UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-21552

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

(Exact name of registrant as specified in charter)

383 Madison Avenue

New York, NY 10179

(Address of principal executive offices) (Zip code)

Abby L. Ingber, Esq.

J.P. Morgan Private Investments Inc.

4 New York Plaza

New York, NY 10004

(Name and address of agent for service)

Copy to:

Jon Rand, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

The Report to Shareholders is attached herewith.

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Statements

For the six months ended September 30, 2021

(Unaudited)

This report is open and authorized for distribution only to qualified and accredited investors or financial intermediaries who have received a copy of the Fund’s Private Placement Memorandum. This document, although required to be filed with the Securities and Exchange Commission (“SEC”), may not be copied, faxed or otherwise distributed to the general public.

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Statements

For the six months ended September 30, 2021

(Unaudited)

Contents

Past performance is no guarantee of future results. Market volatility can significantly impact short-term performance. Results of an investment made today may differ substantially from the Fund’s historical performance. Investment return and principal value will fluctuate so that an investor’s interests, when redeemed, may be worth more or less than original cost.

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments

September 30, 2021

(Unaudited)

| | | | | | | | | | | | | | |

Investment Funds (f) | | Cost ($) | | | Value ($) | | | % of Members’ Capital | | Liquidity (e) | |

| | | | |

Event Driven | | | | | | | | | | | | | | |

HG Vora Special Opportunities Fund, L.P. (b) | | | 8,867,069 | | | | 11,997,452 | | | 4.67 | | | Quarterly | |

Magnetar PRA Fund, Ltd. (b) | | | 4,459,659 | | | | 5,085,873 | | | 1.98 | | | Monthly | |

Sculptor Enhanced Overseas Fund, Ltd. (b) | | | 11,700,000 | | | | 13,451,767 | | | 5.23 | | | Quarterly | |

Strategic Value Restructuring Fund, LP | | | 10,477 | | | | 5,670 | | | 0.00 (a) | | | In Liquidation** | |

Third Point Partners Qualified, L.P. (b) | | | 8,211,675 | | | | 15,565,536 | | | 6.05 | | | Quarterly | |

Varde Credit Partners (Offshore), Ltd. (b) | | | 8,081,190 | | | | 9,397,580 | | | 3.65 | | | Quarterly | |

| | | | | | | | | | | | | | |

Total | | | 41,330,070 | | | | 55,503,878 | | | 21.58 | | | | |

| | | | | | | | | | | | | | |

| | | | |

Long/Short Equities | | | | | | | | | | | | | | |

BlackRock Emerging Frontiers Fund, Ltd. (b) | | | 7,600,000 | | | | 10,135,490 | | | 3.94 | | | Monthly | |

Coatue Qualified Partners, L.P. (b) | | | 4,852,742 | | | | 11,656,345 | | | 4.53 | | | Quarterly | |

Echo Street Goodco Select, LP (b) | | | 9,650,000 | | | | 14,123,169 | | | 5.49 | | | Monthly | |

Lakewood Capital Partners, L.P. (b) | | | 9,706,639 | | | | 12,117,356 | | | 4.71 | | | Quarterly | |

Light Street Argon, L.P. (b) | | | 6,900,000 | | | | 6,941,815 | | | 2.70 | | | Quarterly | |

Redmile Capital Fund LP (b) | | | 7,850,000 | | | | 8,672,485 | | | 3.37 | | | Quarterly | |

RTW Onshore Fund One, LP (b) | | | 3,800,000 | | | | 3,205,742 | | | 1.25 | | | Quarterly | |

Snow Lake Asia Fund Ltd. (b) | | | 4,500,000 | | | | 3,249,419 | | | 1.27 | | | Quarterly | |

| | | | | | | | | | | | | | |

Total | | | 54,859,381 | | | | 70,101,821 | | | 27.26 | | | | |

| | | | | | | | | | | | | | |

| | | | |

Opportunistic/Macro | | | | | | | | | | | | | | |

Brevan Howard, L.P. (b) | | | 12,620,565 | | | | 17,011,934 | | | 6.61 | | | Monthly | |

D.E. Shaw Oculus Fund, LLC (b) | | | 13,398,393 | | | | 21,874,227 | | | 8.51 | | | Quarterly | |

Kirkoswald Global Macro Fund LP (b) | | | 6,500,000 | | | | 6,921,773 | | | 2.69 | | | Quarterly | |

| | | | | | | | | | | | | | |

Total | | | 32,518,958 | | | | 45,807,934 | | | 17.81 | | | | |

| | | | | | | | | | | | | | |

| | | | |

Relative Value | | | | | | | | | | | | | | |

D.E. Shaw Composite Fund, LLC | | | 17,329,077 | | | | 32,849,355 | | | 12.77 | | | Quarterly | |

Dollar Senior Loan Onshore Fund, II L.P. (b) | | | 4,140,894 | | | | 5,030,652 | | | 1.96 | | | Monthly | |

Galton Agency MBS Offshore Fund, Ltd. (b) | | | 5,000,000 | | | | 5,011,826 | | | 1.95 | | | Monthly | |

King Street Capital, L.P. (b) | | | 320,672 | | | | 465,010 | | | 0.18 | | | Side Pocket* | |

LibreMax Partners, L.P. (b) | | | 8,500,000 | | | | 8,099,721 | | | 3.15 | | | Quarterly | |

Magnetar Capital Fund, L.P. | | | 6,837 | | | | 5,141 | | | 0.00 (a) | | | Side Pocket* | |

Magnetar Risk Linked Fund (US), Ltd. | | | 116,513 | | | | 54,806 | | | 0.02 | | | In Liquidation** | |

Magnetar SPV, LLC | | | 325 | | | | 90 | | | 0.00 (a) | | | In Liquidation** | |

SPF Securitized Products Fund L.P. (b) | | | 3,550,000 | | | | 4,162,228 | | | 1.62 | | | Quarterly | |

Two Sigma Spectrum US Fund, L.P. (b) | | | 18,042,774 | | | | 23,919,696 | | | 9.30 | | | Quarterly | |

| | | | | | | | | | | | | | |

Total | | | 57,007,092 | | | | 79,598,525 | | | 30.95 | | | | |

| | | | | | | | | | | | | | |

Total Investments in Investment Funds | | | 185,715,501 | | | | 251,012,158 | | | 97.60 | | | | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

1

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments (continued)

September 30, 2021

(Unaudited)

| | | | | | | | | | | | | | | | |

Registered Investment Companies | | Cost ($) | | | Value ($) | | | % of

Members’

Capital | | | Liquidity | |

| | | | |

Alternative Assets | | | | | | | | | | | | | | | | |

Neuberger Berman Long Short Fund - Institutional Class

Shares | | | 4,429,822 | | | | 4,805,416 | | | | 1.87 | | | | Daily | |

| | | | |

Short-Term Investment | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

JPMorgan U.S. Government Money Market Fund,

Institutional Class Shares, 0.01% (c),(d) | | | 2,960,654 | | | | 2,960,654 | | | | 1.15 | | | | Daily | |

| | | | | | | | | | | | | | | | |

Total Investments in Registered Investment Companies | | | 7,390,476 | | | | 7,766,070 | | | | 3.02 | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments | | | 193,105,977 | | | | 258,778,228 | | | | 100.62 | | | | | |

| | | | |

Liabilities, less other Assets | | | | | | | (1,598,562) | | | | (0.62) | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

