Exhibit 99.1

ANNUAL INFORMATION FORM

For the financial year ended December 31, 2011

Dated March 26, 2012

Table of Contents

| | Page |

| | |

| PRELIMINARY INFORMATION | 1 |

| Date of Information | 1 |

| Incorporation by Reference of Technical Reports | 1 |

| Cautionary Statement Regarding Forward-Looking Statements | 2 |

| Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates | 3 |

| Currency | 3 |

| | | |

| ITEM 1: | CORPORATE STRUCTURE | 4 |

| 1.1 | Name, Address and Incorporation | 4 |

| 1.2 | Intercorporate Relationships | 4 |

| | | |

| ITEM 2: | GENERAL DEVELOPMENT OF THE BUSINESS | 4 |

| | | |

| ITEM 3: | DESCRIPTION OF THE BUSINESS | 10 |

| 3.1 | General | 10 |

| 3.2 | Risk Factors | 13 |

| 3.3 | Banro's Gold Properties | 25 |

| | 3.3.1 | Twangiza | 26 |

| | | 3.3.1.1 | Twangiza Oxide Mine | 26 |

| | | 3.3.1.2 | Twangiza Phase 1 Economic Assessment | 28 |

| | | 3.3.1.3 | Twangiza Exploration (2011-2012) | 34 |

| | 3.3.2 | Namoya | 35 |

| | | 3.3.2.1 | Updated Economic Assessment of Namoya Phase 1 Project Completed in 2012 | 35 |

| | | 3.3.2.2 | Namoya Mine Construction | 36 |

| | | 3.3.2.3 | Namoya Technical Report | 36 |

| | | 3.3.2.4 | Namoya Exploration (2011-2012) | 40 |

| | 3.3.3 | Lugushwa | 41 |

| | 3.3.4 | Kamituga | 43 |

| | 3.3.5 | Other Exploration Properties | 45 |

| | 3.3.6 | Qualified Persons | 45 |

| | | | |

| ITEM 4: | DIVIDENDS | 45 |

| | | |

| ITEM 5: | DESCRIPTION OF CAPITAL STRUCTURE | 45 |

| 5.1 | Authorized Share Capital | 45 |

| 5.2 | Notes | 46 |

| 5.3 | Warrants | 49 |

| 5.4 | Shareholder Rights Plan | 49 |

| | | |

| ITEM 6: | MARKET FOR SECURITIES | 50 |

| | | |

| ITEM 7: | ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 51 |

| | | |

| ITEM 8: | DIRECTORS AND OFFICERS | 51 |

| 8.1 | Name, Occupation and Security Holding | 51 |

| 8.2 | Corporate Cease Trade Orders or Bankruptcies | 55 |

| 8.3 | Personal Bankruptcies | 56 |

| 8.4 | Penalties or Sanctions | 56 |

| 8.5 | Conflicts of Interest | 56 |

TABLE OF CONTENTS

(continued)

| | | Page |

| | | |

| ITEM 9: | AUDIT COMMITTEE INFORMATION | 56 |

| | | |

| ITEM 10: | PROMOTERS | 58 |

| | | |

| ITEM 11: | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 59 |

| | | |

| ITEM 12: | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 59 |

| | | |

| ITEM 13: | TRANSFER AGENTS AND REGISTRAR | 60 |

| | | |

| ITEM 14: | MATERIAL CONTRACTS | 60 |

| | | |

| ITEM 15: | INTERESTS OF EXPERTS | 61 |

| 15.1 | Names of Experts | 61 |

| 15.2 | Interests of Experts | 61 |

| | | |

| ITEM 16: | ADDITIONAL INFORMATION | 62 |

| | | | |

| SCHEDULE "A" - AUDIT COMMITTEE TERMS OF REFERENCE | |

PRELIMINARY INFORMATION

Date of Information

All information in this annual information form ("AIF") is as at December 31, 2011, unless otherwise indicated.

Incorporation by Reference of Technical Reports

The following technical reports, or excerpts from technical reports (as applicable), are incorporated by reference into, and form part of, this AIF. These reports have been filed on, and may be accessed using, the System for Electronic Document Analysis and Retrieval ("SEDAR") on the internet atwww.sedar.com and EDGAR at www.sec.gov.

| 1. | The technicalreport of SENET dated March 9, 2011 (as revised on March 24, 2011) and entitled "Economic Assessment NI 43-101 Technical Report, Twangiza Phase 1 Gold Project, South Kivu Province, Democratic Republic of the Congo". |

| 2. | The technicalreport of Venmyn Rand (Pty) Ltd datedJanuary 24, 2012 and entitled "National Instrument 43-101 Independent Technical Report on the Namoya Gold Project, Maniema Province, Democratic Republic of the Congo". |

| 3. | The technical report of Michael B. Skead (who was Vice President, Exploration of the Company at the time the report was prepared) dated March 30, 2007 and entitled "Third NI 43-101 Technical Report, Lugushwa Project, South Kivu Province, Democratic Republic of the Congo". |

| 4. | Section 2 (entitled "Regional Geology") and section 3 (entitled "Kamituga") of the technical report of Steffen, Robertson and Kirsten (UK) Ltd. dated February 2005 and entitled "NI 43-101 Technical Report Resource Estimation and Exploration Potential at the Kamituga, Lugushwa and Namoya Concessions, Democratic Republic of Congo". |

Any statement contained in a document incorporated by reference herein is not incorporated by reference to the extent that any such statement is modified or superseded by a statement contained herein. Any such modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes.

Cautionary Statement Regarding Forward-Looking Statements

This AIF and the documents incorporated by reference herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Actof 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws (such forward-looking statements and forward-looking information are referred to herein as "forward-looking statements"). Forward-looking statements are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. All statements, other than statements which are reporting results as well as statements of historical fact, that address activities, events or developments that Banro Corporation ("Banro" or the "Company") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of gold production, revenue, cash flow and costs, estimated project economics, mineral resource and mineral reserve estimates, potential mineralization, potential mineral resources and mineral reserves, projected timing of future gold production and the Company's exploration and development plans and objectives with respect to its projects) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual events or results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual events or results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production and economic returns; uncertainties relating to the estimates and assumptions used in the economic studies of the Company's projects; the early stage of gold production at the Company’s Twangiza mine; failure to establish estimated mineral resources or mineral reserves; fluctuations in gold prices and currency exchange rates; inflation; gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production); changes in equity markets; political developments in the Democratic Republic of the Congo (the "DRC"); lack of infrastructure; adoption of proposed rules by the U.S. Securities and Exchange Commission that may affect mining operations in the DRC; failure to procure or maintain, or delays in procuring or maintaining, permits and approvals; lack of availability at a reasonable cost or at all, of plants, equipment or labour; inability to attract and retain key management and personnel; changes to regulations or policies affecting the Company's activities; uncertainties relating to the availability and costs of financing in the future; the uncertainties involved in interpreting drilling results and other geological data; the Company's history of losses; the Company's ability to acquire additional commercially mineable mineral rights; risks related to the integration of any new acquisitions into the Company's existing operations; increased competition in the mining industry; and the other risks disclosed in item 3.2 ("Risk Factors") of this AIF.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

