#900, 688 West Hastings Street, Vancouver, BC, V6B 1P1, Tel: (604) 688-9427

ANNUAL INFORMATION FORM

For the year ended December 31, 2013

April 11, 2014

TABLE OF CONTENTS

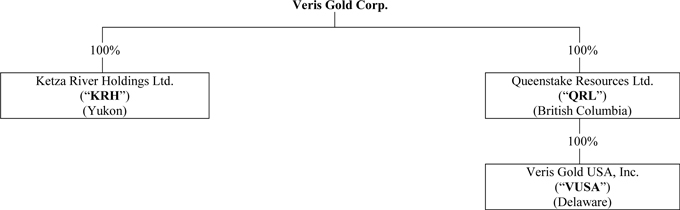

Corporate Structure

Name, Address and Incorporation

The full corporate name of the Company is Veris Gold Corp. (the “Company” or “VG”).

The address of the Company’s head office is #900, 688 West Hastings Street, Vancouver, BC, V6B 1P1. The address of the Company’s registered office is #1040, 999 West Hastings Street, Vancouver, BC, V6C 2W2.

The Company was incorporated under the laws of the Province of British Columbia under the name “YGC Resources Ltd.” on May 30, 1988. On January 25, 2002, the Company was struck from the Register of Companies for British Columbia and dissolved. The Company was restored to the Register on August 1, 2003. On January 5, 2004 the Company consolidated its share capital on a five (5) old for one (1) new basis and increased its authorized share capital from 4,000,000 Shares without par value to 100,000,000 Shares without par value. On June 23, 2005, the Company increased its authorized share capital from 100,000,000 Shares without par value to an unlimited number of Shares without par value. On June 20, 2007 the Company completed a plan or arrangement with QRL Resources Ltd. and changed its name to Yukon-Nevada Gold Corp.

At a Special General Meeting held on October 2, 2012, the Company consolidated its share capital on a ten (10) old Shares for one (1) new Share basis and changed its name to its current name.

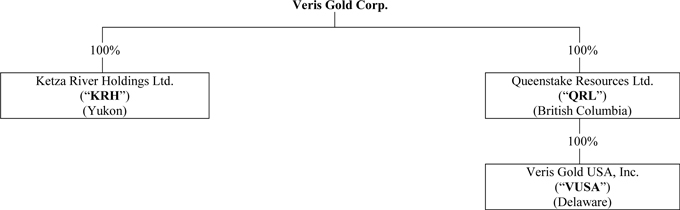

Intercorporate Relationships

Set forth below are the names of the Company’s material subsidiaries:

GENERAL DEVELOPMENT OF THE BUSINESS

The Company is active in the evaluation, development and commercial production of mineral properties. The Company’s principal assets are the Jerritt Canyon gold mine, Nevada and the Ketza River property, Yukon Territory. The favourable price for gold has enabled the Company to raise equity financing, the proceeds of which are used to fund improvements to the Jerritt Canyon processing facilities and exploration of the Ketza River property.

Three-Year History

The principal business of the Company is the production of gold in Nevada and the acquisition, exploration and development of mineral properties of merit with a particular focus on gold, silver, zinc and copper properties in the Yukon Territory and British Columbia in Canada and in Nevada in the United States.

Jerritt Canyon

Over the past three years the Jerritt Canyon processing facility and mining operations located in northern Nevada have developed significantly and this has resulted in incremental increases of gold production each year. In order to facilitate this development the Company entered into various gold forward agreements including a Senior Secured Forward Gold Sale Agreement with Deutsche Bank AG in August 2011 and February 2012. The combined gold forward agreements enabled the Company to refurbish the processing facility resulting in an optimized, efficient and modernized facility. By mid-2012 the operations achieved steady state production.

The Smith Mine came back into production in the first quarter of 2010 and the SSX-Steer Mine came back into production in the fourth quarter of 2011. Finally, the operations production pipeline increased once a third mine, Starvation Canyon, came into production in April 2013. In order to further generate incremental revenues (as the costs of operations are largely fixed) utilizing existing excess capacity at the processing facility the Company entered into toll milling agreements with nearby gold mining companies in 2013.

A second tailings facility was completed in 2013 and options for the reclamation of the original tailings facility are being evaluated. The Company has substantially completed all items under the 2009 Consent Decree including the addition of air emissions control equipment for mercury on all points of emissions at the mill. The final project under the Consent Decree is resolving the most effective treatment methods for seepage from various rock disposal areas from historic mining activity.

Ketza River

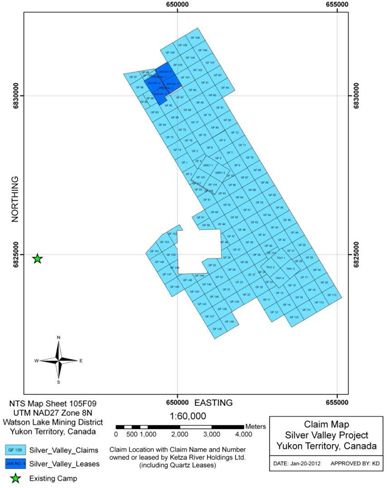

The Yukon Environmental and Socio-Economic Assessment Application was submitted in September 2011 and the final submission date has been extended to July 31, 2014 in order to answer the remaining adequacy review questions as requested by the Yukon Environmental and Socio-Economic Assessment Board as part of the proposed re-opening of the mine.

In April 2012 the Company entered into a Socio-Economic Participation Agreement with the Kaska First Nations. The Agreement is designed to foster and promote social and economic opportunities for First Nations members and contractors.

Ongoing baseline data activities continue on site including monthly water reporting. In addition, the Company is still pursuing the existing tailings dam water license renewal.

Year ended December 31, 2011

In January 2011 the Company entered into a forward gold sale agreement with Monument Mining Ltd. (“Monument”) a public company the shares of which trade on the TSX Venture Exchange. The President of Monument is Robert Baldock, a former President and director of the Company. Graham Dickson and Jean-Edgar de Trentinian, directors of the Company are also directors of Monument. Under the agreement, Monument prepaid $5,000,800 for the gold and received, in lieu of physical gold, $6,000,960 on June 30, 2011. Underground mining continued in January and throughout the year at the Smith Mine using Small Mine Development (SMD) as the mine operator.

In March 2011, the Company completed a $7.1 million non-brokered flow-through private placement for 833,488 flow-through shares (the “FT Shares”) at $8.50 per FT Share. The proceeds were used for new resource exploration at Ketza River at new targets as well as at the Silver Valley property.

At a Special Meeting of the Company held in March 2011, shareholders approved the temporary reduction of the exercise price of eight series of unlisted warrants issued between April 2009 and August 2010 by approximately 18%. The holders of the warrants had 30 days from March 14, 2011 to exercise their warrants, after which the exercise prices of the warrants reverted to their original respective exercise prices. The original prices ranged from $0.80 to $4.00 per share and the reduced prices range from $0.70 to $3.30 per share. An aggregate of 5,981,333 warrants were exercised for gross proceeds of $12,637,880. During the period May 10 to 24, 2011, 14,040,000 warrants exercisable at a price of $3.20 per share held by an insider of the Company were purchased and exercised by various entities, raising an aggregate of $44,928,000 for the Company. Concurrent with the exercise of the warrants, the Company completed a private placement of 3,348,837 units of the Company at a price of $4.30 per Share, raising an aggregate of $14,400,000. Each unit was comprised of one Share and one warrant exercisable at a price of $5.50 for 24 months from closing, subject to an accelerated expiry.

In May the Company announced that it had reached a $3.6M settlement as a result of a class action suit initiated by former employees.

On June 27, 2011, Graham Dickson, resigned as the Company’s COO and was appointed the Senior Vice President of Acquisitions and Corporate Development. Randy Reichert was appointed the Company’s COO.

Shareholders of the Company approved a Senior Secured Forward Gold Sale Agreement dated August 12, 2011 whereby Deutsche Bank AG (“Deutsche Bank”) prepaid US$120,000,000 for the purchase of a maximum of 173,880 ounces of gold produced from the Company’s Jerritt Canyon Mine. The gold is being delivered over a four year period at an average rate of 3,623 ounces per month.

