UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year endedDecember 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to ______

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission file number:001-32399

BANRO CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Canada

(Jurisdiction of Incorporation of Organization)

1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Address of Principal Executive Offices)

Contact: Geoffrey G. Farr; Phone: (416) 366-2221; Fax: (416) 366-7722; Address: 1 First Canadian Place,

100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Class | Name of each exchange on which registered |

| Common Shares | NYSE MKT LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of December 31, 2014:

252,100,672 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting | Other [ ] |

| | Standards as issued by the International | |

| | Accounting Standards Board [X] | |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

[ ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

-ii-

BANRO CORPORATION - FORM 20-F

TABLE OF CONTENTS

-iii-

TABLE OF CONTENTS

(continued)

-iv-

TABLE OF CONTENTS

(continued)

-v-

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F ("Form 20-F") and the documents (or excerpts therefrom) incorporated by reference herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Actof 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws (such forward-looking statements and forward-looking information are referred to herein as "forward-looking statements"). Forward-looking statements are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. All statements, other than statements which are reporting results as well as statements of historical fact, that address activities, events or developments that Banro Corporation (the "Company" or "Banro") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of gold production, revenue, cash flow and costs, estimated project economics, mineral resource and mineral reserve estimates, potential mineralization, potential mineral resources and mineral reserves, projected timing of future gold production, the Company's exploration, development and production plans and objectives with respect to its projects, and the closing of the second Twangiza gold forward sale and the Namoya gold streaming transactions announced in the Company’s February 27, 2015 press release and the anticipated effect of the said transactions on the Company's operations and financial condition) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual events or results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual events or results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production and economic returns; uncertainties relating to the estimates and assumptions used in the economic studies of the Company's projects; the early stage of gold production at the Company’s Twangiza and Namoya mines; delay in achieving commercial gold production at the Company’s Namoya mine; the Company’s current level of indebtedness; failure to complete the second Twangiza gold forward sale and the Namoya gold streaming transactions announced in the Company’s February 27, 2015 press release;failure to establish estimated mineral resources or mineral reserves; fluctuations in gold prices and currency exchange rates; inflation; gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production); changes in equity markets; political developments in the Democratic Republic of the Congo (the "DRC"); lack of infrastructure; implementation of rules adopted by the U.S. Securities and Exchange Commission that may affect mining operations in the DRC; failure to procure or maintain, or delays in procuring or maintaining, permits and approvals; lack of availability at a reasonable cost or at all, of plants, equipment or labour; inability to attract and retain key management and personnel; changes to regulations or policies affecting the Company's activities; uncertainties relating to the availability and costs of financing in the future; the uncertainties involved in interpreting drilling results and other geological data; the Company's history of losses; the Company's ability to acquire additional commercially mineable mineral rights; risks related to the integration of any new acquisitions into the Company's existing operations; increased competition in the mining industry; and the other risks disclosed under the heading "Risk Factors" in this Form 20-F.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

-1-

The mineral resource and mineral reserve figures referred to in this Form 20-F are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the resource and reserve estimates included in this Form 20-F are well established, by their nature, resource and reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances. Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

Statements concerning actual mineral reserve and mineral resource estimates are also deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if (or as) the relevant project or property is developed (or mined). Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING

RESERVE AND RESOURCE ESTIMATES

This Form 20-F, including the documents (or excerpts therefrom) incorporated by reference herein, has been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Without limiting the foregoing, this Form 20-F, including the documents (or excerpts therefrom) incorporated by reference herein, uses the terms "measured", "indicated" and "inferred" resources. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the U.S. Securities and Exchange Commission (the "SEC") does not recognize them. Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the "inferred resources" will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report mineral deposits that do not constitute "reserves" as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this Form 20-F or in the documents (or excerpts therefrom) incorporated by reference, may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

National Instrument 43-101 -Standards of Disclosure for Mineral Projects("NI 43-101") is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this Form 20-F have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ significantly from the requirements of the SEC, and reserve and resource information contained herein and incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. One consequence of these differences is that "reserves" calculated in accordance with Canadian standards may not be "reserves" under the SEC standards.

-2-

U.S. investors are urged to closely consider all of the disclosures in this Form 20-F and other reports filed pursuant to the United StatesSecurities Exchange Act of 1934, as amended, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

CURRENCY

All dollar amounts in this Form 20-F are expressed in United States dollars, except as otherwise indicated. References to "$" or "US$" are to United States dollars and references to "Cdn$" are to Canadian dollars, except as otherwise indicated. For reporting purposes, the Company prepares its financial statements in United States dollars and in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

-3-

PART 1

Item 1. Identity of Directors, Senior Management and Advisors

This Form 20-F is being filed as an annual report under the United StatesSecurities Exchange Act of 1934, as amended, (the "U.S. Exchange Act") and, as such, there is no requirement to provide any information under this item.

Item 2. Offer Statistics and Expected Timetable

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

Item 3. Key Information

A. Selected Financial Data

The selected consolidated financial information set forth below for each of the five years ended December 31, 2014, 2013, 2012, 2011 and 2010, which is expressed in United States dollars (the Company prepares its financial statements in United States dollars), has been derived from the Company's audited consolidated financial statements as at and for the financial years ended December 31, 2014, 2013, 2012, 2011 and 2010. These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board, which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with generally accepted accounting principles in the United States. The selected consolidated financial information should be read in conjunction with the information in Item 5 and item 18 of this Form 20-F. Historical results from any prior period are not necessarily indicative of results to be expected for any future period.

| | | (in $000 except share data) | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | |

| Operating revenue | $ | 125,436 | | $ | 111,808 | | $ | 42,631 | | $ | - | | $ | - | |

| | | | | | | | | | | | | | | | |

| Net income (loss) from operations | | 16,380 | | | 11,792 | | | (2,420 | ) | | (10,168 | ) | | (9,756 | ) |

| | | | | | | | | | | | | | | | |

| Income (loss) for the year | | 320 | | | 1,630 | | | (4,561 | ) | | (9,325 | ) | | (2,276 | ) |

| | | | | | | | | | | | | | | | |

| Comprehensive income (loss) for the year | | 700 | | | 1,535 | | | (4,526 | ) | | (9,450 | ) | | (2,878 | ) |

| | | | | | | | | | | | | | | | |

| Basic and diluted net income (loss) per share | | 0.00 | | | 0.01 | | | (0.02 | ) | | (0.05 | ) | | (0.02 | ) |

| | | | | | | | | | | | | | | | |

| Current assets | | 43,320 | | | 53,718 | | | 60,631 | | | 12,187 | | | 79,707 | |

| | | | | | | | | | | | | | | | |

| Total assets | | 887,482 | | | 822,033 | | | 635,787 | | | 429,141 | | | 337,369 | |

| | | | | | | | | | | | | | | | |

| Current liabilities | | 111,317 | | | 127,010 | | | 57,040 | | | 39,364 | | | 12,074 | |

| | | | | | | | | | | | | | | | |

| Total liabilities | | 394,978 | | | 331,049 | | | 212,502 | | | 40,131 | | | 12,074 | |

| | | | | | | | | | | | | | | | |

| Net assets | | 492,504 | | | 490,984 | | | 423,285 | | | 389,010 | | | 325,295 | |

| | | | | | | | | | | | | | | | |

| Share capital | | 518,615 | | | 518,615 | | | 456,738 | | | 440,738 | | | 373,945 | |

| | | | | | | | | | | | | | | | |

| Total shareholders' equity | | 492,504 | | | 490,984 | | | 423,285 | | | 389,010 | | | 325,295 | |

| | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding (in thousands) | | 252,101 | | | 236,278 | | | 200,607 | | | 190,015 | | | 147,325 | |

