QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on September 11, 2008.

Registration No. 333-153305

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

BANRO CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | |

Canada

(Province or other Jurisdiction of

Incorporation or Organization) | | 1040

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer Identification

Number, if applicable) |

1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario M5X 1E3 (416) 366-2221

(Address and telephone number of Registrant's principal executive offices)

DL Services Inc., 1420 Fifth Avenue, Suite 3400, Seattle, WA 98101, (206) 903-5448

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

| | | | | | | | |

Michael J. Prinsloo

Banro Corporation

1 First Canadian Place

100 King Street West

Suite 7070

Toronto, ON M5X 1E3

Canada

(416) 366-2221 | | Richard J. Lachcik

Macleod Dixon LLP

Toronto-Dominion Centre

Canadian Pacific Tower

100 Wellington Street West

Suite 500

Toronto, ON M5K 1H1

Canada

(416) 360-8511 | | Christopher J. Barry

Dorsey & Whitney LLP

U.S. Bank Centre

1420 Fifth Avenue

Suite 3400

Seattle, WA 98101

USA

(206) 903-8800 | | Al Gourley

Fasken Martineau DuMoulin LLP

17 Hanover Square

Mayfair

London W1S 1HU

United Kingdom

44 (0) 207 917 8500 | | Rod Miller

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, NY 10153-0119

USA

(212) 310-8000 |

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement

Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| | | | | | |

| A. | | þ | | upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| B. | | o | | at some future date (check the appropriate box below) |

| | | 1. | | o | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| | | 2. | | o | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| | | 3. | | o | | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | | 4. | | o | | after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. þ

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

Title of Each Class of

Securities To Be Registered

| | Amount To Be

Registered

| | Proposed Maximum

Offering Price

Per Security

| | Proposed Maximum

Aggregate

Offering Price(1)(2)

| | Amount of

Registration Fee(3)

|

|---|

| |

| Common shares | | — | | — | | — | | — |

| Warrants | | — | | — | | — | | — |

| Units | | — | | — | | — | | — |

| Total | | — | | — | | U.S.$380,000,000 | | U.S.$14,934 |

| |

- (1)

- Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457 of the Securities Act of 1933. Includes common shares issuable pursuant to the exercise of common share purchase warrants that may be issued as part of the units that the underwriters may purchase pursuant to an over-allotment option, if any.

- (2)

- There are being registered under this registration statement an indeterminate number of common shares, warrants and units as may be sold from time to time by the Registrant. There are also being registered hereunder an indeterminate number of common shares as may be issuable upon exercise of warrants or as part of units. The proposed maximum initial offering price per security will be determined, from time to time, by the Registrant in connection with the sale of the securities under this registration statement.

- (3)

- The Registrant previously paid a registration fee of U.S.$19,650 in connection with the initial filing on September 3, 2008.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

I-1

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell these securities in those jurisdictions.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of Banro Corporation at 1 First Canadian Place, P.O. Box 419, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada, telephone (416) 366-2221, and are also available electronically at www.sedar.com.

SHORT FORM BASE SHELF PROSPECTUS

U.S.$380,000,000

Common Shares

Warrants

Units

Banro Corporation ("Banro" or the "Company") may from time to time offer and issue the common shares of the Company (the "Common Shares") and warrants to purchase Common Shares (the "Warrants" and, together with the Common Shares, the "Securities" or individually, a "Security"), or any combination thereof, up to an aggregate total price of U.S.$380,000,000, during the 25-month period that this short form base shelf prospectus, including any amendments hereto, remains effective. The Securities may be sold from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices related to such prevailing market price or at prices to be negotiated with purchasers, as set forth in an accompanying prospectus supplement. The prices at which the Securities may be offered may vary as between purchasers and during the period of distribution. Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale and as set forth in an accompanying prospectus supplement.

There are certain risk factors that should be carefully reviewed by prospective purchasers. See "Risk Factors".

This short form base shelf prospectus qualifies Common Shares, including Common Shares (the "Warrant Shares") issuable on exercise of the common share purchase warrants issued under the Unit Offering (as defined and described herein), and Warrants or any combination thereof. The specific terms of any offering of Securities will be set out in the applicable prospectus supplement, including the number of Securities offered, the offering price, the currency in which the Securities will be issued, and any other specific terms.

All shelf information permitted under applicable laws to be omitted from this short form base shelf prospectus will be contained in one or more prospectus supplements that will be delivered to purchasers together with this short form base shelf prospectus. Each prospectus supplement will be incorporated by reference into this short form base shelf prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the Common Shares and/or Warrants to which the prospectus supplement pertains.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this short form prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

This Offering is made by a foreign issuer that is permitted, under a multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this short form prospectus in accordance with Canadian disclosure requirements. You should be aware that such requirements are different from those of the United States. The financial statements incorporated herein have been prepared in accordance with Canadian generally accepted accounting principles, and they are subject to Canadian auditing and auditor independence standards. As a result, they may not be comparable to the financial statements of U.S. companies.

Prospective investors in the U.S. should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are residents in, or citizens of, the United States may not be fully described herein.

The enforcement by investors of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that the Company is organized under the laws of Canada, that some or all of its officers and directors may be residents of a foreign country, that some or all of the experts named in the registration statement may be residents of a foreign country, and that a substantial portion of the assets of the Company and said persons may be located outside the United States.

(continued on next page)

The outstanding Common Shares are listed for trading on the Toronto Stock Exchange (the "TSX") and on the American Stock Exchange (the "AMEX"), in each case under the symbol "BAA". On September 10, 2008, the last trading day before the filing of this short form base shelf prospectus, the closing price of the Common Shares on the TSX was Cdn$1.70 and the closing price of the Common Shares on the AMEX was U.S.$1.59. For additional information see "Description of Share Capital" and "The Unit Offering". Unless otherwise specified in the applicable prospectus supplement, Securities other than the Common Shares (including the Warrant Shares) will not be listed on any securities exchange.There is currently no market through which the Warrants may be sold and purchasers may not be able to resell the Warrants purchased under this short form base shelf prospectus. This may affect the pricing of the Warrants in the secondary market, the transparency and availability of trading prices, the liquidity of the securities, and the extent of issuer regulation. See "Risk Factors".

This short form base shelf prospectus constitutes a public offering of the Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell the Securities. The Company may offer and sell Securities to, or through, underwriters or dealers and may also offer and sell certain Securities directly to other purchasers or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A prospectus supplement relating to each issue of Securities offered thereby will set forth the names of any underwriters, dealers, or agents involved in the offering and sale of the Securities and will set forth the terms of the offering of the Securities, the method of distribution of the Securities including, to the extent applicable, the proceeds to the Company and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution.

The head office and registered office of the Company is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada.

ii

TABLE OF CONTENTS

| | |

| | Page |

|---|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 1 |

CAUTIONARY NOTE TO U.S. INVESTORS | | 2 |

DOCUMENTS INCORPORATED BY REFERENCE | | 3 |

EXCHANGE RATE INFORMATION | | 4 |

THE COMPANY | | 4 |

BUSINESS OF THE COMPANY | | 5 |

THE UNIT OFFERING | | 12 |

CONSOLIDATED CAPITALIZATION | | 13 |

USE OF PROCEEDS | | 13 |

DESCRIPTION OF SHARE CAPITAL | | 13 |

PRIOR SALES | | 14 |

TRADING PRICE AND VOLUME | | 14 |

DESCRIPTION OF SECURITIES BEING OFFERED | | 15 |

PLAN OF DISTRIBUTION | | 16 |

INCOME TAX CONSIDERATIONS | | 17 |

RISK FACTORS | | 17 |

AUDITORS, TRANSFER AGENT AND REGISTRAR | | 26 |

LEGAL MATTERS | | 26 |

INTEREST OF EXPERTS | | 27 |

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT | | 27 |

ADDITIONAL INFORMATION | | 28 |

ENFORCEABILITY OF CIVIL LIABILITIES BY U.S. INVESTORS | | 28 |

AUDITORS' CONSENT | | A-1 |

Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this short form base shelf prospectus are references to U.S. dollars. References to "Cdn$" are to Canadian dollars and references to "U.S.$" are to U.S. dollars. See "Exchange Rate Information". The Company's financial statements that are incorporated by reference into this short form base shelf prospectus have been prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP"), and are reconciled to generally accepted accounting principles in the United States ("U.S. GAAP"). Unless otherwise indicated, all information in this short form base shelf prospectus assumes no exercise of the Over-Allotment Option (as hereinafter defined).

