StoneMor Debt/Equity Recapitalization Overview June 28, 2019 Exhibit 99.2

Cautionary Statement Certain statements contained in this presentation, including, but not limited to, information regarding the Partnership’s contemplated rights offering and transition to a corporate structure, as well as continued performance and cost structure improvement efforts undertaken by the Partnership, are forward-looking statements. Generally, the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “project,” “expect,” “predict” and similar expressions identify these forward-looking statements. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on management’s current expectations and estimates. These statements are neither promises nor guarantees and are made subject to certain risks and uncertainties that could cause actual results to differ materially from the results stated or implied in this press release. StoneMor’s major risks are related to uncertainties associated with the cash flow from pre-need and at-need sales, trusts and financings, which may impact StoneMor’s ability to meet its financial projections, service its debt and resume paying distributions, with the proposed merger and whether and when the transactions contemplated by the merger and reorganization agreement will be consummated, as well as with StoneMor’s ability to maintain an effective system of internal control over financial reporting and disclosure controls and procedures. StoneMor’s additional risks and uncertainties include, but are not limited to: uncertainties associated with future revenue and revenue growth; uncertainties associated with the integration or anticipated benefits of recent acquisitions or any future acquisitions; StoneMor’s ability to successfully implement its strategic plan relating to achieving operating improvements, including improving sales productivity and reducing operating expenses; the effect of economic downturns; the impact of StoneMor’s significant leverage on its operating plans; the decline in the fair value of certain equity and debt securities held in StoneMor’s trusts; StoneMor’s ability to attract, train and retain an adequate number of sales people; uncertainties associated with the volume and timing of pre-need sales of cemetery services and products; increased use of cremation; changes in the death rate; changes in the political or regulatory environments, including potential changes in tax accounting and trusting policies; StoneMor’s ability to successfully compete in the cemetery and funeral home industry; litigation or legal proceedings that could expose StoneMor to significant liabilities and damage StoneMor’s reputation, including but not limited to litigation and governmental investigations or proceedings arising out of or related to accounting and financial reporting matters; the effects of cyber security attacks due to StoneMor’s significant reliance on information technology; uncertainties relating to the financial condition of third-party insurance companies that fund StoneMor’s pre-need funeral contracts; and various other uncertainties associated with the death care industry and StoneMor’s operations in particular. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements set forth in StoneMor’s Annual Report on Form 10-K and the other reports that StoneMor files with the Securities and Exchange Commission, from time to time. Except as required under applicable law, StoneMor assumes no obligation to update or revise any forward-looking statements made herein or any other forward-looking statements made by it, whether as a result of new information, future events or otherwise.

Table of Contents Slide Executive Summary 5 Recapitalization Summary 10 Investment Highlights 16 Appendix 25

Introductions Joe Redling President & Chief Executive Officer Joined StoneMor in July 2018 Previously served as COO of Vonage and CEO of Nutrisystem, managing both businesses through high-growth periods while also executing aggressive cost-cutting initiatives (combined ~$70M in cost reductions) Previously spent eight years at AOL as President of the subscription business, leading the transformation to an ad-based business model and reducing costs by $1.5B over two years Significant experience leading transformative initiatives at complex, high-fixed cost companies, including Six Flags and Arnold Palmer Golf Management Garry Herdler SVP & Chief Financial Officer Joined StoneMor on April 15, 2019 with over 25 years of experience Previous CFO (6 mid-market PE-owned, a $27B global, a NYSE-listed) Acted in multiple integrations & turnarounds; and in 3 restructurings M&A as CFO: completed > 20 mid-market M&A deals in 6 different CFO roles Most recently: CFO of QuadReal Property Group to financially integrate 4 firms and grow real estate portfolio from $19B to $27B in 17 countries PE Operational Improvement Consulting (Alvarez & Marsal and PE Funds) Leveraged finance Investment Banker (~10 years at Deutsche Bank Securities / Bankers Trust and CIBC); and a KPMG CPA/Tax Advisor Public Board: Diversified Royalty Corp: Chair of Investment Cmte., AC Member

Executive Summary

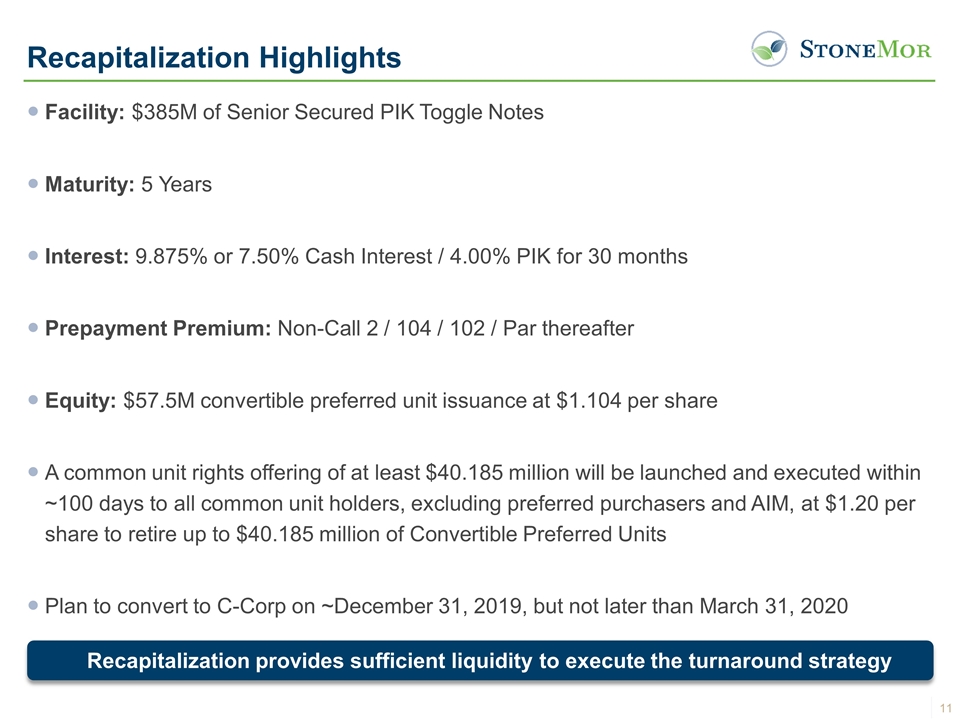

Situation Overview StoneMor has raised $385M of senior secured debt with a $57.5M preferred equity raise to refinance the existing Revolving Credit Facility and Senior Unsecured Notes Fully retire existing Credit Facility due May 2020 and existing Senior Notes due June 2021 A common unit rights offering of at least $40.185M will be launched and executed within ~100 days to all common unit holders, excluding preferred purchasers and AIM, to retire up to 2/3 of the Convertible Preferred Units With the recapitalization, the Company’s Board of Directors is changing significantly Andrew Axelrod – Founder and Managing Partner of Axar Capital – is now Chairman of the Board Addition of two new independent directors to replace existing directors Recapitalization provides sufficient liquidity to execute the turnaround strategy StoneMor formed a new executive team over the last year to spearhead the turnaround CEO, Joe Redling, joined in July 2018 CFO, Garry Herdler, joined April 2019 COO, Jim Ford, joined March 2018 The new management team has already taken decisive action to: Increase sales productivity and drive asset-level accountability and profitability Identify and execute cost reductions; $30M of reductions underway with more to come The Company is now a timely filer with 1Q19, ended 3/31/19, filed on May 10, 2019 Company now well positioned to execute turnaround strategy

