EXHIBIT 99.2

El Pilar Project Form 43-101F1 Technical Report |  |

DATE AND SIGNATURES PAGE

See Appendix A, Feasibility Study Contributors and Professional Qualifications, for the certificate of the Qualified Person responsible for the content of this report, Michael Broch, FAusIMM, Mercator Minerals. This certificate is considered the date and signature of this report in accordance with Form 43-101F1.

This report is current as of October 18, 2012.

Page i

El Pilar Project Form 43-101F1 Technical Report |  |

FORM 43-101F1 TECHNICAL REPORT

2012 FEASIBILITY STUDY UPDATE

TABLE OF CONTENTS

| DATE AND SIGNATURES PAGE | I |

| TABLE OF CONTENTS | II |

| LIST OF FIGURES AND ILLUSTRATIONS | VIII |

| LIST OF TABLES | XII |

| 1 | SUMMARY | 1 |

| | 1.1 | Overall Report Summary | 1 |

| | 1.2 | Introduction Summary | 4 |

| | 1.3 | Reliance on Other Experts | 4 |

| | 1.4 | Property Description and Location | 5 |

| | 1.5 | Accessibility, Climate, Local Resources, Infrastructure & Physiography | 5 |

| | 1.6 | History | 6 |

| | 1.7 | Geological Setting & Mineralization | 7 |

| | 1.8 | Deposit Types | 8 |

| | 1.9 | Exploration | 8 |

| | 1.10 | Drilling | 8 |

| | 1.11 | Sample Preparation, Analyses and Security | 8 |

| | 1.12 | Data Verification | 9 |

| | 1.13 | Mineral Processing and Metallurgical Testing | 9 |

| | 1.14 | Mineral Resource Estimates | 12 |

| | 1.15 | Mineral Reserve Estimates | 13 |

| | 1.16 | Mining Methods | 14 |

| | 1.17 | Recovery Methods | 16 |

| | 1.18 | Project Infrastructure | 16 |

| | 1.19 | Market Studies and Contracts | 18 |

Page ii

El Pilar Project Form 43-101F1 Technical Report |  |

| | 1.20 | Environmental Studies, Permitting and Social or Community Impact | 18 |

| | 1.21 | Capital and Operating Costs | 19 |

| | 1.22 | Economic Analysis | 21 |

| | 1.23 | Adjacent Properties | 21 |

| | 1.24 | Other Relevant Data and Information | 22 |

| | 1.25 | Interpretation and Conclusions | 22 |

| | 1.26 | Recommendations | 22 |

| | 1.27 | References | 23 |

| 2 | INTRODUCTION | 24 |

| | 2.1 | Issuer | 24 |

| | 2.2 | Purpose of Issue | 24 |

| | 2.3 | Sources of Information | 24 |

| | 2.4 | Personal Inspections | 24 |

| | 2.5 | Units and Terms of Reference | 25 |

| 3 | RELIANCE ON OTHER EXPERTS | 27 |

| | 3.1 | Geology and Resource Definition | 27 |

| | 3.2 | Resources & Reserves | 27 |

| | 3.3 | Metallurgy and Process Engineering | 27 |

| | 3.4 | Environmental and Permitting | 27 |

| | 3.5 | Geotechnical | 28 |

| | 3.6 | Hydrology | 28 |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 29 |

| | 4.1 | Property Description | 29 |

| | 4.2 | Mineral Tenure, Royalties and Agreements | 29 |

| | 4.3 | Location | 32 |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE & PHYSIOGRAPHY | 33 |

| | 5.1 | Accessibility | 33 |

| | 5.2 | Climate | 33 |

| | 5.3 | Local Resources and Infrastructure | 33 |

| | 5.4 | Physiography | 34 |

| 6 | | HISTORY | 35 |

Page iii

El Pilar Project Form 43-101F1 Technical Report |  |

| | 6.1 | History Prior to Stingray | 35 |

| | 6.2 | 2001 Polygonal Resources by Normex | 35 |

| | 6.3 | 2003 Block Model Resource Estimate by Magri | 35 |

| | 6.4 | 2007 Inferred Mineral Resource by Woods | 36 |

| | 6.5 | 2009 Stingray Mineral Reserve Feasibility Study | 37 |

| 7 | GEOLOGICAL SETTING & MINERALIZATION | 41 |

| | 7.1 | Regional Geologic Setting – Patagonia Mountains | 41 |

| | 7.2 | Regional Geology of the El Pilar Property | 41 |

| | 7.3 | Geology of the El Pilar Copper Deposit | 43 |

| | 7.4 | Copper Mineralization | 52 |

| 8 | DEPOSIT TYPES | 62 |

| 9 | EXPLORATION | 64 |

| 10 | DRILLING | 70 |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 72 |

| | 11.1 | Pre-Stingray Drilling | 72 |

| | 11.2 | Stingray Drilling | 72 |

| | 11.3 | Comparison of Soluble Copper Assays | 73 |

| | 11.4 | Metallurgical Sample Preparation, Analysis and Security | 74 |

| | 11.5 | Conclusion | 74 |

| 12 | DATA VERIFICATION | 75 |

| | 12.1 | IMC Verification of Assay Database | 75 |

| | 12.2 | Quality Assurance and Quality Control for Stingray Drilling Samples | 75 |

| | 12.3 | Data Verification of Metallurgical Samples | 91 |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 92 |

| | 13.1 | General | 92 |

| | 13.2 | Historic Work - 2004 Noranda & 2009 Stingray Metallurgical Testing | 92 |

| | 13.3 | Evaluation of 2009 Stingray Metallurgical Testing Results | 95 |

| | 13.4 | Additional Metallurgical Testing Done in 2010 and 2011 by Mercator | 96 |

| | 13.5 | Bulk Sample Crib and Column Tests 2010-2011 | 97 |

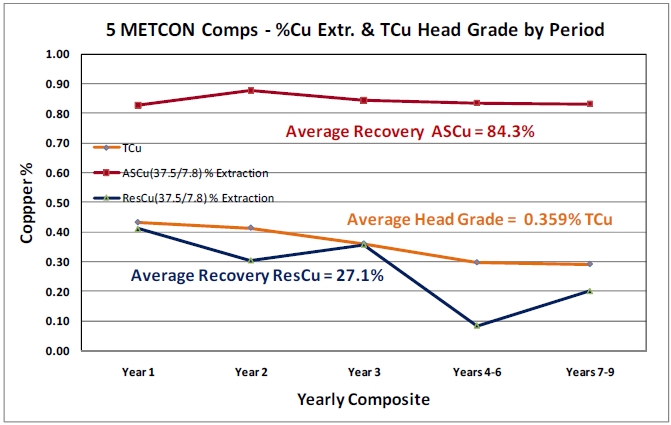

| | 13.6 | Five Metcon Columns to Back-Up the MP Bulk Sample Crib and Column Tests | 113 |

Page iv

El Pilar Project Form 43-101F1 Technical Report |  |

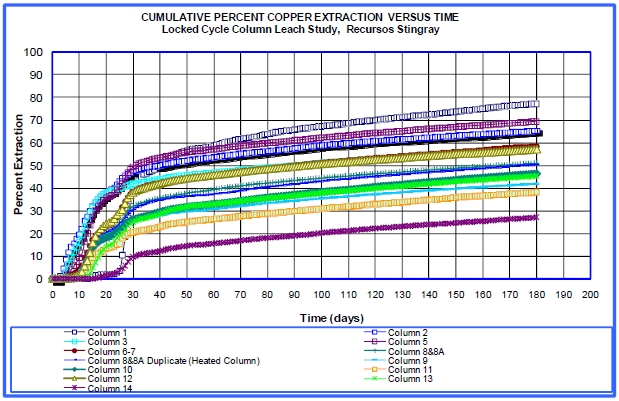

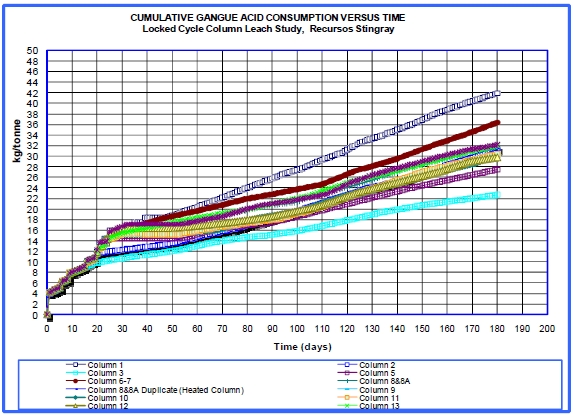

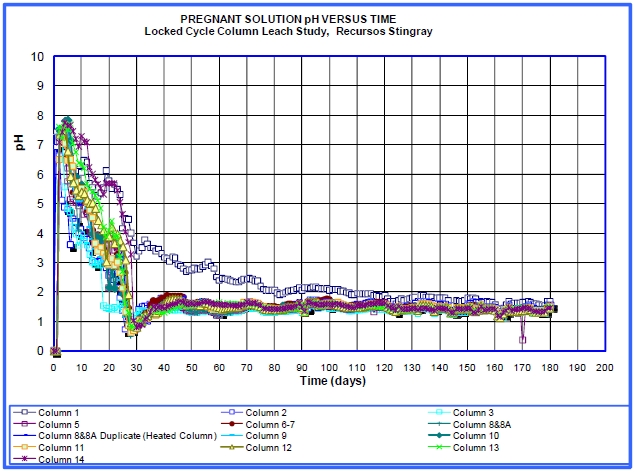

| | 13.7 | Thirteen Columns – Additional Metallurgical Work 2010-2011 | 115 |

| | 13.8 | Metsim Copper Recovery and Acid Consumption Projections | 131 |

| | 13.9 | 2011 Feasibility Study Base Case - 6 Meter Lift Height 180 Day Projected Copper Recovery | 133 |

| | 13.10 | 6 Meter Lift Height 180 Day Height Actual Copper Recovery | 135 |

| | 13.11 | New Base Case - 3 Meter Lift Height 180 Day Copper Recovery | 138 |

| | 13.12 | 3 Meter Lift Height 360 Day Projected Copper Recovery | 141 |

| | 13.13 | New 2012 Data -11 Mini Columns | 144 |

| | 13.14 | El Pilar Lom Acid Consumption Projections | 150 |

| | 13.15 | Discussion of Optimum Acid Precure Amounts | 152 |

| | 13.16 | Copper Recovery Rate Kinetics | 155 |

| | 13.17 | Comparison of Metallurgical Composite Sample Metcon Head Assay to Drillhole Assays | 157 |

| | 13.18 | Summary of El Pilar Metallurgical Results and Project Upsides | 161 |

| 14 | MINERAL RESOURCE ESTIMATES | 161 |

| | 14.1 | Resource Model | 169 |

| | 14.2 | Resource Classification | 170 |

| | 14.3 | Mineral Resource Estimates | 172 |

| | 14.4 | Changes From the July 2008 Resource Model | 175 |

| 15 | MINERAL RESERVE ESTIMATES | 175 |

| | 15.1 | General | 181 |

| | 15.2 | Design Economics and Floating Cone Evaluations | 181 |

| 16 | MINING METHODS | 181 |

| | 16.1 | General | 181 |

| | 16.2 | Operating Parameters and Criteria | 181 |

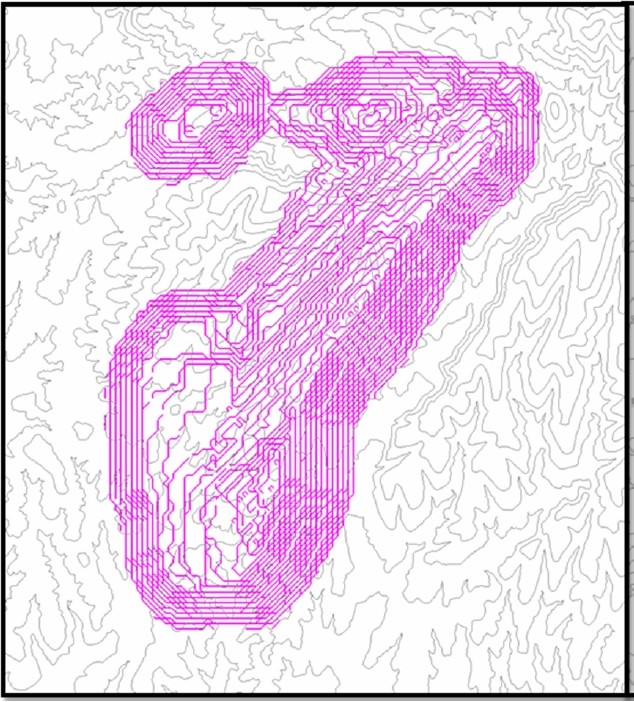

| | 16.3 | Pit and Mining Phase Design | 181 |

| | 16.4 | Mining Production Schedule | 187 |

| | 16.5 | Pit Wall Slope Stability | 190 |

| | 16.6 | Waste Rock Storage Areas | 193 |

| | 16.7 | Annual Mine Drawings | 195 |

| | 16.8 | Mining Equipment | 208 |

| 17 | RECOVERY METHODS | 226 |

Page v

El Pilar Project Form 43-101F1 Technical Report |  |

| | 17.1 | Process Facilities | 226 |

| 18 | PROJECT INFRASTRUCTURE | 240 |

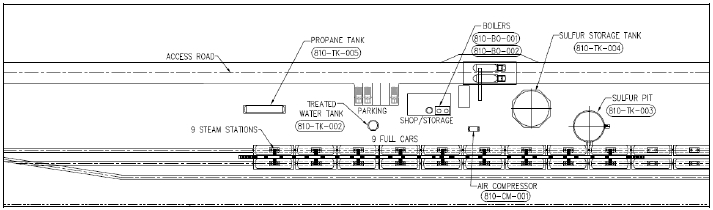

| | 18.1 | Acid Plant | 240 |

| | 18.2 | Access | 247 |

| | 18.3 | Water | 248 |

| | 18.4 | Power Lines | 248 |

| | 18.5 | Railroad Spur | 248 |

| 19 | MARKET STUDIES AND CONTRACTS | 249 |

| | 19.1 | Introduction | 249 |

| | 19.2 | Recommended Marketing Strategy | 249 |

| | 19.3 | Cathode Sales Terms and Net Realizations | 249 |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 251 |

| | 20.1 | General Description of Environmental Conditions | 251 |

| | 20.2 | Waste Management, Site Monitoring and Water | 252 |

| | 20.3 | Project Permitting Requirements and Status | 254 |

| | 20.4 | Reclamation and Closure | 257 |

| 21 | CAPITAL AND OPERATING COSTS | 261 |

| | 21.1 | Capital Costs | 261 |

| | 21.2 | Operating Costs | 268 |

| 22 | ECONOMIC ANALYSIS | 272 |

| | 22.1 | Financial Analysis | 272 |

| | 22.2 | Financial Models | 279 |

| 23 | ADJACENT PROPERTIES | 293 |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 294 |

| 25 | INTERPRETATION AND CONCLUSIONS | 295 |

| | 25.1 | Risks | 296 |

| | 25.2 | Opportunities | 297 |

| 26 | RECOMMENDATIONS | 299 |

| | 26.1 | Mining and Mineral Reserves | 299 |

| | 26.2 | Metallurgy | 299 |

| | 26.3 | Acid Plant | 299 |

| | 26.4 | Environmental | 299 |

Page vi

El Pilar Project Form 43-101F1 Technical Report |  |

| 27 | REFERENCES | 300 |

| | | |

| APPENDIX A: FEASIBILITY STUDY CONTRIBUTORS AND PROFESSIONAL QUALIFICATIONS | 302 |

Page vii

El Pilar Project Form 43-101F1 Technical Report |  |

LIST OF FIGURES AND ILLUSTRATIONS

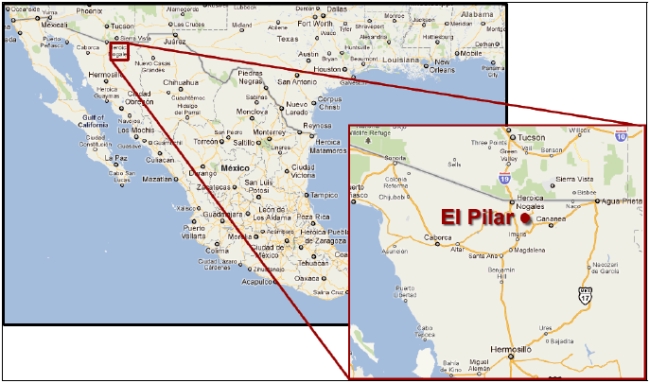

| Figure 1 1: El Pilar Location Map | 5 |

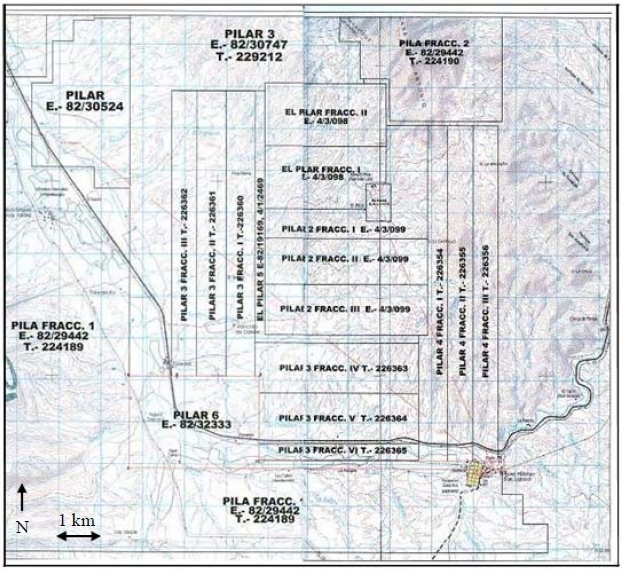

| Figure 4 1: El Pilar Mining Concessions Map | 29 |

| Figure 4 2: El Pilar Location Map | 32 |

| igure 7 1: Geologic map of the El Pilar project area | 42 |

| Figure 7 2: Typical Qfy Core Samples | 44 |

| Figure 7 3: Typical Qwu Core Samples - note large mineralized breccia fragments | 45 |

| Figure 7 4: Qwu out crop consisting of poorly sorted and angular wash material | 46 |

| Figure 7 5: Qwt, note red-brown color and angular fragments of volcanic rocks | 49 |

| Figure 7 6: Qwl - Calcite cemented debris flow deposit with volcanic fragments | 50 |

| Figure 7 7: Mineralized silicic breccia in outcrop | 51 |

| Figure 7 8: Precambrian granite | 52 |

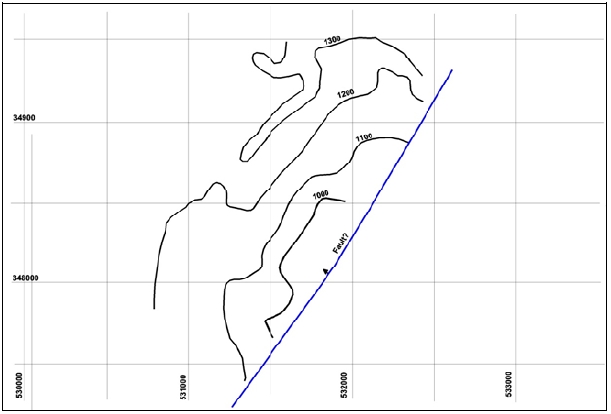

| Figure 7 9: Structural contour map of the top of the El Pilar copper deposit in meters above mean sea level | 53 |

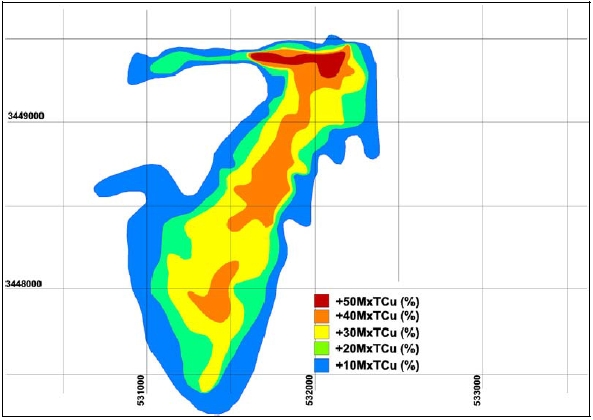

| Figure 7 10: Map of %TCu x thickness (meters) of the El Pilar copper deposit | 53 |

| Figure 7 11: Typical N-S long section showing total copper grade (TCu) and relationship to interpreted sedimentary units | 54 |