-4-

Exchange Rates

On March 20, 2015, the buying rate in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York, was US$1.00 = Cdn$1.2593. The following table sets forth, for each of the years or, as applicable, months indicated, additional information with respect to the noon buying rate for US$1.00 in Canadian dollars and are based upon the rates quoted by the Federal Reserve Bank of New York.

| Rate | 2014 | 2013 | 2012 | 2011 | 2010 |

| Average(1) | 1.1083 | 1.03467 | 0.9996 | 0.9858 | 1.0353 |

__________________________

(1) The average rate means the average of the exchange rates on the last day of each month during the year.

| | October | November | December | January | February | March |

| Rate | 2014 | 2014 | 2014 | 2015 | 2015 | 2015(1) |

| High | 1.1291 | 1.1426 | 1.1644 | 1.2716 | 1.2635 | 1.2803 |

| Low | 1.1150 | 1.1237 | 1.1343 | 1.1725 | 1.2401 | 1.2439 |

__________________________

(1) Provided for the period from March 1, 2015 to March 20, 2015.

B. Capitalization and Indebtedness

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

C. Reason for the Offer and Use of Proceeds

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

D. Risk Factors

There are a number of risks that may have a material and adverse impact on the future operating and financial performance of Banro and could cause the Company's operating and financial performance to differ materially from the estimates described in forward-looking statements relating to the Company. These include widespread risks associated with any form of business and specific risks associated with Banro's business and its involvement in the gold exploration, development and mining industry.

An investment in the Company's common shares is considered speculative and involves a high degree of risk due to, among other things, the nature of Banro's business (which is the mining, development and exploration of gold properties) the present stage of its development and the location of Banro's projects in the DRC. In addition to the other information presented in this Form 20-F, a prospective investor should carefully consider the risk factors set out below and the other information that Banro files with the SEC and with Canadian securities regulators before investing in the Company's common shares. The Company has identified the following non-exhaustive list of inherent risks and uncertainties that it considers to be relevant to its operations and business plans. Such risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. As well, while the following sets out the material risk factors which the Company is aware of, there may be additional risks that the Company is unaware of or that are currently believed to be immaterial that may become important factors that affect the Company's business.

-5-

The assets and operations of Banro are subject to political, economic and other uncertainties as a result ofbeing located in the DRC.

Banro's projects are located in the DRC. The assets and operations of the Company are therefore subject to various political, economic and other uncertainties, including, among other things, the risks of war and civil unrest, expropriation, nationalization, renegotiation or nullification of existing licenses, permits, approvals and contracts, taxation policies, foreign exchange and repatriation restrictions, changing political conditions, international monetary fluctuations, currency controls and foreign governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. Changes, if any, in mining or investment policies or shifts in political climate in the DRC may adversely affect Banro's operations. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights, could result in loss, reduction or expropriation of entitlements. In addition, in the event of a dispute arising from operations in the DRC, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in Canada. The Company also may be hindered or prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. It is not possible for the Company to accurately predict such developments or changes in laws or policy or to what extent any such developments or changes may have a material adverse effect on the Company's operations. There are also risks associated with the enforceability of the Company's mining convention with the DRC and the government of the DRC could choose to review the Company's titles at any time. Should the Company's rights, its mining convention or its titles not be honoured or become unenforceable for any reason, or if any material term of these agreements is arbitrarily changed by the government of the DRC, the Company's business, financial condition and prospects will be materially adversely affected.

Some or all of the Company's properties are located in regions where political instability and violence is ongoing (for example, in November 2012, the M23 rebel group took over the city of Goma (Banro's operations are located about 200 kilometres southwest of Goma), but subsequently withdrew from Goma under international pressure). Some or all of the Company's properties are inhabited by artisanal miners. These conditions may interfere with work on the Company's properties and present a potential security threat to the Company's employees. There is a risk that operations of the Company may be delayed or interfered with, due to the conditions of political instability, violence and the inhabitation of the properties by artisanal miners. The Company uses its best efforts to maintain good relations with the local communities in order to minimize such risks.

The DRC is a developing nation which recently emerged from a period of civil war and conflict. Physical and institutional infrastructure throughout the DRC is in a debilitated condition. The DRC is in transition from a largely state controlled economy to one based on free market principles, and from a non-democratic political system with a centralized ethnic power base, to one based on more democratic principles. There can be no assurance that these changes will be effected or that the achievement of these objectives will not have material adverse consequences for Banro and its operations. The DRC continues to experience instability in parts of the country due to certain militia and criminal elements. While the government and United Nations forces are working to support the extension of central government authority throughout the country, there can be no assurance that such efforts will be successful.

-6-

No assurance can be given that the Company will be able to maintain effective security in connection with its assets or personnel in the DRC where civil war and conflict have disrupted exploration and mining activities in the past and may affect the Company's operations or plans in the future.

HIV/AIDS, malaria and other diseases represent a serious threat to maintaining a skilled workforce in the mining industry in the DRC. HIV/AIDS is a major healthcare challenge faced by the Company's operations in the country. There can be no assurance that the Company will not lose members of its workforce or workforce man-hours or incur increased medical costs, which may have a material adverse effect on the Company's operations.

The DRC has historically experienced relatively high rates of inflation.

No assurances can be given regarding the Company’s future production.

As is typically the case with the mining industry, no assurances can be given that future gold production estimates will be achieved. Estimates of future production for the Company’s mining operations are derived from the Company’s mining plans. These estimates and plans are subject to change. The Company cannot give any assurance that it will achieve its production estimates. The Company’s failure to achieve its production estimates could have a material and adverse effect on the Company’s future cash flows, results of operations, production cost, financial condition and prospects. The plans are developed based on, among other things, mining experience, reserve estimates, assumptions regarding ground conditions, hydrologic conditions and physical characteristics of ores (such as hardness and presence or absence of certain metallurgical characteristics) and estimated rates and costs of production. Actual production may vary from estimates for a variety of reasons, including risks and hazards of the types discussed above, and as set out below, including:

- equipment failures;

- shortages of principal supplies needed for operations;

- natural phenomena such as inclement weather conditions, floods, droughts, rock slides and earthquakes;

- accidents;

- mining dilution;

- encountering unusual or unexpected geological conditions;

- changes in power costs and potential power shortages;

- strikes and other actions by labour; and

- regulatory restrictions imposed by government agencies.

Such occurrences could, in addition to stopping or delaying gold production, result in damage to mineral properties, injury or death to persons, damage to the Company’s property or the property of others, monetary losses and legal liabilities. These factors may also cause a mineral deposit that has been mined profitably in the past to become unprofitable. Estimates of production from properties not yet in production or from operations that are to be expanded are based on similar factors (including, in some instances, feasibility studies prepared by the Company’s personnel and outside consultants) but it is possible that actual operating costs and economic returns will differ significantly from those currently estimated. It is not unusual in new mining operations or mine expansion to experience unexpected problems during the start-up phase. Delays often can occur in the commencement of production.

