As filed with the Securities and Exchange Commission on June 28, 2019

Registration No. 333-229512

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10/A

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AMERICAS SILVER CORPORATION

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English (if applicable))

| Canada | | 1040 | | Not applicable |

(Province or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number (if applicable)) | | (I.R.S. Employer Identification Number (if applicable)) |

145 King Street West, Suite 2870

Toronto, Ontario, Canada M5H 1J8

(416) 848-9503

(Address and telephone number of Registrant’s principal executive offices)

C T Corporation System

1015 15th Street, NW, Suite 1000

Washington, District of Columbia 20005

(202) 572-3111

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

Michael Hickey John Wilkin Blake, Cassels & Graydon LLP 199 Bay Street Suite 4000, Commerce Court West Toronto, Ontario M5L 1A9 Canada (416) 863-2400 | Thomas M. Rose Shona C. Smith Troutman Sanders LLP 401 9th Street, NW Suite 1000 Washington, DC 20004 (202) 274-2950 |

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement.

Province of Ontario

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check appropriate box):

| A. | ¨ | upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| B. | x | at some future date (check appropriate box below) |

| | 1. | ¨ | pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing). |

| | 2. | ¨ | pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date). |

| | 3. | x | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | 4. | ¨ | after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box.x

Explanatory Note: The Registrant hereby amends its Registration Statement on Form F-10 (333-229512) filed with the Commission on February 5, 2019 (the “Original Registration Statement”) to include the final short form base shelf prospectus filed with the Canadian securities commissions on the date hereof, relating to the future offering of securities of the Registrant in Canada and the United States.

The Registrant previously paid the registration fee of US$4,572, in relation to the registration of up to US$37,720,000 aggregate maximum offering price of securities with the Original Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act of 1933, as amended (the “Securities Act”), or on such date as the Commission, acting pursuant to Section 8(a) of the Securities Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

This short form prospectus has been filed under legislation in the provinces of Alberta, British Columbia and Ontario that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such delivery requirements has been obtained.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission but is not yet effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Information has been incorporated by reference in this prospectus from documents filed with the United States Securities and Exchange Commission and with securities commissions or similar authorities in Canada.Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Americas Silver Corporation at 145 King Street West, Suite 2870, Toronto, Ontario, M5H 1J8, telephone (416) 848-9503 and are also available electronically at www.sec.gov/edgar.shtml or www.sedar.com.

SHORT FORM BASE SHELF PROSPECTUS

| New Issue and/or Secondary Offering | June 28, 2019 |

AMERICAS SILVER CORPORATION

C$50,000,000

Common Shares

Subscription Receipts

Warrants

Units

Americas Silver Corporation (“Americas Silver”, “we”, “us”, “our” or the “Company”) may from time to time offer and issue the following securities: (i) common shares (the “Common Shares”); (ii) subscription receipts (the “Subscription Receipts”); (iii) warrants (the “Warrants”); and (iv) securities comprised of more than one of the Common Shares, Subscription Receipts and/or Warrants offered together as a unit (the “Units”). The Common Shares, Subscription Receipts, Warrants and Units (collectively, the “Securities”) may be offered separately or together, in separate series, in amounts, at prices and on terms to be set forth in one or more shelf prospectus supplements (each a “Prospectus Supplement”) to be incorporated by reference in this short form base shelf prospectus (the “Prospectus”) for the purpose of such offering. Certain current or future holders of Common Shares (“Selling Securityholders”) may also offer and sell Common Shares pursuant to this Prospectus.

All shelf information not included in this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus, except in cases where an exemption from such delivery requirements has been obtained. The aggregate initial offering price of Securities that may be sold pursuant to this Prospectus during the 25-month period that this Prospectus, including any amendments hereto, remains valid is limited to C$50,000,000 (or the equivalent thereof in any other currency used to denominate Securities based on the applicable exchange rate at the time of issuance of such Securities).

We are permitted, as a Canadian issuer, under the multi-jurisdictional disclosure system adopted by the United States, to prepare this Prospectus and any Prospectus Supplement in accordance with Canadian disclosure requirements. You should be aware that such requirements are different from those of the United States.

The consolidated financial statements of the Company incorporated by reference herein are reported in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and thus may not be comparable to financial statements of United States companies.

Your ability to enforce civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of Canada, that some or all of our officers and directors may be residents of Canada, that some or all of the experts named in this Prospectus or in any Prospectus Supplement may be residents of Canada and that a substantial portion of our assets and all or a substantial portion of the assets of such persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

You should be aware that the acquisition of the Securities described herein may have tax consequences both in the United States and in Canada. Such tax consequences for investors who are residents in, or citizens of, the United States may not be described fully herein or in any applicable Prospectus Supplement. You should read the tax discussion in any applicable Prospectus Supplement; however, this Prospectus or any applicable Prospectus Supplement may not fully describe these tax consequences, and you should consult your tax adviser prior to making any investment in the Securities.

The specific terms of the Securities in respect of which this Prospectus is being delivered will be set forth in the applicable Prospectus Supplement and may include, where applicable: (A) in the case of Common Shares, (i) the person offering the shares (the Company and/or the Selling Securityholder(s)); (ii) the number of Common Shares offered; (iii) the offering price (in the event that the offering is a fixed price distribution); (iv) the manner of determining the offering price(s) (in the event that the offering is not a fixed price distribution); and (v) any other material specific terms; (B) in the case of Subscription Receipts, (i) the number of Subscription Receipts; (ii) the price at which the Subscription Receipts will be offered and whether the price is payable in instalments; (iii) conditions to the exchange of Subscription Receipts for Securities and the consequences of such conditions not being satisfied; (iv) the procedures for the exchange of the Subscription Receipts for Securities; (v) the number of underlying Securities that may be exchanged upon exercise of each Subscription Receipt; (vi) the dates or periods during which the Subscription Receipts may be exchanged for Securities; (vii) whether the Subscription Receipts and underlying Securities will be listed on any securities exchange; (viii) whether the Subscription Receipts and underlying Securities will be issued in fully registered or “book-entry only” form; (ix) any other rights, privileges, restrictions and conditions attaching to the Subscription Receipts; (x) any risk factors associated with the Subscription Receipts and underlying Securities; and (xi) any other material specific terms; (C) in the case of Warrants, (i) the designation of the Warrants; (ii) the aggregate number of Warrants offered and the offering price; (iii) the quantity and terms of the Securities purchasable upon exercise of the Warrants, and procedures that will result in the adjustment of those numbers; (iv) the exercise price of the Warrants; (v) the dates or periods during which the Warrants are exercisable; (vi) any minimum or maximum number of Warrants that may be exercised at any one time; (vii) whether the Warrants will be listed on any securities exchange; (viii) any terms, procedures and limitations relating to the transferability or exercise of the Warrants; (ix) whether the Warrants will be issued in fully registered or “book-entry only” form; (x) any other rights, privileges, restrictions and conditions attaching to the Warrants; (xi) any risk factors associated with the Warrants; and (xii) any other material specific terms; and (D) in the case of Units, (i) the designation and terms of the Units and of the Securities comprising the Units, including whether and under what circumstances those Securities may be held or transferred separately; (ii) any provisions for the issuance, payment, settlement, transfer or exchange of the Units or of any Securities comprising the Units; (iii) whether the Units will be issued in fully registered or “book-entry only” form; (iv) any risk factors associated with the Units; (v) whether the Units and the Securities comprising the Units will be listed on any securities exchange; and (vi) any other material specific terms. A Prospectus Supplement may include specific variable terms pertaining to the Securities that are not within the alternatives and parameters described in this Prospectus.

The outstanding Common Shares are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “USA” and on the NYSE American LLC (the “NYSE American”) under the symbol “USAS”. On June 27, 2019, the last reported sale price of our Common Shares on the TSX was C$3.07 per Common Share and on the NYSE American was US$2.36 per Common Share. Unless otherwise specified in the applicable Prospectus Supplement, the Subscription Receipts, Warrants and Units will not be listed on any securities exchange.There is no market through which these Securities may be sold and purchasers may not be able to resell any Subscription Receipts, Warrants or Units purchased under this Prospectus and the applicable Prospectus Supplements. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities, and the extent of issuer regulation. See “Risk Factors” as well as the “Risk Factors” section of the applicable Prospectus Supplement.