The mineral resource and mineral reserve figures referred to in this AIF are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the resource and reserve estimates included in this AIF are well established, by their nature, resource and reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances. Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

Statements concerning actual mineral reserve and mineral resource estimates are also deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the relevant project or property is developed. Mineral resources that are not mineral reserves do not have demonstrated economic viability.There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates

This AIF, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Without limiting the foregoing, this AIF, including the documents incorporated by reference herein, uses the terms "measured", "indicated" and "inferred" resources. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the U.S. Securities and Exchange Commission (the "SEC") does not recognize them. Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the "inferred resources" will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report mineral deposits that do not constitute "reserves" as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this AIF or in the documents incorporated by reference, may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

National Instrument 43-101 -Standards of Disclosure for Mineral Projects("NI 43-101") is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this AIF have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ significantly from the requirements of the SEC, and reserve and resource information contained herein and incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. One consequence of these differences is that "reserves" calculated in accordance with Canadian standards may not be "reserves" under the SEC standards.

U.S. investors are urged to consider closely the disclosure in the Company's Form 40-F Registration Statement (File No. 001-32399), which may be secured from the Company, or from the SEC's website at http://www.sec.gov.

Currency

All dollar amounts in this AIF are expressed in United States dollars, except as otherwise indicated. References to "$" or "US$" are to United States dollars and references to "Cdn$" are to Canadian dollars, except as otherwise indicated. For United States dollars to Canadian dollars, based on the Bank of Canada nominal noon rate, the average exchange rate for 2011 and the exchange rate at December 30, 2011 were one United States dollar per $0.9891 and $1.0170 Canadian dollars, respectively. For reporting purposes, the Company prepares its financial statements in United States dollars and in accordance with International Financial Reporting Standards issued by the International Accounting Standards Board.

ITEM 1: CORPORATE STRUCTURE

| 1.1 | Name, Address and Incorporation |

The head office and registered office of Banro is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada.

The Company was incorporated under theCanada Business Corporations Act (the "CBCA") on May 3, 1994 by articles of incorporation. Pursuant to articles of amendment effective May 7, 1996, the name of the Company was changed from Banro International Capital Inc. to Banro Resource Corporation and the authorized share capital of the Company was increased by creating an unlimited number of a new class of shares designated as preference shares, issuable in series. The Company was continued under the OntarioBusiness Corporations Actby articles of continuance effective on October 24, 1996. By articles of amendment effective on January 16, 2001, the name of the Company was changed to Banro Corporation and the Company's outstanding common shares were consolidated on a three old for one new basis. The Company was continued under the CBCAby articles of continuance dated April 2, 2004. By articles of amendment dated December 17, 2004, the Company's outstanding common shares were subdivided by changing each one of such shares into two common shares.

| 1.2 | Intercorporate Relationships |

The following chart illustrates the relationship between Banro and its material subsidiaries, together with the jurisdiction of incorporation of each such subsidiary and the percentage of voting securities beneficially owned, or controlled or directed, directly or indirectly, by Banro.

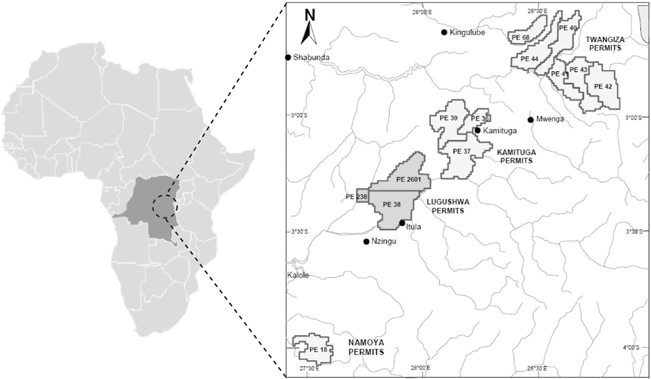

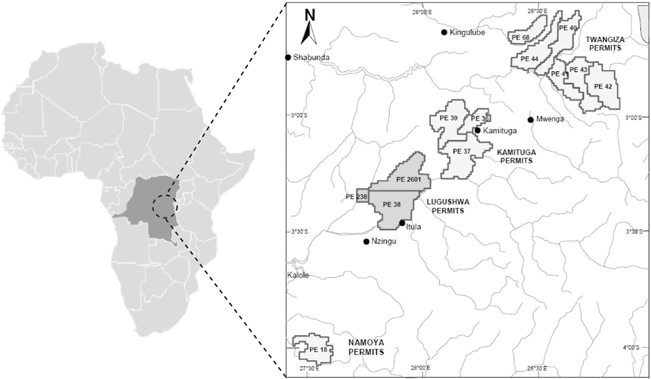

ITEM 2: GENERAL DEVELOPMENT OF THE BUSINESS

The Company holds, through four wholly-owned DRC subsidiaries, a 100% interest in four gold properties, which are known as Twangiza, Namoya, Lugushwa and Kamituga. These properties are covered by a total of 13 exploitation permits and are found along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of eastern DRC. These properties, totalling approximately 2,612 square kilometres, cover all the major, historical producing areas of the gold belt. The Company’s business focus is the exploration and development of these four DRC properties. During the fourth quarter of 2011, the Company commenced gold production at its first mine, located at Twangiza. As at the date of this AIF, the Twangiza mine continues to ramp up to commercial production. Banro’s plans also include the construction of a second gold mine, at its Namoya project where construction of the mine is underway, as well as the development of the Company’s Lugushwa and Kamituga projects. The Company also holds 14 exploration permits covering an aggregate of 2,638 square kilometres. Ten of the permits are located in the vicinity of the Company’s Twangiza property and four are located in the vicinity of the Company’s Namoya property.

General Development of the Business

Background

In 1996, the Company acquired, by way of several transactions, 72% of the outstanding shares of the DRC company, Société Zaïroise Minière et Industrielle du Kivu S.A.R.L. ("SOMINKI"). The DRC government held the remaining 28% of SOMINKI's shares as a participating interest. SOMINKI, which held 100% of the Projects, was an operating, very well-established mining company in the DRC with a long production history. With the acquisition of control of SOMINKI, the Company also acquired SOMINKI's significant library of geological and exploration data that had accumulated since the early 1920s.

