ANNUAL INFORMATION FORM

of

Yukon-Nevada Gold Corp.

#900, 688 West Hastings Street

Vancouver, BC, V6B 1P1

Tel: (604) 688-9427

March 31, 2011

TABLE OF CONTENTS

Page No.

ii

3

ITEM 1: PRELIMINARY NOTES

1.1Incorporation of Financial Statements and Proxy Circular

Specifically incorporated by reference and forming a part of this annual information form (the “AIF”) are the audited consolidated financial statements, including the accompanying notes and the auditor’s report, for the Issuer for the period ended December 31, 2010, together with the auditors’ report thereon, and the Management Proxy Circular, dated April 24, 2010, previously filed with the British Columbia, Alberta and Ontario Securities Commissions.

All financial information in this AIF is prepared in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”).

This report contains “forward-looking statements”, including all statements that are not historical facts, and forward looking information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian Securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of deposits, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

With respect to forward-looking statements and the information included in this MD&A, we have made numerous assumptions, including, among other things, assumptions about the price of gold, anticipated costs and expenditures and our ability to achieve our goals, even though our management believes that the assumptions made and the expectations represented by such statements or information will prove to be accurate. By their nature, forward-looking statements and information are based on assumptions and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from future results, performance or achievements expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include among other things the following: gold price volatility; discrepancies between actual and estimated production and mineral reserves and resources; the speculative nature of gold exploration; mining operational and development risk; and regulatory risks. See our Annual Information Form for additional information on risks, uncertainties and other factors related.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.

1.2Date of Information

All information in this AIF is as of March 28, 2011 unless otherwise indicated.

4

1.3Glossary of Abbreviations and Terms

Certain abbreviations and terms used throughout this Annual Information Form are defined below:

| Abbreviation | Unit or Term | | Abbreviation | Unit or Term |

| A | ampere | | m3 | cubic meter |

| AA | atomic absorption | | mg/l | milligrams/liter |

| Ag | silver | | mm | millimeter |

| Au | gold | | mm2 | square millimeter |

| AuEq | gold equivalent grade | | mm3 | cubic millimeter |

| °C | degrees Centigrade | | NI 43-101 | Canadian National Instrument 43-101 |

| cm | centimeter | | OSC | Ontario Securities Commission |

| cm2 | square centimeter | | oz | troy ounce |

| cm3 | cubic centimeter | | % | percent |

| cfm | cubic feet per minute | | ppb | parts per billion |

| ° | degree (degrees) | | ppm | parts per million |

| dia. | diameter | | QA/QC | Quality Assurance/Quality Control |

| ft | foot (feet) | | RC | rotary circulation drilling |

| g | gram | | RQD | Rock Quality Description |

| gal | gallon | | SEC | U.S. Securities & Exchange Commission |

| gpm | gallons per minute | | s | second |

| g/t | grams per tonne | | SG | specific gravity |

| ha | hectares | | st | short ton (2,000 pounds) |

| hp | horsepower | | t | tonne (metric ton) (2,204.6 pounds) |

| kg | kilograms | | tph | tonnes per hour |

| km | kilometer | | tpd | tonnes per day |

| km2 | square kilometer | | tpy | tonnes per year |

| koz | thousand troy ounce | | TSF | tailings storage facility |

| kt | thousand tonnes | | µ | micron or microns |

| l | liter | | V | volts |

| lb | pound | | W | watt |

| LoM | Life-of-Mine | | yr | year |

| lps | liters per second | | | |

| m | meter | | | |

| m2 | square meter | | | |

| Term | Meaning |

| Assay: | The chemical analysis of mineral samples to determine the metal content |

| Capital Expenditure: | All other expenditures that are not classified as operating costs. |

| Composite: | Combining more than one sample result to give an average result over a larger distance or area. |

| Concentrate: | A metal-rich product resulting from a mineral enrichment process such as gravity concentration or flotation, in which most of the desired mineral has been separated from the waste material in the ore. |

| Crushing: | Initial process of reducing ore particle size to render it more amenable for further processing. |

| Cutoff Grade (CoG): | The grade of mineralized rock, which determines whether or not it is economic to recover its gold content by further concentration. |

| Dilution: | Waste, which is unavoidably mined with ore. |

5

| Term | Meaning |

| Dip: | Angle of inclination of a geological feature/rock from the horizontal. |

| Fault: | The surface of a fracture along which movement has occurred. |

| Footwall: | The underlying side of an orebody or stope. |

| Gangue: | Non-valuable components of the ore. |

| Grade: | The measure of concentration of gold within mineralized rock. |

| Haulage: | A horizontal underground excavation which is used to transport mined ore. |

| Igneous: | Primary crystalline rock formed by the solidification of magma. |

| Kriging: | An interpolation method of assigning values from samples to blocks that minimizes the estimation error. |

| Level: | Horizontal tunnel the primary purpose of which is the transportation of personnel and materials. |

| Lithological: | Geological description pertaining to different rock types. |

| LoM Plans: | Life-of-Mine plans. |

| Material Properties: | Mine properties. |

| Milling: | A general term used to describe the process in which the ore is crushed and ground and subjected to physical or chemical treatment to extract the valuable metals to a concentrate or finished product. |

| Mineral/MiningLease: | A lease area for which mineral rights are held. |

| Mining Assets: | The Material Properties and Significant Exploration Properties. |

| Ongoing Capital: | Capital estimates of a routine nature, which is necessary for sustaining operations. |

| Ore Reserve: | That part of a mineral resource that is considered economic in terms of tonnage and grade following an appropriately detailed study at given commodities prices. |

| Pillar: | Rock left behind to help support the excavations in an underground mine. |

| Sedimentary: | Pertaining to rocks formed by the accumulation of sediments, formed by the erosion of other rocks. |

| Sill: | A thin, tabular, horizontal to sub-horizontal body of igneous rock formed by the injection of magma into planar zones of weakness. |

| Stope: | Underground void created by mining. |

| Stratigraphy: | The study of stratified rocks in terms of time and space. |

| Strike: | Direction of line formed by the intersection of strata surfaces with the horizontal plane, always perpendicular to the dip direction. |

| Sulfide: | A sulfur bearing mineral. |

| Tailings: | Finely ground waste rock from which valuable minerals or metals have been extracted. |

| Thickening: | The process of concentrating solid particles in suspension. |

| Total Expenditure: | All expenditures including those of an operating and capital nature. |

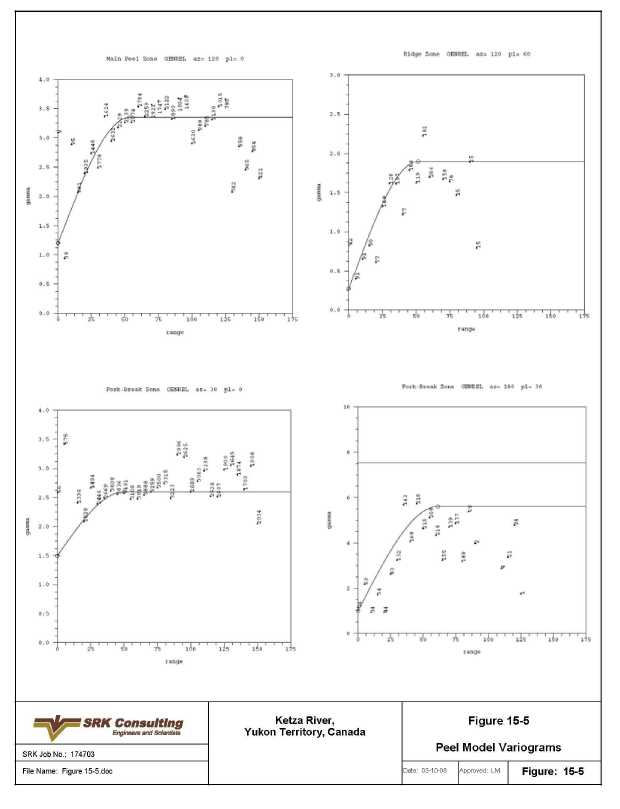

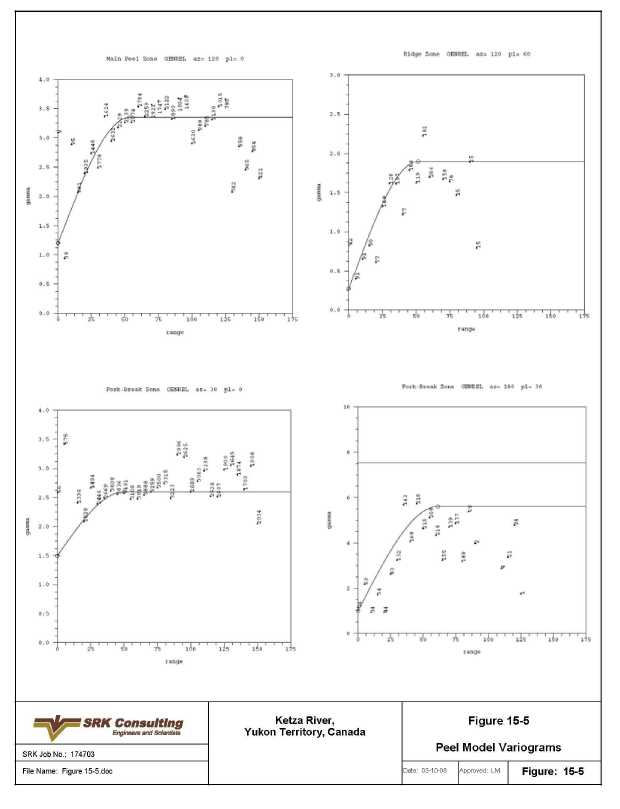

| Variogram: | A statistical representation of the characteristics (usually grade). |

6

1.4Conversion Table

In this AIF a combination of Imperial and metric measures are used with respect to mineral properties located in North America. Conversion rates from Imperial measure to metric and from metric to Imperial are provided below:

| Imperial Measure | = | Metric Unit | Metric Measure | = | Imperial Unit |

| 2.47 acres | | 1 hectare | 0.4047 hectares | | 1 acre |

| 3.28 feet | | 1 metre | 0.3048 metres | | 1 foot |

| 0.62 miles | | 1 kilometre | 1.609 kilometres | | 1 mile |

| 0.032 ounces (troy) | | 1 gram | 31.1 grams | | 1 ounce (troy) |

| 1.102 tons (short) | | 1 tonne | 0.907 tonnes | | 1 ton |

| 0.029 ounces (troy)/ton | | 1 gram/tonne | 34.28 grams/tonne | | 1 ounce (troy/ton) |

1.5Currency

Unless otherwise indicated, all dollar amounts are in Canadian dollars.

1.6Share Capital

On January 5, 2004 the Issuer consolidated its Common Share capital on the basis of one post-consolidated share for five pre-consolidated Shares. Unless otherwise expressed, all references in this Annual Information Form are to post-consolidated Shares.

ITEM 2: CORPORATE STRUCTURE

2.1Name, Address and Incorporation

The full corporate name of the issuer is Yukon-Nevada Gold Corp. (the “Issuer”).

| The address of the head office is: | #900, 688 West Hastings Street |

| | Vancouver, BC, V6B 1P1 |

| | |

| and the address of the registered office is: | #1040, 999 West Hastings Street |

| | Vancouver, B.C. V6C 2W2 |

The Issuer was incorporated under the laws of the Province of British Columbia under the name “YGC Resources Ltd.” (“YGC”) on May 30, 1988. On January 25, 2002, the Issuer was struck from the Register of Companies for British Columbia and dissolved. The Issuer was restored to the Register on August 1, 2003. On January 5, 2004 the Issuer consolidated its share capital on a five (5) old for one (1) new basis and increased its authorized share capital from 4,000,000 Shares without par value to 100,000,000 Shares without par value. On June 23, 2005, the Issuer increased its authorized share capital from 100,000,000 Shares without par value to an unlimited number of Shares without par value.

By Combination Agreement dated March 16, 2007 with Queenstake Resources Ltd. (“Queenstake”), the Issuer entered into an Arrangement with Queenstake, providing for, among other things, the acquisition by the Issuer of all of the issued and outstanding shares of Queenstake. The Arrangement closed on June 20, 2007, at which time the Issuer changed its name to its current name.