-7-

The Company may be adversely affected by fluctuations in gold prices.

The future price of gold will significantly affect the development of Banro's projects and results of its mining operations. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond Banro's control. Such factors include, but are not limited to, interest rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold has fluctuated widely in recent years, and future price declines could cause development of and commercial production from Banro's mineral interests to be impracticable. If the price of gold decreases, projected cash flow from planned mining operations may not be sufficient to justify ongoing operations and Banro could be forced to discontinue development and sell its projects. Future production from Banro's projects is dependent on gold prices that are adequate to make these projects economic.

Mineral reserve calculations and life-of-mine plans using lower gold prices could result in material write-downs of the Company’s investment in mining properties and increased amortization, reclamation and closure charges.

As fuel costs are a significant component of the Company’s operating costs, changes in the price of diesel could have a significant effect on the Company’s operating costs.

Risks Related to the Notes Issued under the Debt Financing and Other Financial Obligations

The Company’s substantial indebtedness could adversely affect the Company’s financial condition.

In March 2012 the Company closed a US$175 million debt financing involving an issuance of notes (the "2012 Notes") (see item 10.B. of this Form 20-F). As well, during 2013 and 2014 the Company secured additional short term loans (the "Short Term Loans") from several lenders. The Company therefore has a significant amount of indebtedness. The Company’s high level of indebtedness could have important adverse consequences, including:

- limiting the Company’s ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements;

- requiring a substantial portion of the Company’s cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes;

- increasing the Company’s vulnerability to general adverse economic and industry conditions;

- limiting the Company’s flexibility in planning for and reacting to changes in the industry in which it competes;

- placing the Company at a disadvantage compared to other, less leveraged competitors; and

- increasing the cost of borrowing.

The Company may not be able to generate sufficient cash to service all of its indebtedness (including the 2012 Notes and the Short Term Loans) and obligations with respect to outstanding preferred shares, and may be forced to take other actions to satisfy its obligations under such indebtedness or with respect to such preferred shares, which may not be successful.

The Company’s ability to make scheduled payments on or refinance the Company’s debt obligations (including the 2012 Notes and the Short Term Loans) and to make payments with respect to outstanding preferred and preference shares (see item 10.B. of this Form 20-F regarding the outstanding preferred and preference shares (collectively, the "preferred shares") of the Company and certain of its subsidiaries) depends on its financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond its control. The Company may be unable to maintain a level of cash flows from operating activities sufficient to permit it to pay the principal, premium, if any, and interest on its indebtedness or to make required payments with respect to outstanding preferred shares.

-8-

If the Company’s cash flows and capital resources are insufficient to fund its debt service obligations or required preferred share payments, the Company could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance the Company’s indebtedness. Banro may not be able to effect any such alternative measures on commercially reasonable terms or at all and, even if successful, those alternatives may not allow the Company to meet its scheduled financial obligations. The indenture under which the 2012 Notes were issued (the "Note Indenture") restricts the Company’s ability to dispose of assets and use the proceeds from those dispositions and may also restrict the Company’s ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. The Company may not be able to consummate those dispositions or to obtain proceeds in an amount sufficient to meet any financial obligations then due.

In addition, Banro is a holding company, and as such it conducts all operations through subsidiaries. Accordingly, repayment of indebtedness (including the 2012 Notes and the Short Term Loans) and payments in relation to preferred shares are dependent on the generation of cash flow by subsidiaries and their ability to make cash available to make such payments. Banro’s subsidiaries may not be able to, or may not be permitted to, make distributions to enable such payments to be made. Each subsidiary is a distinct legal entity, and, under certain circumstances, legal and contractual restrictions may limit the ability to obtain cash from subsidiaries. In the event that distributions are not received from subsidiaries, it may not be possible to make required principal and interest payments on indebtedness or payments with respect to preferred shares.

Banro’s inability to generate sufficient cash flows to satisfy its debt or preferred share obligations, or to refinance the Company’s indebtedness on commercially reasonable terms or at all, would materially and adversely affect the Company’s financial position and results of operations and its ability to satisfy its financial obligations.

If the Company cannot make scheduled payments on its debt, the Company will be in default and holders of the 2012 Notes could declare all outstanding principal and interest to be due and payable, causing a cross-acceleration or cross-default under certain of the Company’s other debt agreements, and the Company could be forced into bankruptcy or liquidation. The Company could also be forced into bankruptcy or liquidation if required payments with respect to preferred shares are not made.

The terms of the Note Indenture restrict the Company’s current and future operations, particularly the Company’s ability to respond to changes or to take certain actions.

The Note Indenture contains a number of restrictive covenants that impose significant operating and financial restrictions on the Company and may limit the Company’s ability to engage in acts that may be in its long-term best interest, including restrictions on the Company’s ability to:

- incur additional indebtedness;

- pay dividends or make other distributions or repurchase or redeem capital stock;

- prepay, redeem or repurchase certain debt;

- make loans and investments;

- sell assets;

- incur liens;

- enter into transactions with affiliates;

- alter the businesses it conducts;

- enter into agreements restricting its subsidiaries’ ability to pay dividends; and

-9-

- consolidate, amalgamate, merge or sell all or substantially all of its assets.

A breach of the covenants under the Note Indenture or the Company’s other debt instruments from time to time could result in an event of default under the applicable indebtedness. Such a default may allow the creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In the event the noteholders or lenders accelerate the repayment of the Company’s borrowings, Banro may not have sufficient assets to repay that indebtedness.

As a result of these restrictions, Banro may be:

- limited in how it conducts its business;

- unable to raise additional debt or equity financing to operate during general economic or business downturns; or

- unable to compete effectively or to take advantage of new business opportunities.

These restrictions may affect the Company’s ability to grow in accordance with its strategy.

The Company must rely on expatriates and third-party nationals to operate its mines.

The Company’s Twangiza mine was the first new commercial gold mining operation in the DRC in over 50 years. As a result, the Company is reliant on attracting and retaining expatriate and third-party nationals with mining experience to staff key operations and administration management positions. The Company’s inability to attract and retain personnel with the skills and experience to manage the operation and train and develop staff, due to the intense international competition for such individuals, may adversely affect its business and future operations.

The Company will need to continuously add to its mineral reserve base.

Given that mines have limited lives based on proven and probable mineral reserves, the Company must continually replace and expand its reserves at its mines. The life-of-mine estimates included in the Company’s continuous disclosure documents filed on SEDAR and EDGAR are subject to adjustment. The Company’s ability to maintain or increase its annual production of gold will be dependent in significant part on its ability to bring new mines into production and to expand reserves at existing mines.

Relations between the Company and its employees may be impacted by changes in labour relations.

The Company is dependent on its workforce to extract and process minerals, and is therefore sensitive to a labour disruption of the Company's mining activities. The Company endeavours to maintain good relations with its workforce in order to minimize the possibility of strikes, lock-outs and other stoppages at its work sites. Relations between the Company and its employees may be impacted by changes in labour relations which may be introduced by, among other things, employee groups, unions, and the relevant governmental authorities.