Members’ Capital | | | | | | | 257,179,666 | | | | 100.00 | | | | | |

| | | | | | | | | | | | | | | | |

| | (a) | Amount rounds to less than 0.005%. |

| | (b) | Partially or wholly held in a pledged account by the Custodian as collateral for existing line of credit. The aggregate value of collateral pledged for the line of credit is $218,097,096. |

| | (c) | Investment in affiliate. The Fund holds 2,960,654 shares in the JPMorgan U.S. Government Money Market Fund, which is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| | (d) | The rate shown is the current yield as of September 30, 2021. |

| | (e) | Certain funds (except registered investment companies) may be subject to an initial lock-up period, as described in Note 1 of the financial statements. |

| | (f) | Non-income producing investments. |

| | * | A side pocket is an account within the Investment Fund that has additional restrictions on liquidity. |

| | ** | The Investment Fund is in the process of ceasing its operations or has created a special purpose vehicle to handle the orderly disposition of the underlying assets, which may result in J.P. Morgan Access Multi-Strategy Fund, L.L.C.’s delayed receipt of redemption proceeds. |

The accompanying notes are an integral part of these financial statements.

2

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments (continued)

September 30, 2021

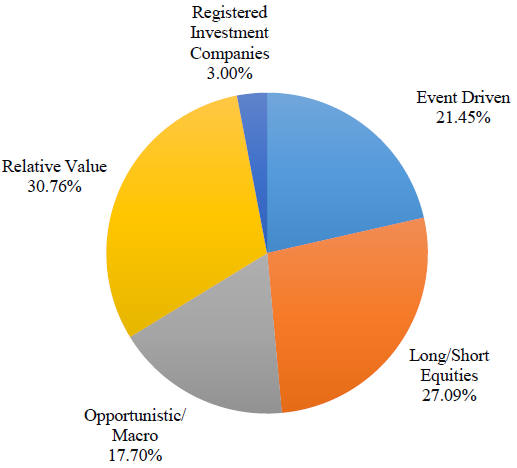

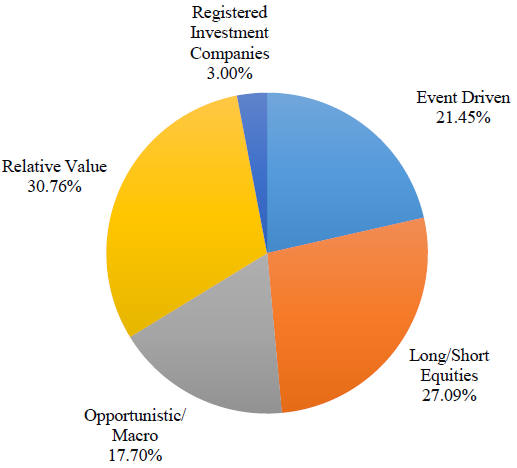

Investment Strategy as a Percentage of Total Investments***

Management agreements of the general partners/managers of the investment funds (excluding registered investment companies) provide for compensation to such general partners/managers in the form of management fees ranging from 0.65% to 3% annually of net assets and incentives of 0% to 30% of net profits earned.

*** The percentages on this page are based on Total Investments. The percentages on the Schedule of Investments differ as they are based on the Members’ Capital.

The accompanying notes are an integral part of these financial statements.

3

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Assets, Liabilities and Members’ Capital

September 30, 2021

(Unaudited)

| | | | |

Assets | | | | |

| |

Investments in non-affiliates, at value (cost $190,145,323) | | $ | 255,817,574 | |

Investments in affiliates, at value (cost $2,960,654) | | | 2,960,654 | |

Cash | | | 800 | |

Investments paid in advance (see Note 2c) | | | 3,000,000 | |

Receivable for Investment Funds sold | | | 1,304,139 | |

Prepaid expenses | | | 26,869 | |

Dividend receivable from affiliates | | | 25 | |

Other receivables | | | 11,208 | |

| | | | |

Total assets | | | 263,121,269 | |

| | | | |

| |

Liabilities | | | | |

Tender offer proceeds payable | | | 4,111,807 | |

Contributions received in advance (see Note 6) | | | 882,000 | |

Professional fees payable | | | 625,248 | |

Management Fee payable | | | 216,781 | |

Administration Fee payable | | | 32,647 | |

Credit facility fees payable | | | 7,917 | |

Other accrued expenses | | | 65,203 | |

| | | | |

Total liabilities | | | 5,941,603 | |

| | | | |

| |

Members’ Capital | | $ | 257,179,666 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

4

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Operations

For the six months ended September 30, 2021

(Unaudited)

| | | | |

Investment income | | | | |

Dividend income from affiliates | | $ | 303 | |

| | | | |

Total investment income | | | 303 | |

| | | | |

| |

Expenses | | | | |

Management Fee (see Note 3) | | | 1,276,619 | |

Professional fees | | | 270,452 | |

Administration Fee (see Note 3) | | | 191,493 | |

Fund accounting and custodian fees | | | 133,002 | |

Credit facility fees (see Note 4) | | | 96,583 | |

Investor servicing fees | | | 41,538 | |

Insurance | | | 26,859 | |

Directors’ and Chief Compliance Officer’s fees | | | 12,939 | |

Other | | | 15,811 | |

| | | | |

Total expenses | | | 2,065,296 | |

| | | | |

| |

Less: Waivers and/or expense reimbursements (see Note 3) | | | (9,766) | |

| | | | |

Net expenses | | | 2,055,530 | |

| | | | |

| |

Net investment income/(loss) | | | (2,055,227) | |

| | | | |

| |

Realized and unrealized gain/(loss) | | | | |

Net realized gain/(loss) from investments in non-affiliates | | | 644,201 | |

Net change in unrealized appreciation/(depreciation) on investments in non-affiliates | | | 10,584,790 | |

| | | | |

| |

Net realized and unrealized gain/(loss) | | | 11,228,991 | |

| | | | |

| |

Net increase/(decrease) in Members’ Capital resulting from operations | | $ | 9,173,764 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

5

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statements of Changes in Members’ Capital

For the six months ended September 30, 2021 (Unaudited)

| | | | | | | | | | | | |

| | | Managing Member* | | | Other Members | | | Total | |

| | | |

From investment activities | | | | | | | | | | | | |

| | | |

Net investment income/(loss) | | $ | – | | | $ | (2,055,227) | | | $ | (2,055,227) | |

Net realized gain/(loss) from investments in non-affiliates | | | – | | | | 644,201 | | | | 644,201 | |

Net change in unrealized appreciation/(depreciation) on investments in non-affiliates | | | – | | | | 10,584,790 | | | | 10,584,790 | |

Distributions of capital gains received from investment companies non-affiliates | | | – | | | | – | | | | – | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from

operations | | | – | | | | 9,173,764 | | | | 9,173,764 | |

| | | |

From Members’ Capital transactions | | | | | | | | | | | | |

Capital contributions | | | – | | | | 11,991,000 | | | | 11,991,000 | |

Repurchase fee | | | – | | | | – | | | | – | |

Capital repurchases | | | – | | | | (10,510,516) | | | | (10,510,516) | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from capital transactions | | | – | | | | 1,480,484 | | | | 1,480,484 | |

| | | | |

Net change in Members’ Capital | | | – | | | | 10,654,248 | | | | 10,654,248 | |

| | | |

Members’ Capital at beginning of period | | | – | | | | 246,525,418 | | | | 246,525,418 | |

| | | | |

Members’ Capital at end of period | | $ | – | | | $ | 257,179,666 | | | $ | 257,179,666 | |

| | | | |

For the year ended March 31, 2021

| | | | | | | | | | | | |

| | | Managing Member* | | | Other Members | | | Total | |

| | | |

From investment activities | | | | | | | | | | | | |

| | | |

Net investment income/(loss) | | $ | – | | | $ | (4,146,259) | | | $ | (4,146,259) | |