7

2.2Intercorporate Relationships

Set forth below are the names of the Issuer’s subsidiaries:

ITEM 3: GENERAL DEVELOPMENT OF THE BUSINESS

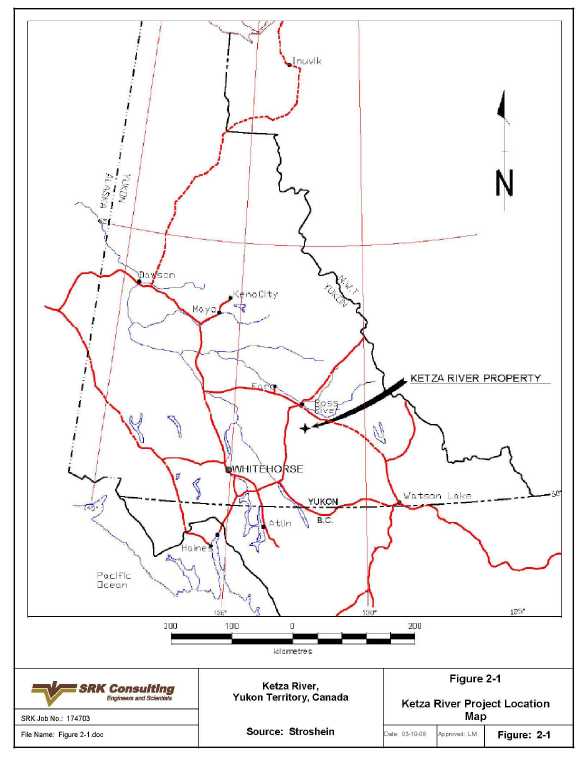

The Shares of the Issuer were called for trading on the Toronto Stock Exchange (the “TSX”) on April 13, 2005. The Issuer is active in the evaluation, development and commercial production of mineral properties. The Issuer’s principal assets are the Jerritt Canyon Gold Mine, Nevada and the Ketza River Property, Yukon Territory. The favourable price for gold has enabled the Issuer to raise equity financing, the proceeds of which are used to fund improvements to the Jerritt Canyon concentrator facilities and exploration of the Ketza River Property.

3.1Three-Year History

The principal business of the Issuer is the production of gold in Nevada and the acquisition, exploration and development of mineral properties of merit with a particular focus on gold, silver, zinc and copper properties in the Yukon Territory and British Columbia in Canada and in Arizona and Nevada in the United States.

The Issuer acquired the Jerritt Canyon gold mine upon completion of its plan of arrangement with Queenstake on June 20, 2007. On May 30, 2003, Queenstake entered into a definitive asset purchase and sale agreement with subsidiaries of AngloGold Limited and Meridian Gold Inc. (collectively, the “Sellers”) pursuant to which Queenstake agreed to acquire the Sellers’ respective 70% and 30% interests in the assets comprising the operating Jerritt Canyon gold mine. The acquisition closed on June 30, 2003.

Jerritt Canyon is a gold property with two underground mines, ore stockpiles and a 1.5 million ton per year capacity processing plant. In addition, the approximately 119 square miles that comprise the Jerritt Canyon property offer a significant number of advanced, early stage and district-scale exploration targets and potential to expand the currently defined mineral reserves and resources proximal to the producing mines.

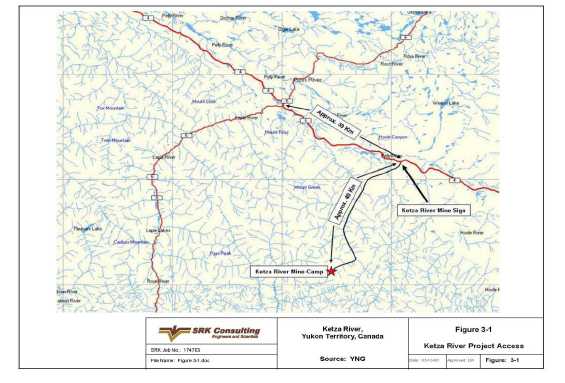

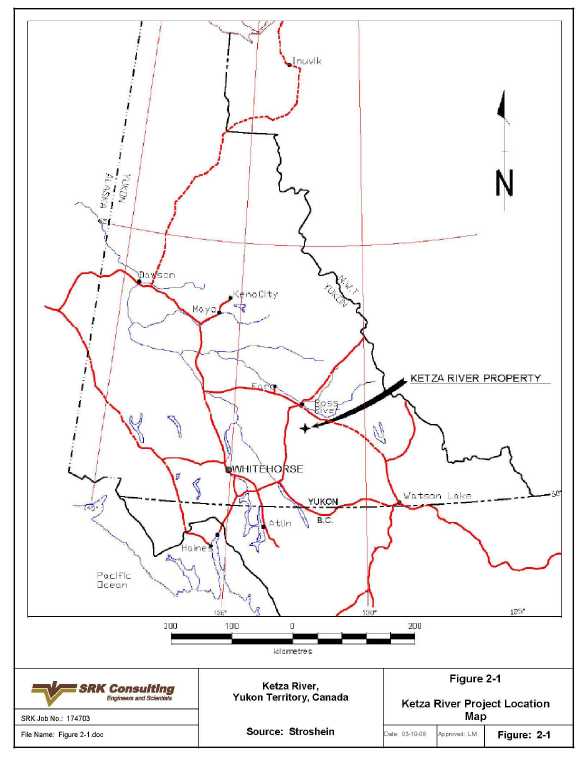

The Issuer has owned the Ketza River Gold Property in the Yukon, since 1994. This former producing mine was shut down in November 1990, due to the depletion of known oxide ore reserves identified at that time. The Ketza River Gold Property includes 593 mineral claims and leases, a gold mill and all associated chattels, tools, equipment and licences. The Issuer’s Chief Operating Officer, Mr. Dickson, who is also a chemist and a professional mining consultant, identified areas which were under-explored and which could be mined and processed by different methods than those employed in the past. In particular, he identified the possibility of discovering significant quantities of sulphide ore. The Issuer has completed diamond drilling that resulted in the discovery of the Chimney and Fork zones and geologic mapping, prospecting, sampling and diamond drilling on the Shamrock zone. The Issuer has also carried out an aggressive diamond drill program in an effort to increase mineral resources, to prepare a feasibility study and, if the results of the feasibility study are positive, to return the Ketza Property to commercial production as a mine. An updated reserve report is expected in 2011 that will show the results of extensive metallurgical work and additional exploration drilling. Currently the Issuer is focusing is on completing the application to the Yukon Environmental and Socio-economic Assessment Board (YESAB) to approve the Issuer’s development plan and allow for the commencement of mining activity at the property.

8

Year ending December 31, 2008

On February 1, 2008 the Issuer’s Board of Directors approved the appointment of David Drips, B.Sc. Mining Engineering, as its new Vice President Mining. The Issuer also promoted Sam Ash, B.Sc. Mining Engineering, to Manager of New Operations.

The Issuer’s Jerritt Canyon Mine operated continuously from the date of acquisition on June 20, 2007 until February 22, 2008 when it shut down to address infrastructure and safety concerns. In May 2008, Jerritt Canyon recommenced commercial production at reduced levels. On August 8, 2008 mining at Jerritt Canyon ceased again as a result of increasing costs and dilution resulting from the mine plan as well as the ongoing required development and infrastructure expenditures resulting from years of neglect. Subsequent to the closure of the mines, as a result of a dirty air fan that was damaged in the following week, the milling operation was also shutdown. Mining and milling operations did not resume for the remainder of 2008 while management pursued additional financing and continued work on addressing environmental concerns raised by the Nevada Division of Environmental Protection (the “NDEP”) in their stop order issued in March of 2008.

On May 12, 2008 the Issuer closed a non-brokered private placement of 10,050,000 Flow-Through Shares (the “FT Shares”) at a price of $2.00 per FT Share for gross proceeds of $20,100,000. No commission was paid.

At the Issuer’s 2008 Annual General Meeting held May 27, 2008, Graham Dickson, Peter Holbek, John R.W. Fox, Neil J.F. Steenberg, E. Lynn Patterson, R.J. (Don) MacDonald, Iain Harris and Robert Chafee were re-elected to the Issuer’s Board of Directors. Peter Bojtos and Dorian Nicol ceased to be directors on May 27, 2008.

On July 2, 2008 Dorian L. Nicol resigned as the Issuer’s Vice President of Exploration. On August 14, 2008 Christopher Oxner resigned as the Issuer’s Chief Financial Officer and on August 15, 2008 David Dripps resigned as the Issuer’s Vice President of Mining.

On July 27, 2008 the Issuer issued 250,000 Warrants which are exercisable at a price of $3.00 per share on or before June 20, 2012.

On November 1, 2008 Shaun Heinrichs was appointed the Issuer’s Chief Financial Officer.

On December 12, 2008 E. Lynn Patterson resigned as the Chairman and a Director of the Issuer.

On December 18, 2008 the Issuer closed a non-brokered private placement of 79,800,000 units (the “Units”) at a price of $0.05 per unit, each Unit comprising one common share (a “Share”), one series “A” share purchase warrant (the ““A” Warrant”), each “A” Warrant entitling the holder to purchase one additional share at a price of $0.07 for a period of 12 months from the closing and one series “B” share purchase warrant (the ““B” Warrant”), each “B” Warrant entitling the holder to purchase one additional share at a price of $0.09 for a period of 18 months from the closing for gross proceeds of 3,990,000. A commission of 7,400,000 Units were issued.

Year Ending December 31, 2009

On February 24, 2009 the Issuer closed a non-brokered private placement of 10,000,000 units (the “Units”) at a price of $0.05 per unit, each Unit comprising one common share (a “Share”), one series “A” share purchase warrant (“A” Warrant”), each “A” Warrant entitling the holder to purchase one additional share at a price of $0.07 for a period of 12 months from the closing and one series “B” share purchase warrant (“B” Warrant”), each “B” Warrant entitling the holder to purchase one additional share at a price of $0.09 for a period of 18 months from the closing for gross proceeds of 3,990,000. A commission of 1,000,000 Shares and 1,000,000 “A” Warrants were issued.

9

On February 25, 2009, the Issuer closed a non-brokered private placement of 17,333,333 Units (the “Units”) at a price of $0.06 per Unit, each Unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of $0.08 for a period of 24 months from the closing. A commission of 400,000 Units were issued.

Milling operations at the Issuer’s Jerritt Canyon Mine resumed March 25, 2009 when approvals were received from NDEP on the progress and plans developed by the Issuer.

On April 12, 2009 Robert F. Baldock was appointed to the Issuer’s Board of Directors.

On April 24, 2009 the Issuer closed a non-brokered private placement of 12,000,000 Unit (the “Units”) at a price of $0.06 per Unit, each Unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of $0.08 for a period of 24 months from the closing. A commission of 400,000 Units were issued.

At an Annual General Meeting of the Issuer held on May 21, 2009, Graham Dickson, Robert F. Baldock, Peter Holbek, John R.W. Fox, Neil J.F. Steenberg, R.J. (Don) MacDonald, Iain Harris and Robert Chafee were elected to the Issuer’s Board of Directors. Mr. Dickson concurrently resigned as the Issuer’s President and Chief Executive Officer and was appointed the Issuer’s Chief Operating Officer and Robert F. Baldock was appointed the Issuer’s President and Chief Executive Officer. Mr. Iain Harris resigned as a director on May 21, 2009.

On May 30, 2009, Jerritt Canyon shutdown roaster operations due to a delay in the fabrication of certain fiberglass ductwork required in the construction of the new mercury emission control system, resulting in the failure to meet the deadline for this equipment to be installed as set by the NDEP in their March restart order. The Issuer was able to complete the installation of a calomel emission system and the system instrumentation on July 20, 2009.

On June 12, 2009 R.J. (Don) MacDonald resigned as a director of the Issuer and on August 1, 2009 Neil J.F. Steenberg and Peter Holbek resigned as directors of the Issuer and Terry Eisenman, Symeon Solomonidis and Jean-Edgar de Trentinian were appointed to the Issuer’s Board of Directors.

On August 6 and 28, 2009 the Issuer closed two tranches of a non-brokered private placement of an aggregate of 41,050,000 Units at a price of $0.10 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of $0.125 for a period of 30 months from the closing. No commission was paid.