The Company is subject to risks and delays related to the construction and start-up of new mines and of theexpansion of existing mines.

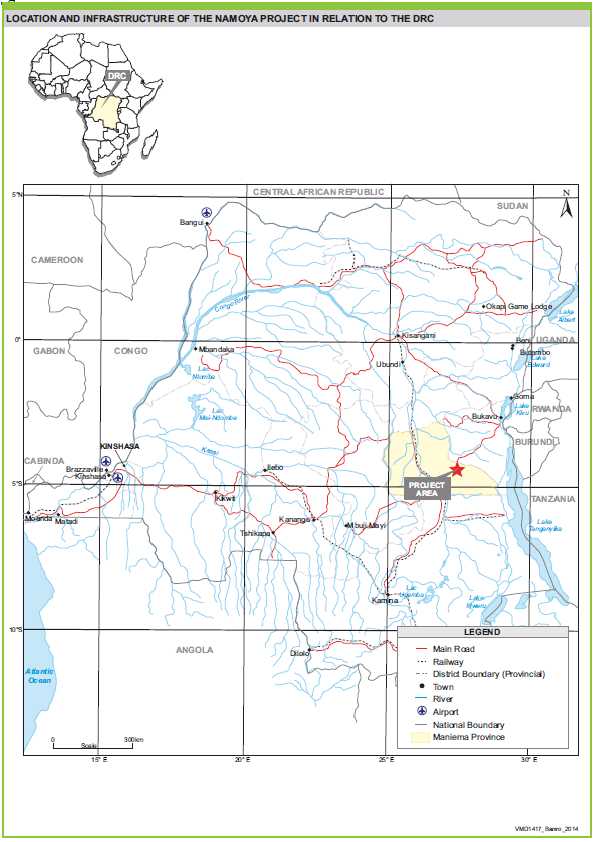

The Company anticipates reaching commercial production levels at its second mine, at Namoya, early in the second half of 2015 and its first mine, at Twangiza, completed a plant upgrade in 2014. The success of construction projects, plant expansions and the start-up of new mines by the Company is subject to a number of factors including the availability and performance of engineering and construction contractors, suppliers and consultants, the receipt of required governmental approvals and permits in connection with the construction of mining facilities and the conduct of mining operations, including environmental permits, price escalation on all components of construction and start-up, the underlying characteristics, quality and unpredictability of the exact nature of mineralogy of a deposit and the consequent accurate understanding of dore or concentrate production, the successful completion and operation of ore passes and conveyors to move ore and other operational elements. Any delay in the performance of any one or more of the contractors, suppliers, consultants or other persons on which the Company is dependent in connection with its construction activities, a delay in or failure to receive the required governmental approvals and permits in a timely manner or on reasonable terms, or a delay in or failure in connection with the completion and successful operation of the operational elements in connection with new mines could delay or prevent the construction and start-up of new mines as planned. There can be no assurance that current or future construction and start-up plans implemented by the Company will be successful.

-10-

The SEC has Adopted Rules That May Affect Mining Operations in the DRC

The Company’s business is subject to evolving corporate governance and public disclosure regulations that have increased both the Company’s compliance costs and the risk of noncompliance, which could have an adverse effect on the Company’s stock price.

The Company is subject to changing rules and regulations promulgated by a number of United States and Canadian governmental and self-regulated organizations, including the SEC, the Canadian Securities Administrators, the New York Stock Exchange, the Toronto Stock Exchange, and the International Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity and many new requirements have been created in response to laws enacted by the United States Congress, making compliance more difficult and uncertain. For example, on July 21, 2010, the United States Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which resulted in the SEC adopting rules that will require the Company to disclose on an annual basis certain payments made by the Company, its subsidiaries or entities controlled by it, to the U.S. government and foreign governments, including sub-national governments. The SEC has also adopted rules under the Dodd Frank Act that will require a company filing reports with the SEC to disclose on an annual basis, beginning in 2014, whether certain “conflict minerals” necessary to the functionality or production of a product manufactured by such company originated in the DRC or any adjoining country. The Company currently holds properties located in the DRC. It is possible that the new SEC rules regarding conflict minerals could adversely affect the value of the minerals mined in the DRC, which may impact the value of the Company’s interests in those properties. The Company’s efforts to comply with the Dodd-Frank Act, the rules and regulations promulgated thereunder, and other new rules and regulations have resulted in, and are likely to continue to result in, increased general and administration expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

-11-

The Company has no history of profitability with respect to its development properties

The Company's properties are in the exploration or development stage, other than the Company’s first mine in commercial production at Twangiza. The development of properties found to be economically feasible requires the construction and operation of mines, processing plants and related infrastructure. As a result, Banro is subject to all of the risks associated with establishing new mining operations and business enterprises including: the timing and cost, which can be considerable, of the construction of mining and processing facilities; the availability and costs of skilled labour and mining equipment; the availability and costs of appropriate smelting and/or refining arrangements; the need to obtain necessary environmental and other governmental approvals and permits, and the timing of those approvals and permits; and, the availability of funds to finance construction and development activities. The costs, timing and complexities of mine construction and development are increased by the remote location of the Company's properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that the Company's activities at one of its development projects will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce gold at one of its development projects.

The Company’s activities are subject to various laws and government approvals and no assurance can be giventhat the Company will be successful in obtaining or maintaining such approvals or that it will successfullycomply with all applicable laws.

Banro's mineral exploration, development and mining activities are subject to various laws governing prospecting, mining, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although Banro's exploration, development and mining activities are currently carried out in accordance with applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail development.

Many of Banro's mineral rights and interests are subject to government approvals, licenses and permits. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of the DRC government. No assurance can be given that Banro will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are not maintained, Banro may be delayed, curtailed or prohibited from continuing or proceeding with planned exploration, development or mining of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be delayed or curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in the exploration, development or mining of mineral properties may be required to compensate those suffering loss or damage by reason of the activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on Banro and cause increases in expenses, capital expenditures or require abandonment or delays in development of mineral interests.

-12-

Most of the Company’s properties are in the exploration and development stage, and there can be no assurancethat these activities will result in commercially viable properties.

The Company's properties are in the exploration or development stage, other than the Company’s first mine in commercial production at Twangiza. The exploration for and development of mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures are required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit, once discovered, will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Banro not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Banro towards the search for and evaluation of mineral deposits will result in discoveries that are commercially viable. In addition, in the case of a commercial ore-body, depending on the type of mining operation involved, several years can elapse from the initial phase of drilling until commercial operations are commenced.

Exploration, development and mining involve a high degree of risk.

Mining operations generally involve a high degree of risk. Such operations are subject to all the hazards and risks normally encountered in the exploration for, and development and production of gold and other precious or base metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, fires, cave-ins, flooding and other conditions involved in the drilling and removal of material as well as industrial accidents, labour force disruptions, fall of ground accidents in underground operations, unanticipated increases in gold lockup and inventory levels at heap-leach operations and force majeure factors, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to person or property, environmental damage, delays, increased production costs, monetary losses and possible legal liability. Milling operations are subject to hazards such as equipment failure or failure of mining pit slopes and retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to the Company or to other companies within the mining industry. The Company may suffer a material adverse effect on its business if it incurs losses related to any significant events that are not covered by insurance policies.

