EXHIBIT 99.1

ANNUAL INFORMATION FORM

For the financial year ended December 31, 2007

Dated March 28, 2008

TABLE OF CONTENTS

| Incorporation by Reference of Technical Reports | 1 |

| Forward-Looking Statements | 1 |

| Cautionary Note to U.S. Investors | 2 |

ITEM 1: CORPORATE STRUCTURE | 2 |

| 1.1 | Name, Address and Incorporation | 2 |

| 1.2 | Intercorporate Relationships | 3 |

ITEM 2: GENERAL DEVELOPMENT OF THE BUSINESS | 3 |

ITEM 3: DESCRIPTION OF THE BUSINESS | 5 |

| 3.3 | Banro’s Gold Projects | 12 |

| 3.4 | New Exploration Properties | 28 |

ITEM 5: DESCRIPTION OF CAPITAL STRUCTURE | 28 |

| 5.1 | Authorized Share Capital | 28 |

| 5.2 | Shareholder Rights Plan | 29 |

ITEM 6: MARKET FOR SECURITIES | 30 |

ITEM 7: ESCROWED SECURITIES AND SECURITIES SUBJECT TO

| CONTRACTUAL RESTRICTION ON TRANSFER | 30 |

ITEM 8: DIRECTORS AND OFFICERS | 30 |

| 8.1 | Name, Occupation and Security Holding | 30 |

| 8.2 | Corporate Cease Trade Orders or Bankruptcies | 33 |

| 8.3 | Personal Bankruptcies | 33 |

| 8.4 | Penalties or Sanctions | 34 |

| 8.5 | Conflicts of Interest | 34 |

ITEM 9: AUDIT COMMITTEE INFORMATION | 34 |

ITEM 11: LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 36 |

ITEM 12: INTEREST OF MANAGEMENT AND OTHERS

| IN MATERIAL TRANSACTIONS | 37 |

ITEM 13: TRANSFER AGENTS AND REGISTRAR | 37 |

ITEM 14: MATERIAL CONTRACTS | 38 |

ITEM 15: INTERESTS OF EXPERTS | 38 |

| 15.2 | Interests of Experts | 38 |

ITEM 16: ADDITIONAL INFORMATION | 39 |

SCHEDULE “A” - AUDIT COMMITTEE TERMS OF REFERENCE

PRELIMINARY INFORMATION

Date of Information

All information in this annual information form ("AIF") is as at December 31, 2007, unless otherwise indicated.

Incorporation by Reference of Technical Reports

The following technical reports, or excerpts from technical reports (as applicable), are incorporated by reference into, and form part of, this AIF. These reports have been filed on, and may be accessed using, the System for Electronic Document Analysis and Retrieval ("SEDAR") on the internet at www.sedar.com.

| 1. | The technical report of SENET dated September 13, 2007 and entitled "Preliminary Assessment NI 43-101 Technical Report, Twangiza Gold Project, South Kivu Province, Democratic Republic of Congo" (the "Twangiza Technical Report"). |

| 2. | The technical report of SENET dated August 17, 2007 and entitled "Preliminary Assessment NI 43-101 Technical Report, Namoya Gold Project, Maniema Province, Democratic Republic of Congo" (the "Namoya Technical Report"). |

| 3. | The technical report of Michael B. Skead (who was Vice President, Exploration of the Company at the time the report was prepared) dated March 30, 2007 and entitled "Third NI 43-101 Technical Report, Lugushwa Project, South Kivu Province, Democratic Republic of the Congo" (the "Lugushwa Technical Report"). |

| 4. | Section 2 (entitled "Regional Geology") and section 3 (entitled "Kamituga") of the technical report of Steffen, Robertson and Kirsten (UK) Ltd. ("SRK") dated February 2005 and entitled "NI 43-101 Technical Report Resource Estimation and Exploration Potential at the Kamituga, Lugushwa and Namoya Concessions, Democratic Republic of Congo" (the "SRK Technical Report"). |

Forward-Looking Statements

This AIF and the documents incorporated by reference herein contain forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that Banro Corporation (the "Company" or "Banro") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, estimated project economics, mineral resource estimates, potential mineralization, potential mineral resources and the Company's exploration and development plans and objectives with respect to its projects) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; the possibility that actual circumstances will differ from the estimates and assumptions used in the preliminary assessments and mine plans in respect of the Company's Twangiza and Namoya

projects; failure to establish estimated mineral resources; fluctuations in gold prices and currency exchange rates; inflation; gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production); changes in equity markets; political developments in the Democratic Republic of the Congo; changes to regulations affecting the Company's activities; uncertainties relating to the availability and costs of financing needed in the future; the uncertainties involved in interpreting drilling results and other geological data; and the other risks discussed in item 3.2 ("Risk Factors") of this AIF.

Although Banro has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the "SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used in this AIF, such as "measured", "indicated", and "inferred" "resources", that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company's Form 40-F Registration Statement, File No. 001-32399, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

Currency

All dollar amounts in this AIF are expressed in United States dollars, except as otherwise indicated. References to "$" or "US$" are to United States dollars and references to "Cdn$" are to Canadian dollars. For United States dollars to Canadian dollars, based on the Bank of Canada nominal noon rate, the average exchange rate for 2007 and the exchange rate at December 31, 2007 were one United States dollar per $1.0748 and $0.9881 Canadian dollars, respectively. For reporting purposes, the Company prepares its financial statements in United States dollars and in conformity with accounting principles generally accepted in Canada.

ITEM 1: CORPORATE STRUCTURE

1.1 | Name, Address and Incorporation |

The head office and registered office of Banro is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3.

The Company was incorporated under the Canada Business Corporations Act (the "CBCA") on May 3, 1994 by articles of incorporation. Pursuant to articles of amendment effective May 7, 1996, the name of the Company was changed from Banro International Capital Inc. to Banro Resource Corporation and the authorized share capital of the Company was increased by creating an unlimited number of a new class of

shares designated as preference shares, issuable in series. The Company was continued under the Ontario Business Corporations Act by articles of continuance effective on October 24, 1996. By articles of amendment effective on January 16, 2001, the name of the Company was changed to Banro Corporation and the Company's outstanding common shares were consolidated on a three old for one new basis. The Company was continued under the CBCA by articles of continuance dated April 2, 2004. By articles of amendment dated December 17, 2004, the Company's outstanding common shares were subdivided by changing each one of such shares into two common shares.

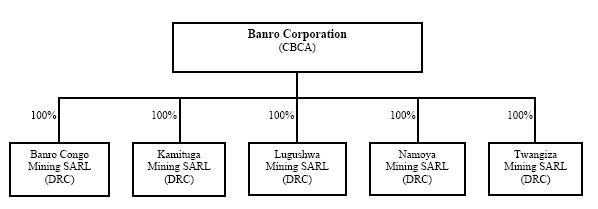

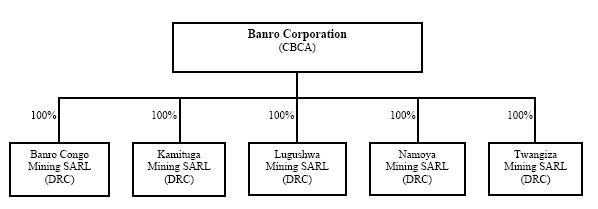

1.2 | Intercorporate Relationships |

The following chart illustrates the relationship between Banro and its material subsidiaries, together with the jurisdiction of incorporation of each such subsidiary and the percentage of voting securities beneficially owned, or controlled or directed, directly or indirectly, by Banro.

