Exhibit 99.1

Exhibit 99.1

Merrill Lynch 2005 Death Care Conference

April 21, 2005

Presented by:

StoneMor Presentation Team

Lawrence Miller

CEO, President and Chairman of the Board of Directors

William R. Shane

CFO, Executive Vice President and Director

3

Disclaimer

This presentation contains certain statements that may be deemed to be “forward-looking statements” within the meaning of the Securities Acts. All statements, other than statements of historical facts, that address activities, events or developments that the Partnership expects, projects, believes or anticipates will or may occur in the future, including, without limitation, the outlook for population growth and death rates, general industry conditions including future operating results of the Partnership’s properties, capital expenditures, asset sales, expansion and growth opportunities, bank borrowings, financing activities and other such matters, are forward-looking statements. Although the Partnership believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ from those projected in the forward-looking statements. For a more detailed discussion of risk factors, please refer to our annual Report on Form 10-K filed with the SEC.

In addition, this presentation contains projections of Distributable Free Cash Flow based upon hypothetical acquisitions by the Partnership. The projected impact of the acquisitions reflect management’s projections as to possible future results based on a number of assumptions that are inherently uncertain, including without limitation the organic growth of the Partnership, the availability of acquisition targets, the purchase prices for the targets, the availability of debt or equity financing from either third parties or the targets and the Partnership’s ability to integrate and manage such acquisitions. The assumptions involve significant elements of subjective judgment and analysis, and no representation is made as to their or the projections’ attainability.

4

Table of Contents

1. Who We Are

2. MLP Structure – Unique Advantages

3. Why We Reorganized

4. Where Do We Go From Here

5. Financial Overview

6. Appendix

5

Who We Are

6

Who We Are

4th largest owner and operator of cemeteries in the U.S.

132 cemeteries 7 funeral homes

More than 22,000 burials performed in 2004

Geographically-diverse operations

Located in 12 states, primarily along the Eastern Seaboard

Operate more than 6,000 acres of land

Weighted average sales life of more than 200 years

Unique MLP application:

Sale of merchandise and services is generally not qualifying income

Sale of real property (high margin product), including interment rights, is qualifying income

Our Mission: To help families memorialize every life with dignity.

7

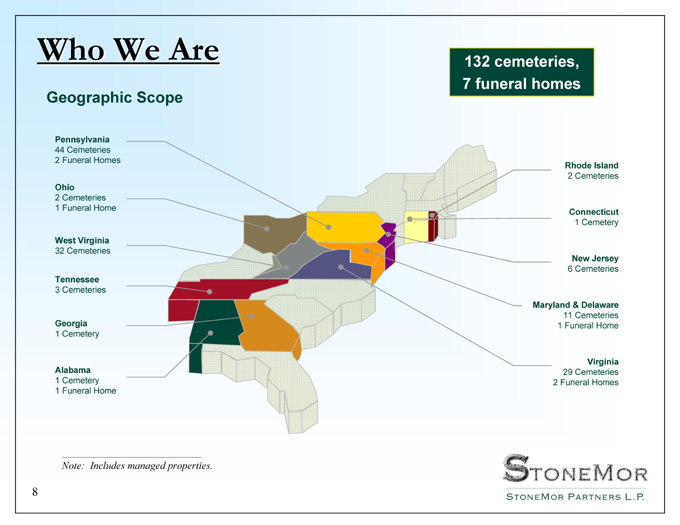

Who We Are

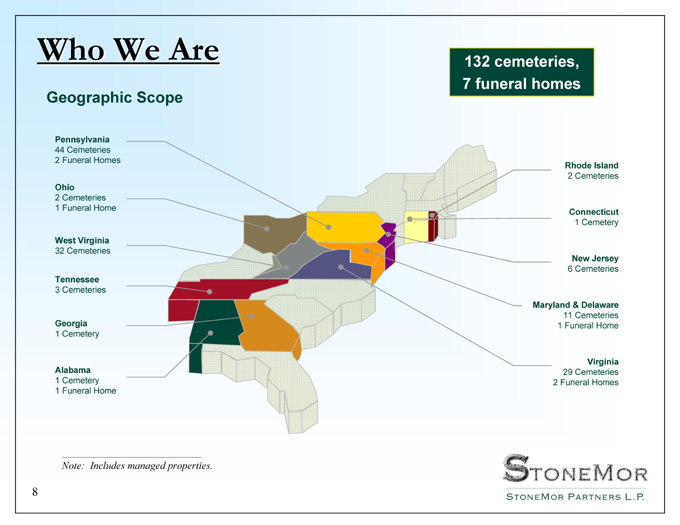

132 cemeteries, 7 funeral homes

Geographic Scope

Pennsylvania

44 Cemeteries 2 Funeral Homes

Ohio

2 Cemeteries 1 Funeral Home

West Virginia

32 Cemeteries

Tennessee

3 Cemeteries

Georgia

1 Cemetery

Alabama

1 Cemetery 1 Funeral Home

Rhode Island

2 Cemeteries

Connecticut

1 Cemetery

New Jersey

6 Cemeteries

Maryland & Delaware

11 Cemeteries 1 Funeral Home

Virginia

29 Cemeteries 2 Funeral Homes

Note: Includes managed properties.