The Securities may be sold to or through underwriters or dealers purchasing as principals, by the Company and/or, in the case of Common Shares, the Selling Securityholders or to one or more purchasers, directly pursuant to applicable statutory exemptions or through agents designated by the Company and/or the Selling Securityholders, as the case may be, from time to time. The Securities may be sold from time to time in one or more transactions at a fixed price or prices or at non-fixed prices. If offered on a non-fixed price basis, the Securities may be offered at market prices prevailing at the time of sale (including, without limitation, sales deemed to be “at-the-market distributions” as defined in National Instrument 44-102 –Shelf Distributions, including sales made directly on the TSX and the NYSE American or other existing trading markets for the Securities), at prices determined by reference to the prevailing price of a specified security in a specified market or at prices to be negotiated with purchasers, in which case the compensation payable to an underwriter, dealer or agent in connection with any such sale will be decreased by the amount, if any, by which the aggregate price paid for the Securities by the purchasers is less than the gross proceeds paid by the underwriter, dealer or agent to the Corporation. The price at which the Securities will be offered and sold may vary from purchaser to purchaser and during the period of distribution. See “Plan of Distribution”. Each Prospectus Supplement will identify the person offering Securities (the Company and/or, in the case of Common Shares, the Selling Securityholders) and each underwriter, dealer or agent engaged in connection with the offering and sale of those Securities to which the Prospectus Supplement relates, and will also set forth the method of distribution and the terms of the offering of such Securities including the net proceeds to the Company or, in the case of Common Shares, to the Company and/or the Selling Securityholders, as the case may be, and, to the extent applicable, any fees, discounts or other compensation payable to the underwriters, dealers or agents. Unless otherwise specified in a Prospectus Supplement, the offerings are subject to approval of certain legal matters by Blake, Cassels & Graydon LLP on behalf of the Company and/or the Selling Securityholders.

Subject to any applicable securities legislation, and other than in relation to an “at-the-market distribution”, in connection with any offering of the Securities (unless otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect transactions which stabilize, maintain or otherwise affect the market price of the Securities offered at levels other than those which might otherwise prevail on the open market. These transactions may be commenced, interrupted or discontinued at any time. See “Plan of Distribution”.

Americas Silver’s head office and registered office is located at 145 King Street West, Toronto, Ontario, M5H 1J8, Canada.

Alan Edwards and Manuel Rivera, two of the Company’s directors, reside outside of Canada and each has appointed Americas Silver Corporation, 145 King Street West, Toronto, Ontario, M5H 1J8, as agent for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if such person has appointed an agent for service of process. See “Service of Process and Enforceability of Civil Liabilities”.

No underwriter has been involved in the preparation of this Prospectus or performed any review of the contents of this Prospectus.

Except as noted, all dollar amounts are expressed in U.S. Dollars. All references to “US$” or “$” are to U.S. Dollars and all references to “C$” are to Canadian Dollars.

TABLE OF CONTENTS

CAUTION REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements made in this Prospectus, including the documents incorporated by reference herein, contain forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders in understanding management’s views regarding those future outcomes and may not be appropriate for other purposes. When used in this Prospectus, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Specific forward-looking statements in this Prospectus, including the documents incorporated by reference herein, include, but are not limited to: any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; estimates of mineral reserves and resources; the realization of mineral reserve estimates; the impairment of mining interests and non-producing properties; the timing and amount of estimated future production, production guidance, costs of production, capital expenditures, costs and timing of development; the success of exploration and development activities; permitting timelines; government regulation of mining operations; environmental risks; the going concern assumption; the timing and possible outcomes of pending disputes or litigation; negotiations or regulatory investigations; exchange rate fluctuations; cyclical or seasonal aspects of our business; our dividend policy; capital expenditures; the potential benefits of the Transaction to shareholders of Americas Silver; statements relating to the financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of Americas Silver; the liquidity of the Common Shares and Americas Silver’s non-voting preferred shares to be created pursuant to the Transaction; statements based on the unaudited pro forma financial statements of Americas Silver attached as Appendix “G” to the Special Meeting Circular (as defined herein); and other events or conditions that may occur in the future.

Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict, that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Some of the risks and other factors, some of which are beyond Americas Silver’s control, which could cause results to differ materially from those expressed in the forward-looking statements and information contained in this Prospectus, including the documents incorporated by reference herein, include, but are not limited to: risks associated with market fluctuations in commodity prices; risks related to changing global economic conditions, which may affect the Company’s results of operations and financial condition; the Company is dependent on the success of the San Rafael project as its Cosalá Operations and the Galena Complex, which are both exposed to operational risks; risks related to mineral reserves and mineral resources, development and production and the Company’s ability to sustain or increase present production; risks related to global financial and economic conditions; risks related to government regulation and environmental compliance; risks related to mining property claims and titles, and surface rights and access; risks related to labour relations, employee recruitment and retention and pension funding; some of the Company’s material properties are located in Mexico and are subject to changes in political and economic conditions and regulations in that country; risks related to the Company’s relationship with the communities where it operates; risks related to actions by certain non-governmental organizations; substantially all of the Company’s assets are located outside of Canada, which could impact the enforcement of civil liabilities obtained in Canadian and U.S. courts; risks related to currency fluctuations that may adversely affect the financial condition of the Company; the Company may need additional capital in the future and may be unable to obtain it or to obtain it on favourable terms; risks associated with the Company’s outstanding debt and our ability to make scheduled payments of interest and principal thereon; the Company may engage in hedging activities; risks associated with the Company’s business objectives; risks related to competition in the mining industry; and there is currently no trading market for any Subscription Receipts, Warrants or Units that may be offered pursuant to this Prospectus and any Prospectus Supplement. The Company is also subject to risks and factors related to the Transaction – see “Risk Factors”, beginning on page 76 of the Special Meeting Circular (as defined herein).

This is not an exhaustive list of the factors that may affect any of the Company’s forward-looking statements. Some of these and other factors are discussed in more detail in the section entitled “Forward-Looking Statements” in the “Management’s Discussion and Analysis” contained in our Annual MD&A. Investors and others should carefully consider these and other factors and not place undue reliance on the forward-looking statements. Further information regarding these and other risk factors is included in the Company’s public filings with provincial securities regulatory authorities which can be found on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website at www.sedar.com and with the SEC which can be found on the Electronic Data-Gathering, Analysis and Retrieval (“EDGAR”) website at www.sec.gov/edgar.shtml.

The forward-looking statements contained in this Prospectus represent the Company’s views only as of the date such statements were made. Forward-looking statements contained in this Prospectus are based on management’s plans, estimates, projections, beliefs and opinions as at the time such statements were made and the assumptions related to these plans, estimates, projections, beliefs and opinions may change. Although the Company believes that the expectations reflected in the forward-looking statements were reasonable at the time such statements were made, there can be no assurance that such expectations will prove to be correct. The Company cannot guarantee future results, levels of activity, performance or achievements and actual results or developments may differ materially from those contemplated by the forward-looking statements. While the Company anticipates that subsequent events and developments may cause the Company’s views to change, the Company does not undertake to update any forward-looking statements, except to the extent required by applicable securities laws.

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

This Prospectus, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of Proven and Probable Reserves (“Mineral Reserves” or “Reserves”) used in NI 43-101 differ from the definitions in the SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of Inferred Mineral Resources may not form the basis of feasibility or prefeasibility studies, except in certain specific cases. Additionally, disclosure of “contained ounces” in a resource is permitted disclosure under Canadian securities laws, however the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements.

Accordingly, information contained in this Prospectus and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

See Appendix A to the Annual Information Form (as defined herein), which is incorporated by reference herein, for a description of certain of the mining terms used in this Prospectus and the documents incorporated by reference herein.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada.