There can be no assurance that an active market for the Company’s securities will be sustained.

The market price of the Company's securities may fluctuate significantly based on a number of factors, some of which are unrelated to the financial performance or prospects of the Company. These factors include macroeconomic developments in North America and globally, market perceptions of the attractiveness of particular industries, short-term changes in commodity prices, other precious metal prices, the attractiveness of alternative investments, currency exchange fluctuation, the political environment in the DRC and the Company's financial condition or results of operations as reflected in its financial statements. Other factors unrelated to the performance of the Company that may have an effect on the price of the securities of the Company include the following: the extent of analytical coverage available to investors concerning the business of the Company may be limited if investment banks with research capabilities do not follow the Company's securities; lessening in trading volume and general market interest in the Company's securities may affect an investor's ability to trade significant numbers of securities of the Company; the size of the Company's public float may limit the ability of some institutions to invest in the Company's securities; the Company's operating performance and the performance of competitors and other similar companies; the public's reaction to the Company's press releases, other public announcements and the Company's filings with the various securities regulatory authorities; changes in estimates or recommendations by research analysts who track the Company's securities or the shares of other companies in the resource sector; the arrival or departure of key personnel; acquisitions, strategic alliances or joint ventures involving the Company or its competitors; the factors listed in this Form 20-F under the heading "Cautionary Statement Regarding Forward-Looking Statements"; and a substantial decline in the price of the securities of the Company that persists for a significant period of time could cause the Company's securities to be delisted from any exchange on which they are listed at that time, further reducing market liquidity. If there is no active market for the securities of the Company, the liquidity of an investor's investment may be limited and the price of the securities of the Company may decline. If such a market does not develop, investors may lose their entire investment in the Company's securities.

-13-

The Company will require a significant amount of funds in order to carry out plans to fully develop all ofitsprojects and there can be no assurance that such funds will be available to the Company.

The Company has only a short history of commercial mining operations (the Company’s first mine at Twangiza commenced commercial production on September 1, 2012; the Company anticipates reaching commercial production levels at its second mine, at Namoya, early in the second half of 2015), and there is no assurance that it will operate profitably or provide a return on investment in the future. The Company's ability to continue as a going concern is dependent upon its ability to generate or secure the funds necessary to meet its obligations and repay liabilities arising from normal business operations when they come due.

The Company will require a significant amount of funds in order to carry out plans to fully develop all of its projects. There can be no assurance that such funds will be available to the Company. If additional financing is raised through the issuance of equity or convertible debt securities of the Company, the interests of the Company's shareholders in the net assets of the Company may be diluted. Any failure of the Company to generate the required funding could have a material adverse effect on the Company's financial condition, results of operations, liquidity, and its ability to continue as a going concern, and may require the Company to cancel or postpone planned capital expenditures.

A holder of shares or warrants may suffer adverse U.S. federal income tax consequences if the Company isdetermined to be a passive foreign investment company or "PFIC"

The Company believes it should not be classified as a "passive foreign investment company" ("PFIC") for its tax year ended December 31, 2014. However, the Company believes that it was classified as a PFIC for its tax year ended December 31, 2011 and in prior tax years. Whether the Company will be a PFIC for the current or future tax year will depend on the Company's assets and income over the course of each such tax year and, as a result, cannot be predicted with certainty as of the date of this Form 20-F. Accordingly, there can be no assurance that the Internal Revenue Service will not challenge the determination made by the Company concerning its PFIC status for any tax year. U.S. federal income tax laws contain rules which result in materially adverse tax consequences to U.S. taxpayers that own shares of a corporation which has been classified as a PFIC during any tax year of such holder's holding period. A U.S. taxpayer who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC may mitigate such negative tax consequences by making certain U.S. federal income tax elections, which are subject to numerous restrictions and limitations. Holders of the Company's sharesand warrants are urged to consult their own tax advisors regarding the acquisition, ownership, and disposition of the Company's sharesand warrants.

-14-

The Company's projects are located in remote areas of the DRC, which lack basic infrastructure.

The Company's projects are located in remote areas of the DRC, which lack basic infrastructure, including sources of power, water, housing, food and transport. In order to develop any of its projects Banro needs to establish the facilities and material necessary to support operations in the remote locations in which they are situated. The remoteness of each project affects the potential viability of mining operations, as Banro also needs to establish substantially greater sources of power, water, physical plant and transport infrastructure than are present in the area. The transportation of equipment and supplies into the DRC and the transportation of resources out of the DRC may also be subject to delays that adversely affect the ability of the Company to proceed with its mineral projects in the country in a timely manner. Shortages of the supply of diesel, mechanical parts and other items required for the Company's operations could have an adverse effect on the Company's business, operating results and financial condition. The lack of availability of such sources may adversely affect mining feasibility and, in any event, requires Banro to arrange significant financing, locate adequate supplies and obtain necessary approvals from national, provincial and regional governments, none of which can be assured. The Company's interests in the DRC are accessed over lands that may also be subject to the interests of third parties which may result in further delays and disputes in the carrying out of the Company's operational activities.

There is uncertainty in the estimation of mineral reserves and mineral resources.

The mineral resource and mineral reserve figures referred to in this Form 20-F and in the Company's filings with the SEC and applicable Canadian securities regulatory authorities, press releases and other public statements that may be made from time to time are estimates. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. There can be no assurance that these estimates will be accurate or that this mineralization could be mined or processed profitably.

The Company has not commenced commercial production on any of its properties other than Twangiza, and has not defined or delineated any proven or probable reserves on any of its properties other than Twangiza and Namoya. Mineralization estimates for the Company's properties may require adjustments or downward revisions based upon further exploration or development work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The resource and reserve estimates referred to in this Form 20-F have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in the market price for gold may render portions of the Company's mineralization uneconomic and result in reduced reported mineralization. Any material reductions in estimates of mineralization, or of the Company's ability to extract this mineralization, could have a material adverse effect on the Company's results of operations or financial condition.

The Company has not established the presence of any proven or probable reserves at any of its properties other than Twangiza and Namoya. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on such properties. The failure to establish proven and probable reserves on such properties could severely restrict the Company's ability to successfully implement its strategies for long-term growth.

There is uncertainty relating to inferred mineral resources.

There is a risk that the inferred mineral resources referred to in this Form 20-F cannot be converted into mineral reserves as the ability to assess geological continuity is not sufficient to demonstrate economic viability. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration.

-15-

The Company is exposed to a heightened degree of risk due to the lack of property diversification.

The Twangiza, Lugushwa, Namoya and Kamituga properties account for the Company's principal mineral properties. Any adverse development affecting the progress of any of these properties may have a material adverse effect on the Company's financial performance and results of operations.

Negative market perception of junior gold companies could adversely affect the Company.

Market perception of junior gold companies such as the Company may shift such that these companies are viewed less favourably. This factor could impact the value of investors' holdings and the ability of the Company to raise further funds, which could have a material adverse effect on the Company's business, financial condition and prospects.