Unless the context otherwise requires, references in this short form base shelf prospectus to "Banro" or the "Company" includes Banro Corporation and each of its material subsidiaries.

iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This short form base shelf prospectus and the documents incorporated by reference herein contain "forward-looking statements" within the meaning of theUnited States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, estimated project economics, mineral resource and mineral reserve estimates, potential mineralization, potential mineral resources and mineral reserves, projected timing of possible production and the Company's exploration and development plans and objectives with respect to its projects) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual events or results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual events or results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of capital and operating costs, production and economic returns; uncertainties relating to the estimates and assumptions used in the technical report of SENET dated August 13, 2008 and entitled "Pre-Feasibility Study NI 43-101 Technical Report, Twangiza Gold Project, South Kivu Province, Democratic Republic of Congo" (the "Twangiza Pre-Feasibility Study Report"), in the technical report of SENET dated August 17, 2007 and entitled "Preliminary Assessment NI 43-101 Technical Report, Namoya Gold Project, Maniema Province, Democratic Republic of Congo" (the "Namoya Preliminary Assessment Report") and other reports referred to or incorporated by reference herein; failure to establish estimated mineral resources or mineral reserves; fluctuations in gold prices and currency exchange rates; inflation; gold recoveries being less than those indicated by the metallurgical testwork carried out to date; changes in equity markets; political developments in the Democratic Republic of the Congo (the "DRC"); lack of infrastructure; failure to procure or maintain, or delays in procuring or maintaining, permits and approvals; lack of availability at a reasonable cost or at all, of plants, equipment or labour; inability to attract and retain key management and personnel; changes to regulations or policies affecting the Company's activities; uncertainties relating to the availability and costs of financing in the future; the uncertainties involved in interpreting drilling results and other geological data; the Company's history of losses and expectation of future losses; the Company's ability to acquire additional commercially mineable mineral rights; risks related to the integration of any new acquisitions into the Company's existing operations; increased competition in the mining industry; and the other risks disclosed under the heading "Risk Factors" in this short form base shelf prospectus and under the heading "Risk Factors" and elsewhere in the Company's annual information form dated March 28, 2008 which is available on SEDAR at www.sedar.com and as an exhibit to the Company's annual report on Form 40-F on EDGAR at www.sec.gov and which is incorporated herein by reference.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

The mineral resource and mineral reserve figures referred to in this short form base shelf prospectus are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the resource and reserve estimates included in this short form base shelf prospectus are well established, by their nature, resource and reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

1

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances set out in NI 43-101 (as defined below). Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The Twangiza pre-feasibility study and the Namoya preliminary assessment referred to in this short form base shelf prospectus are preliminary in nature. The Namoya preliminary assessment includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the Twangiza pre-feasibility study or the Namoya preliminary assessment will be realized.

CAUTIONARY NOTE TO U.S. INVESTORS

This short form base shelf prospectus, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Without limiting the foregoing, this short form base shelf prospectus, including the documents incorporated by reference herein, uses the terms "measured", "indicated" and "inferred" resources. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the U.S. Securities and Exchange Commission (the "SEC") does not recognize them. Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the "inferred resources" will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report mineral deposits that do not constitute "reserves" as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this short form base shelf prospectus or in the documents incorporated by reference, may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this short form base shelf prospectus have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ significantly from the requirements of the SEC, and reserve and resource information contained herein and incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. One consequence of these differences is that "reserves" calculated in accordance with Canadian standards may not be "reserves" under the SEC standards.

2

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada (the "Canadian Securities Authorities"). Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of Banro Corporation at 1 First Canadian Place, P.O. Box 419, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada, telephone (416) 366-2221 and are also available electronically through the Internet on SEDAR which can be accessed under the Company's profile on the SEDAR website at www.sedar.com.

The following documents of the Company, filed by the Company with the Canadian Securities Authorities, are specifically incorporated by reference into and form an integral part of this short form base shelf prospectus:

- (a)

- the annual information form of the Company dated March 28, 2008 for the financial year ended December 31, 2007 (the "AIF") (including the documents incorporated by reference therein except for the technical report entitled "Preliminary Assessment NI 43-101 Technical Report, Twangiza Gold Project, South Kivu Province, Democratic Republic of Congo");

- (b)

- the annual report on Form 40-F/A of the Company for the financial year ended December 31, 2007;

- (c)

- the information circular of the Company dated May 29, 2008 prepared for the purposes of the meeting of shareholders held on June 27, 2008;

- (d)

- the audited comparative consolidated financial statements of the Company, including the notes thereto, as at and for the years ended December 31, 2007, 2006 and 2005, and the auditors' report thereon, as amended and restated;

- (e)

- management's discussion and analysis of the Company for the financial year ended December 31, 2007;

- (f)

- the unaudited interim comparative consolidated financial statements of the Company as at and for the three and six month periods ended June 30, 2008, together with the notes thereto;

- (g)

- management's discussion and analysis of the Company for the six months ended June 30, 2008;

- (h)

- the Twangiza Pre-Feasibility Study Report, together with the document entitled "Confirmations Re: Technical Report" dated August 21, 2008;

- (i)

- the material change report of the Company dated July 16, 2008 filed on Form 51-102F3 announcing results from the Company's pre-feasibility study at its Twangiza property;

- (j)

- the material change report of the Company dated August 8, 2008 filed on Form 51-102F3 announcing further results from the Company's ongoing infill core drilling program at its Twangiza property;

- (k)

- the supplementary note to the unaudited interim comparative consolidated financial statements of the Company as at and for the three and six month periods ended June 30, 2008 entitled "Reconciliation to United States Generally Accepted Accounting Principles"; and

- (l)

- the material change report of the Company dated September 4, 2008 filed on Form 51-102F3 announcing the proposed offering of Units.

Any document of the type referred to in section 11.1 of Form 44-101F1Short Form Prospectus, if filed by the Company after the date of this short form base shelf prospectus and prior to the termination of this distribution, shall be deemed to be incorporated by reference in this short form base shelf prospectus. In addition, to the extent any such document is included in any Report on Form 6-K furnished to the SEC or in any Report on Form 40-F filed with the SEC, such document shall be deemed to be incorporated by reference as an exhibit to the registration statement of which this short form base shelf prospectus forms a part. In addition, if the Company specifically states it in the applicable document, the Company may incorporate by reference into the registration statement of which this short form base shelf prospectus forms a part, information from documents that the Company files with or furnishes to the SEC pursuant to Section 13(a) or 15(d) of theUnited States Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act").

3

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein is not incorporated by reference to the extent that any such statement is modified or superseded by a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein. Any such modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute part of this short form base shelf prospectus; rather only such statement as so modified or superseded shall be considered to constitute part of this short form base shelf prospectus.