In early 1997, the DRC government ratified a new 25 year (subsequently extended to 30 years) mining convention (the "Mining Convention") among itself, SOMINKI and the Company. The Mining Convention provided for the transfer of all of the mineral assets and real property of SOMINKI to a newly created DRC company, Société Aurifère du Kivu et du Maniema S.A.R.L. ("SAKIMA"), and that 93% of SAKIMA's shares were to be held by the Company, with the remaining 7% to be owned by the DRC government as a non-dilutive interest. The Mining Convention also provided for, among other things, confirmation of title in respect of all of the Twangiza, Namoya, Lugushwa and Kamituga properties.

Commencing in August 1997 and ending in April 1998, the Company carried out a phase I exploration program on the Twangiza property which consisted of geological mapping, surveying, data verification, airborne geophysical surveying, diamond drilling and resource modeling.

In July 1998, the DRC government, without prior warning or consultation, issued Presidential decrees which effectively resulted in the expropriation of the Company's properties.

In April 2002, the DRC government formally signed a settlement agreement (the "Settlement Agreement") with the Company. The Settlement Agreement called for, among other things, the Company to hold a 100% interest in the Twangiza, Namoya, Lugushwa and Kamituga properties under a revived Mining Convention. In accordance with the Settlement Agreement, the Company reorganized the said properties by transferring them from SAKIMA to four newly-created, wholly-owned DRC subsidiaries of the Company (which are named Twangiza Mining SARL, Namoya Mining SARL, Lugushwa Mining SARL and Kamituga Mining SARL), each of which owns 100% of its respective property.

In late 2003, the Company re-opened its exploration office in the town of Bukavu in eastern DRC.

Recruitment of Management

During 2004, the Company recruited a management team with extensive African and gold industry experience. Included in the people who joined the Company during 2004 were Peter N. Cowley as Chief Executive Officer, President and a director, Simon F.W. Village as Chairman of the Board and a director, Michael B. Skead as Exploration Manager (later promoted to Vice President, Exploration) and John A. Clarke as a director.

Resumption of Exploration

In November 2004, the Company commenced exploration activities at the Namoya property and in January 2005 the Company commenced exploration activities at the Lugushwa property. The Company commenced the second phase of exploration at the Twangiza property in October 2005.

Stock Exchange Listings

On March 28, 2005, the Company's common shares began trading on the American Stock Exchange (which is now called the NYSE Amex LLC) (the "NYSE Amex"). On November 10, 2005, the Company's common shares began trading on the Toronto Stock Exchange (the "TSX") and ceased trading on the TSX Venture Exchange concurrent with the TSX listing. RBC Capital Markets acted as sponsor to Banro in its application for listing on the TSX.

Financings (2004 to 2006)

In March 2004, the Company completed a Cdn$16,000,000 private placement financing.

In July 2005, the Company completed an Cdn$18,375,000 private placement financing. This placement was made to an investment fund managed by Capital Research and Management Company and to institutional accounts managed by affiliates of Capital Group International, Inc.

In October2005, the Company completed a non-brokered Cdn$13,000,000 private placement financing. The subscribers in respect of this financing were an investment fund managed by Actis Capital LLP and an investment fund co-managed by Actis Capital LLP and Cordiant Capital Inc.

In May2006, the Company completed an equity financing for total gross proceeds of Cdn$56,012,800.The underwriters who conducted this financing were RBC Capital Markets as lead manager, Raymond James Ltd. and MGI Securities Inc.

Acquisition of Additional Properties

In March 2007, the Company announced that its wholly-owned DRC subsidiary, Banro Congo Mining SARL, had acquired 14 exploration permits covering certain groundlocated between and contiguous to the Company's Twangiza, Kamituga and Lugushwa properties. The applications for these permits were originally filed with the Mining Cadastral shortly after implementation of the DRC's new Mining Code in June 2003.

2007 Preliminary Assessments of Twangiza and Namoya

In July 2007, the Company announced the results of its preliminary assessments (i.e. "scoping studies") of its Namoya and Twangiza properties.

Hiring of New C.E.O. in 2007

Michael J. Prinsloo was appointed Chief Executive Officer of the Company effective September 17, 2007. Mr. Prinsloo was hired to lead the Company's transition from gold explorer to developer. Prior to joining Banro, Mr. Prinsloo had accumulated some 35 years of experience in the gold mining industry, including acting as Head of South African Operations of Gold Fields Limited from 2002 to 2006. Mr. Prinsloo was also appointed President of the Company in March 2008 following the retirement of Peter N. Cowley as President. Simon F. W. Village succeeded Mr. Prinsloo as Banro’s President and Chief Executive Officer in 2010 (see "Management Changes in 2010" below).

Twangiza Pre-Feasibility Study

InJuly 2008, the Company announced results of the pre-feasibility study of the Company's Twangizaproperty.

2008 Financing

InSeptember 2008, the Company completed an equity financing for total gross proceeds of US$21,000,000. This financing was completed through a syndicate of underwriters led by RBC Capital Markets and including CIBC World Markets Inc., UBS Securities Canada Inc. and Raymond James Ltd.

Twangiza Feasibility Study

InJanuary 2009, the Company announced results of the feasibility study of the Company's Twangizaproperty.

Twangiza Updated Feasibility Study

In June 2009, the Company announced updated results of the feasibility study of the Company's Twangizaproperty.

2009 Financings

In February 2009, the Company completed a non-brokered equity financing for total gross proceeds of US$14,000,000.

In June 2009, the Company completed an equity financing for total gross proceeds of Cdn$100,001,700. The financing was conducted through a syndicate of underwriters co-led by GMP Securities L.P. and CIBC World Markets Inc.

Title Confirmation and Ratification of Fiscal Arrangement

In February 2009, the Company announced that following discussions it has received official confirmation from the DRC government that all aspects of the Company's Mining Convention and its mining licenses respecting the Twangiza, Namoya, Lugushwa and Kamituga properties are in accordance with Congolese law.

In August 2009, the DRC government ratified the fiscal arrangement between the DRC government and the Company. The Company has agreed to enhance its existing commitment to the DRC and the local communities of South Kivu and the Maniema provinces through:

| · | An advance payment of US$2 million to the DRC government to be made when the Company completes the equity and debt financing process for construction of the mine at Twangiza. These funds will also be used to support social infrastructure development in the Twangiza and Luhwindja communities and will be credited against future taxes; |

| · | A pledge of US$200,000 to settle legacy issues with SOMINKI and the transfer to the central government of certain real estate assets redundant to the Company's operations; |

| · | 4% of future net profits, after return of capital, allocated through the central government to the communities of South Kivu and Maniema provinces for the building of infrastructure projects, including roads and bridges, schools and health care facilities; and |

| · | A royalty of 1% on gold revenues. |

Purchase of Gold Plant and Commencement of Construction of Phase 1 Oxide Mine at Twangiza

The Company intends to develop Twangiza in phases, commencing with a "Phase 1" oxide mining operation. To that end, the Company completed in September 2009 the purchase of a refurbished gold processing plant capable of achieving an upgraded throughput capacity of 1.3 million tonnes per annum. SENET Engineering was selected as the overall project manager and also to manage the erection and commissioning of the plant. The Company began mobilizing equipment at Twangiza in January 2010 in order to facilitate the commencement of construction activities in February 2010. The resettlement process involving all consultative activities with local community members and the construction of resettlement houses commenced during the fourth quarter of 2009. Work on bridge upgrades and roads to the Twangiza site commenced in February 2010.

