UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

x Soliciting Material Under Rule 14a-12

DWS GLOBAL COMMODITIES STOCK FUND, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

WESTERN INVESTMENT HEDGED PARTNERS L.P. WESTERN INVESTMENT ACTIVISM PARTNERS LLC WESTERN INVESTMENT TOTAL RETURN PARTNERS L.P. WESTERN INVESTMENT TOTAL RETURN FUND LTD. ARTHUR D. LIPSON BENCHMARK PLUS PARTNERS, L.L.C. BENCHMARK PLUS INSTITUTIONAL PARTNERS, L.L.C. BENCHMARK PLUS MANAGEMENT, L.L.C. SCOTT FRANZBLAU ROBERT FERGUSON NEIL CHELO MATTHEW S. CROUSE ROBERT H. DANIELS GREGORY R. DUBE GERALD HELLERMAN RICHARD A. RAPPAPORT WILLIAM J. ROBERTS ROBERT A. WOOD LYNN D. SCHULTZ |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Western Investment LLC (“Western Investment”), together with the other Participants named herein, is filing materials contained in this Schedule 14A with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the election of its slate of director nominees at the next meeting of stockholders (the “Annual Meeting”) of DWS Enhanced Commodity Strategy Fund, Inc. (the “Fund”). Western Investment filed a preliminary proxy statement with the SEC with regard to the Annual Meeting on May 28, 2010.

Item 1: Investor Presentation, dated June 7, 2010.

March 5, 2010

Via Email, Fax and First-Class Mail

Michael Clark

Head of DWS Investments Mutual Fund Board Relations

President, DWS Global Commodities Stock Fund, Inc.

345 Park Avenue

New York, NY 10154

Email: michael .clark@db.com

Fax: 212-454-7171

W. Douglas Beck, Managing Director

Head of DWS Investments Product Management

DWS Scudder Distributors, Inc.

345 Park Avenue

New York, NY 10154

Email: doug.beck@db.com

Fax: 212-454-7171

Re: DWS Global Commodities Stock Fund, Inc.

Dear Mr. Clark and Mr. Beck:

You called me this week and told me the GCS board of directors will meet next week. You asked me if I have anything to communicate to you.

I do. At the risk of repetition of what I’ve told your board several times before, here is my message.

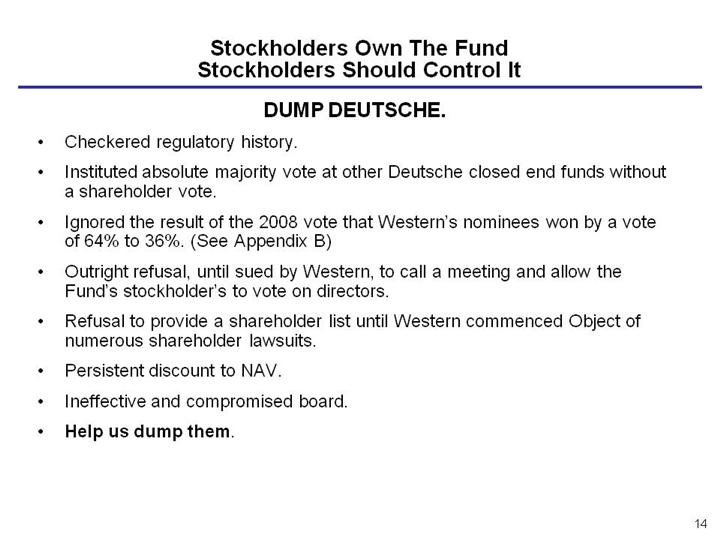

Your board reacted to the mandate of GCS owners, at the 2008 annual meeting, where stockholders voted by a margin of 64% - 36% to replace Deutsche’s “house” directors, by taking the company hostage since then. Your board not only ignored, without any response, my repeated written requests to amend GCS’ by-laws to eliminate majority voting i n contested elections, they’ve completely suspended the stockholder voting process for the past 16+ months. Not holding an annual stockholders meeting in 2009 was arrogant and illegal. Holding onto control this way better befits a Banana Republic junta that won’t risk loss of power through democratic elections, than a board of directors of an American publicly-traded fund.