In October 2011 the Company entered into a Shareholder Rights Plan Agreement with Computershare Trust Company. The agreement has a term of three years and its objective is to achieve full and fair value for the Company’s shareholders in the event of an unsolicited take-over bid. Also in October, the Company restarted underground mining activities at the SSX-Steer Complex.

On October 18, 2011, the Company and the other joint venture shareholders of YS Mining Company Inc. (“YSM”) agreed to dissolve YSM by way of a consent resolution authorizing the dissolution of YSM (the “Resolution”) and the execution of a Corporate Dissolution Agreement (the “Agreement”). During 2011 there had been minimal activity in the joint venture, including in YSM’s wholly owned subsidiary Yukon-Shaanxi Mining Company. Upon execution of the Agreement, all remaining assets, primarily cash, were distributed to the joint venture shareholders. The Company received CAD $2.2 million from the distribution of assets on October 25, 2011. YSM was dissolved on February 9, 2012.

Year ended December 31, 2012

The Company updated its year-end 2012 mineral resource estimate for its Jerritt Canyon gold mine. The mine’s measured and indicated mineral resource (including reserves) as of December 31, 2012 had increased by 290.0 koz of gold representing a 14.8% increase over year end 2007 levels. In addition, during this time period, the following results were announced: the diamond drilling program on its 2011 Smith Mine underground diamond drilling program at the Company’s Jerritt Canyon mine, the results of its 2011 surface drilling program at the Mahala Project and the Starvation Canyon Project, the completion of construction work on a new ore dryer and fine crushing conveying system as well as maintenance upgrades to the roasting facility at the Jerritt Canyon Mine. In March 2012 the Company received notification from the Federal Mine Safety and Health Administration that they had determined a Potential Pattern of Violations did not exist at the Jerritt Canyon mine.

Underground mining continued in January and throughout the year at the Smith Mine using Small Mine Development (SMD) as the mine operator. In addition, the Company operated the SSX-Steer underground mine complex throughout the entire year. Underground Mine development including portal construction was started in November 2012 at Starvation Canyon.

In April 2012 the Company entered into a Socio-Economic Participation Agreement with the Kaska First Nations. The Agreement is designed to foster and promote social and economic opportunities for First Nations members and contractors.

In 2012 the Company entered into a second forward gold sale agreement with Monument. Monument prepaid US$5,000,000 for gold and received, in lieu of physical gold, US$6,000,000 by June 30, 2012. The Company also entered into a Forward Gold Purchase Agreement with Deutsche Bank whereby Deutsche Bank funded a US$20 million prepaid gold forward facility. The Company issued to Deutsche Bank a share purchase warrant which can be exercised to purchase 4,000,000 common shares at a price of $4.40 per share on or before February 7, 2015.

In May 2012, the Company closed a non-brokered private placement of 3,908,177 units at $2.30 per unit for gross proceeds of $8,988,809. Each unit was comprised of one Share and one share purchase warrant. Each warrant is exercisable at $4.00 per share for 36 months from closing, subject to an accelerated expiry. There was no commission paid. In June 2012, the Company completed a private placement of convertible debentures in the amount of $6,000,000 principal sum, which is convertible into up to 5,540,000 Shares, 2,010,125 warrants to purchase an additional 2,010,125 shares and 201,012 structuring shares. In July 2012, the Company completed a private placement of convertible debentures in the amount of $4,000,000 principal sum, which is convertible into up to 3,693,333 Shares, 133,333 warrants to purchase an additional 133,333 shares and 133,333 structuring shares. The Company also settled outstanding indebtedness in the amount of $6,854,220 by the issuance of an aggregate of 2,284,740 Shares. In October 2012, Whitebox Advisors LLC exercised its option to acquire $2,000,000 principal amount of additional unsecured convertible debentures. The option bears interest at a rate of 11% per annum and will mature 42 months from the closing date.

In October 2012, the Company filed a preliminary short form base shelf prospectus with the British Columbia, Alberta and Ontario Securities Commissions and filed the final prospectus on October 31, 2012. The prospectus enables the Company to make offerings of up to $60,000,000 during the 25 month period that the prospectus remains effective. In December 2012, the Company closed an offering of 7,200,000 units at a price of $2.10 per Unit to raise an aggregate of $15,120,000. Each unit is comprised of one share and one-half share purchase warrant. Each whole warrant entitles the holder to purchase one share of the Company at a price of $2.35 expiring 48 months from closing.

During 2012 John Greenslade, Chairman of the Company resigned and Robert Baldock resigned as the President and Chief Executive Officer. The Company appointed Randy Reichert, Dr. Barry Goodfield and Shaun Heinrichs directors. Shaun Heinrichs and Randy Reichert (Chief Financial Officer and Chief Operating Officer) were appointed the Company’s Co-Chief Executive Officers. François Marland and Gerald Ruth, both directors of the Company were appointed Executive Chairman and Lead Director, respectively. Cameron Paterson was appointed the Company’s Vice President – Finance.

At the Company’s Special Meeting held October 2, 2012, shareholders approved the consolidation of the Company’s Shares on a ten (10) pre-consolidated common share for one (1) post consolidation Share and the change of the Company’s name to its current name.

In December 2012, the Company entered into a Shareholder Rights Plan Agreement with Computershare Trust Company. The Shareholder Rights Plan Agreement has a term of three years and its objective is to achieve full and fair value for the Company’s shareholders in the event of an unsolicited take-over bid.

Year Ended December 31, 2013

In January 2013 the Company announced the board of directors had adopted an Advance Notice Policy which policy, amongst other things, includes the provision that requires advance notice to the Company in circumstances where nominations of persons for election to the board of directors are made by shareholders of the Company.

During the year, the Company entered into several Toll Milling Agreements to mill ore at the Jerritt Canyon Roaster facility in Nevada. Toll milling production started in May 2013. The Company continued production at the Smith Mine throughout the year using SMD as the mine contract operator. The Company also continued mine production and operational responsibilities at the SSX-Steer Complex throughout the year. The Company also started production at its Starvation Canyon mine in early April 2013 which is located in the southern part of the Jerritt Canyon property. SMD is operating the Starvation Canyon Mine. Ore from Starvation Canyon is trucked to the Jerritt Canyon processing plant via newly constructed dirt roads from the portal to highway 226, and from highways 226 to 225 through the intersection at Tuscarora Junction. Underground diamond drilling was focused at the SSX-Steer mine in 2013.

The Company secured an eight-month senior unsecured promissory note of US$10,000,000 and in connection therewith issued 3,400,000 Warrants which are exercisable at $1.80 per share for five years. The Note bears interest at 9% per annum and matured eight months from the closing date. An extension of the agreement was negotiated to January 12, 2014 with a reduction in the issued warrants strike price to $0.50 per share. The Company also completed a marketed public offering of units, comprised of one share and one-half share purchase warrants and flow through units, comprised of one flow-through share and one-half share purchase warrant, to raise approximately $8,500,000. The Company raised a further $7,800,000 by the issuance of units, each unit comprised of one share and one-half of one share purchase warrant. In December 2013, the Company closed a public offering of units, each unit comprised of one share and one-half share purchase warrant and flow-through units, comprised of one flow-through share and one-half share purchase warrant, to raise approximately $6,240,000.

In 2013 the Company appointed Robert L. Chapman as its President and Chief Executive Officer and Mr. Chapman was elected as a director, Graham Dickson, a director and Senior Vice President of Corporate Development was appointed the Company’s Chief Operating Officer and Joanne Jobin as its Vice President – Investor Relations. Mr. Chapman was subsequently replaced by François Marland as its President and Chief Executive Officer. Randy Reichert was also let go as the Company’s Chief Operating Officer and Co-Chief Executive Officer and resigned as a director, and Shaun Heinrichs resigned as the Company’s Co-Chief Executive Officer, but remains as the Company’s Chief Financial Officer. Pierre Besuchet and Shaun Heinrichs did not stand for election at the Company’s Annual General Meeting. In October 2013, Robert Chapman resigned as a director, President and Chief Executive Officer and François Marland, a director of the Company was appointed as the Company’s President and Chief Executive Officer and Gerald Ruth, a director of the Company, was appointed Chairman.