On December 1, 2009, the Issuer closed a non-brokered private placement of 10,000,000 Units at a price of $0.10 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of $0.125 for a period of 18 months from the closing. No commission was paid.

After coming to an agreement with the NDEP in the form of a Consent Decree, the Issuer resumed operations on October 20, 2009. The Consent Decree resolves all of the compliance concerns of the NDEP in relation to the mill and surrounding land holdings of the Issuer, as well as related environmental concerns and gives the Issuer the right to operate the milling facility from the effective date.

10

The Issuer incurred exploration expenditures of approximately US $15 million on the Ketza River project and approximately US $1.2 million on the Silver Valley property. Both of these properties are located in the Yukon.

Year Ending December 31, 2010

At the Issuer’s Special Meeting held January 12, 2010, shareholders approved the issuance of Inducement Warrants to holders of existing warrants who elected to exercise their warrants prior to their expiration date. The Issuer issued 170,400,000 warrants exercisable at a price of $0.32 per share, 10,250,000 warrants exercisable at a price of $0.26 per share and 10,000,000 warrants exercisable at a price of $0.128 per share. All of the warrants expire January 12, 2012.

On April 1, 2010 the Issuer’s Board of Directors approved the appointment of Todd W. Johnson as its Vice President of Exploration.

At the Issuer’s 2010 Annual General Meeting held May 13, 2010 Graham Dickson, Robert F. Baldock, Pierre Besuchet, Jay Schnyder, John Greenslade, Symeon Solomonidis, Jean-Edgar de Trentinian and Gerald Ruth were appointed to the Board of Directors. Robert Chafee, Terry Eisenman and John Fox resigned as directors and John Greenslade was also appointed the Issuer’s Chairman.

On July 2, 2010 François Marland was appointed to the Issuer’s Board of Directors and was appointed the Issuer’s Vice Chairman.

In March 26, 2010 the Issuer closed a non-brokered private placement of 22,727,272 Shares (the “Shares”) at $0.22 per Share for gross proceeds of $5,000,000. There was no commission paid.

On May 6 and 12, 2010, the Issuer closed two tranches of a brokered private placement of 34,559,090 Flow-Through Shares (the “FT Shares”) at a price of $0.275 per FT Share for gross proceeds of $9,503,750. A commission was paid on a portion of the private placement of 7.5% cash and 700,000 warrants exercisable at a price of $0.275 per share on or before May 12, 2012.

On August 13, 2010 the Issuer closed a Senior Secured Note financing, issuing US$25,000,000 principal amount senior secured notes (the “Notes”) and 25,000,000 common share purchase warrants (the “Warrants”), raising gross proceeds of US$25,000,000. Each Warrant entitles the holder to purchase one common share of the Issuer at a price of $0.40 per share for a period of three years following closing. The Notes have a maturity date of December 31, 2012 and are secured by a charge over all the assets of the Issuer’s wholly owned subsidiaries, Queenstake Resources Ltd. (“QRL”) and Queenstake Resources U.S.A. Inc. (“Queenstake US”) as well as a share pledge over all shares in QRL and Queenstake US. A commission of 4% of the gross proceeds raised was paid in Shares of the Issuer.

By Agreement dated October 25, 2010, the Issuer entered into an ore purchase agreement with Newmont USA Limited whereby the Issuer will accept delivery of approximately 2,000 tons of gold bearing ore per day from several of Newmont's mines in Nevada.

On October 27, 2010 KPMG LLP resigned as the Issuer’s auditor and Deloitte & Touche LLP was appointed as the Issuer’s successor auditor.

Jerritt Canyon: For the first time since the second quarter of 2008, the Issuer re-opened the Smith Mine using a contract mining company, Small Mine Developers, in the first quarter of 2010. The Issuer began processing the ore in late February 2010.

11

In May 2010, the Issuer shutdown the mill at Jerritt Canyon in order to carry out a significant overhaul of key mill components for compliance with the Consent Decree and as well performed critical maintenance that had been identified subsequent to restart in 2009. During the shutdown, the Issuer replaced one quench tank completely, began upgrade work on the roaster control system, drained and relined the thickener tank, and refurbished the north tertiary cone crusher. After restarting operations it was determined that the cone crusher needed to be replaced entirely, with a new crusher being installed and put into operation in late July. This replacement subsequently resulted in an improvement in the production rates and the Issuer achieved steady state of operations during the third quarter.

In the fourth quarter of 2010 the Issuer successfully negotiated a trial three month contract with Newmont for the delivery of 2,000 tons of gold bearing ore per day commencing October 30, 2010. During the quarter the Issuer purchased 86,257 tons of ore from Newmont under this contract containing 16,905 ounces, at an average cost of $198.53 per dry ton. Due to the success of this initial contract, Newmont is continuing to deliver at a rate of 1,000 tons per day in 2011 while finalizing a longer term contract.

At the beginning of 2010 the Issuer prepared a capital budget that included significant expenditures for the commencement of the construction of a second tailings facility (construction to be completed in 2011), completion of several Consent Decree requirements, and also the winterization of and improvements to the mill facility. This winterization would be achieved by installing heat tracing materials on all piping, housing key areas of the crushing circuit (such as fine crushing), construction of an improved ore dryer which would also be protected from the weather, and increasing the level of materials and supplies on hand to reduce the down time caused by a lack of spare parts. In the second quarter the Issuer made significant progress in completing this capital budget but required additional funding to complete a large portion of the required work. To finance this budget the Issuer negotiated with several lenders during the year but was unable to obtain debt financing until late in the third quarter of 2010. Due to the timing of closing this financing and also the requirement to settle outstanding claims against the Issuer to clear title to the property, a substantial portion of the winterization project was not completed and the Issuer was forced to delay commencement of contruction of the second tailings facility. As well, due to the early onset of severe weather certain Consent Decree projects such as the reclamation of one of the off-take ponds (referred to as the Duck Pond) and the construction of a water treatment facility for acid rock clean up were not completed by their scheduled time.

The delay in these capital investments impacted the milling operations of the Issuer and the corresponding financial results for most of 2010. As a result of being unable to complete the full winterization project and restock materials and supplies to higher levels prior to the onset of severe winter conditions, the operations at Jerritt Canyon experienced significant downtime as sections of the mill, primarily fine crushing and the refinery (where the heat tracing work was not completed prior to winter), were exposed to severe cold and snow resulting in additional strain on equipment, breakdowns, and clogged chutes (due to the freezing of wet ore). This problem was aggravated by the need to freight in necessary parts to complete repair work due to the lack of in house inventories. The delays in completing key environmental projects required by the Consent Decree also resulted in the NDEP levying a significant fine against the Issuer ($0.8 million) late in the fourth quarter. As a result of these issues and resulting low throughput the Issuer continues to experience higher than normal production costs that will need further investment to correct in 2011.