GCS’ majority vote rule for contested elections is an affront to stockholder democracy. Face it. You lost the last election by an almost 2-1 margin. Yet you use this majority vote gimmick to thwart the stockholders’ will. In 1993, Rudy Guiliani succeeded the incumbent, David Dinkins, as mayor of New York when Giuliani won 930,236 votes to Dinkins’ 876,869. Neither candidate received the votes of a majority of New York’s more than five million eligible voters. Under your majority vote rule, David Dinkins would have remained the mayor of NYC, probably for life! That is essentially how your board intends to perpetuate its incumbency.

As if that were not enough, your board recently adopted a blatantly illegal shareholder vote sterilization rule, which is clearly aimed at thwarting the ability of my stockholder group or any other stockholders who might otherwise be able to acquire enough stock, to vote to overcome the near-certain entrenchment effect of your majority vote rule.

Then, your board announced on January 20, 2010 that you had decided to fundamentally change GCS’ investment objective, the character of its investments, its portfolio manager and its name, solely by vote of your unelected holdover board and without first submitting these fundamental changes for a vote of approval from stockholders.

To sum up my message, you are headed toward a proxy contest in 2010 which you will almost certainly lose again. More likely than not, the election will – by your board’s premeditated design – “fail” once again due to the majority vote rule, whereupon the Deutsche “house” directors will continue to claim the right to cling to their seats as “holdovers” and continue to do Deutsche’s bidding. Holdovers, like leftovers, spoil over time and emit a noxious smell. That pretty well describes your board, where 9 of 13 seats were last filled by stockholder votes (really by broker discretionary votes) i n uncontested elections i n 2005 and 2006.

Your board would rather see GCS destroyed than allow anyone other than themselves, and their patron, Deutsche, run it. Their attitude boils down “to hell with what stockholders want; we will cede control only when a court seizes it from our clutches.” Unfortunately, unless you allow the owners of the Fund to truly decide who will manage it, via a fair election with no incumbent – entrenchment majority vote rule, your board leaves us with little choice other than to have the Fund’s future decided by the courts.

| | Very truly yours, WESTERN INVESTMENT LLC |

| | |

| | |

| | |

| | By: | |

| | | Arthur D. Lipson |

WESTERN INVESTMENT LLC

7050 S. Union Park Center, Suite 590

Midvale, Utah 84047

March 20, 2009

BY FEDERAL EXPRESS

Board of Directors

DWS Global Commodities Stock Fund, Inc.

345 Park Avenue

New York, New York 10154

Members of the Board:

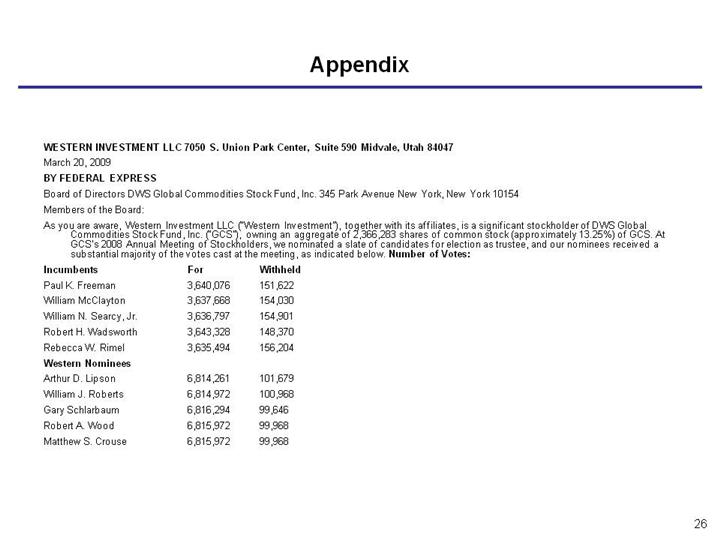

As you are aware, Western Investment LLC (“Western Investment”), together with its affiliates, is a significant stockholder of DWS Global Commodities Stock Fund, Inc. (“GCS”), owning an aggregate of 2,366,283 shares of common stock (approximately 13.25%) of GCS. At GCS’s 2008 Annual Meeting of Stockholders, we nominated a slate of candidates for election as trustee, and our nominees received a substantial majority of the votes cast at the meeting, as indicated below.

