EXHIBIT 99.19

INFORMATION CIRCULAR

for the

Annual General and Special Meeting

of

MERCATOR MINERALS LTD.

to be held on

Wednesday, August 31, 2011

YOUR VOTE IS EXTREMELY IMPORTANT.

PLEASE SUBMIT YOUR YELLOW PROXY TODAY.

INFORMATION CIRCULAR

Mercator Minerals Ltd.

1050 – 625 Howe Street

Vancouver, British Columbia

V6C 2T6

Telephone: (604) 694-0005

Fax: (604) 558-0085

Website: http://www.mercatorminerals.com

(As at July 27, 2011, except as indicated)

Mercator Minerals Ltd. (the "Company") is providing this Information Circular and a form of proxy in connection with management’s solicitation of proxies for use at the annual and special general meeting (the "Meeting") of the Company to be held on Wednesday, August 31, 2011, and at any adjournments. Unless the context otherwise requires, when we refer in this Information Circular to the Company, its subsidiaries are also included. The Company will conduct its solicitation by mail and officers and employees of the Company may, without receiving special compensation, also telephone or make other personal contact. The Company will pay the cost of solicitation.

In addition, the Company has retained the services of Georgeson Shareholder Communications Canada Inc. ("Georgeson") in connection with the solicitation of proxies. For this service, and other advisory services, Georgeson will be paid a fee of up to $45,000 plus certain out-of-pocket expenses. You may contact Georgeson Shareholder Communications Inc., by telephone at 1-866-656-4104 toll-free in North America or 1-781-575-2168 outside of North America or by email at askus@georgeson.com.

APPOINTMENT OF PROXYHOLDER

The purpose of a proxy is to designate persons who will vote the proxy on a shareholder’s behalf in accordance with the instructions given by the shareholder in the proxy (the "Proxy"). The persons whose names are printed in the enclosed form of proxy are officers or Directors of the Company (the "Management Proxyholders").

A shareholder has the right to appoint a person other than a Management Proxyholder, to represent the shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person’s name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a shareholder.

VOTING BY PROXY

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the shareholder on any ballot that may be called for and if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly.

If a shareholder does not specify a choice and the shareholder has appointed one of the Management Proxyholders as proxyholder, the Management Proxyholder will vote in favour of the matters specified in the Notice of Meeting and in favour of all other matters proposed by management at the Meeting.

The enclosed form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

COMPLETION AND RETURN OF PROXY

Completed forms of proxy must be deposited at the office of the Company’s registrar and transfer agent, Computershare Trust Company of Canada ("Computershare"), Toronto Office, Proxy Department, at 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, not later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently. For general inquiries, shareholders may contact Computershare as follows:

| | By Phone: | Within North America: 1-866-732-8683

Outside North America: 1-312-588-4290 |

| | | |

| | By Fax: | Within North America: 1-866-249-7775

Outside North America: 1-416-263-9524 |

| | | |

| | By Internet: | www.investorvote.com |

NON-REGISTERED HOLDERS

Only shareholders whose names appear on the records of the Company as the registered holders of shares or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Company are "non-registered" shareholders because the shares they own are not registered in their names but instead are registered in the name of a nominee such as a brokerage firm through which they purchased the shares; bank, trust company, trustee or administrator of self-administered RRSP's, RRIF's, RESP's and similar plans; or clearing agency such as The Canadian Depository for Securities Limited (a "Nominee"). If you purchased your shares through a broker, you are likely an unregistered holder.

In accordance with securities regulatory policy, the Company has distributed copies of the Meeting materials, being the Notice of Meeting, this Information Circular and the Proxy, to the Nominees for distribution to non-registered holders.

Nominees are required to forward the Meeting materials to non-registered holders to seek their voting instructions in advance of the Meeting. Shares held by Nominees can only be voted in accordance with the instructions of the non-registered holder. The Nominees often have their own form of proxy, mailing procedures and provide their own return instructions. If you wish to vote by proxy, you should carefully follow the instructions from the Nominee in order that your shares are voted at the Meeting.

If you, as a non-registered holder, wish to vote at the Meeting in person, you should appoint yourself as proxyholder by writing your name in the space provided on the request for voting instructions or proxy provided by the Nominee and return the form to the Nominee in the envelope provided. Do not complete the voting section of the form as your vote will be taken at the Meeting.

In addition, Canadian securities legislation now permits the Company to forward meeting materials directly to "non objecting beneficial owners". If the Company or its agent has sent these materials directly to you (instead of through a Nominee), your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Nominee holding on your behalf. By choosing to send these materials to you directly, the Company (and not the Nominee holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii) executing your proper voting instructions.

REVOCABILITY OF PROXY

Any registered shareholder who has returned a proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a registered shareholder, his attorney authorized in writing or, if the registered shareholder is a corporation, a corporation under its corporate seal or by an officer or attorney thereof duly authorized, may revoke a proxy by instrument in writing, including a proxy bearing a later date. The instrument revoking the proxy must be deposited at the registered office of the Company, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or with the chairman of the Meeting on the day of the Meeting. Only registered shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must, at least seven (7) days before the Meeting, arrange for their respective Nominees to revoke the proxy on their behalf.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue an unlimited number of common shares without par value (the "shares"), of which 245,972,823 shares were issued and outstanding at July 27, 2011. Persons who are registered shareholders at the close of business on July 27, 2011 will be entitled to receive notice of and vote at the Meeting and will be entitled to one vote for each share held. The Company has only one class of shares.

To the knowledge of the Directors and executive officers of the Company, other than Pala Investments Holdings Limited which is the holder of 42,282,000 shares in the Company (representing approximately 17.19% of the shares of the Company as at July 27, 2011), as of the date of this Information Circular, there is no person or company that beneficially owns, directly or indirectly, or exercises control or direction over, shares of the Company carrying 10% or more of the voting rights attached to all shares of the Company.

ELECTION OF DIRECTORS

The Directors of the Company are elected at each annual general meeting and hold office until the next annual general meeting or until their successors are appointed. In the absence of instructions to the contrary, the enclosed proxy will be voted for the nominees herein listed.

Shareholder approval will be sought to fix the number of Directors of the Company at eight (8).

The Company has an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee, an Environment, Health and Safety Committee, and a Special Committee. Members of these committees are as set out below.

Management of the Company proposes to nominate each of the following persons for election as a Director. Information concerning such persons, as furnished by the individual nominees, is as follows:

Name, Jurisdiction of Residence and Position (1) | Principal Occupation or employment and, if not a previously elected Director, occupation during the past 5 years | Previous Service as a Director | Number of Common Shares beneficially owned, controlled or directed, directly or indirectly (2) |

Colin K. Benner(4)(7) British Columbia, Canada Director | Chairman of Capstone Mining Corp. from November 2008 to June 2011; Executive Chairman of Creston Moly Corp. from Oct. 2008 to June 2011; Vice Chairman and CEO of Skye Resources from Mar. 2008 to Sept. 2008; Executive Chairman of PBS Coals Ltd. from August 2007 to August 2008; Vice Chairman of Lundin Mining Corp. from April 2007 to March 2008; Vice Chairman and CEO of Lundin Mining Corp. from November 2006 to April 2007; Vice Chairman and CEO of EuroZinc Mining Corp. from December 2004 to October 2006 | June 2011 | 223,532 |

John H. Bowles, FCA, FCIM(3) British Columbia, Canada Director | Retired Partner, PricewaterhouseCoopers (PwC) LLP, Chartered Accountants; Chartered Accountant; Corporate Director June 2006 to present | April 2011 | Nil |