The following documents of the Company, filed with the securities commissions or similar authorities in the provinces of Alberta, British Columbia and Ontario, are specifically incorporated by reference in and form an integral part of this Prospectus:

| (a) | the Company’s annual information form dated March 29, 2019 for the year ended December 31, 2018 (the “Annual Information Form”); |

| (b) | the audited consolidated financial statements of the Company as at and for the years ended December 31, 2018 and 2017 and the reports of the auditors thereon (the “Annual Financial Statements”); |

| (c) | management’s discussion and analysis of the Company for the year ended December 31, 2018 (the “Annual MD&A”); |

| (d) | the management information circular of the Company dated December 4, 2018 with respect to the special meeting of shareholders of the Company held on January 9, 2019 (the “Special Meeting Circular”); |

| (e) | the management information circular dated April 18, 2019 with respect to the annual and special meeting of shareholders of the Company to be held on May 15, 2019; |

| (f) | the material change reports of the Company each dated April 12, 2019 in respect of the Sandstorm Financing (as defined herein) and the completion of the Transaction (as defined herein); |

| (g) | the business acquisition report of the Company dated May 13, 2019 (the “BAR”); |

| (h) | the interim consolidated financial statements of the Company as at and for the three months ended March 31, 2019 and 2018, but excluding the “Notice of No Auditor Review of Condensed Interim Consolidated Financial Statements” contained therein; and |

| (i) | management’s discussion and analysis of the Company for the three months ended March 31, 2019. |

All documents of the Company of the type described in Section 11.1(1) of Form 44-101F1 —Short Form Prospectus to National Instrument 44-101 —Short Form Prospectus Distributions (“NI 44-101”), if filed by the Company with the provincial securities commissions or similar authorities in Canada after the date of this Prospectus and during the currency of this Prospectus, shall be deemed to be incorporated by reference into this Prospectus. In addition, to the extent that any document or information incorporated by reference into this Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC after the date of this Prospectus, such document or information shall be deemed to be incorporated by reference as an exhibit to the registration statement on Form F-10 of which this Prospectus forms a part. In addition, the Company may incorporate by reference into this Prospectus, or the registration statement on Form F-10 of which it forms a part, other information from documents that the Company will file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, if and to the extent expressly provided therein.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at its head office at 145 King Street West, Suite 2870, Toronto, Ontario, M5H 1J8, Canada, telephone (416) 848-9503, and are also available electronically in Canada through the SEDAR at www.sedar.com or in the United States through EDGAR at the website of the SEC at www.sec.gov. The filings of the Company through SEDAR and EDGAR are not incorporated by reference in this Prospectus except as specifically set out herein.

Any template version of any “marketing materials” (as such term is defined in NI 44-101) filed after the date of a Prospectus Supplement and before the termination of the distribution of the Securities offered pursuant to such Prospectus Supplement (together with this Prospectus) is deemed to be incorporated by reference in such Prospectus Supplement.

A Prospectus Supplement containing the specific terms in respect of any Securities and the offering thereof will be delivered, together with this Prospectus, to purchasers of such Securities (except in cases where an exemption from such delivery requirements has been obtained) and will be deemed to be incorporated into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement, but only for the purposes of the distribution of the Securities to which such Prospectus Supplement pertains.

Any statement contained herein, including any document (or part of a document) incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any other currently or subsequently filed document (or part of a document) that is later dated and also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

Upon a new interim financial report and related management’s discussion and analysis of the Company being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous interim financial report and related management’s discussion and analysis of the Company most recently filed shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder. Upon new annual financial statements and related management’s discussion and analysis of the Company being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous annual financial statements and related management’s discussion and analysis of the Company and the previous interim financial report and related management’s discussion and analysis of the Company most recently filed shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder. Upon a new annual information form of the Company being filed with the applicable securities regulatory authorities during the currency of this Prospectus, notwithstanding anything herein to the contrary, the following documents shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder: (i) the previous annual information form; (ii) material change reports filed by the Company prior to the end of the financial year in respect of which the new annual information form is filed; (iii) business acquisition reports filed by the Company for acquisitions completed prior to the beginning of the financial year in respect of which the new annual information form is filed; and (iv) any information circular of the Company filed prior to the beginning of the Company’s financial year in respect of which the new annual information form is filed. Upon a new management information circular prepared in connection with an annual general meeting of shareholders of the Company being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous management information circular prepared in connection with an annual general meeting of the Company shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder.

DESCRIPTION OF THE BUSINESS

General

Americas Silver is a publicly-listed mining company engaged in the evaluation, acquisition, exploration, development and operation of precious and polymetallic mineral properties in North America, primarily those with the potential for near-term production or exhibiting potential for hosting a major mineralized deposit. Americas Silver’s mission is to profitably expand its precious metals production through the development of its own projects and consolidation of complimentary projects. Americas Silver is currently operating in two of the world’s leading silver camps: the Cosalá Operations in Sinaloa, Mexico, which includes the Nuestra Señora silver-zinc-copper-lead mine, the San Rafael silver-zinc-lead mine and the Zone 120 silver-copper exploration project, and the Galena Complex, in Idaho, United States. Americas Silver holds an option to purchase the San Felipe development project in Sonora, Mexico.

Americas Silver was incorporated as “Scorpio Mining Corporation” pursuant to articles of incorporation dated May 12, 1998 under theCanada Business Corporations Act. On December 23, 2014, a merger of equals transaction between Scorpio Mining Corporation and U.S. Silver & Gold Inc. was completed to combine their respective businesses by way of a plan of arrangement of U.S. Silver pursuant to section 182 of theBusiness Corporations Act (Ontario). Following the merger of equals, the combined company changed its name to “Americas Silver Corporation” by way of articles of amendment dated May 19, 2015.

Americas Silver’s head office and registered office is located at 145 King Street West, Toronto, Ontario, M5H 1J8, Canada and our general corporate phone number is (416) 848-9503.

Consistent with past practice and in the normal course, the Company may have outstanding non-binding letters of intent and/or conditional agreements or may otherwise be engaged in discussions with respect to possible acquisitions and/or investments which may or may not be material. However, there can be no assurance that any of these letters, agreements and/or discussions will result in an acquisition or investment and, if they do, what the final terms or timing of any acquisition or investment would be. The Company expects to continue to actively pursue acquisition and investment opportunities during the period that this Prospectus remains valid.

Recent Developments

Completion of Merger Transaction with Pershing Gold Corporation

On September 30, 2018, Americas Silver and Pershing Gold Corporation (“Pershing Gold”) announced that they and R Merger Sub, Inc. had entered into the agreement and plan of merger dated September 28, 2018 (as amended on March 1, 2019, the “Merger Agreement”) pursuant to which Americas Silver would acquire all of the issued and outstanding stock of Pershing Gold (the “Transaction”). Following completion of the review and approval by the Committee of Foreign Investment in the United States, which was received on April 1, 2019, and the satisfaction of all other closing conditions, the Transaction was completed on April 3, 2019.

Pursuant to the terms of the Merger Agreement: (i) holders of Pershing Gold common stock as of the effective time for the Transaction received 0.715 common shares of Americas Silver for each share of common stock of Pershing Gold (the “Exchange Ratio”); and (ii) each outstanding share of Pershing Gold series E preferred stock (“Series E Preferred Stock”) was, at the election of the holder, (a) converted into the right to receive 461.440 new non-voting preferred shares in the capital of Americas Silver (“Preferred Shares”) or (b) converted into the right to receive the number of Common Shares to which the holder would have been entitled if each share of Series E Preferred Stock held had been converted into Pershing Gold common stock and then exchanged for Common Shares at the Exchange Ratio. On closing of the Transaction, Americas Silver issued an aggregate of 24,849,270 Common Shares and 3,678,135 Preferred Shares to former Pershing shareholders.

For detailed information regarding the Transaction, see “The Transaction”, beginning on page 75 of the Special Meeting Circular, which is incorporated by reference herein. A copy of the Merger Agreement can be found on SEDAR atwww.sedar.com and on EDGAR atwww.sec.gov, and is attached as Appendix “H” – “Merger Agreement” to the Special Meeting Circular. Please also see the Special Meeting Circular and the material change report of Americas Silver dated April 12, 2019 relating to the completion of the Transaction, each of which is incorporated by reference herein.

Upon completion of the Transaction, Mr. Stephen Alfers was appointed to the board of directors of Americas Silver.

On April 3, 2019, Americas Silver also announced that it had agreed with the holders of certain outstanding convertible debentures of Americas Silver in the aggregate principal amount of C$5.5 million to covert such debentures into Common Shares, resulting in the issuance of an aggregate of 2,763,518 Common Shares.

Sandstorm Financing

On April 3, 2019, Americas Silver announced that it had entered into an agreement with Sandstorm Gold Ltd. (“Sandstorm”) providing for a US$25 million precious metal delivery and purchase agreement (the “Purchase Agreement”), a US$10 million convertible debenture (the “Convertible Debenture”) and a US$7.5 million equity placement (the “Private Placement” and together with the Purchase Agreement and the Convertible Debenture, the “Sandstorm Financing”).