| | Number of Votes: |

| Incumbents | For | Withheld |

| Paul K. Freeman | 3,640,076 | 151,622 |

| William McClayton | 3,637,668 | 154,030 |

| William N. Searcy, Jr. | 3,636,797 | 154,901 |

| Robert H. Wadsworth | 3,643,328 | 148,370 |

| Rebecca W. Rimel | 3,635,494 | 156,204 |

| Western Nominees | | |

| Arthur D. Lipson | 6,814,261 | 101,679 |

| William J. Roberts | 6,814,972 | 100,968 |

| Gary Schlarbaum | 6,816,294 | 99,646 |

| Robert A. Wood | 6,815,972 | 99,968 |

| Matthew S. Crouse | 6,815,972 | 99,968 |

In seeking election, our nominees took the position that immediate’ action was needed to address GCS’s excessive and persistent discount to Net Asset Value (“NAV”), including, among other things, possibly converting to an exchange-traded fund or exchange-traded note, or as a last resort, open-ending or liquidating GCS. The vote at the 2008 Annual Meeting thus represented a referendum on GCS’s future. The results clearly demonstrate that stockholders believe that eliminating the discount to NAV was a priority.

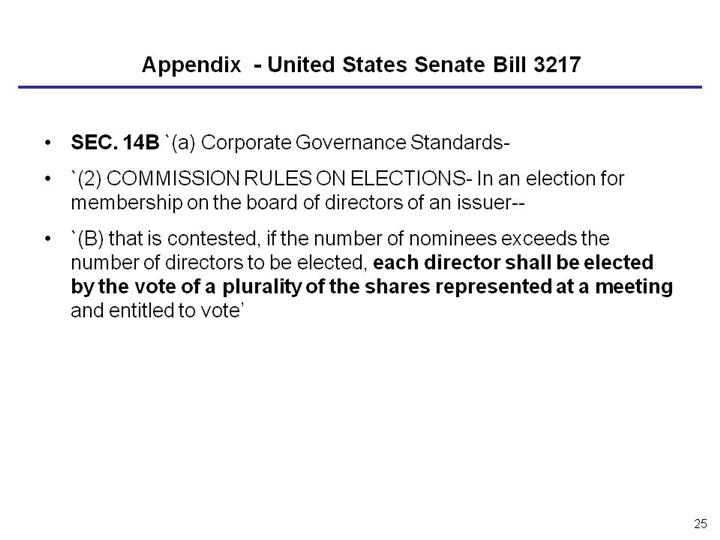

In almost every corporate setting, the candidates receiving the majority of the votes at a duly called meeting prevail, and are afforded an opportunity to implement the wishes of stockholders. Not so at GCS. According to GCS’s Bylaws, directors can only be elected by the affirmative vote of the majority of the outstanding shares. As a result of this provision, the challenger must obtain an absolute majority of the outstanding shares, or the incumbent remains in office. At the 2008 annual meeting, this led to the perverse result that the loser of the vote, the incumbent directors, remained in control of GCS. The incumbents have since maintained the status quo, thwarting the stockholders’ will.

As significant stockholders of GCS, we continue to be alarmed by the Board’s failure to address GCS’s persistent and excessive discount to its NAV. This failure is a textbook example of a Board ignoring its responsibility to maximize stockholder value. The fact that the Board’s conduct is in direct contradiction to the will of stockholders, as expressed at the 2008 Annual Meeting, makes the matter even more appalling. For this reason, we intend to submit nominations for election to the Board at the 2009 annual meeting (the “2009 Annual Meeting”) as soon as permitted by GCS’s Bylaws, and to file solicitation materials with the Securities and Exchange Commission in furtherance of their election.

Due to GCS’s incumbent-protective Bylaws, stockholders may be disenfranchised a second time at the 2009 Annual Meeting. We are therefore calling on GCS to immediately amend its Bylaws to conform to corporate norms and provide that, in a contested election, directors are to be elected by a majority of votes cast at the meeting. The current voting standard serves no other function than to entrench the members of the Board and to deprive stockholders of their ability to have their interests represented.