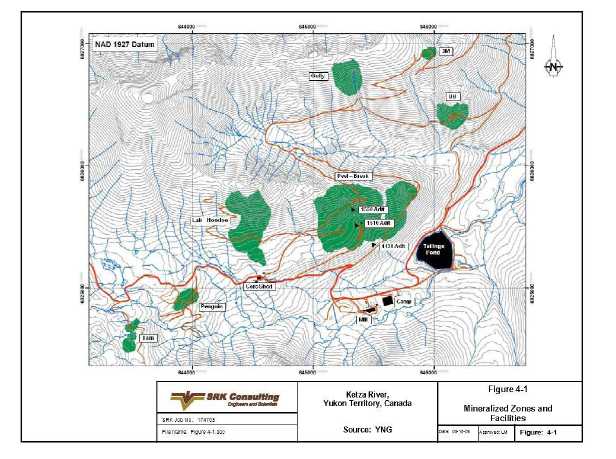

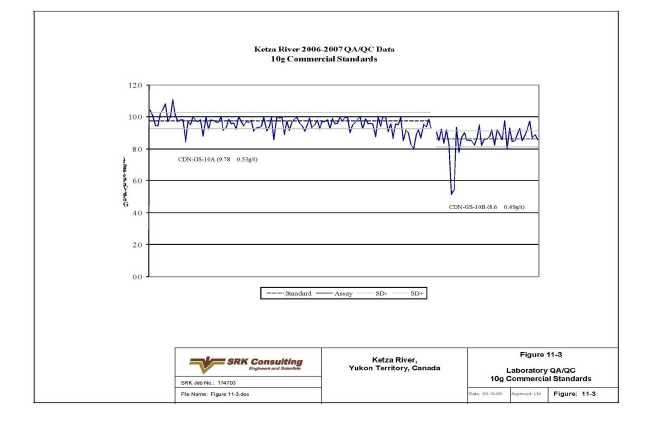

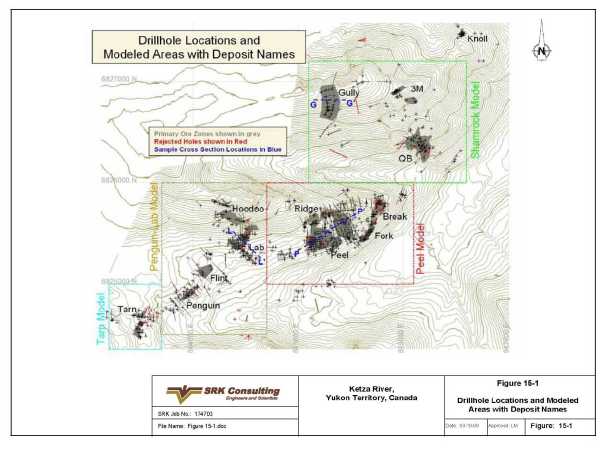

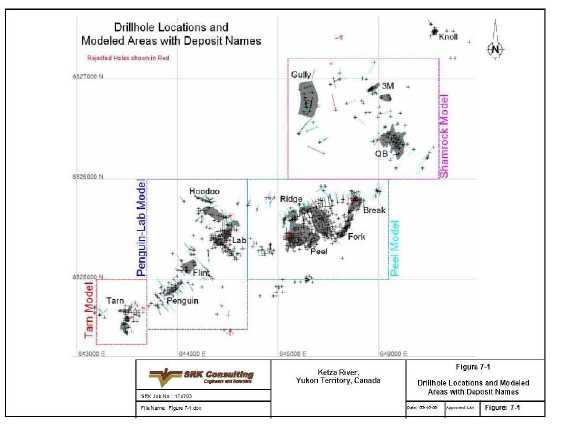

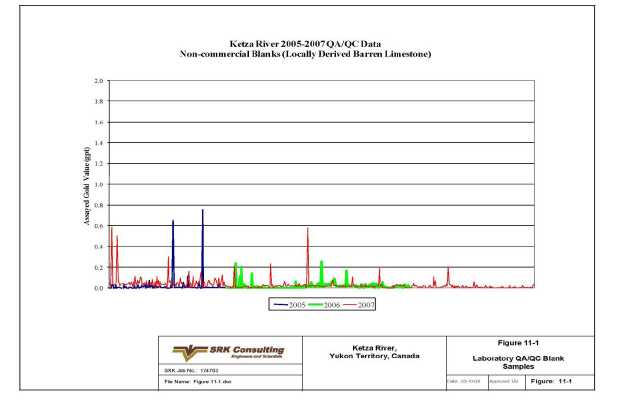

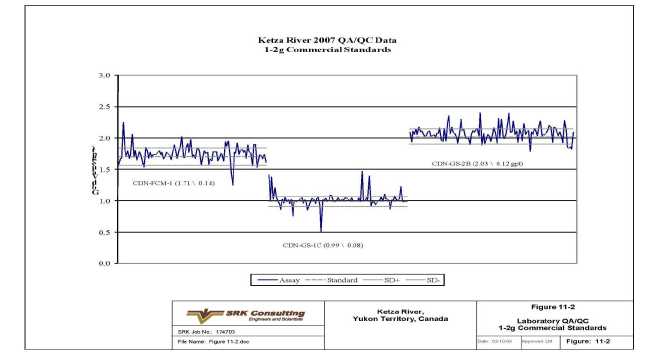

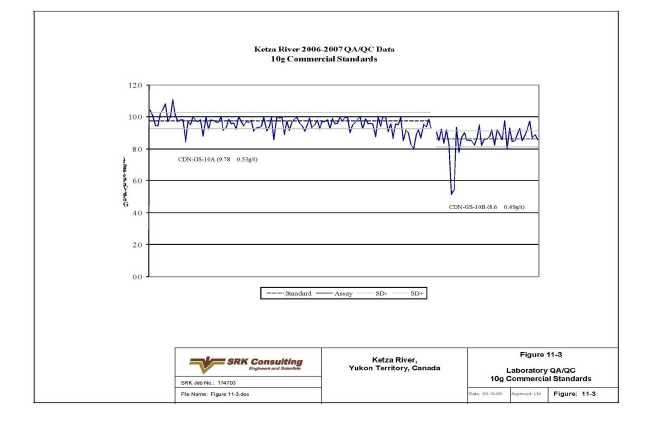

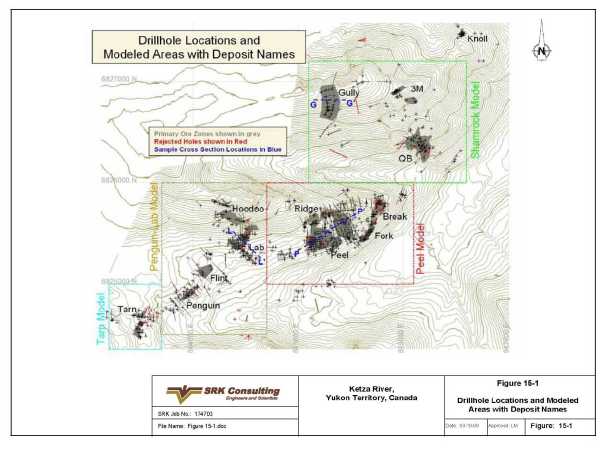

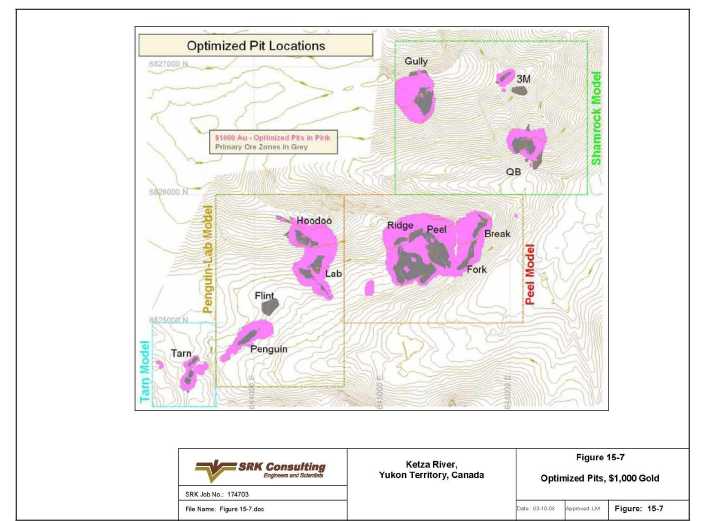

Ketza River: During 2010, a total of 86 exploration diamond drill holes were completed at the Ketza River Project in the Yukon Territory, Canada. This Ketza River drill program tested 11 target areas and consisted of both step-out drilling from existing resources and the testing of new geochemical and geophysical targets. The drilling program contained a Quality Assurance and Quality Control (QA/QC) program including the insertion of certified gold standards and blanks as defined in the previously published Year-end 2007 NI 43-101 report.

12

| Target | Drill Holes Completed | Total Meters | Total Footage |

| Bluff Zone | 8 | 782 | 2,566 |

| QB Deep IP | 3 | 1,601 | 5,251 |

| Vertical Vein | 7 | 1,181 | 3,876 |

| Connector Zone | 10 | 1,755 | 5,758 |

| Break Zone | 11 | 2,297 | 7,537 |

| B-Mag Zone | 14 | 996 | 3,268 |

| Peel Zone | 7 | 771 | 2,529 |

| Hoodoo Zone | 9 | 1,456 | 4,778 |

| Fred’s Vein | 3 | 500 | 1,642 |

| Penguin | 13 | 2,101 | 6,892 |

| Peel Creek Gravity | 1 | 174 | 572 |

| Total | 86 | 13,614 | 44,670 |

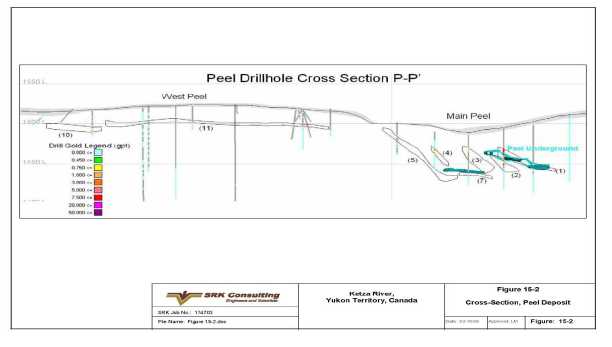

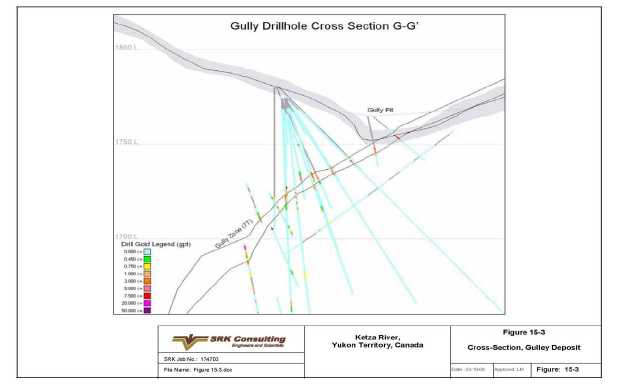

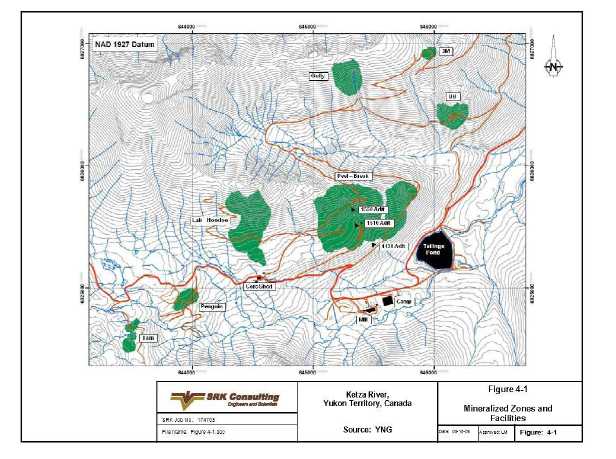

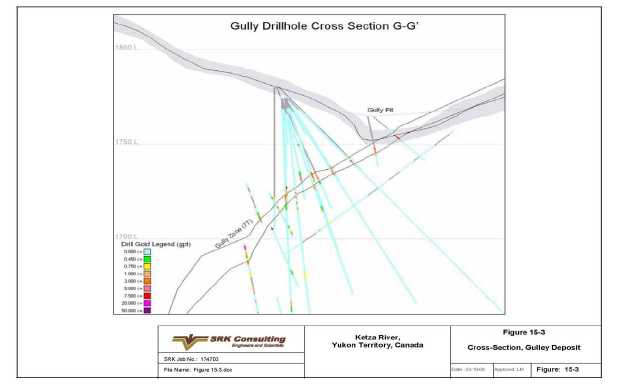

Following up on the successful 2008 drill hole intercepts, a series of 2010 step out drill holes were completed in the Bluff Zone which is located in between the Peel and Lab resource zones. Strong gold mineralization was encountered in some of the 2010 drill holes; however, this phase of drilling defined the bottom of the mineralized zone. The QB Zone – Deep Induced Polarization (IP) target was generated from a Titan-24 survey conducted in August of 2009. The survey identified an extensive zone of anomalous chargeability and conductivity located greater than 700 meters below the surface and beneath the drilled QB Zone resource. The Issuer completed several drill holes that successfully penetrated the geophysical anomaly and indicated strong anomalous gold throughout much of its length.

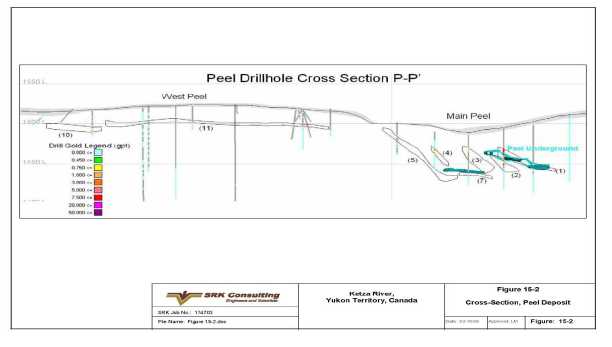

A series of 11 drill holes were completed in the Break Zone in the Peel resource that tested a magnetic anomaly caused by sulfide minerals lying below the existing oxide resource. All but two of the drill holes intersected significant gold mineralization but only from the oxide-rich material.

A total of fourteen step-out drill holes were completed in the southeastern margin of the B-Mag Zone located in the east side of the Peel resource. These drill holes were successful in extending gold mineralization by 15 to 33 meters laterally to the southeast from the existing resource.

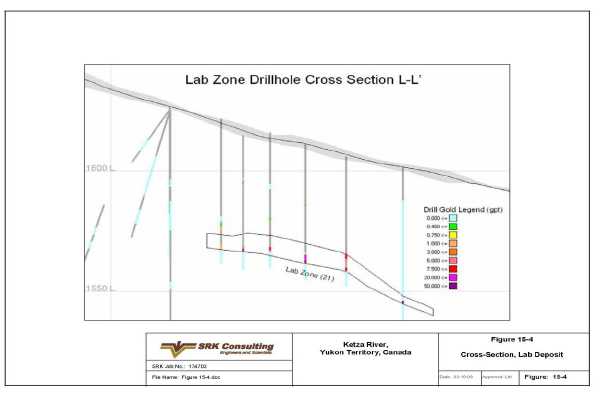

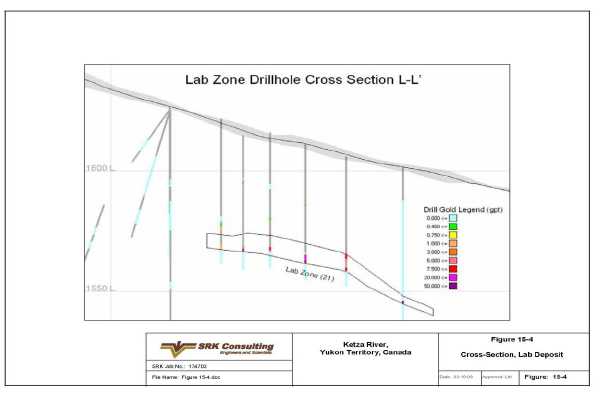

Nine exploration drill holes were targeted as infill holes and local mineralization extensions in the planned high wall of the Lab-Hoodoo open-pit near the top of the ridge. Three fans of three drill holes each tested above, below and to either side of the 2008 drill holes which contained 9.14 meters averaging 32.98 g/t Au. All of the 2010 drill holes in this zone contained strong oxide mineralization. Assay result highlights in this zone include drill holes which intercepted 9.14 meters averaging 37.37 g/t Au, 1.43 m averaging 15.64 g/t Au, and a third which intercepted 2.30 meters averaging 17.60 g/t Au. Cross sections suggest that these drill hole assay intersections approximate true thickness.

A total of 13 drill holes were completed in 2010 at the Penguin Zone. Six of the drill holes tested Very Low Frequency (VLF) geophysical and soil anomalies that were coincident with a zone of massive pyrite and arsenopyrite boulders on the surface. Some of these drill holes contained significant gold mineralization. Seven of the other drill holes in this zone tested three strong magnetic high anomalies. Some of these drill holes encountered several significant gold intercepts containing massive pyrrhotite and pyrite.

Other exploration targets such as Fred’s Vein and the Peel gravity anomaly were also drill tested in 2010 with some indication of gold mineralization but no significant assay intersections.