Pursuant to the Purchase Agreement, Sandstorm committed to fund aggregate advances of US$25 million for the construction and development of the Relief Canyon Project (the “Relief Canyon Project”) against future fixed and variable deliveries of refined gold and silver. The fixed deliveries will consist of 32,022 ounces of refined gold over a period of 66 months that will commence between 12 to 18 months from the date of the Purchase Agreement (subject to extension in certain circumstances), depending on the timing of the first gold pour. Beginning 60 months after the commencement of the fixed delivery period, variable deliveries will commence requiring Americas Silver to sell and deliver refined gold and silver equivalent to 4% of the production from the Relief Canyon Project. For the variable deliveries, Sandstorm will pay Americas Silver a cash price of between 30% and 65% of the market price of gold and silver sold and delivered depending on the area mined. No cash price is payable by Sandstorm for the fixed deliveries. Americas Silver may elect to reduce the variable delivery amount under the Purchase Agreement from 4% to 2% of production by delivering the metal repurchase price (initially 4,000 ounces of refined gold, increasing at a rate of 10% compounded annually). The US$25 million advance is conditional upon, among other things, commencement of construction of the Relief Canyon Project and the associated development plan and operational contracts. Americas Silver and its subsidiaries Pershing Gold and Gold Acquisition Corp. (“GAC”) (the direct owner of the Relief Canyon Project) have agreed to provide security in the form of first ranking pledges of the shares of Pershing Gold and GAC, guarantees from Pershing Gold and GAC, and a first ranking security interest over all of the property and assets of GAC (other than assets which do not relate to the Relief Canyon Project), for the performance of the obligations under the Purchase Agreement.

Americas Silver issued the Convertible Debenture to Sandstorm in an aggregate principal amount of US$10 million. The Convertible Debenture bears interest at a rate of 6.0% per annum, has a maturity date of April 3, 2023 and is repayable by Americas Silver at its option prior to maturity. The principal amount outstanding under the Convertible Debenture is convertible at any time at Sandstorm’s option into Common Shares at a conversion price of US$2.14 per share, subject to typical anti-dilution provisions. The issuance is subject to the approval of the NYSE American. The obligations of Americas Silver under the Convertible Debenture are secured by pledges of the shares of Pershing Gold and GAC.

In addition, as part of the Sandstorm Financing, Sandstorm entered into a subscription agreement to purchase 4,784,689 Common Shares for total consideration of US$7.5 million.

For detailed information on the Sandstorm Financing, see the material change reports of the Company each dated April 12, 2019, which are incorporated by reference herein.

Construction Decision for Relief Canyon Project

In connection with the closing of the Transaction and the announcement of the Sandstorm Financing, the board of directors of Americas Silver also approved the commencement construction of the expanded mining and heap leaching facilities at the Relief Canyon Project. The capital cost to develop the Relief Canyon Project to initial gold pour is estimated to be approximately US$28-30 million with up to an additional US$8 million in working capital (primarily for pre-commercial production operating costs) required prior to the Relief Canyon Project achieving sustainable positive cash flow. The Company expects to achieve first gold pour from the Relief Canyon Project late in the fourth quarter of 2019.

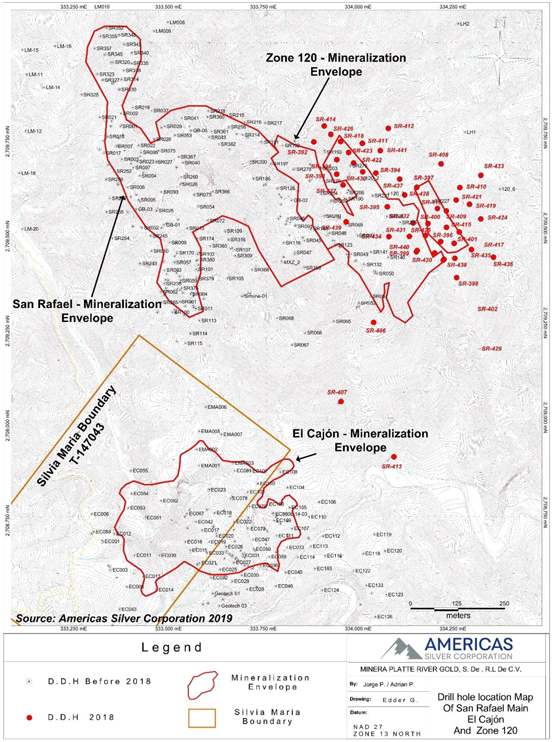

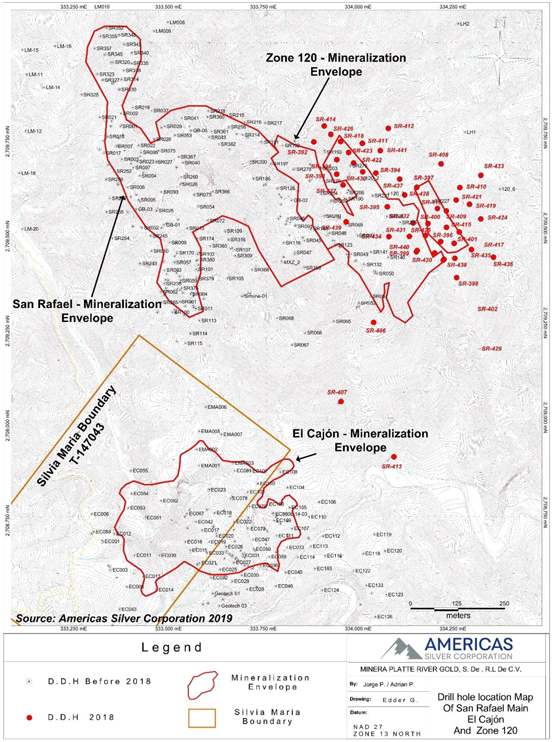

Preliminary Feasibility Study for El Cajón and Zone 120

On April 3, 2019, Americas Silver announced results of technical report entitled “Technical Report on the San Rafael Mine and the EC120 Preliminary Feasibility Study, Sinaloa, Mexico” dated May 17, 2019 and with an effective date of April 3, 2019 (the “Cosalá Technical Report”), which included a preliminary feasibility study and initial mineral reserve estimate prepared internally for a combined operation at its 100% owned El Cajón and Zone 120 silver-copper deposits (“EC120”) located near Cosalá, Sinaloa, Mexico. The Cosalá Technical Report was filed under the Company’s SEDAR profile atwww.sedar.comon May 17, 2019. Permits are in place to allow development to begin; however, due to market conditions the Company has not made a production decision. See “Description of Certain Mineral Properties – Cosalá Operations” for further information regarding these mineral properties and the information and results set out in the Cosalá Technical Report in respect thereof.

DESCRIPTION OF CERTAIN MINERAL PROPERTIES

Relief Canyon Project

Certain of the information below with respect to the Relief Canyon Project has been excerpted or derived from the technical report entitled “Technical Report and Feasibility Study for the Relief Canyon Project, Pershing County, Nevada, U.S.A.” dated July 6, 2018 and prepared in accordance with NI 43-101 (the “Relief Canyon Technical Report”), which was prepared by or under the supervision of Paul Tietz, C.P.G., Neil B. Prenn, P.E., Carl E. Defilippi, P.E. and Mark Jorgensen, Q.P. of Mine Development Associates (“MDA”).

The Company’s Relief Canyon property rights currently total approximately 27,000 acres and are comprised of approximately 1,056 owned unpatented mining claims, 120 owned millsite claims, 100 leased unpatented mining claims, and 2,228 acres of leased and 3,739 acres of subleased private lands.

The Relief Canyon Property is located about 100 miles northeast of Reno, Nevada. The nearest town is Lovelock, Nevada, approximately 15 miles west-southwest of the Relief Canyon Property, which can be reached from both Reno and Lovelock on U.S. Interstate 80. The Relief Canyon Property is reached from Lovelock by travelling approximately seven miles northeast on I-80 to the Coal Canyon Exit (Exit No. 112), then about 10 miles southeast on Coal Canyon Road (State Route 857, a paved road maintained by Pershing County) to Packard Flat, and then north on a gravel road for two miles.

On April 3, 2019, the board of directors of the Company approved the commencement construction of the expanded mining and heap leaching facilities at the Relief Canyon Project.

For further information regarding the Relief Canyon Project, see the Special Meeting Circular and the Relief Canyon Technical Report.

The tables below provide information regarding the economic analysis and cash flow for the Relief Canyon Project in the following three scenarios: pre-tax, after-tax with and without the loss carry forward. It should be noted that Pershing Gold had approximately $73.2 million in net operating losses that can be utilized to reduce the mine’s taxable income, which will lower the amount of income taxes paid over the life of the mine. This was considered in the after-tax analysis. The after-tax cash flow is estimated at $175.7 million. The after-tax NPV at a 5.0 percent discount rate is $133.2 million and the IRR is 86.5 percent. If the $73.2 million in net operating losses were not carried forward with the project, the after-tax cash flow is estimated at $167.0 million, an after-tax NPV at a 5.0 percent discount rate is $125.5 million and the IRR is 79.0 percent. The economic evaluation reported here indicates that the project should proceed.

