[LETTERHEAD OF STONEMOR PARTNERS L.P.]

August 13, 2007

Larry Spirgel

Assistant Director

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| | Re: | StoneMor Partners L.P. |

Forms 10-K and 10-K/A for the fiscal year ended December 31, 2006

Filed March 19, 2007 and April 30, 2007, respectively

File No. 0-50910

Dear Mr. Spirgel:

StoneMor Partners L.P. (the “Company”) submits the following responses to comments raised in the staff’s letter (the “Comment Letter”), dated July 20, 2007. In order to facilitate your review, each of the staff’s comments is followed by the Company’s response below, and the responses are numbered to correspond to the comment numbers in the Comment Letter.

Form 10-K for the year ending December 31, 2006

Consolidated Statement of Cash Flows, page 63

| 1. | Please explain to us how you are currently presenting changes in balance sheet items such as “deferred cemetery revenue,” “deferred selling and obtaining costs,” “non-controlling interest in perpetual care trusts” and “merchandise and perpetual care trust investments” in line items classified within cash provided by operating activities on the cash flow statement. It is not clear if your net presentation, with all activities being classified within operating activities, is in compliance with the requirements of SFAS No. 95 “Statement of Cash Flows”. |

Response:

In accordance with industry practice and paragraphs 21 – 24 of SFAS No. 95,“Statement of Cash Flows”, the Company reflects changes in balance sheet items “deferred cemetery revenue” and “deferred selling and obtaining costs” within cash provided by operating activities. The Company believes that these items are so inherently a part of the Company’s basic core business activities, directly relate to cash receipts from the sale of goods and services and therefore enter into the determination of net income, that they should be classified as cash flow from operations.

Larry Spirgel

August 13, 2007

Page 2

Under the provisions of FIN 46R, the Company’s merchandise and perpetual care trusts are considered variable interest entities in accordance with the guidance set forth in paragraphs 5(a) and 5(b)(1) of FIN 46R. The principal in the perpetual care trusts is required by state law to be held in perpetuity and is not redeemable by the Company or the customers. Accordingly the equity interest in the perpetual care trusts is presented as a non-controlling interest in perpetual care trusts between the liabilities and stockholders’ equity in the Company’s consolidated balance sheet. Therefore, increases in perpetual care trust (use of cash) are offset by increases in non-controlling interest in perpetual care trust (source of cash) and have no net effect on the Company’s cash flow statement. Both the merchandise and perpetual care trusts hold investments in marketable securities, which have been classified as available-for-sale. In accordance with SFAS No. 115,“Accounting for Certain Investments in Debt and Equity Securities”, these investments are recorded at their fair value. The Company is not the legal owner of the securities within the trust and generally has no control over the timing of the withdrawal. As such, the Company considers funds deposited in merchandise trusts as comparable to long-term accounts receivable.

Additionally, also in accordance with industry practice, the Company believes it has met the gross cash flow disclosure requirements as it currently tracks and discloses gross movements within our trust investments in Note 6, Pre-need Merchandise and Services and Merchandise Trusts and Note 7, Perpetual Care Trusts. These disclosures include gross purchase and gross sales of securities within the trust investments and gross contributions and gross distributions of funds to the trusts. In order to further highlight the classification of these cash flows as cash flows from operations, the Company will include the following sentence in the first paragraph in each of these footnotes:

Note 6. “Cash flows from preneed cemetery contracts are presented as operating cash flows in our consolidated statement of cash flows.”

Note 7. “Cash flows from preneed cemetery perpetual care contracts are presented as operating cash flows in our consolidated statement of cash flows.”

Larry Spirgel

August 13, 2007

Page 3

Notes to Consolidated Financial Statements

Summary of Significant Accounting Policies, page 66

| 2. | As your investments in your Merchandise and Perpetual Care Trusts are material, please disclose your accounting policies used for these investments and the methods of applying these policies that materially affect the determination of financial position, cash flows, or results of operations. |

Response:

We disclose our accounting policies within the Cemetery Operations section of Note 1 - Nature of Operations, Basis of Presentation and Summary of Significant Accounting Policies. The following quotes are an excerpt from our 2006 10-K to which we included, and set forth below, the methods of applying these policies that materially affect the determination of financial position, cash flows, or results of operations.