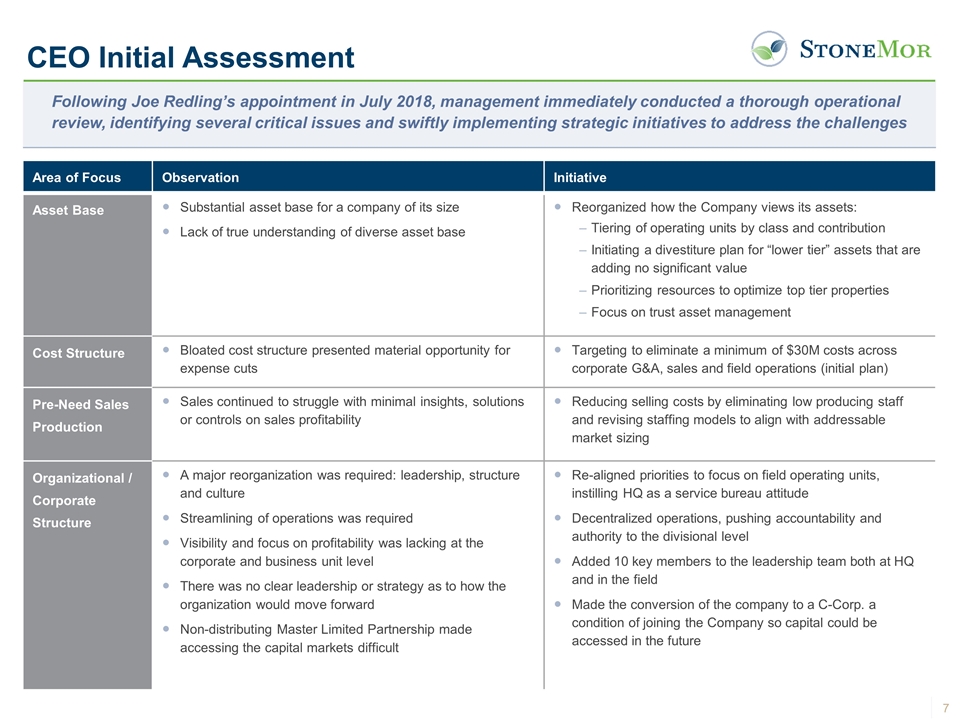

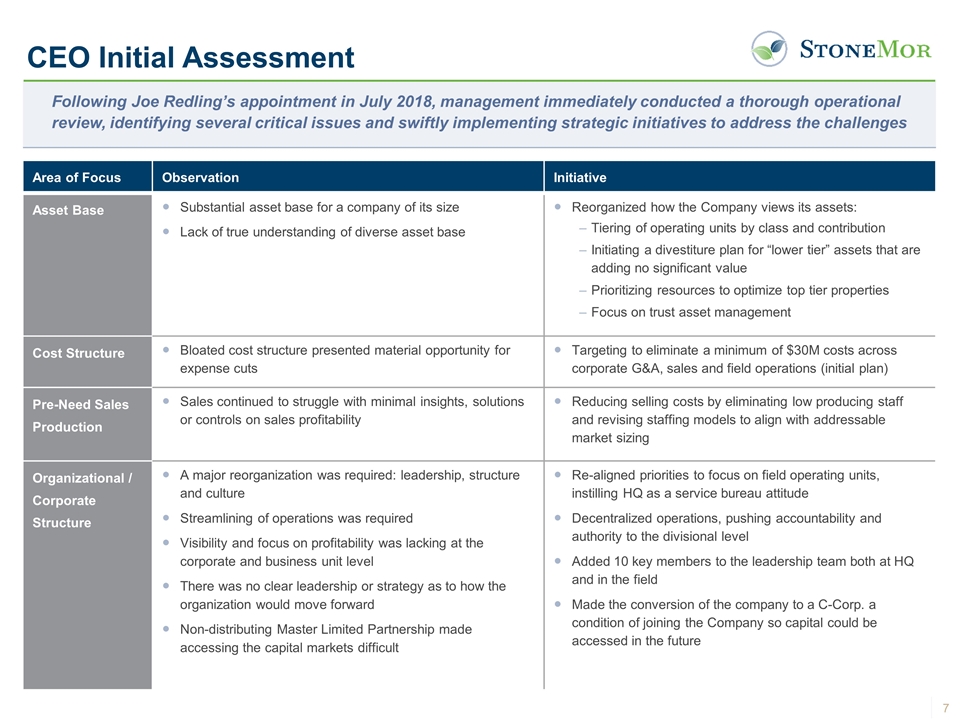

CEO Initial Assessment Following Joe Redling’s appointment in July 2018, management immediately conducted a thorough operational review, identifying several critical issues and swiftly implementing strategic initiatives to address the challenges Area of Focus Observation Initiative Asset Base Substantial asset base for a company of its size Lack of true understanding of diverse asset base Reorganized how the Company views its assets: Tiering of operating units by class and contribution Initiating a divestiture plan for “lower tier” assets that are adding no significant value Prioritizing resources to optimize top tier properties Focus on trust asset management Cost Structure Bloated cost structure presented material opportunity for expense cuts Targeting to eliminate a minimum of $30M costs across corporate G&A, sales and field operations (initial plan) Pre-Need Sales Production Sales continued to struggle with minimal insights, solutions or controls on sales profitability Reducing selling costs by eliminating low producing staff and revising staffing models to align with addressable market sizing Organizational / Corporate Structure A major reorganization was required: leadership, structure and culture Streamlining of operations was required Visibility and focus on profitability was lacking at the corporate and business unit level There was no clear leadership or strategy as to how the organization would move forward Non-distributing Master Limited Partnership made accessing the capital markets difficult Re-aligned priorities to focus on field operating units, instilling HQ as a service bureau attitude Decentralized operations, pushing accountability and authority to the divisional level Added 10 key members to the leadership team both at HQ and in the field Made the conversion of the company to a C-Corp. a condition of joining the Company so capital could be accessed in the future

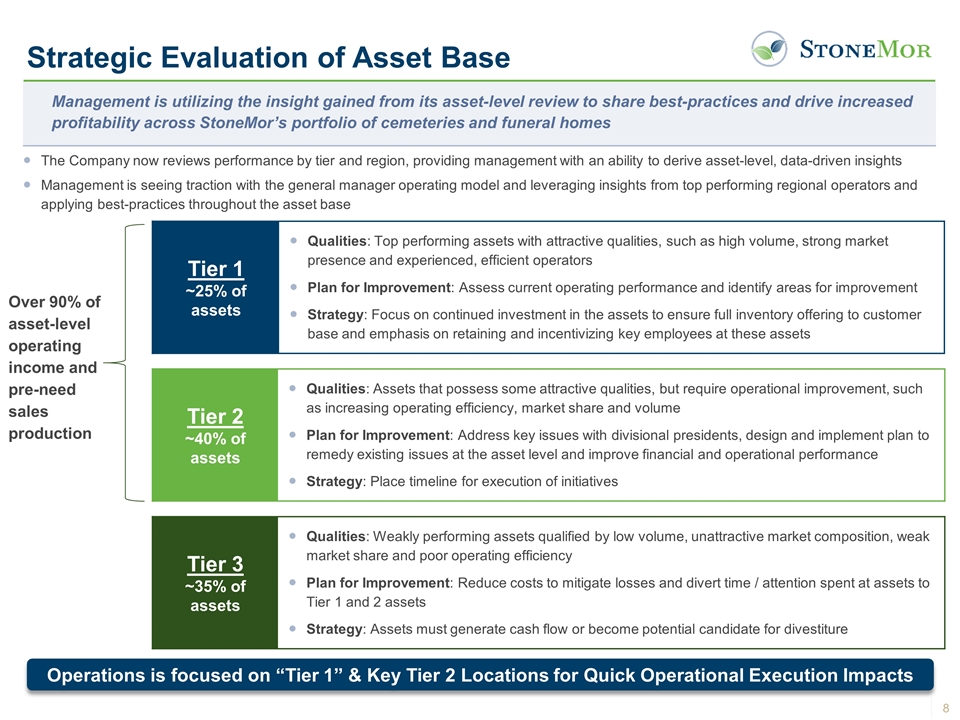

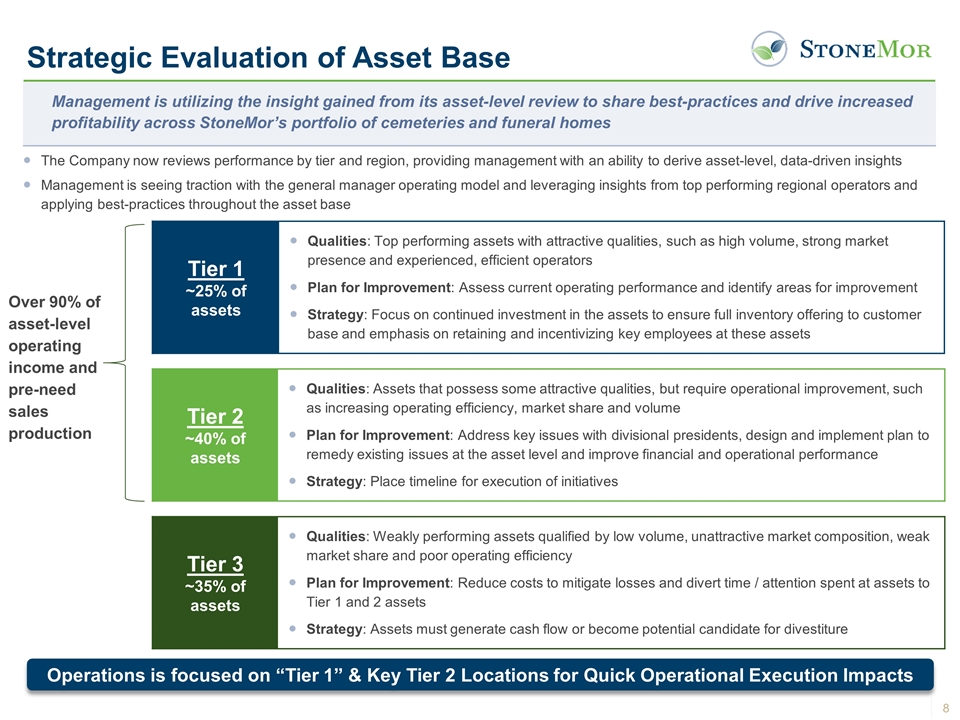

Strategic Evaluation of Asset Base Management is utilizing the insight gained from its asset-level review to share best-practices and drive increased profitability across StoneMor’s portfolio of cemeteries and funeral homes Tier 1 ~25% of assets Qualities: Top performing assets with attractive qualities, such as high volume, strong market presence and experienced, efficient operators Plan for Improvement: Assess current operating performance and identify areas for improvement Strategy: Focus on continued investment in the assets to ensure full inventory offering to customer base and emphasis on retaining and incentivizing key employees at these assets Tier 2 ~40% of assets Qualities: Assets that possess some attractive qualities, but require operational improvement, such as increasing operating efficiency, market share and volume Plan for Improvement: Address key issues with divisional presidents, design and implement plan to remedy existing issues at the asset level and improve financial and operational performance Strategy: Place timeline for execution of initiatives Tier 3 ~35% of assets Qualities: Weakly performing assets qualified by low volume, unattractive market composition, weak market share and poor operating efficiency Plan for Improvement: Reduce costs to mitigate losses and divert time / attention spent at assets to Tier 1 and 2 assets Strategy: Assets must generate cash flow or become potential candidate for divestiture The Company now reviews performance by tier and region, providing management with an ability to derive asset-level, data-driven insights Management is seeing traction with the general manager operating model and leveraging insights from top performing regional operators and applying best-practices throughout the asset base Operations is focused on “Tier 1” & Key Tier 2 Locations for Quick Operational Execution Impacts Over 90% of asset-level operating income and pre-need sales production