Net realized gain/(loss) from investments in non-affiliates | | | – | | | | 4,300,071 | | | | 4,300,071 | |

Net change in unrealized appreciation/(depreciation) on investments in non-affiliates | | | – | | | | 41,533,039 | | | | 41,533,039 | |

Distributions of capital gains received from investment companies non-affiliates | | | – | | | | 309,278 | | | | 309,278 | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from

operations | | | – | | | | 41,996,129 | | | | 41,996,129 | |

| | | |

From Members’ Capital transactions | | | | | | | | | | | | |

Capital contributions | | | – | | | | 19,257,019 | | | | 19,257,019 | |

Repurchase fee | | | – | | | | 4,044 | | | | 4,044 | |

Capital repurchases | | | – | | | | (61,327,050) | | | | (61,327,050) | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from capital transactions | | | – | | | | (42,065,987) | | | | (42,065,987) | |

| | | | |

Net change in Members’ Capital | | | – | | | | (69,858) | | | | (69,858) | |

| | | |

Members’ Capital at beginning of year | | | – | | | | 246,595,276 | | | | 246,595,276 | |

| | | | |

Members’ Capital at end of year | | $ | – | | | $ | 246,525,418 | | | $ | 246,525,418 | |

| | | | |

| * | MSFMM, Inc. is the Fund’s Managing Member and has a capital contribution of less than $1 in the Fund. |

The accompanying notes are an integral part of these financial statements.

6

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Cash Flows

For the six months ended September 30, 2021

(Unaudited)

| | | | |

Cash flows from operating activities | | | | |

| |

Net increase/(decrease) in Members’ Capital resulting from operations | | $ | 9,173,764 | |

| Adjustments to reconcile net increase in Members’ Capital resulting from operations to net cash provided by operating activities: | | | | |

Purchases of non-affiliated Investment Funds and registered investment companies | | | (10,970,463) | |

Sales of non-affiliated Investment Funds and registered investment companies | | | 21,321,776 | |

Sales of short-term investments in affiliates, net | | | 4,354,446 | |

Net realized (gain)/loss from investments in non-affiliates | | | (644,201) | |

Net change in unrealized (appreciation)/depreciation on investments in non-affiliates | | | (10,584,790) | |

Decrease in dividend receivable from affiliates | | | 105 | |

Decrease in prepaid expenses | | | 26,858 | |

Increase in Other receivables | | | (11,208) | |

Decrease in Administration Fee payable | | | (32,666) | |

Decrease in credit facility fees payable | | | (402) | |

Decrease in interest payable | | | (433) | |

Decrease in Management Fee payable | | | (216,175) | |

Increase in professional fees payable | | | 44,886 | |

Decrease in other accrued expenses | | | (3,592) | |

| | | | |

| |

Net cash provided by operating activities | | | 12,457,905 | |

| | | | |

| |

Cash flows from financing activities | | | | |

| |

Capital contributions, including change in contributions received in advance | | | 12,351,000 | |

Capital redemptions, including change in tender offer proceeds payable | | | (24,809,450) | |

| | | | |

| |

Net cash used in financing activities | | | (12,458,450) | |

| | | | |

| |

Net decrease in cash and cash equivalents | | | (545) | |

| |

Cash at beginning of period | | | 1,345 | |

| | | | |

Cash at end of period | | $ | 800 | |

| | | | |

| |

Supplemental disclosure of cash flow information | | | | |

| |

Cash paid during the period for interest | | $ | 433 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

7

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Highlights

Ratios and other Financial Highlights

The following represents the ratios to the other Members’ Capital and other financial highlights information for Members’ Capital other than the Managing Member and Special Member.

| | | | | | | | | | | | |

| | | For the six months ended September 30, 2021 (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | |

| | | Years Ended March 31, |

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

| | | | | | |

Total return | | 3.70% (a) | | 18.06% | | (2.98%) | | 0.74% | | 4.75% | | 6.49% |

Performance allocation | | – | | – | | – | | – | | – | | 0.00% (b) |

Total return after performance allocation | | 3.70% (a) | | 18.06% | | (2.98%) | | 0.74% | | 4.75% | | 6.49% |

| | | | | | |

Ratios to the other Members’ Capital: | | | | | | | | | | | | |

| | | | | | |

Expenses, before waivers | | 1.63% (c) | | 1.67% | | 1.69% | | 1.67% | | 1.64% | | 1.51% |

Expenses, net of waivers | | 1.62% (c) | | 1.66% | | 1.68% | | 1.66% | | 1.63% | | 1.49% |

Performance allocation | | – | | – | | – | | – | | – | | 0.00% (b) |

Expenses, net of performance allocation and net of waivers | | 1.62% (c) | | 1.66% | | 1.68% | | 1.66% | | 1.63% | | 1.49% |

| | | | | | |

Net investment income (loss), before waivers | | (1.63%) (c) | | (1.67%) | | (1.49%) | | (1.34%) | | (1.48%) | | (1.46%) |

Net investment income (loss), net of waivers | | (1.62%) (c) | | (1.66%) | | (1.48%) | | (1.33%) | | (1.47%) | | (1.44%) |

| | | | | | |

Portfolio turnover rate | | 3.20% (a) | | 22.17% | | 26.72% | | 38.58% | | 27.45% | | 26.94% |

| | | | | | |

Members’ Capital applicable to other Members | | $257,179,666 | | $246,525,418 | | $246,595,276 | | $316,679,890 | | $403,719,333 | | $774,117,497 |

The above ratios and total returns are calculated for other Members taken as a whole. An individual investor’s return may vary from these returns based on the timing of capital contributions and performance allocation, if any.

The above expense ratios do not include the expenses from the investment funds and affiliated money market fund. However, total returns take into account all expenses.

| (b) | Amount rounds to less than 0.005%. |

The accompanying notes are an integral part of these financial statements.

8

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited)

1. Organization

J.P. Morgan Access Multi-Strategy Fund, L.L.C. (the “Fund”) was organized as a limited liability company on April 6, 2004 under the laws of the State of Delaware and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified, management investment company. The Fund’s investment objective is to generate consistent capital appreciation over the long term, with relatively low volatility and a low correlation with traditional equity and fixed-income markets. The Fund will seek to accomplish this objective by allocating its assets primarily among professionally selected investment funds (collectively, “Investment Funds” and each individually, “Investment Fund”) that are managed by experienced third-party investment advisers (“Portfolio Managers”) who invest in a variety of markets and employ, as a group, a range of investment techniques and strategies. There can be no assurance that the Fund will achieve its investment objective.

The following is a description of strategies used by third-party investment advisors:

Event Driven – Invests in securities of companies in financial difficulty, reorganization or bankruptcy, involved in mergers, acquisitions, restructurings, liquidations, spin-offs, or other special situations that alter a company’s financial structure or operating strategy, nonperforming and sub-performing bank loans, and emerging market debt. Investment Funds within this strategy are generally subject to 30-90 day redemption notice periods and may have lock-up periods of up to one year.