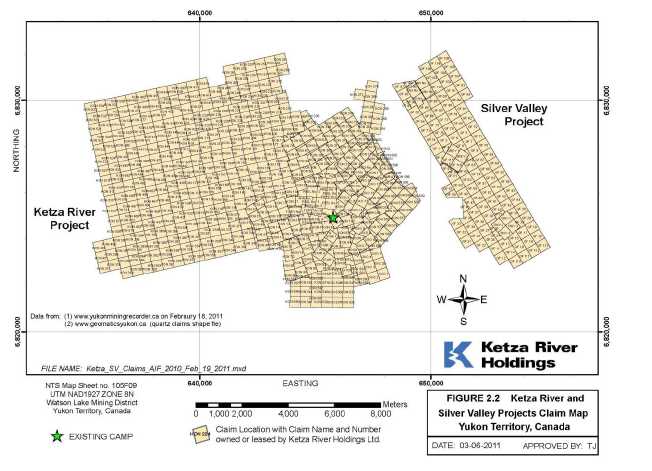

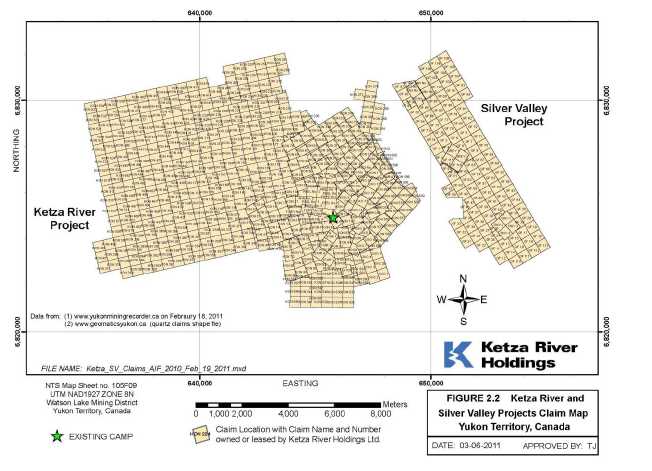

Several inlying claims located within the large Ketza River property were purchased in the summer of 2010 and helped consolidate the ownership into one contiguous block owned or leased by Ketza River Holdings. The Issuer is pursuing other opportunities to extend the claim block at Ketza River.

13

Geophysical and Geochemical Surveys

As noted in the table below (results shown in kilometers, except for soil sampling which shows number of samples) four areas were targeted in 2010 for geophysical and soil exploration: the Shamrock, South Hill target, OK target, and lower tailings option site. The 2010 geophysical studies included Induced Polarization (IP) and ground magnetics.

| Target | South Hill | Shamrock | OK Target | Lower Tailings Site | Total |

| Technique | | | | | |

| Ground Magnetics | 71 | 45.1 | 71 | 41.1 | 157.2 |

| IP | 6.8 | | 36.9 | | 41.3 |

| Line Cutting | | | 34.5 | | 34.5 |

| Soil Sampling | 814 | | | | 814 |

The results of this work will be used to help target a good portion of the 2011 Ketza River drill hole program. The north side of Shamrock, the South Hill Target and the proposed tailings site were covered by a ground magnetic survey which identified numerous strong anomalies and helped refine targets north of the Shamrock Zone. Two Induced Polarization (IP) lines were conducted across the South Hill Target to investigate the possible presence of mineralized pyrite-bearing manto zones that do not have enough pyrrhotite to generate a magnetic anomaly. The 2010 IP survey results were successful at identifying a number of potential sulfide-bearing and mineralized zones.

Drill Hole Database and Resource Modeling

Significant work on the Ketza drill hole database was conducted in 2010 to help support an updated resource estimate. Drill hole assay data were reviewed, database software was upgraded, and assay importing routines were optimized during 2010. An extensive update process was completed as well to integrate all assays for historical drill holes (assays from 1985 to 1997 were digitally compiled from the paper drill hole files). Primary lab assay data for these early drill hole years were selected and methodically entered into the drill hole database and used for the revised 2010 resource model calculation. An updated resource calculation for the Ketza River project is currently in progress and targeted for completion in 2011 which will incorporate all of the previous years drilling information and will include a summary of the metallurgy testing program conducted in 2008. This resource estimate will form the basis of the mine design for the Project Proposal that has a targeted submission date to the Yukon Environmental and Socio-economic Assessment Board (YESAB) of August 2011.

2010 YESAB Project Proposal Work Summary

A number of studies relating to YESAB Project Proposal were continued in 2010. A third party engineering firm is handling the completion of this application with a targeted submission date in the third quarter of 2011.

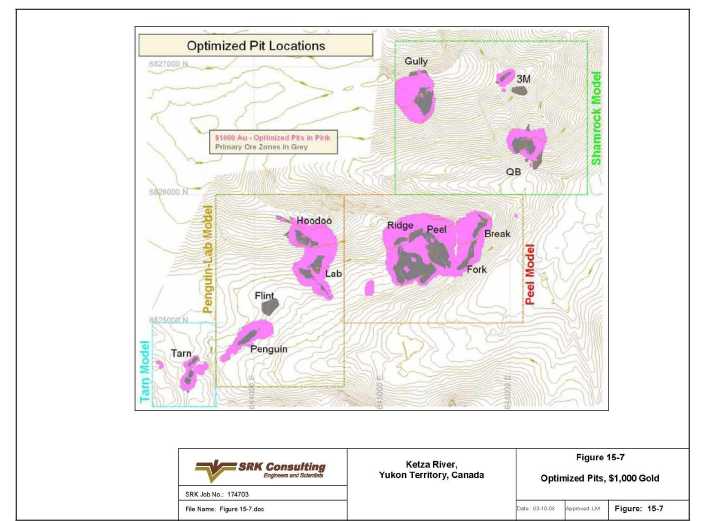

In support of the project proposal a total of 1,233 meters of geotechnical and hydrogeology drilling (see table below) was conducted for the pit-wall stability program. The results of this drilling was combined with the geotechnical drilling information gathered in 2008 to help support pit-wall slope recommendations for the proposed mine design. Two draft geotechnical reports, one on the manto zone deposits and one on the Shamrock zone deposits, were completed for in-house review in December 2010. A few of these 2010 geotechnical drill holes contained significant assay intervals (e.g. a drill hole in Tarn intersected 6.21 m averaging 2.24 g/t Au).

| Area | Drill Holes Completed | Total Meters | Total Footage |

| Peel Zone Geotechnical | 3 | 524 | 1,721 |

| Penguin Zone Geotechnical | 1 | 77 | 252 |

| Tarn Zone Geotechnical | 2 | 145 | 476 |

| Tarn Zone Hydrogeology | 1 | 72 | 236 |

| 3-M Zone Geotechnical | 1 | 103 | 337 |

| Gully Vein Geotechnical | 2 | 312 | 1,024 |

| Total Geotechnical - Open Pits | 10 | 1,233 | 4,046 |

14

A total of 32 drill holes were also completed in and around the footprint of the proposed lower tailings site to help support the YESAB project proposal. Sixteen were diamond drill holes that targeted magnetic anomalies and were designed for either exploration or condemnation purposes. All of these drill holes were logged for geotechnical data and some were used to gather hydrogeology information to help support engineering design studies. Fourteen of the drill holes were completed with a Becker drill and diamond drill core at depth to gather geotechnical information. Some of these drill holes were completed as groundwater monitoring wells. Two additional monitoring wells were installed at the toe berm of the existing tailings dam as requested by the Yukon Water Board.

Various other YESAB work was completed during the year including a site water quality control and assurance program, compilation of hydrogeology data compilation and analysis, Socio-economic, wildlife, fish and aquatic studies, tailings design and tradeoff studies, and conceptual engineering and design studies. Several meetings with local communities (Ross River and Faro) and local First Nations (Ross River Dena and Teslin) were held in November and December to update everyone on the Issuer’s proposed Ketza River Mine Project; additional meetings also took place in early 2011 at Teslin. Numerous meetings were also held with the Water Board, YESAA, Water Resources, and Energy, Mines and Resources to help advance the progress for the YESAB Project Proposal and the water license application for the existing tailings pond.

Silver Valley: A total of 7 diamond drill holes were conducted at the Silver Valley project in 2010.

| Target | Drill Holes Completed | Total Meters | Total Footage |

| River’s Edge | 5 | 817 | 2,680 |

| K-18B South | 2 | 428 | 1,404 |

| Total | 7 | 1,245 | 4,084 |

The 2010 drill holes tested two horizontal-loop electromagnetic (HLEM) geophysical anomalies identified during the 2007 field season. Five drill holes were completed at the River’s Edge target which identified three sub-parallel quartz-siderite-pyrite veins with minor amounts of galena and tetrahedrite. Two other 2010 drill holes tested the north end of the K-18B South target which is a possible fault offset of the K-18B Vein resource that was drilled in 2007. The two 2010 drill holes intersected two pyrite-dominant veins approximately 3 meters in width containing minor galena, sphalerite, stibnite, and tetrahedrite.

YS Mining Company: During 2009, the Issuer, in conjunction with the joint venture partner, Northwest Mining and Geology Group Co., Ltd. for Nonferrous Minerals (“NWME”) performed geological and geophysical work at the Skukum property owned by Tagish Lake Gold (“Tagish”) (see Related Party Transaction section) as part of the ongoing due diligence for a possible merger. In September of 2009, the Amalgamation Agreement was terminated and Yukon-Shaanxi Mining Company (”YSM”), through negotiations with MacQuarie Bank Limited, acquired a credit agreement from MacQuarie Bank with Tagish for total payment of C$1.5 million, secured by the Skukum property. This was funded through an additional equity contribution from NWME of C$1 million and cash from treasury. The Issuer did not participate in this equity contribution and as a result diluted its economic interest from 50% to 37.5% at December 31, 2009. The Issuer continues to have the option to purchase further shares in order to regain its 50% interest.

In April 2010, the joint venture received additional contributions of C$2 million, C$1 million of which was on behalf of the Issuer, and resulted in an increase in its ownership percentage from 37.5% to 41.67% . These funds were used to invest in the shares of Tagish Lake and fund exploration work on the Skukum property. Due to the poor working capital conditions of Tagish Lake and actions taken by other creditors, Tagish Lake was placed into Companies Creditors’ Arrangement Act (“CCAA”), utilizing the proceeds provided from the investment by YSM. During the CCAA process a takeover bid was received from New Pacific Metals Ltd. (“NUX”) for the shares of Tagish Lake which included full payout of any debts. Although the joint venture provided a competing takeover offer and funds were transferred from NWME to support the offer, insufficient shares were tendered to this competing offer to reach the required level of ownership and the majority of the shares were tendered to an improved offer made subsequently by NUX. Both joint venture partners had set a specific fair market value for the Tagish Lake property and the bid was based on these estimates, so an improved offer was not made. Subsequent to the successful take over by NUX, in October 2010 Tagish Lake completed a plan of arrangement under the CCAA with a loan from NUX and the joint venture has recovered all funds that were loaned to Tagish Lake with applicable interest. The joint venture will pursue other opportunities to explore and develop resources in the Yukon.

15

Events Subsequent to December 31, 2010

On March 2, 2011, the Issuer completed a $7.1 million non-brokered flow-through private placement for 8,334,882 flow-through shares (the “FT Shares”) at $0.85 per FT Share. The proceeds of this placement will be for used for new resource exploration at Ketza River at new targets as well as at the Silver Valley property.

At a Special Meeting of the Issuer held March 8, 2011, shareholders approved the temporary reduction of the exercise price of eight series of unlisted warrants issued between April 2009 and August 2010 by approximately 18%. The holders of the warrants have 30 days from March 14, 2011 to exercise their warrants. After 30 days, the exercise prices of the warrants will revert to their original respective exercise prices. The original prices ranged from $0.08 to $0.40 per share and the reduced prices range from $0.07 to $0.33 per share. There are an aggregate of 235,823,053 warrants eligible to be exercised at the reduced rate.

3.2Significant Acquisitions

The Issuer did not complete a significant acquisition in 2010.

ITEM 4: DESCRIPTION OF THE BUSINESS

4.1General

The principal businesses of the Issuer are the continued mining of the Jerritt Canyon gold mine in Nevada, as well as the acquisition, exploration and development of natural resource properties with a particular focus on the Ketza River and Silver Valley Properties in the Yukon Territory.