ITEM 2: GENERAL DEVELOPMENT OF THE BUSINESS

The Company is a Canadian-based gold exploration company focused on the exploration and development of four major, 100% owned gold projects (the "Projects") located along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of the eastern region of the Democratic Republic of the Congo (the "DRC"). These Projects are known as Twangiza, Namoya, Lugushwa and Kamituga.

In 1996, the Company acquired, by way of several transactions, 72% of the outstanding shares of the DRC company, Société Zaïroise Minière et Industrielle du Kivu S.A.R.L. ("SOMINKI"). The DRC government held the remaining 28% of SOMINKI's shares as a participating interest. SOMINKI, which held 100% of the Projects, was an operating, very well-established mining company in the DRC with a long production history. With the acquisition of control of SOMINKI, the Company also acquired SOMINKI's significant library of geological and exploration data that had accumulated since the early 1920s.

In early 1997, the DRC government ratified a new 25 year (subsequently extended to 30 years) mining convention (the "Mining Convention") among itself, SOMINKI and the Company. The Mining Convention provided for the transfer of all of the mineral assets and real property of SOMINKI to a newly created DRC company,

Société Aurifère du Kivu et du Maniema S.A.R.L. ("SAKIMA"), and that 93% of SAKIMA's shares were to be held by the Company, with the remaining 7% to be owned by the DRC government as a non-dilutive interest. The Mining Convention also provided for, among other things, confirmation of title in respect of all of the Projects.

Commencing in August 1997 and ending in April 1998, the Company carried out a phase I exploration program on the Twangiza Project which consisted of geological mapping, surveying, data verification, airborne geophysical surveying, diamond drilling and resource modeling.

In July 1998, the DRC government, without prior warning or consultation, issued Presidential decrees which effectively resulted in the expropriation of the Company's Projects.

In April 2002, the DRC government formally signed a settlement agreement (the "Settlement Agreement") with the Company. The agreement called for, among other things, the Company to hold a 100% interest in the Twangiza, Kamituga, Lugushwa and Namoya Projects under a revived Mining Convention. In accordance with the Settlement Agreement, the Company reorganized the Projects by transferring the Projects from SAKIMA to four newly-created, wholly-owned DRC subsidiaries of the Company (which are named Twangiza Mining SARL, Kamituga Mining SARL, Lugushwa Mining SARL and Namoya Mining SARL), each of which owns 100% of its respective Project (see item 1.2 of this AIF).

In late 2003, the Company re-opened its exploration office in the town of Bukavu in eastern DRC.

Recruitment of Management- During 2004, the Company recruited a management team with extensive African and gold industry experience. Included in the people who joined the Company during 2004 were Peter N. Cowley as Chief Executive Officer, President and a director, Simon F.W. Village as Chairman of the Board and a director, Michael B. Skead as Exploration Manager (later promoted to Vice President, Exploration) and John A. Clarke as a director. See item 8 ("Directors and Officers") of this AIF.

Resumption of Exploration - In November 2004, the Company commenced exploration activities at the Namoya Project and in January 2005 the Company commenced exploration activities at the Lugushwa Project. The Company commenced the second phase of exploration at the Twangiza Project in October 2005.

Stock Exchange Listings - On March 28, 2005, the Company's common shares began trading on the American Stock Exchange. On November 10, 2005, the Company's common shares began trading on the Toronto Stock Exchange (the "TSX") and ceased trading on the TSX Venture Exchange concurrent with the TSX listing. RBC Capital Markets acted as sponsor to Banro in its application for listing on the TSX.

Financings

In March 2004, the Company completed a Cdn$16,000,000 private placement financing. |

In July 2005, the Company completed an Cdn$18,375,000 private placement financing. This placement was made to an investment fund managed by Capital Research and Management Company and to institutional accounts managed by affiliates of Capital Group International, Inc.

In October 005, the Company completed a non-brokered Cdn$13,000,000 private placement financing. The subscribers in respect of this financing were an investment fund managed by Actis Capital LLP and an investment fund co-managed by Actis Capital LLP and Cordiant Capital Inc.

In May2006, the Company completed an equity financing for total gross proceeds of Cdn$56,012,800. The underwriters who conducted this financing were RBC Capital Markets as lead manager, Raymond James Ltd. and MGI Securities Inc.

Acquisition of Additional Properties

In March 2007, the Company announced that its wholly-owned DRC subsidiary, Banro Congo Mining SARL, had acquired 14 exploration permits covering 3,130 square kilometres of ground located between and contiguous to the Company's Twangiza, Kamituga and Lugushwa Projects. The applications for these permits were originally filed with the Mining Cadastral shortly after implementation of the DRC's new Mining Code in June 2003.

Preliminary Assessments

In July 2007, the Company announced the results of its preliminary assessments (i.e. "scoping studies") of its Namoya and Twangiza Projects. These studies were prepared with input from a number of independent consultants including SRK Consulting, Cardiff (mining and environmental), SGS Lakefield, Johannesburg (metallurgical testwork), Knight Piésold Ltd., Vancouver (power) and SENET, Johannesburg (processing and infrastructure). SENET also undertook the preliminary economic valuation and technical report compilation. See items 3.3.1 and 3.3.2 of this AIF for additional information with respect to these preliminary assessments.

Hiring of New C.E.O.

Michael J. Prinsloo was appointed Chief Executive Officer of the Company effective September 17, 2007. Mr. Prinsloo is to lead the Company's transition from gold explorer to developer, with specific responsibility for overseeing the planned feasibility studies on Banro's Twangiza and Namoya Projects and for taking these Projects through the construction stage and into production. Mr. Prinsloo has some 35 years of experience in the gold mining industry, including acting as Head of South African Operations of Gold Fields Limited from 2002 to 2006.

Mr. Prinsloo was also appointed President of the Company in March 2008 following the retirement of Peter N. Cowley as President.

ITEM 3: DESCRIPTION OF THE BUSINESS

The Company is a Canadian-based gold exploration company focused on the exploration and development of four major, 100% owned gold projects (the "Projects") located along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of the eastern region of the Democratic Republic of the Congo (the "DRC"). These Projects are known as Twangiza, Namoya, Lugushwa and Kamituga and consist of a total of 13 exploitation permits held by the following wholly-owned DRC subsidiaries of the Company:Twangiza Mining SARL, Namoya Mining SARL, Lugushwa Mining SARL and Kamituga Mining SARL. See items 3.3.1, 3.3.2, 3.3.3 and 3.3.4 of this AIF for additional information relating to the Company's said four Projects.

In March 2007, the Company announced that its wholly-owned DRC subsidiary, Banro Congo Mining SARL, had acquired 14 exploration permits covering 3,130 square kilometres of ground located between

and contiguous to the Company's Twangiza, Kamituga and Lugushwa Projects. The applications for these permits were originally filed with the Mining Cadastral shortly after implementation of the DRC's new Mining Code in June 2003. With the award of these exploration permits, Banro now controls 5,730 square kilometres of land within and adjacent to the Twangiza-Namoya gold belt.

Employees

The Company and its subsidiaries have a total of 208 full-time employees (as at December 31, 2007).

Social and Environmental Policies

(a) The Banro Foundation

Since launching its current exploration programs in late 2004, Banro has been working with local communities to promote development. In late 2005, the Company formalized this commitment to community development with the creation of the Banro Foundation. The Banro Foundation is a registered charity in the DRC with a mandate to support education, health and infrastructure improvements, principally in the local communities where Banro operates. The Company funds the Banro Foundation and has created a management structure that ensures local participation in decision-making. The Foundation focuses on needs that have been identified by local committees of community leaders and invests in improvements that will benefit communities as a whole. To the extent possible, the Foundation employs local labour in all initiatives.