Long/Short Equities – Makes long and short investments in equity securities that are deemed by the Portfolio Managers to be under or overvalued. Investment Funds within this strategy are generally subject to 30-90 day redemption notice periods and may have lock-up periods of up to one year.

Opportunistic/Macro – Invests in a wide variety of instruments using a broad range of strategies, often assuming an aggressive risk posture, typically with low correlations to other strategies. This strategy uses a combination of macro-economic models and fundamental research to invest across countries, markets, sectors and companies, and have the flexibility to invest in numerous financial instruments. Investment Funds within this strategy are generally subject to 60-90 day redemption notice periods.

Relative Value – Makes simultaneous purchases and sales of similar securities to exploit pricing differentials or have long exposure in non-equity oriented beta opportunities (such as credit). Different relative value strategies include convertible bond arbitrage, statistical arbitrage, pairs trading, yield curve arbitrage and basis trading. Investment Funds within this strategy are generally subject to 20-90 day redemption notice periods and may have lock-up periods of up to one year.

J.P. Morgan Investment Management Inc. (“JPMIM”), a corporation formed under the laws of the State of Delaware and an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan Chase”), acts as Investment Manager (the “Investment Manager”) and Administrator (the “Administrator”), and is responsible for the day-to-day management of the Fund, subject to policies adopted by the Board of Directors (the “Board”). The Investment Manager has in turn delegated substantially all investment authority and the allocation of the Fund’s assets among the Investment Funds and other instruments to J.P. Morgan Private Investments Inc. (the “Sub-Advisor” or “JPMPI”), a corporation formed under the laws of the State of Delaware and a wholly-owned subsidiary of JPMorgan Chase. The

9

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

1. Organization (continued)

Sub-Advisor will allocate Fund assets among the Investment Funds and other investments that, in its view, represent attractive investment opportunities. MSFMM, Inc., an entity established by Intertrust Group B.V., serves as the managing member of the Fund (the “Managing Member”).

Both the Investment Manager and the Sub-Advisor are registered as investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

2. Significant Accounting Policies

a. Use of Estimates

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 - Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in members’ capital (“Members’ Capital”) from operations during the reporting period. Actual results could differ from those estimates.

b. Valuation of Investments

The valuation of the investments is in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board, which established the following approach to valuation, as described more fully below. The Fund values its investments in Investment Funds at fair value. Fair value as of each month-end ordinarily is the net asset value (“NAV”) determined as of such month-end for each Investment Fund in accordance with the Investment Fund’s valuation policies and reported at the time of the Fund’s valuation.

The Administrator has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Administrator implements the valuation policies of the Fund’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Fund as described in detail below. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

On a monthly basis, the NAV is used to determine the fair value of all underlying investments which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Investment Fund will represent the amount that the Fund could

10

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

b. Valuation of Investments (continued)

reasonably expect to receive from an Investment Fund if the Fund’s interest were redeemed at the time of the valuation, based on information reasonably available at the time the valuation is made and that the Administrator believes to be reliable. In the unlikely event that an Investment Fund does not report a month-end NAV to the Fund on a timely basis, the Administrator would determine the fair value of such Investment Fund based on the most recent value reported by the Investment Fund, as well as any other relevant information available at such time. Considerable judgment is required to interpret the factors used to develop estimates at fair value. These factors include, but are not limited to, a review of the underlying securities of the Investment Fund when available, ongoing due diligence of the style, strategy and valuation methodology employed by each Investment Fund, and a review of market inputs that may be expected to impact the performance of a particular Investment Fund. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the financial statements.

Some of the Investment Funds may invest all or a portion of their assets in investments which may be illiquid. Some of these investments are held in “side pockets,” sub funds within the Investment Funds, which provide for their separate liquidation potentially over a much longer period than the liquidity an investment in the Investment Funds may provide. Should the Fund seek to liquidate its investment in an Investment Fund which maintains investments in a side pocket arrangement or which holds substantially all of its assets in illiquid investments, the Fund might not be able to fully liquidate its investment without considerable delay. In such cases, the value of its investment could fluctuate during the period until the Fund is permitted to fully liquidate its interest in the Investment Funds.

Investments in affiliated and non-affiliated registered investment companies are valued at such fund’s NAV per share as of the valuation date.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the fair value of the Fund’s investments are summarized into the three broad levels listed below.

Level 1 – Unadjusted inputs using quoted prices in active markets for identical investments.

Level 2 – Other significant observable inputs including, but not limited to, quoted prices for similar investments or other significant observable inputs.

Level 3 – Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments).

11

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

b. Valuation of Investments (continued)

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The Fund’s investments in affiliated and non-affiliated registered investment companies, as disclosed on the Schedule of Investments, are designated as Level 1.

As of September 30, 2021, Investment Funds with a fair value of $251,012,158 have not been categorized in the fair value hierarchy as the Investment Funds were measured using the NAV per share as a practical expedient.

c. Investments Paid in Advance

Investments paid in advance represent cash which has been sent to Investment Funds prior to September 30, 2021, but the investment is not effective until October 1, 2021. At September 30, 2021, the Fund made the following commitment to purchase Investment Funds:

| | | | |

| Investment Fund | | Amount | |

PSAM WorldArb Partners L.P.* | | $ | 3,000,000 | |

| | | | |

Total | | $ | 3,000,000 | |

| | | | |

| * | The Investment Fund utilizes the Event Driven strategy subject to 45 day redemption notice period and has quarterly liquidity. |

d. Distributions from Investments

Distributions received from Investment Funds or affiliated and non-affiliated investment companies whether in the form of cash or securities, are applied as a reduction of the investment’s cost when identified as a return of capital. Once the investment’s cost is received, any further distributions are recognized as realized gains.

e. Investment Transactions with Affiliates

The Fund invested in affiliated investment companies which are advised by the Investment Manager or its affiliates. An issuer which is under common control with the Fund may be considered an affiliate. For the purposes of the financial statements, the Fund assumes the issuer listed in the table below to be an affiliated issuer. Affiliated investment companies’ distributions may be reinvested into the affiliated investment companies. Reinvestment amounts are included in the purchase cost amounts in the tables below.

12

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

e. Investment Transactions with Affiliates (continued)

| | | | | | | | | | | | | | | | | | |

Security

Description | | Value at

March 31,

2021 | | Purchases at

Cost | | Proceeds from

Sales | | Net

Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation/

(Depreciation) | | Value at

September 30,

2021 | | Shares at

September 30,

2021 | | Dividend

Income | | Capital Gain Distributions |

| | | | | | | | | |

JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 0.01% (a) | | $7,315,100 | | $27,209,644 | | $(31,564,090) | | $ - | | $ - | | $2,960,654 | | 2,960,654 | | $303 | | $ - |

| (a) | The rate shown is the current yield as of September 30, 2021. |

f. Income Recognition and Security Transactions

Distributions of net investment income and realized capital gains from Investment Funds or affiliated and non-affiliated investment companies, if any, are recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Realized gains and losses from Investment Fund transactions are calculated on the identified cost basis. Investments are recorded on the effective date of the subscription in the Investment Fund. All changes in the value of the Investment Funds and non-affiliated investment companies are included in Net change in unrealized appreciation/(depreciation) on investments in non-affiliates on the Statement of Operations.

g. Fund Expenses

The Fund bears all expenses incurred in its business other than those that the Investment Manager assumes. The expenses of the Fund include, but are not limited to, the following: all costs and expenses related to investment transactions and positions for the Fund’s account; legal fees; accounting and auditing fees; custodial fees; costs of computing the Fund’s net asset value; costs of insurance; registration expenses; expenses of meetings of the Board; all costs with respect to communications to members (the “Members”); and other types of expenses as may be approved from time to time by the Board.