“Pursuant to state law, a portion of the proceeds from cemetery merchandise or services sold on a pre-need basis is required to be paid into merchandise trusts.”

| | 1.) | Financial position effect: As we make payments to fund these trusts, these amounts are recorded as assets on our balance sheet and classified as Merchandise Trusts, restricted, at fair value. |

| | 2.) | Cash flow effect: As we make payments to fund these trusts, the cash deposited in the Merchandise trusts reduces our cash flow from operations. |

| | 3.) | Results of operation effect: Cash payments to these trust funds do not impact our results of operation. |

“The Company defers investment earnings generated by the assets in these merchandise trusts (including realized gains and losses) until the associated merchandise is delivered or the services are performed.”

| | 1.) | Financial position effect: As investment income is earned, the earnings are classified as Deferred Cemetery Revenues, net. When the merchandise is delivered or services are performed, the amount of earnings associated with the amounts trusted for the merchandise or services reduces the Deferred Cemetery Revenues, net balance. |

| | 2.) | Cash flow effect: Amounts associated with undistributed trust earnings serve to increase the cash used for Merchandise Trust which is offset in its entirety by cash provided by Deferred Cemetery Revenues and Direct Selling and Obtaining costs and has no net effect on our cash flow from operations. At the time of delivery, the amount of earnings associated with the amounts trusted for the merchandise or services increases cash provided by net income, increases cash provided by Merchandise trusts and increases cash used for Deferred Cemetery Revenues and Direct Selling and Obtaining costs. This creates a net positive effect on cash flow from operations. |

Larry Spirgel

August 13, 2007

Page 4

| | 3.) | Results of operation effect: Amounts associated with undistributed trust earnings do not impact our income statement. Amounts associated with income distributed from the trusts is included in Cemetery revenues on our income statement. |

“The fair value of the funds held in merchandise trusts at December 31, 2005 and December 31, 2006 was approximately $113.4 million and $147.8 million, respectively (see Note 6).”

“A portion of the proceeds from the sale of cemetery property is required by state law to be paid into perpetual care trusts.”

| | 1.) | Financial position effect: At the time we recognize the sale of cemetery property, we record a liability, classified as Merchandise Liability for the amount required to be paid into the trust account. As we make payments to fund these trusts, these amounts are recorded as assets on our balance sheet and classified as Perpetual Care Trusts, restricted, at fair value and reduce our Merchandise Liability. Additionally, we record a liability classified as Non-controlling Interest in Perpetual Care trusts for the same amount. |

| | 2.) | Cash flow effect: At the time we recognize the sale of cemetery property, the expense related to perpetual care serves to reduce net income and increase Merchandise Liability for equivalent amounts and has no effect on our cash flow from operations. As we make payments to fund these trusts, Merchandise Liability is reduced thus reducing our cash flow from operations. |

| | 3.) | Results of operation effect: At the time we recognize the sale of cemetery property, the expense related to perpetual care is recorded in our income statement as Cost of Goods Sold, Perpetual Care. |

“Earnings from the perpetual care trusts are recognized in current cemetery revenues and are used to defray cemetery maintenance costs, which are expensed as incurred. Funds held in perpetual care trusts at December 31, 2005 and December 31, 2006 were $136.7 million and $168.6 million, respectively (see Note 7).”

Additionally, in our Annual Report on Form 10-K for the year ended December 31, 2004 and our Annual Report on Form 10-K for the for the year ended December 31, 2005 we included, within the Accounting Change section of Note 1 - Nature of Operations, Basis of Presentation and Summary of Significant Accounting Policies, the following disclosure.