In October 2007, the Banro Foundation opened new administrative offices at Twangiza, Lugushwa and Namoya, with the participation of the Governors of South Kivu and Maniema provinces and provincial ministers. A number of new community initiatives were launched as part of the inauguration ceremonies.

In February 2008, Banro announced that it has formed a partnership with CARE to promote sustainable development at the communities near its operations in South Kivu and Maniema provinces of the DRC. The Company believes that the partnership will significantly enhance and provide a comprehensive framework for the activities of the Banro Foundation. CARE's experience in a broad range of sectors will allow the Banro Foundation to address not only education, basic health and infrastructure needs, but such challenges as the empowerment of women, private sector development, high child mortality rates and HIV/AIDS, malaria and TB prevention and treatment. CARE will lead a needs assessment mission to the communities of Twangiza, Lugushwa and Namoya during the second quarter of 2008. In the Banro press release announcing the partnership, CARE was quoted as commenting that, "Banro is an appropriate partner for CARE as it has demonstrated a serious commitment to community development through the activities of its Foundation and its success in creating capacity-building jobs and opportunities for local Congolese." CARE proposes using the United Nations' Millennium Development Goals to focus Banro's community development efforts, with the goal of creating long term sustainable economic and social benefits for the communities near Banro's operations.

Additional information with respect to the Banro Foundation can be found on the Company's web site at www.banro.com.

(b) Job Creation

Banro is committed to the creation of jobs and economic opportunities for local Congolese. In a short period of time, Banro has gone from having no presence in the eastern DRC to being one of the largest private employers in the region. As it has grown, the Company has deliberately created opportunities for

many local Congolese. Additional information with respect to job creation can be found on the Company's web site at www.banro.com.

(c) Environmental Protection and Workplace Safety

As set out in the Business Conduct Policy adopted by the Company (a copy of this policy can be obtained from SEDAR at www.sedar.com), the Company believes that effectiveness in environmental standards, along with occupational health and safety, is an essential part of achieving success in the mineral exploration business. The Business Conduct Policy states that Banro will therefore work at continuous improvement in these areas and will be guided by the following principles: (a) creating a safe work environment; (b) minimizing the environmental impacts of its activities; (c) building cooperative working relationships with local communities and governments in the Company's areas of operations; (d) reviewing and monitoring environmental and safety performance; and (e) prompt and effective response to any environmental and safety concerns.

Banro adheres to the E3 Environmental Excellence in Exploration guidelines, which were developed by the Prospectors and Developers Association of Canada.

Banro's management has also taken steps to ensure that all employees and suppliers respect and adhere to the laws of the DRC with respect to the protection of threatened and endangered species.

The exploration and development of gold properties are speculative activities that involve a high degree of financial risk. The risk factors which should be taken into account in assessing the Company's activities and an investment in its securities include, but are not necessarily limited to, those set out below. Any one or more of these risks could have a material adverse effect on the value of any investment in the Company and the business, financial position or operating results of the Company and should be taken into account in assessing the Company's activities.

The following summary, which is not exhaustive, represents some of the major risk factors that affect Banro.

Risks of Operating in the DRC |

Banro's Projects are located in the east of the DRC. The assets and operations of the Company are therefore subject to various political, economic and other uncertainties, including, among other things, the risks of war and civil unrest, expropriation, nationalization, renegotiation or nullification of existing licenses, permits, approvals and contracts, taxation policies, foreign exchange and repatriation restrictions, changing political conditions, international monetary fluctuations, currency controls and foreign governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. Changes, if any, in mining or investment policies or shifts in political attitude in the DRC may adversely affect Banro's operations or profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights, could result in loss, reduction or expropriation of entitlements. In addition, in the event of a dispute arising from operations in the DRC, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in Canada. The Company also may be hindered or

prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. It is not possible for the Company to accurately predict such developments or changes in laws or policy or to what extent any such developments or changes may have a material adverse effect on the Company's operations.

The DRC is a developing nation emerging from a period of civil war and conflict. Physical and institutional infrastructure throughout the DRC is in a debilitated condition. The DRC is in transition from a largely state controlled economy to one based on free market principles, and from a non-democratic political system with a centralized ethnic power base, to one based on more democratic principles (presidential and parliamentary elections were successfully held in 2006). There can be no assurance that these changes will be effected or that the achievement of these objectives will not have material adverse consequences for Banro and its operations. The DRC continues to experience instability in parts of the country due to certain militia and criminal elements. While the government and United Nations forces are working to support the extension of central government authority throughout the country, there can be no assurance that such efforts will be successful.

HIV/AIDS, malaria and other diseases represent a serious threat to maintaining a skilled workforce in the mining industry in the DRC. HIV/AIDS is a major healthcare challenge faced by the Company's operations in the country. There can be no assurance that the Company will not lose members of its workforce or workforce manhours or incur increased medical costs, which may have a material adverse effect on the Company's operations.

The DRC has historically experienced relatively high rates of inflation.

Exploration and Mining Risks

All of the Company's properties are in the exploration stage only and none of the properties contain a known body of commercial ore. The exploration for and development of mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit, once discovered, will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Banro not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Banro towards the search for and evaluation of mineral deposits will result in discoveries that are commercially viable. In addition, assuming discovery of a commercial ore-body, depending on the type of mining operation involved, several years can elapse from the initial phase of drilling until commercial operations are commenced.

Mining operations generally involve a high degree of risk. Such operations are subject to all the hazards and risks normally encountered in the exploration for, and development and production of gold and other precious or base metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Milling operations are subject to hazards

such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability.

Finance Requirements

The Company will require significant financing in order to carry out plans to develop its Projects. The Company has no revenues and is wholly reliant upon external financing to fund such plans. There can be no assurance that such financing will be available to the Company or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of equity or convertible debt securities of the Company, the interests of the Company's shareholders in the net assets of the Company may be diluted. Any failure of the Company to obtain required financing on acceptable terms could have a material adverse effect on the Company's financial condition, results of operations and liquidity and require the Company to cancel or postpone planned capital investments.

Infrastructure for the Projects

The Company's Projects are located in remote areas of the DRC, which lack basic infrastructure, including sources of power, water, housing, food and transport. In order to develop any of its Projects Banro will need to establish the facilities and material necessary to support operations in the remote locations in which they are situated. The remoteness of each Project will affect the potential viability of mining operations, as Banro will also need to establish substantially greater sources of power, water, physical plant and transport infrastructure than are currently present in the area. The lack of availability of such sources may adversely affect mining feasibility and will, in any event, require Banro to arrange significant financing, locate adequate supplies and obtain necessary approvals from national, provincial and regional governments, none of which can be assured.

Gold Prices

The future price of gold will significantly affect the development of Banro's Projects. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond Banro's control. Such factors include, but are not limited to, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold has fluctuated widely in recent years, and future serious price declines could cause continued development of and commercial production from Banro's mineral interests to be impracticable. Depending on the price of gold, projected cash flow from planned mining operations may not be sufficient and Banro could be forced to discontinue development and may be forced to sell its Projects. Future production from Banro's Projects is dependent on gold prices that are adequate to make these Projects economic.

No History of Mining Operations or Profitability

Banro does not have a history of mining operations, and there is no assurance that it will produce revenue, operate profitably or provide a return on investment in the future. Banro has only incurred operating losses, and the development of its Projects is at an early stage. It is therefore not possible to evaluate future prospects based on past performance. There can be no certainty that Banro will achieve or sustain profitability or achieve or sustain positive cash flow from its operating activities.