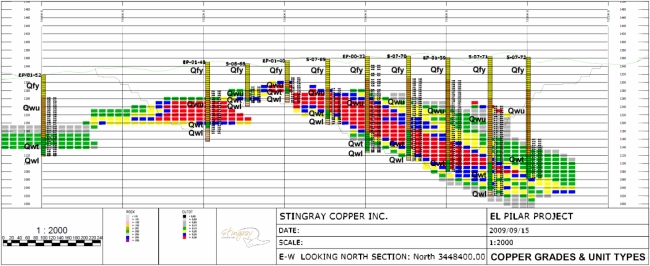

| Figure 7 12: Typical E-W cross section showing total copper grade (TCu) and relationship to interpreted sedimentary units | 54 |

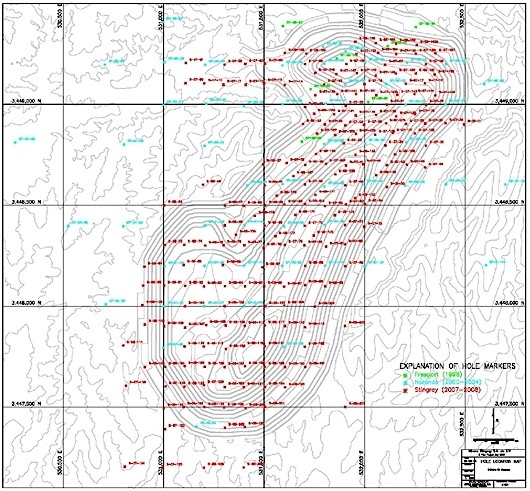

| Figure 7 13: El Pilar Drill Hole Location Map | 55 |

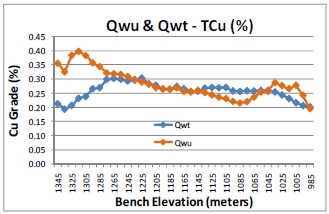

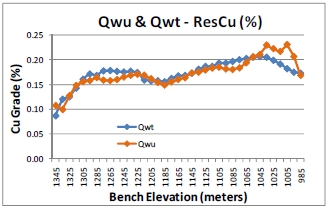

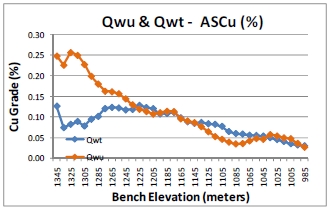

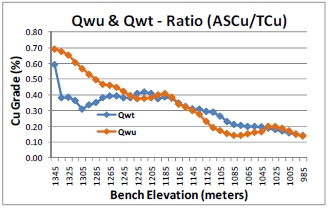

| Figure 7 14: Variations in copper grades by bench at El Pilar | 56 |

| Figure 7 15: TCu grades | 57 |

| Figure 7 16: ASCu grades | 57 |

| Figure 7 17: ResCu grades | 57 |

| Figure 7 18: Ratio grades | 57 |

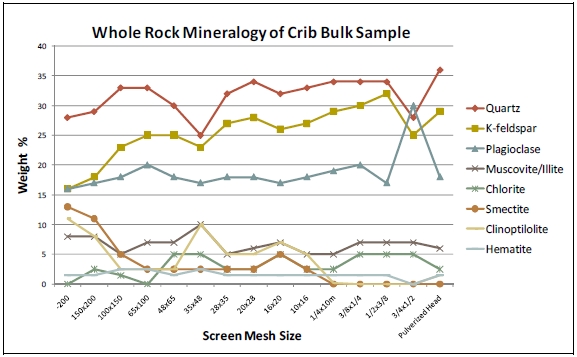

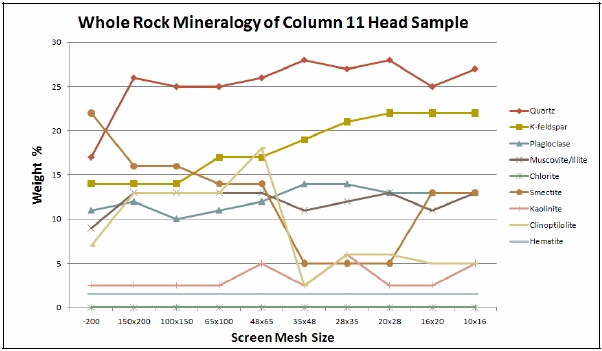

| Figure 7 19: Bulk sample whole rock mineralogy by screen size fraction | 58 |

| Figure 7 20: Column 13 sample whole rock mineralogy by screen size fraction | 59 |

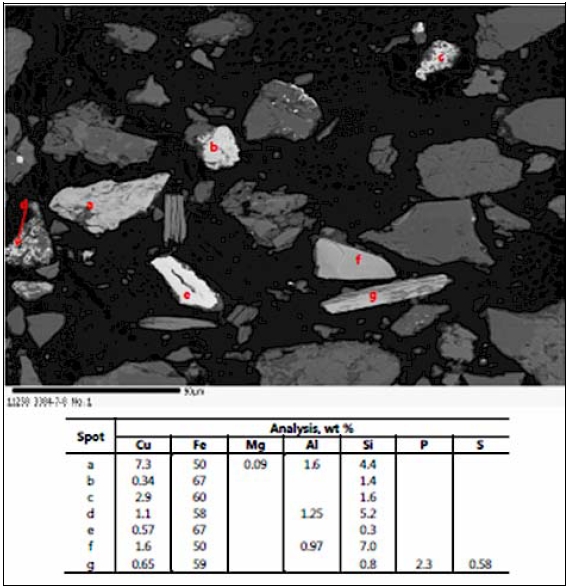

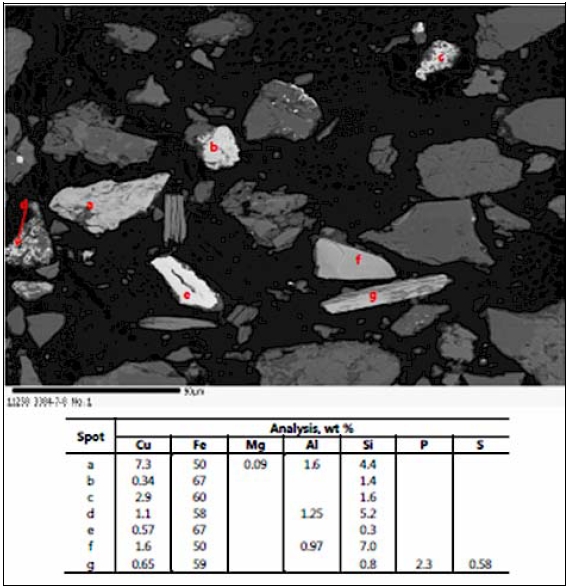

| Figure 7 21: Backscatter electron (Bsc) image of Sample 3448-7-8 showing discrete particles of copper-bearing iron oxides (spots a-g) | 60 |

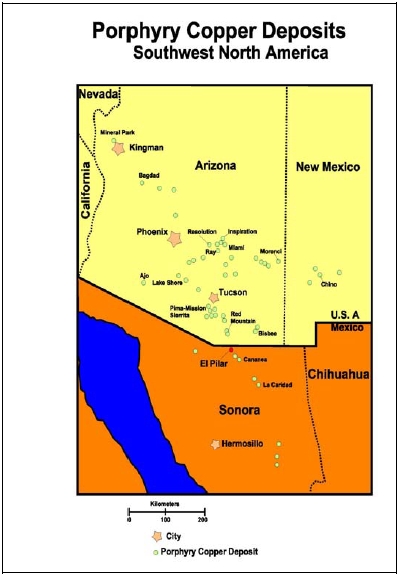

| Figure 8 1: Porphyry Copper Deposits of Southwest North America | 62 |

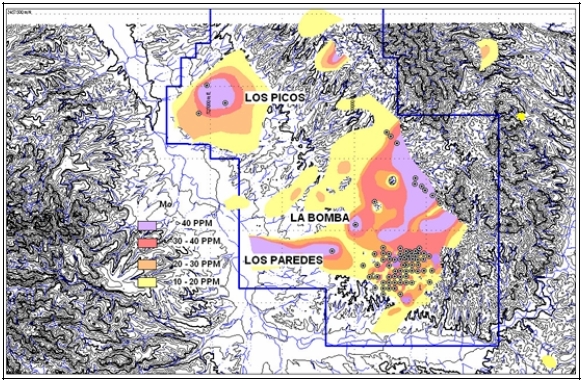

| Figure 9 1: Regional Mesquite Sample | 65 |

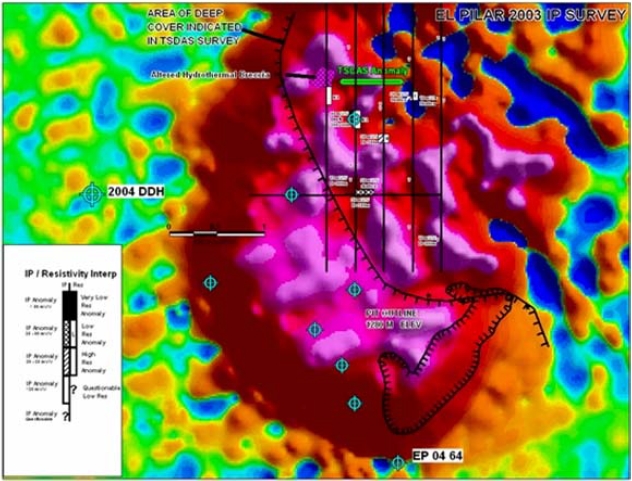

| Figure 9 2: Titan 24 MT-DCIP Line Locations | 67 |

Page viii

El Pilar Project Form 43-101F1 Technical Report |  |

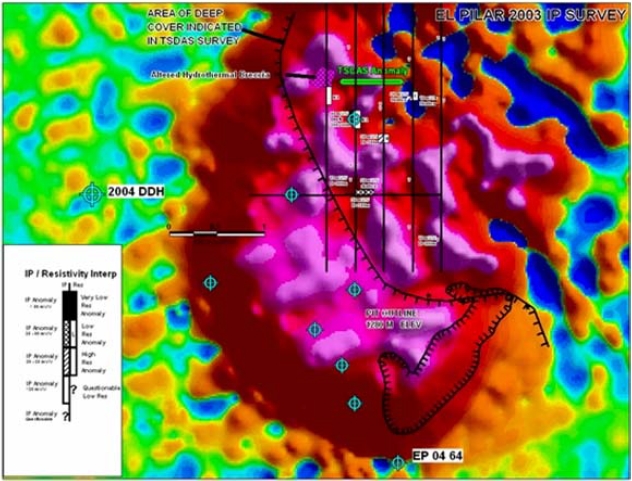

| Figure 9 3: Dipole-Dipole Time Domain IP | 68 |

| Figure 10 1: El Pilar Drillhole Locations | 71 |

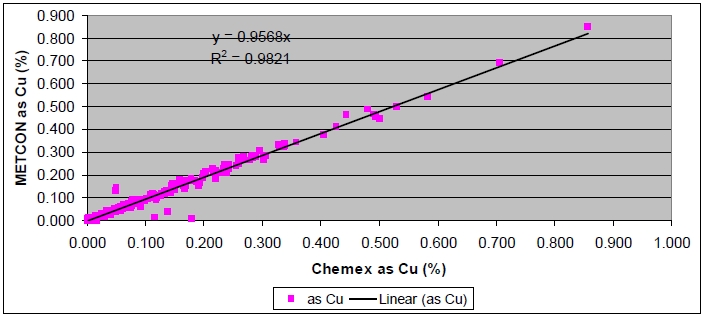

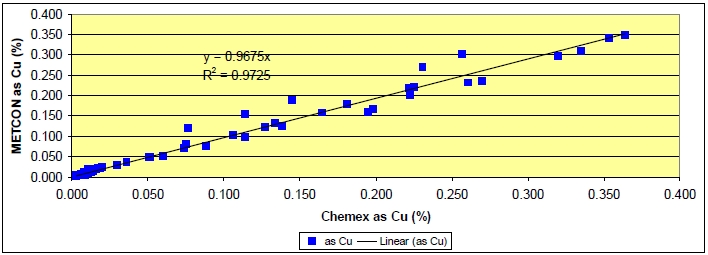

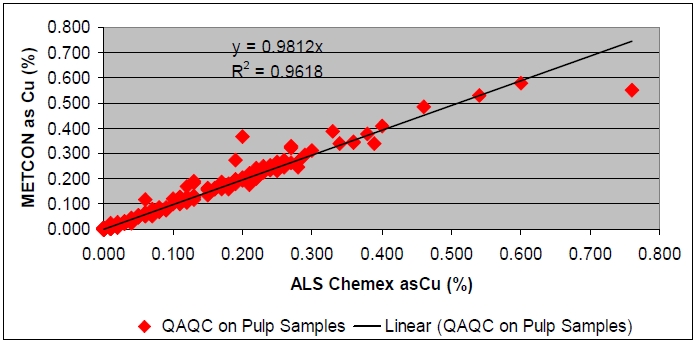

| Figure 12 1: Total Copper Analyses – Pulp Samples Originally Assayed At ALS Chemex & Re-assayed At METCON | 76 |

| Figure 12 2: Acid Soluble Copper Analyses – Pulp Samples Originally Assayed At ALS Chemex & Re-assayed At METCON | 76 |

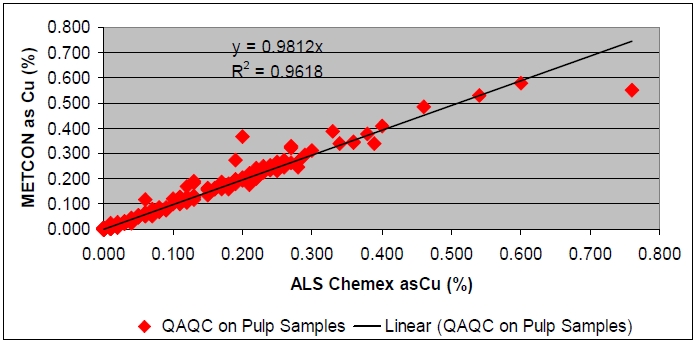

| Figure 12 3: Total Copper Analyses – Pulp Samples Originally Assayed At METCON & Re-assayed At ALS Chemex | 76 |

| Figure 12 4: Acid Soluble Copper Analyses – Pulp Samples Originally Assayed At METCON & Re-assayed At ALS Chemex | 77 |

| Figure 12 5: QA/QC on High Grade Standard Sample – Total Copper Analyses | 88 |

| Figure 12 6: QA/QC on High Grade Standard Sample – Acid Soluble Copper Analyses | 89 |

| Figure 12 7: QA/QC on Low Grade Standard Sample – Total Copper Analyses | 80 |

| Figure 12 8: QA/QC on Low Grade Standard Sample – Acid Soluble Copper Analyses | 80 |

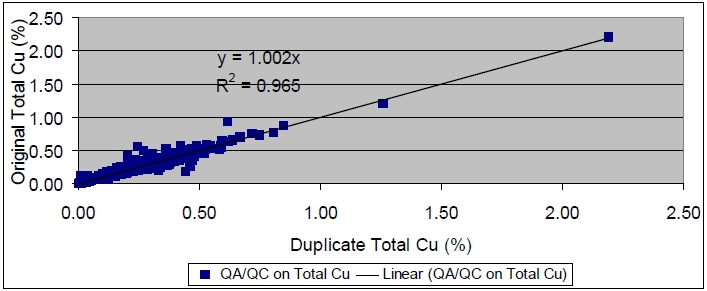

| Figure 12 9: QA/QC on Duplicate Samples – Total Copper Analyses | 81 |

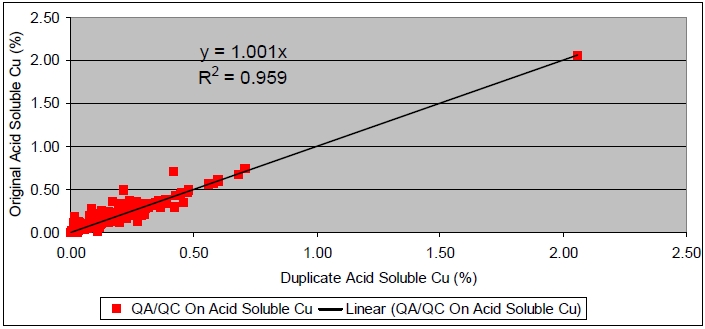

| Figure 12 10: QA/QC on Duplicate Samples – Acid Soluble Copper Analyses | 81 |

| Figure 12 11: QA/QC on Coarse Reject Samples – Total Copper Analyses | 82 |

| Figure 12 12: QA/QC on Coarse Reject Samples – Acid Soluble Copper Analyses | 83 |

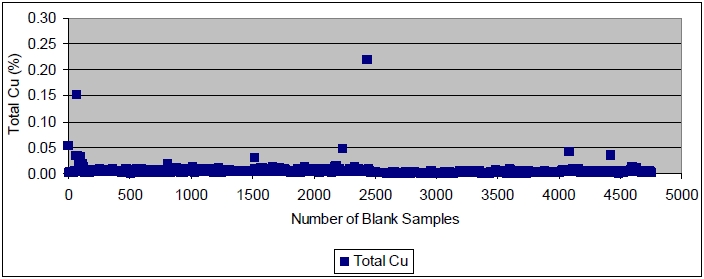

| Figure 12 13: Blank Samples - Total Copper Analyses | 83 |

| Figure 12 14: Blank Samples – Acid Soluble Copper Analyses | 94 |

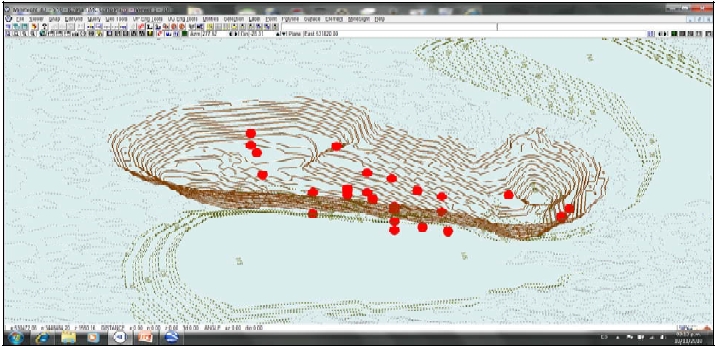

| Figure 13 1: Distribution of Stingray Five Composite Metallurgical Samples | 95 |

| Figure 13 2: Copper Solubility & Recovery – Stingray Yearly Composites | 94 |

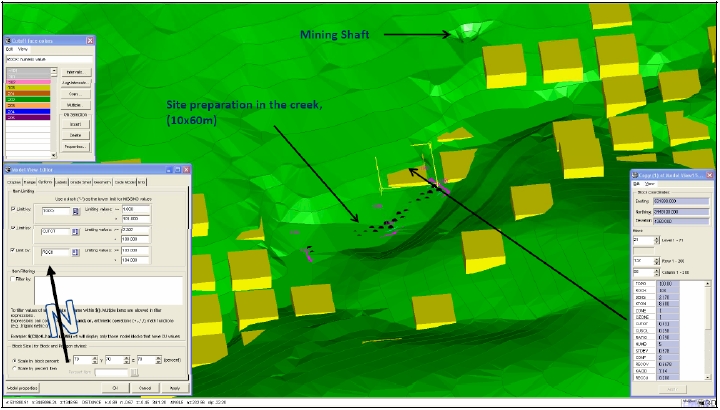

| Figure 13 3: MineSight Screen Capture Showing Bulk Sample Location | 96 |

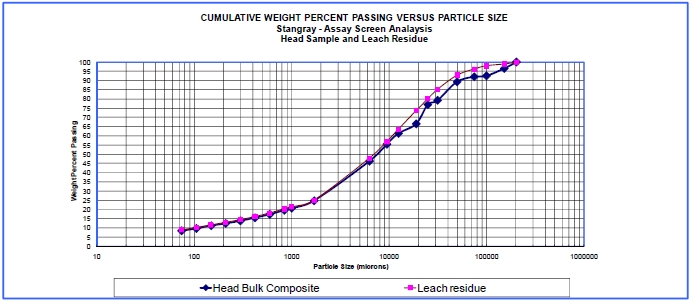

| Figure 13 4: Chart Comparison Bulk Sample Screen Fractions Head vs. Tails | 97 |

| Figure 13 5: Correlation between METCON and Mercator Copper Assays | 101 |

| Figure 13 6: Copper Recovery Curves for Mineral Park Cribs and Columns | 105 |

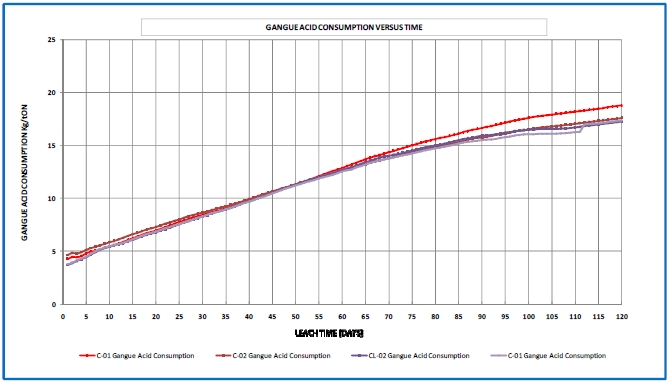

| Figure 13 7: Acid Consumption Curves for Mineral Park Cribs and Columns | 108 |