The Fund invests in Investment Funds and affiliated and non-affiliated investment companies, and, as a result, bears a portion of the expenses incurred by these investments. These expenses are not reflected in the expenses shown on the Statement of Operations and are not included in the ratios to the other Members’ Capital shown in the Financial Highlights. Certain expenses incurred indirectly through investment in an affiliated money market fund are waived by the Fund as described in Note 3.

h. Income Taxes

The Fund intends to operate and has elected to be treated as a partnership for Federal income tax purposes. Accordingly, no provision for the payment of Federal, state or local income taxes has been provided. Each Member is individually responsible to report on its own tax return its distributive share of the Fund’s taxable income or loss.

13

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

h. Income Taxes (continued)

Management evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s financial statements to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions with respect to tax at the Fund level not deemed to meet the “more-likely-than-not” threshold would be recorded as a tax benefit or expense in the current year. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits or expense will significantly change in the next twelve months. Management’s conclusions regarding tax positions will be subject to review and may be adjusted at a later date based on factors including, but not limited to, on-going analyses of tax laws, regulations and interpretations thereof.

Management has reviewed the Fund’s tax positions for all open tax years and has determined that as of September 30, 2021, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

i. Recent Accounting Pronouncement

In March 2020, the FASB issued Accounting Standards Update No. 2020-04 (“ASU 2020-04”), Reference Rate Reform (Topic 848), Facilitation of the Effects of Reference Rate Reform on Financial Reporting. ASU 2020-04 provides optional temporary financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other interbank-offered based reference rates as of the end of 2021. ASU 2020-04 became effective upon the issuance and its optional relief can be applied through December 31, 2022. Management is currently evaluating the impact, if any, to the Fund’s financial statements of applying ASU 2020-04.

3. Management Fee, Related Party Transactions and Other

The Fund has entered into an investment management agreement with the Investment Manager. In consideration of the advisory services provided by the Investment Manager to the Fund, the Fund pays the Investment Manager a management fee at an annual rate of 1.00% (the “Management Fee”), payable monthly at the rate of 1/12 of 1.00% of the month-end capital account balance of each Member, before giving effect to repurchases or Repurchase Fees (if any, as defined in Note 6), but after giving effect to the Fund’s other expenses. The Management Fee is an expense paid out of the Fund’s assets. The Management Fee is paid monthly in arrears within 30 days of the calculation of the Fund’s month-end Members’ Capital of each month. For the six months ended September 30, 2021, the Management Fee earned by JPMIM totaled $1,276,619.

The Investment Manager, on behalf of the Fund, has entered into an investment sub-advisory agreement with JPMPI. For its services as sub-advisor, the Investment Manager pays JPMPI a monthly sub-advisory fee of 1/12 of 0.85% of the month-end capital account balance of each Member of the Fund.

14

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

3. Management Fee, Related Party Transactions and Other (continued)

The Sub-Advisor was the special member of the Fund (the “Special Member”). Prior to January 1, 2017, the Special Member was entitled to all incentive-based performance allocations, if any, from Members’ accounts (see Note 6).

Pursuant to an Administration Agreement, the Administrator provides certain administration services to the Fund. In consideration of these services, the Administrator receives a fee (the “Administration Fee”) paid monthly at the annual rate of 0.15% of the Fund’s month-end Members’ Capital before giving effect to repurchases or Repurchase Fees (if any, as defined in Note 6), but after giving effect to the Fund’s other expenses. For the six months ended September 30, 2021, the Administration Fee earned by JPMIM totaled $191,493.

The Investment Manager, the Sub-Advisor and the Administrator, have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses, other than certain money market fund fees as described below, dividend and interest expenses on securities sold short, interest, brokerage commissions, taxes, expenses related to litigation and potential litigation, expenses related to director election and extraordinary expenses not incurred in the ordinary course of the Fund’s business) exceed 1.92% on an annualized basis of the Fund’s Members’ Capital as of the end of each month. This expense limitation agreement is in effect until August 1, 2023. Under this agreement, none of these parties expect the Fund to repay any such waived fees and reimbursed expenses in future years. There were no fees waived pursuant to this agreement during the six months ended September 30, 2021.

The Fund may invest in one or more money market funds advised by the Investment Manager or its affiliates (affiliated money market funds). The Investment Manager and/or Administrator have contractually agreed to waive fees and/or reimburse expenses in an amount sufficient to offset the respective net fees each collects from an affiliated money market fund on the Fund’s investment in such affiliated money market funds. The amount of waivers resulting from investments in the affiliated money market funds for the six months ended September 30, 2021 was $9,766. None of these parties expect the Fund to repay any such waived fees and reimbursed expenses in future years.

Entities may be retained by the Fund to assist in the placement of interests. These entities (“Placement Agents”), which may include the Investment Manager and its affiliates, will generally be entitled to receive a placement fee of up to 2.0% of the invested amount from each investor purchasing an interest through a Placement Agent. The placement fee will be added to a prospective investor’s subscription amount; it will not constitute a capital contribution made by the investor to the Fund nor will it be included as part of the assets of the Fund. The placement fee may be adjusted or waived in the sole discretion of the Placement Agent.

Certain officers of the Fund are affiliated with the Investment Manager and the Administrator. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

15

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

3. Management Fee, Related Party Transactions and Other (continued)

The Board appointed a Chief Compliance Officer to the Fund in accordance with Federal securities regulations. The Fund, along with other affiliated investment companies, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Directors’ and Chief Compliance Officer’s fees on the Statement of Operations.

4. Line of Credit

The Fund has a line of credit with Credit Suisse International in the amount of $38 million and from time to time may borrow cash under the credit agreement. Interest charged on borrowings, which is calculated on any outstanding loan balance, and based on a LIBOR based rate, is payable on a monthly basis. The Fund also pays a monthly fee on the unused amount of the line of credit. The Fund had no outstanding loan balance on this line of credit as of September 30, 2021. This agreement terminates on May 25, 2022.

During the six months ended September 30, 2021, the Fund had borrowings under the credit agreement as follows:

| | | | | | | | |

Average Daily

Loan Balance* | | Weighted

Average Interest

Rate | | Interest

Expense** | | Number of Days

Borrowings Were

Outstanding | | Credit Facility

Fee** |

$ - | | -% | | $ - § | | - | | $96,583 § |

| * | For the days borrowings were outstanding. |

| ** | For the six months ended September 30, 2021. |

| § | Interest expense and credit facility fees incurred for the six months ended September 30, 2021 are included in the Statement of Operations. |

The Fund is required to pledge cash or securities as collateral to Credit Suisse International in an amount equal to a certain percentage of the available line of credit. Securities segregated as collateral are denoted on the Schedule of Investments.

At a meeting held in May 2021, the Board approved the renewal of the line of credit until May 25, 2022, effective May 26, 2021.

5. Security Transactions

During the six months ended September 30, 2021, purchases and sales of investments (excluding short-term investments) amounted to $7,970,463 and $8,036,062, respectively.