Events subsequent to December 31, 2013

On January 29, 2014 the Company announced that it has received a notice of default from Deutsche Bank AG (“DB”) with respect to payment defaults under two forward gold purchase agreements with the Company. The Company failed to make its December 2013 monthly gold delivery or pay the cash equivalent due to an electrical accident which resulted in a fire at Jerritt Canyon, which resulted in a temporary suspension of operations and negatively affected gold production in December. The agreements with DB do not contain a “force majeure” provision. DB is considering what actions, if any, it may make.

On February 24, 2014 Robert Baldock resigned as a director of the Company.

On March 11, 2014 the Company’s annual maintenance shutdown at Jerritt Canyon commenced and on April 1, 2014 the mill re-commenced operations.

On April 1, 2014, the British Columbia Securities Commission granted the Company a Management Cease Trade Order (“MCTO”). Management had requested the MCTO due to the delay in the preparation and the filing of the Company’s year end December 31, 2013 audited financial statements. Details are set out under the headingDirectors and Officers - Cease Trade Orders, Bankruptcies, Penalties or Sanctions.

DESCRIPTION OF THE BUSINESS

General

The principal businesses of the Company are the continued mining of the Jerritt Canyon gold mine in Nevada, as well as the acquisition, exploration and development of natural resource properties with a particular focus on the Ketza River and Silver Valley Properties in the Yukon Territory.

Jerritt Canyon is an operating gold complex with three producing underground mines, ore stockpiles and a 1.5 million ton per year capacity processing plant. In addition, the approximately 119 square miles that comprise the Jerritt Canyon property offer a significant number of advanced, early stage and district-scale exploration targets and potential to expand the currently defined mineral reserves and resources proximal to the producing mines.

In April 2013, the Company announced commencement of production at its third underground gold mine at Jerritt Canyon. The Company produced approximately 18,400 tons of ore averaging 0.15 ounce per ton, per month, during the development phase and ramped up to 1,000 tons per day in June. The long term targeted mining rate is 600 tons per day averaging 0.24 ounce per ton.

Summary

The Company is engaged in the acquisition, exploration, development and operation of precious metal properties. The Company continues to investigate and negotiate the acquisition of additional precious metal mining properties or interests in such properties in order to increase the reserve life. There is no assurance that any such investigations or negotiations will result in the completion of an acquisition.

Production and Services

The Company’s principal product is gold, with gold production forming the primary source of revenues. There is a global gold market into which the Company can sell gold and, as a result, the Company is not dependent on a particular purchaser with regard to the sale of the gold that it produces.

Specialized Skill and Knowledge

In order to carry on exploration, mining and milling activities the Company draws on the expertise of various personnel including geologists, engineers, and metallurgists.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company must compete with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties, especially in the current market. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties and provide necessary ore to the current facilities, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Environmental Protection

The Jerritt Canyon facilities have been designed to mitigate environmental impacts. The operations have processes, procedures or facilities in place to manage substances that have the potential to be harmful to the environment. In order to prevent and control spills and protect water quality, the mine utilizes multiple levels of spill containment procedures and routine inspection and monitoring of its facilities. The mine has installed air pollution control devices on its facilities that exceeds the minimum requirements significantly and, in the case of mercury emissions, has set the new standard for the state of Nevada. The mine also has various programs to reuse and conserve water at its operations.

In 2009 the Company reached an agreement with the Nevada Division of Environmental Protection (“NDEP”) in the form of a Consent Decree issued by the Attorney General of the State of Nevada, representing the NDEP (the “Consent Decree”). The Consent Decree resolved all of the environmental compliance concerns of the NDEP in relation to the Jerritt Canyon mill and surrounding land holdings, as well as related environmental concerns, and gives the Company the right to operate the Jerritt Canyon milling facility from the effective date. The Consent Decree records and agrees both parties to the terms of an environmental work program and includes penalties for not completing these work programs. The company has completed all but the following work under the Consent Decree:

For 2012 the Company budgeted significant environmental expenditures (approximately $30 million) in order to not only meet the requirements of the Consent Decree (“CD”), but also to meet commitments made to the State of Nevada to improve the compliance of the operations and to improve its environmental performance. One of the most significant capital projects in 2012 was completion of the new tailings facility (“TSF2”) and ancillary water storage reservoirs. These reservoirs support ongoing operations and will facilitate the closure and reclamation of the first tailings pond (“TSF1”). Other significant restoration projects in 2012 included improvements to stormwater controls for several waste rock disposal areas (“RDA’s”) and the advancement of technologies for treating seepage from the RDA’s.

Beginning in 2012, TSF-2 will transition as a replacement repository for mill tailings. The Company anticipates TSF-1 will cease receiving tailings no later than January 2013. TSF-1 will then enter closure and reclamation. The Company is also planning to perform approximately $10.3 million in restoration projects at the mine site, including the initial actions for closure and reclamation of TSF1 and improvements to the reclamation of waste rock disposal areas to diminish the seepage from them.

In 2012, the Company tested on a pilot scale an active method to treat the DASH East Rock Disposal Area (RDA) seepage. If the efforts to diminish the flow rates and the applicable requirements cannot be met, then treatment may be required for the RDA seepages.

QRL has financed the Jerritt Canyon Operation’s reclamation and closure costs by funding a commutation account within an insurance policy with Chartis Insurance (Chartis). This insurance policy and additional cash placed by QRL in a money market account also with Chartis, collateralizes the surety provided to government agencies for closure and reclamation. As of early September 2011, the surety provided to Government agencies was US$81,590,537, including the closure and reclamation of the TSF-2, WSR, expanded mining activities, and additional costs mandated by the State for closure of TSF-1. Approximately 45% of the bond costs are related to control and remedy of the seepage from TSF-1. The Mine Reclamation Plan and Reclamation Cost Estimate dated June 2010 and later revised in September 2010 was submitted to the Bureau of Mining Reclamation (BMRR) Branch. The required surety to government agencies for reclamation of the private land facilities was $70,015,433. QRL estimates the net present value to its closure and reclamation obligations for the Jerritt Canyon Operations at the end of the mine life to be US$44,081,377 (using a 2.6% discount rate). Bond increases are a result of more surface disturbance, increased unit costs (labour, equipment, and fuel costs), and increased remedial actions mandated by government agencies.

Employees

As of December 31, 2013, the Company had 10 full-time employees at the head office in Vancouver, 14 full time employees and one seasonal worker, who work on a two weeks on and two weeks off schedule at the Ketza River location (these numbers are subject to some seasonality), and approximately 386 employees at the Jerritt Canyon gold mine. The Company uses a number of consultants and contractors for a variety of specialized tasks.

Reorganization

Commencing in December 2003, Graham Dickson, the then President of the Company, took the initiative in reorganizing the Company by restoring it with the Register of Companies and returning the Company to good standing as a reporting Company in the provinces of British Columbia and Alberta. On January 5, 2004, the Company’s share capital was consolidated on a five (5) old for one (1) new basis and its authorized share capital was increased from 4,000,000 Shares without par value to 100,000,000 Shares without par value; subsequently the Company’s share capital was increased to an unlimited number if Shares without par value. On April 13, 2005, the Company’s Shares commenced trading on the TSX. In 2007 the Company amalgamated with QRL by way of a Plan of Arrangement and renamed the Company from YGC Resources Ltd. to Yukon-Nevada Gold Corp. On October 9, 2012, the Company’s share capital was consolidated on a ten (10) old for one (1) new basis and changed its name to its current name.

Social or Environmental Policies

The Company believes in working with the local community and conducting the hiring of the workforce primarily from within the local area at both the Canadian and US properties to the extent possible. The Company has a policy of working with environmental agencies as closely as possible to ensure compliance with the ever-evolving environmental regulations.