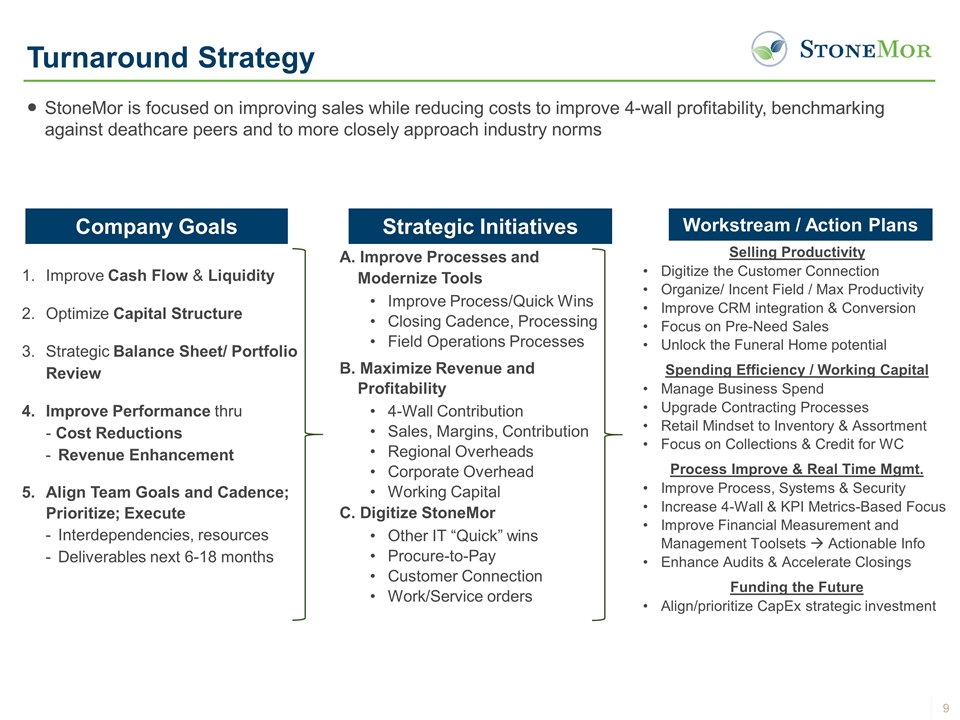

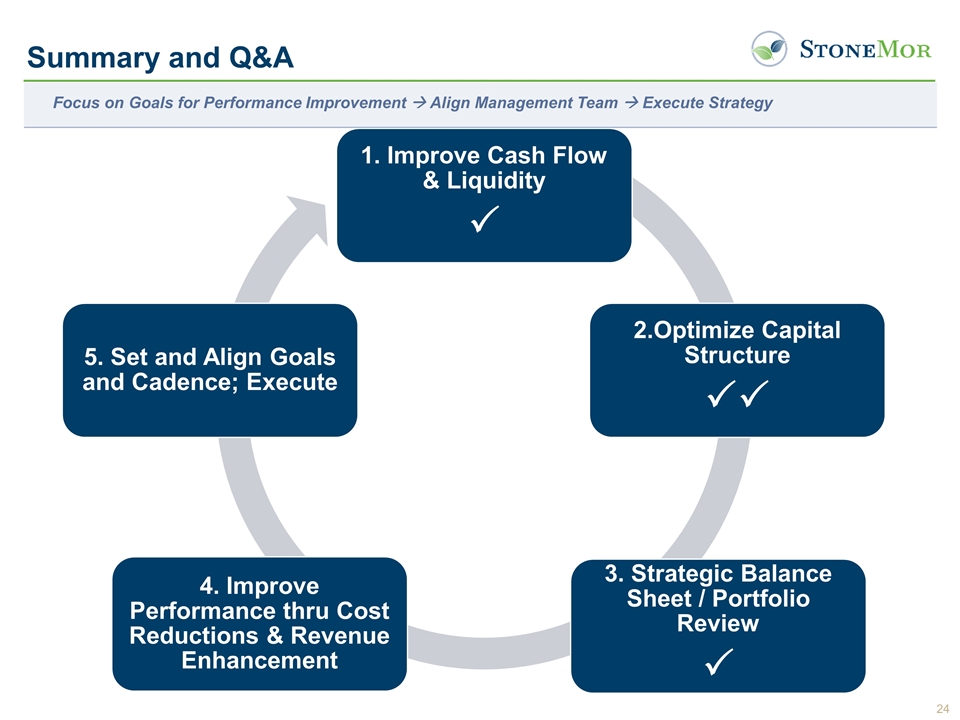

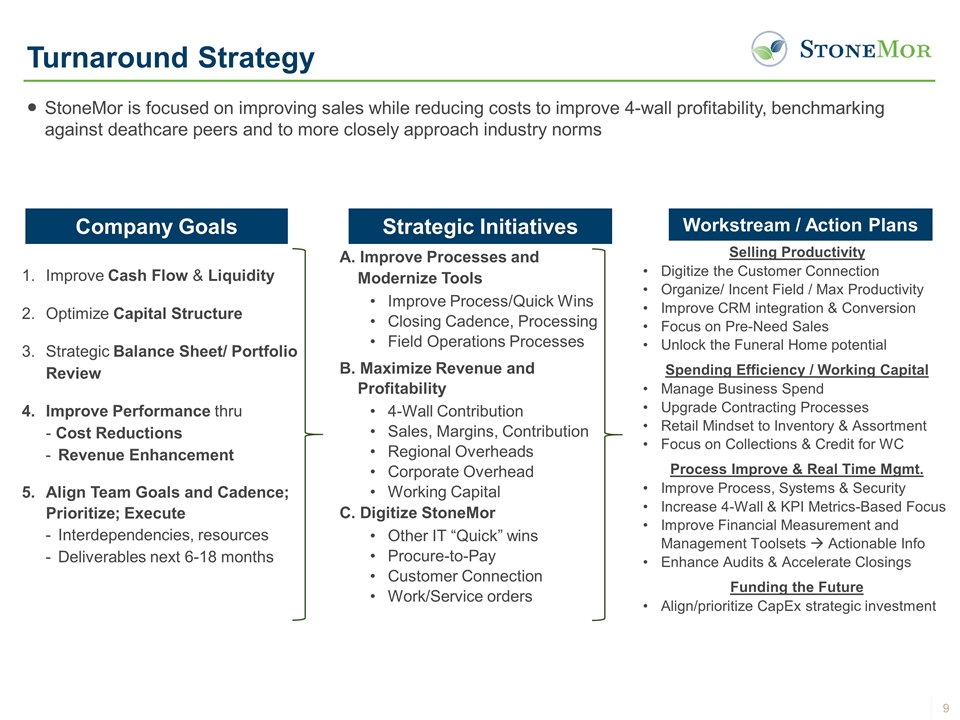

Turnaround Strategy Company Goals Strategic Initiatives Workstream / Action Plans Improve Cash Flow & Liquidity Optimize Capital Structure Strategic Balance Sheet/ Portfolio Review Improve Performance thru - Cost Reductions Revenue Enhancement Align Team Goals and Cadence; Prioritize; Execute Interdependencies, resources Deliverables next 6-18 months A. Improve Processes and Modernize Tools Improve Process/Quick Wins Closing Cadence, Processing Field Operations Processes B. Maximize Revenue and Profitability 4-Wall Contribution Sales, Margins, Contribution Regional Overheads Corporate Overhead Working Capital C. Digitize StoneMor Other IT “Quick” wins Procure-to-Pay Customer Connection Work/Service orders Selling Productivity Digitize the Customer Connection Organize/ Incent Field / Max Productivity Improve CRM integration & Conversion Focus on Pre-Need Sales Unlock the Funeral Home potential Spending Efficiency / Working Capital Manage Business Spend Upgrade Contracting Processes Retail Mindset to Inventory & Assortment Focus on Collections & Credit for WC Process Improve & Real Time Mgmt. Improve Process, Systems & Security Increase 4-Wall & KPI Metrics-Based Focus Improve Financial Measurement and Management Toolsets à Actionable Info Enhance Audits & Accelerate Closings Funding the Future Align/prioritize CapEx strategic investment StoneMor is focused on improving sales while reducing costs to improve 4-wall profitability, benchmarking against deathcare peers and to more closely approach industry norms

Recapitalization Summary

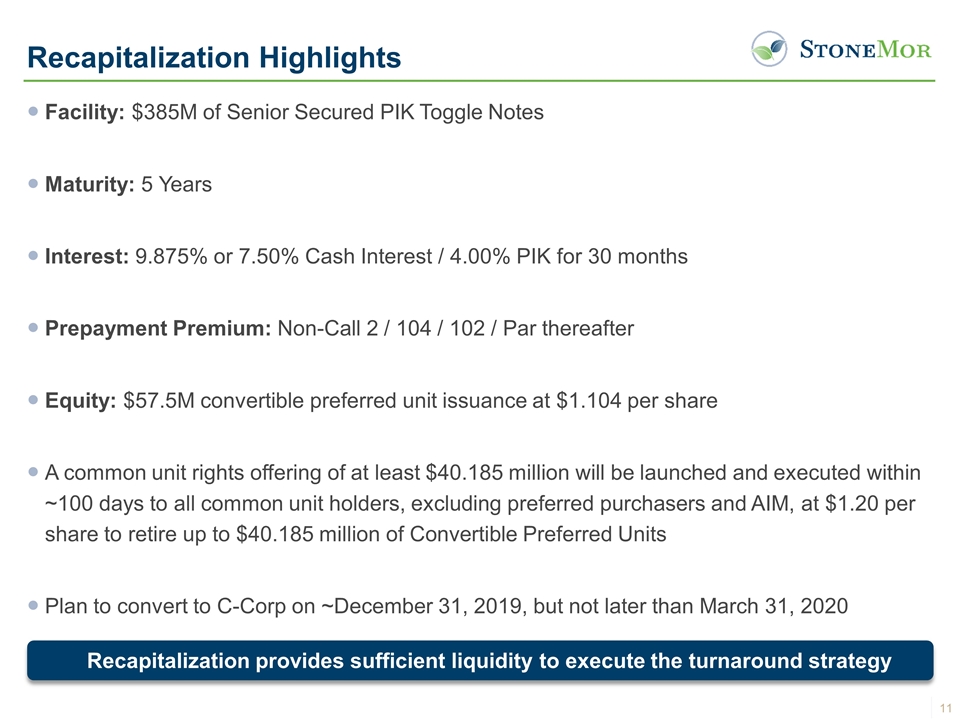

Recapitalization Highlights Facility: $385M of Senior Secured PIK Toggle Notes Maturity: 5 Years Interest: 9.875% or 7.50% Cash Interest / 4.00% PIK for 30 months Prepayment Premium: Non-Call 2 / 104 / 102 / Par thereafter Equity: $57.5M convertible preferred unit issuance at $1.104 per share A common unit rights offering of at least $40.185 million will be launched and executed within ~100 days to all common unit holders, excluding preferred purchasers and AIM, at $1.20 per share to retire up to $40.185 million of Convertible Preferred Units Plan to convert to C-Corp on ~December 31, 2019, but not later than March 31, 2020 Recapitalization provides sufficient liquidity to execute the turnaround strategy