Uncertainty in the Estimation of Mineral Resources

There is a degree of uncertainty to the calculation of mineral resources. Until mineral resources are actually mined and processed, the quantity and grade of mineral resources must be considered as estimates only. In addition, the quantity and grade of mineral resources may vary depending on, among other things, metal prices. Any material change in quantity or grade of mineral resources may affect the economic viability of the deposit. In addition, there can be no assurance that gold recoveries or other metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Uncertainty Relating to Inferred Mineral Resources

There is a risk that the inferred mineral resources cannot be converted into mineral reserves as the ability to assess geological continuity is not sufficient to demonstrate economic viability. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration.

Dependence on Limited Properties

The Twangiza, Lugushwa, Namoya and Kamituga Projects account for all of the Company's mineral resources. Any adverse development affecting the progress of any of these Projects may have a material adverse effect on the Company's financial performance and results of operations.

Market Perception

Market perception of junior gold exploration companies such as the Company may shift such that these companies are viewed less favourably. This factor could impact the value of investors' holdings and the ability of the Company to raise further funds, which could have a material adverse effect on the Company's business, financial condition and prospects.

Uninsured Risks

Banro may become subject to liability for accidents, pollution and other hazards against which it may elect not to insure because of premium costs or for other reasons, or in amounts which exceed policy limits. Losses from these events may cause Banro to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Environmental Risks and Hazards

All phases of Banro's operations are subject to environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect Banro's operations. Environmental hazards may exist on the properties on which Banro holds interests which are unknown to Banro at present and which have been caused by previous owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required.

Government Regulation

Banro's mineral exploration and planned development activities are subject to various laws governing prospecting, mining, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although Banro's exploration and development activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail development.

Many of Banro's mineral rights and interests are subject to government approvals, licenses and permits. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of the applicable governments or governmental officials. No assurance can be given that Banro will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are required and not obtained, Banro may be curtailed or prohibited from continuing or proceeding with planned exploration or development of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on Banro and cause increases in exploration expenses, capital expenditures or require abandonment or delays in development of mineral interests.

Share Price Risk

The market price of a publicly traded stock, particularly a junior resource issuer like the Company, is affected by many variables not directly related to the success of the company, including the market for all junior resource sector shares, the breadth of the public market for the stock, and the attractiveness of alternative investments. The affect of these and other factors on the market price of common shares on the exchanges on which the Company trades suggests that the Company’s shares will be volatile.

Future Sales of Common Shares by Existing Shareholders

Sales of a large number of the Company's common shares in the public markets, or the potential for such sales, could decrease the trading price of such shares and could impair Banro's ability to raise capital through future sales of common shares. Banro has previously completed private placements at prices per share which are lower than the current market price of its common shares. Accordingly, a significant number of the Company's shareholders have an investment profit in the common shares that they may seek to liquidate.

Currency Risk

The Company uses the United States dollar as its functional currency. Fluctuations in the value of the United States dollar relative to the Canadian dollar could have a material impact on the Company’s

consolidated financial statements by creating gains or losses. No currency hedge policies are in place or are presently contemplated.

Dependence on Management and Key Personnel

The success of the Company depends on the good faith, experience and judgment of the Company's management and advisors in supervising and providing for the effective management of the business and the operations of the Company. The Company is dependent on a relatively small number of key personnel, the loss of any one of whom could have an adverse effect on the Company. The Company currently does not have key person insurance on these individuals. The Company may need to recruit additional qualified personnel to supplement existing management and there is no assurance that the Company will be able to attract such personnel.

Competition

The natural resource industry is intensely competitive in all of its phases, and the Company competes with many companies possessing greater financial resources and technical facilities than itself.

Conflict of Interest

A number of directors of the Company also serve as directors and/or officers of other companies involved in the exploration and development of natural resource properties. As a result, conflicts may arise between the obligations of these individuals to the Company and to such other companies.

The Company holds, through four wholly-owned DRC subsidiaries, a 100% interest in four gold Projects, which are known as Twangiza, Namoya, Lugushwa, and Kamituga. These Projects are comprised of a total of 13 exploitation permits and are found along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of eastern DRC. These Projects, totalling 2,600 square kilometres, cover all the major, historical producing areas of the gold belt, where approximately 2.4 million ounces of gold were reportedly produced in the past from alluvial and hard rock sources.

Qualified Persons

The "qualified person" (as such term is defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators) who oversees the Company's exploration programs is Daniel K. Bansah. Mr. Bansah, who is Vice President, Exploration of Banro, has reviewed and approved the technical information in this AIF. See item 15.1 of this AIF for the names of the "qualified persons" (as such term is defined in NI 43-101) for the purposes of the various technical reports referred to in the following items 3.3.1 to 3.3.4 of this AIF.

The following is a reproduction of the summary from the Twangiza Technical Report, a copy of which can be obtained from SEDAR at www.sedar.com. Refer to the Twangiza Technical Report for detailed disclosure regarding the Twangiza Project. The Twangiza Technical Report is incorporated into this AIF by reference. Note that, following the filing of the Twangiza Technical Report in September 2007, the Company announced, in a press release dated January 15, 2008, updated mineral resource estimates for the Twangiza Project. Accordingly, the mineral resource estimates for the Twangiza Project set out in Twangiza Technical Report and included in the following reproduction of the summary from such report

have been superseded. See the disclosure below under the heading "Updated Mineral Resource Estimates for Twangiza (January 2008)" which sets out the current mineral estimates for the Twangiza Project.

Reproduction of Summary from Twangiza Technical Report

"The 1,164 square kilometre Twangiza Property is located in the South Kivu Province of the Democratic Republic of the Congo (DRC), 35 kilometres west of the Burundi border and 45 kilometres to the south southwest of Bukavu (Figures 1 and 2). The Twangiza Property consists of six exploitation permits, which are wholly-owned by Banro Corporation (Banro) indirectly through a Congolese subsidiary, Twangiza Mining sarl (Figures 3 and 4).

The Twangiza deposit is located at the hinge of the Twangiza anticline, which is underlain by mudstone, siltstones and greywackes that have been intruded along bedding planes by porphyry sills. Auriferous sulphides (pyrite and arsenopyrite) occur as dissemination and vein gangue in both the sediments and the feldspar porphyry sills. Sulphide content is greatest at the axial plane of the fold as brittle deformation is greatest due to extension forces from the folding.

This technical report summarizes the results of geological modelling and resource estimation of the Twaniza Main and the recently discovered Twangiza North deposits, the evaluation of the Mwana River “Valley Fill” and the recently completed preliminary economic assessment of the Twangiza Property.

The resource estimates come at the end of the third phase of resource drilling and sampling of the Twangiza Main and Twangiza North deposits which was completed in May 2007, and the Mwana River “Valley Fill” sampling completed in December 2006. Appendix I is the evaluation report of the Mwana River "Valley Fill".

One hundred recent diamond drill holes totalling 23,873.12 metres, nineteen diamond holes (9,122 metres) drilled in 1997/98 and previously developed and verified adit and trench data were used in the remodelling exercise. As part of the Company's QA/QC procedures, internationally recognised standards, duplicates and blanks were inserted into the sample batches. A total of 2,033 relative density measurements were taken from the recent drill core to convert volumes into tonnages. The amount of sampling data, geological mapping and assaying results are therefore considered to have been adequately checked for it to be employed in the estimation of the current mineral resources.