2010 Financing

In May 2010, the Company completed an equity financing for total gross proceeds of Cdn$137,555,000. The financing was conducted through a syndicate of underwriters co-led by GMP Securities L.P. and CIBC World Markets Inc.

Management Changes in 2010

In August 2010, the Company announced the restructuring of its executive management group and that it had fully staffed the mine development team responsible for constructing the Twangiza Phase 1 mine. The restructuring included the departure of Michael J. Prinsloo as President and Chief Executive Officer of the Company in September 2010. Simon Village, who was Banro’s Chairman of the Board at the time of Mr. Prinsloo’s departure, succeeded Mr. Prinsloo as President and Chief Executive Officer of the Company. Gary Chapman, who joined Banro in July 2010, took over responsibility for mine development from Mr. Prinsloo. See item 8 of this AIF, "Directors and Officers".

2011 Preliminary Assessment of Namoya Heap Leach Project

In January 2011, the Company announced the results of a preliminary assessment of a heap leach project at Namoya (the "2011 Namoya Study"). The 2011 Namoya Study, which was prepared with input from a number of independent consultants, followed on from the 2007 preliminary assessment of Namoya (see "Preliminary Assessments of Twangiza and Namoya" above) which assumed a CIL (carbon-in-leach) only processing route for the mineral resources. The 2011 Namoya Study assumed a heap leach only processing route and was undertaken to assess a lower capital cost alternative to the previous CIL option.

2011 Financing

In February 2011, the Company completed an equity financing for total gross proceeds of Cdn$56,875,000. The financing was conducted through a syndicate of investment dealers led by GMP Securities L.P. and included CIBC World Markets Inc., Cormark Securities Inc. and Raymond JamesCanada Inc.

Twangiza Phase 1 Economic Assessment

In March 2011, the Company announced the results of an economic assessment in respect of the Company’s Twangiza Phase 1 project. This economic assessment was prepared with input from a number of independent consultants.

Commencement of Gold Production at Twangiza

In October 2011, the Company announced first gold production at its Twangiza property.

Updated Economic Assessment of Namoya Project

In January 2012, the Company announced the results of an updated economic assessment for the Namoya project (the "2012 Namoya Study"). The Namoya project is planned to have two phases, with Phase 1 involving a CIL/gravity and heap leach process ("gravity heap leach") for the recovery of easily leachable oxide and transitional ores and Phase II involving a milling/carbon-in-leach (CIL) plant to treat the fresh rock and optimize recoveries. The 2012 Namoya Study relates only to the Namoya project Phase 1 production potential.

The 2011 Namoya Study, which utilized the delineated measured, indicated and inferred mineral resources at that time, was based on an agglomerated heap leach model for ore processing. The 2012 Namoya Study is based on a gravity heap leach operation without the need to agglomerate, and uses the updated measured and indicated mineral resources for Namoya announced by the Company in December 2011.

2012 Debt Financing

In March 2012, the Company closed a brokered private placement debt financing for total gross proceeds of US$175 million. The financing was conducted by a syndicate of investment dealers comprising GMP Securities and BMO Capital Markets (as co-lead managers and co-book-runners) and CIBC World Markets Inc., Cormark Securities Inc. and Dundee Securities Ltd. as co-managers. The net proceeds from the financing are planned to be used for the development of the Company’s Namoya project (where construction of the Company’s second gold mine is underway), the repayment of an existing credit facility and general corporate purposes.

This debt financing involved an offering by the Company of 175,000 units consisting of US$175,000,000 aggregate principal amount of senior secured notes with an interest rate of 10% and a maturity date of March 1, 2017 (the "Notes") and 8,400,000 warrants (the "Warrants") to purchase an aggregate of 8,400,000 common shares of the Company. Each such unit consisted of US$1,000 principal amount of Notes and 48 Warrants, with each Warrant entitling the holder to purchase one common share of the Company at a price of US$6.65 for a period of five years from the date of issuance of the Warrant.

ITEM 3: DESCRIPTION OF THE BUSINESS

The Company holds, through four wholly-owned DRC subsidiaries, a 100% interest in four gold properties, which are known as Twangiza, Namoya, Lugushwa and Kamituga. These properties are covered by a total of 13 exploitation permits and are found along the 210 kilometre-long Twangiza-Namoya gold belt in the South Kivu and Maniema Provinces of eastern DRC. These properties, totalling approximately 2,612 square kilometres, cover all the major, historical producing areas of the gold belt. The Company’s business focus is the exploration and development of these four DRC properties. During the fourth quarter of 2011, the Company commenced gold production at its first mine, located at Twangiza. As at the date of this AIF, the Twangiza mine continues to ramp up to commercial production. Banro’s plans also include the construction of a second gold mine, at its Namoya project where construction of the mine is underway, as well as the development of the Company’s Lugushwa and Kamituga projects. See items 3.3.1, 3.3.2, 3.3.3 and 3.3.4 of this AIF for additional information relating to the said four properties.

The Company also holds 14 exploration permits covering an aggregate of 2,638 square kilometres. Ten of the permits are located in the vicinity of the Company's Twangiza property and four are located in the vicinity of the Company's Namoya property.

The following illustrates the location of the Company's four principal properties and the related exploitation permits.

Under DRC mining law, an exploitation permit entitles the holder thereof to the exclusive right to carry out, within the perimeter over which it is granted and during its term of validity, exploration, development, construction and exploitation works in connection with the mineral substances for which the permit has been granted and associated substances if the holder has obtained an extension of the permit. In addition, an exploitation permit entitles the holder to: (a) enter the exploitation perimeter to conduct mining operations; (b) build the installations and infrastructures required for mining exploitation; (c) use the water and wood within the mining perimeter for the requirements of the mining exploitation, provided that the requirements set forth in the environmental impact study and the environmental management plan of the project are complied with; (d) use, transport and freely sell the holder's products originating from within the exploitation perimeter; (e) proceed with concentration, metallurgical or technical treatment operations, as well as the transformation of the mineral substances extracted from the exploitation perimeter; and (f) proceed to carry out works to extend the mine.