Amendment of Financial Statements

In connection with a review of its interim consolidated financial statements for the three and six month periods ended June 30, 2008 carried out in connection with the Offering, the Company determined that its previously issued interim consolidated financial statements for the three month period ended March 31, 2008 required an adjustment in the accounting for the dilution of its interest in BRC DiamondCore Ltd. ("BRC") and the treatment of its loss of significant influence. The dilution of the Company's interest in BRC resulted from the acquisition by BRC of Diamond Core Resources Limited on February 11, 2008. Pursuant to such transaction, the Company's ownership interest in BRC was reduced from 27% to 14%. Accordingly, the Company amended and restated its interim consolidated financial statements and related management's discussion and analysis for the three month period ended March 31, 2008 and filed such documents under the Company's profile on SEDAR atwww.sedar.com on August 28, 2008.

The impact of the restatement on the interim consolidated financial statements for the three month period ended March 31, 2008 was to increase net income by U.S.$11,363,090, decrease contributed surplus by U.S.$333,270 and decrease accumulated other comprehensive income by U.S.$11,029,820. This resulted in a net income per share of U.S.$0.24 from a previously reported net loss per share of U.S.$0.04. For a further discussion of the impact of the restatement on the interim consolidated financial statements, see the explanatory note included in the restated interim consolidated financial statements for the three month period ended March 31, 2008. The Company notes that the changes to the financial statements referred to above are of a non-cash nature and had no effect on the Company's financial position or operations.

In connection with the review of its interim consolidated financial statements for the three and six month periods ended June 30, 2008 the Company also re-examined the accounting treatment of dilution gains for the purposes of the reconciliation of its financial statements to US GAAP in its consolidated financial statements for the years ended December 31, 2007 and 2006 and determined that gains related to the dilution of BRC should have been recorded in capital as a result of Staff Accounting Bulletin Topic 5-H (SEC 4940) which outlines the position of staff of the United States Securities and Exchange Commission on certain dilution gains related to development stage companies. The Company refiled such statements to reflect the required changes on SEDAR on September 2, 2008.

Under U.S. GAAP, the impact of the restatement on the consolidated financial statements for the year ended December 31, 2007 was to increase the net loss by $1,281,529 (2006 — $1,648,038; 2005 — $646,331) and increase total comprehensive loss by $1,300,354 (2006 — $1,584,695; 2005 — $646,331). This resulted in an increase in net loss per share amount by $0.04 (2006 — $0.04; 2005 — $0.03). The foregoing changes only affected the reconciliation of Canadian GAAP to U.S. GAAP. There was no impact on the Company's audited financial statements prepared in accordance with Canadian GAAP.

4

EXCHANGE RATE INFORMATION

All references to "U.S.$" or "U.S. dollars" in this short form base shelf prospectus refer to U.S. dollars and "Cdn$" or "Canadian dollars" refers to Canadian dollars. The noon exchange rate on September 10, 2008 as reported by the Bank of Canada for the conversion of Canadian dollars into U.S. dollars was Cdn$1.00 equals U.S.$0.9313.

During the periods set forth below, the noon-day exchange rates for the U.S. dollar per Canadian dollar as quoted by the Bank of Canada were:

| | | | | | | | | | | | | |

| |

| | Years Ended December 31, | |

|---|

| | Month Ended

August 31, 2008

(U.S.$) | | 2007

(U.S.$) | | 2006

(U.S.$) | | 2005

(U.S.$) | |

|---|

Rate at end of period | | | 0.9411 | | | 1.0120 | | | 0.8581 | | | 0.8577 | |

Average rate during period | | | 0.9484 | | | 0.9304 | | | 0.8818 | | | 0.8253 | |

Highest rate during period | | | 0.9753 | | | 1.0905 | | | 0.9099 | | | 0.8690 | |

Lowest rate during period | | | 0.9365 | | | 0.8437 | | | 0.8528 | | | 0.7872 | |

THE COMPANY

The head office and registered office of Banro is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada.

The Company was incorporated under the Canada Business Corporations Act (the "CBCA") on May 3, 1994 by articles of incorporation. Pursuant to articles of amendment effective May 7, 1996, the name of the Company was changed from Banro International Capital Inc. to Banro Resource Corporation. The Company was continued under the Business Corporations Act (Ontario) by articles of continuance effective on October 24, 1996. By articles of amendment effective on January 16, 2001, the name of the Company was changed to Banro Corporation and the Company's outstanding Common Shares were consolidated on a three-to-one basis. The Company was continued under the CBCA by articles of continuance dated April 2, 2004. By articles of amendment dated December 17, 2004, the Company's outstanding Common Shares were subdivided by changing each one of such shares into two Common Shares.

The Company is a Canada based gold exploration company focused on the exploration and development of four major gold properties located along the 210 kilometre-long Twangiza Namoya gold belt in the South Kivu and Maniema Provinces of the eastern region of the DRC.

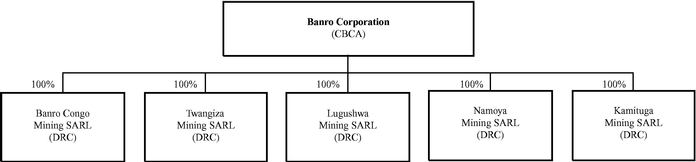

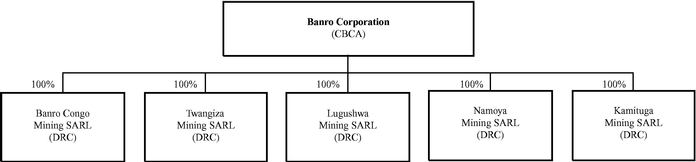

The following chart illustrates the relationship between Banro and its material subsidiaries, together with the jurisdiction of incorporation of each such subsidiary and the percentage of voting securities beneficially owned or over which control or direction is exercised by Banro.

5

BUSINESS OF THE COMPANY

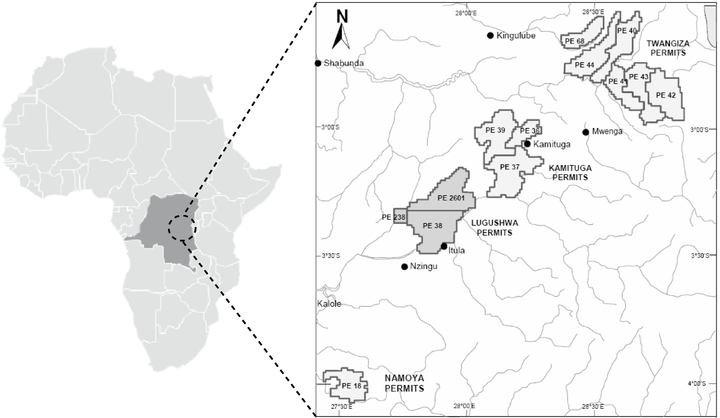

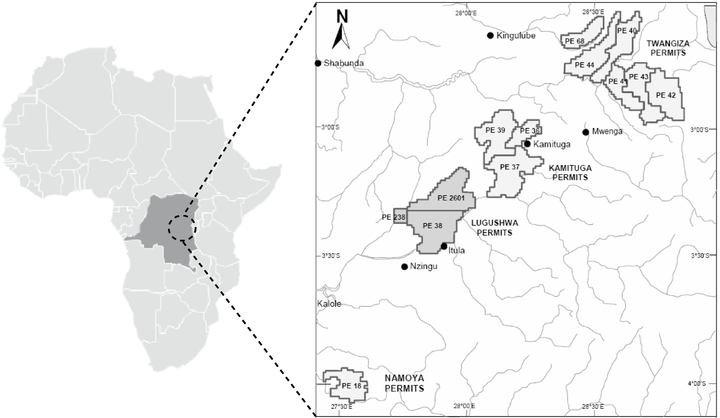

The Company holds, through four wholly-owned DRC subsidiaries, a 100% interest in four gold properties, which are known as Twangiza, Namoya, Lugushwa and Kamituga. These properties are covered by a total of 13 exploitation permits and are found along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of eastern DRC. These properties, totalling approximately 2,600 square kilometres, cover all the major, historical producing areas of the gold belt. The Company's business focus is the exploration and development of these four DRC properties. The Company also holds 14 exploration permits covering an aggregate of 2,710.91 square kilometres. Ten of the permits are located in the vicinity of the Company's Twangiza property and four are located in the vicinity of the Company's Namoya property.