The methodology employed in estimating the mineral resources utilised a 3-dimensional wireframe model of the mineralization interpreted within a 0.3 - 1.0 g/t Au sample cutoff, defined first in plan using the adit and trench data at 20 metre intervals, and then with drill hole data on cross sections at 40 - 160 meter intervals. The increased geological knowledge is a major constraining factor on the Twangiza resource. The geological aspects considered were lithological and the structural relationship to the antiformal axis and some faulting on the east limb as well as the Twangiza North mineralisation. For the Twangiza Main deposit, the ore body model was constrained within the wireframe with primary block dimensions of 20 meters in the strike and cross structure directions, and 10 meters in the vertical direction. For the Twangiza North deposit, only grade envelopes were used in the modelling process, a function which is reflected in the classification of resources. The orebody model was constrained within the grade wireframe with primary

block dimensions of 10 meters in the strike and cross structure directions, and 5 meters in the vertical direction.

Semi-variograms were constructed using two-metre sample composite of the gold values that locate within the mineralized domain. Some structure was apparent in the along strike and down-dip directions of the Twangiza Main data allowing for ordinary kriging interpolation algorithm to be employed. For Twangiza North, inverse distance squared weighting was used to interpolate grades into the model, a feature which is reflected in the classification of the resource.

Ore classification was carried out using solid wireframes to flag blocks as Measured, Indicated and Inferred Resources. For the Twangiza Main deposit, the improved geological knowledge coupled with the increased data density, the continuity of the mineralization and the increase reliability of the database, have allowed resources to be classified with higher confidence.

Steffen, Robertson and Kirtsen (UK) Ltd. (SRK), who undertook the initial data compilation in 1998 and followed it up with a valuation of the project between 1999 and 2003, have reviewed the field work and the modelling and estimation procedures in respect of the Twangiza Property and concur with the approach used by Banro.

The tables below summarize the current Mineral Resource Estimates for Twangiza using a 1.0 g/t Au cut-off (with an effective date of June 6, 2007).

Mineral Resource Category | Tonnes | Grade (g/t Au) | Contained Gold (Ounces) |

Measured | 14,510,000 | 2.82 | 1,313,400 |

Indicated | 31,460,000 | 1.81 | 1,832,800 |

Measured & Indicated | 45,970,000 | 2.13 | 3,146,200 |

Inferred | 47,474,000 | 2.02 | 3,088,100 |

Material Type | Measured & Indicated | Inferred |

| Tonnes | Grade

(g/t Au) | Contained Gold (Ounces) | Tonnes | Grade

(g/t Au) | Contained Gold (Ounces) |

Oxide | 13,080,000 | 2.72 | 1,143,900 | 5,121,000 | 3.37 | 555,100 |

Transition | 11,356,000 | 2.32 | 846,100 | 3,845,000 | 3.05 | 377,100 |

Fresh | 21,534,000 | 1.67 | 1,156,200 | 38,508,000 | 1.74 | 2,155,900 |

Total | 45,970,000 | 2.13 | 3,146,200 | 47,474,000 | 2.02 | 3,088,100 |

Tonnage rounded to the nearest '000 and ounces rounded to the nearest '00.

The Inferred Mineral Resource is inclusive of the "Valley Fill" material of 0.132 million ounces of gold (0.985 million tonnes grading 4.16 g/t Au).

The current estimates for the Measured and Indicated Mineral Resources of Twangiza compare to the previous estimates (January 2007) as follows:

June 2007 Estimates: 45.97 Mt at a mean grade of 2.13 g/t containing 3,146,200 ounces of gold.

January 2007 Estimates: 39.23 Mt at a mean grade of 2.39 g/t containing 3,008,000 ounces of gold.

The increase in the metal content of the high confidence resources in the current estimates relative to the January 2007 estimates is a function of the increased data density and improved geological knowledge as a result of the additional drilling.

The current resource estimates are encouraging in terms of the increases in the Mineral Resources, and give a clear scope and direction to the project.

A preliminary assessment of the Twangiza Project was completed in July 2007 and the results are summarized in this report. Pit optimizations and Mining studies were undertaken on the Measured, Indicated and Inferred Mineral Resources from which mining schedules were estimated. Results from metallurgical testwork of the various ore types at Twangiza were used to determine metallurgical recoveries and determine the gravity/Carbon-in-Leach (CIL) processing flow sheet. Infrastructural and site services were estimated for the Project together with hydroelectric and diesel power alternatives.

An economic model and financial analysis was undertaken based on the following assumptions:

Parameter | Units | Hydroelectric Assumption | Diesel Assumption |

Gold Price | US$/oz | 600 | 600 |

Discount Rate | % | 5% | 5% |

Life of Mine after pre-production | Years | 13 | 11 |

Oxides LoM Tonnage | t | 20,251,636 | 19,361,597 |

Oxides LoM Grade | g/t Au | 2.49 | 2.49 |

Oxides Recovery | % | 91.0% | 91.0% |

Transition-FP LoM Tonnage | t | 6,389,376 | 5,644,887 |

Transition- FP LoM Grade | g/t Au | 2.58 | 2.54 |

Transition- FP LoM Recovery | % | 84% | 84% |

Transition-CMS LoM Tonnage | t | 5,164,548 | 4,886,450 |

Transition- CMS LoM Grade | g/t Au | 2.91 | 2.89 |

Transition- CMS LoM Recovery | % | 38% | 38% |

Fresh- FP LoM Tonnage | t | 14,016,303 | 10,511,452 |

Fresh -FP LoM Grade | g/t Au | 1.53 | 1.53 |

Fresh-FP LoM Recovery | % | 90% | 90% |

Fresh- CMS LoM Tonnage | t | 17,339,827 | 11,461,992 |

Fresh -CMS LoM Grade | g/t Au | 1.83 | 1.85 |

Fresh-CMS LoM Recovery | % | 54% | 54% |

Stockpile Tonnage | t | 1,837,025 | 3,013,077 |

| Parameter | Units | Hydroelectric Assumption | Diesel Assumption |

Stockpile Grade | g/t Au | 2.59 | 2.33 |

Stockpile Recovery | % | 72% | 70% |

Royalty | % | n/a | n/a |

Tax Rate | % | 5 % on imports | 5 % on imports |

Initial Capital Costs | US$ 000 | 347,469 | 299,193 |

Sustaining Capital | US$ 000 | 32,823 | 27,703 |

Fixed Equipment Capital resale | % | 10% | 10% |

Hydro Equipment Capital resale | % | 30% | n/a |

The results of the financial analysis for the Twangiza hydroelectric and diesel options are summarized below:

Summary of Financial Analysis | | | |

| | Hydroelectric | Diesel |

Gold Annual Production - First 7 years | oz | 317,502 | 312,526 |

Gold Annual Production - LoM | oz | 260,336 | 268,899 |

Cash Operating Costs - First 7 years | US$/oz | 215 | 293 |

Cash Operating Costs - LoM | US$/oz | 257 | 331 |

Post Tax NPV at discount rate of 5% | US$ million | 511 | 312 |

IRR | % | 33.4% | 29.1% |

Payback time | years | 2.6 | 2.7 |

Project net cash flow after tax and capex | US$ million | 791 | 480 |

The results of the preliminary assessment of the Twangiza Project are encouraging and warrant the progression of the Twangiza Project to the pre-feasibility study stage.