Larry Spirgel

August 13, 2007

Page 5

“In January 2003 and December 2003, the FASB issued FASB Interpretation (FIN) No. 46 and No. 46 revised (FIN 46R),Consolidation of Variable Interest Entities: an Interpretation of Accounting Research Bulletin (ARB) No. 51. FIN 46 and FIN 46R clarify the application of ARB No. 51,Consolidated Financial Statements, to certain entities in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. FIN 46R further defines the terms related to variable interest entities and clarifies if such entities should be consolidated. FIN 46R applies to enterprises that have a variable interest in variable interest entities and was effective for the first financial reporting period ending after March 15, 2004. The requirements of this interpretation, as revised, were applicable to the Company for the quarter ending March 31, 2004.

The adoption of FIN 46R resulted in the consolidation of the merchandise trusts (including the funeral trusts) and perpetual care trusts in the Company’s consolidated balance sheet, but did not change the legal relationships among the merchandise trusts and perpetual care trusts, the Company, and its holders of pre-need contracts. To the extent that the customers are the legal beneficiaries of the merchandise trusts, the Company recognizes a non-controlling interest in merchandise trusts. The principal in the perpetual care trusts is required by state law to be held in perpetuity and is not redeemable by the Company or the customers. Accordingly the equity interest in the perpetual care trusts is presented as a non-controlling interest in perpetual care trusts between the liabilities and stockholders’ equity in the Company’s consolidated balance sheet. The adoption of FIN 46R did not impact the Company’s net income or its consolidated statement of cash flows from operating, investing or financing activities.

Both the merchandise and perpetual care trusts hold investments in marketable securities, which have been classified as available-for-sale. In accordance with SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities, these investments are recorded at their fair value, with unrealized gains and losses excluded from earnings and reported as a separate component of accumulated other comprehensive income in the Company’s consolidated balance sheet. Unrealized gains and losses of the merchandise trusts that are attributable to the Company that have not been earned through the performance of services or delivery of merchandise are reclassified from accumulated other comprehensive income to deferred cemetery revenues, net. Unrealized gains and losses of the merchandise trusts (including the funeral trusts) that are attributable to the non-controlling interest holders are

Larry Spirgel

August 13, 2007

Page 6

reclassified from accumulated other comprehensive income and recognized as a non-controlling interest in merchandise trusts. Unrealized gains and losses of the perpetual care trusts are reclassified from accumulated other comprehensive income to non-controlling interest in perpetual care trusts.

The Company recognizes realized earnings of the merchandise trusts that are attributable to the Company that have been earned as other income in the Company’s consolidated statement of operations. Realized earnings of the merchandise trusts that are attributable to the Company that have not been earned through the performance of services or delivery of merchandise are recorded in deferred cemetery revenues, net, in the Company’s consolidated balance sheet. Realized earnings of the merchandise trusts (including the funeral trusts) that are attributable to non-controlling interest holders are recognized as a non-controlling interest in merchandise trusts. To the extent of qualifying cemetery maintenance costs, distributable earnings from the perpetual care trusts are recognized in cemetery revenues; otherwise realized earnings of the perpetual care trusts are recognized in other income.”

We will include a disclosure of our current accounting policies as they relate to FIN 46R in future filings, similar to the disclosure included above.

Cemetery Operations, page 66

| 3. | We note your disclosure with regards to the deferred direct obtaining costs. In view of the fact that you are not an insurance company, tell us your basis to defer these costs under SFAS 60. Also, identify for us each of the cost elements comprising deferred costs. |

Response:

At the time of implementation of SAB 101(SAB 104) the Company considered various accounting literature to determine the appropriate accounting policy as it relates to deferred direct obtaining costs. In addition to considering paragraphs 11, 28 and 29 of SFAS 60 we also considered paragraphs 5 – 7 of SFAS 91,Accounting for Nonrefundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases. Our analysis concluded that SFAS 60 was more analogous to the way we conduct our business in that we are providing guaranteed benefits in the future once the customers make certain payments as stipulated in their contracts. Although the revenue associated with the service or product is completely deferred until performance or delivery, we believe the nature of our sales activity is more similar to the activities of insurance companies rather than lenders. Deferred direct selling and obtaining costs consists of commissions and bonuses paid to sales people and sales managers and associated payroll taxes and benefits.