Jerritt Canyon is an operating gold complex with two producing underground mines, ore stockpiles and a 1.5 million ton per year capacity processing plant. In addition, the approximately 119 square miles that comprise the Jerritt Canyon property offer a significant number of advanced, early stage and district-scale exploration targets and potential to expand the currently defined mineral reserves and resources proximal to the producing mines. The Issuer intends to seek and acquire additional near production stage properties worthy of development and within economic trucking distance of the Jerritt Canyon mill.

Summary

The Issuer is engaged in the acquisition, exploration, development and operation of precious metal properties. The Issuer continues to investigate and negotiate the acquisition of additional precious metal mining properties or interests in such properties in order to increase the reserve life. There is no assurance that any such investigations or negotiations will result in the completion of an acquisition.

Production and Services

The Issuer’s principal product is gold, with gold production forming the primary source of revenues. There is a global gold market into which the Issuer can sell gold and, as a result, the Issuer is not dependent on a particular purchaser with regard to the sale of the gold that it produces.

16

Specialized Skill and Knowledge

In order to carry on exploration, mining and milling activities the Issuer draws on the expertise of various personnel including geologists, engineers, and metallurgists.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Issuer must compete with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties, especially in the current market. The ability of the Issuer to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties and provide necessary ore to the current facilities, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Economic Dependence

Not applicable to the Issuer.

Changes to Contracts

Not applicable to the Issuer.

Environmental Protection

The Jerritt Canyon facilities have been designed to mitigate environmental impacts. The operations have processes, procedures or facilities in place to manage substances that have the potential to be harmful to the environment. In order to prevent and control spills and protect water quality, the mine utilizes multiple levels of spill containment procedures and routine inspection and monitoring of its facilities. The mine has installed air pollution control devices on its facilities that exceeds the minimum requirements significantly and, in the case of mercury emissions, has set the new standard for the state of Nevada. The mine also has various programs to reuse and conserve water at its operations.

In 2009 the Issuer reached an agreement with the Nevada Division of Environmental Protection (“NDEP”) in the form of a Consent Decree issued by the Attorney General of the State of Nevada, representing the NDEP. The Consent Decree resolved all of the environmental compliance concerns of the NDEP in relation to the Jerritt Canyon mill and surrounding land holdings, as well as related environmental concerns, and gives the Issuer the right to operate the Jerritt Canyon milling facility from the effective date. The Consent Decree records and agrees both parties to the terms of an environmental work program and includes penalties for not completing these work programs. The Issuer is carrying out significant work programs under the Consent Decree, including the following key projects to be completed in 2010:

For 2011 the Issuer has budgeted significant environmental expenditures (approximately $63.4 million) in order to not only meet the requirements of the Consent Decree but also to meet commitments made to the state to improve the compliance of the operations. Although significant progress has been made on the containment of mercury emissions at the facility, the Issuer must make significant investments in the management of fluids in order to ensure the long term viability of the project and increase the capacity of the mill. One of the most significant projects in 2011 is the construction of a new tailings facility as well as a second water storage facility to facilitate the reclamation of the first tailings pond. The issuer is also planning to perform approximately $3.9 million in restoration projects at the mine site, including the reclamation of the first tailings facility.

17

Employees

As of December 31, 2010, the Issuer had twelve (12) full-time employees at the head office in Vancouver, fourteen (14) full-time employees at the Ketza River location (this number is subject to some seasonality), and approximately 188 employees at the Jerritt Canyon gold mine. The Issuer uses a number of consultants and contractors for a variety of specialized tasks.

Foreign Operations

The Issuers principal operations are within North America.

Bankruptcy and Similar Procedures

As at the date hereof, neither the Issuer, nor its subsidiaries, has been subjected to any bankruptcy, receivership or similar proceedings.

Reorganization

Commencing in December 2003, Graham Dickson, the president of the Issuer, took the initiative in reorganizing the Issuer by restoring it with the Register of Companies and returning the Issuer to good standing as a reporting issuer in the provinces of British Columbia and Alberta. On January 5, 2004, the Issuer’s share capital was consolidated on a five (5) old for one (1) new basis and its authorized share capital was increased from 4,000,000 Shares without par value to 100,000,000 Shares without par value; subsequently the Issuer’s share capital was increased to an unlimited number if Shares without par value. On April 13, 2005, the Issuer’s Shares commenced trading on the TSX. In 2007 the Issuer amalgamated with Queenstake Resources Ltd. by way of a Plan of Arrangement and renamed the Issuer from YGC Resources Ltd. to Yukon-Nevada Gold Corp.

Social or Environmental Policies

The Issuer believes in hiring the majority of the workforce from within the local community at both the Canadian and US properties to the extent possible. The Issuer has a policy of working with environmental agencies as closely as possible to ensure compliance with the ever-evolving environmental regulations.

Jerritt Canyon Property

The Issuer conducts ongoing exploration, mine production, closure, and restoration on the Jerritt Canyon Property. Precious metals production has been conducted continuously on the Jerritt Canyon Property for thirty years and the Issuer is now preparing for a new phase of productive life for the Jerritt Canyon Property. Several major permits have been renewed in the last two years and are being modified further to support ongoing operations while establishing the base for future growth. The Issuer and the NDEP entered into a Consent Decree in October of 2009 to address legacy issues and environmental controls. Several, but not all, modifications to operations are parts of that Consent Decree (CD). The Issuer has also responded to information requests from the United States Environmental Protection Agency (USEPA) on two issues described later in this section.

The Nevada mining permit which regulates water pollution control was renewed in June of 2009 for five years. In December of 2010 the Issuer submitted an application for a major modification to this permit to allow the construction of a new tailings storage facility (TSF2) that included another full update. This new TSF2 will replace the current tailings storage facility (TSF1) first constructed in 1981 and last modified in 1998 which is nearing capacity. The second tailings facility is anticipated to provide six years of storage at planned production rates. All current and planned mining operations have been incorporated into this permit.

18

An application to renew the site wide Title V Air Quality Permit was accepted by the State of Nevada in June 2008, also for five years. The issuer is addressing new information requirements under that permit. New air pollution control technologies have been developed under the CD to control mercury emissions and the State of Nevada is modifying air pollution control permits for these emissions controls. Construction of the new controls is planned for 2011. These modifications will allow compliance with State and Federal air pollution control regulations. The end result will be a fully compliant and permitted Title V permit for the operations in latter 2012.

A large portion of the Jerritt Canyon mine is located on public land administered by the U.S. Forest Service. The Jerritt Canyon staff maintains a proactive relationship with the U.S. Forest Service personnel, which includes frequent site inspections and up-dates. A majority of the Jerritt Canyon mining district has undergone a formal National Environmental Policy Act (“NEPA”) review as part of the 30 year mining and exploration history of the District. Environmental resources and issues are well defined in this documentation and appropriate mitigation strategies are in place to support and expand operations. Evolving regulatory programs may result in additional review of environmental issues associated with ongoing or planned future operations. Periodic NEPA review of these issues may be required for future expansions and modifications in the operations.

The Issuer’s operations on public lands managed by the US Bureau of Land Management (BLM) are limited to a very small area associated with the Starvation Canyon Mine access road. The Issuer has the necessary approvals from the BLM. Additional approvals may be required for expanded exploration plans in the future.

In September, 2010, the site wide Reclamation Permit with the State of Nevada was renewed and includes all current activities at the Jerritt Canyon Property on public and private lands. A modification of this permit is planned for early 2011 to allow construction of TSF2 and a water storage reserve and to add Starvation Canyon Mine operations.

TSF1 is scheduled to enter closure during 2012 independent of the obligations under the CD. The Issuer is completing closure of certain legacy facilities at the Jerritt Canyon Property in accordance with the CD. The Issuer will improve surface water controls for legacy waste rock disposal areas in 2011 under the CD. Reclamation projects are scheduled annually and are completed concurrently with the completion of mining activities. To date over 1,500 acres of mined lands have been reclaimed.

Reclamation and closure activities are defined and surety is provided to the Federal Government and the State of Nevada for the associated site restoration obligations in the total amount of US$54.88 million. These surety bonds are collateralized by a reclamation and closure insurance policy independently administered by Chartis Insurance Company (Chartis), formerly American Insurance Group (AIG). As reclamation is completed, payment for completing the insured activity is paid to the Issuer from a pre-funded Commutation Account administered by Chartis. The capacity of this collateralized bond was surpassed in 2010 and was supplemented with cash to make the collateral sufficient. The surety requirements are anticipated to increase as new facilities become necessary and older facilities have not yet been closed and reclaimed. The Issuer will ensure additional surety capacity as new mines and plant expansions develop in the future

The Issuer temporarily halted operations on the Jerritt Canyon Property in 2009. The State of Nevada then issued a regulatory Stop Order for the operations. The Issuer negotiated a Consent Decree with the State of Nevada to lift the Stop Order and resume operations. The Consent Decree required closure of certain legacy facilities, improvement of engineered controls for water pollution and development of new air pollution controls for mercury as a condition for lifting the Stop Order. At the time of writing this AIF, the Issuer was preparing to negotiate an extension and new terms for the CD for those actions not yet completed.

In 2009, the US Department of Justice (DOJ) signed a complaint against the Issuer but offered not to file the case with a court if the Issuer agreed to negotiate a settlement. The Issuer has maintained this agreement, the filing of the case has been held in abeyance, and the agreement is renewed on a 6-month basis. The complaint was not provided to the Issuer by the DOJ but the Issuer was informed that the complaint relates to mercury handling at the Jerritt Canyon Property. The Issuer has been improving mercury controls under the CD with the State of Nevada with operating and monitoring provided under the agreement with EPA. Monitoring of the effectiveness of mercury controls will be performed after the controls are constructed in 2011.

19

In 2009, the Jerritt canyon Property was selected by the USEPA for a „desktop’ audit of annual reports submitted for its Toxic Release Inventory program. The Issuer worked with the USEPA to satisfy information requests in 2010. The Issuer has received no response from the USEPA regarding the results of the audit on December 31, 2010.

The Issuer is committed to conducting its operations with high environmental values, ethics as well as to social issues. The Issuer operates in the following manner:

| | | Complies with applicable laws, regulations, and permit conditions and, where practicable, exceed their minimum requirements; |

| | | Establishes and maintains management systems to monitor all environmental aspects of its activities; |

| | | Reviews these management systems regularly to evaluate their effectiveness and modify them as appropriate to optimize their effectiveness; |

| | | Proactively pursues and evaluates engineering alternatives to better address closure and reclamation obligations; |

| | | Ensures that financial resources are available to meet environmental and reclamation obligations; |

| | | Ensures that the Issuer’s employees and contractors are aware of the Issuer’s environmental policies and understand their relevant responsibilities; and |

| | | Actively participates in the ongoing public and private sector debate on environmental and social matters that relate to the mining industry. |

The Issuer is continually striving to improve its environmental performance. Planned environmental capital expenditures and restoration expenditures for 2011 are US$67.3 million.

Ketza River Property

The Issuer currently manages the environmental compliance program in the Yukon Territory through a contracted environmental engineering firm and has onsite personnel to administer the monitoring requirements needed. There are regular consultations with the Yukon Territorial Government to ensure the Issuer is complying with regulatory requirements. During 2010 the Issuer conducted a number of environmental and social impact studies relating to the Yukon Environmental and Socio-economic Assessment Board project proposal to be submitted in 2011. Approval of this project proposal will allow the Issuer to commence construction of the tailings facility at the site to allow for mine production in the future.

4.2Risk Factors

The Issuer operates in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Shareholders should carefully consider the risks described below before purchasing its Shares. The occurrence of any of the following events could harm the Issuer. If these events occur, the trading price of its Shares could decline, and shareholders may lose part or even all of their investment.

Precious Metal Price Fluctuations

The Issuer's profitability from proposed operations will be dependent in part on:

| | | the market price of precious metals; |

20

| | the price of metals or interests related thereto has fluctuated widely and is affected by numerous factors beyond our control including: |

| | | | international economic and political conditions; |

| | | | expectations of inflation; |

| | | | international currency exchange rates; |

| | | | interest rates; |

| | | | global or regional consumptive patterns; |

| | | | speculative activities; |

| | | | levels of supply and demand; |

| | | increased production due to new mine developments and improved mining and production methods; |

| | | | availability and costs of metal substitutes; and |

| | | | metal stock levels maintained by producers and others and inventory carrying costs. |

Although it cannot predict the exact effect of these factors, the combination of these may result in the Issuer not receiving an adequate return on invested capital or an investment retaining its value.