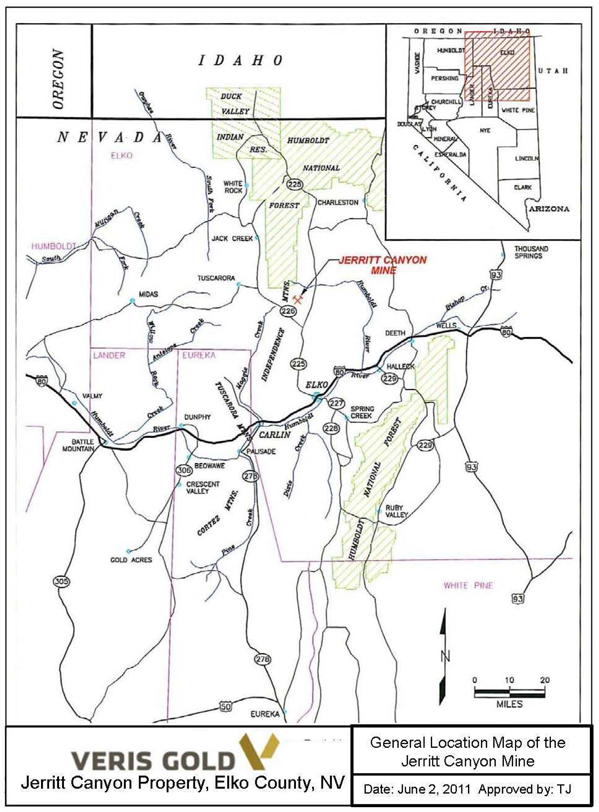

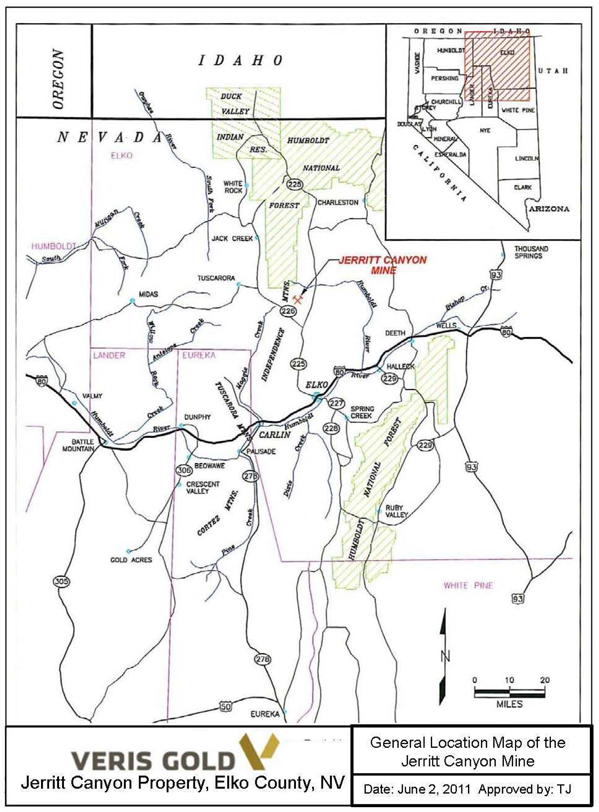

Jerritt Canyon Property

The Company’s ownership of the Jerritt Canyon property began on June 20, 2007, when QRL merged with YGC Resources Ltd. to form Yukon-Nevada Gold Corp. As part of this merger the latter company acquired the wholly-owned subsidiary of VUSA (formerly Queenstake Resources USA, Inc.), which owns and operates the Jerritt Canyon Mine in northern Nevada. As of October 5, 2012, Yukon-Nevada Gold Corp. changed its name to Veris Gold Corp.

In summary, the Jerritt Canyon Mine is owned and operated by VUSA, a wholly owned subsidiary of Veris. The Company commissioned a National Instrument 43-101 (“NI 43-101”) compliant Technical Report update on its Jerritt Canyon operating gold mine property north of Elko, Nevada which was prepared by Todd Johnson P.E., Vice President Exploration, the Company, Mark Odell, P.E., Consulting Mine Engineer, Practical Mining LLC, Karl Swanson, Mining Consultant, SME, MAusIMM, Michele White, Geologic Consultant, CPG#11252 AIPG, and John Fox, P. Eng., Consulting Metallurgist. The technical report was prepared for Veris and reflects the most recent resource and reserves based on data produced through December 31, 2012. The effective date of the Company’s most recent technical report is December 31, 2012 and it was filed on SEDAR as of July 11, 2013 (the “Technical Report”).

Jerritt Canyon contains over 22 separately exploited Carlin-Type sediment-hosted deposits that have either been mined from open pit and/or underground methods since 1981 and processed at the property or remain intact still and form part of the December 31, 2012 Mineral Resources and/or Reserves. Since July 1981, the Jerritt Canyon processing plant has produced over 8.0 million ounces of gold primarily from ores originating from the Jerritt Canyon property.

Certain of Newmont’s ores and stockpiles have been processed at the Jerritt Canyon processing plant. Newmont USA Limited’s (“Newmont”) original Carlin Deposit discovered in the early 1960’s lies approximately 34 miles (55 km) southwest of the operating SSX-Steer underground mine at Jerritt Canyon.

The Jerritt Canyon Carlin-Type deposits occur in a north-northeast trending mineralized belt called the Independence trend. The primary host rock for the Jerritt Canyon Carlin-Type deposits is the Silurian and Ordovician Hanson Creek Formation with much less mineralization hosted in the overlying Devonian and Silurian Roberts Mountain Formation. Dike rocks locally contain ore grade gold mineralization but are volumetrically insignificant relative to the sedimentary rock hosted ore materials.

The Jerritt Canyon sulfide ores are double refractory in nature because the gold mineralization is both included in solid solution within sulfide minerals (arsenic-rich pyrite), and is also locally associated as free grains with organic carbon in the host rock. The permitted and operating on-site Jerritt Canyon processing facility contains crushing and grinding circuits, two parallel, two-stage oxygen fluid-bed Dorr Oliver roasters (commissioned in 1989), a cyanidation circuit, and a refinery. The processing plant has a maximum capacity of 1.5 million tons per year. The roaster helps oxidize the refractory ores for subsequent cyanidation and has a currently permitted capacity of 250 tons per hour (6,000 tons per day) which is the engineering design capacity.

Underground mining production in 2012 at the property was from the Smith and SSX-Steer mines. Underground mining methods use both long-hole stopping and modified drift and fill. Split set rock bolts and welded wire mesh provide the primary means of ground support with supplementary resin anchor rebar bolts, cable bolts and/or shotcrete where necessary.

Mining at Smith in 2013 was done by contract miner Small Mine Development LLC (SMD) whereas mining at SSX-Steer was performed by VUSA staff. Exploration and development (resource conversion) drilling was active at Smith and SSX-Steer in 2012 using one contract diamond drill. Development drift and stope drilling and minor exploration using RC Cubex drills were also active at both operating mines in 2012. Initial underground development work (portal excavation and drift development) at Starvation Canyon started in November 2012 and continued through the end of the year and mining production at Starvation Canyon, operated by SMD, commenced in early April 2013.

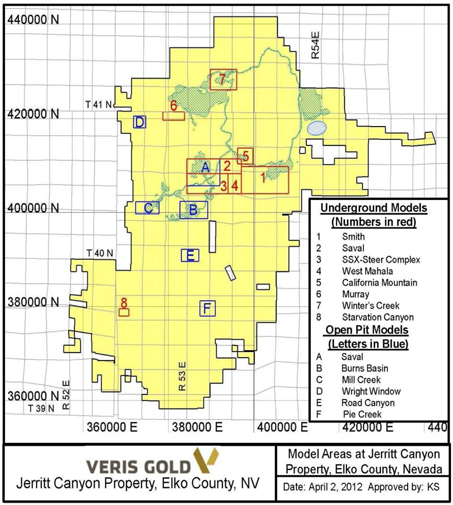

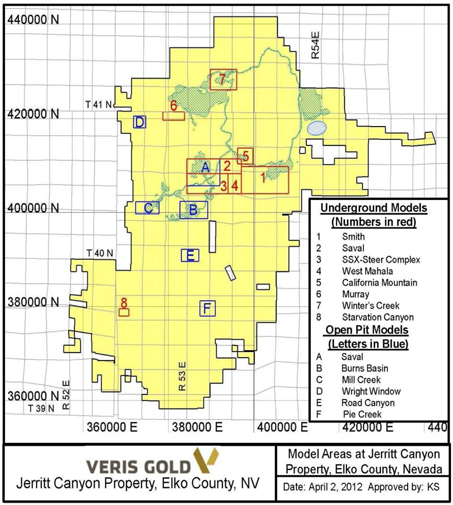

The December 31, 2012 Mineral Resources and Reserves from 6 underground areas (Smith mine, SSX-Steer mine, Saval, Murray, Starvation Canyon and Winters Creek) and 6 open pits (Burns Basin, Mill Creek, Pie Creek, Road Canyon, Saval, and Wright Window) have been updated in the Company’s Technical Report based on additional drilling completed in 2012 and/or based on recent remodeling work. Reserve additions included in this Technical Report relative to the previous report are located at the Smith, SSX-Steer and Starvation underground mines and at the Burns Basin open pit. The Smith and SSX-Steer underground mines comprise the majority of the mineral reserves in the district.