Without an exploitation permit, the holder of an exploration permit may not conduct exploitation work on the perimeter covered by the exploration permit. So long as a perimeter is covered by an exploitation permit, no other application for a mining or quarry right for all or part of the same perimeter can be processed.

An exploration permit entitles the holder thereof to the exclusive right, within the perimeter over which it is granted and for the term of its validity, to carry out mineral exploration work for mineral substances, substances for which the licence is granted and associated substances if an extension of the permit is obtained. However, the holder of an exploration permit cannot commence work on the property without obtaining approval in advance of its mitigation and rehabilitation plan. An exploration permit also entitles its holder to the right to obtain an exploitation permit for all or part of the mineral substances and associated substances, if applicable, to which the exploration permit or any extension thereto applies if the holder discovers a deposit which can be economically exploited.

On February 13, 1997, the Company entered into a mining convention with the Republic of Zaire (now called the Democratic Republic of the Congo) and SOMINKI (the "Mining Convention"). In July 1998, the Company was expropriated of all its properties, rights and titles by Presidential decree. The Company initiated arbitration procedures against the DRC State seeking compensation for this expropriation. A settlement agreement between the DRC State and the Company was signed in April 2002 (the "Settlement Agreement"). The Settlement Agreement effectively revived the expropriated Mining Convention. Under this revived Mining Convention, the Company held a 100% equity interest in its Twangiza, Namoya, Lugushwa and Kamituga properties, was entitled to a ten-year tax holiday from the start of production, and was exempt from custom duties and royalty payments.

On July 11, 2002, the DRC State enacted a Mining Code (the "Mining Code") to govern all the exploration and exploitation of mineral resources in the DRC. Holders of mining rights who derived their rights from previously existing mining conventions had the option to choose between being governed, either exclusively by the terms and conditions of their own mining convention with the DRC State or by the provisions of the Mining Code. Pursuant to this right of option which is prescribed in Section 340 paragraph 1 of the Mining Code, the Company elected to remain subject to the terms and conditions of its Mining Convention with respect to its 13 exploitation permits it acquired before the enactment of the Mining Code. Nevertheless, the 14 exploration permits (which were acquired by the Company after the implementation of the Mining Code) are exclusively governed by the provisions of the Mining Code and related mining regulations.

Employees

As at December 31, 2011, the Company and its subsidiaries had a total of 646 employees. The following provides a breakdown of these employees by location:

| Location | | Number of Employees | |

| | | | |

| Banro office in Toronto, Canada | | | 11 | |

| | | | | |

| Banro office and sampling facility in Bukavu, DRC | | | 112 | |

| | | | | |

| Banro office in Kinshasa, DRC | | | 12 | |

| | | | | |

| Twangiza mine | | | 358 | |

| | | | | |

| Twangiza exploration | | | 21 | |

| | | | | |

| Namoya project | | | 55 | |

| | | | | |

| Lugushwa project | | | 32 | |

| | | | | |

| Kamituga project | | | 45 | |

| | | | | |

| Total: | | | 646 | |

Neither the Company nor any of its subsidiaries has any unionized employees.

Contractors and local labour hire companies engaged by the Company’s DRC subsidiaries employed a total of 3,399 employees as at December 31, 2011 in respect of the Company’s DRC projects.

Social and Environmental Policies

(a) The Banro Foundation

Since launching its current exploration programs in late 2004, Banro has been working with local communities to promote development. In late 2005, the Company formalized this commitment to community development with the creation of the Banro Foundation. The Banro Foundation is a registered charity in the DRC with a mandate to support education, health and infrastructure improvements, principally in the local communities where Banro operates. The Company funds the Banro Foundation and has created a management structure that ensures local participation in decision-making. The Foundation focuses on needs that have been identified by local committees of community leaders and invests in improvements that will benefit communities as a whole. To the extent possible, the Foundation employs local labour in all initiatives. Since 2009, the projects completed by the Banro Foundation include the construction of seven new schools and the rehabilitation of two schools, a potable water delivery system serving 18,000 people in four villages, the construction or re-construction of over 100 kilometres of roads and bridges, a large health centre, a women’s resource centre and two separate distributions of medical equipment from Canada to regional hospitals and clinics in South Kivu province. 2012 is expected to be the most active year to date for the Foundation, with the construction of new schools and health care clinics, the completion of a formal commercial marketplace and the rehabilitation of a community hydro-electric facility. Additional information with respect to the Banro Foundation, including a list of projects undertaken by the Banro Foundation to date, can be found on the Company's web site at www.banro.com.

(b) Job Creation

Banro is committed to the creation of jobs and economic opportunities for local Congolese. In a short period of time, Banro has gone from having no presence in the eastern DRC to being one of the largest private employers in the region. As it has grown, the Company has deliberately created opportunities for many local Congolese. As of December 31, 2011, the Company employed 577 Congolese directly and an additional 3,301 Congolese indirectly through contractors and local labour hire companies.

(c) Environmental Protection and Workplace Safety

As set out in the Business Conduct Policy adopted by the Company (a copy of this policy can be obtained from SEDAR at www.sedar.com), the Company believes that effectiveness in environmental standards, along with occupational health and safety, is an essential part of achieving success in the mineral exploration, development and mining business. The Business Conduct Policy states that Banro will therefore work at continuous improvement in these areas and will be guided by the following principles: (a) creating a safe work environment; (b) minimizing the environmental impacts of its activities; (c) building cooperative working relationships with local communities and governments in the Company's areas of operations; (d) reviewing and monitoring environmental and safety performance; and (e) prompt and effective response to any environmental and safety concerns.

Banro adheres to the E3 Environmental Excellence in Exploration guidelines, which were developed by the Prospectors and Developers Association of Canada.

Banro's management has also taken steps to ensure that all employees and suppliers respect and adhere to the laws of the DRC with respect to the protection of threatened and endangered species.

The Company is working to international best practice standards in environmental and social appraisal. SRK Consulting (South Africa) (Pty) Ltd. was contracted to develop an Equator Principles 2-compliant environmental and social impact assessment report and associated environmental and social impact mitigation and management plan in respect of the development of the Twangiza mine. As well, Banro has sourced proposals from environmental consultants for the development of an Equator Principles 2-compliant environmental and social impact assessment report and associated environmental and social impact mitigation and management plan in respect of the development of the Namoya mine. This is in addition to the initial work completed by SRK Consulting (South Africa) (Pty) Ltd. for Namoya.

There are a number of risks that may have a material and adverse impact on the future operating and financial performance of Banro and could cause the Company's operating and financial performance to differ materially from the estimates described in forward-looking statements relating to the Company. These include widespread risks associated with any form of business and specific risks associated with Banro's business and its involvement in the gold exploration, development and mining industry.