Larry Spirgel

August 13, 2007

Page 7

Deferred Cemetery Revenues, Net, page 67

| 4. | Tell us how you ensure appropriate recognition of deferred obtaining costs in your income statement. Tell us if you are able to directly relate each element of deferred acquisition cost with a corresponding contract. Please cite the accounting guidance used as the basis for your policy and include this disclosure in future filings. |

Response:

It is our policy to defer obtaining costs under SFAS 60. We have designed our computer systems to track each individual contract whereby we are able to specifically relate each obtaining/acquisition cost to a specific contract. As the contracts are recognized into income the corresponding obtaining cost is recognized as expense. This item is currently disclosed within the Cemetery Operations section of Note 1 - Nature of Operations, Basis of Presentation and Summary of Significant Accounting Policies.

Merchandise Liability, page 68

| 5. | We note your discussion concerning pre-need cemetery merchandise and services on pages 36-37 and your policy footnote disclosures. Please disclose and explain to us why the sum of the amount of your merchandise liability and the amount of deferred merchandise trust revenue reported in footnote 10 does not equal the amount of your merchandise trust asset in 2006. |

Response:

The sum of the merchandise liability and the deferred merchandise trust revenue will not necessarily equal the value of the merchandise trusts. The merchandise liability accounts for the cost that the Company will have to pay to either deliver the product or provide the service which may be less than the amount required to be trusted in accordance with applicable state law. The merchandise trust asset is funded based on a percentage of the sales price of the product or service. Virtually every sale of a product or service must be trusted – trusting percentages vary based on individual state laws. For example, in the Commonwealth of Pennsylvania, we are required to place 70% of the sales price of burial vaults sold on a pre-need basis in the merchandise trust. If we sell a vault for $500, which costs us $125, we would be required to put $350 in trust.

Larry Spirgel

August 13, 2007

Page 8

Segment Reporting and Related Information, page 69

| 6. | We note that you have one reportable segment – death care services. However, we also note that you operate cemeteries in distinct geographical areas of the country. Please explain to us your full consideration of the guidance in SFAS No. 131 when concluding that you have one reportable segment. Please separately address each of the following issues when responding to his comment. |