Mineral Resource Estimate

The December 31, 2012 Mineral Resources at Jerritt Canyon are contained within 6 open pits including Burns Basin, Mill Creek, Pie Creek, Road Canyon, Saval, and Wright Window, and 6 underground areas including Murray, Smith, SSX (including West Mahala), Saval, Starvation Canyon, and Winter’s Creek. The recently revised underground mineral resource estimates are based on extensive underground and surface drilling data, a strict 0.10 opt grade shell digitized by hand on 50 foot cross-sections, and using geology constrained kriging estimation methods. Block modeling techniques incorporate 5x5x5 ft. block sizes within the digitized grade shells.

Measured Resources as of December 31, 2012 total 4511 ktons averaging 0.198 opt Au containing 891.7 koz. Indicated Resources as of December 31, 2012 total 7,932 ktons averaging 0.171 opt Au containing 1,359.4 koz. Combined Measured and Indicated Resources as of December 31, 2012 total 12,443 ktons at 0.181 opt Au, containing 2,251.1 koz. There is an additional Inferred Resource of 3,845 tons at 0.170 opt Au, containing 653.2 koz. Resources were determined using a US$1,620/oz two-year average trailing gold price.

For this Technical Report, new drilling information for the open pit resources has been included for the Saval and Burns Basin open pits. Also for this Technical Report, new drilling information for underground resources has been included for Starvation, Smith and SSX underground mines.

One of the independent contributory authors of the Technical Report conducted a January 2013 database audit of assay results from drilled material sampled between June 18, 2011 and December 31, 2012 for underground drilling, and between July 18, 2011 and December 21, 2011 for surface drilling. There was very little surface drilling in 2012. This database audit reviewed between 5 to 25 percent of the actual records and concluded excellent correlation between certified sampling results and the database as discussed below. The results of this audit commend the 2013 database for use in the new resource and reserve estimates listed below.

Jerritt Canyon mineral resources including reserves – December 31, 2012

| | Measured | Indicated | Measured + Indicated | Inferred |

| Area | kt | opt | koz | kt | opt | koz | kt | opt | koz | kt | opt | koz |

| Open Pit | | | | | | | | | | | | |

| Burns Basin | 46 | 0.106 | 4.9 | 430 | 0.096 | 41.4 | 476 | 0.097 | 46.3 | 5 | 0.061 | 0.3 |

| Mill Creek | 3 | 0.089 | 0.3 | 299 | 0.094 | 28.0 | 302 | 0.094 | 28.3 | 4 | 0.153 | 0.6 |

| Saval | 51 | 0.148 | 7.6 | 315 | 0.085 | 26.7 | 367 | 0.093 | 34.3 | 10 | 0.083 | 0.8 |

| Wright Window | 5 | 0.174 | 0.9 | 115 | 0.090 | 10.3 | 120 | 0.094 | 11.2 | 5 | 0.088 | 0.4 |

| Pie Creek | - | - | - | 225 | 0.086 | 19.2 | 225 | 0.086 | 19.2 | 5 | 0.089 | 0.5 |

| Road Canyon | - | - | - | 17 | 0.070 | 1.2 | 17 | 0.070 | 1.2 | 187 | 0.081 | 15.2 |

| Stockpiles | 37 | 0.124 | 4.6 | 254 | 0.049 | 12.4 | 291 | 0.059 | 17.1 | - | - | - |

| Open Pit Resource | 144 | 0.128 | 18.3 | 1,654 | 0.084 | 139.3 | 1,798 | 0.088 | 157.6 | 216 | 0.082 | 17.8 |

| | | | | | | | | | | | | |

| Underground | | | | | | | | | | | | |

| Smith | 2,980 | 0.200 | 597.3 | 2,214 | 0.204 | 452.1 | 5,193 | 0.202 | 1,049.4 | 977 | 0.179 | 174.6 |

| SSX Including West Mahala | 1,205 | 0.201 | 242.6 | 2,438 | 0.198 | 481.7 | 3,643 | 0.199 | 724.3 | 2,508 | 0.173 | 433.6 |

| Saval | 17 | 0.276 | 4.6 | 160 | 0.247 | 39.6 | 177 | 0.250 | 44.2 | 51 | 0.238 | 12.2 |

| Murray | 142 | 0.163 | 23.1 | 404 | 0.165 | 66.8 | 545 | 0.165 | 89.9 | 61 | 0.162 | 10.0 |

| Starvation | 24 | 0.238 | 5.8 | 946 | 0.176 | 166.8 | 970 | 0.178 | 172.6 | 21 | 0.170 | 3.6 |

| Winters Creek | - | - | - | 117 | 0.112 | 13.1 | 117 | 0.112 | 13.1 | 10 | 0.145 | 1.5 |

| Underground Resource | 4,367 | 0.200 | 873.4 | 6,278 | 0.194 | 1,220.1 | 10,645 | 0.197 | 2,093.5 | 3,629 | 0.175 | 635.4 |

| Resource Total | 4,511 | 0.198 | 891.7 | 7,932 | 0.171 | 1,359.4 | 12,443 | 0.181 | 2,251.1 | 3,845 | 0.170 | 653.2 |

Notes:

| (1) | Mineral Resources that are not mineral reserves do not have demonstrated economic viability; |

| (2) | Open Pit Mineral Resources are contained within Lerch Grossman pit shells constructed at $1,620/oz. gold price and meet the minimum cutoff grade; |

| (3) | Open Pit Mineral Resources include 5% mining losses and 5% dilution; |

| (4) | Underground Mineral Resources are constrained to 0.10 opt grade shells and occur outside existing asbuilts workings and sterilized areas, and are deemed by the Qualified Person to be potentially economic; and |

| (5) | Underground Mineral Resources include 5% mining losses and 5-10% dilution. |

Mineral Reserves Estimate

Mineral Reserves as of December 31, 2012 are listed below. The following parameters were used to determine Mineral Reserves for each area:

| · | A three-year average trailing gold price of $1,490 per ounce |

| · | Grade dependent gold recoveries varying from 75% to 90% |

| · | $0.40 per ounce refining charges |

| · | Open pit cut off grades vary from a low of 0.043 to 0.046 opt |

| · | Underground cut off grades vary from 0.106 to 0.116 opt. |

Jerritt Canyon mineral reserves – December 31, 2012

| | Proven | Probable | Proven + Probable |

| Area | kt | opt | koz | kt | opt | koz | kt | opt | koz |

| Open Pit | | | | | | | | | |

| Burns Basin | 32 | 0.100 | 3.2 | 391 | 0.101 | 39.6 | 423 | 0.101 | 42.8 |

| Mill Creek | 3 | 0.089 | 0.3 | 194 | 0.090 | 17.4 | 197 | 0.090 | 17.7 |

| Saval | 51 | 0.155 | 7.9 | 32 | 0.089 | 2.9 | 83 | 0.129 | 10.8 |

| Wright Window | 5 | 0.174 | 0.9 | 109 | 0.093 | 10.1 | 114 | 0.096 | 11.0 |

| Stockpiles | 37 | 0.124 | 4.6 | 167 | 0.053 | 8.9 | 204 | 0.066 | 13.5 |

| Open Pit Reserve | 128 | 0.131 | 17.0 | 892 | 0.088 | 78.9 | 1,021 | 0.094 | 95.7 |