An investment in theCompany's common shares is considered speculative and involves a high degree of risk due to, among other things, the nature of Banro's business (which is the exploration, development and mining of gold properties), the present stage of its development and the location of Banro's projects in the DRC. In addition to the other information presented in this AIF, a prospective investor should carefully consider the risk factors set out belowand the other information that Banro files with Canadian securities regulators and with the SEC in the U.S. before investing in the Company's common shares. The Company has identified the following non-exhaustive list of inherent risks and uncertainties that it considers to be relevant to its operations and business plans. Such risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. As well, while the following sets out the material risk factors which the Company is aware of, there may be additional risks that the Company is unaware of or that are currently believed to be immaterial that may become important factors that affect the Company's business.

Risks of Operating in the DRC

Banro's projects are located in the DRC. The assets and operations of the Company are therefore subject to various political, economic and other uncertainties, including, among other things, the risks of war and civil unrest, expropriation, nationalization, renegotiation or nullification of existing licenses, permits, approvals and contracts, taxation policies, foreign exchange and repatriation restrictions, changing political conditions, international monetary fluctuations, currency controls and foreign governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. Changes, if any, in mining or investment policies or shifts in political climate in the DRC may adversely affect Banro's operations. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights, could result in loss, reduction or expropriation of entitlements. In addition, in the event of a dispute arising from operations in the DRC, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in Canada. The Company also may be hindered or prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. It is not possible for the Company to accurately predict such developments or changes in laws or policy or to what extent any such developments or changes may have a material adverse effect on the Company's operations. There are also risks associated with the enforceability of the Company's mining convention with the DRC and the government of the DRC could choose to review the Company's titles at any time. Should the Company's rights, its mining convention or its titles not be honoured or become unenforceable for any reason, or if any material term of these agreements is arbitrarily changed by the government of the DRC, the Company's business, financial condition and prospects will be materially adversely affected.

Some or all of the Company's properties are located in regions where political instability and violence is ongoing. Some or all of the Company's properties are inhabited by artisanal miners. These conditions may interfere with work on the Company's properties and present a potential security threat to the Company's employees. There is a risk that operations of the Company may be delayed or interfered with, due to the conditions of political instability, violence and the inhabitation of the properties by artisanal miners. The Company uses its best efforts to maintain good relations with the local communities in order to minimize such risks.

The DRC is a developing nation which recently emerged from a period of civil war and conflict. Physical and institutional infrastructure throughout the DRC is in a debilitated condition. The DRC is in transition from a largely state controlled economy to one based on free market principles, and from a non-democratic political system with a centralized ethnic power base, to one based on more democratic principles. There can be no assurance that these changes will be effected or that the achievement of these objectives will not have material adverse consequences for Banro and its operations. The DRC continues to experience instability in parts of the country due to certain militia and criminal elements. While the government and United Nations forces are working to support the extension of central government authority throughout the country, there can be no assurance that such efforts will be successful.

No assurance can be given that the Company will be able to maintain effective security in connection with its assets or personnel in the DRC where civil war and conflict have disrupted exploration and mining activities in the past and may affect the Company's operations or plans in the future.

HIV/AIDS, malaria and other diseases represent a serious threat to maintaining a skilled workforce in the mining industry in the DRC. HIV/AIDS is a major healthcare challenge faced by the Company's operations in the country. There can be no assurance that the Company will not lose members of its workforce or workforce man-hours or incur increased medical costs, which may have a material adverse effect on the Company's operations.

The DRC has historically experienced relatively high rates of inflation.

Early Stage of Production at Twangiza

Mining operations generally involve a high degree of risk. The Company’s early stage producing mine at Twangiza is subject to all the hazards and risks normally associated with early stage mineral production, including equipment failure, damage to or destruction of plant and equipment, unusual and unexpected geologic formations, pit collapse, injury or life endangerment, environmental damage, fire, equipment failure or structural failures, such as retaining walls or tailings dams, potentially resulting in environmental pollution and consequent liability. The payment of such liabilities may have a material adverse effect on the Company’s financial position.

Gold Prices

The future price of gold will significantly affect the development of Banro's projects. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond Banro's control. Such factors include, but are not limited to, interest rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold has fluctuated widely in recent years, and future serious price declines could cause development of and commercial production from Banro's mineral interests to be impracticable. If the price of gold decreases, projected cash flow from planned mining operations may not be sufficient to justify ongoing operations and Banro could be forced to discontinue development and sell its projects. Future production from Banro's projects is dependent on gold prices that are adequate to make these projects economic.

Risks Related to the Notes Issued under the Debt Financing

The Company’s substantial indebtedness could adversely affect the Company’s financial condition.

In March 2012 the Company closed a US$175 million debt financing (see item 2 of this AIF), a result of which financing the Company has a significant amount of indebtedness. The Company’s high level of indebtedness could have important adverse consequences, including:

| · | limiting the Company’s ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| · | requiring a substantial portion of the Company’s cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes; |

| · | increasing the Company’s vulnerability to general adverse economic and industry conditions; |

| · | limiting the Company’s flexibility in planning for and reacting to changes in the industry in which it competes; |

| · | placing the Company at a disadvantage compared to other, less leveraged competitors; and |

| · | increasing the cost of borrowing. |

The Company may not be able to generate sufficient cash to service all of its indebtedness, including the Notes, and may be forced to take other actions to satisfy its obligations under such indebtedness, which may not be successful.

The Company’s ability to make scheduled payments on or refinance the Company’s debt obligations, including the Notes, depends on its financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond its control. The Company may be unable to maintain a level of cash flows from operating activities sufficient to permit it to pay the principal, premium, if any, and interest on the indebtedness, including the Notes.

If the Company’s cash flows and capital resources are insufficient to fund its debt service obligations, the Company could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance the Company’s indebtedness, including the Notes. Banro may not be able to effect any such alternative measures on commercially reasonable terms or at all and, even if successful, those alternatives may not allow the Company to meet its scheduled debt service obligations. The indenture under which the Notes were issued (the "Note Indenture") restricts the Company’s ability to dispose of assets and use the proceeds from those dispositions and may also restrict the Company’s ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. The Company may not be able to consummate those dispositions or to obtain proceeds in an amount sufficient to meet any debt service obligations then due.

In addition, Banro is a holding company, and as such it conducts all operations through subsidiaries,. Accordingly, repayment of indebtedness, including the Notes, is dependent on the generation of cash flow by subsidiaries and their ability to make such cash available to Banro. Banro’s subsidiaries may not be able to, or may not be permitted to, make distributions to enable the Company to make payments in respect of its indebtedness, including the Notes. Each subsidiary is a distinct legal entity, and, under certain circumstances, legal and contractual restrictions may limit the Company’s ability to obtain cash from its subsidiaries. In the event that Banro does not receive distributions from its subsidiaries, the Company may be unable to make required principal and interest payments on Banro’s indebtedness, including the Notes.