8

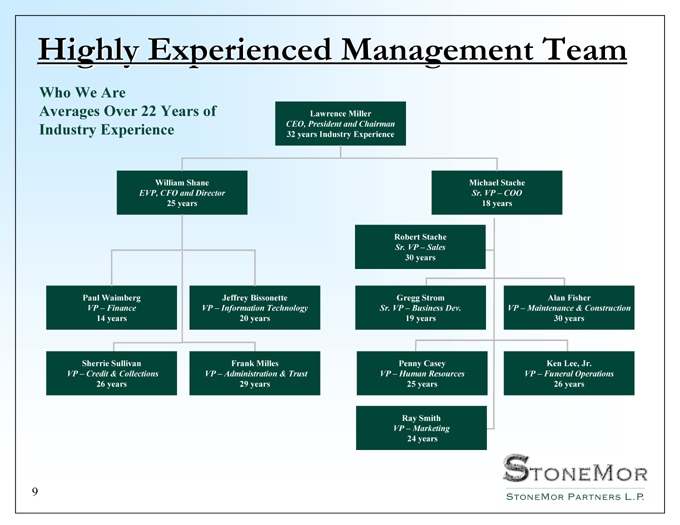

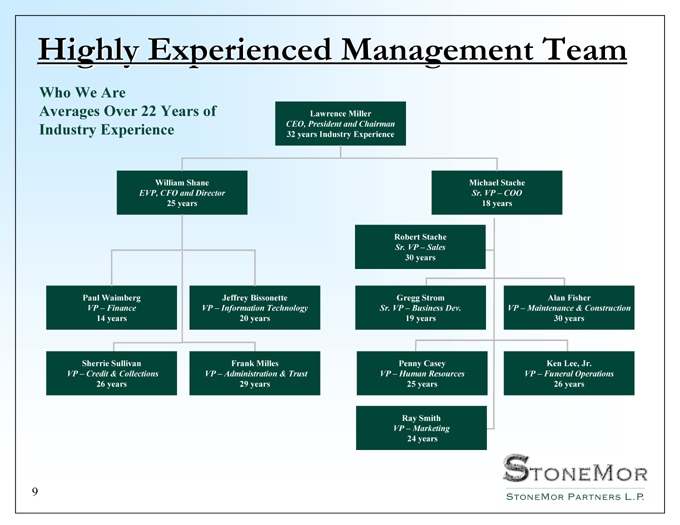

Highly Experienced Management Team

Who We Are

Averages Over 22 Years of Industry Experience

Lawrence Miller

CEO, President and Chairman

32 years Industry Experience

William Shane

EVP, CFO and Director

25 years

Michael Stache

Sr. VP – COO

18 years

Paul Waimberg

VP – Finance

14 years

Jeffrey Bissonette

VP – Information Technology

20 years

Sherrie Sullivan

VP – Credit & Collections

26 years

Frank Milles

VP – Administration & Trust

29 years

Robert Stache

Sr. VP – Sales

30 years

Gregg Strom

Sr. VP – Business Dev.

19 years

Alan Fisher

VP – Maintenance & Construction

30 years

Penny Casey

VP – Human Resources

25 years

Ken Lee, Jr.

VP – Funeral Operations

26 years

Ray Smith

VP – Marketing

24 years

9

Who We Are

Management Team

Morlan International 1972 – 1987

Osiris Holding Corporation 1988 – 1995

Loewen/Alderwoods 1995 – 1999

Cornerstone Family Services 1999 – 2004

StoneMor Partners September 2004 –

10

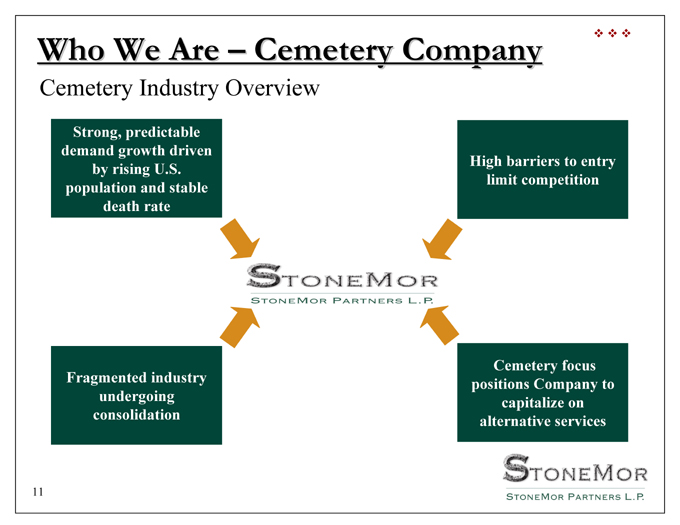

Who We Are – Cemetery Company

Cemetery Industry Overview

Strong, predictable demand growth driven by rising U.S. population and stable death rate

Fragmented industry undergoing consolidation

High barriers to entry limit competition

Cemetery focus positions Company to capitalize on alternative services

11

MLP Structure – Unique Advantages

12

MLP Structure – Unique Advantages

StoneMor Partners is a cemetery company organized as a Master Limited Partnership (MLP).