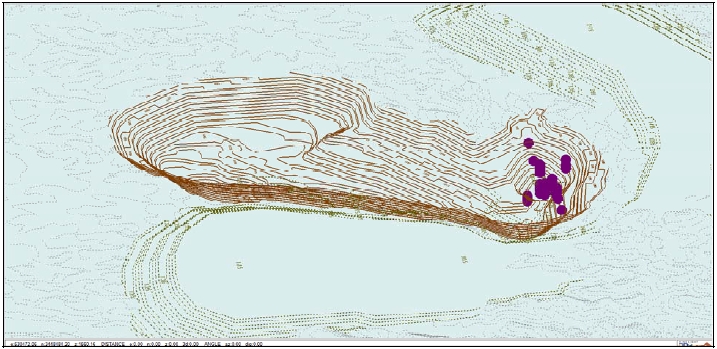

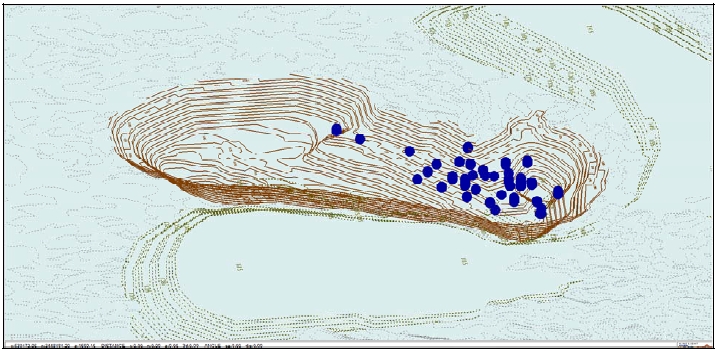

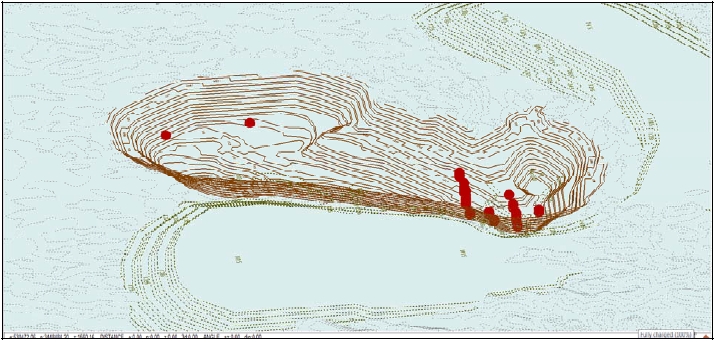

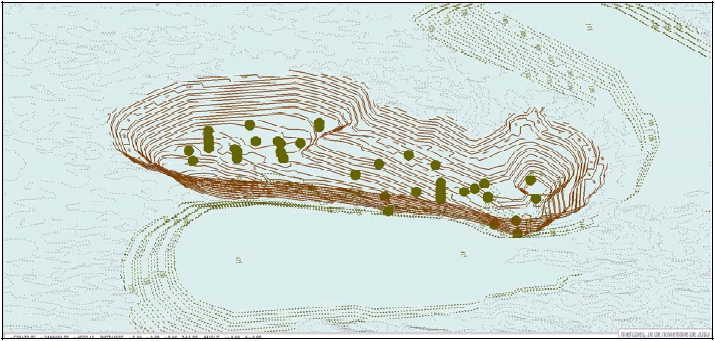

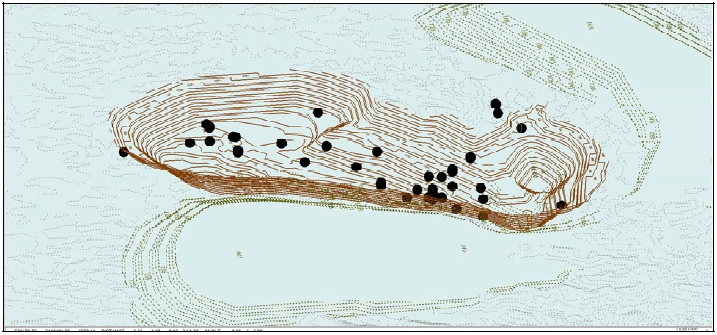

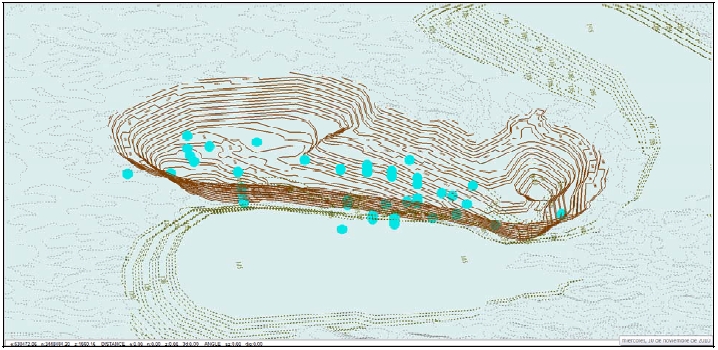

| Figure 13 8: Sample Composite Locations – Column #1 | 109 |

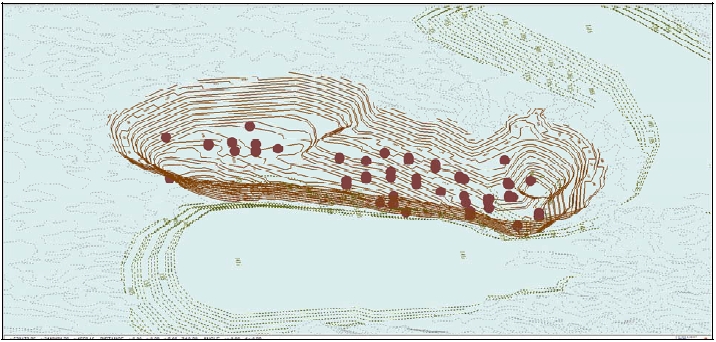

| Figure 13 9: Sample Composite Locations – Column #2 | 119 |

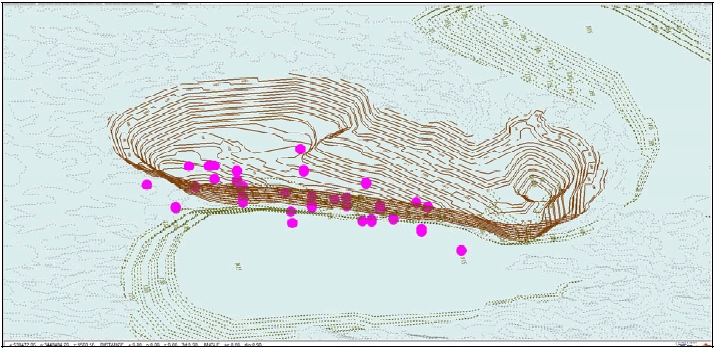

| Figure 13 10: Sample Composite Locations – Column #3 | 120 |

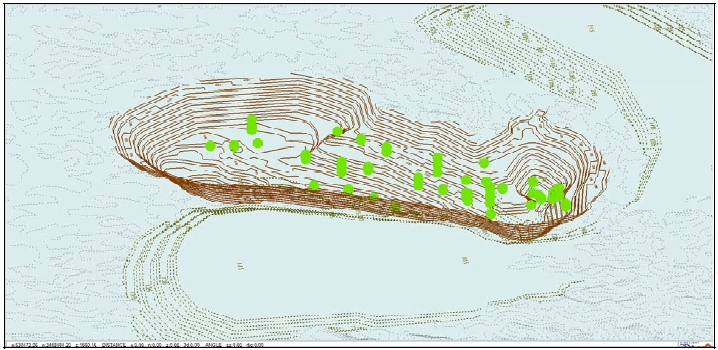

| Figure 13 11: Sample Composite Locations – Column #5 | 120 |

| Figure 13 12: Sample Composite Locations – Column #6 | 121 |

| Figure 13 13: Sample Composite Locations – Column #8 | 121 |

| Figure 13 14: Sample Composite Locations – Column #9 | 122 |

Page ix

El Pilar Project Form 43-101F1 Technical Report |  |

| Figure 13 15: Sample Composite Locations – Column #10 | 122 |

| Figure 13 16: Sample Composite Locations – Column #11 | 123 |

| Figure 13 17: Sample Composite Locations – Column #12 | 123 |

| Figure 13 18: Sample Composite Locations – Column #13 | 124 |

| Figure 13 19: Sample Composite Locations – Column #14 | 124 |

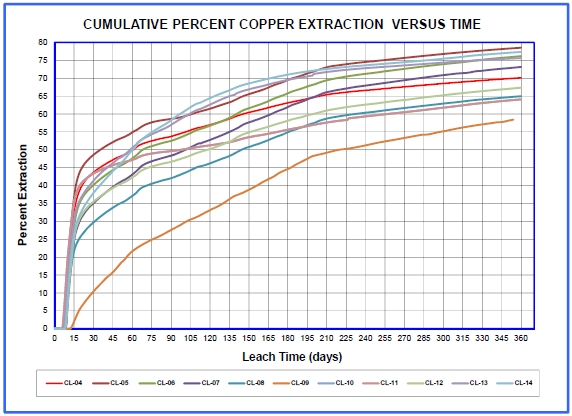

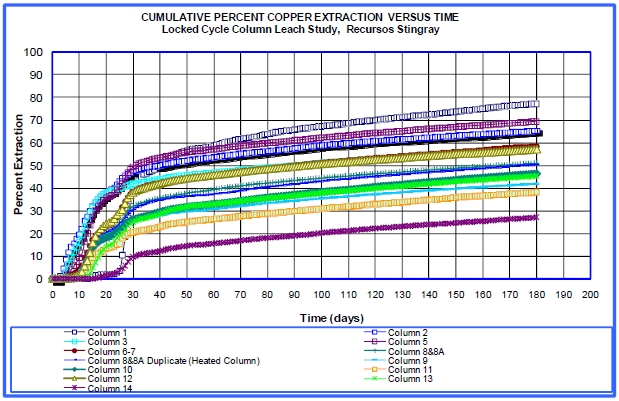

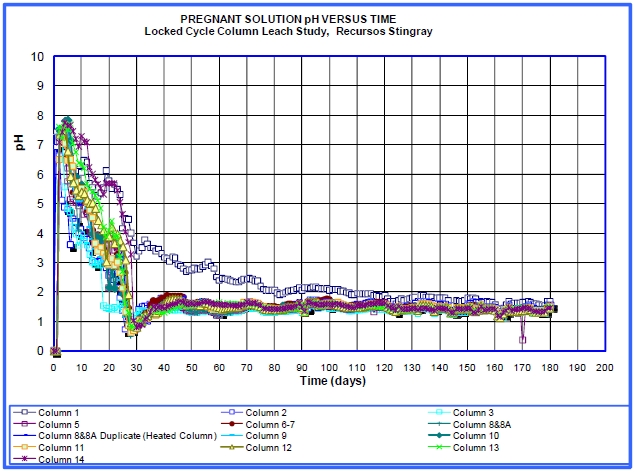

| Figure 13 20: 13 Columns Cumulative Copper Extraction | 130 |

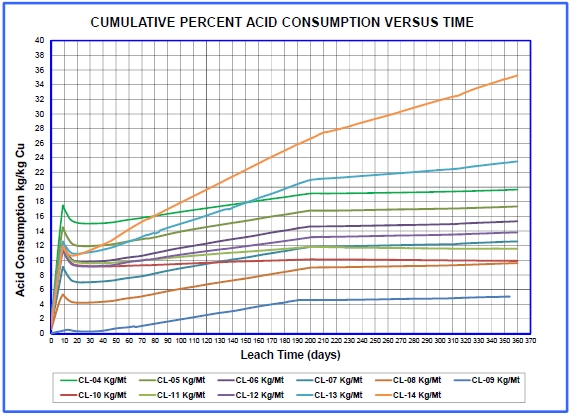

| Figure 13 21: 13 Columns Gangue Acid Consumption | 130 |

| Figure 13 22: 13 Columns PLS pH | 131 |

| Figure 13 23: 2011 Base Case Copper Recovery Algorithm for El Pilar Ores | 135 |

| Figure 13 24: El Pilar Copper Extraction – Actual 180 Day Leach Data | 138 |

| Figure 13 25: Relationship between 3 Meter and 6 Meter Copper Extraction. | 140 |

| Figure 13 26: El Pilar Copper Extraction – 180 Days 3 Meter Lift Height | 141 |