Joseph M. Keane(3)(4) Green Valley, Arizona, U.S.A Director | Professional Engineer President, Keane Mineral Engineering LLC, mineral processing consulting corporation (2006-2008); President, KD Engineering Co., mineral engineering design corporation (1982-2006) | December 2009 | 11,850 |

D. Bruce McLeod British Columbia, Canada President and CEO | President and CEO the Company since June 22, 2011; President and CEO of Troon Ventures Ltd. from June 1989 to July 15, 2011; Principal of the Northair Group 1996 to July 6, 2011; President and CEO of Creston Moly Corp. from August 2009 to June 2011; formerly Executive Chairman of Sherwood Copper Corp. from September 2005 to November 2008 | June 2011 | 602,124 |

Robert J. Quinn(5) (6) Texas, USA Director | Attorney, Quinn & Brooks LLP | September 2005 | Nil |

Name, Jurisdiction of Residence and Position (1) | Principal Occupation or employment and, if not a previously elected Director, occupation during the past 5 years | Previous Service as a Director | Number of Common Shares beneficially owned, controlled or directed, directly or indirectly (2) |

Stephen P. Quin(6)(7) British Columbia, Canada Director | President & CEO of Midas Gold Inc. (public mineral exploration company) since January 2011, President & COO of Capstone Mining Corp. (public mining company) from November 2008 to December 2010, formerly President & CEO of Sherwood Copper Corporation (public mining company) until its combination with Capstone (September 2005); Executive VP, Miramar Mining Corporation (public mineral exploration company) 1990 to 2005 | February 2005 | 19,591 |

Gavin Thomas(3)(4)(5)(7) Australia Non-Executive Chairman and Director | Geologist, Chief Executive Officer, Kingsgate Consolidated Limited (public mining company) (since November 2004) | January 2005 | 46,839 |

Ronald Earl Vankoughnett (3)(4)(5)(7) British Columbia, Canada Director | Independent Businessman | May 2005 | 50,000 |

| (1) | The information as to country and province or state of residence, and principal occupation, not being within the knowledge of the Company, has been furnished by the respective nominees. |

| (2) | Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at July 27, 2011, based upon information furnished to the Company by individual Directors. Unless otherwise indicated, such shares are held directly. |

| (3) | Member of the Audit Committee. |

| (4) | Member of the Compensation Committee. |

| (5) | Member of the Special Committee. |

| (6) | Member of the Environment, Health and Safety Committee. |

| (7) | Member of the Corporate Governance and Nominating Committee. |

No proposed Director is to be elected under any arrangement or understanding between the proposed director and any other person or company, except the Directors and executive officers of the Company acting solely in such capacity.

To the best of management’s knowledge, save for Colin K. Benner as is further discussed below, no proposed Director:

| (a) | is, as at the date of the Information Circular, or has been, within 10 years before the date of the Information Circular, a director, chief executive officer ("CEO") or chief financial officer ("CFO") of any company (including the Company) that: |

| | (i) | was the subject, while the proposed Director was acting in the capacity as director, CEO or CFO of such company, of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or |

| | (ii) | was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed Director ceased to be a |

| | director, CEO or CFO but which resulted from an event that occurred while the proposed Director was acting in the capacity as director, CEO or CFO of such company; or |

| (b) | is, as at the date of this Information Circular, or has been within 10 years before the date of the Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed Director; or |

| (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (e) | has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed Director. |

Mr. Benner was a director of Tahera Diamond Corporation which, on January 16, 2008, was granted creditor protection by the Ontario Superior Court of Justice under the Companies’ Creditors Arrangement Act (Canada). Mr. Benner resigned as a director of Tahera Diamond Corporation on September 29, 2008.

EXECUTIVE COMPENSATION

The following table (presented in accordance with the amended National Instrument Form 51-102F6 ("Statement of Executive Compensation") which came into force on December 31, 2008 (the "Form 51-102F6")) sets forth all annual and long term compensation for services in all capacities to the Company for the three most recently completed financial years of the Company (to the extent required by the Form 51-102F6) in respect of each of the individuals comprised of the Chief Executive Officer and the Chief Financial Officer as at December 31, 2010 and the other three most highly compensated executive officers of the Company as at December 31, 2010 whose individual total compensation for the most recently completed financial year exceeded $150,000 and any individual who would have satisfied these criteria but for the fact that individual was not serving as such an officer at the end of the most recently completed financial year (each a "Named Executive Officer" or "NEO"). (All dollar values in the following table are denominated in US dollars unless otherwise stated.)

Summary Compensation Table

NEO Name and

Principal Position | Year | Salary (US$) | Share-Based Awards | Option-Based

Awards (US$)(1) | Non-Equity Incentive

Plan Compensation (US$) | Pension

Value (US$) | All Other

Compensation (US$) | Total

Compensation (US$) |

Annual Incentive

Plans(2) | Long-term Incentive Plans |

Michael L. Surratt, President and CEO(3) | 2010 2009 2008 | $460,000 $460,000 $460,000 | N/A N/A N/A | Nil $1,455,707 Nil | Nil Nil Nil | N/A N/A N/A | N/A N/A N/A | Nil Nil Nil | $460,000 $1,919,707 $460,000 |

Raymond R. Lee, CFO(4) | 2010 2009 2008 | $220,000 $220,000 $220,000 | N/A N/A N/A | Nil $867,424 Nil | Nil Nil Nil | N/A N/A N/A | N/A N/A N/A | Nil Nil Nil | $220,000 $1,087,424 $220,000 |

Gary Simmerman, VP Engineering(5) | 2010 2009 2008 | $204,616 $200,000 $200,000 | N/A N/A N/A | Nil $722,854 Nil | Nil Nil Nil | N/A N/A N/A | N/A N/A N/A | Nil Nil Nil | $204,616 $922,854 $200,000 |

Craig Smith, Project Manager, Mineral Park Mine(6) | 2010 2009 2008 | $204,616 $200,000 $200,000 | N/A N/A N/A | Nil $67,921 Nil | Nil Nil Nil | N/A N/A N/A | N/A N/A N/A | Nil Nil Nil | $204,616 $200,000 $200,000 |

Robert Spengler, Environmental manager, Mineral Park Mine(7) | 2010 2009 2008 | $204,616 $200,000 $200,000 | N/A N/A N/A | Nil $639,463 Nil | Nil Nil Nil | N/A N/A N/A | N/A N/A N/A | Nil Nil Nil | $204,616 $839,463 $200,000 |

| | (1) | The amounts in this column represent the fair value of stock options which is estimated on the date of grant using a Black-Scholes option pricing model. See discussion below. |

| | (2) | There were no bonuses paid for these financial years. |

| | (3) | Mr. Surratt resigned as President & CEO, and as a Director, of the Company effective June 22, 2011 in conjunction with the business combination of Creston Moly Corp. Mr. Surratt was replaced as President and CEO by D. Bruce McLeod on June 22, 2011. |

| | (4) | Mr. Lee resigned as CFO of the Company effective January 15, 2011, and was replaced by Mark Distler. Mr. Lee ceased to be a Director of the Company effective June 22, 2011. |

| | (5) | Effective September 26, 2010, the salaries for Messrs. Simmerman, Smith and Spengler were increased to $220,000 and the salary figures reflect the increased salary that was paid for the remainder of the most recently completed financial year. |

The compensation amounts reported as Option Awards in the above table represent the estimated grant date fair value of the stock options granted during the year. All of these stock options were granted with an exercise price equal to the market price of the Company’s common shares on the date of grant. The amounts reported do not represent the net cash proceeds received by the individuals from the exercise of stock options. See section entitled "Outstanding Share-Based Awards and Option-Based Awards" below for more information.