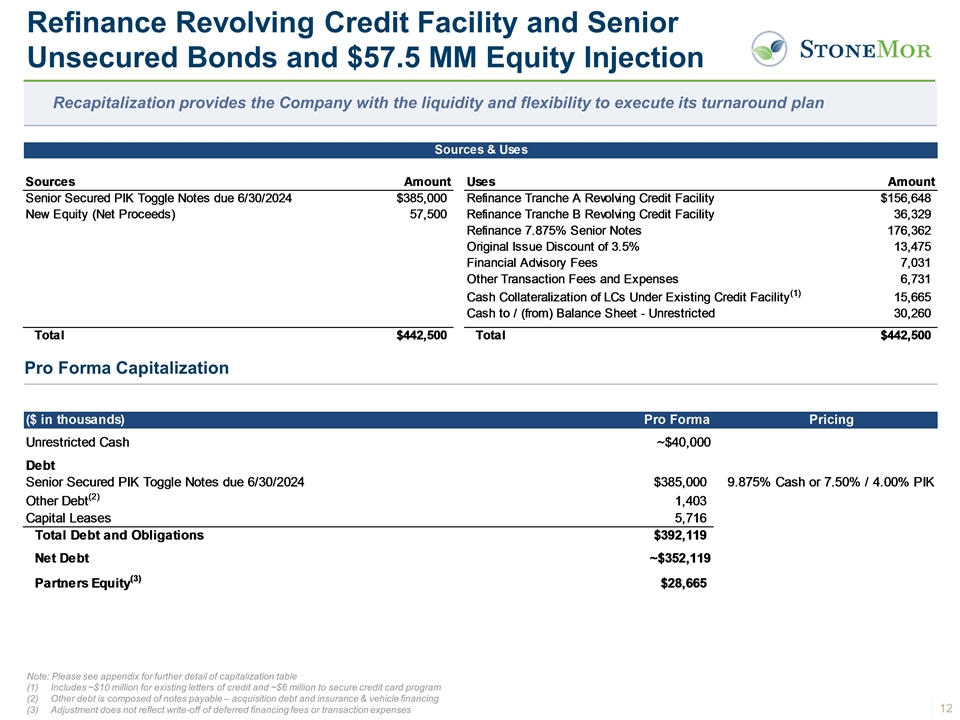

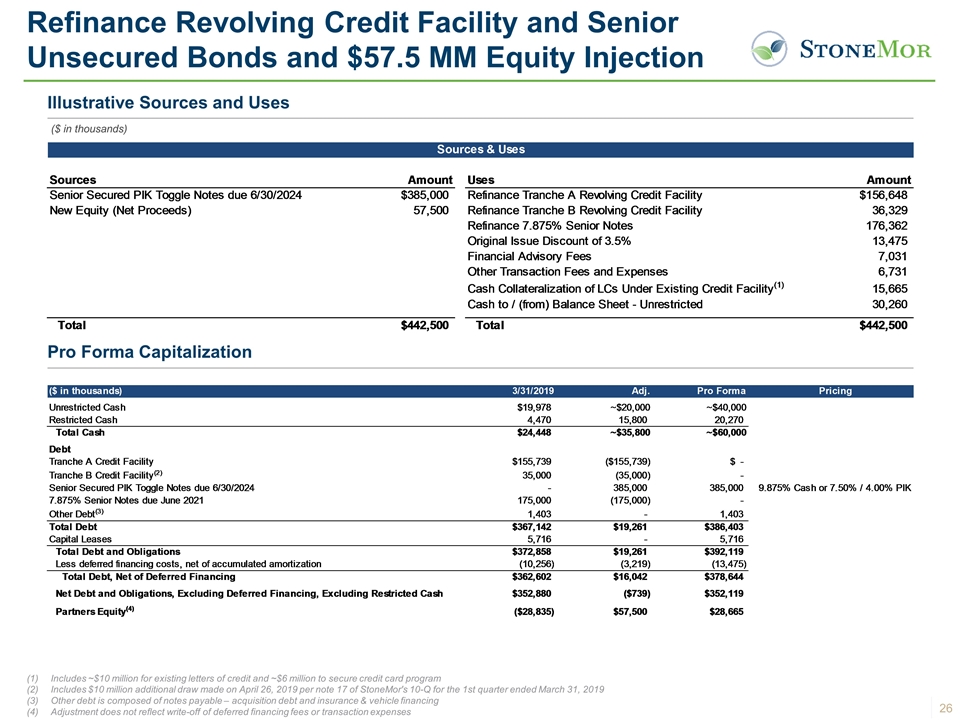

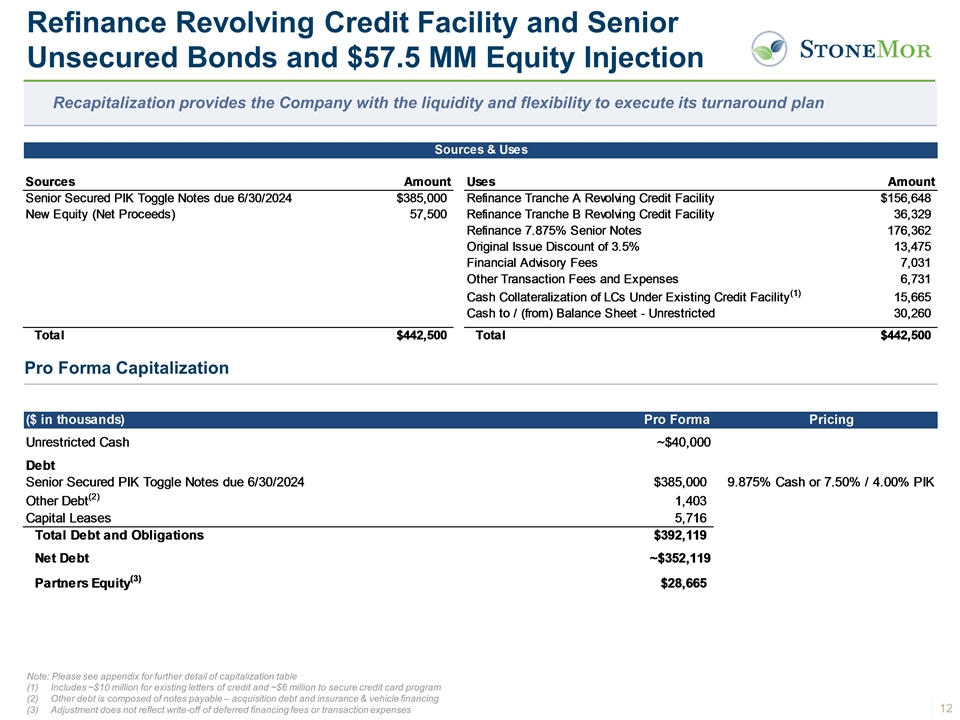

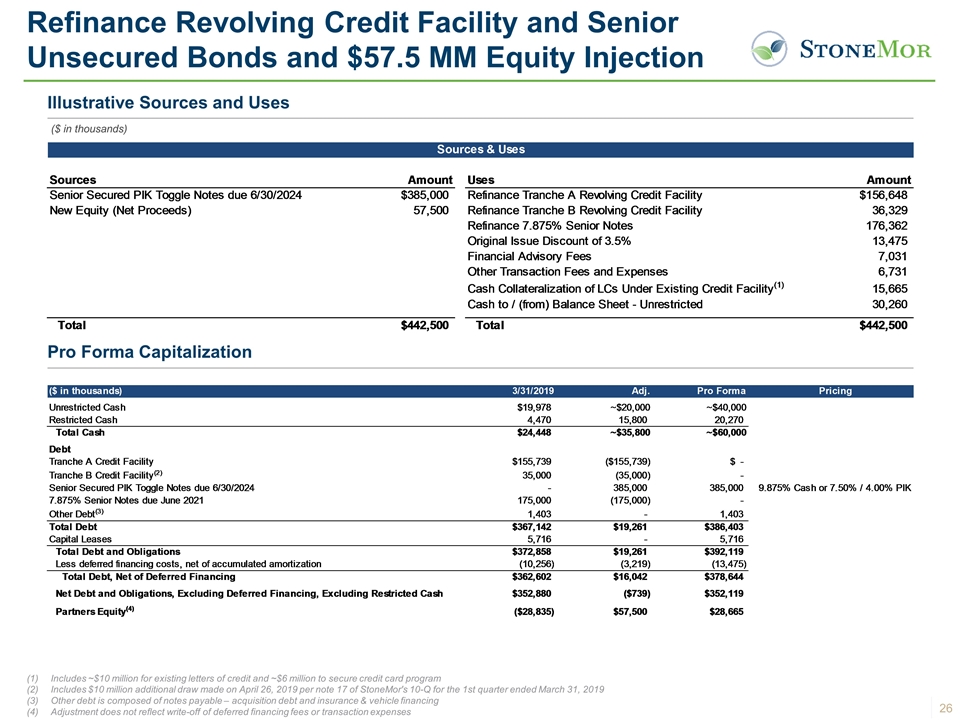

Refinance Revolving Credit Facility and Senior Unsecured Bonds and $57.5 MM Equity Injection Pro Forma Capitalization Recapitalization provides the Company with the liquidity and flexibility to execute its turnaround plan Note: Please see appendix for further detail of capitalization table Includes ~$10 million for existing letters of credit and ~$6 million to secure credit card program Other debt is composed of notes payable – acquisition debt and insurance & vehicle financing Adjustment does not reflect write-off of deferred financing fees or transaction expenses