It is recommended that the exploration programme at Twangiza for the rest of 2007 should focus on the following:

| • | Continue with regional exploration to define known mineralization as well as identify new targets. |

| • | Diamond drilling to test soil geochemical anomalies in order to generate additional Indicated and Inferred Mineral Resources. |

| • | Infill diamond drilling to obtain sufficient information for moving the Inferred Resources to the Indicated category and Indicated Resources to the Measured category. |

| • | Refine the geological model and update the resource model, and subsequently convert the mineral resources to mineral reserves on completion of optimized pit designs. |

| • | Completion of a pre-feasibility study to provide increased confidence on the economic viability of the Twangiza Project. For completion of the pre-feasibility study, the following will need to be undertaken in addition to the infill drilling: |

| • | Geotechnical drilling to better assess pit slope stabilities for the proposed open pits. |

| • | Additional metallurgical testwork to further define the chemical and physical characteristics of the various ore material types in order to optimise plant recoveries and further define the processing plant flowsheet. |

| • | Select preferred tailings site location and undertake initial geotechnical assessment. |

| • | Select preferred plant and other plant infrastructure sites (i.e. access roads, haul roads, waste dumps, and accommodation village). |

| • | Undertake a pre-feasibility study on the hydroelectric potential for the Twangiza Project. |

| • | Further define access and transportation routes. |

| • | Complete a pre-feasibility Environmental and Social Impact Assessment for the Twangiza Project. |

| • | Further define capital and operating costs and reduce contingency costs. |

The budget for the Twangiza Project for 2007 is US$13,226,673 (Table 125). A total of US$5,709,600 has been assigned to drilling which accounts for approximately 43% of the total budget. The actual expenditures incurred at Twangiza during 2007 will be dependent on the exploration results achieved during 2007."

Cautionary Statements

The preliminary assessment of Twangiza is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the preliminary assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

See also the disclosure under the heading "Forward-Looking Statements" on page 1 of this AIF.

Updated Mineral Resource Estimates for Twangiza (January 2008)

In a press release dated January 15, 2008, the Company announced updated mineral resource estimates for the Twangiza Project. The said press release, a copy of which can be obtained from SEDAR at www.sedar.com, is incorporated into this AIF by reference. An additional 65 core holes totalling 13,751.24 metres were included in this resource update since the previous resource update in June 2007. Table I below summarizes the current mineral resource estimates for the Twangiza Project. These estimates relate to the Twangiza Main and Twangiza North deposits and have an effective date of December 12, 2007.

Table I below summarizes the current mineral resource estimates for the Twangiza Project. These estimates relate to the Twangiza Main and Twangiza North deposits and have an effective date of December 12, 2007.

Table I

Mineral Resource Category | Tonnes | Grade | Ounces |

| | (g/t Au) | |

Measured | 14,510,000 | 2.82 | 1,315,000 |

Indicated | 39,119,000 | 2.03 | 2,558,000 |

Measured & Indicated | 53,629,000 | 2.25 | 3,872,000 |

| | | |

Inferred | 46,188,000 | 1.82 | 2,705,000 |

(using a 1.0 g/t Au cut-off and with tonnes and ounces rounded to nearest ‘000).

Table II below summarizes the estimated mineral resources for the Twangiza project in terms of oxide, transitional and fresh rock (sulphide) categories.

Table II

Material Type | Measured & Indicated | Inferred |

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces |

| | (g/t Au) | | | (g/t Au) | |

Oxide | 16,925,000 | 2.82 | 1,535,600 | 3,002,000 | 2.84 | 274,000 |

Transition | 14,310,000 | 2.40 | 1,104,000 | 2,491,000 | 1.94 | 155,000 |

Fresh (sulphide) | 22,394,000 | 1.71 | 1,233,100 | 40,695,000 | 1.74 | 2,276,000 |

Total | 53,629,000 | 2.25 | 3,872,000 | 46,188,000 | 1.82 | 2,705,000 |

(using a 1.0 g/t Au cut-off and with tonnes and ounces rounded to nearest ‘000).

Table III below summarizes the current mineral resource estimates for the newly discovered Twangiza North deposit alone.

Table III

Mineral Resource Category | Tonnes | Grade | Ounces |

| | (g/t Au) | |

Indicated | 7,332,000 | 2.97 | 700,000 |

| | | |

Inferred | 6,349,000 | 2.40 | 490,000 |

(using a 1.0 g/t Au cut-off and with tonnes and ounces rounded to nearest ‘000).

Additional Information

In 2007, 120 core holes totalling 26,411.10 metres were drilled on the Twangiza Project using four core rigs. Drilling was focused on the Twangiza Main and Twangiza North deposits. As well, as part of the regional programme, LIDAR, airborne magnetic and radiometric surveys were completed over the entire Twangiza property during 2007, and a target generation exercise for ground follow-up was initiated. The LIDAR survey was carried out for the Company by independent contractor, Southern Mapping Company, and the airborne magnetic and radiometric surveys were carried out for the Company by independent contractor, New Resolution Geophysics.

The Company has established a new camp at the major artisanal site at Mufwa, which is situated 14 kilometres northwest of the Twangiza Main deposit. Additional rigs are being mobilized to Twangiza so this new prospect can be drilled during the coming months after groundwork has been completed.

Exploration and Development Plans

The Company's objectives at Twangiza for 2008 include completing a pre-feasibility study by the end of June 2008 and completing a full feasibility study by the end of the year. To achieve these targets, a total of 39,960 metres of core drilling is proposed at the Twangiza North and Twangiza Main deposits during 2008, focusing on upgrading the existing mineral resources to higher confidence resources and extensions to these deposits, as well as drilling newly defined targets from the ongoing field exploration. Additional drilling, including geotechnical holes to optimize pit slopes and hydro-geological holes to monitor ground water flow and quality, is expected to be undertaken as part of the ongoing pre-feasibility and full feasibility studies.

An increased amount of metallurgical testwork is also planned to be undertaken to further optimise the recoveries of the oxide, transitional and sulphide ore types.

As well, the Company plans to continue the exploration, including drilling, on the Mufwa prospect and intensify ground follow-up on regional targets generated from the LIDAR, airborne magnetic and radiometric surveys.

The budget allocated to the Twangiza Project for 2008 is approximately $16.57 million. The actual expenditures incurred in relation to Twangiza during 2008 will be dependent in part on the exploration results achieved during 2008.

The following is a reproduction of the summary from the Namoya Technical Report, a copy of which can be obtained from SEDAR at www.sedar.com. Refer to the Namoya Technical Report for detailed disclosure regarding the Namoya Project. The Namoya Technical Report is incorporated into this AIF by reference.

Reproduction of Summary from Namoya Technical Report

"The Namoya Project consists of one exploitation permit covering an area of 174 square kilometres and is located approximately 225 kilometres southwest of the town of Bukavu in Maniema Province in the east of the Democratic Republic of the Congo (the "DRC") (Figures 1 to 3). Namoya Mining SARL, which is wholly owned by Banro Corporation ("Banro"), has a 100% interest in the said permit. The Namoya property comprises four separate deposits: Mwendamboko and Muviringu to the northwest, Kakula in the centre and Namoya Summit to the southeast (Figure 4).

The main host rock for the gold mineralization is a fine grained sericite schist with associated albite, quartz, chlorite and calcite. Quartz veins and quartz ‘stockworks’ cross-cut the majority of the host sediments which have also been intruded by quartz-feldspar porphyry. The quartz systems and its associated sediments host the primary gold mineralization.

This technical report summarizes the results of the most recent mineral resource update of the Namoya mineralization, as well as the recently completed preliminary economic assessment of the Namoya Project. This report is intended to comply with the requirements of National Instrument 43-101 ("NI 43-101"), including Form 43-101F1.