| Figure 13 27: CL-02 Copper Extraction Over 240 Days of Leaching. | 142 |

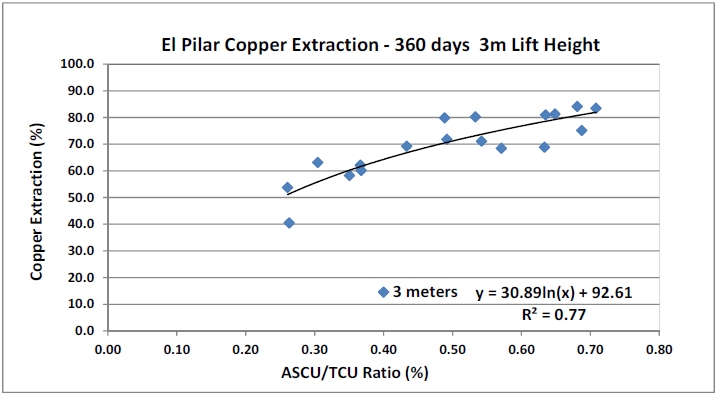

| Figure 13 28: El Pilar Copper Extraction – 360 Day 3 Meter Lift Height | 144 |

| Figure 13 29: Mini Columns 360 Day Cumulative Copper Extraction | 148 |

| Figure 13 30: Mini Columns 360 Day Cumulative Acid Consumption | 148 |

| Figure 13 31: Mini Column 5 Acid to Copper Ratio vs. Time | 150 |

| Figure 13 32: Copper Species Eh-pH Diagram for Column MCL-01 | 153 |

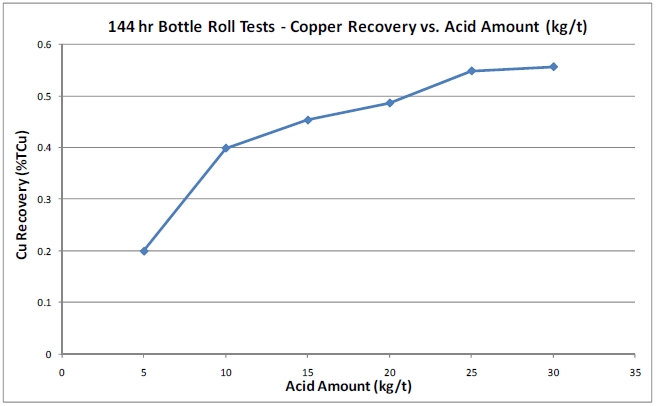

| Figure 13 33: 144 Hour Bottle Rolls Copper Recovery vs. Acid Precure | 154 |

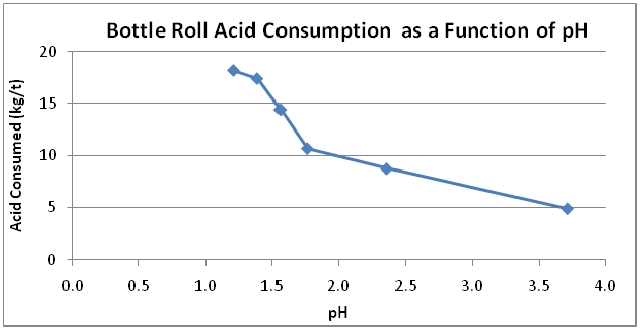

| Figure 13 34: 144 Hour Bottle Roll Acid Consumption & pH | 155 |

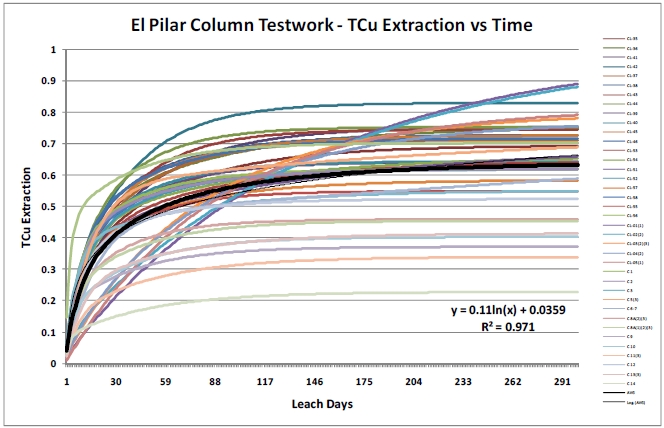

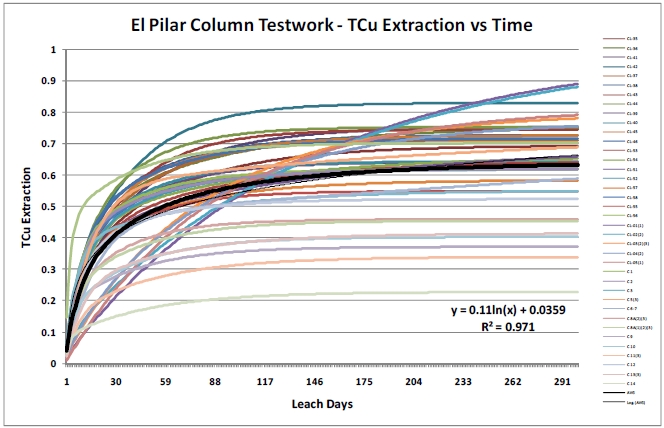

| Figure 13 35: TCu Extraction vs. Time for all Column Tests | 156 |

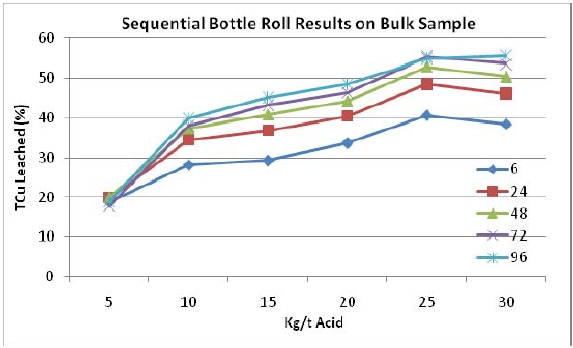

| Figure 13 36: Copper Rate Recoveries from Sequential Bottle Roll Tests | 157 |

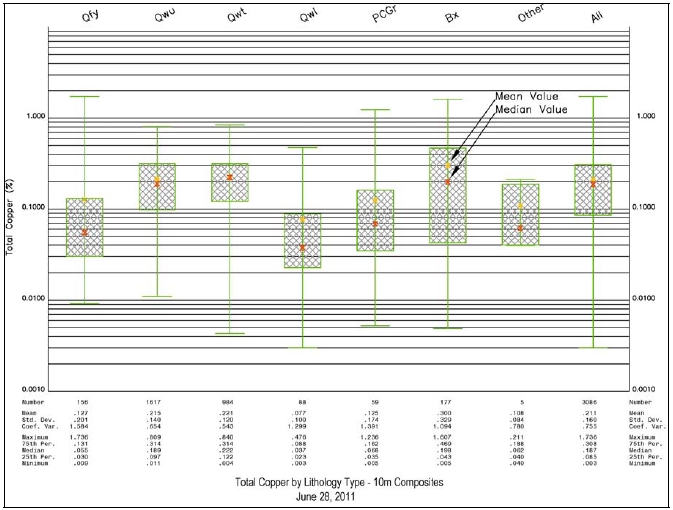

| Figure 14 1: TCu by Lithology Type | 162 |

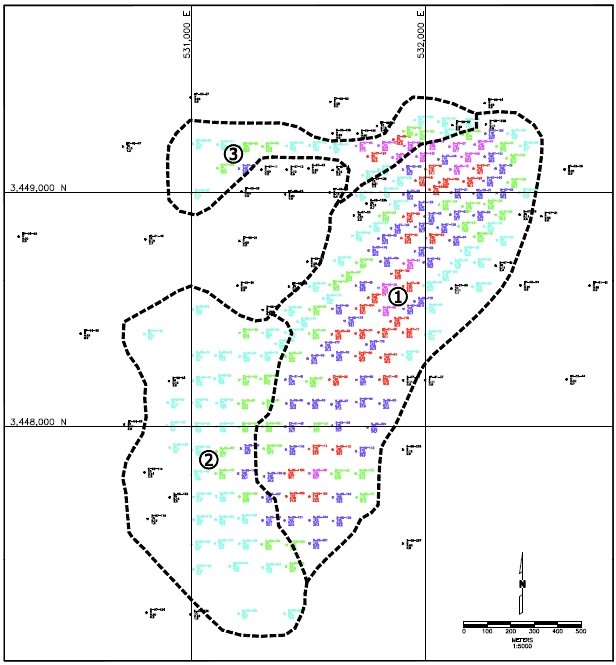

| Figure 14 2: Structural Zones | 164 |

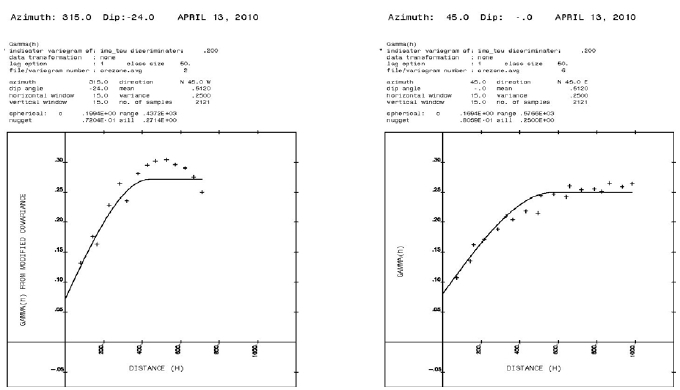

| Figure 14 3: Total Copper - Main Ore Zone Variogram | 165 |

| Figure 14 4: Indicator Variograms Discriminator of 0.2% Cu | 166 |

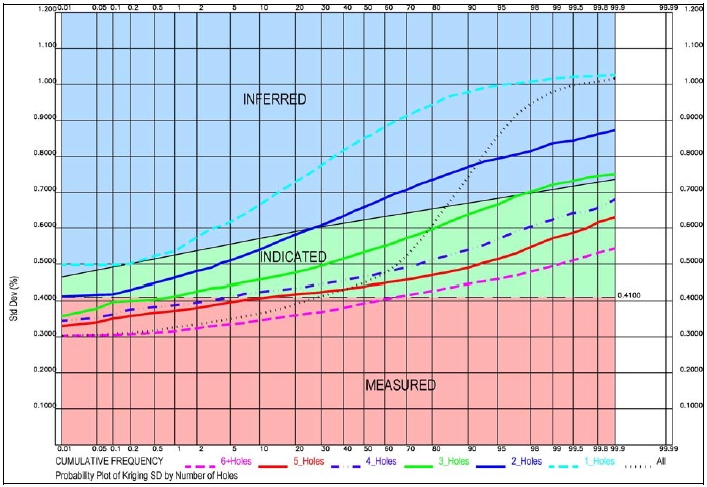

| Figure 14 5: Kriging Standard Deviation | 170 |

| Figure 15 1: Floating Cone Based on Design Price ($2.15 Cu) and Costs. | 178 |

| Figure 15 2: Final Pit Design – Phase 6 | 179 |

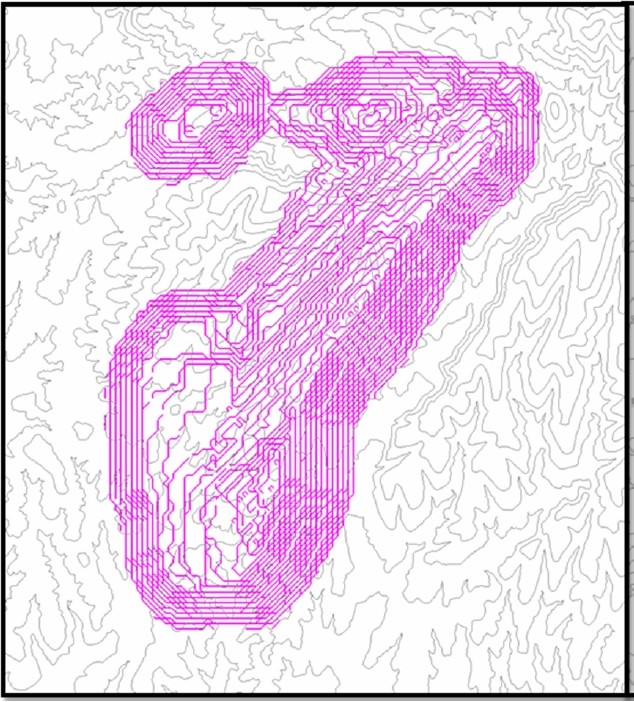

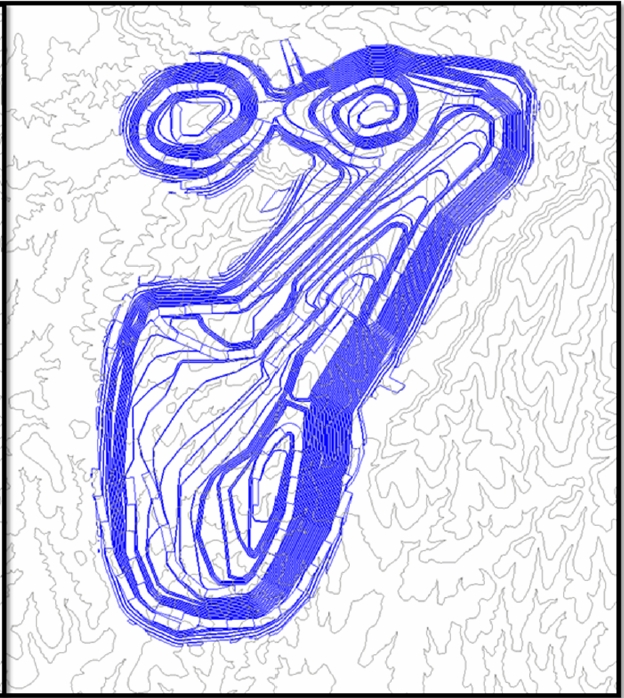

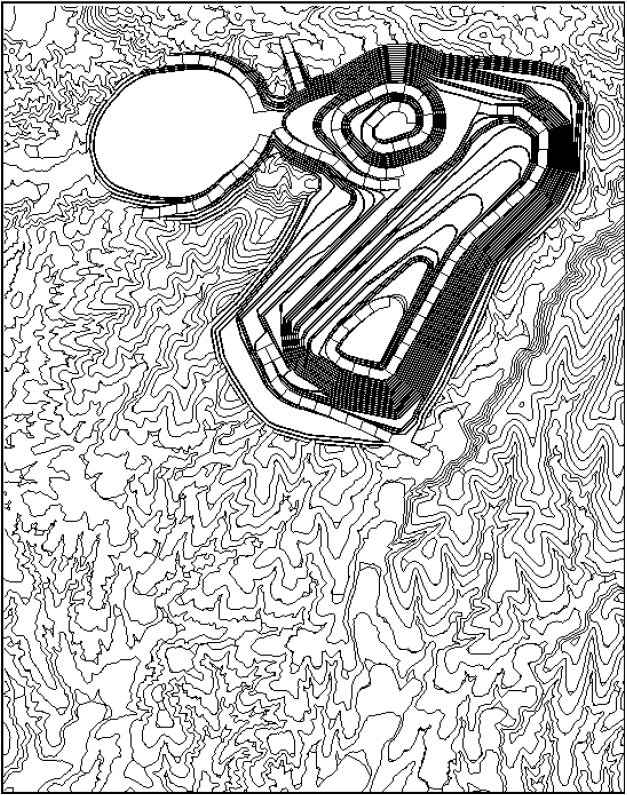

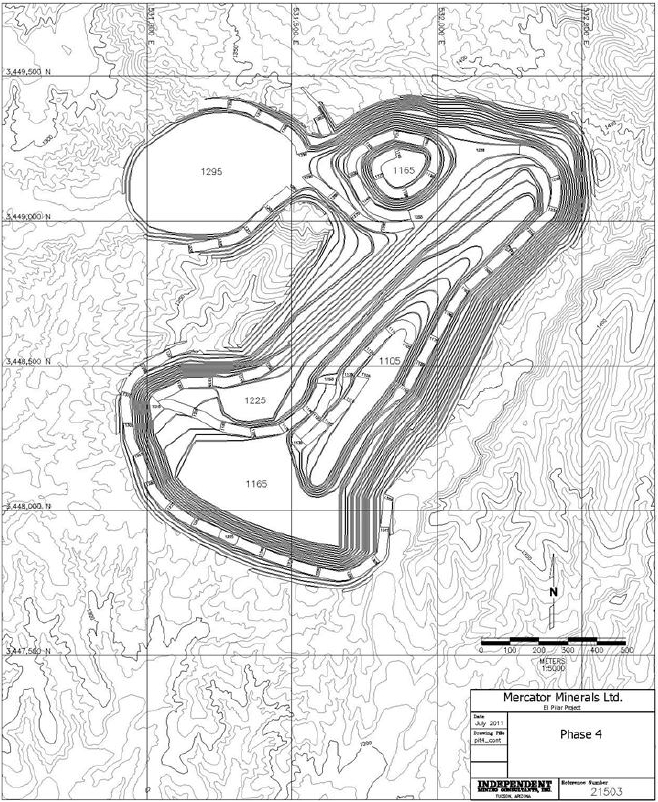

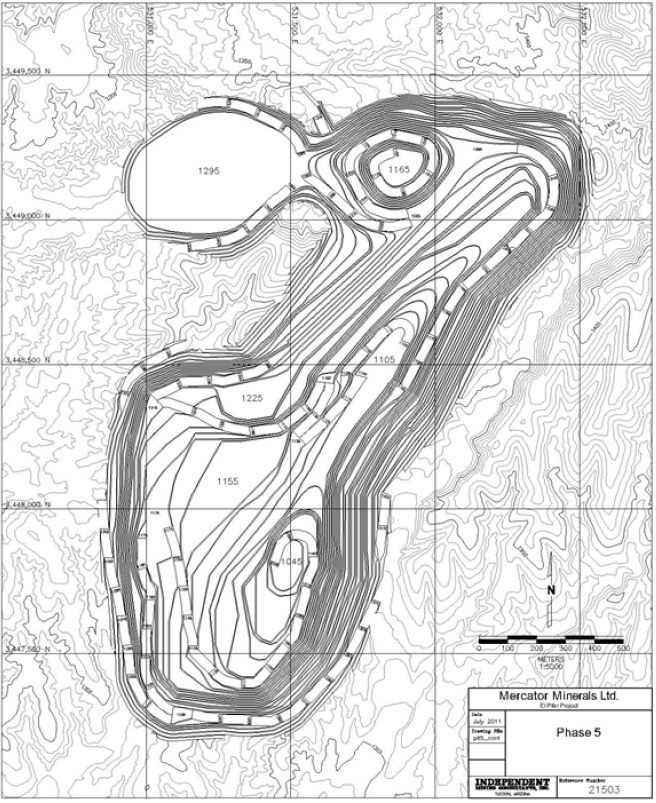

| Figure 16 1: Final Pit Design - Starter Pit | 182 |

| Figure 16 2: Final Pit Design – Phase 2 | 183 |

| Figure 16 3: Final Pit Design - Phase 3 | 184 |

Page x

El Pilar Project Form 43-101F1 Technical Report |  |

| Figure 16 4: Final Pit Design - Phase 4 | 185 |

| Figure 16 5: Final Pit Design - Phase 5 | 186 |

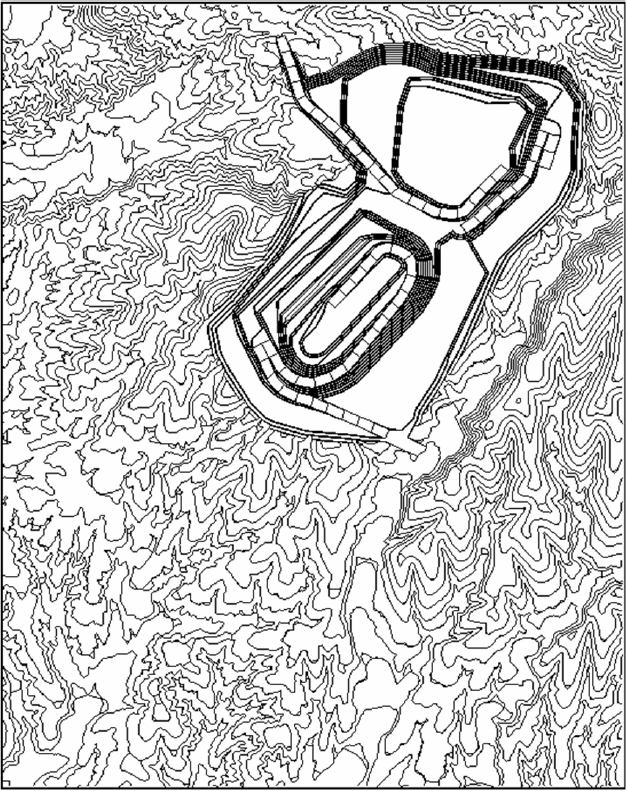

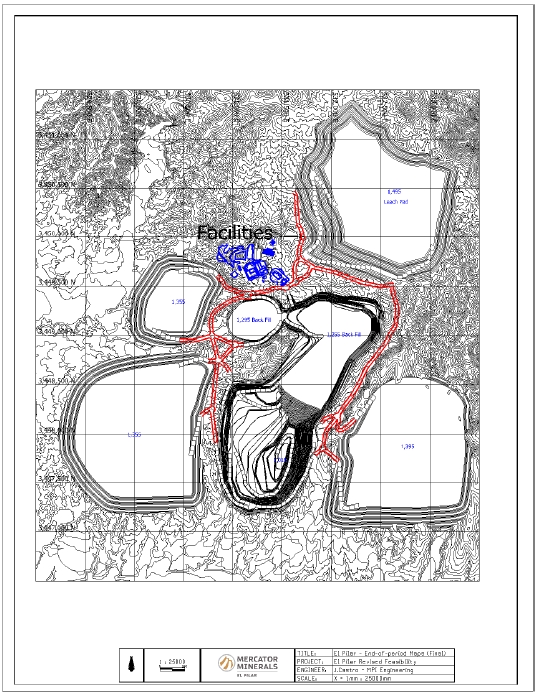

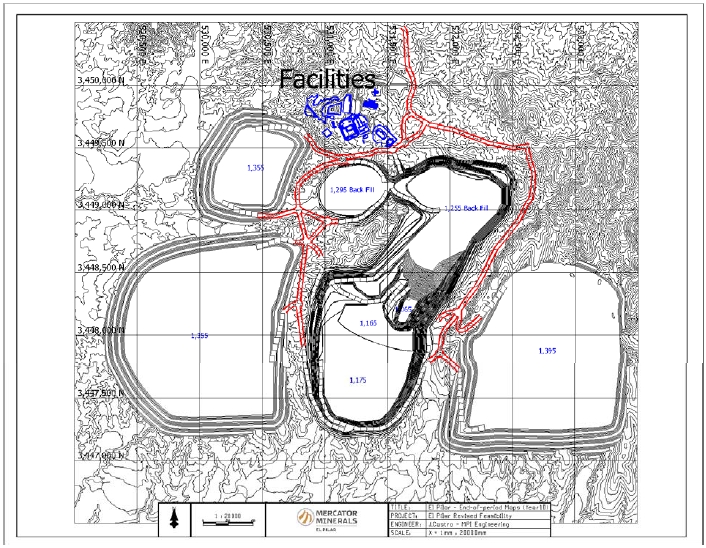

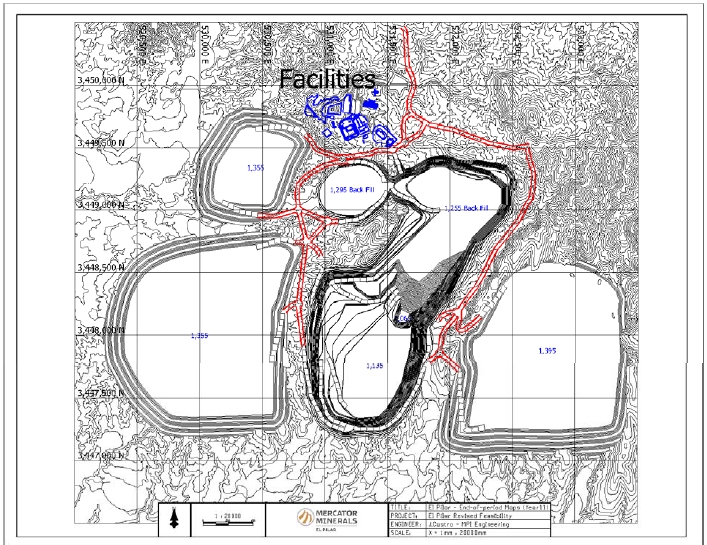

| Figure 16 6: Final Pit and Dumps (Year 13) | 194 |

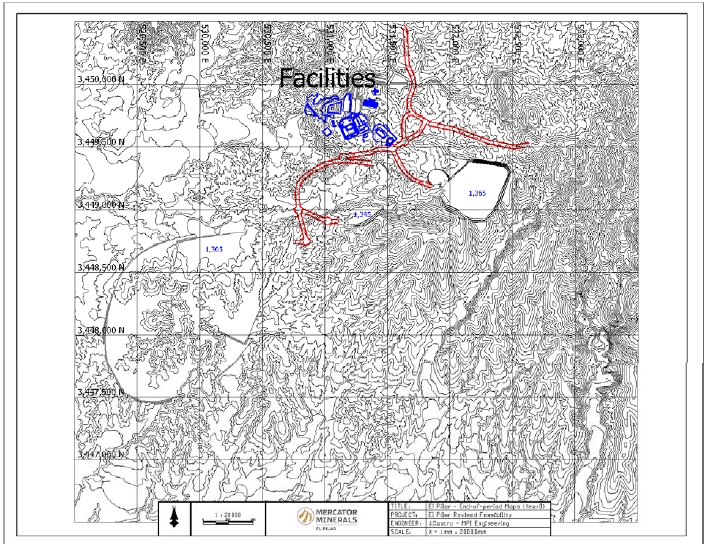

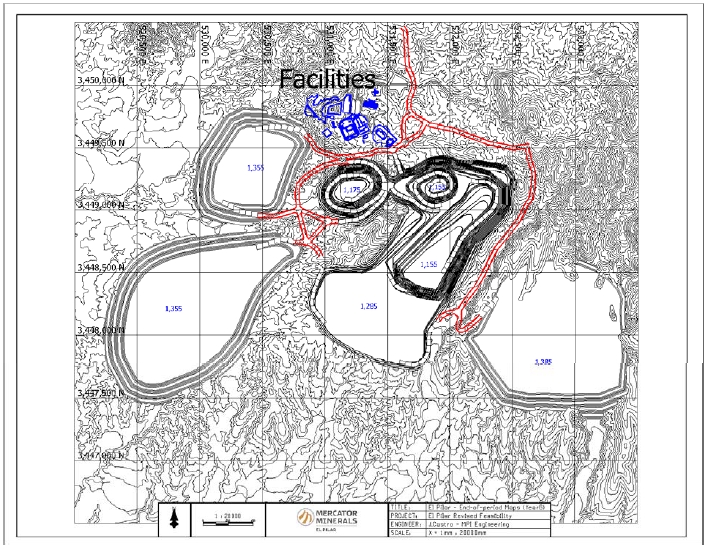

| Figure 16 7: End of Preproduction Year 0 | 195 |

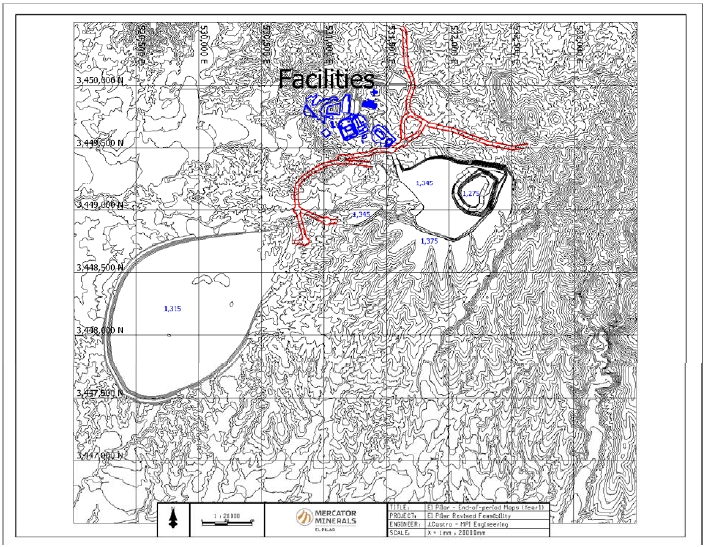

| Figure 16 8: End of Year 1 | 196 |

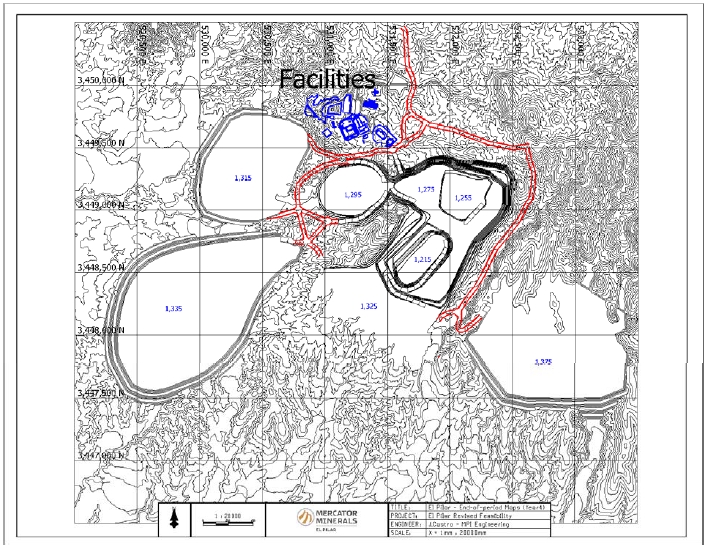

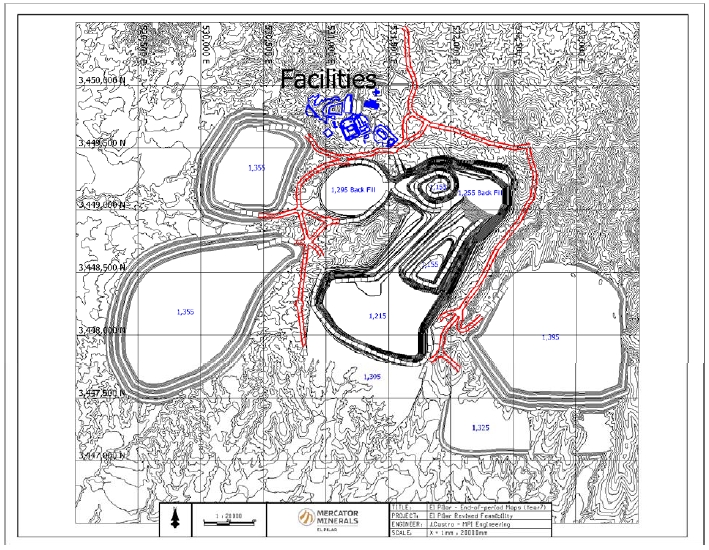

| Figure 16 9: End of Year 2 | 197 |

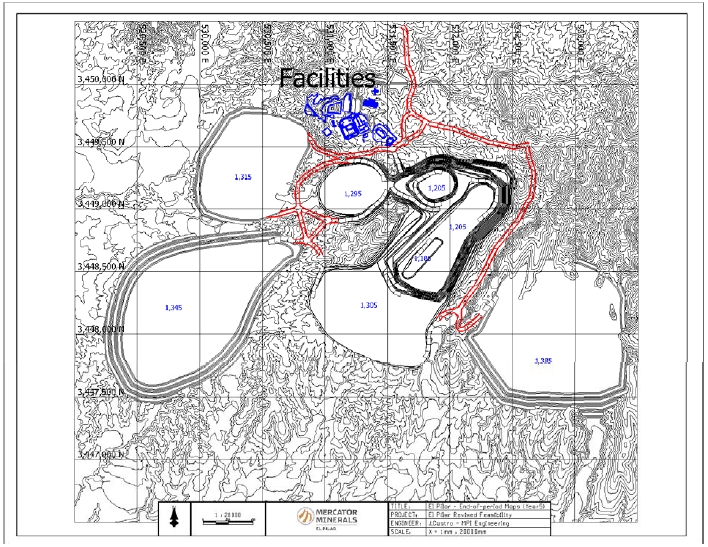

| Figure 16 10: End of Year 3 | 198 |

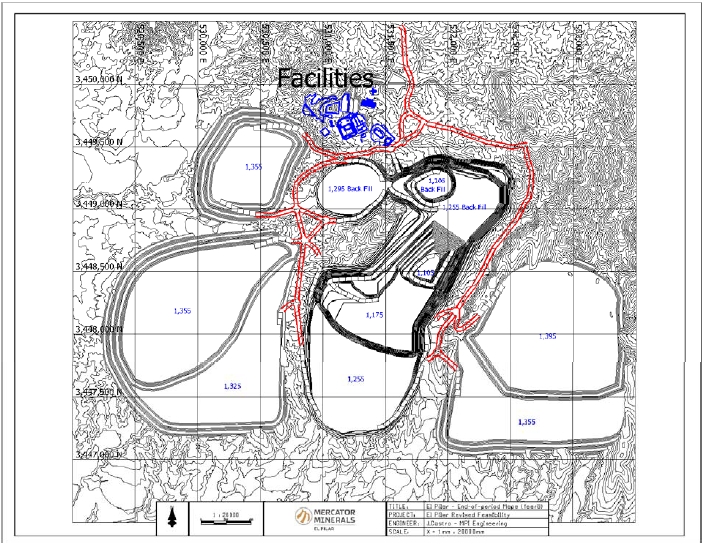

| Figure 16 11: End of Year 4 | 199 |

| Figure 16 12: End of Year 5 | 200 |

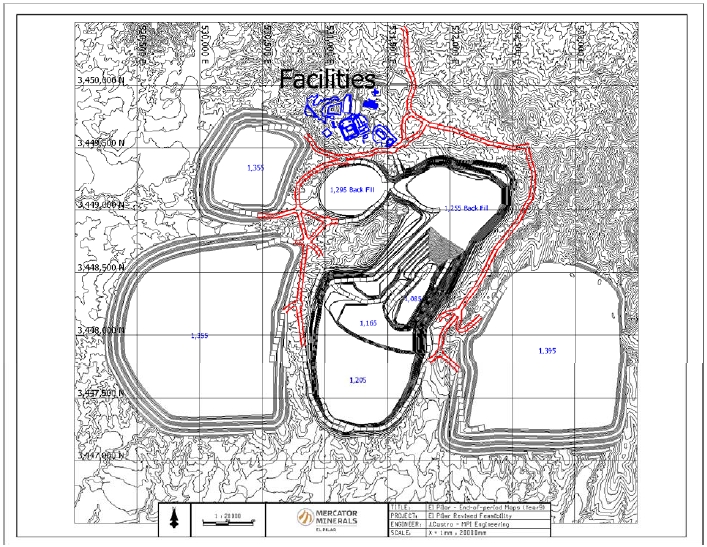

| Figure 16 13: End of Year 6 | 201 |

| Figure 16 14: End of Year 7 | 202 |

| Figure 16 15: End of Year 8 | 203 |

| Figure 16 16: End of Year 9 | 204 |

| Figure 16 17: End of Year 10 | 205 |

| Figure 16 18: End of Year 11 | 206 |

| Figure 16 19: End of Year 12 | 207 |

| Figure 17 1: General Site Plan (000-GA-001) | 227 |

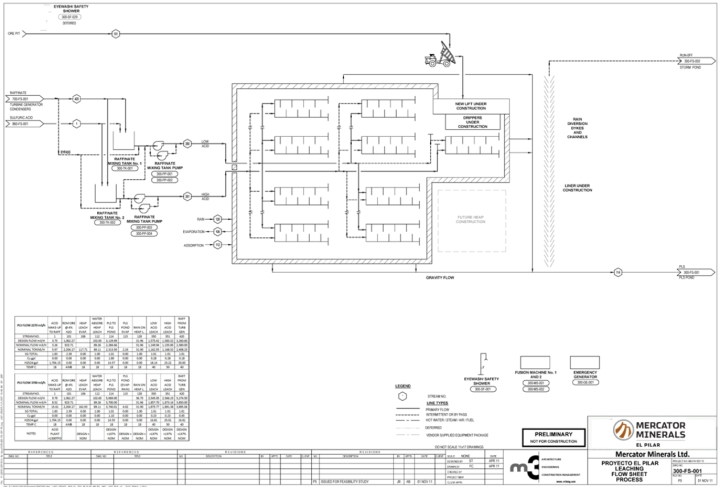

| Figure 17 2: Heap Leaching Flowsheet (300-FS-001) | 230 |

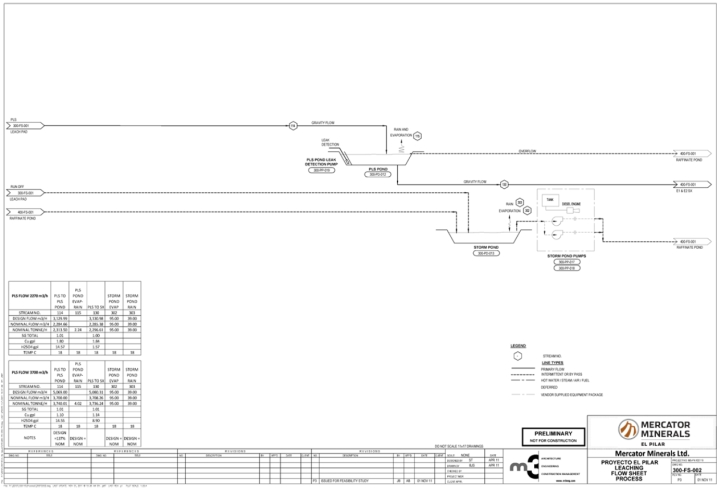

| Figure 17 3: Heap Leaching Flow Sheet (300-FS-002) | 231 |

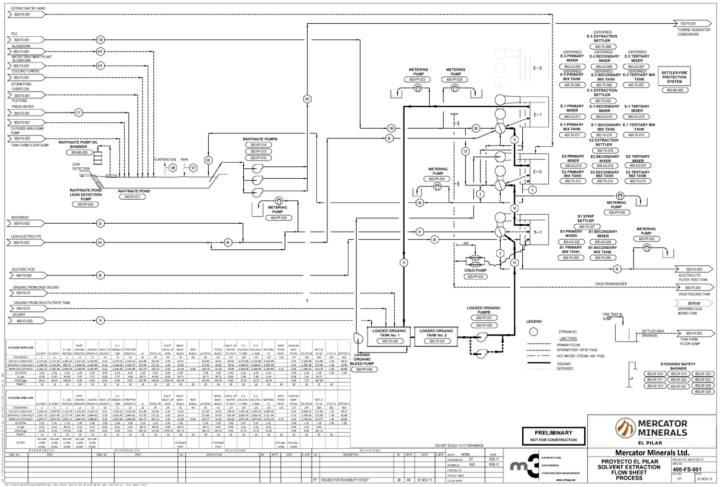

| Figure 17 4: Solvent Extraction Flowsheet (400-FS-001) | 236 |

| Figure 17 5: Solvent Extraction Plan (400-GA-001) | 237 |