| | a. | Identify for us your chief operating decision maker. |

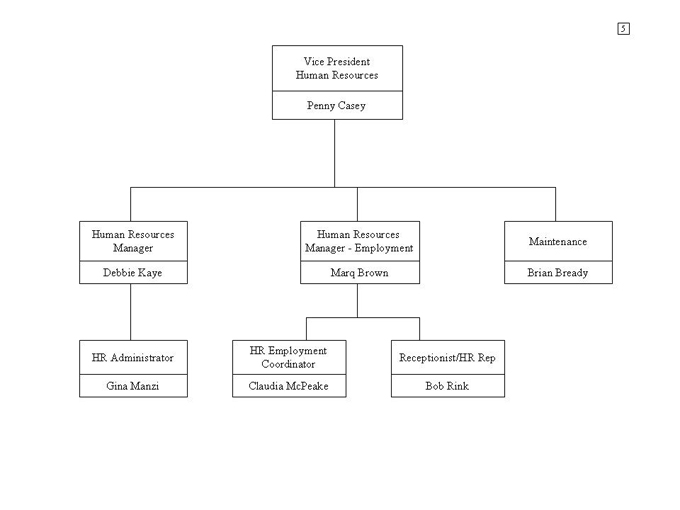

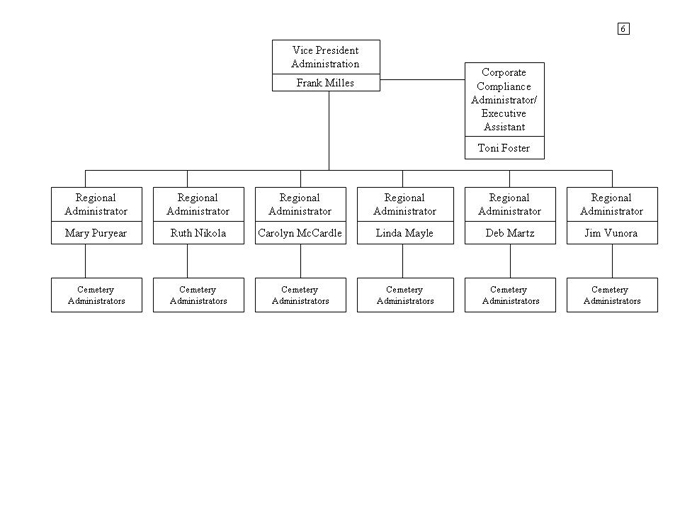

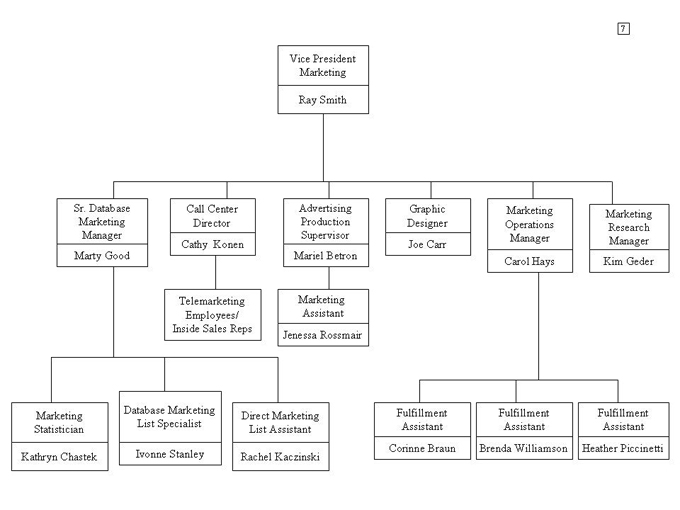

| | b. | Provide us an organizational chart of the Company that identifies the various levels of management and summarizes their responsibilities. |

| | c. | Describe for us the management reports reviewed by the Chief Operating Decision Maker and explain how he uses them. Specifically discuss the measure of profit and loss reviewed by the CODM. |

| | d. | Identify for us your operating segments and explain how they were determined. Refer to paragraph 10 of SFAS No. 131. |

| | e. | If you have aggregated several operating segments into one reportable segment, explain to us how you met the criteria for aggregation in paragraph 17 of SFAS 131, including the requirement that the segments have similar economic characteristics. |

Response:

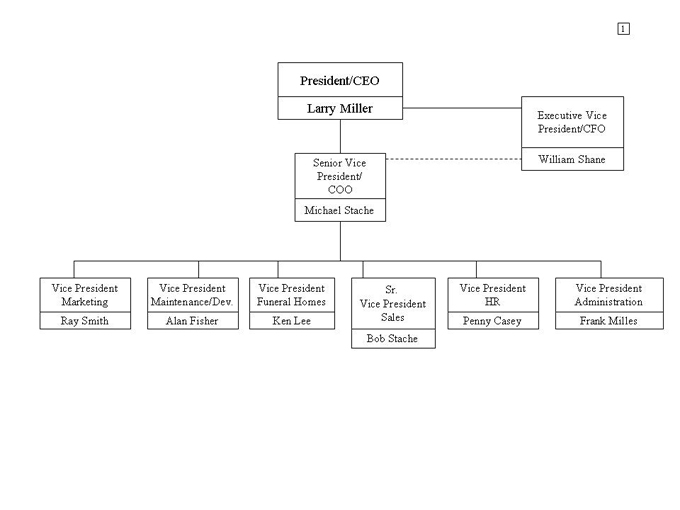

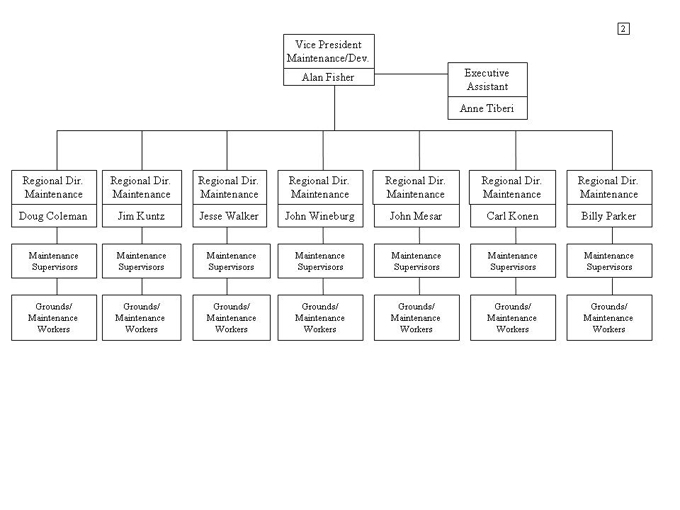

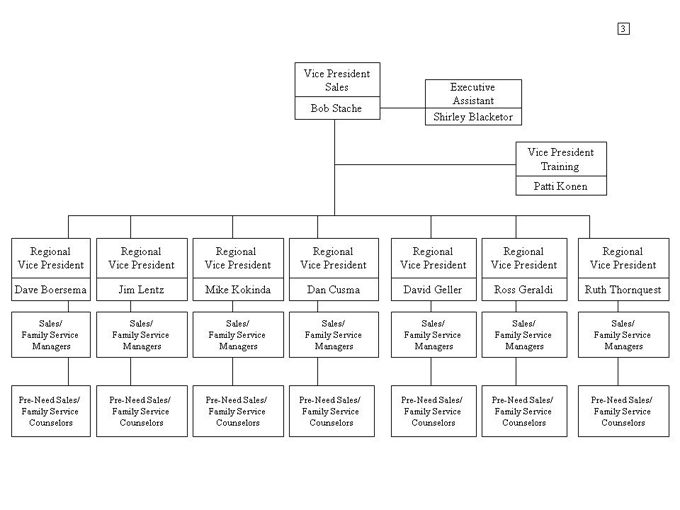

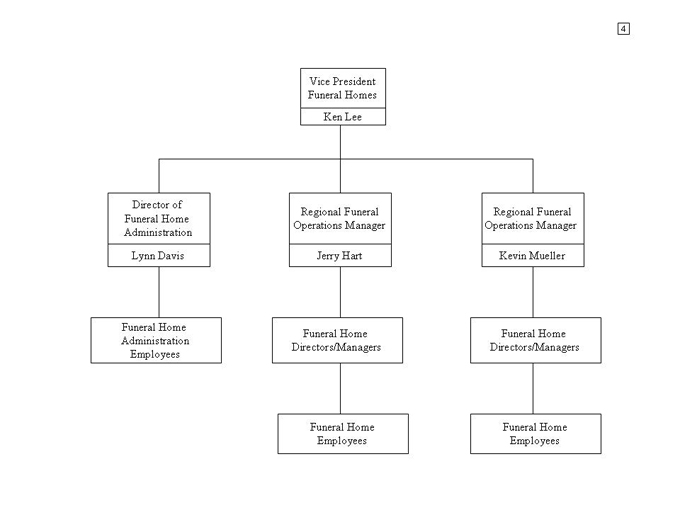

The Company currently operates 178 cemeteries and 27 funeral homes in 21 states. The operation of these locations is centrally managed from our corporate headquarters located in Bristol, Pennsylvania. Each functional area (i.e. Sales, Maintenance and Construction and Administration) is managed by a corporate executive located in Bristol who report to our Chief Executive Officer, Chief Financial Officer and Chief Operating Officer (collectively, “Chief Executive Group”). As such, we consider this group to be the chief operating decision maker from a strategic point-of-view while the executives handle the tactical aspects of the execution of the strategy (see attached organizational chart). We currently divide our locations into seven regions to facilitate the management of the functional areas.