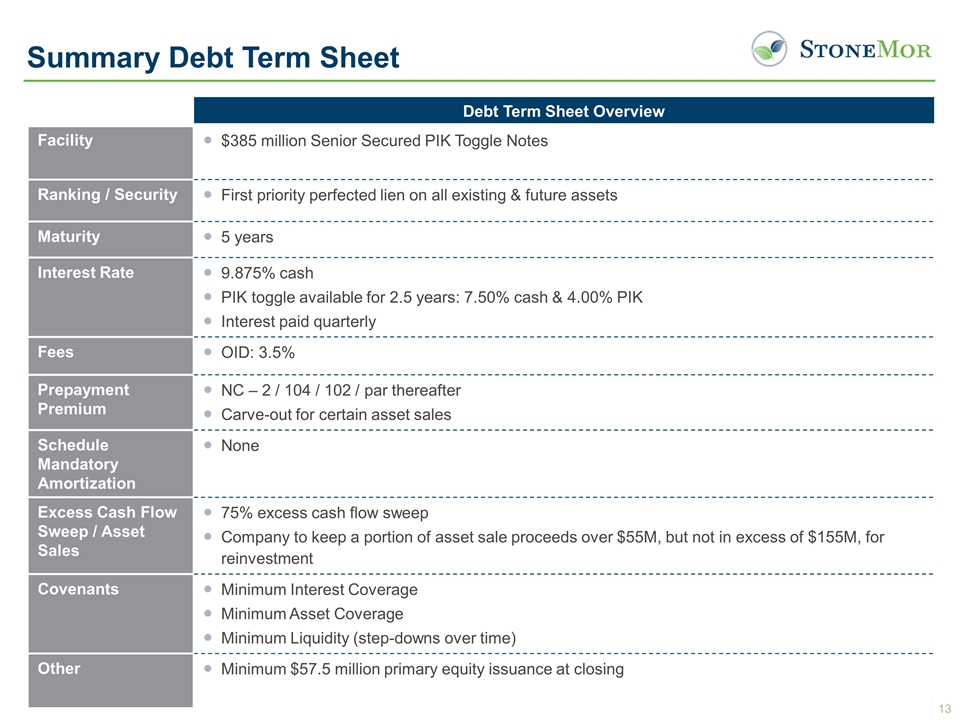

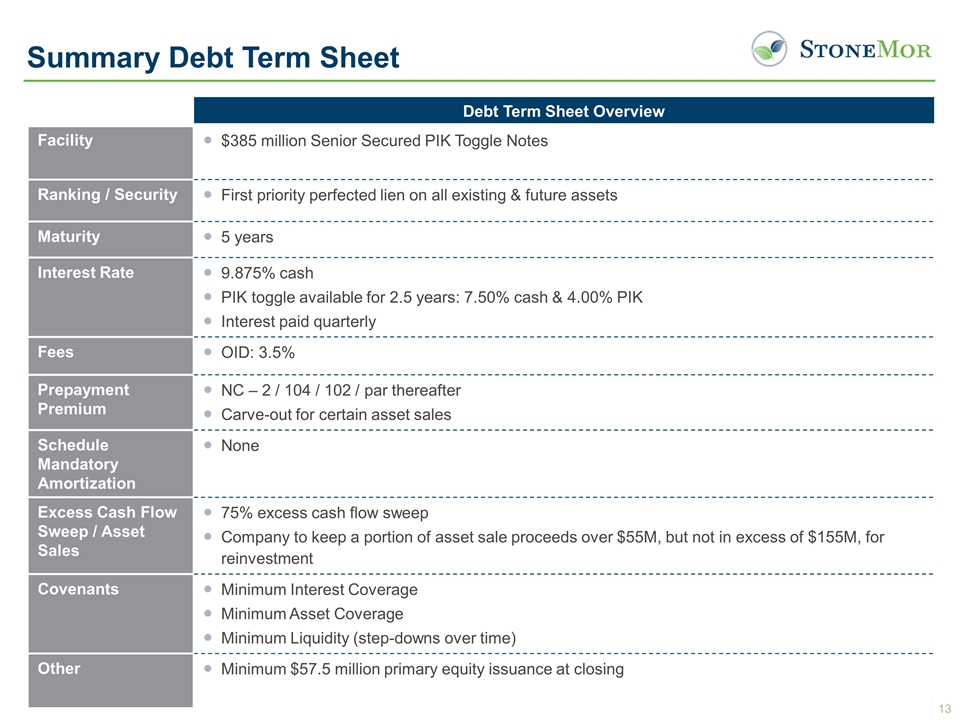

Summary Debt Term Sheet Debt Term Sheet Overview Facility $385 million Senior Secured PIK Toggle Notes Ranking / Security First priority perfected lien on all existing & future assets Maturity 5 years Interest Rate 9.875% cash PIK toggle available for 2.5 years: 7.50% cash & 4.00% PIK Interest paid quarterly Fees OID: 3.5% Prepayment Premium NC – 2 / 104 / 102 / par thereafter Carve-out for certain asset sales Schedule Mandatory Amortization None Excess Cash Flow Sweep / Asset Sales 75% excess cash flow sweep Company to keep a portion of asset sale proceeds over $55M, but not in excess of $155M, for reinvestment Covenants Minimum Interest Coverage Minimum Asset Coverage Minimum Liquidity (step-downs over time) Other Minimum $57.5 million primary equity issuance at closing

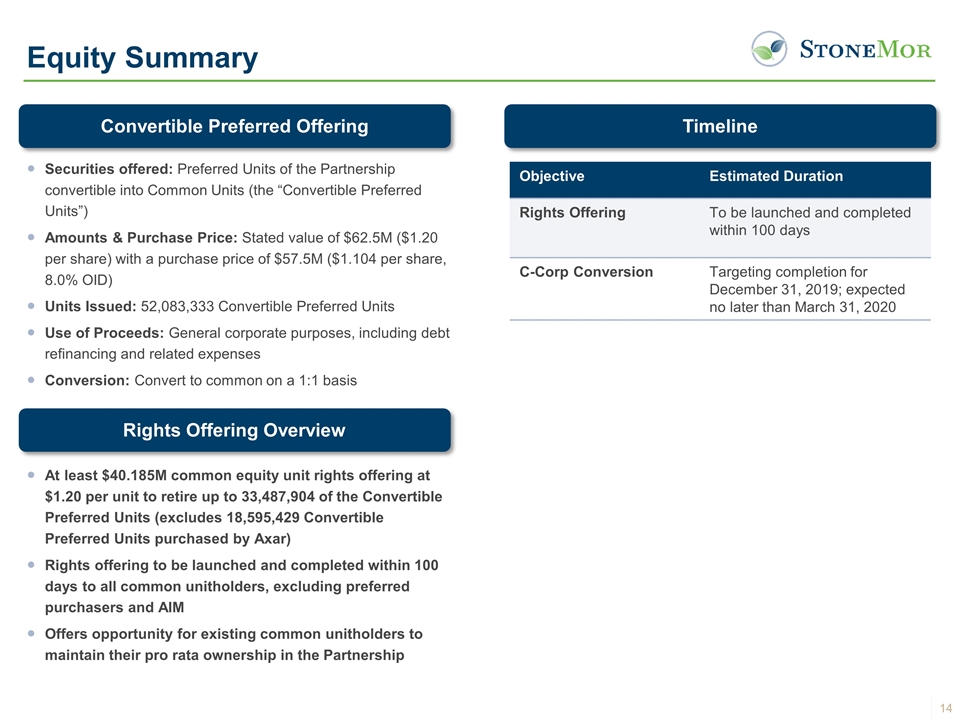

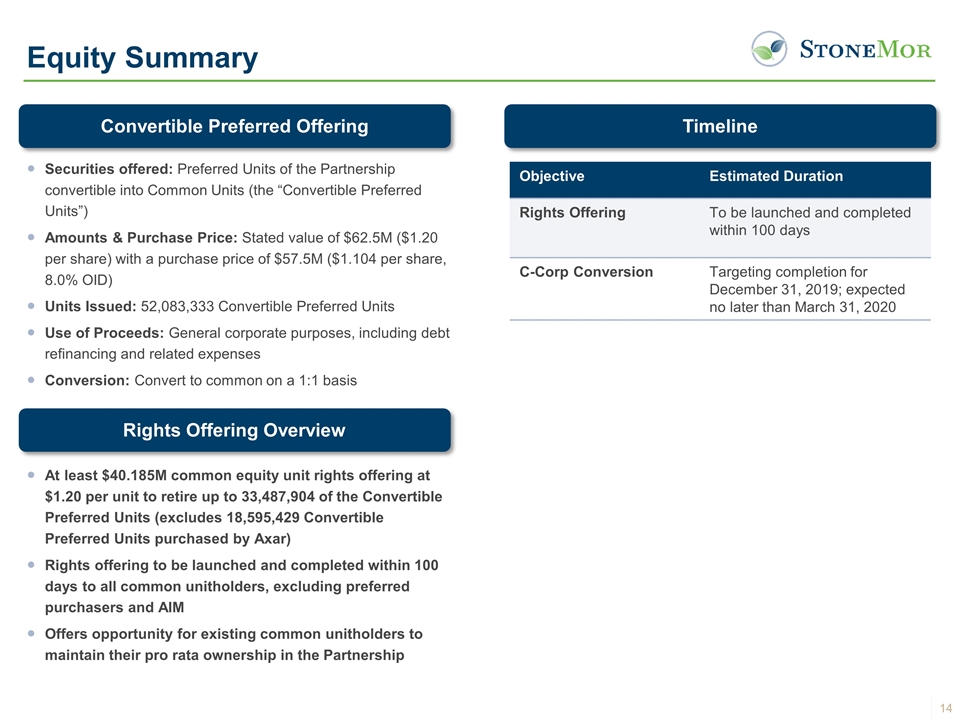

Equity Summary At least $40.185M common equity unit rights offering at $1.20 per unit to retire up to 33,487,904 of the Convertible Preferred Units (excludes 18,595,429 Convertible Preferred Units purchased by Axar) Rights offering to be launched and completed within 100 days to all common unitholders, excluding preferred purchasers and AIM Offers opportunity for existing common unitholders to maintain their pro rata ownership in the Partnership Rights Offering Overview Timeline Objective Estimated Duration Rights Offering To be launched and completed within 100 days C-Corp Conversion Targeting completion for December 31, 2019; expected no later than March 31, 2020 Convertible Preferred Offering Securities offered: Preferred Units of the Partnership convertible into Common Units (the “Convertible Preferred Units”) Amounts & Purchase Price: Stated value of $62.5M ($1.20 per share) with a purchase price of $57.5M ($1.104 per share, 8.0% OID) Units Issued: 52,083,333 Convertible Preferred Units Use of Proceeds: General corporate purposes, including debt refinancing and related expenses Conversion: Convert to common on a 1:1 basis