Banro’s inability to generate sufficient cash flows to satisfy its debt obligations, or to refinance the Company’s indebtedness on commercially reasonable terms or at all, would materially and adversely affect the Company’s financial position and results of operations and its ability to satisfy its obligations under the Notes.

If the Company cannot make scheduled payments on its debt, the Company will be in default and holders of the Notes could declare all outstanding principal and interest to be due and payable, causing a cross-acceleration or cross-default under certain of the Company’s other debt agreements, if any, and the Company could be forced into bankruptcy or liquidation.

The terms of the Note Indenture restrict the Company’s current and future operations, particularly the Company’s ability to respond to changes or to take certain actions.

The Note Indenture contains a number of restrictive covenants that impose significant operating and financial restrictions on the Company and may limit the Company’s ability to engage in acts that may be in its long-term best interest, including restrictions on the Company’s ability to:

| · | incur additional indebtedness; |

| · | pay dividends or make other distributions or repurchase or redeem capital stock; |

| · | prepay, redeem or repurchase certain debt; |

| · | make loans and investments; |

| · | enter into transactions with affiliates; |

| · | alter the businesses it conducts; |

| · | enter into agreements restricting its subsidiaries’ ability to pay dividends; and |

| · | consolidate, amalgamate, merge or sell all or substantially all of its assets. |

A breach of the covenants under the Note Indenture or the Company’s other debt instruments from time to time could result in an event of default under the applicable indebtedness. Such a default may allow the creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In the event the Noteholders or lenders accelerate the repayment of the Company’s borrowings, Banro may not have sufficient assets to repay that indebtedness.

As a result of these restrictions, Banro may be:

| · | limited in how it conducts its business; |

| · | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| · | unable to compete effectively or to take advantage of new business opportunities. |

These restrictions may affect the Company’s ability to grow in accordance with its strategy.

The SEC has Proposed Rules That May Affect Mining Operations in the DRC

The Dodd Frank Wall Street Reform and Consumer Protection Act has directed the SEC to adopt rules regarding disclosure on potential conflict minerals that are necessary to the functionality or production or a product manufactured by a company that files reports with the SEC, and the SEC has issued proposed rules in response to their requirement. Conflict minerals include tantalum, tin, gold and tungsten or their derivatives or any other mineral or its derivatives determined by the Secretary of State to be financing conflict in the DRC or a bordering country. Under the rules as proposed by the SEC, reporting companies must disclose the origin of and certain other information concerning the conflict minerals. Banro is currently exploring and developing properties in the DRC and mining for conflict minerals (i.e. gold). The mining of minerals may be deemed to be considered the manufacturing of such minerals.

If the proposed rules are adopted in their present form, Banro will be required to disclose in its Annual Report on Form 40-F that it files with the SEC, its minerals originated in the DRC and will need to furnish a conflict minerals report which includes a due diligence report of the issuer and a certified independent private sector audit that is to be made publicly available on Banro’s website. The report will need to disclose whether or not Banro and the audit have determined that the conflict minerals are "conflict free", meaning that they did not benefit or finance armed groups in the DRC. The report must include the due diligence measures that Banro took regarding the source and chain of custody of the minerals.

As the final rules have not been adopted, both content of the final rules and their effect remain uncertain. Compliance with the new rules may be demanding on both financial resources and personnel. The requirement that all SEC reporting companies disclose whether their products include conflict minerals, and if so, information concerning the origin of the conflict minerals, might cause companies to take steps, or require their suppliers to take steps, to assure that minerals originating in the DRC are not included in minerals supplied to them for use in their products. Accordingly, it is possible that the rules could adversely affect the ability of Banro to sell minerals mined in the DRC or the price at which the minerals can be sold.

No History of Commercial Mining Operations or Profitability

The Company's properties are in the exploration or development stage, other than the Company’s early stage producing mine at Twangiza. The development of properties found to be economically feasible requires the construction and operation of mines, processing plants and related infrastructure. As a result, Banro is subject to all of the risks associated with establishing new mining operations and business enterprises including: the timing and cost, which can be considerable, of the construction of mining and processing facilities; the availability and costs of skilled labour and mining equipment; the availability and costs of appropriate smelting and/or refining arrangements; the need to obtain necessary environmental and other governmental approvals and permits, and the timing of those approvals and permits; and, the availability of funds to finance construction and development activities. The costs, timing and complexities of mine construction and development are increased by the remote location of the Company's properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that the Company's activities will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce gold at any of its properties.

Government Regulation

Banro's mineral exploration, development and mining activities are subject to various laws governing prospecting, mining, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although Banro's exploration, development and mining activities are currently carried out in accordance with applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail development.

Many of Banro's mineral rights and interests are subject to government approvals, licenses and permits. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of the DRC government. No assurance can be given that Banro will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are not maintained, Banro may be delayed, curtailed or prohibited from continuing or proceeding with planned exploration, development or mining of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be delayed or curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in the exploration, development or mining of mineral properties may be required to compensate those suffering loss or damage by reason of the activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on Banro and cause increases in exploration expenses, capital expenditures or require abandonment or delays in development of mineral interests.

Exploration and Mining Risks

The Company's properties are in the exploration or development stage, other than the Company’s early stage producing mine at Twangiza. The exploration for and development of mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures are required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit, once discovered, will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Banro not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Banro towards the search for and evaluation of mineral deposits will result in discoveries that are commercially viable. In addition, in the case of a commercial ore-body, depending on the type of mining operation involved, several years can elapse from the initial phase of drilling until commercial operations are commenced.

Mining operations generally involve a high degree of risk. Such operations are subject to all the hazards and risks normally encountered in the exploration for, and development and production of gold and other precious or base metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, fires, cave-ins, flooding and other conditions involved in the drilling and removal of material as well as industrial accidents, labour force disruptions, fall of ground accidents in underground operations, unanticipated increases in gold lock-up and inventory levels at heap-leach operations and force majeure factors, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to person or property, environmental damage, delays, increased production costs, monetary losses and possible legal liability. Milling operations are subject to hazards such as equipment failure or failure of mining pit slopes and retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to the Company or to other companies within the mining industry. The Company may suffer a material adverse effect on its business if it incurs losses related to any significant events that are not covered by insurance policies.