Larry Spirgel

August 13, 2007

Page 9

Each region is supervised by a Regional Administrator, a Regional Construction and Maintenance Manager and a Regional Vice President of Sales. With the exception of the Chief Executive Group none of these employees has complete profit and loss accountability for any of the regions. The Chief Executive Group reviews our internal financial statements, which are not prepared in accordance with GAAP, as it is not representative of the way we manage our business, on the consolidated basis. They utilize regional sales reports to research items and trends that vary from the norm and take action through one of the functional corporate executives. Any other regional reporting is function specific and utilized primarily by the regional personnel. Additionally, quarterly reporting to our Board of Directors presents operating results of our cemeteries with no further geographic or product based disaggregation. We do discuss individual location performance with our directors, however, this information is on a location by location basis and is only a discussion of revenue as compared to budget, when a location is considered an over performer or an underperformer. The Chief Executive Group does review certain regional information from the seven regions we have identified. This information is from the revenue aspect only, even though other expense information is available. Our experience has told us the revenues compared to budget and not necessarily last year are more significant than evaluating regional profitability. As such, the Chief Executive Group reviews profitability, gross margins and operating margins on a consolidated basis only.

In accordance with paragraph 10 of SFAS No. 131, we determined that we have two operating segments; cemetery and funeral home. Before making this decision, the company considered all of the factors disclosed in paragraphs 10-15 of SFAS No. 131. Both operating segments earn revenue and incur expenses, have results that are reviewed by the chief operating decision maker and have discrete financial information available. Based on the guidance contained in paragraph 17 of SFAS No. 131, the Company aggregates the results of the two segments for the following reasons: 1.) Both segments operate in the deathcare services industry which encompasses a series of transactions beginning with arrangements for memorialization and cemetery merchandise and services (caskets, vaults, grave memorialization, etc.), either in advance of the time of need or at the time of need and ends with the final disposition of the deceased. 2.) Cemeteries and funeral homes both sell the same or similar merchandise if state law permits. 3.) Generally, both segments serve the same customers at the same time. 4.) The activities of both segments are governed by the same or similar state agencies. 5.) Both operating segments have similar gross margin percentages as detailed in the table below. Also in our determination to aggregate the two segments, we evaluated the quantitative thresholds contained in paragraph 18 of SFAS No. 131. The following table demonstrates that the funeral home segment does not contribute segment revenues, profits or assets greater than the 10% limit established in the guidance.

Larry Spirgel

August 13, 2007

Page 10

StoneMor Partners L.P.

Operating Segment Results

For the Year Ended 12/31/2006

(in thousands)

| | | | | | | | | | | | |

| | | Cemetery | | | Funeral

Home | | | Total | |

Revenues | | $ | 108,995 | | | $ | 6,118 | | | $ | 115,113 | |

Operating Expenses | | | (75,023 | ) | | | (4,836 | ) | | | (79,859 | ) |

Overhead Allocation | | | (19,402 | ) | | | (573 | ) | | | (19,975 | ) |

| | | | | | | | | | | | |

Segment Profit | | $ | 14,570 | | | $ | 709 | | | $ | 15,279 | |

| | | | | | | | | | | | |

Percent of total Segment Revenue | | | 94.69 | % | | | 5.31 | % | | | 100.00 | % |

Percent of total Segment Profits | | | 95.36 | % | | | 4.64 | % | | | 100.00 | % |

Segment Assets | | $ | 549,981 | | | $ | 10,335 | | | $ | 560,316 | |

Percent of total Segment Assets | | | 98.16 | % | | | 1.84 | % | | | 100.00 | % |

2006 Gross margin | | | 13.37 | % | | | 11.59 | % | | | | |

Other Information

In connection with responding to the foregoing comments, the Company acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

Larry Spirgel

August 13, 2007

Page 11

| | • | | staff comments or changes to disclosure in response to staff comments do not foreclose the Securities and Exchange Commission (the “Commission”) from taking any action with respect to the filing; and |

| | • | | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you or any other member of the staff has any questions or would like to discuss these matters at greater length, please do not hesitate to contact the undersigned at (215) 826-2800.

|

| Sincerely, |

|

| /s/ William R. Shane |

William R. Shane Executive Vice President and Chief Financial Officer of StoneMor GP LLC, general partner of StoneMor Partners L.P. |

| cc: | Joe Cascarano, Staff Accountant |

Robert Littlepage, Accountant Branch Chief