| | | | | | | | | | |

| Underground | | | | | | | | | |

| Smith | 1,750 | 0.162 | 283.5 | 1,262 | 0.168 | 211.8 | 3,012 | 0.164 | 495.3 |

| SSX Including West Mahala | 566 | 0.172 | 97.5 | 1,056 | 0.159 | 167.4 | 1,621 | 0.163 | 272.0 |

| Saval | 18 | 0.239 | 4.3 | 150 | 0.203 | 30.4 | 168 | 0.207 | 34.8 |

| Murray | 142 | 0.163 | 23.1 | 354 | 0.166 | 58.6 | 495 | 0.165 | 81.7 |

| Starvation | 24 | 0.238 | 5.8 | 946 | 0.176 | 166.8 | 970 | 0.178 | 172.6 |

| Underground Reserve | 2,499 | 0.166 | 414.3 | 3,766 | 0.169 | 635.0 | 6,266 | 0.167 | 1,049.3 |

| Reserve Total | 2,628 | 0.164 | 431.1 | 4,659 | 0.153 | 713.9 | 7,287 | 0.157 | 1,145.0 |

The reserves listed above are a subset of the resources listed in the first table. Dewatering of some of the Smith, West Mahala and Murray reserve areas that lie below the water table will be required. The operating and capital costs at these mines contain provisions for construction and operation of the dewatering systems. The processing plant requires 700 gpm of makeup water which is derived from seepage wells surrounding the existing tailings storage facility (TSF-1) and from fresh water supply wells. With the replacement of TSF-1, the source of seepage water will gradually diminish and ultimately will no longer be available. Mine dewatering operations will replace the TSF-1 seepage over time. A water treatment plant and rapid infiltration basin (RIB) will be required to dispose of dewatering in excess of the 700 gpm process water requirement.

From January 1, 2012 to December 31, 2012 Jerritt Canyon processed 978 ktons of ore containing 127.7 kozs from Smith, SSX and stockpile sources (Hofer, W. 2013). During the year all ores processed at Jerritt Canyon were from onsite sources and no ore from offsite was processed.

Reserve additions net of depletion total 84 koz relative to the previous NI 43-101 report and the gains are concentrated at the Starvation and Smith underground mines with lesser additions at Burns Basin open pit. Stockpile reserves decreased by 44 koz due to depletion and reclassification based on a trenching sampling program conducted in 2012. Reserves at the SSX-Steer underground (including West Mahala) and Murray underground decreased slightly.

Conclusions

The six year Life of Mine Reserves Plan will produce robust financial results. Achieving sustained ore mining and processing rates of 1.5 million tons per year is critical to the success of the Jerritt Canyon mine operation. In 2013 ore will be sourced from the Smith and SSX underground mines, new underground mine at Starvation Canyon, and low grade ore stockpiles.

Recommendations

Additional ore sources need to be developed at the Saval Underground and Burns Basin Pit during the next two years to enhance production and replace the stockpile ores as they are depleted. Reopening of the Murray underground mine and adding to open pit reserves will be required to maintain processing rates at the desired level over the 6 year reserve life.

Resource conversion near the existing and planned underground workings should remain a drilling priority. Conversion of resources near the planned open pits could also significantly add to the project life and economics.

Dewatering will be necessary to recover 234 koz of the current reserves located in the Smith, SSX and Murray mines. Engineering and permitting of the dewatering facilities must be a high priority to ensure these reserves are available when needed.

Mining operations can implement more economical mining plans including raising the cutoff grade and including inferred resources in the LOM plan. The processing of third party toll milling ores to increase and maximize the mill capacity would also help lower the operating cost per ton and increase revenue but cannot be included in the present Cash flow Analysis due to NI 43-101 rules that limit this work to reserve materials sourced from the Jerritt Canyon property.

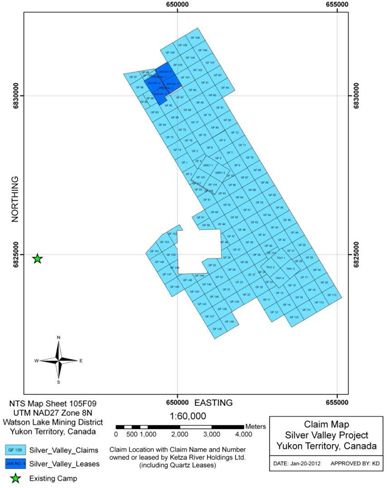

Ketza River Property

The Company conducted a number of environmental and social impact studies relating to the Yukon Environmental and Socio-economic Assessment Board (YESAB) project proposal and application that was submitted in late September 2011. The Company currently manages its environmental compliance program in the Yukon Territory with onsite personnel to administer the monitoring requirements with occasional help from contracted environmental engineering firms during the YESSA application period. There are regular consultations with the Yukon Territorial Government to ensure the Company is complying with regulatory requirements. In February 2013, the Company submitted responses to the first set of questions from YESAB as part of the Adequacy Review process and has now received an extension to July 2014 to answer the following rounds of inquiries. After the application has successfully passed Adequacy Review, the Screening process will continue. Approval of this project proposal will allow the Company to commence construction of the tailings facility at the site and allow for mine production.

Risk Factors

VG’s indebtedness and the conditions and restrictive covenants imposed on VG by various financing agreements could materially and adversely affect VG’s business and results of operations.

The Company is a party to various financing agreements, including various forward gold purchase contracts. Under the forward gold purchase contracts, the Company has committed to deliver specified amounts of gold in the aggregate amount of 121,808 ounces as of March 28, 2013 over specified periods of time in consideration for gross cash payments from the lenders. The Company’s ability to meet regularly scheduled gold deliveries under the forward gold purchase contracts will depend on the Company’s future operating performance, which in turn will depend on prevailing economic conditions and other factors, many of which may be beyond the Company’s control.

In addition, the Company’s forward gold purchase contracts include various conditions and covenants that require VG to obtain lenders’ consents prior to carrying out certain activities and entering into certain transactions, such as incurring additional debt, creating additional charges on Company assets, and providing additional guarantees or disposing of certain assets.

As a result of the restrictive covenants or other terms of any existing or new loan or other financing agreements, the Company may be significantly restricted in its ability to raise additional capital through bank borrowings and debt to engage in some transactions that VG expects to be of benefit to the Company. The inability to meet these conditions and covenants or obtain lenders’ consent to carry out restricted activities could materially and adversely affect the business and results of operations of VG.

On December 18, 2013 operations at the Company's Jerritt Canyon processing facility were interrupted due to an electrical arc-flash explosion that took place in the primary crushing building. This incident affected various areas of the remaining milling operations and resulted in an unscheduled temporary shut-down of the Jerritt Canyon operations for the remainder of December. This interruption negatively affected production during the December and the fourth quarter of 2013, ultimately leading to a significant shortfall in production and the Company being unable to make the scheduled December 2013 gold deliveries under each of the two forward gold purchase agreements held with Deutsche Bank AG, London Branch (“DB”). On January 28, 2014 the Company received a notice of default from DB in respect of the failure to make the scheduled December 31, 2013 payment. Under the terms of the Gold Facility the default cannot be cured, however both parties are actively working to a resolution to ensure the continuation of the Company’s operations for the benefit of the shareholders.

Changes in the market price of gold and other precious metals, which in the past have fluctuated widely, affect the financial condition of VG.

The Company’s profitability and long-term viability depend, in large part, upon the market price of gold and other metals and minerals produced from the Company’s mineral properties. The market price of gold and other precious metals is volatile and is impacted by numerous factors beyond the Company’s control, including:

| · | global or regional consumption patterns; |

| · | expectations with respect to the rate of inflation; |

| · | the relative strength of the U.S. dollar and certain other currencies; |

| · | global or regional political or economic conditions, including interest rates and currency values; |

| · | supply and demand for jewellery and industrial products containing metals; and |

| · | sales by central banks and other holders, speculators and producers of metals in response to any of the above factors. |

The Company cannot predict the effect of these factors on metal prices. A decrease in the market price of gold and other precious metals could affect the Company’s ability to finance its mineral projects. There can be no assurance that the market price of gold and other precious metals will remain at current levels or that such prices will improve. In particular, an increase in worldwide supply, and consequent downward pressure on prices, may result over the longer term from increased production from mines developed or expanded as a result of current metal price levels.