| Figure 17 6: Electrowinning Flowsheet (600-FS-001) | 239 |

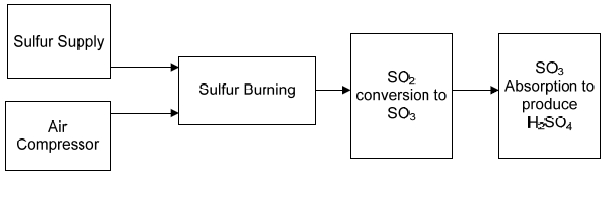

| Figure 18 1: Acid Plant Block Flow Process Diagram. | 241 |

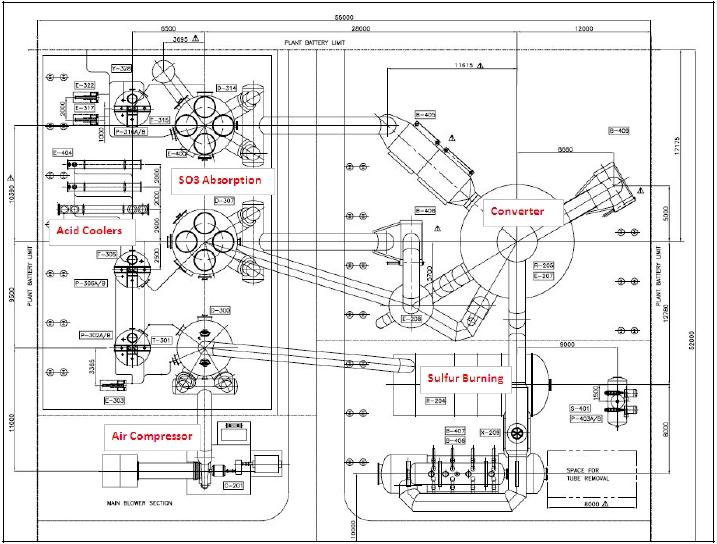

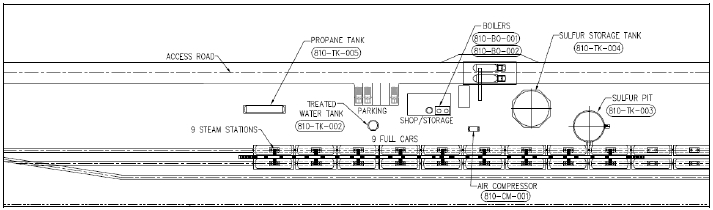

| Figure 18 2: Acid Plant Layout. | 241 |

| Figure 18 3: Sketch of Sulfur Unloading Facilities. | 245 |

| Figure 22 1: Base Case – Chart 1 Sensitivity After-Tax NPV@8% | 277 |

| Figure 22 2: Base Case – Chart 2 Sensitivity After-Tax NPV@8% | 278 |

| Figure 22 3: Base Case – Copper Recovery Sensitivity After-Tax NPV@8% | 279 |

Page xi

El Pilar Project Form 43-101F1 Technical Report |  |

LIST OF TABLES

| Table 1 1: El Pilar Mineral Resource – 0.15% Copper Cutoff | 2 |

| Table 1 2: El Pilar Mineral Resource @ Various Copper Cutoff Grades | 2 |

| Table 1 3: El Pilar Mineral Reserves | 3 |

| Table 1 4: El Pilar Economic Summary | 4 |

| Table 1 5: El Pilar Mineral Resource – 0.15% Copper Cutoff | 12 |

| Table 1 6: El Pilar Measured & Indicated Mineral Resources at Different Cutoff Grades | 12 |

| Table 1 7: El Pilar Inferred Mineral Resources at Different Cutoff Grades | 13 |

| Table 1 8: El Pilar Mineral Reserve | 13 |

| Table 1 9: Mine Production Schedule | 15 |

| Table 1 10: Permitting Requirements | 19 |

| Table 1 11: Operating Cash Cost – Contract Mine Site Cost Summary | 19 |

| Table 1 12: Overall Capital Cost Estimate | 20 |

| Table 1 13: Main Parameters Before and After Taxes | 22 |

| Table 2 1: Abbreviations | 26 |

| Table 4 1: Mining Concession Status | 30 |

| Table 6 1: Magri 2003 Kriging Results for Lithological Units | 36 |

| Table 6 2: Woods 2007 Inferred Resource | 37 |

| Table 6 3: Hester 2009 Mineral Resource - 0.15% Copper Cutoff | 38 |

| Table 6 4: Hester 2009 Mineral Resource - 0.20% Copper Cutoff | 38 |

| Table 6 5: Hester 2009 Mineral Resource - 0.25% Copper Cutoff | 38 |

| Table 6 6: Hester 2009 Mineral Reserves at 0.15% Copper Cutoff | 39 |

| Table 6 7: Hester 2009 Mineral Resources (Exclusive of Reserve) | 39 |

| Table 6 8: Hester 2011 Mineral Reserves | 40 |

| Table 7 1: Mineralogy of Qwu by Sieve Size (%) | 46 |

| Table 7 2: Qwu Bulk Sample Size Analysis & Assays | 47 |

| Table 7 3: Mineralogy of Qwt by Sieve Size (%) | 48 |

| Table 7 4: Microprobe data from Crib Head sample showing copper in smectite | 59 |

| Table 10 1: El Pilar Tabulation of Historical Drilling | 70 |

| Table 12 1: Core Recovery Table 1 | 86 |

| Table 12 2: Core Recovery Table 2 | 87 |

Page xii

El Pilar Project Form 43-101F1 Technical Report |  |

| Table 12 3: Core Recovery Table 3 | 88 |

| Table 12 4: Core Recovery Table 4 | 89 |

| Table 12 5: Core Recovery Table 5 | 90 |

| Table 13 1: Yearly Composite Bottle Roll Results | 94 |

| Table 13 2: METCON Locked Cycle Test Results – Five Yearly Composites | 95 |

| Table 13 3: Results of Bulk Sample Dry Screening | 98 |

| Table 13 4: Bulk Sample Fractions to METCON & Duplicates | 98 |

| Table 13 5: Bulk Sample (Qwu) Head Size Analysis & Assays | 99 |

| Table 13 6: Bulk Sample (Qwu) Tail Size Analysis & Assays | 100 |

| Table 13 7: Crib Truck Loads & Weights | 102 |

| Table 13 8: Final Acid Curing Data for MP Cribs | 103 |

| Table 13 9: Final Acid Curing Data for MP Columns | 103 |

| Table 13 10: Bulk Sample Bottle Roll Results – Part 1 | 106 |

| Table 13 11: Bulk Sample Bottle Roll Results – Part 2 | 107 |

| Table 13 12: MP Crib & Column Metallurgical Test Results | 108 |

| Table 13 13: C-01 Crib Tail Analysis | 110 |

| Table 13 14: C-02 Crib Tail Analysis | 110 |

| Table 13 15: Summary of Bulk Sample 150 Day Leach Crib & Column Results. | 110 |

