As the country is in the midst of an unprecedented crisis, Kite Realty Group is focused on a number of key principles, including employee safety, continuous operation of our centers to provide essential items, supporting our impacted tenants and striving to be a good corporate citizen. We are working with our tenants to help mitigate the impact of this ordeal. These tenants are the backbone of the US economy and our retail sector. Their survival is needed to not only make our centers thrive, but also to make the US economy thrive. We are committed to honoring our obligations, and, by doing so, we can minimize the further spread of economic dislocation. In order to do this though, we are relying on our well-capitalized tenants to also do their part. We are all in this together, and together we will survive this threat and emerge as a stronger retail sector. © 2020 Kite Realty Group COVID-19 UPDATE | 2

Embrace our core values Define the end game and focus on protecting the following: – Safety and security of all of our constituents – Occupancy, cash flow, and long-term value – Reputation as best-in-class landlord Craft and execute the game plan Recognize extraordinary times require extraordinary measures Don’t allow short-term disruption to impact long-term focus When reflecting back, be proud of how KRG handled the crisis © 2020 Kite Realty Group COVID-19 UPDATE | 3

▪ Protect employee safety, security, mental health, and productivity – Instituted work from home for all non-essential employees – Activated business continuity plan – Offering employees ample resources to enable effective employee engagement ▪ Keep centers open and operating to provide for consumers – Ensure essential retailers get whatever they need to operate most efficiently – Allow flexible use of parking lots for restaurants / grocers / retailers doing curbside pickup ▪ Focus on the long-term viability of our tenants – Continuous communication with tenants via asset managers and emails – Providing information regarding CARES Act to all tenants – Offering accommodations for smaller shop tenants – Discussing with national tenants the fact that the survival of the retail eco-system requires their support ▪ Ensure ample corporate liquidity to handle various scenarios – Conserve cash spend – Protect our capital provider relationships © 2020 Kite Realty Group COVID-19 UPDATE | 4

▪ 2020 & 2021 debt maturities = $0 ▪ Scaling back capital expenditures ▪ Outstanding committed development spend for 2020 = $3.6M ▪ Outstanding committed Big Box spend for 2020 = $16M ▪ Borrowed $300 million from our $600 million revolving credit facility ▪ Cash on hand as of 3/31/2020 = ~$350 million ▪ Paid all April debt obligations © 2020 Kite Realty Group COVID-19 UPDATE | 5

Other Non-Essential, 2% Office / Professional Service, 2% Communication, Other Specialty Food, 2% 7% Grocery / Theatres, 2% Drug, 12% Pet Stores, 4% Fitness, 4% Medical, 3% Personal Service, 7% Hardware / Auto, 2% Banks, 2% Restaurants, Other Essential, 1% 16% Soft Goods, 35% % of ABR As of 3/31/2020 © 2020 Kite Realty Group COVID-19 UPDATE | 6