The following illustrates the location of the Company's properties and exploitation permits.

Regional and prospect exploration is currently being undertaken at the Twangiza, Namoya and Lugushwa properties. Banro expanded its exploration programs in 2008 and there are currently nine core drill rigs on these properties, where Banro is working with the objective of delineating new inferred mineral resources and upgrading current inferred mineral resources into the measured and indicated mineral resource categories, as it moves the properties through feasibility, pre-feasibility and preliminary assessment stages of development, respectively. Management budgeted for approximately 63,000 metres of drilling in 2008 on the three properties and is currently on track to meet that target. The Company is intending to commence drilling at Kamituga in 2009.

Under DRC mining law, an exploitation permit entitles the holder thereof to the exclusive right to carry out, within the perimeter over which it is granted and during its term of validity, exploration, development, construction and exploitation works in connection with the mineral substances for which the permit has been granted and associated substances if the holder has obtained an extension of the permit. In addition, an exploitation permit entitles the holder to: (a) enter the exploitation perimeter to conduct mining operations; (b) build the installations and infrastructures required for mining exploitation; (c) use the water and wood within the mining perimeter for the requirements of the mining exploitation, provided that the requirements set forth in the environmental impact study and the environmental management plan of the project are complied with; (d) use, transport and freely sell the holder's products originating from within the exploitation perimeter;

6

(e) proceed with concentration, metallurgical or technical treatment operations, as well as the transformation of the mineral substances extracted from the exploitation perimeter; and (f) proceed to carry out works to extend the mine.

Without an exploitation permit, the holder of an exploration permit may not conduct exploitation work on the perimeter covered by the exploration permit. So long as a perimeter is covered by an exploitation permit, no other application for a mining or quarry right for all or part of the same perimeter can be processed.

An exploration permit entitles the holder thereof to the exclusive right, within the perimeter over which it is granted and for the term of its validity, to carry out mineral exploration work for mineral substances, substances for which the licence is granted and associated substances if an extension of the permit is obtained. However, the holder of an exploration permit cannot commence work on the property without obtaining approval in advance of its mitigation and rehabilitation plan. An exploration permit also entitles its holder to the right to obtain an exploitation permit for all or part of the mineral substances and associated substances, if applicable, to which the exploration permit or any extension thereto applies if the holder discovers a deposit which can be economically exploited.

On February 13, 1997, the Company entered into a mining convention with the Republic of Zaire and Société Minière et Industrielle du Kivu (the "Mining Convention"). In or around 1998, the Company was expropriated of all its properties, rights and titles by presidential decree. The Company initiated arbitration procedures against the DRC State seeking compensation for this expropriation. This resulted in a settlement agreement between the DRC State and the Company which was signed on April 18, 2002 (the "Settlement Agreement"). The Settlement Agreement effectively revived the expropriated Mining Convention. Under this revived Mining Convention, the Company held a 100% equity interest in its properties, was entitled to a ten-year tax holiday from the start of production, and was exempt from custom duties and royalty payments.

On July 11, 2002, the DRC State enacted a Mining Code (the "Mining Code") to govern all the exploration and exploitation of mineral resources in the DRC. Holders of mining rights who derived their rights from previously existing mining conventions had the option to choose between being governed, either exclusively by the terms and conditions of their own mining convention with the DRC State or by the provisions of the Mining Code. Pursuant to this right of option which is prescribed in Section 340 paragraph 1 of the Mining Code, the Company elected to remain subject to the terms and conditions of its Mining Convention with respect to its 13 exploitation permits it acquired before the enactment of the Mining Code. Nevertheless, the 14 exploration permits (which were acquired by the Company after the implementation of the Mining Code) are exclusively governed by the provisions of the Mining Code and related mining regulations.

Twangiza

The 1,156 square kilometre Twangiza property is located in the South Kivu Province of the DRC, approximately 35 kilometres west of the Burundi border and approximately 45 kilometres to the south southwest of the town of Bukavu, the provincial capital. The Twangiza property consists of six exploitation permits. Banro's wholly-owned DRC subsidiary, Twangiza Mining SARL, has a 100% interest in the said permits.

The most recent mineral resource estimates for Twangiza, which are summarized below, came at the end of the fourth phase of resource drilling and sampling of the Twangiza Main and Twangiza North deposits, which was completed in May 2008.

The current exploration at Twangiza commenced in October 2005, and by May 2008 a total of 216 diamond drill holes had been completed by Banro. The programme included resource delineation drilling on the 3.5 kilometre north trending mining target comprising Twangiza Main and Twangiza North. Definition drilling continues with six diamond drill rigs on the property.

SRK Consulting (UK) Ltd. ("SRK (UK)") has prepared an independent estimate of the mineral resources at Twangiza, which is set out below. The effective date of the estimate is June 23, 2008. The estimate is based on a cut-off grade of 0.5 g/t Au. The mineral resource is considered to have reasonable prospects for economic

7

extraction by open pit mining and has been restricted to an optimum pit shell which uses a U.S.$910/oz gold price and technical and economic factors resulting from the Twangiza pre-feasibility study.

| | | | | | | | | | |

Resource Category | | Tonnes

(Millions) | | Grade

(g/t Au) | | Gold Ounces

(Millions) | |

|---|

Measured | | | 16.7 | | | 2.59 | | | 1.39 | |

Indicated | | | 42.5 | | | 1.72 | | | 2.35 | |

Measured & Indicated | | | 59.2 | | | 1.96 | | | 3.74 | |

Inferred | | | 10.0 | | | 1.80 | | | 0.60 | |

The mineral resources are found within three deposits: Twangiza Main, which contains 87% of the total mineral resources; Twangiza North, which contains 11% of the total mineral resources; and the transported Twangiza "Valley Fill" deposit, which contains 2% of the total mineral resources.

Based on the above mineral resource estimates, SRK Consulting (South Africa) (Pty) Ltd. ("SRK (SA)") estimated the following mineral reserves for the Twangiza pre-feasibility study:

| | | | | | | | | | | | |

Reserve Category | | Deposit | | Tonnes

(Millions) | | Grade

(g/t Au) | | Gold Ounces

(Millions) | |

|---|

Proven | | Twangiza Main | | | 15.22 | | | 2.60 | | | 1.273 | |

| | Twangiza North | | | 0.07 | | | 1.19 | | | 0.003 | |

| | | | | | | | | | |

Total Proven | | | | | 15.29 | | | 2.60 | | | 1.276 | |

| | | | | | | | | | |

Probable | | Twangiza Main | | | 27.47 | | | 1.81 | | | 1.594 | |

| | Twangiza North | | | 6.13 | | | 2.23 | | | 0.440 | |

| | | | | | | | | | |

Total Probable | | | | | 33.60 | | | 1.88 | | | 2.034 | |

| | | | | | | | | | |

Total Proven and Probable | | Twangiza Project | | | 48.89 | | | 2.11 | | | 3.310 | |

| | | | | | | | | | |

There remains potential to increase the mineral resource contained in the pre-feasibility study pit resulting from the ongoing deposit definition drilling. It is noted that assay results for an additional 30 drill holes completed since data was provided to SRK (UK) were reported in the Company's press release dated July 31, 2008. A number of significant intercepts were obtained, including 192 metres grading 2.02g/t Au, 149 metres grading 1.71 g/t Au, 77.8 metres grading 2.17 g/t Au and 60 metres grading 3.50 g/t Au.