| Table 13 16: Summary of Crib Results Sequential Copper Extraction per Layer | 112 |

| Table 13 17: METCON 5 Column Bulk Sample 120 Day Metallurgical Test Results | 113 |

| Table 13 18: METCON 5 Column Bulk Sample 180 Day Metallurgical Test Results | 115 |

| Table 13 19: Composite Selection Criteria for Thirteen New Columns | 117 |

| Table 13 20: 13 Column Final Composite Assays | 125 |

| Table 13 21: 13 Column Bottle Rolls Columns 1 – 7 | 126 |

| Table 13 22: 13 Column Bottle Rolls Columns 8 – 12 | 127 |

| Table 13 23: 13 Columns 120 Day Leach Data | 129 |

| Table 13 24: 13 Columns 180 Day Leach Data | 129 |

| Table 13 25: METSIM Metallurgical Projections for Five Yearly Composites | 132 |

| Table 13 26: METSIM Metallurgical Projections for Five Backup Columns | 132 |

| Table 13 27: METSIM Metallurgical Projections for 13 Columns | 133 |

| Table 13 28: 180 Day Copper Recovery Projections Used for Recovery Algorithm | 134 |

| Table 13 29: Final 180 Day Leach Recovery Data | 136 |

Page xiii

El Pilar Project Form 43-101F1 Technical Report |  |

| Table 13 30: Comparison between Assay and Calculated Heads | 137 |

| Table 13 31: Comparison of 6 Meter and 3 Meter Copper Extraction | 139 |

| Table 13 32: 3 Meter Lift Height Projected 180 Day Copper Extraction. | 140 |

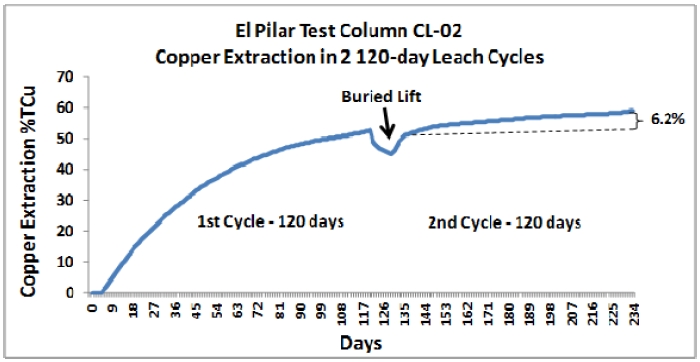

| Table 13 33: Column CL-02 Initial and Buried Lift Results | 142 |

| Table 13 34: 3 Meter Lift Height Projected 360 Day Copper Extraction. | 143 |

| Table 13 35: Mini Column Details. | 145 |

| Table 13 36: Mini Column 180 Day Leach Results. | 146 |

| Table 13 37: Mini Column 360 Day Leach Results. | 147 |

| Table 13 38: Comparison of Mini Column Results | 149 |

| Table 13 39: Bottle Roll Acid Consumptions Used for LOM Acid Consumption | 151 |

| Table 13 40: Acid Consumption Increments Used in the Reserve & Economic Model | 152 |

| Table 13 41: 180 Day Period Copper Recovery of RCu | 156 |

| Table 13 42: Comparison of Metallurgical Composite Drillhole vs. METCON Assays | 158 |

| Table 14 1: Description of El Pilar Rock Types | 162 |

| Table 14 2: Copper Estimation Parameters – Table 1 | 167 |

| Table 14 3: Copper Estimation Parameters – Table 2 | 168 |

| Table 14 4: Specific Gravity Determinations | 169 |

| Table 14 5: El Pilar Mineral Resources – Inclusive of Mineral Reserves | 171 |

| Table 14 6: El Pilar Mineral Resources – Exclusive of Mineral Reserves | 171 |

| Table 14 7: Measured & Indicated Mineral Resources at Various Cutoff Grades | 171 |

| Table 14 8: Inferred Mineral Resources at Various Cutoff Grades | 172 |

| Table 14 9: Comparison of Models for Measured and Indicated Mineral Resources | 173 |

| Table 14 10: Comparison of Models for Inferred Mineral Resources | 174 |

| Table 15 1: Economic Parameters for Reserve Calculation | 175 |

| Table 15 2: 2011 El Pilar Slope Parameters | 177 |

| Table 15 3: El Pilar Mineral Reserve | 180 |

| Table 16 1: El Pilar Mining Phases | 187 |

| Table 16 2 Mine Production Schedule by Year | 188 |

| Table 16 3: Mine Production Schedule Year 0 – Year 2 by Months | 189 |

| Table 16 4: Summary of Recommended Catch Bench Widths and Inter-Ramp Angles | 192 |

| Table 16 5: 2011 El Pilar Pit Slope Parameters | 193 |

| Table 16 6: Major Equipment Requirements | 208 |

Page xiv

El Pilar Project Form 43-101F1 Technical Report |  |

| Table 16 7: Summary of Mine Material Movements & Operations Schedule | 210 |

| Table 16 8: Operating Time per Shift | 211 |

| Table 16 9: Material Characteristics. | 211 |

| Table 16 10: Additional Material Characteristics | 212 |

| Table 16 11: Blasting Inputs & Assumptions | 213 |

| Table 16 12: Drilling Inputs & Assumptions | 214 |

| Table 16 13: Drilling Requirements by Year | 216 |

| Table 16 14: Shovel Requirements | 218 |

| Table 16 15: Loader Requirements | 220 |

| Table 16 16: Truck Requirements | 222 |

| Table 16 17: Truck Speed, Loading & Shift Factors | 223 |

| Table 16 18: Support Equipment Requirements | 225 |

| Table 18 1: Acid Plant Key Operating Parameters. | 242 |

| Table 18 2: Expected Performance Characteristics of Turbine Generator. | 242 |

| Table 18 3: Preliminary Well Water Analysis. | 243 |

| Table 18 4: Acid Plant Expected Water Quality | 244 |

| Table 18 5: LOM Economic Model Sulfur Pricing | 246 |

| Table 18 6: Acid Plant Costs & Parameters by Year | 247 |

| Table 20 1: Environmental Monitoring Program | 253 |

| Table 20 2: Permitting Requirements | 254 |

| Table 20 3: Permit Matrix | 256 |

| Table 21 1: Facility Initial Capital Costs | 262 |

| Table 21 2: Capital Cost Expenditures by Month | 263 |

| Table 21 3: Mining Capital Costs | 265 |

| Table 21 4: Unit Costs for Major Mine Equipment | 266 |

| Table 21 5: LOM Capital Costs Summary | 267 |

| Table 21 6: Life-of-Mine Mining Costs | 268 |

| Table 21 7: Incremented LOM Acid Consumption | 269 |

| Table 21 8: Life-of-Mine Processing Costs | 270 |

| Table 21 9: Life-of-Mine Administrative (G&A) Costs | 270 |

| Table 21 10: Comparison between Operating Costs Used for Reserve and Economics | 271 |

| Table 22 1: Life of Mine Ore, Waste Quantities, and Ore Grade | 272 |

Page xv

El Pilar Project Form 43-101F1 Technical Report |  |

| Table 22 2: 180 Day Leach Copper Recovery by Period | 273 |

| Table 22 3: Copper Prices Used for Economic Analyses Cases | 274 |

| Table 22 4: Financial Analysis Summary of Base Case and Cases 2-7 Copper Pricing | 276 |

| Table 22 5: Base Case Financial Model, Unlevered, After-Tax | 280 |

| Table 22 6: Constant Copper Price Case 1 @$2.50 Copper Financial Model, Unlevered, After-Tax | 282 |

| Table 22 7: Constant Copper Price Case 2 @$3.00 Copper Financial Model, Unlevered, After-Tax | 283 |

| Table 22 8: Constant Copper Price Case 3 @$3.50 Copper Financial Model, Unlevered, After-Tax | 284 |

| Table 22 9: Constant Copper Price Case 4 @$4.00 Copper Financial Model, Unlevered, After-Tax | 285 |

| Table 22 10: Constant Copper Price Case 5 @$4.50 Copper Financial Model, Unlevered, After-Tax | 286 |

| Table 22 11: Constant Copper Price Case 6 @$5.00 Copper Financial Model, Unlevered, After-Tax | 287 |

| Table 22 12: Financial Model for 3 Meter Lift Height 360 Day Copper Recovery Case. | 289 |

| Table 22 13: Financial Model for LOM Contract Mining | 291 |

| Table 25 1: Main Parameters Before and After Tax | 295 |

| Table 25 2: Sensitivities - After Tax | 295 |

Page xvi

El Pilar Project Form 43-101F1 Technical Report |  |

A Feasibility Study Contributors and Professional Qualifications

| Feasibility Study Contributors & Professional Qualifications |

| Responsibility | Author | Registration | Designation | Company |

| Feasibility Study | Michael

Broch | FAusIMM | Qualified Person

(QP) | Mercator Minerals Ltd. |

Data Verification: QA/QC, Resource Modeling, Mine Planning, and Reserves | Mike Hester | FAusIMM | Other Expert | IMC |

| Geology | John Dreier | P. Geo | Other Expert | Exploration, Development and Mining Consultants, Inc. |

Metallurgy, Flow Sheets and Process Plant | Thomas L. Drielick | P. E. | Other Expert | M3 Engineering |

| Process Plant (SX-EW) | Mark Vancas | | Other Expert | |

| Pit Geotechnical | Ken Myers | P. E. | Other Expert | The Mines Group |

Heap Design / Geotechnical | Anthony Crews | P. E. | Other Expert | The Mines Group |

Environmental and Permits | Julian Bennett | M. Sc. | Other Expert | M3M |

| Hydrology | Dr. Miguel Rangel | Ph. D. | Other Expert | IDEAS |

Acid Plant / Power Plant Sulfur Unloading | Eric Partelpoeg | Ph. D. | Other Expert | EHP |

| Sulfur Pricing Study | Robert Boyd | | Other Expert | Elkbury Sulfur Consultants, Inc. |

Page xvii

El Pilar Project Form 43-101F1 Technical Report |  |

| 1 | SUMMARY |

| | |

| 1.1 | Overall Report Summary |

This report is an update to the November 2011 Feasibility Study (2011 Study) authored by M3 Engineering and Technology and others. The 2011 Study is substantially repeated herein, with the only significant modification being the incorporation of a new Base Case that utilizes enhanced copper recoveries based on converting the leach pad from 6 meter to 3 meter (m) lift heights. The metallurgical data used for the 3 m copper recoveries were presented in the 2011 Study, but the case was referred to in that report as a “semi-quantified recovery case”, because to fully quantify the 3 m case required redoing the reserve and mine plan under an extended time schedule not available at that time.

As a result of using the 3 m lift height copper recovery algorithm, the primary differences between this report and the 2011 Study are as follows; 1) the 3 m lift height copper recovery algorithm is used for the Base Case reserve and economics, 2) a new mineral reserve is presented, and 3) a new mine plan is included based on the new reserve. These differences result in substantially improved project economics and in one additional year of mine life. Other new information or differences include 1) new metallurgical data from 11 mini columns is presented 2) where needed in the economic model, the acid plant is run at 110% of capacity, from 1300 tpd to a maximum of 1430 tpd, and 3) the timing of the preproduction period has changed from 12 months to 15 months for first cathode and to 18 months for completion of the acid plant, which requires that market acid be purchased during the first three months of leaching.

For ease of comparison, this report is based on the same capital cost estimates as the 2011 Study and utilizes the same copper prices. In other words, this report is an update to higher metallurgical copper recoveries projected for the 3 meter high lifts, but it is not an update to the 2011 capital costs estimated by M3 and others. Although the capital costs utilized herein are the same as the 2011 Study, there are some differences in timing of the costs, due to greater leach pad area being required early in the mine life due to use of the 3 m lifts.

Mercator Minerals Ltd. (ML), through its subsidiary Recursos Stingray de Cobre, S.A. de C.V. (“Stingray”), plans to develop the 100% wholly owned El Pilar oxide copper project into one of Sonora, Mexico’s new copper mines. The El Pilar copper project is a “greenfield” project with no existing mining infrastructure or equipment on the property. The Santa Cruz River flows year around 2 km south of the project. The railway of Ferrocarril Mexicano follows this river basin, as do local roads. Power is available at Nogales approximately 28 km to the northwest of the project area.

The basis of this updated Feasibility Study (“Study”) is the use of mining contractor in Years 0-2 followed by owner mining starting in Year 3 for the remainder of the mine life. Therefore, the mining process assumes the use of haul trucks for mining and stacking onto the ore heap, followed by solvent extraction and electro-winning (SXEW) processing in facilities as outlined in the process flow drawing developed in the 2011 Study.

El Pilar Project Form 43-101F1 Technical Report |  |

Michael J. Broch, FAusIMM, of Mercator Minerals Ltd. (the Author”), is the Qualified Person responsible for the technical content of this Study, except where reliance on Other Experts is expressly indicated.

As estimated by Independent Mining Consultants (“IMC”) in the 2011 Study, and unchanged, and still reliable and current from that earlier estimate, Measured and Indicated mineral resources are presented in Table 1-1 and Table 1-2 below:

Table 1-1: El Pilar Mineral Resource – 0.15% Copper Cutoff

| El Pilar Mineral Resources (Inclusive of Reserve) |

| | 0.15% Copper Cutoff |

| Mineral Resource Class | Ore Ktonnes | Total Cu (%) | Sol Cu (%) | Copper (Mlbs) |

| Measured Mineral Resource | 128,094 | 0.307 | 0.128 | 867.0 |

| Indicated Mineral Resource | 231,154 | 0.266 | 0.095 | 1,355.5 |

| Measured/Indicated Resource | 359,248 | 0.281 | 0.107 | 2,222.5 |

| Inferred Mineral Resource | 67,996 | 0.239 | 0.082 | 358.3 |

Table 1-2: El Pilar Mineral Resource @ Various Copper Cutoff Grades

| Measure and Indicated Mineral Resources @ Different Cutoff Grades |

TCu

Cutoff

(%) | Measured Mineral Resource | Indicated Mineral

Resource | Measured/Indicated

Mineral Resource |

| Ore Ktonnes | Total Cu (%) | Soluble Cu (%) | Ore Ktonnes | Total Cu (%) | Soluble Cu (%) | Ore Ktonnes | Total Cu (%) | Soluble Cu (%) |

| 0.30 | 64,377 | 0.385 | 0.193 | 67,814 | 0.366 | 0.172 | 132,191 | 0.375 | 0.182 |

| 0.25 | 86,144 | 0.357 | 0.168 | 119,222 | 0.326 | 0.132 | 205,366 | 0.339 | 0.151 |

| 0.20 | 109,304 | 0.329 | 0.145 | 178,495 | 0.292 | 0.113 | 287,799 | 0.306 | 0.125 |

| 0.15 | 128,094 | 0.307 | 0.128 | 231,154 | 0.266 | 0.095 | 359,248 | 0.281 | 0.107 |

| 0.10 | 137,301 | 0.295 | 0.121 | 255,218 | 0.253 | 0.087 | 392,519 | 0.268 | 0.099 |

Proven and Probable mineral reserves (Table 1-3) planned for mining over a period of 13 years are calculated on the basis of $2.15 per lb copper and are estimated to be 258.5 Mt averaging 0.304% total copper (TCu). This is as compared to the 2011 Study reserve of 230.2 Mt averaging 0.313% TCu, which was calculated on the basis of $2.75 per lb copper. The mine-life waste to ore stripping ratio is currently estimated to be 1.76:1, as compared to the 1.95:1 reported in 2011.

El Pilar Project Form 43-101F1 Technical Report |  |

Table 1-3: El Pilar Mineral Reserves

| El Pilar Mineral Reserves |

| | | | Ore | Total Cu | Sol Cu | Copper |

| Reserve Class | | Ktonnes | (%) | (%) | (Mlbs) |

| Proven Mineral Reserve | | 108,546 | 0.322 | 0.143 | 771.2 |

| Probable Mineral Reserve | | 149,999 | 0.291 | 0.121 | 961.8 |

| Proven/Probable Mineral Reserve | 258,545 | 0.304 | 0.13 | 1,733.0 |

| Total Pit Material | 712,311 | Ktonnes. | Waste:Ore | 1.76 | |

The project mine design rate reaches its maximum of 22 Mt of ore per year, or approximately 60,000 tpd in Year 4. The project is expected to produce 998.3 million pounds (Mlbs) of cathode copper over the 13 year mine life. This is an improvement of 116.6 Mlbs over the 881.7 Mlbs of copper projected over a 12 year mine life in the 2011 Study. The cathode product is expected to meet ASTM 115 Grade 1 copper cathode specifications (99.99+% copper) and will be purchased FOB at the El Pilar mine site.

For this report, a 13 year mine schedule was developed. At the process plant design rate, the project is expected to produce a maximum of 39,400 t (87 million pounds) of copper cathode per year. Actual production averages 85.4 and 85.7 Mlbs per year for the first 5 and 8 years of the project, respectively after which copper production declines due to declining acid soluble copper head grades. For economical and practical reasons, the maximum mine ore capacity was designed to be 22 Mt per year. At this capacity, the average copper cathode production over the 13 year LOM is 79.3 Mlbs per year. This production schedule forms the basis for the financial model.

The initial capital cost for the El Pilar Base Case Project is estimated to be US$279.9 million, including a 1300 tpd acid plant and the use of a mining contractor in Years 0-2, followed by owner mining. This is as compared to the US$244 initial capital cost estimated in 2011. The difference is mostly due to the to the requirement that the $26.4 M Phase II heap leach expansion, originally slated for Year 3 in the 2011 Study, now be constructed in Year 0, due to the larger pad area required by the 3 meter lifts. Also, in order to match M3’s contingency estimates, a 15% contingency has been added to the Phase II heap leach capital total, bringing the total amount brought forward to $35.9 M. Sustaining capital of $19.1 million is also estimated over the life of mine.

A cash reserve of $33.8 million is recommended. The operating cash cost for the project is calculated at $1.34 per pound of copper, as compared to $1.37 in 2011. At a Base Case average copper price of $2.82 per pound, the El Pilar Project has an after tax IRR of 36.6%, and an after-tax net present value (NPV), discounted at 8%, of $416.0 million (M). This is compared to the 2011 estimated IRR of 35.7% and an NPV@8% of $335.3 M. The estimated payback of capital is now 1.8 years, as compared to 1.6 years in the 2011 Study. A summary of the project economics is included below in Table 1-4.

El Pilar Project Form 43-101F1 Technical Report |  |

Table 1-4: El Pilar Economic Summary

| EL PILAR | ECONOMIC SUMMARY* |

Initial Capital Cost (includes Acid Plant) | $ 279.9 million |

| Cash Reserve | $ 33.8 million |

| Sustaining Capital | $ 19.1 million |

| Cash Operating Cost | $ 1.34 per lb copper |

| IRR (after taxes) | 36.6% |

| NPV@8% (after taxes) | $416.0 M |

| Payback (after taxes) | 1.77 years |

| | * Base case at $3.82/lb copper price per pound Years 0 and 1, $3.44/lb Year 2, $3.14/lb Year 3, and $2.60/lb for the remaining life of mine, averaging $2.82/lb copper over the life of mine. |

In 2011, Mercator Minerals Ltd. (ML) engaged M3 to prepare the updated Feasibility Study of the El Pilar oxide copper project (Project) to assess the viability of commercial operations. That work is essentially repeated herein, except for differences that result from using copper recoveries projected for a 3 meter, rather than a 6 meter, leach pad lift height. Due to the limited number of changes from the 2011 Study, this report is being authored in-house by ML and will be the cornerstone for project financing, permitting, planning and construction of a copper mining operation at El Pilar. The information from the 2011 Study referred to in this report is still reliable and current and there have been no material changes.