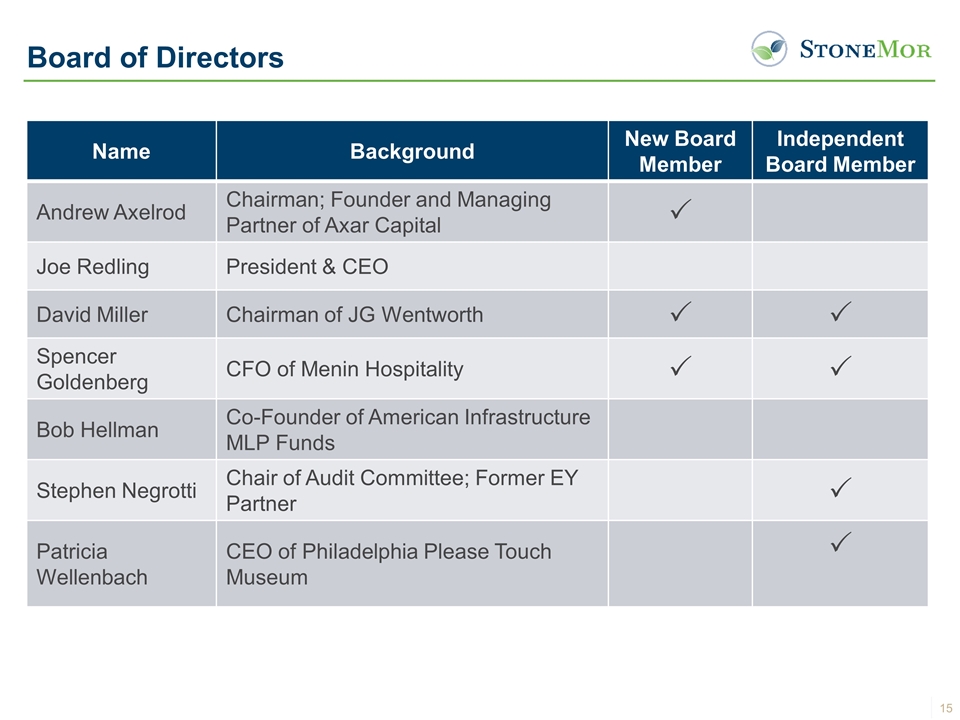

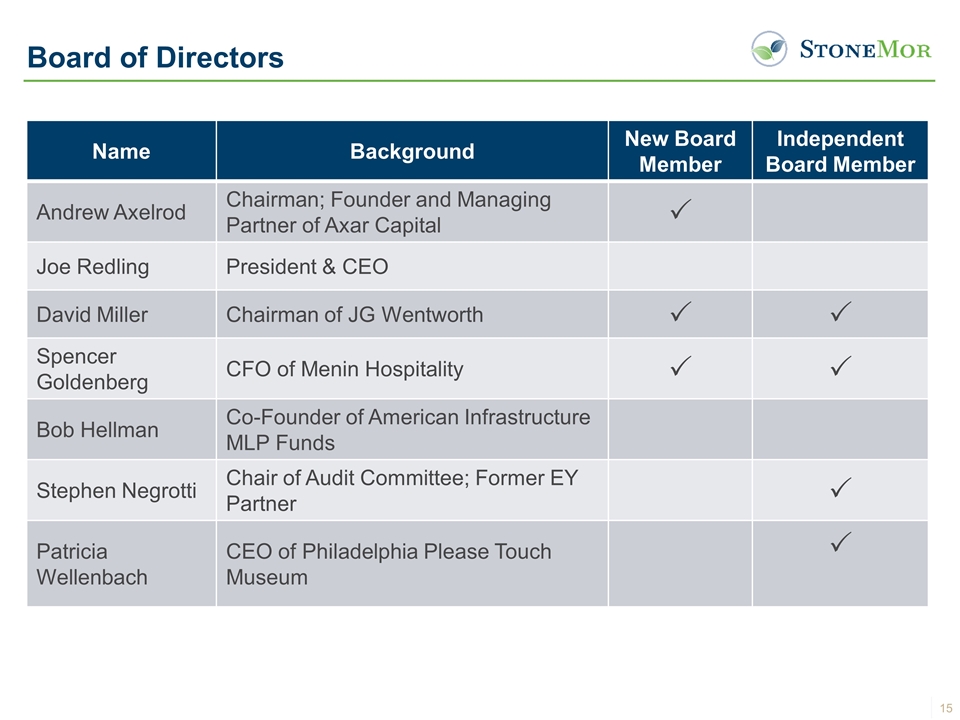

Board of Directors Name Background New Board Member Independent Board Member Andrew Axelrod Chairman; Founder and Managing Partner of Axar Capital P Joe Redling President & CEO David Miller Chairman of JG Wentworth P P Spencer Goldenberg CFO of Menin Hospitality P P Bob Hellman Co-Founder of American Infrastructure MLP Funds Stephen Negrotti Chair of Audit Committee; Former EY Partner P Patricia Wellenbach CEO of Philadelphia Please Touch Museum P

Investment Highlights

Investment Highlights Highly Attractive Market Opportunity Strategic Initiatives Driving Improved Performance Significant Backlog Experienced Management Team and Reconstituted Board Strong Asset Base with Meaningful Intrinsic Value 1 2 3 4 5

Source: IBIS World (1) SCI and Carriage are based on publicly available information. NorthStar and Arbor are based on internal estimates Highly Attractive Market Opportunity Historical & Projected U.S. Deaths (in millions) Aging 65+ Population 92% North American Deathcare Market Share (1) Large, steady and growing addressable market and significant fragmentation provide for a highly attractive market opportunity Cemeteries and funeral homes represent a ~$21B market opportunity annually Addressable market continues to expand with the aging of the baby boomer generation Highly fragmented industry; top 5 players control ~21% of market Fragmentation presents significant opportunity for future consolidation with no distinct number 2 player in North America Large, Steady and Growing Addressable Market Highly Fragmented Industry with Significant Consolidation Opportunities Industry Characteristics 1 2 3 4 5 SCI StoneMor Carriage NorthStar Arbor 15.1% 1.5% 1.3% 1.2% 1.1%

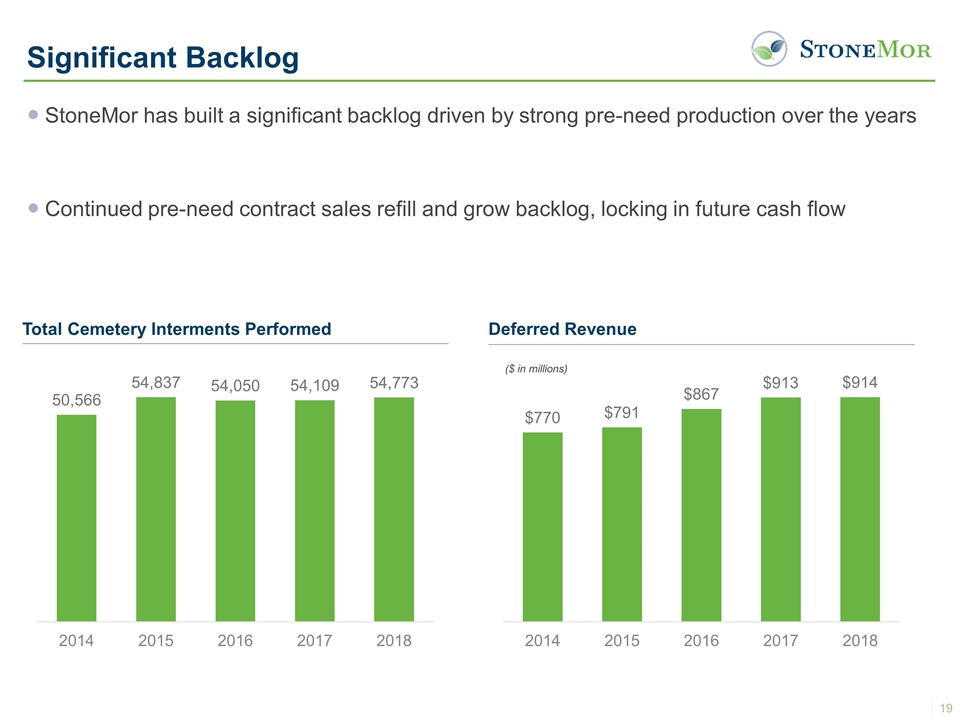

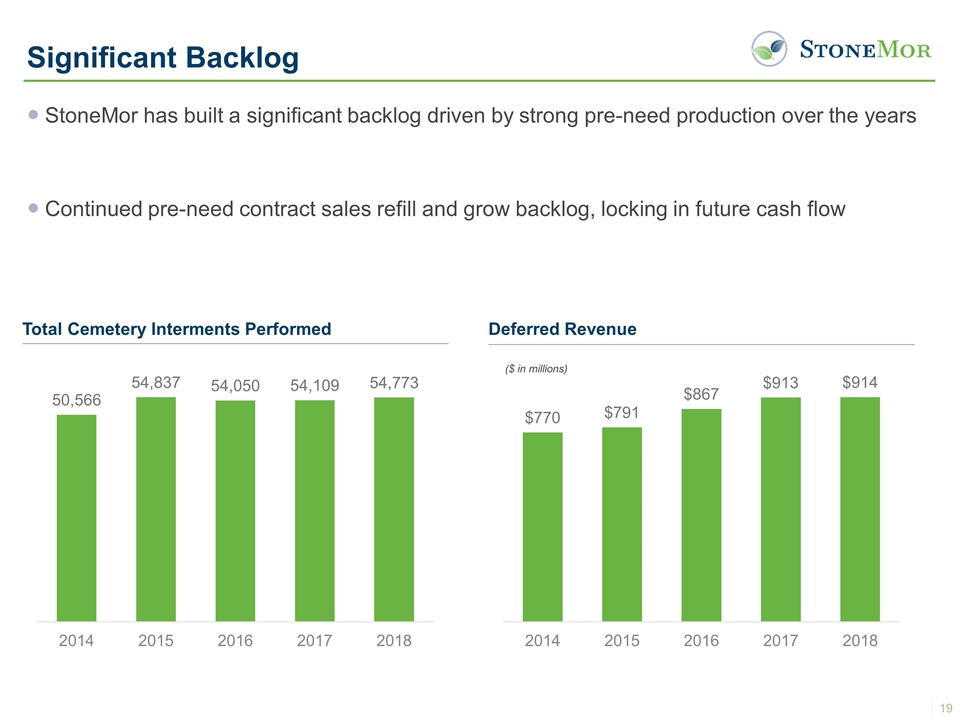

StoneMor has built a significant backlog driven by strong pre-need production over the years Continued pre-need contract sales refill and grow backlog, locking in future cash flow Total Cemetery Interments Performed Deferred Revenue Significant Backlog ($ in millions)