The Company is not insured to cover all potential risks.

Although the Company maintains insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with a mining company’s operations. The Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability

If the Company fails to maintain an effective system of internal control, the Company may not be able to accurately report financial results or prevent fraud.

Effective internal controls are necessary to provide reliable financial reports and to assist the effective prevention of fraud. The Company must annually evaluate its internal control procedures to satisfy the requirements of applicable United States and Canadian securities laws, which require management and, in the case of U.S. securities laws, auditors to assess the effectiveness of internal controls. As further described in item 15 of this Form 20-F, management has concluded that, because of material weaknesses in information technology general controls and in the internal controls over financial reporting relating to the presentation and review of the statement of cash flow and sufficiency of documentary evidence supporting the precision of review over the completeness and accuracy of inputs, assumptions and formulas included in the impairment models, the Company’s disclosure controls and procedures were not effective as of December 31, 2014. If the Company fails to correct these material weaknesses in its internal controls, or having corrected such material weaknesses, thereafter fails to maintain the adequacy of its internal controls, the Company could be subjected to regulatory scrutiny, penalties or litigation. In addition, continued or future failure to maintain adequate internal controls could result in financial statements that do not accurately reflect the Company’s financial condition.

The Company’s operations may be adversely affected by environmental hazards on the properties and relatedenvironmental regulations.

All phases of Banro's operations are subject to environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on behalf of the Company and may cause material changes or delays in the Company's intended activities. There is no assurance that future changes in environmental regulation, if any, will not adversely affect Banro's operations. Environmental hazards may exist on the properties on which Banro holds interests which are unknown to Banro at present and which have been caused by previous owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required. Banro has acquired its principal mineral properties through a cession from Société Zaïroise Minière et Industrielle du Kivu S.A.R.L. ("SOMINKI"). As such, Banro will be liable to the DRC State for any environmental damage caused by SOMINKI as previous owner and operator of such properties.

There are difficulties for investors in foreign jurisdictions in bringing actions and enforcing judgments

The Company is organized under the laws of Canada and its principal executive office is located in Toronto, Canada. All of the Company's directors and executive officers, and all of the experts referred to in this Form 20-F, reside outside of the United States, and all or a substantial portion of their assets, and a substantial portion of the Company's assets, are located outside of the United States. As a result, it may be difficult for investors in the United States or otherwise outside of Canada to bring an action against directors, officers or experts who are not resident in the United States or in other jurisdictions outside Canada. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions outside Canada against those persons or the Company.

-16-

There is uncertainty regarding the Company’s ability to acquire additional commercially mineable mineralrights.

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any anticipated level of recovery of ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of reserves, resources, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

Banro's future growth and productivity will depend, in part, on its ability to identify and acquire additional commercially mineable mineral rights, and on the costs and results of continued exploration and development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to: establish ore reserves through drilling and metallurgical and other testing techniques; determine metal content and metallurgical recovery processes to extract metal from the ore; and construct, renovate or expand mining and processing facilities.

In addition, upon an ore discovery, it takes several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional commercially mineable (or viable) mineral rights.

Litigation may adversely affect the Company’s financial position, results of operations or the Company’sproject development operations.

The Company may from time to time be involved in various legal proceedings. While the Company believes it is unlikely that the final outcome of any such proceedings will have a material adverse effect on the Company's financial position or results of operation, defence and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, there can be no assurance that the resolution of any particular legal matter will not have a material adverse effect on the Company's future cash flow, results of operations or financial condition.

Future hedging activities may result in selling products at a price lower than could have otherwise beenreceived.

The Company has entered into forward contracts to sell gold that it expects to produce in the future, and may do so again in the future. Forward contracts obligate the holder to sell hedged production at a price set when the holder enters into the contract, regardless of what the price is when the product is actually mined. Accordingly, there is a risk that the price of the product is higher at the time it is mined than when the Company entered into the contracts, so that the product must be sold at a price lower than could have been received if the contract was not entered. There is also the risk that the Company may have insufficient gold production to deliver into forward sales positions. The Company may enter into option contracts for gold to mitigate the effects of such hedging.

-17-

Increased sales of the Company’s common shares by shareholders could lower the trading price of the shares.

Sales of a large number of the Company's common shares in the public markets, or the potential for such sales, could decrease the trading price of such shares and could impair Banro's ability to raise capital through future sales of common shares.

Fluctuations in currency could have a material impact on the Company’s financial statements.

The Company uses the United States dollar as its functional currency. Fluctuations in the value of the United States dollar relative to other currencies (including the Canadian dollar) could have a material impact on the Company's consolidated financial statements by creating gains or losses. No currency hedge policies are in place or are presently contemplated.

The loss of key management personnel or the inability to recruit additional qualified personnel may adverselyaffect the Company’s business.

The success of the Company depends on the good faith, experience and judgment of the Company's management and advisors in supervising and providing for the effective management of the business and the operations of the Company. The Company is dependent on a relatively small number of key personnel, the loss of any one of whom could have an adverse effect on the Company. The Company currently does not have key person insurance on these individuals. The Company may need to recruit additional qualified personnel to supplement existing management and there is no assurance that the Company will be able to attract such personnel.

The Company may not be able to compete with current and potential gold companies, some of whom havegreater resources and technical facilities.

The natural resource industry is intensely competitive in all of its phases. Significant competition exists for the acquisition of properties producing, or capable of producing, gold or other metals. The Company competes with many companies possessing greater financial resources and technical facilities than itself. The Company may also encounter increasing competition from other mining companies in its efforts to hire experienced mining professionals. As well, there is competition for exploration resources at all levels, particularly affecting the availability of manpower, drill rigs and helicopters. Increased competition could also adversely affect the Company's ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Certain directors and officers may be in a position of conflict of interest with respect to the Company due totheir relationship with other resource companies.

A number of directors and officers of the Company also serve as directors and/or officers of other companies involved in the mineral resource industry. As a result, conflicts may arise between the obligations of these individuals to the Company and to such other companies.

Item 4. Information on the Company

A. History and Development of the Company

Banro’s head office and registered office is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada, and its telephone number is (416) 366-2221. The Company was incorporated under theCanada Business Corporations Act (the "CBCA") on May 3, 1994 by articles of incorporation. Pursuant to articles of amendment effective May 7, 1996, the name of the Company was changed from Banro International Capital Inc. to Banro Resource Corporation. The Company was continued under the OntarioBusiness Corporations Actby articles of continuance effective on October 24, 1996. By articles of amendment effective on January 16, 2001, the name of the Company was changed to Banro Corporation. The Company was continued under the CBCAby articles of continuance dated April 2, 2004.