The Company uses a Black-Scholes option pricing model to estimate the fair value of stock options at the date of grant. The following weighted-average assumptions were used in the valuation model:

| | 2010 | 2009 | 2008 |

| Expected volatility | 108% | 83% | 83% |

| Risk-free interest rate | 2.31% | 2.87% | 2.87% |

| Expected life | 54 months | 60 months | 60 months |

| Dividend yield | Nil | Nil | Nil |

Incentive Plan Awards

The Company does not have any incentive plans, pursuant to which non-equity compensation that depends on achieving certain performance goals or similar conditions within a specified period is awarded, earned, paid or payable to the Named Executive Officer(s).

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding under incentive plans of the Company pursuant to which compensation that depends on achieving certain performance goals or similar conditions within a specified period, at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to each of the Named Executive Officers:

| | Option-Based Awards | Share-Based Awards |

| Name | Number of

Securities

Underlying

Unexercised

Options (#) | Option

Exercise Price (CDN$) | Option

Expiration Date | Value of

Unexercised

In-The-Money

Options (1) (CDN$) | Number of

Shares Or Units

Of Shares That

Have Not Vested (#) | Market or

Payout Value Of

Share-Based

Awards That

Have Not Vested (CDN$) |

Michael L. Surratt,

President and CEO(2) | 166,667 400,000 800,000 500,000 500,000 | $1.00 $3.30 $3.10 $1.65 $2.27 | Jan. 11, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Dec. 23, 2014 | $495,001 $268,000 $696,000 $1,160,000 $850,000 | Nil | Nil |

Raymond R. Lee, CFO(3) | 150,000 300,000 300,000 | $3.30 $1.65 $2.27 | Feb. 21, 2012 May 2, 2014 Dec. 23, 2014 | $100,500 $348.000 $510,000 | Nil | Nil |

Gary Simmerman,

VP Engineering and Mine Manager | 200,000 250,000 250,000 | $3.30 $1.65 $2.27 | Feb. 21, 2012 May 2, 2014 Dec. 23, 2014 | $134,000 $464,000 $425,000 | Nil | Nil |

Craig Smith,

Project Manager, Mineral Park Mine | 200,000 | $3.30 | Feb. 21, 2012 | $134,000 | Nil | Nil |

| Robert Spengler, Environmental Manager, Mineral Park Mine | 100,000 250,000 200,000 | $3.30 $1.65 $2.27 | Feb. 21, 2012 May 2, 2014 Dec. 23, 2014 | $67,000 $580,000 $340,000 | Nil | Nil |

| 1) | This amount is calculated based on the difference between the market value of the securities underlying the options at the end of the most recently completed financial year, which was $3.97, and the exercise or base price of the option. |

| (2) | Mr. Surratt resigned as President & CEO, and as a Director, of the Company effective June 22, 2011 in conjunction with the business combination of Creston Moly Corp. Mr. Surratt was replaced as President and CEO by D. Bruce McLeod on June 22, 2011. |

| (3) | Mr. Lee resigned as CFO of the Company effective January 15, 2011, and was replaced by Mark Distler. Mr. Lee ceased to be a Director of the Company effective June 22, 2011. |

| | Value Vested or Earned During the Year |

The value vested or earned during the most recently completed financial year of incentive plan awards granted to Named Executive Officers are as follows:

| NEO Name | Option-Based Awards -

Value Vested During The Year (1) (US$) | Share-Based Awards - Value Vested During The Year (US$) | Non-Equity Incentive Plan Compensation - Value Earned During The Year (US$) |

Michael L. Surratt,

President and CEO(2) | $95,190 | Nil | Nil |

Raymond R. Lee,

CFO(3) | $57,114 | Nil | Nil- |

Gary Simmerman,

VP Engineering and Mine Manager | $47,595 | Nil | Nil |

Craig Smith,

Project Manager, Mineral Park Mine | Nil | Nil | Nil |

Robert Spengler,

Environmental Manager, Mineral Park Mine | $38,076 | Nil | Nil |

| (1) | This amount is the dollar value that would have been realized computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise or base price of the options under the option-based award on the vesting date. |

| (2) | Mr. Surratt resigned as President & CEO, and as a Director, of the Company effective June 22, 2011 in conjunction with the business combination of Creston Moly Corp. Mr. Surratt was replaced as President and CEO by D. Bruce McLeod on June 22, 2011. |

| (3) | Mr. Lee resigned as CFO of the Company effective January 15, 2011, and was replaced by Mark Distler. Mr. Lee ceased to be a Director of the Company effective June 22, 2011. |

Pension Plan Benefits

The Company does not have a defined benefit, defined contribution or deferred compensation plan for the Named Executive Officers.

Termination and Change of Control Benefits

Effective June 1, 2010, the Company entered into amended employment agreements with the Named Executive Officers’, replacing the employment agreements that had been previously in place, reducing the amounts payable on termination of the NEO’s employment by either Mercator or the NEO following a change of control of the Company, or by the Company at any time without notice for just cause, or at any time without any advance notice other than for just cause. The NEOs' employment agreements provide for the payment of compensation upon termination of the NEO's employment by either the Company or

the NEO following a change of control of the Company, or by the Company at any time without notice for just cause, or at any time without any advance notice other than for just cause.

In the event of termination for reasons other than just cause, the NEO will be entitled to receive an amount equal to 24 months’ salary (less any required withholdings).

If, within a 24 month period following the effective date of a change of control (a) the Company terminates the NEO but excluding termination for cause; or (b) the NEO terminates employment with the Company for good reason, then the NEO will be entitled to a lump sum payment equal to three times his annual compensation (i.e., salary and bonus). Any such termination requires two months' written notice by either the Company in connection with an involuntarily termination or by the NEO if the NEO terminates employment for good reason.

In lieu of monies payable to a NEO under the prior paragraph on a change of control, a NEO may elect, on ten days' written notice, to voluntarily terminate his employment with the Company for any reason beginning six months following a change of control and extending for a window period of 30 days thereafter, in which case the NEO will be entitled to a lump sum payment equal to three times his annual compensation (i.e., salary and bonus).

The employment agreements for Michael L. Surratt (the President and CEO of the Company as at the end of the most recently completed financial year, but who was replaced by D. Bruce McLeod on June 22, 2011) and Raymond R. Lee (the CFO of the Company as at the end of the most recently completed financial year, but who was replaced by Mark Distler on January 15, 2011) provided that, in the event of a change of control, Mr. Surratt will be entitled to receive a change of control bonus of US$460,000 and that Mr. Lee will be entitled to a change of control bonus of US$220,000. Additionally, the agreements provided that following the termination of employment of Messrs. Surratt and Lee after a change of control, the Company, upon request by either of Messrs. Surratt or Lee, as applicable, shall enter into a consulting agreement with either of Messrs. Surratt or Lee, as applicable, whereby either of Messrs. Surratt or Lee, as applicable, will provide consulting services to Mercator, as a non-employee for a period of 24 months and 12 months respectively, at a monthly fee equal to 1/12 of the salary in effect on the date of termination. Please see the chart on the following page for further details.