13

MLP Structure – Unique Advantages

StoneMor is:

An investing vehicle with general and limited partners

Publicly-traded partnership taxed as a partnership, not a corporation MLPs distribute available cash flow on a quarterly basis Portion of distribution is tax deferred

Minimum annual per unit distribution of $1.85, which equals a yield of 8.4% based on stock price of April 13, 2005

Due to yield, partnership currently trades at a premium to a standard C corporation.

Access to attractive acquisition currency

14

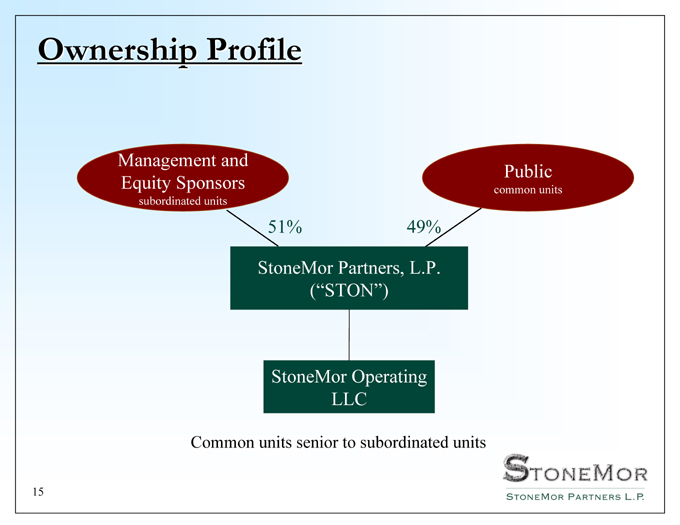

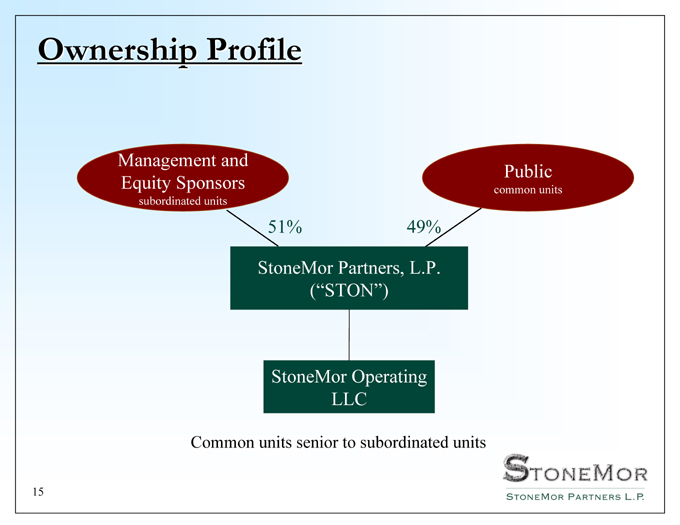

Ownership Profile

Management and Equity Sponsors

subordinated units

51%

Public

common units

49%

StoneMor Partners, L.P.

(“STON”)

StoneMor Operating LLC

Common units senior to subordinated units

15

Why We Reorganized

16

Why We Reorganized

Historic Economic Situation – Industry

Industry issues of 1990s had eliminated companies’ access to capital markets Limited amount of acquisition activity Significant decline in yield curve and equity markets Tightening of lending markets Change in accounting principles to SAB 101

17

Where Do We Go From Here?

18

Where Do We Go From Here?

We generate return for our investors by growing distributable cash flow.

Grow unit distributions by

Acquisitions Pre-need sales Manage trusts

19

Where Do We Go From Here?

Robust opportunity for growth through acquisition

Fragmented industry structure affords plentiful acquisition opportunities

Target acquisitions intended to be accretive on a cash basis

Rigorous diligence process leads to attractive acquisition multiples

Experienced management team has completed numerous acquisitions

22 years of average industry experience

Partnership management has acquired more than 400 cemeteries while working together Stock (units) is attractive acquisition currency