Changes in environmental regulations and permits could impact the ability or cost of VG to operate either the Nevada or Yukon properties.

The Company’s operations and exploration and development activities in Canada and the United States are subject to extensive federal, state, provincial, territorial and local laws and regulations governing various matters, including management of natural resources and environmental protections. The Company’s current and anticipated future operations, including further exploration and development activities and commencement of production on the Company’s properties, require permits from various United States and Canadian federal, state, provincial, territorial and local governmental authorities. There can be no assurance that all permits that the Company requires for the construction of mining facilities, to conduct mining operations and to conduct its other operations will be obtainable on reasonable terms, or at all. Delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that the Company has obtained, could have a material adverse impact on the Company.

The mine at Jerritt Canyon is currently operating under the Consent Decree relating to certain environmental issues that the Company is to address. Delays or a failure to remedy such issues could have a material adverse impact on the Company.

Operating costs and production are subject to a number of external factors that could impact the sustainability of the Jerritt Canyon mining operations.

The cost of gold production may be impacted by numerous variables including mined ore grade and gold recovery, backfill and development required, fuel and consumable costs, labour and benefit cost, equipment operating and maintenance costs, and numerous other factors.

Production risk factors may include poor gold recovery, unavailability of skilled labour and management, labour issues with the existing workforce, availability of mining equipment, availability of consumables used in mining, mine pan implementation, weather, governmental regulations and other operating factors.

The figures for VG’s resources and reserves are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in this Annual Information Form and in the Company’s other filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by Company personnel and independent geologists. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. There can be no assurance that:

| · | these estimates will be accurate; |

| · | reserve, resource or other mineralization figures will be accurate; or |

| · | this mineralization could be mined or processed profitably. |

Mineralization estimates for the Company’s properties may require adjustments or downward revisions based upon further exploration or development work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that minerals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production scale.

The estimating of mineral reserves and mineral resources is a subjective process that relies on the judgment of the persons preparing the estimates. The process relies on the quantity and quality of available data and is based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and reserve estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. There can be no assurances that actual results will meet the estimates contained in studies. As well, further studies are required.

Estimated mineral reserves or mineral resources may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence mineral reserve or mineral resource estimates. The extent to which mineral resources may ultimately be reclassified as mineral reserves is dependent upon the demonstration of their profitable recovery. Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. The Company cannot provide assurance that mineralization can be mined or processed profitably.

The resource and reserve estimates contained herein have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for precious metals may render portions of the Company’s mineralization uneconomic and result in reduced reported mineralization. Any material reductions in estimates of mineralization, or of the Company’s ability to extract this mineralization, could have a material adverse effect on VG’s results of operations or financial condition.

The failure to establish proven and probable reserves could restrict the Company’s ability to successfully implement its strategies for long-term growth and could impact future cash flows, earnings, results of operation and financial condition.

VG’s ability to continue its production and exploration activities, and to continue as a going concern, will depend in part on its ability to continue production and generate material revenues or to obtain suitable financing.

VG has limited financial resources. In the future, the Company’s ability to continue its production and exploration activities, if any, will depend in part on the Company’s ability to continue production and generate material revenues or to obtain suitable financing. Any unexpected costs, problems or delays could severely impact the Company’s ability to continue these activities.

There can be no assurance that the Company will continue production at its Jerritt Canyon Mine or generate sufficient revenues to meet its obligations as they become due or obtain necessary financing on acceptable terms, if at all. The Company’s failure to meet its ongoing obligations on a timely basis could result in the loss or substantial dilution of the Company’s interests (as existing or as proposed to be acquired) in its properties. In addition, should the Company incur significant losses in future periods, it may be unable to continue as a going concern, and realization of assets and settlement of liabilities in other than the normal course of business may be at amounts materially different than the Company’s estimates.

VG is exposed to credit, liquidity, interest rate and currency risk.

Credit risk is the risk of an unexpected loss if a customer or third party to a financial instrument fails to meet its contractual obligations. The Company’s cash equivalents and short-term investments are held through large Canadian financial institutions. Short-term and long-term investments (including those presented as part of cash and cash equivalents) are composed of financial instruments issued by Canadian banks and companies with high investment-grade ratings. These investments mature at various dates over the current operating period.

Liquidity risk is the risk of loss from not having sufficient funds to meet financial obligations as they fall due. The Company manages liquidity risk through forecasting its cash flows from operations and anticipating investing and financing activities. Senior management is actively involved in the review and approval of planned expenditures and typically ensures that it has sufficient cash on demand to meet expected operating expenses.

Interest rate risk is the risk that the fair values and future cash flows of the Company will fluctuate because of changes in market interest rates. The Company is exposed to interest rate risk on its cash and cash equivalents. The Company’s cash and cash equivalents contain highly liquid investments that earn interest at market rates. Fluctuations in market interest rates do not have a significant impact on the Company’s results from operations due to the short term to maturity of the investments held.

The Company is exposed to the financial risk related to the fluctuation of foreign exchange rates. The Company operates in Canada and the United States and a portion of its expenses are incurred in U.S. dollars. A significant change in the currency exchange rates between the Canadian dollar relative to the U.S. dollar could have an effect on the Company’s results of operations, financial position or cash flows. The Company has not hedged its exposure to currency fluctuations.

VG’s ability to continue as a going concern is dependent on raising additional capital, which it may not be able to do on favorable terms, or at all.

VG will need to raise additional capital to support its continuing operations. The Company can provide no assurance that additional funding will be available on a timely basis, on terms acceptable to the Company, or at all. If the Company is unsuccessful raising additional funding, its business may not continue as a going concern. Even if the Company does find additional funding sources, it may be required to issue securities with greater rights than those currently possessed by holders of its common shares. The Company may also be required to take other actions that may lessen the value of its common shares or dilute its common shareholders, including borrowing money on terms that are not favorable to the Company or issuing additional equity securities. If the Company experiences difficulties raising money in the future, its business and liquidity will be materially adversely affected.

General economic conditions may adversely affect VG’s growth, future profitability and ability to finance.

The unprecedented events in global financial markets in the past several years have had a profound impact on the global economy. Many industries, including the mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations, high volatility in global equity, commodity, foreign exchange and precious metal markets and a lack of market liquidity. A worsening or slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates and tax rates, may adversely affect the Company’s growth and ability to finance. Specifically:

| · | the global credit/liquidity crisis could impact the cost and availability of financing and the Company’s overall liquidity; |

| · | the volatility of metal prices would impact the Company’s revenues, profits, losses and cash flow; |

| · | negative economic pressures could adversely impact demand for the Company’s production; |

| · | construction related costs could increase and adversely affect the economics of any of the Company’s projects; |

| · | volatile energy, commodity and consumables prices and currency exchange rates would impact the Company’s production costs; and |

| · | the devaluation and volatility of global stock markets would impact the valuation of the Company’s equity and other securities. |

Significant uncertainty exists related to inferred mineral resources.

There is a risk that inferred mineral resources referred to herein cannot be converted into measured or indicated mineral resources as there may be limited ability to assess geological continuity. Due to the uncertainty relating to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute measured and indicated resources as a result of continued exploration. See“Cautionary Note to United States Investors”.

Mining is inherently dangerous and subject to conditions or events beyond VG’s control, which could have a material adverse effect on VG’s business.

Mining involves various types of risks and hazards, including:

| · | metallurgical and other processing problems; |

| · | unusual or unexpected rock formations; |

| · | structural cave-ins or slides; |

| · | landslides and avalanches; |

| · | mechanical equipment and facility performance problems; |

| · | availability of materials and equipment; |

| · | periodic interruptions due to inclement or hazardous weather conditions. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties; personal injury or death, including to employees; environmental damage; delays in mining; increased production costs; asset write downs; monetary losses; and possible legal liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to the Company or to other companies within the mining industry. The Company may suffer a material adverse impact on its business if it incurs losses related to any significant events that are not covered by its insurance policies.