The employment agreements were approved by the Company’s Compensation Committee and the Board of Directors. In each agreement, a "change of control" is defined as the occurrence of any one or more of the following events:

| | (A) | The consummation of a merger, amalgamation, or arrangement of the Company with any other person or persons different from the persons holding equity securities of the Company immediately prior to the transaction, other than (a) a merger, amalgamation, or arrangement which would result in the equity securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) more than 60% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger, amalgamation, or arrangement; or (b) a merger, amalgamation, or arrangement effected to implement a recapitalization of the Company (or similar transaction) in which no person acquires more than 30% of the combined voting power of the Company’s then outstanding equity securities; |

| | (B) | Any person (other than the Company and any entity owned, directly or indirectly, by the stockholders of the Company in substantially the same proportion as their ownership of equity |

| | securities of the Company), is or becomes the beneficial owner, directly or indirectly, of equity securities of the Company representing 30% or more of the combined voting power of the Company’s then outstanding securities; |

| | (C) | During any period of not more than six consecutive months, individuals who at the beginning of such period constitute the Company’s Board of Directors cease for any reason to constitute at least a majority thereof; or |

| | (D) | Any other transaction which the Company’s Board of Directors designates as a change of control. |

The following chart shows the amounts payable to the NEOs as at the end of the most recently completed financial year stated in US Dollars, in the event of a termination of the NEO by the Company without cause where no change of control has taken place, for a change of control, and for a termination by the Company or by the NEO following a change of control, in each case assuming that the termination, and change of control if any, took place as at December 31, 2010.

Named Executive

Officer | Termination by the

Company if No

Change of Control (1) | Change in Control

Bonus (2) | Termination by the

Company Post Change

of Control (3) | Termination by NEO

Post Change of

Control (4) |

Michael L. Surratt President & CEO(5) | $920,000 | $460,000 | $2,115,000 | $2,115,000 |

Raymond R. Lee, CFO(6) | $440,000 | $220,000 | $840,000 | $840,000 |

| Gary Simmerman, VP Engineering and Mine Manager | $400,000 | Nil | $600,000 | $600,000 |

| Craig Smith, Project Manager, Mineral Park Mine | $400,000 | Nil | $600,000 | $600,000 |

| Robert Spengler, Environmental Manager, Mineral Park Mine | $400,000 | Nil | $600,000 | $600,000 |

| (1) | Consists of 24 months' salary in the year in which termination occurs to which each of the NEOs would have been entitled as at December 31, 2010. |

| (2) | The bonus payable to each NEO in the event of a change of control. |

| (3) | The estimated payment to the NEO upon termination by the Company following a change of control, in addition to the change of control payment previously paid. Consists of three times the total of the annual salary in the year in which termination occurs and an amount equal to the highest annual bonus paid to each of the NEOs within the four most recent years. The termination by the Company must occur within 24 months of the control of control. See also footnote (5). |

| (4) | The estimated payment to the NEO upon termination by the NEO following a change of control, in addition to the change of control payment previously paid. Consists of three times the total of the annual salary in the year in which termination occurs and an amount equal to the highest annual bonus paid to each of the NEOs within the four most recent years. The termination by the NEO must occur within six months of the change of control or, if certain triggering events related to the NEO's conditions of employment occur after the change of control, within 24 months of the change of control. |

| (5) | Mr. Surratt resigned as President & CEO, and as a Director, of the Company effective June 22, 2011 in conjunction with the business combination of Creston Moly Corp. On his resignation as President and CEO, a retirement allowance of $2.575 million was payable to Mr. Surratt in connection with his resignation as the President and CEO of the Company. The Company also entered into a 2 year consulting agreement with Mr. Surratt in accordance with the terms of his employment agreement, to serve as a consultant to the President and CEO. |

| (6) | Mr. Lee resigned as CFO of the Company effective January 15, 2011, and was replaced by Mark Distler effective that same date. Mr. Lee ceased to be a Director of the Company effective June 22, 2011. |

The Company has also entered into an employment agreement with the current CFO, Mark Distler. Among other things, the agreement provides for a salary of US$210,000 per annum. The remaining provisions of the employment agreement with Mr. Distler are similar to those of the previous CFO, as described previously in this Information Circular, except there is no provision for a change of control bonus payment or a consulting agreement in the event of a termination after a change of control.

On the closing of the acquisition of Creston Moly Corp, as disclosed above, Mr. Surratt resigned as the Company’s President and CEO, and D. Bruce McLeod was appointed President and CEO. Effective June 22, 2011, the Company entered into an employment agreement with Mr. McLeod. The employment agreement with Mr. McLeod provides for base salary at an annualized rate of CDN$400,000 and benefits, and the payment of compensation upon termination of Mr. McLeod's employment by either the Company or Mr. McLeod following a change of control of the Company, or by the Company at any time without notice for just cause, or at any time without any advance notice other than for just cause.

In the event of termination for reasons other than just cause, Mr. McLeod will be entitled to receive an amount equal to 15 months’ salary together with any accrued but unused vacation and unreimbursed expenses, plus one (1) additional month's salary for each completed year of employment with the Company (prorated for partial years), up to a maximum of twenty-four (24) months' salary (less any required withholdings).

If, within a 12 month period following the effective date of a change of control (a) the Company terminates Mr. McLeod but excluding termination for cause; or (b) Mr. McLeod terminates employment with the Company for good reason, then Mr. McLeod will be entitled to a lump sum payment equal to two and one-half (2 1/2) times his annual compensation (i.e., salary and bonus). Any such termination requires two months' written notice by either the Company in connection with an involuntarily termination or by the NEO if the NEO terminates employment for good reason.

Mr. McLeod’s employment agreement was approved by the Company’s Compensation Committee and the Board of Directors. In the agreement, a "change of control" is defined as previously described above in relation to other employment agreements.

Composition of the Compensation Committee

The Compensation Committee is responsible for, among other things, reviewing and making recommendations to the Board of Directors with respect to the Company’s compensation policies and practices, reviewing and making recommendations to the Board of Directors with respect to the compensation of the Chief Executive Officer, reviewing and approving the compensation of all other senior executive officers, and administering the Company’s stock option plan. The Compensation Committee bases its recommendations on the performance of the applicable individual and of the Company. The Board (exclusive of the executive officers of the Company who are also members of the Board) reviews such recommendations and gives final approval to the compensation of the executive officers.

The Compensation Committee periodically reviews the compensation paid to Directors and management based on such factors as time commitment, comparative fees paid by similar companies in the industry and level of responsibility.

The Compensation Committee of the Board consists of Ronald Earl Vankoughnett (Chair), Colin K. Benner, Joseph M. Keane and Gavin Thomas, all of whom are considered independent for the purposes of NI 52-110, except for, except Mr. Benner, who served as the Executive Chairman of Creston Moly Corp., and who, on closing of the acquisition of Creston Moly Corp. by the Company effective June 22, 2011,

received a severance payment of CDN$182,000 in connection with the terms of a consulting agreement with Creston Moly Corp.

Compensation Discussion and Analysis

The Company’s principal goal is to create value for its shareholders. The Company believes that the compensation of the Directors, officers and employees should be aligned with both the short and long term interests of the shareholders of the Company.

The overall objective adopted by the Compensation Committee is to ensure that executive compensation is fair and reasonable, rewards management performance and is sufficient to attract and retain experienced and talented executives. This objective also recognizes the fundamental value added by a motivated and committed management team. The Compensation Committee also believes that compensation design must recognize the cyclical nature of the mining industry.

To this end, the executive compensation program formulated by the Compensation Committee is comprised of three components: base salary, annual cash bonus and long-term incentive in the form of stock options. The program is structured to be competitive with a select group of comparative North American mining companies. A portion of the annual cash bonus is directly related to the overall performance of the Company. In 2010, the Compensation Committee reviewed and set the executive compensation levels using the Coopers Consulting Limited 2009 National Mining Industries Salary Survey. The survey is a competitive analysis of the compensation paid to mining executives in Canada. The Company participated in the Consulting Limited 2009 National Mining Industries Salary Survey for US Companies, as the Company’s operations are mainly in the United States, and the bulk of the Company’s expenses are incurred in US dollars. The results of the 2009 Survey were used by the Compensation Committee in reviewing the compensation of the officers in connection with the 2010 fiscal year and the performance of the Company and the officers for 2010.