20

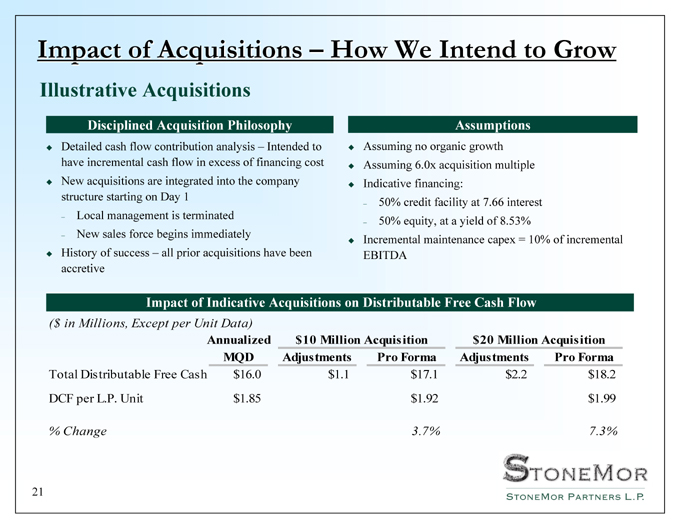

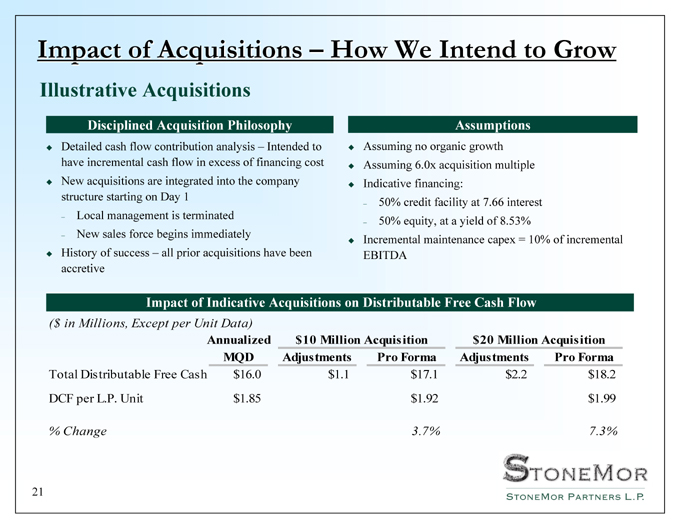

Impact of Acquisitions – How We Intend to Grow

Illustrative Acquisitions

Disciplined Acquisition Philosophy

Detailed cash flow contribution analysis – Intended to have incremental cash flow in excess of financing cost New acquisitions are integrated into the company structure starting on Day 1

Local management is terminated New sales force begins immediately

History of success – all prior acquisitions have been accretive

Assumptions

Assuming no organic growth Assuming 6.0x acquisition multiple Indicative financing:

50% credit facility at 7.66 interest 50% equity, at a yield of 8.53%

Incremental maintenance capex = 10% of incremental EBITDA

Impact of Indicative Acquisitions on Distributable Free Cash Flow

($ in Millions, Except per Unit Data)