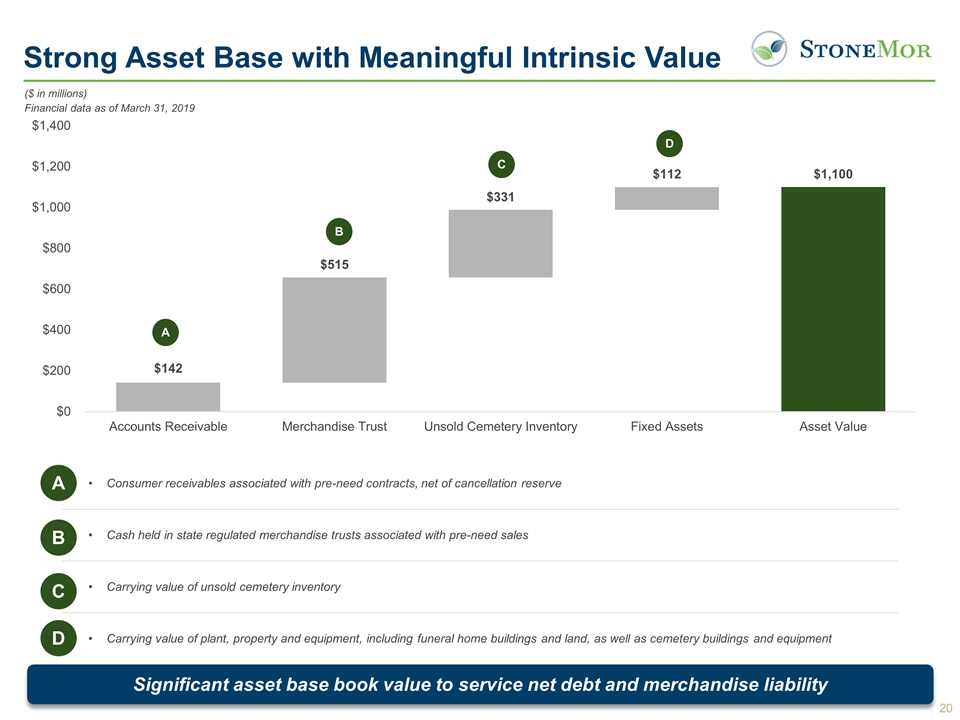

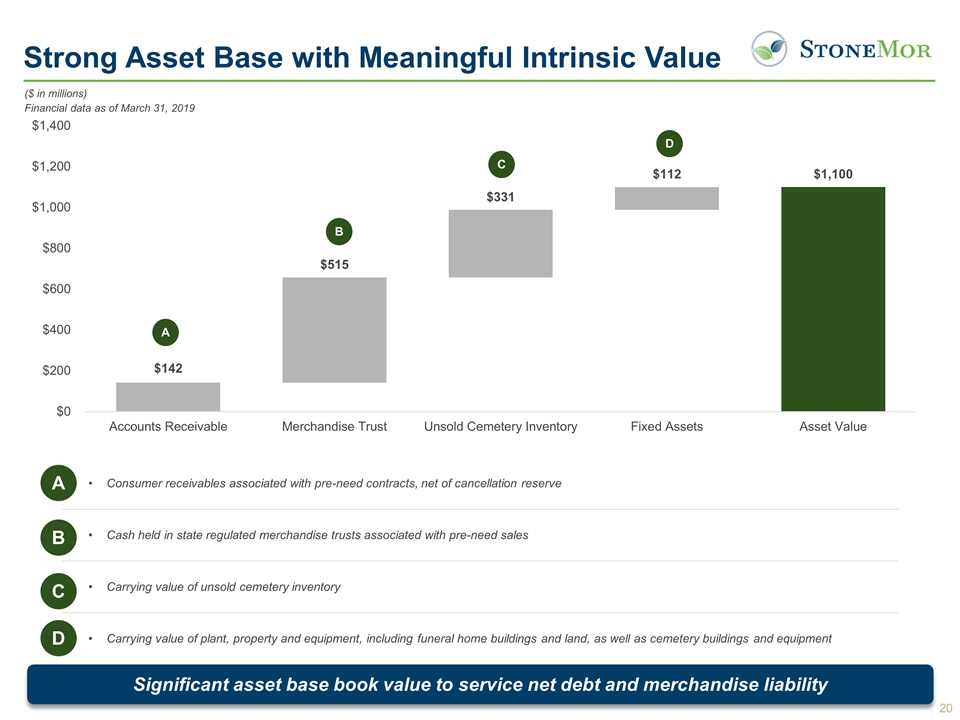

Strong Asset Base with Meaningful Intrinsic Value Consumer receivables associated with pre-need contracts, net of cancellation reserve Cash held in state regulated merchandise trusts associated with pre-need sales Carrying value of unsold cemetery inventory Carrying value of plant, property and equipment, including funeral home buildings and land, as well as cemetery buildings and equipment A B C D A B C D ($ in millions) Financial data as of March 31, 2019 Significant asset base book value to service net debt and merchandise liability

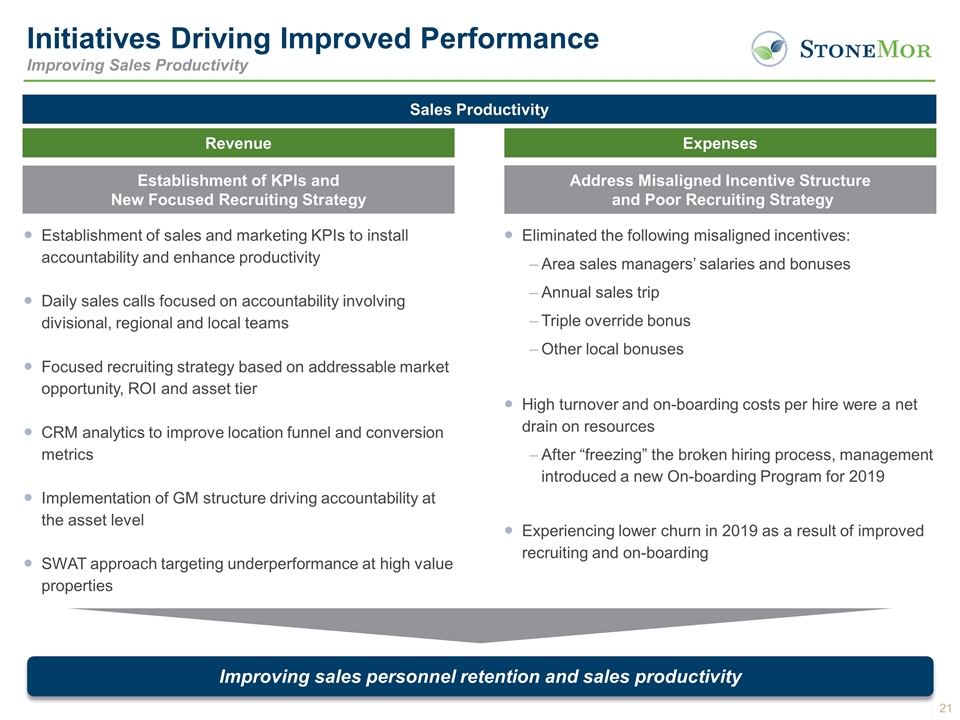

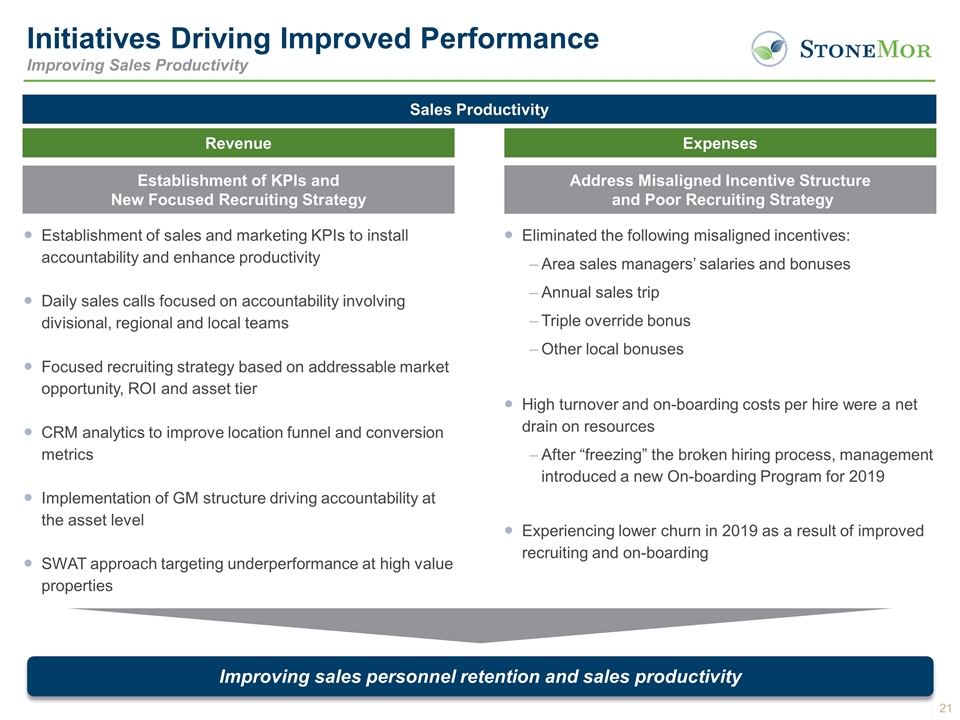

Initiatives Driving Improved Performance Improving Sales Productivity Revenue Expenses Establishment of KPIs and New Focused Recruiting Strategy Address Misaligned Incentive Structure and Poor Recruiting Strategy Sales Productivity Improving sales personnel retention and sales productivity Establishment of sales and marketing KPIs to install accountability and enhance productivity Daily sales calls focused on accountability involving divisional, regional and local teams Focused recruiting strategy based on addressable market opportunity, ROI and asset tier CRM analytics to improve location funnel and conversion metrics Implementation of GM structure driving accountability at the asset level SWAT approach targeting underperformance at high value properties Eliminated the following misaligned incentives: Area sales managers’ salaries and bonuses Annual sales trip Triple override bonus Other local bonuses High turnover and on-boarding costs per hire were a net drain on resources After “freezing” the broken hiring process, management introduced a new On-boarding Program for 2019 Experiencing lower churn in 2019 as a result of improved recruiting and on-boarding