Base Salary

Base salary is the principal component of an executive officer’s compensation package. To ensure that the Company is capable of attracting, motivating and retaining individuals with exceptional executive skills, cash compensation is reviewed and adjusted annually, based primarily on individual and corporate performance as well as compensation practices of similar mining companies. In determining base salaries and bonuses, the Compensation Committee took into account the financial performance of the Company for 2010 and to date in 2011.

The level of the base salary for each employee of the Company is determined by the level of responsibility and the importance of the position to the Company and the officers’ individual responsibilities, experience, performance and contribution toward enhancing shareholder value, within competitive industry ranges.

By keeping base salaries at or near the average base salaries for the mining industry, the Company has more flexibility in tying reward to performance as a greater percentage of compensation earned by officers of the Company can be paid in the form of bonuses and stock option grants, which are payable at the discretion of the Company.

The Compensation Committee determines the base salaries and bonuses for senior management and employees of the Company. Each of the Named Executive Officers has an employment contract with the Company which provides that the annual base salary of such executive is subject to review on an annual basis (see "Termination of Employment, Changes in Responsibility and Employment Contracts").

Bonus

The Chief Executive Officer of the Company presents recommendations to the Compensation Committee with respect to bonuses to be awarded to the other members of senior management and the other employees of the Company. The Compensation Committee evaluates each member of senior management and the other employees of the Company in terms of their performance and the performance of the Company. Corporate performance is measured by reviewing personal performance and other significant factors, such as level of responsibility and importance of the position to the Company. The individual performance factor allows the Company to recognize and reward those individuals whose efforts have assisted the Company to attain its corporate performance objective. The Compensation Committee then makes a determination of the bonuses, if any, to be awarded to each member of senior management and to the employees of the Company, which are reported to the Board of Directors of the Company. In 2010, none of the members of the executive management team received a performance bonus for work done in 2009. To date in 2011, bonus allocations for the members of the executive management team have been deferred. As of the date of this Information Circular, no performance bonuses have been granted or paid to the executive management team for work done in 2010.

Stock Options

The Company grants long-term incentives to its executive officers in the form of stock options.

The purpose of the Company’s stock option plan is to develop the interest and incentive of eligible service providers, employees, officers and Directors in the Company’s growth and development by giving an opportunity to purchase common shares on a favourable basis, thereby advancing the interests of the Company, enhancing the value of the common shares for the benefit of all shareholders and increasing the ability of the Company to attract and retain skilled and motivated individuals. Stock option grants are directly linked to increases in shareholder value and the individual’s contribution to that central goal. The Company believes that stock options play an important role in building shareholder value by aligning the interests of officers with the interests of shareholders. Options to purchase the Company’s shares are granted by the Compensation Committee at not less than the closing price of the Company’s shares on the Toronto Stock Exchange (the "TSX") on the business day immediately prior to the date of grant.

The Compensation Committee takes into account each executive’s stock option position, peer comparison group benchmark and individual performance when determining whether and how many new stock option grants will be made to an executive officer.

Under the Current Stock Option Plan (as defined below) there are currently options to purchase 11,863,850 common shares allocated and granted to Directors, officers, employees and consultants, representing approximately 4.82% of the issued shares of the Company on July 27, 2011. Additionally, there are currently (i) 58,750 options to purchase common shares (representing approximately 0.02% of the issued shares of the Company on July 27, 2011) under the Stingray Copper Inc. option plan which the Company assumed as part of the Company’s acquisition of Stingray Copper Inc. in 2009, and (ii) 2,241,024 options to purchase common shares (representing approximately 0.91% of the issued shares of the Company on July 27, 2011) under the Creston Moly Corp. option plan which the Company assumed as part of the Company’s acquisition of Creston Moly Corp. in June of 2011. No further options can be granted under either of the Stingray Copper Inc. option plan or the Creston Moly Corp. option plan, and the outstanding options under these plans are not included for the purposes of determining the maximum number of options issuable pursuant to the proposed New Fixed Stock Option Plan. See "Securities Authorized for Issuance Under Equity Compensation Plans" and "Approval of New Fixed Stock Option Plan" below for further details.

The Current Stock Option Plan and the Compensation Committee Charter provide that the Compensation Committee, subject to the approval of the Board of Directors, may determine performance measures to be met as a pre-condition to the granting or vesting of an option. These performance measures can be either for the Company as a whole or the individual. Individual performance measures that the Compensation Committee may implement may vary based on an executive’s ability to affect business results.

No options granted to the NEO’s and senior management during 2010. In making the decision on option grants during 2010, the Compensation Committee considered individual performance and Company performance, including share price performance, operating and financial performance, corporate development and organizational development.

Options granted by the Compensation Committee under the Current Stock Option Plan are subject to approval by the Board of Directors. Options are not transferable. See "Current Stock Option Plan" for further discussion of the Current Stock Option Plan.

Current Stock Option Plan

The Company's stock option plan is administered by the entire Board of Directors, based on recommendations made by the Compensation Committee, and is intended to advance the interests of the Company through the motivation, attraction and retention of key employees, officers and Directors of the Company and subsidiaries of the Company and to secure for the Company and its shareholders the benefits inherent in the ownership of common shares of the Company by key employees, officers and Directors of the Company and subsidiaries of the Company. Each grant of options is approved by the Board of Directors of the Company.

The Company's current "rolling" stock option plan (the "Current Stock Option Plan") was originally adopted in 2000, amended in 2004, and subsequently amended again in 2005, to comply with the requirements for listing on the TSX. TSX policies require that all unallocated options, rights or other entitlements ("unallocated entitlements") under a stock option plan that does not have a fixed maximum number of securities issuable be approved by shareholders (a 'renewal approval') every three years after institution of the stock option plan. On June 26, 2008, at the Company’s meeting of the shareholders, the shareholders re-approved the Current Stock Option Plan and approved amendments of a housekeeping nature to the Current Stock Option Plan, principally to update terminology, and to incorporate amendments to the Current Stock Option Plan mandated by the TSX and other regulatory agencies.

The Current Stock Option Plan complies with the rules and policies of the TSX. The number of common shares of the Company which may be subject to option under the Option Plan in favour of any one individual and in the aggregate is limited under the terms of the Option Plan and cannot be increased without shareholder and regulatory approval. Options granted under the Option Plan have a maximum term of ten years and are exercisable at a price per share determined by the Board of Directors of the Company at the time the option is granted, which price may not be less than the closing price of the common shares on the TSX on the last trading day immediately preceding the date of grant of the option. All grants of options are reviewed by the Compensation Committee and recommended to the Board of Directors for approval.

The Company plans to have shareholders approve a new fixed stock option plan at the Meeting (see "Approval of New Fixed Stock Option Plan" under "Particulars of Matters to be Acted Upon" below).

Benefits

Benefits provided to senior executives are designed to be competitive with industry practice and include health and life insurance, and certain perquisites such as automobile benefits.

Compensation of the Chief Executive Officer

The components of total compensation for the Chief Executive Officer are the same as those which apply to other senior executive officers of the Company, namely, annual salary and performance bonus and long-term incentives.