Annualized $10 Million Acquisition $20 Million Acquisition

MQD Adjustments Pro Forma Adjustments Pro Forma

Total Distributable Free Cash $16.0 $1.1 $17.1 $2.2 $18.2

DCF per L.P. Unit $1.85 $1.92 $1.99

% Change 3.7% 7.3%

21

Financial Overview

22

Financial Overview

Distribution of Revenues

100% 80% 60% 40% 20% 0%

2002 2003 2004

Service and Other Trust Funds At-Need Sales Pre-Need Sales

23

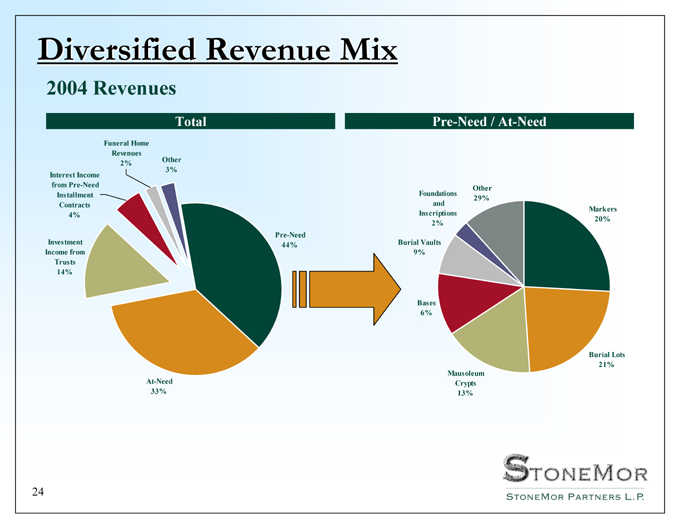

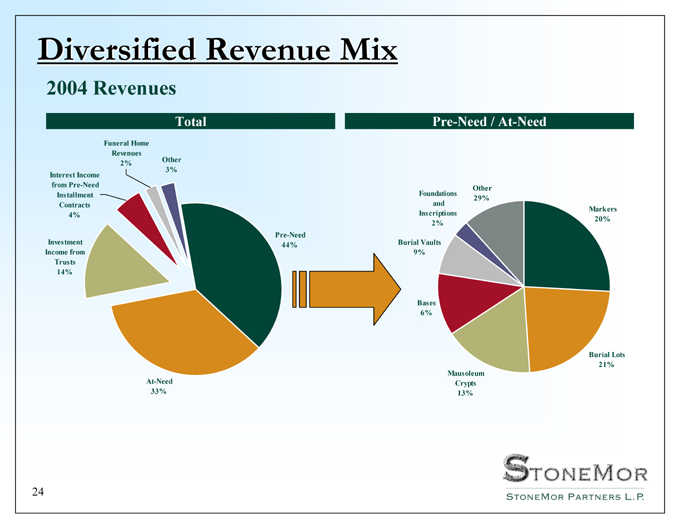

Diversified Revenue Mix

2004 Revenues

Total

Funeral Home Revenues 2%

Other 3%

Interest Income from Pre-Need Installment Contracts 4%

Investment Income from Trusts 14%

At-Need 33%

Pre-Need 44%

Foundations and Inscriptions 2%

Burial Vaults 9%

Bases 6%

Mausoleum Crypts 13%

Burial Lots 21%

Markers 20%

Other 29%

Pre-Need / At-Need

24

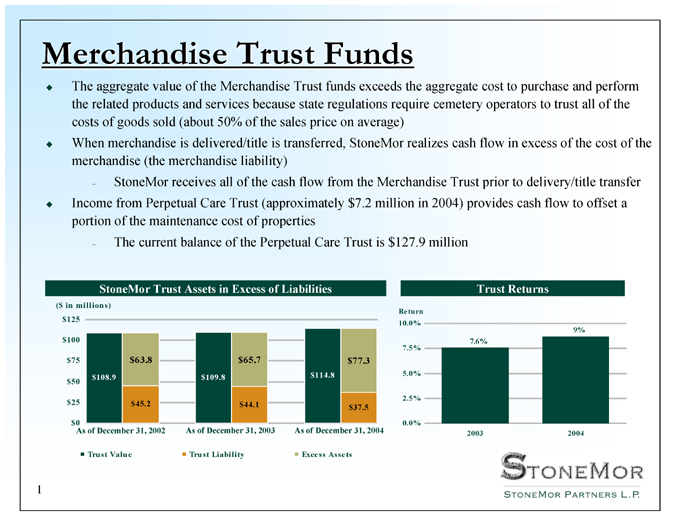

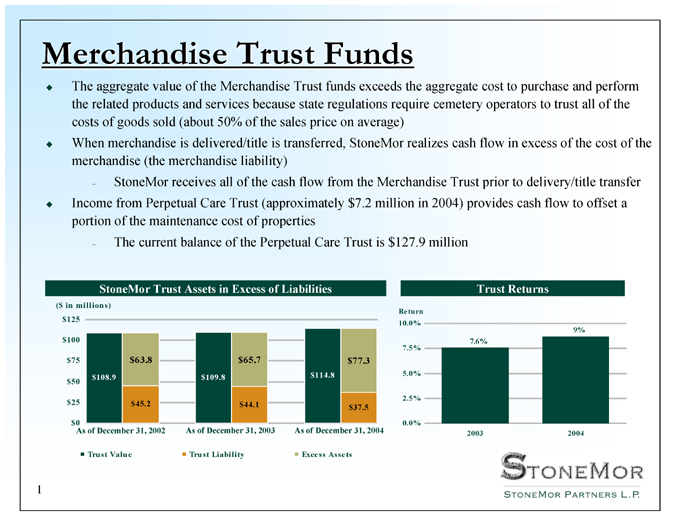

Merchandise Trust Funds

The aggregate value of the Merchandise Trust funds exceeds the aggregate cost to purchase and perform the related products and services because state regulations require cemetery operators to trust all of the costs of goods sold (about 50% of the sales price on average) When merchandise is delivered/title is transferred, StoneMor realizes cash flow in excess of the cost of the merchandise (the merchandise liability)

StoneMor receives all of the cash flow from the Merchandise Trust prior to delivery/title transfer Income from Perpetual Care Trust (approximately $7.2 million in 2004) provides cash flow to offset a portion of the maintenance cost of properties

The current balance of the Perpetual Care Trust is $127.9 million

StoneMor Trust Assets in Excess of Liabilities

($ in millions)