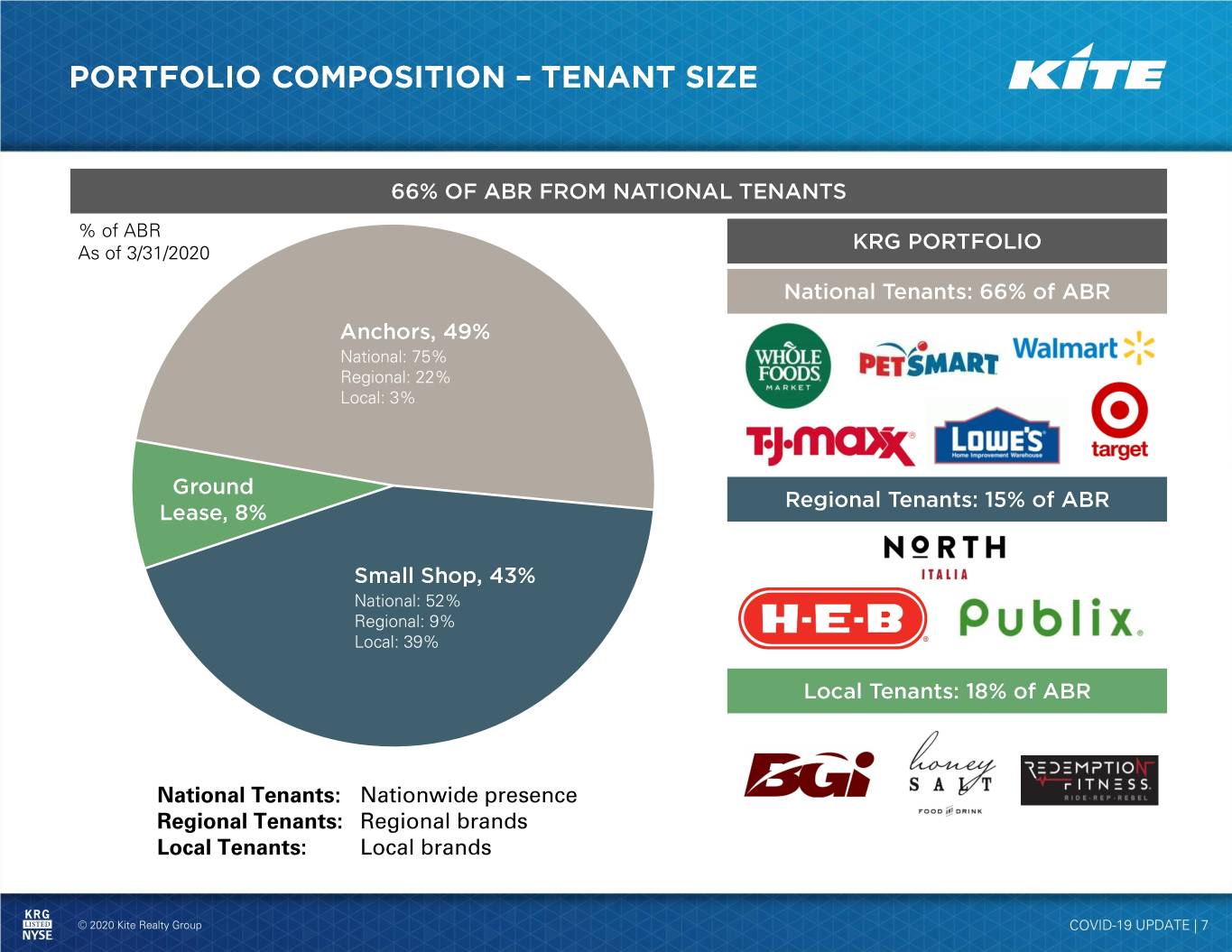

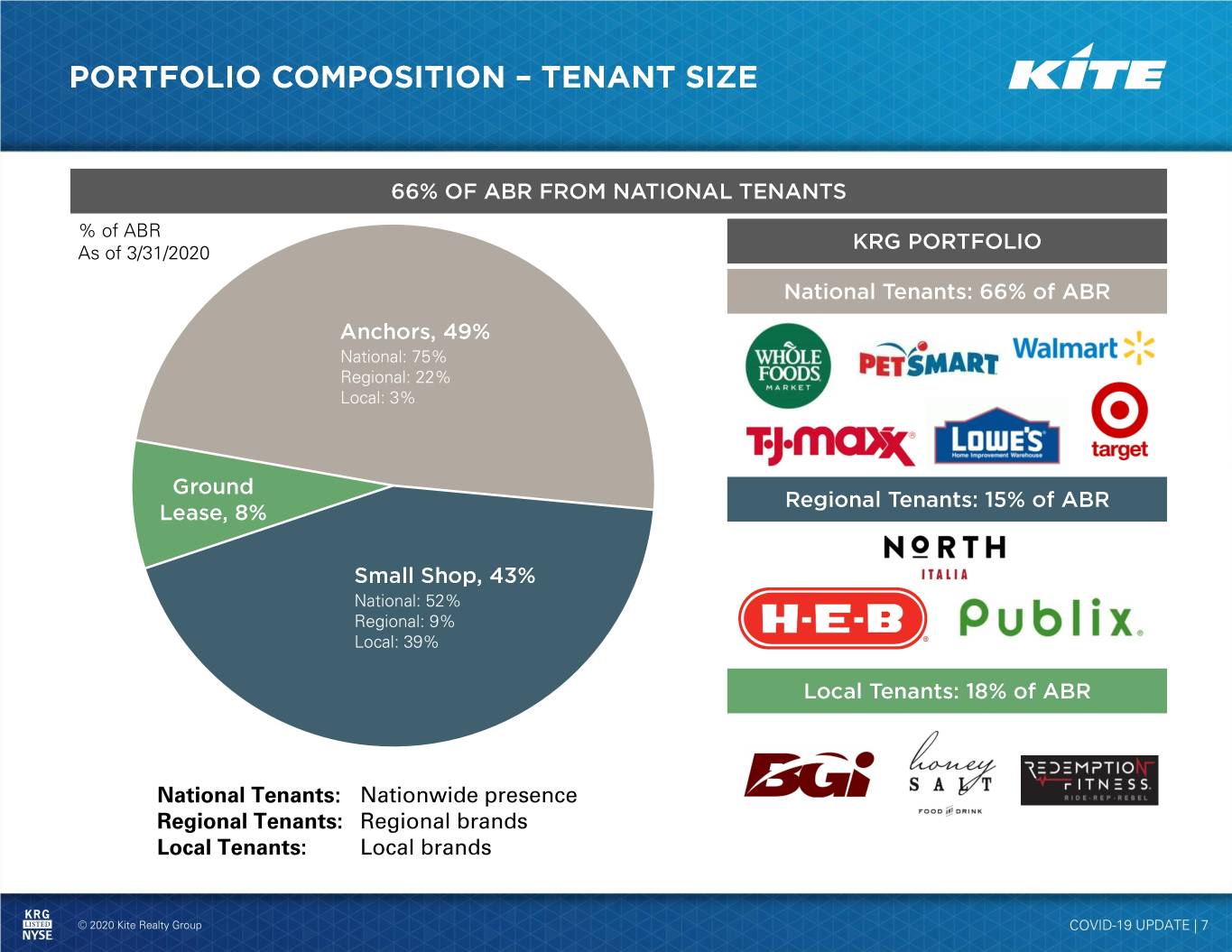

% of ABR As of 3/31/2020 National: 75% Regional: 22% Local: 3% National: 52% Regional: 9% Local: 39% National Tenants: Nationwide presence Regional Tenants: Regional brands Local Tenants: Local brands © 2020 Kite Realty Group COVID-19 UPDATE | 7