Table 1 – Pre-Tax Cash Flow

| Item | | Units | | Preproduction | | | Year 1 | | | Year 2 | | | Year 3 | | | Year 4 | | | Year 5 | | | Year 6 | | | Year 7 | | | Year 8 | | | Production Totals | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dozed Material | | 000’s tons | | | 131 | | | | 114 | | | | | | | | 141 | | | | | | | | | | | | | | | | | | | | | | | | 255 | |

| Ore | | 000’s tons | | | 24 | | | | 5,886 | | | | 5,932 | | | | 5,918 | | | | 4,516 | | | | 4,568 | | | | 3,392 | | | | | | | | | | | | 30,212 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Waste Dump Material | | 000’s tons | | | 25 | | | | 701 | | | | 0 | | | | 0 | | | | 578 | | | | 1,214 | | | | 0 | | | | | | | | | | | | 2,492 | |

| Alluvium | | 000’s tons | | | 383 | | | | 2,255 | | | | 3,147 | | | | 788 | | | | 2,905 | | | | 1,476 | | | | 7 | | | | | | | | | | | | 10,579 | |

| Rock Waste | | 000’s tons | | | 1,537 | | | | 12,510 | | | | 16,792 | | | | 18,241 | | | | 23,292 | | | | 23,443 | | | | 7,618 | | | | | | | | | | | | 101,896 | |

| Total Waste | | 000’s tons | | | 1,945 | | | | 15,466 | | | | 19,939 | | | | 19,029 | | | | 26,774 | | | | 26,132 | | | | 7,625 | | | | | | | | | | | | 114,967 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Material | | | | | 1,969 | | | | 21,353 | | | | 25,872 | | | | 24,947 | | | | 31,290 | | | | 30,701 | | | | 11,017 | | | | | | | | | | | | 145,179 | |

| Crushed Material Summary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tons | | 000’s tons | | | | | | | 5,732.4 | | | | 5,990.0 | | | | 6,007.6 | | | | 4,546.6 | | | | 4,541.0 | | | | 3,419.4 | | | | | | | | | | | | 30,237 | |

| Grade | | oz Au/ton | | | | | | | 0.015 | | | | 0.017 | | | | 0.019 | | | | 0.024 | | | | 0.028 | | | | 0.027 | | | | | | | | | | | | 0.021 | |

| Ounces | | 000’s ounces | | | | | | | 87.9 | | | | 100.9 | | | | 115.2 | | | | 108.2 | | | | 125.4 | | | | 93.7 | | | | | | | | | | | | 631.3 | |

| Total Silver Produced | | 000’s ounces | | | | | | | 4.0 | | | | 51.8 | | | | 93.6 | | | | 101.2 | | | | 84.2 | | | | 85.3 | | | | 11.3 | | | | | | | | 431.4 | |

| Total Gold Produced | | 000’s ounces | | | | | | | 68.7 | | | | 83.3 | | | | 86.4 | | | | 83.8 | | | | 93.5 | | | | 93.2 | | | | 0.6 | | | | | | | | 509.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | $000’s | | | | | | $ | 88,576.8 | | | $ | 107,418.7 | | | $ | 111,441.9 | | | $ | 108,164.1 | | | $ | 120,639.7 | | | $ | 120,194.6 | | | $ | 837.8 | | | | | | | $ | 657,273.5 | |

| Refining and Transportation | | 000’s | | | | | | $ | 686.6 | | | $ | 832.7 | | | $ | 863.9 | | | $ | 838.5 | | | $ | 935.2 | | | $ | 931.7 | | | $ | 6.5 | | | | | | | $ | 5,095.1 | |

| Royalties (2.15%) | | $000’s | | | | | | $ | 1,888.3 | | | $ | 2,273.8 | | | $ | 2,345.2 | | | $ | 2,272.7 | | | $ | 2,544.7 | | | $ | 2,534.8 | | | $ | 14.0 | | | | | | | $ | 13,873.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Profit | | $000’s | | | | | | $ | 86,001.9 | | | $ | 104,312.2 | | | $ | 108,232.7 | | | $ | 105,052.9 | | | $ | 117,159.8 | | | $ | 116,728.0 | | | $ | 817.3 | | | | | | | $ | 638,304.9 | |

| Operating Cost | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver Credit | | $000’s | | | | | | $ | (64.2 | ) | | $ | (829.4 | ) | | $ | (1,497.2 | ) | | $ | (1,619.6 | ) | | $ | (1,346.8 | ) | | $ | (1,364.1 | ) | | $ | (180.8 | ) | | | | | | $ | (6,902.1 | ) |

| Mining | | $000’s | | | | | | $ | 41,670.4 | | | $ | 46,331.3 | | | $ | 49,889.0 | | | $ | 61,942.2 | | | $ | 64,225.1 | | | $ | 24,035.4 | | | | | | | | | | | $ | 288,093.5 | |

| Load Crusher | | $000’s | | | | | | $ | 2,121.0 | | | $ | 2,216.3 | | | $ | 2,222.8 | | | $ | 1,682.3 | | | $ | 1,680.2 | | | $ | 1,265.2 | | | | | | | | | | | $ | 11,187.7 | |

| Processing | | $000’s | | | | | | $ | 15,760.0 | | | $ | 16,328.0 | | | $ | 16,728.0 | | | $ | 15,292.0 | | | $ | 12,364.0 | | | $ | 9,723.0 | | | | | | | | | | | $ | 86,195.0 | |

| G & A | | $000’s | | | | | | $ | 2,450.2 | | | $ | 2,450.2 | | | $ | 2,148.2 | | | $ | 2,148.2 | | | $ | 2,148.2 | | | $ | 1,675.6 | | | | | | | | | | | $ | 13,020.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Operating Cost | | $000’s | | | | | | $ | 61,937.4 | | | $ | 66,496.5 | | | $ | 69,490.8 | | | $ | 79,445.1 | | | $ | 79,070.7 | | | $ | 35,335.2 | | | $ | (180.8 | ) | | $ | 0.0 | | | $ | 391,594.8 | |

| Cost $/ton Ore | | | | | | | | | 11.0 | | | | 11.5 | | | | 12.0 | | | | 17.2 | | | | 13.7 | | | | 6.6 | | | | | | | | | | | $ | 12.95 | |

| Cost $/ounce Au recovered | | | | | | | | | 922.1 | | | | 824.3 | | | | 837.0 | | | | 931.8 | | | | 636.8 | | | | 155.8 | | | | | | | | | | | $ | 768.56 | |

| | | | | | | | | $ | 61,937.4 | | | $ | 66,496.5 | | | $ | 69,490.8 | | | $ | 79,445.1 | | | $ | 79,070.7 | | | $ | 35,335.2 | | | $ | (180.8 | ) | | $ | 0.0 | | | $ | 391,594.8 | |

| Net after Operating Costs | | $000’s | | | | | | $ | 24,064.5 | | | $ | 37,815.7 | | | $ | 38,741.9 | | | $ | 25,607.8 | | | $ | 38,089.2 | | | $ | 81,392.8 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 246,710.1 | |

| Cumulative Cashflow | | $000’s | | | | | | $ | 24,064.5 | | | $ | 61,880.2 | | | $ | 100,622.2 | | | $ | 126,230.0 | | | $ | 164,319.1 | | | $ | 245,712.0 | | | $ | 246,710.1 | | | | | | | | | |

| Capital Cost | | $000’s | | $ | 28,238.8 | | | $ | 10,571.0 | | | $ | (5,260.9 | ) | | $ | 9,197.3 | | | $ | 0.0 | | | $ | 0.0 | | | $ | (3,000.0 | ) | | $ | 4,000.0 | | | $ | (690.0 | ) | | | | |

| Cash Flow with Capital | | $000’s | | $ | (28,238.8 | ) | | $ | 13,493.5 | | | $ | 43,076.7 | | | $ | 29,544.7 | | | $ | 25,607.8 | | | $ | 38,089.2 | | | $ | 84,392.8 | | | $ | (3,001.9 | ) | | $ | 690.0 | | | $ | 203,654.0 | |

| Cumulative Including Capital | | $000’s | | $ | (28,238.8 | ) | | $ | (14,745.3 | ) | | $ | 28,331.4 | | | $ | 57,876.1 | | | $ | 83,483.9 | | | $ | 121,573.0 | | | $ | 205,965.8 | | | $ | 202,964.0 | | | $ | 203,654.0 | | | | | |