Consistent with the Company’s philosophy of targeting salaries and performance bonuses for the Company’s executive officers at median levels of executives in the Coopers Consulting Limited annual National Mining Industries Salary Survey, Mr. Surratt’s annual salary was intended to reflect annual salaries paid to the chief executive officers in the survey.

During 2010, Mr. Surratt was paid a salary at an annualized rate of US$460,000 in accordance with the terms of his employment agreement with the Company. In connection with the completion of the arrangement with Creston Moly Corp. in June 2011, Mr. Surratt, agreed to step down as President and CEO of the Company and was replaced by D. Bruce McLeod. Immediately following his resignation, Mr. Surratt assumed an ongoing consulting role with the Company as discussed immediately below. (See also previous section entitled "Termination and Change of Control Benefits" for further details regarding such consulting arrangements.)

With the change to the post of President and CEO, the Board determined that the ongoing involvement of the Company’s development and operating team is essential to the success of expansion at Mineral Park and the developments of the El Pilar project and the El Creston project. In order to protect shareholder value, and to secure the ongoing involvement of Mr. Surratt and his operating team, discussions between the relevant Board Committee Chairs (Mercator Special Committee & Compensation Committee), together with legal and financial advisors, commenced with respect to a separation agreement for Mr. Surratt. Upon the recommendation of both the Mercator Special Committee and the Compensation Committee, Mr. Surratt and Mercator agreed to a separation payment in the order of $2.575 million and a two year consulting arrangement. The Company believes that Mr. Surratt will be able to provide essential advice to the newly merged company and save the Company more than this cost with respect to the ongoing development projects at El Pilar and El Creston.

As disclosed above under the section titled “Termination and Change of Control Benefits”, the Company entered into an employment agreement with Mr. McLeod as the Company’s new President and CEO, effective June 22, 2011, pursuant to which Mr. McLeod was paid a salary at an annualized rate of $400,000 in accordance with the terms of his employment agreement with the Company.

Going forward, the Compensation Committee and, as appropriate, the Board of Directors, will address other issues relating to executive compensation, including the relative emphasis on the components of executive compensation, including compensation for the Company’s President and CEO and other executive officers.

Director Compensation

Compensation the most recently completed financial year for Directors who are also Named Executive Officers has already been disclosed above. In 2009, the Company first implemented compensation arrangements, pursuant to which Directors are compensated by the Company or its subsidiaries for their

services in their capacity as Directors, or for committee participation, involvement in special assignments or for services as a consultant or an expert, during the most recently completed financial year. The comparator group of companies used by the Compensation Committee for director compensation included the following companies:

| Amerigo Resources Ltd. | Corriente Resources Inc. | Capstone Mining Corp. |

| | | |

| HudBay Minerals Inc. | Lundin Mining Corporation | North American Palladium Ltd. |

| | | |

| Quadra Mining Ltd. (pre combination with FNX Mining Company) | Taseko Mines Limited | Thompson Creek Metals Company |

During the Company’s most recently completed financial year, the Company’s Directors who are not also an executive officer each received a Directors’ fee of CDN$9,000 per quarter with each Director also receiving CDN$1,000 per meeting attended in person and CDN$500 per meeting attended by teleconference; the Chairman of the Board of Directors received an additional CDN$5,000 per quarter; the Chairman of the Audit Committee received an additional CDN$3,000 per quarter; the Chairman of other committees of the Board received an additional CDN$2,000 per quarter and members of other committees (other than the Chairman) also received CDN$1,000 per quarter for committee membership fees.

During the year ended December 31, 2010, a law firm of which Robert J. Quinn is a partner, was paid US$187,599 for legal services rendered by the firm.

The Company has the Current Stock Option Plan for the granting of incentive stock options to the officers, employees and Directors. The purpose of granting options to the Directors of the Company is to assist the Company in compensating, attracting, retaining and motivating the Directors of the Company and to closely align the personal interests of such persons to that of the shareholders. As noted above, the Company plans to have shareholders approve a new fixed stock option plan at the Meeting (see "Approval of New Fixed Stock Option Plan").

The following table sets forth all amounts of compensation provided to each of the Directors, who are not Named Executive Officers, for the Company’s most recently completed financial year, including compensation for services, if any, not related to their directorships:

| United States currency |

| Director Name | Fees

Earned ($) | Share-

Based

Awards ($) | Option-

Based

Awards ($)(3) | Non-Equity

Incentive

Plan Compensation ($) | Pension

Value ($) | All Other

Compensation ($) | Total ($) |

| Joseph M. Keane | $40,295.01 | Nil | $200,756.01 | Nil | Nil | Nil | $241,051.02 |

Michael D. Lindeman(1) | $52,121.80 | Nil | $200,756.01 | Nil | Nil | Nil | $252,877.81 |

| Stephen P. Quin | $44,306.02 | Nil | $200,756.01 | Nil | Nil | Nil | $245,062.03 |

Robert J. Quinn(2) | $46,149.71 | Nil | $200,756.01 | Nil | Nil | $187,599.00 | $434,504.72 |

| Gavin Thomas | $79,216.82 | Nil | $200,756.01 | Nil | Nil | Nil | $279,972.83 |

| Ronald Earl Vankoughnett | $71,927.00 | Nil | $200,756.01 | Nil | Nil | Nil | $272,683.01 |

| | (1) | Mr. Lindeman resigned as a Director of the Company on April 25, 2011. |

| | (2) | During the year ended December 31, 2010, a law firm of which Robert J. Quinn is a partner was paid US$187,599 for legal services rendered by such firm. |

| | (3) | The amounts in this column represent the fair value of stock options which is estimated on the date of grant using a Black-Scholes option pricing model. See previous discussion below the Summary Compensation Table disclosure in the "Executive Compensation" of this Information Circular. |

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding under incentive plans of the Company pursuant to which compensation that depends on achieving certain performance goals or similar conditions within a specified period, at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to each of the Directors who are not Named Executive Officers:

| | Option-Based Awards | Share-Based Awards |

| Director Name | Number of

Securities

Underlying

Unexercised

Options (#) | Option Exercise

Price (CDN$) | Option

Expiration Date | Value of

Unexercised

In-The-Money

Options (1) (CDN$) | Number of

Shares Or Units

Of Shares That

Have Not

Vested (#) | Market or

Payout Value

Of Share-Based

Awards That

Have Not

Vested (CDN$) |

| Joseph M. Keane | 6,250(2) 12,500(2) 12,500(2) 12,500(2) 100,000 | $4.80 $4.80 $3.00 $1.88 $2.48 | April 27, 2012 June 28, 2012 June 18, 2013 June 17, 2014 Jan. 4, 2015 | Nil Nil $12,125 $26,125 $149,000 | Nil | Nil |