At September 30, 2021, the estimated cost of investments for Federal income tax purposes was $253,842,004. Accordingly, gross unrealized appreciation on investments was $67,985,814 and gross unrealized depreciation was $63,049,590, resulting in net unrealized appreciation of $4,936,224. The estimated cost of investments for

16

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

5. Security Transactions (continued)

Federal income tax purposes is adjusted for items of taxable income or loss allocated to the Fund from the Investment Funds. The allocated taxable income or loss is reported to the Fund by the Investment Funds on their respective Schedule K-1. The Fund has not yet received all such Schedule K-1’s for the tax year ended December 31, 2020; therefore, the tax basis cost of investments as of September 30, 2021 is estimated based on information available, and will not be finalized by the Fund until after the fiscal year end.

6. Contributions, Redemptions, and Performance Allocation

Generally, initial and additional contributions for Interests (“Interests”) by eligible investors may be accepted at such times as the Fund may determine. The Fund reserves the right to reject any contributions for Interests in the Fund. The initial acceptance for contributions for Interests was April 1, 2004 (the “Initial Closing Date”). After the Initial Closing Date, the Fund generally accepts contributions for Interests as of the first day of each month. At September 30, 2021, the Fund received $882,000 in contribution proceeds in advance of the October 1, 2021 contribution date, which included Repurchase Fees, if any as defined below, related to repurchase of Members’ Interests at September 30, 2021. This amount is included in the Statement of Assets, Liabilities and Members’ Capital.

The Fund from time to time may offer to repurchase Interests pursuant to written tenders by Members. These repurchases will be made at such times, and in such amounts, and on such terms as may be determined by the Board, in its sole discretion. The Investment Manager expects to typically recommend to the Board that the Fund offer to repurchase Interests from Members of up to 35% of the Fund’s Members’ Capital quarterly, effective as of the last day of March, June, September, and December, although such recommendation may be less than or greater than 35%. A 1.5% repurchase fee (the “Repurchase Fee”) payable to the Fund will be charged for repurchases of Members’ Interests at any time prior to the day immediately preceding the one-year anniversary of a Member’s purchase of its Interests. For the six months ended September 30, 2021, the Fund did not earn any Repurchase Fees.

At the end of each Allocation Period of the Fund, any net capital appreciation or net capital depreciation of the Fund (both realized and unrealized), as the case may be, is allocated to the capital accounts of all of the Members (including the Special Member and the Managing Member) in proportion to their respective opening capital account balances for such Allocation Period. The initial “Allocation Period” began on the Initial Closing Date, with each subsequent Allocation Period beginning immediately after the close of the preceding Allocation Period. Each Allocation Period closes on the first to occur of (1) the last day of each month, (2) the date immediately prior to the effective date of (a) the admission of a new Member or (b) an increase in a Member’s capital contribution, (3) the effective date of any repurchase of Interests, or (4) the date when the Fund dissolves.

Effective January 1, 2017, the Fund is no longer subject to the Performance Allocation. In connection with this change, the Fund is no longer required to have a Special Member to receive the Performance Allocation.

17

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

7. Risk Exposure

In the normal course of business, the Investment Funds trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short-selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swaps contracts. The Fund’s risk of loss in these Investment Funds is limited to the value of the Fund’s investments in the Investment Funds.

In pursuing its investment objectives, the Fund invests in Investment Funds that are not registered under the 1940 Act. These Investment Funds may utilize diverse investment strategies, which are not generally managed against traditional investment indices. The Investment Funds selected by the Fund will invest in and actively traded securities and other financial instruments using a variety of strategies and investment techniques that may involve significant risks. Such risks arise from the volatility of the equity, fixed income, commodity and currency markets, leverage both on and off balance sheet associated with borrowings, short sales and derivative instruments, the potential illiquidity of certain instruments including emerging markets, private transactions, derivatives, and counterparty and broker defaults. Various risks are also associated with an investment in the Fund, including risks relating to the multi-manager structure of the Fund, risks relating to compensation arrangements and risks related to limited liquidity of the Investment Funds. The Investment Funds provide for periodic redemptions generally ranging from monthly to semi-annually, and may be subject to various lock-up provisions and early withdrawal fees.

Because of the Fund’s investment in the Investment Funds, the Fund indirectly pays a portion of the expenses incurred by the Investment Funds. As a result, a cost of investing in the Fund may be higher than the cost of investing in a fund that invests directly in individual securities and financial instruments.

The investments of the Investment Funds are subject to normal market fluctuations and other risks inherent in investing in securities and there can be no assurance that any appreciation in value will occur. The value of investments can fall as well as rise and investors may not realize the amount that they invest.

Although the Investment Manager will seek to select Investment Funds that offer the opportunity to have their shares or units redeemed within a reasonable timeframe, there can be no assurance that the liquidity of the investments of such Investment Funds will always be sufficient to meet redemption requests as, and when, made.

The Investment Manager may invest the Fund’s assets in Investment Funds that invest in illiquid securities and do not permit frequent withdrawals. Illiquid securities owned by Investment Funds are generally riskier than liquid securities because the Investment Funds may not be able to dispose of the illiquid securities if their investment performance deteriorates, or may be able to dispose of the illiquid securities only at a greatly reduced price. Similarly, the illiquidity of the Investment Funds may cause Members to incur losses because of an inability to withdraw their investments from the Fund during or following periods of negative performance.

The Investment Funds may invest in the securities of foreign companies that involve special risks and considerations not typically associated with investing in U.S. companies. These risks include devaluation of currencies, less reliable information about issuers, different securities transaction clearance and settlement practices, and future adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those securities of comparable U.S. companies.

18

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

7. Risk Exposure (continued)

Because of the Fund’s investments in registered investment companies, the Fund indirectly pays a portion of the expenses incurred by these registered investment companies. As a result, the cost of investing in the Fund may be higher than the cost of investing in a mutual fund that invests directly in individual securities and financial instruments. The Fund is also subject to certain risks related to the registered investment companies’ investments in securities and financial instruments such as fixed income securities, including high yield, asset-backed and mortgage-related securities, equity securities, foreign and emerging markets securities, commodities and real estate securities. These securities are subject to risks specific to their structure, sector or market.

In addition, the registered investment companies may use derivative instruments in connection with their individual investment strategies including futures, forward foreign currency exchange contracts, options, swaps and other derivatives, which are also subject to specific risks related to their structure, sector or market and may be riskier than investments in other types of securities. Specific risks and concentrations present in the registered investment companies are disclosed within their individual financial statements and registration statements, as appropriate since the Fund is non-diversified, it may invest a greater percentage of its assets in a particular issuer or group of issuers than a diversified fund would. This increased investment in fewer issuers may result in the Fund being more sensitive to economic results of those issuing the securities.