$125 $100 $75 $50 $25 $0

As of December 31, 2002

As of December 31, 2003

As of December 31, 2004

$108.9 $63.8 $45.2 $109.8 $65.7 $44.1 $114.8 $77.3 $37.5

Trust Value

Trust Liability

Excess Assets

Trust Returns

Return

10.0% 7.5% 5.0% 2.5% 0.0%

2003 2004

7.6% 9%

1

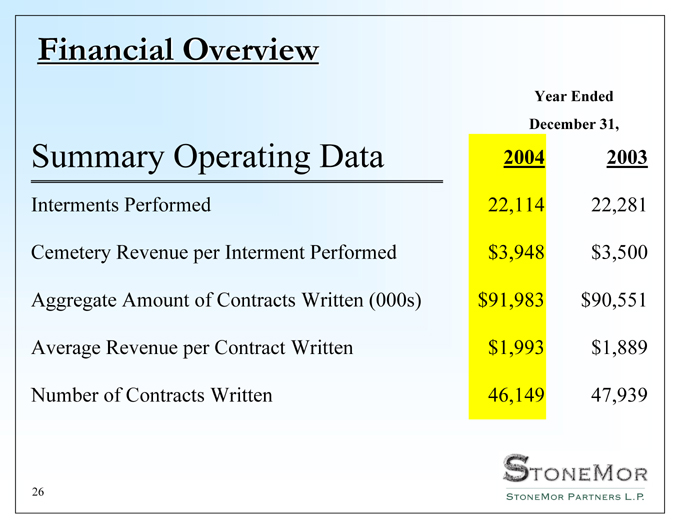

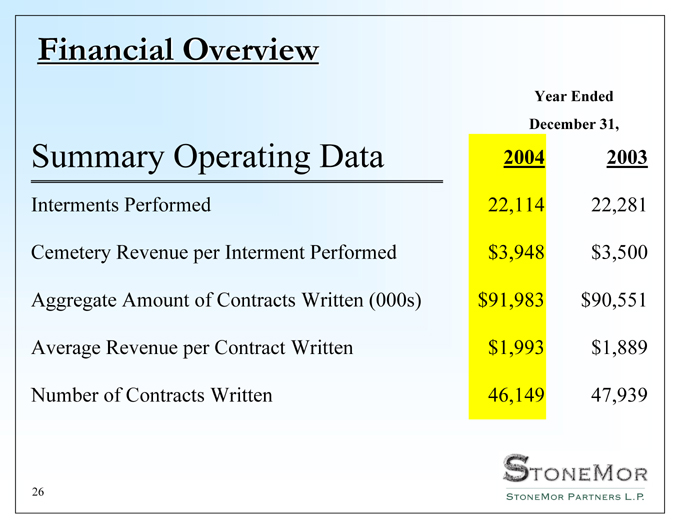

Financial Overview

Year Ended

December 31,

Summary Operating Data 2004 2003

Interments Performed 22,114 22,281

Cemetery Revenue per Interment Performed $3,948 $3,500

Aggregate Amount of Contracts Written (000s) $91,983 $ 90,551

Average Revenue per Contract Written $1,993 $1,889

Number of Contracts Written 46,149 47,939

26

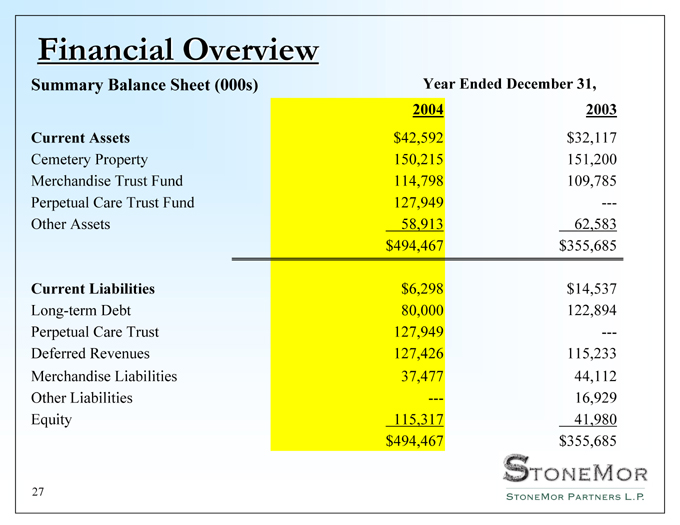

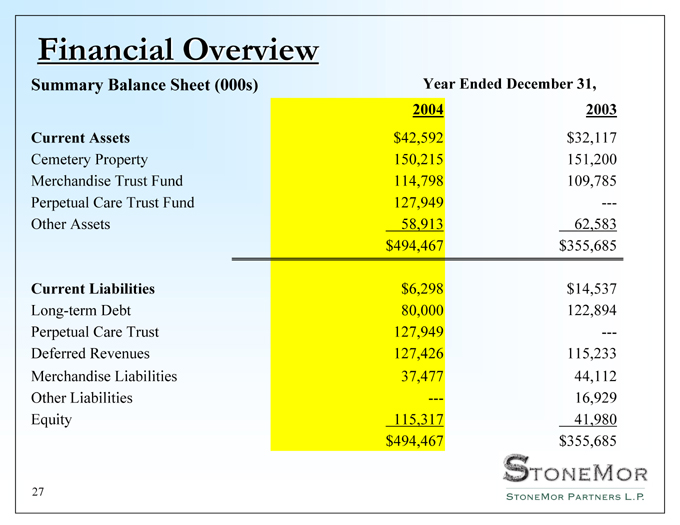

Financial Overview

Summary Balance Sheet (000s) Year Ended December 31,

2004 2003

Current Assets $42,592 $32,117

Cemetery Property 150,215 151,200

Merchandise Trust Fund 114,798 109,785

Perpetual Care Trust Fund 127,949 —-

Other Assets 58,913 62,583

$494,467 $355,685

Current Liabilities $6,298 $14,537

Long-term Debt 80,000 122,894

Perpetual Care Trust 127,949 —-

Deferred Revenues 127,426 115,233

Merchandise Liabilities 37,477 44,112

Other Liabilities —- 16,929

Equity 115,317 41,980

$494,467 $355,685

27

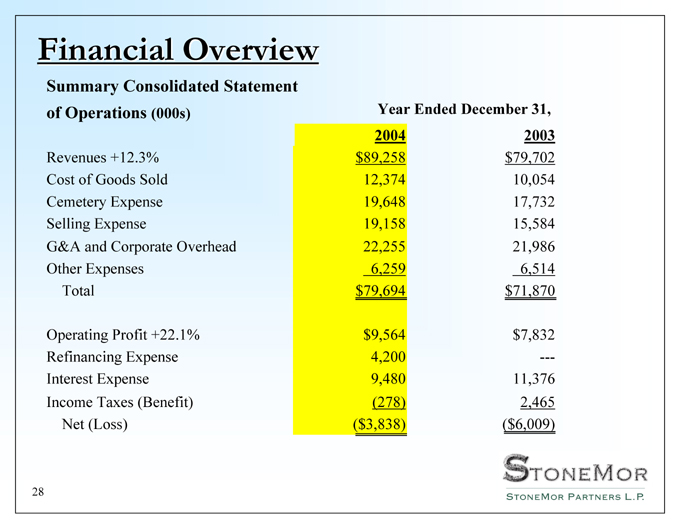

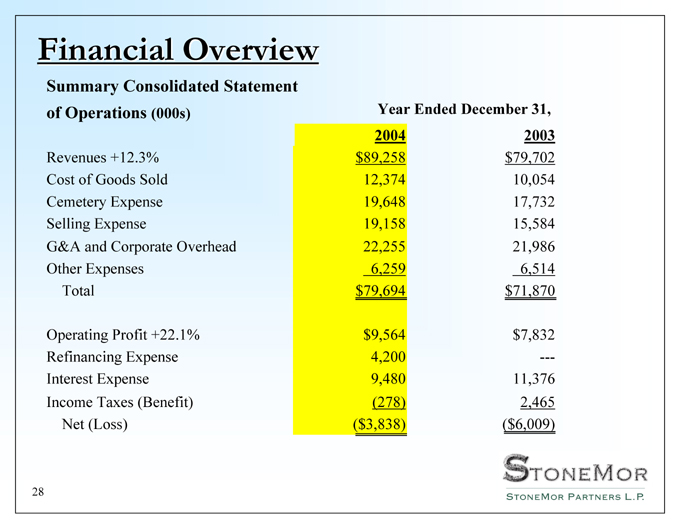

Financial Overview

Summary Consolidated Statement

of Operations (000s) Year Ended December 31,

2004 2003

Revenues +12.3% $89,258 $79,702