The most recent mineral resource estimates for Namoya were completed in June 2007 following the completion of an additional 7,411.53 metres (36 drill holes) of drilling since the previous Namoya mineral resource determination in September 2006. These new mineral resource estimates have been incorporated into a preliminary assessment of the Namoya Project. As part of Banro's QA/QC procedures, internationally recognised standards, duplicates and blanks were inserted into the sample batches. A total of 1,861 relative density measurements were taken from drill core at the deposits to convert volumes into tonnages. The mineral resources were estimated from the current and previous core drilling programs as well as previous verified adit information.

The methodology employed in estimating the mineral resources utilised a 3-dimensional wireframe model of the mineralization interpreted with 0.5 - 1.0 g/t Au sample cut-off, defined first in plan and on cross sections at 20-40 meters interval. The ore body models were constrained within the wireframe with primary block dimensions of 10 meters in the strike and cross structure directions, and 5 meters in the vertical direction.

Semi-variorums were constructed for each deposit using one metre sample composite of the gold values. Some structure was apparent in the along strike and down-dip directions, and a Krige interpolation algorithm was adopted for the estimates given in the Table below. The Inferred Mineral Resources generated for Muviringu employed the inverse distance weighting interpolation algorithm.

The recent topographic survey and in particular the updated pit survey at Mwendamboko have been used to deplete the models.

Ore classification was carried out using solid wireframes to flag blocks as indicated and inferred. The improved geological knowledge coupled with the increased data density, the continuity of the mineralization and the increase reliability of the database, have allowed mineral resources to be classified with higher confidence.

SRK Consulting (UK) Limited ("SRK"), who undertook the initial data compilation in 1998 and followed it up with a valuation between 1999 and 2003, have reviewed the estimation method in respect of the Namoya Project and concur with the approach used by Banro.

The table below summarizes the current mineral resource estimates for Namoya using a 1.0 g/t Au block cut-off.

DEPOSIT | CLASS | MTonnes | GRADE (Au g/t) | METAL (MGrams Au) | CONTAINED GOLD (Ounces) |

Mwendamboko | Indicated | 4.095 | 4.05 | 16.573 | 532,800 |

Mwendamboko | Inferred | 2.237 | 2.68 | 5.986 | 192,500 |

Kakula | Indicated | 2.894 | 2.60 | 7.516 | 241,700 |

Kakula | Inferred | 0.809 | 2.69 | 2.173 | 69,800 |

Namoya Summit | Indicated | 1.936 | 2.64 | 5.111 | 164,300 |

Namoya Summit | Inferred | 1.372 | 3.06 | 4.204 | 135,200 |

Muviringu | Inferred | 2.656 | 2.62 | 6.968 | 224,000 |

Total | Indicated | 8.925 | 3.27 | 29.200 | 938,800 |

| Inferred | 7.074 | 2.73 | 19.331 | 621,500 |

Tonnage rounded to the nearest '000 and ounces rounded to the nearest '00. | |

The estimates for the Indicated Mineral Resources at Namoya compare to the previous (September 2006) estimates as follows:

Current Estimates: 8.925 Mt at a mean grade of 3.27 g/t containing 29,200 kg gold.

Previous Estimates: 7.386 Mt at a mean grade of 2.91 g/t containing 21,489kg gold.

The increase in the metal content of the Indicated Resource in the current estimates relative to the previous estimates is a function of the increased data density and improved geological knowledge as a result of the additional drilling.

The current mineral resource estimates are encouraging in terms of the increase in the Indicated Resources, and gives a clear scope and direction to the Project.

A preliminary assessment of the Namoya Project was completed in July 2007 and the results are summarized in this report. Pit optimizations and underground mining studies were undertaken on the Indicated and Inferred Mineral Resources from which mining schedules were estimated. Results from metallurgical testwork of the various ore types at Namoya were used to determine metallurgical recoveries and determine the gravity/Carbon-in-Leach (CIL) processing flow sheet. Infrastructural and site services were estimated for the Project together with hydroelectric and diesel power alternatives.

An economic model and financial analysis was undertaken based on the following assumptions:

Parameter | Units | Hydroelectric Assumption | Diesel Assumption |

Gold Price | US$/oz | 600 | 600 |

Discount Rate | % | 5% | 5% |

Life of Mine after pre-production | Years | 8 | 7 |

Oxides LoM Tonnage | t | 7,653,363 | 6,467,642 |

Oxides LoM Grade | g/t Au | 2.85 | 3.17 |

Oxides Recovery | % | 93.6% | 93.6% |

Transition LoM Tonnage | t | 2,853,871 | 2160665.00 |

Transition LoM Grade | g/t Au | 3.08 | 3.62 |

Transition LoM Recovery | % | 93.0% | 93.0% |

Fresh Rock LoM Tonnage | t | 3,501,546 | 3,350,940 |

Fresh Rock LoM Grade | g/t Au | 3.51 | 3.41 |

Fresh Rock LoM Recovery | % | 92.6% | 92.60% |

Stockpile Tonnage | t | 1,495,429 | 1,421,541 |

Stockpile Grade | g/t Au | 0.76 | 0.76 |

Stockpile Recovery | % | 93.0% | 93.0% |

Royalty | % | n/a | n/a |

Tax Rate | % | 5 % on imports | 5 % on imports |

Initial Capital Costs | US$ 000 | 186,545 | 161,996 |

Sustaining Capital | US$ 000 | 27,478 | 25,974 |

Parameter | Units | Hydroelectric Assumption | Diesel Assumption |

Fixed Equipment Capital resale | % | 20% | 20% |

Hydro Equipment Capital resale | % | 60% | n/a |

Mobile Equipment Capital resale | % | 20% | 20% |

The results of the financial analysis for the Namoya hydroelectric and diesel options are summarized below:

Summary of Financial Analysis | | | |

| Units | Hydroelectric | Diesel |

Gold Annual Production- First 5 years | oz | 193,949 | 198,139 |

Gold Annual Production- LoM | oz | 164,988 | 174,632 |

Cash Operating Costs - First 5 years | US$/oz | 217.11 | 265.37 |

Cash Operating Costs - LoM | US$/oz | 238.24 | 285.84 |

Post Tax NPV at discount rate of 5% | US$ million | 204 | 145 |

IRR | % | 37.3% | 41.0% |

Payback time | years | 2.3 | 1.6 |

Project net cash flow after tax and capex | US$ million | 290 | 197 |

The results of the preliminary assessment of the Namoya Project is encouraging and warrants the progression of the Namoya Project to the pre-feasibility study stage.

It is recommended that the exploration programme at Namoya for the rest of 2007 should focus on the following:

| • | Continue with regional exploration to define known mineralization as well as identify new targets. |

| • | Diamond drilling to test soil geochemical anomalies in order to generate additional Indicated and Inferred Mineral Resources. |

| • | Infill diamond drilling to obtain sufficient information for moving the Inferred Resources to the Indicated category and Indicated Resources to the Measured category. |

| • | Refine the geological model and update the resource model, and subsequently convert the mineral resources to mineral reserves on completion of optimised pit designs. |

| • | Completion of a pre-feasibility study to provide increased confidence on the economic viability of the Namoya Project. For completion of the pre-feasibility study, the following will need to be undertaken in addition to the infill drilling: |

| • | Geotechnical drilling to better assess pit slope stabilities for the proposed open pits. |

| • | Additional metallurgical testwork to further define the chemical and physical characteristics of the various ore material types in order to optimise plant recoveries and further define the processing plant flowsheet. |

| • | Select preferred tailings site location and undertake initial geotechnical assessment. |

| • | Select preferred plant and other plant infrastructure sites (ie. access roads, haul roads, waste dumps, accommodation village). |

| • | Undertake a pre-feasibility study on the hydroelectric potential for the Namoya Project. |

| • | Further define access and transportation routes. |

| • | Complete a pre-feasibility Environmental and Social Impact Assessment for the Namoya Project. |

| • | Further define capital and operating costs and reduce contingency costs. |

The budget for the Namoya Project for 2007 is US$5,543,877. A total of US$1,569,000 has been assigned to drilling which accounts for approximately 28% of the total budget. The actual expenditures incurred at Namoya during 2007 will be dependent on the exploration results achieved during 2007."

