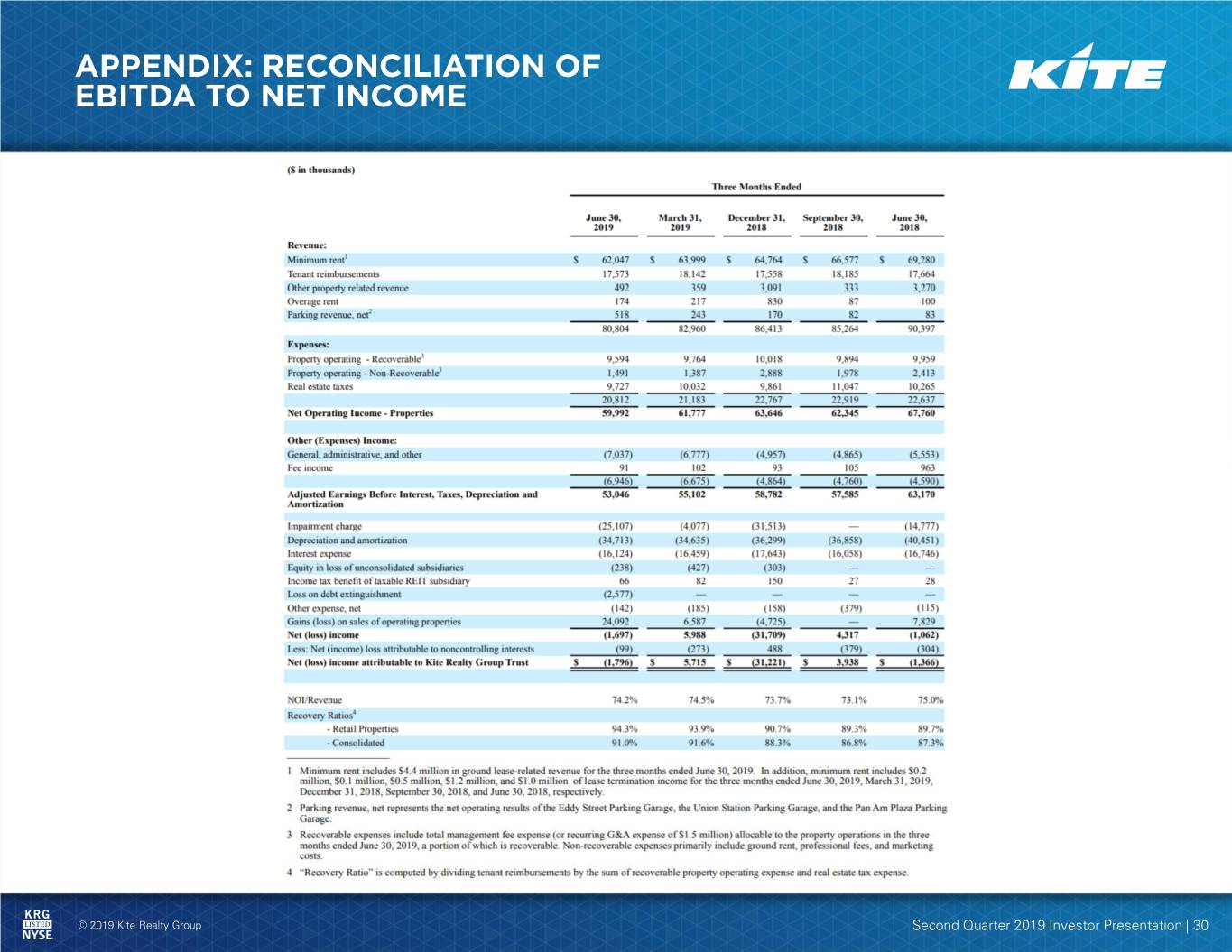

© 2019 Kite Realty Group Second Quarter 2019 Investor Presentation | 30