Michael D. Lindeman(3) | 50,000 50,000 50,000 100,000 100,000 | $2.09 $3.30 $3.10 $1.65 $2.48 | May 19, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Jan. 4, 2015 | $94,000 $33,500 $43,500 $232,000 $149,000 | Nil | Nil |

| Stephen P. Quin | 50,000 50,000 25,000 100,000 100,000 | $2.09 $3.30 $3.10 $1.65 $2.48 | May 19, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Jan. 4, 2015 | $94,000 $33,500 $21,750 $232,000 $149,000 | Nil | Nil |

| Robert J. Quinn | 50,000 50,000 50,000 100,000 100,000 | $2.09 $3.30 $3.10 $1.65 $2.48 | May 19, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Jan. 4, 2015 | $94,000 $33,500 $43,500 $232,000 $149,000 | Nil | Nil |

| Gavin Thomas | 50,000 50,000 50,000 100,000 100,000 | $2.09 $3.30 $3.10 $1.65 $2.48 | May 19, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Jan. 4, 2015 | $94,000 $33,500 $43,500 $232,000 $149,000 | Nil | Nil |

| Ronald Earl Vankoughnett | 50,000 50,000 50,000 100,000 100,000 | $2.09 $3.30 $3.10 $1.65 $2.48 | May 19, 2011 Feb. 21, 2012 Mar. 16, 2012 May 2, 2014 Jan. 4, 2015 | $94,000 $33,500 $43,500 $232,000 $149,000 | Nil | Nil |

| | (1) | This amount is calculated based on the difference between the market value of the securities underlying the options at the end of the most recently completed financial year, which was CDN$3.97, and the exercise or base price of the option. |

| | (2) | Mr. Keane became a Director of the Company upon the completion of the Company’s acquisition of Stingray Copper Inc. on December 21, 2009. The options identified by the note above are options that were granted to Mr. Keane as a |

| | director of Stingray Copper Inc. Under the arrangement with Stingray Copper Inc., all Stingray options were exchanged for converted options to purchase shares in the capital of the Company at the rate of 0.25 of one Company share in lieu of one Stingray share, on the same terms and conditions as the original Stingray option. See "Securities Authorized for Issuance Under Equity Compensation Plans" for further details. |

| | (3) | Mr. Lindeman resigned as a Director of the Company on April 25, 2011. |

Incentive Plan Awards - Value Vested or Earned During the Year

The value vested or earned during the most recently completed financial year of incentive plan awards granted to Directors who are not Named Executive Officers are as follows:

| Director Name | Option-Based Awards -

Value Vested During The Year (1) (CDN$) | Share-Based Awards - Value Vested During The Year (2) (CDN$) | Non-Equity Incentive

Plan Compensation - Value Earned During The Year (CDN$) |

| Joseph M. Keane | $11,000 | N/A | Nil |

Michael D. Lindeman(3) | $11,000 | N/A | Nil |

| Stephen P. Quin | $11,000 | N/A | Nil |

| Robert J. Quinn | $11,000 | N/A | Nil |

| Gavin Thomas | $11,000 | N/A | Nil |

| Ronald Earl Vankoughnett | $11,000 | N/A | Nil |

| (1) | This amount is the dollar value that would have been realized computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise or base price of the options under the option-based award on the vesting date. |

| (2) | This amount is the dollar value realized computed by multiplying the number of shares or units by the market value of the underlying shares on the vesting date. |

| (3) | Mr. Lindeman resigned as a Director of the Company on April 25, 2011. |

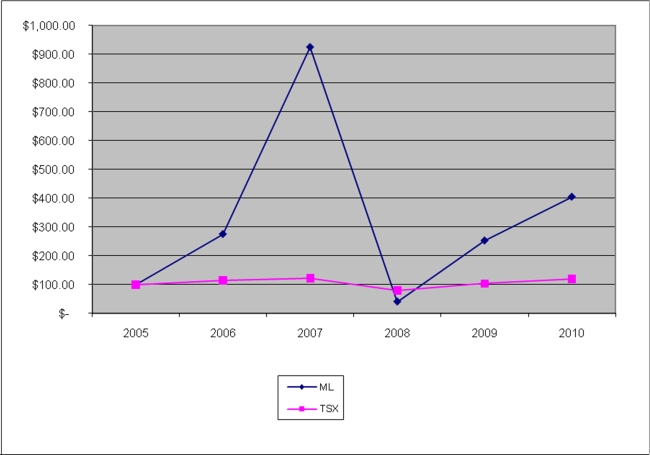

The following graph compares the yearly percentage change in the cumulative total shareholder return for CDN$100 invested in common shares of the Company, for the last five years, with the cumulative total return of the S&P/TSX Composite index. The common share trading data is as reported by the TSX. The value of each year represents the closing price as of December 31 on that year.

| | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| ML | $100.00 | $275.51 | $925.51 | $40.82 | $253.06 | $405.10 |

| TSX Composite | $100.00 | $114.51 | $122.72 | $79.73 | $104.20 | $119.26 |

The trend shown by this graph does not reflect the trend in the Company’s compensation to executive officers over the same period. Over the five years, the Compensation Committee established compensation objectives believed appropriate during the evolution of the Company from an exploration company to its current position as an emerging copper and molybdenum producer, and compensation to executive officers increased nominally. The share price of exploration companies and copper and molybdenum producers fluctuate with changes in commodity prices and at no time during the period shown in the graph was compensation intended to reflect share price.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes relevant information as of the end of the most recently completed financial year with respect to compensation plans under which equity securities are authorized for issuance.

| Plan Category | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights (a) | Weighted average

exercise price of

outstanding options,

warrants and rights (CDN$) (b) | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a) (c) |

| Equity compensation plans approved by security holders | 10,869,117 58,750(1) | $2.73 $3.41 | 8,893,030 Nil |

| Equity compensation plans not approved by security holders | Nil | Nil | Nil |

| Total | 10,927,867(2)(3) | $2.74 | 8,893,030 |

| | (1) | These options are the remaining converted Stingray options outstanding from the Company’s acquisition of Stingray Copper Inc. in 2009, and are subject to the provisions of the Stingray Copper Inc. option plan. No further options may be granted under the Stingray Copper Inc. option plan and these options are not included for the purposes of determining the maximum number of shares issuable under the Current Stock Option Plan or the New Fixed Stock Option Plan. |

| | (2) | Subsequent to the end of the most recently completed financial year, the Company completed the acquisition of Creston Moly Corp. As part of the transaction, the options outstanding were converted to options to purchase shares in the Company at the ratio of .15 Company shares for each option to purchase a share in Creston Moly Corp. The Converted Creston options are subject to the provisions of the Creston Moly Corp. option plan. No further options may be granted under the Creston Moly Corp. option plan and these options are not included for the purposes of determining the maximum number of shares issuable under the Current Stock Option Plan or the New Fixed Stock Option Plan. |

| | (3) | As at the date of this Information Circular, there were 58,750 converted options outstanding under the Stingray Copper Inc. option plan, 2,241,024 converted options outstanding under the Creston Moly Corp. plan, and 11,863,850 options outstanding under the Current Stock Option Plan, representing an aggregate total of 14,163,624 common shares of the Company to be issued on the exercise of outstanding options. |

The following is a summary of the principal features of the Current Stock Option Plan, which authorizes the Board of Directors (or Compensation Committee) to grant stock options to the Optionees on the following terms:

1. The number of shares subject to each stock option is determined by the Board of Directors (or Compensation Committee) provided that the Current Stock Option Plan, together with all other previously established or proposed share compensation arrangements, may not result in:

(a) the number of common shares of the Company reserved for issuance to insiders exceeding 10% of the outstanding issue; or

(b) the issuance, to insiders of the Company of a number of common shares of the Company exceeding, within a one year period, 10% of the outstanding issue; or

(c) the issue to any one participant or any one person who is an insider of the Company within a one year period of more than 5% of the outstanding issue.

The 'outstanding issue' is the number of common shares of the Company outstanding immediately prior to any option grant.

2. The maximum number of common shares of the Company which may be issued pursuant to stock options granted under the Current Stock Option Plan, unless otherwise approved by shareholders, is 10% of the issued and outstanding common shares at the time of the grant. Any increase in the issued and outstanding common shares will result in an increase in the available number of common shares issuable

under the Current Stock Option Plan, and any exercises of stock options will make new grants available under the Plan.

3. All unallocated entitlements under the Current Stock Option Plan must be approved and ratified by shareholders every three years.