8

The pre-feasibility study of Twangiza was completed in July 2008 by SENET. The economic model and financial analysis for the purposes of the Twangiza pre-feasibility study was undertaken based on the following assumptions:

| | | | | | | |

Parameter | | Units | | Assumption | |

|---|

Gold Price | | U.S.$/oz | | | 850 | |

Discount Rate | | % | | | 5% | |

Life of Mine ("LoM") After Pre-Production | | Years | | | 12 | |

Oxides: | | | | | | |

| | (i) LoM Tonnage | | t | | | 16,729,023 | |

| | (ii) LoM Grade | | g/t Au | | | 2.35 | |

| | (iii) LoM Recovery | | % | | | 89.8% | |

Transition: | | | | | | |

| | (i) FP LoM Tonnage(1) | | t | | | 6,631,919 | |

| | (ii) FP LoM Grade | | g/t Au | | | 1.75 | |

| | (iii) FP LoM Recovery | | % | | | 87.0% | |

| | (iv) CMS LoM Tonnage(2) | | t | | | 8,940,654 | |

| | (v) CMS LoM Grade | | g/t Au | | | 2.55 | |

| | (vi) CMS LoM Recovery | | % | | | 38.0% | |

Fresh: | | | | | | |

| | (i) FP LoM Tonnage | | t | | | 6,456,282 | |

| | (ii) FP LoM Grade | | g/t Au | | | 1.51 | |

| | (iii) FP LoM Recovery | | % | | | 82.2% | |

| | (iv) CMS LoM Tonnage | | t | | | 10,136,482 | |

| | (v) CMS LoM Grade | | g/t Au | | | 1.74 | |

| | (vi) CMS LoM Recovery | | % | | | 54.0% | |

Royalty | | % | | | n/a | |

Tax Rate | | % | | | 5% on imports | |

Initial Capital Costs | | U.S.$ 000 | | | 541,202 | |

Sustaining Capital | | U.S.$ 000 | | | 39,380 | |

Fixed Equipment Capital Resale | | % | | | 5% | |

Hydro Equipment Capital Resale | | % | | | 30% | |

Notes:

- (1)

- "FP" means feldspar prophyry.

- (2)

- "CMS" means carbonaceous mudstone.

The results of the Twangiza pre-feasibility study, which are contained in the Twangiza Pre-Feasibility Study Report are summarized below:

| | | | | | |

Hydro Electric Plant Option | | Units | | Pre-Feasibility Study | |

|---|

Gold Annual Production — First 3 years | | oz | | | 345,125 | |

Gold Annual Production — First 7 years | | oz | | | 236,144 | |

Gold Annual Production — LoM | | oz | | | 195,772 | |

Cash Operating Costs — First 3 years | | U.S.$/oz | | | 212 | |

Cash Operating Costs — First 7 years | | U.S.$/oz | | | 351 | |

Cash Operating Costs — LoM | | U.S.$/oz | | | 345 | |

Post Tax NPV (5%) | | U.S.$ million | | | 352 | |

IRR(1) | | % | | | 20.5% | |

Discounted Payback Period | | Years | | | 2.78 | |

Project Net Cash Flow After Tax and Capex | | U.S.$ million | | | 583 | |

Note:

- (1)

- "IRR" means internal rate of return.

9

Full details of the Twangiza pre-feasibility study are set out in the Twangiza Pre-Feasibility Study Report, which is incorporated by reference herein.

With the Twangiza pre-feasibility study now completed, the Company intends to complete a bankable feasibility study of Twangiza by the end of 2008. The objective of the current drilling program at Twangiza is to upgrade inferred resources into the measured and indicated categories with the goal of determining reserves as part of the bankable feasibility study.

An increased amount of metallurgical testwork is also planned to be undertaken to further optimise the recoveries of the oxide, transitional and sulphide ore types and to finalize the metallurgical plant design for the bankable feasibility study.

The Company plans to continue with the ground exploration of Luhwindja, which neighbours Twangiza North, including drilling. Following a positive soil and adit sampling programme, an initial 10-hole drilling programme on the Mufwa prospect has been initiated.

Namoya

The Namoya property consists of one exploitation permit covering an area of 174 square kilometres and is located approximately 225 kilometres southwest of the town of Bukavu in Maniema Province in the east of the DRC. Namoya Mining SARL, which is wholly-owned by Banro, has a 100% interest in the said permit. The Namoya property comprises four separate deposits: Mwendamboko and Muviringu to the northwest, Kakula in the center and Namoya Summit to the southeast.

The most recent mineral resource estimates for Namoya were completed in June 2007 following the completion of an additional 7,411.53 metres (36 drill holes) of drilling since the previous Namoya mineral resource determination in September 2006. These most recent mineral resource estimates were included in the Namoya Preliminary Assessment Report.

The table below summarizes the current mineral resource estimates for Namoya using a 1.0 g/t Au block cut-off. These estimates are outlined in the Namoya Preliminary Assessment Report.

| | | | | | | | | | |

Class | | Tonnage

(Tonnes) | | Grade

(Au g/t) | | Contained Gold

(Ounces) | |

|---|

Indicated | | | 8,925,000 | | | 3.27 | | | 938,800 | |

Inferred | | | 7,074,000 | | | 2.73 | | | 621,500 | |

The Namoya preliminary assessment was completed in July 2007 and the results which are included in the Namoya Preliminary Assessment Report are summarized below. Pit optimizations and underground mining studies were undertaken on the indicated and inferred mineral resources from which mining schedules were estimated. Results from metallurgical testwork of the various ore types at Namoya were used to determine metallurgical recoveries and determine the gravity/Carbon-in-Leach (CIL) processing flow sheet. Infrastructural and site services were estimated for the project together with hydroelectric and diesel power alternatives.

An economic model and a financial analysis were undertaken based on the following assumptions:

| | | | | | | | | | |

Parameter | | Units | | Hydroelectric

Assumption | | Diesel

Assumption | |

|---|

Gold Price | | U.S.$/oz | | | 600 | | | 600 | |

Discount Rate | | % | | | 5% | | | 5% | |

LoM After Pre-Production | | Years | | | 8 | | | 7 | |

Oxides: | | | | | | | | | |

| | (i) LoM Tonnage | | t | | | 7,653,363 | | | 6,467,642 | |

| | (ii) LoM Grade | | g/t Au | | | 2.85 | | | 3.17 | |

| | (iii) LoM Recovery | | % | | | 93.6% | | | 93.6% | |

Transition: | | | | | | | | | |

| | (i) LoM Tonnage | | t | | | 2,853,871 | | | 2,160,665 | |

| | (ii) LoM Grade | | g/t Au | | | 3.08 | | | 3.62 | |

| | (iii) LoM Recovery | | % | | | 93.0% | | | 93.0% | |

10

| | | | | | | | | | |

Parameter | | Units | | Hydroelectric

Assumption | | Diesel

Assumption | |

|---|

Fresh Rock: | | | | | | | | | |

| | (i) LoM Tonnage | | t | | | 3,501,546 | | | 3,350,940 | |

| | (ii) LoM Grade | | g/t Au | | | 3.51 | | | 3.41 | |

| | (iii) LoM Recovery | | % | | | 92.6% | | | 92.6% | |

Stockpile: | | | | | | | | | |

| | (i) LoM Tonnage | | t | | | 1,495,429 | | | 1,421,541 | |

| | (ii) LoM Grade | | g/t An | | | 0.76 | | | 0.76 | |

| | (iii) LoM Recovery | | % | | | 93.0% | | | 93.0% | |

Royalty | | % | | | n/a | | | n/a | |

Tax Rate | | % | | | 5% on imports | | | 5% on imports | |

Initial Capital Costs | | U.S.$000 | | | 186,545 | | | 161,996 | |

Sustaining Capital | | U.S.$000 | | | 27,478 | | | 25,974 | |

Fixed Equipment Capital Resale | | % | | | 20% | | | 20% | |

Hydro Equipment Capital Resale | | % | | | 60% | | | n/a | |

Mobile Equipment Capital Resale | | % | | | 20% | | | 20% | |

The results of the financial analysis for the Namoya hydroelectric and diesel options are summarized below:

| | | | | | | | | |

| | Units | | Hydroelectric

Assumption | | Diesel

Assumption | |

|---|

Gold Annual Production — First 5 years | | oz | | | 193,949 | | | 198,139 | |

Gold Annual Production — LoM | | oz | | | 164,988 | | | 174,632 | |

Cash Operating Costs — First 5 years | | U.S.$/oz | | | 217.11 | | | 265.37 | |

Cash Operating Costs — LoM | | U.S.$/oz | | | 238.24 | | | 285.84 | |

Post Tax NPV (5%) | | U.S.$ million | | | 204 | | | 145 | |

IRR | | % | | | 37.3% | | | 41.0% | |

Payback Time | | Years | | | 2.3 | | | 1.6 | |

Project Net Cash Flow After Tax and Capex | | U.S.$ million | | | 290 | | | 197 | |

The Company's objectives at Namoya for 2008 include completing a pre-feasibility study during the fourth quarter of 2008. The outcome of the pre-feasibility study will indicate whether the Company should pursue a CIL option or a heap leach option, as the best way forward for the Namoya property. This option will then be progressed to a full feasibility during 2009.

The current drilling program at Namoya is part of the pre-feasibility study, with the objective of upgrading inferred mineral resources into the measured and indicated categories so that open pit reserves can be determined as part of the pre-feasibility study. The current mineral resource estimates for Namoya were determined using the assay results from drill holes NDD001 to NDD106.

An increased amount of metallurgical testwork is also planned to be undertaken to further optimise the recoveries of the oxide, transitional and sulphide ore types and to test the feasibility of the heap leach option.

Lugushwa

The Lugushwa property consists of three exploitation permits covering an area of 641 square kilometres and is located approximately 150 kilometres southwest of the town of Bukavu in the South Kivu Province in the east of the DRC. Banro's wholly-owned DRC subsidiary, Lugushwa Mining SARL, has a 100% interest in the said permits.

The table below summarizes the current mineral resource estimates for the Lugushwa property utilizing a 1.0 g/t Au cut-off grade. These estimates, which are included in the technical report of Michael B. Skead dated

11

March 30, 2007 and entitled "Third NI 43-101 Technical Report, Lugushwa Project, South Kivu Province, Democratic Republic of the Congo", relate to the D18/19, G20/21, G7 Mapale and Simali deposits.

| | | | | | | | | | |

Category | | Tonnage

(000s) | | Grade

(Au g/t) | | Contained Gold

(000s) | |

|---|

Inferred | | | 37,000 | | | 2.3 | | | 2,735 | |

The focus of the 2008 programme at Lugushwa is on upgrading the inferred mineral resources to higher confidence resources and progressing this to the completion of a preliminary assessment (i.e., "scoping study") by the end of 2008 or early 2009, depending on the progress of the drilling programme and the metallurgical testwork required for the completion of the preliminary assessment study. The heap leach option (similar to Namoya) will be progressed as part of this study. It is proposed to carry out 10,000 metres of core drilling during 2008 with two rigs, once infill drilling for the pre-feasibility studies at Twangiza and Namoya have been completed, focusing on the existing deposits and extensions as well as drilling newly defined targets. The Company is currently on track to meet its drilling target for 2008.

The target generation and ground follow-up exercise that was initiated in 2007 is planned to be intensified to define new drill targets. Metallurgical testwork is also planned to be undertaken to optimise the recoveries of the oxide, transitional and sulphide ore types.

Kamituga

The Kamituga property consists of three exploitation permits covering an area of 641 square kilometres and is located approximately 100 kilometres southwest of the town of Bukavu in the South Kivu Province in the east of the DRC. Banro's wholly-owned DRC subsidiary, Kamituga Mining SARL, has a 100% interest in the said permits.

In Sections 2 and 3 of the technical report of SRK (UK) (formerly Steffen, Robertson and Kirsten (UK) Ltd.) dated February 2005 and entitled "NI 43-101 Technical Report Resource Estimation and Exploration Potential at the Kamituga, Lugushwa and Namoya Concessions, Democratic Republic of Congo", SRK (UK) outlined the following mineral resource estimates for Kamituga, using a 1.0 g/t Au cut-off grade and based on polygonal methods using historical assay results from underground and surface channel sampling.

| | | | | | | | | | |

Resource Category | | Tonnes

(Millions) | | Grade

(Au g/t) | | Gold Ounces

(Millions) | |

|---|

Inferred | | | 7.26 | | | 3.90 | | | 0.915 | |

During 2007, the Kamituga project was covered by the LIDAR, aeromagnetic and radiometric surveys that were carried out as part of the Company's regional programme.

Banro is proposing to commence exploration activities at Kamituga in late 2008 or 2009, such activities to consist of reviewing and assessing the historical data, stream sediment sampling, gridding, geological mapping, soil, trench and adit sampling, followed by drilling. Kamituga is located in an area with artisanal miners, violence and political instability which could cause delays in Banro's activities on the Kamituga property. Exploration will focus on: (a) the disseminated sulphide wall rock mineralization that may have been neglected in the past by previous mining activities when the focus was on high grade quartz veins and stockworks; and (b) locating additional zones of oxide mineralization elsewhere on the property.

Other Exploration Properties

The Company's wholly-owned DRC subsidiary, Banro Congo Mining SARL, holds 14 exploration permits covering an aggregate of 2,710.91 square kilometres of ground located between and contiguous to the Company's Twangiza, Kamituga and Lugushwa properties and northwest of Namoya. The applications for these permits were originally filed with the Mining Cadastral shortly after implementation of the DRC's new Mining Code in June 2003.

No ground field work was conducted during 2007 in respect of these properties. The properties relating to two of the exploration permits (located between Kamituga and Lugushwa) were covered by the aeromagnetic and radiometric surveys that were carried out during 2007 as part of the regional programme. During 2008, the

12

Company continued its regional programme encompassing LIDAR, aeromagnetic and radiometric surveys over certain of these properties (to the extent not covered during 2007) for target generation and ground follow-up for 2009 and 2010.

Qualified Persons

The "qualified person" (as such term is defined in NI 43-101) who oversees the Company's exploration programs is Daniel K. Bansah. Mr. Bansah, who is Vice President, Exploration of Banro, has reviewed and approved the technical information in this short form base shelf prospectus. The "qualified persons" for the purposes of the various technical reports referred to or incorporated by reference into this short form base shelf prospectus are set out in the applicable technical report.

THE UNIT OFFERING

On September 2, 2008, the Company filed a preliminary short form prospectus with the securities commission or similar regulatory authority in each of the provinces of Canada (other than Québec) and filed a registration statement on Form F-10 with the SEC in connection with the offering of units by the Company to the public in Canada and the United States (the "Unit Offering"). Each unit of the Company offered thereunder (each, a "Unit") consists of one Common Share (each, a "Unit Share") and one-half of a warrant (each whole warrant, a "Unit Warrant"). Each Unit Warrant will entitle the holder thereof to purchase one Warrant Share at a price of U.S.$2.20 at any time up to 5:00 p.m. (Toronto time) on the date which is 36 months following the Unit Offering Closing Date (as defined below). The Unit Offering is expected to be completed on or about September 17, 2008, or such other date as may be agreed upon by the Company and the Underwriters (as defined below), but in any event no later than September 25, 2008 (the "Unit Offering Closing Date"). The exercise price of the Unit Warrants was determined by negotiation between the Company and the Underwriters (as defined below).