ML plans to develop the Project in Sonora, Mexico as an open pit mining heap leach operation with a solvent extraction and electro-winning processing plant (SXEW). The El Pilar deposit contains 258.5 million tonnes (Mt) of ore with a copper content of 0.304%, containing a total of 1.73 billion pounds of copper, of which 998.3 million pounds are estimated to be recoverable. The process plant will be designed to produce up 39,400 tonnes of copper cathode (87 million pounds) per year. ML plans to begin engineering and then construction immediately upon completion of project financing. All environmental permits are in place to begin construction. In parallel with the preparation of this Feasibility Study, ML has been investigating project financing options and plans to complete project construction as soon as practical.

| 1.3 | Reliance on Other Experts |

Reports received from Other Experts have been reviewed for factual errors by ML. Any changes made as a result of these reviews did not involve any alteration to the conclusions made. The statements and opinions expressed in these documents are given in good faith and in the belief that such statements and opinions are true and accurate at the date of these reports. Details on information provided from the Other Experts are found in Section 3 of this report.

El Pilar Project Form 43-101F1 Technical Report |  |

| 1.4 | Property Description and Location |

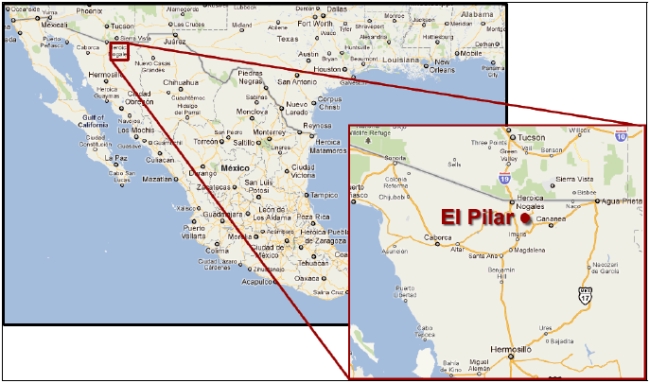

The El Pilar Property is located in north central Sonora Sate, Mexico about 15 km south of the international border with United States of America (See Figure 1-1). The property is situated within lands of Ejido Miguel Hidalgo (also referred to as San Lazaro), in the Santa Cruz Municipality. The property is situated between UTM coordinates 3,446,000N to 3,455,000N and 526,800 E to 534,700 E.

Figure 1-1: El Pilar Location Map

The El Pilar property comprises 7,170 hectares in eighteen concessions (See Section 4.1 for the Concession Map). These concessions are wholly owned by Recursos Stingray de Cobre S.A de C.V. (formerly Normex), the wholly owned Mexican subsidiary of ML.

The status of the mining concessions is outlined in Section 4. A total of 1,926 hectares of surface rights have been successfully negotiated with the Ejido Miguel Hidalgo, which allows for all required land ownership rights needed for project development.

| 1.5 | Accessibility, Climate, Local Resources, Infrastructure & Physiography |

The El Pilar deposit is located at the southwest margin of the Patagonia Mountains near the base of a mountain range. The topography near the deposit permits sufficient surface space for a mining operation, leaching pads, waste disposal areas, and other facilities.

The property can be reached by road from Hermosillo, Sonora in Mexico and from Tucson, Arizona in the USA. The route from Hermosillo to Miguel Hidalgo takes about 3 1/2 hours of

El Pilar Project Form 43-101F1 Technical Report |  |

driving time. The route from Tucson to Miguel Hidalgo is currently a 2 hour drive. The site is a green-field mining site with no existing infrastructure. Experienced mining personnel and related contractors are available within driving distance.

The project area’s climate allows year-round mining and processing operations. The climate is classified as semidry with a summer rainy season and limited rains the rest of the year. The average annual temperature is 17.8°C. The project site elevation ranges from 1,250 m to 1,425 m above sea level (masl). The hottest months are June to September. Most of the rainfall occurs in the form of summer storms during the months of July, August and September. Mean annual precipitation is 543.6 mm.

A power line is located 3 km to the south, in the village of Miguel Hidalgo (San Lazaro). The project will require construction of a high voltage power line from the site to connect with the high voltage power lines accessible in Nogales, 29.5 km northwest. A railroad is located four km south of the deposit. Construction of a new railway spur approximately 3.8 km in length is planned for the delivery of molten sulfur or sulfuric acid.

The history of exploration in the El Pilar area before 1992 is not well documented. It is known that in the 1970’s, Cyprus Amax Minerals had claims in the area. According to verbal communications with local people and field evidence, it is clear that a geophysical survey and a few drill holes were completed in the northern part of the El Pilar Discovery area. Results of both the drilling and the geophysical survey are unknown.

Before Normex's direct involvement, there was no mineral resource known, only small old workings following narrow veins with erratic copper and molybdenum mineralization. Other small workings in the area were dug by local miners (gambusinos), searching for azurite and turquoise.

Normex began acquiring ground at El Pilar in 1992. From 1992 to 1997, Normex carried out an exploration program that included regional mapping, sampling and limited geophysical surveying. From 1998 to 1999, Freeport Copper, under an agreement with Normex, carried out an exploration program that included regional mapping, rock and vegetation sampling, and some geophysical surveys. After the exploration agreement with Freeport ended in 2000, Normex continued with a short CSAMT survey and soil sampling exploration program. In addition, Normex carefully assessed the data generated by Freeport, emphasizing lab checks for validating the copper assays from the gravels. From September 2000 to March 2001, Normex completed a drill program. Following Normex’s drilling campaign, resource calculations were undertaken in 2001, and again in 2003. An inferred mineral resource estimate was completed by Magri in 2003. In April 2007, a Form 43-101 F1 Technical Report on the El Pilar Property was completed by Gary Woods, P. Geo.

Preliminary metallurgical test work was carried out at Falconbridge’s Lomas Bayas mine in Chile in 2003 and 2004 and by METCON in 2001 and 2005. This work included bottle roll testing and column leach tests. A scoping level economic evaluation was prepared by AMEC E&C Services Inc. of Phoenix, Arizona in 2005-2006 for Normex. The study concluded that the

El Pilar Project Form 43-101F1 Technical Report |  |

El Pilar project demonstrated positive economics and was worthy of further assessment. Stingray acquired the property at that juncture. Mercator Minerals Ltd. purchased Stingray Copper in 2009.

In April 2009, an NI 43-101 compliant Feasibility Study was filed on behalf of Stingray by M3 Engineering. Included within the NI 43-101 are mineral resource and a mineral reserve estimates done independently by Mike Hester of IMC in Tucson.

In 2010 and 2011, additional metallurgical work was undertaken through METCON and new studies were undertaken to better understand the geology and mineralogy of the deposit in order to better estimate LOM and period copper recoveries and acid consumption. In addition, the project was optimized significantly in terms of relocating facilities for maximum efficiency and new engineering work was carried out through M3 Engineering. All of this work resulted in the November 2011 updated Feasibility Study, which is substantially repeated herein.

| 1.7 | Geological Setting & Mineralization |

The deposit is located along the southwest flank of the Patagonia Mountains. The geology of the El Pilar property consists of Precambrian intrusive rocks overlain by Paleozoic sedimentary rocks. These units are overlain by Tertiary sedimentary rocks. Intrusives of granitic to monzonitic composition with some pegmatitic and aplitic facies intrude all the older units. Tertiary and Quaternary alluvial fan and alluvial wash sediments cover the flanks of the ranges and the intervening valleys.

The El Pilar copper deposit occurs within unconsolidated, poorly sorted, poorly bedded, proximal facies alluvial wash deposits that are overlain by dissected younger alluvial fan deposits. The copper bearing sediments at El Pilar are comprised solely of alluvial wash gravels deposited into a paleotopographic range-front depression. At the northern boundary of the deposit, these basin-fill sediments are juxtaposed against unmineralized Precambrian granitic rocks by an east-west to northwest-trending, south dipping zone of faulting and hydrothermal brecciation. The faulting is of unknown displacement. The breccia zone comprises a multi-stage, highly silicified, copper mineralized hydrothermal breccia that is up to 100 m wide and 600 meters long. The El Pilar copper deposit is interpreted to have been formed by erosion of this breccia over time into the range-front topographic depression.

Mineralization predominantly consists of the copper oxide mineral chrysocolla, which occurs as coatings on clasts of highly silicified breccia and as grains in the sedimentary gravel matrix. The main gravel sequence that hosts copper mineralization consists of poorly consolidated angular to sub-rounded fragments of breccia, intrusive rocks and minor volcanic fragments cemented in a sandy matrix. These productive gravels, referred to as Quaternary Alluvial Wash Deposits Upper (Qwu) and Quaternary Alluvial Wash Deposits Transitional (Qwt), range from 30 m to 180 m in thickness. The main zone of copper mineralization occurs within a southwest/south trending channel that extends for more than 2 km.

El Pilar Project Form 43-101F1 Technical Report |  |

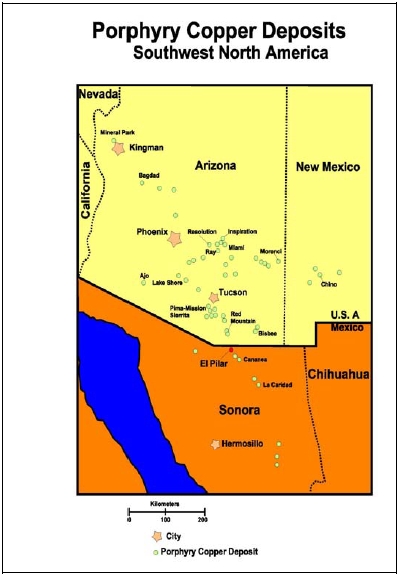

El Pilar lies within the Sonora-Arizona Porphyry Copper Province, about 45 km northwest of the Cananea copper mine owned by Grupo Mexico. Cananea is the largest porphyry copper deposit in Mexico and one of the largest in the world. Both El Pilar and Cananea are situated in a highly prospective belt of copper deposits that range from La Caridad in the south through to central Arizona. The main types of copper deposits in this belt are related to porphyry copper systems and mineralization typically occurs in hydrothermal breccias pipes and as disseminations and stockworks. The El Pilar property hosts a gravel hosted or transported copper resource that is atypical for the area. Copper at El Pilar is hosted by range front alluvial wash deposits with clasts of intrusive, porphyry and highly silicified rock derived from a proximal, exposed hydrothermal breccia zone. The mineralization is interpreted to have been derived at least in part from that breccia and possibly also in part from a pre-existing porphyry copper deposit on the property that is yet to be identified. Reconstruction of events suggests that the breccia was mechanically weathered and eroded, transported and deposited in a channel and alluvial fan sequence that overlies a lower more indurated alluvial wash unit (Qwl).

Normex and partners began exploration at the property in the late 1990s, conducting geophysical and geochemical exploration programs over the property. Pre-Stingray drilling amounts to 61 holes representing 11,988 m that were drilled by Freeport and Noranda between 1998 and 2004. In terms of meters of drilling, this represents 23% of the total drilling to date.

The Stingray geologic and drill hole database was provided to IMC for review and included 255 holes that represented 52,810 m of drilling.

During 2007 and 2008, Stingray drilled 194 HQ core holes representing 40,822 m (see Section 10 of this report for figures and details). This drilling represents 77% of the drill hole database in terms of meters drilled. The purpose for the drilling was to: 1) validate the Freeport and Noranda drilling, 2) extend the resource base, and 3) collect samples to perform metallurgical testing over the entire copper deposit.

| 1.11 | Sample Preparation, Analyses and Security |

All of the analytical work that was done for Noranda was performed by the Bondar Clegg Lab in Vancouver, B.C., following sample preparation by Bondar’s affiliate in Hermosillo. For sample security, after splitting of the core, the samples were bagged by project geologists and driven to the sample preparation laboratory in Hermosillo by Noranda personnel. Sample preparation and shipment of the pulps to the Vancouver analytical laboratory was conducted by lab personnel. Noranda personnel were not involved in sample preparation.

Sample preparations and analysis for Stingray drilling was performed at two different laboratories. About 60% of the drilling analyses were done by ALS Chemex laboratories and about 40%, particularly the drilling used for metallurgical testing, were done by the METCON

El Pilar Project Form 43-101F1 Technical Report |  |

laboratory in Tucson, Arizona. Sample preparation for ALS Chemex was done at their Hermosillo, Mexico facility, after which the pulps were shipped to Vancouver for analysis. As part of the QA/QC work several hundred pulps were analyzed at both laboratories. ALS Chemex laboratories are highly regarded facilities for sample preparation and analysis. Most laboratories are registered to ISO 9001:2000 standards and many are ISO 17025 accredited.

Total copper analysis was done by a four acid digestion, nitric, perchloric, hydrofluoric, and hydrochloric acid, followed by analysis with Inductively Coupled Plasma - Atomic Emission Spectroscopy (ICP-AES).

To validate the El Pilar database, in 2011 IMC compared the database with assay certificates for eight pre-Stingray holes and eight Stingray holes. This represents 6.3% of all holes and about 8% of the holes with significant mineralization (about 200 of the 255 holes). No significant discrepancies were found. IMC concluded that the database fairly captured the correct assay data.

Stingray conducted a comprehensive program to assure the quality of its sample preparation and analysis (assaying). Standard, blank and duplicate samples from the El Pilar exploration program were subjected to quality assurance. The standard samples were prepared at METCON using interval samples provided by Stingray. The blank sample came from a monzonite outcrop at the El Pilar and is not anomalous in copper. The standard, blank and duplicate samples were generally inserted (used) as follows:

| | ● | Duplicate samples were inserted every ten samples. |

| | ● | Blank samples were inserted every 20 intervals. |

| | ● | Standard samples were inserted every ten interval samples. |

It is the opinion of IMC that the sampling method is appropriate for the nature of mineralization at El Pilar. The current density of drill holes is also appropriate. There are more holes than would typically be drilled into a disseminated copper deposit at the feasibility study level, though much of the drilling was for the collection of metallurgical samples.

| 1.13 | Mineral Processing and Metallurgical Testing |

The El Pilar mine will be an open pit, oxide copper mine, whereby copper is recovered from the heap leach pad via the application of sulfuric acid-bearing raffinate pumped from a raffinate pond. The pregnant leach solution (PLS) is then collected and copper is recovered in the plant via the process of solvent extraction/electrowinning (SXEW) in a two-stage process that first extracts and upgrades copper ions from low-grade leach solutions into a concentrated electrolyte, and then deposits pure copper onto cathodes using an electrolytic procedure. Extensive metallurgical work has been conducted historically and more recently in 2010 and 2011 to best determine how much copper will be recovered from the ores and how much acid will be consumed by the process.

El Pilar Project Form 43-101F1 Technical Report |  |

In preparation for the updated 2011 El Pilar Feasibility Study, a detailed review of all technical studies was conducted with particular attention to project metallurgical conclusions and conducted extensive new metallurgical testing. The additional metallurgical testing performed in 2010 and 2011 was done on a 600 tonne bulk sample collected onsite and on 13 new drill core composites. The following was concluded from results of the locked cycle tests conducted on the bulk sample composite, as reported in the 2011 Study.

| | ● | Run of mine particle size distribution at 80 percent passing 1 ¼ inches did not negatively impact copper extraction and gangue acid consumption compared to 80 percent passing 37.5 mm, 19 mm and irrigation flow rates of 6.1 and 7.8 lph/m2, respectively, using a sulfuric acid cured dosage of 4 kilogram per tonne of material. |

| | ● | The copper extractions on the two composites, C-01 and C-02 ranged from 67.9% to 63.7% and gangue acid consumption ranged from 5.7 to 5.0 kilogram per kilogram of copper extracted (kg/kg Cu), and 20.7 to 17.7 kilogram acid per tonne of material (kg/ tonne) after a total leach cycle of 166 days (including 7 days of cure, 150 days of leach, 7 days of wash and 2 days of drain cycles). |

| | ● | The highest copper extraction of approximately 71 percent was achieved at the size distribution of minus 3/4 inches on the crib C-01. |

| | ● | The lowest copper extraction of approximately of 43.5 percent was achieved at the size distribution of plus 3/4 inches on the crib C-02. |

| | ● | Percolation problems were not observed in the cribs during the leach cycle. |

| | ● | There is a good correlation between the calculated head and assay head for copper and iron. |

Combined metallurgical tests from the Stingray 2009 program and from the bulk sample and 13 column composites tested in 2010 and 2011, and reported in the 2011 Study, resulted in the following conclusions:

| | 1. | The El Pilar copper deposit consists of gravels that are poorly cemented and disaggregate almost completely into a “pre-crushed” size distribution on mining. |

| | 2. | As a result of the above and based on the crib results, Run-of-Mine (ROM) leaching should attain recoveries comparable to the column test averages. |

| | 3. | A 180 day leach cycle should be assumed initially, although real operating conditions may show that a shorter leach cycle is viable. |

| | 4. | Copper recoveries at El Pilar are at least initially a function of copper solubility, although mineralogical studies suggest that over longer periods of time a considerable amount of the residual copper may be recovered. |

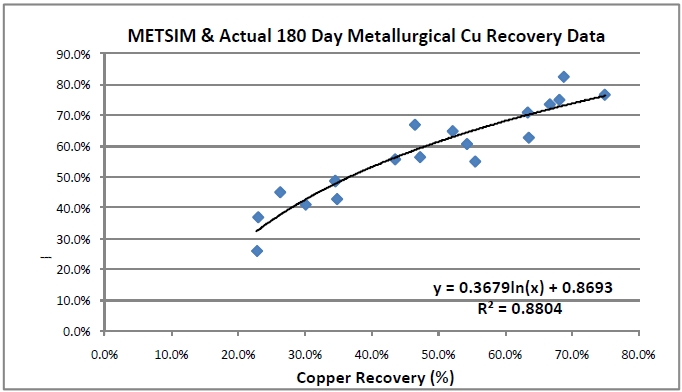

| | 5. | There is a grade recovery relationship for 6 m high lifts leached for 180 days, as defined by the formula, Recovery % (of TCu) = 0.3679ln(X) + 0.8693, where X is the Ratio (%ASCu/%TCu). This formula results in 55.5% copper recovery over the LOM. |

| | 6. | There is a grade recovery relationship for 3 m high lifts leached for 180 days, as defined by the formula, Recovery % (of TCu) = 0.3352ln(X) + 0.8841, where X is the Ratio (%ASCu/%TCu). This formula results in 57.6% copper recovery over the LOM. |

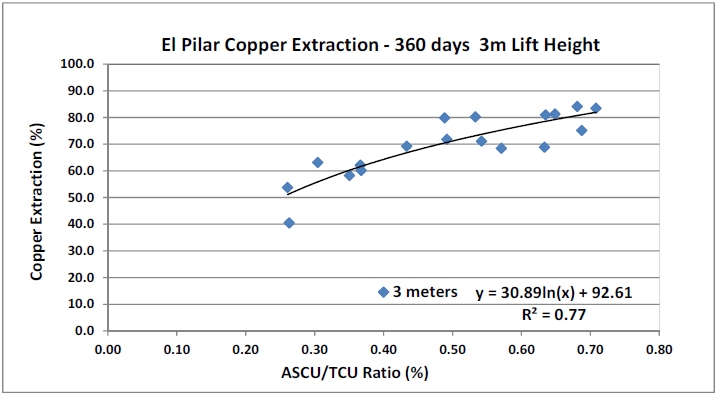

| | 7. | There is a grade recovery relationship for 3 m high lifts leached for 360 days, as defined by the formula, Recovery % (of TCu) = 0.3080ln(X) + 0.92611, where X is the Ratio (%ASCu/%TCu). This formula results in 64.9% copper recovery over the LOM. |

El Pilar Project Form 43-101F1 Technical Report |  |

| | 8. | An initial precure rate of about 10 to 15 kg per tonne acid is assumed. |

| | 9. | LOM acid consumption should average approximately 22 kg acid per tonne of ore. |

Additional metallurgical testing on 11 mini columns 3 m high was undertaken in late 2011 and 2012, after the 2011 Study was complete, and this information is reported as new data in this report. Several important considerations can be concluded from the mini column results, as follows:

| | 1. | Copper extraction rates (kinetics) are directly related to the initial acid precure amount up to 15 kg/t, with the best initial copper extraction being Column 5, which was cured at the 15 kg/t acid precure rate. However, for at least for one sample, Column 4, initial copper recovery was not improved by adding 18 kg/t of acid precure. This column actually recovered less copper than Column 5, suggesting that there is no benefit to that level of acid precuring. |

| | 2. | Initial acid consumption in the first 10 days or so is related to the acid precure amount, but ongoing acid consumption is a function raffinate pH, with lower acid consumption related to higher raffinate pH. |

| | 3. | Acid consumption is not directly related to the amount of acid applied. Column 5, with an acid precure amount of 15 kg/t, was run under relatively high raffinate pH conditions of pH 1.8, but had nearly the best overall copper recovery after 180 days of leaching of 69.5% coupled with only modest acid consumption of 16.2 kg/t. |

| | 4. | Importantly, after the solution application rate was halved from 4.0 lph/m2 to 2.0 lph/m2 after leach day 192, which had the effect of halving the amount of acid subsequently added to the columns, copper recovery continued at nearly the same positive rate, whereas acid consumption flat lined. |

| | 5. | At the time of the writing of this report, significant copper continues to be recovered from the columns even after 325 days of total leaching, supporting 360 day projected recoveries. As well. The continued long term copper extraction indicates that the “ultimate” recovery of copper from the El Pilar ores is not yet known and that significant additional copper may be recovered from the buried lifts, which will effectively be “under leach” for years. |

Whereas the 6 meter lift height 180 day copper recovery algorithm was used for the 2011 Study Base Case, this report replaces that Base Case with a new Base Case that utilizes the 3 m lift height 180 day copper recovery algorithm. The difference between these two algorithms is that the 2011 Study estimated that 881.7 M lbs of copper would be recovered over the LOM averaging 55.5 % recovery of total copper. This report projects that 998.3 M lbs of copper will be recovered over the LOM from essentially the same material averaging 57.6% copper recovery.