Table 2 – After-Tax Cash Flow

| Item | | Units | | Year -1 | | | Year 1 | | | Year 2 | | | Year 3 | | | Year 4 | | | Year 5 | | | Year 6 | | | Year 7 | | | Year 8 | | | Totals | |

| After Tax Evaluation-Lease Equipment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Profit before Tax | | $000’s | | | | | | $ | 24,064.5 | | | $ | 37,815.7 | | | $ | 38,741.9 | | | $ | 25,607.8 | | | $ | 38,089.2 | | | $ | 81,392.8 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 246,710.1 | |

| Nevada Net Proceeds | | $000’s | | | | | | $ | 476.6 | | | $ | 1,899.9 | | | $ | 1,295.1 | | | $ | 998.5 | | | $ | 1,652.1 | | | $ | 4,071.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 10,393.3 | |

| Net after Net Proceeds | | $000’s | | | | | | $ | 23,587.9 | | | $ | 35,915.8 | | | $ | 37,446.9 | | | $ | 24,609.3 | | | $ | 36,437.1 | | | $ | 77,321.7 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 236,316.8 | |

| Depreciation | | $000’s | | | | | | $ | 3,744.5 | | | $ | 5,295.5 | | | $ | 3,643.4 | | | $ | 5,637.9 | | | $ | 5,046.6 | | | $ | 2,970.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 26,338.0 | |

| Net before Depletion | | $000’s | | | | | | $ | 19,843.4 | | | $ | 30,620.3 | | | $ | 33,803.5 | | | $ | 18,971.4 | | | $ | 31,390.4 | | | $ | 74,351.6 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 209,978.7 | |

| Depletion (15%) | | $000’s | | | | | | $ | 12,900.3 | | | $ | 15,646.8 | | | $ | 16,234.9 | | | $ | 15,757.9 | | | $ | 17,574.0 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 95,623.1 | |

| Depletion (50% max) | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,901.7 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 37,175.8 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 104,490.3 | |

| Depletion Taken | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,234.9 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 84,156.9 | |

| Taxable Income | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 17,568.6 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 56,842.4 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 125,821.8 | |

| Loss Carry Forward | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 17,568.6 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 5,218.7 | | | | | | | | | | | $ | 73,200.0 | |

| Taxable Income | | $000’s | | | | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 51,623.7 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 52,621.8 | |

| Income Tax (21%) | | $000’s | | | | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 17,552.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 17,552.1 | |

| Income After Tax | | $000’s | | | | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 34,071.6 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 35,069.8 | |

| Loss Carry Forward | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 17,568.6 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 5,218.7 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 73,200.0 | |

| Depletion | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,234.9 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 84,156.9 | |

| Depreciation | | $000’s | | | | | | $ | 3,744.5 | | | $ | 5,295.5 | | | $ | 3,643.4 | | | $ | 5,637.9 | | | $ | 5,046.6 | | | $ | 2,970.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 26,338.0 | |

| Net After Tax | | $000’s | | | | | | $ | 23,587.9 | | | $ | 35,915.8 | | | $ | 37,446.9 | | | $ | 24,609.3 | | | $ | 36,437.1 | | | $ | 59,769.6 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 218,764.7 | |

| Capital Cost | | $000’s | | $ | 28,238.8 | | | $ | 10,788.0 | | | $ | (5,478.0 | ) | | $ | 9,197.3 | | | $ | 0.0 | | | $ | 0.0 | | | $ | (3,000.0 | ) | | $ | 4,000.0 | | | $ | (690.0 | ) | | $ | 43,056.1 | |

| After Tax Cashflow | | $000’s | | $ | (28,238.8 | ) | | $ | 12,799.8 | | | $ | 41,393.8 | | | $ | 28,249.6 | | | $ | 24,609.3 | | | $ | 36,437.0 | | | $ | 62,769.6 | | | $ | (3,001.9 | ) | | $ | 690.0 | | | $ | 175,708.6 | |

| Cumulative After Tax Cashflow | | $000’s | | $ | (28,238.8 | ) | | $ | (15,438.9 | ) | | $ | 25,954.9 | | | $ | 54,204.5 | | | $ | 78,813.8 | | | $ | 115,250.8 | | | $ | 178,020.4 | | | $ | 175,018.6 | | | $ | 175,708.6 | | | | | |

| NPV (5%) | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 133,208.4 | |

| NPV 7.5% | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 116,544.3 | |

| NPV 10% | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 102,252.6 | |

| IRR | | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 86.5 | % |

Table 3 – After-Tax Cash Flow (no loss carry forward)

| Item | | Units | | Year -1 | | | Year 1 | | | Year 2 | | | Year 3 | | | Year 4 | | | Year 5 | | | Year 6 | | | Year 7 | | | Year 8 | | | Totals | |

| After Tax Evaluation-Lease Equipment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Profit before Tax | | $000’s | | | | | | $ | 24,064.5 | | | $ | 37,815.7 | | | $ | 38,741.9 | | | $ | 25,607.8 | | | $ | 38,089.2 | | | $ | 81,392.8 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 246,710.1 | |

| Nevada Net Proceeds | | $000’s | | | | | | $ | 476.6 | | | $ | 1,899.9 | | | $ | 1,295.1 | | | $ | 998.5 | | | $ | 1,652.1 | | | $ | 4,071.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 10,393.3 | |

| Net after Net Proceeds | | $000’s | | | | | | $ | 23,587.9 | | | $ | 35,915.8 | | | $ | 37,446.9 | | | $ | 24,609.3 | | | $ | 36,437.1 | | | $ | 77,321.7 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 236,316.8 | |

| Depreciation | | $000’s | | | | | | $ | 3,744.5 | | | $ | 5,295.5 | | | $ | 3,643.4 | | | $ | 5,637.9 | | | $ | 5,046.6 | | | $ | 2,970.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 26,338.0 | |

| Net before Depletion | | $000’s | | | | | | $ | 19,843.4 | | | $ | 30,620.3 | | | $ | 33,803.5 | | | $ | 18,971.4 | | | $ | 31,390.4 | | | $ | 74,351.6 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 209,978.7 | |

| Depletion (15%) | | $000’s | | | | | | $ | 12,900.3 | | | $ | 15,646.8 | | | $ | 16,234.9 | | | $ | 15,757.9 | | | $ | 17,574.0 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 95,623.1 | |

| Depletion (50% max) | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,901.7 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 37,175.8 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 104,490.3 | |

| Depletion Taken | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,234.9 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 84,156.9 | |

| Taxable Income | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 17,568.6 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 56,842.4 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 125,821.8 | |

| Loss Carry Forward | | $000’s | | | | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | | | | | | | | | $ | 0.0 | |

| Taxable Income | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 17,568.6 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 56,842.4 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 125,821.8 | |

| Income Tax (21%) | | $000’s | | | | | | $ | 2,083.6 | | | $ | 3,215.1 | | | $ | 3,689.4 | | | $ | 1,992.0 | | | $ | 3,296.0 | | | $ | 11,936.9 | | | | | | | $ | 0.0 | | | $ | 26,213.0 | |

| Income After Tax | | $000’s | | | | | | $ | 7,838.1 | | | $ | 12,095.0 | | | $ | 13,879.2 | | | $ | 7,493.7 | | | $ | 12,399.2 | | | $ | 44,905.5 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 99,608.9 | |

| Loss Carry Forward | | $000’s | | | | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | |

| Depletion | | $000’s | | | | | | $ | 9,921.7 | | | $ | 15,310.2 | | | $ | 16,234.9 | | | $ | 9,485.7 | | | $ | 15,695.2 | | | $ | 17,509.2 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 84,156.9 | |

| Depreciation | | $000’s | | | | | | $ | 3,744.5 | | | $ | 5,295.5 | | | $ | 3,643.4 | | | $ | 5,637.9 | | | $ | 5,046.6 | | | $ | 2,970.1 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 26,338.0 | |

| Net After Tax | | $000’s | | | | | | $ | 21,504.3 | | | $ | 32,700.7 | | | $ | 33,757.5 | | | $ | 22,617.3 | | | $ | 33,141.1 | | | $ | 65,384.8 | | | $ | 998.1 | | | $ | 0.0 | | | $ | 210,103.8 | |

| Capital Cost | | $000’s | | $ | 28,238.8 | | | $ | 10,788.0 | | | $ | (5,478.0 | ) | | $ | 9,197.3 | | | $ | 0.0 | | | $ | 0.0 | | | $ | (3,000.0 | ) | | $ | 4,000.0 | | | $ | (690.0 | ) | | $ | 43,059.1 | |

| After Tax Cashflow | | $000’s | | $ | (28,238.8 | ) | | $ | 10,716.3 | | | $ | 38,178.7 | | | $ | 24,560.2 | | | $ | 22,617.3 | | | $ | 33,141.0 | | | $ | 68,384.8 | | | $ | (3,001.9 | ) | | $ | 690.0 | | | $ | 167,047.7 | |