Cost of Goods Sold 12,374 10,054

Cemetery Expense 19,648 17,732

Selling Expense 19,158 15,584

G&A and Corporate Overhead 22,255 21,986

Other Expenses 6,259 6,514

Total $ 79,694 $71,870

Operating Profit +22.1% $9,564 $7,832

Refinancing Expense 4,200 —-

Interest Expense 9,480 11,376

Income Taxes (Benefit) (278) 2,465

Net (Loss) ($3,838) ($6,009)

28

Financial Overview

Cash Flow

Key – Generate distributable free cash flow to pay $1.85 minimum per unit distribution or approximately $16,000,000 annually. Minimum return is 8.4% based on stock price of April 13, 2005.

The Company defines distributable free cash flow as net cash provided by operating activities before appropriate reserves, if any, adjusted for expenditures related to its initial public offering less maintenance capital expenditures and debt payments not funded by the proceeds of that offering. A reconciliation between net cash provided by operating activities (the GAAP financial measure the Company believes is most directly comparable to distributable free cash flow) and distributable free cash flow for the quarter ended December 31, 2004 follows:

29

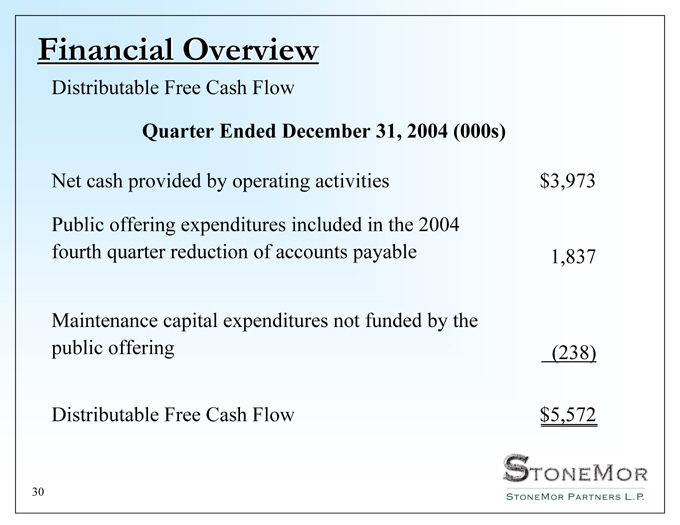

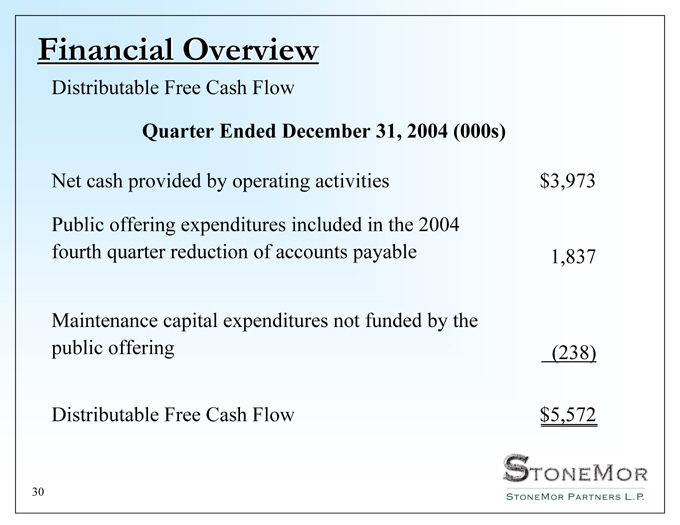

Financial Overview

Distributable Free Cash Flow

Quarter Ended December 31, 2004 (000s)

Net cash provided by operating activities $3,973

Public offering expenditures included in the 2004

fourth quarter reduction of accounts payable 1,837

Maintenance capital expenditures not funded by the

public offering (238)