In connection with the Unit Offering, the Company has entered into an underwriting agreement dated September 10, 2008 with a syndicate of underwriters (the "Underwriters"), pursuant to which the Company has agreed to sell, and the Underwriters have severally agreed to purchase from the Company, 11,000,000 Units (not including the Over-Allotment Option granted to the Underwriters in connection with the Unit Offering, as defined and described below), at a price of U.S.$1.75 per Unit.

Pursuant to the underwriting agreement, the Company has agreed to pay to the Underwriters a fee of U.S.$1,155,000 (the "Underwriters' Fee"), representing 6% of the aggregate gross proceeds of the Unit Offering. The Company has also granted to the Underwriters an option (the "Over-Allotment Option") to acquire up to 1,000,000 additional Unit Shares (each, an "Over-Allotment Share") at a price of U.S.$1.60 per Over-Allotment Share and/or up to 500,000 additional Unit Warrants (each, an "Over-Allotment Warrant") at a price of U.S.$0.30 per Over-Allotment Warrant. Each Over-Allotment Warrant will entitle the holder thereof to purchase one Common Share (each, an "Over-Allotment Warrant Share") at a price of U.S.$2.20 at any time up to 5:00 p.m. (Toronto time) on the date which is 36 months from the Unit Offering Closing Date. The Over-Allotment Option is exercisable in whole or in part at any time up to 30 days from the Unit Offering Closing Date. If the Over-Allotment Option is exercised in full, the total price to the public, Underwriters' Fee and net proceeds to the Company from the Unit Offering will be U.S.$21,000,000, U.S.$1,260,000 and U.S.$19,740,000, respectively.

In connection with the Unit Offering, the TSX and the AMEX have conditionally approved the listing of: (i) the Unit Shares and Unit Warrants to be issued upon closing of the Unit Offering; (ii) the Over-Allotment Shares and Over-Allotment Warrants to be issued at any time upon exercise of the Over-Allotment Option; (iii) the Warrant Shares to be issued upon due exercise of the Unit Warrants; and (iv) the Over-Allotment Warrant Shares to be issued upon due exercise of the Over-Allotment Warrants. Listing will be subject to Banro fulfilling all of the listing requirements of the TSX and the AMEX including, with respect to the listing of the Unit Warrants and the Over-Allotment Warrants, the distribution of the Unit Warrants and the Over-Allotment Warrants to a minimum number of public securityholders.

In connection with the Unit Offering, the Company has agreed it will file and clear this short form base shelf prospectus and a prospectus supplement relating to the Warrant Shares in Canada other than Quebec and concurrently, pursuant to the multi-jurisdictional disclosure system, file a registration statement on Form F-10 and a prospectus supplement relating to the Warrant Shares with the SEC covering the issuance of the Warrant Shares upon the exercise of the Unit Warrants.

13

CONSOLIDATED CAPITALIZATION

Since June 30, 2008 and to the date of this short form base shelf prospectus, the Company has not issued any Common Shares. No stock options have been granted since June 30, 2008 and to the date of this short form base shelf prospectus. There have been no other material changes in the Company's share or loan capital, on a consolidated basis, since June 30, 2008. The following table sets forth the consolidated capitalization of the Company as at the dates indicated before and after completion of the Unit Offering. This table should be read in conjunction with the consolidated financial statements of the Company (including the notes thereto) incorporated by reference into this short form base shelf prospectus.

| | | | | | | |

| | As at June 30, 2008

before giving effect to

the Unit Offering | | As at June 30, 2008

after giving effect to

the Unit Offering(1)(2) | |

|---|

Shareholders' Equity | | | | | | | |

Common Shares | | | U.S.$140,302,546 | | | U.S.$156,846,546 | |

(Authorized: Unlimited) | | | 40,482,938 shares | | | 51,482,938 shares | |

Warrants | | | Nil | | | U.S.$1,551,000 | |

Contributed surplus | | | U.S.$13,837,810 | | | U.S.$13,837,810 | |

Accumulated other comprehensive income | | | Nil | | | Nil | |

Deficit | | | U.S.$(53,789,581) | | | U.S.$(53,789,581) | |

| | | | | | |

Total capitalization | | | U.S.$100,350,775 | | | U.S.$118,445,775 | |

| | | | | | |

Notes:

- (1)

- After deducting the Underwriters' Fee of U.S.$1,155,000 but before deducting expenses of the Unit Offering, which are estimated at U.S.$1,500,000.

- (2)

- Assumes no exercise of any outstanding Warrants or of the Over-Allotment Option.

Further relevant information, if any, will be contained in the applicable prospectus supplement.

USE OF PROCEEDS

Unless otherwise indicated in an applicable prospectus supplement relating to an offering of Common Shares and/or Warrants, the Company anticipates using the net proceeds received from the sale of such Common Shares and/or Warrants for general corporate purposes, which may include exploration and development costs for the Company's properties. The amount of net proceeds to be used for any purpose will be described in the applicable prospectus supplement.

DESCRIPTION OF SHARE CAPITAL

The Company's authorized share capital consists of an unlimited number of Common Shares and an unlimited number of preference shares issuable in series, of which 40,482,938 Common Shares and no preference shares were issued and outstanding as of the date of this short form base shelf prospectus. The following is a summary of the material provisions attaching to the Common Shares and preference shares.

Common Shares

The holders of the Common Shares are entitled to receive notice of and to attend all meetings of the shareholders of the Company and shall have one vote for each Common Share held at all meetings of the shareholders of the Company, except for meetings at which only holders of another specified class or series of shares are entitled to vote separately as a class or series. Subject to the prior rights of the holders of the preference shares or any other shares ranking senior to the Common Shares, the holders of the Common Shares are entitled to (a) receive any dividends as and when declared by the board of directors, out of the assets of the Company properly applicable to the payment of dividends, in such amount and in such form as the board of directors may from time to time determine, and (b) receive the remaining property of the Company in the event of any liquidation, dissolution or winding-up of the Company.

14

Preference Shares

The board of directors of the Company may issue the preference shares at any time and from time to time in one or more series, each series of which shall have the designations, rights, privileges, restrictions and conditions fixed by the directors. The preference shares of each series shall rank on a parity with the preference shares of every other series, and shall be entitled to priority over the Common Shares and any other shares of the Company ranking junior to the preference shares, with respect to priority in the payment of dividends and the return of capital and the distribution of assets of the Company in the event of the liquidation, dissolution or winding-up of the Company.

PRIOR SALES

Prior Sales

Set forth below is information with respect to the securities of the Company issued during the 12-month period prior to the date of this short form base shelf prospectus.

Common Shares

| | | | | | | |

Date of Issuance | | Number of

Common Shares

Issued(1) | | Price per

Common Share

(Cdn$) | |

|---|

September 27, 2007 | | | 3,300 | | $ | 4.00 | |

October 4, 2007 | | | 36,700 | | $ | 4.00 | |

October 4, 2007 | | | 50,000 | | $ | 6.65 | |

February 8, 2008 | | | 200,000 | | $ | 4.70 | |

March 14, 2008 | | | 100,000 | | $ | 3.00 | |

April 11, 2008 | | | 317,801 | | $ | 5.25 | |

April 15, 2008 | | | 2,100 | | $ | 4.00 | |

April 16, 2008 | | | 2,900 | | $ | 4.00 | |

Note:

- (1)

- All of these share issuances were pursuant to the exercise of previously issued stock options of the Company.