| Cumulative After Tax Cashflow | | $000’s | | $ | (28,238.8 | ) | | $ | (17,522.5 | ) | | $ | 20,656.2 | | | $ | 45,216.4 | | | $ | 67,833.7 | | | $ | 100,974.7 | | | $ | 169,359.5 | | | $ | 166,357.7 | | | $ | 167,047.7 | | | | | |

| NPV (5%) | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 125,476.2 | |

| NPV 7.5% | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 106,303.1 | |

| NPV 10% | | $000’s | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 95,379.2 | |

| IRR | | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 79.0 | % |

Cosalá Operations

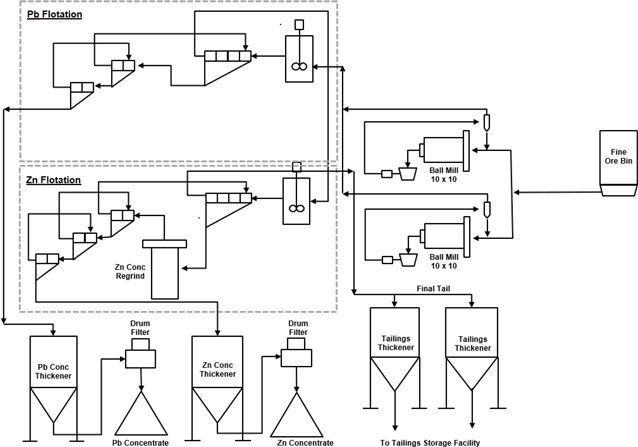

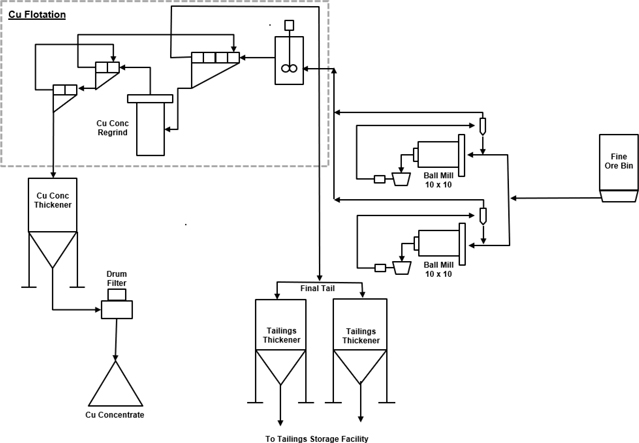

In Sinaloa, Mexico, the Company operates the 100%-owned Cosalá Operations, which is made up of the Nuestra Señora silver-zinc-copper-lead mine, which has been placed on care and maintenance, the San Rafael silver-zinc-lead mine (“San Rafael”), which entered commercial production in December 2018, and the Zone 120 silver-copper exploration project.

Technical information described below relating to the Cosalá Operations is derived from Cosalá Technical Report. The qualified persons named as authors of the Cosalá Technical Report are Daren Dell, P.Eng., Shawn Wilson, P.Eng., Neil de Bruin, P.Geo, and James Stonehouse, SME (RM), each of the Company. The Cosalá Technical Report, which constitutes the current technical report for the Cosalá Operations, was filed on SEDAR on May 17, 2019 and is available under the Company’s profile atwww.sedar.com.

Property Description, Location and Access

The San Rafael mine, EC120 Project and Los Braceros plant are located in the east-central portion of Sinaloa, Mexico near the town of Cosalá. The town of Cosalá is approximately 180km north of Mazatlán. Mazatlán is serviced by an international airport with daily flights connecting it to Mexico City and several major centres in the United States. Access to site from Mazatlán is via Mexico Highway 15N, a major north-south trucking route, and then SIN Highway 1. Driving time is about 2.5 hours. Access to San Rafael and EC120 from Cosalá is via rural paved and dirt roads approximately 15km in length. These roads can accommodate standard highway vehicles. The entire project area is easily accessible year-round with two-wheel-drive vehicles.

The property consists of 67 mining concessions covering a total area of 19,390.7ha. These concessions and fractional concessions are 100% owned by Americas Silver’s subsidiaries Minera Platte River Gold S. de R.L. de C.V. (“MPRG”) and Minera Cosalá S.A. (“MCO”). The Company is current with respect to all applicable concession lease payments and work commitments. Americas Silver also holds certain surface rights for portions of the property.

The mining concessions are held under two separate entities at Cosalá. MPRG holds 51 mineral concessions totalling 6,718.9 ha. MCO holds 16 mining concessions totalling 12,671.8 ha. In total, Americas Silver holds 67 mining concessions covering a total area of 19,390.7ha.

All concessions remain valid for 50 years from the date of title as long as the semi-annual mining duties are paid and minimum annual work requirements are met. The mining duties are based on the number of years for which the concession has been held and the area of the concession. Total, current, semi-annual mining duties for the 67 concessions owned by Americas Silver are approximately MXN3.3 million, payable to the Secretaría de Economía, Coordinación General de Minería, Dirección General de Minas. The current total minimum annual work commitment, including exploration and mining, for all the concessions is approximately MXN56.9 million.

On March 16, 2011, Scorpio, a predecessor to Americas Silver, acquired five mineral concessions in the Cosalá district, immediately adjacent to its existing concessions, from Grupo Industrial Minera Mexico S.A. de C.V. (“IMMSA”), a subsidiary of Grupo Mexico. These concessions (El Cajón, El Cajón 2, El Magistral, La Escondida and Simon) covering 1,387ha are subject to a 1.25% net smelter return (“NSR”) royalty payable to IMMSA on future production. Additionally, Cosalá 2 concession covering 307ha is subject to a 1.5% NSR payable to two private individuals on future production. The planned San Rafael and EC120 production does not extend onto any of these six concessions.

History

The Cosalá district was discovered and locally worked by the Spanish approximately 400 years ago with production of enriched silver ore from the upper levels of the Nuestra Señora mine. However, no records of any kind remain from their activities. At the turn of the 19th century, French engineers through Negociación Minera La República reportedly developed and worked the Nuestra Señora mine with a 10-stamp mill that produced 800 to 1,000kg of silver per month. Activities in the area may have been halted after the 1910 Mexican Revolution.

In 1949, Asarco Mexicana (“Asarco”) purchased the Nuestra Señora mine and property and carried out exploration and development, putting the property into production in 1954. Ore was mined from four nearby deposits (Nuestra Señora, Santo Domingo, Candelaria and Santa Teresa), with most of the production coming from the Nuestra Señora mine down to the 8th level. The Ag-Zn-Pb-Cu-Au ore was processed in a 450tpd flotation plant. Asarco also mined similar material from the La Estrella mine north of San Rafael. In addition, Asarco conducted some work at El Cajón, sending the material to the mill at La Estrella.

In or about February 1965, Asarco ceased production from Nuestra Señora, presumably because of anticipated Mexican government policies (Spring and Breede, 2008), and subsequently removed all of the mining equipment. Asarco let its concessions lapse in 1980.

Over the years, there have been numerous companies that have owned, operated and explored the property. Americas Silver acquired the property through its merger with Scorpio on December 23, 2014. During this time, the Nuestra Señora mine was in operation and processing ore at its Los Braceros plant. The Company released results of the preliminary feasibility study for the San Rafael project (the “2016 San Rafael PFS”) in March 2016 and started construction of the mine in September 2016.

In early April 2016, unusual ground movement was observed at the Nuestra Señora mine. The disturbance was located in the upper levels of the mine near old workings which predate the Company’s involvement with the project. An analysis of the situation showed there was a risk to the structural integrity of the mine portal. A new portal and approximately 120m of development were completed to re-establish safe access to the mine and operations resumed in late June 2016. During the suspension of ore production from Nuestra Señora, mill feed consisted of stockpiled material as well as historic dumps and near surface mineralization at the past-producing La Estrella mine at the north end of the Company’s land holdings.

Primary ramp development at San Rafael advanced with approximately 25% complete by year end in 2016. The project received initial deliveries of new mobile equipment, and transfer of workers and equipment from the Nuestra Señora mine began. Ongoing review of development plans and savings from the relocation and reuse of existing equipment allowed the initial capital cost estimate to be reduced to $18 million from the original cost of $22 million presented in the 2016 San Rafael PFS.

Development at the El Cajón project recommenced in Q4 2016. Plans were put in place to have mill feed supplemented by El Cajón production as the Nuestra Señora mine wound down. A small stockpile had been established by year-end 2016.

In early 2017, production from the Nuestra Señora mine began to slow as preparations were made to transition the Cosalá Operation to other ore sources. Activities continued at the previously-idle El Cajón mine to bring it into limited production beginning in Q1 2017. A total of approximately 110,000 tonnes were processed between January and September 2017. The El Cajón mine is currently on care and maintenance.