If GCS does not amend its Bylaws before the 2009 Annual Meeting, there is a strong chance that stockholders will fail to elect directors for the second year in a row. Such a deadlock would have serious repercussions for GCS, would result in an additional year where no directors were elected, and would be to the severe detriment of stockholders. The Board should act to prevent such a deadlock. Its failure to do so will speak volumes about the Board’s willingness to engage in oppressive conduct. GCS’s failure to amend its Bylaws prior to the 2009 Annual Meeting will likely result in the continued disenfranchisement of stockholders for a second year in a row. We look forward to your response.

| | Very truly yours, WESTERN INVESTMENT LLC |

| | |

| | By: | |

| | | Name: | Arthur D. Lipson |

| | | Title: | Managing Member |

CERTAIN INFORMATION CONCERNING PARTICIPANTS

Western Investment LLC (“Western Investment”), together with the other Participants (as defined below) named herein, intends to make a preliminary filing with the Securities and Exchange Commission (the “SEC”) of a proxy statement and accompanying proxy card to be used to solicit votes for the election of its slate of nominees at the annual meeting of stockholders of DWS Enhanced Commodity Strategy Fund, Inc., a Maryland corporation (the “Fund”).

WESTERN INVESTMENT STRONGLY ADVISES ALL STOCKHOLDERS OF THE FUND TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE SOLICITATION WILL PROVIDE COPIES OF DEFINITIVE PROXY MATERIALS, WITHOUT CHARGE, UPON REQUEST.