Exploration, construction and production activities may be limited and delayed by inclement weather and shortened exploration, construction and development seasons.

VG is subject to certain uninsured risks which may result in losses and have a material adverse effect upon the financial performance and results of operations of VG.

The Company’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, fire and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company’s properties or the properties of others, delays in mining, monetary losses and possible legal liability.

The Company currently maintains a limited amount of liability insurance. Although the Company may in the future maintain additional insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with a mining company’s operations. VG may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. The Company might also become subject to liability for pollution or other hazards which may not be insured against or which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

VG requires various permits to conduct its current and anticipated future operations, and delays or failures in renewing such permits, or a failure to comply with the terms of any such permits that VG has obtained, could have a material adverse impact on VG.

The Company’s current and anticipated future operations, including further exploration and development activities and commencement of production on the Company’s properties, require permits from various United States and Canadian federal, state, provincial, territorial and local governmental authorities. There can be no assurance that all permits that the Company requires for the construction of mining facilities and to conduct mining operations will be obtainable on reasonable terms, or at all. Delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that the Company has obtained, could have a material adverse impact on the Company.

The duration and success of efforts to obtain and renew permits are contingent upon many variables not within the Company’s control. Shortage of qualified and experienced personnel in the various levels of government could result in delays or inefficiencies. Backlog within the permitting agencies could affect the permitting timeline of the various projects. Other factors that could affect the permitting timeline include (i) the number of other large-scale projects currently in a more advanced stage of development which could slow down the review process and (ii) significant public response regarding a specific project. As well, it can be difficult to assess what specific permitting requirements will ultimately apply to all the projects.

VG is subject to significant regulation from various governmental authorities and failure to comply with their requirements may result in increased cost or an interruption in VG’s operations.

The Company’s operations and exploration and development activities in Canada and the United States are subject to extensive federal, state, provincial, territorial and local laws and regulations governing various matters, including:

| · | management of natural resources; |

| · | exploration and development of mines, production and post-closure reclamation; |

| · | taxation and mining royalties; |

| · | regulations concerning business dealings with native groups; |

| · | labor standards and occupational health and safety, including mine safety; and |

| · | historic and cultural preservation. |

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining, curtailing or closing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in the Company incurring significant expenditures. The Company may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements.It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of the Company’s operations and delays in the exploration and development of the Company’s properties.

VG has ongoing reclamation on some of its mineral properties and may be required to fund additional work that could have a material adverse effect on its financial position.

Land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance. Reclamation may include requirements to:

| · | treat ground and surface water to drinking water standards; |

| · | control dispersion of potentially deleterious effluents; and |

| · | reasonably re-establish pre-disturbance land forms and vegetation. |

Financial resources spent on reclamation might otherwise be spent on further exploration and development programs. In addition, regulatory changes could increase the Company’s obligations to perform reclamation and mine closing activities. There can be no assurance that the Company will not be required to fund additional reclamation work at these sites that could have a material adverse effect on the Company’s financial position.

Title and other rights to VG’s mineral properties cannot be guaranteed, are subject to agreements with other parties and may be subject to prior unregistered agreements, transfers or claims and other defects.

The Company cannot guarantee that title to its properties will not be challenged. The Company may not have, or may not be able to obtain, all necessary surface rights to develop a property. Title insurance is generally not available for mineral properties and the Company’s ability to ensure that it has obtained secure claim to individual mineral properties or mining concessions may be severely constrained. The Company’s mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. The Company has not conducted surveys of all of the claims in which it holds direct or indirect interests. A successful challenge to the precise area and location of these claims could result in the Company being unable to operate on its properties as permitted or being unable to enforce its rights with respect to its properties. This could result in the Company not being compensated for its prior expenditure relating to the property.

VG currently relies on a limited number of properties.

The principal property interests of the Company are currently its interest in the properties known as the Jerritt Canyon gold mine in Nevada and the Ketza River and Silver Valley Properties in the Yukon Territory. As a result, unless the Company acquires additional property interests, any adverse developments affecting those properties could have a material adverse effect upon the Company and could materially and adversely affect the potential mineral resource production, profitability, financial performance and results of operations of the Company.

VG’s issuance of debt may impair its ability to take advantage of future business opportunities.

The Company may enter into transactions to acquire assets or the shares of other corporations which may be financed partially or wholly with debt, which may increase its debt levels above industry standards. The Company’s articles do not limit the amount of indebtedness that it can incur. The level of the Company’s indebtedness could impair its ability to obtain additional financing in the future to take advantage of business opportunities that may arise.

VG may be subject to legal proceedings.

Due to the nature of its business, the Company may be subject to numerous regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of its business. The results of these legal proceedings cannot be predicted with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on the Company’s business.

Increased competition could adversely affect VG’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

The mining industry is intensely competitive. Significant competition exists for the acquisition of properties producing or capable of producing metals. The Company may be at a competitive disadvantage in acquiring additional mining properties because it must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than the Company or are further advanced in their development or are significantly larger and have access to greater mineral reserves, for the acquisition of mineral claims, leases and other mineral interests. The Company may also encounter increasing competition from other mining companies in its efforts to hire experienced mining professionals. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower, drill rigs and helicopters. Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future. If the Company is unsuccessful in acquiring additional mineral properties or qualified personnel, it will not be able to grow at the rate it desires, or at all.

VG may experience difficulty attracting and retaining qualified management and technical personnel to meet the needs of its anticipated growth, and the failure to manage VG’s growth effectively could have a material adverse effect on VG’s business and financial condition.

The Company is dependent on the services of key executives. Due to the Company’s relatively small size, the loss of these persons or the Company’s inability to attract and retain additional highly skilled employees required for the development of the Company’s activities may have a material adverse effect on the Company’s business or future operations.

There can be no assurance that VG will successfully acquire additional mineral rights.

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery of ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. If current exploration programs do not result in the discovery of commercial ore, the Company may need to write-off part or all of its investment in existing exploration stage properties, and may need to acquire additional properties. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

VG’s future growth and productivity will depend, in part, on its ability to identify and acquire additional mineral rights, and on the costs and results of continued exploration and development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

| · | establish ore reserves through drilling and metallurgical and other testing techniques; |

| · | determine metal content and metallurgical recovery processes to extract metal from the ore; and |

| · | construct, renovate or expand mining and processing facilities. |

In addition, if the Company discovers a mineral deposit, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional mineral rights.

Some of the directors have conflicts of interest as a result of their involvement with other natural resource companies.

Certain of the directors of the Company also serve as directors, or have significant shareholdings in, other companies involved in natural resource exploration and development or mining-related activities. To the extent that such other companies may participate in ventures in which the Company may participate in, or in ventures which the Company may seek to participate in, the directors may have a conflict of interest. In all cases where the directors have an interest in other companies, such other companies may also compete with the Company for the acquisition of mineral property investments. Such conflicts of the directors may result in a material and adverse effect on the Company’s profitability, results of operation and financial condition. As a result of these conflicts of interest, the Company may miss the opportunity to participate in certain transactions, which may have a material adverse effect on the Company’s financial position.

Global climate change is an international concern, and could impact VG’s ability to conduct future operations.

Global climate change is an international issue and receives an enormous amount of publicity. The Company would expect that the imposition of international treaties or U.S. or Canadian federal, state, provincial or local laws or regulations pertaining to mandatory reductions in energy consumption or emissions of greenhouse gasses could affect the feasibility of mining projects and increase operating costs.

Adverse publicity from non-governmental organizations could have a material adverse effect on the Company.

There is an increasing level of public concern relating to the effect of mining production on its surroundings, communities and environment. Non-governmental organizations (“NGOs”), some of which oppose resource development, are often vocal critics of the mining industry. While the Company seeks to operate in a socially responsible manner, adverse publicity generated by such NGOs related to extractive industries, or the Company's operations specifically, could have an adverse effect on the reputation and financial condition of the Company or its relationships with the communities in which it operates.

VG may be a “passive foreign investment company” under the U.S. Internal Revenue Code, which could result in adverse tax consequences for investors in the United States.