Operating Hazards and Risks

Mining operations involve a high degree of risk, such as unusual or unexpected formations and other conditions, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which the Issuer has a direct or indirect interest are subject to all the hazards and risks normally incidental to exploration, development and production of precious metals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. The Issuer presently carries a limited amount of liability insurance, and may become subject to liability for pollution, cave-ins or other hazards, and the payment of such liabilities could have a material adverse effect on its financial position.

Exploration and Development

Mineral exploration and development involves a high degree of risk as few properties which are explored are developed into producing mines. The Issuer cannot provide assurance that its continuing mineral exploration and development activities will result in any discoveries of bodies of commercial ore. The long-term profitability of the operations will be in part directly related to the cost and success of its exploration and development programs, which may be adversely affected by a number of factors.

The Issuer may require funding for the substantial expenditures which are required to establish reserves through drilling, to evaluate metallurgical processes to extract metal from ore and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis.

Numerous factors will affect the marketability of any minerals acquired or discovered which are beyond the Issuer’s control and cannot be accurately predicted, including market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting minerals and environmental protection.

21

Calculation of Reserves, Resources and Metal Recoveries

There is a degree of uncertainty attributable to the calculation of reserves and resources and corresponding grades being mined or dedicated to future production. Until reserves or resources are actually mined and processed, the quantity of mineralization and grades must be considered as estimates only. In addition, the quantity of reserves and resources may vary depending on metal prices. Any material change in quantity of reserves, resources, grade, stripping ratio, or metallurgical recoveries may affect the economic viability of our properties. In addition, the Issuer cannot provide assurance that metallurgical recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Title to Mining Properties

Although the Issuer has taken steps to verify title to its mineral properties in a manner consistent with industry practice for the current stage of its evaluation of our properties, there is no guarantee that its title to the properties will not be challenged or impugned. The Issuer has not conducted surveys of some of the claims in which it holds a direct or indirect interest, therefore the precise area and location of the claims may be in doubt. There could be prior unregistered agreements or transfers or native land claims and its title may be affected by undetected defects.

Issuance of Debt

The Issuer may enter into transactions to acquire assets or the shares of other corporations which may be financed partially or wholly with debt, which may increase its debt levels above industry standards. The Issuer’s articles do not limit the amount of indebtedness that it can incur. The level of the Issuer’s indebtedness could impair its ability to obtain additional financing in the future to take advantage of business opportunities that may arise.

Dilution

In order to finance its working capital requirements and to raise equity for the development of its projects the Issuer may enter into commitments which would require the issuance of additional Shares, options, warrants and convertible debt. These commitments will comply with securities laws and could require the approval of the securities regulatory bodies, and in some cases, its shareholders.

Regulatory and environmental matters

The following discussion is necessarily brief and must not be taken to constitute a complete discussion of the various statutes, rules and governmental orders to which our operations may be subject. The Issuer’s existing properties are located in Canada and the United States, and are subject to extensive federal, state, provincial and local governmental regulations in these countries. These regulations may be revised or expanded at any time. A broad number of matters are subject to regulation. Generally, compliance with these regulations requires it to obtain permits issued by federal, state, provincial and local regulatory agencies. Certain permits require periodic renewal or review of their conditions. It is impossible to predict whether it will be possible to obtain or renew such permits or whether material changes in permit conditions will be imposed. The inability to obtain or renew permits or the imposition of additional conditions could have a material adverse effect on its ability to develop and operate its properties.

Environmental laws and regulations to which the Issuer is subject as it progresses from the development stage to the production stage give rise to additional concerns and requirements. Failure to comply with applicable laws, regulations and permits can result in injunctive actions, suits for damages, and civil and criminal penalties. The laws and regulations applicable to its activities change frequently and it is not possible to predict the potential impact to the Issuer from any such future changes.

22

Passive Foreign Investment Company (“PFIC”)

The Issuer has not determined whether it meets the definition of PFIC, within the meaning of Sections 1291 through 1298 of the U.S. Internal Revenue Code of 1986, as amended, for the current tax year and any prior tax years. It may or may not qualify as a PFIC in subsequent years due to changes in its assets and business operations. A U.S. shareholder who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to numerous special U.S. federal income taxation rules and may elect to be taxed under two alternative tax regimes. A U.S. shareholder should consult their own U.S. tax advisor with respect to an investment in the Issuer’s Shares and to ascertain which of the alternative tax regimes, if any, might be beneficial to the U.S. shareholder’s own facts and circumstances.

Enforcement of Civil Liabilities

The Issuer was incorporated under the laws of British Columbia, Canada. Some of its assets are located outside Canada and its directors and officers are residents of countries other than Canada. It could be difficult for its investors to effect service of process within Canada upon the Issuer and its directors and officers, or to realize in Canada upon judgments of courts of Canada predicated upon civil liability of it and its directors and officers under Canadian federal securities laws.

Likewise, given that the Issuer is incorporated under the laws of British Columbia and some of its assets are located in Canada, it may also be difficult for U.S. investors to effect service of process within the United States upon the Issuer or any of its directors and officers who are not residents of the United States, or to realize in the United States upon judgments of U.S. courts predicated upon civil liabilities under U.S. securities laws. A judgment of a U.S. court predicated solely upon such civil liabilities may be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter.

4.3Companies with Asset-backed Securities Outstanding

The Issuer has not historically held any asset-backed securities and does not have any plans to hold this security in the future.

4.4Companies with Mineral Projects

(a) Jerritt Canyon Mine, Nevada

On June 20, 2007 the Issuer acquired Queenstake Resources Ltd. (“Queenstake”) which owns the Jerritt Canyon mine located in Nevada. The Jerritt Canyon mine is an operating gold property with two producing underground mines and ore stock piles, currently feeding ore to a 1.5 million ton per year capacity processing plant.

Within the description below are references to "NI 43-101" and "SRK Report" which specifically refer to the December 31, 2007 period covered by the NI 43-101 report prepared by SRK Consulting and filed by the Issuer on April 18, 2008. Data or information noted below subsequent December 31, 2007 has not been reviewed or prepared by SRK Consulting but rather by management of the Issuer from previously published results, and has not been incorporated to date within any NI 43-101 report.

23

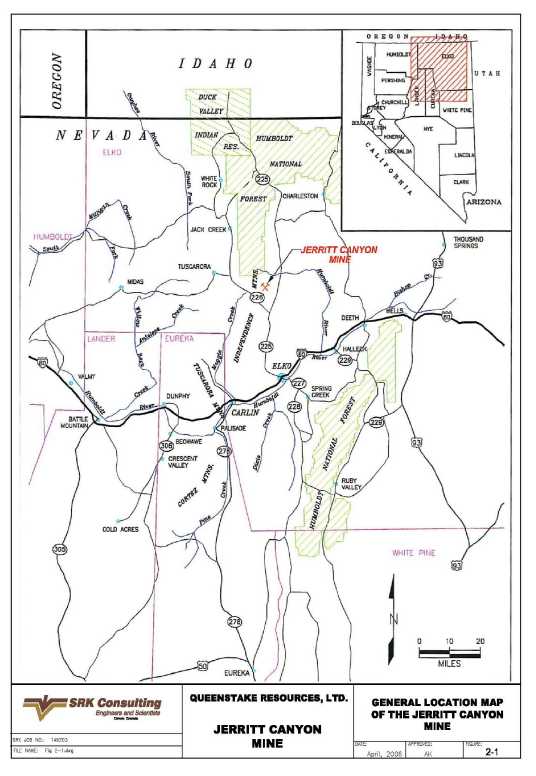

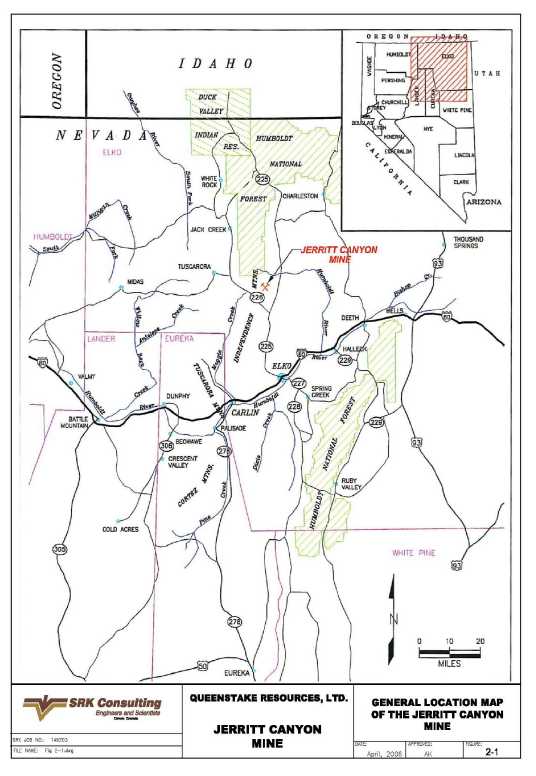

Figure 1: General Location Map of the Jerritt Canyon Mine

24

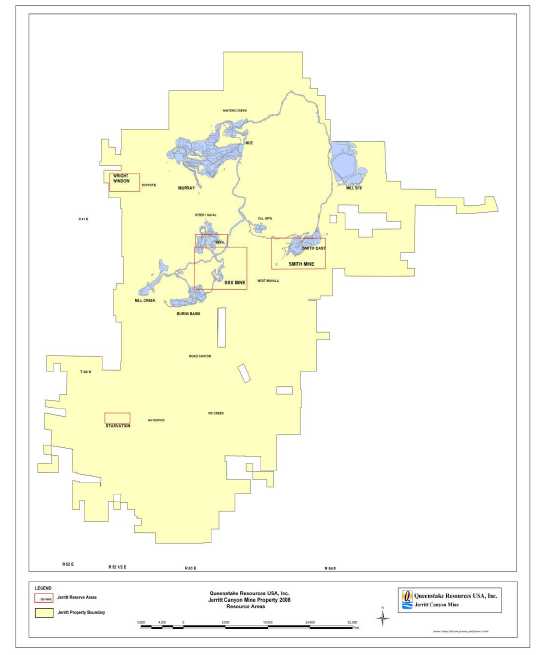

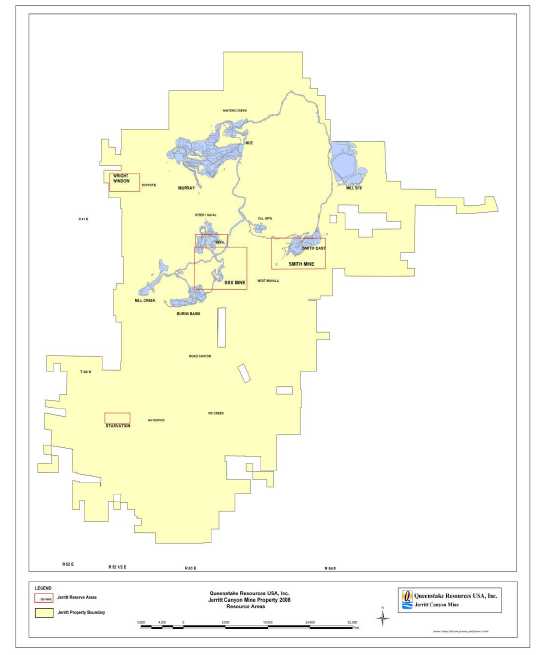

Figure 2: General Land Map of the Jerritt Canyon District

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Jerritt Canyon Mine is located in Elko County, Nevada, approximately 50 miles north of Elko. Access to the property is by State Road 225 to the mine access road. The roads are paved and in excellent condition all the way to the main gate where the administrative offices, process plant, warehouse, and tailings impoundment are located. The mines are accessed by haul roads on Queenstake controlled land.

The climate is temperate with winter temperatures between 0ºF and 40ºF and summer temperatures between 35ºF and 90ºF. Average annual precipitation at the tailings impoundment is estimated at 14 inches per year with an estimated annual average evaporation of 43 inches. A significant amount of the total precipitation falls as snow and increases with elevation to the mining areas. Mine operations are only rarely halted by weather conditions, although ore haulage from the mines may be slowed. The mill, warehouse, shop, and administrative facilities are at a lower elevation and therefore are less exposed to weather extremes.