-18-

Background

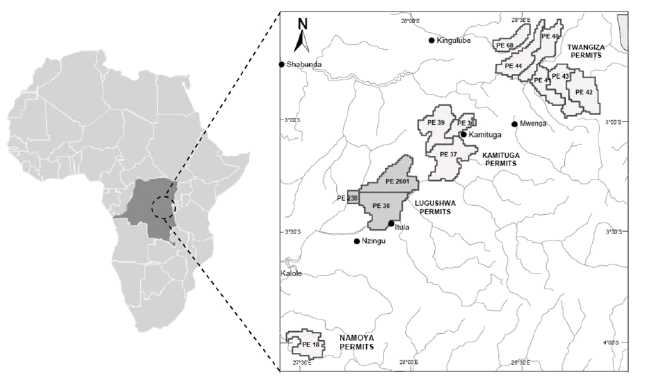

In 1996, the Company acquired, by way of several transactions, 72% of the outstanding shares of the DRC company, Société Zaïroise Minière et Industrielle du Kivu S.A.R.L. ("SOMINKI"). The DRC government held the remaining 28% of SOMINKI's shares as a participating interest. SOMINKI, which held 100% of the Twangiza, Namoya, Lugushwa and Kamituga properties, was an operating, very well-established mining company in the DRC with a long production history. With the acquisition of control of SOMINKI, the Company also acquired SOMINKI's significant library of geological and exploration data that had accumulated since the early 1920s.

In early 1997, the DRC government ratified a new 25 year (subsequently extended to 30 years) mining convention (the "Mining Convention") among itself, SOMINKI and the Company. The Mining Convention provided for the transfer of all of the mineral assets and real property of SOMINKI to a newly created DRC company, Société Aurifère du Kivu et du Maniema S.A.R.L. ("SAKIMA"), and that 93% of SAKIMA's shares were to be held by the Company, with the remaining 7% to be owned by the DRC government as a non-dilutive interest. The Mining Convention also provided for, among other things, confirmation of title in respect of all of the Twangiza, Namoya, Lugushwa and Kamituga properties.

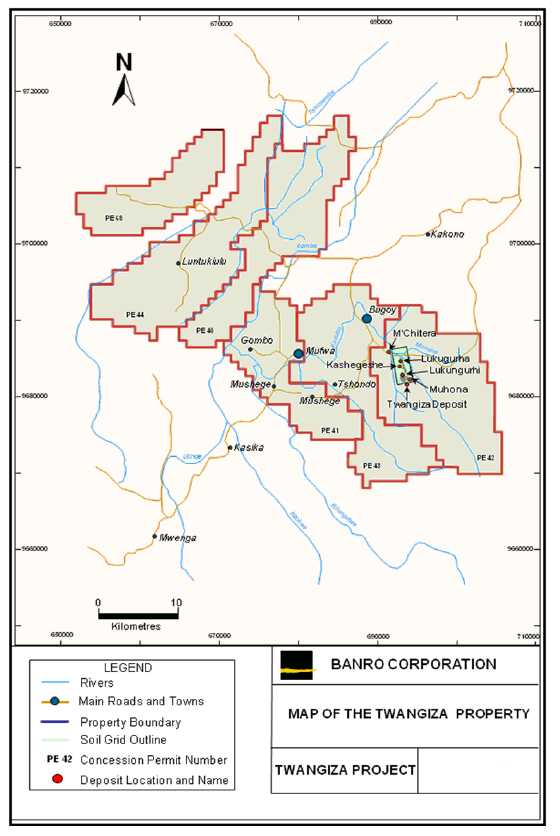

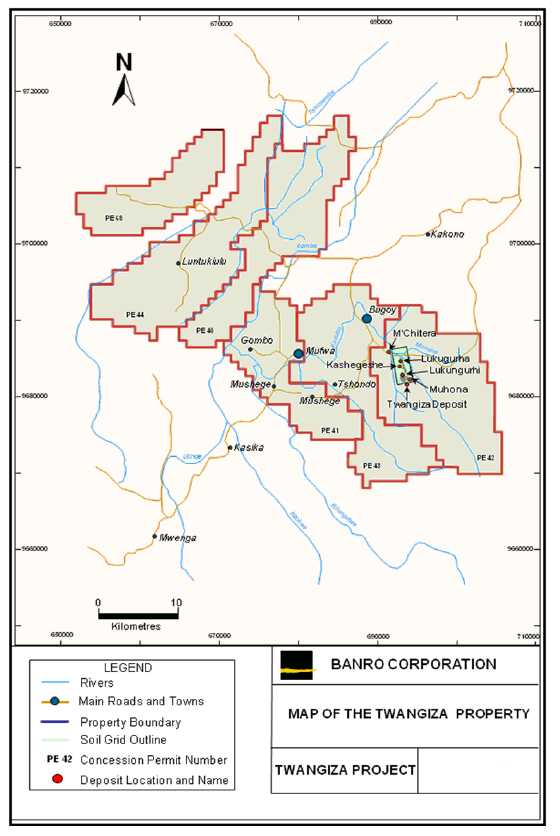

Commencing in August 1997 and ending in April 1998, the Company carried out a phase I exploration program on the Twangiza property which consisted of geological mapping, surveying, data verification, airborne geophysical surveying, diamond drilling and resource modeling.

In July 1998, the DRC government, without prior warning or consultation, issued Presidential decrees which effectively resulted in the expropriation of the Company's properties.

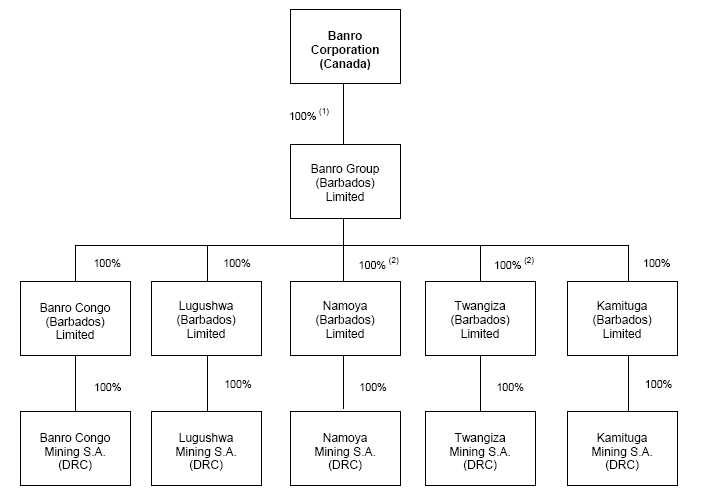

In April 2002, the DRC government formally signed a settlement agreement (the "Settlement Agreement") with the Company. The Settlement Agreement called for, among other things, the Company to hold a 100% interest in the Twangiza, Namoya, Lugushwa and Kamituga properties under a revived Mining Convention. In accordance with the Settlement Agreement, the Company reorganized the said properties by transferring them from SAKIMA to four newly-created, wholly-owned DRC subsidiaries of the Company (which are now named Twangiza Mining S.A., Namoya Mining S.A., Lugushwa Mining S.A. and Kamituga Mining S.A.), each of which owns 100% of its respective property.

In late 2003, the Company re-opened its exploration office in the town of Bukavu in eastern DRC.

Recruitment of Management

During 2004, the Company recruited a management team with extensive African and gold industry experience. Included in the people who joined the Company during 2004 were Peter N. Cowley as Chief Executive Officer, President and a director, Simon F.W. Village as Chairman of the Board and a director, Michael B. Skead as Exploration Manager (later promoted to Vice President, Exploration) and Dr. John A. Clarke as a director (Dr. Clarke was appointed Chief Executive Officer and President of the Company in 2013; see below).