Several other project upsides are suggested by the metallurgical testing program and results, as flows:

| | 1. | Using longer leach data from two columns and based on 360 copper recovery Metsim projections for the remaining columns, an alternate 3 meter lift height 360 day grade/recovery algorithm results in 1,142.6 M lbs of copper being recovered over the |

El Pilar Project Form 43-101F1 Technical Report |  |

| | | LOM, averaging 64.9% LOM total copper recovery. This equates to 144.4M lbs more copper being produced over 360 days of leaching than the Base Case. This case is semi-quantified as an alternate Financial Copper Recovery Case in the Economic Analysis section of this report. |

| | 2. | Under managed pH conditions during real operations, as opposed to the very high acid application rates of 10 gpl free acid used for the metallurgical tests, and also under managed solution application rates, LOM acid consumption may be lower than presently projected. |

| | 3. | Due apparently to differences in assay procedures between the METCON test results and the drillhole database, up to 3.6 percentage points more soluble copper may be present than modeled. This could equate to as much as 45 M lbs more copper being produced over the LOM. |

| | 4. | Using a 10 to 15 kg per tonne acid precure, rather than the 4 kg per tonne precure used in almost all of the metallurgical tests, will likely result in faster copper recovery rates that could positively impact project economics and allow for a shortened leach cycle, as well as for potentially better copper recoveries over the life of mine. |

| 1.14 | Mineral Resource Estimates |

The following tables (Table 1-5 and Table 1-6) present the mineral resource for the El Pilar Project as calculated by Mike Hester, FAusIMM of IMC and Other Expert for the purposes of this report, under the supervision of the Author. They are inclusive of the mineral reserve.

Table 1-5: El Pilar Mineral Resource – 0.15% Copper Cutoff

| El Pilar Mineral Resources (Inclusive of Reserve) |

| | 0.15% Copper Cutoff |

| Mineral Resource Class | Ore Ktonnes | Total Cu (%) | Sol Cu (%) | Copper (Mlbs) |

| Measured Mineral Resource | 128,094 | 0.307 | 0.128 | 867 |

| Indicated Mineral Resource | 231,154 | 0.266 | 0.095 | 1,356 |

| Measured & Indicated Resource | 359,248 | 0.281 | 0.107 | 2,223 |

| Inferred Mineral Resource | 67,996 | 0.239 | 0.082 | 358 |

Table 1-6: El Pilar Measured & Indicated Mineral Resources at Different Cutoff Grades

| Measure and Indicated Mineral Resources @ Different Cutoff Grades |

TCu Cutoff (%) | Measured Mineral Resource | Indicated Mineral Resource | Measured/Indicated Mineral Resource |

Ore Ktonnes | Total Cu (%) | Soluble Cu (%) | Ore Ktonnes | Total Cu (%) | Soluble Cu (%) | Ore Ktonnes | Total Cu (%) | Soluble Cu (%) |

| 0.30 | 64,377 | 0.385 | 0.193 | 67,814 | 0.366 | 0.172 | 132,191 | 0.375 | 0.182 |

| 0.25 | 86,144 | 0.357 | 0.168 | 119,222 | 0.326 | 0.132 | 205,366 | 0.339 | 0.151 |

| 0.20 | 109,304 | 0.329 | 0.145 | 178,495 | 0.292 | 0.113 | 287,799 | 0.306 | 0.125 |

| 0.15 | 128,094 | 0.307 | 0.128 | 231,154 | 0.266 | 0.095 | 359,248 | 0.281 | 0.107 |

| 0.10 | 137,301 | 0.295 | 0.121 | 255,218 | 0.253 | 0.087 | 392,519 | 0.268 | 0.099 |

El Pilar Project Form 43-101F1 Technical Report |  |

Mineral Resources at different cutoff grades are summarized in Table 1-7.

Table 1-7: El Pilar Inferred Mineral Resources at Different Cutoff Grades

Inferred Resources @ Various Cutoffs |

TCu Cutoff (%) | Inferred Mineral Resource |

Ore Ktonnes | Total Cu (%) | Soluble Cu (%) |

| 0.30 | 9,969 | 0.422 | 0.216 |

| 0.25 | 20,898 | 0.344 | 0.153 |

| 0.20 | 39,612 | 0.286 | 0.111 |

| 0.15 | 67,966 | 0.239 | 0.082 |

| 0.10 | 90,333 | 0.212 | 0.068 |

The mineral resources are based on a three-dimensional (3D) block model developed by IMC and ML personnel during July and August 2011. The mineral resource estimates are compliant with the current CIM standards and definitions specified by NI 43-101. The resource also meets the “reasonable prospects for economic extraction” conditions of the NI 43-101 code.

ML does not know of any environmental, permitting, legal, title, taxation, socio-economic, marketing, or political issues which would affect the mineral resource or mineral reserve estimates. Note, however, that mineral resources that are not converted to mineral reserves do not have demonstrated economic viability. Also, inferred mineral resources are speculative in nature and may not be converted to measured and indicated mineral resources or to mineral reserve.

| 1.15 | Mineral Reserve Estimates |

Table 1-8 below summarizes the El Pilar mineral reserves for the new 3 m lift height Base Case as calculated by Mike Hester of IMC under the supervision of the Author. The proven and probable mineral reserves are 258 Mt at 0.304% total copper for 1.73 billion pounds of contained copper.

Table 1-8: El Pilar Mineral Reserve

| El Pilar Mineral Reserve |

| | | | Ore | Total Cu | Sol Cu | Copper |

| Reserve Class | | | Ktonnes | (%) | (%) | (Mlbs) |

| Proven Mineral Reserve | | 108,546 | 0.322 | 0.143 | 771.2 |

| Probable Mineral Reserve | | 149,999 | 0.291 | 0.121 | 961.8 |

| Proven/Probable Mineral Reserve | | 258,545 | 0.304 | 0.13 | 1,773.0 |

| Total Pit Material | 712,311 Ktonnes. | | | Waste:Ore 1.76 | |

The mining reserve used in the Study was determined by Mike Hester of IMC under the supervision of the Author and forms the basis for the Feasibility Study. The El Pilar mining

El Pilar Project Form 43-101F1 Technical Report |  |

reserve and mineral resource were determined from the drilling that extended from drill section 9300 North to drill section 7200 North at its southernmost limit. The drill spacing in the northern “Starter Pit” area of the deposit, which represents the initial 3 years of operation, is approximately 70 m and elsewhere in the deposit averages approximately 100 m. Surface topography was determined via an aerial topographic survey completed by Cooper Aerial in 2007. The copper mineralization remains open at its southern limit, albeit it is lower grade and relatively deep. The mineral resource at El Pilar exceeds the mining reserve scheduled for mining in this Study and additional mineral resources and mining reserves may be available at El Pilar, subject to appropriate programs of drilling and confirmation.

Mike Hester of IMC is the Outside Expert responsible for the preparation of the mine plan, the open pit design and the mining schedule used in this Feasibility Study. IMC incorporated the

results of the Mines Group geotechnical report “El Pilar Pit Slope Design” into the open pit design criteria.

The mining reserve of 258.5 Mt is scheduled for an annual forecast of projected ore tonnes and copper grade available in each year. The mining objective is based on moving approximately 34,250 ore t/d during the first full year of operation, gradually increasing to a maximum of 60,270 ore t/d in year 3 and thereafter, over a planned period of 365 operating days per year. This equates to a maximum target of approximately 22 Mt/y of ore being mined.

The basis mine production schedule developed by IMC is shown in Table 1-9 below.

El Pilar Project Form 43-101F1 Technical Report |  |

Table 1-9: Mine Production Schedule

| Mine Production Schedule |

| | | Copper Grades | | | | | | | |

Mining Period | Ore Ktonnes | Total Copper % | Soluble

Copper % | Recoverable Copper % | Residual Copper % | Ratio (TCu/ASCu) | Waste Ktonnes | Total Ktonnes | Waste: Ore Ratio | Acid Cons. (kg/t) | Copper Recovery % | Contained Cu (Klbs) | Recovered Cu (Klbs) |

| PP | 2,250 | 0.309 | 0.191 | 0.221 | 0.118 | 0.618 | 12,750 | 15,000 | 5.67 | 16.00 | 71.5% | 15,327 | 10,962 |

| Year 1 | 17,800 | 0.355 | 0.202 | 0.243 | 0.153 | 0.569 | 22,200 | 40,000 | 1.25 | 16.00 | 68.4% | 139,309 | 95,359 |

| Year 2 | 14,650 | 0.382 | 0.206 | 0.256 | 0.176 | 0.539 | 28,350 | 43,000 | 1.94 | 17.00 | 67.0% | 123,376 | 82,682 |

| Year 3 | 20,150 | 0.315 | 0.158 | 0.202 | 0.157 | 0.502 | 47,849 | 67,999 | 2.37 | 18.00 | 64.1% | 139,931 | 89,735 |

| Year 4 | 21,110 | 0.313 | 0.136 | 0.183 | 0.177 | 0.435 | 46,889 | 67,999 | 2.22 | 19.00 | 58.5% | 145,667 | 85,167 |

| Year 5 | 21,900 | 0.31 | 0.127 | 0.174 | 0.183 | 0.410 | 45,099 | 66,999 | 2.06 | 20.00 | 56.1% | 149,670 | 84,009 |

| Year 6 | 23,500 | 0.289 | 0.125 | 0.166 | 0.164 | 0.433 | 49,000 | 72,500 | 2.09 | 21.00 | 57.4% | 149,725 | 86,002 |

| Year 7 | 23,600 | 0.28 | 0.121 | 0.165 | 0.159 | 0.432 | 54,400 | 78,000 | 2.31 | 22.00 | 58.9% | 145,680 | 85,848 |

| Year 8 | 21,800 | 0.312 | 0.136 | 0.181 | 0.176 | 0.436 | 62,200 | 84,000 | 2.85 | 23.00 | 58.0% | 149,948 | 86,990 |

| Year 9 | 20,600 | 0.293 | 0.103 | 0.151 | 0.19 | 0.352 | 51,900 | 72,500 | 2.52 | 24.00 | 51.5% | 133,065 | 68,577 |

| Year 10 | 21,000 | 0.262 | 0.107 | 0.149 | 0.155 | 0.408 | 15,671 | 36,671 | 0.75 | 25.00 | 56.9% | 121,297 | 68,983 |

| Year 11 | 20,200 | 0.278 | 0.098 | 0.143 | 0.18 | 0.353 | 8,907 | 29,107 | 0.44 | 26.00 | 51.4% | 123,802 | 63,683 |

| Year 12 | 19,000 | 0.302 | 0.096 | 0.147 | 0.206 | 0.318 | 4,835 | 23,835 | 0.25 | 27.00 | 48.7% | 126,500 | 61,575 |

| Year 13 | 10,985 | 0.284 | 0.075 | 0.118 | 0.209 | 0.264 | 3,718 | 14,702 | 0.34 | 28.00 | 41.7% | 68,775 | 28,685 |

| Total/Avg. | 258,545 | 0.304 | 0.130 | 0.175 | 0.174 | 0.428 | 453,768 | 712,312 | 1.95 | 21.86 | 57.6% | 1,732,074 | 998,256 |

El Pilar Project Form 43-101F1 Technical Report |  |

The Run-of-Mine (ROM) ore from the open pit will be transported to the leach pad facility using contract and owner mine haul trucks. The ROM ore will be end dumped on the Heap Leach Pad (HLP) and spread to nominal 3 meter thick lifts initially, although thicker lifts may be used in the future as real operating conditions become better known. After the initial leach cycle, the lifts will be ripped before new ore is placed on the successive lift.

Leaching will consist of the application of acidic solution to the heaped ore on the lined pad utilizing a distribution network of piping, drip emitters and/or sprinklers. A perforated pipe network embedded in the liner cover fill material will collect the pregnant leachate solution at the base of the heap, above the HLP primary geomembrane liner. The solution collection pipes will transport the solution flows to the PLS pond. From the PLS pond, the pregnant solution will flow to the SX facility via a HDPE pipe.

The PLS coming from the leaching area will be processed to recover copper using conventional solvent extraction, electro-winning (SXEW) technology. The SXEW plant is designed to process a maximum of 3,700 m3/h of PLS and produce an average of 79.3 million pounds of cathode copper per year (35,946 tonnes per year) over the LOM.

The copper will be recovered from the PLS in a SX facility consisting of two parallel extraction stages and one stripping stage as shown in Solvent Extraction Diagram 400-FS-001, below. In the extraction stages the PLS loaded with copper (or aqueous solution) is contacted with a reagent diluted in a solvent, together called the “organic solution”, and then the solutions are left to separate by density difference in the settlers. The reagent extracts the copper from the PLS, the solution depleted of copper, or Raffinate, is pumped back to the leach pad to again recover copper. The organic solution carries the copper to the Stripping Stage, where the organic solution is contacted with a highly acidic solution, called Lean Electrolyte returning from the electro-winning tank house (EW). The high acid concentration in the Lean Electrolyte causes the reagent to release the copper, increasing the copper concentration to produce a Rich Electrolyte, which is pumped to the electro-winning tank house (EW).

The Rich Electrolyte pumped from the SX plant to the EW tank house will be distributed to 92 electrowinning cells each of which contains 67 lead anodes paired with 66 stainless steel cathodes. A direct electrical current will be applied to the cells to plate the copper on the stainless steel blanks. The copper plates will be removed in a 7 day cycle. Copper cathodes will be the final product of the EW circuit. At the planned throughput rate, the plant will produce 35,946 t/y of copper cathode or approximately 98.5 t of copper cathode per operating day.

Copper cathode sheets will be weighed, sampled and assayed, and securely stored on site pending delivery to market. The El Pilar copper cathode product should meet ASTM B115, latest revision, Grade 1 specifications.

| 1.18 | Project Infrastructure |

Project infrastructure beyond the processing plant includes the following:

El Pilar Project Form 43-101F1 Technical Report |  |

| | ● | Acid Plant and Power Plant |

The copper production process will require 600 to approximately 1,430 metric tons per day (tpd) of sulfuric acid to support the leaching of copper from the ore. In order to provide these acid requirements at the lowest cost possible, the project includes a sulfur-burning acid plant to provide both acid and power.

The El Pilar property can be reached by road from Hermosillo, Sonora in Mexico and from Tucson, Arizona in the USA. The route from Hermosillo to Miguel Hidalgo takes about 3 1/2 hours of driving time. The route from Tucson to Miguel Hidalgo is currently a two hour drive and utilizes a paved road from Nogales, Sonora to Miguel Hidalgo (30 km).

A main access road to the plant site from the main Nogales access road on west side of the project will be by way of a 6.5 km long gravel road that will be constructed early in the project development schedule. The project access road includes a crossing over the Santa Cruz River bed by way of a concrete dip, with hydraulic/drainage structures as required.

Based on the hydrological study conducted by IDEAS and the process water balance, the project includes three water wells to supply the necessary water volume for processing and services. Two of the three wells have been drilled, cased and tested, with yields of 30 lps and 40 lps, respectively. These wells yield a total of 2.3 Mm3/yr of the 3.5 Mm3/yr required. A third and possibly a fourth well will be drilled to fulfill maximum projected water requirements. All wells are located within the property and are located a relatively short distance from the facilities (about 2.5 km).

Power will be supplied to the project area in part via a 115 KV transmission line from a substation located 21 km south of Nogales, Mexico. The substation is 30 km west of the project area. The substation is owned and operated by Comisión Federal de Electricidad (CFE), which has confirmed power availability and provided an area next to the substation for the installation of switchgear and instrumentation. The power line will be 31 km long and built with dip galvanized structural steel towers, except for along urban areas where steel tapered poles may be used. The line will have capacity to supply all of the power requirements of the project estimated at a maximum of ~20 MW as backup, although most of the project power will be generated onsite by the sulfur burning acid plant.

As part of the infrastructure of the acid plant a railroad spur will be constructed to the plant site. The purpose of the spur is to provide a safe, economic and efficient access to sulfur deliveries by rail. The rail spur will access the property from the Ferromex rail system located on west side of the property, about 3.8 km distance from the sulfur unloading station. Rail facilities will allow for unloading and parking at least 18 railcars, with deliveries expected on a weekly basis.

El Pilar Project Form 43-101F1 Technical Report |  |

| 1.19 | Market Studies and Contracts |

The projected production volume is too small to justify a direct marketing effort, and it is recommended that full production be tendered to a selected group of major merchants. This strategy will ensure immediate market entry and expedited payment with little or no credit risk in an increasingly competitive regional market.

| 1.20 | Environmental Studies, Permitting and Social or Community Impact |

The area encompasses modest hilly topography formed by erosion and weathering primarily of unconsolidated range-front sediments. The area is bounded to the west and south by the Santa Cruz River.

Landscape will be affected at first by clearing and grubbing, road construction and construction of mining facilities. Ultimately, impacts will be from the mine pit, waste dumps, and placement of ore on the heap leach pad. The effects of mining are irreversible, although some landscape effects are partially reversible in the long run through planned restoration and reforestation methods.

Surface preservation and mitigation measures planned are: impermeable retention areas where chemical substances or process solutions are handled, implementation of a hazardous and non-hazardous waste handling program, monitoring of surface water and creek sedimentation and water quality, and storm water diversion around disturbed areas where required.

Prevention and mitigation measures contemplated to protect groundwater quality include an impermeable layer in the leach pad, sumps and process areas, as well as installation of water monitoring wells below mining facilities with regular water quality monitoring.