Stock Options and Warrants

There were no stock options or warrants issued by the Company during the 12-month period prior to the date of this short form base shelf prospectus.

15

TRADING PRICE AND VOLUME

The Common Shares are listed for trading on the TSX and the AMEX under trading symbol "BAA". The following tables set forth information relating to the trading of the Common Shares on the TSX and the AMEX for the periods indicated.

Toronto Stock Exchange

| | | | | | | | | | |

Period | | High

(Cdn$) | | Low

(Cdn$) | | Volume | |

|---|

September 2008 (to September 10, 2008) | | | 3.68 | | | 1.05 | | | 777,986 | |

August 2008 | | | 4.79 | | | 3.35 | | | 505,560 | |

July 2008 | | | 7.99 | | | 3.70 | | | 3,509,061 | |

June 2008 | | | 8.40 | | | 6.70 | | | 373,646 | |

May 2008 | | | 8.95 | | | 8.00 | | | 3,044,574 | |

April 2008 | | | 9.00 | | | 7.75 | | | 876,600 | |

March 2008 | | | 10.13 | | | 8.00 | | | 1,787,336 | |

February 2008 | | | 10.53 | | | 8.70 | | | 1,615,549 | |

January 2008 | | | 12.35 | | | 9.56 | | | 1,211,381 | |

December 2007 | | | 12.50 | | | 8.04 | | | 796,484 | |

November 2007 | | | 12.85 | | | 11.00 | | | 1,262,806 | |

October 2007 | | | 13.00 | | | 10.73 | | | 1,624,209 | |

September 2007 | | | 12.50 | | | 8.79 | | | 2,015,993 | |

August 2007 | | | 12.50 | | | 8.74 | | | 1,343,868 | |

American Stock Exchange

| | | | | | | | | | |

Period | | High

(U.S.$) | | Low

(U.S.$) | | Volume | |

|---|

September 2008 (to September 10, 2008) | | | 3.48 | | | 1.41 | | | 386,000 | |

August 2008 | | | 4.65 | | | 3.19 | | | 579,800 | |

July 2008 | | | 7.50 | | | 3.55 | | | 680,500 | |

June 2008 | | | 8.42 | | | 6.50 | | | 258,300 | |

May 2008 | | | 8.75 | | | 7.40 | | | 192,000 | |

April 2008 | | | 8.79 | | | 7.63 | | | 287,800 | |

March 2008 | | | 10.66 | | | 7.89 | | | 360,400 | |

February 2008 | | | 10.57 | | | 8.89 | | | 174,700 | |

January 2008 | | | 11.99 | | | 9.55 | | | 230,300 | |

December 2007 | | | 12.20 | | | 8.10 | | | 271,200 | |

November 2007 | | | 13.80 | | | 11.00 | | | 238,500 | |

October 2007 | | | 13.55 | | | 10.79 | | | 336,900 | |

September 2007 | | | 12.20 | | | 8.78 | | | 277,300 | |

August 2007 | | | 11.89 | | | 8.32 | | | 279,700 | |

DESCRIPTION OF SECURITIES BEING OFFERED

Common Shares

Details regarding the Common Shares (including the Warrant Shares) can be found above under "Description of Share Capital — Common Shares".

Warrants

The specific terms relating to the Warrants qualified hereunder will be contained in the applicable prospectus supplement. This description will include, where applicable:

- •

- the designation and aggregate number of Warrants;

16

- •

- the price at which the Warrants will be offered;

- •

- the currency or currencies in which the Warrants will be offered;

- •

- the date on which the right to exercise the Warrants will commence and the date on which the right will expire;

- •

- the number of Common Shares that may be purchased upon exercise of each Warrant and the price at which and currency or currencies in which the Common Shares may be purchased upon exercise of each Warrant;

- •

- the designation and terms of any securities with which the Warrants will be offered, if any, and the number of the Warrants that will be offered with each such security;

- •

- the date or dates, if any, on or after which the Warrants and the related securities will be transferable separately;

- •

- whether the Warrants will be subject to redemption and, if so, the terms of such redemption provisions;

- •

- material Canadian and United States federal income tax consequences of owning the Warrants; and

- •

- any other material terms or conditions of the Warrants.

Warrants may be offered separately or together with other securities, as the case may be. Each series of Warrants may be issued under a separate warrant indenture or warrant agency agreement to be entered into between the Company and one or more banks or trust companies acting as warrant agent or may be issued as stand-alone contracts. The applicable prospectus supplement will include details of the warrant agreements, if any, governing the Warrants being offered. A copy of any warrant indenture or any warrant agency agreement relating to an offering of Warrants will be filed by the Company with the securities regulatory authorities in Canada and the United States after it has been entered into by the Company.

Units

The Company may issue Units comprised of one or more of the other Securities described in this short form base shelf prospectus in any combination. Each Unit will be issued so that the holder of the Unit is also the holder of each Security included in the Unit. Thus, the holder of a Unit will have the rights and obligations of a holder of each included Security. The unit agreement, if any, under which a Unit is issued may provide that the Securities included in the Unit may not be held or transferred separately, at any time or at any time before a specified date.

The particular terms and provisions of Units offered by any prospectus supplement, and the extent to which the general terms and provisions described below may apply thereto, will be described in the prospectus supplement filed in respect of such Units. This description will include, where applicable:

- •

- the designation and aggregate number of Units offered;

- •

- the price at which the Units will be offered;

- •

- if other than Canadian dollars, the currency or currency unit in which the Units are denominated;

- •

- the terms of the Units and of the Securities comprising the Units, including whether and under what circumstances those Securities may be held or transferred separately;

- •

- the number of Securities that may be purchased upon exercise of each Unit and the price at which and currency or currency unit in which that amount of Securities may be purchased upon exercise of each Unit;

- •

- any provisions for the issuance, payment, settlement, transfer or exchange of the Units or of the Securities comprising the Units; and

- •

- any other material terms, conditions and rights (or limitations on such rights) of the Units.

17

The Company reserves the right to set forth in a prospectus supplement specific terms of the Units that are not within the options and parameters set forth in this short form base shelf prospectus. In addition, to the extent that any particular terms of the Units described in a prospectus supplement differ from any of the terms described in this short form base shelf prospectus, the description of such terms set forth in this short form base shelf prospectus shall be deemed to have been superseded by the description of such differing terms set forth in such prospectus supplement with respect to such Units.

PLAN OF DISTRIBUTION

The Company may sell the Securities to or through underwriters or dealers, and, subject to applicable securities laws, may also sell the Securities to one or more other purchasers directly or through agents. Each prospectus supplement will set forth the terms of the offering, including the name or names of any underwriters or agents, the purchase price or prices of the Securities and the proceeds to the Company from the sale of the Securities.

The Securities may be sold from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices related to such prevailing market price or at prices to be negotiated with purchasers, as set forth in an accompanying prospectus supplement. The prices at which the Securities may be offered may vary as between purchasers and during the period of distribution. If, in connection with the offering of Securities at a fixed price or prices, the underwriters have made a bona fide effort to sell all of the Securities at the initial offering price fixed in the applicable prospectus supplement, and have been unable to do so, the public offering price may be decreased and thereafter further changed, from time to time, to an amount not greater than the initial public offering price fixed in such prospectus supplement, in which case the compensation realized by the underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Securities is less than the gross proceeds paid by the underwriters to the Company.

Underwriters, dealers or agents who participate in the distribution of the Securities may be entitled, under agreements to be entered into with the Company, to indemnification by the Company against certain liabilities, including liabilities under the U.S. Securities Act of 1933, as amended, and Canadian securities legislation, or to contribution with respect to payments which such underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for, the Company in the ordinary course of business.