-19-

Resumption of Exploration

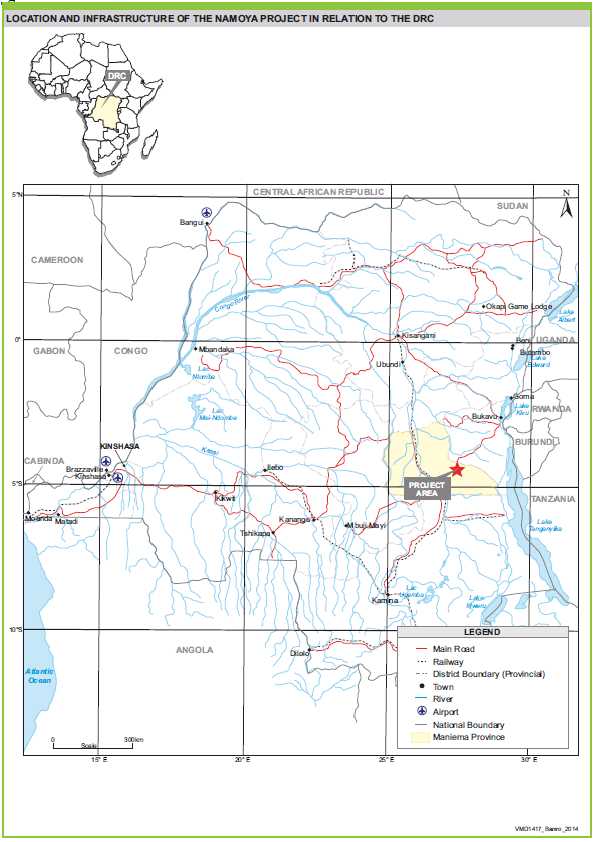

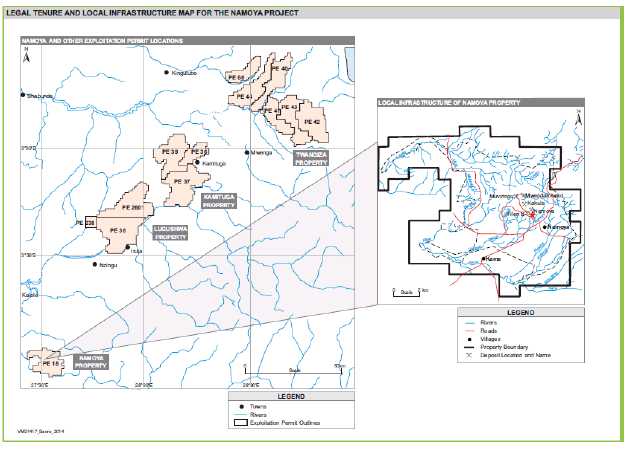

In November 2004, the Company commenced exploration activities at the Namoya property and in January 2005 the Company commenced exploration activities at the Lugushwa property. The Company commenced the second phase of exploration at the Twangiza property in October 2005.

Stock Exchange Listings

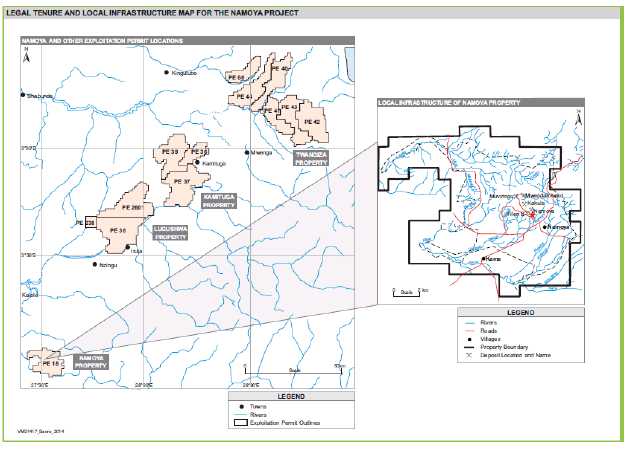

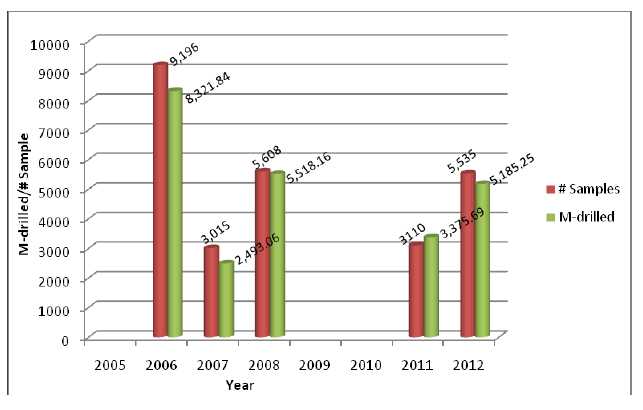

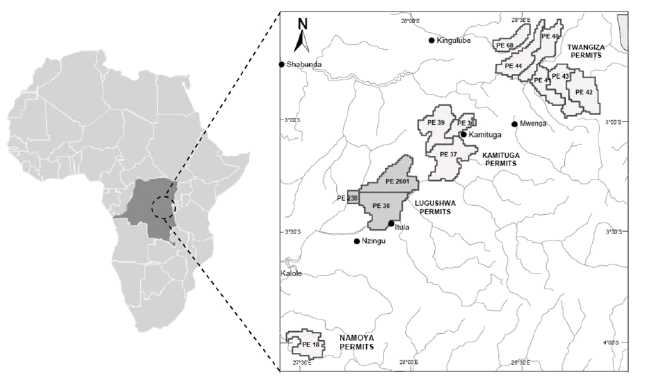

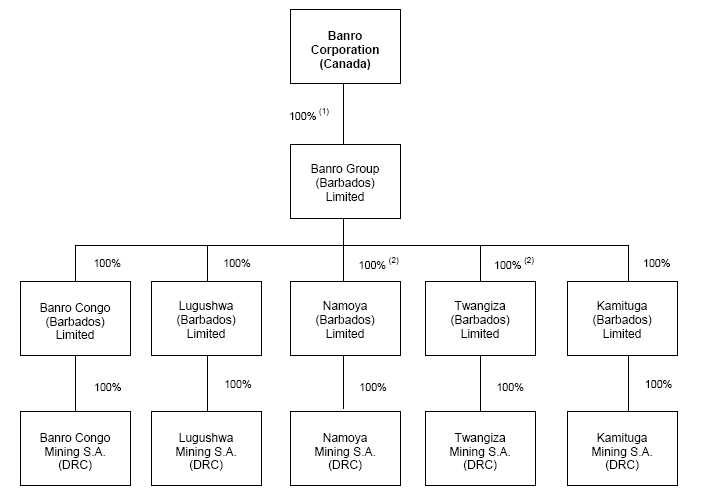

On March 28, 2005, the Company's common shares began trading on the American Stock Exchange (which is now called the NYSE MKT LLC) (the "NYSE MKT"). On November 10, 2005, the Company's common shares began trading on the Toronto Stock Exchange (the "TSX") and ceased trading on the TSX Venture Exchange concurrent with the TSX listing. RBC Capital Markets acted as sponsor to Banro in its application for listing on the TSX.