Cautionary Statements

The preliminary assessment of Namoya is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the preliminary assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

See also the disclosure under the heading "Forward-Looking Statements" on page 1 of this AIF.

Additional Information including Exploration and Development Plans

During 2007, a total of 23 core holes totalling 5,582.19 metres were completed at Namoya, initially with one rig during the first half of the year and with two rigs during the fourth quarter of 2007. There was no drilling undertaken during the third quarter of 2007. In total, the Company has drilled 121 core holes at Namoya totalling 20,752 metres since the commencement of drilling in August 2005.

As well, as part of the regional programme, LIDAR, airborne magnetic and radiometric surveys were completed over the entire Namoya property during 2007 , and a target generation exercise for ground follow-up was initiated. The LIDAR survey was carried out for the Company by independent contractor, Southern Mapping Company, and the airborne magnetic and radiometric surveys were carried out for the Company by independent contractor, New Resolution Geophysics.

The Company's objectives at Namoya for 2008 include completing a pre-feasibility study by the end of June 2008 and completing a full feasibility study by the end of the year. It is proposed that a total of 13,440 metres of core drilling be carried out at Namoya during 2008, focusing on the existing deposits and extensions as well as drilling newly defined targets from the ongoing field exploration. Additional drilling, including geotechnical holes to optimize pit slopes and hydro-geological holes to monitor ground water flow and quality, is expected to be undertaken as part of the ongoing pre-feasibility and full feasibility studies.

An increased amount of metallurgical testwork is also planned to be undertaken to further optimise the recoveries of the oxide, transitional and sulphide ore types. The target generation and ground follow-up exercise that was initiated in 2007 is planned to be intensified to aggressively define new drill targets.

The budget allocated to the Namoya Project for 2008 is approximately $8.94 million. The actual expenditures incurred in relation to Namoya during 2008 will be dependent in part on the exploration results achieved during 2008.

The following is a reproduction of the summary from the Lugushwa Technical Report, a copy of which can be obtained from SEDAR at www.sedar.com. Refer to the Lugushwa Technical Report for detailed disclosure regarding the Lugushwa Project. The Lugushwa Technical Report is incorporated into this AIF by reference.

Reproduction of Summary from Lugushwa Technical Report

"Through its wholly-owned subsidiary, Lugushwa Mining SARL, Banro Corporation ("Banro") is carrying out a gold exploration programme on the Lugushwa Project in the Democratic Republic of the Congo (the "DRC"). The Lugushwa Project consists of three exploitation permits covering an area of 641 km2, and is located approximately 150 km southwest of the town of Bukavu in South Kivu Province in the east of the DRC. Lugushwa Mining SARL has a 100% interest in the said permits.

The Lugushwa area was explored and exploited for alluvial gold between 1957 and 1963. However, from 1963 to the outbreak of political unrest in 1996/7, primary gold mineralization was the main exploration and mining target. Production records are incomplete, but at least 457,000 ounces of alluvial gold were produced, with a further 10,000 ounces from primary sources.

In 1996, Banro acquired control of the Lugushwa Project together with a large library of historical data relating to the Lugushwa Project. Consolidation, computerisation and interpretation of this data were carried out for Banro by CME & Company during 1997 and 1998. Steffen, Robertson and Kirsten (UK) Ltd. ("SRK") completed a detailed geological review in 1999, and carried out a follow-up visit in 2004, on the basis of which the following Inferred Mineral Resource (using a 1.0 g/t Au cut-off grade) was outlined in four historical deposits: 37 million tonnes at an average grade of 2.3 g/t Au for 2.735 million ounces of gold.

Banro commenced an exploration programme in Lugushwa in January 2005, comprising geological mapping, soil geochemistry, trenching, adit mapping and surveying. This work has provided a clearer understanding of the mineralization style and controls. In addition, significant extensions to the known deposits have been identified by soil geochemistry and tested by trenching. This work was concentrated in the vicinity of the known deposits, within an area representing approximately 6% of the total property area. Historical data and current artisanal mining activity elsewhere in the property indicate good potential for locating additional mineralization through the continuation of systematic exploration.

In January 2006, Banro commenced a diamond drilling programme, targeting the known mineralised occurrences and the extensions identified through mapping, geochemistry and trenching. Fifty-four boreholes totalling 8,322 metres have been drilled to date.

The mineralization at Lugushwa is interpreted to be associated with the Sn-W bearing granites that have intruded the metasediments of the Proterozoic Kibara belt. This class of intrusion-related gold deposits has been identified in several parts of the world, and individual deposits have the potential for hosting large, multi-million ounce resources. At Lugushwa, the mineralization takes the form of (a) cross-cutting auriferous quartz vein sets in several orientations, with disseminated, sulphide-associated mineralization in the surrounding rock, and (b) discrete, locally high grade quartz veins.

The mineralization controls are interpreted to be:

| • | Lithological, with less competent and more chemically reactive metapelite units interbedded with quartzites and siltstones. |

| • | Folding, which has (a) caused more abundant and complex fracturing and bedding-parallel dilation in the axial zones of the folds, and (b) focussed fluids in the low pressure zones in the fold closures. |

| • | Shearing, which may have formed channel-ways for the mineralising fluids. |

Mineralization appears to be most intense where interbedded metapelites and siltstones occur in the hinges of northerly-plunging folds, due to (a) migration of hydrothermal fluids into the low-pressure zones, (b) a higher density of host structures for quartz vein emplacement, and (c) more intense fluid-wall rock interaction and subsequent disseminated style mineralization. This setting is more conducive for the formation of bulk-mineable deposits. Outside these areas, particularly in the quartzite-dominated parts of the succession, the mineralizing fluids tend to form more isolated and discrete veins, with less opportunity for wall-rock interaction and disseminated mineralization.

The field exploration work undertaken by Banro from January 2005 to date at Lugushwa is compliant with National Instrument 43-101 ("NI 43-101"). The mineral resource estimate for Lugushwa conforms to the reporting standards of NI 43-101.

It is recommended that the exploration programme at Lugushwa during 2007 should focus on the following:

| • | Further diamond drilling to upgrade Inferred Resources to the Indicated category. |

| • | Initiation of a scoping study to provide preliminary indications of the economic viability of the deposits. |

| • | Completion of sufficient drilling to enable the estimation of Inferred Resources in the new zones of mineralization, recently identified through soil geochemistry, trenching and preliminary drilling. |

| • | Continuation of regional exploration elsewhere on the Lugushwa Project, through the use of remote sensing, stream sediment sampling and soil geochemistry. |

| • | Acquisition of airborne geophysical data (magnetics and radiometrics) for the whole of the Lugushwa Project. Airborne electromagnetics may also prove to be a valuable exploration tool, and an orientation survey over the area of known mineralization is planned for the first half of 2007. |