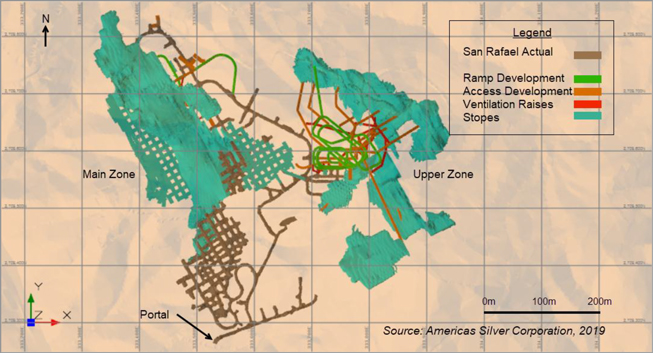

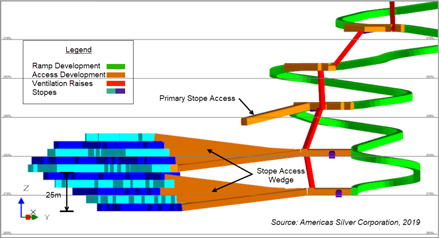

Successful development of the San Rafael mine was the Company’s top priority during 2017 and commercial production was declared as of December 2017. Ramp development was slowed during the year by difficult ground conditions at the contact between the overlying volcanic rock and the limestone beneath. However, improvements were found in other areas of the mine design and the Company began stockpiling ore in late August. Construction of the mill modifications was completed, and the plant switched to San Rafael ore as the sole feed source in November. The Los Braceros mill averaged approximately 1,400 tonnes per day (“tpd”) through the pre-production period with silver, zinc and lead recoveries within 5% of Company expectations consistent with the 2016 San Rafael PFS. Construction was completed for approximately $16 million, 32% below the pre-feasibility study estimate.

Exploration drilling resumed in 2017 at the Cosalá Operation for the first time since 2014. An initial 4,000m diamond drill program at the silver-copper Zone 120 deposit adjacent to the San Rafael mine commenced in April, focusing on upgrading the existing resource as well as expanding the footprint of mineralization to the southeast. Following up on the success of stepout drilling, the Company drilled 3,260m in seven holes to further test continuity and expand the mineralized footprint.

Production from the Nuestra Señora mine stopped in early 2018 and the mine is currently on care and maintenance. The San Rafael mine continued advancing underground development into the Main Zone during 2018 in order to prepare the mine for 2019 production with targeted silver grades of approximately 60g/t with further increases expected in the silver grade in 2020 and beyond.

Geological Setting, Mineralization and Deposit Types

The Cosalá mining district lies along the western edge of the Sierra Madre Occidental, an extensive volcanic province covering approximately 800,000km2. The pre-volcanic basement consists of a variety of tectonic/stratigraphic terranes of Precambrian, Paleozoic and Mesozoic rocks. Within the western Sierra Madre Occidental, the Mesozoic rocks have been altered to recrystallized limestone and skarn in many locations. An extensional, basin and range-type phase of faulting overprinted the western portion of the Sierra Madre Occidental during formation of the Gulf of California in Miocene time. In the Cosalá region, this late-Tertiary faulting produced an extensive, northwest-trending graben and related, parallel fault system, along with later northeast-trending dextral faults.

Mineralization within the Cosalá mining district is related to granodioritic or granitic intrusions of the Sinaloa Batholith, a composite gabbroic to granodioritic complex that induced strong contact metamorphism in adjacent sedimentary and volcano-sedimentary units.

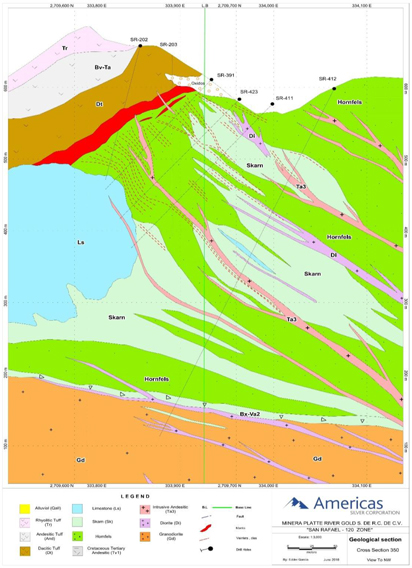

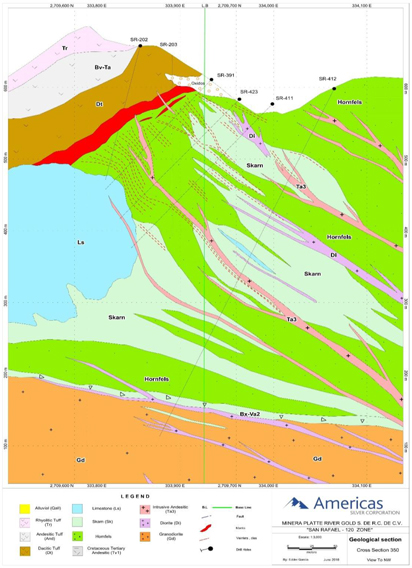

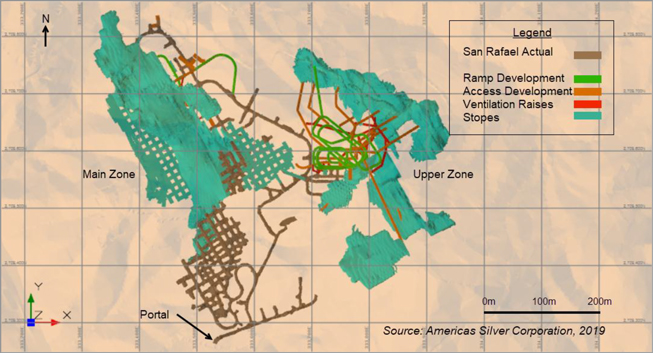

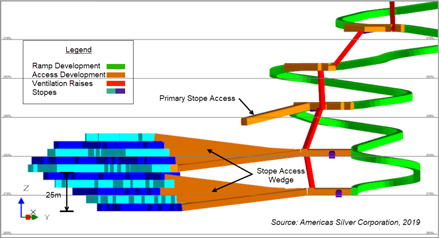

The surface geology of the San Rafael area is dominated by intrusive and extrusive volcanic rocks that make up much of the Sierra Madre Occidental. Cretaceous limestone, commonly recrystallized and marbleized, but only locally skarn-altered, is exposed within windows in the Tertiary volcanic rocks and is the oldest unit identified to date in the San Rafael- EC120 area. The basal Tertiary unit is a volcaniclastic arenite (“volc-arenite”) composed of heterolithic volcanic clasts that are variable in size, sub-angular to sub-rounded, and commonly porphyritic. This unit is divided by Americas Silver geologists into an upper unit, Va1, and a lower unit, Va2. Clast and grain size generally range from fine-grained sand to medium-sized boulders, and the unit commonly displays graded bedding. The arenite is an extensive rock type on the property and is also the primary host for skarn alteration/mineralization at Zone 120 and the original La Verde mine. Va2 is characterized by higher content of sedimentary derived (carbonate) fragments and is prone to skarn development and forms a referred host rock for mineralization. Va1 is more siliceous and forms a hornfelsic rock which is less favourable for replacement ores and characterized by fracture filling and veinlets when mineralized. The contact between the Cretaceous limestone and the volc-arenite is disconformable and is often represented by a karst surface. Overlying the basal arenite are andesitic flows, andesitic tuffs and dacitic tuffs. At San Rafael, the basal arenite section is missing, and massive sulphide mineralization occurs primarily along the dacite tuff-Cretaceous limestone contact, with additional mineralization within the dacite in the Upper Zone and more distal skarn-altered volc-arenite, which is the main host rock for Zone 120, where it reoccurs northeast of San Rafael. The youngest rock type is felsic rhyolite tuff. The rhyolite tuff contains quartz phenocrysts and small lithic fragments. Although there are silver-gold veinlets that cross cut the tuff, no strong silver-copper-gold or silver-lead-zinc mineralization has been identified in the rhyolite. Figure 1 shows the geology of the San Rafael and EC120 areas.

Figure 1 – Detailed Geology

Three types of intrusions are present in the San Rafael-El Cajón area. Medium- to coarse-grained granodiorite, which is part of the district-wide batholith, crops out in the western part of the project area and was also intersected at the bottom of a number of PRG drill holes in the El Cajón area. There are also large, local intrusions of diorite, often occurring as sills, that are interpreted to be related to the emplacement of the batholith. Andesitic dikes and sills, which are sometimes weakly magnetic, are also present.