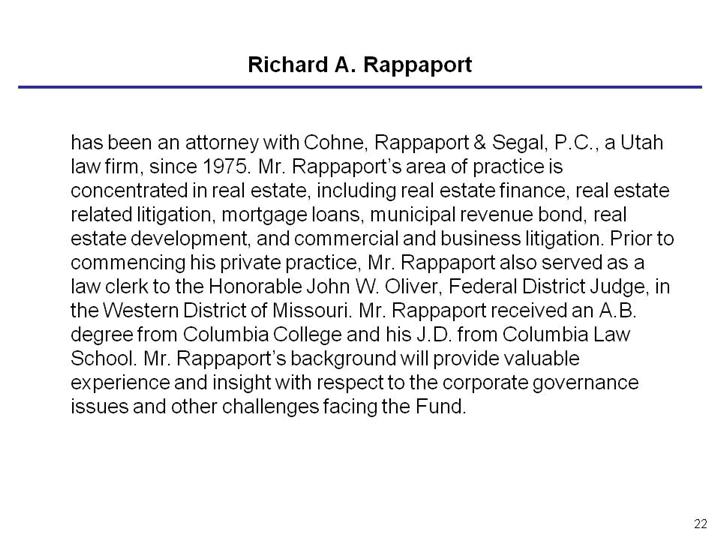

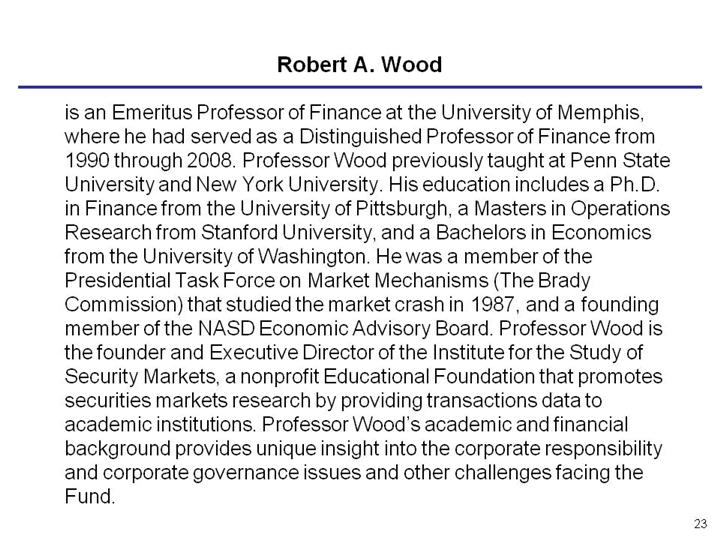

The participants in the solicitation are anticipated to be Western Investment, a Delaware limited liability company, Western Investment Hedged Partners L.P., a Delaware limited partnership (“WIHP”), Western Investment Activism Partners LLC, a Delaware limited liability company (“WIAP”), Western Investment Total Return Partners L.P., a Delaware limited partnership (“WITRP”), Western Investment Total Return Fund Ltd., a Cayman Islands corporation (“WITRL”), Arthur D. Lipson (“Mr. Lipson,” and together with Western Investment, WIHP, WIAP, WITRP and WITRL, the “Western Entities”), Benchmark Plus Partners, L.L.C., a Delaware limited liability company (“BPP”), Benchmark Plus Institutional Partners, L.L.C., a Delaware limited liability company (“BPIP� 221;), Benchmark Plus Management, L.L.C., a Delaware limited liability company (“BPM”), Scott Franzblau (“Mr. Franzblau”), Robert Ferguson (“Mr. Ferguson,” and together with BPP, BPIP, BPM and Mr. Franzblau, the “Benchmark Entities”), Neil Chelo (“Mr. Chelo”), Matthew S. Crouse (“Mr. Crouse”), Robert H. Daniels (“Mr. Daniels”), Gregory R. Dube (“Mr. Dube”), Richard A. Rappaport (“Mr. Rappaport”), William J. Roberts (“Mr. Roberts”), Professor Robert A. Wood (“Professor Wood”) and Lynn D. Schultz (“Ms. Schultz,” and collectively with the Western Entities, the Benchmark Entities, Mr. Chelo, Mr. Crouse, Mr. Daniels, Mr. Dube, Mr. Hellerman, Mr. Rappaport, Mr. Roberts and Professor Wood, the “Participants”).

As of the date of this filing, WIHP, WIAP, WITRP and WITRL beneficially owned 530,570, 530,328, 531,032 and 529,909 Shares, respectively. As the managing member of WIAP, the investment manager of WITRL and the general partner of each of WIHP and WITRP, Western Investment may be deemed to beneficially own the 2,121,839 Shares owned in the aggregate by WIHP, WIAP, WITRP and WITRL, in addition to the 1,337.24 Shares it holds directly. As the managing member of Western Investment, Mr. Lipson may be deemed to beneficially own the 2,123,176.24 Shares beneficially owned by Western Investment, in addition to the 19,275 Shares he owns directly. As members of a “group” for the purposes of Rule 13d-5(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Western Entities may be deemed to beneficially own the 891,520.1 Shares owned by the other Participants. The Western Entities disclaim beneficial ownership of such Shares.

As of the date of this filing, BPIP and BPP beneficially owned 456,903 and 433,080 Shares, respectively. As the managing member of BPIP and BPP, BPM may be deemed to beneficially own the 889,983 Shares owned in the aggregate by BPIP and BPP. As managing members of BPM, Messrs. Franzblau and Ferguson may be deemed to beneficially own the 889,983 Shares beneficially owned by BPM. As members of a “group” for the purposes of Rule 13d-5(b)(1) of the Exchange Act, the Benchmark Entities may be deemed to beneficially own the 2,143,988.34 Shares owned by the other Participants. The Benchmark Entities disclaim beneficial ownership of such Shares.

As of the date of this filing, Mr. Daniels directly owned 1,437.1 Shares. As a member of a “group” for the purposes of Rule 13d-5(b)(1) of the Exchange Act, Mr. Daniels may be deemed to beneficially own the 3,032,534.24 Shares beneficially owned in the aggregate by the other Participants. Mr. Daniels disclaims beneficial ownership of such Shares.

As of the date of this filing, Ms. Schultz directly owned 100 Shares. As a member of a “group” for the purposes of Rule 13d-5(b)(1) of the Exchange Act, Ms. Schultz may be deemed to beneficially own the 3,033,871.34 Shares beneficially owned in the aggregate by the other Participants. Ms. Schultz disclaims beneficial ownership of such Shares.

None of Messrs. Chelo, Crouse, Dube, Rappaport or Roberts or Professor Wood directly owns any Shares. As members of a “group” for the purposes of Rule 13d-5(b)(1) of the Exchange Act, each of Messrs. Chelo, Crouse, Dube, Rappaport and Roberts and Professor Wood may be deemed to beneficially own the 3,033,971.34 Shares beneficially owned in the aggregate by the other Participants. Each of Messrs. Chelo, Crouse, Dube, Rappaport and Roberts and Professor Wood disclaims beneficial ownership of such Shares.