LIBOR is intended to represent the rate at which contributing banks may obtain short-term borrowings from each other in the London interbank market. On March 5, 2021, the U.K. Financial Conduct Authority (“FCA”) publicly announced that (i) immediately after December 31, 2021, publication of the 1-week and 2-month U.S. Dollar LIBOR settings will permanently cease; (ii) immediately after June 30, 2023, publication of the overnight and 12-month U.S. Dollar LIBOR settings will permanently cease; and (iii) immediately after June 30, 2023, the 1-month, 3-month and 6-month U.S. Dollar LIBOR settings will cease to be provided or, subject to the FCA’s consideration of the case, be provided on a synthetic basis and no longer be representative of the underlying market and economic reality they are intended to measure and that representativeness will not be restored. There is no assurance that the dates announced by the FCA will not change or that the administrator of LIBOR and/or regulators will not take further action that could impact the availability, composition or characteristics of LIBOR or the currencies and/or tenors for which LIBOR is published. Public and private sector industry initiatives are currently underway to implement new or alternative reference rates to be used in place of LIBOR. There is no assurance that any such alternative reference rate will be similar to or produce the same value or economic equivalence as LIBOR or that it will have the same volume or liquidity as did LIBOR prior to its discontinuance or unavailability, which may affect the value or liquidity or return on certain of a Fund’s instruments or investments comprising some or all of a Fund’s investments and result in costs incurred in connection with closing out positions and entering into new trades. These risks may also apply with respect to changes in connection with other interbank offering rates (e.g., Euribor) and a wide range of other index levels, rates and values that are treated as “benchmarks” and are the subject of recent regulatory reform.

The Fund is subject to infectious disease epidemics/pandemics risk. Recently, the worldwide outbreak of COVID-19, a novel coronavirus disease, has negatively affected economies, markets and individual companies throughout the world. The effects of this COVID-19 pandemic to public health, and business and market conditions, including exchange trading suspensions and closures may continue to have a significant negative

19

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements September 30, 2021 (Unaudited) (continued)

7. Risk Exposure (continued)

impact on the performance of the Fund’s investments, increase the Fund’s volatility, exacerbate other pre-existing political, social and economic risks to the Fund and negatively impact broad segments of businesses and populations. The Fund’s operations may be interrupted as a result, which may have a significant negative impact on investment performance. In addition, governments, their regulatory agencies, or self-regulatory organizations may take actions in response to the pandemic that affect the instruments in which the Fund invests, or the issuers of such instruments, in ways that could also have a significant negative impact on the Fund’s investment performance. The full impact of this COVID-19 pandemic, or other future epidemics/pandemics, is currently unknown.

8. Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

9. Concentrations

As of September 30, 2021, an affiliate of the Investment Manager managed their client’s holdings in the Fund, which collectively represented all of the Members’ Capital. Significant Member transactions, if any, may impact the Fund’s performance.

10. Subsequent Events

Effective October 1, 2021, JPMPI replaced JPMIM as Investment Manager and Administrator of the Fund. In addition, the Sub-Advisory agreement between JPMIM and JPMPI for the Fund has been terminated effective October 1, 2021.

As such, effective October 1, 2021, the Fund has entered into an investment management agreement with JPMPI as Investment Manager for which the Management fee will remain the same at an annual rate of 1.00% of the month-end capital account balance of each Members’ Capital before giving effect to repurchases or Repurchase Fees (if any, as defined in Note 6), but after giving effect to the Fund’s other expenses.

The Fund has also entered into an Administration Agreement effective October 1, 2021 with JPMPI as Administrator for which the Administrator will receive an Administration Fee at an annual rate of 0.13% of the Fund’s month-end Members’ Capital before giving effect to repurchases or Repurchase Fees (if any, as defined in Note 6), but after giving effect to the Fund’s other expenses. The expense limitation agreement and the waiver of the affiliated money market funds’ fees, as discussed in Note 3, will remain the same with the exception of the change of entities from JPMIM to JPMPI.

20

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Special Shareholder Meeting Results (Unaudited)

The J.P. Morgan Access Multi-Strategy Fund, L.L.C. held a special meeting of shareholders on September 24, 2021, for the purpose of considering and voting upon the following proposals:

Proposal 1: Election of a New Board of Directors

A new Board of Directors was elected by the shareholders of the J.P. Morgan Access Multi-Strategy Fund, L.L.C. The results of the voting were as follows:

| | | | |

| | | Votes Received (Amounts in thousands) |

| | |

Lisa M. Borders | | In Favor | | 239,398 |

| | |

| | Withheld | | 0 |

| | |

James P. Donovan | | In Favor | | 239,398 |

| | |

| | Withheld | | 0 |

| | |

Neil Medugno | | In Favor | | 239,398 |

| | |

| | Withheld | | 0 |

| | |

Lauren K. Stack | | In Favor | | 239,398 |

| | |

| | Withheld | | 0 |

| | |

Mary E. Savino | | In Favor | | 239,398 |

| | |

| | Withheld | | 0 |

Proposal 2: To approve a new investment management agreement with J.P. Morgan Private Investments Inc. (“JPMPI”) for the J.P. Morgan Access Multi-Strategy Fund, L.L.C. The results of the voting were as follows:

| | | | | | |

| | | Votes Received (Amounts in thousands) | |

| | |

For | | | | | 239,398 | |

| | |

Against | | | | | 0 | |

| | |

Abstain | | | | | 0 | |

21

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Board Approval of Investment Advisory Agreement (Unaudited)

The Board of Directors has established various standing committees composed of Directors with diverse backgrounds, to which the Board of Directors has assigned specific subject matter responsibilities to further enhance the effectiveness of the Board’s oversight and decision making. The Board of Directors and its investment committees (money market and alternative products, equity, and fixed income) meet regularly throughout the year and consider factors that are relevant to their annual consideration of investment advisory agreements at each meeting. They also meet for the specific purpose of considering investment advisory agreement annual renewals. The Board of Directors held meetings in June and August 2021, at which the Directors considered the continuation of the investment management and sub-advisory agreements for the Fund whose semi-annual report is contained herein (each an “Advisory Agreement” and, collectively, the “Advisory Agreements”). In accordance with SEC guidance, due to the COVID-19 pandemic, the meetings were conducted through video conference. At the June meeting, the Board’s investment committees met to review and consider performance, expense and related information for the J.P. Morgan Funds. Each investment committee reported to the full Board, which then considered the investment committee’s preliminary findings. At the August meeting, the Directors continued their review and consideration. The Directors, including a majority of the Directors who are not parties to the Advisory Agreements or “interested persons” (as defined in the 1940 Act) of any party to the Advisory Agreements or any of their affiliates, approved the continuation of each Advisory Agreement on August 11, 2021, conditioned on the approval by Fund shareholders of the new investment management agreement with J.P. Morgan Private Investments Inc.

As part of their review of the Advisory Agreements, the Directors considered and reviewed performance and other information about the Fund received from the Investment Manager and Sub-Advisor. This information includes the Fund’s performance as compared to the performance of its peers and benchmarks and analyses by the Investment Manager of the Fund’s performance. In addition, at each of their regular meetings throughout the year, the Directors considered reports on the performance of certain J.P. Morgan Funds provided by an independent investment consulting firm (“independent consultant”). In addition, in preparation for the June and August meetings, the Directors requested, received and evaluated extensive materials from the Investment Manager and/or Sub-Advisor, including performance and expense information compiled by Broadridge, using data from Lipper Inc. and/or Morningstar, Inc., independent providers of investment company data (together, “Broadridge”). The Directors’ independent consultant also provided additional quantitative and statistical analyses of the Fund, including risk/ and performance return assessment as compared to the Fund’s objectives, benchmarks, and peers. Before voting on the Advisory Agreements, the Directors reviewed the Advisory Agreements with representatives of the Investment Manager and/or Sub-Advisor, counsel to the Fund and independent legal counsel, and received a memorandum from independent legal counsel to the Directors discussing the legal standards for their consideration of the Advisory Agreements. The Directors also discussed the Advisory Agreements in executive sessions with independent legal counsel at which no representatives of the Investment Manager or Sub-Advisor were present.