4. The exercise price of an option may not be set at less than the closing price of the common shares of the Company on the TSX on the trading day immediately preceding the date of grant of the option.

5. The options may be exercisable for a period of up to ten years, such period and any vesting schedule to be determined by the Board of Directors (or Compensation Committee) of the Company, and are non-assignable, except in certain circumstances.

6. The expiry date of an option is the specified expiry date in the option agreement, and in any event, may have a maximum term of ten years.

7. The options can be exercised by the optionee as long as the optionee is a Director, officer, employee or service provider to the Company or its subsidiaries or within a period of not more than 90 days after ceasing to be a Director, officer, employee or service provider (or such longer period as may be specified in an employment contract) or, if the optionee dies, within one year from the date of the optionee's death. If the optionee ceases to be employed or engaged by the Company or its subsidiaries for cause, each option held by the optionee shall be cancelled effective immediately as of the date of termination. Each option held by any optionee performing or engaged in investor relations activities for the Company shall be exercisable at any time up to but not after the earlier of the Expiry Date of that option and the date which is 30 days after the optionee ceases to be engaged in investor relations activities for the Company.

8. The Board may from time to time in the absolute discretion of the Board amend, modify and change the provisions of an option granted under the Current Stock Option Plan, or the Current Stock Option Plan, without obtaining approval of shareholders to:

(a) make amendments of a grammatical, typographical, clerical and administrative nature and any amendments required by a regulatory authority;

(b) change vesting provisions of an option or the Current Stock Option Plan;

(c) change the termination provisions of an option or the Current Stock Option Plan which does not entail an extension beyond the original expiry date of the option or the Current Stock Option Plan;

(d) change the termination provisions of an option or the Current Stock Option Plan which does entail an extension beyond the original expiry date of the option or the Current Stock Option Plan for an optionee who is not an insider;

(e) reduce the exercise price of an option for an optionee who is not an insider;

(f) implement a cashless exercise feature, payable in cash or securities, provided that such feature provides for a full deduction of the number of shares from the number of shares reserved under the Current Stock Option Plan; and

(g) make any other amendments of a non-material nature which are approved by the TSX.

All other amendments, modifications or changes to the Current Stock Option Plan shall only be effective upon such amendment, modification or change being approved by the shareholders of the Company given by the affirmative vote of a majority of the shares represented at the meeting of the shareholders of the Company at which a motion to approve the Current Stock Option Plan or an amendment thereto. Any amendment, modification or change of any provision of the Current Stock Option Plan shall be subject to approval, if required, by any regulatory body having jurisdiction.

9. Stock options granted under the Current Stock Option Plan carry with them associated stock appreciation rights which allow a holder of an option under the Plan to elect not to exercise all or a portion of options held and instead receive the number of common shares of the Company disregarding fractions, which, when multiplied by the 'fair value' of the common shares to which an option relates (determined as the weighted average market price for the common shares of the Company on the TSX for the immediately preceding five trading days), has a total value equal to the product of the number of such common shares multiplied by the difference between the weighted average market price determined as of the day immediately preceding the date of termination of such Option, or part thereof, and the Option Price per share of the Optioned Shares to which the Option, or part thereof, so terminated relates, less any amount (which amount may be withheld in Optioned Shares) required to be withheld on account of income taxes.

The approval of the unallocated entitlements under the Current Stock Option Plan was not submitted within the three year required period for approval and ratification by the shareholders, and as such, no further options may be granted under the Current Option Plan. The options currently outstanding continue to be governed by the terms and conditions of the Current Option Plan. The Company plans to have shareholders approve a new fixed stock option plan at the Meeting (see "Approval of New Fixed Stock Option Plan" under "Particulars of Matters to be Acted Upon" below).

Other Equity Compensation Plans

As noted in the table above, 2,299,774 common shares in the Company are issuable upon exercise of outstanding options pursuant to stock option plans that the Company inherited through acquisitions of other entities that are now subsidiaries of the Company. Details regarding such options are outlined below.

On June 22, 2011, the Company completed an arrangement under the Business Corporations Act (British Columbia) with Creston Moly Corp., pursuant to which Mercator acquired all of the issued and outstanding shares of Creston Moly Corp., and it became a wholly owned subsidiary of the Company. As part of this arrangement, all holders of Creston Moly Corp. options became entitled to receive shares in the Company upon exercise of such options (the "Creston Options"). A total of 2,241,024 such Creston Options remain outstanding as of the date of this Information Circular. Each such Creston Option continues to be governed by and be subject to the terms of the Creston stock option plan and any applicable stock option agreement thereunder.

On December 21, 2009, the Company completed a business combination with Stingray Copper Inc. ("Stingray") by way of plan of arrangement under the Canada Business Corporations Act. Upon completion of the business combination, Stingray became a wholly-owned subsidiary of the Company. As part of the combination, all outstanding options to acquire common shares of Stingray were exchanged for options to purchase 0.25 of one share in lieu of one Stingray option (the "Stingray Options"). A total of 58,750 Stingray Options remain outstanding as of the date of this Information Circular and such options remain subject to the same terms and conditions as the original Stingray option under the Stingray option plan and any applicable stock option agreement thereunder.

INDEBTEDNESS TO COMPANY OF DIRECTORS AND EXECUTIVE OFFICERS

As at the date of this Information Circular, there was no indebtedness outstanding of any current or former Director, executive officer or employee of the Company or any of its subsidiaries which is owing to the Company or any of its subsidiaries or to another entity which is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries, entered into in connection with a purchase of securities or otherwise.

No individual who is, or at any time during the most recently completed financial year was, a Director or executive officer of the Company, no proposed nominee for election as a Director of the Company and no associate of such persons:

| (i) | is or at any time since the beginning of the most recently completed financial year has been, indebted to the Company or any of its subsidiaries; or |

| (ii) | whose indebtedness to another entity is, or at any time since the beginning of the most recently completed financial year has been, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries, |

in relation to a securities purchase program or other program.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed, no informed person or proposed Director of the Company and no associate or affiliate of the foregoing persons has or has had any material interest, direct or indirect, in any transaction since the commencement of the Company's most recently completed financial year or in any proposed transaction which in either such case has materially affected or would materially affect the Company or any of its subsidiaries.

MANAGEMENT CONTRACTS

No management functions of the Company or subsidiary are performed to any substantial degree by a person other than the Directors or executive officers of the Company or subsidiary.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as set out herein, no person who has been a Director or executive officer of the Company at any time since the beginning of the Company’s last financial year, no proposed nominee of management of the Company for election as a Director of the Company and no associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership or otherwise, in matters to be acted upon at the Meeting other than the election of Directors and the appointment of auditors.

CORPORATE GOVERNANCE DISCLOSURE

National Instrument 58-201 establishes corporate governance guidelines which apply to all public companies. The Company has reviewed its own corporate governance practices in light of these guidelines and, as prescribed by National Instrument 58-101, discloses its corporate governance practices.

Independence of Members of Board

The Company's Board consists of eight (8) Directors. All are considered independent for the purposes of National Instrument 58-101, with the exception of D. Bruce McLeod, who is the current President and CEO of the Company; Colin K. Benner, who served as the Executive Chairman of Creston Moly Corp., and who, on closing of the acquisition of Creston Moly Corp. by the Company effective June 22, 2011, received a severance payment of CDN$182,000 in connection with the terms of the consulting agreement with Creston Moly Corp.; and Robert J. Quinn, who is a partner of a law firm which rendered legal services to the Company during the most recently concluded financial year and which billed the Company US$187,599 for these services rendered. As such, a majority of the Directors of the Company are independent.

Management Supervision by Board