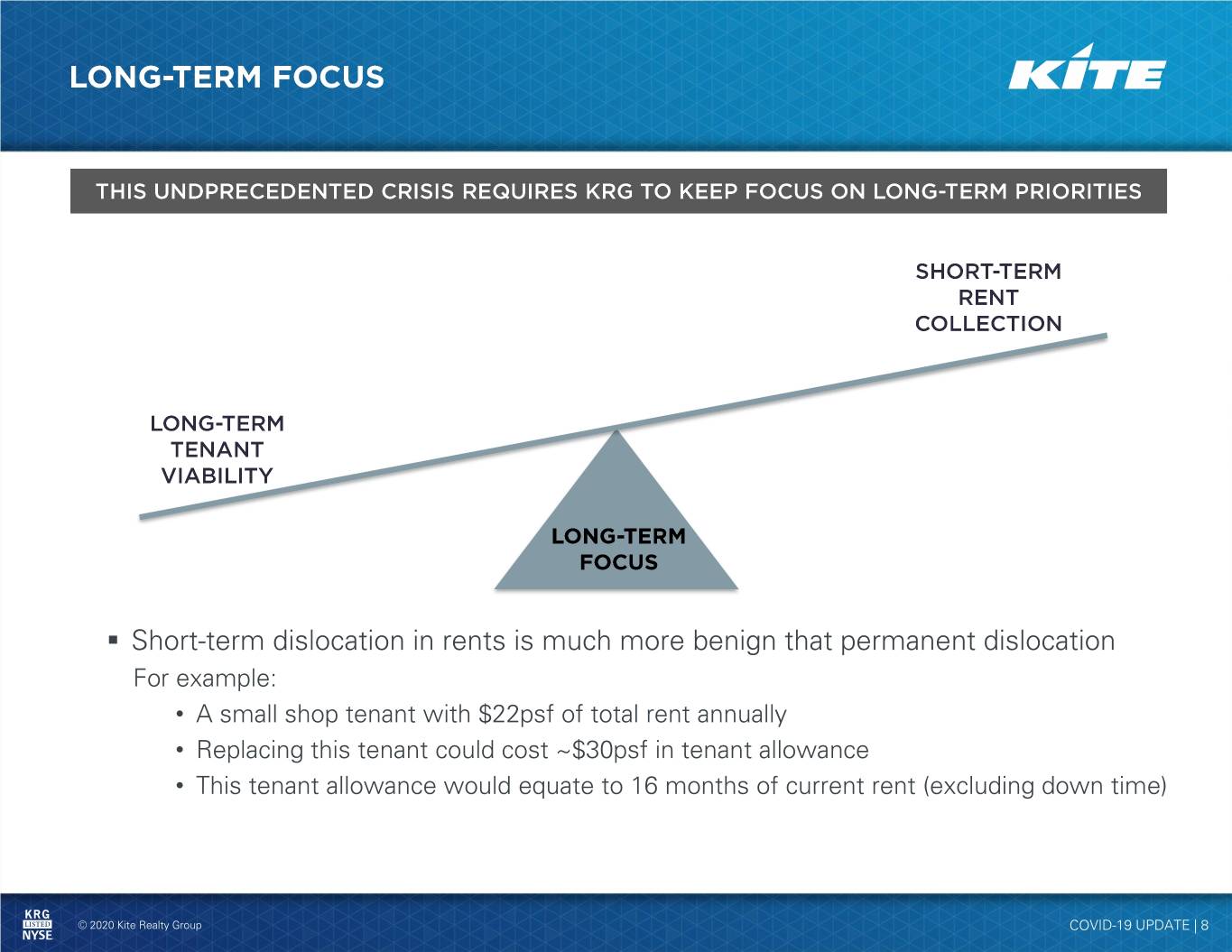

▪ Short-term dislocation in rents is much more benign that permanent dislocation For example: • A small shop tenant with $22psf of total rent annually • Replacing this tenant could cost ~$30psf in tenant allowance • This tenant allowance would equate to 16 months of current rent (excluding down time) © 2020 Kite Realty Group COVID-19 UPDATE | 8

▪ The best scientific minds in the world are racing to find a cure/vaccine and one of our core values is optimism ▪ The list of people that warrant a “thank you for your service” is expanding to include health care workers, cashiers at our necessity-based retailers, delivery drivers, restaurant workers fulfilling “to go” orders, public sanitation workers, remote school teachers, etc. – it’s their dedication that allows many of us to shelter at home ▪ At this time, we believe there isn’t such thing as “too much” communication – Frequent disclosure to ALL our stakeholders including employees, tenants and investors ▪ There is no doubt the landscape will be different when we reach the other side – Some challenged retailers will close, others will emerge stronger, and new ones will be born ▪ When we look back at this time, it will bring a new appreciation for many of the things we took for granted: – Dinner with friends and family at a restaurant – Casually strolling through the produce aisle – Getting a haircut – Going to the movies – Back-to-school shopping – Happy hour with colleagues © 2020 Kite Realty Group COVID-19 UPDATE | 9

Forward-Looking Statements This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to: • national and local economic, business, real estate and other market conditions, particularly in connection with low or negative growth in the U.S. economy as well as economic uncertainty; • potential adverse effects of the COVID-19 pandemic and other potential future outbreaks of infectious diseases on the financial condition, results of operations, cash flows and performance of us and our tenants, real estate, the economy and financial markets; • financing risks, including the availability of, and costs associated with, sources of liquidity; • our ability to refinance, or extend the maturity dates of, our indebtedness; • the level and volatility of interest rates; • the financial stability of tenants, including their ability to pay rent and the risk of tenant insolvency and bankruptcy; • the competitive environment in which the Company operates; • acquisition, disposition, development and joint venture risks; • property ownership and management risks; • our ability to maintain our status as a real estate investment trust for U.S. federal income tax purposes; • potential environmental and other liabilities; • impairment in the value of real estate property the Company owns; • the actual and perceived impact of e-commerce on the value of shopping center assets; • risks related to the geographical concentration of our properties in Florida, Indiana, Texas, Nevada and North Carolina; • insurance costs and coverage; • risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; • other factors affecting the real estate industry generally; and • other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and in our quarterly reports on Form 10-Q. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. © 2020 Kite Realty Group COVID-19 UPDATE | 10