A summary of the material factors evaluated by the Directors in determining whether to approve the Advisory Agreements is provided below. Each Director attributed different weights to the various factors and no factor alone was considered determinative. The Directors considered information provided with respect to the Fund throughout the year, including additional reporting and information provided in connection with the COVID-19 pandemic, as well as materials furnished specifically in connection with the annual review process. From year to year, the Directors consider and place emphasis on relevant information in light of changing circumstances in market and economic conditions.

After considering and weighing the factors and information they had received, the Directors found that the compensation to be received by the Investment Manager from the Fund and by the Sub-Advisor from the Investment Manager under the Advisory Agreements were fair and reasonable under the

22

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Board Approval of Investment Advisory Agreement (Unaudited) (continued)

circumstances and determined that the continuance of the Advisory Agreements was in the best interests of the Fund and its Members.

Nature, Extent and Quality of Services Provided by the Investment Manager and Sub-Advisor

The Directors received and considered information regarding the nature, extent and quality of services provided to the Fund under the Advisory Agreements. The Directors took into account information furnished throughout the year at Director meetings, as well as the materials furnished specifically in connection with this annual review process. The Directors considered the background and experience of the Investment Manager’s and Sub-Advisor’s senior management, personnel changes, if any, and the expertise of, and the amount of attention given to the Fund by, investment personnel of the Investment Manager and Sub-Advisor. In addition, the Directors reviewed the qualifications, backgrounds and responsibilities of the portfolio management team primarily responsible for the day-to-day management of the Fund and the infrastructure supporting the team, including personnel changes, if any. In addition, the Board considered its discussions with the Investment Manager regarding the Investment Manager’s business continuity plan and steps the Investment Manager was taking to provide ongoing services to the Fund during the COVID-19 pandemic, and the Investment Manager’s success in continuing to provide services to the Fund and its Members throughout this period. The Directors also considered information provided by the Investment Manager and Sub-Advisor about the structure and distribution strategy of the Fund. The Directors reviewed information relating to the Investment Manager’s and Sub-Advisor’s risk governance model and reports showing the Investment Manager’s and Sub-Advisor’s compliance structure and ongoing compliance processes. The Directors also considered the quality of the administration services provided by the Investment Manager in its role as administrator.

The Directors also considered their knowledge of the nature and quality of services provided by the Investment Manager and Sub-Advisor and their affiliates to the Fund gained from their experience as Directors of the J.P. Morgan Funds. In addition, they considered the overall reputation and capabilities of the Investment Manager, Sub-Advisor and their affiliates, the commitment of the Investment Manager and Sub-Advisor to provide high quality service to the Fund, their overall confidence in the Investment Manager’s and Sub-Advisor’s integrity and the Investment Manager’s and Sub-Advisor’s responsiveness to questions or concerns raised by them, including the Investment Manager’s and Sub-Advisor’s willingness to consider and implement organizational and operational changes designed to improve investment results and the services provided to the Fund. In addition, the Directors considered the different roles and responsibilities performed by the Investment Manager and Sub-Advisor under the Advisory Agreements, including the Investment Manager’s monitoring and evaluating of the Sub-Advisor to help assure that the Sub-Advisor is managing the Fund consistently with its investment objectives and restrictions.

Based upon these considerations and other factors, the Directors concluded that they were satisfied with the nature, extent and quality of the investment advisory services provided to the Fund by the Investment Manager and Sub-Advisor.

Costs of Services Provided and Profitability to the Investment Manager and its Affiliates

The Directors received and considered information regarding the profitability to the Investment Manager and its affiliates in providing services to the Fund. The Directors reviewed and discussed this information. The Directors recognized that this information is not audited and represents the Investment Manager’s determination of its and its affiliates’ revenues from the contractual services provided to the Fund, less expenses of providing such services. Expenses include direct and indirect costs and are calculated using an allocation methodology developed by the Investment Manager. The Directors also recognized that it is difficult to make comparisons of profitability from fund investment advisory contracts because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the types of funds it manages, its business mix,

23

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Board Approval of Investment Advisory Agreement (Unaudited) (continued)

numerous assumptions regarding allocations and the fact that publicly-traded fund managers’ operating profits and net income are net of distribution and marketing expenses. Based upon their review, and taking into consideration the factors noted above, the Directors concluded that the profitability to the Investment Manager under the Advisory Agreement was not unreasonable in light of the services and benefits provided to the Fund.

The Directors also considered that the Investment Manager, an affiliate of the Sub-Advisor, earns fees from the Fund for providing administration services. These fees were shown separately in the profitability analysis presented to the Directors. The Directors also considered the fees that may be paid to JPMorgan Chase Bank, N.A., J.P. Morgan Institutional Investments Inc., J.P. Morgan Securities LLC, J.P. Morgan Trust Company, N.A., and JPMorgan Distribution Services, Inc. for various services.

Fall-Out Benefits

The Directors reviewed information regarding potential “fall-out” or ancillary benefits received by the Investment Manager and its affiliates as a result of their relationship with the Fund. The Directors also noted that the Investment Manager supports a diverse set of products and services, which benefits the Investment Manger by allowing it to leverage its infrastructure to serve additional clients, including benefits that may be received by the Investment Manager and its affiliates in connection with certain J.P. Morgan Funds’ potential investments in other funds advised by the Investment Manager. The Directors also reviewed the Investment Manager’s allocation of fund brokerage for the J.P. Morgan Funds complex, including allocations to brokers who provide research to the Investment Manager as well as the Investment Manager’s use of affiliates to provide other services and the benefits to such affiliates of doing so.

Economies of Scale

The Directors considered the extent to which the Fund may benefit from economies of scale. The Directors considered that there may not be a direct relationship between economies of scale realized by the Fund and those realized by the Investment Manager as assets increase. The Directors considered the extent to which the Fund was priced to scale and whether it would be appropriate to add advisory fee breakpoints, but noted that the Fund has implemented fee waivers and contractual expense limitations (“Fee Caps”) which allow the Fund’s Members to share potential economies of scale from its inception and that the fees remain satisfactory relative to peer funds. The Directors further considered the Investment Manager’s and Sub-Advisor’s ongoing investments in their business in support of the Fund, including the Investment Manager’s and/or Sub-Advisor’s investments in trading systems, technology (including improvements to the J.P. Morgan Fund’s website, and cybersecurity improvements), retention of key talent, and regulatory support enhancements. The Directors concluded that the current fee structure for the Fund, including Fee Caps that the Investment Manager has in place that serve to limit the overall net expense ratio of the Fund at competitive levels, was reasonable. The Directors concluded that the Fund’s Members received the benefits of potential economies of scale through the Fee Caps and the Investment Manager’s reinvestment in its operations to serve the Fund and its Members. The Directors noted that the Investment Manager’s reinvestment ensures sufficient resources in terms of personnel and infrastructure to support the Fund.

Independent Written Evaluation of the Fund’s Chief Compliance Officer

The Directors noted that, upon their direction, the Chief Compliance Officer for the Fund had prepared an independent written evaluation in order to assist the Directors in determining the reasonableness of the proposed management fees. The Directors considered the written evaluation in determining whether to continue the Advisory Agreements.

24

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Board Approval of Investment Advisory Agreement (Unaudited) (continued)

Fees Relative to Investment Manager’s Other Clients