25

The vegetation is typical of the Basin and Range province with sagebrush vegetation dominant at the lower elevations. Small stands of aspen and isolated fir trees grow in canyons and drainages.

Jerritt Canyon mine is located in the Independence Mountain Range in the Basin and Range province of northern Nevada. The topography ranges from about 6,400 feet at the administrative facilities and mill site to about 8,000 feet at the highest point of the haul road to the mines.

Elko, Nevada with a population of about 36,000 is the closest city to the mine. The city is on Interstate 80 and is serviced by daily commercial flights to Salt Lake City, Utah. Elko is a center for the mining operations in northern Nevada and services necessary for the mine are readily available there.

History

The Jerritt Canyon mine is wholly owned by Queenstake Resources USA, Inc. after the purchase by that company from the joint venture of Anglo Gold and Meridian Gold in June 2003. The joint venture was formed in 1976 between Freeport Minerals Company, later Freeport McMoran Inc., and FMC, later Meridian Gold. In 1990, Freeport sold its interest in Jerritt Canyon to Minorco and their wholly owned subsidiary, Independence Mining Company, which became the new joint venture partner and operator of the mine. In 1998, Minorco’s North American gold assets, including a 70% interest in Jerritt Canyon were sold to Anglo Gold.

Prospectors explored the district for antimony in the 1910’s. Thirty to forty tons of stibnite as antimony ore were reportedly mined and shipped from the Burns Basin mine in the Jerritt Canyon district between 1918 and 1945. In the early 1970’s there was a renewed interest in antimony exploration when its price reached historic highs of $40 per pound. Around 1971, FMC began exploring for antimony in the Independence Mountains. In 1972, FMC, later known as Meridian, discovered a disseminated gold deposit in the Jerritt Canyon area. In 1976, a joint venture was formed with Freeport Minerals Company to explore and develop the area, and mining commenced at Jerritt Canyon in 1981.

Open pit mining was conducted at the site from startup in 1981 until 1999. The first underground operation at Jerritt Canyon started up in 1993 at West Generator. The mine during 2007 consisted of three underground mining operations feeding ore to a process plant consisting of a roaster followed by carbon-in-leach processing. The mines are mechanized operations using backfill for ground control and to increase ore recovery. In the early years, the ores mined at the operation were less refractory and were processed through a “wet” mill. This “wet” mill continued to operate until 1997 and is still located on site. With ores becoming more carbonaceous and refractory, as well as with the introduction of higher-grade ore from underground operations, a dry mill with an ore roasting circuit was added in 1989 and is currently in operation.

Since its inception, the Jerritt Canyon Mine has produced over eight million ounces of gold. Annual production has historically averaged between 125,000 and 350,000 ounces of gold. During 2010 only one mine, the Smith mine, was operating and produced 71,173 tons of ore containing 14,919 ounces of gold at Jerritt Canyon as the Issuer raises additional capital to purchase mining equipment for the second mine (the SSX/Steer). During 2010 the Jerritt Canyon mill processed a total of 578,089 tons of ore through the roasters containing 73,876 ounces of gold.

Surface exploration drilling and underground core drilling which is also used as an exploration tool, decreased from 2001 to 2002, when the former owner, Anglo Gold shifted focus from exploration to reserve development. In 2000, about 445,000 feet of exploration and development were completed, of which 165,000 feet consisted of surface Reverse Circulation (RC) drilling and the remainder was underground (UG) core and RC drilling. In 2001, a total of about 500,450 feet were drilled, 65,450 of which were surface RC holes. In 2002, 435,000 feet were drilled, all of which were from underground. After the acquisition of Jerritt Canyon at mid-2003, Queenstake started more aggressive exploration and mine development programs and those programs continued after the merger of Queenstake Resources Ltd. and YGC in June 2007. Due to the shutdown of the Jerritt Canyon operations in 2008 exploration activity at Jerritt Canyon was not performed in 2009 and for the first half of 2010 until adequate funding could be obtained. In July of 2008 the Issuer recommenced underground exploration and began updating the bonding requirements to recommence surface drilling. This bonding was subsequently placed in the first quarter of 2011.

26

The measured and indicated mineral resources, including reserves, at Jerritt Canyon during Queenstake’s ownership, as documented in NI 43-101 filings are given in Table 1.

Table 1: Historic Measured and Indicated Mineral Resources during Queenstake’s Ownership

| Year | Tons | Grade | Ounces |

| 2003 | 9,497,000 | 0.242 | 2,295,000 |

| 2004 | 9,988,000 | 0.241 | 2,410,000 |

| 2005 | 8,812,000 | 0.236 | 2,079,000 |

| 2006 | 8,203,000 | 0.232 | 1,907,000 |

The proven and probable reserves at Jerritt Canyon during Queenstake’s ownership, as documented in NI 43-101 filings are given in Table 2.

Table 2: Historic Proven and Probable Mineral Reserves during Queenstake’s Ownership

| Year | Tons | Grade | Ounces |

| 2003 | 3,065,000 | 0.268 | 820,000 |

| 2004 | 3,511,000 | 0.249 | 875,000 |

| 2005 | 3,723,000 | 0.236 | 878,000 |

| 2006 | 1,985,000 | 0.245 | 486,000 |

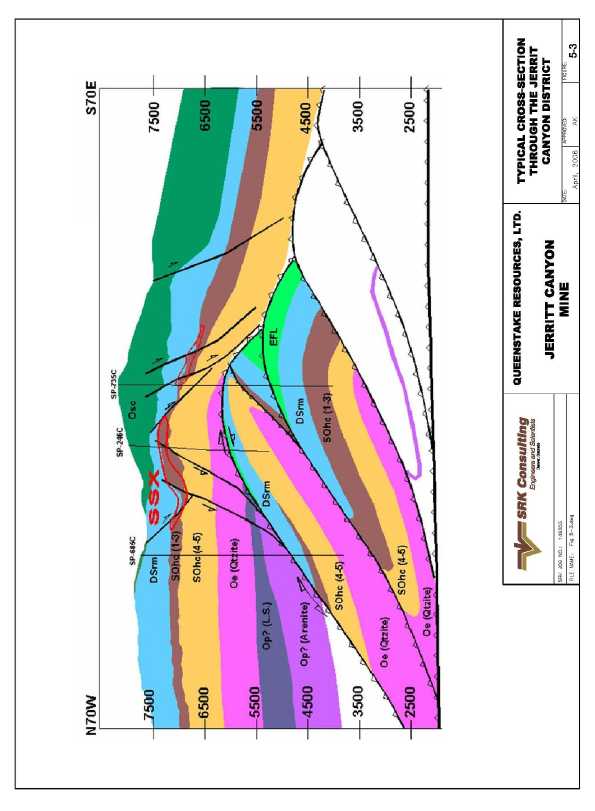

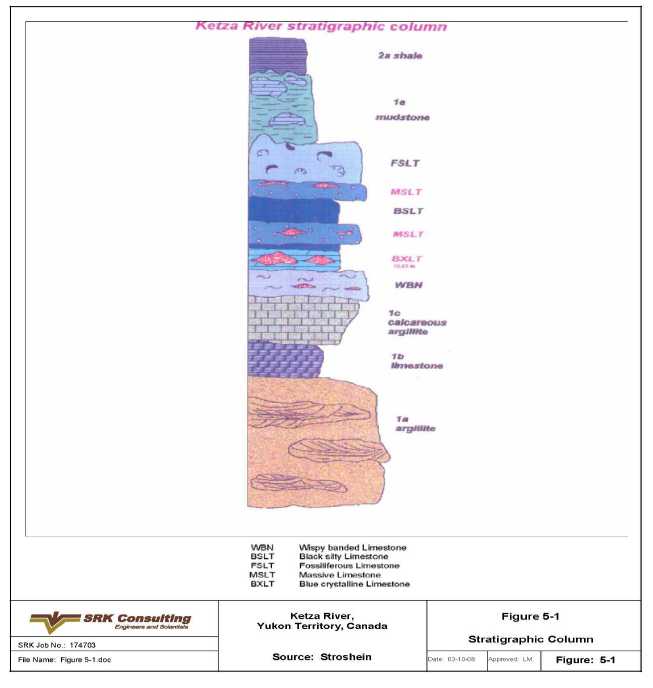

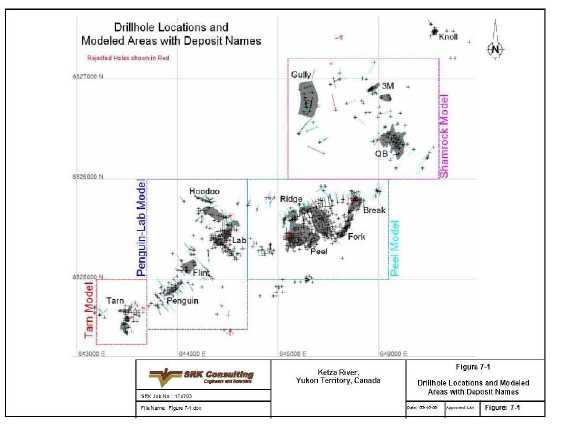

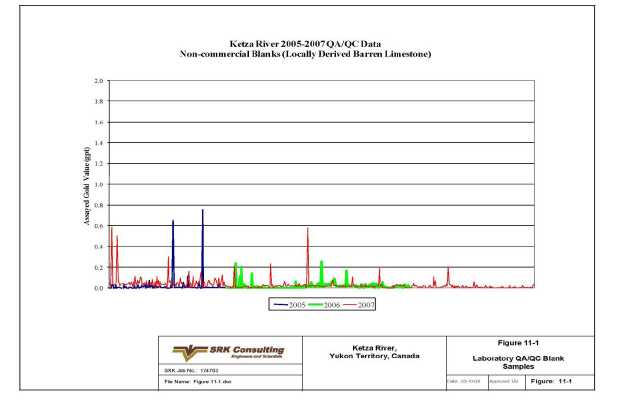

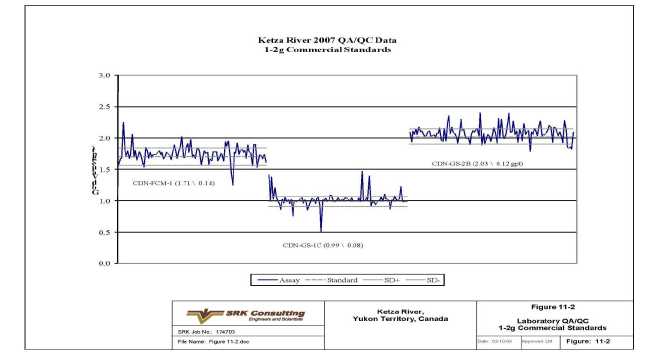

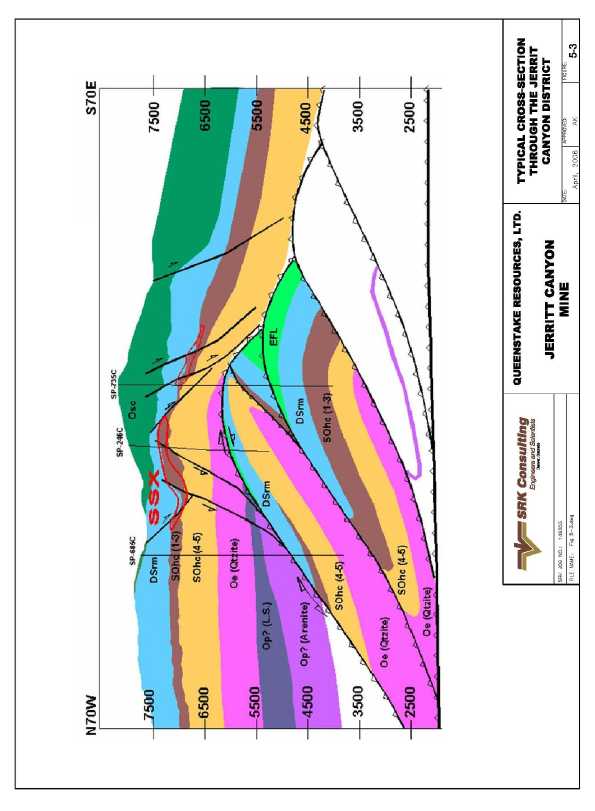

Geological Setting