Distributable Free Cash Flow $5,572

30

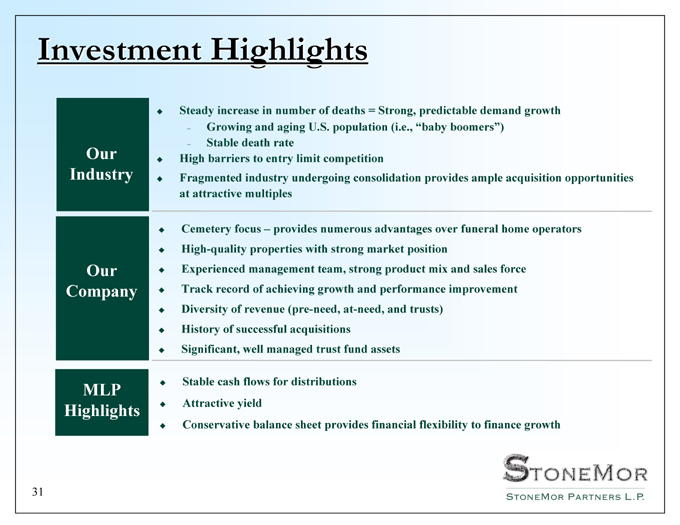

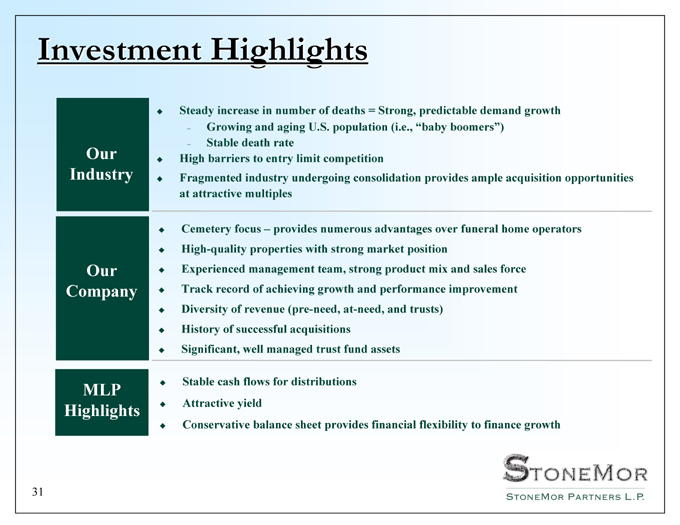

Investment Highlights

Steady increase in number of deaths = Strong, predictable demand growth

Growing and aging U.S. population (i.e., “baby boomers”) Stable death rate

High barriers to entry limit competition

Fragmented industry undergoing consolidation provides ample acquisition opportunities at attractive multiples

Cemetery focus – provides numerous advantages over funeral home operators High-quality properties with strong market position Experienced management team, strong product mix and sales force Track record of achieving growth and performance improvement Diversity of revenue (pre-need, at-need, and trusts) History of successful acquisitions Significant, well managed trust fund assets

Stable cash flows for distributions Attractive yield

Conservative balance sheet provides financial flexibility to finance growth

Our Industry

Our Company

MLP Highlights

31

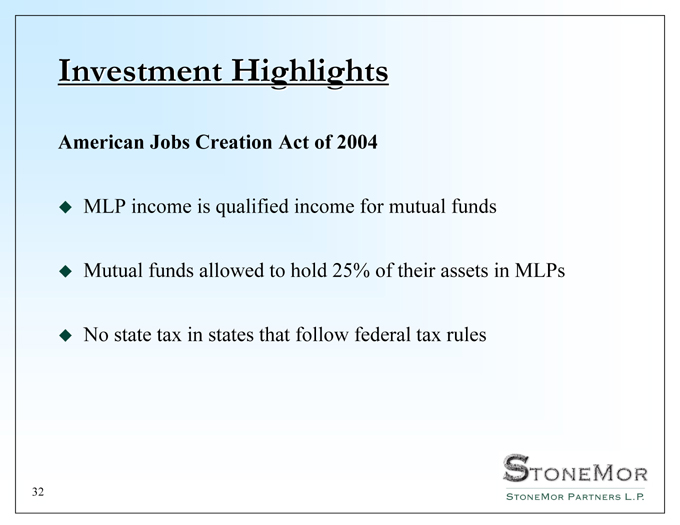

Investment Highlights

American Jobs Creation Act of 2004

MLP income is qualified income for mutual funds Mutual funds allowed to hold 25% of their assets in MLPs No state tax in states that follow federal tax rules

32

Appendix

33

Appendix

Distributable Free Cash Flow

We present distributable free cash flow because management believes this information is a useful adjunct to net cash provided by operating activities under GAAP. Distributable free cash flow is a significant liquidity metric that we believe is an indicator of our ability to generate cash flow at a level sufficient to pay the minimum quarterly cash distribution to the holders of our common units and subordinated units and for other purposes such as repaying debt and expanding through strategic investments.

Distributable free cash flow is similar to quantitative standards of free cash flow used throughout the deathcare industry and to quantitative standards of distributable cash flow used throughout the investment community with respect to publicly traded partnerships, but is not intended to be a prediction of the future. However, our calculation of distributable free cash flow may not be consistent with calculations of free cash flow, distributable cash flow or other similarly titled measures of other companies. Distributable free cash flow is not a measure of financial performance and should not be considered as an alternative to cash flows from operating, investing, or financing activities.

34