Development of an Active Market and Volatility

There can be no assurance that an active market for the Company's securities will be sustained. The market price of the Company's securities may fluctuate significantly based on a number of factors, some of which are unrelated to the financial performance or prospects of the Company. These factors include macroeconomic developments in North America and globally, market perceptions of the attractiveness of particular industries, short-term changes in commodity prices, other precious metal prices, the attractiveness of alternative investments, currency exchange fluctuation, the political environment in the DRC and the Company's financial condition or results of operations as reflected in its financial statements. Other factors unrelated to the performance of the Company that may have an effect on the price of the securities of the Company include the following: the extent of analytical coverage available to investors concerning the business of the Company may be limited if investment banks with research capabilities do not follow the Company's securities; lessening in trading volume and general market interest in the Company's securities may affect an investor's ability to trade significant numbers of securities of the Company; the size of the Company's public float may limit the ability of some institutions to invest in the Company's securities; the Company's operating performance and the performance of competitors and other similar companies; the public's reaction to the Company's press releases, other public announcements and the Company's filings with the various securities regulatory authorities; changes in estimates or recommendations by research analysts who track the Company's securities or the shares of other companies in the resource sector; the arrival or departure of key personnel; acquisitions, strategic alliances or joint ventures involving the Company or its competitors; the factors listed in this AIF under the heading "Cautionary Statement Regarding Forward-Looking Statements"; and a substantial decline in the price of the securities of the Company that persists for a significant period of time could cause the Company's securities to be delisted from any exchange on which they are listed at that time, further reducing market liquidity. If there is no active market for the securities of the Company, the liquidity of an investor's investment may be limited and the price of the securities of the Company may decline. If such a market does not develop, investors may lose their entire investment in the Company's securities.

Financing Requirements

The Company does not have a history of commercial mining operations, and there is no assurance that it will operate profitably or provide a return on investment in the future. The Company has only incurred operating losses, and the development of its projects is still at an early stage. The Company's ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay liabilities arising from normal business operations when they come due.

The Company will require significant amount of funds in order to carry out plans to develop its projects. There can be no assurance that such funds will be available to the Company. If additional financing is raised through the issuance of equity or convertible debt securities of the Company, the interests of the Company's shareholders in the net assets of the Company may be diluted. Any failure of the Company to generate the required funding could have a material adverse effect on the Company's financial condition, results of operations, liquidity, and its ability to continue as a going concern, and may require the Company to cancel or postpone planned capital expenditures.

A holder of common shares or warrants may suffer adverse U.S. federal income tax consequences if the Company is determined to be a passive foreign investment company or "PFIC"

Based on current business plans and financial expectations, the Company expects that it should not be classified as a "passive foreign investment company" ("PFIC") for its current tax year and for the foreseeable future. The Company believes that it was classified as a PFIC for its tax year ended December 31, 2011 and in prior tax years. Whether the Company will be a PFIC for the current or future tax year will depend on the Company's assets and income over the course of each such tax year and, as a result, cannot be predicted with certainty as of the date of this AIF. Accordingly, there can be no assurance that the IRS will not challenge the determination made by the Company concerning its PFIC status for any tax year. U.S. federal income tax laws contain rules which result in materially adverse tax consequences to U.S. taxpayers that own shares of a corporation which has been classified as a PFIC during any tax year of such holder's holding period. A U.S. taxpayer who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC may mitigate such negative tax consequences by making certain U.S. federal income tax elections, which are subject to numerous restrictions and limitations. Holders of the Company's common sharesand warrants are urged to consult their own tax advisors regarding the acquisition, ownership, and disposition of the Company's common sharesand warrants.

History of Losses and Expected Future Losses

The Company has incurred losses since its inception. The Company incurred the following net losses during each of the following periods:

| · | US$9.3 million for the year ended December 31, 2011; and |

| · | US$3.0 million for the year ended December 31, 2010. |

The Company had an accumulated deficit of approximately US$79.76 million as of December 31, 2011. The losses do not include capitalized mineral property exploration and development costs.

The Company expects to continue to incur losses until such time as its Twangiza mine enters into commercial production and generate sufficient revenues to fund continuing operations. The development of the Company's properties will require the commitment of substantial financial resources. The amount and timing of expenditures will depend on a number of factors, including the progress of ongoing exploration and development, the results of consultants' analysis and recommendations, the rate at which any operating losses are incurred, and the Company's acquisition of additional properties, some of which are beyond the Company's control. There can be no assurance that the Company will ever achieve profitability.

Infrastructure for the Projects

The Company's projects are located in remote areas of the DRC, which lack basic infrastructure, including sources of power, water, housing, food and transport. In order to develop any of its projects Banro needs to establish the facilities and material necessary to support operations in the remote locations in which they are situated. The remoteness of each project affects the potential viability of mining operations, as Banro also needs to establish substantially greater sources of power, water, physical plant and transport infrastructure than are present in the area. The transportation of equipment and supplies into the DRC and the transportation of resources out of the DRC may also be subject to delays that adversely affect the ability of the Company to proceed with its mineral projects in the country in a timely manner. Shortages of the supply of diesel, mechanical parts and other items required for the Company's operations could have an adverse effect on the Company's business, operating results and financial condition. The lack of availability of such sources may adversely affect mining feasibility and, in any event, requires Banro to arrange significant financing, locate adequate supplies and obtain necessary approvals from national, provincial and regional governments, none of which can be assured. The Company's interests in the DRC are accessed over lands that may also be subject to the interests of third parties which may result in further delays and disputes in the carrying out of the Company's operational activities.

Uncertainty in the Estimation of Mineral Reserves and Mineral Resources

The mineral resource and mineral reserve figures referred to in this AIF and in the Company's filings with the SEC and applicable Canadian securities regulatory authorities, press releases and other public statements that may be made from time to time are estimates. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. There can be no assurance that these estimates will be accurate or that this mineralization could be mined or processed profitably.

The Company has not commenced commercial production on any of its properties, and has not defined or delineated any proven or probable reserves on any of its properties other than Twangiza. Mineralization estimates for the Company's properties may require adjustments or downward revisions based upon further exploration or development work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The resource and reserve estimates referred to in this AIF have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in the market price for gold may render portions of the Company's mineralization uneconomic and result in reduced reported mineralization. Any material reductions in estimates of mineralization, or of the Company's ability to extract this mineralization, could have a material adverse effect on the Company's results of operations or financial condition.

The Company has not established the presence of any proven or probable reserves at any of its properties other than Twangiza. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on such properties. The failure to establish proven and probable reserves on such properties could severely restrict the Company's ability to successfully implement its strategies for long-term growth.

Uncertainty Relating to Inferred Mineral Resources

There is a risk that the inferred mineral resources referred to in this AIF cannot be converted into mineral reserves as the ability to assess geological continuity is not sufficient to demonstrate economic viability. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration.

Dependence on Limited Properties