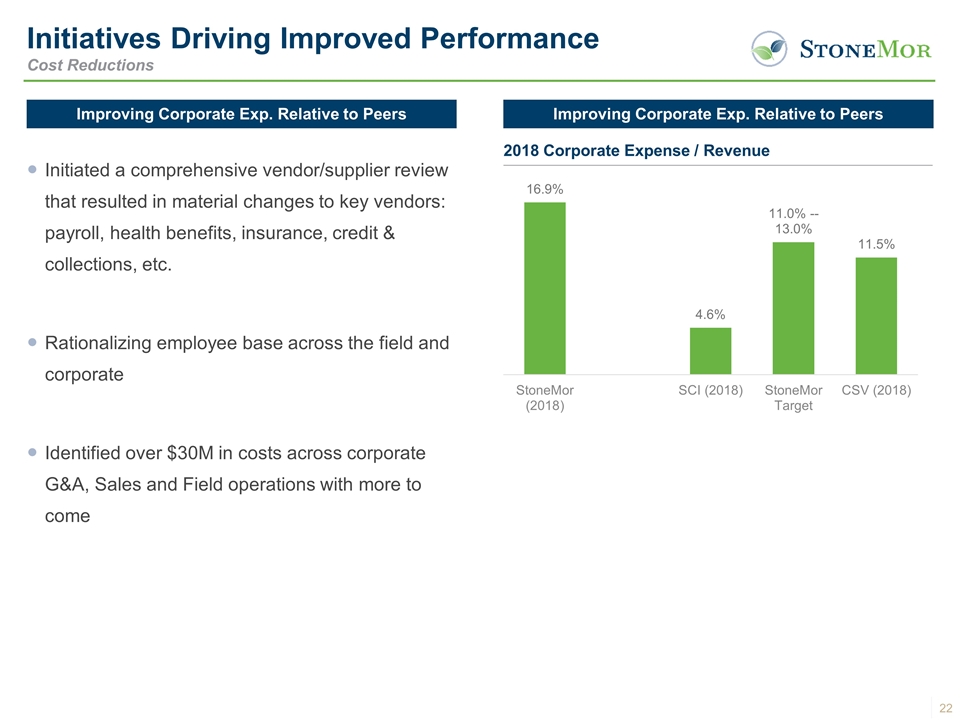

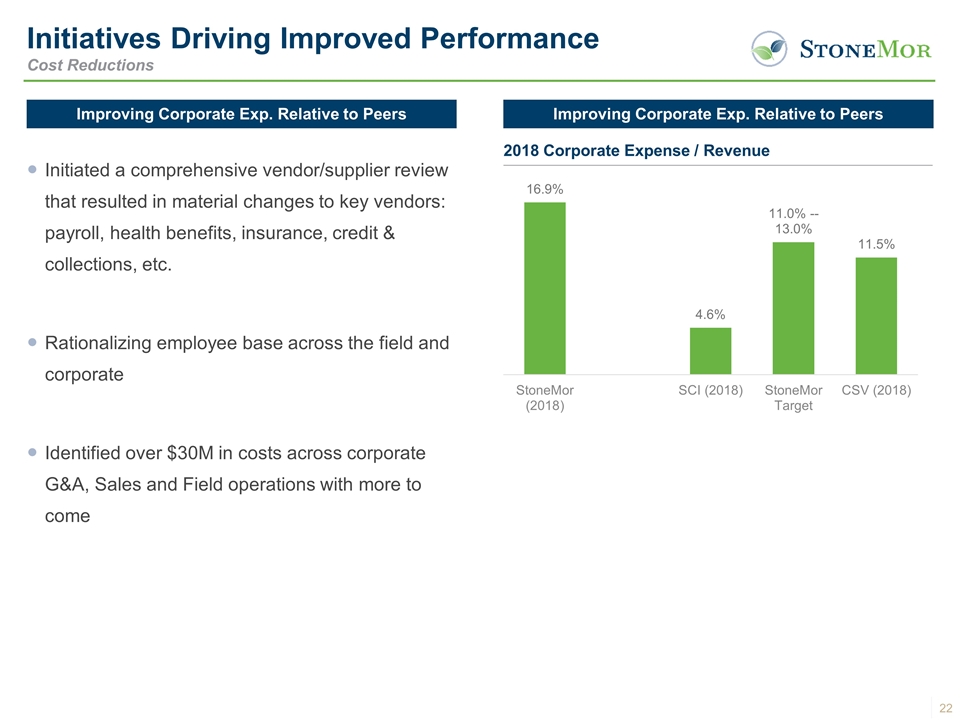

Initiatives Driving Improved Performance Cost Reductions Initiated a comprehensive vendor/supplier review that resulted in material changes to key vendors: payroll, health benefits, insurance, credit & collections, etc. Rationalizing employee base across the field and corporate Identified over $30M in costs across corporate G&A, Sales and Field operations with more to come Improving Corporate Exp. Relative to Peers 2018 Corporate Expense / Revenue Improving Corporate Exp. Relative to Peers

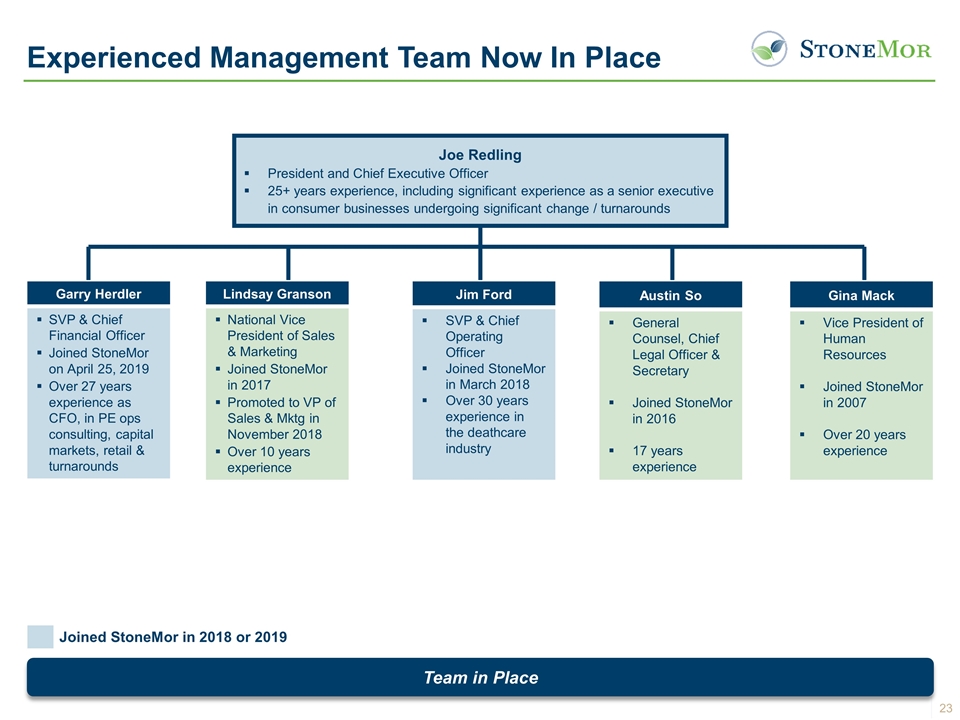

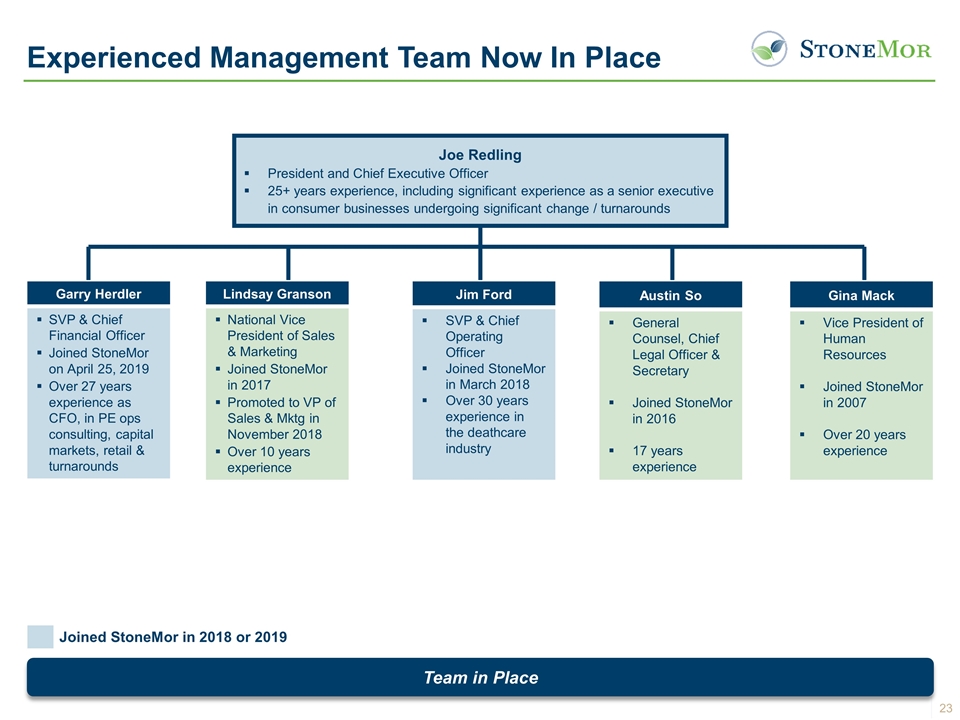

Experienced Management Team Now In Place Joe Redling President and Chief Executive Officer 25+ years experience, including significant experience as a senior executive in consumer businesses undergoing significant change / turnarounds Team in Place Jim Ford SVP & Chief Operating Officer Joined StoneMor in March 2018 Over 30 years experience in the deathcare industry Lindsay Granson National Vice President of Sales & Marketing Joined StoneMor in 2017 Promoted to VP of Sales & Mktg in November 2018 Over 10 years experience Gina Mack Vice President of Human Resources Joined StoneMor in 2007 Over 20 years experience Austin So General Counsel, Chief Legal Officer & Secretary Joined StoneMor in 2016 17 years experience Joined StoneMor in 2018 or 2019 Garry Herdler SVP & Chief Financial Officer Joined StoneMor on April 25, 2019 Over 27 years experience as CFO, in PE ops consulting, capital markets, retail & turnarounds

Summary and Q&A Focus on Goals for Performance Improvement à Align Management Team à Execute Strategy 1. Improve Cash Flow & Liquidity P 2.Optimize Capital Structure PP 3. Strategic Balance Sheet / Portfolio Review P 5. Set and Align Goals and Cadence; Execute 4. Improve Performance thru Cost Reductions & Revenue Enhancement

Appendix

Refinance Revolving Credit Facility and Senior Unsecured Bonds and $57.5 MM Equity Injection ($ in thousands) Illustrative Sources and Uses Pro Forma Capitalization Includes ~$10 million for existing letters of credit and ~$6 million to secure credit card program Includes $10 million additional draw made on April 26, 2019 per note 17 of StoneMor's 10-Q for the 1st quarter ended March 31, 2019 Other debt is composed of notes payable – acquisition debt and insurance & vehicle financing Adjustment does not reflect write-off of deferred financing fees or transaction expenses